Exhibit 13

TABLE OF CONTENTS

A SHORT HISTORY

Washington Federal, Inc. (Company or Washington Federal) is a savings and loan holding company headquartered in Seattle, Washington. Its principal subsidiary is Washington Federal Savings, which operates 122 offices in seven western states.

The Company had its origin on April 24, 1917 as Ballard Savings and Loan Association. In 1935, the state-chartered Company converted to a federal charter, became a member of the Federal Home Loan Bank (FHLB) system and obtained federal insurance. In 1958, Ballard Federal Savings and Loan Association merged with Washington Federal Savings and Loan Association of Bothell, and the latter name was retained for wider geographical acceptance. In 1971, Seattle Federal Savings and Loan Association, with three offices, merged into the Company, and at the end of 1978, was joined by the 10 offices of First Federal Savings and Loan Association of Mount Vernon.

On November 9, 1982, the Company converted from a federal mutual to a federal stock association. In 1987 and 1988, acquisitions of United First Federal, Provident Federal Savings and Loan, and Northwest Federal Savings and Loan, all headquartered in Boise, Idaho, added 28 Idaho offices to the Company. In 1988, the acquisition of Freedom Federal Savings and Loan Association in Corvallis, Oregon added 13 Oregon offices, followed in 1990 by the eight Oregon offices of Family Federal Savings.

In 1991, the Company added three branches with the acquisition of First Federal Savings and Loan Association of Idaho Falls, Idaho, and acquired the deposits of First Western Savings Association of Las Vegas, Nevada, in Portland and Eugene, Oregon, where they were doing business as Metropolitan Savings Association. In 1993, 10 branches were added with the acquisition of First Federal Savings Bank of Salt Lake City, Utah. In 1994, the Company expanded into Arizona.

In 1995, the stockholders approved a reorganization whereby Washington Federal Savings became a wholly owned subsidiary of a newly formed holding company, Washington Federal, Inc. That same year, the Company purchased West Coast Mutual Savings Bank with its one branch in Centralia, Washington, and opened six additional branches. In 1996, the Company acquired Metropolitan Bancorp of Seattle, adding eight offices in Washington in addition to opening four branches in existing markets. Between 1997 and 1999, Washington Federal Savings continued to develop its branch network, opening a total of seven branches and consolidating three offices into existing locations.

In 2000, the Company expanded into Las Vegas, opening its first branch in Nevada along with two branches in Arizona. In 2001, the Company opened two additional branches in Arizona and its first branch in Texas with an office in the Park Cities area of Dallas. In 2002, Washington Federal Savings opened five full-service branches in existing markets. In 2003, the Company purchased United Savings and Loan Bank with its four branches in the Seattle metropolitan area, added one new branch in Puyallup, Washington and consolidated one branch in Nampa, Idaho. In 2004, the Company consolidated two branches in Mount Vernon, Washington into one and opened branches in Plano, Texas and West Bend, Oregon. In 2005, the Company opened locations in Klamath Falls, Oregon, Richardson, Texas and another in Las Vegas, Nevada.

The Company obtains its funds primarily through savings deposits from the general public, from repayments of loans, borrowings and retained earnings. These funds are used largely to make first lien loans to borrowers for the purchase of new and existing homes, the acquisition and development of land for residential lots, the construction of homes, the financing of small multi-family housing units, and for investment in obligations of the U.S. government, its agencies and municipalities.

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | |

| September 30, | | 2005 | | | 2004 | | | % Change | |

| | | (In thousands, except per share data) | |

Assets | | $ | 8,234,450 | | | $ | 7,169,205 | | | +15 | % |

Cash and cash equivalents | | | 637,791 | | | | 508,361 | | | +25 | |

Investment securities | | | 214,993 | | | | 414,683 | | | –48 | |

Loans receivable and securitized assets subject to repurchase, net | | | 6,008,932 | | | | 5,093,443 | | | +18 | |

Mortgage-backed securities | | | 1,075,342 | | | | 641,215 | | | +68 | |

Customer accounts | | | 5,031,505 | | | | 4,610,358 | | | +9 | |

FHLB advances and other borrowings | | | 1,885,000 | | | | 1,300,000 | | | +45 | |

Stockholders’ equity | | | 1,187,308 | | | | 1,120,188 | | | +6 | |

Net income | | | 145,889 | | | | 131,868 | | | +11 | |

Diluted earnings per share | | | 1.67 | | | | 1.51 | | | +11 | |

Dividends per share | | | 0.78 | | | | 0.75 | | | +4 | |

Stockholders’ equity per share | | | 13.66 | | | | 12.94 | | | +6 | |

Shares outstanding | | | 86,933 | | | | 86,548 | | | | |

Return on average stockholders’ equity | | | 12.63 | % | | | 12.12 | % | | | |

Return on average assets | | | 1.90 | | | | 1.78 | | | | |

Efficiency ratio | | | 19.16 | | | | 18.57 | | | | |

TO OUR STOCKHOLDERS

Dear Stockholder:

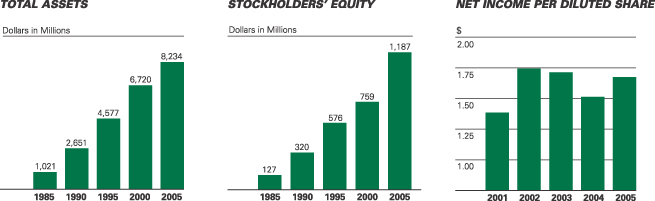

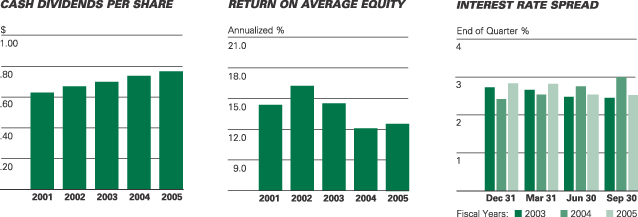

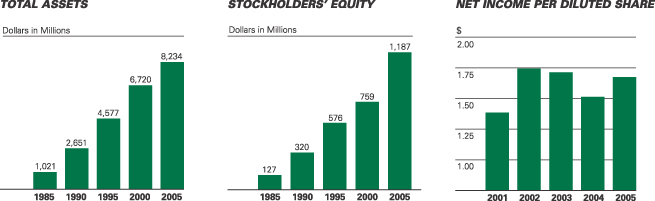

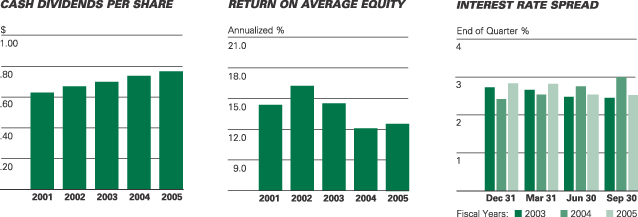

The financial performance of a traditional thrift institution like Washington Federal depends primarily on the health of the housing market and the spread between short and long-term interest rates. During the fiscal year just completed, the residential real estate market continued to sizzle within our lending territory; likewise, for much of the year the interest rate spread on which we rely was somewhat higher than average. As a result, I am privileged to report that your Company enjoyed very strong financial performance during the past year. Net income amounted to $145,889,000, which was an 11% increase over the $131,868,000 recorded during the prior fiscal year. Earnings per share of $1.67 also represented an increase of 11% from $1.51 recorded in the previous year. Return on average assets of 1.90% was at or near the top of the range for industry peers of similar size, while return on equity improved to 12.63%, which we believe was respectable given your Company’s conservative capital position and the historically low interest rate environment in which it was operating.

The past year also saw some interesting and important milestones achieved. For example, total assets grew by nearly 15% and at year-end exceeded $8 billion for the first time. Most of that growth came as a result of record loan originations of $2.44 billion, which enabled the loan portfolio to top $6 billion for the first time in your Company’s history. Total deposit growth was also very encouraging during the year as customer accounts grew by 9% and totaled over $5 billion at year-end, also a new high mark.

Asset quality was superb. Non-performing assets (foreclosed real estate plus loans on which we are no longer receiving payments) amounted to only $7.3 million, or less than one-tenth of 1% of total assets at year-end. This is the lowest level of problem assets reported by your Company since going public in 1982. Net loan charge-offs recorded during the year were also astoundingly low at only $250,000. We are proud to report such positive results, although management believes that these numbers represent peak performance and do not necessarily reflect the actual credit risk embedded in the loan portfolio. As the housing market inevitably cools, we expect problem assets and charge-offs to increase and have taken the precaution of establishing appropriate reserves. Yet for now, we celebrate the relative absence of credit related difficulties.

