UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01519

STATE FARM ASSOCIATES’ FUNDS TRUST

(Exact name of registrant as specified in charter)

One State Farm Plaza

Bloomington, IL 61710-0001

(Address of principal executive offices) (Zip code)

| | |

| | Alan Goldberg |

| | K&L Gates LLP |

| Paul J. Smith | | Three First National Plaza |

| One State Farm Plaza | | 70 West Madison St., Suite 3100 |

| Bloomington, Illinois 61710-0001 | | Chicago, Illinois 60602 |

(Names and addresses of agents for service)

Registrant’s telephone number, including area code: 1-800-447-0740

Date of fiscal year end: 11/30/2013

Date of reporting period: 11/30/2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

November 30, 2013

Before investing, consider the Funds’ investment objectives, risks, charges and expenses. Contact State Farm VP Management Corp. (1-800-447-0740) for a prospectus or summary prospectus containing this and other information. Read it carefully.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, and information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, are available without charge upon request at 1-800-447-0740 and at “http://www.sec.gov.”

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at “http://www.sec.gov.” The Funds’ Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Funds make the information on Form N-Q available to shareholders upon request without charge at 1-800-447-0740.

Any website referenced in this report is an inactive textual reference only, and information contained in or otherwise accessible through that website does not form a part of, and is not incorporated by reference into, this report.

ANNUAL REPORT

Electronic Delivery

As a State Farm Mutual Funds shareholder, we wish to remind you that you can elect to have future Annual Reports, Semi-Annual Reports, Prospectuses, statements, and tax forms delivered electronically rather than receiving large, bulky paper reports through the mail. This is a great way to help reduce internal fund costs related to printing and mailing these materials as well as a way to be environmentally friendly. Please consider signing up for electronic delivery today by going on statefarm.com or contacting the State Farm Mutual Funds Response Center at 1-800-447-0740 for assistance.

Compensation Deduction or Automatic Investment Plan (AIP)1

State Farm Mutual Funds allow you to make regular investments in a Fund with compensation deduction (agent/employee only) or an Automatic Investment Plan through an electronic transfer of funds from your bank/credit union account. If you wish to begin compensation deduction or an Automatic Investment Plan, the minimum amount required for both initial and subsequent investments is $50. Please consider signing up today for compensation deduction by going on the State Farm intranet or signing up for AIP by contacting the State Farm Mutual Funds Response Center at 1-800-447-0740 for assistance.

| 1 | Automatic investment plans do not assure a profit or protect against loss. |

Message to Shareholders of State Farm Associates’ Funds Trust

Dear Fellow Shareholders,

Thank you for investing with State Farm Mutual Funds. Enclosed is the Annual Report for the 12-month period ended November 30, 2013. In this report you will find management’s discussion of investment philosophy and process for each of the Funds offered by the Trust, factors that affected each Fund’s performance over the 12-month period, and benchmark index comparisons that are designed to put that performance into context.

During the 2013 fiscal year, the U.S. and international equity markets experienced positive returns while fixed income markets were mixed, with some fixed income indices achieving negative single-digit total returns, due primarily to higher interest rates.

The table below shows annual total returns for each of the four Funds compared to their respective benchmarks for the 12-month period ended November 30, 2013.

| | |

Average Annual Total Returns (as of November 30, 2013)1 | | |

| Fund | | Annual Total Returns

1-year |

State Farm Growth Fund | | 24.06% |

Benchmark: S&P 500® Index | | 30.30% |

| | |

State Farm Balanced Fund | | 12.59% |

Benchmark: Blended benchmark* | | 17.21% |

| | |

State Farm Interim Fund | | -0.51% |

Benchmark: Barclays 1-5 Year U.S. Treasury Index | | 0.25% |

| | |

State Farm Municipal Bond Fund | | -2.05% |

Benchmark: Barclays 7-Year Municipal Bond Index | | -1.77% |

| | | |

* 60% S&P 500 Index / 40% Barclays Intermediate Gov/Credit Index (rebalanced on a monthly basis) |

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate and Fund shares, when redeemed, may be worth more or less than their original cost. Recent performance may be less than the figures shown. Obtain total returns current to the most recent month-end by calling our Mutual Funds Response Center at 1-800-447-0740. It is not possible to invest directly in an index.

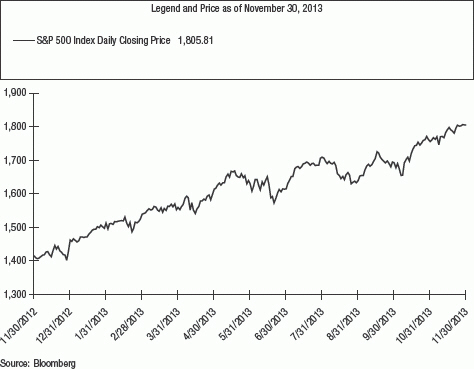

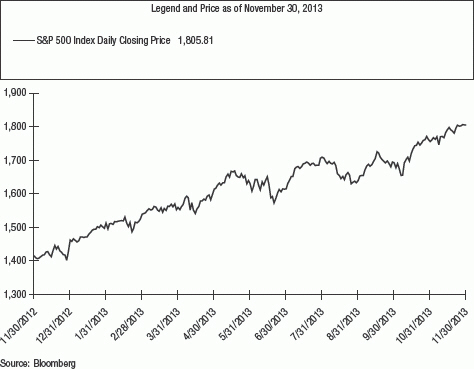

In the U.S., equity markets (as represented by the S&P 500® Index) achieved positive total returns in ten of the past twelve months ended November 30, 2013. Throughout the period, equity markets were influenced by many positive factors including: generally subdued inflation, improving corporate earnings, and modest positive growth in Gross Domestic Product (GDP) – all factors that contributed to improved investor confidence and an increase in equity market price-to-earnings (P/E) valuations. In addition, the Federal Reserve maintained an accommodative monetary policy by leaving the Fed Funds Rate unchanged in a target range of 0% to 0.25%, where it remained for the entire 12-month period ended November 30, 2013.

| 1 | Source: State Farm Mutual Funds returns prepared by State Farm Investment Management Corp. (SFIMC), the Funds’ investment adviser. S&P 500 Index return provided by Bloomberg. The S&P 500 Index is a capitalization-weighted measure of common stocks of 500 large U.S. companies. S&P 500 is a registered trademark of Standard & Poor’s Financial Services LLC. |

| | The blended benchmark return provided by SFIMC. The blended benchmark is comprised of 60% S&P 500 Index / 40% Barclays Intermediate Gov/Credit Index. The Barclays Intermediate Gov/Credit Index contains approximately 4,758 U.S. Treasury, corporate and other securities with an average maturity of about 4.17 years. |

| | The Barclays 1-5 Year U.S. Treasury Index return provided by Barclays Inc. The Barclays 1-5 Year U.S. Treasury Index measures the performance of short-term U.S. Treasury Securities maturing within one to five years. |

| | The Barclays 7-Year Municipal Bond Index return provided by Barclays Inc. The Barclays 7-Year Municipal Bond Index is an unmanaged index comprised of investment grade municipal bonds with maturities of six to eight years. |

1

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

However, the market environment was not without its challenges. In December 2012, equity markets became concerned with the U.S. congressional budget vote on what was known as the “fiscal cliff” and the impacts of the resulting fiscal decisions. During February and March, several international equity markets turned negative and became increasingly volatile as unresolved concerns about sovereign debt issues in several European countries as well as a banking crisis in the small island nation of Cyprus weighed on investor sentiment.2 Throughout the second half of the fiscal year, the markets were focused on commentary from the Federal Reserve about its intentions and timing of potentially reducing its asset-purchase programs known as “quantitative easing.” In addition, in the fall of 2013, the markets digested renewed fears of the fiscal cliff and a two week U.S. government shutdown in October 2013. Despite these challenges, the S&P 500 Index reached all-time highs during the year. For the 12-month period ended November 30, 2013, the S&P 500 Index had a price increase from 1,416.18 to 1,805.81, and posted a total return of 30.30%, including reinvested dividends.

