This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Washington Federal’s management and are subject to significant risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of the presentation, and Washington Federal assumes no duty, and does not undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking statements. 1 Investor Presentation As of March 31, 2023

2 Contents Overview 3 Vision 6 Asset Quality 13 Liability Trends 21 Interest Rate Risk 26 Profitability 29 Capital 36

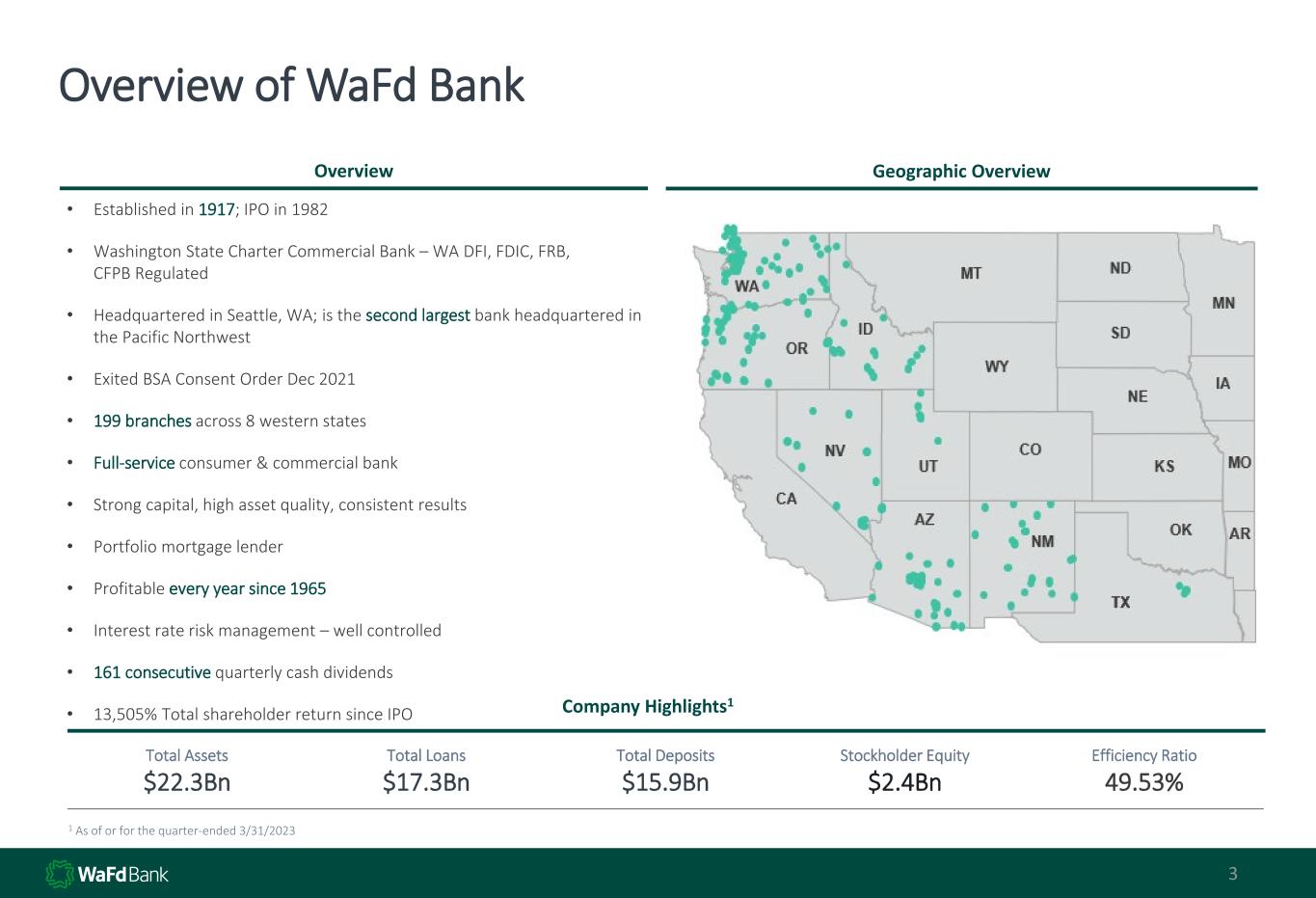

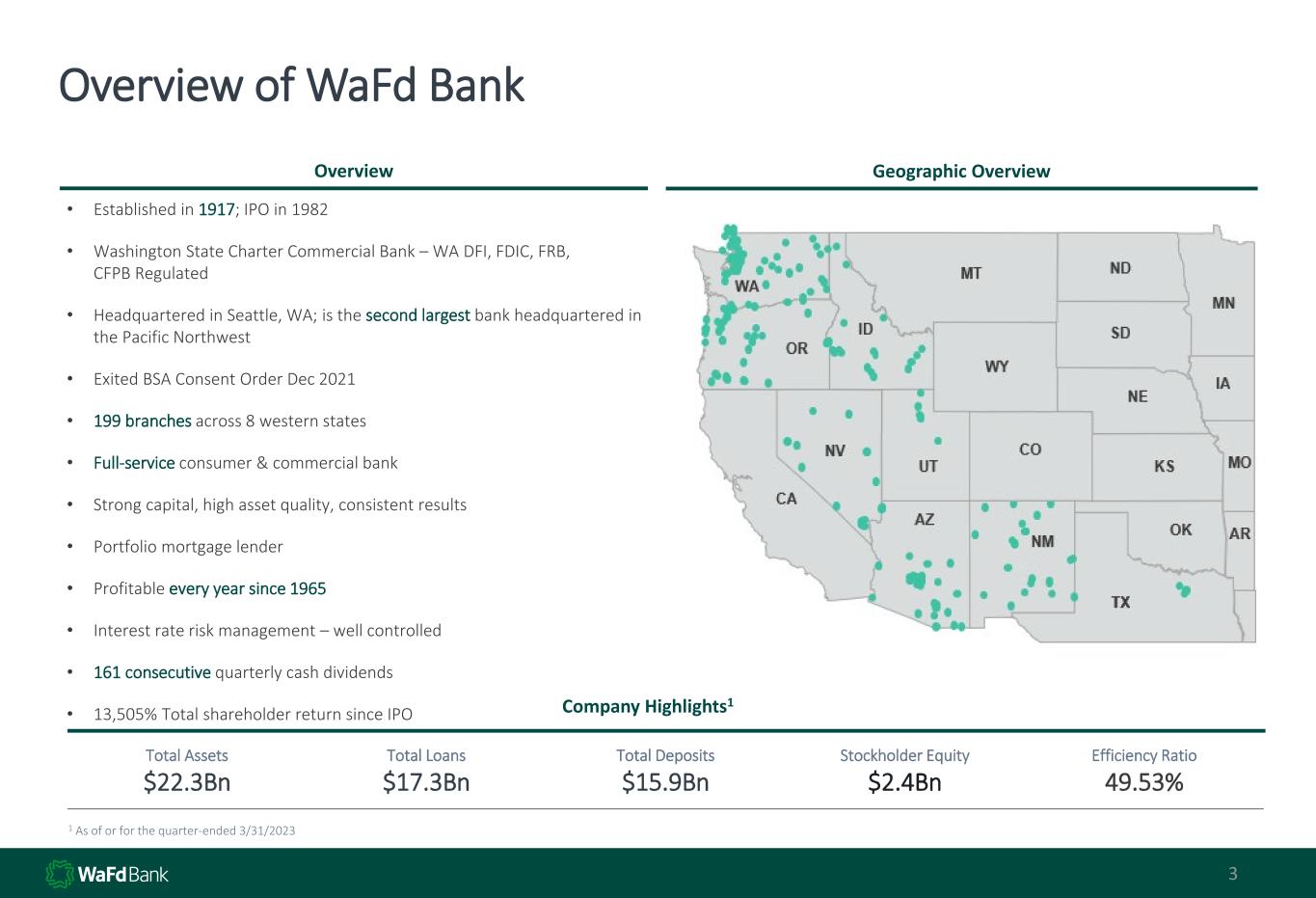

Overview of WaFd Bank 3 • Established in 1917; IPO in 1982 • Washington State Charter Commercial Bank – WA DFI, FDIC, FRB, CFPB Regulated • Headquartered in Seattle, WA; is the second largest bank headquartered in the Pacific Northwest • Exited BSA Consent Order Dec 2021 • 199 branches across 8 western states • Full-service consumer & commercial bank • Strong capital, high asset quality, consistent results • Portfolio mortgage lender • Profitable every year since 1965 • Interest rate risk management – well controlled • 161 consecutive quarterly cash dividends • 13,505% Total shareholder return since IPO Total Assets $22.3Bn Total Loans $17.3Bn Total Deposits $15.9Bn Stockholder Equity $2.4Bn Efficiency Ratio 49.53% 1 As of or for the quarter-ended 3/31/2023 Overview Geographic Overview Company Highlights1 3

WaFd Bank Executive Management Committee 4 Kelli Holz SEVP Chief Financial Officer Brent Beardall President and Chief Executive Officer 4 Ryan Mauer EVP Chief Credit Officer Cathy Cooper EEVP Chief Consumer Banker Kim Robison EVP Chief Operating Officer James Endrizzi EVP Chief Commercial Banker

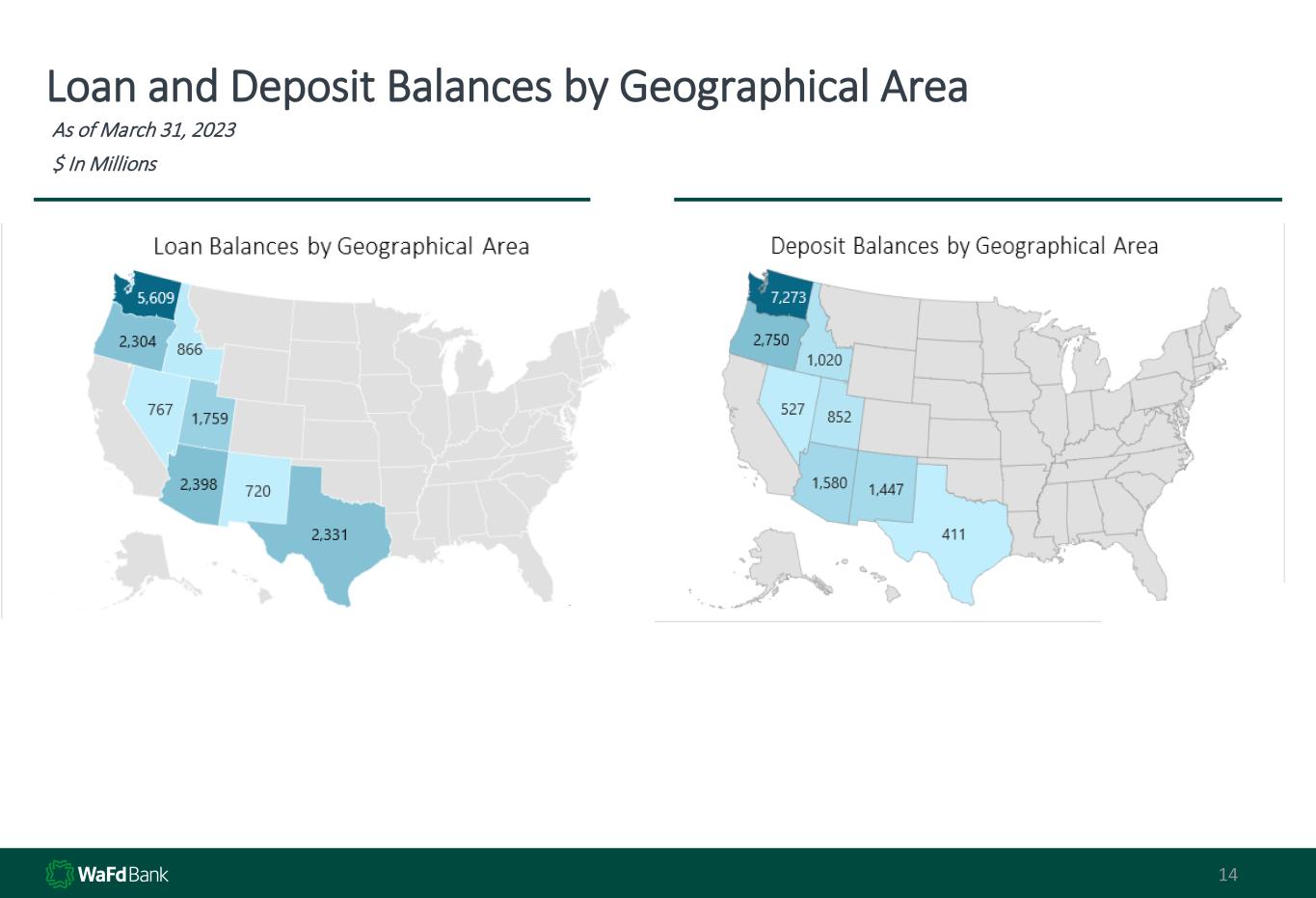

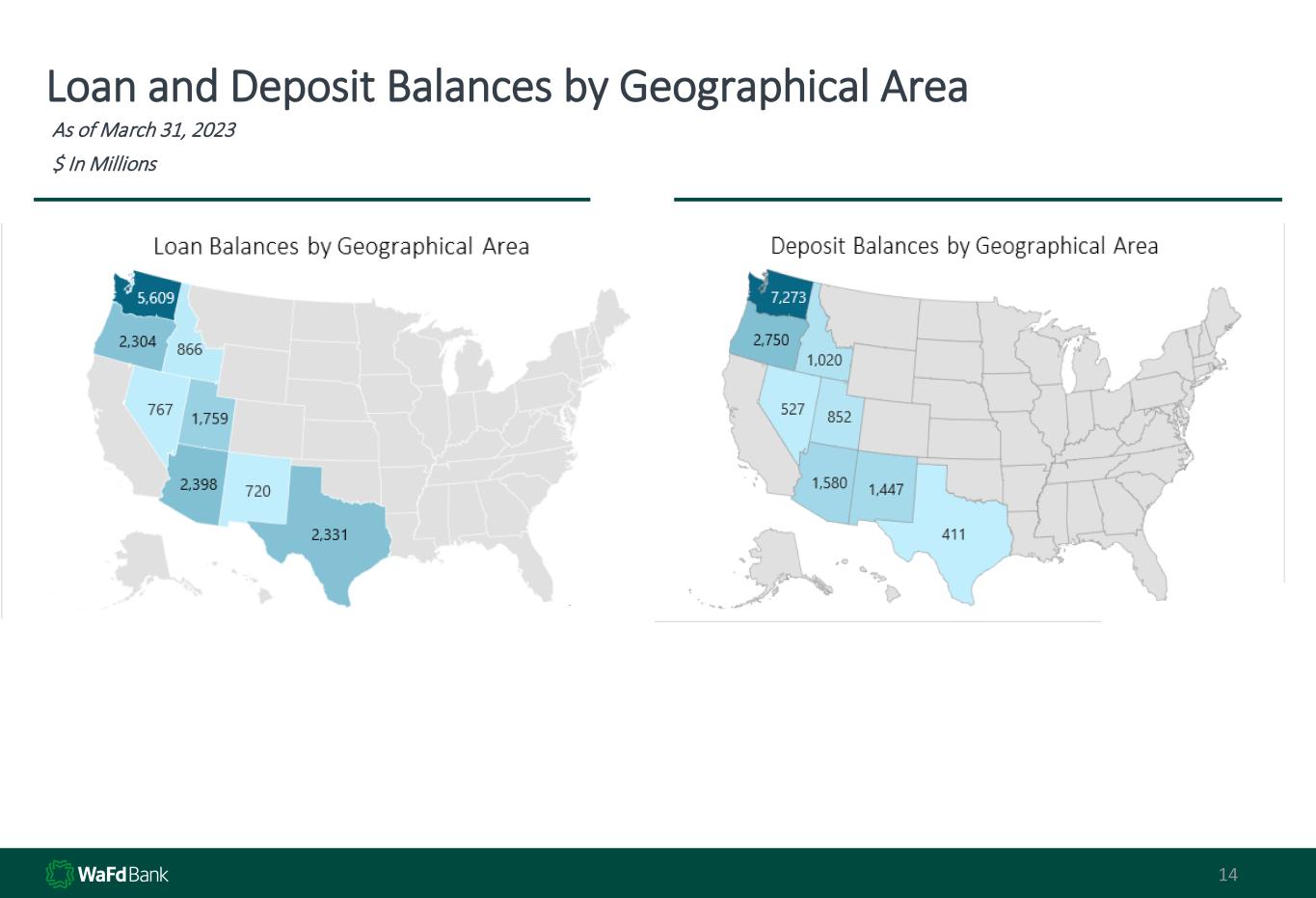

5 WaFd Bank Demographics Our markets are among the most desirable in the US and create a foundation for loan growth without excessive risk State Number of Branches Company Deposits in Market ($000) Deposit Market Share (%) Percent of National Franchise (%) Total Population 2023 (Actual) Population Change 2010-2023 (%) Projected Population Change 2023-2028 (%) Median HH Income 2023 ($) Projected HH Income Change 2023-2028 (%) Washington 71 7,273,498 3.06 43.9 7,863,719 16.94 4.33 89,976 15.87 Oregon 36 2,750,323 2.68 19.2 4,295,710 12.13 3.45 75,279 15.18 Arizona 28 1,579,815 0.74 10.3 7,380,760 15.47 3.76 71,447 16.88 New Mexico 19 1,446,675 2.93 8.2 2,120,216 2.96 0.74 58,342 13.27 Idaho 22 1,020,154 2.47 6.9 1,941,205 23.83 5.79 68,632 14.75 Utah 9 852,062 0.70 4.8 3,408,723 23.33 5.04 87,338 16.23 Nevada 8 527,449 0.47 3.3 3,198,164 18.43 3.95 70,540 11.48 Texas 6 410,972 0.05 3.4 30,065,904 19.57 4.14 71,347 11.18 Totals: 199 15,860,948 100 60,274,401 Weighted Average 15.64 3.92 79,775 15.27 Aggregate: National 334,500,069 8.34 2.14 73,503 13.37 Deposit market share and percent of national franchise are from the FDIC's Summary of Deposit reports and is as of 09/30/2022. All other data is as of 3/31/2023.

