WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

Table of Contents

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

A SHORT HISTORY

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company headquartered in Seattle, Washington. Its principal subsidiary is Washington Federal (Bank), which operates 190 offices in eight western states.

The Company had its origin on April 24, 1917, as Ballard Savings and Loan Association. In 1935, the state-chartered Company converted to a federal charter, became a member of the Federal Home Loan Bank (FHLB) system and obtained federal deposit insurance. In 1958, Ballard Federal Savings and Loan Association merged with Washington Federal Savings and Loan Association of Bothell, and the latter name was retained for wider geographical acceptance. In 1971, Seattle Federal Savings and Loan Association, with three offices, merged into the Company, and at the end of 1978 was joined by the 10 offices of First Federal Savings and Loan Association of Mount Vernon.

On November 9, 1982, the Company converted from a federal mutual to a federal stock association. In 1987 and 1988, acquisitions of United First Federal, Provident Federal Savings and Loan, and Northwest Federal Savings and Loan, all headquartered in Boise, Idaho, added 28 Idaho offices to the Company. In 1988, the acquisition of Freedom Federal Savings and Loan Association in Corvallis, Oregon, added 13 Oregon offices, followed in 1990 by the eight Oregon offices of Family Federal Savings.

In 1991, the Company added three branches with the acquisition of First Federal Savings and Loan Association of Idaho Falls, Idaho, and acquired the deposits of First Western Savings Association of Las Vegas, Nevada, in Portland and Eugene, Oregon, where it was doing business as Metropolitan Savings Association. In 1993, 10 branches were added with the acquisition of First Federal Savings Bank of Salt Lake City, Utah. In 1994, the Company expanded into Arizona.

In 1995, the stockholders approved a reorganization whereby the Bank became a wholly owned subsidiary of a newly formed holding company, Washington Federal, Inc. That same year, the Company purchased West Coast Mutual Savings Bank with its one branch in Centralia, Washington, and opened six additional branches. In 1996, the Company acquired Metropolitan Bancorp of Seattle, adding eight offices in Washington as well as opening four branches in existing markets. Between 1997 and 1999, the Company continued to develop its branch network, opening a total of seven branches and consolidating three offices into existing locations.

In 2000, the Company expanded into Las Vegas, opening its first branch in Nevada along with two branches in Arizona. In 2001, the Company opened two additional branches in Arizona and its first branch in Texas, with an office in the Park Cities area of Dallas. In 2002, five full-service branches were opened in existing markets. In 2003, the Company purchased United Savings and Loan Bank with its four branches in Seattle, added one new branch in Puyallup, Washington, and consolidated one branch in Nampa, Idaho. In 2005, the Company consolidated two branches in Mount Vernon, Washington, into one and opened branches in Plano, Texas, and West Bend, Oregon. In 2006, the Company opened locations in Klamath Falls, Oregon, and Richardson, Texas, added another location in Las Vegas, Nevada, and opened a branch in Medford, Oregon.

The Company acquired First Federal Banc of the Southwest, Inc., the holding company for First Federal Bank located in Roswell, New Mexico, on February 13, 2007. First Federal Bank had 13 branch locations, 11 in New Mexico and two in El Paso, Texas. The Company acquired First Mutual Bancshares, Inc. (“First Mutual”), the holding company for First Mutual Bank, on February 1, 2008. First Mutual had 12 branches primarily located on the eastside of Seattle. The Company also opened a location in Redmond, Oregon, in 2009. During 2010, the Company opened two new locations, one in Las Vegas, Nevada, and the other in Prescott Valley, Arizona.

On January 8, 2010, the Company acquired certain assets and liabilities, including most of the loans and deposits, of Horizon Bank (Horizon), headquartered in Bellingham, Washington, from the Federal Deposit Insurance Corporation ("FDIC"), as receiver for Horizon. Horizon operated 18 full-service offices, four commercial loan centers and four real estate loan centers in Washington. Through consolidation with existing Washington Federal branches, there was a net increase of 10 branches as a result of the Horizon acquisition.

On October 14, 2011, the Company acquired six branch locations, four in Albuquerque, New Mexico, and two in Santa Fe, New Mexico, from Charter Bank.

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

On December 16, 2011, the Company acquired 3 branches, along with certain assets and liabilities, including most of the loans and deposits, of Western National Bank, headquartered in Phoenix, Arizona (“WNB”) from the FDIC in an FDIC-assisted transaction. Effective October 31, 2012, the Company acquired South Valley Bancorp, Inc. ("South Valley"), the holding company for South Valley Bank & Trust headquartered in Klamath Falls, Oregon. The 24 South Valley branches acquired in the transaction are located in central and southern Oregon.

The Company obtains its funds primarily through deposits from the general public, repayments of loans, borrowings and retained earnings. These funds are used largely to make loans to individuals and businesses, including loans for the purchase of new and existing homes, construction and land loans, commercial real estate loans, commercial and industrial loans and loans for investments.

FINANCIAL HIGHLIGHTS

|

| | | | | | | |

| September 30, | 2012 | 2011 | % Change |

| | (In thousands, except per share data) |

| Assets | $ | 12,472,944 |

| $ | 13,440,749 |

| (7.2%) |

| Cash and cash equivalents | 751,430 |

| 816,002 |

| (7.9) |

| Investment securities | 612,524 |

| 246,004 |

| +149.0 |

| Loans receivable, net | 7,451,998 |

| 7,935,877 |

| (6.1) |

| Covered loans, net | 288,376 |

| 382,183 |

| (24.5) |

| Mortgage-backed securities | 2,360,668 |

| 3,056,176 |

| (22.8) |

| Customer accounts | 8,576,618 |

| 8,665,903 |

| (1.0) |

| FHLB advances and other borrowings | 1,880,000 |

| 2,762,066 |

| (31.9) |

| Stockholders’ equity | 1,899,752 |

| 1,906,533 |

| (0.4) |

| Net income available to common shareholders | 138,183 |

| 111,141 |

| +24.3 |

| Diluted earnings per share | 1.29 |

| 1.00 |

| +29.0 |

| Dividends per share | 0.32 |

| 0.24 |

| +33.3 |

| Stockholders’ equity per share | 17.89 |

| 17.49 |

| +2.3 |

| Shares outstanding | 106,178 |

| 108,976 |

| (2.6) |

| Return on average stockholders’ equity | 7.23 | % | 5.99 | % | NM |

| Return on average assets | 1.03 |

| 0.83 |

| NM |

| Efficiency ratio (1) | 34.54 |

| 31.30 |

| NM |

| |

| (1) | Calculated as total operating costs divided by net interest income, plus other income (excluding investment gains) |

NM – not meaningful

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

TO OUR STOCKHOLDERS

Dear Stockholder,

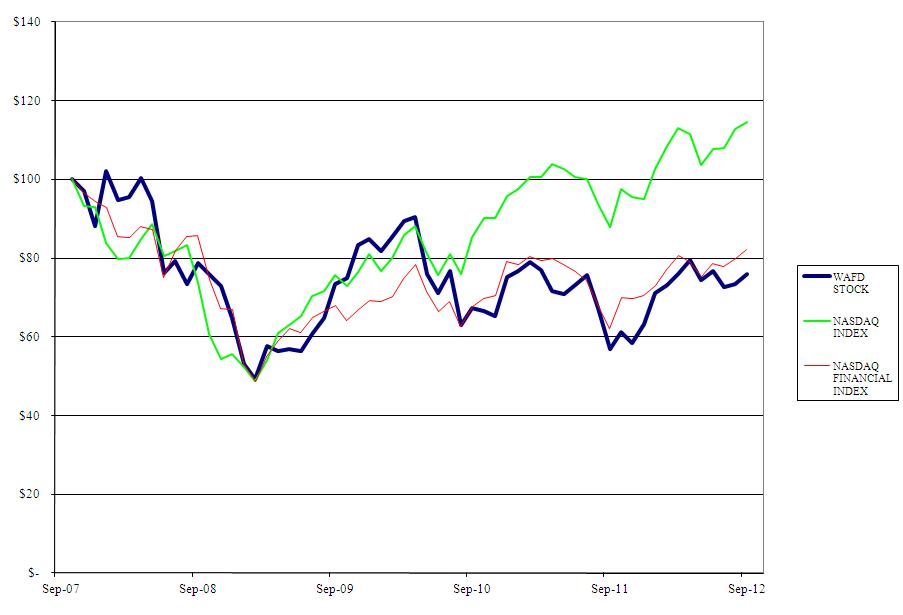

It is a privilege to advise you that fiscal 2012 was another successful year for Washington Federal. Net income for the Company totaled $138,183,000, an increase of 24% from $111,141,000 in fiscal 2011. Earnings per share increased by 29% to $1.29 in fiscal 2012, and reflected both higher net income and nearly 4% fewer average shares outstanding. Return on assets during the year also improved to 1.03% and return on equity was 7.23%. Both measures are below historical averages for the Company and are attributable to ongoing weakness in the overall economy and historically low interest rates. The really good news though, is that improved operating results translated to a considerably higher share price. From the beginning of the fiscal year to the end, the price per share increased from $12.45 to $16.60, leading to a 35% total shareholder return when cash dividends are included