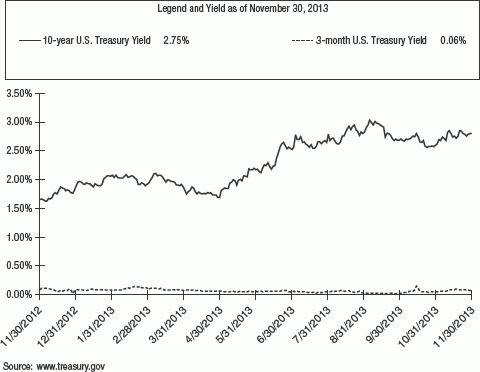

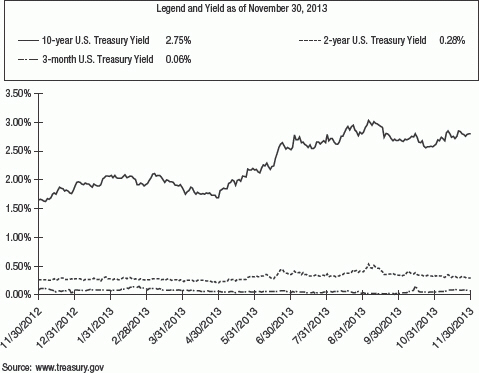

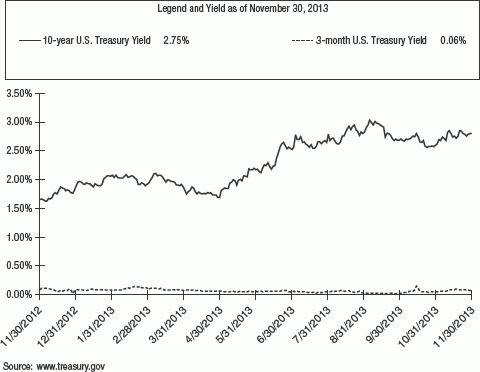

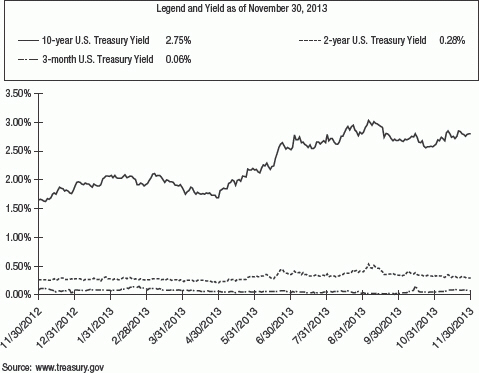

Meanwhile, prices of Treasury bonds declined as concerns grew that the Federal Reserve might start reducing the amount of its asset-purchase programs sooner than expected by the markets. Over the entire 12-months, the yield on 10-year U.S. Treasuries rose from 1.62% at the beginning of the period, to a high of 2.98% on September 5, 2013, before settling down to 2.75% on November 30, 2013. Short-term yields remained low, with 3-month U.S. Treasury yields declining 2 basis points from 0.08% at the beginning of the period, to 0.06% on November 30, 2013.3

| 2 | Foreign securities involve risks not normally associated with investing in the U.S., including higher trading and custody costs, less stringent accounting, legal and reporting practices, potential for political and economic instability, and the fluctuation and potential regulation of currency exchange and exchange rates, all of which are magnified in emerging markets. |

| 3 | Source: The U.S. Department of Treasury. A 10-year U.S. Treasury Bond is a debt obligation issued by the U.S. Treasury that has a term of more than one year, but not more than 10 years. A 3-month U.S. Treasury Bill is a debt obligation issued by the U.S. Treasury that has a term of 92 days or less. U.S. Treasury securities are backed by the full faith and credit of the U.S. government and are guaranteed only as to the prompt payment of principal and interest, and are subject to market risks if sold prior to maturity. Bonds have historically been less volatile than stocks, but are sensitive to changes in interest rates. Past performance does not guarantee future results. |

2

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

Among major fixed income indices, the Barclays 1-5 Year Treasury Index and the Barclays 7-Year Municipal Bond Index posted total returns of 0.25% and –1.77%, respectively, over the 12-month period ended November 30, 2013, as bond price declines, due primarily to higher interest rates, offset bond coupon income.

With negative total returns for some bond-oriented indices, it is important to remember the risk that is present when investing, even in bond funds. Investing involves risk, including a potential for loss.

While dramatic changes in the markets, either positive or negative, are part of investing, State Farm Investment Management Corp. has consistently maintained a long term, disciplined approach to managing investment risk.

Included for your review are audited financial statements and a complete list of portfolio holdings to help you further understand the Funds you own. We encourage your review and consideration of this entire report. Thank you for your continued investment in State Farm Mutual Funds.

|

| Sincerely, |

|

|

|

| Joe R. Monk Jr. |

| Senior Vice President |

| State Farm Investment Management Corp. |

3

State Farm Growth Fund Management’s Discussion of Fund Performance (unaudited)

Overview

Describe the Fund’s investment objective and philosophy.

The State Farm Growth Fund is managed with a long-term investment orientation. Our investment process is based on a rigorous fundamental analysis of companies. We focus on risk as well as the potential for reward. We look for well managed companies with a niche or business specialty that serves an appropriately-sized market opportunity. We prefer companies with a strong customer focus and a history of prudent financial decisions. We also believe that dividends are an important part of an investment’s total return and therefore prefer companies that pay a regular dividend. While we are conscious of how the Fund’s portfolio differs from its broad-based benchmark, the S&P 500 Index, we do not make decisions based upon the Index.

Describe the relevant market environment as it related to the Fund for the reporting period.

The market environment was influenced by many positive factors including: generally subdued inflation, improving corporate earnings, and modest positive growth in Gross Domestic Product (GDP) – all factors that contributed to improved investor confidence and an increase in equity market price-to-earnings (P/E) valuations. In addition, the Federal Reserve maintained an accommodative monetary policy by leaving the Fed Funds Rate unchanged in a target range of 0% to 0.25%, where it remained for the entire 12-month period ended November 30, 2013.

However, the market environment was not without its challenges. In December 2012, equity markets became concerned with the U.S. congressional budget vote on what was known as the “fiscal cliff” and the impacts of the resulting fiscal decisions. During February and March, several international equity markets turned negative and became increasingly volatile as unresolved concerns about sovereign debt issues in several European countries as well as a banking crisis in the small island nation of Cyprus weighed on investor sentiment. Throughout the second half of the fiscal year, the markets were focused on commentary from the Federal Reserve about its intentions and timing of potentially reducing its asset-purchase programs known as “quantitative easing.” In addition, in the fall of 2013, the markets digested renewed fears of the fiscal cliff and a two week U.S. government shutdown in October 2013.

Throughout the year, oil and gold prices were volatile. Oil prices began the period at around $89/barrel and ranged between approximately $86 and $111/barrel during the period, before ending the period November 2013 around $93/barrel, an increase of 4% for the 12-month period. Gold prices began the period at around $1,711 per troy ounce and ranged between approximately $1,183 and $1,722 per troy ounce during the period, before ending the period November 2013 around $1,251/oz., a decrease of –27% for the 12-month period.

Despite the sovereign debt crisis in Europe, the U.S. dollar fell against the euro during the period. For the period December 2012 through November 2013, the U.S. dollar declined by approximately –4% to $1.36/euro. Versus the British pound, the U.S. dollar fell by approximately –2% during the period to $1.64/£.

The 12-month total return for the S&P 500 Index was 30.30% for the period ended November 30, 2013. The total return for the period reflected an increase in corporate earnings per share for the S&P 500 Index companies of approximately 6%, an expansion of the price/earnings valuation of the S&P 500 Index of approximately 22%, and a dividend return of approximately 2.20%.

4

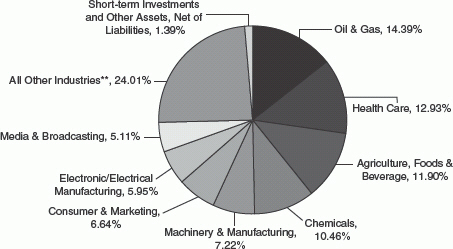

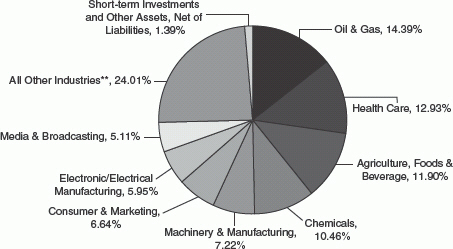

Provide an illustration of the Fund’s investments.

Fund Composition*

(unaudited)

| | * | Illustrated by Industry and based on total net assets as of November 30, 2013. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| | ** | Represents 10 other industries, each of which represents less than 5% of total net assets. |

5

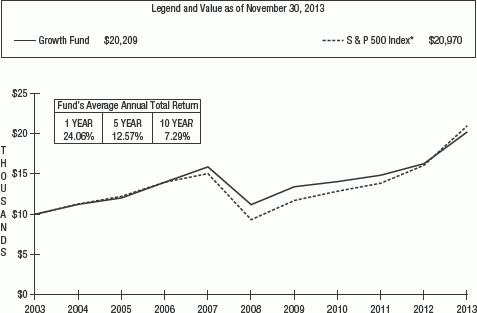

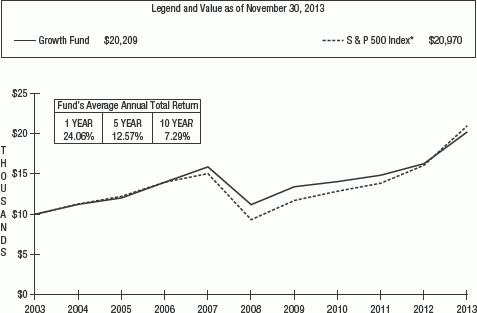

How did the Fund perform during the reporting period?

For the 1-year period ended November 30, 2013, the State Farm Growth Fund had a total return of 24.06% after expenses, compared to a 30.30% total return for the S&P 500 Index. The line graph below provides additional perspective on the Fund’s long term results.

Comparison of change in value of $10,000 investment

for the years ended November 30

The performance data quoted above represents past performance and does not guarantee future results. Investment return and principal value will fluctuate and Fund shares, when redeemed, may be worth more or less than their original cost. Recent performance may be less than the figures shown. Obtain total returns current to the most recent month-end by calling our Mutual Funds Response Center at 1-800-447-0740. These figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Analysis

What factors helped and hindered performance during the reporting period?

The tables below show the securities that were the leading contributors and detractors to Fund performance during the period as well as the performance of the top ten holdings of the Fund.

