WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

Table of Contents

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

A SHORT HISTORY

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company headquartered in Seattle, Washington. Its principal subsidiary is Washington Federal (Bank ), which operates 160 offices in eight western states.

The Company had its origin on April 24, 1917, as Ballard Savings and Loan Association. In 1935, the state-chartered Company converted to a federal charter, became a member of the Federal Home Loan Bank (FHLB) system and obtained federal deposit insurance. In 1958, Ballard Federal Savings and Loan Association merged with Washington Federal Savings and Loan Association of Bothell, and the latter name was retained for wider geographical acceptance. In 1971, Seattle Federal Savings and Loan Association, with three offices, merged into the Company, and at the end of 1978 was joined by the 10 offices of First Federal Savings and Loan Association of Mount Vernon.

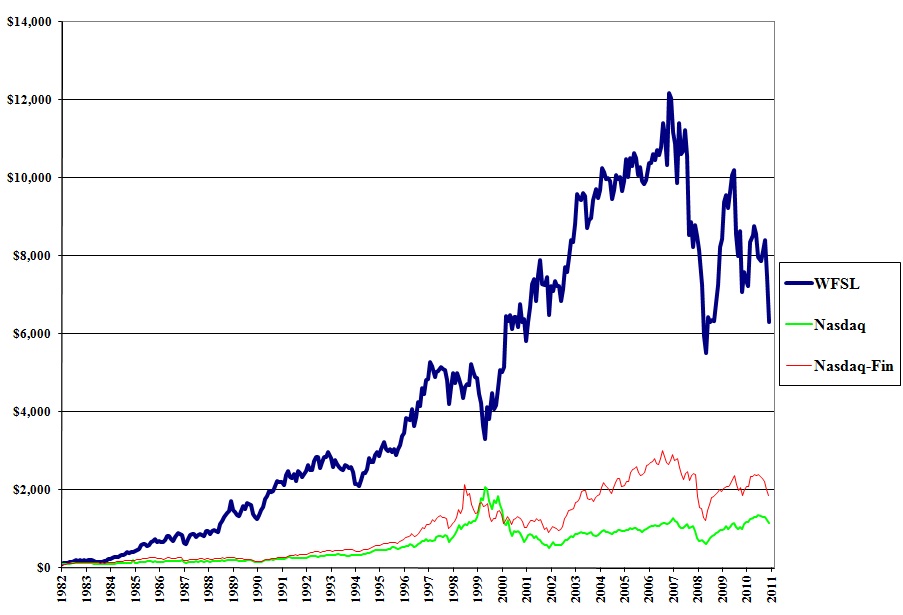

On November 9, 1982, the Company converted from a federal mutual to a federal stock association. In 1987 and 1988, acquisitions of United First Federal, Provident Federal Savings and Loan, and Northwest Federal Savings and Loan, all headquartered in Boise, Idaho, added 28 Idaho offices to the Company. In 1988, the acquisition of Freedom Federal Savings and Loan Association in Corvallis, Oregon, added 13 Oregon offices, followed in 1990 by the eight Oregon offices of Family Federal Savings.

In 1991, the Company added three branches with the acquisition of First Federal Savings and Loan Association of Idaho Falls, Idaho, and acquired the deposits of First Western Savings Association of Las Vegas, Nevada, in Portland and Eugene, Oregon, where it was doing business as Metropolitan Savings Association. In 1993, 10 branches were added with the acquisition of First Federal Savings Bank of Salt Lake City, Utah. In 1994, the Company expanded into Arizona.

In 1995, the stockholders approved a reorganization whereby the Bank became a wholly owned subsidiary of a newly formed holding company, Washington Federal, Inc. That same year, the Company purchased West Coast Mutual Savings Bank with its one branch in Centralia, Washington, and opened six additional branches. In 1996, the Company acquired Metropolitan Bancorp of Seattle, adding eight offices in Washington as well as opening four branches in existing markets. Between 1997 and 1999, the Company continued to develop its branch network, opening a total of seven branches and consolidating three offices into existing locations.

In 2000, the Company expanded into Las Vegas, opening its first branch in Nevada along with two branches in Arizona. In 2001, the Company opened two additional branches in Arizona and its first branch in Texas, with an office in the Park Cities area of Dallas. In 2002, five full-service branches were opened in existing markets. In 2003, the Company purchased United Savings and Loan Bank with its four branches in Seattle, added one new branch in Puyallup, Washington, and consolidated one branch in Nampa, Idaho. In 2005, the Company consolidated two branches in Mount Vernon, Washington, into one and opened branches in Plano, Texas, and West Bend, Oregon. In 2006, the Company opened locations in Klamath Falls, Oregon, and Richardson, Texas, added another location in Las Vegas, Nevada, and opened a branch in Medford, Oregon.

The Company acquired First Federal Banc of the Southwest, Inc., the holding company for First Federal Bank located in Roswell, New Mexico, on February 13, 2007. First Federal Bank had 13 branch locations, 11 in New Mexico and two in El Paso, Texas. The Company acquired First Mutual Bancshares, Inc. (“First Mutual”), the holding company for First Mutual Bank, on February 1, 2008. First Mutual had 12 branches primarily located on the eastside of Seattle. The Company also opened a location in Redmond, Oregon, in 2009. During 2010, the Company opened two new locations, one in Las Vegas, Nevada, and the other in Prescott Valley, Arizona.

On January 8, 2010, the Company acquired certain assets and liabilities, including most of the loans and deposits, of Horizon Bank (Horizon), headquartered in Bellingham, Washington, from the Federal Deposit Insurance Corporation (FDIC), as receiver for Horizon. Horizon operated 18 full-service offices, four commercial loan centers and four real estate loan centers in Washington. Through consolidation with existing Washington Federal branches, there was a net increase of 10 branches as a result of the Horizon acquisition.

In July 2011, the Company changed the name of its operating subsidiary from “Washington Federal Savings and Loan Association” to “Washington Federal,” acknowledging the increasing mix of product offerings as well as customer recognition

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

of the Washington Federal brand. On October 14, 2011, the Company acquired six branch locations, four in Albuquerque, New Mexico, and two in Santa Fe, New Mexico, from Charter Bank.

The Company obtains its funds primarily through deposits from the general public, repayments of loans, borrowings and retained earnings. These funds are used largely to make loans to individuals and businesses, including loans for the purchase of new and existing homes, construction and land loans, commercial real estate loans, commercial and industrial loans and loans for investments.

FINANCIAL HIGHLIGHTS

|

| | | | | | | |

| September 30, | 2011 | 2010 | % Change |

| | (In thousands, except per share data) |

| Assets | $ | 13,440,749 |

| $ | 13,486,379 |

| (0.3%) |

| Cash and cash equivalents | 816,002 |

| 888,622 |

| (8.2) |

| Investment securities | 246,004 |

| 358,061 |

| (31.3) |

| Loans receivable, net | 7,935,877 |

| 8,423,703 |

| (5.8) |

| Covered loans, net | 382,183 |

| 534,474 |

| (28.5) |

| Mortgage-backed securities | 3,056,176 |

| 2,203,139 |

| +38.7 |

| Customer accounts | 8,665,903 |

| 8,852,540 |

| (2.1) |

| FHLB advances and other borrowings | 2,762,066 |

| 2,665,548 |

| +3.6 |

| Stockholders’ equity | 1,906,533 |

| 1,841,147 |

| +3.6 |

| Net income available to common shareholders | 111,141 |

| 118,653 |

| (6.3) |

| Diluted earnings per share | 1.00 |

| 1.05 |

| (4.8) |

| Dividends per share | 0.24 |

| 0.20 |

| +20.0 |

| Stockholders’ equity per share | 17.49 |

| 16.37 |

| +6.8 |

| Shares outstanding | 108,976 |

| 112,484 |

| (3.1) |

| Return on average stockholders’ equity | 5.99 | % | 6.55 | % | NM |

| Return on average assets | 0.83 |

| 0.89 |

| NM |

| Efficiency ratio (1) | 31.30 |

| 26.26 |

| NM |

| |

| (1) | Calculated as total operating costs divided by net interest income, plus other income (excluding Investment gains) |

NM – not meaningful

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

TO OUR STOCKHOLDERS

Dear Shareholder,

It is a privilege for me to report that your company had another very successful year of operations, with much improved core earnings despite challenging conditions. Net income in fiscal year 2011 amounted to $111,141,000, which represents a 6% decline from reported net income of $118,653,000 in 2010. However, after excluding two large non-recurring items recorded in 2010, an $86 million pretax acquisition gain and the recapture of a $39 million contingent tax liability, earnings actually improved by $86 million or 345%. We view this as a significant accomplishment in light of ongoing economic and industry upheaval.

The strong increase in core earnings resulted largely from improved asset quality. After peaking at $606 million in June of 2009, non-performing assets (defined as loans on which payment is no longer being made plus foreclosed assets) have declined by 39% and ended the fiscal year at $370 million, or 2.76% of total assets. We are also pleased to report considerable improvement in net loan charge-offs, as they fell by nearly one-half, from $184 million last year to $98 million in fiscal 2011. Likewise, losses on the disposition of foreclosed real estate declined by 50% from $80 million to $40 million. Improvement in those measures provides evidence that the bottom of this credit cycle was reached well in the past.