The most significant contributor to improved earnings was a material decline in costs related to the resolution of problem loans. These costs fell by 59% during the year to $54,776,000, as asset quality measures improved across the board. Total non-performing assets, a measure that combines loans on which payments are no longer being made plus foreclosed real estate, declined by 26% during the year to $273,000,000. This is the lowest level of problem assets reported since 2008. Delinquent loans also declined during the year to 2.57% of the portfolio from 3.43% one year earlier, and real estate acquired through foreclosure declined by 37% to $99,478,000 during the year. Consumer foreclosures continue to be higher than normal, yet properties now sell quickly and at better prices than a year ago. Virtually all large foreclosed properties are under contract at amounts equal to or exceeding current book value. We look for the favorable trend in credit costs to continue, albeit at a slower pace, in 2013.

Along with improved asset quality, the Company's balance sheet maintained a fortress-like condition. Liquidity remained abundant and capital ratios were among the best in the industry at year-end. For example, the Company's year-end ratio of tangible common equity to tangible assets, the purest measure of capital adequacy, was 13.45%, the sixth highest among the 100 largest banks in the United States. A strong capital position not only provides a shock absorber for unexpected losses, but also gives management the flexibility and wherewithal to take advantage of new opportunities as they appear. Capital strength enabled the Company to repurchase 2,895,000 shares at an average price of $14.48 in fiscal 2012. The cash dividend was also increased by 33% over the prior year.

Contributing to the robust capital position was a partial restructuring of the balance sheet that reduced total assets managed by approximately $1 billion. This occurred in the fourth quarter with the sale of a large portion of the Company's mortgage-backed securities portfolio at a net gain of $95 million. The gain was harvested due to concern that changes in interest rates and/or accelerating prepayments would cause it to evaporate. The profits were then used to fund prepay charges and retire high cost long-term debt. The net effects of the restructuring are improved operating margins in the near term and additional protection against higher interest rates in the long term.

In contrast to the fine operating results, quality new loan origination opportunities were limited in 2012. Most were found in the commercial segments of our business, where a great deal of success was experienced, though not enough to offset the runoff in the mortgage portfolio. In 2012, the Federal Reserve induced yet another round of record low mortgage rates, using hyper aggressive monetary policy actions with obscure sounding names such as “Quantitative Easing” and “Operation Twist”. These actions were taken to further stimulate the struggling economy. The resulting low rates enabled outstanding, if temporary, results for mortgage lenders with an “originate and sell” model, while placing portfolio lenders like Washington Federal at a severe competitive disadvantage. Our retail banking group nonetheless originated $539 million of single family mortgage loans in 2012 by focusing on products such as custom construction, jumbo loans and other home loan niches where pricing commensurate with risk can still be obtained. The bottom line for Washington Federal is that current rates on 30 year, fixed rate, secondary market conforming mortgage loans are just too low to justify placing significant amounts on the balance sheet.

We are often asked why Washington Federal sticks to the portfolio lending model as opposed to the “originate and sell” model that is so profitable during times like these. There are several straightforward reasons. Most importantly, in the portfolio lending model, the risk stays with the originator, making for a more honest and, in the long run, a more consumer friendly market. Today, some 96% of all mortgage loans end up in a government financing bucket of one form or another. Private sector originators extract large front-end fees and sell off the risk to the market, generally with an explicit government guarantee. This transfer of risk from the private sector to the taxpayer is a moral hazard we find impossible to support, even though it means that we forgo generous profits during periods of frenzied refinance activity.

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

Sale of the loan also disrupts the mutual sense of responsibility between lender and borrower. For the borrower, default is less morally reprehensible if the party incurring loss is unknown to them. Likewise, loan servicers tend to be less caring and responsive toward the borrower if they have no principal at risk and no other relationship with the borrower. The “originate and sell” model also requires a very aggressive approach to managing variable expenses, meaning staff expansion during times of high volume, followed by layoffs when volumes decline. These short-term staffing increases have historically introduced unqualified lending agents into the market and led to an erosion of integrity, followed by angry consumers. When the boom fades and the downsizing begins, employee loyalty and cultural cohesion suffer, inevitably impacting financial performance. Nary a soul was laid off from Washington Federal during the Great Recession and employee morale is as high as ever. Satisfied employees make for satisfied customers and, in turn we believe, for satisfied shareholders.

Accounting considerations present another problem with the “originate and sell” model. Servicing retained when the loan is sold requires the booking of an intangible asset, the true value of which is known only in hindsight. Mortgage servicing rights are difficult to hedge and can add substantial volatility to earnings. A highly cyclical business model like “originate and sell” would not allow us to produce the long-term consistency that shareholders have come to rely on from the Company. It seems to us that the current mortgage financing structure in the U.S. is fundamentally unsound. We just can't bring ourselves to participate in a system that enriches large institutions at taxpayer risk, distorts markets and depersonalizes financial obligations. Winding down Freddie Mac and Fannie Mae and replacing them with a private market solution would be a great step toward a more rational approach to resource allocation in America and would perhaps help to avert another housing crisis down the road.

Deposit gathering efforts were directed at changing the mix in 2012 toward more checking, savings and money market accounts. Overall deposit growth was not required given weak loan demand and the Company's already healthy liquidity position. Traditional savers, worn down by the cumulative effect of low rates, began to seek higher yields than those offered on certificates of deposit. These are the unsung heroes of the economy who are bearing the brunt of current monetary policy. Many are seniors who live off the income of their life savings along with social security. They have little choice but to take more risk to get a better return, something I'm sure they would prefer not to do at their stage of life. We have kept our rates at the high end of the market to support these core and loyal customers, but even the best rates in the market offer meager income. Management expects that certificates of deposit will continue to runoff in 2013, so to offset the loss of those deposits, the focus will again be on growing checking, savings and money market accounts from businesses and consumers.

Operating expenses increased in 2012 relative to assets managed, revenues, net interest income, or any other measure one might care to use. This is a function of the Company's changing business mix, a higher regulatory burden, a smaller balance sheet, and lower yields on earning assets. Gone are the days when Washington Federal could operate with a 17% efficiency ratio. More likely, it will cost between 35 and 40 cents next year for the Company to produce one dollar of net revenue. Still, the cost control gene is firmly imbedded in our DNA and will always assert itself. Even with higher expenses this year, Washington Federal was once again named by theStreet.com as the Most Efficient Bank in America, a title we hope to retain in years to come.

In a soft economy, acquisitions can be the best source of growth. During the fiscal year, the Company completed two small transactions. In November, five branches of the former Charter Bank were purchased in New Mexico, improving our presence in Albuquerque and adding two branches in Santa Fe. In December, the former Western National Bank was acquired with FDIC assistance and added an additional branch in Scottsdale, Arizona. A third acquisition, South Valley Bank & Trust, closed after the fiscal year end, adding $800 million in assets and 24 branch locations in southern and central Oregon. That transaction is expected to be accretive to shareholders in the coming year. De novo branching is a less attractive option for growth than in the past and only two de novo branches, in Ahwatukee, Arizona and Yakima, Washington, were opened during the year.

The primary reason for the reduced importance of brick and mortar branches in banking is the rapid adoption of new technology. It will come as no surprise that consumers and businesses are opting to bank online and by smart phone for routine transactions and are using branches less frequently. Washington Federal enhanced its electronic delivery systems during the year with the addition of mobile banking, e-statements, and a personal money management tool known as Snap!. As with the online banking product added a few years ago, customers have rapidly signed up for these new products. This is an area where we will invest heavily over the next few years in order to keep pace with changing customer demands and expectations.

