UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01519

STATE FARM ASSOCIATES’ FUNDS TRUST

(Exact name of registrant as specified in charter)

| | |

One State Farm Plaza Bloomington, IL | | 61710-0001 |

| (Address of principal executive offices) | | (Zip code) |

| | |

| | Mark Greer |

| Paul J. Smith | | Stradley Ronon Stevens & Young |

| One State Farm Plaza | | 191 North Wacker Dr., Suite 1601 |

| Bloomington, Illinois 61710-0001 | | Chicago, Illinois 60606 |

| (Names and addresses of agents for service) |

Registrant’s telephone number, including area code: 1-800-447-0740

Date of fiscal year end: 11/30/2021

Date of reporting period: 05/31/2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) [Report]

(b) Not applicable.

May 31,2021

State Farm Associates’ Funds Trust

SEMI-ANNUAL REPORT

State Farm Growth Fund

State Farm Balanced Fund

State Farm Interim Fund

State Farm Municipal Bond Fund

Before investing, consider the Funds’ investment objectives, risks, charges and expenses. Contact State Farm VP Management Corp. (1-800-447-0740) for a prospectus or summary prospectus containing this and other information. Read it carefully.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, and information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, are available without charge upon request at 1-800-447-0740 and at sec.gov.

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year and as an exhibit to its report on Form N-PORT. The Funds’ Forms N-PORT are available on the Commission’s website at sec.gov. The Funds make the information on Form N-PORT available to shareholders upon request without charge at 1-800-447-0740.

Any website referenced in this report is an inactive textual reference only, and information contained in or otherwise accessible through that website does not form a part of, and is not incorporated by reference into, this report.

SEMI-ANNUAL REPORT

Electronic Delivery

As a State Farm Mutual Funds shareholder, we wish to remind you that you can elect to have future Annual Reports, Semi-Annual Reports, Prospectuses, statements and tax forms delivered electronically rather than receiving large, bulky paper reports through the mail. This is a great way to help reduce internal fund costs related to printing and mailing these materials as well as a way to be environmentally friendly. Please consider signing up for electronic delivery today by going on statefarm.com or by calling 1-800-447-0740.

Compensation Deduction or Automatic Investment Plan (AlP)1

State Farm Mutual Funds allow you to make regular investments in a Fund with compensation deduction (agent/employee only) or an Automatic Investment Plan through an electronic transfer of funds from your bank/credit union account. If you wish to begin compensation deduction or an Automatic Investment Plan, the minimum amount required for both initial and subsequent investments is $50. Please consider signing up today for compensation deduction by going on the State Farm intranet or signing up for AIP by calling 1-800-447-0740 for assistance.

State Farm VP Management Corp.

(Underwriter and Distributor of Securities Products)

One State Farm Plaza

Bloomington, Illinois 61710-0001

1-800-447-0740

statefarm.com

| 1 | Automatic investment plans do not assure a profit or protect against loss. |

Message to Shareholders of State Farm Associates’ Funds Trust

Dear Shareholders,

Thank you for investing with State Farm Mutual Funds®. Enclosed is the Semi-Annual Report for the 6-month period ended May 31, 2021, for the State Farm Associates’ Funds Trust (“the Trust”). We encourage your review and consideration of the entire report.

State Farm Investment Management Corp. has consistently maintained a long-term, disciplined approach to managing investment risk and providing competitive investment products that can help you, our valued shareholder, with your investment goals.1 We believe that remaining focused on your long-term goals and maintaining an appropriate asset allocation mix are important elements in pursuing investment success.2

On June 17, 2021, AFT shareholders approved the reorganization of the mutual funds within AFT into similar new mutual funds offered by Advisers Investment Trust (AIT). The reorganization is planned for late August 2021. The AIT funds will continue to be advised by State Farm Investment Management Corp. with Northern Trust Investments, Inc. providing day-to-day portfolio management and shareholder servicing. The AIT funds have the same or substantially similar investment objectives, principal investment strategies, risks, and fees as the AFT funds.

Market Review

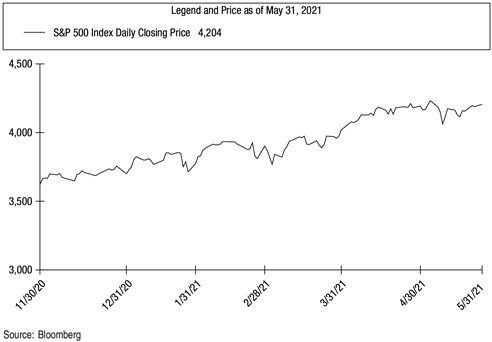

During the 6-month period ended May 31, 2021, the U.S. equity market experienced a positive total return while the U.S. fixed income market was mixed.

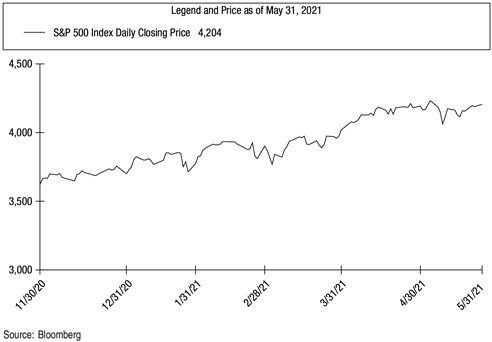

As represented by the S&P 500 Index (the “Index”) in the chart below, U.S. equities rose to several record closing prices throughout the period, including crossing the 4,000-point threshold for the first time on April 1.3 The historic mark was followed by the Index continuing to set new highs during the remainder of April and into May, ultimately reaching its peak record close of 4,232 on May 7. The Index finished the period at 4,204 – a sizeable increase from where it had started (3,621) – while posting a 16.43% total return, including dividends.

| 1 | Investing involves risk, including potential for loss. |

| 2 | Asset allocation does not assure a profit or protect against loss. |

| 3 | Source: Standard & Poor’s. The S&P 500 Index is a capitalization-weighted measure of the common stocks of 500 large U.S. companies. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

1

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

The time period began with encouraging COVID-19 vaccine news in combination with another round of stimulus packages and continued loose monetary policy, which helped the U.S. equity market finish the calendar year with a positive return. News of more fiscal support helped maintain positive sentiment early in January, as President Biden proposed his $1.9 trillion coronavirus relief package that included among other things, up to $1,400 in additional direct payments, increased federal unemployment benefits, aid to state and local governments, and funding for vaccine distribution. However, stocks subsequently experienced a slight pullback as the S&P 500 fell by -1.0% in January. The retreat, which occurred late in the month shortly after the Index had reached a new all-time high on January 26, saw U.S. equities decline by -3.5% in the last three trading days of the month, on fears of extended market valuations.