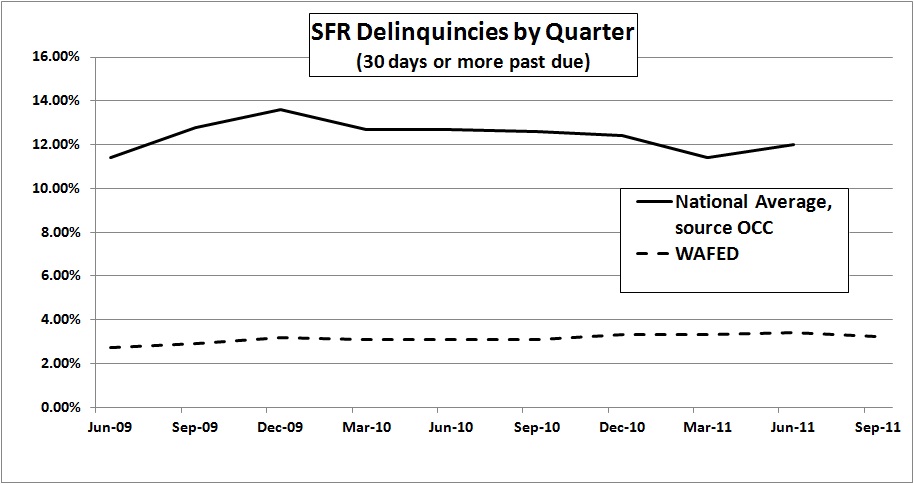

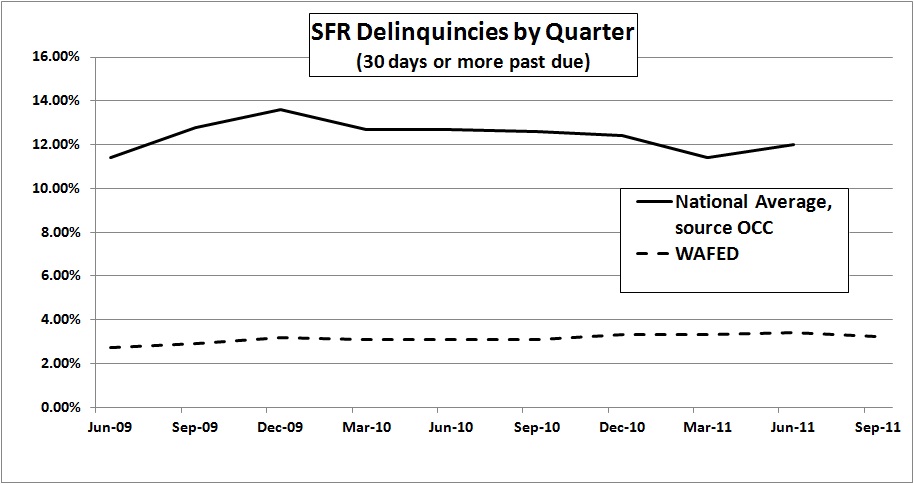

The largest of our loan portfolios is performing much better than the balance of the industry, as evidenced by the nearby chart comparing our mortgage delinquencies to those of the industry as a whole. It is encouraging to note that the level of past due mortgage loans as a percentage of our total portfolio remains steady, even though total mortgage loans outstanding declined along with housing prices in virtually all of our markets. The differential in quality is a testament to those in our company who underwrite and service those mortgage loans.

The steep decline in housing values and the jobless recovery, however, have left many mortgage borrowers challenged to make payments. In response, as we previously reported to you, in 2009 the Company created a Mortgage Resource Center, staffed with some of our most experienced mortgage lenders, to provide a single area within the Company where troubled borrowers could seek assistance. Since then, we have voluntarily modified some 1,946 mortgage loans to enable families suffering a temporary disruption in income to stay in their homes. Happily, our willingness to do so has been rewarded, as 85% of those modified loans are paying as agreed and many have now returned to the originally scheduled amortization.

Since the inception of the Mortgage Resource Center, 31% of those seeking a modification have been declined because in our view the impairment was permanent. In those cases, we concluded that the only viable alternative was a foreclosure or a deed in lieu of foreclosure. Throughout the devastating housing downturn that has led to so much hardship for consumers and to the outright failure of many lenders, our professional workout staff has maintained its poise and has done a terrific job of assisting troubled borrowers while protecting the interests of the Company. Anyone can behave well when times are good. Reputations

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

though, are made in tough times and there is little doubt that our reputation for integrity and fairness has grown over the past two years thanks to their efforts.

Virtually all other financial measures of the Company's performance during the year were positive. Operating expenses remained at the very low end of the industry range. The Company's efficiency ratio, an expression of pennies spent to produce $1 of net revenue, was 31.3%, compared to an industry average of 61.1%. This is a world class level of cost effectiveness, despite a significant increase in expenses outside our control, mostly related to heightened regulatory demands and a twenty-fold increase in FDIC insurance premiums.

Capital and liquidity remain remarkably strong. After cash dividends and the repurchase of 0.0 million shares during the fiscal year, an increase in capital accounts of $65 million was reported. The Company's ratio of tangible common equity to tangible assets, the purest measure of capital strength, increased to 12.52% in 2011 from 11.97% in 2010 and stands as the 2nd best such ratio among the 50 largest publicly traded financial institutions in the country. To reinforce management's belief that Washington Federal continues to be one of the strongest banks in America, consider that in the impossible event that 100% of non-performing assets were charged off tomorrow, the tangible common equity ratio would still amount to 10.9%, rank 5th and amount to 128% of the average for that same peer group.

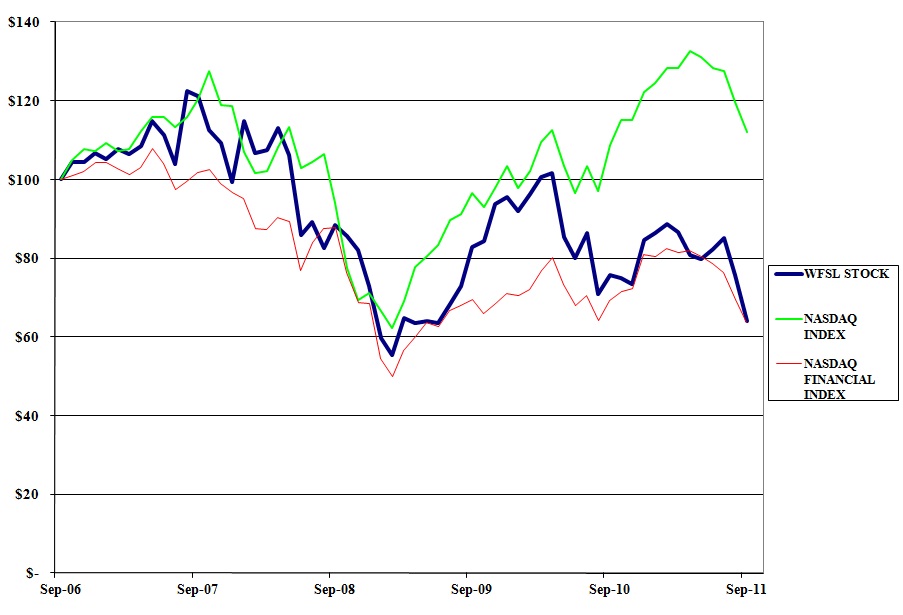

With all of the positive news reported here, one would expect the price per share of Washington Federal common stock to have improved, yet as you are well aware - it did not. This decline in value is particularly painful for shareholders because it comes on the heels of the banking crisis and the housing bust, during which the company's price per share fell for readily apparent reasons. This past year, though, the decline in value stands in marked contrast to the performance of the company, which was considerably improved in comparison to the prior two years. The absence of correlation between the share price and the Company's performance can be partially attributed to a market driven more by macroeconomic and geopolitical events than by the financial metrics of individual companies. A range of concerns, including slow growth in the U.S. economy characterized by stubbornly high unemployment and further declines in housing values, have created an environment of uncertainty and bearishness that has simply overwhelmed the Company's improved financial results.

Other industry issues affecting the Company's stock price include excess capacity, ultra-low interest rates and the virtual monopoly that the government enjoys in housing finance. It is also clear that the Dodd-Frank Act has caused investors to discount the future profitability of the industry. The Durbin Amendment to the Dodd-Frank Act, for example, produced an estimated $7 billion windfall in debit card revenues for retailers; unfortunately though, this gain will come directly from the bottom line of the banking industry. Dodd-Frank also adds uncertainty and cost through the layering of additional regulation. Washington Federal has gone from a single primary regulator to three. The Federal Reserve now has regulatory jurisdiction over the parent company, the Office of the Comptroller of the Currency supervises the regulated subsidiary and the Consumer Financial Protection Bureau has responsibility for regulating our delivery of consumer products. Only experience will show the full impact of these changes, but each of our new regulators has reached out constructively and, based upon those conversations, we believe that we are positioned to meet their requirements.