Net interest income, which is the difference between interest income and interest expense, is the primary driver of earnings at Washington Federal and increased by $22.6 million over the prior year. This critical measure came under increasing pressure during the year due to a steady upward trend in deposit costs as the Federal Reserve tightened the supply of money and raised short-term rates from 1.5% to 3.75%. The resulting higher deposit costs were offset by an increase in floating rate construction loans, by redeploying cash into higher yielding, longer-term assets and by growth of the balance sheet using additional leverage. Your Company’s ability to offset anticipated future increases in funding costs is extensive, yet ultimately limited and will depend on many factors including the speed and extent to which short-term rates increase and the degree to which long-term rates move commensurately. As always, this is the major risk managed by your Company, yet it is one which management has prepared for by building capital and maintaining excess liquidity, by extending the maturity of borrowed funds, by taking a conservative posture on credit risk and by managing to the lowest cost structure in the industry. It’s also worth a reminder that we have been through this before, although no two rate cycles are alike.

Results this year were also dampened a bit by our investment exposure to U.S. government sponsored enterprises. Historically, investments in Fannie Mae, Freddie Mac and the Federal Home Loan Bank System were considered to be of the very highest quality due to their conservative operating models and the implied guarantee of the federal government. More recently though, as their business models became more complex, investments in these institutions have been shown to entail a higher degree of risk than was previously thought. Two years ago, our investment in the Federal Home Loan Bank of Seattle produced a tax-deferred dividend yield of 6.0%. Today, due to what appear to be temporary financial difficulties, they are currently unable to support a dividend. During the year, management also recognized a $4 million write down in the carrying values of investments in preferred stock issues of Fannie Mae and Freddie Mac. The reduction in the carrying values reflects the reduced market value of these securities as a result of their well-publicized accounting and financial difficulties. We have chosen to maintain these investments on our books because we believe them to be “money-good” assets at the end of the day; however, we continue to monitor them closely. Such investments, excluding mortgage-backed securities, represented approximately 4% of assets at fiscal year-end.

For the 40th time since going public in 1982, the Board of Directors of your Company declared a cash dividend increase during the year. The new annualized dividend rate of $.80 per share represents a payout ratio of 48% of last year’s earnings and a dividend yield of approximately 3.5% based on recent prices of your Company’s stock. In February, stockholders were again delivered a 10% stock dividend. This was the 20th time since 1982 that your Company has declared additional stock distributions to owners in the form of a stock split or stock dividend. After cash dividends, retained earnings allowed your Company to increase its capital account by $67 million. The ratio of capital to total assets stood at 14.42 % at year-end, which is considerably higher than the industry average and gives management great flexibility to take advantage of opportunities that may present themselves in the future.

The filing of our annual report this year also brought with it the requirement for compliance with Section 404 of the Sarbanes-Oxley Act, which mandates the step-by-step documentation and testing of all key internal controls. The completion of this task came at great expense and much hard work by a group of key employees and I am pleased to report that your Company was not found to have any material weaknesses in its internal controls over financial reporting. On a related note, this year we

2

also welcomed a new member to the Board of Directors. Thomas J. Kelley is a Certified Public Accountant, currently instructing at Seattle University, who spent much of his career auditing financial institutions as a partner with the former Arthur Andersen firm. With his addition to the Audit Committee, we believe that all three of its members meet the definition of “Audit Committee Financial Expert” and that this represents a significant strengthening of the Board’s ability to meet its financial oversight responsibilities.

Lately, we have received a number of questions from investors regarding your Company’s exposure to the so-called “exotic” mortgages such as the Interest-Only and Option-ARM products that have become so popular of late. We have none. Our view is that the repayment characteristics and credit risks associated with these products are untested through the credit and interest rate cycles; therefore, management has elected to stay on the sidelines until these products are indeed proven to be profitable to lenders without toxic side effects for borrowers.

Looking ahead, the strength of our balance sheet and the earnings momentum from last year give reasons for optimism about your Company’s future prospects, particularly in the long-term. On the other hand, the near-term risks of a break in the housing market and/or a spike in inflation that would necessitate more aggressive tightening by the Fed seem more likely than they did one year ago. Yet regardless of the various environmental possibilities, in the year to come we plan to stick with the simple, comfortable and familiar operating model that has served us so well over the years. We plan to open 2-4 new branches and gather sufficient new loans and deposits to adequately leverage the new capital we acquire through earnings. We will continue to operate as a high-touch, low-tech provider of residential real estate loans, and we will continue to provide a very safe place for thrift-minded people to keep their hard-earned savings. With a healthy underpinning of capital and a frugal management style, your Company should continue to prosper.

To our loyal customers goes a special note of appreciation. We thank you for entrusting us with your business and recognize that we have to earn your business every day. I would also like to thank the Executive Management Committee and all of our hard working employees for their dedicated efforts during the past year. Each year they somehow deliver just a little more and are the indispensable ingredient in the Washington Federal recipe for success. I would also like to thank the Board of Directors for their unwavering support and wise counsel to management and also for their commitment to protecting the interests of all stockholders.

Finally, I wish to thank our many stockholders for their continued support. For the benefit of your investment, please remember to send your friends and neighbors to Washington Federal for all their savings and home finance requirements. I hope to see you at the Annual Meeting of Stockholders to be held at 2:00 PM, on January 18, 2006 at Benaroya Hall in downtown Seattle, Washington.

Sincerely,

Roy M. Whitehead

Vice Chairman, President and Chief Executive Officer

(Standing - left to right) Edwin C. Hedlund, Executive Vice President and Secretary, Roy M. Whitehead, Vice Chairman, President and Chief Executive Officer, Linda S. Brower, Executive Vice President, (Seated - left to right) Jack B. Jacobson, Executive Vice President and Chief Lending Officer, Brent J. Beardall, Senior Vice President and Chief Financial Officer.

3

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

GENERAL | Washington Federal, Inc. (Company or Washington Federal) is a savings and loan holding company. The Company’s primary operating subsidiary is Washington Federal Savings. |

The Company’s fiscal year end is September 30th. All references to 2005 represent balances as of September 30, 2005 or activity for the fiscal year then ended. All references to 2004 represent balances as of September 30, 2004 or activity for the fiscal year then ended.

CRITICAL ACCOUNTING POLICIES | Preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses in the Company’s consolidated financial statements. Accordingly, estimated amounts may fluctuate from one reporting period to another due to changes in assumptions underlying estimated values. |

The Company has determined that the only accounting policy deemed critical to an understanding of the consolidated financial statements of Washington Federal, Inc. relates to the methodology for determining the valuation of the allowance for loan losses, as described below.

The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company’s methodology for assessing the appropriateness of the allowance consists of several key elements, which include the formula allowance and specific allowances.

The formula portion of the general loan loss allowance is established by applying a loss percentage factor to the different loan types. The allowance is provided based on Management’s continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, geographic concentrations, seasoning of the loan portfolio, specific industry conditions and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company’s control, which may result in losses or recoveries differing from those provided.

Specific allowances are established in cases where Management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

INTEREST RATE RISK | The Company accepts a high level of interest rate volatility as a result of its policy to originate fixed-rate single-family home loans that are longer-term than the short-term characteristics of its liabilities of customer accounts and borrowed money. The following table shows the estimated repricing periods for earning assets and paying liabilities. |

| | | | | | | | | | | | | | | | |

| | | Repricing Period

| |

| | | Within One Year | | | After 1 year -

before 4 Years | | | Thereafter | | | Total | |

| | | (In thousands) | |

As of September 30, 2005 | | | | | | | | | | | | | | | | |

Earning Assets * | | $ | 2,547,230 | | | $ | 2,224,709 | | | $ | 3,294,572 | | | $ | 8,066,511 | |

Paying Liabilities | | | (4,673,467 | ) | | | (1,480,044 | ) | | | (762,994 | ) | | | (6,916,505 | ) |

| | |

|

|

| | | | |

Excess (Liabilities) Assets | | $ | (2,126,237 | ) | | $ | 744,665 | | | $ | 2,531,578 | | | | | |

| | |

|

|

| | | | |

Excess as % of Total Assets | | | –25.82 | % | | | | | | | | | | | | |

Policy limit for one year excess | | | –60.00 | % | | | | | | | | | | | | |

| | * | Asset repricing period includes estimated prepayments based on historical activity |

At September 30, 2005, the Company had approximately $2,126,237,000 more liabilities subject to repricing in the next year than assets, which amounted to a negative maturity gap of 26% of total assets. As of September 30, 2004, the amount of excess liabilities subject to repricing within one year was $1,761,103,000 or 25% of total assets. The increase of $365,134,000 of liabilities in excess of assets repricing within one year was due to deposit growth and a shift in deposit maturities towards shorter-term maturities. The negative one year maturity gap as a percentage of total assets increased only one percent due to the growth of total assets by 15% to $8,234,450,000. By having an excess of liabilities repricing within one year over assets, the Company is subject to decreasing net interest income should rates rise. However, if the size and/or mix of the balance sheet changes, rising rates may not cause a decrease in net interest income. The Company’s interest rate risk approach has never resulted in the recording of a monthly operating loss.

