This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Washington Federal’s management and are subject to significant risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of the presentation, and Washington Federal assumes no duty, and does not undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking statements. 1 Investor Presentation September 30th, 2022

2 Contents Overview 3 Vision 6 Asset Quality 14 Liability Trends 17 Interest Rate Risk 19 Profitability 20 Capital 25

Overview of WaFd Bank 3 • Established in 1917; IPO in 1982 • Washington State Charter Commercial Bank – WA DFI, FDIC, FRB, CFPB Regulated • Headquartered in Seattle, WA; is the second largest bank headquartered in the Pacific Northwest • Exited BSA Consent Order Dec 2021 • 201 branches across 8 western states • Full-service consumer & commercial bank • Strong capital, high asset quality, consistent results • Portfolio mortgage lender • Profitable every year since 1965 • Interest rate risk management – well controlled • 159 consecutive quarterly cash dividends • 13,079% Total shareholder return since IPO Total Assets $20.77Bn Total Loans $16.11Bn Total Deposits $16.03Bn Stockholder Equity $2.27Bn Efficiency Ratio 49.52% 1 As of or for the quarter-ended 9/30/2022 Overview Geographic Overview Company Highlights1 3

WaFd Bank Executive Management Committee 4 Vincent Beatty EVP Chief Financial Officer Brent Beardall President and Chief Executive Officer 4 Ryan Mauer EVP Chief Credit Officer Cathy Cooper EEVP Chief Consumer Banker Kim Robison EVP Chief Operating Officer James Endrizzi EVP Chief Commercial Banker

