UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01519

STATE FARM ASSOCIATES’ FUNDS TRUST

(Exact name of registrant as specified in charter)

| | |

One State Farm Plaza Bloomington, IL | | 61710-0001 |

| (Address of principal executive offices) | | (Zip code) |

| | |

| | |

| | Alan Goldberg |

| | K&L Gates LLP |

| Paul J. Smith | | Three First National Plaza |

| One State Farm Plaza | | 70 West Madison St., Suite 3100 |

| Bloomington, Illinois 61710-0001 | | Chicago, Illinois 60602 |

(Names and addresses of agents for service)

Registrant’s telephone number, including area code: 1-800-447-0740

Date of fiscal year end: 11/30/2014

Date of reporting period: 05/31/2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Before investing, consider the Funds’ investment objectives, risks, charges and expenses. Contact State Farm VP Management Corp. (1-800-447-0740) for a prospectus or summary prospectus containing this and other information. Read it carefully.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, and information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, are available without charge upon request at 1-800-447-0740 and at “http://www.sec.gov.”

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at “http://www.sec.gov.” The Funds’ Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Funds make the information on Form N-Q available to shareholders upon request without charge at 1-800-447-0740.

Any website referenced in this report is an inactive textual reference only, and information contained in or otherwise accessible through that website does not form a part of, and is not incorporated by reference into, this report.

SEMI-ANNUAL REPORT

Electronic Delivery

As a State Farm Mutual Funds shareholder, we wish to remind you that you can elect to have future Annual Reports, Semi-Annual Reports, Prospectuses, statements, and tax forms delivered electronically rather than receiving large, bulky paper reports through the mail. This is a great way to help reduce internal fund costs related to printing and mailing these materials as well as a way to be environmentally friendly. Please consider signing up for electronic delivery today by going on statefarm.com or contacting the State Farm Mutual Funds Response Center at 1-800-447-0740 for assistance.

Compensation Deduction or Automatic Investment Plan (AIP)1

State Farm Mutual Funds allow you to make regular investments in a Fund with compensation deduction (agent/employee only) or an Automatic Investment Plan through an electronic transfer of funds from your bank/credit union account. If you wish to begin compensation deduction or an Automatic Investment Plan, the minimum amount required for both initial and subsequent investments is $50. Please consider signing up today for compensation deduction by going on the State Farm intranet or signing up for AIP by contacting the State Farm Mutual Funds Response Center at 1-800-447-0740 for assistance.

| 1 | Automatic investment plans do not assure a profit or protect against loss. |

Message to Shareholders of State Farm Associates’ Funds Trust

Dear Shareholders,

Thank you for investing with State Farm Mutual Funds®. Enclosed is the Semi-Annual Report for the 6-month period ended May 31, 2014, for the State Farm Associates’ Funds Trust. We encourage your review and consideration of this entire report.

State Farm Investment Management Corp. has consistently maintained a long-term, disciplined approach to managing investment risk and providing competitive investment products that can help you, our valued shareholder, with your investment goals1. We believe that remaining focused on your long-term goals and maintaining an appropriate asset allocation mix are important elements in pursuing investment success2.

Market Review

During the 6-month period ended May 31, 2014, the equity and fixed income markets both experienced positive returns.

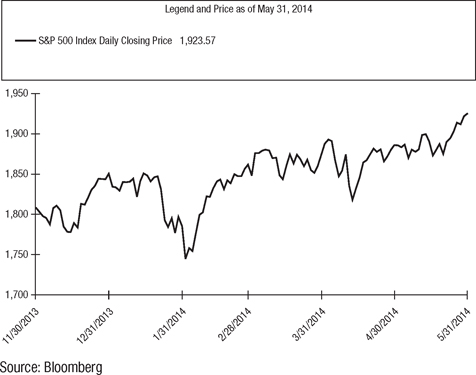

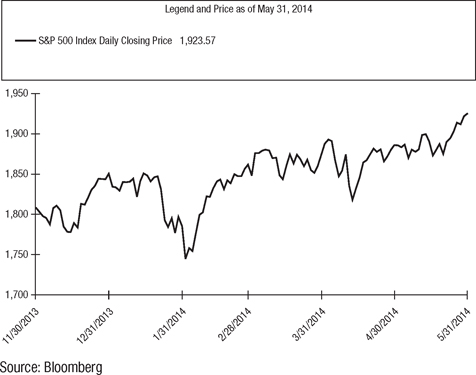

The U.S. equity markets (as represented by the S&P 500 Index3) rose in December and continued an uneven climb during the 6-month period ended May 31, 2014, as illustrated in the chart below. The S&P 500 Index achieved positive total returns for five of those six months, and suffered its only monthly decline (–3.5%) in January. Investors absorbed mixed news throughout the period to help push the S&P 500 Index total return to 7.6% for the 6-month period ended May 31, 2014, and saw the S&P 500 Index reach a new closing price high (1,923.57) at period end.

The positive factors influencing U.S. equity markets included improved corporate earnings, growing levels of business cash-on-hand, a continued trend of generally subdued inflation, and improvement in several sectors of the U.S. economy, such as labor, manufacturing, and consumer spending. In addition, the Federal Reserve (the “Fed”) continued its accommodative monetary policy, keeping the Federal Funds Rate unchanged with a target range of 0% to 0.25%.

| 1 | Investing involves risk, including potential for loss. |

| 2 | Asset allocation does not assure a profit or protect against loss. |

| 3 | Source: Standard & Poor’s. The S&P 500® Index is a capitalization-weighted measure of common stocks of 500 large U.S. companies. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

1

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

Meanwhile, political and military tensions between Russia and Ukraine provided uncertainty for the markets early in 2014, but those negative headwinds subsided as tensions eased in May. First quarter (January-March) U.S. Gross Domestic Product (GDP) was revised downward to –2.9% on an annualized basis, representing the economy’s first contraction in three years. However, for the most part, investors viewed the slowdown as temporary and attributed it to the severe ‘polar vortex’ winter weather system that affected a majority of the country, as well as to the drawdown of business inventories that had built-up in the prior year.

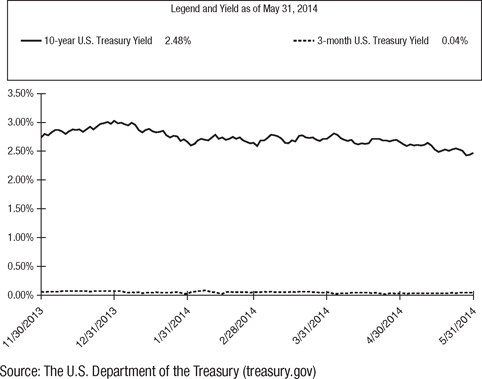

The relative strength of the bond markets surprised many in 2014 after fixed income investments in general suffered losses in the prior year, due in part, to changing interest rate expectations resulting from the Fed announcing that it would start reducing the amount of its asset-purchase programs known as “quantitative easing.”

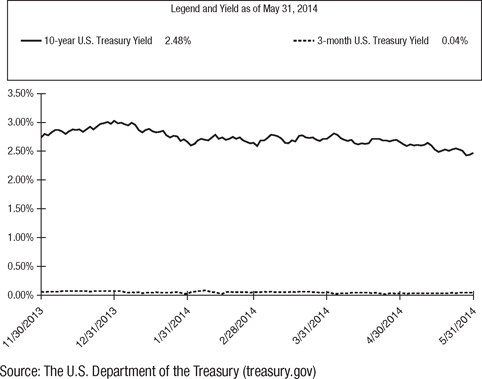

Among major fixed income indices, the Barclays 1-5 year Treasury Index4 and the Barclays 7-year Municipal Bond Index5 posted total returns of 0.41% and 3.92%, respectively, over the 6-month period ended May 31, 2014, as price increases added to bond coupon income. Meanwhile, as the chart below shows, after beginning December at 2.75% and rising above 3.0% at the end of 2013, 10-year U.S. Treasury yields decreased in early 2014 and maintained that level to finish the period ended May 31, 2014, at 2.48%6. Short-term yields remained low, with the 3-month U.S. Treasury yields starting December at 0.06%, climbing to 0.07% at the end of 2013, and settling at 0.04% for the period ended May 31, 2014.

| 4 | Source: Barclays Inc. The Barclays 1-5 Year U.S. Treasury Index measures the performance of short-term U.S. Treasury Securities maturing within one to five years. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 5 | Source: Barclays Inc. The Barclays 7-year Municipal Bond Index is an unmanaged index comprised of investment grade municipal bonds with maturities of six to eight years. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 6 | Source: The U.S. Department of the Treasury. A 10-year U.S. Treasury Bond is a debt obligation issued by the U.S. Treasury that has a term of more than one year, but not more than 10 years. A 3-month U.S. Treasury Bill is a debt obligation issued by the U.S. Treasury that has a term of 92 days or less. U.S. Treasury securities are backed by the full faith and credit of the U.S. government and are guaranteed only as to the prompt payment of principal and interest, and are subject to market risks if sold prior to maturity. Bonds have historically been less volatile than stocks, but are sensitive to changes in interest rates. Past performance does not guarantee future results. |

2

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

In December, the Fed started reducing its $85 billion per month “quantitative easing” purchases to $75 billion per month, and it repeated similar $10 billion per month reductions in January, March and April as new Fed chair Janet Yellen marked her debut with no abrupt changes in U.S. monetary policy. Despite this continued Fed tapering and evidence that the economy was on solid ground, the major U.S. fixed income markets generated positive total returns, as the demand for bonds outstripped supply during the 6-month period ended May 31, 2014.

Look for a detailed discussion of factors that impacted the performance of the Funds during the time frame of December 1, 2013 through November 30, 2014 in the State Farm Associates’ Funds Trust Annual Report.

