FORM 6-K

SECURITIES & EXCHANGE COMMISSION

Washington, DC 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of July 2008.

PACIFIC HARBOUR CAPITAL LTD.

(formerly Venture Pacific Development Corp.)

(Translation of registrant’s name into English)

Suite 1502, 543 Granville Street

Vancouver, B.C. V6C 1X8

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-FX Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes X No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-27608.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| PACIFIC HARBOUR CAPITAL LTD. |

| |

| |

| By:"Thomas Pressello" |

| Thomas Pressello, |

| President and CEO |

Dated: July 29, 2008

Attachments:

Notice

Information Circular

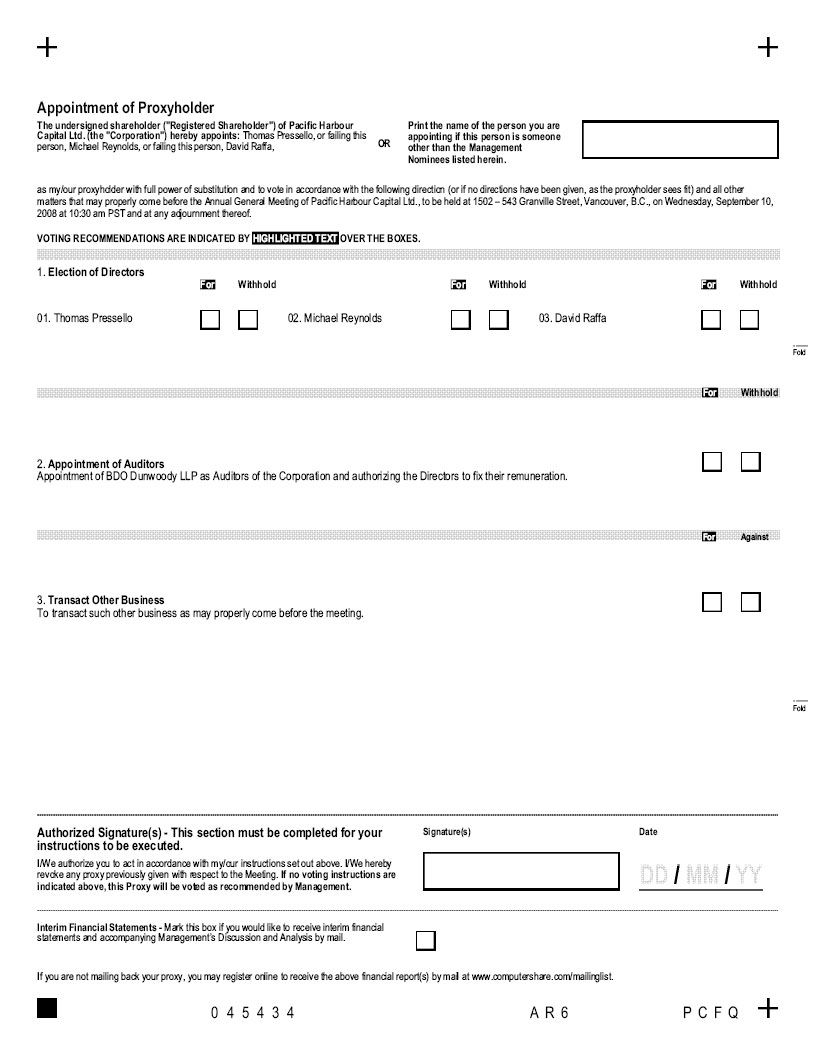

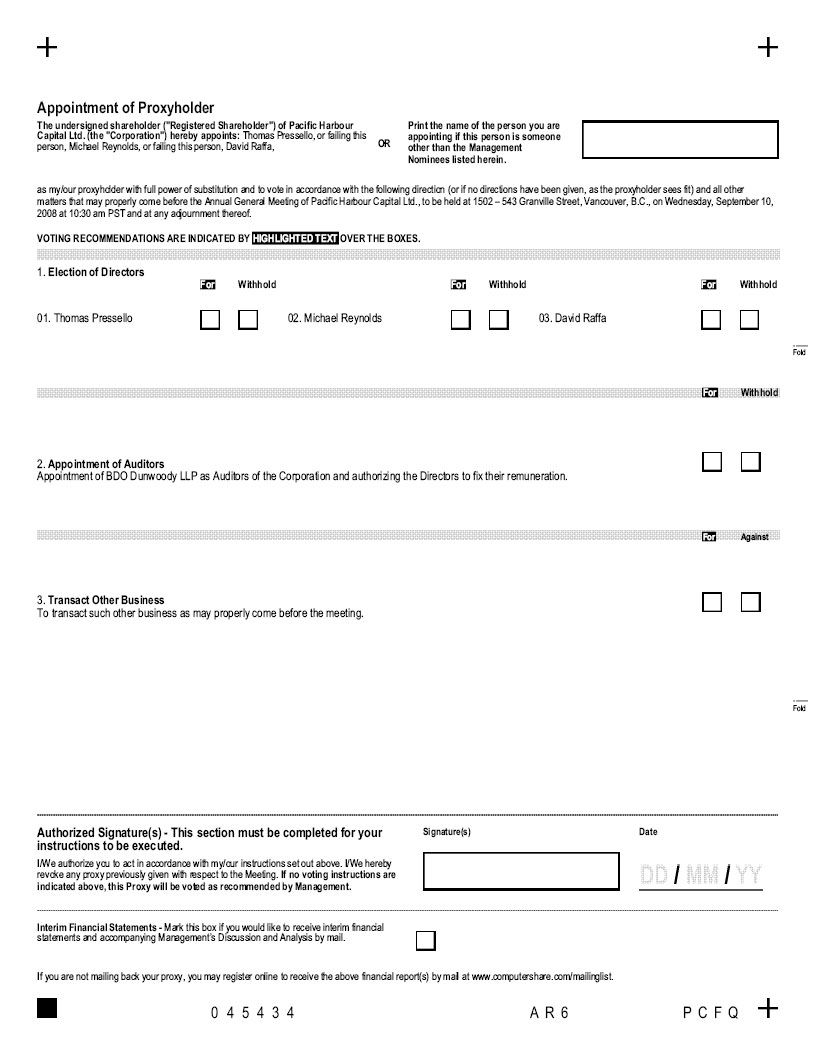

Proxy

PACIFIC HARBOUR CAPITAL LTD.

NOTICE OF ANNUAL GENERAL MEETINGOF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of Shareholders (the “Meeting”) ofPacific Harbour Capital Ltd.,(the “Company”) will be held in the boardroom of the Company's offices located at Suite 1502, 543 Granville Street, Vancouver, British Columbia, Canada, onWednesday, September 10th, 2008,at the hour of 10:30 o’clock in the forenoon (Vancouver time) for the following purposes:

| | 1. | To receive the comparative financial statements of the Company and the auditors’ report thereon for the fiscal year ended March 31, 2008. |

| |

| 2. | To elect directors for the ensuing year. |

| |

| 3. | To appoint auditors and to authorize the directors to fix the remuneration of such auditors. |

| |

| 4. | To transact such other business as may properly come before the Meeting and any adjournment or adjournments thereof. |

| |

An Information Circular and a form of Proxy accompany this Notice. The Information Circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this Notice.

The board of directors have fixed the close of business on July 14th, 2008 as the record date for determination of shareholders entitled to receive notice of the Meeting, or any adjournment or adjournments thereof, and the right to vote thereat.