The year-end also brings the retirement of two directors with combined experience of 25 years on the board. Derek Chinn joined the board following the acquisition of his family-owned bank, the United Savings & Loan Bank, in 2003. The institution was founded by his father at a time when Chinese immigrants had very restricted access to the banking system. Derek has been an important link to the Asian-American community in Seattle. His knowledge of this market and his expertise in mortgage lending added a great deal to our decision-making during his time on the board. John Clearman became a director in 1996 and has served as Chairman of the Audit Committee and as Lead Independent Director. His experience and knowledge of accounting and business in general make for a deep store of wisdom that was called on often. Mostly though, we'll miss his common sense and calm

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

demeanor in the face of overzealous critics and situations that others attempted to hype out of proportion. John is always the adult in the room. I hope you'll take a moment to thank both of them for their service representing shareholders though some very interesting and challenging times.

This year we also welcomed two new directors. Randy Talbot built a 35 year career in the insurance industry as the owner of a large agency in New Mexico, served as President of Safeco Life and ultimately served as President, CEO and Director of Symetra Financial Corp, a $35 billion publicly traded life insurance and financial services company headquartered in Bellevue, Washington. Randy also serves as the Lead Independent Director of Concur Technologies (NASDAQ:CNQR), and is currently Managing Director of Talbot Financial, a family office and registered investment advisor. David Grant began his professional life as a certified public accountant with Touche Ross but spent most of his career with publicly traded Shurgard Storage Centers, serving ultimately as Chief Executive Officer and a member of the board. After the sale of Shurgard in 2006, David formed Catalyst Storage Partners and serves as its Managing Director. We are thankful that both Randy and David are willing to serve at a time when so much is expected of directors.

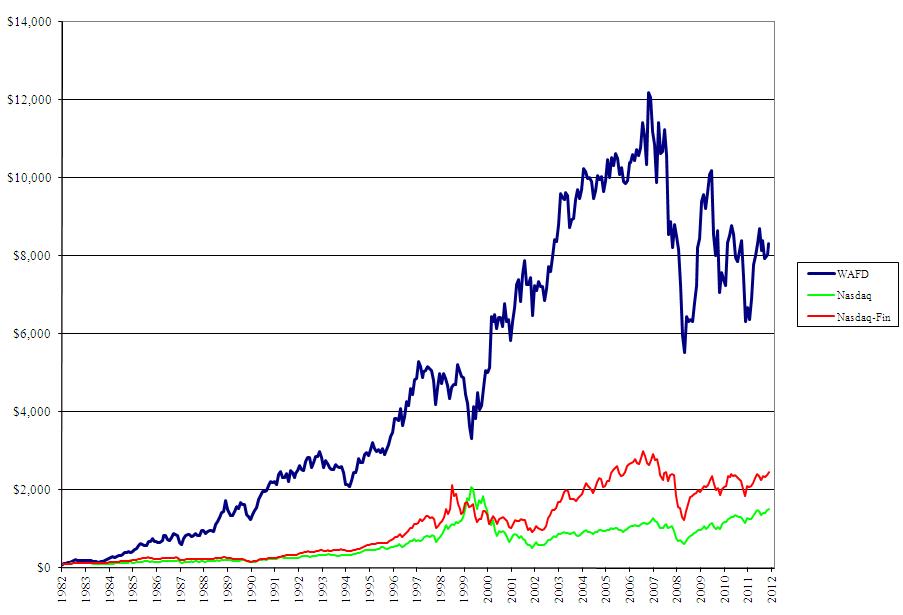

On November 9th, 2012 the Company completed its thirtieth year since the initial public offering in 1982. You might be interested to know that the Company was sold to the public for $32 million that year and since then has reported cumulative net income of nearly $2.7 billion. Shareholders have received 32 times their original investment in cash dividends and the total return on $10,000 invested would be $771,845 today. That's a pretty good return for a company managed to such a low risk profile. Our anniversary gave us a chance to remark upon the contributions of those who came before and to remember their example of stewardship that enabled them to pass the company on to the current board and management team in such great condition. We hope to emulate them for the benefit of the next generation.

Turning to the future, investors in the industry should continue to be realistic in their expectations. Even a great company like Washington Federal is not exempt from the effects of a soft economy and the corresponding low interest rates. The Dodd-Frank Act and heightened regulatory scrutiny will also serve to make the industry less profitable through price controls and new rules that limit our ability to serve certain clients and market segments as we have in the past. The new regulatory climate also requires substantial additional expenses to comply not only with formal regulations, but also with informal regulatory expectations. In this environment it seems unlikely that the industry will experience much overall growth in 2013. Instead, shrinking margins will likely pressure the bottom line of all banks and motivate additional consolidation. Washington Federal is well positioned to be an acquirer, but we intend to be disciplined as we have been in the past. As a way to improve shareholder value, stock repurchases provide a sound alternative to growth from internal or external sources and will be aggressively pursued at prices below or near book value.

In closing, I'd like to express appreciation to the Executive Management Committee, the Company's officers and employees, and the Board of Directors for the combined effort that led to our success during the past year. Each of them will be working on your behalf in the year ahead to safely grow the value of your investment. You can help by sending your friends, relatives, neighbors and business acquaintances to Washington Federal for all their banking needs.

I hope to see you at the 2013 Annual Meeting of Stockholders to be held at 2:00 PM on January 16th at the Red Lion Hotel in downtown Seattle.

Sincerely,

Roy M. Whitehead

Chairman, President and Chief Executive Officer

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

(From left to right) Brent J. Beardall, Executive Vice President, Simon E. Powley, Senior Vice President, Linda S. Brower, Executive Vice President, Mark A. Schoonover, Executive Vice President, Roy M. Whitehead, Chairman, President and CEO, Thomas E. Kasanders, Executive Vice President, Angela D. Veksler, Executive Vice President, Edwin C. Hedlund, Executive Vice President and Secretary, Jack B. Jacobson, Executive Vice President.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

We make statements in this Annual Report on Form 10-K that constitute forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates,” “intends,” “forecasts,” “projects” and other similar expressions as well as future or conditional verbs such as “will,” “should,” “would” and “could” are intended to help identify such forward-looking statements. These statements are not historical facts, but instead represent current expectations, plans or forecasts of the Company and are based on the beliefs and assumptions of the management of the Company and the information available to management at the time that these disclosures were prepared. The Company intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and often are beyond the Company's control. Actual outcomes and results may differ materially from those expressed in, or implied by, the Company's forward-looking statements.

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties discussed elsewhere in this report, including under Item 1A. “Risk Factors,” and in any of the Company's other subsequent Securities and Exchange Commission filings, which could cause our future results to differ materially from the plans, objectives, goals, estimates, intentions, and expectations expressed in forward-looking statements:

| |

| • | a deterioration in economic conditions, including declines in the real estate market and home sale volumes and financial stress on borrowers as a result of the uncertain economic environment; |

| |

| • | the severe effects of the continued economic downturn, including high unemployment rates and declines in housing prices and property values, in our primary market areas; |

| |

| • | the effects of and changes in monetary and fiscal policies of the Board of Governors of the Federal Reserve System and the U.S. Government; |

| |

| • | fluctuations in interest rate risk and changes in market interest rates; |

| |

| • | the Company's ability to make accurate assumptions and judgments about the collectability of its loan portfolio, including the creditworthiness of its borrowers and the value of the assets securing these loans; |

| |

| • | the Company's ability to successfully complete merger and acquisition activities and realize expected strategic and operating efficiencies associated with such activities; |

| |

| • | legislative and regulatory limitations, including those arising under the Dodd-Frank Wall Street Reform Act and potential limitations in the manner in which we conduct our business and undertake new investments and activities; |

| |

| • | the ability of the Company to obtain external financing to fund its operations or obtain this financing on favorable terms; |

| |

| • | changes in other economic, competitive, governmental, regulatory, and technological factors affecting the Company's markets, operations, pricing, products, services and fees; |

| |

| • | the success of the Company at managing the risks involved in the foregoing and managing its business; and |

| |

| • | the timing and occurrence or non-occurrence of events that may be subject to circumstances beyond the Company's control. |

All forward-looking statements speak only as of the date on which such statements are made, and Washington Federal undertakes no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events, changes to future operating results over time, or the impact of circumstances arising after the date the forward-looking statement was made.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

GENERAL

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company. The Company's primary operating subsidiary is Washington Federal (Bank), a federally chartered savings association.

The Company's fiscal year end is September 30th. All references to 2012, 2011 and 2010 represent balances as of September 30, 2012, September 30, 2011 and September 30, 2010, or activity for the fiscal years then ended. References to net income in this document refer to net income available to common shareholders.