On behalf of the entire State Farm Mutual Funds team, thank you for your continued business and allowing us to help serve your investment needs.

|

| Sincerely, |

|

|

| Joe R. Monk Jr. |

| Senior Vice President |

| State Farm Investment Management Corp. |

3

Portfolio Summary

State Farm Growth Fund

Fund Composition*

(unaudited)

| * | Illustrated by Industry and based on total net assets as of May 31, 2014. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Represents 9 other industries, each of which represents less than 5% of total net assets. |

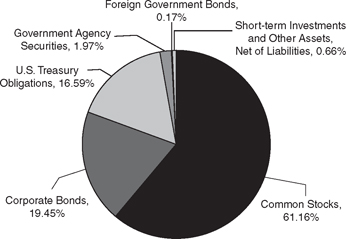

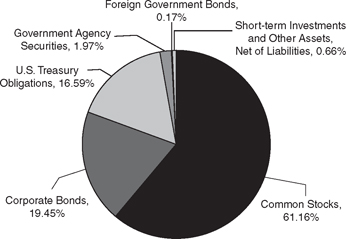

State Farm Balanced Fund

Fund Composition*

(unaudited)

| * | Illustrated by Type of Security and based on total net assets as of May 31, 2014. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

4

Portfolio Summary (continued)

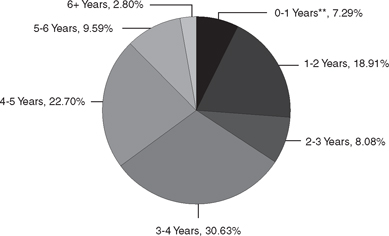

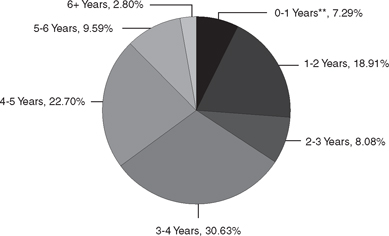

State Farm Interim Fund

Fund Composition*

(unaudited)

| * | Illustrated by Maturity and based on total investments as of May 31, 2014. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Includes a 0.21% allocation to the JPMorgan US Government Money Market Fund. |

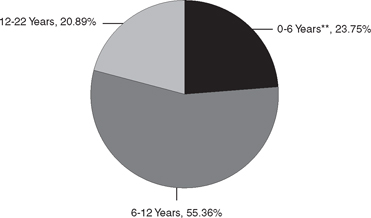

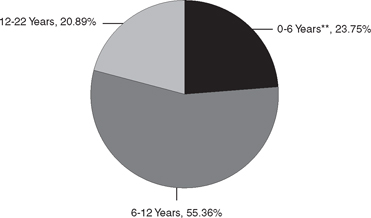

State Farm Municipal Bond Fund

Fund Composition*

(unaudited)

| * | Illustrated by Maturity and based on total investments as of May 31, 2014. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Includes a 3.07% allocation to the JPMorgan Tax Free Money Market Fund. |

5

Expense Example (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including management fees and other Fund expenses. The Example in the following table is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as stated in the table below.

Actual Expenses

The first line under each Fund name in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value for a Fund by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account for that Fund during this period. If your account has multiple Fund positions, add up the results calculated for each Fund position within your account to estimate the expenses you paid on your total account value. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second line under each Fund name in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee that you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of increasing the costs of investing.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line under each Fund name in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, including those that have transactional costs, such as sales charges (loads), redemption fees, or exchange fees.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

December 1, 2013 | | | Ending

Account Value

May 31, 2014 | | | Annualized Expense

Ratio Based

on the Period

December 1, 2013 to

May 31, 2014 | | | Expenses Paid

During Period

December 1, 2013 to

May 31, 2014* | |

State Farm Growth Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,082.93 | | | | 0.12 | % | | $ | 0.62 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.33 | | | | 0.12 | % | | $ | 0.61 | |

| | | | | | | | | | | | | | | | |

State Farm Balanced Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,071.38 | | | | 0.13 | % | | $ | 0.67 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.28 | | | | 0.13 | % | | $ | 0.66 | |

| | | | | | | | | | | | | | | | |

State Farm Interim Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,003.74 | | | | 0.16 | % | | $ | 0.80 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.13 | | | | 0.16 | % | | $ | 0.81 | |

| | | | | | | | | | | | | | | | |

State Farm Municipal Bond Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,044.61 | | | | 0.16 | % | | $ | 0.82 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.13 | | | | 0.16 | % | | $ | 0.81 | |

| | | | | | | | | | | | | | | | |

| * | Expenses are equal to the applicable Fund’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

6

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (98.08%) | | | | | | | | |

Agriculture, Foods, & Beverage (11.96%) | | | | | | | | |

Archer-Daniels-Midland Co. | | | 3,477,500 | | | $ | 156,278,850 | |

Coca-Cola Co., The | | | 2,054,600 | | | | 84,053,686 | |

Kellogg Co. | | | 930,000 | | | | 64,151,400 | |

McCormick & Company Inc. | | | 428,600 | | | | 30,992,066 | |

Nestle SA ADR | | | 1,175,800 | | | | 92,388,485 | |

PepsiCo Inc. | | | 641,400 | | | | 56,654,862 | |

| | | | | | | | |

| | | | | | | 484,519,349 | |

| | | | | | | | |

Banks (4.79%) | | | | | | | | |

M&T Bank Corp. | | | 213,400 | | | | 25,900,358 | |

Northern Trust Corp. | | | 460,500 | | | | 27,814,200 | |

U.S. Bancorp | | | 141,400 | | | | 5,965,666 | |

Wells Fargo & Co. | | | 2,643,100 | | | | 134,216,618 | |

| | | | | | | | |

| | | | | | | 193,896,842 | |

| | | | | | | | |

Building Materials & Construction (1.56%) | | | | | | | | |

Vulcan Materials Co. | | | 1,039,200 | | | | 63,360,024 | |

| | | | | | | | |

Chemicals (11.01%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 830,000 | | | | 99,575,100 | |

Croda International PLC | | | 25,800 | | | | 1,138,123 | |

E.I. du Pont de Nemours & Co. | | | 229,200 | | | | 15,885,852 | |

International Flavors & Fragrances Inc. | | | 525,000 | | | | 52,111,500 | |

Novozymes A/S B Shares | | | 135,300 | | | | 6,614,163 | |

Sigma-Aldrich Corp. | | | 2,750,000 | | | | 270,957,500 | |

| | | | | | | | |

| | | | | | | 446,282,238 | |

| | | | | | | | |

Computer Software & Services (1.40%) | | | | | | | | |

Automatic Data Processing Inc. | | | 109,900 | | | | 8,756,832 | |

Facebook Inc.

Class A (a) | | | 115,000 | | | | 7,279,500 | |

Google Inc. Class A (a) | | | 5,900 | | | | 3,372,735 | |

Google Inc. Class C (a) | | | 5,900 | | | | 3,309,782 | |

SAP AG | | | 444,800 | | | | 34,055,190 | |

| | | | | | | | |

| | | | | | | 56,774,039 | |

| | | | | | | | |

Computers (5.14%) | | | | | | | | |

Hewlett-Packard Co. | | | 3,019,400 | | | | 101,149,900 | |

International Business Machines Corp. | | | 580,000 | | | | 106,928,800 | |

| | | | | | | | |

| | | | | | | 208,078,700 | |

| | | | | | | | |

Consumer & Marketing (6.11%) | | | | | | | | |

AptarGroup Inc. | | | 677,405 | | | | 45,108,399 | |

Colgate-Palmolive Co. | | | 872,600 | | | | 59,685,840 | |

Procter & Gamble Co., The | | | 1,765,155 | | | | 142,606,872 | |

| | | | | | | | |

| | | | | | | 247,401,111 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (5.68%) | | | | | | | | |

Agilent Technologies Inc. | | | 548,071 | | | | 31,207,163 | |

Emerson Electric Co. | | | 729,400 | | | | 48,672,862 | |

General Electric Co. | | | 3,848,900 | | | | 103,112,031 | |

Linear Technology Corp. | | | 1,023,400 | | | | 47,240,144 | |

| | | | | | | | |

| | | | | | | 230,232,200 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Financial Services (0.77%) | | | | | | | | |

Berkshire Hathaway Inc. Class A (a) | | | 162 | | | $ | 31,104,000 | |

Berkshire Hathaway Inc. Class B (a) | | | 143 | | | | 18,353 | |

| | | | | | | | |

| | | | | | | 31,122,353 | |

| | | | | | | | |

Health Care (12.90%) | | | | | | | | |

Abbott Laboratories | | | 847,500 | | | | 33,908,475 | |

AbbVie Inc. | | | 847,500 | | | | 46,044,675 | |

Amgen Inc. | | | 159,250 | | | | 18,471,408 | |

Baxter International Inc. | | | 43,600 | | | | 3,244,276 | |

Eli Lilly and Co. | | | 997,000 | | | | 59,680,420 | |

Johnson & Johnson | | | 2,481,600 | | | | 251,783,136 | |

Merck & Co. Inc. | | | 296,750 | | | | 17,169,955 | |

Novo Nordisk A/S Sponsored ADR | | | 105,600 | | | | 4,464,768 | |

Pfizer Inc. | | | 2,239,031 | | | | 66,342,489 | |

Zoetis Inc. | | | 705,696 | | | | 21,664,867 | |

| | | | | | | | |

| | | | | | | 522,774,469 | |

| | | | | | | | |

Machinery & Manufacturing (7.25%) | | | | | | | | |

3M Co. | | | 564,000 | | | | 80,398,200 | |

ASML Holding NV NY Reg. Shares | | | 55,050 | | | | 4,727,694 | |

Caterpillar Inc. | | | 877,700 | | | | 89,727,271 | |

Deere & Co. | | | 42,900 | | | | 3,911,193 | |

Donaldson Company Inc. | | | 112,800 | | | | 4,594,344 | |

HNI Corp. | | | 1,439,200 | | | | 53,869,256 | |

Illinois Tool Works Inc. | | | 652,500 | | | | 56,473,875 | |

| | | | | | | | |

| | | | | | | 293,701,833 | |

| | | | | | | | |

Media & Broadcasting (5.66%) | | | | | | | | |

Walt Disney Co., The | | | 2,728,640 | | | | 229,233,046 | |

| | | | | | | | |

Mining & Metals (3.14%) | | | | | | | | |

BHP Billiton PLC | | | 941,859 | | | | 29,476,864 | |

Nucor Corp. | | | 531,200 | | | | 26,894,656 | |

Rio Tinto PLC | | | 476,280 | | | | 24,393,622 | |

Rio Tinto PLC ADR | | | 907,200 | | | | 46,611,936 | |

| | | | | | | | |

| | | | | | | 127,377,078 | |

| | | | | | | | |

Oil & Gas (13.77%) | | | | | | | | |

BG Group PLC | | | 3,199,100 | | | | 65,442,818 | |

Chevron Corp. | | | 1,060,000 | | | | 130,157,400 | |

Devon Energy Corp. | | | 212,204 | | | | 15,681,876 | |

Dril-Quip Inc. (a) | | | 16,100 | | | | 1,645,742 | |

Exxon Mobil Corp. | | | 2,615,200 | | | | 262,906,056 | |

Imperial Oil Ltd. | | | 25,300 | | | | 1,245,519 | |

Noble Energy Inc. | | | 89,300 | | | | 6,435,851 | |

Royal Dutch Shell PLC ADR Class A | | | 487,900 | | | | 38,348,940 | |

Schlumberger Ltd. | | | 113,200 | | | | 11,777,328 | |

Spectra Energy Corp. | | | 399,950 | | | | 16,229,971 | |

Tidewater Inc. | | | 154,191 | | | | 8,036,435 | |

| | | | | | | | |

| | | | | | | 557,907,936 | |

| | | | | | | | |

Retailers (2.54%) | | | | | | | | |

Wal-Mart Stores Inc. | | | 1,339,100 | | | | 102,802,707 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 7 |