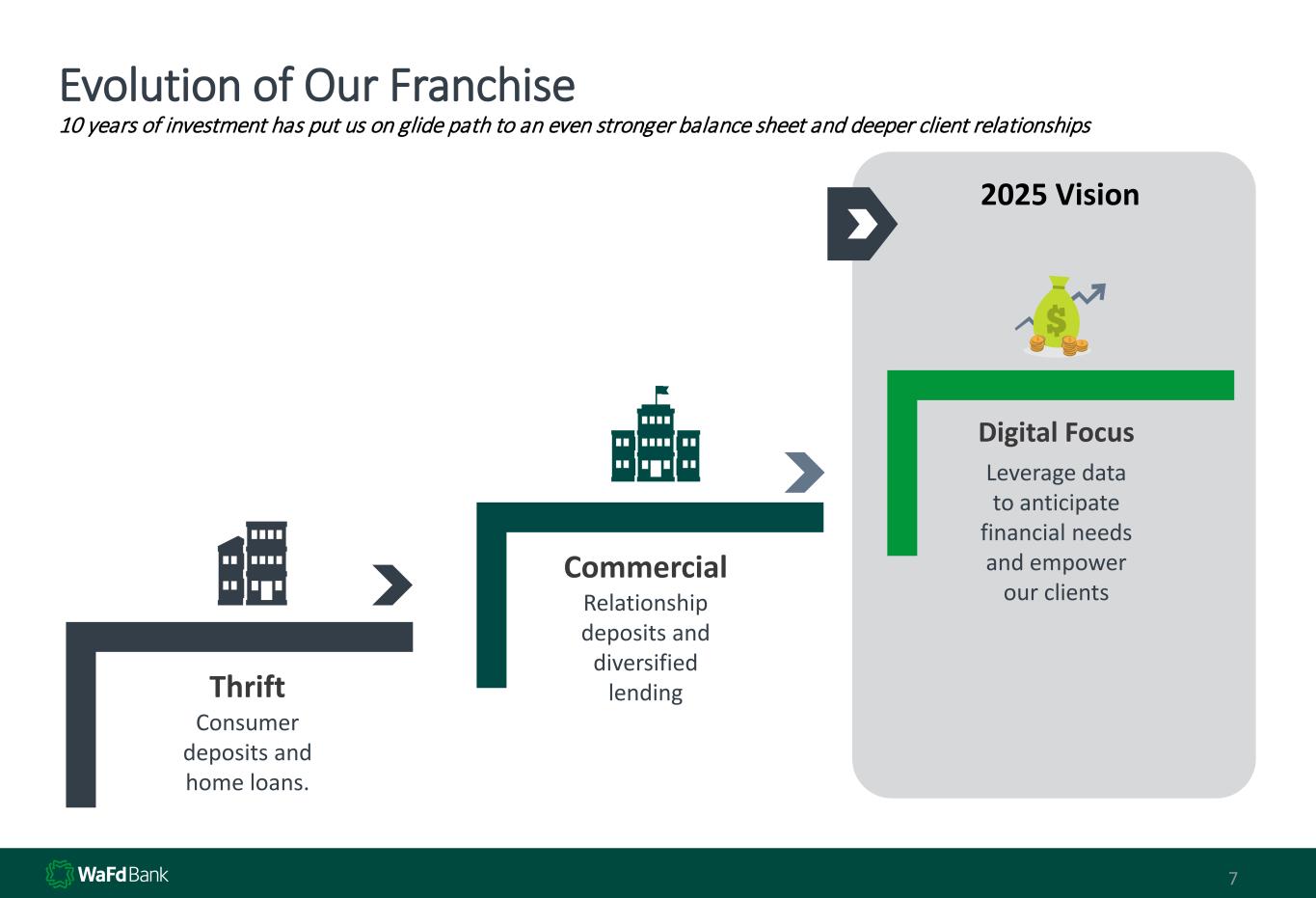

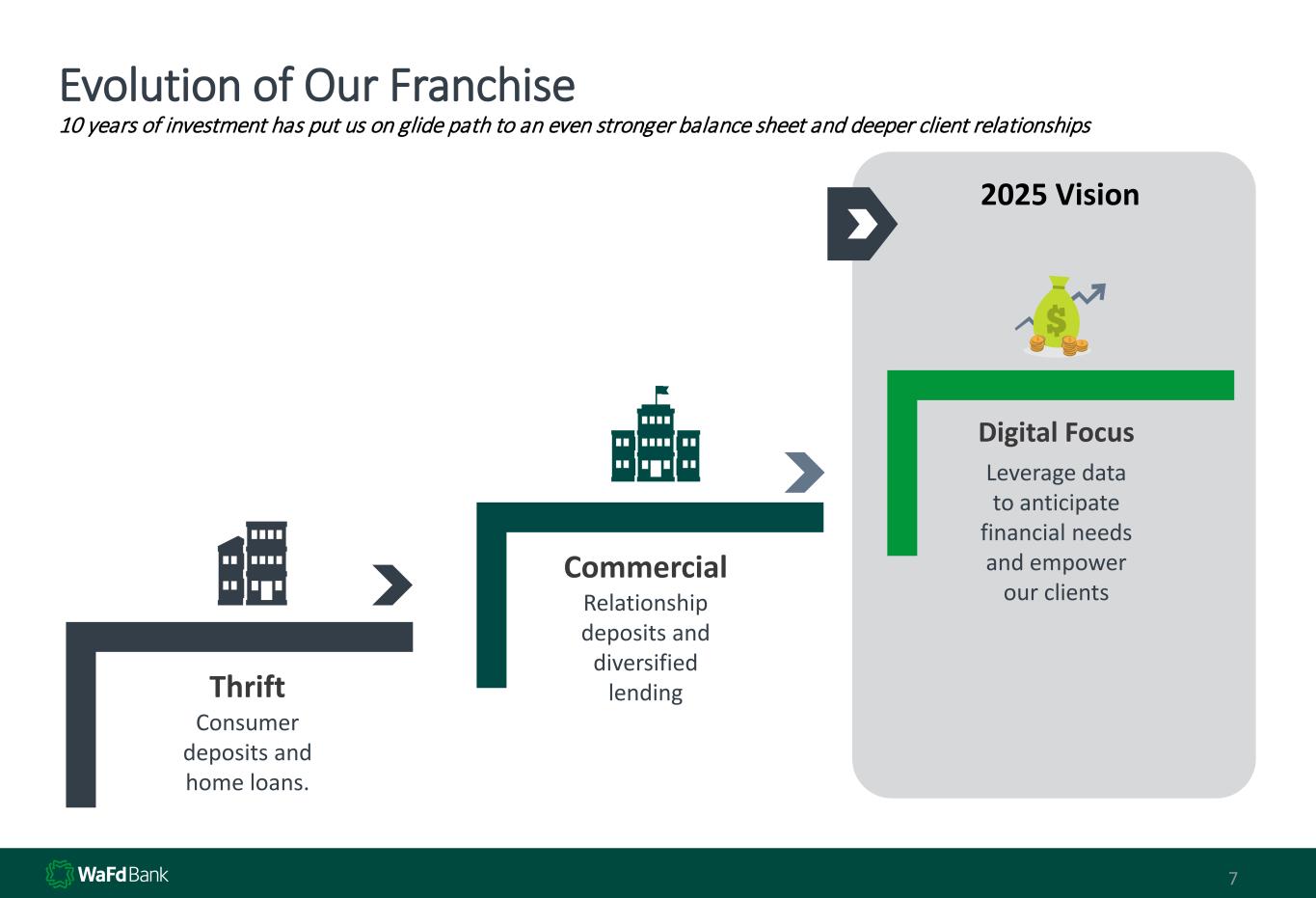

Our Objective: A highly-profitable, digital-first bank that leverages data to anticipate financial needs and empower our clients by creating frictionless experiences across all interactions and devices. Our Values: Integrity, Teamwork, Ownership, Service, Simplicity & Discipline Vision 2025 6

Evolution of Our Franchise Thrift Consumer deposits and home loans. Commercial Relationship deposits and diversified lending Digital Focus Leverage data to anticipate financial needs and empower our clients 1917-2007 2007-2018 2025 Vision 7 10 years of investment has put us on glide path to an even stronger balance sheet and deeper client relationships 7

8 WAFD’s Evolution from Thrift to Bank Funding Note: Balances shown as of fiscal year ended September 30. $5,979 $8,577 $10,835 $16,030 2007Y 2012Y 2017Y 2022Y Time Deposits Money Market Savings Checking $ in millions Note: Balances as of fiscal year ending September 30.

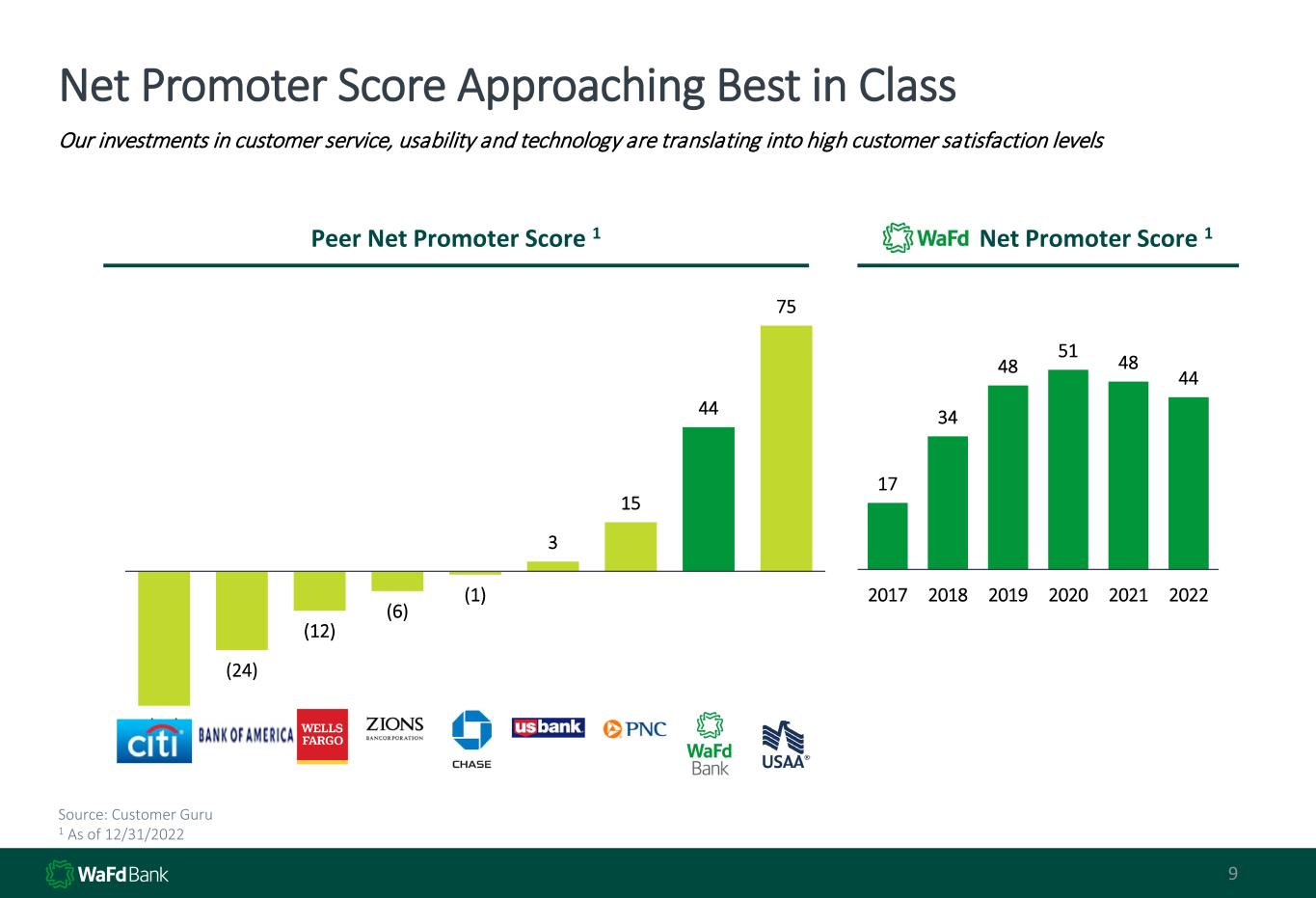

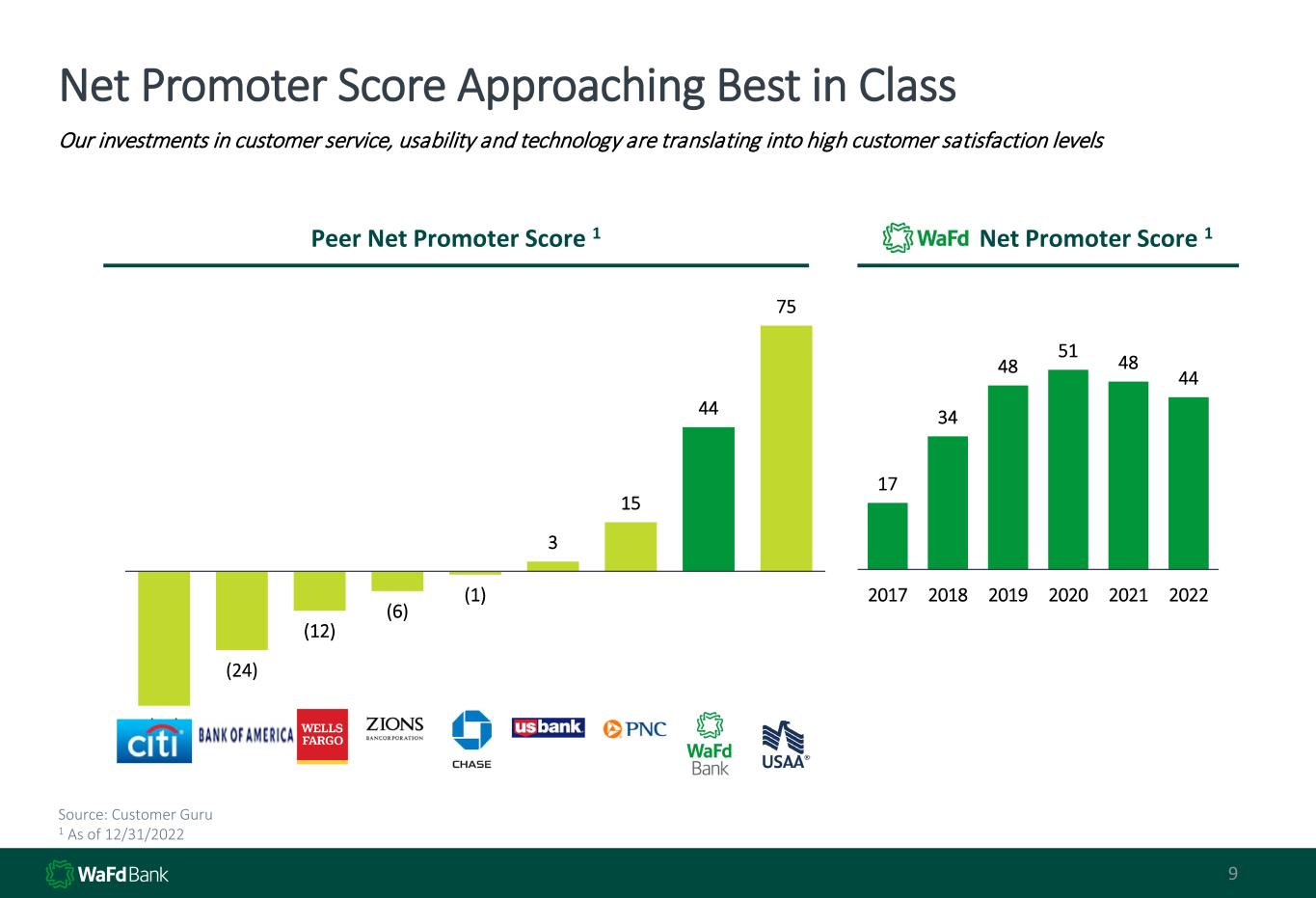

(41) (24) (12) (6) (1) 3 15 44 75 Net Promoter Score Approaching Best in Class 9 Our investments in customer service, usability and technology are translating into high customer satisfaction levels Source: Customer Guru WaFdaa Net Promoter Score 1 17 34 48 51 48 44 2017 2018 2019 2020 2021 2022 Peer Net Promoter Score 1 1 As of 12/31/2022 9

Speed Matters – Website Is the New Storefront 10 New wafdbank.com Google page speed scores 0 10 20 30 40 50 60 70 80 90 100 Desktop Mobile