The Company’s net interest spread decreased from 3.00% at September 30, 2004 to 2.54% at September 30, 2005. Net interest spread represents the difference between the contractual rates of earning assets less the contractual rates of paying liabilities as of a specific date. The spread decreased primarily because rates on customer

4

| | accounts increased by 98 basis points over the prior year while rates on earning assets increased by only 29 basis points (see Period End Spread table on page 8). |

During 2005 the Company chose to grow earning assets by increasing the net amount of loans and investments (a net increase of $1,150,000,000 ). This growth was funded by a net increase in borrowings of $585,000,000. During the year the Company borrowed $700,000,000 in long-term funding with a weighted average contractual maturity of 7.8 years at a weighted average rate of 3.94%, combined with deposit growth of $421,000,000. As of September 30, 2005, the Company had $638,000,000 in cash and cash equivalents, which can be invested long-term in the future to generate additional revenues.

ASSET QUALITY | The Company maintains an allowance to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. In analyzing the existing loan portfolio, the Company applies specific loss percentage factors to the different loan types. The loss percentages are based on Management’s continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience and current economic conditions. |

Multi-family loans, builder construction loans and certain other loans are reviewed on an individual basis to assess the ability of the borrowers to continue to service all of their principal and interest obligations. If the loans show signs of weakness, they are downgraded and, if warranted, placed on non-accrual status. The Company has an Asset Quality Review Committee that reports the results of its internal reviews to the Board of Directors on a quarterly basis.

Non-performing assets were $7,344,000, or .09% of total assets at September 30, 2005 compared to $14,945,000, or .21% of total assets at September 30, 2004. Total delinquencies over 30 days were $16,723,000, or .20% of total assets at September 30, 2005 compared to $21,419,000, or .30% of total assets at September 30, 2004. The aforementioned asset quality indicators demonstrate the continued excellent quality of the loan portfolio.

LIQUIDITY AND CAPITAL RESOURCES | The principal sources of funds for the Company’s activities are retained earnings, loan repayments (including prepayments), net savings inflows, sales of loans, sales of investments, loan participations, deposits and borrowings. Washington Federal’s principal sources of revenue are interest on loans, interest and dividends on investments and gains on sale of investments and real estate. |

The Company’s net worth at September 30, 2005 was $1,187,308,000, or 14.4% of total assets. This is an increase of $67,120,000 from September 30, 2004 when net worth was $1,120,188,000, or 15.6% of total assets. The Company’s net worth increased due in part to net income of $145,889,000, proceeds received from the exercise of common stock options of $4,006,000 and purchases by the Employee Stock Ownership Plan of $1,526,000. Net worth was reduced by $67,719,000 as a result of cash dividends paid and a decrease in accumulated other comprehensive income of $17,811,000. The Company paid out 46.4% of its 2005 earnings in the form of cash dividends, compared with 49.1% last year.

Washington Federal’s percentage of net worth to total assets is among the highest in the nation and is over three times the minimum required under Office of Thrift Supervision (OTS) regulations (see Note M). Management believes this strong net worth position will help protect the Company against interest rate risk and will enable it to compete more effectively.

Customer accounts increased $421,147,000, or 9.1% from one year ago. Management’s strategy during this phase of the interest rate cycle has been to remain competitive in its deposit pricing to attract the new deposit relationships necessary to help fund asset growth.

The Company’s cash and cash equivalents amounted to $637,791,000 at September 30, 2005, a 10% decrease from the cash, cash equivalents and repurchase agreements balance of $708,361,000 one year ago. The decrease resulted primarily from using the funds to help grow net loans and investments over the prior year. See “Interest Rate Risk” on page 4 and the “Statement of Cash Flows” included in the financial statements.

CHANGES IN FINANCIAL POSITION | Available-for-sale and held-to-maturity securities. The Company purchased $827,178,000 of securities during 2005, $747,178,000 of which have been classified as available-for-sale and $80,000,000 of which have been classified as held-to-maturity. |

The Company had $127,544,000 in sales of available-for-sale securities, resulting in a net realized loss of $3,534,000. Included in the 2005 net loss amount is a loss on impairment of Government Sponsored Entities (GSE) preferred stock of $4,100,000. As of September 30, 2005, the Company had net unrealized losses in its available-for-sale portfolio of $1,113,000.

Loans receivable and securitized assets subject to repurchase. Loans receivable and securitized assets subject to repurchase increased 18.0% to $6,008,932,000 at September 30, 2005 from $5,093,443,000 one year earlier. The increase resulted primarily from record loan production of $2,436,826,000 combined with whole loan purchases of $331,456,000. Loan repayments (including prepayments) during the year were $1,769,058,000, an increase of $75,916,000 or 4.5% from 2004. The allowance for losses on loans and securitized assets subject to repurchase

5

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

| | decreased $384,000 during the year due to a $134,000 reversal of the reserve combined with net charge-offs of $250,000. In analyzing the allowance for loan losses, Management believes the 18.0% growth in the loan portfolio was principally offset by the Company’s nonperforming loan balances decreasing during the year from $10,884,000 to $6,588,000 or 39%, combined with improving economic conditions throughout the Company’s primary markets. The percentage of loans outside of Washington, Idaho, Oregon, Utah and Arizona increased to 12.1% of loans outstanding at September 30, 2005 from 7.3% one year earlier, resulting from the purchase of whole loans and increased loan production by the branches located in Nevada and Texas. Gross construction and land loans increased to 22.1% of the portfolio at September 30, 2005 from 20.4% at September 30, 2004. The amount of reserves allocated to impaired loans decreased to $300,000 at September 30, 2005 from an allocation of $700,000 in the prior year based on the estimated value of the underlying collateral of the impaired loans. |

Real estate held for sale. The balance of real estate held for sale at September 30, 2005 was $5,631,000, a decrease from $8,630,000 reported one year ago. The decrease was primarily due to strong demand for housing in the Company’s primary markets.

FHLB stock. FHLB stock amounted to $129,453,000 at September 30, 2005 compared with $137,274,000 one year ago. The Company had a net redemption of $8,208,000 in FHLB stock during the year. No gain or loss was recognized on the redemption.

Intangible assets. The Company’s intangible assets are made up of $54,484,000 of goodwill, as well as the unamortized balances of the core deposit intangible and the non-compete agreement intangible of $2,440,000 and $335,000, respectively, at September 30, 2005.

Other assets. Other assets decreased $6,065,000 to $7,714,000 at September 30, 2005 primarily due to the correction of an error related to hedge accounting for certain derivative instruments in the current year (see Note A).

Customer accounts. Customer accounts at September 30, 2005 totaled $5,031,505,000 compared with $4,610,358,000 at September 30, 2004, a 9.1% increase. See “Liquidity and Capital Resources” on page 5.

FHLB advances and other borrowings. Total borrowings increased $585,000,000, or 45.0%, to $1,855,000,000 at September 30, 2005 as the Company chose to fund asset growth with a mix of customer accounts and borrowed money. See “Interest Rate Risk” on page 4.

Contractual obligations. The following table presents, as of September 30, 2005, the Company’s significant fixed and determinable contractual obligations, within the categories described below, by payment date or contractual maturity. These contractual obligations, except for the operating lease, are included in the Consolidated Statements of Financial Condition. The payment amounts represent those amounts contractually due.

| | | | | | | | | | | | | |

| Contractual Obligations | | Total | | Less than

1 Year | | 1 to 5

Years | | Over 5

Years | |

| | | (In thousands) | |

Debt obligations* | | $ | 1,885,000 | | $ | 55,000 | | $ | 630,000 | | $ | 1,200,000 | |

Operating lease obligations | | | 6,500 | | | 1,928 | | | 4,050 | | | 522 | |

| | |

|

|

|

| | | $ | 1,891,500 | | $ | 56,928 | | $ | 634,050 | | $ | 1,200,522 | |

| | |

|

|

|

| | * | Represents final maturities of debt obligations. See a description in Notes H and I. |

RESULTS OF OPERATIONS | GENERAL |

See Note P, “Selected Quarterly Financial Data (Unaudited),” which highlights the quarter-by-quarter results for the years ended September 30, 2005 and 2004.

COMPARISON OF 2005 RESULTS WITH 2004

In 2005 net income increased 11% from 2004.

Interest income on loans, securitized assets subject to repurchase and mortgage-backed securities increased $50,961,000 (13.4%) in 2005 from 2004 due to a 15.4% increase in the average outstanding balance of loans, securitized assets subject to repurchase and mortgage-backed securities, offset partially by a 12 basis point decrease in the weighted average yield from 6.85% in 2004 to 6.73% in 2005. Additionally, the correction of the error in hedge accounting recorded by the Company in 2005, as described in Note A, increased interest income on mortgage-backed securities by $11.1 million.