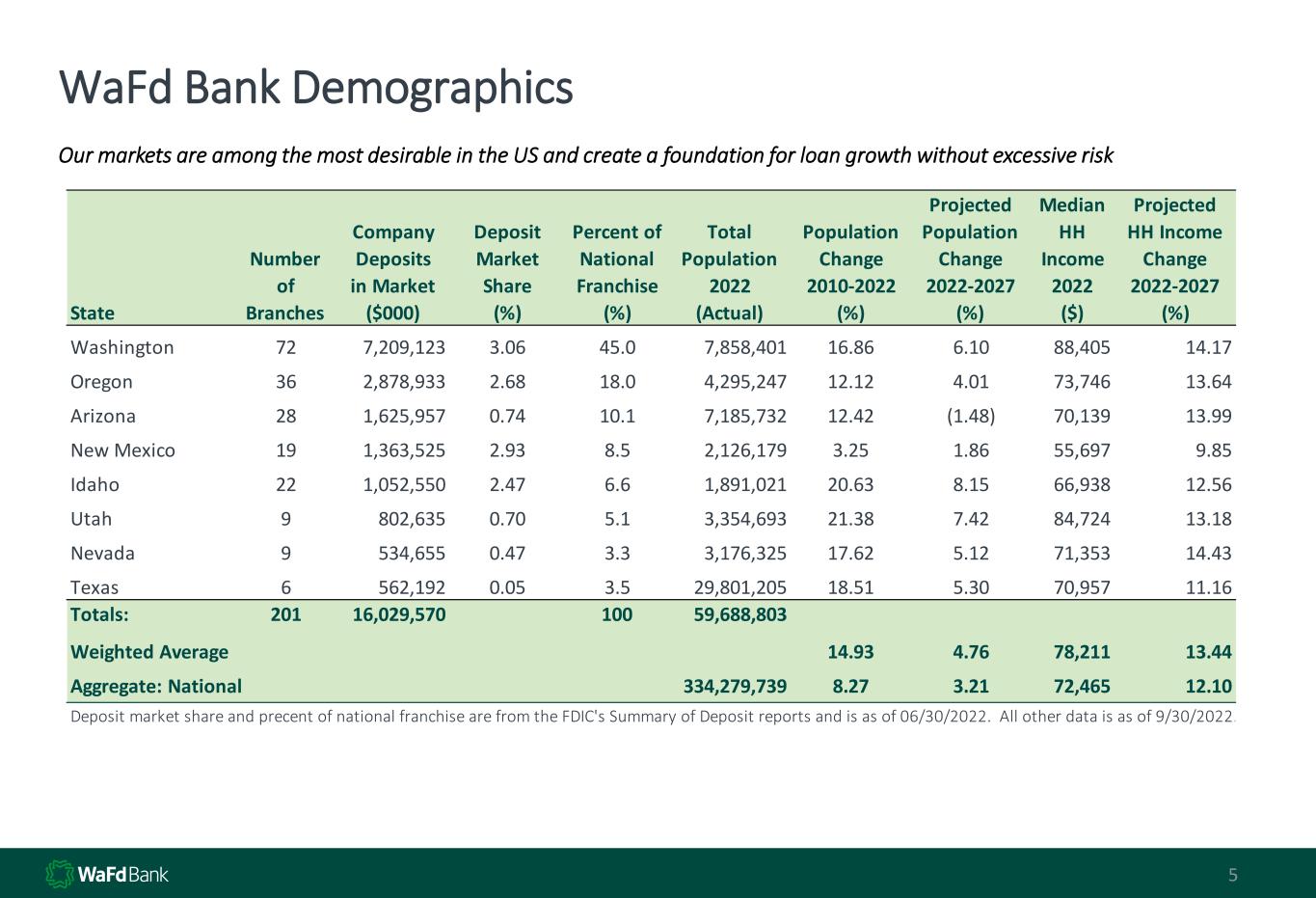

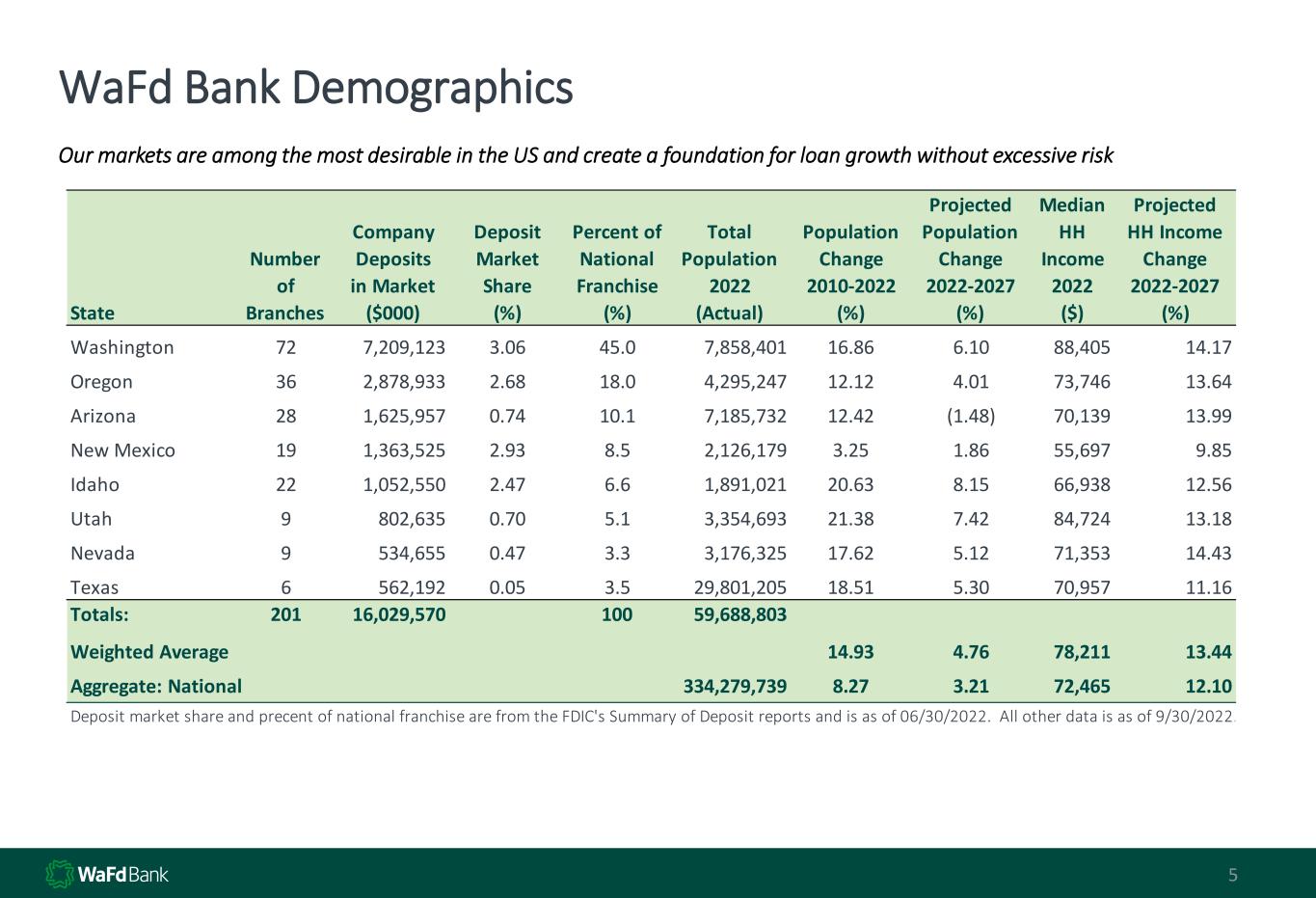

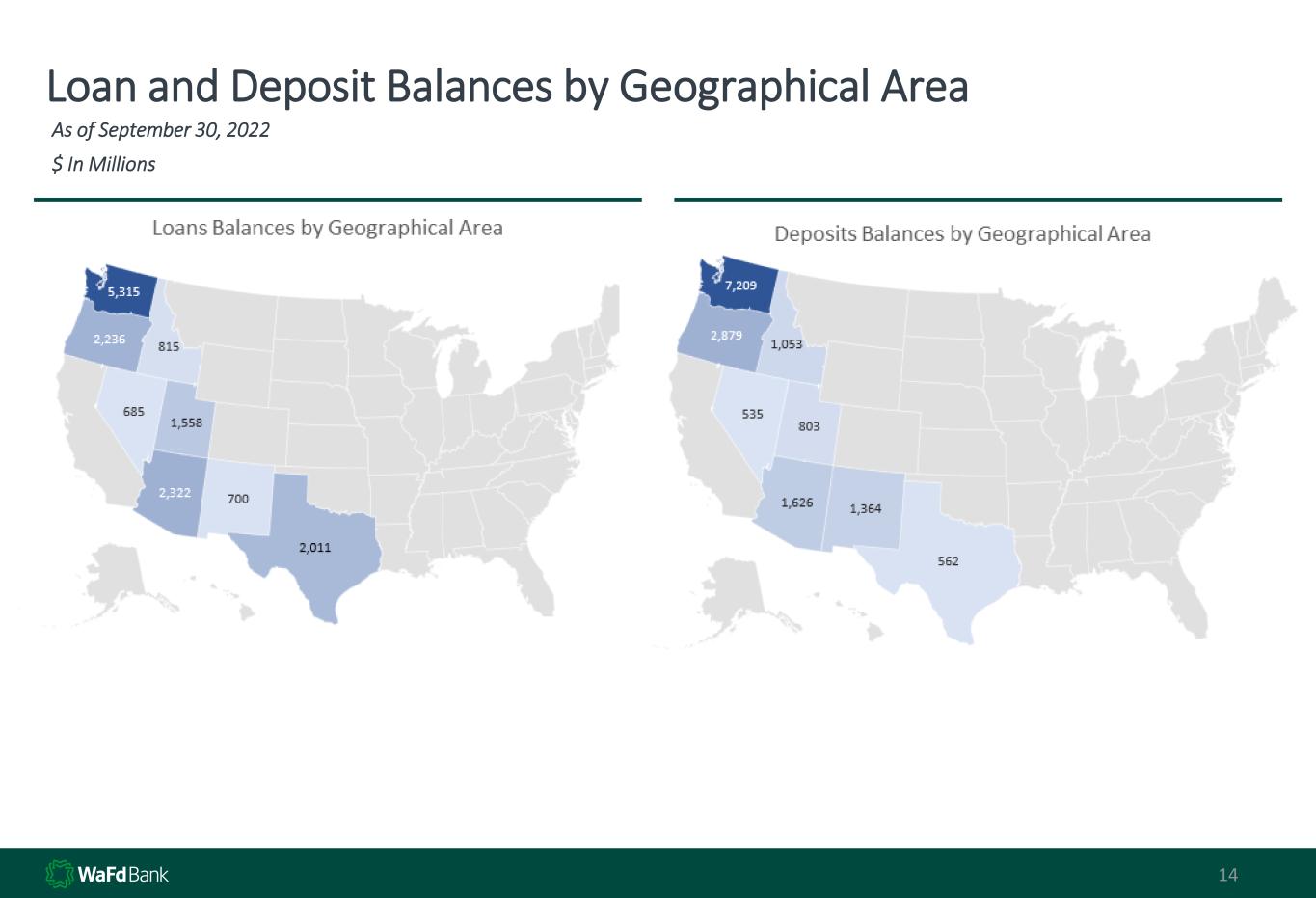

5 WaFd Bank Demographics Our markets are among the most desirable in the US and create a foundation for loan growth without excessive risk State Number of Branches Company Deposits in Market ($000) Deposit Market Share (%) Percent of National Franchise (%) Total Population 2022 (Actual) Population Change 2010-2022 (%) Projected Population Change 2022-2027 (%) Median HH Income 2022 ($) Projected HH Income Change 2022-2027 (%) Washington 72 7,209,123 3.06 45.0 7,858,401 16.86 6.10 88,405 14.17 Oregon 36 2,878,933 2.68 18.0 4,295,247 12.12 4.01 73,746 13.64 Arizona 28 1,625,957 0.74 10.1 7,185,732 12.42 (1.48) 70,139 13.99 New Mexico 19 1,363,525 2.93 8.5 2,126,179 3.25 1.86 55,697 9.85 Idaho 22 1,052,550 2.47 6.6 1,891,021 20.63 8.15 66,938 12.56 Utah 9 802,635 0.70 5.1 3,354,693 21.38 7.42 84,724 13.18 Nevada 9 534,655 0.47 3.3 3,176,325 17.62 5.12 71,353 14.43 Texas 6 562,192 0.05 3.5 29,801,205 18.51 5.30 70,957 11.16 Totals: 201 16,029,570 100 59,688,803 Weighted Average 14.93 4.76 78,211 13.44 Aggregate: National 334,279,739 8.27 3.21 72,465 12.10 Deposit market share and precent of national franchise are from the FDIC's Summary of Deposit reports and is as of 06/30/2022. All other data is as of 9/30/2022.

Our Objective: A highly-profitable, digital-first bank that leverages data to anticipate financial needs and empower our clients by creating frictionless experiences across all interactions and devices. Our Values: Integrity, Teamwork, Ownership, Service, Simplicity & Discipline Vision 2025 6