Despite the slight downturn in January, the U.S. equity market rebounded swiftly in February and March to help the Index rise 6.2% during the first calendar quarter of 2021, finishing those three months at an all-time high. The expanding rollout of vaccines and the steady decline in COVID-19 related cases, hospitalizations and deaths enabled more states and municipalities to ease restrictions, thereby allowing the U.S. economic recovery to gain traction. As a result, shares of companies most sensitive to changing economic conditions led U.S. stock gains during the quarter. The rotation into these cyclical sectors more than offset weakness in the handful of stay-at-home stocks, primarily large-cap technology companies that benefited during most of 2020 as people sheltered in place and worked from home.

In April, the U.S. equity market spent much of the month grappling with two competing dynamics: signs of a strong economic rebound – particularly in the U.S. – and worsening COVID-19 cases elsewhere in the world that threatened to hamper the global recovery. Robust corporate earnings as well as improved U.S. economic data helped push the Index to record levels throughout the month, finishing ahead 5.3%. The 6-month period ended with the S&P 500 setting several more all-time highs in the first half of May, while experiencing some volatility during the second half of the month due to inflationary concerns, rising input costs and a tight labor market. Ultimately, the Index closed higher, up 0.7% in May, while finishing with a positive total return in five of the six months during the time period.

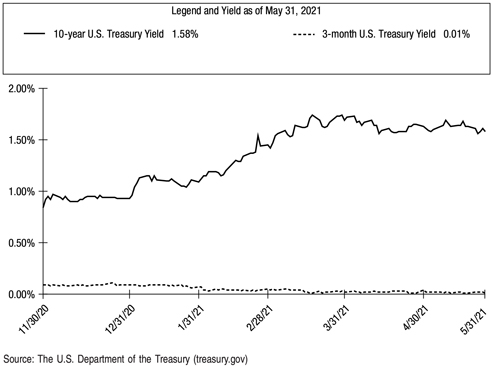

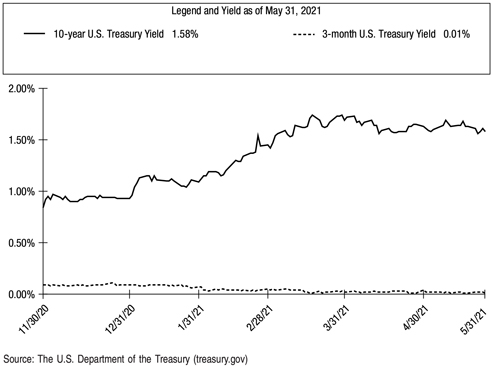

Among the major fixed income indices, the Bloomberg Barclays 1 -5 Year Treasury Index4 and the Bloomberg Barclays 7-Year Municipal Bond Index5 posted total returns of -0.15% and 0.60%, respectively, as price declines ate into coupon returns. To start the period, longer-term government bond yields trended higher as the market seemed to be looking forward to better economic growth on the back of positive corporate earnings, improving coronavirus developments, vaccination momentum and continued monetary and fiscal tailwinds. While the 10-year Treasury yield saw a rise in February and March – closing the first calendar quarter at 1.74% – short-term (3-month) yields continued to remain flat and hover near 0%. Inflationary concerns and doubt around the Fed’s ability to maintain low interest rates prompted some fixed income investors to sell off longer-dated bonds in exchange for short-term paper.

Uncertainty over the timing of recovery in both the domestic and global economies stoked some volatility in the bond market in April and May. Also, the Federal Reserve reiterated its commitment to near-zero interest rates as the economy continued to rebound, with Chairman Powell stressing that transitory inflationary concerns would not warrant a rate hike. Ultimately, short-term yields finished the period at 0.01%, while longer-term Treasuries pulled back slightly from their March highs but still remained higher than the 0.84% where they started the fiscal year, closing at 1.58%.6

| 4 | Source: Bloomberg Barclays Inc. The Bloomberg Barclays 1-5 Year U.S. Treasury Index measures the performance of short-term U.S. Treasury Securities maturing within one to five years. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 5 | Source: Bloomberg Barclays Inc. The Bloomberg Barclays 7-year Municipal Bond Index is an unmanaged index comprised of investment grade municipal bonds with maturities of six to eight years. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 6 | Source: The U.S. Department of the Treasury. A 3-month U.S. Treasury Bill is a debt obligation issued by the U.S. Treasury that has a term of 92 days or less. A 10-year U.S. Treasury Note is a debt obligation issued by the U.S. Treasury with a maturity of 10 years and that pays interest every six months. U.S. Treasury securities are backed by the full faith and credit of the U.S. government and are guaranteed only as to the prompt payment of principal and interest, and are subject to market risks if sold prior to maturity. Bonds have historically been less volatile than stocks, but are sensitive to changes in interest rates. Past performance does not guarantee future results. |

2

Message to Shareholders of State Farm Associates’ Funds Trust (continued)

In the municipal bond market, early period expectations of higher taxes as well as more fiscal stimulus coming from a Democratic-controlled White House and Congress helped boost investor appetite for municipal bonds and further eroded the historically close correlation between U.S. Treasury yields and those on municipal bonds. Strong demand continued into February, and coupled with relatively low issuance, helped to push municipal yields lower while credit spreads continued to tighten. While nominally down for the calendar first quarter, municipal bonds outperformed counterparts given the fiscal boost the American Rescue Plan Act was expected to provide to state and local governments, while also benefitting from the improved outlook for rising tax revenues as the U.S. economy continued to reopen. That momentum carried into the last couple months of the 6-month period, as municipals went on to finish strong, posting positive total returns for April and May.