Interest and dividend income on investment securities and cash equivalents decreased $2,832,000 (8.3%) in 2005 from 2004. This decrease was due to a decrease in the average combined balance. The average combined balance of investment securities, cash equivalents and FHLB stock decreased 33.6% to $1,074,169,000 for the year ended September 30, 2005 versus $1,618,783,000 for the year ended September 30, 2004. Partially offsetting this decrease, the weighted average yield on investment securities, cash equivalents and FHLB stock increased from 2.12% in 2004 to 2.92% in 2005 primarily as a result of the Federal Reserve increasing short-term interest rates during the year.

6

Interest expense on customer accounts increased 34.5% to $115,826,000 for 2005 from $86,099,000 for 2004. The increase primarily related to a 58 basis point increase in the average cost of customer accounts to 2.47% during the year compared to 1.89% one year ago combined with the 9.1% increase in the balance of customer accounts over the prior year. Interest expense on FHLB advances and other borrowings decreased to $79,434,000 in 2005 from $83,654,000 in 2004 due to a decrease in the average cost of borrowings for the year ended September 30, 2005 to 4.77% from 5.10% for the same period one year ago. This decrease was accomplished by replacing higher cost borrowings with lower rate borrowings available during the year due to the relatively low level of long-term interest rates.

The Company recorded a $134,000 reversal of the provision for loan losses in 2005 compared to a $231,000 reversal of the provision in 2004. The current year reversal is due to a reduction in the Company’s nonperforming loan balances as well as an improvement in the number of delinquent loans, which was offset by the 18.0% growth in loans receivable and securitized assets subject to repurchase over the prior year. Non-performing assets decreased to $7,344,000, or .09% of total assets at September 30, 2005 compared with $14,945,000, or .21% of total assets at September 30, 2004. Total delinquencies over 30 days were $16,723,000, or .20% of total assets at September 30, 2005 compared to $21,419,000, or .30% of total assets at September 30, 2004. Management believes the allowance for loan losses, totaling $24,756,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income increased $1,266,000 (24.6%) in 2005 from 2004. The increase is primarily the result of recognizing $990,000 of income as a result of the favorable settlement of a loan obligation. In addition, there was a reduction in the amount of loss on the extinguishment of debt of $2,194,000 in 2005 versus $5,191,000 in the prior year. Net losses on the sale of securities totaled $3,534,000 in 2005 compared to net losses of $890,000 in 2004.

Compensation expense increased $2,786,000 or 8.9% in 2005 due to the combination of a $1,914,000 bonus expense resulting from increased earnings per share as well as annual cost of living and merit increases. There was no bonus expense in 2004. Personnel, including part-time employees considered on a full-time equivalent basis, decreased to 749 at September 30, 2005 compared to 754 one year ago.

Occupancy expense increased $975,000 or 12.5% during the year resulting from an expense of $1,225,000 related to the amortization of leasehold improvements that brings the Company into conformity with a recent clarification of the accounting standard for leases. The Company now amortizes leasehold improvements over the shorter of the original lease term, excluding option periods, or the expected useful life of the improvements. Partially offsetting this additional amortization expense was a reduction in the amount of maintenance expense. The branch network increased to 122 offices at September 30, 2005 versus 120 offices one year ago.

Other expenses increased $2,892,000 during the year due mainly to a $1,500,000 expense for a state business tax assessment as well as an increase in accounting and other professional fees of $615,000. Other expense for 2005 and 2004 equaled .68% and .62% of average assets, respectively.

Income tax expense increased $4,575,000 (6.4%) in 2005 due to a higher taxable income base. The effective tax rate was 34.38% for 2005 versus 35.27% for 2004. The effective income tax rate for 2005 decreased as a result of a $2,500,000 reversal of a contingent tax liability that was resolved in the fourth quarter.

COMPARISON OF 2004 RESULTS WITH 2003

Interest income on loans, securitized assets subject to repurchase and mortgage-backed securities decreased $35,786,000 (8.6%) in 2004 from 2003 as interest rates declined to 6.17% from 6.40% one year prior. The Company originated $2,070,984,000 in loans, which was offset by loan repayments and payoffs of $1,693,142,000 in 2004.

Interest and dividend income on investment securities and cash equivalents increased $263,000 (0.8%) in 2004 from 2003. Rates increased to 3.01% at September 30, 2004 compared with 1.98% at September 30, 2003, primarily as a result of the increase in short term interest rates during 2004. The combined investment securities, cash equivalents and FHLB stock portfolio decreased 34.1% to $1,211,957,000 at September 30, 2004 versus $1,839,847,000 one year prior.

Interest expense on customer accounts decreased 18.7% to $86,099,000 for 2004 from $105,919,000 for 2003. The decrease related to a small increase in customer accounts to $4,610,358,000 from $4,577,598,000 the prior year, coupled with a significant decrease in the average cost of customer accounts to 1.89% at year end compared to 2.38% one year ago. This decrease was primarily the result of higher rate CD’s repricing throughout the year to lower market rates.

Interest expense on FHLB advances and other borrowings decreased to $83,654,000 in 2004 from $88,965,000 in 2003 primarily due to the repayment of $450,000,000 in FHLB advances during the year. The average cost of borrowings as of September 30, 2004 decreased to 4.96% from 5.03% from one year ago.

The Company recorded a $231,000 reversal of the provision for loan losses in 2004 compared to a $1,500,000 increase in the provision in 2003. This decrease reflects a reduction in the Company’s nonperforming loan

7

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

| | balances as well as an improvement in the number of delinquent loans. Non-performing assets decreased to $14,945,000, or .21% of total assets at September 30, 2004 compared with $27,434,000, or .36% of total assets at September 30, 2003. Management believed the allowance for loan losses, totaling $25,140,000, was sufficient to absorb estimated losses inherent in the portfolio. |

Total other income decreased $11,622,000 (69.3%) in 2004 from 2003. This decrease was primarily the result of a pre-tax charge of $5,191,000 related to the extinguishment of debt in 2004 compared to a $3,382,000 gain on the sale of real estate in 2003. Net losses on the sale of securities totaled $890,000 in 2004 compared to net gains of $1,040,000 in 2003.

Total other expense increased $505,000 (1.1%) in 2004 over 2003. Compensation expense remained relatively consistent by increasing only $565,000 in 2004. Personnel, including part-time employees considered on a full- time equivalent basis, remained the same at 754 at September 30, 2004 compared to one year ago. Routine operating expenses decreased $2,346,000 in 2004 due to an increase of deferred loan origination costs associated with record production (per SFAS No. 91) and general cost containment measures. The branch network increased to 120 offices at September 30, 2004 versus 119 offices one year ago. Other expense for both 2004 and 2003 equaled .62% of average assets.

Income tax expense decreased $2,836,000 (3.5%) in 2004. The effective tax rate was 35.27% for 2004 versus 35.19% for 2003.

PERIOD END SPREAD – AS OF THE DATE SHOWN

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dec 31

2003 | | | Mar 31

2004 | | | Jun 30

2004 | | | Sep 30

2004 | | | Dec 31

2004 | | | Mar 31

2005 | | | Jun 30

2005 | | | Sep 30

2005 | |

Interest rate on loans and mortgage-backed securities* | | 6.31 | % | | 6.23 | % | | 6.16 | % | | 6.17 | % | | 6.16 | % | | 6.16 | % | | 6.14 | % | | 6.19 | % |

Interest rate on investment securities** | | 1.75 | | | 2.26 | | | 2.61 | | | 3.01 | | | 2.86 | | | 3.46 | | | 3.22 | | | 3.74 | |

| | |

|

|

Combined | | 5.21 | | | 5.30 | | | 5.44 | | | 5.62 | | | 5.63 | | | 5.80 | | | 5.78 | | | 5.91 | |

| | |

|

|

Interest rate on customer accounts | | 1.92 | | | 1.87 | | | 1.90 | | | 1.96 | | | 2.11 | | | 2.37 | | | 2.70 | | | 2.94 | |

Interest rate on borrowings | | 5.03 | | | 5.03 | | | 5.03 | | | 4.96 | | | 4.74 | | | 4.74 | | | 4.66 | | | 4.51 | |

| | |

|

|

Combined | | 2.78 | | | 2.75 | | | 2.67 | | | 2.62 | | | 2.78 | | | 2.97 | | | 3.23 | | | 3.37 | |

| | |

|

|

Interest rate spread | | 2.43 | % | | 2.55 | % | | 2.77 | % | | 3.00 | % | | 2.85 | % | | 2.83 | % | | 2.55 | % | | 2.54 | % |

| | |

|

|

| | * | Includes securitized assets subject to repurchase |

| | ** | Includes municipal bonds at tax-equivalent rates and cash equivalents |

The interest rate spread decreased during 2005 from 3.00% at September 30, 2004 to 2.54% at September 30, 2005. See “Interest Rate Risk” on pages 4 and 5.