CRITICAL ACCOUNTING POLICIES

Preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses in the Company's consolidated financial statements. Accordingly, estimated amounts may fluctuate from one reporting period to another due to changes in assumptions underlying estimated values.

The Company has determined that the only accounting policy critical to an understanding of the consolidated financial statements of Washington Federal relates to the methodology for determining the valuation of the allowance for loan losses, as described below.

The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company's methodology for determining the appropriateness of the allowance consists of several key elements, including the general allowance and specific allowances.

The general loan loss allowance is established by applying a loss percentage factor to each of the different loan types. The allowance is provided based on management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company's control, which may result in losses or recoveries differing from those provided.

Specific allowances are established for loans that are individually evaluated, where management has identified significant conditions or circumstances related to a loan indicating the probability that a loss has been incurred.

INTEREST RATE RISK

The primary source of income for the Company is net interest income, which is the difference between the interest income generated by our interest-earning assets and the interest expense generated by our interest-bearing liabilities. The level of net interest income is a function of the average balances of our interest-earnings assets and liabilities and the spread between the yield on such assets and the cost of such liabilities. These factors are influenced by both the pricing and mix of our interest-earning assets and our interest-bearing liabilities. If the interest rates on our interest-bearing liabilities increase at a faster pace than the interest rates on our interest-earning assets, the result could be a reduction in net interest income, and with it, a reduction in our earnings.

The Company accepts a higher level of interest rate volatility as a result of its significant holdings of fixed-rate single-family home loans that are longer-term than the short-term characteristics of its primary liabilities of customer accounts. As a result, assets do not respond as quickly to changes in interest rates as liabilities. Due to this strategy, net interest income typically would decline when interest rates rise and would expand when interest rates fall as compared to a portfolio of matched maturities of assets and liabilities, if the balance sheet did not change in size or composition.

The Company manages its interest rate risk in part by originating more fixed-rate loans when yields are higher and adding loans and investments with shorter term characteristics, such as construction and commercial loans, when loan rates are lower. This balance sheet strategy, in conjunction with a strong capital position and low operating costs has allowed the Company to manage interest rate risk, within guidelines established by the Board of Directors, through all interest rate cycles. Although a

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

significant increase in market interest rates could adversely affect the net interest income of the Company, the Company's interest rate risk approach has never resulted in the recording of a monthly operating loss.

During the fourth quarter the Company took steps intended to reduce the Company's interest rate risk and improve its future earnings potential. During the quarter, the Company sold $2.3 billion of fixed rate mortgage-backed securities for a pre-tax gain of $95 million. In the same period, the Company pre-paid $876 million of long term debt at a pre-tax loss of $95 million. The weighted average rate on the retired debt was 3.94%. In related transactions, the Company also purchased a mix of short and longer term assets totaling $2.0 billion with an anticipated weighted average yield of 1.83%, and restructured an additional $830 million of long term debt to lengthen maturity and reduce the weighted average rate from 4.48% to 3.43%. These transactions are expected to reduce the volatility of net interest income and stabilize the margin going forward.

The Company's objective in managing its interest rate risk is to grow the amount of net interest income through the rate cycles, acknowledging that there will be some periods of time when that will not be feasible. The chart below shows the volatility of our period end net interest spread (dotted line measured against the right axis) compared to the relatively consistent growth in net interest income (solid line measured against the left axis). This consistency is accomplished by managing the size and composition of the balance sheet through different rate cycles.

The following table shows the estimated repricing periods for earning assets and paying liabilities.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | |

| | Repricing Period | | |

| | Within One

Year | | After 1 year -

before 6 Years | | Thereafter | | Total |

| | (In thousands) | | |

| As of September 30, 2012 | | | | | | | |

| Earning Assets (1) | $ | 5,125,945 |

| | $ | 4,563,372 |

| | $ | 1,929,366 |

| | $ | 11,618,683 |

|

| Paying Liabilities | (6,380,043 | ) | | (3,012,010 | ) | | (1,177,982 | ) | | (10,570,035 | ) |

| Excess (Liabilities) Assets | $ | (1,254,098 | ) | | $ | 1,551,362 |

| | $ | 751,384 |

| | |

| Excess as % of Total Assets | (10.05 | )% | | | | | | |

| Policy limit for one year excess | (35.00 | )% | | | | | | |

(1) Asset repricing period includes estimated prepayments based on historical activity

At September 30, 2012, the Company had approximately 1.3 billion more liabilities than assets subject to repricing in the next year, which amounted to a negative maturity gap of 10.05% of total assets, approximately the same as the prior year. Having this excess of liabilities, relative to assets, that will be repricing within the next year, the Company is subject to decreasing net interest income should interest rates rise. However, if management were to take steps to change the size and/or mix of the balance sheet, rising rates may not cause a decrease in net interest income.Cash and cash equivalents of $751,430,000 and stockholders' equity of $1,899,752,000 provides management with flexibility in managing interest rate risk going forward.

The interest rate spread decreased to 2.80% at September 30, 2012 from 3.13% at September 30, 2011. Net interest spread represents the difference between the contractual rates of earning assets and the contractual rates of paying liabilities as of a specific date. The spread decreased due to lower asset yields. Rates on customer accounts decreased by 79 basis points over the prior year while rates on earning assets decreased by 24 basis points (see Period End Spread table below).

As of September 30, 2012, total assets decreased by $967,805,000, or 7.20%, from $13,440,749,000 at September 30, 2011. For the year ended September 30, 2012, compared to September 30, 2011, loans (both non-covered and covered) decreased $577,686,000, or 6.94%, while investment securities decreased $328,988,000, or 9.96%.

ASSET QUALITY & ALLOWANCE FOR LOAN LOSSES

The Company maintains an allowance to absorb losses inherent in the loan portfolio. The amount of the allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company's methodology for determining the appropriateness of the allowance consists of several key elements, including the general allowance and specific allowances.

The general portion of the loan loss allowance is established by applying a loss percentage factor to the different loan types. Management believes loan types are the most relevant factor in the allowance calculation for group of homogeneous loans as the risk characteristics within these groups are similar. The loss percentage factor is made up of two parts - the historical loss factor (“HLF”) and the qualitative loss factor (“QLF”). The HLF takes into account historical charge-offs, while the QLF is determined by loan type and allows management to augment reserve levels to reflect the current environment and portfolio performance trends including recent charge-off trends. Allowances are provided based on management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions, and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company's control, which may result in losses or recoveries differing from those estimated.

Specific allowances are established for loans which are individually evaluated; in cases where management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Loans for commercial purposes, including multi-family loans, builder construction loans and commercial loans are reviewed on an individual basis to assess the ability of the borrowers to continue to service all of their principal and interest obligations. If a loan shows signs of weakness, it is downgraded and, if warranted, placed on non-accrual status. On collateral dependent commercial loans, updated valuations are generally obtained from external sources when a loan exhibits weakness or is modified. The Company also has an asset quality review function that reports the results of its internal reviews to the Board of Directors on a quarterly basis.

Restructured single-family residential loans are reserved for under the Company's general reserve methodology. If any individual loan is significant in balance, the Company may establish a specific reserve as warranted.

Most restructured loans are accruing and performing loans where the borrower has proactively approached the Company about modifications due to temporary financial difficulties. Each request is individually evaluated for merit and likelihood of success. As of September 30, 2012 single-family residential loans comprised 83% of restructured loans. The concession for these loans is typically a payment reduction through a rate reduction of from 100 to 200 bps for a specific term, usually six to twelve months. Interest-only payments may also be approved during the modification period. The subsequent default rate on restructured single- family mortgage loans has been 14.5% for the last two years. Concessions for construction (3.7%), land A&D (3.5%) and multi-family loans (4.0%) are typically an extension of maturity combined with a rate reduction of normally 100 bps. The subsequent default rate on restructured commercial loans has been 5.8% over the last two years.

For commercial loans, six consecutive payments on newly restructured loan terms are required prior to returning the loan to accrual status. In some instances after the required six consecutive payments are made a management assessment will conclude that collection of the entire principal balance is still in doubt. In those instances, the loan will remain on non-accrual. Homogeneous loans may or may not be on accrual status at the time of restructuring, but all are placed on accrual status upon the restructuring of the loan. Homogeneous loans are restructured only if the borrower can demonstrate the ability to meet the restructured payment terms; otherwise, collection is pursued and the loan remains on non-accrual status until liquidated. If the homogeneous restructured loan does not perform it is placed in non-accrual status when it is 90 days delinquent.