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Telecom & Telecom Equipment (3.32%) | | | | | | | | |

AT&T Inc. | | | 2,140,534 | | | $ | 75,924,741 | |

Corning Inc. | | | 1,284,600 | | | | 27,361,980 | |

Verizon Communications Inc. | | | 624,900 | | | | 31,220,004 | |

| | | | | | | | |

| | | | | | | 134,506,725 | |

| | | | | | | | |

Transportation (0.54%) | | | | | | | | |

GATX Corp. | | | 190,700 | | | | 12,557,595 | |

Union Pacific Corp. | | | 47,575 | | | | 9,480,270 | |

| | | | | | | | |

| | | | | | | 22,037,865 | |

| | | | | | | | |

Utilities & Energy (0.54%) | | | | | | | | |

Duke Energy Corp. | | | 306,966 | | | | 21,819,143 | |

| | | | | | | | |

Total Common Stocks | | | | | | | | |

(cost $1,141,888,707) | | | | | | | 3,973,827,658 | |

| | | | | | | | |

Short-term Investments (1.57%) | | | | | | | | |

JPMorgan U.S. Government Money Market Fund | | | 63,624,434 | | | | 63,624,434 | |

| | | | | | | | |

Total Short-term Investments | | | | | | | | |

(cost $63,624,434) | | | | | | | 63,624,434 | |

| | | | | | | | |

TOTAL INVESTMENTS (99.65%) | | | | | | | | |

(cost $1,205,513,141) | | | | | | | 4,037,452,092 | |

OTHER ASSETS, NET OF LIABILITIES (0.35%) | | | | | | | 14,304,955 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | | | | $ | 4,051,757,047 | |

| | | | | | | | |

| (a) | Non-income producing security. |

ADR - American Depositary Receipt

| | |

| 8 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (61.16%) | | | | | | | | |

Agriculture, Foods, & Beverage (7.17%) | | | | | | | | |

Archer-Daniels-Midland Co. | | | 940,561 | | | $ | 42,268,811 | |

Campbell Soup Co. | | | 26,000 | | | | 1,193,400 | |

Coca-Cola Co., The | | | 410,000 | | | | 16,773,100 | |

Kellogg Co. | | | 310,000 | | | | 21,383,800 | |

Nestle SA ADR | | | 252,500 | | | | 19,840,188 | |

PepsiCo Inc. | | | 110,100 | | | | 9,725,133 | |

Sysco Corp. | | | 165,300 | | | | 6,203,709 | |

| | | | | | | | |

| | | | | | | 117,388,141 | |

| | | | | | | | |

Banks (3.26%) | | | | | | | | |

M&T Bank Corp. | | | 58,300 | | | | 7,075,871 | |

Northern Trust Corp. | | | 104,700 | | | | 6,323,880 | |

U.S. Bancorp | | | 48,300 | | | | 2,037,777 | |

Wells Fargo & Co. | | | 747,600 | | | | 37,963,128 | |

| | | | | | | | |

| | | | | | | 53,400,656 | |

| | | | | | | | |

Building Materials & Construction (0.60%) | | | | | | | | |

Vulcan Materials Co. | | | 160,200 | | | | 9,767,394 | |

| | | | | | | | |

Chemicals (6.52%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 230,000 | | | | 27,593,100 | |

Dow Chemical Co., The | | | 69,000 | | | | 3,596,280 | |

E.I. du Pont de Nemours & Co. | | | 132,105 | | | | 9,156,198 | |

International Flavors & Fragrances Inc. | | | 120,000 | | | | 11,911,200 | |

Novozymes A/S B Shares | | | 124,350 | | | | 6,078,871 | |

Sigma-Aldrich Corp. | | | 491,000 | | | | 48,378,230 | |

| | | | | | | | |

| | | | | | | 106,713,879 | |

| | | | | | | | |

Computer Software & Services (0.99%) | | | | | | | | |

Automatic Data Processing Inc. | | | 47,400 | | | | 3,776,832 | |

Facebook Inc. Class A (a) | | | 68,950 | | | | 4,364,535 | |

Google Inc. Class A (a) | | | 3,550 | | | | 2,029,358 | |

Google Inc. Class C (a) | | | 3,550 | | | | 1,991,479 | |

SAP AG | | | 52,800 | | | | 4,042,523 | |

| | | | | | | | |

| | | | | | | 16,204,727 | |

| | | | | | | | |

Computers (3.26%) | | | | | | | | |

Hewlett-Packard Co. | | | 754,000 | | | | 25,259,000 | |

International Business Machines Corp. | | | 152,100 | | | | 28,041,156 | |

| | | | | | | | |

| | | | | | | 53,300,156 | |

| | | | | | | | |

Consumer & Marketing (3.24%) | | | | | | | | |

AptarGroup Inc. | | | 134,100 | | | | 8,929,719 | |

Colgate-Palmolive Co. | | | 80,000 | | | | 5,472,000 | |

Procter & Gamble Co., The | | | 477,700 | | | | 38,593,383 | |

| | | | | | | | |

| | | | | | | 52,995,102 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (2.75%) | | | | | | | | |

Agilent Technologies Inc. | | | 143,787 | | | | 8,187,232 | |

Emerson Electric Co. | | | 98,600 | | | | 6,579,578 | |

General Electric Co. | | | 796,300 | | | | 21,332,877 | |

KLA-Tencor Corp. | | | 45,100 | | | | 2,954,952 | |

Linear Technology Corp. | | | 130,100 | | | | 6,005,416 | |

| | | | | | | | |

| | | | | | | 45,060,055 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Financial Services (0.40%) | | | | | | | | |

Berkshire Hathaway Inc. Class A (a) | | | 34 | | | $ | 6,528,000 | |

Berkshire Hathaway Inc. Class B (a) | | | 533 | | | | 68,405 | |

| | | | | | | | |

| | | | | | | 6,596,405 | |

| | | | | | | | |

Health Care (8.90%) | | | | | | | | |

Abbott Laboratories | | | 92,000 | | | | 3,680,920 | |

AbbVie Inc. | | | 92,000 | | | | 4,998,360 | |

Allergan Inc. | | | 154,800 | | | | 25,922,808 | |

Amgen Inc. | | | 70,750 | | | | 8,206,292 | |

Baxter International Inc. | | | 29,100 | | | | 2,165,331 | |

Eli Lilly and Co. | | | 212,000 | | | | 12,690,320 | |

Johnson & Johnson | | | 417,700 | | | | 42,379,842 | |

Medtronic Inc. | | | 21,600 | | | | 1,318,248 | |

Merck & Co. Inc. | | | 103,200 | | | | 5,971,152 | |

Novo Nordisk A/S Sponsored ADR | | | 107,700 | | | | 4,553,556 | |

Pfizer Inc. | | | 728,140 | | | | 21,574,788 | |

Teva Pharmaceutical Industries Ltd. Sponsored ADR | | | 103,900 | | | | 5,245,911 | |

Zoetis Inc. | | | 229,495 | | | | 7,045,496 | |

| | | | | | | | |

| | | | | | | 145,753,024 | |

| | | | | | | | |

Machinery & Manufacturing (4.45%) | | | | | | | | |

3M Co. | | | 124,600 | | | | 17,761,728 | |

ASML Holding NV NY Reg. Shares | | | 32,500 | | | | 2,791,100 | |

Caterpillar Inc. | | | 262,400 | | | | 26,825,152 | |

Deere & Co. | | | 38,700 | | | | 3,528,279 | |

Donaldson Company Inc. | | | 115,800 | | | | 4,716,534 | |

HNI Corp. | | | 160,000 | | | | 5,988,800 | |

Illinois Tool Works Inc. | | | 130,600 | | | | 11,303,430 | |

| | | | | | | | |

| | | | | | | 72,915,023 | |

| | | | | | | | |

Media & Broadcasting (5.49%) | | | | | | | | |

Lee Enterprises Inc. Class A (a) | | | 84,000 | | | | 342,720 | |

Walt Disney Co., The | | | 1,065,995 | | | | 89,554,240 | |

| | | | | | | | |

| | | | | | | 89,896,960 | |

| | | | | | | | |

Mining & Metals (3.12%) | | | | | | | | |

BHP Billiton PLC | | | 169,900 | | | | 5,317,271 | |

Newmont Mining Corp. | | | 29,200 | | | | 668,388 | |

Nucor Corp. | | | 436,800 | | | | 22,115,184 | |

Rio Tinto PLC | | | 153,825 | | | | 7,878,452 | |

Rio Tinto PLC ADR | | | 293,000 | | | | 15,054,340 | |

| | | | | | | | |

| | | | | | | 51,033,635 | |

| | | | | | | | |

Oil & Gas (7.15%) | | | | | | | | |

BG Group PLC | | | 256,800 | | | | 5,253,264 | |

Chevron Corp. | | | 288,000 | | | | 35,363,520 | |

Devon Energy Corp. | | | 76,170 | | | | 5,628,963 | |

Exxon Mobil Corp. | | | 448,000 | | | | 45,037,440 | |

Noble Energy Inc. | | | 39,800 | | | | 2,868,386 | |

Royal Dutch Shell PLC ADR Class A | | | 216,400 | | | | 17,009,040 | |

Schlumberger Ltd. | | | 25,900 | | | | 2,694,636 | |

Spectra Energy Corp. | | | 79,650 | | | | 3,232,197 | |

| | | | | | | | |

| | | | | | | 117,087,446 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 9 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Retailers (1.30%) | | | | | | | | |