Registered shareholders are entitled to vote at the Meeting in person or by proxy. Registered shareholders who are unable to attend the Meeting, or any adjournment thereof, in person, are requested to read, complete, sign and date the form of Proxy accompanying this Notice in accordance with the instructions set out in the form of Proxy and in the Information Circular accompanying this Notice. Unregistered shareholders who receive the form of Proxy accompanying this Notice through an intermediary must deliver the Proxy in accordance with the instructions given by such intermediary.

DATED at Vancouver, British Columbia, this 24thday of July, 2008.

BY ORDER OF THE BOARD OF DIRECTORS

“Thomas Pressello”

Thomas Pressello, President & CEO

PACIFIC HARBOUR CAPITAL LTD.

INFORMATION CIRCULAR

(All information as at July 24th, 2008 unless otherwise indicated)

SOLICITATION OF PROXIES

This information circular is furnished in connection with the solicitation of proxies by the management of Pacific Harbour Capital Ltd., (the "Company") for use at the annual general meeting of the shareholders of the Company (the "Meeting") to be heldWednesday, September 10, 2008,for the purposes set forth in the accompanying notice of Meeting and at any adjournment thereof. The solicitation will be by mail and possibly supplemented by telephone or other personal contact to be made without special compensation by regular officers and employees of the Company. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company. The Company does not reimburse shareholders, nominees or agents for the costs incurred in obtaining from their principal's authorization to execute forms of proxy.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed proxy form are directors and/or senior officers of the Company, and are proxyholders nominated by management.A shareholder has the right to appoint some other person (who need not be a shareholder) to represent him at the meeting and may do so by striking out the names of the nominees of management named in the proxy and inserting their nominee's name in the blank space provided in the proxy form. To be valid, the completed proxy form must be deposited with the Company's registrar and transfer agent, Computershare Investor Services, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1; fax number within North America: 1-866-249-7775; fax number outside North America: (416) 263-9524, not less than forty-eight (48) hours (excluding Saturdays, Sundays and holidays), prior to the commencement of the Meeting or any adjournment thereof.