A loan that defaults and is subsequently modified would impact the Company's delinquency trend, which is part of the QLF component of the general reserve calculation. Any modified loan that re-defaults and is charged-off would impact the HLF component of our general reserve calculation.

Non-performing assets were $272,905,000, or 2.19%, of total assets, at September 30, 2012, compared to $370,294,000, or 2.76%, of total assets, at September 30, 2011. This continued elevated level of non-performing assets is a result of the significant decline in housing values in the western United States and the national recession over the last three years. This level of non-performing assets remains significantly higher than the 0.91% average over the Company's 30+ year history as a public company.

The following table details non-performing asset by type, comparing 2012 and 2011.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | |

| | | September 30, | | | | |

| Non-Performing Assets | | 2012 | | 2011 | | $ Change | | % Change |

| | | (In thousands) | | |

| Non-accrual loans: | | | | | | | | |

| Single-family residential | | $ | 131,193 |

| | $ | 126,624 |

| | $ | 4,569 |

| | 3.6 | % |

| Construction – speculative | | 10,634 |

| | 15,383 |

| | (4,749 | ) | | (30.9 | ) |

| Construction – custom | | 539 |

| | 635 |

| | (96 | ) | | (15.1 | ) |

| Land – acquisition & development (A&D) | | 13,477 |

| | 37,339 |

| | (23,862 | ) | | (63.9 | ) |

| Land – consumer lot loans | | 5,149 |

| | 8,843 |

| | (3,694 | ) | | (41.8 | ) |

| Multi-Family | | 4,185 |

| | 7,664 |

| | (3,479 | ) | | (45.4 | ) |

| Commercial real estate | | 7,653 |

| | 11,380 |

| | (3,727 | ) | | (32.8 | ) |

| Commercial & industrial | | 16 |

| | 1,679 |

| | (1,663 | ) | | (99.0 | ) |

| HELOC | | 198 |

| | 481 |

| | (283 | ) | | (58.8 | ) |

| Consumer | | 383 |

| | 437 |

| | (54 | ) | | (12.4 | ) |

| Total non-accrual loans | | 173,427 |

| | 210,465 |

| | (37,038 | ) | | (17.6 | ) |

| Total REO & REHI | | 99,478 |

| | 159,829 |

| | (60,351 | ) | | (37.8 | ) |

| Total non-performing assets | | $ | 272,905 |

| | $ | 370,294 |

| | $ | (97,389 | ) | | (26.3 | )% |

| | | | | | | | | |

In response to the improving overall credit quality of our loan portfolio, the total allowance for loan loss decreased by $24,013,000, or 15.3%, over 2011. $117,164,000 of the allowance is calculated under the formulas contained in our general allowance methodology and the remaining $15,983,000 is made up of specific reserves on loans that were deemed to be impaired at September 30, 2012. The general reserve increased by $1,916,000, or 1.7%, to $117,164,000 while the specific reserve decreased by $25,929,000, or 61.9%. The primary reasons for the shift in total allowance allocation from specific reserves to general reserves is due to the Company having already addressed many of the problem loans focused in the speculative construction and land A&D portfolios, combined with above normal delinquencies and elevated charge-offs in the single-family residential portfolio.

LIQUIDITY AND CAPITAL RESOURCES

The principal sources of funds for the Company's activities are retained earnings, loan repayments (including prepayments), net deposit inflows, repayments and sales of investments and borrowings. Washington Federal's principal sources of revenue are interest on loans and interest and dividends on investments.

The Company's net worth at September 30, 2012, was $1,899,752,000 or 15.2%, of total assets. This is a decrease of $6,781,000 from September 30, 2011, when net worth was $1,906,533,000, or 14.2%, of total assets. The Company's net worth was impacted in the year by net income of $138,183,000, the payment of $34,115,000 in cash dividends, treasury stock purchases that totaled $41,914,000, as well as an decrease in other comprehensive income of $72,483,000. The Company paid out 23.5% of its 2012 earnings in cash dividends to common shareholders, compared with 24.0% last year. Over the long term, the Company would prefer its dividend payout ratio to be less than 50.0%. For the year ended September 30, 2012, $76,029.000, or 55.0%, of net income was returned to shareholders in the form of cash dividends or share repurchases.

Management believes this strong net worth position will help the Company manage its interest rate risk and provide the capital support needed for controlled growth in a regulated environment.

The Company has a credit line with the Federal Home Loan Bank of Seattle (FHLB) equal to 50.0% of total assets, providing a substantial source of liquidity if needed. FHLB advances are collateralized as provided for in the Advances, Pledge and Security Agreement by all FHLB stock owned by the Company, deposits with the FHLB and certain mortgages or deeds of trust securing such properties as provided in the agreements with the FHLB.

The Company's cash and cash equivalents amounted to $751,430,000 at September 30, 2012, a 7.9% decrease from the cash and cash equivalents balance of $816,002,000 one year ago. The Company continues to maintain higher than normal amounts of liquidity due to concern about potentially rising interest rates in the future. Additionally, see “Interest Rate Risk” above and the “Statement of Cash Flows” included in the financial statements.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CHANGES IN FINANCIAL CONDITION

Available-for-sale and held-to-maturity securities. Available for sale securities decreased $1,473,439,000, or 45.3% during the year ended September 30, 2012. This net decrease included the purchase of $2,442,184,000 of available-for-sale investment securities, net sales $2,257,913,000 of available-for-sale securities at a gain of $95,234,000 and principal repayments of $1,608,603,000. Held to maturity securities increased $1,144,451,000 during the year ended September 30, 2012. This increase included the purchase of $1,167,121,000 of held to maturity securities. As of September 30, 2012, the Company had net unrealized gains on available-for-sale securities of $13,306,000, net of tax, which were recorded as part of stockholders' equity. These changes in the available for sale and held to maturity investment portfolios were part of the balance sheet restructuring the Company completed in August 2012 to reduce the Company's interest rate risk, help limit potential margin compression from prepayments on securities, improve its future earnings potential and provide more financial flexibility in the future.

Loans receivable. Loans receivable decreased $483,879,000, or 6.1%, to $7,451,998,000 at September 30, 2012, from $7,935,877,000 one year earlier. This decrease resulted primarily from loan repayments (including prepayments) of $1,855,484,000, which exceeded originations of $1,390,278,000 by $465,206,000. This decrease is consistent with management's strategy to reduce the Company's exposure to land and construction loans and not to aggressively compete for 30 year fixed-rate loans at rates below 4.00%, due to the duration risk associated with such low mortgage rates, which contributed to the net run off of the loan portfolio. Additionally, during the year, $160,971,000 of loans were transferred to REO. If the current low rates on 30 year fixed-rate mortgages persist, management will consider continuing to shrink the Company's loan portfolio. The following table shows the change in the geographic distribution by state of the gross loan portfolio from 2011 to 2012.

|

| | | | | | |

| 2012 | 2011 | Change |

| Washington | 46.1 | % | 46.6 | % | (0.5 | )% |

| Oregon | 16.6 |

| 17.4 |

| (0.8 | )% |

| Other | 5.5 |

| 5.2 |

| 0.3 | % |

| Idaho | 6.0 |

| 6.6 |

| (0.6 | )% |

| Arizona | 11.1 |

| 9.1 |

| 2.0 | % |

| Utah | 7.3 |

| 7.6 |

| (0.3 | )% |

| New Mexico | 3.8 |

| 3.8 |

| — | % |

| Texas | 2.1 |

| 1.9 |

| 0.2 | % |

| Nevada | 1.5 |

| 1.8 |

| (0.3 | )% |

| 100.0 | % | 100.0 | % |

|

Covered loans. As of September 30, 2012, covered loans had decreased 24.5%, or $93,807,000, to $288,376,000, compared to September 30, 2011, due to continued paydowns and transfers of the properties into covered real estate owned. This portfolio of loans is expected to continue to decline over time, absent another FDIC assisted transaction.