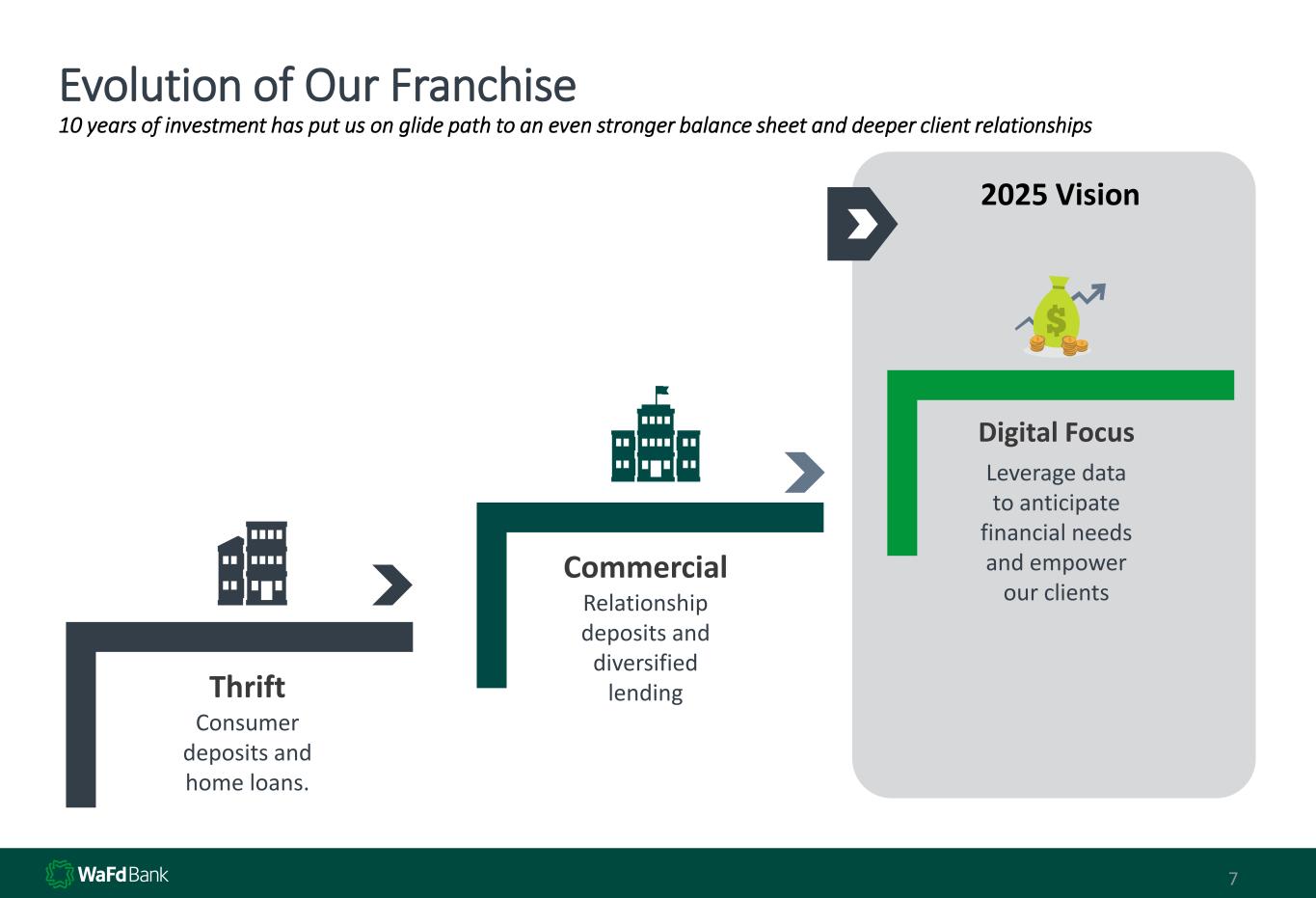

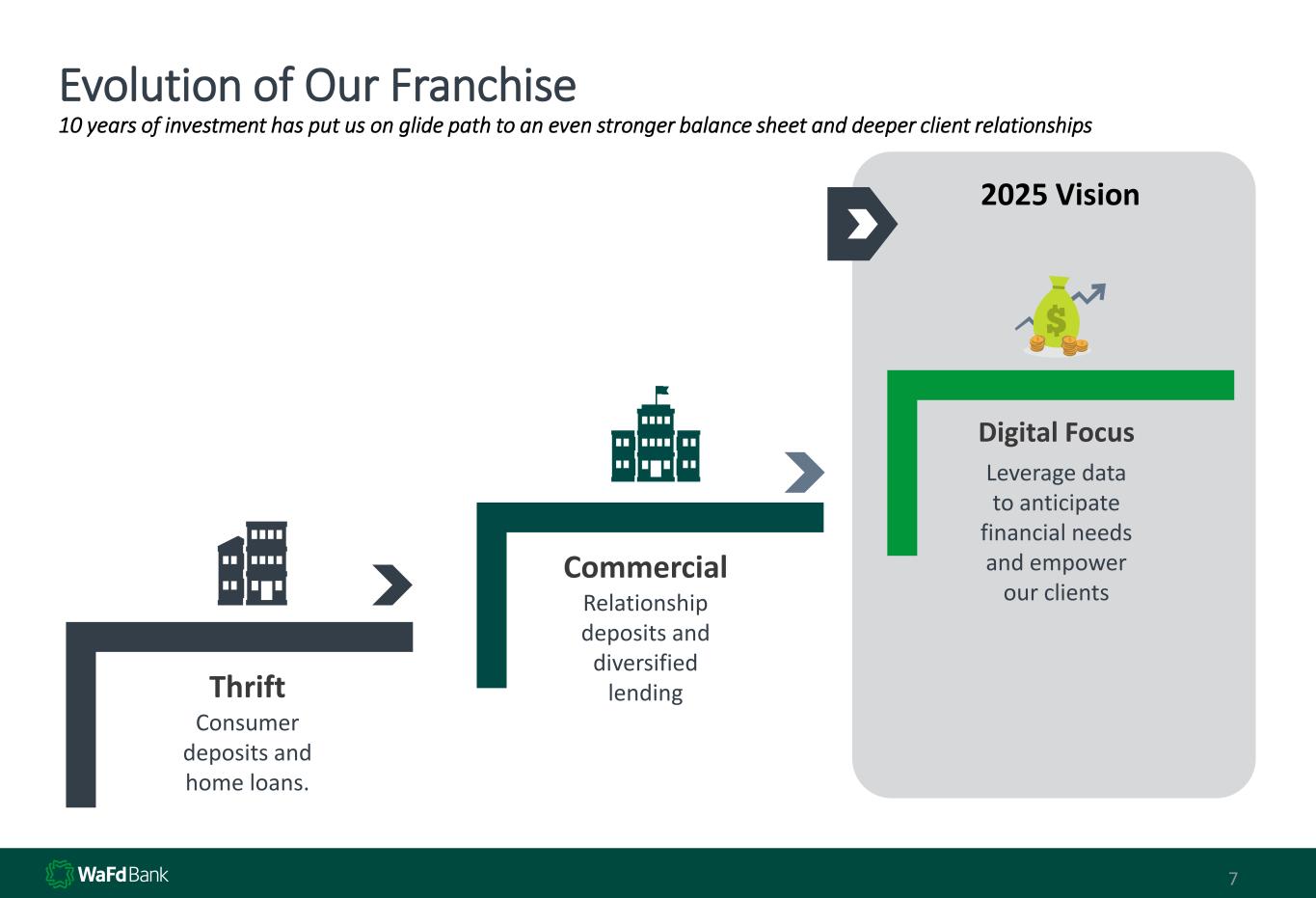

Evolution of Our Franchise Thrift Consumer deposits and home loans. Commercial Relationship deposits and diversified lending Digital Focus Leverage data to anticipate financial needs and empower our clients 1917-2007 2007-2018 2025 Vision 7 10 years of investment has put us on glide path to an even stronger balance sheet and deeper client relationships 7

(12) (10) (5) (5) 2 3 (1) 48 75 Net Promoter Score Approaching Best in Class 8 Our investments in customer service, usability and technology are translating into high customer satisfaction levels Source: Customer Guru WaFdaa Net Promoter Score 1 17 34 48 51 48 2017 2018 2019 2020 2021 Peer Net Promoter Score 1 1 As of 10/19/2021 8

Speed Matters – Website Is the New Storefront 9 New wafdbank.com Google page speed scores

Getting Customers to Your Website is Mission Critical 10 Back links to WAFDbank.com vs. Washingtonfederal.com

Up to 55 55-65 Over 65 0-4 years 5-10 years Over 10 years People of Color Other Female Male 11 Commitment to ESG & Diversity We believe our enduring franchise comes from core principles focused on helping the neighborhoods we serve and creating long- term value for all stakeholders led by a Board, management and employee base that bring together a diversity of backgrounds Board Composition ESG & Diversity Policy Highlights Our Corporate Social and Environmental Responsibility Policy flows from WaFd Bank’s core principles, which are: Gender of Directors Ethnicity of Directors 1 Tenure of Directors Age of Directors 2 To provide common- sense banking that helps neighborhoods flourish Adhere to the primary corporate value of integrity Exercise prudent risk management Maintain transparency in its business practices Resolve to create long-term value for all stakeholders 1 2 3 4 5 Community Development Over $248 million dollars invested towards community development lending and affordable housing investments Washington Federal Foundation The Washington Federal Foundation awarded 238 grants to local community organizations totaling $746,050 for the fiscal year Volunteerism WaFd employees participated in 8,179 volunteer hours in support of more than 447 organizations and initiatives United Way Matching Campaign WaFd Bank matches employee contributions made to United Way agencies in all eight states. In fiscal year 2022 pledges from colleagues were $402,109. WaFd matched $3327,375 for a total of $729,484 1 Based on self-identification 2 As of 9/30/21