On behalf of the entire State Farm Mutual Funds team, thank you for your business and allowing us to help serve your investment needs.

|

| Sincerely, |

|

|

Joe R. Monk Jr. Senior Vice President |

| State Farm Investment Management Corp. |

3

Portfolio Summary

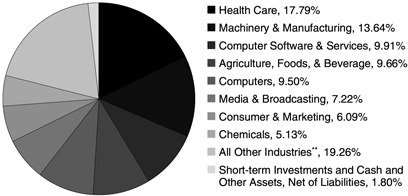

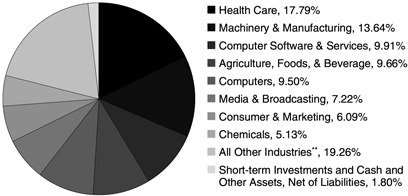

State Farm Growth Fund

Fund Composition*

(unaudited)

| * | Illustrated by Industry and based on total net assets as of May 31, 2021. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Represents 9 other industries, each of which represents less than 5% of total net assets. |

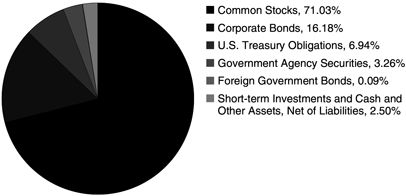

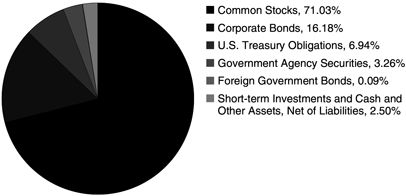

State Farm Balanced Fund

Fund Composition*

(unaudited)

| * | Illustrated by Type of Security and based on total net assets as of May 31, 2021. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

4

Portfolio Summary (continued)

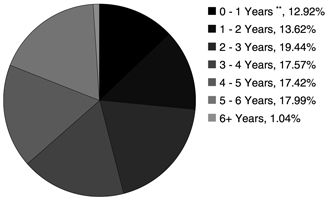

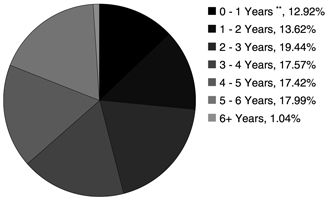

State Farm Interim Fund

Fund Composition*

(unaudited)

| * | Illustrated by Maturity and based on total investments as of May 31, 2021. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Includes a 1.10% allocation to the JPMorgan US Government Money Market Fund Capital Shares. |

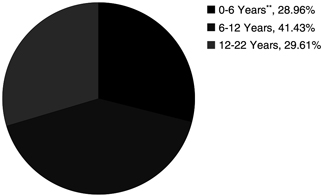

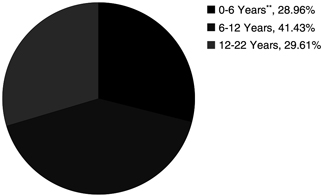

State Farm Municipal Bond Fund

Fund Composition*

(unaudited)

| * | Illustrated by Maturity and based on total investments as of May 31, 2021. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Includes a 2.21% allocation to the JPMorgan US Government Money Market Fund Capital Shares. |

5

Expense Example (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including management fees and other Fund expenses. The Example in the following table is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as stated in the table below.

Actual Expenses

The first line under each Fund name in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value for a Fund by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account for that Fund during this period. If your account has multiple Fund positions, add up the results calculated for each Fund position within your account to estimate the expenses you paid on your total account value. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second line under each Fund name in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee that you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of increasing the costs of investing.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line under each Fund name in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, including those that have transactional costs, such as sales charges (loads), redemption fees, or exchange fees.

| | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized Expense | | | | |

| | | | | | | | | Ratio Based | | | Expenses Paid | |

| | | Beginning | | | Ending | | | on the Period | | | During Period | |

| | | Account Value | | | Account Value | | | December 1, 2020 to | | | December 1, 2020 to | |

| | | December 1, 2020 | | | May 31, 2021 | | | May 31, 2021 | | | May 31, 2021* | |

State Farm Growth Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,188.50 | | | | 0.12 | % | | $ | 0.65 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.33 | | | | 0.12 | % | | $ | 0.61 | |

| | | | | | | | | | | | | | | | |

State Farm Balanced Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,136.39 | | | | 0.13 | % | | $ | 0.69 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.28 | | | | 0.13 | % | | $ | 0.66 | |

| | | | | | | | | | | | | | | | |

State Farm Interim Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 994.46 | | | | 0.16 | % | | $ | 0.80 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.13 | | | | 0.16 | % | | $ | 0.81 | |

| | | | | | | | | | | | | | | | |

State Farm Municipal Bond Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,003.41 | | | | 0.16 | % | | $ | 0.80 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.13 | | | | 0.16 | % | | $ | 0.81 | |

| | | | | | | | | | | | | | | | |

| * | Expenses are equal to the applicable Fund’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

6

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (98.20%) | |

Agriculture, Foods, & Beverage (9.66%) | |

Archer-Daniels-Midland Co. | | | 3,477,500 | | | $ | 231,358,075 | |

Coca-Cola Co., The | | | 2,054,600 | | | | 113,598,834 | |

Kellogg Co. | | | 930,000 | | | | 60,905,700 | |

McCormick & Company Inc. | | | 857,200 | | | | 76,342,232 | |

Nestle SA ADR | | | 609,147 | | | | 75,333,210 | |

PepsiCo Inc. | | | 641,400 | | | | 94,888,716 | |

| | | | | | | | |

| | | | | | | 652,426,767 | |

| | | | | | | | |

Banks (3.74%) | | | | | | | | |

M&T Bank Corp. | | | 213,400 | | | | 34,291,246 | |

Northern Trust Corp. | | | 422,700 | | | | 51,227,013 | |

U.S. Bancorp | | | 710,821 | | | | 43,203,700 | |

Wells Fargo & Co. | | | 2,643,100 | | | | 123,485,632 | |

| | | | | | | | |

| | | | | | | 252,207,591 | |

| | | | | | | | |

Building Materials & Construction (2.82%) | |

Vulcan Materials Co. | | | 1,039,200 | | | | 190,506,144 | |

| | | | | | | | |

Chemicals (5.13%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 830,000 | | | | 248,717,800 | |