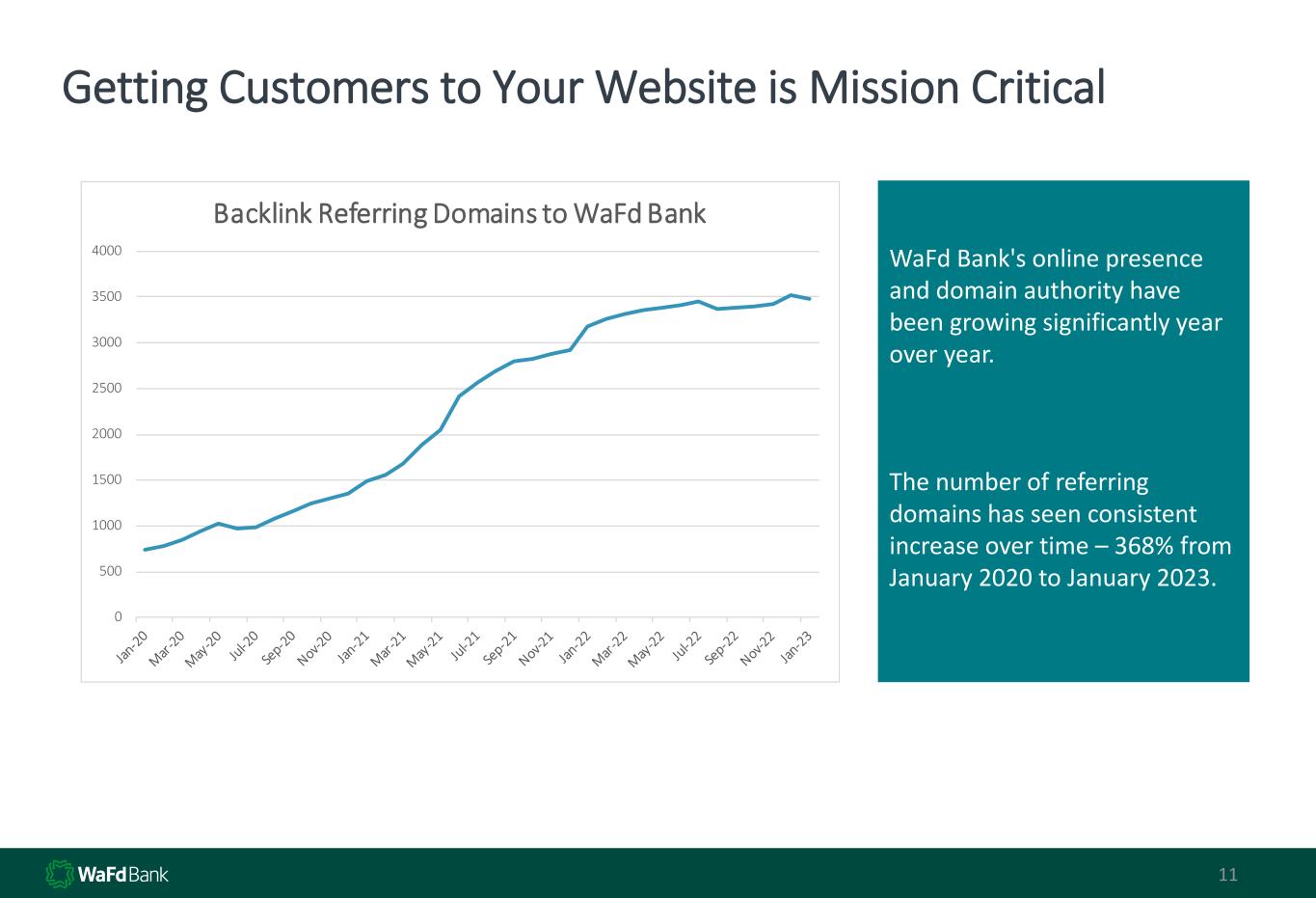

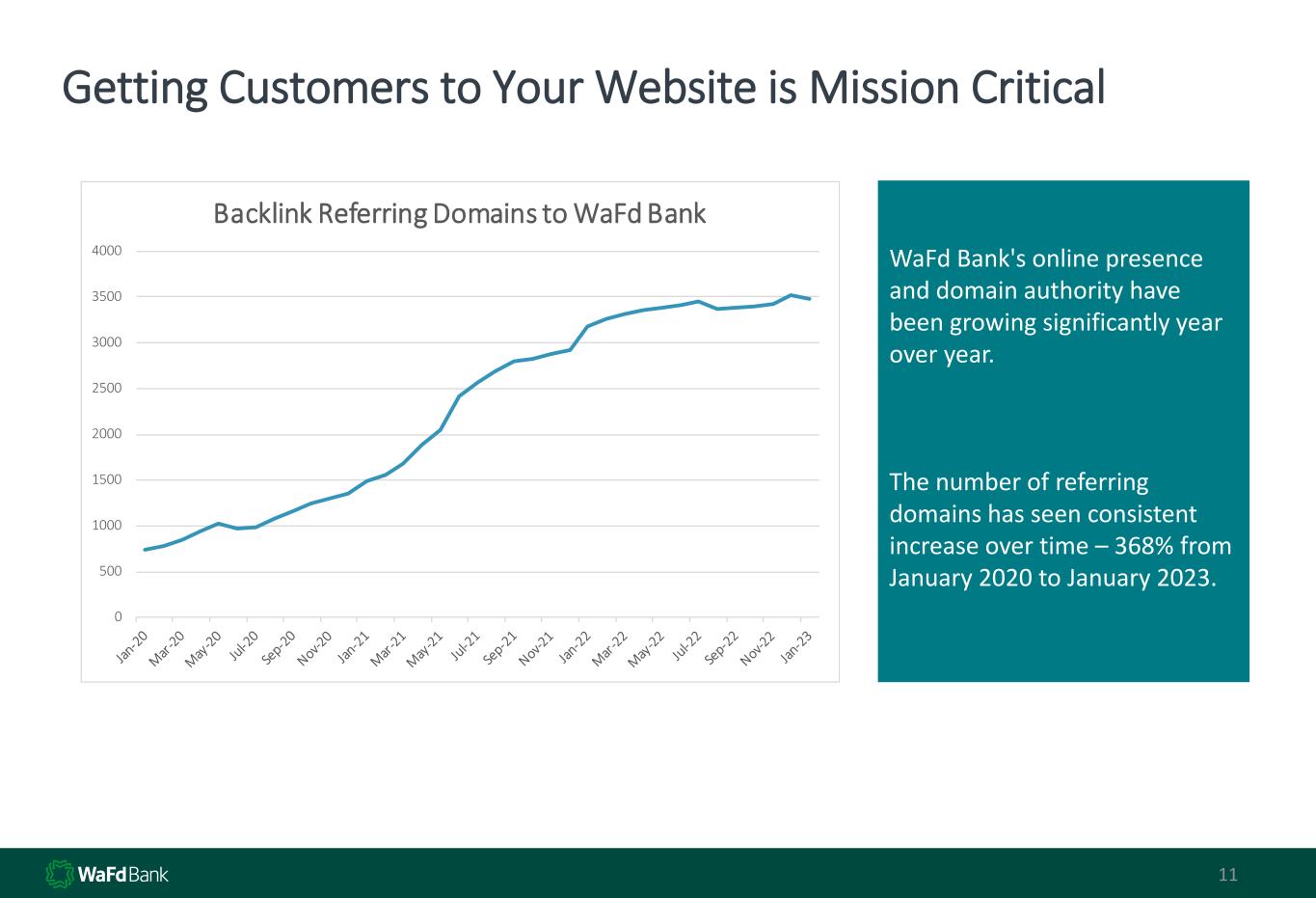

Getting Customers to Your Website is Mission Critical 11 0 500 1000 1500 2000 2500 3000 3500 4000 Backlink Referring Domains to WaFd Bank WaFd Bank's online presence and domain authority have been growing significantly year over year. The number of referring domains has seen consistent increase over time – 368% from January 2020 to January 2023.

12 Commitment to ESG & Diversity We believe our enduring franchise comes from core principles focused on helping the neighborhoods we serve and creating long- term value for all stakeholders led by a Board, management and employee base that bring together a diversity of backgrounds Board Composition1 ESG & Diversity Policy Highlights Our Corporate Social and Environmental Responsibility Policy flows from WaFd Bank’s core principles, which are: To provide common- sense banking that helps neighborhoods flourish Adhere to the primary corporate value of integrity Exercise prudent risk management Maintain transparency in its business practices Resolve to create long-term value for all stakeholders 1 2 3 4 5 Community Development Over $203 million dollars invested towards community development lending and affordable housing investments Washington Federal Foundation The Washington Federal Foundation awarded 218 grants to local community organizations totaling $705 million for the fiscal year Volunteerism WaFd employees participated in 8,179 volunteer hours in support of more than 447 organizations and initiatives United Way Matching Campaign WaFd Bank matches employee contributions made to United Way agencies in all eight states. In fiscal year 2022 pledges from colleagues were $402,109. WaFd matched $327,375 for a total of $729,484 1 Based on self-identification 2 As of 9/30/22 Gender Identity Female Male Not Disclosed Directors 2 7 1 Demographic Background African American or Black 2 Hispanic or Latinx 1 Asian 1 White 1 4 Not Disclosed 1

13 5 Year Change by Percentage in Each Geographical Area From March 31, 2017, to March 31, 2023

14 Loan and Deposit Balances by Geographical Area As of March 31, 2023 $ In Millions

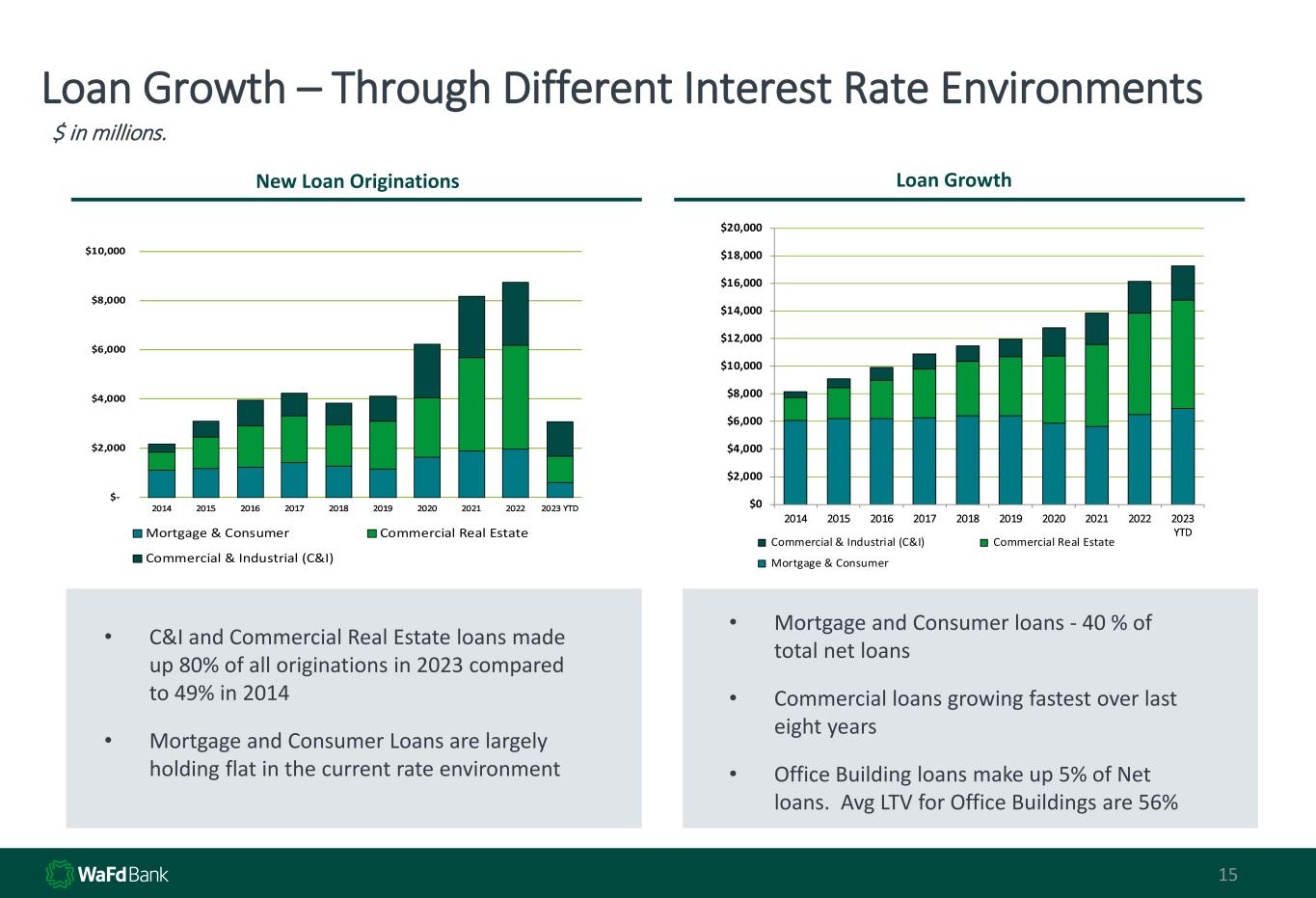

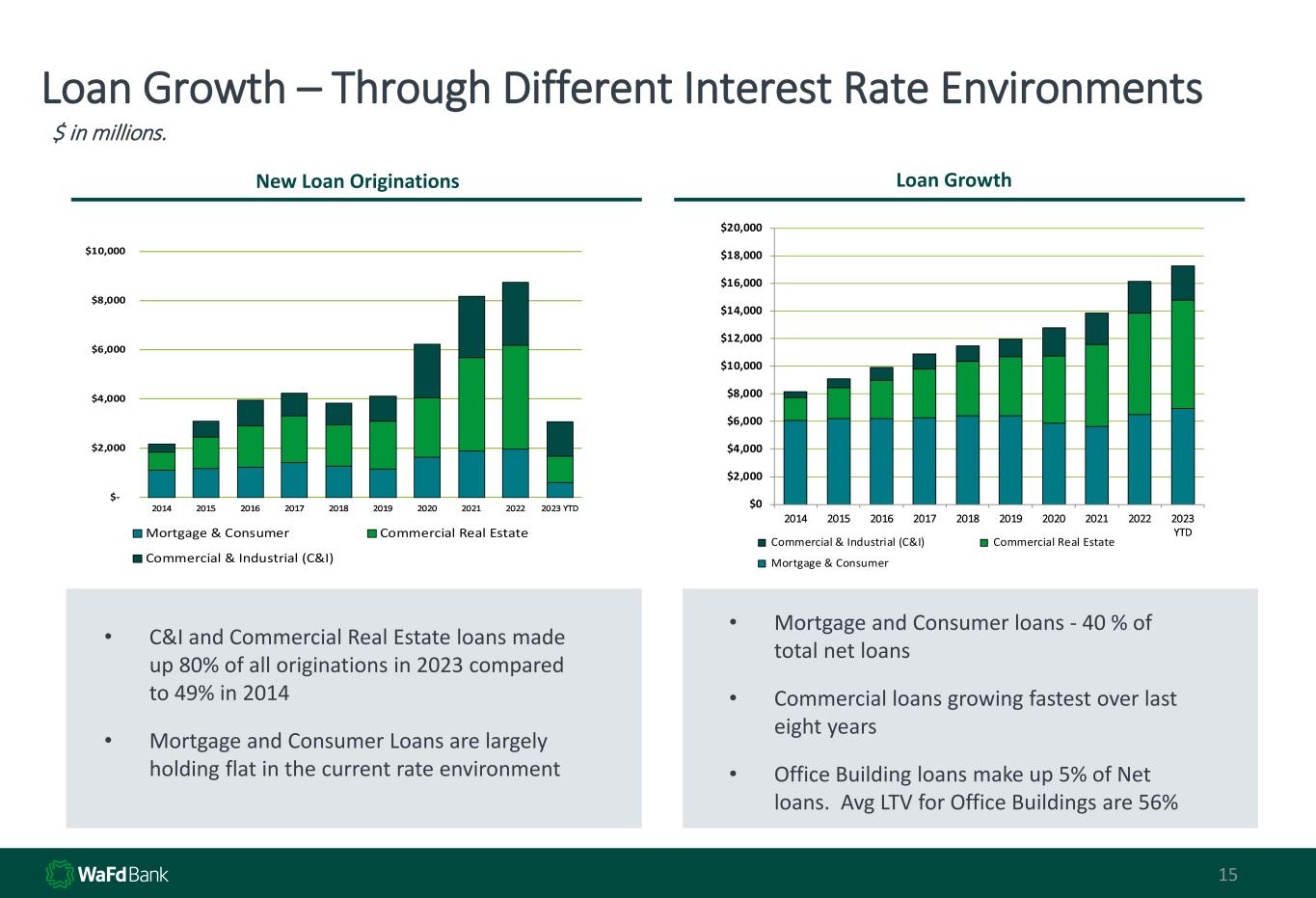

15 Loan Growth – Through Different Interest Rate Environments • Mortgage and Consumer loans - 40 % of total net loans • Commercial loans growing fastest over last eight years • Office Building loans make up 5% of Net loans. Avg LTV for Office Buildings are 56% Loan GrowthNew Loan Originations $ in millions. • C&I and Commercial Real Estate loans made up 80% of all originations in 2023 compared to 49% in 2014 • Mortgage and Consumer Loans are largely holding flat in the current rate environment $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD Commercial & Industrial (C&I) Commercial Real Estate Mortgage & Consumer $- $2,000 $4,000 $6,000 $8,000 $10,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD Mortgage & Consumer Commercial Real Estate Commercial & Industrial (C&I)

Non-Performing Assets Near Record Lows 16 We have retained a strong ACL while NPAs have declined since 2010 • ACL at 3/31/2023 amounted to $177.4 million, representing 379% of total NPAs 1 • Non-performing assets $46.7 million as of 3/31/2023 3.22% 2.76% 2.18% 1.63% 1.00% 0.88% 0.48% 0.46% 0.44% 0.27% 0.20% 0.22% 0.21% 0.21% 1.79% 1.85% 1.69% 1.47% 1.36% 1.15% 1.13% 1.12% 1.11% 1.09% 1.29% 1.22% 1.06% 1.02% FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 2023 YTD Non-Performing Assets to Total Assets ACL to Total Loans Non-Performing Assets to Total Assets and ACL to Total Loans 1 For Fiscal Year End 9/30 1 ACL to Total Loans does not include ACL related to unfunded commitments of $28.5 million. 2 Effective October 1, 2020, the Company implemented FASB’s Current Expected Credit Loss (CECL) Standard 2