NON-REGISTERED HOLDERS

Most shareholders of the Company are non-registered shareholders (referred to herein as "Beneficial Shareholders") because the shares they own are not registered in their names but are held on their behalf:

| | (a) | in the name of an Intermediary (an "Intermediary") that the Beneficial Shareholder deals with in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSP's, RRIF's, RESP's and similar plans, or |

| |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited ("CDS"), of which the Intermediary is a participant. |

| |

Shares held by brokers (or their agents or nominees) on behalf of a broker's client can only be voted at the Meeting at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker's clients.Therefore, each Beneficial Shareholder should ensure that their voting instructions are communicated to the appropriate party well in advance of the Meeting.

- 2 -

Regulatory policies require Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings. Beneficial Shareholders have the option of not objecting to their Intermediary disclosing certain ownership information to the Company (such Beneficial Shareholders are designated as non-objecting beneficial owners, or "NOBO's) or objecting to their Intermediary disclosing ownership information to the Company (such Beneficial Shareholders are designated as objecting beneficial owners, or "OBO's").

In accordance with the requirements of National Instrument 54-101 (Communication with Beneficial Owners of Securities of Reporting Companies) published by the Canadian Securities Administrators, the Company has distributed copies of the Notice of Meeting, this Information Circular and the Proxy (collectively, the “Meeting Materials”) directly to the NOBO's and indirectly through Intermediaries and clearing agencies for onward distribution to the OBO's.

Meeting Materials sent to Beneficial Shareholders are accompanied by a request for voting instructions (a "VIF") instead of a proxy. By returning the VIF in accordance with the instructions noted on it, a Beneficial Shareholder is able to instruct the Intermediary (or other registered shareholder) how to vote the Beneficial Shareholder's shares on the their behalf. For this to occur, it is important that the VIF is completed and returned in accordance with the specific instructions noted on the VIF.

The majority of Intermediaries now delegate responsibility for obtaining instructions from Beneficial Shareholders to Broadridge Investor Communication Solutions ("Broadridge") in Canada. Broadridge typically prepares a machine-readable VIF, mails these VIF's to Beneficial Shareholders and asks them to return the completed VIF's to Broadridge, usually by way of mail, the Internet or telephone. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting by proxies for which Broadridge has solicited voting instructions. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote shares directly at the Meeting. The VIF must be returned to Broadridge (or instructions respecting the voting of shares must otherwise by communicated to Broadridge) well in advance of the Meeting in order to have the shares voted. If you have any questions respecting the voting of share s held through an Intermediary, please contact the Intermediary for assistance.

In either case, the purpose of this procedure is to permit Beneficial Shareholders to direct the voting of the shares which they beneficially own.A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote shares directly at the Meeting. Beneficial Shareholders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.Should a Beneficial Shareholder who receives a VIF wish to attend the Meeting or have someone else attend on their behalf, the Beneficial Shareholder may request a legal proxy as set forth in the VIF, which will grant the Beneficial Shareholder or their nominee the right to attend and vote at the Meeting.

All references to shareholders in this information circular and the accompanying instrument of proxy and notice of Meeting are to registered shareholders unless specifically stated otherwise.

The Meeting Materials are being sent to both registered and non-registered owners of shares. If you are a Beneficial Shareholder and the Company or its agent has sent the Meeting Materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding shares on your behalf. By choosing to send the Meeting Materials to you directly, the Company (and not the

- 3 -

Intermediary holding shares on your behalf) has assumed responsibility for (i) delivering the Meeting Materials to you, and (ii) executing your proper voting instructions.

REVOCATION OF PROXIES

A proxy may be revoked by:

(a) signing a proxy bearing a later date and depositing it at the place and within the time specified;

(b) signing and dating a written notice of revocation (in the same manner as the proxy is required to be executed, as set out in the notes to the proxy) and either delivering the revocation to the Company's registered office at #1502 – 543 Granville Street, Vancouver, B.C., V6C 1X8, at any time up to and including the last business day preceding the day of the meeting, or any adjournment thereof at which the proxy is to be used, or to the chairman of the meeting on the day of the meeting or any adjournment thereof;

(c) attending the Meeting or any adjournment thereof and registered with the scrutineer as a shareholder present in person, whereupon such proxy shall be deemed to have been revoked. Or

(d) in any other manner permitted by law.

Only registered shareholders have the right to revoke a proxy. A non-registered shareholder who wishes to change their vote must, at least seven days before the Meeting, arrange for the Intermediary to revoke the proxy on their behalf.

VOTING OF SHARES AND EXERCISE OF DISCRETION OF PROXIES

A shareholder’s instructions on his Proxy Form as to the exercise of voting rights will be followed in casting such shareholder’s votes on any ballot that may be called for.IN THE ABSENCE OF ANY INSTRUCTIONS, THE SHARES WILL BE VOTED BY THE PROXYHOLDER, IF A NOMINEE OF MANAGEMENT, AS IF THE SHAREHOLDER HAD SPECIFIED AN AFFIRMATIVE VOTE. If any amendments or variations to such matters, or any other matters, are properly brought before the meeting, the proxyholder, if a nominee of management, will exercise its discretion and vote on such matters in accordance with its best judgment.