Corteva Inc. | | | 97,944 | | | | 4,456,452 | |

Dow Inc. | | | 97,944 | | | | 6,701,328 | |

DuPont de Nemours Inc. | | | 46,493 | | | | 3,932,843 | |

International Flavors & Fragrances Inc. | | | 561,941 | | | | 79,610,182 | |

Novozymes A/S B Shares | | | 39,188 | | | | 2,863,391 | |

| | | | | | | | |

| | | | | | | 346,281,996 | |

| | | | | | | | |

Computer Software & Services (9.91%) | |

Alphabet Inc. Class A (a) | | | 112,635 | | | | 265,463,800 | |

Alphabet Inc. Class C (a) | | | 5,916 | | | | 14,266,789 | |

Automatic Data Processing Inc. | | | 109,900 | | | | 21,542,598 | |

Facebook Inc. Class A (a) | | | 82,675 | | | | 27,177,753 | |

Microsoft Corp. | | | 1,129,669 | | | | 282,055,756 | |

SAP SE | | | 83,800 | | | | 11,760,726 | |

Texas Instruments Inc. | | | 245,807 | | | | 46,659,084 | |

| | | | | | | | |

| | | | | | | 668,926,506 | |

| | | | | | | | |

Computers (9.50%) | | | | | | | | |

Apple Inc. | | | 5,148,868 | | | | 641,600,441 | |

| | | | | | | | |

Consumer & Marketing (6.09%) | | | | | | | | |

AptarGroup Inc. | | | 677,405 | | | | 99,788,530 | |

Colgate-Palmolive Co. | | | 872,600 | | | | 73,106,428 | |

Procter & Gamble Co., The | | | 1,765,155 | | | | 238,031,152 | |

| | | | | | | | |

| | | | | | | 410,926,110 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (0.96%) | |

Emerson Electric Co. | | | 126,400 | | | | 12,095,216 | |

General Electric Co. | | | 3,744,419 | | | | 52,646,531 | |

| | | | | | | | |

| | | | | | | 64,741,747 | |

| | | | | | | | |

Health Care (17.79%) | | | | | | | | |

Abbott Laboratories | | | 847,500 | | | | 98,860,875 | |

AbbVie Inc. | | | 847,500 | | | | 95,937,000 | |

Agilent Technologies Inc. | | | 548,071 | | | | 75,705,047 | |

Amgen Inc. | | | 190,085 | | | | 45,228,825 | |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Health Care (Cont.) | | | | | | | | |

Eli Lilly and Co. | | | 997,000 | | | $ | 199,140,780 | |

Johnson & Johnson | | | 2,481,600 | | | | 420,010,800 | |

Merck & Co. Inc. | | | 296,750 | | | | 22,520,357 | |

Pfizer Inc. | | | 2,239,031 | | | | 86,717,671 | |

Roche Holding AG Sponsored ADR | | | 732,281 | | | | 32,044,617 | |

Zoetis Inc. | | | 705,696 | | | | 124,682,369 | |

| | | | | | | | |

| | | | | | | 1,200,848,341 | |

| | | | | | | | |

Machinery & Manufacturing (13.64%) | |

3M Co. | | | 564,000 | | | | 114,514,560 | |

ASML Holding NV NY Reg. Shares | | | 364,933 | | | | 246,501,293 | |

Caterpillar Inc. | | | 1,162,621 | | | | 280,284,671 | |

Deere & Co. | | | 42,900 | | | | 15,491,190 | |

Donaldson Company Inc. | | | 765,513 | | | | 47,147,946 | |

HNI Corp. | | | 1,439,200 | | | | 65,656,304 | |

Illinois Tool Works Inc. | | | 652,500 | | | | 151,223,400 | |

| | | | | | | | |

| | | | | | | 920,819,364 | |

| | | | | | | | |

Media & Broadcasting (7.22%) | |

Walt Disney Co., The(a) | | | 2,728,640 | | | | 487,471,536 | |

| | | | | | | | |

Mining & Metals (1.98%) | | | | | | | | |

Nucor Corp. | | | 531,200 | | | | 54,469,248 | |

Rio Tinto PLC ADR | | | 907,200 | | | | 79,316,496 | |

| | | | | | | | |

| | | | | | | 133,785,744 | |

| | | | | | | | |

Oil & Gas (3.89%) | |

Chevron Corp. | | | 1,060,000 | | | | 110,017,400 | |

Exxon Mobil Corp. | | | 2,615,200 | | | | 152,649,224 | |

| | | | | | | | |

| | | | | | | 262,666,624 | |

| | | | | | | | |

Retailers (2.82%) | |

Walmart Inc. | | | 1,339,100 | | | | 190,192,373 | |

| | | | | | | | |

Telecom & Telecom Equipment (2.29%) | |

AT&T Inc. | | | 2,140,534 | | | | 62,995,916 | |

Corning Inc. | | | 1,284,600 | | | | 56,047,098 | |

Verizon Communications Inc. | | | 624,900 | | | | 35,300,601 | |

| | | | | | | | |

| | | | | | | 154,343,615 | |

| | | | | | | | |

Transportation (0.30%) | | | | | | | | |

GATX Corp. | | | 190,700 | | | | 18,814,462 | |

Wabtec Corp. | | | 20,111 | | | | 1,664,386 | |

| | | | | | | | |

| | | | | | | 20,478,848 | |

| | | | | | | | |

Utilities & Energy (0.46%) | | | | | | | | |

Duke Energy Corp. | | | 306,966 | | | | 30,764,133 | |

| | | | | | | | |

Total Common Stocks | | | | | | | | |

(cost $1,355,567,197) | | | | | | | 6,628,987,880 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 7 |

STATE FARM ASSOCIATES’ FUNDS TRUST GROWTH FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Short-term Investments (1.53%) | |

JPMorgan U.S. Government Money Market Fund Capital Shares, 0.03% (b) | | | 102,993,983 | | | $ | 102,993,983 | |

| | | | | | | | |

Total Short-term Investments | |

(cost $102,993,983) | | | | | | | 102,993,983 | |

| | | | | | | | |

TOTAL INVESTMENTS (99.73%) | |

(cost $1,458,561,180) | | | | | | | 6,731,981,863 | |

CASH AND OTHER ASSETS, NET OF LIABILITIES (0.27%) | | | | 18,258,581 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | $ | 6,750,240,444 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Rate shown is the 7-day yield as of May 31, 2021. |