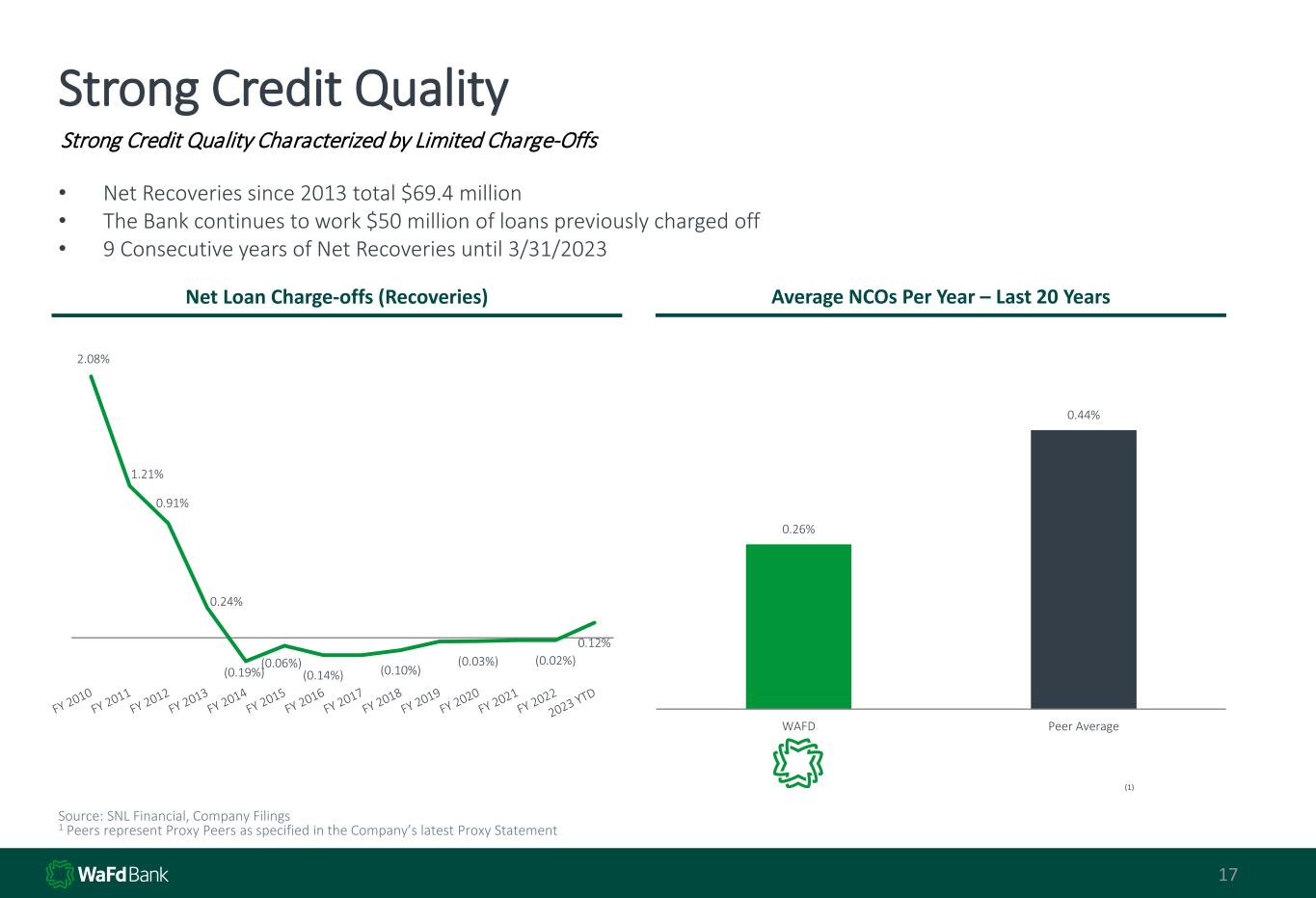

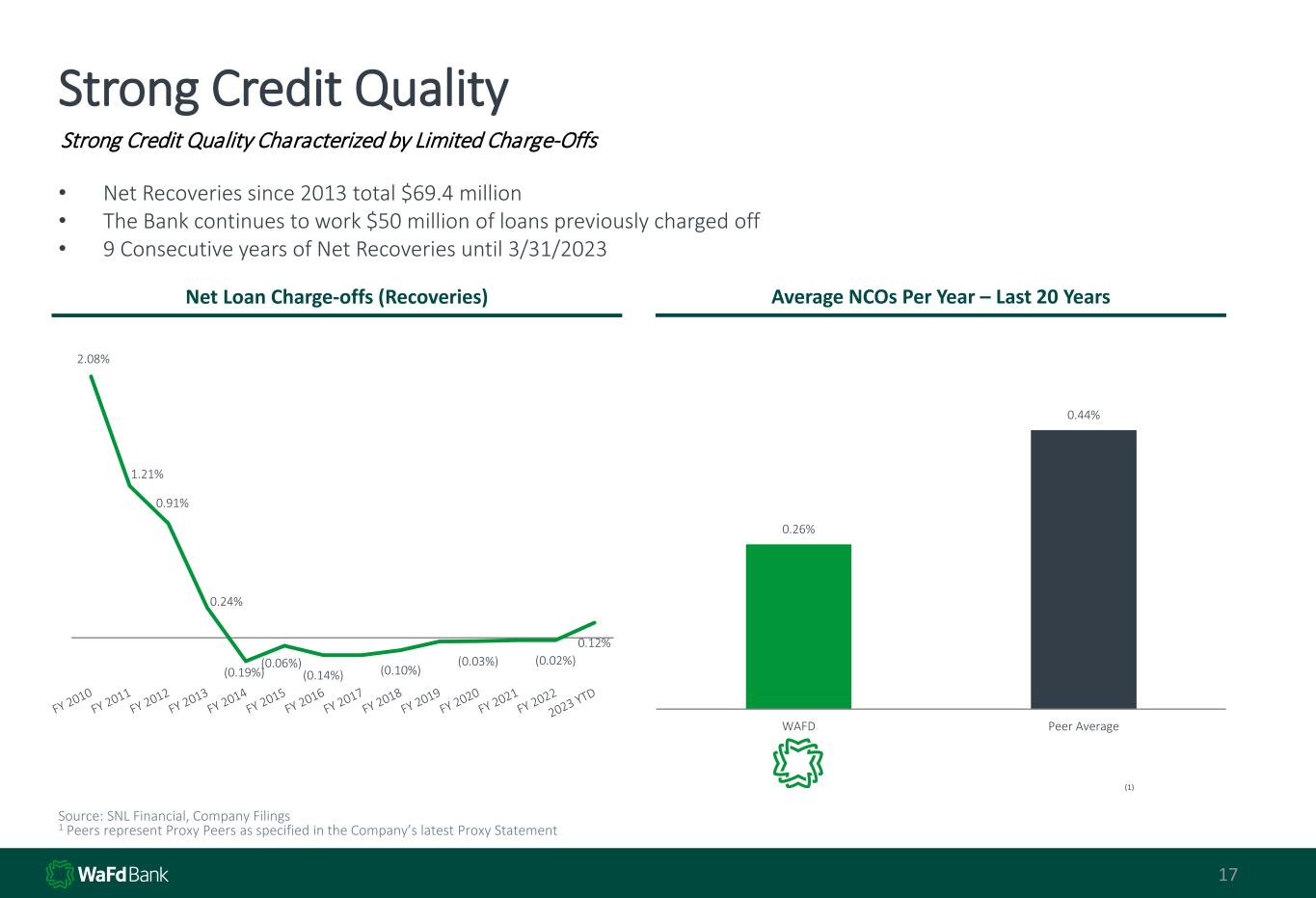

0.26% 0.44% WAFD Peer Average Strong Credit Quality 17 2.08% 1.21% 0.91% 0.24% (0.19%) (0.06%) (0.14%) (0.10%) (0.03%) (0.02%) 0.12% Net Loan Charge-offs (Recoveries) Average NCOs Per Year – Last 20 Years Source: SNL Financial, Company Filings 1 Peers represent Proxy Peers as specified in the Company’s latest Proxy Statement (1) Strong Credit Quality Characterized by Limited Charge-Offs • Net Recoveries since 2013 total $69.4 million • The Bank continues to work $50 million of loans previously charged off • 9 Consecutive years of Net Recoveries until 3/31/2023

Net Loan Portfolio Average Current LTV 18 As of March 31, 2023 $ In Thousands Net Balance % of Loans WTD Avg Current LTV % with Current LTV >75% Avg LTV when above 75% Multifamily 2,846,956$ 16% 43% 2% 77% CRE - Office 839,179 5% 56% 38% 80% CRE - Other 2,391,323 14% 41% 13% 80% CRE Construction - Multifamily 938,312 5% 49% 1% 83% CRE Construction - Other 644,175 4% 43% 14% 81% C&I 2,521,895 15% NA SFR 6,107,105 35% 36% 7% 84% SFR Custom Construction 400,327 2% 59% 22% 80% Other 582,636 3% NA 17,271,906$ 100%

Significant Liquidity and High-Quality Securities Portfolio 19 High quality, $3.5 billion cash and investment portfolio with $9.8 billion remaining collateral and lines as a source of additional potential liquidity Cash and Securities Composition Total Cash and Securities: $3.5Bn Cash and Securities / Total Assets: 16% Cash & Securities / Total Assets1 1 US Govt Backed, 38% Cash, 31% High Quality Bonds, 31% As of 3/31/2023, WAFD maintains over $3.5bn of balance sheet liquidity. • Cash and Securities is 16% of assets • Investment Portfolio targets low credit risk / moderate duration • 69% Cash, US Government-backed Agency Bonds and MBS 2 • Yield on the Investment Portfolio is 3.92% Liquidity is tested quarterly through running various scenarios to determine their affect on available liquidity. Whether minor or extreme, these tests show strong liquidity as a result of deposits and borrowing capacity from reliable collateralized sources. Source: SNL Financial, Company Filings 1 Peers represent Proxy Peers as specified in the Company’s latest Proxy Statement Total Cash and Securities: $3.2Bn Cash and Securities / Total Assets: 15% December 31, 2022 March 31, 2023

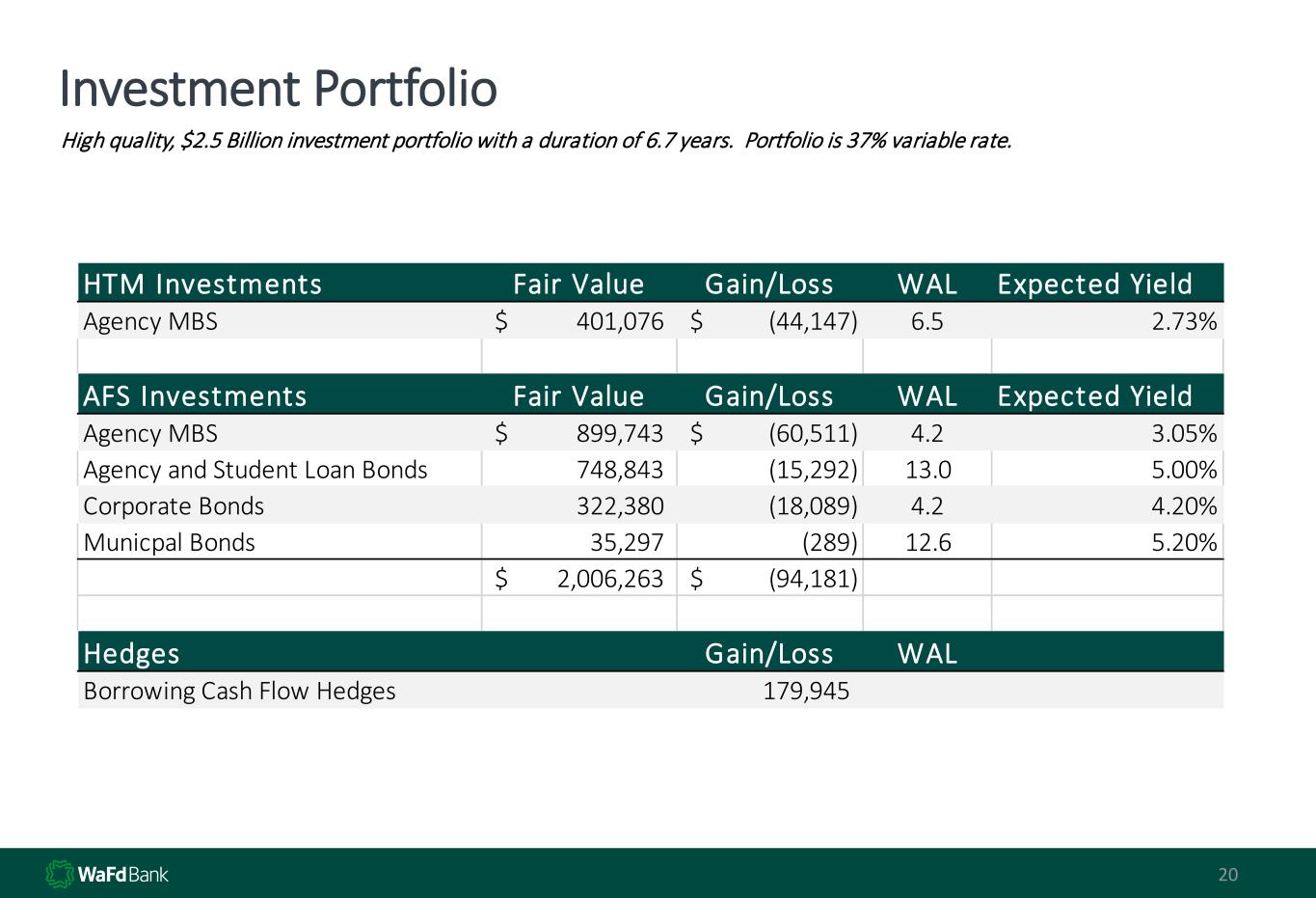

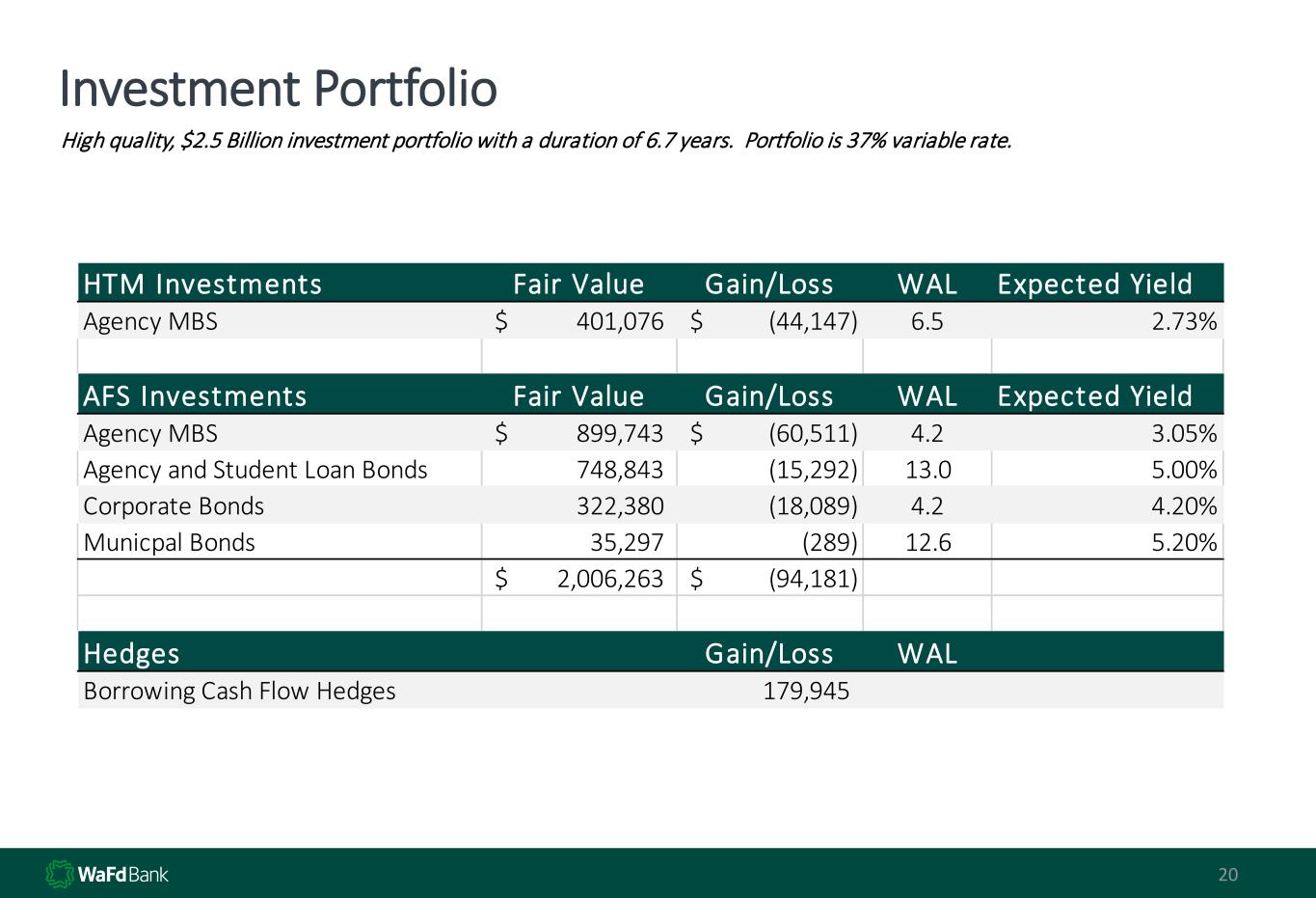

Investment Portfolio 20 High quality, $2.5 Billion investment portfolio with a duration of 6.7 years. Portfolio is 37% variable rate. HTM Investments Fair Value Gain/Loss WAL Expected Yield Agency MBS 401,076$ (44,147)$ 6.5 2.73% AFS Investments Fair Value Gain/Loss WAL Expected Yield Agency MBS 899,743$ (60,511)$ 4.2 3.05% Agency and Student Loan Bonds 748,843 (15,292) 13.0 5.00% Corporate Bonds 322,380 (18,089) 4.2 4.20% Municpal Bonds 35,297 (289) 12.6 5.20% 2,006,263$ (94,181)$ Hedges Gain/Loss WAL Borrowing Cash Flow Hedges 179,945

Highly Diversified Deposit Base 21 Top 20 depositors make up 11% of total deposits. 26.7% of total deposits are uninsured as of March 31, 2023.

Transaction Accounts $11,880 75% Time Deposits $3,981 25% As of 3/31/2023 Transaction Accounts $3,525 39% Time Deposits $5,628 61% As of 3/31/2013 22 Deposit Trends Core Deposits = 92.3% of Total Shifting away from time deposits in favor of transaction accounts. Checking accounts now make up 44%. 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 Transaction Accounts Time Deposits WTD Rate In Millions

23 Deposit Flows *(Balances $ in thousands) Customer Deposit Accounts 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 4/30/2023 5/10/2023 Checking - Noninterest Bearing 3,279,841$ 3,251,603$ 3,269,773$ 3,266,734$ 3,070,895$ 2,856,165$ 2,770,925$ 2,775,067$ Checking - Interest Bearing 3,688,822 3,897,185 3,472,402 3,497,795 3,971,814 4,125,554 4,251,496 4,236,364 Savings 1,043,003 1,078,146 1,069,801 1,059,093 1,002,034 943,915 910,463 873,296 Money Market 4,538,396 4,912,671 4,856,275 4,867,905 4,503,090 3,954,709 3,743,075 3,702,273 CDs 3,351,985 3,251,042 3,297,369 3,338,043 3,412,203 3,980,605 4,129,682 4,333,860 Total 15,902,046 16,390,648 15,965,620 16,029,570 15,960,035 15,860,948 15,805,641 15,920,860 Quarter Change (359,934) 488,602 (425,028) 63,950 (69,534) (99,088) 59,912 Month to Date Change 25,418 (55,307) 115,219 Uninsured Deposits 5,016,880 5,334,562 5,164,602 4,856,149 4,876,840 4,238,629 4,077,855 4,093,845 % of Total Deposits 31.5% 32.5% 32.3% 30.3% 30.6% 26.7% 25.8% 25.7% $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 4/30/2023 5/10/2023 Checking - Noninterest Bearing Checking - Interest Bearing Savings Money Market CDs

Borrowings Outstanding & Weighted Rate 24 Borrowings are 90% FHLB and 10% Fed’s Bank Term Funding and are used in part to manage interest rate risk. Current period increase reflects increased use of short-term borrowings to fund loan growth. Rates have increased with market rates. Increase in borrowings for 2020 was from locking in $1 billion of funding at a fixed rate of 66 bps for 10 years. Effective Maturity Schedule Amount $ million Rate Within 1 year: $2,700 4.74% 1 to 3 years: $ 300 2.07% 3 to 5 years: $ - - % 5+ years: $ 800 0.76% 3.69% -0.25% 0.25% 0.75% 1.25% 1.75% 2.25% 2.75% 3.25% 3.75% 4.25% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Utilization of Fed’s Bank Term Funding Program 25 Due to the highly favorable terms of the program WaFd has elected to borrow from the program and use savings relative to other wholesale costs to subsidize further actions to strengthen fortress liquidity position. Sources and Uses of Funds & Net Interest Income Impacts Features of Bank Term Funding Program in Support of Utilization • Prepayable at any time without penalty – great given high volatility/uncertainty • Lowest cost funding source available – yield curve inversion outstrips 10bps pay-up over 1-year Fed Funds Overnight Interest Rate Swaps • Additional collateral value on small portion of securities portfolio with mark to market losses • Enables increasing cash position without a drag to net interest income • Wholesale deposits added at terms up to 1 year and 5.4% rate to ensure there is ample liquidity on-hand in case of persistent stresses on banking sector Amount ($MM) Rate Quarterly NII Impact ($MM) Sources Draw Fed Bank Term Funding Program 375 4.37% -4.10 FHLB Advance Draw 125 5.13% -1.60 500 4.56% -5.70 Uses Increase in Cash Held at Fed 500 4.90% 6.13 500 4.90% 6.13