Performance of Top 5 Contributors

| | | | | | |

| Security | | Sector | | % of Net Assets as of 11/30/13 | | 12/1/12 to 11/30/13 % Price Change |

| Johnson & Johnson | | Health Care | | 6.2% | | 36% |

| Walt Disney Co., The | | Media & Broadcasting | | 5.1% | | 42% |

| Archer-Daniels-Midland Co. | | Agriculture, Foods, & Beverage | | 3.7% | | 51% |

| Hewlett-Packard Co. | | Computers | | 2.2% | | 111% |

Sigma-Aldrich Corp. | | Chemicals | | 6.3% | | 19% |

| * | The S&P 500 Index is a capitalization-weighted measure of the common stocks of 500 large U.S. companies. |

The S&P 500 Index represents an unmanaged group of stocks that differs from the composition of the Growth Fund. Unlike an investment in the Growth Fund, a theoretical investment in the Index does not reflect any expenses. It is not possible to invest directly in an index.

6

Performance of Top 5 Detractors

| | | | | | |

| Security | | Sector | | % of Net Assets as of 11/30/13 | | 12/1/12 to 11/30/13 % Price Change |

| International Business Machines Corp. | | Computers | | 2.8% | | -5% |

| BHP Billiton PLC | | Mining & Metals | | 0.8% | | -3% |

| Caterpillar Inc. | | Machinery & Manufacturing | | 2.0% | | -1% |

| Royal Dutch Shell PLC ADR Class A | | Oil & Gas | | 0.9% | | -0.4% |

| Croda International PLC* | | Chemicals | | 0.03% | | -3% |

*Purchased after 11/30/12. Price Change period is from date of purchase to 11/30/13. |

Performance of Top 10 Holdings

| | | | | | |

| Security | | Sector | | % of Net Assets as of 11/30/13 | | 12/1/12 to 11/30/13 % Price Change |

| Exxon Mobil Corp. | | Oil & Gas | | 6.5% | | 6% |

| Sigma-Aldrich Corp. | | Chemicals | | 6.3% | | 19% |

| Johnson & Johnson | | Health Care | | 6.2% | | 36% |

| Walt Disney Co., The | | Media & Broadcasting | | 5.1% | | 42% |

| Procter & Gamble Co., The | | Consumer & Marketing | | 3.9% | | 21% |

| Archer-Daniels-Midland Co. | | Agriculture, Foods, & Beverage | | 3.7% | | 51% |

| Chevron Corp. | | Oil & Gas | | 3.4% | | 16% |

| Wells Fargo & Co. | | Banks | | 3.1% | | 33% |

| Wal-Mart Stores Inc. | | Retailers | | 2.9% | | 12% |

International Business Machines Corp. | | Computers | | 2.8% | | -5% |

The State Farm Growth Fund’s portfolio turnover over the past 12-months was 0.68%, which is consistent with the Fund’s investment philosophy and approach. There were 72 holdings in the Fund totaling approximately $3.7 billion in assets at the end of the reporting period compared to 63 holdings and approximately $3.1 billion in assets one year earlier. As discussed in the Overview – we feel that a company’s dividend policy is an important component in the analysis and selection of securities for the State Farm Growth Fund. From December 1, 2012, through November 30, 2013, 47 of the stocks in the portfolio, accounting for over 73% of the Fund’s total net assets, increased their dividends.

Given the performance analysis above, what factors should shareholders take into consideration when reviewing the Fund’s performance?

We are long-term investors who spend a lot of time getting to know companies and the people who run them. We seek to understand the company’s long term strategies as well as the competitive advantages and risks inherent in them. When we invest in a company, it is normally our intention to maintain that investment for a very long period of time. Our investment strategy generally is not influenced by short term factors. Our philosophy sometimes will result in periods when the Fund’s performance trails that of the market. We define risk as the permanent loss of investment capital. We believe that our philosophy combined with our views on risk have produced competitive returns versus the benchmark over a long period of time.

7

State Farm Balanced Fund Management’s Discussion of Fund Performance (unaudited)

Overview

Describe the Fund’s investment objective and philosophy.

The State Farm Balanced Fund is invested in a combination of stocks and bonds in the pursuit of long-term growth of principal while providing some current income. The Balanced Fund seeks to achieve its objective by investing approximately 60% of its total assets in common stocks, and ordinarily limits its common stock investments to no more than 75% of total assets. The Balanced Fund ordinarily invests at least 25% of its total assets in fixed income securities, but for a time may choose to invest as much as 75% of its total assets in fixed income securities, including short-term securities. The equity allocation is managed with a conservative bias that favors large capitalization companies that we believe are well managed with a niche or business specialty. The fixed income component invests in high quality U.S. government and corporate bonds primarily of intermediate maturity and seeks to provide shareowners with current income in addition to some protection from equity market volatility. We tend to maintain a long term investment orientation with both the stock and bond investments in the Fund.

Describe the relevant market environment as it related to the Fund for the reporting period.

The market environment was influenced by many positive factors including: generally subdued inflation, improving corporate earnings, and modest positive growth in Gross Domestic Product (GDP) – all factors that contributed to improved investor confidence and an increase in equity market price-to-earnings (P/E) valuations. In addition, the Federal Reserve maintained an accommodative monetary policy by leaving the Fed Funds Rate unchanged in a target range of 0% to 0.25%, where it remained for the entire 12-month period ended November 30, 2013.

However, the market environment was not without its challenges. In December 2012, equity markets became concerned with the U.S. congressional budget vote on what was known as the “fiscal cliff” and the impacts of the resulting fiscal decisions. During February and March, several international equity markets turned negative and became increasingly volatile as unresolved concerns about sovereign debt issues in several European countries as well as a banking crisis in the small island nation of Cyprus weighed on investor sentiment. Throughout the second half of the fiscal year, the markets were focused on commentary from the Federal Reserve about its intentions and timing of potentially reducing its asset-purchase programs known as “quantitative easing.” In addition, in the fall of 2013, the markets digested renewed fears of the fiscal cliff and a two week U.S. government shutdown in October 2013.

Throughout the year, oil and gold prices were volatile. Oil prices began the period at around $89/barrel and ranged between approximately $86 and $111/barrel during the period, before ending the period November 2013 around $93/barrel, an increase of 4% for the 12-month period. Gold prices began the period at around $1,711 per troy ounce and ranged between approximately $1,183 and $1,722 per troy ounce during the period, before ending the period November 2013 around $1,251/oz., a decrease of –27% for the 12-month period.

Despite the sovereign debt crisis in Europe, the U.S. dollar fell against the euro during the period. For the period December 2012 through November 2013, the U.S. dollar declined by approximately –4% to $1.36/euro. Versus the British pound, the U.S. dollar fell by approximately –2% during the period to $1.64/£.

The 12-month total return for the S&P 500 Index was 30.30% for the period ended November 30, 2013. The total return for the period reflected an increase in corporate earnings per share for the S&P 500 Index companies of approximately 6%, an expansion of the price/earnings valuation of the S&P 500 Index of approximately 22%, and a dividend return of approximately 2.20%.

Bond markets, as represented by the Barclays Intermediate Government/Credit Index, generated a total return of

–0.33% during the 12-month period ended November 30, 2013. The performance of the Index was comprised of the Intermediate Credit-portion (35.8% Index weighting), which posted a total return of 0.30%, and the Intermediate Government-portion (64.2% Index weighting), which generated a total return of –0.68%. The total return of the Intermediate Credit-portion was comprised of a price return of –3.45% and a coupon return of 3.75%. Meanwhile, the total return of the Intermediate Government-portion was comprised of a price return of –2.48% and a coupon return of 1.80%.1

8

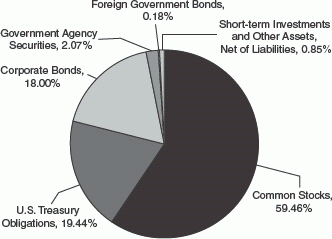

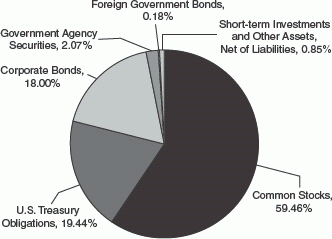

Provide an illustration of the Fund’s investments.

Fund Composition*

(unaudited)

| | * | Illustrated by Type of Security and based on total net assets as of November 30, 2013. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

9

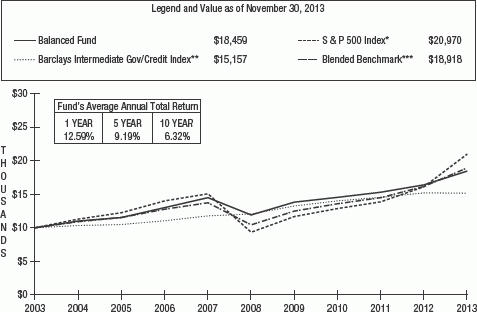

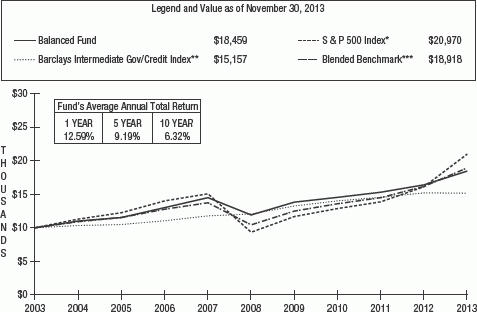

How did the Fund perform during the reporting period?