ADR - American Depositary Deposit

| | |

| 8 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (71.03%) | |

Agriculture, Foods, & Beverage (6.72%) | |

Archer-Daniels-Midland Co. | | | 940,561 | | | $ | 62,575,523 | |

Campbell Soup Co. | | | 26,000 | | | | 1,265,420 | |

Coca-Cola Co., The | | | 410,000 | | | | 22,668,900 | |

Kellogg Co. | | | 310,000 | | | | 20,301,900 | |

Nestle SA ADR | | | 319,174 | | | | 39,472,249 | |

PepsiCo Inc. | | | 110,100 | | | | 16,288,194 | |

| | | | | | | | |

| | | | | | | 162,572,186 | |

| | | | | | | | |

Banks (2.91%) | | | | | | | | |

M&T Bank Corp. | | | 58,300 | | | | 9,368,227 | |

Northern Trust Corp. | | | 104,700 | | | | 12,688,593 | |

U.S. Bancorp | | | 218,145 | | | | 13,258,853 | |

Wells Fargo & Co. | | | 747,600 | | | | 34,927,872 | |

| | | | | | | | |

| | | | | | | 70,243,545 | |

| | | | | | | | |

Building Materials & Construction (1.21%) | |

Vulcan Materials Co. | | | 160,200 | | | | 29,367,864 | |

| | | | | | | | |

Chemicals (4.25%) | | | | | | | | |

Air Products & Chemicals Inc. | | | 230,000 | | | | 68,921,800 | |

Corteva Inc. | | | 79,452 | | | | 3,615,066 | |

Dow Inc. | | | 79,452 | | | | 5,436,106 | |

DuPont de Nemours Inc. | | | 37,715 | | | | 3,190,312 | |

International Flavors & Fragrances Inc. | | | 131,488 | | | | 18,627,905 | |

Novozymes A/S B Shares | | | 39,191 | | | | 2,863,610 | |

| | | | | | | | |

| | | | | | | 102,654,799 | |

| | | | | | | | |

Computer Software & Services (8.34%) | |

Alphabet Inc. Class A (a) | | | 36,687 | | | | 86,465,756 | |

Alphabet Inc. Class C (a) | | | 3,559 | | | | 8,582,742 | |

Automatic Data Processing Inc. | | | 47,400 | | | | 9,291,348 | |

Facebook Inc. Class A (a) | | | 49,575 | | | | 16,296,790 | |

Microsoft Corp. | | | 276,321 | | | | 68,991,827 | |

SAP SE | | | 52,800 | | | | 7,410,099 | |

Texas Instruments Inc. | | | 24,373 | | | | 4,626,483 | |

| | | | | | | | |

| | | | | | | 201,665,045 | |

| | | | | | | | |

Computers (6.56%) | |

Apple Inc. | | | 1,272,704 | | | | 158,591,645 | |

| | | | | |

Consumer & Marketing (4.25%) | | | | | |

AptarGroup Inc. | | | 134,100 | | | | 19,754,271 | |

Colgate-Palmolive Co. | | | 80,000 | | | | 6,702,400 | |

Procter & Gamble Co., The | | | 477,700 | | | | 64,417,845 | |

Unilever PLC | | | 198,705 | | | | 11,916,339 | |

| | | | | | | | |

| | | | | | | 102,790,855 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (0.85%) | |

Emerson Electric Co. | | | 98,600 | | | | 9,435,034 | |

General Electric Co. | | | 796,300 | | | | 11,195,978 | |

| | | | | | | | |

| | | | | | | 20,631,012 | |

| | | | | | | | |

Health Care (10.94%) | | | | | | | | |

Abbott Laboratories | | | 146,675 | | | | 17,109,639 | |

AbbVie Inc. | | | 92,000 | | | | 10,414,401 | |

Agilent Technologies Inc. | | | 143,787 | | | | 19,861,298 | |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (Cont.) | | | | | | | | |