Wal-Mart Stores Inc. | | | 276,700 | | | $ | 21,242,259 | |

| | | | | | | | |

Telecom & Telecom Equipment (1.82%) | | | | | | | | |

AT&T Inc. | | | 533,359 | | | | 18,918,244 | |

Corning Inc. | | | 372,300 | | | | 7,929,990 | |

Verizon Communications Inc. | | | 57,800 | | | | 2,887,688 | |

| | | | | | | | |

| | | | | | | 29,735,922 | |

| | | | | | | | |

Transportation (0.43%) | | | | | | | | |

GATX Corp. | | | 68,200 | | | | 4,490,970 | |

Union Pacific Corp. | | | 12,825 | | | | 2,555,638 | |

| | | | | | | | |

| | | | | | | 7,046,608 | |

| | | | | | | | |

Utilities & Energy (0.31%) | | | | | | | | |

Duke Energy Corp. | | | 72,333 | | | | 5,141,430 | |

| | | | | | | | |

Total Common Stocks | | | | | | | | |

(cost $299,557,418) | | | | | | | 1,001,278,822 | |

| | | | | | | | |

| | |

| | | Principal

amount | | | Value | |

Corporate Bonds (19.45%) | | | | | | | | |

Aerospace/Defense (0.06%) | | | | | | | | |

Lockheed Martin Corp. | | | | | | | | |

3.350%, 09/15/2021 | | $ | 1,000,000 | | | $ | 1,046,234 | |

| | | | | | | | |

Agriculture, Foods, & Beverage (1.41%) | | | | | | | | |

General Mills Inc. | | | | | | | | |

5.200%, 03/17/2015 | | | 500,000 | | | | 518,459 | |

Bottling Group LLC | | | | | | | | |

5.500%, 04/01/2016 | | | 1,000,000 | | | | 1,089,792 | |

Hershey Co. | | | | | | | | |

5.450%, 09/01/2016 | | | 500,000 | | | | 552,514 | |

Kraft Foods Inc. | | | | | | | | |

6.500%, 08/11/2017 | | | 1,000,000 | | | | 1,154,366 | |

Coca-Cola Co., The | | | | | | | | |

5.350%, 11/15/2017 | | | 2,000,000 | | | | 2,283,260 | |

Sysco Corp. | | | | | | | | |

5.250%, 02/12/2018 | | | 1,000,000 | | | | 1,126,110 | |

Pepsico Inc. | | | | | | | | |

5.000%, 06/01/2018 | | | 1,000,000 | | | | 1,131,492 | |

Coca-Cola Co., The | | | | | | | | |

2.450%, 11/01/2020 | | | 1,000,000 | | | | 1,010,831 | |

Kellogg Co. | | | | | | | | |

4.000%, 12/15/2020 | | | 2,000,000 | | | | 2,129,124 | |

Pepsico Inc. | | | | | | | | |

2.750%, 03/05/2022 | | | 1,000,000 | | | | 989,133 | |

Kellogg Co. | | | | | | | | |

3.125%, 05/17/2022 | | | 1,000,000 | | | | 1,004,744 | |

Sysco Corp. | | | | | | | | |

2.600%, 06/12/2022 | | | 1,000,000 | | | | 968,380 | |

Campbell Soup Co. | | | | | | | | |

2.500%, 08/02/2022 | | | 1,000,000 | | | | 943,341 | |

Kellogg Co. | | | | | | | | |

2.750%, 03/01/2023 | | | 1,000,000 | | | | 963,876 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Agriculture, Foods, & Beverage (Cont.) | | | | | | | | |

Pepsico Inc. | | | | | | | | |

2.750%, 03/01/2023 | | $ | 1,000,000 | | | $ | 973,561 | |

Coca-Cola Co., The | | | | | | | | |

2.500%, 04/01/2023 | | | 2,000,000 | | | | 1,930,900 | |

Hershey Co. | | | | | | | | |

2.625%, 05/01/2023 | | | 1,300,000 | | | | 1,262,396 | |

Mondelez International Inc. | | | | | | | | |

4.000%, 02/01/2024 | | | 1,000,000 | | | | 1,035,127 | |

General Mills Inc. | | | | | | | | |

3.650%, 02/15/2024 | | | 1,000,000 | | | | 1,028,419 | |

Pepsico Inc. | | | | | | | | |

3.600%, 03/01/2024 | | | 1,000,000 | | | | 1,027,783 | |

| | | | | | | | |

| | | | | | | 23,123,608 | |

| | | | | | | | |

Automotive (0.44%) | | | | | | | | |

American Honda Finance Corp. | | | | | | | | |

2.125%, 10/10/2018 | | | 500,000 | | | | 509,138 | |

Toyota Motor Credit Corp. | | | | | | | | |

2.000%, 10/24/2018 | | | 1,000,000 | | | | 1,014,443 | |

2.100%, 01/17/2019 | | | 500,000 | | | | 506,010 | |

Johnson Controls Inc. | | | | | | | | |

4.250%, 03/01/2021 | | | 2,000,000 | | | | 2,174,760 | |

Toyota Motor Credit Corp. | | | | | | | | |

2.750%, 05/17/2021 | | | 1,000,000 | | | | 1,012,900 | |

3.300%, 01/12/2022 | | | 1,000,000 | | | | 1,030,057 | |

2.625%, 01/10/2023 | | | 1,000,000 | | | | 974,177 | |

| | | | | | | | |

| | | | | | | 7,221,485 | |

| | | | | | | | |

Banks (0.80%) | | | | | | | | |

US Bank NA | | | | | | | | |

4.950%, 10/30/2014 | | | 1,500,000 | | | | 1,529,109 | |

Wachovia Bank NA | | | | | | | | |

5.600%, 03/15/2016 | | | 750,000 | | | | 813,676 | |

Bank of America NA | | | | | | | | |

6.000%, 06/15/2016 | | | 1,000,000 | | | | 1,097,102 | |

5.300%, 03/15/2017 | | | 500,000 | | | | 551,000 | |

Wachovia Corp. | | | | | | | | |

5.750%, 06/15/2017 | | | 750,000 | | | | 850,354 | |

Wachovia Bank NA | | | | | | | | |

6.000%, 11/15/2017 | | | 500,000 | | | | 575,354 | |

Wells Fargo & Co. | | | | | | | | |

5.625%, 12/11/2017 | | | 500,000 | | | | 569,198 | |

Bank of New York Mellon Corp. | | | | | | | | |

2.100%, 08/01/2018 | | | 1,000,000 | | | | 1,015,402 | |

US Bancorp | | | | | | | | |

1.950%, 11/15/2018 | | | 1,000,000 | | | | 1,008,483 | |

Wells Fargo & Co. | | | | | | | | |

2.150%, 01/15/2019 | | | 500,000 | | | | 505,552 | |

Bank of New York Mellon Corp. | | | | | | | | |

2.200%, 03/04/2019 | | | 1,000,000 | | | | 1,010,301 | |

Wells Fargo & Co. | | | | | | | | |

3.000%, 01/22/2021 | | | 1,000,000 | | | | 1,020,840 | |

| | |

| 10 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Banks (Cont.) | | | | | | | | |

US Bancorp | | | | | | | | |

3.000%, 03/15/2022 | | $ | 1,000,000 | | | $ | 1,011,863 | |

3.700%, 01/30/2024 | | | 500,000 | | | | 520,996 | |

Bank of New York Mellon Corp. | | | | | | | | |

3.650%, 02/04/2024 | | | 1,000,000 | | | | 1,034,604 | |

| | | | | | | | |

| | | | | | | 13,113,834 | |

| | | | | | | | |

Chemicals (0.50%) | | | | | | | | |

Praxair Inc. | | | | | | | | |

4.625%, 03/30/2015 | | | 1,000,000 | | | | 1,035,588 | |

5.375%, 11/01/2016 | | | 1,000,000 | | | | 1,100,613 | |

Monsanto Co. | | | | | | | | |

1.850%, 11/15/2018 | | | 500,000 | | | | 501,333 | |

Praxair Inc. | | | | | | | | |

2.450%, 02/15/2022 | | | 2,000,000 | | | | 1,929,240 | |

Monsanto Co. | | | | | | | | |

2.200%, 07/15/2022 | | | 1,300,000 | | | | 1,237,587 | |

PPG Industries Inc. | | | | | | | | |

2.700%, 08/15/2022 | | | 500,000 | | | | 483,238 | |

E.I. du Pont de Nemours and Co. | | | | | | | | |

2.800%, 02/15/2023 | | | 1,000,000 | | | | 978,962 | |

Praxair Inc. | | | | | | | | |

2.700%, 02/21/2023 | | | 1,000,000 | | | | 978,836 | |

| | | | | | | | |

| | | | | | | 8,245,397 | |

| | | | | | | | |

Commercial Service/Supply (0.16%) | | | | | | | | |

Pitney Bowes Inc. | | | | | | | | |

5.750%, 09/15/2017 | | | 500,000 | | | | 562,836 | |

Cintas Corp. No. 2 | | | | | | | | |

3.250%, 06/01/2022 | | | 2,000,000 | | | | 1,998,988 | |

| | | | | | | | |

| | | | | | | 2,561,824 | |

| | | | | | | | |

Computer Software & Services (0.79%) | | | | | | | | |

Oracle Corp. | | | | | | | | |

2.375%, 01/15/2019 | | | 1,000,000 | | | | 1,024,120 | |

Microsoft Corp. | | | | | | | | |

4.000%, 02/08/2021 | | | 2,000,000 | | | | 2,210,972 | |

2.125%, 11/15/2022 | | | 2,000,000 | | | | 1,909,662 | |

Intel Corp. | | | | | | | | |

2.700%, 12/15/2022 | | | 2,000,000 | | | | 1,951,112 | |

Microsoft Corp. | | | | | | | | |

2.375%, 05/01/2023 | | | 1,000,000 | | | | 962,298 | |

Texas Instruments Inc. | | | | | | | | |

2.250%, 05/01/2023 | | | 3,000,000 | | | | 2,801,181 | |

Oracle Corp. | | | | | | | | |

3.625%, 07/15/2023 | | | 1,000,000 | | | | 1,035,970 | |

Google Inc. | | | | | | | | |

3.375%, 02/25/2024 | | | 1,000,000 | | | | 1,027,378 | |

| | | | | | | | |

| | | | | | | 12,922,693 | |

| | | | | | | | |

Computers (0.37%) | | | | | | | | |

International Business Machines Corp. | | | | | | | | |

5.700%, 09/14/2017 | | | 1,000,000 | | | | 1,143,578 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Computers (Cont.) | | | | | | | | |

1.875%, 05/15/2019 | | $ | 3,000,000 | | | $ | 3,001,077 | |

1.625%, 05/15/2020 | | | 2,000,000 | | | | 1,919,164 | |

| | | | | | | | |

| | | | | | | 6,063,819 | |

| | | | | | | | |

Consumer & Marketing (1.54%) | | | | | | | | |

Ecolab Inc. | | | | | | | | |

4.875%, 02/15/2015 | | | 1,000,000 | | | | 1,029,134 | |

Procter & Gamble Co., The | | | | | | | | |

3.150%, 09/01/2015 | | | 2,000,000 | | | | 2,071,142 | |

Kimberly-Clark Corp. | | | | | | | | |

6.125%, 08/01/2017 | | | 1,500,000 | | | | 1,732,926 | |

Danaher Corp. | | | | | | | | |

5.625%, 01/15/2018 | | | 1,000,000 | | | | 1,145,803 | |

McDonald’s Corp. | | | | | | | | |

5.350%, 03/01/2018 | | | 1,000,000 | | | | 1,143,193 | |

Unilever Capital Corp. | | | | | | | | |

2.200%, 03/06/2019 | | | 1,000,000 | | | | 1,017,348 | |

Kimberly-Clark Corp. | | | | | | | | |

1.900%, 05/22/2019 | | | 500,000 | | | | 501,008 | |

Unilever Capital Corp. | | | | | | | | |

4.250%, 02/10/2021 | | | 3,000,000 | | | | 3,315,900 | |

McDonald’s Corp. | | | | | | | | |

3.625%, 05/20/2021 | | | 2,000,000 | | | | 2,137,280 | |

2.625%, 01/15/2022 | | | 1,000,000 | | | | 988,248 | |

Procter & Gamble Co., The | | | | | | | | |

2.300%, 02/06/2022 | | | 1,000,000 | | | | 976,018 | |

Colgate-Palmolive Co. | | | | | | | | |

2.300%, 05/03/2022 | | | 2,000,000 | | | | 1,954,894 | |

1.950%, 02/01/2023 | | | 1,000,000 | | | | 923,541 | |

2.100%, 05/01/2023 | | | 2,000,000 | | | | 1,868,070 | |

NIKE Inc. | | | | | | | | |

2.250%, 05/01/2023 | | | 1,500,000 | | | | 1,420,832 | |

Kimberly-Clark Corp. | | | | | | | | |

2.400%, 06/01/2023 | | | 1,000,000 | | | | 953,231 | |

Procter & Gamble Co., The | | | | | | | | |

3.100%, 08/15/2023 | | | 2,000,000 | | | | 2,021,186 | |

| | | | | | | | |

| | | | | | | 25,199,754 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (0.29%) | | | | | | | | |