For the 1-year period ended November 30, 2013, the State Farm Balanced Fund had a total return of 12.59% after expenses. The total return of the blended benchmark was 17.21% for the same period. The blended benchmark used is a combination of 60% S&P 500 Index and 40% Barclays Intermediate Government/Credit Index (rebalanced on a monthly basis). The total return of the all equity benchmark S&P 500 Index was 30.30%, while the fixed income benchmark Barclays Intermediate Government/Credit Index had a total return of –0.33% over the same time period. The line graph below provides additional perspective on the Fund’s long term results.

Comparison of change in value of $10,000 investment

for the years ended November 30

The performance data quoted above represents past performance and does not guarantee future results. Investment return and principal value will fluctuate and Fund shares, when redeemed, may be worth more or less than their original cost. Recent performance may be less than the figures shown. Obtain total returns current to the most recent month-end by calling our Mutual Funds Response Center at 1-800-447-0740. These figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| |

| * | | The S&P 500 Index is a capitalization-weighted measure of the common stocks of 500 large U.S. companies. |

| |

| ** | | The Barclays Intermediate Government/Credit Index contains approximately 4,758 U.S. Treasury, corporate and other securities with an average maturity of about 4.17 years. |

| |

| *** | | State Farm Investment Management Corp. computes the Blended Benchmark using 60% S&P 500 Index and 40% Barclays Intermediate Gov/Credit Index (rebalanced on a monthly basis). |

| |

| | The S&P 500 Index and the Barclays Intermediate Gov/Credit Index represent unmanaged groups of stocks and bonds that differ from the composition of the Balanced Fund. Unlike an investment in the Balanced Fund, theoretical investments in the Indices or Blended Benchmark do not reflect any expenses. It is not possible to invest directly in an index or the Blended Benchmark. |

10

Performance Analysis

What factors helped and hindered performance during the reporting period?

Equity portion of the Fund (59.46% of total net assets at the end of the period)

The tables below show the equity securities that were the leading contributors and detractors to Fund performance during the period as well as the performance of the top ten equity holdings of the Fund.

Performance of Top 5 Contributors

| | | | | | |

Security | | Sector | | % of Net Assets

as of 11/30/13 | | 12/1/12 to 11/30/13

% Price Change |

| Walt Disney Co., The | | Media & Broadcasting | | 4.9% | | 42% |

| Archer-Daniels-Midland Co. | | Agriculture, Foods, & Beverage | | 2.5% | | 51% |

| Hewlett-Packard Co. | | Computers | | 1.3% | | 111% |

| Johnson & Johnson | | Health Care | | 2.6% | | 36% |

| Wells Fargo & Co. | | Banks | | 2.1% | | 33% |

Performance of Top 5 Detractors

| | | | | | |

Security | | Sector | | % of Net Assets

as of 11/30/13 | | 12/1/12 to 11/30/13

% Price Change |

| International Business Machines Corp. | | Computers | | 1.8% | | -5% |

| Newmont Mining Corp. | | Mining & Metals | | 0.05% | | -47% |

| BHP Billiton PLC | | Mining & Metals | | 0.3% | | -3% |

| Catepillar Inc. | | Machinery & Manufacturing | | 1.4% | | -1% |

| Royal Dutch Shell PLC ADR Class A | | Oil & Gas | | 0.9% | | -0.4% |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Performance of Top 10 Holdings

| | | | | | |

Security | | Sector | | % of Net Assets

as of 11/30/13 | | 12/1/12 to 11/30/13

% Price Change |

| Walt Disney Co., The | | Media & Broadcasting | | 4.9% | | 42% |

| Sigma-Aldrich Corp. | | Chemicals | | 2.7% | | 19% |

| Exxon Mobil Corp. | | Oil & Gas | | 2.7% | | 6% |

| Procter & Gamble Co., The | | Consumer & Marketing | | 2.6% | | 21% |

| Johnson & Johnson | | Health Care | | 2.6% | | 36% |

| Archer-Daniels-Midland Co. | | Agriculture, Foods, & Beverage | | 2.5% | | 51% |

| Chevron Corp. | | Oil & Gas | | 2.3% | | 16% |

| Wells Fargo & Co. | | Banks | | 2.1% | | 33% |

International Business Machines Corp. | | Computers | | 1.8% | | -5% |

| Air Products & Chemicals Inc. | | Chemicals | | 1.6% | | 31% |

Turnover in the equity portion of the State Farm Balanced Fund’s portfolio over the past 12 months was 1.14%, which is consistent with the Fund’s investment philosophy and approach. There were 76 holdings in the equity portion of the Fund totaling approximately $916 million in assets at the end of the reporting period compared to 72 holdings and approximately $738 million in assets one year earlier. We also feel that a company’s dividend policy is an important component in the analysis and selection of equity securities for the State Farm Balanced Fund. From December 1, 2012, through November 30, 2013, 51 of the stocks in the portfolio, accounting for over 70% of the equity portion of the Fund’s net assets, increased their dividends.

Fixed Income portion of the Fund (40.13% of total net assets at the end of the period)

An intermediate maturity structure continues to be the Fund’s investment orientation with 75.6% of the fixed income securities (representing 30.4% of total net assets) maturing within 3-11 years. These securities included U.S. Treasury securities (19.44% of total net assets) and corporate bonds (18.00% of total net assets). From a credit rating standpoint, the majority of the fixed income portion of the Fund was invested in Aaa-rated securities, including U.S. Treasury bonds and certain corporate bonds (50.2% of fixed income assets). The remaining corporate fixed income portfolio was invested in Aa-rated bonds (9.9% of fixed income assets), single A-rated debt (29.2% of fixed income assets), and Baa-rated bonds (4.8% of fixed income assets).2

| | 2 | Ratings by Moody’s Investor Services Inc. (“Moody’s”). Percentages are based on total fixed income investments as of November 30, 2013. Of the remaining fixed income investments, 4.37% were not rated by Moody’s, and 1.09% were short-term investments. |

11

The negative total return of the fixed income portion of the Fund over the 12-month period was generated by the Fund’s holdings of U.S. Treasury securities and corporate bonds, which both had negative total returns in the low-single digits. The Fund’s corporate bonds provided the greatest detraction to the returns of the fixed income portion of the Fund. The Fund’s fixed-income investment orientation of investing in intermediate-term, higher quality bonds helped to provide stability and serve as a buffer to the volatility from the equity portion of the State Farm Balanced Fund throughout the year. The duration of the State Farm Balanced Fund’s bond portfolio at the end of November 2013 stood at 4.8 years, which is up from 4.6 years on December 1, 2012. Duration is a statistical calculation that measures a bond’s (or in this case, a bond portfolio’s) price sensitivity relative to general movements in interest rates.

Given the performance analysis above, what factors should shareholders take into consideration when reviewing the Fund’s performance?

The Fund is designed and managed as a balanced fund that blends both stocks and bonds together in one convenient investment. Given that structure, performance for the Fund over the long term will typically (but not always) fall somewhere in between the return of a stock index like the S&P 500 Index and a bond index like the Barclays Intermediate Government/Credit Index.

12

State Farm Interim Fund Management’s Discussion of Fund Performance (unaudited)

Overview

Describe the Fund’s investment objective and philosophy.

The State Farm Interim Fund is managed in a fashion that seeks to achieve over a period of years, the highest yield consistent with relatively low price volatility. When managing the Fund, we are generally buy-and-hold investors who focus primarily on U.S. Government obligations. General investment practice within the Fund is to distribute the Fund’s investments in varying amounts among securities maturing in up to six or seven years from the time of purchase, but may occasionally purchase securities maturing in up to 15 years.

Describe the relevant market environment as it related to the Fund for the reporting period.

Throughout the 1-year period ended November 30, 2013, fixed income markets were impacted by factors including: generally subdued inflation, improving corporate earnings, and modest positive growth in Gross Domestic Product (GDP). Moreover, the Federal Reserve maintained an accommodative monetary policy by leaving the Fed Funds Rate unchanged in a target range of 0% to 0.25%, where it remained for the entire 12-month period ended November 30, 2013.

Interest rates were affected by concerns arising from the December 2012 U.S. congressional budget vote on what was known as the “fiscal cliff” and the anticipated impacts of the resulting fiscal decisions. In addition, during the second half of the fiscal year, the markets were focused on commentary from the Federal Reserve about its intentions and timing of potentially reducing its asset-purchase programs known as “quantitative easing.” In the fall of 2013, the markets digested renewed fears of another fiscal cliff and a two week U.S. government shutdown in October 2013.

During the 1-year period, the U.S. Treasury yield curve steepened with interest rates rising on long- and intermediate-maturity U.S. Treasuries, while decreasing or remaining flat on shorter-maturity U.S. Treasuries. For example, the yield on 10-year U.S. Treasuries increased 113 basis points from 1.62% at the beginning of the period, to 2.75% on November 30, 2013, while the yield on 2-year U.S. Treasuries increased only 3 basis points from 0.25% at the beginning of the period, to 0.28% on November 30, 2013. Short-term yields remained at low levels, with 3-month U.S. Treasury yields decreasing from 0.08% at the beginning of the period, to 0.06% on November 30, 2013.