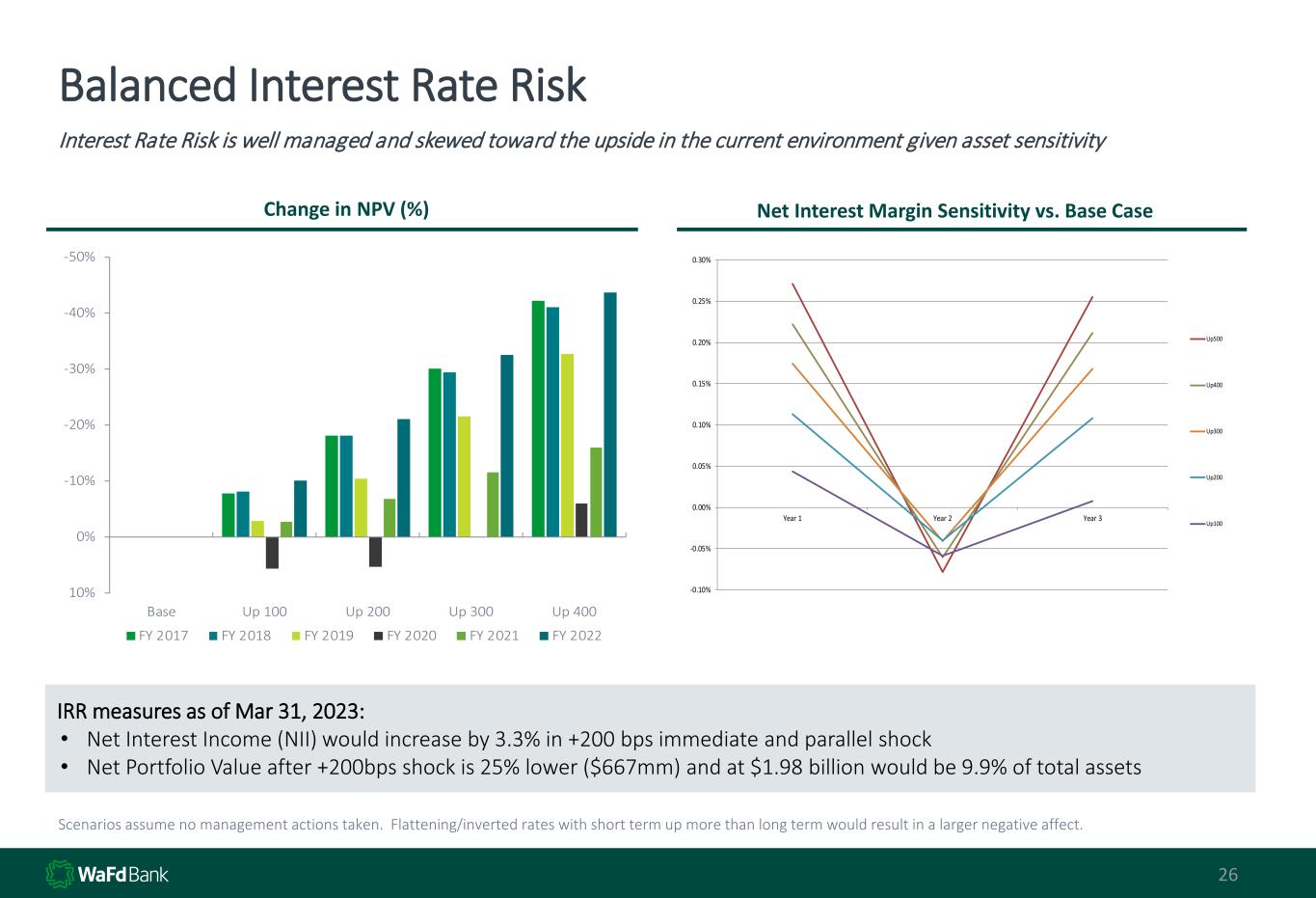

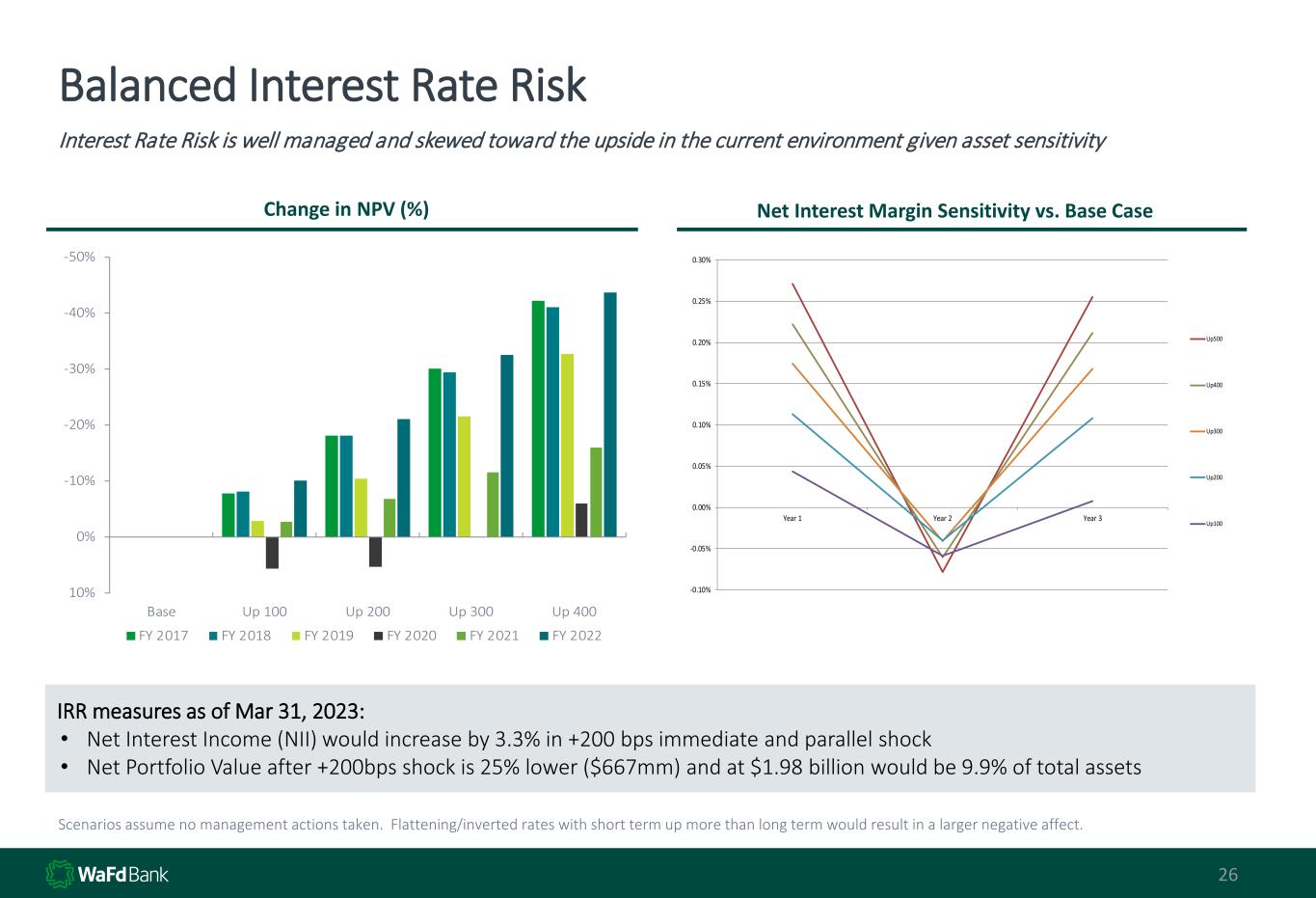

Scenarios assume no management actions taken. Flattening/inverted rates with short term up more than long term would result in a larger negative affect. Balanced Interest Rate Risk 26 Interest Rate Risk is well managed and skewed toward the upside in the current environment given asset sensitivity IRR measures as of Mar 31, 2023: • Net Interest Income (NII) would increase by 3.3% in +200 bps immediate and parallel shock • Net Portfolio Value after +200bps shock is 25% lower ($667mm) and at $1.98 billion would be 9.9% of total assets Change in NPV (%) Net Interest Margin Sensitivity vs. Base Case -50% -40% -30% -20% -10% 0% 10% Base Up 100 Up 200 Up 300 Up 400 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 -0.10% -0.05% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% Year 1 Year 2 Year 3 Up500 Up400 Up300 Up200 Up100

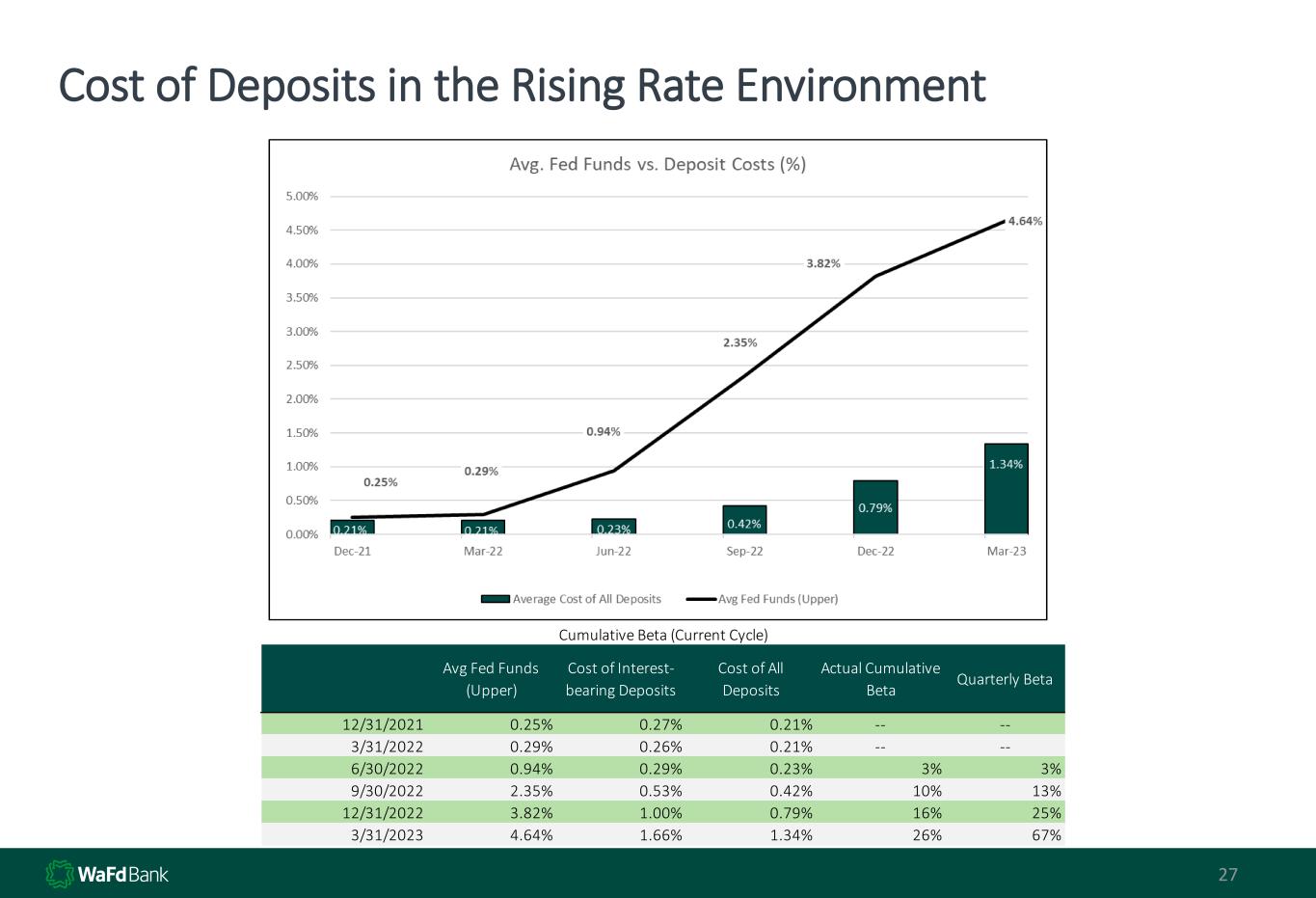

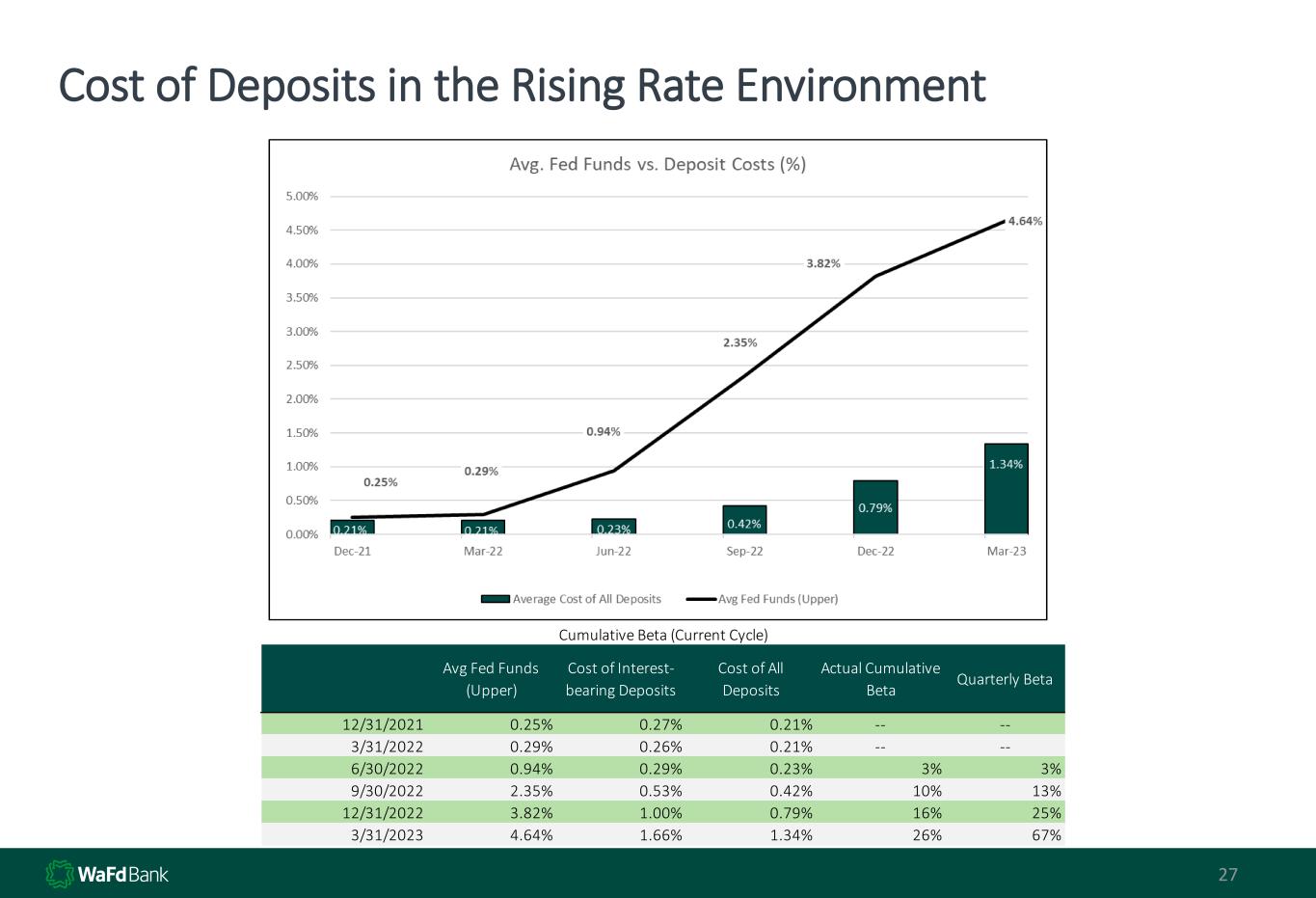

Cost of Deposits in the Rising Rate Environment 27 Avg Fed Funds (Upper) Cost of Interest- bearing Deposits Cost of All Deposits Actual Cumulative Beta Quarterly Beta 12/31/2021 0.25% 0.27% 0.21% -- -- 3/31/2022 0.29% 0.26% 0.21% -- -- 6/30/2022 0.94% 0.29% 0.23% 3% 3% 9/30/2022 2.35% 0.53% 0.42% 10% 13% 12/31/2022 3.82% 1.00% 0.79% 16% 25% 3/31/2023 4.64% 1.66% 1.34% 26% 67% Cumulative Beta (Current Cycle)

AOCI vs our Peers 28 -70% -60% -50% -40% -30% -20% -10% 0% 10% 20% Total Accumulated Other Comprehensive Income as a percent of Equity WAFD BANR ZION WAL COLB