12 Loan Growth – Through Different Interest Rate Environments • Mortgage and Consumer loans - 40 % of total net loans • Commercial loans growing fastest over last eight years • Commercial growth is primary focus Loan GrowthNew Loan Originations $ in millions. • C&I and Commercial Real Estate loans made up 78% of all originations in 2022 compared to 49% in 2014 • Mortgage and Consumer Loans are largely holding flat in the current rate environment $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 Commercial & Industrial (C&I) Commercial Real Estate Mortgage & Consumer $- $2,000 $4,000 $6,000 $8,000 $10,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 Mortgage & Consumer Commercial Real Estate Commercial & Industrial (C&I)

13 5 Year Change by Percentage in Each Geographical Area From September 30, 2017, to September 30, 2022

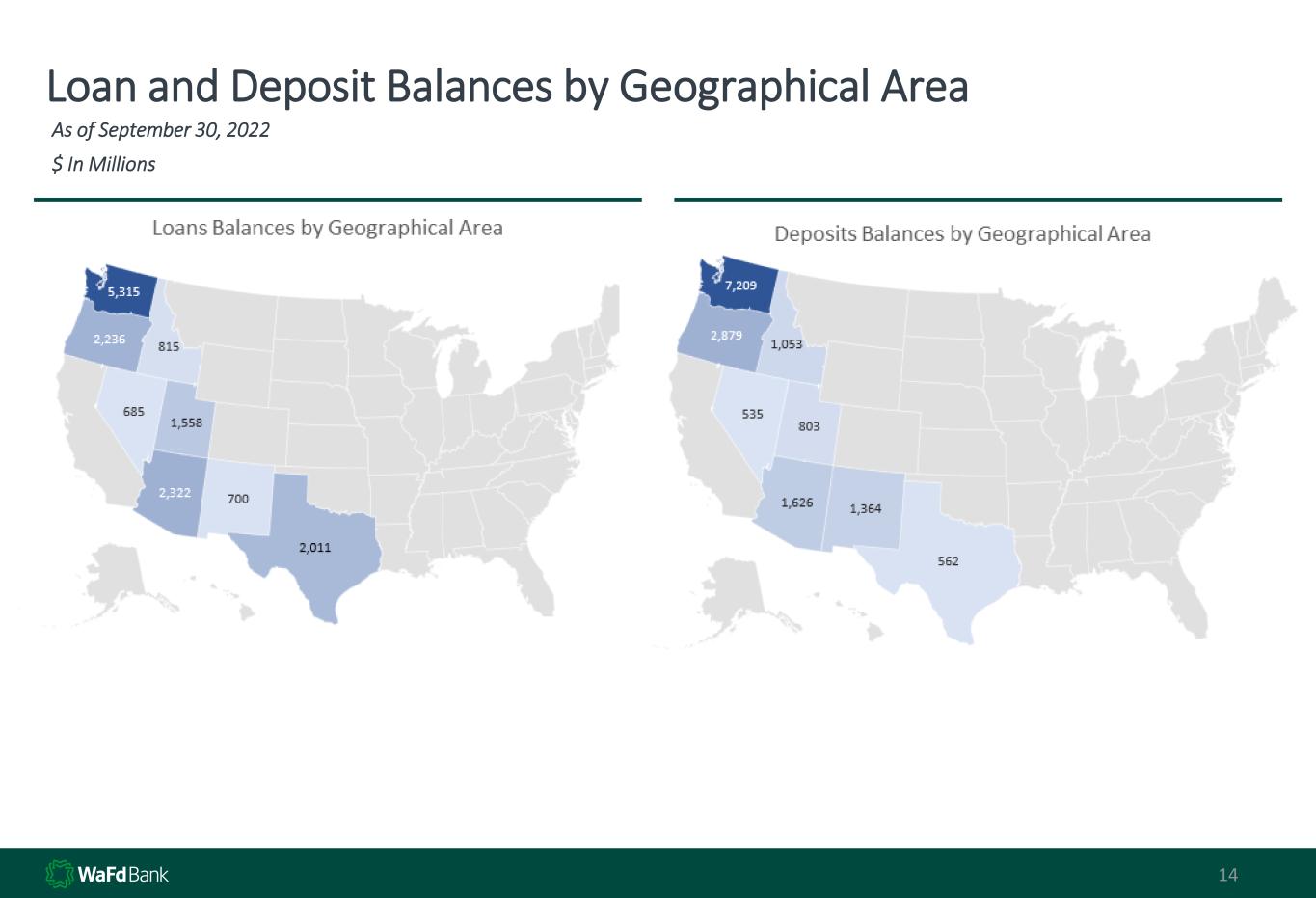

14 Loan and Deposit Balances by Geographical Area As of September 30, 2022 $ In Millions

15 Helping Small Businesses and Individuals Deferred loan payments now resuming 9,000 approved loans Over $1 billion in lending Paycheck Protection Program Cares Act Deferrals • Using nimbleness, technology and hard work to serve clients and communities • PPP efforts providing benefit of strong organic growth and happy customers • Approximately 45% of Round 1 PPP loans established a new client relationship for WaFd • Deferral Program successful with only a small number of post deferral delinquencies • Only 1 loan still in deferral $480 M $5 K $475 M $5.6 M