Emerson Electric Co. | | | | | | | | |

5.375%, 10/15/2017 | | | 1,000,000 | | | | 1,133,058 | |

5.250%, 10/15/2018 | | | 500,000 | | | | 575,540 | |

General Electric Co. | | | | | | | | |

2.700%, 10/09/2022 | | | 1,000,000 | | | | 985,450 | |

Emerson Electric Co. | | | | | | | | |

2.625%, 02/15/2023 | | | 1,000,000 | | | | 976,168 | |

General Electric Co. | | | | | | | | |

3.375%, 03/11/2024 | | | 1,000,000 | | | | 1,018,998 | |

| | | | | | | | |

| | | | | | | 4,689,214 | |

| | | | | | | | |

Financial Services (0.50%) | | | | | | | | |

JPMorgan Chase Bank NA | | | | | | | | |

5.875%, 06/13/2016 | | | 500,000 | | | | 549,080 | |

| | |

| See accompanying notes to financial statements. | | 11 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Financial Services (Cont.) | | | | | | | | |

General Electric Capital Corp. | | | | | | | | |

5.375%, 10/20/2016 | | $ | 500,000 | | | $ | 552,914 | |

5.400%, 02/15/2017 | | | 500,000 | | | | 557,717 | |

5.625%, 09/15/2017 | | | 500,000 | | | | 567,015 | |

JPMorgan Chase Bank NA | | | | | | | | |

6.000%, 10/01/2017 | | | 1,500,000 | | | | 1,709,826 | |

General Electric Capital Corp. | | | | | | | | |

5.625%, 05/01/2018 | | | 500,000 | | | | 574,566 | |

JPMorgan Chase & Co. | | | | | | | | |

4.500%, 01/24/2022 | | | 1,000,000 | | | | 1,093,317 | |

General Electric Capital Corp. | | | | | | | | |

3.150%, 09/07/2022 | | | 1,000,000 | | | | 1,011,807 | |

JPMorgan Chase & Co. | | | | | | | | |

3.200%, 01/25/2023 | | | 1,000,000 | | | | 991,229 | |

3.625%, 05/13/2024 | | | 500,000 | | | | 503,644 | |

| | | | | | | | |

| | | | | | | 8,111,115 | |

| | | | | | | | |

Health Care (2.26%) | | | | | | | | |

AstraZeneca PLC | | | | | | | | |

5.400%, 06/01/2014 | | | 2,000,000 | | | | 2,000,000 | |

Baxter International Inc. | | | | | | | | |

1.850%, 01/15/2017 | | | 1,000,000 | | | | 1,024,283 | |

Eli Lilly and Co. | | | | | | | | |

5.200%, 03/15/2017 | | | 1,000,000 | | | | 1,113,775 | |

Amgen Inc. | | | | | | | | |

5.850%, 06/01/2017 | | | 1,000,000 | | | | 1,130,321 | |

Johnson & Johnson | | | | | | | | |

5.550%, 08/15/2017 | | | 1,000,000 | | | | 1,144,587 | |

AstraZeneca PLC | | | | | | | | |

5.900%, 09/15/2017 | | | 750,000 | | | | 860,752 | |

GlaxoSmithKline Capital Inc. | | | | | | | | |

5.650%, 05/15/2018 | | | 1,000,000 | | | | 1,155,254 | |

Baxter International Inc. | | | | | | | | |

5.375%, 06/01/2018 | | | 2,000,000 | | | | 2,283,550 | |

Eli Lilly and Co. | | | | | | | | |

1.950%, 03/15/2019 | | | 1,000,000 | | | | 1,003,750 | |

Pfizer Inc. | | | | | | | | |

2.100%, 05/15/2019 | | | 1,000,000 | | | | 1,008,108 | |

Amgen Inc. | | | | | | | | |

2.200%, 05/22/2019 | | | 1,000,000 | | | | 1,000,590 | |

AstraZeneca PLC | | | | | | | | |

1.950%, 09/18/2019 | | | 500,000 | | | | 498,314 | |

Becton Dickinson & Co. | | | | | | | | |

3.125%, 11/08/2021 | | | 1,000,000 | | | | 1,029,288 | |

Medtronic Inc. | | | | | | | | |

3.125%, 03/15/2022 | | | 2,000,000 | | | | 2,040,134 | |

Bristol-Myers Squibb Co. | | | | | | | | |

2.000%, 08/01/2022 | | | 1,500,000 | | | | 1,394,498 | |

Baxter International Inc. | | | | | | | | |

2.400%, 08/15/2022 | | | 1,000,000 | | | | 946,359 | |

Merck & Co. Inc. | | | | | | | | |

2.400%, 09/15/2022 | | | 1,000,000 | | | | 958,605 | |

Novartis Capital Corp. | | | | | | | | |

2.400%, 09/21/2022 | | | 2,000,000 | | | | 1,929,956 | |

GlaxoSmithKline Capital Inc. | | | | | | | | |

2.800%, 03/18/2023 | | | 1,000,000 | | | | 977,258 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Health Care (Cont.) | | | | | | | | |

Medtronic Inc. | | | | | | | | |

2.750%, 04/01/2023 | | $ | 500,000 | | | $ | 486,672 | |

Merck & Co. Inc. | | | | | | | | |

2.800%, 05/18/2023 | | | 3,000,000 | | | | 2,935,308 | |

Baxter International Inc. | | | | | | | | |

3.200%, 06/15/2023 | | | 1,000,000 | | | | 993,226 | |

Pfizer Inc. | | | | | | | | |

3.000%, 06/15/2023 | | | 2,000,000 | | | | 1,987,892 | |

Johnson & Johnson | | | | | | | | |

3.375%, 12/05/2023 | | | 1,500,000 | | | | 1,571,883 | |

Medtronic Inc. | | | | | | | | |

3.625%, 03/15/2024 | | | 1,000,000 | | | | 1,036,548 | |

Novartis Capital Corp. | | | | | | | | |

3.400%, 05/06/2024 | | | 1,500,000 | | | | 1,529,506 | |

Pfizer Inc. | | | | | | | | |

3.400%, 05/15/2024 | | | 1,000,000 | | | | 1,017,150 | |

Stryker Corp. | | | | | | | | |

3.375%, 05/15/2024 | | | 1,000,000 | | | | 998,943 | |

Amgen Inc. | | | | | | | | |

3.625%, 05/22/2024 | | | 1,000,000 | | | | 1,009,647 | |

| | | | | | | | |

| | | | | | | 37,066,157 | |

| | | | | | | | |

Machinery & Manufacturing (1.71%) | | | | | | | | |

Cooper U.S. Inc. | | | | | | | | |

5.450%, 04/01/2015 | | | 500,000 | | | | 520,441 | |

Ingersoll-Rand Co. Ltd. | | | | | | | | |

4.750%, 05/15/2015 | | | 1,000,000 | | | | 1,039,642 | |

Eaton Corp. | | | | | | | | |

5.300%, 03/15/2017 | | | 1,500,000 | | | | 1,649,120 | |

John Deere Capital Corp. | | | | | | | | |

5.500%, 04/13/2017 | | | 1,000,000 | | | | 1,125,039 | |

Cooper U.S. Inc. | | | | | | | | |

6.100%, 07/01/2017 | | | 1,000,000 | | | | 1,129,734 | |

United Technologies Corp. | | | | | | | | |

5.375%, 12/15/2017 | | | 1,500,000 | | | | 1,711,500 | |

Dover Corp. | | | | | | | | |

5.450%, 03/15/2018 | | | 1,000,000 | | | | 1,135,255 | |

Caterpillar Financial Services Corp. | | | | | | | | |

5.450%, 04/15/2018 | | | 1,000,000 | | | | 1,145,000 | |

3M Co. | | | | | | | | |

1.625%, 06/15/2019 | | | 2,000,000 | | | | 1,985,322 | |

John Deere Capital Corp. | | | | | | | | |

2.800%, 03/04/2021 | | | 500,000 | | | | 507,782 | |

Caterpillar Inc. | | | | | | | | |

3.900%, 05/27/2021 | | | 2,000,000 | | | | 2,169,940 | |

John Deere Capital Corp. | | | | | | | | |

2.750%, 03/15/2022 | | | 1,000,000 | | | | 992,544 | |

Caterpillar Financial Services Corp. | | | | | | | | |

2.850%, 06/01/2022 | | | 1,000,000 | | | | 995,945 | |

United Technologies Corp. | | | | | | | | |

3.100%, 06/01/2022 | | | 1,000,000 | | | | 1,020,828 | |

Deere & Co. | | | | | | | | |

2.600%, 06/08/2022 | | | 2,000,000 | | | | 1,954,964 | |

Covidien International | | | | | | | | |

3.200%, 06/15/2022 | | | 2,000,000 | | | | 2,023,034 | |

| | |

| 12 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Machinery & Manufacturing (Cont.) | | | | | | | | |