Overall, for the year ended November 30, 2013, short- and intermediate-maturity U.S. Treasuries outperformed relative to longer-maturity U.S. Treasuries. For the 1-year period, the total return for 1-3 year U.S. Treasuries and Intermediate-maturity U.S. Treasuries were 0.53% and –0.76%, respectively, compared to a total return of –14.03% on 20+ year U.S. Treasuries.

13

Provide an illustration of the Fund’s investments.

Provided below is the maturity allocation of the Interim Fund as of November 30, 2013, along with the maturity allocation of the Barclays 1-5 Year U.S. Treasury Index for comparison.

Maturity Allocation: State Farm Interim Fund

compared to the Barclays 1-5 Year U.S. Treasury Index

(unaudited)*

| | | | | | |

Maturity | | State Farm

Interim Fund

Allocation | | Barclays

1-5 Year U.S. Treasury Index

Allocation | | |

0 - 1 Years | | 10.75%** | | 0.00% | | |

1 - 2 Years | | 12.33% | | 33.27% | | |

2 - 3 Years | | 13.01% | | 27.06% | | |

3 - 4 Years | | 13.64% | | 20.60% | | |

4 - 5 Years | | 30.93% | | 16.06% | | |

5 - 6 Years | | 19.34% | | 3.01% | | |

6+ Years | | 0.00% | | 0.00% | | |

| | | | | | | |

Totals | | 100.00% | | 100.00% | | |

| | * | Illustrated by Maturity and based on total investments for the Fund and total securities for the Index as of November 30, 2013. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. | |

| | ** | Includes a 0.14% allocation to the JPMorgan U.S. Government Money Market Fund. | |

14

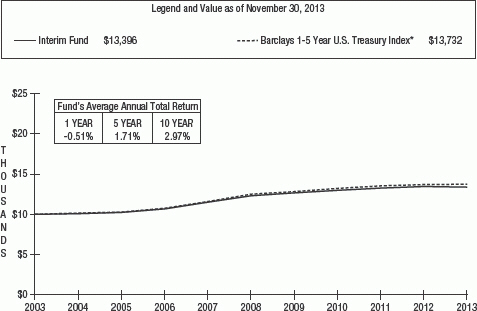

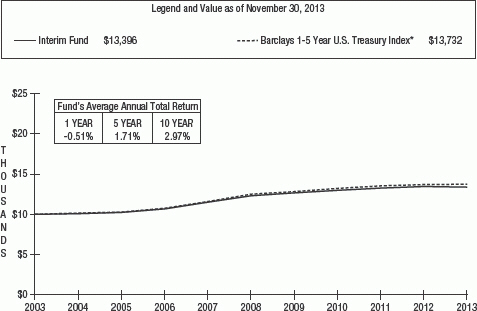

How did the Fund perform during the reporting period?

For the 1-year period ended November 30, 2013, the State Farm Interim Fund had a total return of –0.51% after expenses, compared to a total return of 0.25% for the Barclays 1-5 Year U.S. Treasury Index. The line graph below provides perspective on the Fund’s long term results.

Comparison of change in value of $10,000 investment

for the years ended November 30

The performance data quoted above represents past performance and does not guarantee future results. Investment return and principal value will fluctuate and Fund shares, when redeemed, may be worth more or less than their original cost. Recent performance may be less than the figures shown. Obtain total returns current to the most recent month-end by calling our Mutual Funds Response Center at 1-800-447-0740. These figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Analysis

What factors helped and hindered performance during the reporting period?

Short-maturity U.S. Treasury Notes provided a positive total return while U.S. Treasury Notes with maturities greater than four years had a negative total return for the 1-year period. The Fund’s exposure to U.S. Treasury Notes with maturities greater than four years contributed to the Fund underperforming its benchmark. As mentioned earlier, the Fund generally maintains exposure across a six-year maturity spectrum. As U.S. Treasury Notes mature, they are reinvested in U.S. Treasury Notes at prevailing interest rate levels.

The duration of the State Farm Interim Fund at the end of November 2013 stood at 3.3 years, which is up from 3.2 years on December 1, 2012. The Fund’s duration was higher than the duration of its benchmark (the Barclays 1-5 Year U.S. Treasury Index) of 2.6 years as of November 30, 2013. In an environment of rising interest rates during the reporting period, the Fund underperformed relative to its benchmark due in part to its higher duration orientation. Duration is a statistical calculation that measures a bond’s (or in this case, a bond fund’s) price sensitivity relative to general movements in interest rates.

Given the performance analysis above, what factors should shareholders take into consideration when reviewing the Fund’s performance?

Given its investment objective of high current income consistent with low price volatility, the Fund is designed to be a stable, low risk element of a diversified portfolio. As interest rates fall, bond prices rise and vice versa. If interest rates remain at current low levels or decline further, total returns (interest plus price gains) may increase. Conversely, if interest rates increase, total returns may decline.

| * | The Barclays 1-5 Year U.S. Treasury Index measures the performance of short-term U.S. Treasury Securities maturing within one to five years. |

The Barclays 1-5 Year U.S. Treasury Index represents an unmanaged group of bonds that differs from the composition of the Interim Fund. Unlike an investment in the Interim Fund, a theoretical investment in the Index does not reflect any expenses. It is not possible to invest directly in an index.

15

State Farm Municipal Bond Fund Management’s Discussion of Fund Performance (unaudited)

Overview

Describe the Fund’s investment objective and philosophy.

The State Farm Municipal Bond Fund seeks as high a rate of income exempt from federal income taxes as is consistent with prudent investment management. Income may be subject to state and local taxes and (if applicable) the Alternative Minimum Tax (AMT). In managing the Fund, we focus on high credit quality bonds with an investment philosophy that seeks to provide competitive total returns, while managing for tax efficiency within the municipal bond asset class over the long run. The municipal bond market, while relatively small in total assets compared to the taxable market, is very broad by number of issuers. As a result, we believe that fundamental research and professional management are critical to success. While we diversify the maturity spectrum of the bonds within the portfolio, we tend to favor the intermediate-maturity range for the bulk of the Fund’s assets. The Fund also seeks to remain invested mainly in bonds of high-credit quality in an attempt to reduce the risk of loss to investment principal as a result of credit losses.

In selecting securities for the Fund, we generally invest in the 5-15 year maturity range and avoid long maturities. While we are conscious of how the Fund’s portfolio differs from its benchmark, the Barclays 7-Year Municipal Bond Index, we do not make decisions based upon the Index.

Describe the relevant market environment as it related to the Fund for the reporting period.

Throughout the 1-year period ended November 30, 2013, fixed income markets were impacted by factors including: generally subdued inflation, improving corporate earnings, and modest positive growth in Gross Domestic Product (GDP). Moreover, the Federal Reserve maintained an accommodative monetary policy by leaving the Fed Funds Rate unchanged in a target range of 0% to 0.25%, where it remained for the entire 12-month period ended November 30, 2013.

Interest rates were affected by concerns arising from the December 2012 U.S. congressional budget vote on what was known as the “fiscal cliff” and the anticipated impacts of the resulting fiscal decisions. In addition, during the second half of the fiscal year, the markets were focused on commentary from the Federal Reserve about its intentions and timing of potentially reducing its asset-purchase programs known as “quantitative easing.” In the fall of 2013, the markets digested renewed fears of another fiscal cliff and a two week U.S. government shutdown in October 2013.

As illustrated in Table 1 below, the municipal bond yield curve steepened as intermediate- and longer-maturity yields increased while short-maturity yields declined over the 1-year period ended November 30, 2013.

Table 1: Municipal Market Data (MMD) Yields (%) - AAA-Rated General Obligation Municipal Bonds1

| | | | | | | | |

Date | | 1-Year | | 5-Year | | 10-Year | | 20-Year |

December 1, 2012 | | 0.20% | | 0.64% | | 1.47% | | 2.10% |

November 30, 2013 | | 0.17% | | 1.16% | | 2.65% | | 3.77% |

| | | | | | | | | |

Increase (Decrease) in Yield | | -0.03% | | 0.52% | | 1.18% | | 1.67% |

| | 1 | The Municipal Market Data AAA yield curve is indicative of AAA tax-exempt offered-side, institutional yield levels and may vary from actual yields attained. Source: © 2013 Thomson Reuters. Information provided by Thomson Reuters is not intended for trading purposes, nor do they provide any form of advice (investment, tax, legal) amounting to investment advice, or make any recommendations regarding particular financial instruments, investments or products. Neither Thomson Reuters nor its third party content providers shall be liable for any errors, inaccuracies, or for any actions taken in reliance thereon. THOMSON REUTERS EXPRESSLY DISCLAIMS ALL WARRANTIES, EXPRESSED OR IMPLIED, AS TO THE ACCURACY OF THE INFORMATION, OR AS TO THE FITNESS OF THE INFORMATION FOR ANY PURPOSE. |

As illustrated in Table 2 below, annual total returns (as of November 30, 2013) on various components of the Barclays Municipal Bond Index were negative along the longer-end of the maturity yield curve.