These high level circumstances are the best explanation available for our stock trading below book value at a time when the company is so solidly profitable, with improving trends nearly across the board. We believe that the selling is overdone and that the current stock price does not reflect the intrinsic value of the Company.

As always, we are continuing to provide our customers with valuable banking services such as a safe place for deposits and mortgage and business loans. These activities also provide stable jobs for our employees, benefits to our communities, including tax payments, and profits for our shareholders.

Looking ahead, we are optimistic about future prospects within the construct of the new economic realities. For many of the reasons cited above, gone for some time are the days when we could earn 2% on assets, yet there are still excellent opportunities to create shareholder value. The highest and best use of excess capital is organic growth and we are in fact attracting new business even with our conservative tolerance for risk. Industry consolidation will continue and perhaps accelerate, and the Company also has the capital, the talent and the infrastructure to acquire. If neither of these opportunities comes to pass, we will continue to return excess capital to you in the form of cash dividends or stock repurchases. In June, the board of directors authorized the repurchase of an additional ten million shares. At this writing 2,306,186 shares have been repurchased under that authorization, so significant capacity remains. One way or another, management and the Board are committed to rewarding shareholder patience with an improved stock price. Toward that end, the Board has begun taking a substantial portion of its compensation in stock, and long-term management incentives are now largely driven by total shareholder return.

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

Interest rate risk, defined as the impact on earnings of a change in interest rates, will also be an area of management focus this year. With interest rates at all time lows, caution must be exercised in originating long term assets. To protect against higher interest rates in the future, marketing and new business development will be targeted to shorter maturity fixed rate assets, floating rate assets and low cost transaction accounts. Liquidity levels will likely remain higher than normal along with capital, so that if rates do increase management will have the ability to leverage and acquire assets at the new higher rates in order to offset the decline in profitability of the existing balance sheet. This conservative approach to financial management means that we are effectively paying an insurance premium through reduced short-term earnings in order to assure our performance in the long term. Investors are encouraged to review the interest rate risk disclosures included in this report to gain a more complete understanding of this key risk, which has always been well-managed by the Company.

In January, Jim Doud and Denny Halvorson will step down from the board after reaching the retirement age prescribed by informal policy. Mr. Halvorson joined the board after the Company's acquisition of Metropolitan Savings in 1996 and has served as Chairman of the Compensation Committee and as the board's Lead Independent Director since 2006. Mr. Doud was elected to the board in 2008 after serving as a director of First Mutual, Inc. prior to its acquisition by Washington Federal, served on the Audit & Risk Policy Committee and, as a member of the Nominating & Governance Committee, was instrumental in the recruiting of replacement directors. I wish to thank both of them for their thoughtful leadership and the seriousness with which they approached their director responsibilities. Both have been very strong contributors to the Company's success and the depth of their experience will certainly be missed. In light of their retirements, I also wish to thank John Clearman for his agreement to an additional one-year term, during which he will serve as the Lead Independent Director.

In anticipation of the above retirements, the Company was fortunate to recruit two new directors with experience managing large, successful companies. Mark Tabbutt, Chairman of Saltchuk Resources, joined the board in April 2011, and Liane Pelletier, former Chairman, President & CEO of Alaska Communications Corp, was appointed to the board in August. Mark will serve as Chairman of the Regulatory Compliance Committee next year, while Liane will join the Audit & Risk Policy Committee. In light of their relative youth, we hope that they will serve for many years and extend our long history of strong, stable management and board oversight. I thank both of them for their willingness to serve at a time when so much is expected of public company directors.

After the end of our fiscal year, the Company completed its acquisition of six branches formerly owned by Charter Bank in New Mexico. The transaction adds $250 million in deposits, along with two branches in Santa Fe and four new locations in Albuquerque. The acquisition brings total deposits in New Mexico to over $700 million. I'd like to welcome the former Charter Bank employees, whom we have found to be most professional, and their clients to Washington Federal.

In closing, I'd like to express appreciation for the work of the Executive Management Committee, our loyal employees and our dedicated Board of Directors. All will be working hard to grow the business next year and, as always, you can help by sending your friends, relatives and neighbors to Washington Federal for all their banking needs.

I hope to see you at the 2012 Annual Meeting of Stockholders to be held at 2:00 PM on January 18th at the Westin Hotel in downtown Seattle.

Sincerely,

Roy M. Whitehead

Chairman, President and Chief Executive Officer

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2011 ANNUAL REPORT

(Back row - from left to right) Thomas E. Kasanders, Executive Vice President, Linda S. Brower, Executive Vice President, Mark A. Schoonover, Executive Vice President and Chief Credit Officer, Angela D. Veksler, Senior Vice President and Chief Information Officer (Front row - from left to right) Jack B. Jacobson, Executive Vice President, Roy M. Whitehead, Chairman, President and Chief Executive Officer, Edwin C. Hedlund, Executive Vice President and Secretary, Brent J. Beardall, Executive Vice President and Chief Financial Officer.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Annual Report on Form 10-K and the documents into which it may be incorporated by reference may contain, and from time to time our management may make, certain statements that constitute forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. These statements are not historical facts, but instead represent the current expectations, plans or forecasts of the Company and are based on the beliefs and assumptions of the management of the Company and the information available to management at the time that these disclosures were prepared. The Company intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and often are beyond the Company's control. Actual outcomes and results may differ materially from those expressed in, or implied by, the Company's forward-looking statements.

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties discussed elsewhere in this report, including under Item 1A, “Risk Factors,” and in any of the Company's other subsequent Securities and Exchange Commission filings:

▪negative economic conditions, including sharp declines in the real estate market, home sale volumes and financial stress on borrowers as a result of the uncertain economic environment, that adversely affect our borrowers and their customers, and may adversely affect our financial condition and results of operations;

▪the severe effects of the continued economic downturn, including high unemployment rates and severe declines in housing prices and property values, in our primary market areas;

▪fluctuations in interest rate risk and changes in market interest rates, which may negatively affect the Company's results of operations and financial conditions;

▪the Company's ability to make accurate assumptions and judgments about the collectability of its loan portfolio, including the creditworthiness of its borrowers and the value of the assets securing these loans;

▪legislative and regulatory limitations, including those arising under the Dodd-Frank Wall Street Reform Act and potential limitations in the manner in which we conduct our business and undertake new investments and activities;

▪the Bank's ability to comply with the terms of its memorandum of understanding with the OCC;

▪changes in other economic, competitive, governmental, regulatory, and technological factors affecting the Company's markets, operations, pricing, products, services and fees; and

▪the timing and occurrence or non-occurrence of events that may be subject to circumstances beyond the Company's control.

All forward-looking statements speak only as of the date on which such statements are made, and Washington Federal undertakes no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events, changes to future operating results over time, or the impact of circumstances that arise after the date the forward-looking statement was made.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

GENERAL

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company. The Company's primary operating subsidiary is Washington Federal (Bank or Washington Federal Bank), a federally chartered savings association.

The Company's fiscal year end is September 30th. All references to 2011, 2010 and 2009 represent balances as of September 30, 2011, September 30, 2010 and September 30, 2009, or activity for the fiscal years then ended. References to net income in this document refer to net income available to common shareholders.

CRITICAL ACCOUNTING POLICIES

Preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses in the Company's consolidated financial statements. Accordingly, estimated amounts may fluctuate from one reporting period to another due to changes in assumptions underlying estimated values.

The Company has determined that the only accounting policy deemed critical to an understanding of the consolidated financial statements of Washington Federal relates to the methodology for determining the valuation of the allowance for loan losses, as described below.

The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company's methodology for assessing the appropriateness of the allowance consists of several key elements, which include the general allowance and specific allowances.

The general loan loss allowance is established by applying a loss percentage factor to each of the different loan types. The allowance is provided based on Management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company's control, which may result in losses or recoveries differing from those provided.

Specific allowances are established for loans which are individually evaluated, in cases where management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

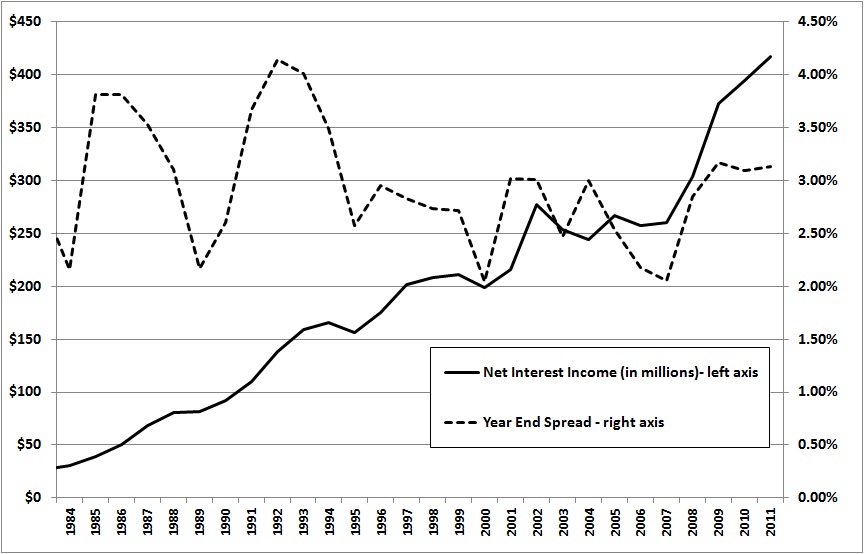

INTEREST RATE RISK

The primary source of income for the Company is net interest income, which is the difference between the interest income generated by our interest-earning assets and the interest expense generated by our interest-bearing liabilities. The level of net interest income is a function of the average balances of our interest-earnings assets and liabilities and the spread between the yield on such assets and the cost of such liabilities. These factors are influenced by both the pricing and mix of our interest-earning assets and our interest-bearing liabilities. If the interest rates on our interest-bearing liabilities increase at a faster pace than the interest rates on our interest-earning assets, the result could be a reduction in net interest income and with it, a reduction in our earnings.