3M Co. | | | | | | | | |

2.000%, 06/26/2022 | | $ | 1,500,000 | | | $ | 1,428,879 | |

Thermo Fisher Scientific Inc. | | | | | | | | |

3.150%, 01/15/2023 | | | 1,000,000 | | | | 991,981 | |

Caterpillar Financial Services Corp. | | | | | | | | |

2.625%, 03/01/2023 | | | 1,000,000 | | | | 967,039 | |

Covidien International | | | | | | | | |

2.950%, 06/15/2023 | | | 1,000,000 | | | | 974,594 | |

Total Capital Canada Ltd. | | | | | | | | |

2.750%, 07/15/2023 | | | 500,000 | | | | 484,360 | |

Honeywell International Inc. | | | | | | | | |

3.350%, 12/01/2023 | | | 1,000,000 | | | | 1,022,304 | |

Caterpillar Inc. | | | | | | | | |

3.400%, 05/15/2024 | | | 1,000,000 | | | | 1,015,126 | |

| | | | | | | | |

| | | | | | | 27,990,373 | |

| | | | | | | | |

Media & Broadcasting (0.44%) | | | | | | | | |

Walt Disney Co., The | | | | | | | | |

6.000%, 07/17/2017 | | | 1,000,000 | | | | 1,149,252 | |

1.850%, 05/30/2019 | | | 2,000,000 | | | | 1,995,520 | |

Comcast Corp. | | | | | | | | |

3.125%, 07/15/2022 | | | 2,000,000 | | | | 2,035,596 | |

Reed Elsevier Capital | | | | | | | | |

3.125%, 10/15/2022 | | | 1,000,000 | | | | 983,163 | |

Comcast Corp. | | | | | | | | |

3.600%, 03/01/2024 | | | 1,000,000 | | | | 1,033,449 | |

| | | | | | | | |

| | | | | | | 7,196,980 | |

| | | | | | | | |

Mining & Metals (0.59%) | | | | | | | | |

BHP Billiton Finance USA Ltd. | | | | | | | | |

5.250%, 12/15/2015 | | | 2,000,000 | | | | 2,148,562 | |

5.400%, 03/29/2017 | | | 500,000 | | | | 560,890 | |

Rio Tinto Finance USA PLC | | | | | | | | |

2.250%, 12/14/2018 | | | 500,000 | | | | 507,398 | |

Alcoa Inc. | | | | | | | | |

5.720%, 02/23/2019 | | | 2,244,000 | | | | 2,476,593 | |

Rio Tinto Finance USA Ltd. | | | | | | | | |

3.500%, 11/02/2020 | | | 500,000 | | | | 522,876 | |

BHP Billiton Finance USA Ltd. | | | | | | | | |

3.250%, 11/21/2021 | | | 1,000,000 | | | | 1,033,031 | |

Alcoa Inc. | | | | | | | | |

5.870%, 02/23/2022 | | | 756,000 | | | | 819,920 | |

Rio Tinto Finance USA PLC | | | | | | | | |

2.875%, 08/21/2022 | | | 1,000,000 | | | | 974,736 | |

BHP Billiton Finance USA Ltd. | | | | | | | | |

3.850%, 09/30/2023 | | | 500,000 | | | | 525,292 | |

| | | | | | | | |

| | | | | | | 9,569,298 | |

| | | | | | | | |

Oil & Gas (1.67%) | | | | | | | | |

ConocoPhillips Canada | | | | | | | | |

5.625%, 10/15/2016 | | | 500,000 | | | | 558,153 | |

Shell International Finance | | | | | | | | |

5.200%, 03/22/2017 | | | 1,000,000 | | | | 1,117,801 | |

Total Capital International SA | | | | | | | | |

1.550%, 06/28/2017 | | | 1,500,000 | | | | 1,521,766 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Oil & Gas (Cont.) | | | | | | | | |

Marathon Oil Corp. | | | | | | | | |

5.900%, 03/15/2018 | | $ | 1,000,000 | | | $ | 1,154,031 | |

ConocoPhillips | | | | | | | | |

5.200%, 05/15/2018 | | | 1,000,000 | | | | 1,133,174 | |

Shell International Finance | | | | | | | | |

1.900%, 08/10/2018 | | | 1,000,000 | | | | 1,015,855 | |

Total Capital SA | | | | | | | | |

2.125%, 08/10/2018 | | | 1,000,000 | | | | 1,022,488 | |

Chevron Corp. | | | | | | | | |

4.950%, 03/03/2019 | | | 3,000,000 | | | | 3,443,187 | |

BP Capital Markets PLC | | | | | | | | |

4.750%, 03/10/2019 | | | 3,000,000 | | | | 3,377,985 | |

Exxon Mobil Corp. | | | | | | | | |

1.819%, 03/15/2019 | | | 1,000,000 | | | | 1,011,807 | |

Shell International Finance | | | | | | | | |

4.300%, 09/22/2019 | | | 1,000,000 | | | | 1,114,703 | |

Trans-Canada Pipelines | | | | | | | | |

2.500%, 08/01/2022 | | | 2,000,000 | | | | 1,924,240 | |

Shell International Finance | | | | | | | | |

2.375%, 08/21/2022 | | | 1,000,000 | | | | 965,611 | |

Chevron Corp. | | | | | | | | |

2.355%, 12/05/2022 | | | 1,000,000 | | | | 960,127 | |

Total Capital International SA | | | | | | | | |

2.700%, 01/25/2023 | | | 1,000,000 | | | | 973,774 | |

Occidental Petroleum Corp. | | | | | | | | |

2.700%, 02/15/2023 | | | 2,000,000 | | | | 1,947,246 | |

Chevron Corp. | | | | | | | | |

3.191%, 06/24/2023 | | | 1,000,000 | | | | 1,014,137 | |

Schlumberger Investment | | | | | | | | |

3.650%, 12/01/2023 | | | 1,000,000 | | | | 1,040,977 | |

Exxon Mobil Corp. | | | | | | | | |

3.176%, 03/15/2024 | | | 2,000,000 | | | | 2,049,498 | |

| | | | | | | | |

| | | | | | | 27,346,560 | |

| | | | | | | | |

Retailers (1.09%) | | | | | | | | |

Lowe’s Companies Inc. | | | | | | | | |

5.000%, 10/15/2015 | | | 1,000,000 | | | | 1,060,687 | |

Home Depot Inc. | | | | | | | | |

5.400%, 03/01/2016 | | | 1,000,000 | | | | 1,085,076 | |

Target Corp. | | | | | | | | |

5.875%, 07/15/2016 | | | 1,300,000 | | | | 1,443,586 | |

Lowe’s Companies Inc. | | | | | | | | |

5.400%, 10/15/2016 | | | 1,000,000 | | | | 1,106,547 | |

Target Corp. | | | | | | | | |

5.375%, 05/01/2017 | | | 1,500,000 | | | | 1,683,600 | |

6.000%, 01/15/2018 | | | 500,000 | | | | 579,668 | |

Wal-Mart Stores Inc. | | | | | | | | |

5.800%, 02/15/2018 | | | 1,000,000 | | | | 1,160,438 | |

Home Depot Inc. | | | | | | | | |

2.250%, 09/10/2018 | | | 1,000,000 | | | | 1,028,355 | |

CVS Caremark Corp. | | | | | | | | |

2.250%, 12/05/2018 | | | 1,000,000 | | | | 1,014,466 | |

Wal-Mart Stores Inc. | | | | | | | | |

4.250%, 04/15/2021 | | | 2,000,000 | | | | 2,231,656 | |

| | |

| See accompanying notes to financial statements. | | 13 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Retailers (Cont.) | | | | | | | | |

Lowe’s Companies Inc. | | | | | | | | |

3.120%, 04/15/2022 | | $ | 1,000,000 | | | $ | 1,024,071 | |

Home Depot Inc. | | | | | | | | |

2.700%, 04/01/2023 | | | 2,000,000 | | | | 1,945,060 | |

Wal-Mart Stores Inc. | | | | | | | | |

2.550%, 04/11/2023 | | | 1,000,000 | | | | 969,227 | |

CVS Caremark Corp. | | | | | | | | |

4.000%, 12/05/2023 | | | 1,000,000 | | | | 1,055,682 | |

Wal-Mart Stores Inc. | | | | | | | | |

3.300%, 04/22/2024 | | | 500,000 | | | | 506,722 | |

| | | | | | | | |

| | | | | | | 17,894,841 | |

| | | | | | | | |

Telecom & Telecom Equipment (0.80%) | | | | | | | | |

AT&T Inc. | | | | | | | | |

2.375%, 11/27/2018 | | | 1,000,000 | | | | 1,020,858 | |

2.300%, 03/11/2019 | | | 1,000,000 | | | | 1,010,503 | |

Verizon Communications Inc. | | | | | | | | |

4.500%, 09/15/2020 | | | 1,000,000 | | | | 1,105,300 | |

3.450%, 03/15/2021 | | | 1,000,000 | | | | 1,036,813 | |

AT&T Inc. | | | | | | | | |

3.000%, 02/15/2022 | | | 3,000,000 | | | | 2,994,351 | |

Vodafone Group PLC | | | | | | | | |

2.500%, 09/26/2022 | | | 1,000,000 | | | | 934,790 | |

Verizon Communications Inc. | | | | | | | | |

2.450%, 11/01/2022 | | | 2,000,000 | | | | 1,886,298 | |

Vodafone Group PLC | | | | | | | | |

2.950%, 02/19/2023 | | | 1,000,000 | | | | 958,465 | |

Cisco Systems Inc. | | | | | | | | |

3.625%, 03/04/2024 | | | 1,000,000 | | | | 1,027,946 | |

Verizon Communications Inc. | | | | | | | | |

4.150%, 03/15/2024 | | | 1,000,000 | | | | 1,047,721 | |

| | | | | | | | |

| | | | | | | 13,023,045 | |

| | | | | | | | |

Transportation (0.56%) | | | | | | | | |

United Parcel Service Inc. | | | | | | | | |

5.500%, 01/15/2018 | | | 1,000,000 | | | | 1,148,275 | |

Union Pacific Corp. | | | | | | | | |

2.250%, 02/15/2019 | | | 1,000,000 | | | | 1,018,925 | |

Burlington North Santa Fe | | | | | | | | |

3.050%, 09/01/2022 | | | 500,000 | | | | 499,363 | |

United Parcel Service Inc. | | | | | | | | |

2.450%, 10/01/2022 | | | 2,000,000 | | | | 1,941,448 | |

Burlington North Santa Fe | | | | | | | | |

3.000%, 03/15/2023 | | | 1,500,000 | | | | 1,478,596 | |

Union Pacific Corp. | | | | | | | | |

2.750%, 04/15/2023 | | | 1,000,000 | | | | 980,097 | |

Norfolk Southern Corp. | | | | | | | | |

3.850%, 01/15/2024 | | | 1,000,000 | | | | 1,040,111 | |

Burlington North Santa Fe | | | | | | | | |

3.750%, 04/01/2024 | | | 1,000,000 | | | | 1,036,318 | |

| | | | | | | | |

| | | | | | | 9,143,133 | |

| | | | | | | | |

Utilities & Energy (3.47%) | | | | | | | | |

Commonwealth Edison Co. | | | | | | | | |

4.700%, 04/15/2015 | | | 1,000,000 | | | | 1,036,757 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Utilities & Energy (Cont.) | | | | | | | | |