The enclosed form of proxy, in the absence of any instructions in the proxy, confers discretionary authority on any proxyholder, other than the nominees of management named in the form of proxy with respect to (a) amendments or variations to matters identified in the Notice of Meeting and (b) other matters which may properly come before the Meeting or any adjournment thereof. To enable a proxyholder to exercise its discretionary authority, a shareholder must strike out the names of the nominees of management in the enclosed form of proxy and insert the name of its nominee in the space provided, and not specify a choice with respect to the matters to be acted upon. This will enable the proxyholder to exercise its discretion and vote on such matters in accordance with its best judgment.

At the time of printing of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the meeting other than the matters referred to in the Notice of Meeting.

- 4 -

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As at the date hereof, the Company has issued and outstanding:

| Authorized Share Capital: | 100,000,000 | | Common Shares without par value |

| | 100,000,000 | | Preferred Shares without par value |

| |

| Issued & Outstanding: | 7,247,703 | | Fully paid and non-assessable Common |

| | | | Shares without par value, each share carrying |

| | | | the right to one vote |

| |

| | Nil | | Preferred Shares without par value |

On a poll, every shareholder will have one vote for each share of which he is the registered holder, and may exercise such vote at the meeting in person or by proxy holder.

Any shareholder of record at the close of business on July 14, 2008 who either personally attends the Meeting or who has completed and delivered a proxy, subject to the provisions described above, shall be entitled to vote or to have such shareholder’s shares voted at the Meeting.

To the best of the knowledge of the directors and senior officers of the Company, the only persons or corporations, which beneficially own, directly or indirectly, or exercises control or direction over shares carrying more than 10% of the voting rights attached to all outstanding shares of the Company are:

| SHAREHOLDER NAME & | NUMBER OF SHARES | PERCENTAGE OF ISSUED |

| ADDRESS | | SHARES |

| | | |

| Michael Reynolds | 1,249,060 | 17.23% |

| 1502 – 543 Granville Street | | |

| Vancouver, B.C. | | |

| V6C 1XB | | |

| | | |

| Thomas Pressello | 741,310 * | 10.23% |

| 1502 – 543 Granville Street | | |

| Vancouver, B.C. | * of this figure, 370,655 shares | |

| V6C 1Xb | are held by the Pressello Trust | |

| | of which Thomas Pressello is a | |

| | beneficiary and trustee | |

- 5 -

ELECTION OF DIRECTORS

The Board of Directors (the "Board") presently consists of three directors and it is anticipated that three directors will be elected for the coming year. The term of office for persons elected at the Meeting will expire at the next annual general meeting of shareholders of the Company, unless a director resigns or is otherwise removed in accordance with the by-laws of the Company or theBritish Columbia Business Corporations Act.

The persons named below will be presented at the Meeting for election as directors as nominees of management, and the persons named in the enclosed instrument of proxy intend to vote for the election of these nominees.

The following table sets out the following information with respect to each of management’s nominees for election as directors: the person’s name and country of residence; all positions and offices in the Company presently held by him; his present principal occupation or employment, the period during which he has served as a director; and the number of Common Shares that he has advised are beneficially owned by him, directly or indirectly, or over which control or direction is exercised, as of the record date for the Meeting.

| Name, Municipality of | | Date of | Common |

| Residence and Position | Present and | Appointment | Shares Owned |

| with Company | Principal Occupation | as Director | or Controlled |

| THOMAS PRESSELLO(1) | Businessman; Chief Executive Officer, | December 14, | 741,310 | (2) |

| Vancouver, BC, Canada | President and Director of the | 2001 | | |

| Chief Executive Officer, | Company; | | | |

| President and Director | | | | |

| MICHAEL REYNOLDS(1) | Businessman; Investment Advisor | July 26, 2005 | 1,249,060 | |

| Vancouver, BC, Canada | with Canaccord Capital from 1986 to | | | |

| Director | January 2005 | | | |

| DAVID RAFFA(1) | COO of Lions Liquidity Investment | December 7, | Nil | |

| Vancouver, BC, Canada | Fund I Limited Partnership, (formerly | 2005 | | |

| Director | partner in Catalyst Corporate Finance | | | |

| | Lawyers) | | | |

| (1) | Current members of the Company’s Audit Committee. |

| |

| (2) | Of this figure, 370,655 shares are owned by the Pressello Trust, of which Thomas Pressello is a beneficiary and trustee. |

| |

The Company does not presently have an executive committee.