Health Care (Cont.) | | | | | | | | |

Amgen Inc. | | | 70,750 | | | $ | 16,834,255 | |

Eli Lilly and Co. | | | 212,000 | | | | 42,344,880 | |

Johnson & Johnson | | | 417,700 | | | | 70,695,725 | |

Medtronic PLC | | | 21,600 | | | | 2,734,344 | |

Merck & Co. Inc. | | | 103,200 | | | | 7,831,848 | |

Pfizer Inc. | | | 728,140 | | | | 28,200,862 | |

Roche Holding AG Sponsored ADR | | | 179,815 | | | | 7,868,704 | |

Zoetis Inc. | | | 229,495 | | | | 40,547,177 | |

| | | | | | | | |

| | | | | | | 264,443,133 | |

| | | | | | | | |

Machinery & Manufacturing (7.43%) | |

3M Co. | | | 124,600 | | | | 25,298,784 | |

ASML Holding NV NY Reg. Shares | | | 15,321 | | | | 10,348,876 | |

Caterpillar Inc. | | | 262,400 | | | | 63,259,392 | |

Deere & Co. | | | 72,202 | | | | 26,072,142 | |

Donaldson Company Inc. | | | 279,017 | | | | 17,184,657 | |

HNI Corp. | | | 160,000 | | | | 7,299,200 | |

Illinois Tool Works Inc. | | | 130,600 | | | | 30,267,856 | |

| | | | | | | | |

| | | | | | | 179,730,907 | |

| | | | | | | | |

Media & Broadcasting (7.88%) | | | | | | | | |

Walt Disney Co., The(a) | | | 1,065,995 | | | | 190,440,007 | |

| | | | | |

Mining & Metals (2.91%) | | | | | | | | |

Nucor Corp. | | | 436,800 | | | | 44,789,472 | |

Rio Tinto PLC ADR | | | 293,000 | | | | 25,616,990 | |

| | | | | | | | |

| | | | | | | 70,406,462 | |

| | | | | | | | |

Oil & Gas (2.86%) | | | | | | | | |

Chevron Corp. | | | 288,000 | | | | 29,891,520 | |

Enbridge Inc. | | | 78,375 | | | | 3,015,870 | |

Exxon Mobil Corp. | | | 512,400 | | | | 29,908,788 | |

Schlumberger Ltd. | | | 201,727 | | | | 6,320,107 | |

| | | | | | | | |

| | | | | | | 69,136,285 | |

| | | | | | | | |

Retailers (1.63%) | | | | | | | | |

Walmart Inc. | | | 276,700 | | | | 39,299,701 | |

| | | | | | | | |

Telecom & Telecom Equipment (1.58%) | |

AT&T Inc. | | | 533,359 | | | | 15,696,756 | |

Corning Inc. | | | 372,300 | | | | 16,243,449 | |

Verizon Communications Inc. | | | 112,490 | | | | 6,354,560 | |

| | | | | | | | |

| | | | | | | 38,294,765 | |

| | | | | | | | |

Transportation (0.41%) | | | | | | | | |

GATX Corp. | | | 68,200 | | | | 6,728,612 | |

Union Pacific Corp. | | | 12,066 | | | | 2,711,592 | |

Wabtec Corp. | | | 4,276 | | | | 353,882 | |

| | | | | | | | |

| | | | | | | 9,794,086 | |

| | | | | | | | |

Utilities & Energy (0.30%) | | | | | | | | |

Duke Energy Corp. | | | 72,333 | | | | 7,249,213 | |

| | | | | | | | |

Total Common Stocks | | | | | | | | |

(cost $372,722,517) | | | | | | | 1,717,311,510 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 9 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (16.18%) | |

Aerospace/Defense (0.64%) | |

Lockheed Martin Corp. | | | | | | | | |

3.350%, 09/15/2021 | | $ | 556,000 | | | $ | 560,978 | |

Boeing Co. | | | | | | | | |

2.850%, 10/30/2024 | | | 1,000,000 | | | | 1,053,679 | |

General Dynamics Corp. | | | | | | | | |

2.375%, 11/15/2024 | | | 500,000 | | | | 529,783 | |

Raytheon Technologies Corp. | | | | | | | | |

3.150%, 12/15/2024 | | | 1,000,000 | | | | 1,077,974 | |

Northrop Grumman Corp. | | | | | | | | |

2.930%, 01/15/2025 | | | 1,000,000 | | | | 1,070,017 | |

Lockheed Martin Corp. | | | | | | | | |

2.900%, 03/01/2025 | | | 1,000,000 | | | | 1,077,461 | |

Precision Castparts Corp. | | | | | | | | |

3.250%, 06/15/2025 | | | 1,000,000 | | | | 1,089,519 | |

Rolls-Royce PLC (b) | | | | | | | | |

3.625%, 10/14/2025 | | | 1,000,000 | | | | 1,005,000 | |

Boeing Co. | | | | | | | | |

2.250%, 06/15/2026 | | | 500,000 | | | | 509,081 | |

General Dynamics Corp. | | | | | | | | |

2.125%, 08/15/2026 | | | 500,000 | | | | 524,889 | |

Airbus SE (b) | | | | | | | | |

3.150%, 04/10/2027 | | | 1,000,000 | | | | 1,076,762 | |

United Technologies Corp. | | | | | | | | |

3.125%, 05/04/2027 | | | 1,000,000 | | | | 1,083,867 | |

General Dynamics Corp. | | | | | | | | |

2.625%, 11/15/2027 | | | 500,000 | | | | 538,806 | |

Northrop Grumman Corp. | | | | | | | | |

3.250%, 01/15/2028 | | | 1,000,000 | | | | 1,083,120 | |

General Dynamics Corp. | | | | | | | | |

3.750%, 05/15/2028 | | | 1,200,000 | | | | 1,355,110 | |

Raytheon Technologies Corp. | | | | | | | | |

2.250%, 07/01/2030 | | | 1,500,000 | | | | 1,497,805 | |

Bae Systems PLC (b) | | | | | | | | |

1.900%, 02/15/2031 | | | 500,000 | | | | 474,182 | |

| | | | | | | | |

| | | | | | | 15,608,033 | |

| | | | | | | | |

Agriculture, Foods, & Beverage (1.58%) | |

JM Smucker Co. | | | | | | | | |

3.000%, 03/15/2022 | | | 1,000,000 | | | | 1,021,162 | |

Sysco Corp. | | | | | | | | |

2.600%, 06/12/2022 | | | 1,000,000 | | | | 1,022,389 | |

Campbell Soup Co. | | | | | | | | |

2.500%, 08/02/2022 | | | 1,000,000 | | | | 1,025,253 | |

Kellogg Co. | | | | | | | | |

2.750%, 03/01/2023 | | | 1,000,000 | | | | 1,040,343 | |

Hershey Co. | | | | | | | | |

2.625%, 05/01/2023 | | | 1,300,000 | | | | 1,349,679 | |

General Mills Inc. | | | | | | | | |

3.650%, 02/15/2024 | | | 1,000,000 | | | | 1,080,320 | |

PepsiCo Inc. | | | | | | | | |

3.600%, 03/01/2024 | | | 1,000,000 | | | | 1,080,555 | |

JM Smucker Co. | | | | | | | | |

3.500%, 03/15/2025 | | | 1,000,000 | | | | 1,092,613 | |

PepsiCo Inc. | | | | | | | | |

3.500%, 07/17/2025 | | | 1,000,000 | | | | 1,104,202 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | |

Agriculture, Foods, & Beverage (Cont.) | |

Hershey Co. | | | | | | | | |

3.200%, 08/21/2025 | | $ | 1,000,000 | | | $ | 1,087,379 | |

PepsiCo Inc. | | | | | | | | |

2.850%, 02/24/2026 | | | 1,000,000 | | | | 1,089,010 | |

Sysco Corp. | | | | | | | | |

3.300%, 07/15/2026 | | | 1,000,000 | | | | 1,092,529 | |

Hershey Co. | | | | | | | | |

2.300%, 08/15/2026 | | | 1,000,000 | | | | 1,063,535 | |

Danone SA(b) | | | | | | | | |

2.947%, 11/02/2026 | | | 1,000,000 | | | | 1,076,285 | |

General Mills Inc. | | | | | | | | |

3.200%, 02/10/2027 | | | 1,000,000 | | | | 1,093,897 | |

Coca-Cola Co., The | | | | | | | | |

2.900%, 05/25/2027 | | | 500,000 | | | | 546,034 | |

Sysco Corp. | | | | | | | | |

3.250%, 07/15/2027 | | | 500,000 | | | | 543,979 | |

PepsiCo Inc. | | | | | | | | |

3.000%, 10/15/2027 | | | 1,500,000 | | | | 1,653,177 | |

Kellogg Co. | | | | | | | | |

3.400%, 11/15/2027 | | | 1,000,000 | | | | 1,094,415 | |

JM Smucker Co. | | | | | | | | |

3.375%, 12/15/2027 | | | 1,500,000 | | | | 1,656,213 | |

Campbell Soup Co. | | | | | | | | |

4.150%, 03/15/2028 | | | 1,000,000 | | | | 1,130,827 | |

General Mills Inc. | | | | | | | | |

4.200%, 04/17/2028 | | | 1,000,000 | | | | 1,145,486 | |

Mondelez International Inc. | | | | | | | | |

4.125%, 05/07/2028 | | | 2,000,000 | | | | 2,289,998 | |

Kellogg Co. | | | | | | | | |

4.300%, 05/15/2028 | | | 1,000,000 | | | | 1,148,097 | |

Coca-Cola Co., The | | | | | | | | |

2.125%, 09/06/2029 | | | 1,000,000 | | | | 1,016,881 | |

Kellogg Co. | | | | | | | | |

2.100%, 06/01/2030 | | | 500,000 | | | | 492,898 | |

Nestle Holdings Co. (b) | | | | | | | | |

1.250%, 09/15/2030 | | | 4,000,000 | | | | 3,773,596 | |

PepsiCo Inc. | | | | | | | | |

1.400%, 02/25/2031 | | | 1,500,000 | | | | 1,428,585 | |

Coca-Cola Co., The | | | | | | | | |

2.000%, 03/05/2031 | | | 3,000,000 | | | | 2,977,296 | |

1.375%, 03/15/2031 | | | 1,000,000 | | | | 937,403 | |

| | | | | | | | |

| | | | | | | 38,154,036 | |

| | | | | | | | |

Automotive (0.49%) | |

Daimler Finance NA LLC (b) | | | | | | | | |

2.000%, 07/06/2021 | | | 1,000,000 | | | | 1,001,711 | |

American Honda Finance Corp. | | | | | | | | |

1.650%, 07/12/2021 | | | 500,000 | | | | 500,787 | |

Toyota Motor Credit Corp. | | | | | | | | |

2.900%, 04/17/2024 | | | 1,000,000 | | | | 1,068,192 | |

BMW US Capital LLC (b) | | | | | | | | |

2.800%, 04/11/2026 | | | 500,000 | | | | 534,058 | |

American Honda Finance Corp. | | | | | | | | |

2.300%, 09/09/2026 | | | 1,000,000 | | | | 1,055,269 | |

BMW US Capital LLC (b) | | | | | | | | |

3.300%, 04/06/2027 | | | 1,000,000 | | | | 1,099,017 | |

| | |

| 10 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Automotive (Cont.) | | | | | | | | |