8

SELECTED FINANCIAL DATA

| | | | | | | | | | | | | |

| Year ended September 30, | | 2005 | | | 2004 | | | 2003 | | 2002 | | 2001 | |

| | | (In thousands, except per share data) | |

Interest income | | $461,901 | | | $413,772 | | | $449,295 | | $511,802 | | $540,064 | |

Interest expense | | 195,260 | | | 169,753 | | | 194,884 | | 234,941 | | 320,120 | |

| | |

|

|

Net interest income | | 266,641 | | | 244,019 | | | 254,411 | | 276,861 | | 219,944 | |

Provision for (reversal of) loan losses | | (134 | ) | | (231 | ) | | 1,500 | | 7,000 | | 1,850 | |

Other income | | 7,852 | | | 5,726 | | | 16,571 | | 10,163 | | 12,013 | |

Other expense | | 52,319 | | | 46,264 | | | 45,759 | | 50,828 | | 48,697 | |

| | |

|

|

Income before income taxes | | 222,308 | | | 203,712 | | | 223,723 | | 229,196 | | 181,410 | |

Income taxes | | 76,419 | | | 71,844 | | | 78,724 | | 80,812 | | 63,946 | |

| | |

|

|

Net income | | $145,889 | | | $131,868 | | | $144,999 | | $148,384 | | $117,464 | |

| | |

|

|

Per share data | | | | | | | | | | | | | |

Basic earnings | | $1.68 | | | $1.53 | | | $1.72 | | $1.75 | | $1.39 | |

Diluted earnings | | 1.67 | | | 1.51 | | | 1.71 | | 1.74 | | 1.38 | |

Cash dividends | | 0.78 | | | 0.75 | | | 0.71 | | 0.68 | | 0.64 | |

| | | | | |

| September 30, | | 2005 | | | 2004 | | | 2003 | | 2002 | | 2001 | |

| | | (In thousands) | |

Total assets | | $8,234,450 | | | $7,169,205 | | | $7,535,975 | | $7,392,441 | | $7,026,743 | |

Loans and mortgage-backed securities* | | 7,084,274 | | | 5,734,658 | | | 5,443,266 | | 5,990,223 | | 6,537,010 | |

Investment securities | | 214,993 | | | 414,683 | | | 310,218 | | 117,417 | | 145,724 | |

Cash and cash equivalents | | 637,791 | | | 708,361 | | | 1,437,208 | | 975,153 | | 30,331 | |

Customer accounts | | 5,031,505 | | | 4,610,358 | | | 4,577,598 | | 4,521,922 | | 4,316,692 | |

FHLB advances | | 1,230,000 | | | 1,200,000 | | | 1,650,000 | | 1,650,000 | | 1,637,500 | |

Other borrowings | | 655,000 | | | 100,000 | | | 100,000 | | 100,000 | | 30,000 | |

| | | | | |

Stockholders’ equity | | 1,187,308 | | | 1,120,188 | | | 1,055,596 | | 960,718 | | 874,009 | |

| | | | | |

Number of | | | | | | | | | | | | | |

Customer accounts | | 232,707 | | | 216,405 | | | 217,785 | | 213,404 | | 211,570 | |

Mortgage loans | | 36,272 | | | 34,873 | | | 33,975 | | 38,096 | | 42,032 | |

Offices | | 122 | | | 120 | | | 119 | | 115 | | 111 | |

| * | Includes securitized assets subject to repurchase |

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| | | | | | | | |

| September 30, | | 2005 | | | 2004 | |

| | | (In thousands, except per

share data) | |

| ASSETS | | | | | | | | |

Cash and cash equivalents, including repurchase agreements of$575,000 and $460,000 | | $ | 637,791 | | | $ | 508,361 | |

Repurchase agreements | | | — | | | | 200,000 | |

Available-for-sale securities, including encumbered securities of$571,462 and $64,587 | | | 1,077,856 | | | | 899,525 | |

Held-to-maturity securities, including encumbered securities of$68,759 and $54,811 | | | 212,479 | | | | 156,373 | |

Securitized asset subject to repurchase, net | | | 71,257 | | | | 110,607 | |

Loans receivable, net | | | 5,937,675 | | | | 4,982,836 | |

Interest receivable | | | 34,048 | | | | 29,832 | |

Premises and equipment, net | | | 63,287 | | | | 63,049 | |

Real estate held for sale | | | 5,631 | | | | 8,630 | |

FHLB stock | | | 129,453 | | | | 137,274 | |

Intangible assets | | | 57,259 | | | | 58,939 | |

Other assets | | | 7,714 | | | | 13,779 | |

| | |

|

|

|

| | | $ | 8,234,450 | | | $ | 7,169,205 | |

| | |

|

|

|

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Liabilities | | | | | | | | |

Customer accounts | | | | | | | | |

Savings and demand accounts | | $ | 5,002,172 | | | $ | 4,569,245 | |

Repurchase agreements with customers | | | 29,333 | | | | 41,113 | |

| | |

|

|

|

| | | | 5,031,505 | | | | 4,610,358 | |

FHLB advances | | | 1,230,000 | | | | 1,200,000 | |

Other borrowings | | | 655,000 | | | | 100,000 | |

Advance payments by borrowers for taxes and insurance | | | 27,533 | | | | 25,226 | |

Federal and state income taxes, including net deferred liabilities of$43,491 and $55,522 | | | 44,617 | | | | 62,081 | |

Accrued expenses and other liabilities | | | 58,487 | | | | 51,352 | |

| | |

|

|

|

| | | | 7,047,142 | | | | 6,049,017 | |

Stockholders’ equity | | | | | | | | |

Common stock, $1.00 par value, 300,000,000 shares authorized,104,140,966 and 103,821,846 shares issued;86,933,294 and 86,547,557 shares outstanding | | | 104,141 | | | | 94,383 | |

Paid-in capital | | | 1,240,310 | | | | 1,161,627 | |

Accumulated other comprehensive income (loss), net of tax | | | (704 | ) | | | 17,107 | |

Treasury stock, at cost;17,207,672 and 17,274,289 shares | | | (205,874 | ) | | | (206,666 | ) |

Retained earnings | | | 49,435 | | | | 53,737 | |

| | |

|

|

|

| | | | 1,187,308 | | | | 1,120,188 | |

| | |

|

|

|

| | | $ | 8,234,450 | | | $ | 7,169,205 | |

| | |

|

|

|

| | |

10 | | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | |

| Year ended September 30, | | 2005 | | | 2004 | | | 2003 | |

| | | (In thousands, except per share data) | |

| INTEREST INCOME | | | | | | | | | |

Loans | | $369,023 | | | $330,967 | | | $353,286 | |

Mortgage-backed securities | | 61,459 | | | 48,554 | | | 62,021 | |

Investment securities | | 31,419 | | | 34,251 | | | 33,988 | |

| | |

|

|

| | | 461,901 | | | 413,772 | | | 449,295 | |

| INTEREST EXPENSE | | | | | | | | | |

Customer accounts | | 115,826 | | | 86,099 | | | 105,919 | |

FHLB advances and other borrowings | | 79,434 | | | 83,654 | | | 88,965 | |

| | |

|

|

| | | 195,260 | | | 169,753 | | | 194,884 | |

| | |

|

|

Net interest income | | 266,641 | | | 244,019 | | | 254,411 | |

Provision for (reversal of) loan losses | | (134 | ) | | (231 | ) | | 1,500 | |

| | |

|

|

Net interest income after provision for loan losses | | 266,775 | | | 244,250 | | | 252,911 | |

| | | |

| OTHER INCOME | | | | | | | | | |

Gain (loss) on sale of investments, net | | (3,534 | ) | | (890 | ) | | 1,040 | |