No proposed director

| | (a) | is, as at the date of this Information Circular, or has been, within the preceding 10 years, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity: |

| |

- 6 -

| | | (i) | was subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, while the proposed director was acting in the capacity as director and/or executive officer, or; |

| | |

| | (ii) | was subject cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, after the proposed director ceased to be a director and/or executive officer and which resulted from an event that occurred while that person was acting in the capacity as director and/or executive officer; |

| | |

| | (b) | is, at the date of this information circular, or has been within 10 years before the date of this information circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

| |

| (c) | has, within the 10 years before the date of the Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or |

| |

| (d) | been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with securities regulator authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable investor making an investment decision. |

| |

EXECUTIVE COMPENSATION

The following table sets forth all annual and long term compensation for services in all capacities to the Company for the three most recently completed financial years in respect of the Chief Executive Officer as at March 31, 2008, and the other three most highly compensated executive offices of the Company as at March 31, 2008, whose individual total compensation for the most recently completed financial year exceeded $150,000 (of which there were none) and any individual who would have satisfied these criteria but for the fact that individual was not serving as such officer at the end of the most recently completed financial year (collectively the "Named Executive Officers").

As of March 31, 2008, the end of the most recently completed financial year, the Company had one Named Executive Officer, Thomas Pressello, President, Chief Executive Officer and director of the Company.

- 7 -

Named Executive Officers

| | | Annual Compensation | Long-Term Compensation | | |

| | | | | | Awards | Payouts | | |

| | | | | | Securities | Restricted | | | |

| | | | | | Under | Shares | | | |

| | | | | Other | Options | or | | All | |

| | | | | Annual | Granted/ | Restricted | | Other | |

| Name and | Financial | | | Compensa | SARs | Share | LTIP | Compen- | |

| Principal | Year | Salary | Bonus | -tion | Granted | Units | Payout | sation | |

| Position | Ending | ($) | ($) | ($) | (#) | ($) | ($) | ($) | |

| | | | | | | | | | |

| THOMAS | 2008 | Nil | Nil | Nil | Nil | Nil | Nil | $ 24,000 | (1) |

| PRESSELLO | 2007 | Nil | Nil | Nil | Nil | Nil | Nil | $ 24,000 | (1) |

| C.E.O & | 2006 | Nil | Nil | Nil | Nil | Nil | Nil | $ 44,240 | (1) |

| PRESIDENT | | | | | | | | | |

(1)These consulting fees were paid to Equation Capital Consulting Ltd, a private B.C. company whose shares are held by the Pressello Trust and as previously disclosed of which Thomas Pressello is a beneficiary and trustee.

LONG-TERM INCENTIVE PLAN (“LTIP”) AWARDS

The Company does not have a LTIP, pursuant to which cash or non-cash compensation intended to serve as an incentive for performance (whereby performance is measured by reference to financial performance or the price of the Company’s securities), was paid or distributed to the Named Executive Officer during the most recently completed financial year.

STOCK APPRECIATION RIGHTS (“SAR’S”) GRANTED

DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR

Stock Appreciation Rights ("SAR's") means a right, granted by an issuer or any of its subsidiaries as compensation for services rendered or in connection with office or employment, to receive a payment of cash or an issue or transfer of securities based wholly on or in part on changes in the trading price of the Company's shares. No SAR's were granted or exercised during the most recently completed financial year.

OPTIONS AND SAR'S GRANTED DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR

The Company has a 2002 Fixed Stock Option Plan (the “Plan”) in place which received shareholder approval on September 19, 2002. During the most recently completed financial year of the Company, no incentive stock options were granted under the Plan to the Named Executive Officer. Subsequent to the year end, the expiry date of the option previously granted to the Named Executive Officer was extended to June 25, 2012; all other terms remained the same.

AGGREGATED OPTIONS/SARS EXERCISED DURING THE MOST RECENTLY COMPLETED FISCAL YEAR AND FISCAL YEAR END OPTIONS/SAR VALUES

The following table sets out forth details of all exercises of stock options during the most recently completed fiscal year be the Named Executive Officer and the number of unexercised options held by

- 8 -

the Named Executive Officer. During this period, no outstanding SAR's were held by the Named Executive Officer.

| | | | Unexercised | |

| | | | Options at | |

| | Securities | Aggregate | Fiscal Year-End | Value of Unexercised |

| | Acquired | Value | Exercisable/ | In -The-Money Options |

| | on | Realized | Unexercisable | At Fiscal Year-End ($) |

| Name | Exercise | ($)(1) | (#) | Exercisable/Unexercisable(2) |

| THOMAS PRESSELLO | | | | |

| CEO & PRESIDENT | Nil | Nil | 352,014 | $33,441.33 |

| | | | Unexercised | |

| 1) | Based on the difference between the option exercise price and the closing market price of the Company’s shares on the date of exercise. |

| |

| 2) | Value of unexercised in-the-money options calculated using the closing price of $0.335 for the common shares of the Company on the TSX-VE on March 6, 2008 (the last day traded prior to fiscal year end); less the exercise price of in-the- money options. |

| |

PENSION PLAN

The Company has no pension plan or other arrangement for non-cash compensation, except the grant of incentive stock options.