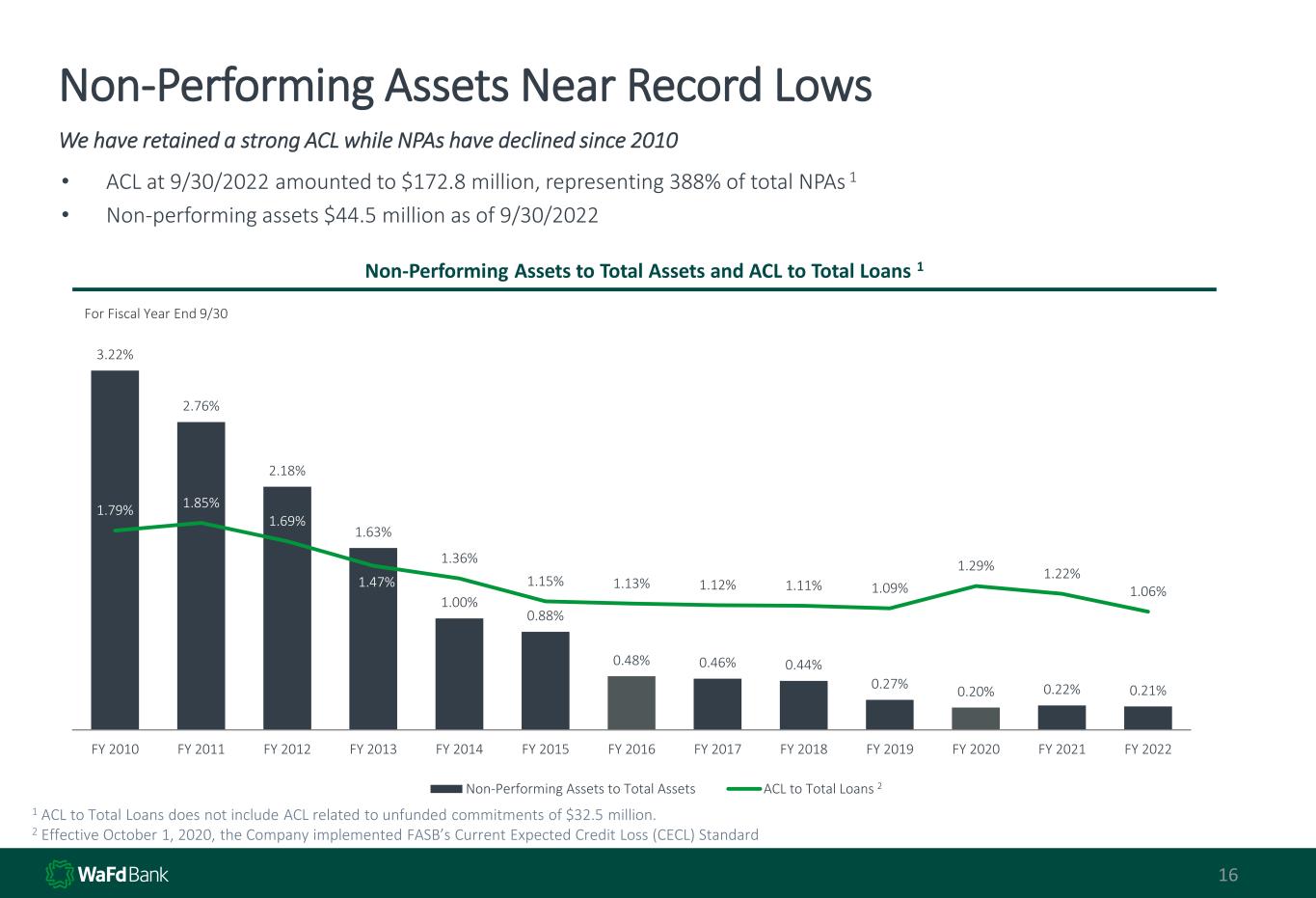

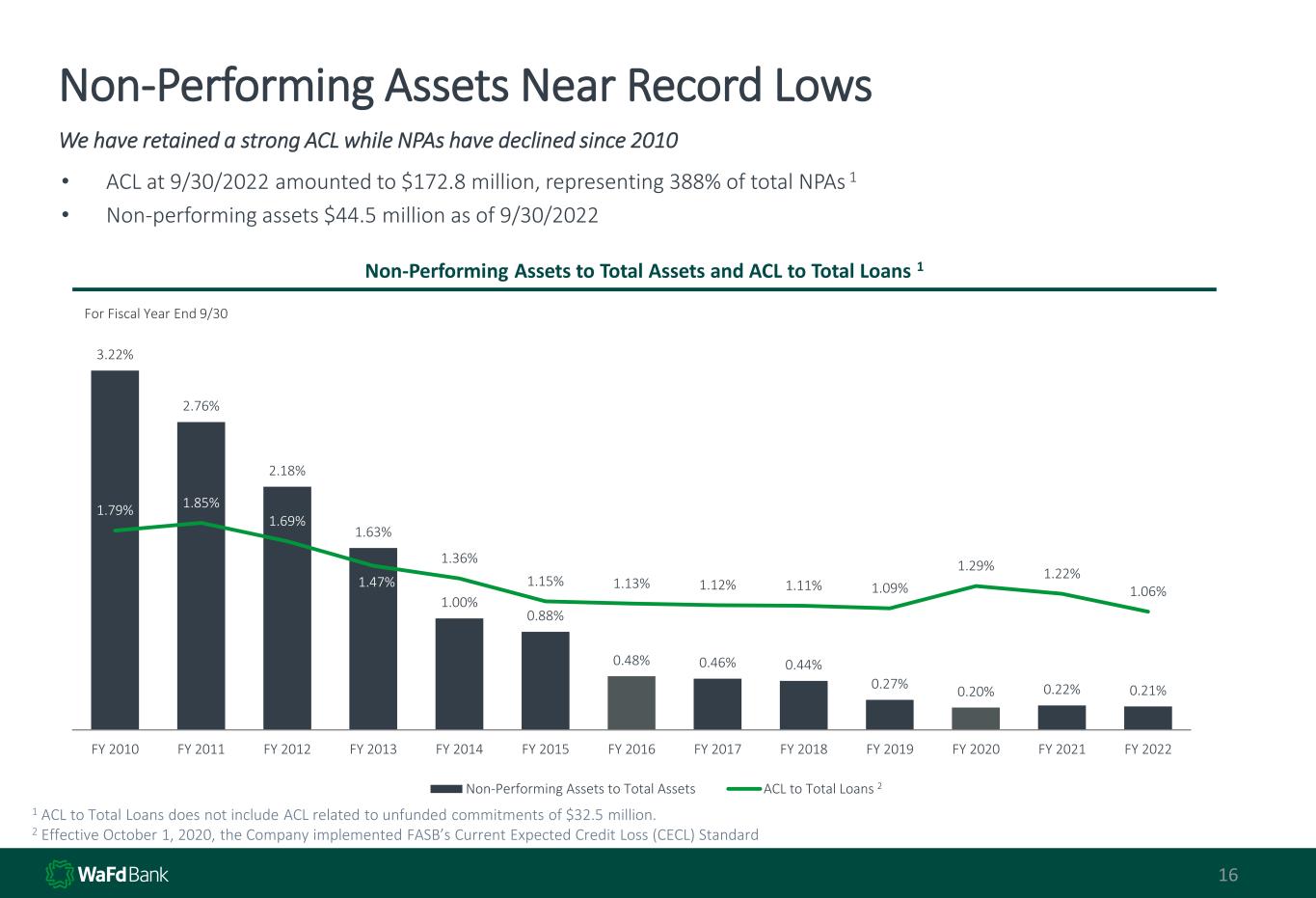

Non-Performing Assets Near Record Lows 16 We have retained a strong ACL while NPAs have declined since 2010 • ACL at 9/30/2022 amounted to $172.8 million, representing 388% of total NPAs 1 • Non-performing assets $44.5 million as of 9/30/2022 3.22% 2.76% 2.18% 1.63% 1.00% 0.88% 0.48% 0.46% 0.44% 0.27% 0.20% 0.22% 0.21% 1.79% 1.85% 1.69% 1.47% 1.36% 1.15% 1.13% 1.12% 1.11% 1.09% 1.29% 1.22% 1.06% FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Non-Performing Assets to Total Assets ACL to Total Loans Non-Performing Assets to Total Assets and ACL to Total Loans 1 For Fiscal Year End 9/30 1 ACL to Total Loans does not include ACL related to unfunded commitments of $32.5 million. 2 Effective October 1, 2020, the Company implemented FASB’s Current Expected Credit Loss (CECL) Standard 2

0.26% 0.44% WAFD Peer Average Strong Credit Quality 17 2.08% 1.21% 0.91% 0.24% (0.19%) (0.06%) (0.14%) (0.10%) (0.03%) (0.02%) Net Loan Charge-offs (Recoveries) For Fiscal Year End 9/30 Average NCOs Per Year – Last 20 Years Source: SNL Financial, Company Filings 1 Peers represent Proxy Peers as specified in the Company’s latest Proxy Statement (1) Strong Credit Quality Characterized by Limited Charge-Offs • Net Recoveries since 2013 total $74.8 million • The Bank continues to work $50 million of loans previously charged off • 9 Consecutive years of Net Recoveries

Significant Liquidity and High-Quality Securities Portfolio 18 High quality, $3.2 billion cash and investment portfolio with $9.8 billion remaining collateral and lines as a source of additional potential liquidity As of 9/30/2022, WAFD maintains over $3.2bn of balance sheet liquidity. • Cash and Securities is 16% of assets • Investment Portfolio targets low credit risk / moderate duration • 63% Cash, US Government-backed Agency Bonds and MBS 2 • Yield on the Investment Portfolio is 3.2% Cash and Securities Composition 2 Source: SNL Financial, Company Filings 1 Peers represent Proxy Peers as specified in the Company’s latest Proxy Statement 2 As of 9/30/2022 Total Cash and Securities: $3.2Bn 2 Cash and Securities / Total Assets: 16% 2 Cash & Securities / Total Assets 1 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 WAFD Peers US Govt Backed, 42% Cash, 21% High Quality Bonds, 37%