Gain on sale of real estate | | — | | | — | | | 3,382 | |

Loss on extinguishment of debt | | (2,194 | ) | | (5,191 | ) | | — | |

Other | | 12,137 | | | 11,224 | | | 12,343 | |

| | |

|

|

| | | 6,409 | | | 5,143 | | | 16,765 | |

| | | |

| OTHER EXPENSE | | | | | | | | | |

Compensation and fringe benefits | | 34,197 | | | 31,411 | | | 30,846 | |

Amortization of intangibles | | 1,198 | | | 1,397 | | | 126 | |

Occupancy expense | | 8,788 | | | 7,813 | | | 6,798 | |

Other | | 13,700 | | | 10,808 | | | 11,043 | |

Deferred loan origination costs | | (5,564 | ) | | (5,165 | ) | | (3,054 | ) |

| | |

|

|

| | | 52,319 | | | 46,264 | | | 45,759 | |

Gain (loss) on real estate acquired through foreclosure, net | | 1,443 | | | 583 | | | (194 | ) |

| | |

|

|

Income before income taxes | | 222,308 | | | 203,712 | | | 223,723 | |

Income taxes | | | | | | | | | |

Current | | 78,024 | | | 77,270 | | | 80,106 | |

Deferred | | (1,605 | ) | | (5,426 | ) | | (1,382 | ) |

| | |

|

|

| | | 76,419 | | | 71,844 | | | 78,724 | |

| | |

|

|

NET INCOME | | $145,889 | | | $131,868 | | | $144,999 | |

| | |

|

|

| | | |

| PER SHARE DATA | | | | | | | | | |

Basic earnings | | $ 1.68 | | | $ 1.53 | | | $ 1.72 | |

Diluted earnings | | 1.67 | | | 1.51 | | | 1.71 | |

Cash dividends | | 0.78 | | | 0.75 | | | 0.71 | |

Weighted average number of shares outstanding,

including dilutive stock options | | 87,478,708 | | | 87,130,787 | | | 84,981,560 | |

| | |

| SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |

11 |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | |

| | | Common

Stock | | Paid-in

Capital | | Retained

Earnings | | | Accumulated

Other

Comprehensive

Income (loss) | | | Treasury

Stock | | | Total | |

| | | (In thousands) | |

Balance at September 30, 2002 | | $ | 76,212 | | $ | 968,858 | | $ | 66,207 | | | $ | 47,720 | | | $ | (198,279 | ) | | $ | 960,718 | |

Eleven-for-ten stock split

distributed February 21, 2003 | | | 7,622 | | | 79,612 | | | (87,369 | ) | | | | | | | | | | | (135 | ) |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | 144,999 | | | | | | | | | | | | 144,999 | |

Other comprehensive income,

net of tax of $11,340: | | | | | | | | | | | | | | | | | | | | | | |

Unrealized losses on securities | | | | | | | | | | | | | (20,157 | ) | | | | | | | (20,157 | ) |

Reclassification adjustment | | | | | | | | | | | | | (673 | ) | | | | | | | (673 | ) |

| | | | | | | | | | | | | | | | | | | | |

|

|

|

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | 124,169 | |

Dividends | | | | | | | | | (60,004 | ) | | | | | | | | | | | (60,004 | ) |

Proceeds from exercise of

common stock options | | | 357 | | | 4,369 | | | | | | | | | | | | | | | 4,726 | |

Tax benefit related to

exercise of stock options | | | | | | | | | 1,218 | | | | | | | | | | | | 1,218 | |

Restricted stock | | | 14 | | | 332 | | | (212 | ) | | | | | | | | | | | 134 | |

Proceeds from Employee

Stock Ownership Plan | | | | | | 546 | | | | | | | | | | | 976 | | | | 1,522 | |

Acquisition-related stock issuance | | | 1,349 | | | 31,933 | | | | | | | | | | | | | | | 33,282 | |

Treasury stock | | | | | | | | | | | | | | | | | (10,034 | ) | | | (10,034 | ) |

| | |

|

|

|

Balance at September 30, 2003 | | $ | 85,554 | | $ | 1,085,650 | | $ | 64,839 | | | $ | 26,890 | | | $ | (207,337 | ) | | $ | 1,055,596 | |

| | |

|

|

|

Eleven-for-ten stock split

distributed February 20, 2004 | | | 8,558 | | | 70,066 | | | (78,624 | ) | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | 131,868 | | | | | | | | | | | | 131,868 | |

Other comprehensive income,

net of tax of $5,326: | | | | | | | | | | | | | | | | | | | | | | |

Unrealized losses on securities | | | | | | | | | | | | | (10,359 | ) | | | | | | | (10,359 | ) |

Reclassification adjustment | | | | | | | | | | | | | 576 | | | | | | | | 576 | |

| | | | | | | | | | | | | | | | | | | | |

|

|

|

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | 122,085 | |

Dividends | | | | | | | | | (64,696 | ) | | | | | | | | | | | (64,696 | ) |

Proceeds from exercise of

common stock options | | | 250 | | | 3,267 | | | | | | | | | | | | | | | 3,517 | |

Tax benefit related to

exercise of stock options | | | | | | | | | 748 | | | | | | | | | | | | 748 | |

Restricted stock | | | 21 | | | 559 | | | (398 | ) | | | | | | | | | | | 182 | |

Proceeds from Employee

Stock Ownership Plan | | | | | | 2,085 | | | | | | | | | | | 2,610 | | | | 4,695 | |

Treasury stock | | | | | | | | | | | | | | | | | (1,939 | ) | | | (1,939 | ) |

| | |

|

|

|

Balance at September 30, 2004 | | $ | 94,383 | | $ | 1,161,627 | | $ | 53,737 | | | $ | 17,107 | | | $ | (206,666 | ) | | $ | 1,120,188 | |

| | |

|

|

|

Eleven-for-ten stock split

distributed February 18, 2005 | | | 9,446 | | | 73,988 | | | (83,434 | ) | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | 145,889 | | | | | | | | | | | | 145,889 | |

Other comprehensive income,

net of tax of $9,803: | | | | | | | | | | | | | | | | | | | | | | |

Unrealized losses on securities | | | | | | | | | | | | | (20,090 | ) | | | | | | | (20,090 | ) |

Reclassification adjustment | | | | | | | | | | | | | 2,279 | | | | | | | | 2,279 | |

| | | | | | | | | | | | | | | | | | | | |

|

|

|

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | 128,078 | |

Dividends | | | | | | | | | (67,719 | ) | | | | | | | | | | | (67,719 | ) |

Proceeds from exercise of

common stock options | | | 302 | | | 3,704 | | | | | | | | | | | | | | | 4,006 | |

Tax benefit related to exercise

of stock options | | | | | | | | | 954 | | | | | | | | | | | | 954 | |

Restricted stock | | | 10 | | | 257 | | | 8 | | | | | | | | | | | | 275 | |

Proceeds from Employee

Stock Ownership Plan | | | | | | 734 | | | | | | | | | | | 792 | | | | 1,526 | |

Treasury stock | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

|

Balance at September 30, 2005 | | $ | 104,141 | | $ | 1,240,310 | | $ | 49,435 | | | $ | (704 | ) | | $ | (205,874 | ) | | $ | 1,187,308 | |

| | |

|

|

|

| | |

12 | | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | |

| Year ended September 30, | | 2005 | | | 2004 | | | 2003 | |

| | | (In thousands) | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | | | | |

Net income | | $ | 145,889 | | | $ | 131,868 | | | $ | 144,999 | |

Adjustments to reconcile net income to net cash provided by operating activities | | | | | | | | | | | | |

Amortization of fees, discounts, and premiums, net | | | (9,959 | ) | | | (12,792 | ) | | | (12,206 | ) |

Amortization of intangible assets | | | 1,198 | | | | 1,397 | | | | 126 | |

Depreciation | | | 3,847 | | | | 2,624 | | | | 3,099 | |

Provision for (reversal of) loan losses | | | (134 | ) | | | (231 | ) | | | 1,500 | |

Loss (gain) on investment securities and real estate held for sale, net | | | 2,091 | | | | 306 | | | | (4,228 | ) |

Loss on extinguishment of debt | | | 2,194 | | | | 5,191 | | | | — | |

Decrease (increase) in accrued interest receivable | | | (4,216 | ) | | | (343 | ) | | | 9,126 | |

Increase (decrease) in income taxes payable | | | (6,307 | ) | | | 1,607 | | | | (5,308 | ) |

FHLB stock dividends | | | (387 | ) | | | (5,912 | ) | | | (8,155 | ) |

Decrease (increase) in other assets | | | 1,898 | | | | 10,195 | | | | (11,202 | ) |

Increase (decrease) in accrued expenses and other liabilities | | | 7,134 | | | | (8,137 | ) | | | 3,226 | |

| | |

|

|

|

Net cash provided by operating activities | | | 143,248 | | | | 125,773 | | | | 120,977 | |

| | |

|

|

|

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | |

Loans originated | | | | | | | | | | | | |

Single-family residential loans | | | (1,209,555 | ) | | | (1,108,216 | ) | | | (1,059,450 | ) |

Construction loans | | | (716,569 | ) | | | (580,882 | ) | | | (487,692 | ) |

Land loans | | | (358,863 | ) | | | (244,048 | ) | | | (163,533 | ) |

Multi-family loans | | | (151,839 | ) | | | (137,838 | ) | | | (156,437 | ) |

| | |

|

|

|

| | | | (2,436,826 | ) | | | (2,070,984 | ) | | | (1,867,112 | ) |

| | | |

Savings account loans originated | | | (2,282 | ) | | | (1,779 | ) | | | (1,866 | ) |

Loan principal repayments | | | 1,769,058 | | | | 1,693,142 | | | | 2,604,297 | |

Increase in undisbursed loans in process | | | 84,162 | | | | 127,591 | | | | 71,804 | |

Loans purchased | | | (331,456 | ) | | | (31,911 | ) | | | (417,669 | ) |

Repurchase agreements matured (purchased) | | | 200,000 | | | | (200,000 | ) | | | — | |