Georgia Power Co. | | | | | | | | |

5.250%, 12/15/2015 | | $ | 2,000,000 | | | $ | 2,138,672 | |

Union Electric Co. | | | | | | | | |

5.400%, 02/01/2016 | | | 2,000,000 | | | | 2,148,198 | |

Consolidated Edison Co. NY | | | | | | | | |

5.300%, 12/01/2016 | | | 1,000,000 | | | | 1,109,796 | |

Georgia Power Co. | | | | | | | | |

5.700%, 06/01/2017 | | | 1,000,000 | | | | 1,128,769 | |

MidAmerican Energy Co. | | | | | | | | |

5.950%, 07/15/2017 | | | 500,000 | | | | 569,605 | |

NSTAR Electric Co. | | | | | | | | |

5.625%, 11/15/2017 | | | 1,500,000 | | | | 1,704,522 | |

Northern States Power Co. | | | | | | | | |

5.250%, 03/01/2018 | | | 1,000,000 | | | | 1,130,574 | |

PECO Energy Co. | | | | | | | | |

5.350%, 03/01/2018 | | | 1,000,000 | | | | 1,130,300 | |

Commonwealth Edison Co. | | | | | | | | |

5.800%, 03/15/2018 | | | 500,000 | | | | 574,597 | |

Ameren Union Electric | | | | | | | | |

6.000%, 04/01/2018 | | | 1,000,000 | | | | 1,126,593 | |

Consolidated Edison Co. NY | | | | | | | | |

5.850%, 04/01/2018 | | | 500,000 | | | | 576,971 | |

Duke Energy Carolinas | | | | | | | | |

5.100%, 04/15/2018 | | | 1,000,000 | | | | 1,133,538 | |

Public Service Electric and Gas Co. | | | | | | | | |

5.300%, 05/01/2018 | | | 500,000 | | | | 570,684 | |

2.300%, 09/15/2018 | | | 1,000,000 | | | | 1,023,105 | |

MidAmerican Energy Co. | | | | | | | | |

2.400%, 03/15/2019 | | | 1,500,000 | | | | 1,535,670 | |

Public Service Electric and Gas Co. | | | | | | | | |

1.800%, 06/01/2019 | | | 1,000,000 | | | | 996,807 | |

Kentucky Utilities | | | | | | | | |

3.250%, 11/01/2020 | | | 500,000 | | | | 522,756 | |

Southern California Edison Co. | | | | | | | | |

3.875%, 06/01/2021 | | | 2,000,000 | | | | 2,167,756 | |

San Diego Gas & Electric Co. | | | | | | | | |

3.000%, 08/15/2021 | | | 500,000 | | | | 515,789 | |

Carolina Power & Light Co. | | | | | | | | |

2.800%, 05/15/2022 | | | 2,000,000 | | | | 2,000,376 | |

Consumers Energy Co. | | | | | | | | |

2.850%, 05/15/2022 | | | 1,000,000 | | | | 1,000,188 | |

Georgia Power Co. | | | | | | | | |

2.850%, 05/15/2022 | | | 1,000,000 | | | | 992,446 | |

Detroit Edison Co. | | | | | | | | |

2.650%, 06/15/2022 | | | 500,000 | | | | 494,381 | |

CenterPoint Energy Houston LLC | | | | | | | | |

2.250%, 08/01/2022 | | | 1,000,000 | | | | 962,442 | |

Baltimore Gas & Electric Co. | | | | | | | | |

2.800%, 08/15/2022 | | | 1,000,000 | | | | 987,887 | |

Northern States Power Co. | | | | | | | | |

2.150%, 08/15/2022 | | | 500,000 | | | | 475,370 | |

Pacific Gas & Electric | | | | | | | | |

2.450%, 08/15/2022 | | | 1,000,000 | | | | 957,650 | |

Ameren Illinois Co. | | | | | | | | |

2.700%, 09/01/2022 | | | 1,000,000 | | | | 990,682 | |

| | |

| 14 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Utilities & Energy (Cont.) | | | | | | | | |

PPL Electric Utilities | | | | | | | | |

2.500%, 09/01/2022 | | $ | 1,000,000 | | | $ | 977,514 | |

PECO Energy Co. | | | | | | | | |

2.375%, 09/15/2022 | | | 500,000 | | | | 482,322 | |

Public Service Company of Colorado | | | | | | | | |

2.250%, 09/15/2022 | | | 1,000,000 | | | | 957,632 | |

Tampa Electric Co. | | | | | | | | |

2.600%, 09/15/2022 | | | 500,000 | | | | 481,597 | |

NSTAR Electric Co. | | | | | | | | |

2.375%, 10/15/2022 | | | 500,000 | | | | 476,411 | |

Public Service Company of Colorado | | | | | | | | |

2.500%, 03/15/2023 | | | 1,000,000 | | | | 963,343 | |

Virginia Electric & Power Co. | | | | | | | | |

2.750%, 03/15/2023 | | | 1,000,000 | | | | 984,054 | |

Northern States Power Co. | | | | | | | | |

2.600%, 05/15/2023 | | | 1,000,000 | | | | 965,962 | |

Public Service Electric and Gas Co. | | | | | | | | |

2.375%, 05/15/2023 | | | 2,000,000 | | | | 1,910,552 | |

Florida Power & Light Co. | | | | | | | | |

2.750%, 06/01/2023 | | | 2,000,000 | | | | 1,975,276 | |

Pacificorp | | | | | | | | |

2.950%, 06/01/2023 | | | 1,000,000 | | | | 993,181 | |

Pacific Gas & Electric | | | | | | | | |

3.250%, 06/15/2023 | | | 1,000,000 | | | | 1,002,545 | |

Consumers Energy Co. | | | | | | | | |

3.375%, 08/15/2023 | | | 1,000,000 | | | | 1,033,399 | |

Laclede Gas Co. | | | | | | | | |

3.400%, 08/15/2023 | | | 1,000,000 | | | | 1,021,626 | |

Duke Energy Ohio Inc. | | | | | | | | |

3.800%, 09/01/2023 | | | 1,000,000 | | | | 1,061,029 | |

San Diego Gas & Electric Co. | | | | | | | | |

3.600%, 09/01/2023 | | | 2,000,000 | | | | 2,103,228 | |

Public Service Company of New Hampshire | | | | | | | | |

3.500%, 11/01/2023 | | | 500,000 | | | | 517,145 | |

Delmarva Power & Light Co. | | | | | | | | |

3.500%, 11/15/2023 | | | 1,000,000 | | | | 1,034,420 | |

Alabama Power Co. | | | | | | | | |

3.550%, 12/01/2023 | | | 1,000,000 | | | | 1,043,688 | |

Virginia Electric & Power Co. | | | | | | | | |

3.450%, 02/15/2024 | | | 1,000,000 | | | | 1,024,257 | |

DTE Electric Co. | | | | | | | | |

3.650%, 03/15/2024 | | | 2,000,000 | | | | 2,092,608 | |

Potomac Electric Power Co. | | | | | | | | |

3.600%, 03/15/2024 | | | 1,000,000 | | | | 1,037,832 | |

Florida Power & Light Co. | | | | | | | | |

3.250%, 06/01/2024 | | | 1,000,000 | | | | 1,013,881 | |

| | | | | | | | |

| | | | | | | 56,856,383 | |

| | | | | | | | |

Total Corporate Bonds | | | | | | | | |

(cost $307,429,537) | | | | | | | 318,385,747 | |

| | | | | | | | |

Foreign Government Bonds (0.17%) | | | | | | | | |

Province of New Brunswick (Canada) | | | | | | | | |

5.200%, 02/21/2017 | | | 2,500,000 | | | | 2,792,525 | |

| | | | | | | | |

Total Foreign Government Bonds | | | | | | | | |

(cost $2,496,988) | | | | | | | 2,792,525 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Government Agency Securities (b) (1.97%) | | | | | | | | |

Agency Commercial Mortgage-Backed Securities (1.67%) | | | | | | | | |

Federal Home Loan Mortgage Corp. | | | | | | | | |

2.789%, 01/25/2022 | | $ | 10,000,000 | | | $ | 10,182,220 | |

2.839%, 10/25/2022 | | | 9,774,835 | | | | 10,149,211 | |

Federal National Mortgage Association | | | | | | | | |

2.715%, 02/25/2022 | | | 7,000,000 | | | | 7,027,545 | |

| | | | | | | | |

| | | | | | | 27,358,976 | |

| | | | | | | | |

Agency Notes & Bonds (0.30%) | | | | | | | | |

Tennessee Valley Authority | | | | | | | | |

5.500%, 07/18/2017 | | | 1,000,000 | | | | 1,139,783 | |

1.750%, 10/15/2018 | | | 1,500,000 | | | | 1,519,127 | |

3.875%, 02/15/2021 | | | 2,000,000 | | | | 2,211,800 | |

| | | | | | | | |

| | | | | | | 4,870,710 | |

| | | | | | | | |

Total Government Agency Securities | | | | | | | | |

(cost $31,594,259) | | | | | | | 32,229,686 | |

| | | | | | | | |

U.S. Treasury Obligations (16.59%) | | | | | | | | |

U.S. Treasury Notes | | | | | | | | |

4.250%, 11/15/2014 | | | 15,000,000 | | | | 15,281,835 | |

4.000%, 02/15/2015 | | | 15,000,000 | | | | 15,412,500 | |

4.125%, 05/15/2015 | | | 20,000,000 | | | | 20,760,940 | |

4.500%, 02/15/2016 | | | 15,000,000 | | | | 16,081,050 | |

5.125%, 05/15/2016 | | | 20,000,000 | | | | 21,854,680 | |

4.625%, 02/15/2017 | | | 20,000,000 | | | | 22,129,680 | |

3.250%, 03/31/2017 | | | 5,000,000 | | | | 5,354,690 | |

3.500%, 02/15/2018 | | | 15,000,000 | | | | 16,313,670 | |

3.750%, 11/15/2018 | | | 10,000,000 | | | | 11,047,660 | |

3.125%, 05/15/2019 | | | 15,000,000 | | | | 16,153,125 | |

3.625%, 08/15/2019 | | | 10,000,000 | | | | 11,028,910 | |

3.375%, 11/15/2019 | | | 10,000,000 | | | | 10,911,720 | |

3.625%, 02/15/2020 | | | 10,000,000 | | | | 11,049,220 | |

3.500%, 05/15/2020 | | | 20,000,000 | | | | 21,960,940 | |

3.625%, 02/15/2021 | | | 10,000,000 | | | | 11,062,500 | |

2.000%, 11/15/2021 | | | 25,000,000 | | | | 24,794,925 | |

2.500%, 08/15/2023 | | | 10,000,000 | | | | 10,103,120 | |

2.750%, 11/15/2023 | | | 10,000,000 | | | | 10,296,880 | |

| | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | | |

(cost $256,034,893) | | | | | | | 271,598,045 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 15 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Short-term Investments (0.50%) | | | | | | | | |