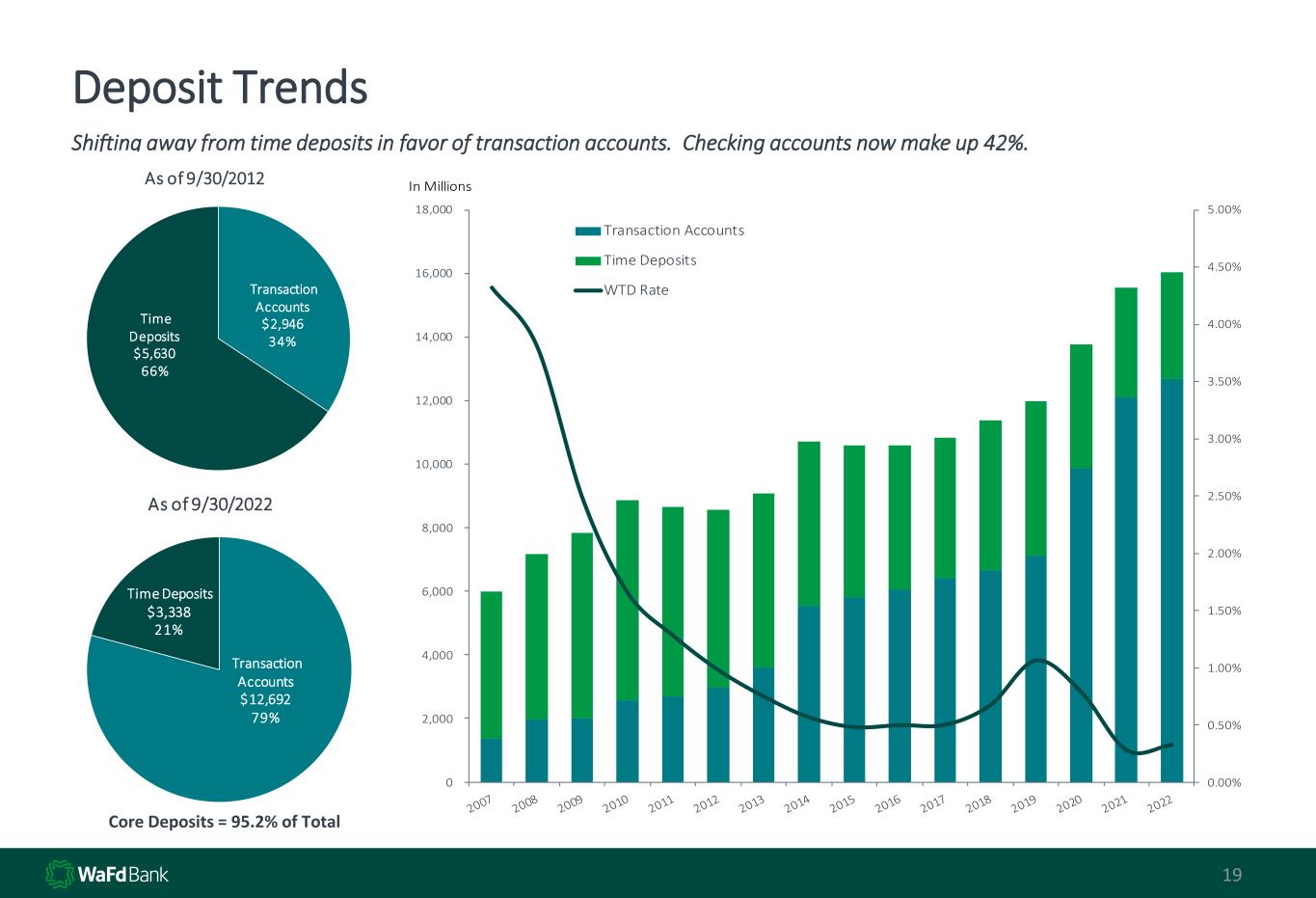

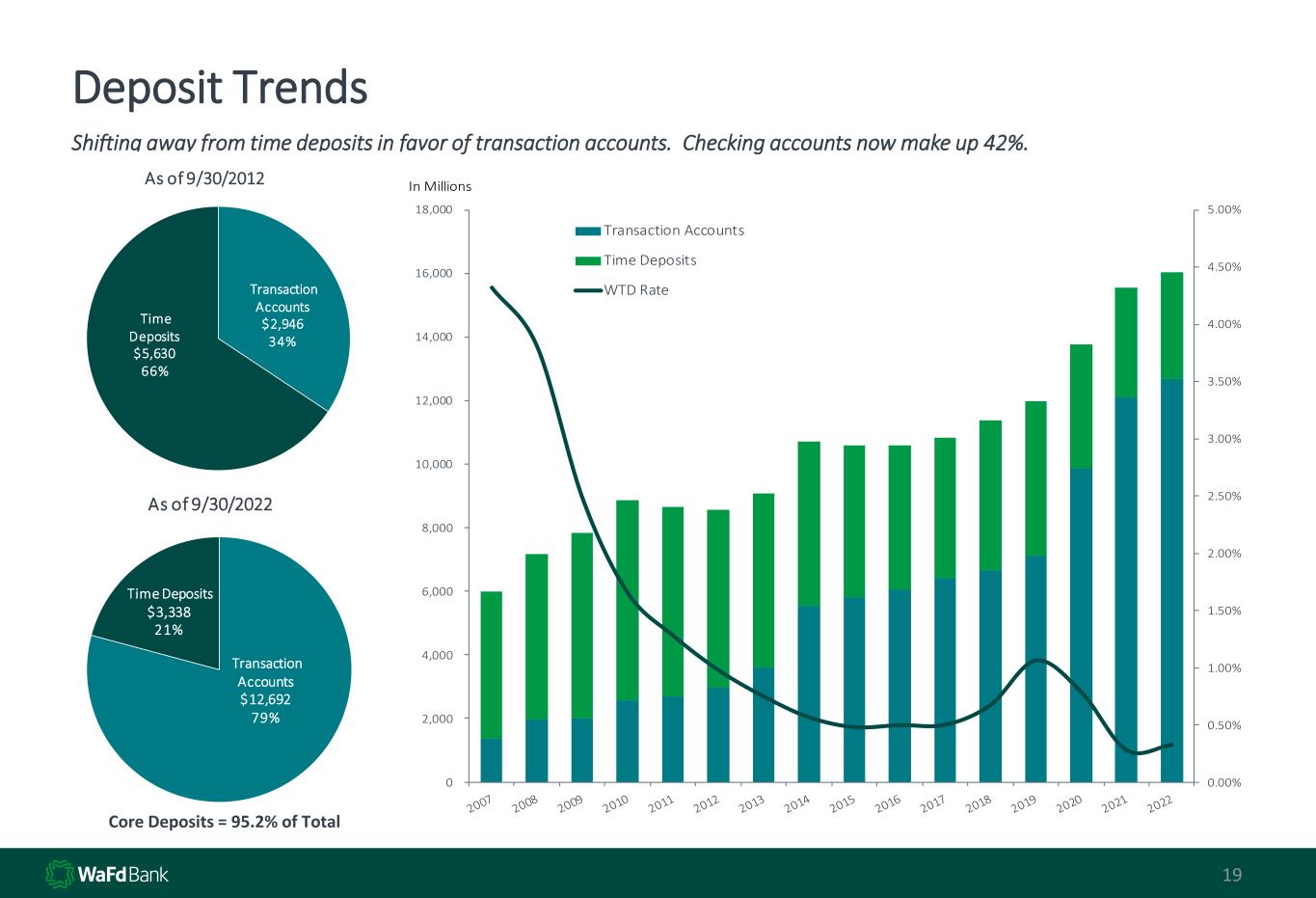

Transaction Accounts $12,692 79% Time Deposits $3,338 21% As of 9/30/2022 19 Deposit Trends Core Deposits = 95.2% of Total Shifting away from time deposits in favor of transaction accounts. Checking accounts now make up 42%. Transaction Accounts $2,946 34% Time Deposits $5,630 66% As of 9/30/2012 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 Transaction Accounts Time Deposits WTD Rate In Millions