TERMINATION OF EMPLOYMENT, CHANGE IN RESPONSIBILITIES AND EMPLOYMENT CONTRACTS

The Company has no employment contract with the Named Executive Officers nor any compensatory plan, contract or arrangement where the Named Executive Officers are entitled to receive any money from the Company or its subsidiaries in the event of the resignation, retirement or any other termination of the Named Executive Officers’ employment with the Company and its subsidiaries, a change in control of the Company or any its subsidiaries or a change in the Named Executive Officers’ responsibilities following a change in control.

COMPENSATION OF DIRECTORS

The directors of the Company have not been paid fees or other cash compensation in their capacity as directors during the most recently completed financial year. The Company has no standard arrangement pursuant to which directors are compensated by the Company or its subsidiaries for their services in their capacity as directors or for committee participation, except for the granting from time to time of incentive stock options in accordance with the policies of the TSX Venture Exchange.

During the most recently completed financial year, a stock option was granted to a director of the Company for 175,000 shares exercisable at $0.27 per share up to and including March 13, 2013. As of the most recently completed financial year, a stock option previously granted to a director of the Company in the amount of 25,000 shares exercisable at $0.24 per share expired unexercised on December 13, 2007. As of the most recently completed financial year no options have been exercised by directors or officers of the Company.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out the number of the Company’s shares to be issued and remaining available for future issuance under the Company’s Incentive Stock Option Plan as the end of the Company’s most recently completed financial year.

- 9 -

| | Number of securities | Weighted average | Number of securities remaining |

| | to be issued upon | exercise price of | available for future issuance |

| | exercise of | outstanding | under equity compensation |

| | outstanding options, | options, warrants | plans (excluding securities |

| | warrants and rights | and rights | reflected in column (a)) |

| | | | |

| Plan Category | (a) | (b) | (c) |

| | | | |

| Equity compensation | 1,159,028 | $0.24 | 249,027 |

| plans approved by | | | |

| securityholders | | | |

| | | | |

| Equity compensation | N/A | N/A | N/A |

| plans not approved by | | | |

| shareholders | | | |

| | | | |

| Total | 1,159,028 | $0.24 | 249,027 |

CORPORATE GOVERNANCE DISCLOSURE

Effective June 30, 2005, National Instrument 58-101 (“NI 58-101”) Disclosure of Corporate Governance Practices and National Policy 58-201 (“NP 58-201”) Corporate Governance Guidelines were adopted in each of the provinces and territories of Canada. NI 58-101 requires issuers to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on corporate governance practices.

This section sets out the Company’s approach to corporate governance and addresses the Company’s compliance with NI 58-101.

1. Board of Directors

Directors are considered to be independent if they have no direct or indirect material relationship with the Company. A “material relationship” is a relationship which could, in the view of the Company’s board of directors, reasonably interfere with the exercise of a director’s independent judgment.

The Company’s Board of Directors currently has three members and the Board facilitates its independent supervision over management by reviewing all significant transactions of the Company.

The independent members of the Board of Directors are Michael Reynolds and David Raffa.

Thomas Pressello is not an independent member of the Board of Directors as he serves as Chief Executive Officer and President of the Company.

2. Directorships

Mr. Raffa is a director of the following reporting issuers: Voice Mobility International, Inc.

- 10 -

3. Orientation and Continuing Education

The Company does not have formal orientation and training programs, however new directors are provided with access to all company documents at their request.

4. Ethical Business Conduct

The Company has adopted a written Code of Ethical Business Conduct (the "Code") for its directors, officers and employees. Each director, officer and employee is expected to comply with relevant corporate and securities laws and be committed to act honestly and in good faith with a view to the best interests of the Company and its shareholders. Any interested party may obtain a copy of the Code by contacting the corporate office of the Company either by telephone at (604) 697-0687 Ext. 4 or by e-mail to the Corporate Secretary, Deborah McDonald, atdmcdonald@pacificharbour.ca.

5.Nomination of Directors

Any director may make recommendations to the board as to prospective nominees for the Board of Directors. The Board would take into account the nominees previous experience and skills appropriate for the Company.

6. Compensation

The Company has no standard arrangement pursuant to which the CEO and directors are compensated by the Company for services in their capacities as CEO and directors.

7. Other Board Committees

The Board has no committees other than the Audit Committee.

8. Assessments

The Board of Directors monitors but does not formally assess the performance of individual directors.

AUDIT COMMITTEE

Multilateral Instrument 52-110 of the Canadian Securities Administrators (“MI-52-110”) requires reporting issuers in those jurisdictions which have adopted MI-52-110 to disclose annually in its Information Circular certain information concerning the constitution of its audit committee and its relationship with its independent auditor. The Company is a reporting issuer in B.C. and Alberta. MI 52-110 has not been adopted in B.C., but it has been adopted in Alberta. Accordingly, the Company provides the following disclosure with respect to its Audit Committee:

Audit Committee Charter

The Board has adopted a charter for the Audit Committee, which sets out the Audit Committee's mandate, organization, powers and responsibilities. The Audit Committee's charter is attached as Schedule A to this information circular.