JPMorgan U.S. Government Money Market Fund | | | 8,241,864 | | | $ | 8,241,864 | |

| | | | | | | | |

Total Short-term Investments | | | | | | | | |

(cost $8,241,864) | | | | | | | 8,241,864 | |

| | | | | | | | |

TOTAL INVESTMENTS (99.84%) | | | | | | | | |

(cost $905,354,959) | | | | | | | 1,634,526,689 | |

OTHER ASSETS, NET OF LIABILITIES (0.16%) | | | | | | | 2,585,333 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | | | | $ | 1,637,112,022 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The obligations of these U.S. Government-sponsored entities are neither issued nor guaranteed by the United States Treasury. On September 7, 2008, the Federal Housing Finance Agency placed the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corp. (“Freddie Mac”) into conservatorship. The United States Treasury has put in place a set of financing agreements to help ensure that these entities continue to meet their obligations to holders of bonds they have issued or guaranteed. |

ADR - American Depositary Receipt

| | |

| 16 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST INTERIM FUND

SCHEDULE OF INVESTMENTS

May 31, 2014

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

U.S. Treasury Obligations (99.07%) | | | | | | | | |

U.S. Treasury Notes | | | | | | | | |

2.625%, 06/30/2014 | | $ | 5,000,000 | | | $ | 5,009,765 | |

4.250%, 08/15/2014 | | | 10,000,000 | | | | 10,085,550 | |

4.250%, 11/15/2014 | | | 5,000,000 | | | | 5,093,945 | |

4.000%, 02/15/2015 | | | 5,000,000 | | | | 5,137,500 | |

4.125%, 05/15/2015 | | | 5,000,000 | | | | 5,190,235 | |

1.750%, 07/31/2015 | | | 10,000,000 | | | | 10,187,110 | |

4.250%, 08/15/2015 | | | 20,000,000 | | | | 20,985,940 | |

2.625%, 02/29/2016 | | | 10,000,000 | | | | 10,410,550 | |

2.625%, 04/30/2016 | | | 20,000,000 | | | | 20,872,660 | |

1.500%, 06/30/2016 | | | 8,000,000 | | | | 8,181,248 | |

1.000%, 10/31/2016 | | | 10,000,000 | | | | 10,109,380 | |

3.000%, 02/28/2017 | | | 10,000,000 | | | | 10,628,120 | |

2.375%, 07/31/2017 | | | 10,000,000 | | | | 10,469,530 | |

1.875%, 08/31/2017 | | | 10,000,000 | | | | 10,309,380 | |

1.875%, 09/30/2017 | | | 10,000,000 | | | | 10,304,690 | |

1.875%, 10/31/2017 | | | 10,000,000 | | | | 10,303,120 | |

2.250%, 11/30/2017 | | | 10,000,000 | | | | 10,427,340 | |

2.750%, 12/31/2017 | | | 12,500,000 | | | | 13,253,900 | |

2.625%, 01/31/2018 | | | 12,000,000 | | | | 12,671,256 | |

2.750%, 02/28/2018 | | | 10,000,000 | | | | 10,609,380 | |

2.875%, 03/31/2018 | | | 10,000,000 | | | | 10,655,470 | |

2.625%, 04/30/2018 | | | 10,000,000 | | | | 10,558,590 | |

2.375%, 05/31/2018 | | | 10,000,000 | | | | 10,461,720 | |

2.375%, 06/30/2018 | | | 10,000,000 | | | | 10,462,500 | |

2.250%, 07/31/2018 | | | 10,000,000 | | | | 10,405,470 | |

1.375%, 11/30/2018 | | | 10,000,000 | | | | 10,000,780 | |

1.375%, 12/31/2018 | | | 10,000,000 | | | | 9,988,280 | |

1.250%, 01/31/2019 | | | 10,000,000 | | | | 9,916,410 | |

1.375%, 02/28/2019 | | | 10,000,000 | | | | 9,959,380 | |

1.500%, 03/31/2019 | | | 10,000,000 | | | | 10,010,160 | |

1.125%, 05/31/2019 | | | 10,000,000 | | | | 9,803,910 | |

1.250%, 10/31/2019 | | | 15,000,000 | | | | 14,689,455 | |

1.375%, 01/31/2020 | | | 10,000,000 | | | | 9,807,030 | |

1.875%, 06/30/2020 | | | 10,000,000 | | | | 10,025,000 | |

| | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | | |

(cost $354,646,455) | | | | | | | 356,984,754 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Short-term Investments (0.20%) | | | | | | | | |

JPMorgan U.S. Government Money Market Fund | | | 735,714 | | | $ | 735,714 | |

| | | | | | | | |

Total Short-term Investments | | | | | | | | |

(cost $735,714) | | | | | | | 735,714 | |

| | | | | | | | |

TOTAL INVESTMENTS (99.27%) | | | | | | | | |

(cost $355,382,169) | | | | | | | 357,720,468 | |

OTHER ASSETS, NET OF LIABILITIES (0.73%) | | | | | | | 2,621,267 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | | | | $ | 360,341,735 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 17 |

STATE FARM ASSOCIATES’ FUNDS TRUST MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

May 31, 2014

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Coupon

rate | | | Maturity date | | | Rating (a) | | | Principal

amount | | | Value | |

Long-term Municipal Bonds (96.30%) | | | | | | | | | | | | | | | | | | | | |

Alabama (1.54%) | | | | | | | | | | | | | | | | | | | | |

City of Phenix City, General Obligation Warrants, Series 2010-B | | | 5.000 | % | | | 02/01/2019 | | | | AA- | | | $ | 1,030,000 | | | $ | 1,192,606 | |

City of Athens, Alabama, General Obligation Warrants | | | 4.000 | % | | | 09/01/2019 | | | | AA- | | | | 1,145,000 | | | | 1,294,308 | |

Board of Education of the City of Hoover, Capital Outlay Warrants, Series 2005 | | | 3.500 | % | | | 02/15/2026 | | | | Aa2 | | | | 985,000 | | | | 987,197 | |

City of Madison (Alabama), General Obligation School Warrants, Series 2009 | | | 5.250 | % | | | 02/01/2027 | | | | Aa2 | | | | 2,540,000 | | | | 2,918,790 | |

City of Madison (Alabama), General Obligation School Warrants, Series 2009 | | | 5.250 | % | | | 02/01/2028 | | | | Aa2 | | | | 1,500,000 | | | | 1,721,520 | |

City of Florence (Alabama), Water and Sewer Revenue Warrants, Series 2011 | | | 5.000 | % | | | 08/15/2029 | | | | A1 | | | | 1,620,000 | | | | 1,814,141 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 9,928,562 | |

| | | | | | | | | | | | | | | | | | | | |

Alaska (1.84%) | | | | | | | | | | | | | | | | | | | | |

Municipality of Anchorage, Alaska, Senior Lien Refunding Electric Revenue Bonds, 1996 | | | 6.500 | % | | | 12/01/2014 | | | | NR | | | | 2,000,000 | | | | 2,061,680 | |

Municipality of Anchorage, Alaska, Senior Lien Electric Revenue Bonds, 2009 Series A (Tax-Exempt) | | | 4.000 | % | | | 12/01/2021 | | | | A+ | | | | 1,955,000 | | | | 2,075,702 | |

Municipality of Anchorage, Alaska, Wastewater Revenue and Refunding Bonds, 2007 | | | 4.625 | % | | | 05/01/2022 | | | | AA | | | | 585,000 | | | | 632,479 | |

Municipality of Anchorage, Alaska, Water Revenue and Refunding Bonds, 2007 | | | 4.625 | % | | | 05/01/2022 | | | | AA | | | | 295,000 | | | | 317,028 | |

Municipality of Anchorage, Alaska, 2007 General Obligation Refunding Bonds, Series B (Schools) | | | 4.500 | % | | | 09/01/2022 | | | | AAA | | | | 1,000,000 | | | | 1,112,030 | |

Municipality of Anchorage, Alaska, Wastewater Revenue and Refunding Bonds, 2007 | | | 4.750 | % | | | 05/01/2023 | | | | AA | | | | 645,000 | | | | 699,244 | |

Municipality of Anchorage, Alaska, Water Revenue and Refunding Bonds, 2007 | | | 4.750 | % | | | 05/01/2023 | | | | AA | | | | 1,110,000 | | | | 1,194,182 | |

Municipality of Anchorage, Alaska, 2005 General Obligation Bonds, Series F (General Purpose) | | | 4.125 | % | | | 09/01/2023 | | | | Aa2 | | �� | | 1,000,000 | | | | 1,027,530 | |

Matanuska-Susitna Borough, Alaska, General Obligation School Bonds, 2009 Series A | | | 5.500 | % | | | 07/01/2025 | | | | Aa2 | | | | 1,190,000 | | | | 1,393,788 | |

Matanuska-Susitna Borough, Alaska, General Obligation Transportation System Bonds, 2014 Series A | | | 5.000 | % | | | 08/01/2031 | | | | AA+ | | | | 1,225,000 | | | | 1,390,461 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 11,904,124 | |

| | | | | | | | | | | | | | | | | | | | |

Arizona (5.33%) | | | | | | | | | | | | | | | | | | | | |

Maricopa County, Arizona, Cave Creek Unified School District No. 93, School Improvement Bonds, Project of 2000, Series C (2006) | | | 4.250 | % | | | 07/01/2015 | | | | A+ | | | | 525,000 | | | | 546,892 | |

Tucson Unified School District No. 1 of Pima County, Arizona, Refunding Bonds, Tax-Exempt Series 2011 | | | 4.000 | % | | | 07/01/2016 | | | | Aa2 | | | | 450,000 | | | | 480,730 | |

Amphitheater Unified School District No. 10 of Pima County, Arizona, School Improvement Bonds, Project of 2007, Series B (2009), (Bank Qualified) | | | 4.000 | % | | | 07/01/2019 | | | | A+ | | | | 500,000 | | | | 550,820 | |

City of Glendale, Arizona, General Obligation Refunding Bonds, Series 2010 | | | 5.000 | % | | | 07/01/2019 | | | | BBB+ | | | | 4,180,000 | | | | 4,692,050 | |

Tucson Unified School District No. 1 of Pima County, Arizona, Refunding Bonds, Tax-Exempt Series 2011 | | | 5.000 | % | | | 07/01/2020 | | | | Aa2 | | | | 1,965,000 | | | | 2,314,141 | |

Amphitheater Unified School District No. 10 of Pima County, Arizona, School Improvement Bonds, Project of 2007, Series B (2009), (Bank Qualified) | | | 5.000 | % | | | 07/01/2021 | | | | A+ | | | | 500,000 | | | | 578,575 | |