Table 2: Barclays Municipal Bond Index - Component Returns by Maturity2

| | |

| | | Annual Total Return |

| Maturity | | (as of November 30, 2013) |

1-Year Municipal Bonds | | 0.77% |

3-Year Municipal Bonds | | 1.19% |

5-Year Municipal Bonds | | 0.33% |

7-Year Municipal Bonds | | -1.77% |

10-Year Municipal Bonds | | -3.24% |

15-Year Municipal Bonds | | -4.66% |

20-Year Municipal Bonds | | -5.72% |

Long-Bond (22+ Year) Municipal Bonds | | -7.18% |

| | 2 | Source: Barclays Live®. Past performance does not guarantee future results. The data illustrated provides component annual total returns by municipal bond maturities of the Barclays Municipal Bond Index. |

16

From a total return standpoint, the higher end of investment-grade quality municipal bonds (Aaa and Aa rated bonds) outperformed relative to lower investment-grade quality municipal bonds (A and Baa rated bonds) within the Barclays Municipal Bond Index over the reporting period as illustrated by those credit quality component returns in Table 3 below.

Table 3: Barclays Municipal Bond Index - Component Returns by Credit Quality Ratings3

| | |

Credit Quality | | Annual Total Return

(as of November 30, 2013) |

Aaa Rated Bonds | | -2.43% |

Aa Rated Bonds | | -3.03% |

A Rated Bonds | | -3.76% |

Baa Rated Bonds | | -7.74% |

| | 3 | Source: Barclays Live®. Past performance does not guarantee future results. The data illustrated provides component annual total returns by credit quality ratings of the Barclays Municipal Bond Index. |

As of November 30, 2013, the 3.77% yield on 20-year Aaa-rated municipal bonds exceeded the 3.54% yield offered on comparable 20-year taxable U.S. Treasuries by 23 basis points, which is not a normal yield spread relationship. Typically, long-term municipal bonds offer approximately 75% to 90% of the yields available on comparable U.S. Treasuries because of the income tax benefits associated with municipal bonds. This yield comparison has been typically used as a general gauge within the industry to determine the relative attractiveness of municipal securities.

Provide an illustration of the Fund’s investments.

Provided below is the maturity allocation of the Municipal Bond Fund as of November 30, 2013, along with the maturity allocation of the Barclays 7-Year Municipal Bond Index for comparison.

Maturity Allocation: State Farm Municipal Bond Fund

compared to the Barclays 7-Year Municipal Bond Index

(unaudited)*

| | | | |

Maturity | | State Farm

Municipal Bond Fund

Allocation | | Barclays

7-Year Municipal Bond Index

Allocation |

0-6 Years | | 20.63%** | | 0.00% |

6-12 Years | | 57.01% | | 100.00% |

12-22 Years | | 22.36% | | 0.00% |

22+ Years | | 0.00% | | 0.00% |

| | | | | |

Totals | | 100.00% | | 100.00% |

| | * | Illustrated by Maturity and based on total investments for the Fund and total securities for the Index as of November 30, 2013. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. | |

| | ** | Includes a 0.77% allocation to the JPMorgan Tax Free Money Market Fund. | |

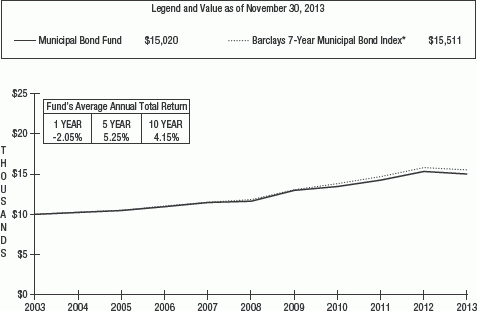

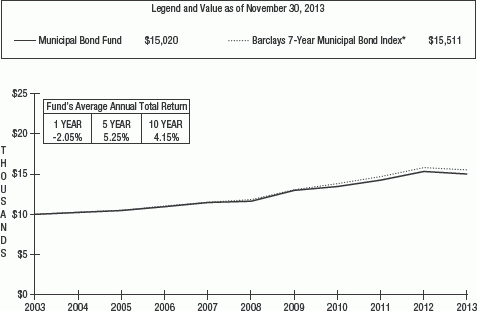

How did the Fund perform during the reporting period?

The State Farm Municipal Bond Fund had a total return of –2.05% for the 1-year period ended November 30, 2013, after expenses, compared to a –1.77% for the Barclays 7-Year Municipal Bond Index. The line graph below provides additional perspective on the Fund’s long term results.

17

Comparison of change in value of $10,000 investment

for the years ended November 30

The performance data quoted above represents past performance and does not guarantee future results. Investment return and principal value will fluctuate and Fund shares, when redeemed, may be worth more or less than their original cost. Recent performance may be less than the figures shown. Obtain total returns current to the most recent month-end by calling our Mutual Funds Response Center at 1-800-447-0740. These figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Analysis

What factors helped and hindered performance during the reporting period?

The Fund produced a negative total return for the 1-year period. As illustrated in Table 2 above, longer-maturity bonds underperformed intermediate maturities, which in turn underperformed short maturities over the 1-year period. Consistent with the Fund’s intermediate-maturity orientation, none of the Fund’s total investments were in bonds having maturities over 22 years as of November 30, 2013. Relative to the Barclays 7-Year Municipal Bond Index, the Fund had a higher concentration in bonds having maturities between 12-22 years, which underperformed relative to intermediate-maturity bonds during the year. This factor played a part in the Fund underperforming the Barclays 7-Year Municipal Bond Index during the reporting period.

We seek to maintain the risk profile of the Fund with respect to volatility (duration), interest rate risk and capital (credit risk). Throughout the reporting period, the Fund’s modified duration decreased slightly from 4.50 years as of December 1, 2012 to 4.44 years as of November 30, 2013. Modified duration is a statistical calculation that measures a bond’s (or in this case, a bond fund’s) price sensitivity relative to general movements in interest rates. The Fund maintained a high quality credit orientation consistent with the Fund’s historical investment philosophy throughout the reporting period ended November 30, 2013.

Table 4 below provides an illustration of the Fund’s credit quality orientation compared to the Index benchmark as of November 30, 2013. Over the reporting period, the higher end of investment-grade quality municipal bonds (Aaa and Aa rated bonds) outperformed relative to lower investment-grade quality municipal bonds (A and Baa rated bonds) as previously illustrated in Table 3 above.

| * | The Barclays 7-Year Municipal Bond Index is an unmanaged index comprised of investment grade municipal bonds with maturities of six to eight years. |

| | The Barclays 7-Year Municipal Bond Index differs from the composition of the Municipal Bond Fund. Unlike an investment in the Municipal Bond Fund, a theoretical investment in the Index does not reflect any expenses. It is not possible to invest directly in an index. |

18

Table 4: Credit Ratings Comparison (as of November 30, 2013)4

| | | | | | | | |

Credit Ratings | | State Farm

Municipal Bond Fund

Allocation | | | Barclays

7-Year Municipal Bond Index

Allocation | |

Aaa/AAA | | | 10.22% | | | | 14.72% | |

Aa/AA | | | 74.38% | | | | 52.13% | |

A | | | 12.03% | | | | 26.42% | |

Baa/BBB or Lower | | | 0.00% | | | | 6.21% | |

NR (Not Rated) | | | 3.37%* | | | | 0.52% | |

| | | | | | | | | |

Totals | | | 100.00% | | | | 100.00% | |

| | 4 | Illustrated by Credit Quality and based on total investments for the Fund and total securities for the Index as of November 30, 2013. Reflects the lower of Moody’s and Standard and Poor’s issuer specific ratings. The issuer specific ratings do not reflect any bond insurer rating. |

| | * | Includes a 0.77% allocation to the JPMorgan Tax Free Money Market Fund. |

As highlighted earlier, the difference in maturity structure between the Fund and its benchmark along with the Fund’s higher credit quality orientation than its benchmark played a role in the Fund’s relative performance versus the benchmark during the reporting period. The objective of the Fund is to seek as high a rate of income exempt from federal income taxes as is consistent with prudent investment management. The Fund has been invested with a bias towards high-credit quality, intermediate maturity bonds. Adopting additional risk by increasing duration significantly and/or increasing the weighting in lower-credit quality bonds would not have been consistent with the Fund’s historical investment philosophy.

The number of individual bonds held in the portfolio over the reporting period increased by one, from 438 to 439 bonds. Turnover for the reporting period was 10.5%. Investments within the State of Florida represented the largest single allocation in any state representing 6.20% of total net assets, which is up from 5.90% from the beginning of the reporting period.

The largest additions to the portfolio included net acquisitions of bonds in Michigan and Arkansas. Bonds secured by a general obligation pledge accounted for approximately 80% of all new acquisitions with revenue bond purchases representing 20% of the total. The average ratings quality of new bond purchases was Aa/AA. The largest net reduction of holdings occurred through sales and maturities of bonds in Louisiana and Illinois.

Given the performance analysis above, what factors should shareholders take into consideration when reviewing the Fund’s performance?

The State Farm Municipal Bond Fund seeks a high level of income exempt from federal income tax through investment in a diversified portfolio of high quality bonds. We utilize a long-term philosophy seeking to provide competitive total returns relative to the municipal bond asset class while managing for tax efficiency.

19

Expense Example (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including management fees and other Fund expenses. The Example in the following table is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as stated in the table below.

Actual Expenses

The first line under each Fund name in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value for a Fund by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account for that Fund during this period. If your account has multiple Fund positions, add up the results calculated for each Fund position within your account to estimate the expenses you paid on your total account value. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second line under each Fund name in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee that you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of increasing the costs of investing.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line under each Fund name in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, including those that have transactional costs, such as sales charges (loads), redemption fees, or exchange fees.