Composition

The Company’s audit committee is comprised of three directors, namely Thomas Pressello, Michael Reynolds and David Raffa. Michael Reynolds and David Raffa are both "independent directors". All audit committee members are “financially literate” as defined in MI 52-110.

All members of the Audit Committee have been involved for a number of years in the review and compilation of financial statements for junior public companies.

- 11 -

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, the Company’s Board of Directors has not failed to adopt a recommendation of the audit committee to nominate or compensate an external auditor.

Reliance on Certain Exemptions

Since the commencement of the Company's most recently completed financial year, the Company has not relied on the exemption in section 2.4(De Minimus Non-audit Services)of NI 52-110 or an exemption from NI 52-110, in whole or in part, granted under Part 8(Exemptions)of NI 52-110.

Pre-Approval Policies and Procedures

The Audit Committee has not adopted specific policies and procedures for the engagement of non-audit services; however, as provided for in NI 52-110, the Audit Committee must pre-approve all non-audit services to be provided to the Company.

External Auditor Service Fees

| Type of Fees | | March 31, 2008 | | March 31, 2007 |

| Audit fee | $ | 12,800.00 | $ | 12,800.00 |

| Audited Related Fees | | 0 | | 0 |

| Tax Fees | | 0 | | 0 |

| All Other Fees | | 204.80 | | 204.80 |

| Total Fees | $ | 13,004.80 | $ | 13,004.80 |

Audit Related Fees

No additional fees were paid during either of the fiscal years ended March 31, 2008 or March 31, 2007.

Tax Fees

No additional fees were paid during either of the fiscal years ended March 31, 2008 or March 31, 2007.

All Other Fees

This fee is paid to the Canadian Public Accountability Board (CPAB) a not-for-profit corporation incorporated under theCanada Business Corporations Actwith the mandate to promote high-quality external audits of reporting issuers. It was created by the CICA, the Canadian Securities Administrators, and the Office of the Superintendent of Financial Institutions, and is one of several Canadian initiatives designed to improve corporate governance, accounting, and auditing. The application process for the CPAB was activated on November 21, 2003. With the implementation of "National Instrument 52-108" by the various securities commissions across Canada, all "reporting issuers" in Canada are required to have an audit completed by a CPAB participant firm.

Exemption

The Company is relying upon the exemption in Section 6.1 of NI 52-110 which exempts "venture issuers" from the requirement of Part 3Composition of the Audit Committeeand Part 5Reporting Obligationsof NI 52-110.

INDEBTEDNESS OF DIRECTORS, EXECUTIVE AND SENIOR OFFICERS

None of the directors or executive officers of the Company, no proposed nominee for election as a director of the Company, and no associates or affiliates of any of the foregoing persons, is or has been

- 12 -

indebted to the Company or its subsidiaries at any time since the beginning of the Company’s last completed financial year.

MANAGEMENT CONTRACTS

Management functions of the Company are substantially performed by directors or executive officers of the Company and not, to any substantial degree, by any other person with whom the Company has contracted.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, no person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last completed financial year, no proposed nominee of management of the Company for election as a director of the Company and no associate or affiliate of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors or the appointment of auditors.

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

Except as disclosed herein, since the commencement of the last completed financial year, no insider of the Company, nominee for director, or any associate or affiliate of an insider or nominee, has any material interest, direct or indirect, in any transaction or any proposed transaction which has materially affected or would materially affect the Company.

APPOINTMENT AND REMUNERATION OF AUDITOR

Shareholders will be asked to approve the appointment of BDO Dunwoody LLP, Chartered Accountants, (formerly Amisano Hanson) #604 -750 West Pender Street, Vancouver, B.C., V6C 2T7as auditors of the Company to hold office until the next Annual General Meeting of shareholders at remuneration to be fixed by the directors. BDO Dunwoody (as Amisano Hanson) Chartered Accountants have been the Company’s auditors since March 16, 2000.

PARTICULARS OF MATTERS TO BE ACTED UPON

Management of the Company is not aware of any matters to come before the Meeting other than those set forth in the Notice of Annual General Meeting. If other matters properly come before the Meeting, it is the intention of the person named in the accompanying form of proxy to vote the shares represented thereby in accordance with his best judgment on such matters.

ADDITIONAL INFORMATION

Additional information relating to the Company can be viewed on SEDAR at www.sedar.com. Shareholders may contact the Company at 1502 – 543 Granville Street, Vancouver, B.C., V6C 1X8 to request copies of the Company’s financial statements and MD&A.

Financial information is provided in the Company’s comparative financial statements and MD&A for its most recently completed financial year which can be accessed under the Company’s profile on SEDAR.

Dated at Vancouver, British Columbia this 24thday of July, 2008.