The Company accepts a higher level of interest rate volatility as a result of its significant holdings of fixed-rate single-family home loans that are longer-term than the short-term characteristics of its primary liabilities of customer accounts. As a result, assets do not respond as quickly to changes in interest rates as liabilities. Due to this strategy, net interest income typically would decline when interest rates rise and would expand when interest rates fall as compared to a portfolio of matched maturities of assets and liabilities, if the balance sheet did not change in size or composition.

The Company manages its interest rate risk in part by originating more fixed-rate loans when yields are higher and adding loans and investments with shorter term characteristics, such as construction and commercial loans, when loan rates are lower. This balance sheet strategy, in conjunction with a strong capital position and low operating costs has allowed the Company to

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

manage interest rate risk, within guidelines established by the Board of Directors, through all interest rate cycles. Although a significant increase in market interest rates could adversely affect the net interest income of the Company, the Company's interest rate risk approach has never resulted in the recording of a monthly operating loss.

The Company's objective in managing its interest rate risk is to grow the amount of net interest income, through the rate cycles acknowledging that there will be some periods of time when that will not be feasible. The chart below shows the volatility of our period end net interest spread (dotted line which is measured against the right axis) compared to the relatively consistent growth in net interest income (solid line which is measured against the left axis). This consistency is accomplished by managing the size and composition of the balance sheet through different rate cycles.

The following table shows the estimated repricing periods for earning assets and paying liabilities.

|

| | | | | | | | | | | | | | | |

| | Repricing Period | | |

| | Within One

Year | | After 1 year -

before 6 Years | | Thereafter | | Total |

| | (In thousands) | | |

| As of September 30, 2011 | | | | | | | |

| Earning Assets (1) | $ | 1,742,054 |

| | $ | 854,212 |

| | $ | 10,203,095 |

| | $ | 12,799,361 |

|

| Paying Liabilities | (3,950,391 | ) | | (3,841,189 | ) | | (3,655,531 | ) | | (11,447,111 | ) |

| Excess (Liabilities) Assets | $ | (2,208,337 | ) | | $ | (2,986,977 | ) | | $ | 6,547,564 |

| | |

| Excess as % of Total Assets | (16.50 | )% | | | | | | |

| Policy limit for one year excess | (40.00 | )% | | | | | | |

(1) Asset repricing period includes estimated prepayments based on historical activity

At September 30, 2011, the Company had approximately 2.2 billion more liabilities than assets subject to repricing in the next year than assets, which amounted to a negative maturity gap of 16.50% of total assets, approximately the same as the prior year. Having this excess of liabilities, relative to assets, that will be repricing within the next year, the Company is subject to

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

decreasing net interest income should interest rates rise. However, if the size and/or mix of the balance sheet changes, rising rates may not cause a decrease in net interest income.

The interest rate spread increased to 3.13% at September 30, 2011 from 3.09% at September 30, 2010. Net interest spread represents the difference between the contractual rates of earning assets and the contractual rates of paying liabilities as of a specific date. The spread increased due to lower deposit costs, partially offset by lower asset yields. In addition, loan yields are lower as a result of refinancing of fixed-rate mortgages into historically low long-term interest rates. Rates on customer accounts decreased by 37 basis points over the prior year while rates on earning assets decreased by 24 basis points (see Period End Spread table below).

As of September 30, 2011, total assets decreased by $45,630,000, or 0.34%, from $13,486,379,000 at September 30, 2010. For the year ended September 30, 2011, compared to September 30, 2010, loans (both non-covered and covered) decreased $640,117,000, or 7.15%, while investment securities increased $740,980,000, or 28.93%. Cash and cash equivalents of $816,002,000 and stockholders' equity of $1,906,533,000 provides management with flexibility in managing interest rate risk going forward.

ASSET QUALITY & ALLOWANCE FOR LOAN LOSSES

The Company maintains an allowance to absorb losses inherent in the loan portfolio. The amount of the allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company's methodology for assessing the appropriateness of the allowance consists of several key elements, which include the general allowance and specific allowances.

The general portion of the loan loss allowance is established by applying a loss percentage factor to the different loan types. Management believes loan types are the most relevant factor in the allowance calculation for group of homogeneous loans as the risk characteristics within these groups are similar. The loss percentage factor is made up of two parts - the historical loss factor (“HLF”) and the qualitative loss factor (“QLF”). The HLF takes into account historical charge-offs, while the QLF is determined by loan type and allows management to augment reserve levels to reflect the current environment and portfolio performance trends including recent charge-off trends. Allowances are provided based on management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions, and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company's control, which may result in losses or recoveries differing from those provided.

Specific allowances are established for loans which are individually evaluated; in cases where management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

Loans for commercial purposes, including multi-family loans, builder construction loans and commercial loans are reviewed on an individual basis to assess the ability of the borrowers to continue to service all of their principal and interest obligations. If a loan shows signs of weakness, it is downgraded and, if warranted, placed on non-accrual status. On collateral dependent commercial loans, updated valuations are generally obtained from external sources when a loan exhibits weakness or is modified. The Company also has an asset quality review function that reports the results of its internal reviews to the Board of Directors on a quarterly basis.

Restructured single-family residential loans are reserved for under the Company's general reserve methodology. If any individual loan is significant in balance, the Company may establish a specific reserve as warranted.

Most restructured loans are accruing and performing loans where the borrower has proactively approached the Company about modifications due to temporary financial difficulties. Each request is individually evaluated for merit and likelihood of success. As of September 30, 2011 single-family residential loans comprised 82% of restructured loans. The concession for these loans is typically a payment reduction through a rate reduction of from 0 to 0 bps for a specific term, usually six to twelve months. Interest-only payments may also be approved during the modification period. The subsequent default rate on restructured single- family mortgage loans has been approximately 14% since inception of the program in November 2008.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Concessions for construction (4.1%), land A&D (4.8%) and multi-family loans (5.0%) are typically an extension of maturity combined with a rate reduction of normally 0 bps. Since December 2008 the subsequent default rate on restructured commercial loans has been less than 10%.

For commercial loans, six consecutive payments on newly restructured loan terms are required prior to returning the loan to accrual status. In some instances after the required six consecutive payments are made a management assessment will conclude that collection of the entire principal balance is still in doubt. In those instances, the loan will remain on non-accrual. Homogeneous loans may or may not be on accrual status at the time of restructuring, but all are placed on accrual status upon the restructuring of the loan. Homogeneous loans are restructured only if the borrower can demonstrate the ability to meet the restructured payment terms; otherwise, collection is pursued and the loan remains on non-accrual status until liquidated. If the homogeneous restructured loan does not perform it is placed in non-accrual status when it is 90 days delinquent.

A loan that defaults and is subsequently modified would impact the Company's delinquency trend, which is part of the QLF component of the general reserve calculation. Any modified loan that re-defaults and is charged-off would impact the HLF component of our general reserve calculation.

Non-performing assets were $370,294,000, or 2.76%, of total assets, at September 30, 2011, compared to $434,530,000, or 3.22%, of total assets, at September 30, 2010. This continued elevated level of non-performing assets is a result of the significant decline in housing values in the western United States and the national recession over the last three years. This level of NPAs remains significantly higher than the 0.88% average over the Company's 28+ year history as a public company. Total delinquencies over 30 days were $279,222,000, or 3.43%, of net loans at September 30, 2011, compared to $304,665,000 or 3.53%, of net loans at September 30, 2010.