Real estate held for sale. Real estate held for sale decreased by $60.4 million or 37.8% to $99,478,000 from $159,829,000 as of September 30, 2011, as the Company has continued to liquidate foreclosed properties. During the year the Company sold 663 properties for net proceeds of $142.8 million and a net loss on sale of $15.9 million. The total net loss on sale of real estate, measured against the original loan balance of $266.5 million, was $123.6 million or 46.4% for properties sold in fiscal 2012. Net loss on real estate acquired through foreclosure, which includes gains and the aforementioned losses on sale, ongoing maintenance expense and periodic write-downs from lower valuations, decreased by 75.5% from the prior year to $9.8 million. This decrease is due to land prices stabilizing in 2012, compared to the significant depreciation of land values in 2010 - 2011. As of September 30, 2012, real estate held for sale consisted of 449 properties totaling $99.5 million. Land represents $47.6 million or 48.0% of total real estate held for sale.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Intangible assets. The Company's intangible assets are made up of $251,653,000 of goodwill, servicing rights intangible of $286,000, as well as the unamortized balances of the core deposit intangible of $4,137,000 at September 30, 2012.

Customer deposits. Customer deposits at September 30, 2012, totaled $8,576,618,000 compared with $8,665,903,000 at September 30, 2011, a 1.0% decrease. However, the Company was able to grow transaction accounts by $284,265,000 or 10.7%, while time deposits decreased by $373,550,000 or 6.2%. The weighted average rate paid on customer deposits during the year was 0.99%, a decrease of 33 basis points from the previous year, as a result of the low interest rate environment.

FHLB advances and other borrowings. Total borrowings decreased $882,066,000 or 31.94%, to $1,880,000,000 at September 30, 2012 as part of the balance sheet restructuring in August 2012. See “Interest Rate Risk” above.

Contractual obligations. The following table presents, as of September 30, 2012, the Company's significant fixed and determinable contractual obligations, within the categories described below, by payment date or contractual maturity.

|

| | | | | | | | | | | | | | | | |

| Contractual Obligations | | Total | | Less than

1 Year | | 1 to 5

Years | | Over 5

Years |

| | | (In thousands) |

| Debt obligations (1) | | $ | 1,880,000 |

| | $ | — |

| | $ | 750,000 |

| | $ | 1,130,000 |

|

| Operating lease obligations | | 11,719 |

| | 3,303 |

| | 6,703 |

| | 1,713 |

|

| | | $ | 1,891,719 |

| | $ | 3,303 |

| | $ | 756,703 |

| | $ | 1,131,713 |

|

(1) Represents final maturities of debt obligations.

These contractual obligations, except for the operating leases, are included in the Consolidated Statements of Financial Condition. The payment amounts represent those amounts contractually due.

RESULTS OF OPERATIONS

GENERAL

See Note P, “Selected Quarterly Financial Data (Unaudited),” which highlights the quarter-by-quarter results for the years ended September 30, 2012 and 2011.

COMPARISON OF 2012 RESULTS WITH 2011

In 2012 net income increased $27,042,000, or 24.3%, to $138,183,000 for the year ended September 30, 2012 as compared to $111,141,000 for the year ended September 30, 2011. The net income for the twelve months ended September 30, 2012 benefited from overall lower credit costs, which included the provision for loan losses and net loss on real estate owned. The provision for loan losses amounted to $44,955,000 for the year ended September 30, 2012, as compared to $93,104,000 for the year ago period. In additions, losses recognized on real estate acquired through foreclosure was $9,819,000 for the year ended September 30, 2012, as compared to $40,050,000 for the fiscal year ended September 30, 2011.

The table below sets forth certain information regarding changes in interest income and interest expense of the Company for the 2012. For each category of interest-earning asset and interest-bearing liability, information is provided on changes

attributable to: (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old average volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

| | | | | | | | | |

| | Year Ended

September 30, 2012 |

| | Volume | Rate | Total |

| Interest income: | | | |

| Loans and covered assets | $ | (36,593 | ) | $ | (804 | ) | $ | (37,397 | ) |

| Mortgaged-backed securities | 21,346 |

| (33,411 | ) | (12,065 | ) |

| Investments (1) | 799 |

| (5,701 | ) | (4,902 | ) |

| | | | |

| All interest-earning assets | (14,448 | ) | (39,916 | ) | (54,364 | ) |

| | | | |

| Interest expense: | | | |

| Customer accounts | (795 | ) | (28,101 | ) | (28,896 | ) |

| FHLB advances and other borrowings | (1,741 | ) | (3,810 | ) | (5,551 | ) |

| | | | |

| All interest-bearing liabilities | (2,536 | ) | (31,911 | ) | (34,447 | ) |

| | | | |

| Change in net interest income | $ | (11,912 | ) | $ | (8,005 | ) | $ | (19,917 | ) |

| | | | |

| (1) Includes interest on cash equivalents and dividends on FHLB stock | | | |

The Company recorded a $44,955,000 provision for loan losses in 2012 compared to $93,104,000 in 2011. Non-performing assets (NPA's) decreased by $97,389,000 over 2011. The Company had net charge-offs of $69,721,000 for the twelve months ended September 30, 2012 compared with $98,285,000 of net charge-offs for the same period one year ago. The decrease in the provision for loan losses is in response to four primary factors: first, the amount of NPA's improved year-over-year; second, non-accrual loans as a percentage of total loans decreased from 2.54% at September 30, 2011, to 2.20% at September 30, 2012; third, the percentage of loans 30 days or more delinquent decreased from 3.43% at September 30, 2011, to 2.57% at September 30, 2012; and finally, the Company's exposure in the land A&D and speculative construction portfolios, the source of the majority of losses during this credit cycle, has decreased from a combined 4.10% of the gross loan portfolio at September 30, 2011, to 3.30% at September 30, 2012. Management believes the allowance for loan losses, totaling $133,147,000, or 1.69% of gross loans, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income decreased $9,416,000, or 36.3%, in 2012 from 2011. During the fiscal year ended September 30, 2012, the Company sold $2.4 billion of fixed rate mortgage backed securities, recognizing a $95.2 million gain. In addition, the Company prepaid $876 million in long term debt realizing a loss of $95.5 million. The net effect is a loss of $331,000 for the twelve months ended September 30, 2012 compared to $8.1 million in realized gains on the sale of $131.3 million of available for sale securities during the fiscal year ended September 30, 2011.

Compensation expense increased $5,594,000, or 7.8%, in 2012 primarily due to bonus accruals as the result of increased net income and the addition of the employees from the Charter Bank acquisition October 2011 and the Western National Bank transaction with the FDIC in December 2011. The number of staff, including part-time employees on a full-time equivalent basis, was 1,260 and 1,221 at September 30, 2012 and 2011, respectively.

Occupancy expense increased to $15,971,000 for the twelve months ended September 30, 2012 from $14,480,000 for the fiscal year ended September 30, 2011 as a result of increased branch facilities through both acquisition and de novo growth. The branch network consisted of 166 offices at September 30, 2012 and 160 offices at September 30, 2011. The number of branches has increased subsequent to the fiscal year end to 190, due to the South Valley Acquisition on October 31, 2012.

FDIC insurance expense decreased to $16,093,000 for 2012 from $20,582,000 in 2011. The FDIC instituted a new assessment basis in the fourth quarter of fiscal 2011, which resulted in an overall lower insurance expense for the Company.

Other expenses increased 17.41% to $34,631,000 for the twelve months ended September 30, 2012 from $29,496,000 for the comparable period one year ago. This increase is due in large part to the two acquisitions discussed above and increased information technology and advertising expenses. Operating expense for 2012 and 2011 equaled 1.07% and 1.01% of average

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

assets, respectively. Despite the increase in operating expenses, the Company continues to operate as one of the most efficient financial institutions in the country.

The loss on real estate acquired through foreclosure decreased 75.5% to $9,819,000 in 2011 from $40,050,000 in 2011, due primarily to the decline in balances of real estate acquired through foreclosure, as the Company continues to liquidate foreclosed properties. The net loss on real estate acquired through foreclosure, includes gains and losses on sale, ongoing maintenance expense and periodic write-downs from lower property valuations.

Income tax expense increased to $77,728,000 in 2012 from $62,518,000 for the fiscal year ended September 30, 2011. The effective tax rate was 36.00% for September 30, 2012 and 2011. The Company expects an effective tax rate of 36.00% going forward.

COMPARISON OF 2011 RESULTS WITH 2010

In 2011 net income decreased $7,512,000, or 6.3%, to $111,141,000 for the year ended September 30, 2011 as compared to $118,653,000 for the year ended September 30, 2010. The net income for the year ended September 30, 2010 included a $54,789,000 after tax gain on the acquisition of Horizon and a $38,865,000 tax benefit related to the settlement of a contingent tax liability. Excluding these two non-recurring items from the prior year, net income increased by $86.1 million, or 345%. The net income for the twelve months ended September 30, 2011 benefited from overall lower credit costs, which included the provision for loan losses and real estate owned expenses. The provision for loan losses amounted to $93,104,000 for the year ended September 30, 2011, as compared to $179,909,000 for the year ago period. In additions, losses recognized on real estate acquired through foreclosure was $40,050,000 for the year ended September 30, 2011, as compared to $80,475,000 for the fiscal year ended September 30, 2010.