APPROVED BY THE BOARD OF DIRECTORS

"Thomas Pressello"

Thomas Pressello, President & CEO

- 13 -

Schedule "A" to the Information Circular of

Pacific Harbour Capital Ltd. (the "Company")

CHARTER OF THE AUDIT COMMITTEE

Mandate

The Audit Committee appointed by the Board of Directors has the primary responsibility of assisting the Board in fulfilling its financial reporting obligations. Primary duties and responsibilities are:

| | a) | overseeing the process of selecting and appointing the Company’s external auditor; |

| |

| b) | overseeing the conduct of the audit; |

| |

| c) | ensure the independence of the Company's auditor in accordance with applicable standards and monitor the performance; |

| |

| d) | determine whether the audit fees by the auditor appear adequate in relation to the work required to support an audit opinion; |

| |

| e) | assessing management's overall process to identify principal risks that could affect financial reporting and the achievement of the Company's business plans, and to monitor the process to manage such risks; |

| |

| d) | monitor the effectiveness of the Company's financial reporting process and system of internal controls with respect to financial reporting and accounting compliance; |

| |

| f) | establish effective communication between the Committee, directors and external auditors. |

| |

Authority of the Audit Committee

The Audit Committee has the authority to conduct any review or investigation appropriate to fulfilling its responsibilities. The Committee shall have the authority to engage independent outside counsel, advisors or consultants it determines necessary to assist it in discharging its functions and will be provided with the necessary funding to compensate any counsel, advisors or consultants it engages.

The Audit Committee will have direct communication access to both internal and external auditors and anyone in the Company that it deems necessary.

Composition and Quorum

| | a) | The Audit Committee shall consist of a minimum of three directors, a majority of whom shall qualify as independent Directors as that term is defined in National Instrument 52-110. |

| |

| b) | All members of the Audit Committee shall be financially literate, with financial literacy being the ability to read and understand a set of financial statements that present the level of complexity of accounting issues that are generally comparable to the complexity of the issues that can reasonably be expected to be raised by the Company's financial statements. |

| |

| c) | The Chair of the Audit Committee shall be appointed by the Audit Committee from among their number and shall be financially literate. |

| |

| d) | A quorum for the transaction of business at all meetings of the Audit Committee shall be a majority of members. |

| |

| e) | A resolution in writing signed by all members of the Audit Committee entitled to vote on that resolution shall be as valid as if it has been passed at a duly called and constituted meeting. |

| |

| | Such resolutions in writing may be in one or more counterparts, all of which when taken together, shall be deemed to constitute one resolution. Any minutes of the proceedings of the |

| |

- 14 -

Audit Committee and any resolutions in writing shall be kept in the Company Minute Book and be available for inspection by any director of the Company.

Principal Responsibilities and Functions

The overall duties and responsibilities of the Committee shall be as follows:

| | a) | assist the Board in the discharge of its responsibilities relating to the Company's accounting principles and reporting practices, including its approval of the Company's annual and quarterly consolidated financial statements and corresponding Management Discussion & Analysis ("MD&A"), |

| |

| b) | to establish and maintain a direct line of communication with the Company's internal and external auditors and assess their performance. |

| |

| c) | to ensure that the management of the Company has designed, implemented and is maintaining an effective system of internal financial controls; and |

| |

| d) | to report regularly to the Board on the fulfilment of its duties and responsibilities. |

| |

Annual Financial Statements

| | a) | discuss and review with the external auditors the Company's annual audited financial statements and related documents prior to their filing or distribution; |

| |

| b) | review and formally recommend approval to the Board, the Company's |

| |

| | 1. | year-end audited financial statements; |

| |

| | 2. | Management Discussion & Analysis |

| |

| | 3. | Annual Information Form |

| |

| c) | all press releases containing financial information extracted or derived from the Company's financial statements or MD&A. |

| |

The review shall include a report prepared by the external auditors about the quality of the most significant accounting principles and practices governing the Company's financial statements and which involve the most complex, subjective or significant judgemental decisions or assessments.

Quarterly Financial Statements

Review with management and, where applicable the external auditors; and either approve, including authorization for public release, or formally recommend for approval to the Board the Company's

| | a) | quarterly unaudited financial statements |

| |

| b) | Management Discussion & Analysis |

| |

| c) | any significant changes to the Company's accounting principles |

| |

Where applicable, review and discuss quarterly reports from the external auditors with regard to:

| | a) | all critical accounting policies and practices to be used |

| |

| b) | all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, the ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the external auditors; and |

| |

- 15 -

| | c) | Other material written communications between the external auditors and management, such as any management letter or schedule of unadjusted differences. |

| |

Internal Control

| A. | review and discuss significant financial risks or exposures and assess the steps management has taken to monitor, control, report and mitigate such risk to the Company; |

| |

| B. | review the effectiveness of the overall process for identifying the principal risks affecting the achievement of business plans and prove the Committee's view to the Board of Directors; |

| |

| C. | review significant findings prepared by the external auditors, together with management's responses. |

| |