The following table details non-performing asset by type, comparing 2011 and 2010 .

|

| | | | | | | | | | | | | | | |

| | | September 30, | | | | |

| Non-Performing Assets | | 2011 | | 2010 | | $ Change | | % Change |

| | | (In thousands) | | |

| Non-accrual loans: | | | | | | | | |

| Single-family residential | | $ | 126,624 |

| | $ | 123,624 |

| | $ | 3,000 |

| | 2.4 | % |

| Construction – speculative | | 15,383 |

| | 39,915 |

| | (24,532 | ) | | (61.5 | )% |

| Construction – custom | | 635 |

| | — |

| | 635 |

| | NM |

|

| Land – acquisition & development (A&D) | | 37,339 |

| | 64,883 |

| | (27,544 | ) | | (42.5 | )% |

| Land – consumer lot loans | | 8,843 |

| | — |

| | 8,843 |

| | NM |

|

| Multi-Family | | 7,664 |

| | 4,931 |

| | 2,733 |

| | 55.4 | % |

| Commercial real estate | | 11,380 |

| | 10,831 |

| | 549 |

| | 5.1 | % |

| Commercial & industrial | | 1,679 |

| | 371 |

| | 1,308 |

| | 352.6 | % |

| HELOC | | 481 |

| | — |

| | 481 |

| | NM |

|

| Consumer | | 437 |

| | 977 |

| | (540 | ) | | (55.3 | )% |

| Total non-accrual loans | | 210,465 |

| | 245,532 |

| | (35,067 | ) | | (14.3 | )% |

| Total REO & REHI | | 159,829 |

| | 188,998 |

| | (29,169 | ) | | (15.4 | )% |

| Total non-performing assets | | $ | 370,294 |

| | $ | 434,530 |

| | $ | (64,236 | ) | | (14.8 | )% |

| | | | | | | | | |

| NM - not meaningful |

In response to the improving overall credit quality of our loan portfolio, the total allowance for loan loss decreased by $5,934,000, or 3.6%, over 2010. $115,248,000 of the allowance is calculated under the formulas contained in our general allowance methodology and the remaining $41,912,000 is made up of specific reserves on loans that were deemed to be impaired at September 30, 2011. The general reserve increased by $17,156,000, or 17.5%, to $115,248,000 while the specific reserve decreased by $23,090,000, or 35.5%. The primary reasons for the shift in total allowance allocation from specific

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

reserves to general reserves is due to the Company having already addressed many of the problem loans focused in the speculative construction and land A&D portfolios, combined with above normal delinquencies and elevated charge-offs in the single-family residential portfolio.

LIQUIDITY AND CAPITAL RESOURCES

The principal sources of funds for the Company's activities are retained earnings, loan repayments (including prepayments), net deposit inflows, repayments and sales of investments and borrowings. Washington Federal's principal sources of revenue are interest on loans and interest and dividends on investments.

The Company's net worth at September 30, 2011, was $1,906,533,000 or 14.2%, of total assets. This is an increase of $65,386,000 from September 30, 2010, when net worth was $1,841,147,000, or 13.7%, of total assets. The Company's net worth was impacted in the year by net income of $111,141,000, the payment of $26,796,000 in cash dividends, treasury stock purchases that totaled $59,680,000, as well as an increase in other comprehensive income of $36,107,000. The Company paid out 24.0% of its 2011 earnings in cash dividends to common shareholders, compared with 19.0% last year. Over the long term, the Company would prefer its dividend payout ratio to be less than 50.0%. For the year ended September 30, 2011, $86.4 million, or 77.8%, of net income was returned to shareholders in the form of cash dividends or share repurchases.

Management believes this strong net worth position will help the Company manage its interest rate risk and provide the capital support needed for controlled growth in a regulated environment.

The Company has a credit line with the Federal Home Loan Bank (FHLB) of Seattle equal to 50.0% of total assets, providing a substantial source of liquidity if needed. FHLB advances are collateralized as provided for in the Advances, Pledge and Security Agreement by all FHLB stock owned by the Company, deposits with the FHLB and certain mortgages or deeds of trust securing such properties as provided in the agreements with the FHLB.

The Company's cash and cash equivalents amounted to $816,002,000 at September 30, 2011, a 8.2% decrease from the cash and cash equivalents balance of $888,622,000 one year ago. The Company continues to maintain higher than normal amounts of liquidity due to concern about potentially rising interest rates in the future. Additionally, see “Interest Rate Risk” above and the “Statement of Cash Flows” included in the financial statements.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CHANGES IN FINANCIAL CONDITION

Available-for-sale and held-to-maturity securities. Available for sale securities increased $774,051,000, or 31.2% during the year ended September 30, 2011. This increase included the purchase of $1,585,945,000 of available-for-sale investment securities. During the same period, $131,361,000 of available-for-sale securities were sold at a gain of $8,147,000. There were no purchases or sales of held-to-maturity securities in the same period. As of September 30, 2011 the Company had net unrealized gains on available-for-sale securities of $85,789,000, net of tax, which were recorded as part of stockholders' equity. The Company increased its available-for-sale investment portfolio to partially replace some of the lost interest income on maturing and prepaying loans and mortgage-backed securities.

Loans receivable. Loans receivable decreased $487,826,000, or 5.8%, to $7,935,877,000 at September 30, 2011, from $8,423,703,000 one year earlier. This decrease resulted primarily from loan repayments (including prepayments) of $1,704,826,000, which exceeded originations of $1,310,444,000 by $394,382,000. This decrease is consistent with management's strategy to reduce the Company's exposure to land and construction loans and not to aggressively compete for 30 year fixed-rate loans at rates below 4.5%, due to the duration risk associated with such low mortgage rates, which contributed to the net run off of the loan portfolio. Additionally, during the year, $112,693,000 of loans were transferred to REO. If the current low rates on 30 year fixed-rate mortgages persist, management will consider continuing to shrink the Company's loan portfolio. The following table shows the change in the geographic distribution by state of the gross loan portfolio from 2010 to 2011.

|

| | | | | | |

| 2011 | 2010 | Change |

| Washington | 46.6 | % | 43.8 | % | 2.8 | % |

| Oregon | 17.4 |

| 17.6 |

| (0.2 | )% |

| Other | 5.2 |

| 7.2 |

| (2.0 | )% |

| Idaho | 6.6 |

| 7.0 |

| (0.4 | )% |

| Arizona | 9.1 |

| 8.8 |

| 0.3 | % |

| Utah | 7.6 |

| 7.6 |

| — | % |

| New Mexico | 3.8 |

| 3.9 |

| (0.1 | )% |

| Texas | 1.9 |

| 2.2 |

| (0.3 | )% |

| Nevada | 1.8 |

| 1.9 |

| (0.1 | )% |

| 100.0 | % | 100.0 | % |

|

Covered loans. As of September 30, 2011, covered loans had decreased 28.5%, or $152,291,000, to $382,183,000, compared to September 30, 2010, due to continued paydowns and transfers of the properties into covered real estate owned.

Real estate held for sale. Real estate held for sale decreased by $29.2 million or 15.4% to $159,829,000 from $188,998,000 as of September 30, 2010, as the Company has continued to liquidate foreclosed properties. During the year the Company sold 570 properties for net proceeds of $110.4 million and a net loss on sale of $0.3 million. The total net loss on sale of real estate, measured against the original loan balance of $190.8 million, was $80.4 million or 42.1% for properties sold in fiscal 2011. As of September 30, 2011, real estate held for sale consisted of 566 properties totaling $159.8 million. Land represents $95.2 million or 60.1% of total real estate held for sale. Net loss on real estate acquired through foreclosure, which includes gains and losses on sale, ongoing maintenance expense and periodic write-downs from lower valuations, decreased by 50.2% from the prior year to $40.1 million. This decrease is due to land prices stabilizing in 2011, compared to the significant depreciation of land values in 2010.

Intangible assets. The Company's intangible assets are made up of $251,653,000 of goodwill, servicing rights intangible of $1,246,000, as well as the unamortized balances of the core deposit intangible of $3,372,000 at September 30, 2011.

Customer deposits. Customer deposits at September 30, 2011, totaled $8,665,903,000 compared with $8,852,540,000 at September 30, 2010, a 2.1% decrease. However, the Company was able to grow transaction accounts by $107,426,000 or 4.2%,

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

while time deposits decreased by $294,063,000 or 4.7%. The weighted average rate paid on customer deposits during the year was 1.32%, a decrease of 37 basis points from the previous year, as a result of the low interest rate environment.

FHLB advances and other borrowings. Total borrowings increased $96,518,000 or 3.62%, to $2,762,066,000 at September 30, 2011. See “Interest Rate Risk” above.

Contractual obligations. The following table presents, as of September 30, 2011, the Company's significant fixed and determinable contractual obligations, within the categories described below, by payment date or contractual maturity.

|

| | | | | | | | | | | | | | | | |

| Contractual Obligations | | Total | | Less than

1 Year | | 1 to 5

Years | | Over 5

Years |

| | | (In thousands) |

| Debt obligations (1) | | $ | 2,762,066 |

| | $ | — |

| | $ | 1,712,066 |

| | $ | 1,050,000 |

|

| Operating lease obligations | | 9,551 |

| | 2,433 |

| | 5,701 |

| | 1,417 |

|

| | | $ | 2,771,617 |

| | $ | 2,433 |

| | $ | 1,717,767 |

| | $ | 1,051,417 |

|

(1) Represents final maturities of debt obligations.

These contractual obligations, except for the operating leases, are included in the Consolidated Statements of Financial Condition. The payment amounts represent those amounts contractually due.

RESULTS OF OPERATIONS

GENERAL

See Note P, “Selected Quarterly Financial Data (Unaudited),” which highlights the quarter-by-quarter results for the years ended September 30, 2011 and 2010.