Borrowings Outstanding & Weighted Rate 20 Borrowings are 100% FHLB and are used in part to manage interest rate risk. Rates have declined with market rates. Increase in borrowings for 2020 was from locking in $1 billion of funding at a fixed rate of 66 bps for 10 years. FHLB Effective Maturity Schedule Amount $ million Rate Within 1 year: $1,025 3.06% 1 to 3 years: $ 200 2.18% 3 to 5 years: $ 100 1.92% 5+ years: $ 800 0.67% 2.02% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Scenarios assume no management actions taken. Flattening/inverted rates with short term up more than long term would result in a larger negative affect. Balanced Interest Rate Risk 21 Interest Rate Risk is well managed and skewed toward the upside in the current environment given asset sensitivity IRR measures as of June 30, 2022: • Net Interest Income (NII) would increase by 1.87% in +200 bps immediate and parallel shock • Net Portfolio Value after +200bps shock is 21% lower ($616mm) and at $2.3 billion would be 12.5% of total assets Change in NPV (%) Net Interest Margin Sensitivity vs. Base Case -50% -40% -30% -20% -10% 0% 10% Base Up 100 Up 200 Up 300 Up 400 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 -0.10% -0.05% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% Year 1 Year 2 Year 3 Up500 Up400 Up300 Up200 Up100

AOCI vs our Peers 22 -40% -35% -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% Total Accumulated Other Comprehensive Income as a percent of Equity WAFD BANR ZION WAL UMPQ COLB

23 Income Statement Comparison 23 9/30/2022 9/30/2022 $ Change % Change INTEREST INCOME Loans.............................................................................................. 601,592$ 537,660$ 63,932$ 11.9% Mortgage-backed securities.......................................................... 26,332 24,708 1,624 6.6% Investment securities and cash equivalents.................................. 38,435 29,242 9,193 31.4% 666,359 591,610 74,749 12.6% INTEREST EXPENSE Customer accounts......................................................................... 43,041 42,313 728 1.7% FHLB advances and other borrowings............................................ 28,729 44,188 (15,459) -35.0% 71,770 86,501 (14,731) -17.0% NET INTEREST INCOME ............................................................... 594,589 505,109 89,480 17.7% Provision (release) for credit losses.............................................. 3,000 500 2,500 Net interest income after provision(reversal)........................... 591,589$ 504,609$ 86,980$ 17.2% Fiscal YTD

24 Income Statement Comparison Efficiency Ratio of 54.25% for YTD fiscal year 2022 down from 58.77% for the same period of prior year. Effective tax rate year to date ended September 2022 is 21.23% compared to 21.24% from the same period ended September 2021 9/30/2022 9/30/2022 $ Change % Change OTHER INCOME 66,372$ 60,561$ 5,811$ 9.6% OTHER EXPENSE Compensation and benefits........................................................... 193,917 176,106 17,811 10.1% Occupancy...................................................................................... 42,499 39,610 2,889 7.3% FDIC insurance............................................................................... 9,531 14,368 (4,837) -33.7% Product delivery.............................................................................. 19,536 18,505 1,031 5.6% Information technology.................................................................. 47,202 42,737 4,465 10.4% Other expense................................................................................ 45,890 41,133 4,757 11.6% 358,575 332,459 26,116 7.9% Gain (loss) on REO......................................................................... 651 427 224 52.5% Income before income taxes.......................................................... 300,037 233,138 66,899 28.7% Income taxes.................................................................................. 63,707 49,523 14,184 28.6% NET INCOME.................................................................................. 236,330$ 183,615$ 52,715$ 28.7% Dividends on preferred stock......................................................... 14,625 10,034 4,591 Net Income available to common shareholders........................ 221,705$ 173,581$ 48,124$ 27.7% Fiscal YTD