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2013 | | Ending

Account Value

November 30, 2013 | | Annualized Expense

Ratio Based

on the Period

June 1, 2013 to

November 30, 2013 | | Expenses Paid

During Period

June 1, 2013 to

November 30, 2013* |

| | | | |

State Farm Growth Fund | | | | | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,091.06 | | | | | 0.12 | % | | | $ | 0.63 | |

| | | | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,024.47 | | | | | 0.12 | % | | | $ | 0.61 | |

| | | | |

State Farm Balanced Fund | | | | | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,050.20 | | | | | 0.13 | % | | | $ | 0.67 | |

| | | | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,024.42 | | | | | 0.13 | % | | | $ | 0.66 | |

| | | | |

State Farm Interim Fund | | | | | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,002.06 | | | | | 0.16 | % | | | $ | 0.80 | |

| | | | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,024.27 | | | | | 0.16 | % | | | $ | 0.81 | |

| | | | |

State Farm Municipal Bond Fund | | | | | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | $ | 1,000.00 | | | | $ | 989.19 | | | | | 0.16 | % | | | $ | 0.80 | |

| | | | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,024.27 | | | | | 0.16 | % | | | $ | 0.81 | |

| * | Expenses are equal to the applicable Fund’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

20

Board Approval of Investment Advisory Agreement (unaudited)

At a meeting of the Board of Trustees (the “Board”) of State Farm Associates’ Funds Trust (“Associates’ Funds Trust”) held on June 14, 2013 all of the Trustees present, including those Trustees who were not “interested persons” as defined by Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “Independent Trustees”), of Associates’ Funds Trust, approved the continuation of the Investment Advisory and Management Services Agreement between State Farm Investment Management Corp. (“SFIMC”) and Associates’ Funds Trust (the “Advisory Agreement”).

In considering whether to approve the continuation of the Advisory Agreement, the Independent Trustees were assisted in their review by independent legal counsel, which had sent to SFIMC a request for information to be provided to the Independent Trustees in connection with their consideration of the continuation of the Advisory Agreement. SFIMC provided materials to the Independent Trustees responding to that request, including a fund-by-fund profitability analysis on each series of the Associates’ Funds Trust (each, a “Fund,” and collectively, the “Funds”), as well as an explanation of the methodology by which SFIMC had calculated that profitability. SFIMC also provided the Board with additional information that SFIMC believed would be useful to the Board in evaluating whether to approve the continuation of the Advisory Agreement. The Board also received a report prepared by Strategic Insight, an independent fund tracking organization (the “Strategic Insight Report”), relating to the performance and expenses of each Fund. In addition, the Board received and reviewed a memorandum from the legal counsel to Associates’ Funds Trust and its Independent Trustees regarding their responsibilities (particularly the Independent Trustees’ responsibilities) in considering whether to approve the continuation of the Advisory Agreement.

The Independent Trustees of Associates’ Funds Trust reviewed these materials at meetings held on March 15, 2013, May 29, 2013, and June 14, 2013, during which meetings SFIMC management responded to specific questions from the Independent Trustees and provided follow-up information. The Independent Trustees discussed all of this material extensively among themselves, with their independent legal counsel and with the other Board members, after which the Board considered various factors described below, no one of which alone was considered dispositive. However, the material factors and conclusions that formed the basis for the Board’s determination to approve the continuation of the Advisory Agreement are discussed separately below.

Investment Performance

The Board considered the performance of each Fund. Among other things, the Board examined the year-to-date, one-, three-, five- and ten-year performance of each Fund as compared to the performance of one or more benchmark indexes and a peer group of funds with comparable investment objectives, investment strategies, asset size and no-load structures compiled by Strategic Insight (“Peer Funds”). The Board considered the information contained in the Strategic Insight Report relating to the overall performance of the Funds, including as compared to each Fund’s benchmark and/or index and Peer Funds. The Board noted the favorable long-term performance of the Growth and Balanced Funds compared to each Fund’s benchmark(s) and Peer Funds. The Board noted that the short-term performance of the Growth Fund and Balanced Fund had moderately lagged the performance of each Fund’s benchmark(s) and Peer Funds given the conservative nature by which SFIMC manages those Funds. In that regard, management confirmed to the Board its philosophy to manage the Growth Fund and Balanced Fund in a manner such that the Funds generally will tend to underperform their benchmarks and Peer Funds in periods of strong market performance or periods in which increased risk is rewarded. The Board and management noted that over long-term market cycles, this conservative investment approach generally has provided competitive investment performance for these two Funds and for the other Funds of Associates’ Funds Trust. The Board also noted the favorable performance of the Interim and Municipal Bond Funds compared to each Fund’s benchmark(s) and Peer Funds. After extensive discussion of this and other performance information, the Board concluded that the investment performance of the Funds over the periods reviewed was acceptable.

Fees and Expenses

The Board examined the fee structure and expense ratio of each Fund, including in comparison to Peer Funds. The Board concluded that each Fund’s expense structure and overall fees were relatively low and were acceptable. In connection with examining the fee structure and expense ratio of each Fund, the Board considered the amount of profits earned (or losses incurred) by SFIMC in providing advisory and management services to each Fund, as well as the methodology by which that profit (or loss) was calculated. The Board concluded that each Fund’s expense structure and overall fees were acceptable.

In the context of reviewing the Funds’ fees, the Board also discussed the extent to which economies of scale will be realized as each Fund grows and whether each Fund’s fee levels reflect economies of scale for the benefit of the Fund. Economies of scale occur when a mutual fund’s expenses per unit, such as per dollar invested in the fund, decreases as the fund increases in size. The Board considered that the Advisory Agreement includes breakpoints for each Fund, which can lead to economies of scale for Fund shareholders as assets increase.

21

Nature, Extent and Quality of Services

The Board considered the nature, extent and quality of the advisory services provided by SFIMC to the Funds. The Board considered the make-up, education and experience of the SFIMC investment management teams responsible for managing the Funds, and concluded that these teams have a satisfactory, long-term track record in managing the Funds. The Board also considered the compliance environment of the Funds, and SFIMC’s management of that environment. After considering this information, the Board concluded that SFIMC had more than sufficient resources and expertise to capably continue to manage the Funds.

The Board next discussed whether SFIMC derives any other direct or indirect benefits from serving as investment adviser to the Funds. SFIMC discussed the various ancillary services that it provides the Funds, including serving as transfer agent, and its affiliate, State Farm VP Management Corp., serving as the Funds’ distributor. SFIMC explained to the Board that, in exchange for providing transfer agency services, SFIMC receives proceeds from the account fee imposed on shareholders of Associates’ Funds Trust. Management also explained that State Farm VP Management Corp. receives no fees from Associates’ Funds Trust for providing distribution services. SFIMC indicated to the Board that it was not aware of any other ancillary or other benefits that SFIMC (and its affiliates) receive from Associates’ Funds Trust, particularly because SFIMC does not execute securities trades on behalf of the Funds through an affiliated broker-dealer. The Board concluded that the lack of any material ancillary, or so-called “fallout,” benefits enables SFIMC to manage assets of the Funds in a manner that appears to be free of conflicts of interest.

Based on the Trustees’ deliberations and their evaluation of the information provided by SFIMC, the Board, including all of the Independent Trustees voting separately, unanimously approved the continuation of the Advisory Agreement for all the Funds through June 30, 2014.

22

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS

November 30, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (98.61%) | | | | | |

|

Agriculture, Foods, & Beverage (11.90%) | |

Archer-Daniels-Midland Co. | | | 3,477,500 | | | $ | 139,969,375 | |

Coca-Cola Co., The | | | 2,054,600 | | | | 82,574,374 | |

Kellogg Co. | | | 930,000 | | | | 56,395,200 | |

McCormick & Company Inc. | | | 428,600 | | | | 29,573,400 | |

Nestle SA ADR | | | 1,175,800 | | | | 85,962,738 | |

PepsiCo Inc. | | | 641,400 | | | | 54,172,644 | |

| | | | | | | | |

| | | | | | | 448,647,731 | |

| | | | | | | | |

Banks (4.61%) | | | | | | | | |

M&T Bank Corp. | | | 213,400 | | | | 24,617,824 | |

Northern Trust Corp. | | | 460,500 | | | | 27,164,895 | |

U.S. Bancorp | | | 141,400 | | | | 5,545,708 | |

Wells Fargo & Co. | | | 2,643,100 | | | | 116,349,262 | |

| | | | | | | | |

| | | | | | | 173,677,689 | |

| | | | | | | | |

Building Materials & Construction (1.55%) | |

Vulcan Materials Co. | | | 1,039,200 | | | | 58,579,704 | |

| | | | | | | | |

Chemicals (10.46%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 830,000 | | | | 90,328,900 | |