FHLB stock redeemed | | | 56,208 | | | | 12,489 | | | | — | |

FHLB stock repurchased | | | (48,000 | ) | | | — | | | | — | |

Available-for-sale securities purchased | | | (747,178 | ) | | | (666,990 | ) | | | (459,895 | ) |

Principal payments and maturities of available-for-sale securities | | | 424,476 | | | | 250,431 | | | | 487,438 | |

Available-for-sale securities sold | | | 127,544 | | | | 303,171 | | | | 80,000 | |

Held-to-maturity securities purchased | | | (80,000 | ) | | | (56,900 | ) | | | (100,100 | ) |

Principal payments and maturities of held-to-maturity securities | | | 24,207 | | | | 55,196 | | | | 115,812 | |

Cash provided by acquisition | | | — | | | | — | | | | 94,314 | |

Proceeds from sales of real estate held for sale | | | 6,281 | | | | 14,816 | | | | 16,342 | |

Premises and equipment purchased, net | | | (4,085 | ) | | | (4,731 | ) | | | (4,730 | ) |

| | |

|

|

|

Net cash provided (used) by investing activities | | | (957,891 | ) | | | (576,459 | ) | | | 618,635 | |

| | |

|

|

|

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

Net increase (decrease) in customer accounts | | | 421,147 | | | | 32,760 | | | | (214,248 | ) |

Net increase (decrease) in short-term borrowings | | | 52,806 | | | | (255,191 | ) | | | — | |

Net proceeds from (repayments of) long-term borrowings | | | 530,000 | | | | (200,000 | ) | | | — | |

Proceeds from exercise of common stock options | | | 4,006 | | | | 4,265 | | | | 5,944 | |

Dividends paid | | | (67,719 | ) | | | (64,696 | ) | | | (60,004 | ) |

Proceeds from Employee Stock Ownership Plan | | | 1,526 | | | | 4,695 | | | | 1,522 | |

Treasury stock purchased, net | | | — | | | | (1,939 | ) | | | (10,034 | ) |

Increase (decrease) in advance payments by borrowers for taxes and insurance | | | 2,307 | | | | 1,945 | | | | (737 | ) |

| | |

|

|

|

Net cash provided (used) by financing activities | | | 944,073 | | | | (478,161 | ) | | | (277,557 | ) |

| | |

|

|

|

Increase (decrease) in cash and cash equivalents | | | 129,430 | | | | (928,847 | ) | | | 462,055 | |

Cash and cash equivalents at beginning of year | | | 508,361 | | | | 1,437,208 | | | | 975,153 | |

| | |

|

|

|

Cash and cash equivalents at end of year | | $ | 637,791 | | | $ | 508,361 | | | $ | 1,437,208 | |

| | |

|

|

|

| | |

| SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |

13 |

CONSOLIDATED STATEMENTS OF CASH FLOWS(CONTINUED)

| | | | | | | | | | |

| Year ended September 30, | | 2005 | | 2004 | | 2003 | |

| | | (In thousands) | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | | | |

Noncash investing activities | | | | | | | | | | |

Real estate acquired through foreclosure | | $ | 1,839 | | $ | 6,659 | | $ | 11,771 | |

Cash paid during the year for | | | | | | | | | | |

Interest | | | 191,398 | | | 172,195 | | | 195,360 | |

Income taxes | | | 81,553 | | | 75,004 | | | 83,878 | |

| | | |

The following summarizes the non-cash activities related to the United Savings and Loan acquisition | | | | | | | | | | |

Fair value of assets and intangibles acquired, including goodwill | | $ | — | | $ | — | | $ | (343,626 | ) |

Fair value of liabilities assumed | | | — | | | — | | | 276,872 | |

Fair value of stock issued | | | — | | | — | | | 33,282 | |

| | |

|

|

|

Cash paid out in acquisition | | | — | | | — | | | (33,472 | ) |

Plus cash acquired | | | — | | | — | | | 127,786 | |

| | |

|

|

|

Net cash provided by acquisition | | $ | — | | $ | — | | $ | 94,314 | |

| | |

|

|

|

| | |

14 | | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED SEPTEMBER 30, 2005, 2004 AND 2003

NOTE A | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Principles of consolidation. The consolidated financial statements include the accounts of Washington Federal, Inc. (Company or Washington Federal) and its wholly owned subsidiaries. Intercompany transactions and balances have been eliminated.

Description of business. Washington Federal, Inc. is a savings and loan holding company. The Company’s principal operating subsidiary is Washington Federal Savings. The Company is principally engaged in the business of attracting savings deposits from the general public and investing these funds, together with borrowings and other funds, in one-to-four family residential real estate loans and multi-family real estate loans. The Company conducts its activities through a network of 122 offices located in Washington, Oregon, Idaho, Utah, Arizona, Nevada, and Texas.

The Company’s fiscal year end is September 30th. All references to 2005 represent balances as of September 30, 2005 or activity for the fiscal year then ended. All references to 2004 represent balances as of September 30, 2004 or activity for the fiscal year then ended.

Cash and cash equivalents. Cash and cash equivalents include cash on hand, amounts due from banks, overnight investments and repurchase agreements with an initial maturity of three months or less.

Repurchase Agreements. Repurchase agreements are fully collateralized investments with an initial maturity exceeding three months.

Investments and mortgage-backed securities. The Company accounts for investments and mortgage-backed securities in two categories: held-to-maturity and available-for-sale.

Held-to-maturity securities– Securities classified as held-to-maturity are accounted for at amortized cost, but the Company must have both the positive intent and the ability to hold those securities to maturity. There are very limited circumstances under which securities in the held-to-maturity category can be sold without jeopardizing the cost basis of accounting for the remainder of the securities in this category.

Available-for-sale securities – Securities not classified as held-to-maturity are considered to be available-for-sale. Gains and losses realized on the sale of these securities are based on the specific identification method. Unrealized gains and losses for available-for-sale securities are excluded from earnings and reported as a net amount in the accumulated other comprehensive income component of stockholders’ equity.

Management evaluates debt and equity securities for other than temporary impairment on a quarterly basis based on the securities’ current credit quality, interest rates, term to maturity and management’s intent and ability to hold the securities until the net book value is recovered. Any other than temporary declines in fair value are recognized in the statement of operations as loss on sale of investments.

Premiums and discounts on investments are deferred and recognized over the life of the asset using the effective interest method.

Securitized assets subject to repurchase. In March 2001, the Company transferred some of its permanent single-family residential loans into a Real Estate Mortgage Investment Conduit (REMIC). The REMIC then issued securities backed by such loans, all of which were retained by the Company. The terms of the transfer of the loans to the REMIC contain a call provision whereby the Company can repurchase the loans when the outstanding balance of the pool declines to 15% or less of the original amount; therefore, the transfer did not qualify as a sale under generally accepted accounting principles. Accordingly, the retained interests continue to be accounted for in a manner similar to loans and are included in the accompanying statement of financial condition as securitized assets subject to repurchase.

Loans receivable. Loans receivable more than 90 days past due are placed on non-accrual status and an allowance for accrued interest is established. Any interest ultimately collected is credited to income in the period of recovery.

The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company’s methodology for assessing the appropriateness of the allowance consists of several key elements, which include the formula allowance and specific allowances.

15

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(CONTINUED)

The formula portion of the general loan loss allowance is established by applying a loss percentage factor to the different loan types. The allowances are provided based on Management’s continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, geographic concentrations, seasoning of the loan portfolio, specific industry conditions, and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company’s control, which may result in losses or recoveries differing from those provided.

Specific allowances are established in cases where Management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

Impaired loans consist of loans receivable that are not expected to be repaid in accordance with their contractual terms and are measured using the fair value of the collateral. Smaller balance loans are excluded from this analysis.

Premises and equipment. Premises and equipment are stated at cost, less accumulated depreciation. Depreciation is computed on the straight-line method over the estimated useful lives of the respective assets. Expenditures are capitalized for betterments and major renewals. Charges for ordinary maintenance and repairs are expensed to operations as incurred.

Real estate held for sale. Properties acquired in settlement of loans or acquired for development are recorded at the lower of cost or fair value.

Derivatives. The Company accepts a high level of interest rate risk as a result of its policy to originate fixed-rate single-family home loans that are longer-term than the short-term characteristics of its liabilities of customer accounts and borrowed money. The Company enters into forward contracts (derivative contract) to purchase mortgage-backed securities as part of its interest rate risk management program. The forward contracts allow the Company to hedge the risk of varying mortgage-backed securities spot prices in the future as the result of changes in interest rates. The purchase contracts are generally for periods of 30 to 90 days.