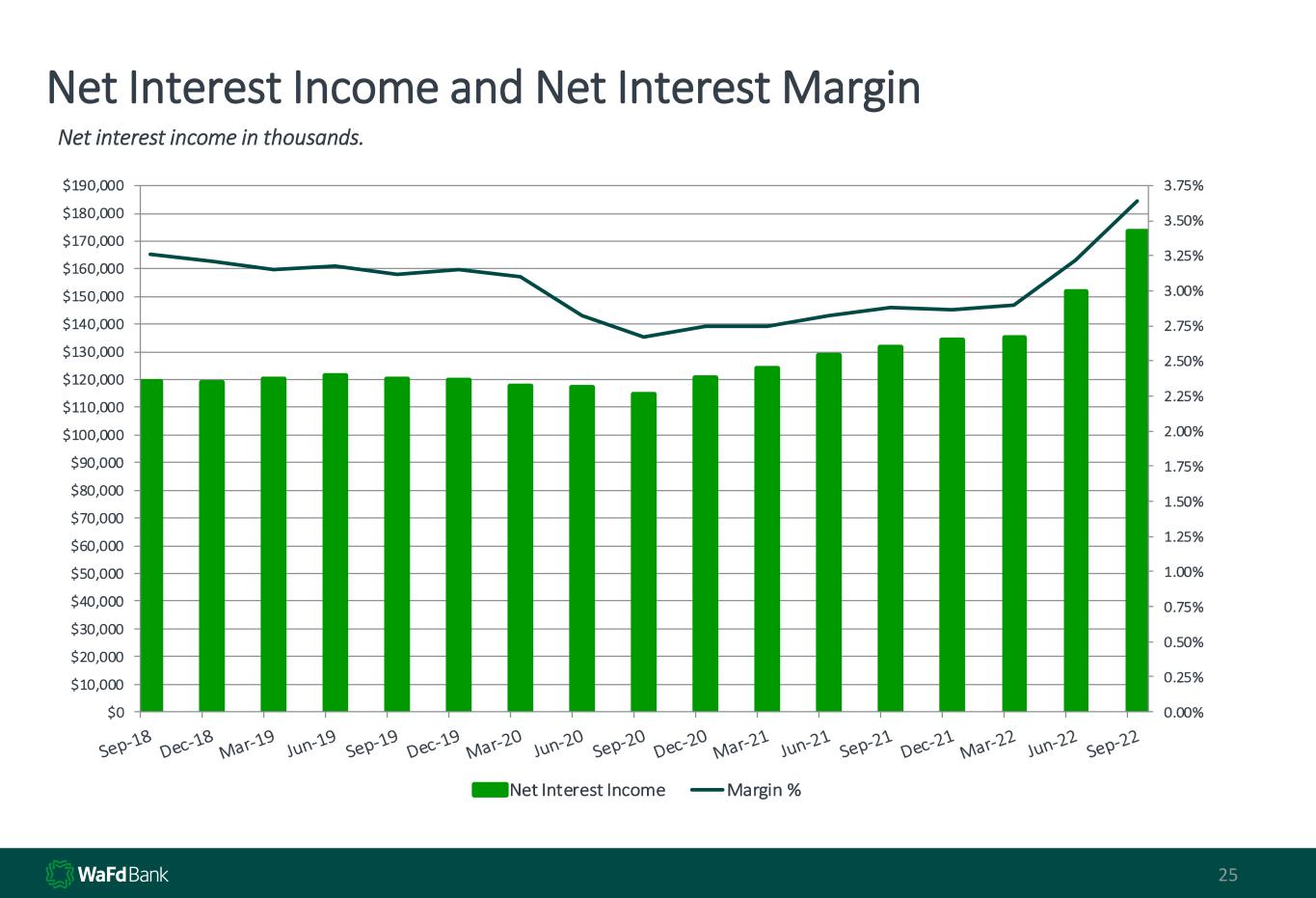

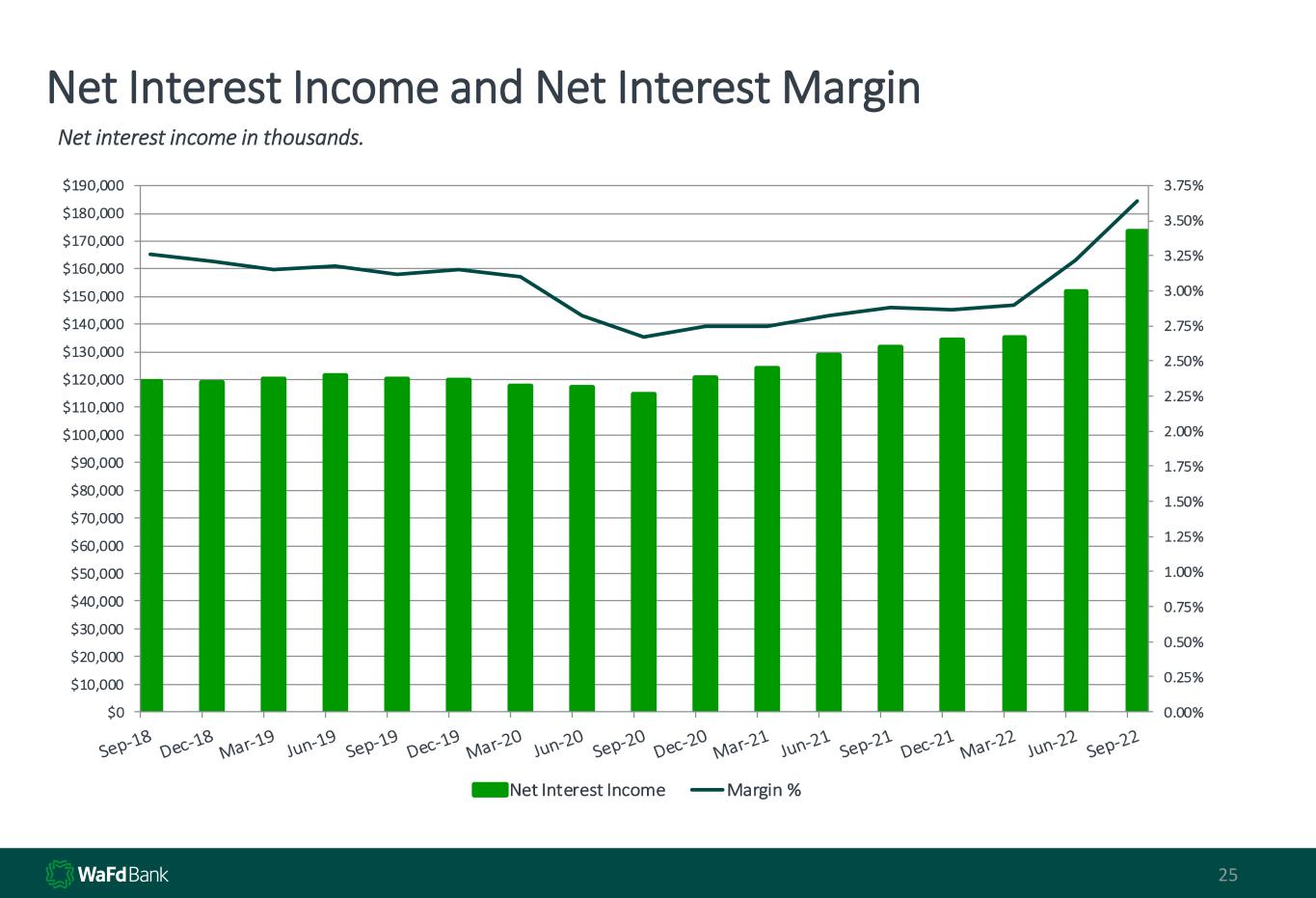

25 Net Interest Income and Net Interest Margin Net interest income in thousands. 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 $160,000 $170,000 $180,000 $190,000 Net Interest Income Margin %

26 Net Income and Common Earnings Per Share Issued $300 million of Preferred Stock in February 2021 with a dividend of 4.875% Annual Quarterly - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 Net Income EPS $0 $50,000 $100,000 $150,000 $200,000 $250,000 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 Net Income (in thousands) EPS

Non-Interest Income 27 Diverse sources of Non-Interest Income provide steady growth and balance our revenue profile Non-Interest Income for Quarter-Ended 9/30/2022 Non-Interest Income Over Time ($MM)Non-Interest Income / Total Loan Revenue Other Income includes: • BOLI income • Rental income • Gains on property sales • WAFD Insurance Income • Income on equity method investments Loan Fees 8% Deposit Fees 46% Other Income 46% 11% 9% 11% 16% 12% 10% FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 $4.3 $3.8 $3.9 $7.3 $6.9 $7.2 $22.6 $25.9 $24.9 $23.7 $24.7 $25.9 $23.2 $14.7 $23.3 $24.1 $28.6 $33.2 $10.1 $30.7 $- FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Loan Fees Deposit Fees Other Income Gain on Sale of Investments Gain on Sale of Buildings

28 Non-Interest Expense Over Time Annual and Quarterly - Expenses in millions Annual Quarterly 57.1% 59.3% 57.7% 62.1% 60.6% 59.0% 59.0% 56.8% 58.6% 58.7% 51.6% 49.5% 0% 10% 20% 30% 40% 50% 60% 70% $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 Other expense Occupancy Compensation Efficiency Ratio 35.0% 41.0% 46.9% 49.5% 50.8% 47.8% 50.4% 52.1% 59.0% 58.8% 54.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 Other expense Occupancy Compensation Efficiency Ratio

$11.4 $11.6 $9.8 $10.9 $14.4 $9.5 $14.0 $16.4 $15.9 $17.0 $18.5 $19.5 $28.9 $34.6 $38.9 $52.9 $42.7 $47.2 $29.8 $41.7 $34.6 $47.5 $41.1 $45.9 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FDIC Premiums Product Delivery Information Technology Other Expense 29 Breakout of Other Expense Other Expense includes: • FDIC Premiums • Product Delivery • Information Technology • Miscellaneous ‘Other’ line-item expenses include professional services, marketing and administrative costs.

30 Capital Ratios WAFD does not seek to maximize leverage. Rather, we aspire to be the bank that can best weather the next storm on the horizon. • Source: SNL Financial, Company Filings 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% Sep 2017 Sep 2018 Sep 2019 Sep 2020 Sep 2021 Sep 2022 Common Equity Tier 1 Ratio Washington Federal, Inc. Top 100 Banks Peer Banks Well Capitalized 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Sep 2017 Sep 2018 Sep 2019 Sep 2020 Sep 2021 Sep 2022 Total Risk-Based Capital Washington Federal, Inc. Top 100 Banks Peer Banks Well Capitalized

31 Impact of February 2021 Preferred Stock Issuance

Returning Capital to Shareholders Recent Capital Activities • Current cash dividend of $0.24 provides a yield of 2.51% based on the current stock price • Since 2013, 47 million shares repurchased which is 44% of total outstanding shares as of 9/30/2012 • 3.7 million shares remaining in buyback authorization • During the 3rd and 4th Fiscal Quarters of 2021, the Company used additional proceeds from the preferred stock issuance to repurchase 7,952,529 shares of common stock. 32 Common Dividend as a % of Net Income 30.4% 42.9% 27.5% 30.1% 38.3% 38.0% 27.8% 2016 2017 2018 2019 2020 2021 2022 Net Income Stock Buyback & Dividends Percent of Income returned to Shareholders 2015 $160,316 $177,791 111% 2016 $164,049 $137,808 84% 2017 $173,532 $172,892 100% 2018 $203,850 $220,246 108% 2019 $210,256 $187,163 89% 2020 $173,438 $178,629 103% 2021 $173,581 $414,527 239% 2022 $221,705 $64,837 29% # of Shares Wtd Price Paid % Outstanding at beginning of the year 2015 5,841,204 $21.70 6% 2016 3,867,563 $22.72 4% 2017 3,137,178 $31.36 3% 2018 4,865,357 $33.74 6% 2019 4,065,352 $30.46 5% 2020 3,339,530 $33.58 4% 2021 10,810,113 $32.25 14% 2022 92,774 $35.14 0.1% Return of Income to Common Shareholders

As of 9/30/2022: Book Value per Share $30.22 Tangible Book Value per Share $25.49 Price to BV: .99 Price to TBV: 1.18 Stock Price & Book Value Per Share 33 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 Stock Price Book Value per Share

Managing Capital Text Text Text Tex 34 Perspective through the last Credit Cycle Stock Performance Comparison as of 9/30/2022 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 WAFD BANR ZION WAL UMPQ COLB *Stock prices obtained from Yahoo! Finance and reflect monthly adjusted (stock splits and dividends) close prices. Chart reflects the value of $1 invested in each stock on 1/1/2007. January 2007 month end chosen to coincide with the average peak in stock price among the 6 banks.

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Washington Federal’s management and are subject to significant risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of the presentation, and Washington Federal assumes no duty, and does not undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking statements.