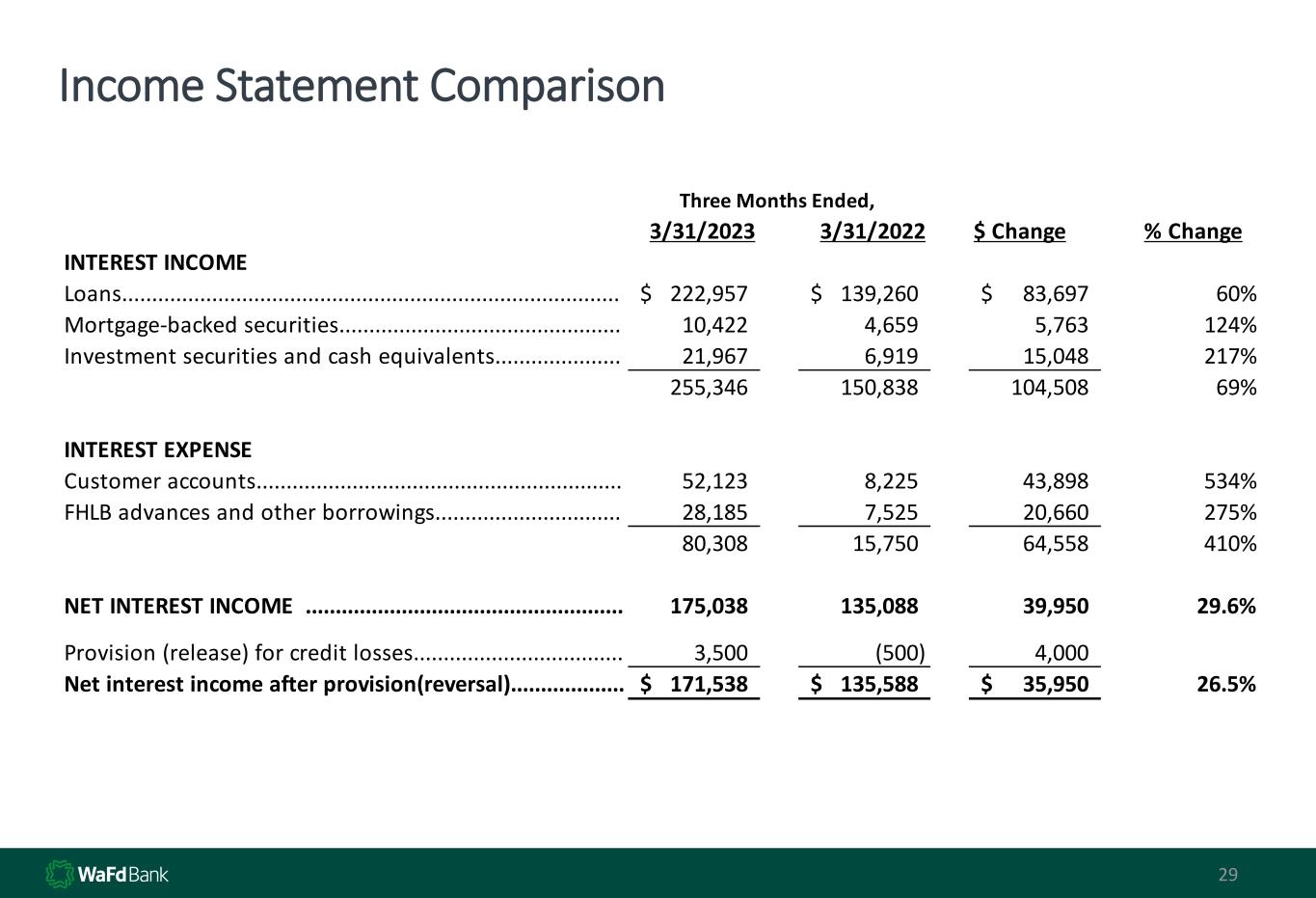

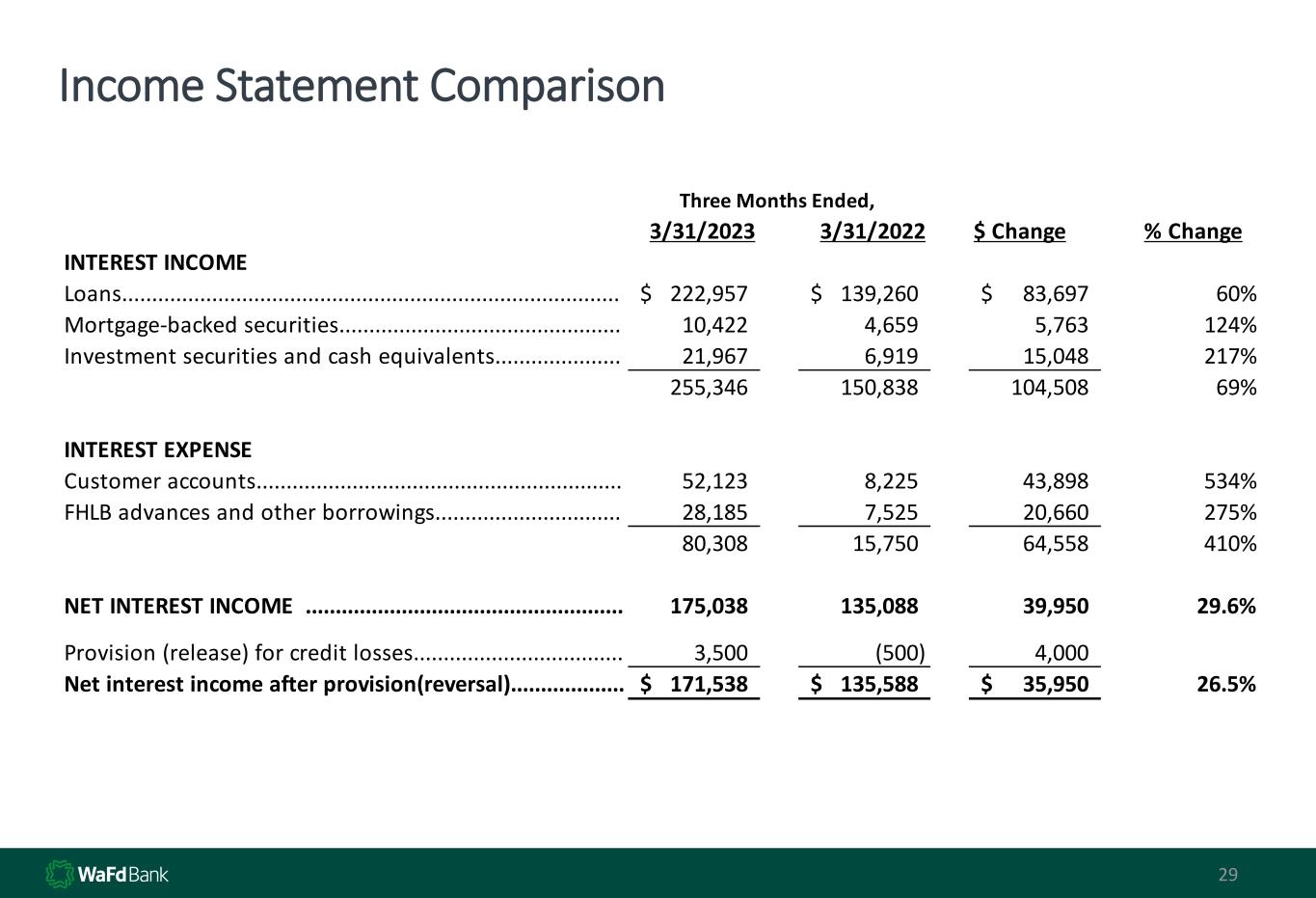

29 Income Statement Comparison 29 3/31/2023 3/31/2022 $ Change % Change INTEREST INCOME Loans................................................................................... 222,957$ 139,260$ 83,697$ 60% Mortgage-backed securities............................................... 10,422 4,659 5,763 124% Investment securities and cash equivalents..................... 21,967 6,919 15,048 217% 255,346 150,838 104,508 69% INTEREST EXPENSE Customer accounts............................................................. 52,123 8,225 43,898 534% FHLB advances and other borrowings............................... 28,185 7,525 20,660 275% 80,308 15,750 64,558 410% NET INTEREST INCOME ..................................................... 175,038 135,088 39,950 29.6% Provision (release) for credit losses................................... 3,500 (500) 4,000 Net interest income after provision(reversal)................... 171,538$ 135,588$ 35,950$ 26.5% Three Months Ended,

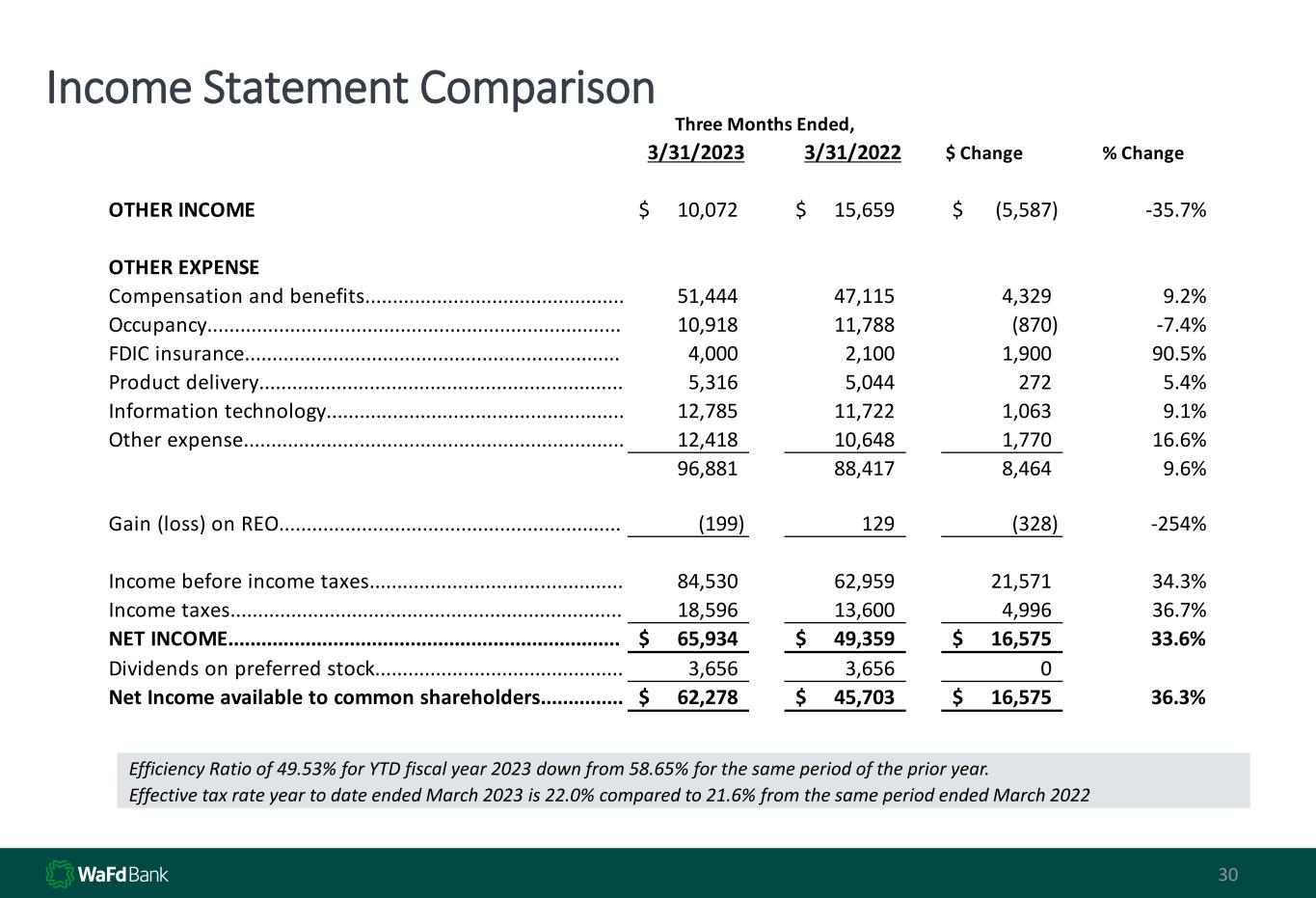

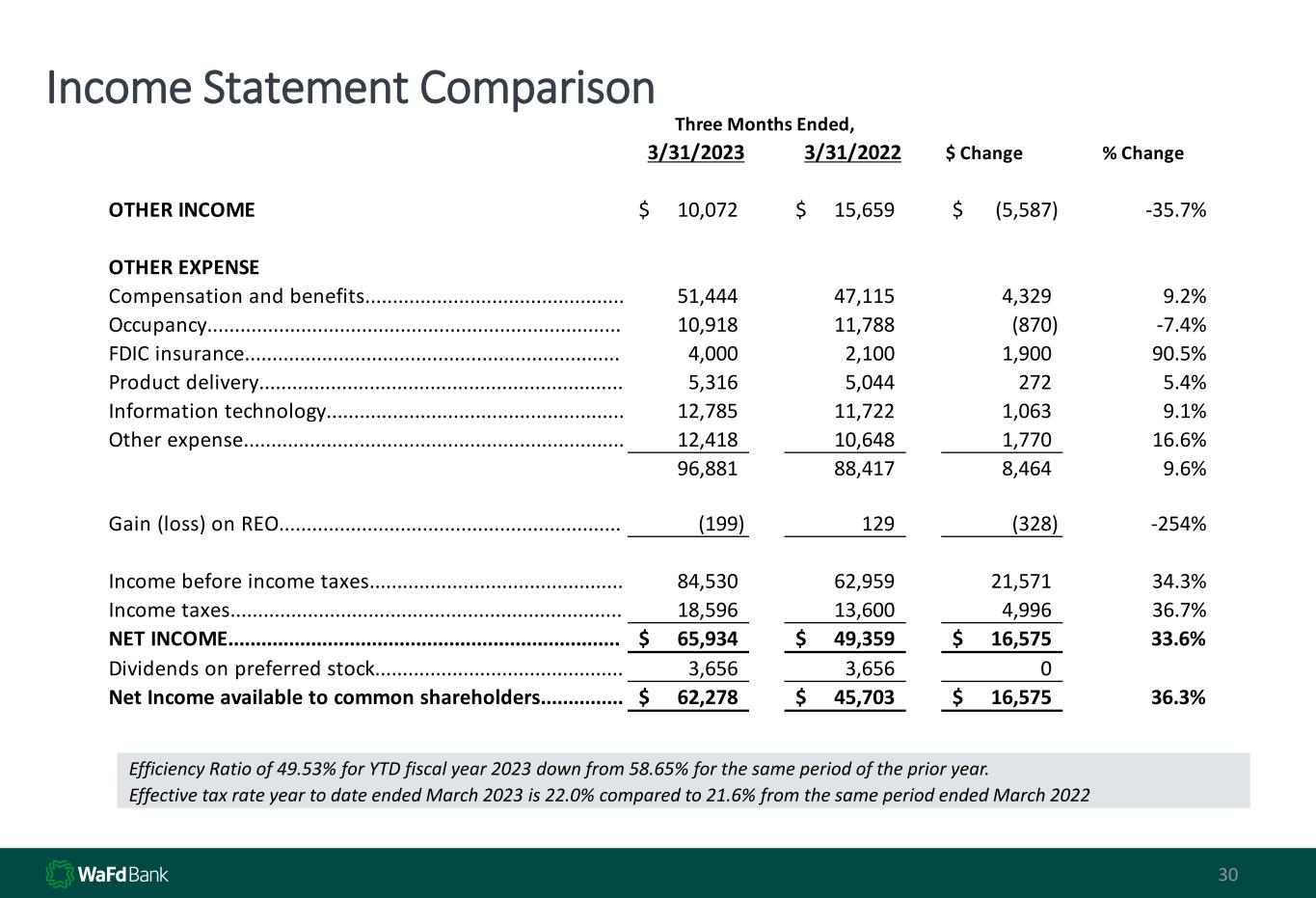

30 Income Statement Comparison Efficiency Ratio of 49.53% for YTD fiscal year 2023 down from 58.65% for the same period of the prior year. Effective tax rate year to date ended March 2023 is 22.0% compared to 21.6% from the same period ended March 2022 3/31/2023 3/31/2022 $ Change % Change OTHER INCOME 10,072$ 15,659$ (5,587)$ -35.7% OTHER EXPENSE Compensation and benefits............................................... 51,444 47,115 4,329 9.2% Occupancy........................................................................... 10,918 11,788 (870) -7.4% FDIC insurance.................................................................... 4,000 2,100 1,900 90.5% Product delivery.................................................................. 5,316 5,044 272 5.4% Information technology...................................................... 12,785 11,722 1,063 9.1% Other expense..................................................................... 12,418 10,648 1,770 16.6% 96,881 88,417 8,464 9.6% Gain (loss) on REO.............................................................. (199) 129 (328) -254% Income before income taxes.............................................. 84,530 62,959 21,571 34.3% Income taxes....................................................................... 18,596 13,600 4,996 36.7% NET INCOME....................................................................... 65,934$ 49,359$ 16,575$ 33.6% Dividends on preferred stock............................................. 3,656 3,656 0 Net Income available to common shareholders............... 62,278$ 45,703$ 16,575$ 36.3% Three Months Ended,