On the date the Company enters into a derivative contract, the derivative instrument is designated as a hedge of the variability in expected future cash flows associated with a probable future transaction. Under cash flow hedge accounting, if specific criteria are met, the effective portion of the derivative instrument is recognized as a component of stockholders’ equity through comprehensive income until the related forecasted transaction affects earnings, either through the recognition of interest income or through the sale of the security. To the extent that forward contracts to purchase securities are not designated as cash flow hedges or fail to meet hedging criteria, including purchasing the mortgage-backed securities within a specific time frame, the fair value of the contracts will be included in earnings. As of September 30, 2005 and 2004, the Company had outstanding forward purchase commitments of $20,000,000 and $315,000,000 with an estimated fair value of $0 and $10,259,000, respectively.

During 2005, the Company reviewed its accounting for derivatives and concluded that it had not met the criteria established by Statement of Financial Accounting Standards No. 133 as amended to account for such instruments as cash flow hedges. The cumulative effect of the correction of the error, as of January 1, 2005 was $7.9 million, net of tax. The amount was recorded as additional interest income on mortgage-backed securities and loss on sale of securities, in March 2005. The effect of the error was not material to any prior quarter in 2005 or 2004, nor was it material to any prior year.

Intangible assets. Goodwill represents the excess of the cost of businesses acquired over the fair value of the net assets acquired. The core deposit intangible and non-compete agreement intangible are acquired assets that lack physical substance but can be distinguished from goodwill. Goodwill is evaluated for impairment on an annual basis. Other intangible assets are amortized over their estimated lives and are subject to impairment testing when events or circumstances change. If circumstances indicate that the carrying value of the assets may not be recoverable, an impairment charge could be recorded. No impairment of intangible assets has ever been identified. The Company amortizes the core deposit intangible on an accelerated basis over its estimated life of seven years; the non-compete agreement intangible is amortized on a straight-line basis over its life of five years.

16

The table below presents the estimated intangible asset amortization expense for the next five years:

| | | |

| Year ended September 30, | | Amortization expense |

| | | (In thousands) |

| 2006 | | $ | 1,000 |

| 2007 | | | 801 |

| 2008 | | | 593 |

| 2009 | | | 289 |

| 2010 | | | 91 |

Deferred fees and discounts on loans. Loan discounts and loan fees are deferred and recognized over the life of the loans using the effective interest method based on actual loan payments. Deferred loan origination costs are deducted from other expenses.

Accounting for stock-based compensation. In October 1995, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation”. SFAS No. 123 requires expanded disclosures of stock-based compensation arrangements with employees and encourages application of the fair value recognition provisions in the statement. Companies may continue following rules to recognize and measure compensation as outlined in Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees”, but are now required to disclose the pro forma amounts of net income and earnings per share that would have been reported had the Company elected to follow the fair value recognition provisions of SFAS No. 123. The Company adopted the disclosure requirements of SFAS No. 123, but continues to measure its stock-based employee compensation arrangements under the provisions of APB Opinion No. 25 and related Interpretations. In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure” which provides guidance on the transition from the intrinsic value method of accounting for stock-based employee compensation under APB Opinion No. 25 to the fair value method described in SFAS No. 123, if a company elects to do so. The Company has elected to continue to follow the intrinsic value method in accounting for stock options as provided in APB Opinion No. 25.

The Company has three stock-option employee compensation plans, which are described more fully in Note L. The fair value of options granted under the Company’s stock option plans is estimated on the date of grant using the Black-Scholes option-pricing model which utilizes the weighted-average assumptions in the following table:

| | | | | | |

| Year ended September 30, | | 2004 | | | 2003 | |

Annual dividend yield | | 3.42 | % | | 4.19 | % |

Expected volatility | | 27 | % | | 28 | % |

Risk-free interest rate | | 3.14 | % | | 2.63 | % |

Expected life | | 5 years | | | 5 years | |

17

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(CONTINUED)

No options were granted in 2005; as a result no assumptions for 2005 are presented in the table on page 17. No stock-option employee compensation cost is reflected in net income, as all options granted had an exercise price equal to the market value of the underlying common stock on the date of grant, and the number of shares of each grant is fixed at the grant date. The following table illustrates the effect on net income and earnings per share if the Company had applied the fair value recognition provisions of SFAS No. 123:

| | | | | | | | | | | | |

| Year ended September 30, | | 2005 | | | 2004 | | | 2003 | |

| | | (In thousands, except per share data) | |

Net income, as reported | | $ | 145,889 | | | $ | 131,868 | | | $ | 144,999 | |

Deduct: Total stock-based employee compensation expense determined under fair value based method for all awards, net of related tax effects | | | (1,717 | ) | | | (1,824 | ) | | | (1,111 | ) |

| | |

|

|

|

Pro forma net income | | $ | 144,172 | | | $ | 130,044 | | | $ | 143,888 | |

| | |

|

|

|

Earnings per share: | | | | | | | | | | | | |

Basic – as reported | | $ | 1.68 | | | $ | 1.53 | | | $ | 1.72 | |

Basic – pro forma | | | 1.66 | | | | 1.51 | | | | 1.71 | |

Diluted – as reported | | | 1.67 | | | | 1.51 | | | | 1.71 | |

Diluted – pro forma | | | 1.65 | | | | 1.49 | | | | 1.69 | |

Use of estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates reported in the financial statements include the allowance for loan losses, intangible assets, deferred taxes and contingent liabilities. Actual results could differ from these estimates.

In the second quarters of 2005, 2004 and 2003, the Company declared an eleven-for-ten stock split in the form of a 10% stock dividend. All share and per share amounts have been adjusted to reflect these stock dividends.

Business segments. The Company has determined that its current business and operations consist of one business segment.

Accounting changes. In December 2004, the FASB issued SFAS No. 123R, “Share-Based Payment” (“SFAS 123R”), a revision of SFAS No. 123. SFAS 123R will require the Company to, among other things, measure all employee stock-based compensation awards using a fair value method and record such expense in the Company’s consolidated financial statements. The provisions of SFAS 123R, as amended by SEC Staff Accounting Bulletin No. 107, “Share-Based Payment,” are effective no later than the beginning of the next fiscal year that begins after June 15, 2005; the Company will adopt the new requirements in its first quarter of fiscal 2006 using the modified prospective transition method. The adoption of SFAS 123R will increase the Company’s future compensation expense for unvested awards outstanding as of September 30, 2005 by the following estimated amounts:

| | | |

| Year ended September 30, | | Estimated Additional

Compensation Expense |

| | | (In thousands) |

2006 | | $ | 1,552 |

2007 | | | 1,150 |

2008 | | | 1,101 |

2009 | | | 723 |

2010 | | | 685 |

Reclassifications. Certain reclassifications have been made to the financial statements for years prior to September 30, 2005 to conform to current year classifications.

18

NOTE B | INVESTMENT SECURITIES |

| | | | | | | | | | | | | | | | |

| September 30, | | 2005 | |

| | | (In thousands) | |

| | | Amortized

Cost | | Gross Unrealized

| | | Fair

Value | | | |

| | | | Gains | | Losses | | | | Yield | |

Available-for-sale securities | | | | | | | | | | | | | | | | |

U.S. government and agency securities due | | | | | | | | | | | | | | | | |

Within 1 year | | $ | 72,290 | | $ | 1,477 | | $ | (288 | ) | | | 73,479 | | 7.52 | % |

1 to 5 years | | | 15,094 | | | — | | | (245 | ) | | | 14,849 | | 4.29 | |

5 to 10 years | | | 1,000 | | | — | | | (20 | ) | | | 980 | | 3.50 | |

Over 10 years | | | 84,692 | | | 4,695 | | | (760 | ) | | | 88,627 | | 8.00 | |

Mortgage-backed Securities | | | | | | | | | | | | | | | | |

Agency pass-through certificates | | | 905,893 | | | 3,436 | | | (9,408 | ) | | | 899,921 | | 5.58 | |

| | |

|

|

|

| | | | 1,078,969 | | | 9,608 | | | (10,721 | ) | | | 1,077,856 | | 5.88 | |

| | |

|

|

|

Held-to-maturity securities | | | | | | | | | | | | | | | | |

Tax-exempt municipal bonds due | | | | | | | | | | | | | | | | |

5 to 10 years | | | 1,800 | | | 211 | | | — | | | | 2,011 | | 9.06 | |

Over 10 years | | | 8,358 | | | 734 | | | — | | | | 9,092 | | 8.61 | |

U.S. government and agency securities due | | | | | | | | | | | | | | | | |

1 to 5 years | | | 26,900 | | | — | | | (424 | ) | | | 26,476 | | 2.95 | |

Mortgage-backed Securities | | | | | | | | | | | | | | | | |

Agency pass-through certificates | | | 175,421 | | | 1,408 | | | (2,812 | ) | | | 174,017 | | 5.60 | |

| | |

|

|

|

| | | | 212,479 | | | 2,353 | | | (3,236 | ) | | | 211,596 | | 5.41 | |

| | |

|

|

|