COMPARISON OF 2011 RESULTS WITH 2010

In 2011 net income decreased $7,512,000, or 6.3%, to $111,141,000 for the year ended September 30, 2011 as compared to $118,653,000 for the year ended September 30, 2010. The net income for the year ended September 30, 2010 included a $54,789,000 after tax gain on the acquisition of Horizon and a $38,865,000 tax benefit related to the settlement of a contingent tax liability. Excluding these two non-recurring items from the prior year, net income increased by $86.1 million, or 345%. The net income for the twelve months ended September 30, 2011 benefited from overall lower credit costs, which included the provision for loan losses and real estate owned expenses. The provision for loan losses amounted to $93,104,000 for the year ended September 30, 2011, as compared to $179,909,000 for the year ago period. In additions, losses recognized on real estate acquired through foreclosure was $40,050,000 for the year ended September 30, 2011, as compared to $80,475,000 for the fiscal year ended September 30, 2010.

The table below sets forth certain information regarding changes in interest income and interest expense of the Company for the 2011. For each category of interest-earning asset and interest-bearing liability, information is provided on changes

attributable to: (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old average volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

| | | | | | | | | |

| | Year Ended

September 30, 2011 |

| | Volume | Rate | Total |

| Interest income: | | | |

| Loans and covered assets | $ | (36,101 | ) | $ | (2,738 | ) | $ | (38,839 | ) |

| Mortgaged-backed securities | 25,601 |

| (9,169 | ) | 16,432 |

|

| Investments (1) | (142 | ) | 3,624 |

| 3,482 |

|

| | | | |

| All interest-earning assets | (10,642 | ) | (8,283 | ) | (18,925 | ) |

| | | | |

| Interest expense: | | | |

| Customer accounts | 2,684 |

| (33,209 | ) | (30,525 | ) |

| FHLB advances and other borrowings | (8,315 | ) | (2,565 | ) | (10,880 | ) |

| | | | |

| All interest-bearing liabilities | (5,631 | ) | (35,774 | ) | (41,405 | ) |

| | | | |

| Change in net interest income | $ | (5,011 | ) | $ | 27,491 |

| $ | 22,480 |

|

The Company recorded a $93,104,000 provision for loan losses in 2011 compared to $179,909,000 in 2010. Non-performing assets (NPA's) decreased by $64,236,000 over 2010. The Company had net charge-offs of $98,284,000 for the twelve months ended September 30, 2011 compared with $183,651,000 of net charge-offs for the same period one year ago. The decrease in the provision for loan losses is in response to four primary factors: first, the amount of NPA's improved year-over-year; second, non-accrual loans as a percentage of total loans decreased from 2.80% at September 30, 2010, to 2.54% at September 30, 2011; third, the percentage of loans 30 days or more delinquent decreased from 3.53% at September 30, 2010, to 3.43% at September 30, 2011; and finally, the Company's exposure in the land A&D and speculative construction portfolios, the source of the majority of losses during this period of the cycle, has decreased from a combined 5.40% of the gross loan portfolio at September 30, 2010, to 4.10% at September 30, 2011. Management expects the provision to remain elevated until housing values stabilize. Management believes the allowance for loan losses, totaling $157,160,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income decreased $94,497,000, or 78.5%, in 2011 from 2010. The year ended September 30, 2010, included an $85,608,000 non-recurring gain on the acquisition of Horizon (see Note A).

Compensation expense increased $2,155,000, or 3.1%, in 2011 primarily due to operating for a full year with the Horizon branches. The number of personnel, including part-time employees considered on a full-time equivalent basis, decreased to 1,221 at September 30, 2011, compared to one year ago.

Occupancy expense increased slightly to $14,480,000 for the twelve months ended September 30, 2011 from $13,933,000 for the fiscal year ended September 30, 2010. The branch network consisted of 160 offices at both September 30, 2011 and 2010.

FDIC insurance expense increased to $20,582,000 for 2011 from $18,626,000 in 2010 as a result of the significant increase in the number of bank failures during the year which has depleted the FDIC fund. The FDIC has undertaken to replenish the FDIC fund through changes to the assessment calculation, special assessments and higher insurance premiums for all insured depository institutions.

Other expenses increased slightly to $29,496,000 for the twelve months ended September 30, 2011 from $28,830,000 for the comparable period one year ago. Operating expense for 2011 and 2010 equaled 1.01% and 0.98% of average assets, respectively. Despite the increase in operating expenses, the Company continues to operate as one of the most efficient financial institutions in the country.

The loss on real estate acquired through foreclosure decreased 50.2% to $40,050,000 in 2011 from $80,475,000 in 2010, due primarily to the decline in balances of real estate acquired through foreclosure, as the Company continues to liquidate foreclosed properties. The net loss on real estate acquired through foreclosure, includes gains and losses on sale, ongoing

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

maintenance expense and periodic write-downs from lower property valuations.

Income tax expense increased to $62,518,000 in 2011 from $4,372,000 for the fiscal year ended September 30, 2010. The fiscal 2010 amount included a $38,865,000 tax benefit related to the settlement of a contingent tax liability (see Note A). The effective tax rate was 36.00% for 2011 versus 3.55% for 2010. The Company expects an effective tax rate of 36.00% going forward.

COMPARISON OF 2010 RESULTS WITH 2009

In 2010 net income increased $77,969,000, or 191.6%, from 2009, primarily as a result of the $54,789,000 after tax gain on the acquisition of Horizon and a $38,865,000 tax benefit related to the settlement of a contingent tax liability. In addition, during the twelve months ended September 30, 2010, the Company recognized a gain on sale of available-for-sale securities of $22,409,000. Losses recognized on real estate acquired through foreclosure was $80,475,000 for the twelve months ended September 30, 2010 as compared to $16,354,000 for the fiscal year ended September 30, 2009.

Interest income on loans, covered loans and mortgage-backed securities decreased $35,886,000, or 5.2%, in 2010 due to a 1.7% decrease in the average outstanding balance, as well as a 21 basis point decrease in the weighted average yield during the year from 6.04% in 2009 to 5.83% in 2010.

Interest and dividend income on investment securities and cash equivalents increased $7,672,000, or 252.0%, in 2010 from 2009. This increase was primarily due to an increase in the average outstanding balance of investment securities, cash equivalents and FHLB stock, which increased 251.0% to $1,252,991,000.

Interest expense on customer accounts decreased 23.5% to $146,360,000 for 2010 from $191,435,000 for 2009. The decrease primarily related to a 87 basis point decrease in the average cost of customer accounts to 1.69% during the year compared to 2.56% one year ago, offset by a 15.4% increase in the average balance of customer accounts over the prior year. Interest expense on FHLB advances and other borrowings decreased to $122,741,000 in 2010 from $127,192,000 in 2009 due to a decrease in the average balance of borrowings to $2,880,322,000 during 2010 from $3,235,231,000 during 2009. Partially offsetting the decrease in the average balance of borrowings was the increase in the average cost of borrowings for the year ended September 30, 2010 to 4.26% from 3.93% for the same period one year ago.

The Company recorded a $179,909,000 provision for loan losses in 2010 compared to $193,000,000 in 2009. Non-performing assets decreased by $122,590,000 over 2009. The Company had net charge-offs of $183,651,000 for the twelve months ended September 30, 2010 compared with $111,222,000 of net charge-offs for the same period one year ago. The decrease in the provision for loan losses is in response to four primary factors: first, the improvement in the amount of NPA's year-over-year; second, non-accrual loans as a percentage of total loans decreased from 4.23% at September 30, 2009, to 2.91% at September 30, 2010; third, the percentage of loans 30 days or more delinquent decreased from 4.86% at September 30, 2009, to 3.53% at September 30, 2010; and finally, the Company's exposure in the land A&D and speculative construction portfolios, where the majority of losses have come from during this period of the cycle, has decreased from a combined 8.4% of the gross loan portfolio at September 30, 2009, to 5.4% at September 30, 2010. Management expects the provision to remain at elevated levels until NPA's and charge-offs improve measurably. Management believes the allowance for loan losses, totaling $163,094,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income increased $101,421,000, or 533.5%, in 2010 from 2009. The year ended September 30, 2010, included an $85,608,000 gain on the acquisition of Horizon (see Note A).

Compensation expense increased $12,782,000, or 22.4%, in 2010 primarily due to the addition of Horizon employees and incentive compensation paid related to the increase in net income. Personnel, including part-time employees considered on a full-time equivalent basis, increased to 1,223 at September 30, 2010 compared to 1,105 one year ago.

Occupancy expense increased $884,000, or 6.77%, during the year primarily due to the additional branches acquired in the Horizon transaction. The branch network increased to 160 offices at September 30, 2010 versus 150 offices one year ago.

FDIC insurance expense increased to $18,626,000 for 2010 from $10,688,000 in 2009 as a result of the significant increase in bank failures during the year which has depleted the FDIC fund. The FDIC has undertaken to replenish the FDIC fund through

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

special assessments and higher insurance premiums for all insured depository institutions. Other expenses increased $3,725,000 during the year primarily related to the operating costs added from the Horizon acquisition and increased information technology spending. Operating expense for 2010 and 2009 equaled 0.98% and .87% of average assets, respectively.