The table below sets forth certain information regarding changes in interest income and interest expense of the Company for the 2011. For each category of interest-earning asset and interest-bearing liability, information is provided on changes

attributable to: (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old average volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

|

| | | | | | | | | |

| | Year Ended

September 30, 2011 |

| | Volume | Rate | Total |

| | (In thousands) |

| Interest income: | | | |

| Loans and covered assets | $ | (36,101 | ) | $ | (2,738 | ) | $ | (38,839 | ) |

| Mortgaged-backed securities | 25,601 |

| (9,169 | ) | 16,432 |

|

| Investments (1) | (142 | ) | 3,624 |

| 3,482 |

|

| | | | |

| All interest-earning assets | (10,642 | ) | (8,283 | ) | (18,925 | ) |

| | | | |

| Interest expense: | | | |

| Customer accounts | 2,684 |

| (33,209 | ) | (30,525 | ) |

| FHLB advances and other borrowings | (8,315 | ) | (2,565 | ) | (10,880 | ) |

| | | | |

| All interest-bearing liabilities | (5,631 | ) | (35,774 | ) | (41,405 | ) |

| | | | |

| Change in net interest income | $ | (5,011 | ) | $ | 27,491 |

| $ | 22,480 |

|

The Company recorded a $93,104,000 provision for loan losses in 2011 compared to $179,909,000 in 2010. Non-performing assets (NPA's) decreased by $64,236,000 over 2010. The Company had net charge-offs of $98,284,000 for the twelve months

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ended September 30, 2011 compared with $183,651,000 of net charge-offs for the same period one year ago. The decrease in the provision for loan losses is in response to four primary factors: first, the amount of NPA's improved year-over-year; second, non-accrual loans as a percentage of total loans decreased from 2.80% at September 30, 2010, to 2.54% at September 30, 2011; third, the percentage of loans 30 days or more delinquent decreased from 3.53% at September 30, 2010, to 3.43% at September 30, 2011; and finally, the Company's exposure in the land A&D and speculative construction portfolios, the source of the majority of losses during this period of the cycle, has decreased from a combined 5.40% of the gross loan portfolio at September 30, 2010, to 4.10% at September 30, 2011. Management expects the provision to remain elevated until housing values stabilize. Management believes the allowance for loan losses, totaling $157,160,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income decreased $94,497,000, or 78.5%, in 2011 from 2010. The year ended September 30, 2010, included an $85,608,000 non-recurring gain on the acquisition of Horizon (see Note A).

Compensation expense increased $2,155,000, or 3.1%, in 2011 primarily due to operating for a full year with the Horizon branches. The number of personnel, including part-time employees considered on a full-time equivalent basis, decreased to 1,221 at September 30, 2011, compared to one year ago.

Occupancy expense increased slightly to $14,480,000 for the twelve months ended September 30, 2011 from $13,933,000 for the fiscal year ended September 30, 2010. The branch network consisted of 160 offices at both September 30, 2011 and 2010.

FDIC insurance expense increased to $20,582,000 for 2011 from $18,626,000 in 2010 as a result of the significant increase in the number of bank failures during the year which has depleted the FDIC fund. The FDIC has undertaken to replenish the FDIC fund through changes to the assessment calculation, special assessments and higher insurance premiums for all insured depository institutions.

Other expenses increased slightly to $29,496,000 for the twelve months ended September 30, 2011 from $28,830,000 for the comparable period one year ago. Operating expense for 2011 and 2010 equaled 1.01% and 0.98% of average assets, respectively. Despite the increase in operating expenses, the Company continues to operate as one of the most efficient financial institutions in the country.

The loss on real estate acquired through foreclosure decreased 50.2% to $40,050,000 in 2011 from $80,475,000 in 2010, due primarily to the decline in balances of real estate acquired through foreclosure, as the Company continues to liquidate foreclosed properties. The net loss on real estate acquired through foreclosure, includes gains and losses on sale, ongoing maintenance expense and periodic write-downs from lower property valuations.

Income tax expense increased to $62,518,000 in 2011 from $4,372,000 for the fiscal year ended September 30, 2010. The fiscal 2010 amount included a $38,865,000 tax benefit related to the settlement of a contingent tax liability (see Note A). The effective tax rate was 36.00% for 2011 versus 3.55% for 2010. The Company expects an effective tax rate of 36.00% going forward.

PERIOD END SPREAD - AS OF THE DATE SHOWN

|

| | | | | | | | | | | | | | | | | | | | | | | |

| DEC 2010 |

| MAR 2011 |

| JUN 2011 |

| SEP 2011 |

| DEC 2011 |

| MAR 2012 |

| JUN 2012 |

| SEP 2012 |

| Interest rate on loans and mortgage-backed securities | 5.66 | % |

| 5.58 | % |

| 5.49 | % |

| 5.43 | % |

| 5.32 | % |

| 5.23 | % |

| 5.15 | % |

| 4.72 | % |

| Interest rate on investment securities | 1.30 |

|

| 1.11 |

|

| 1.26 |

|

| 0.98 |

|

| 0.93 |

|

| 1.84 |

|

| 1.47 |

|

| 1.41 |

|

| Combined | 5.12 |

|

| 5.05 |

|

| 5.07 |

|

| 4.97 |

|

| 4.85 |

|

| 4.72 |

|

| 4.57 |

|

| 4.18 |

|

| Interest rate on customer accounts | 1.40 |

|

| 1.32 |

|

| 1.24 |

|

| 1.14 |

|

| 1.03 |

|

| 0.98 |

|

| 0.95 |

|

| 0.90 |

|

| Interest rate on borrowings | 4.14 |

|

| 4.14 |

|

| 4.14 |

|

| 4.04 |

|

| 4.04 |

|

| 4.04 |

|

| 4.04 |

|

| 3.59 |

|

| Combined | 2.03 |

|

| 1.98 |

|

| 1.92 |

|

| 1.84 |

|

| 1.74 |

|

| 1.71 |

|

| 1.69 |

|

| 1.38 |

|

| Interest rate spread | 3.09 | % |

| 3.07 | % |

| 3.15 | % |

| 3.13 | % |

| 3.11 | % |

| 3.01 | % |

| 2.88 | % |

| 2.80 | % |

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2012 ANNUAL REPORT

The interest rate spread decreased during 2012 from 3.13% at September 30, 2011 to 2.80% at September 30, 2012. See “Interest Rate Risk” section above.

SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | |

| Year ended September 30, | 2012 | 2011 | 2010 | 2009 | 2008 |

| | (In thousands, except per share data) |

| Interest income | $ | 590,271 |

| $ | 644,635 |

| $ | 663,560 |

| $ | 691,774 |

| $ | 701,428 |

|

| Interest expense | 193,249 |

| 227,696 |

| 269,101 |

| 318,627 |

| 397,641 |

|

| Net interest income | 397,022 |

| 416,939 |

| 394,459 |

| 373,147 |

| 303,787 |

|

| Provision for loan losses | 44,955 |

| 93,104 |

| 179,909 |

| 193,000 |

| 60,516 |

|

| Other income | 6,698 |

| (14,117 | ) | 39,955 |

| 2,655 |

| (60,212 | ) |

| Other expense | 142,854 |

| 136,059 |

| 131,480 |

| 107,060 |

| 87,220 |

|

| Income before income taxes | 215,911 |

| 173,659 |

| 123,025 |

| 75,742 |

| 95,839 |

|

| Income taxes | 77,728 |

| 62,518 |

| 4,372 |

| 27,570 |

| 33,507 |

|

| Net income | $ | 138,183 |

| $ | 111,141 |

| $ | 118,653 |

| $ | 48,172 |

| $ | 62,332 |

|

| Preferred dividends accrued | — |

| — |

| — |

| 7,488 |

| — |

|

| Net income available to common shareholders | $ | 138,183 |

| $ | 111,141 |

| $ | 118,653 |

| $ | 40,683 |

| $ | 62,332 |

|

| Per share data | | | | | |

| Basic earnings | $ | 1.29 |

| $ | 1.00 |

| $ | 1.06 |

| $ | 0.46 |

| $ | 0.71 |

|

| Diluted earnings | 1.29 |

| 1.00 |

| 1.05 |

| 0.46 |

| 0.71 |

|

| Cash dividends | 0.32 |

| 0.24 |

| 0.20 |

| 0.20 |

| 0.84 |

|

| | | | | | |

| September 30, | 2012 | 2011 | 2010 | 2009 | 2008 |

| Total assets | $ | 12,472,944 |

| $ | 13,440,749 |

| $ | 13,486,379 |

| $ | 12,582,475 |

| $ | 11,830,141 |

|

| Loans and mortgage-backed securities | 9,812,666 |

| 10,992,053 |

| 10,626,842 |

| 11,266,295 |

| 11,053,223 |

|

| Investment securities | 612,524 |

| 246,004 |

| 358,061 |

| 21,259 |

| 49,001 |

|

| Cash and cash equivalents | 751,430 |

| 816,002 |

| 888,622 |

| 498,388 |

| 82,600 |

|

| Customer accounts | 8,576,618 |

| 8,665,903 |

| 8,852,540 |

| 7,842,310 |

| 7,169,539 |

|

| FHLB advances | 1,880,000 |

| 1,962,066 |

| 1,865,548 |

| 2,078,930 |

| 1,998,308 |

|

| Other borrowings | — |

| 800,000 |

| 800,000 |

| 800,600 |

| 1,177,600 |

|

| Stockholders’ equity | 1,899,752 |

| 1,906,533 |

| 1,841,147 |

| 1,745,485 |

| 1,332,674 |

|

| Number of | | | | | |

| Customer accounts | 308,282 |

| 309,532 |

| 327,430 |

| 305,129 |

| 298,926 |

|

| Loans | 37,522 |

| 39,986 |

| 42,540 |

| 44,453 |

| 47,331 |

|

| Offices | 166 |

| 160 |

| 160 |

| 150 |

| 148 |

|

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

|

| | | | | | | |

| September 30, | 2012 | | 2011 |

| | (In thousands, except share data) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 751,430 |

| | $ | 816,002 |

|

| Available-for-sale securities, including encumbered securities of $0 and $965,927, at fair value | 1,781,705 |

| | 3,255,144 |

|

| Held-to-maturity securities, including encumbered securities of $0 and $45,086, at amortized cost | 1,191,487 |

| | 47,036 |

|

| Loans receivable, net | 7,451,998 |

| | 7,935,877 |

|

| Covered loans, net | 288,376 |

| | 382,183 |

|

| Interest receivable | 46,857 |

| | 52,332 |

|

| Premises and equipment, net | 178,845 |

| | 166,593 |

|

| Real estate held for sale | 99,478 |

| | 159,829 |

|

| Covered real estate held for sale | 29,549 |

| | 56,383 |

|

| FDIC indemnification asset | 87,571 |

| | 101,634 |

|

| FHLB stock | 149,840 |

| | 151,755 |

|

| Intangible assets, including goodwill of $251,653 | 256,076 |

| | 256,271 |

|

| Federal and state income taxes, net | 22,513 |

| | — |

|

| Other assets | 137,219 |

| | 59,710 |

|

| | $ | 12,472,944 |

| | $ | 13,440,749 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | | | |

| Customer accounts | | | |

| Transaction deposit accounts | $ | 2,946,453 |

| | $ | 2,662,188 |

|

| Time deposit accounts | 5,630,165 |

| | 6,003,715 |

|

| | 8,576,618 |

| | 8,665,903 |

|

| FHLB advances | 1,880,000 |

| | 1,962,066 |

|

| Other borrowings | — |

| | 800,000 |

|

| Advance payments by borrowers for taxes and insurance | 40,041 |

| | 39,548 |

|

| Federal and State income taxes, including net deferred assets (liabilities) of $8,449 and $(17,075) | — |

| | 1,535 |

|

| Accrued expenses and other liabilities | 76,533 |

| | 65,164 |

|

| | 10,573,192 |

| | 11,534,216 |

|

| Stockholders’ equity | | | |

Common stock, $1.00 par value, 300,000,000 shares authorized;

129,950,223 and 129,853,534 shares issued; 106,177,615 and 108,976,410 shares outstanding | 129,950 |

| | 129,854 |

|

| Paid-in capital | 1,586,295 |

| | 1,582,843 |

|

| Accumulated other comprehensive income, net of taxes | 13,306 |

| | 85,789 |

|

| Treasury stock, at cost; 23,772,608 and 20,877,124 shares | (310,579 | ) | | (268,665 | ) |

| Retained earnings | 480,780 |

| | 376,712 |

|

| | 1,899,752 |

| | 1,906,533 |

|

| | $ | 12,472,944 |

| | $ | 13,440,749 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| | | | | | | | | |

| Year ended September 30, | 2012 | 2011 | 2010 |

| | (In thousands, except per share data) |

| INTEREST INCOME | | | |

| Loans | $ | 484,833 |

| $ | 522,230 |

| $ | 561,069 |

|

| Mortgage-backed securities | 96,142 |

| 108,207 |

| 91,775 |

|

| Investment securities and cash equivalents | 9,296 |

| 14,198 |

| 10,716 |

|

| | 590,271 |

| 644,635 |

| 663,560 |

|

| INTEREST EXPENSE | | | |

| Customer accounts | 86,939 |

| 115,835 |

| 146,360 |

|

| FHLB advances and other borrowings | 106,310 |

| 111,861 |

| 122,741 |

|

| | 193,249 |

| 227,696 |

| 269,101 |

|

| Net interest income | 397,022 |

| 416,939 |

| 394,459 |

|

| Provision for loan losses | 44,955 |

| 93,104 |

| 179,909 |

|

| Net interest income after provision for loan losses | 352,067 |

| 323,835 |

| 214,550 |

|

| OTHER INCOME | | | |

| Gain on FDIC-assisted transaction | — |

| — |

| 85,608 |

|

| Prepayment penalty on long-term debt | (95,565 | ) | — |

| (8,150 | ) |

| Gain on sale of investments | 95,234 |

| 8,147 |

| 22,409 |

|

| Other | 16,848 |

| 17,786 |

| 20,563 |

|

| | 16,517 |

| 25,933 |

| 120,430 |

|

| OTHER EXPENSE | | | |

| Compensation and benefits | 77,628 |

| 72,034 |

| 69,879 |

|

| Amortization of intangibles | 1,509 |

| 1,447 |

| 2,140 |

|

| Occupancy | 15,971 |

| 14,480 |

| 13,933 |

|

| FDIC insurance premiums | 16,093 |

| 20,582 |

| 18,626 |

|

| Other | 34,631 |

| 29,496 |

| 28,830 |

|

| Deferred loan origination costs | (2,978 | ) | (1,980 | ) | (1,928 | ) |

| | 142,854 |

| 136,059 |

| 131,480 |

|

| Loss on real estate acquired through foreclosure, net | (9,819 | ) | (40,050 | ) | (80,475 | ) |

| Income before income taxes | 215,911 |

| 173,659 |

| 123,025 |

|

| Income taxes | | | |

| Current | 61,138 |

| 88,373 |

| (19,890 | ) |

| Deferred | 16,590 |

| (25,855 | ) | 24,262 |

|

| | 77,728 |

| 62,518 |

| 4,372 |

|

| NET INCOME | 138,183 |

| 111,141 |

| 118,653 |

|

| Preferred dividends accrued | — |

| — |

| — |

|

| Net income available to common shareholders | $ | 138,183 |

| $ | 111,141 |

| $ | 118,653 |

|

| | | | |

| PER SHARE DATA | | | |

| Basic earnings | $ | 1.29 |

| $ | 1.00 |

| $ | 1.06 |

|

| Diluted earnings | 1.29 |

| 1.00 |

| 1.05 |

|

| Cash dividends per share | 0.32 |

| 0.24 |

| 0.20 |

|

| Basic weighted average number of shares outstanding | 107,108,703 |

| 111,383,877 |

| 112,438,059 |

|

| Diluted weighted average number of shares outstanding, including dilutive stock options | 107,149,240 |

| 111,460,106 |

| 112,745,261 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

| | | | | | | | | | | |

| | 2012 | | 2011 | | 2010 |

| | (In thousands) |

| | | | | | |

| Net income | $ | 138,183 |

| | $ | 111,141 |

| | $ | 118,653 |

|

| Other comprehensive income (loss) net of tax: | | | | | |