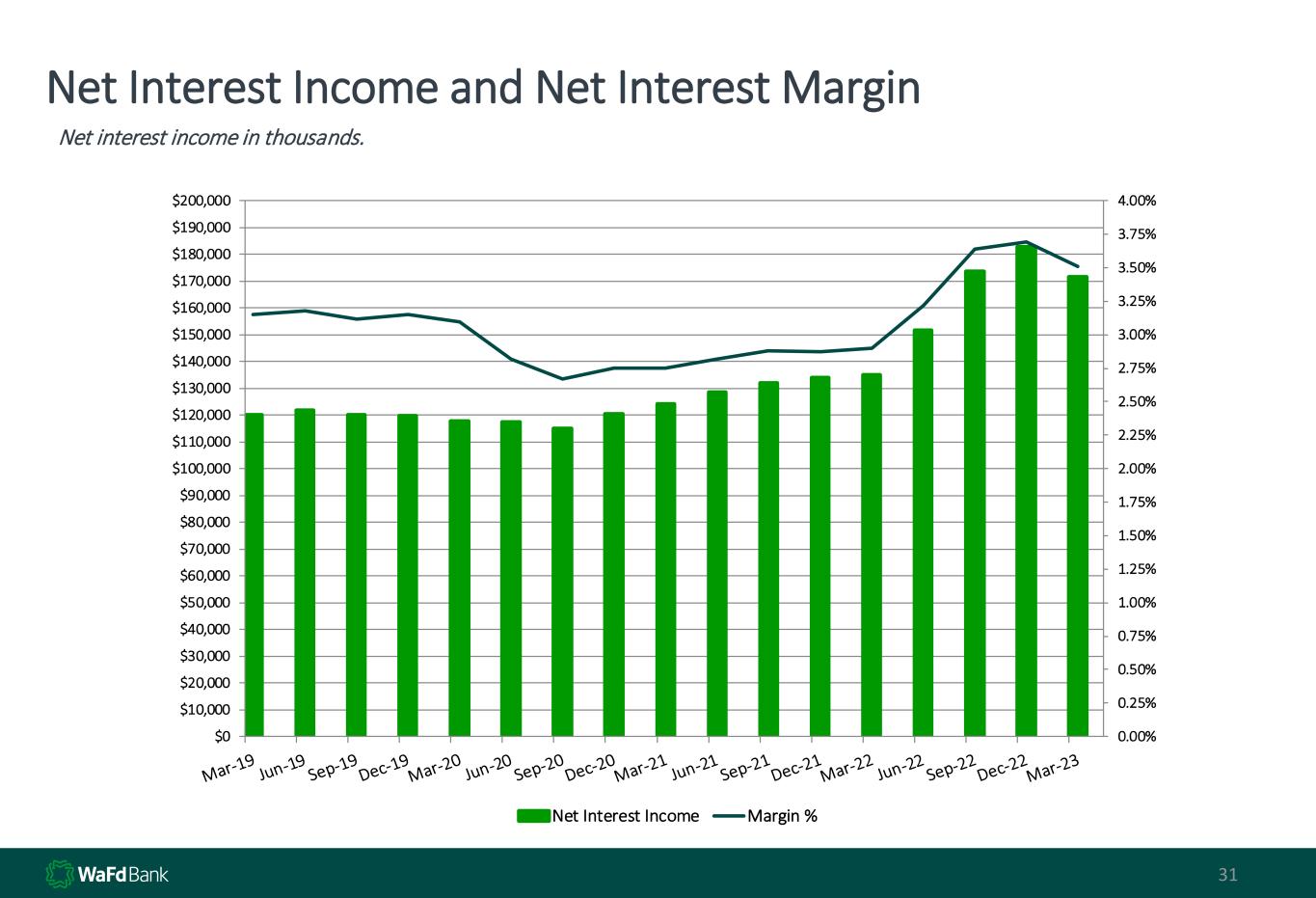

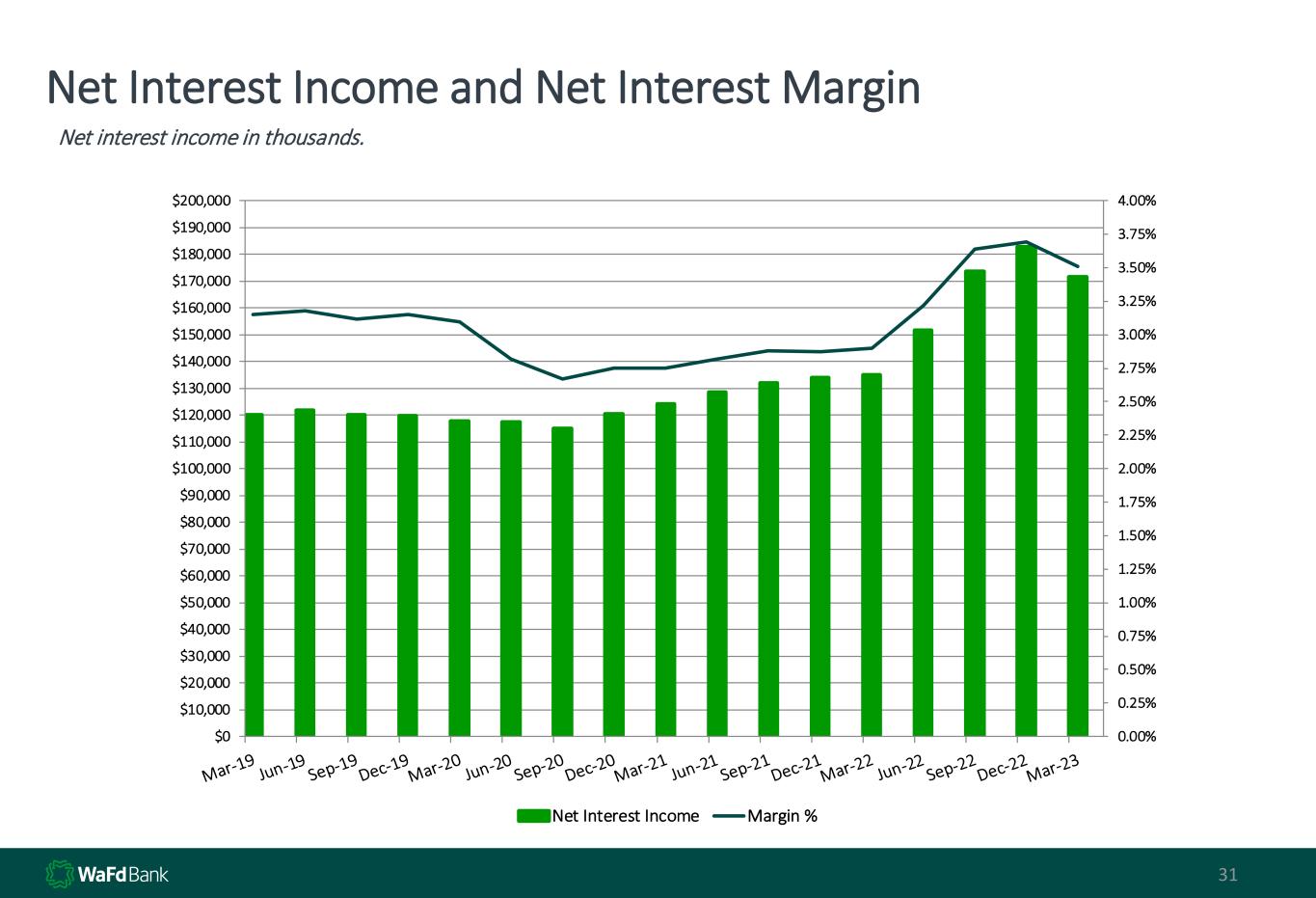

31 Net Interest Income and Net Interest Margin Net interest income in thousands. 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 $160,000 $170,000 $180,000 $190,000 $200,000 Net Interest Income Margin %

32 Net Income and Common Earnings Per Share Annual Quarterly $0 $50,000 $100,000 $150,000 $200,000 $250,000 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 Net Income (in thousands) EPS - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 Net Income EPS

Non-Interest Income 33 Diverse sources of Non-Interest Income provide steady growth and balance our revenue profile Non-Interest Income for Quarter-Ended 3/31/2023 Non-Interest Income Over Time ($MM)Non-Interest Income / Total Loan Revenue Other Income includes: • BOLI income • Rental income • Gains on property sales • WAFD Insurance Income • Income on equity method investments Loan Fees 6% Deposit Fees 62% Other Income 32% 11% 9% 11% 16% 12% 10% 6% FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 2023 YTD $4.3 $3.8 $3.9 $7.3 $6.9 $7.2 2.2 $22.6 $25.9 $24.9 $23.7 $24.7 $25.9 $12.5 $23.2 $14.7 $23.3 $24.1 $28.6 $33.2 $9.4 $10.1 $30.7 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 2023 YTD Loan Fees Deposit Fees Other Income Gain on Sale of Investments Gain on Sale of Buildings

34 Non-Interest Expense Over Time Annual and Quarterly - Expenses in millions Annual Quarterly

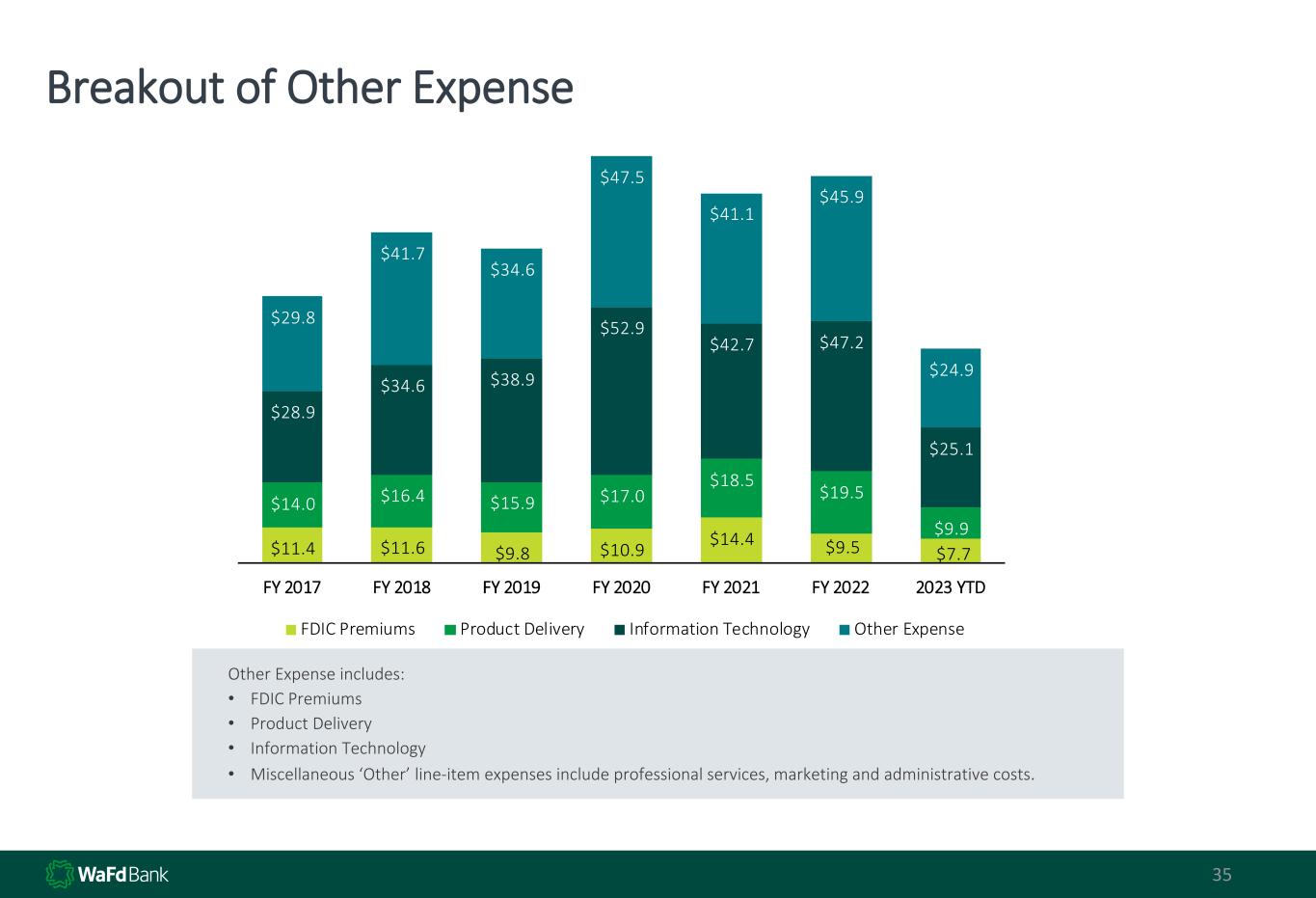

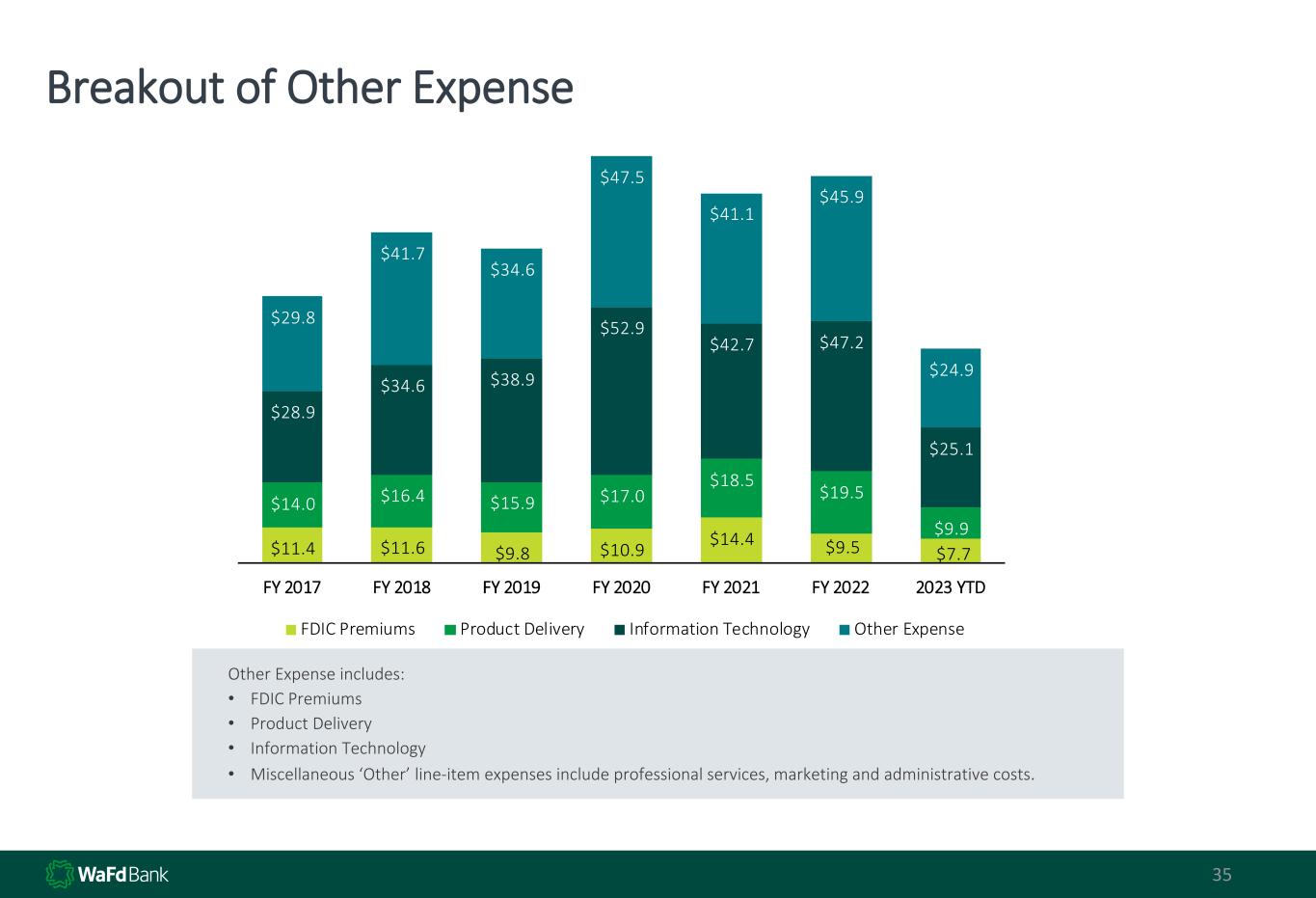

$11.4 $11.6 $9.8 $10.9 $14.4 $9.5 $7.7 $14.0 $16.4 $15.9 $17.0 $18.5 $19.5 $9.9 $28.9 $34.6 $38.9 $52.9 $42.7 $47.2 $25.1 $29.8 $41.7 $34.6 $47.5 $41.1 $45.9 $24.9 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 2023 YTD FDIC Premiums Product Delivery Information Technology Other Expense 35 Breakout of Other Expense Other Expense includes: • FDIC Premiums • Product Delivery • Information Technology • Miscellaneous ‘Other’ line-item expenses include professional services, marketing and administrative costs.

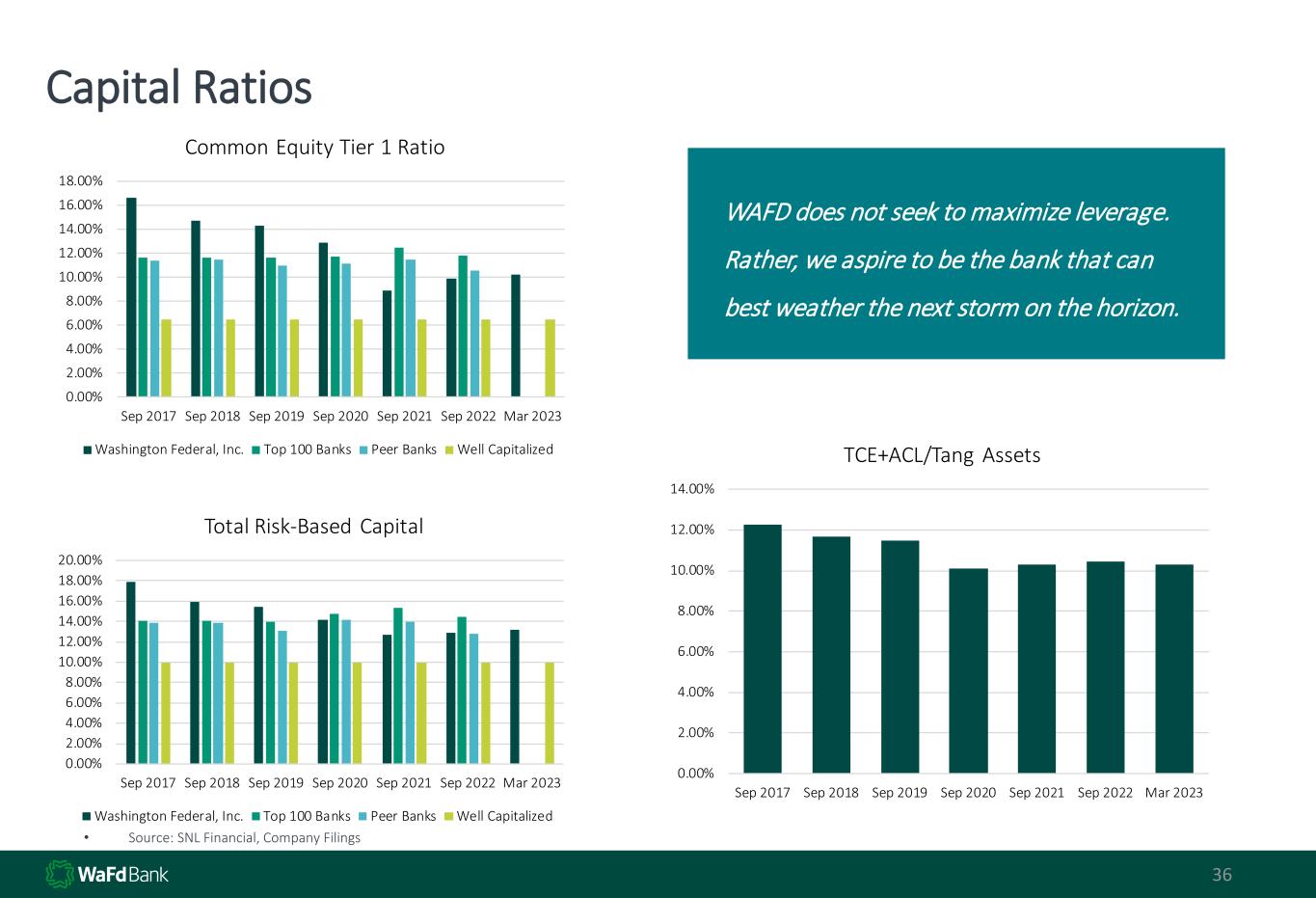

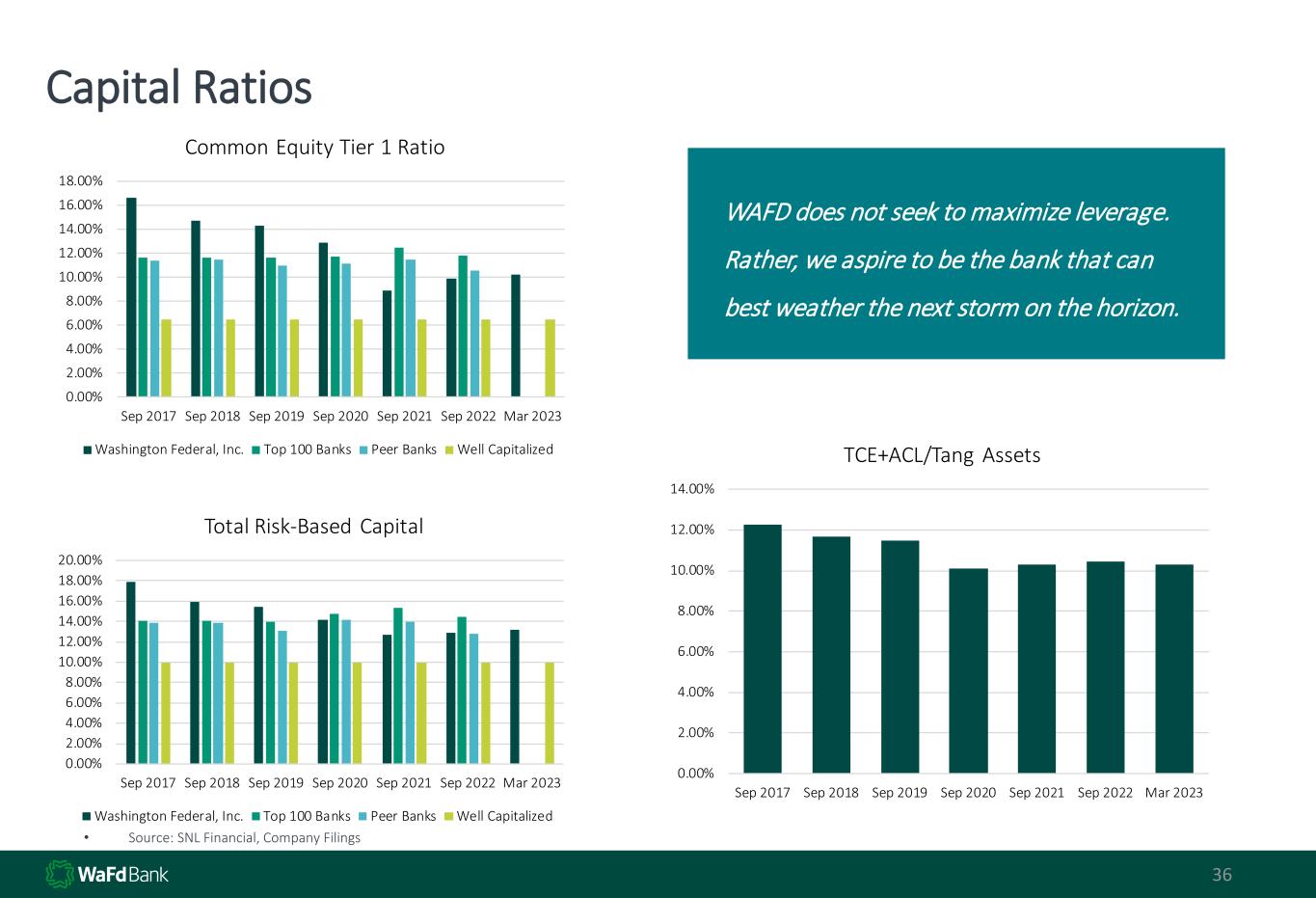

36 Capital Ratios WAFD does not seek to maximize leverage. Rather, we aspire to be the bank that can best weather the next storm on the horizon. 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Sep 2017 Sep 2018 Sep 2019 Sep 2020 Sep 2021 Sep 2022 Mar 2023 TCE+ACL/Tang Assets 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% Sep 2017 Sep 2018 Sep 2019 Sep 2020 Sep 2021 Sep 2022 Mar 2023 Common Equity Tier 1 Ratio Washington Federal, Inc. Top 100 Banks Peer Banks Well Capitalized 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Sep 2017 Sep 2018 Sep 2019 Sep 2020 Sep 2021 Sep 2022 Mar 2023 Total Risk-Based Capital Washington Federal, Inc. Top 100 Banks Peer Banks Well Capitalized • Source: SNL Financial, Company Filings