The loss on real estate acquired through foreclosure increased from $16,354,000 in 2009 to $80,475,000 in 2010 due to the growth in balances of real estate acquired through foreclosure, combined with the resulting net loss on sale and any additional valuation adjustments of properties stemming from continued declines in real estate values.

Income tax expense decreased $23,198,000 or 84.1%, in 2010 as a result of a $38,865,000 tax benefit related to the settlement of a contingent tax liability (see Note A). The effective tax rate was 3.55% for 2010 versus 36.40% for 2009.

PERIOD END SPREAD - AS OF THE DATE SHOWN

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| DEC 2009 |

| MAR 2010 |

| JUN 2010 |

|

| SEP 2010 |

| DEC 2010 |

| MAR 2011 |

| JUN 2011 |

| SEP 2011 |

| Interest rate on loans and mortgage-backed securities | 6.00 | % |

| 5.97 | % |

| 5.89 | % |

|

| 5.75 | % |

| 5.66 | % |

| 5.58 | % |

| 5.49 | % |

| 5.43 | % |

| Interest rate on investment securities | 0.56 |

|

| 1.21 |

|

| 1.21 |

|

|

| 1.26 |

|

| 1.30 |

|

| 1.11 |

|

| 1.26 |

|

| 0.98 |

|

| Combined | 5.49 |

|

| 5.37 |

|

| 5.21 |

|

|

| 5.21 |

|

| 5.12 |

|

| 5.05 |

|

| 5.07 |

|

| 4.97 |

|

| Interest rate on customer accounts | 1.75 |

|

| 1.70 |

|

| 1.63 |

| — |

| 1.51 |

|

| 1.40 |

|

| 1.32 |

|

| 1.24 |

|

| 1.14 |

|

| Interest rate on borrowings | 4.25 |

|

| 4.19 |

|

| 4.19 |

|

|

| 4.14 |

|

| 4.14 |

|

| 4.14 |

|

| 4.14 |

|

| 4.04 |

|

| Combined | 2.41 |

|

| 2.30 |

|

| 2.25 |

|

|

| 2.12 |

|

| 2.03 |

|

| 1.98 |

|

| 1.92 |

|

| 1.84 |

|

| Interest rate spread | 3.08 | % |

| 3.07 | % |

| 2.96 | % |

|

| 3.09 | % |

| 3.09 | % |

| 3.07 | % |

| 3.15 | % |

| 3.13 | % |

The interest rate spread increased during 2011 from 3.09% at September 30, 2010 to 3.13% at September 30, 2011. See “Interest Rate Risk” section above.

SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | |

| Year ended September 30, | 2011 | 2010 | 2009 | 2008 | 2007 |

| | (In thousands, except per share data) |

| Interest income | $ | 644,635 |

| $ | 663,560 |

| $ | 691,774 |

| $ | 701,428 |

| $ | 618,682 |

|

| Interest expense | 227,696 |

| 269,101 |

| 318,627 |

| 397,641 |

| 358,501 |

|

| Net interest income | 416,939 |

| 394,459 |

| 373,147 |

| 303,787 |

| 260,181 |

|

| Provision for loan losses | 93,104 |

| 179,909 |

| 193,000 |

| 60,516 |

| 1,550 |

|

| Other income | (14,117 | ) | 39,955 |

| 2,655 |

| (60,212 | ) | 15,569 |

|

| Other expense | 136,059 |

| 131,480 |

| 107,060 |

| 87,220 |

| 64,888 |

|

| Income before income taxes | 173,659 |

| 123,025 |

| 75,742 |

| 95,839 |

| 209,312 |

|

| Income taxes | 62,518 |

| 4,372 |

| 27,570 |

| 33,507 |

| 74,295 |

|

| Net income | $ | 111,141 |

| $ | 118,653 |

| $ | 48,172 |

| $ | 62,332 |

| $ | 135,017 |

|

| Preferred dividends accrued | — |

| — |

| 7,488 |

| — |

| — |

|

| Net income available to common shareholders | $ | 111,141 |

| $ | 118,653 |

| $ | 40,683 |

| $ | 62,332 |

| $ | 135,017 |

|

| Per share data | | | | | |

| Basic earnings | $ | 1.00 |

| $ | 1.06 |

| $ | 0.46 |

| $ | 0.71 |

| $ | 1.55 |

|

| Diluted earnings | 1.00 |

| 1.05 |

| 0.46 |

| 0.71 |

| 1.54 |

|

| Cash dividends | 0.24 |

| 0.20 |

| 0.20 |

| 0.84 |

| 0.83 |

|

| | | | | | |

| September 30, | 2011 | 2010 | 2009 | 2008 | 2007 |

| Total assets | $ | 13,440,749 |

| $ | 13,486,379 |

| $ | 12,582,475 |

| $ | 11,830,141 |

| $ | 10,285,417 |

|

| Loans and mortgage-backed securities | 10,992,053 |

| 10,626,842 |

| 11,266,295 |

| 11,053,223 |

| 9,601,947 |

|

| Investment securities | 246,004 |

| 358,061 |

| 21,259 |

| 49,001 |

| 240,391 |

|

| Cash and cash equivalents | 816,002 |

| 888,622 |

| 498,388 |

| 82,600 |

| 61,378 |

|

| Customer accounts | 8,665,903 |

| 8,852,540 |

| 7,842,310 |

| 7,169,539 |

| 5,996,785 |

|

| FHLB advances | 1,962,066 |

| 1,865,548 |

| 2,078,930 |

| 1,998,308 |

| 1,760,979 |

|

| Other borrowings | 800,000 |

| 800,000 |

| 800,600 |

| 1,177,600 |

| 1,075,000 |

|

| Stockholders’ equity | 1,906,533 |

| 1,841,147 |

| 1,745,485 |

| 1,332,674 |

| 1,318,127 |

|

| Number of | | | | | |

| Customer accounts | 309,532 |

| 327,430 |

| 305,129 |

| 298,926 |

| 281,778 |

|

| Loans | 39,986 |

| 42,540 |

| 44,453 |

| 47,331 |

| 44,713 |

|

| Offices | 160 |

| 160 |

| 150 |

| 148 |

| 135 |

|

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

|

| | | | | | | |

| September 30, | 2011 | | 2010 |

| | (In thousands, except share data) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 816,002 |

| | $ | 888,622 |

|

Available-for-sale securities, including encumbered securities of $965,927 and $933,315, at fair value | 3,255,144 |

| | 2,481,093 |

|

Held-to-maturity securities, including encumbered securities of $45,086 and $60,970, at amortized cost | 47,036 |

| | 80,107 |

|

| Loans receivable, net | 7,935,877 |

| | 8,423,703 |

|

| Covered loans, net | 382,183 |

| | 534,474 |

|

| Interest receivable | 52,332 |

| | 49,020 |

|

| Premises and equipment, net | 166,593 |

| | 162,721 |

|

| Real estate held for sale | 159,829 |

| | 188,998 |

|

| Covered real estate held for sale | 56,383 |

| | 44,155 |

|

| FDIC indemnification asset | 98,871 |

| | 131,128 |

|

| FHLB stock | 151,755 |

| | 151,748 |

|

| Intangible assets, including goodwill of $251,653 | 256,271 |

| | 257,718 |

|

| Federal and state income taxes, net | — |

| | 8,093 |

|

| Other assets | 62,473 |

| | 84,799 |

|

| | $ | 13,440,749 |

| | $ | 13,486,379 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | | | |

| Customer accounts | | | |

| Transaction deposit accounts | $ | 2,662,188 |

| | $ | 2,554,762 |

|

| Time deposit accounts | 6,003,715 |

| | 6,297,778 |

|

| | 8,665,903 |

| | 8,852,540 |

|

| FHLB advances | 1,962,066 |

| | 1,865,548 |

|

| Other borrowings | 800,000 |

| | 800,000 |

|

| Advance payments by borrowers for taxes and insurance | 39,548 |

| | 39,504 |

|

Federal and State income taxes, including net deferred liabilities of $17,075 and $21,951 | 1,535 |

| | — |

|

| Accrued expenses and other liabilities | 65,164 |

| | 87,640 |

|

| | 11,534,216 |

| | 11,645,232 |

|

| Stockholders’ equity | | | |

Common stock, $1.00 par value, 300,000,000 shares authorized; 129,853,534 and 129,555,956 shares issued; 108,976,410 and 112,483,632 shares outstanding | 129,854 |

| | 129,556 |

|

| Paid-in capital | 1,582,843 |

| | 1,578,527 |

|

| Accumulated other comprehensive income, net of taxes | 85,789 |

| | 49,682 |

|

Treasury stock, at cost; 20,877,124 and 17,072,324 shares | (268,665 | ) | | (208,985 | ) |

| Retained earnings | 376,712 |

| | 292,367 |

|

| | 1,906,533 |

| | 1,841,147 |

|

| | $ | 13,440,749 |

| | $ | 13,486,379 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| | | | | | | | | |