Croda International PLC | | | 25,800 | | | | 981,112 | |

E.I. du Pont de Nemours & Co. | | | 229,200 | | | | 14,068,296 | |

International Flavors & Fragrances Inc. | | | 525,000 | | | | 46,383,750 | |

Novozymes A/S B Shares | | | 135,300 | | | | 5,233,260 | |

Sigma-Aldrich Corp. | | | 2,750,000 | | | | 237,160,000 | |

| | | | | | | | |

| | | | | | | 394,155,318 | |

| | | | | | | | |

Computer Software & Services (1.52%) | |

Automatic Data Processing Inc. | | | 109,900 | | | | 8,794,198 | |

Facebook Inc. Class A (a) | | | 115,000 | | | | 5,406,150 | |

Google Inc. Class A (a) | | | 5,900 | | | | 6,251,581 | |

SAP AG | | | 444,800 | | | | 36,843,251 | |

| | | | | | | | |

| | | | | | | 57,295,180 | |

| | | | | | | | |

Computers (4.96%) | | | | | | | | |

Hewlett-Packard Co. | | | 3,019,400 | | | | 82,580,590 | |

International Business Machines Corp. | | | 580,000 | | | | 104,214,400 | |

| | | | | | | | |

| | | | | | | 186,794,990 | |

| | | | | | | | |

Consumer & Marketing (6.64%) | | | | | |

AptarGroup Inc. | | | 677,405 | | | | 43,977,133 | |

Colgate-Palmolive Co. | | | 872,600 | | | | 57,425,806 | |

Procter & Gamble Co., The | | | 1,765,155 | | | | 148,661,354 | |

| | | | | | | | |

| | | | | | | 250,064,293 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (5.95%) | |

Agilent Technologies Inc. | | | 548,071 | | | | 29,360,163 | |

Emerson Electric Co. | | | 729,400 | | | | 48,862,506 | |

General Electric Co. | | | 3,848,900 | | | | 102,611,674 | |

Linear Technology Corp. | | | 1,023,400 | | | | 43,545,670 | |

| | | | | | | | |

| | | | | | | 224,380,013 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

|

Financial Services (0.75%) | |

Berkshire Hathaway Inc. Class A (a) | | | 162 | | | $ | 28,309,500 | |

Berkshire Hathaway Inc. Class B (a) | | | 143 | | | | 16,664 | |

| | | | | | | | |

| | | | | | | 28,326,164 | |

| | | | | | | | |

Health Care (12.93%) | | | | | | | | |

Abbott Laboratories | | | 847,500 | | | | 32,366,025 | |

AbbVie Inc. | | | 847,500 | | | | 41,061,375 | |

Amgen Inc. | | | 106,300 | | | | 12,126,704 | |

Baxter International Inc. | | | 43,600 | | | | 2,984,420 | |

Eli Lilly & Co. | | | 997,000 | | | | 50,069,340 | |

Johnson & Johnson | | | 2,481,600 | | | | 234,908,256 | |

Merck & Co. Inc. | | | 419,400 | | | | 20,898,702 | |

Pfizer Inc. | | | 2,239,031 | | | | 71,044,454 | |

Zoetis Inc. | | | 705,696 | | | | 21,982,430 | |

| | | | | | | | |

| | | | | | | 487,441,706 | |

| | | | | | | | |

Machinery & Manufacturing (7.22%) | |

3M Co. | | | 564,000 | | | | 75,299,642 | |

ASML Holding NV NY Reg. Shares | | | 55,050 | | | | 5,140,569 | |

Caterpillar Inc. | | | 877,700 | | | | 74,253,420 | |

Deere & Co. | | | 42,900 | | | | 3,613,896 | |

Donaldson Company Inc. | | | 112,800 | | | | 4,707,144 | |

HNI Corp. | | | 1,439,200 | | | | 57,049,888 | |

Illinois Tool Works Inc. | | | 652,500 | | | | 51,925,950 | |

| | | | | | | | |

| | | | | | | 271,990,509 | |

| | | | | | | | |

Media & Broadcasting (5.11%) | |

Walt Disney Co., The | | | 2,728,640 | | | | 192,478,266 | |

| | | | | | | | |

Mining & Metals (3.43%) | | | | | | | | |

BHP Billiton PLC | | | 941,859 | | | | 28,650,237 | |

Nucor Corp. | | | 531,200 | | | | 27,123,072 | |

Rio Tinto PLC | | | 476,280 | | | | 25,418,075 | |

Rio Tinto PLC ADR | | | 907,200 | | | | 48,126,960 | |

| | | | | | | | |

| | | | | | | 129,318,344 | |

| | | | | | | | |

Oil & Gas (14.39%) | |

BG Group PLC | | | 3,199,100 | | | | 65,355,071 | |

Bill Barrett Corp. (a) | | | 767,300 | | | | 20,632,697 | |

Chevron Corp. | | | 1,060,000 | | | | 129,786,400 | |

Devon Energy Corp. | | | 212,204 | | | | 12,863,806 | |

Dril-Quip Inc. (a) | | | 16,100 | | | | 1,747,816 | |

Exxon Mobil Corp. | | | 2,615,200 | | | | 244,468,896 | |

Imperial Oil Ltd. | | | 25,300 | | | | 1,089,165 | |

Noble Energy Inc. | | | 89,300 | | | | 6,272,432 | |

Royal Dutch Shell PLC ADR Class A | | | 487,900 | | | | 32,542,930 | |

Schlumberger Ltd. | | | 59,100 | | | | 5,225,622 | |

Spectra Energy Corp. | | | 399,950 | | | | 13,418,322 | |

Tidewater Inc. | | | 154,191 | | | | 8,795,055 | |

| | | | | | | | |

| | | | | | | 542,198,212 | |

| | | | | | | | |

| | | | |

| See accompanying notes to financial statements. | | | 23 | |

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | |

| | |

Retailers (2.88%) | | | | | | | | |

Wal-Mart Stores Inc. | | | 1,339,100 | | | $ | 108,480,491 | |

| | | | | | | | |

Telecom & Telecom Equipment (3.40%) | |

AT&T Inc. | | | 2,140,534 | | | | 75,368,202 | |

Corning Inc. | | | 1,284,600 | | | | 21,940,968 | |

Verizon Communications Inc. | | | 624,900 | | | | 31,007,538 | |

| | | | | | | | |

| | | | | | | 128,316,708 | |

| | | | | | | | |

Transportation (0.34%) | | | | | |

GATX Corp. | | | 190,700 | | | | 9,567,419 | |

Union Pacific Corp. | | | 20,825 | | | | 3,374,483 | |

| | | | | | | | |

| | | | | | | 12,941,902 | |

| | | | | | | | |

Utilities & Energy (0.57%) | | | | | |

Duke Energy Corp. | | | 306,966 | | | | 21,475,341 | |

| | | | | | | | |

Total Common Stocks (cost $1,147,592,581) | | | | 3,716,562,561 | |

| | | | | | | | |

Short-term Investments (1.00%) | |

JPMorgan U.S. Government Money Market Fund | | | 37,721,085 | | | | 37,721,085 | |

| | | | | | | | |

Total Short-term Investments (cost $37,721,085) | | | | 37,721,085 | |

| | | | | | | | |

TOTAL INVESTMENTS (99.61%) (cost $1,185,313,666) | | | | 3,754,283,646 | |

OTHER ASSETS, NET OF LIABILITIES (0.39%) | | | | 14,840,402 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | | | | $ | 3,769,124,048 | |

| | | | | | | | |

| (a) | Non-income producing security. |

ADR – American Depositary Receipt

| | |

24 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS

November 30, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (59.46%) | | | | | | | | |

|

Agriculture, Foods, & Beverage (6.97%) | |

Archer-Daniels-Midland Co. | | | 940,561 | | | $ | 37,857,580 | |

Campbell Soup Co. | | | 26,000 | | | | 1,006,980 | |

Coca-Cola Co., The | | | 410,000 | | | | 16,477,900 | |

Kellogg Co. | | | 310,000 | | | | 18,798,400 | |

Nestle SA ADR | | | 252,500 | | | | 18,460,275 | |

PepsiCo Inc. | | | 110,100 | | | | 9,299,046 | |

Sysco Corp. | | | 165,300 | | | | 5,559,039 | |

| | | | | | | | |

| | | | | | | 107,459,220 | |

| | | | | | | | |

Banks (3.10%) | | | | | | | | |

M&T Bank Corp. | | | 58,300 | | | | 6,725,488 | |

Northern Trust Corp. | | | 104,700 | | | | 6,176,253 | |

U.S. Bancorp | | | 48,300 | | | | 1,894,326 | |

Wells Fargo & Co. | | | 747,600 | | | | 32,909,352 | |

| | | | | | | | |

| | | | | | | 47,705,419 | |

| | | | | | | | |

Building Materials & Construction (0.59%) | |

Vulcan Materials Co. | | | 160,200 | | | | 9,030,474 | |

| | | | | | | | |

Chemicals (6.07%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 230,000 | | | | 25,030,900 | |

Dow Chemical Co., The | | | 69,000 | | | | 2,695,140 | |

E.I. du Pont de Nemours & Co. | | | 132,105 | | | | 8,108,605 | |

International Flavors & Fragrances Inc. | | | 120,000 | | | | 10,602,000 | |

Novozymes A/S B Shares | | | 124,350 | | | | 4,809,726 | |

Sigma-Aldrich Corp. | | | 491,000 | | | | 42,343,840 | |

| | | | | | | | |

| | | | | | | 93,590,211 | |

| | | | | | | | |

Computer Software & Services (0.98%) | |

Automatic Data Processing Inc. | | | 47,400 | | | | 3,792,948 | |

Facebook Inc. Class A (a) | | | 68,950 | | | | 3,241,340 | |

Google Inc. Class A (a) | | | 3,550 | | | | 3,761,544 | |