Returning Capital to Shareholders Recent Capital Activities • Current cash dividend of $0.25 provides a yield of 3.91% based on the current stock price (5/9) • Since 2013, 47 million shares repurchased which is 44% of total outstanding shares as of 9/30/2012 • 3.7 million shares remaining in buyback authorization • During the 3rd and 4th Fiscal Quarters of 2021, the Company used additional proceeds from the preferred stock issuance to repurchase 7,952,529 shares of common stock. 37 Common Dividend as a % of Net Income 30.4% 42.9% 27.5% 30.1% 38.3% 38.0% 27.8% 23.0% 2016 2017 2018 2019 2020 2021 2022 2023 YTD Net Income Stock Buyback & Dividends Percent of Income returned to Shareholders 2015 $160,316 $177,791 111% 2016 $164,049 $137,808 84% 2017 $173,532 $172,892 100% 2018 $203,850 $220,246 108% 2019 $210,256 $187,163 89% 2020 $173,438 $178,629 103% 2021 $173,581 $414,527 239% 2022 $221,705 $64,837 29% # of Shares Wtd Price Paid % Outstanding at beginning of the year 2015 5,841,204 $21.70 6% 2016 3,867,563 $22.72 4% 2017 3,137,178 $31.36 3% 2018 4,865,357 $33.74 6% 2019 4,065,352 $30.46 5% 2020 3,339,530 $33.58 4% 2021 10,810,113 $32.25 14% 2022 92,774 $35.14 0.1% Return of Income to Common Shareholders

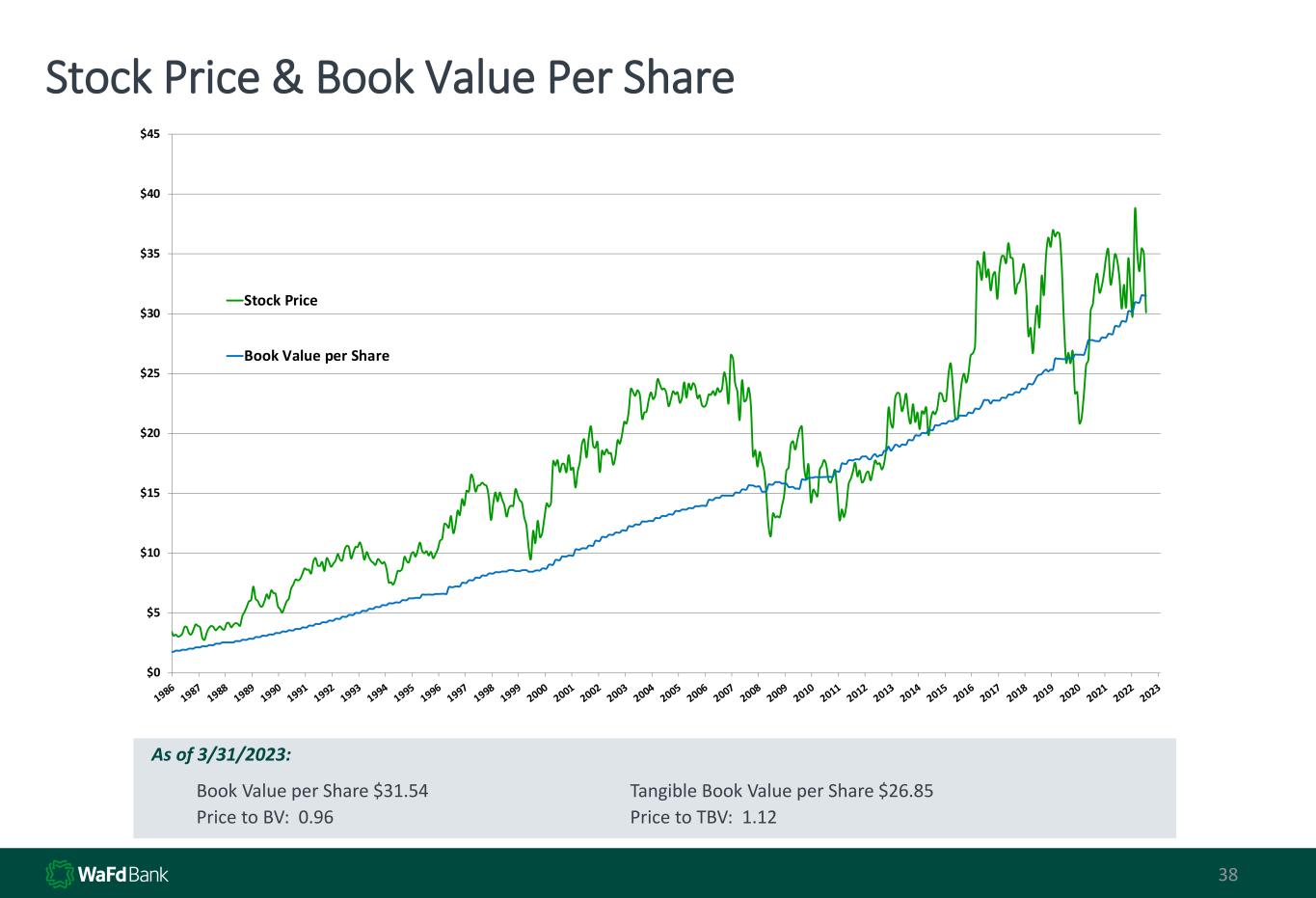

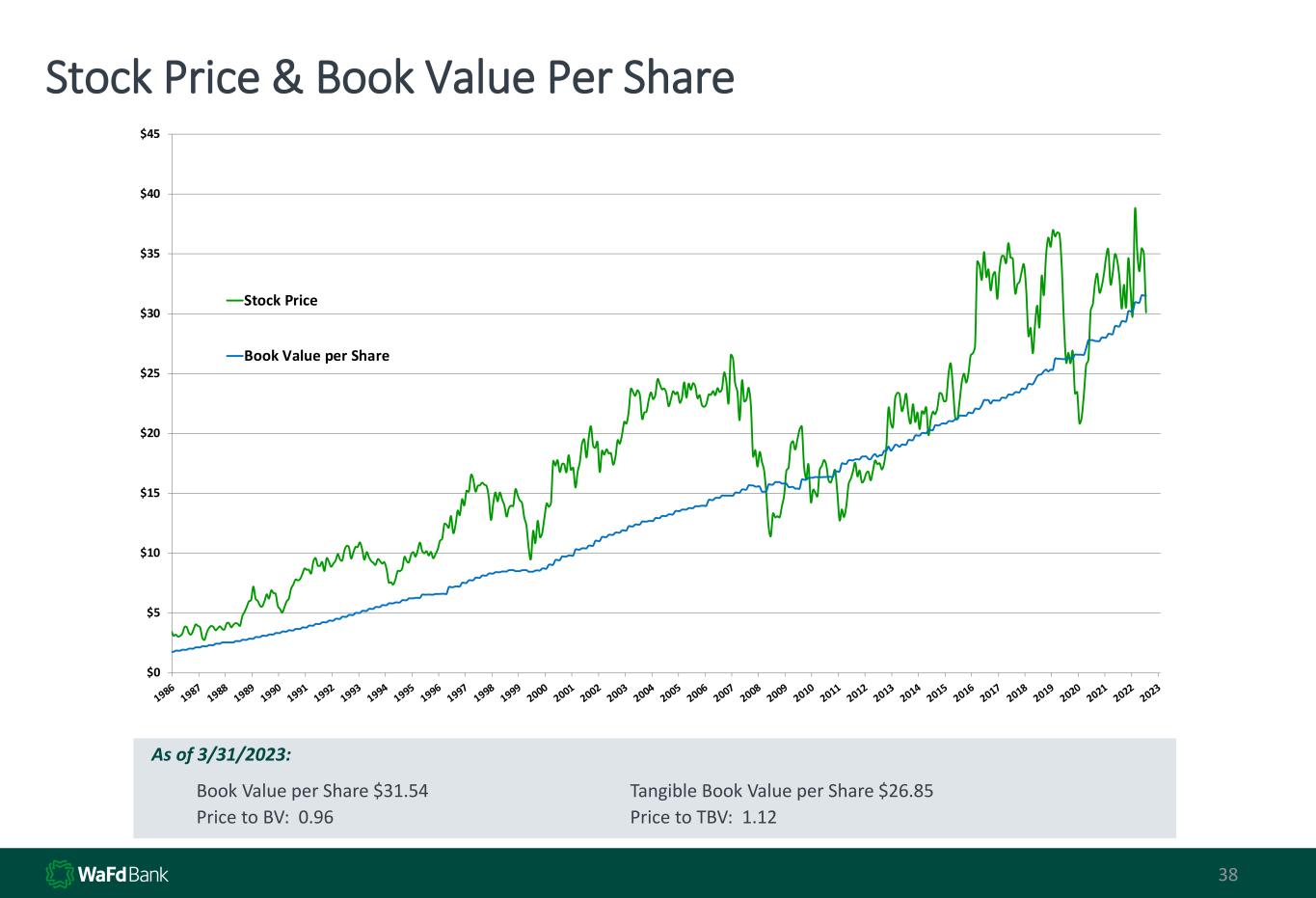

As of 3/31/2023: Book Value per Share $31.54 Tangible Book Value per Share $26.85 Price to BV: 0.96 Price to TBV: 1.12 Stock Price & Book Value Per Share 38 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 Stock Price Book Value per Share

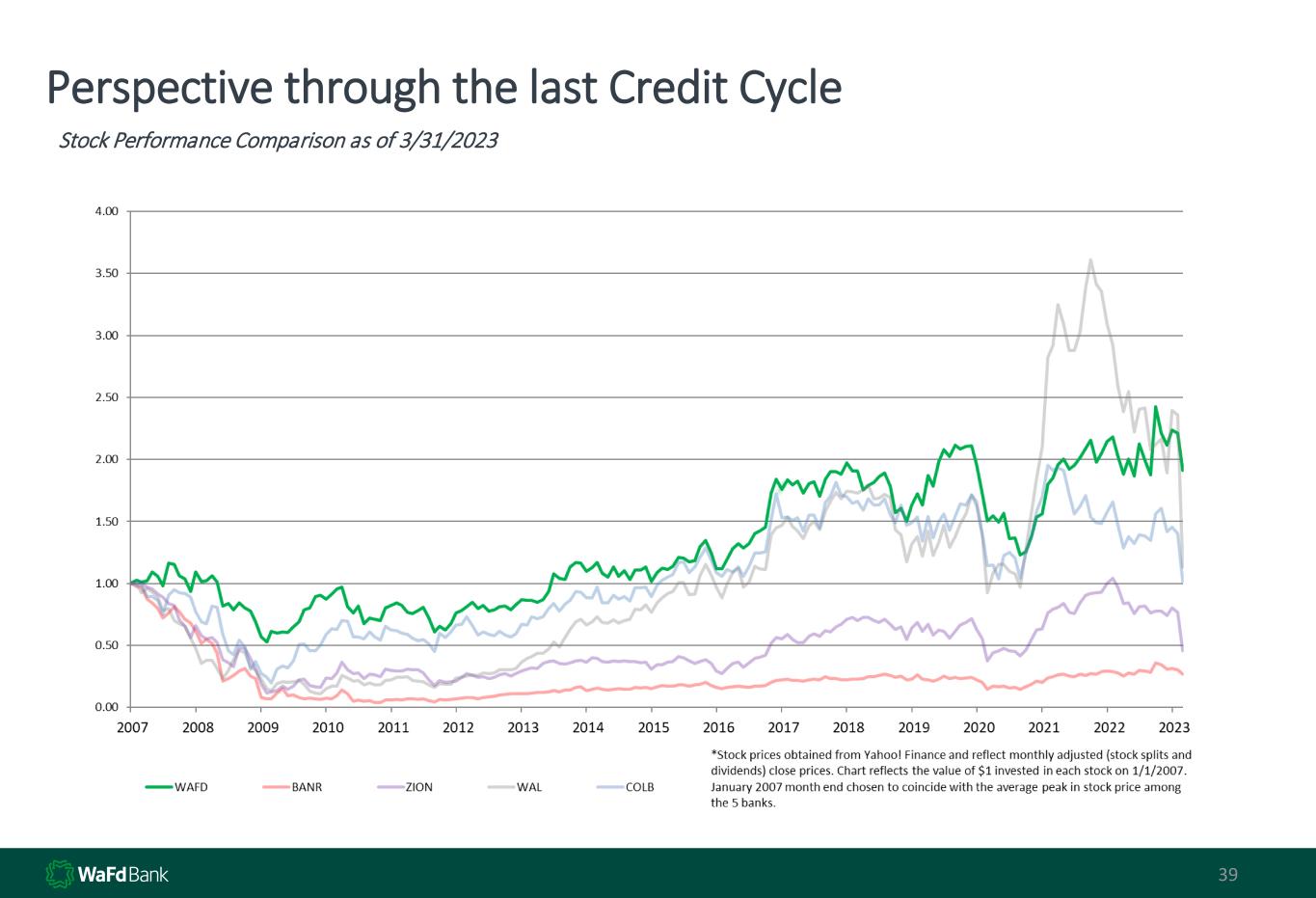

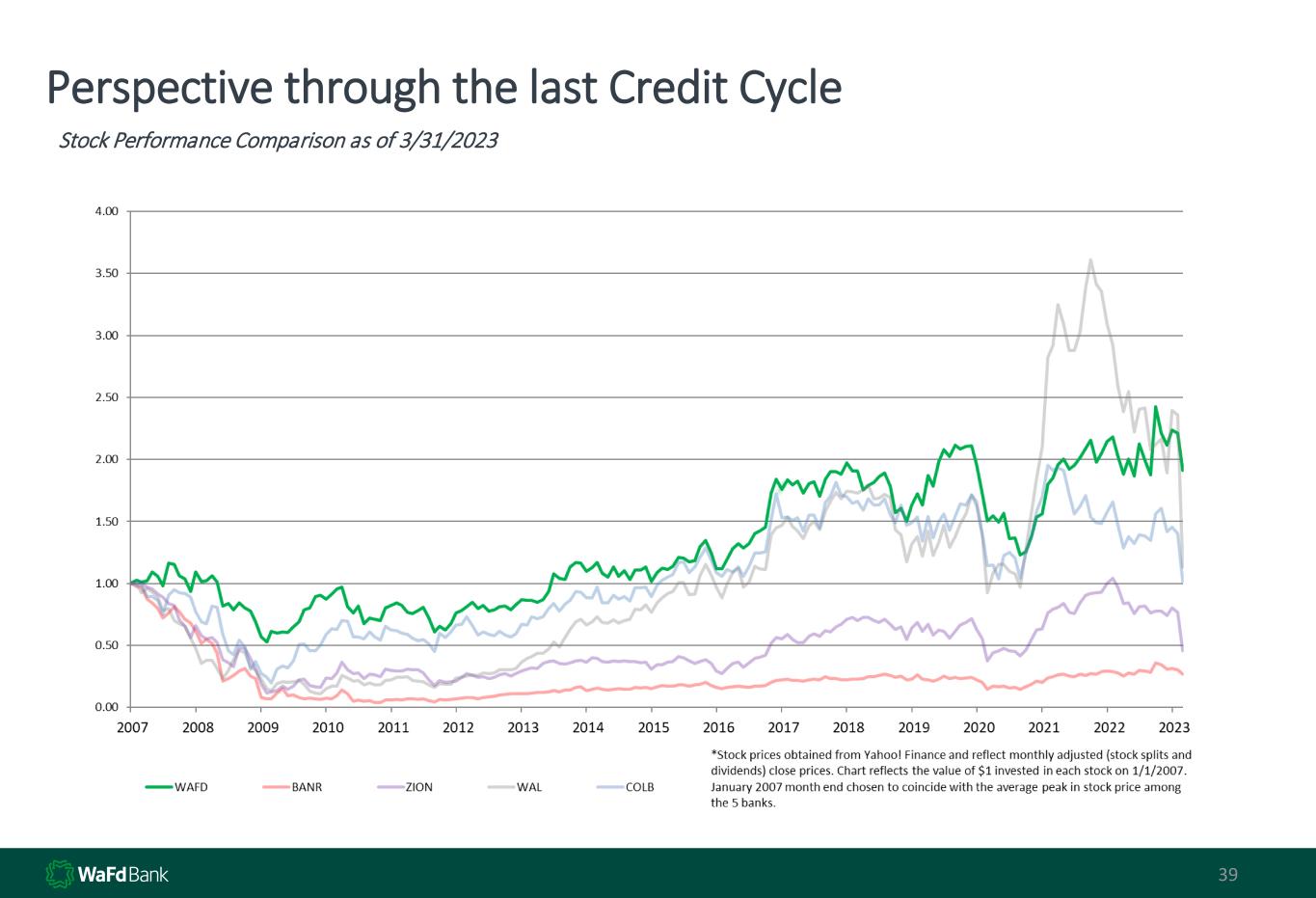

Managing Capital Text Text Text Tex 39 Perspective through the last Credit Cycle Stock Performance Comparison as of 3/31/2023

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Washington Federal’s management and are subject to significant risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of the presentation, and Washington Federal assumes no duty, and does not undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking statements.