| Year ended September 30, | 2011 | 2010 | 2009 |

| | (In thousands, except per share data) |

| INTEREST INCOME | | | |

| Loans | $ | 522,230 |

| $ | 561,069 |

| $ | 579,244 |

|

| Mortgage-backed securities | 108,207 |

| 91,775 |

| 109,486 |

|

| Investment securities and cash equivalents | 14,198 |

| 10,716 |

| 3,044 |

|

| | 644,635 |

| 663,560 |

| 691,774 |

|

| INTEREST EXPENSE | | | |

| Customer accounts | 115,835 |

| 146,360 |

| 191,435 |

|

| FHLB advances and other borrowings | 111,861 |

| 122,741 |

| 127,192 |

|

| | 227,696 |

| 269,101 |

| 318,627 |

|

| Net interest income | 416,939 |

| 394,459 |

| 373,147 |

|

| Provision for loan losses | 93,104 |

| 179,909 |

| 193,000 |

|

| Net interest income after provision for loan losses | 323,835 |

| 214,550 |

| 180,147 |

|

| OTHER INCOME | | | |

| Gain on FDIC-assisted transaction | — |

| 85,608 |

| — |

|

| Prepayment penalty on FHLB advance | — |

| (8,150 | ) | — |

|

| Gain on sale of investments | 8,147 |

| 22,409 |

| — |

|

| Other | 17,786 |

| 20,563 |

| 19,009 |

|

| | 25,933 |

| 120,430 |

| 19,009 |

|

| OTHER EXPENSE | | | |

| Compensation and benefits | 72,034 |

| 69,879 |

| 57,097 |

|

| Amortization of intangibles | 1,447 |

| 2,140 |

| 3,331 |

|

| Occupancy | 14,480 |

| 13,933 |

| 13,049 |

|

| FDIC insurance premiums | 20,582 |

| 18,626 |

| 10,688 |

|

| Other | 29,496 |

| 28,830 |

| 25,105 |

|

| Deferred loan origination costs | (1,980 | ) | (1,928 | ) | (2,210 | ) |

| | 136,059 |

| 131,480 |

| 107,060 |

|

| Loss on real estate acquired through foreclosure, net | (40,050 | ) | (80,475 | ) | (16,354 | ) |

| Income before income taxes | 173,659 |

| 123,025 |

| 75,742 |

|

| Income taxes | | | |

| Current | 88,373 |

| (19,890 | ) | 56,075 |

|

| Deferred | (25,855 | ) | 24,262 |

| (28,505 | ) |

| | 62,518 |

| 4,372 |

| 27,570 |

|

| NET INCOME | 111,141 |

| 118,653 |

| 48,172 |

|

| Preferred dividends accrued | — |

| — |

| 7,488 |

|

| Net income available to common shareholders | $ | 111,141 |

| $ | 118,653 |

| $ | 40,684 |

|

| | | | |

| PER SHARE DATA | | | |

| Basic earnings | $ | 1.00 |

| $ | 1.06 |

| $ | 0.46 |

|

| Diluted earnings | 1.00 |

| 1.05 |

| 0.46 |

|

| Cash dividends per share | 0.24 |

| 0.20 |

| 0.20 |

|

| Basic weighted average number of shares outstanding | 111,383,877 |

| 112,438,059 |

| 88,689,553 |

|

| Diluted weighted average number of shares outstanding, including dilutive stock options | 111,460,106 |

| 112,745,261 |

| 88,711,694 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

|

| | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | Preferred Stock | Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (loss) | Treasury Stock | Total |

| | (In thousands) |

| Balance at September 30, 2008 | $ | 105,093 |

| $ | — |

| $ | 1,261,032 |

| $ | 174,327 |

| $ | 2,472 |

| $ | (210,250 | ) | $ | 1,332,674 |

|

| Comprehensive income: | | | | | | | |

| Net income | | | | 48,172 |

| | | 48,172 |

|

| Other comprehensive income, net of tax of $28,598: | | | | | | | |

| Unrealized gains on securities | | | | | 51,273 |

| | 51,273 |

|

| Reclassification adjustment | | | | | 686 |

| | 686 |

|

| Total comprehensive income | | | | | | | 100,131 |

|

| Preferred stock issuance | | 197,873 |

| | | | | 197,873 |

|

| Preferred stock discount and accretion | | 2,127 |

| | (2,127 | ) | | | — |

|

| Dividends paid on common stock | | | | (18,847 | ) | | | (18,847 | ) |

| Dividends paid on preferred stock | | | | (5,361 | ) | | | (5,361 | ) |

| Preferred stock redemption | | (200,000 | ) | | | | | (200,000 | ) |

| Compensation expense related to common stock options | | | 1,327 |

| | | | 1,327 |

|

| Proceeds from exercise of common stock options | 13 |

| | 145 |

| | | | 158 |

|

| Proceeds from issuance of common stock | 24,150 |

| | 309,027 |

| | | | 333,177 |

|

| Tax benefit related to exercise of stock options | | | 22 |

| | | | 22 |

|

| Restricted stock | 64 |

| | 799 |

| | | | 863 |

|

| Issuance of Warrants | | | 2,127 |

| | �� | | 2,127 |

|

| Proceeds from Employee Stock Ownership Plan | | | 76 |

| | | 1,265 |

| 1,341 |

|

| Treasury stock | | | | | | | — |

|

| Balance at September 30, 2009 | $ | 129,320 |

| $ | — |

| $ | 1,574,555 |

| $ | 196,164 |

| $ | 54,431 |

| $ | (208,985 | ) | $ | 1,745,485 |

|

| Comprehensive income: | | | | | | | |

| Net income | | | | 118,653 |

| | | 118,653 |

|

| Other comprehensive income, net of tax of $2,614: | | | | | | | |

| Unrealized gains on securities | | | | | (19,203 | ) | | (19,203 | ) |

| Reclassification adjustment | | | | | 14,454 |

| | 14,454 |

|

| Total comprehensive income | | | | | | | 113,904 |

|

| Dividends paid on common stock | | | | (22,450 | ) | | | (22,450 | ) |

| Compensation expense related to common stock options | | | 1,213 |

| | | | 1,213 |

|

| Proceeds from exercise of common stock options | 145 |

| | 1,614 |

| | | | 1,759 |

|

| Tax benefit related to exercise of stock options | | | 181 |

| | | | 181 |

|

| Restricted stock | 91 |

| | 964 |

| | | | 1,055 |

|

| Treasury stock | | | | | | | — |

|

| Balance at September 30, 2010 | $ | 129,556 |

| $ | — |

| $ | 1,578,527 |

| $ | 292,367 |

| $ | 49,682 |

| $ | (208,985 | ) | $ | 1,841,147 |

|

| Comprehensive income: | | | | | | | |

| Net income | | | | 111,141 |

| | | 111,141 |

|

| Other comprehensive income,net of tax of $19,873: | | | | | | | |

| Unrealized gains on securities | | | | | 30,852 |

| | 30,852 |

|

| Reclassification adjustment | | | | | 5,255 |

| | 5,255 |

|

| Total comprehensive income | | | | | | | 147,248 |

|

| Dividends paid on common stock | | | | (26,796 | ) | | | (26,796 | ) |

| Compensation expense related to common stock options | | | 1,087 |

| | | | 1,087 |

|

| Proceeds from exercise of common stock options | 104 |

| | 1,527 |

| | | | 1,631 |

|

| Tax benefit related to exercise of stock options | | | 55 |

| | | | 55 |

|

| Restricted stock | 194 |

| | 1,647 |

| | | | 1,841 |

|

| Treasury stock | | | | | | (59,680 | ) | (59,680 | ) |

| Balance at September 30, 2011 | $ | 129,854 |

| $ | — |

| $ | 1,582,843 |

| $ | 376,712 |

| $ | 85,789 |

| $ | (268,665 | ) | $ | 1,906,533 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| | | | | | | | | | | |

| Year ended September 30, | 2011 | | 2010 | | 2009 |

| | (In thousands) |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 111,141 |

| | $ | 118,653 |

| | $ | 48,172 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Amortization (accretion) of fees, discounts, premiums and intangible assets, net | 20,663 |

| | 21,624 |

| | 4,813 |

|

| Cash received from FDIC under loss share | 32,828 |

| | 92,551 |

| | — |

|

| Depreciation | 6,667 |

| | 5,766 |

| | 5,153 |

|

| Stock option compensation expense | 1,087 |

| | 1,213 |

| | 1,327 |

|

| Provision for loan losses | 93,104 |

| | 179,909 |

| | 193,000 |

|

| Loss on investment securities and real estate held for sale, net | 23,315 |

| | 58,066 |

| | 15,101 |

|

| Gain on FDIC-assisted transaction | — |

| | (85,608 | ) | | — |

|

| Decrease (increase) in accrued interest receivable | (3,312 | ) | | 7,999 |

| | 1,077 |

|

| Increase in FDIC loss share receivable | (7,707 | ) | | — |

| | — |

|

| Decrease in income taxes payable | (11,351 | ) | | (23,408 | ) | | (45,831 | ) |