Toyota Motor Credit Corp. | | | | | | | | |

3.050%, 01/11/2028 | | $ | 1,000,000 | | | $ | 1,085,182 | |

American Honda Finance Corp. | | | | | | | | |

3.500%, 02/15/2028 | | | 1,000,000 | | | | 1,109,695 | |

Daimler Finance NA LLC (b) | | | | | | | | |

3.750%, 02/22/2028 | | | 1,000,000 | | | | 1,108,716 | |

Toyota Motor Credit Corp. | | | | | | | | |

3.650%, 01/08/2029 | | | 1,000,000 | | | | 1,129,530 | |

Daimler Finance NA LLC (b) | | | | | | | | |

4.300%, 02/22/2029 | | | 1,000,000 | | | | 1,144,064 | |

2.450%, 03/02/2031 | | | 1,000,000 | | | | 1,009,310 | |

| | | | | | | | |

| | | | | | | 11,845,531 | |

| | | | | | | | |

Banks (0.77%) | | | | | | | | |

U.S. Bancorp | | | | | | | | |

3.000%, 03/15/2022 | | | 1,000,000 | | | | 1,020,576 | |

3.700%, 01/30/2024 | | | 500,000 | | | | 541,607 | |

Bank of New York Mellon Corp. | | | | | | | | |

3.650%, 02/04/2024 | | | 1,000,000 | | | | 1,083,321 | |

State Street Corp. | | | | | | | | |

3.300%, 12/16/2024 | | | 1,000,000 | | | | 1,097,060 | |

PNC Bank NA | | | | | | | | |

3.250%, 06/01/2025 | | | 500,000 | | | | 545,477 | |

State Street Corp. | | | | | | | | |

3.550%, 08/18/2025 | | | 500,000 | | | | 557,366 | |

Wells Fargo & Co. | | | | | | | | |

3.000%, 04/22/2026 | | | 1,000,000 | | | | 1,083,590 | |

Bank of New York Mellon Corp. | | | | | | | | |

2.800%, 05/04/2026 | | | 500,000 | | | | 540,633 | |

State Street Corp. | | | | | | | | |

2.650%, 05/19/2026 | | | 1,000,000 | | | | 1,079,040 | |

U.S. Bancorp | | | | | | | | |

2.375%, 07/22/2026 | | | 1,000,000 | | | | 1,059,171 | |

Bank of New York Mellon Corp. | | | | | | | | |

2.450%, 08/17/2026 | | | 500,000 | | | | 530,697 | |

Wells Fargo & Co. | | | | | | | | |

3.000%, 10/23/2026 | | | 1,500,000 | | | | 1,626,577 | |

U.S. Bancorp | | | | | | | | |

3.150%, 04/27/2027 | | | 1,000,000 | | | | 1,094,383 | |

PNC Bank NA | | | | | | | | |

3.100%, 10/25/2027 | | | 1,000,000 | | | | 1,097,254 | |

Bank of New York Mellon Corp. | | | | | | | | |

3.400%, 01/29/2028 | | | 2,000,000 | | | | 2,206,338 | |

U.S. Bancorp | | | | | | | | |

3.900%, 04/26/2028 | | | 1,000,000 | | | | 1,145,995 | |

Wells Fargo & Co. | | | | | | | | |

4.150%, 01/24/2029 | | | 1,000,000 | | | | 1,142,893 | |

Bank of America Corp. (c) | | | | | | | | |

3.974%, 02/07/2030 | | | 1,000,000 | | | | 1,122,303 | |

| | | | | | | | |

| | | | | | | 18,574,281 | |

| | | | | | | | |

Chemicals (0.50%) | | | | | | | | |

| | | | | | | | |

Praxair Inc. | | | | | | | | |

2.450%, 02/15/2022 | | | 1,000,000 | | | | 1,010,174 | |

2.700%, 02/21/2023 | | | 1,000,000 | | | | 1,034,867 | |

3.200%, 01/30/2026 | | | 1,000,000 | | | | 1,096,746 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Chemicals (Cont.) | | | | | | | | |

Air Liquide Finance (b) | | | | | | | | |

2.500%, 09/27/2026 | | $ | 1,000,000 | | | $ | 1,064,331 | |

Ecolab Inc. | | | | | | | | |

2.700%, 11/01/2026 | | | 1,000,000 | | | | 1,074,927 | |

3.250%, 12/01/2027 | | | 1,500,000 | | | | 1,658,346 | |

PPG Industries Inc. | | | | | | | | |

3.750%, 03/15/2028 | | | 2,000,000 | | | | 2,255,280 | |

E.l. du Pont de Nemours and Co. | | | | | | | | |

2.300%, 07/15/2030 | | | 1,000,000 | | | | 1,011,928 | |

Ecolab Inc. | | | | | | | | |

1.300%, 01/30/2031 | | | 2,000,000 | | | | 1,851,750 | |

| | | | | | | | |

| | | | | | | 12,058,349 | |

| | | | | | | | |

Commercial Service/Supply (0.08%) | |

Cintas Corp. No. 2 | | | | | | | | |

3.250%, 06/01/2022 | | | 2,000,000 | | | | 2,043,438 | |

| | | | | | | | |

Computer Software & Services (0.68%) | |

Microsoft Corp. | | | | | | | | |

2.125%, 11/15/2022 | | | 2,000,000 | | | | 2,054,840 | |

Intel Corp. | | | | | | | | |

2.700%, 12/15/2022 | | | 1,000,000 | | | | 1,038,024 | |

Texas Instruments Inc. | | | | | | | | |

2.250%, 05/01/2023 | | | 3,000,000 | | | | 3,099,978 | |

Alphabet Inc. | | | | | | | | |

3.375%, 02/25/2024 | | | 1,000,000 | | | | 1,086,128 | |

Intel Corp. | | | | | | | | |

3.700%, 07/29/2025 | | | 1,000,000 | | | | 1,109,878 | |

Automatic Data Processing Inc. | | | | | | | | |

3.375%, 09/15/2025 | | | 1,000,000 | | | | 1,103,673 | |

Intel Corp. | | | | | | | | |

2.600%, 05/19/2026 | | | 1,000,000 | | | | 1,072,266 | |

Oracle Corp. | | | | | | | | |

2.650%, 07/15/2026 | | | 1,000,000 | | | | 1,059,904 | |

Microsoft Corp. | | | | | | | | |

2.400%, 08/08/2026 | | | 500,000 | | | | 533,492 | |

Alphabet Inc. | | | | | | | | |

1.998%, 08/15/2026 | | | 1,000,000 | | | | 1,049,240 | |

Microsoft Corp. | | | | | | | | |

3.300%, 02/06/2027 | | | 500,000 | | | | 556,800 | |

QUALCOMM Inc. | | | | | | | | |

3.250%, 05/20/2027 | | | 1,000,000 | | | | 1,106,096 | |

Texas Instruments Inc. | | | | | | | | |

2.900%, 11/03/2027 | | | 500,000 | | | | 545,431 | |

Oracle Corp. | | | | | | | | |

3.250%, 11/15/2027 | | | 1,000,000 | | | | 1,087,872 | |

| | | | | | | | |

| | | | | | | 16,503,622 | |

| | | | | | | | |

Computers (0.04%) | | | | | | | | |

International Business Machines Corp. | | | | | | | | |

1.950%, 05/15/2030 | | | 1,000,000 | | | | 985,964 | |

| | | | | | | | |

| | |

| See accompanying notes to financial statements. | | 11 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | |

Consumer & Marketing (0.70%) | | | | | |

Procter & Gamble Co., The | | | | |

2.300%, 02/06/2022 | | $ | 1,000,000 | | | $ | 1,014,876 | |

Colgate-Palmolive Co. | | | | | | | | |

2.100%, 05/01/2023 | | | 2,000,000 | | | | 2,069,832 | |

NIKE Inc. | | | | | | | | |

2.250%, 05/01/2023 | | | 500,000 | | | | 516,874 | |

Reckitt Benckiser Treasury Services PLC (b) | | | | | | | | |

2.750%, 06/26/2024 | | | 1,000,000 | | | | 1,060,794 | |

Unilever Capital Corp. | | | | | | | | |

3.100%, 07/30/2025 | | | 1,000,000 | | | | 1,092,178 | |

Kimberly-Clark Corp. | | | | | | | | |

3.050%, 08/15/2025 | | | 1,000,000 | | | | 1,085,488 | |

Procter & Gamble Co., The | | | | | | | | |

2.700%, 02/02/2026 | | | 500,000 | | | | 541,837 | |

Kimberly-Clark Corp. | | | | | | | | |

2.750%, 02/15/2026 | | | 1,000,000 | | | | 1,081,108 | |

Unilever Capital Corp. | | | | | | | | |

2.000%, 07/28/2026 | | | 500,000 | | | | 522,037 | |

NIKE Inc. | | | | | | | | |

2.375%, 11/01/2026 | | | 1,000,000 | | | | 1,065,290 | |

Unilever Capital Corp. | | | | | | | | |

2.900%, 05/05/2027 | | | 500,000 | | | | 543,246 | |

Reckitt Benckiser Treasury Services PLC(b) | | | | | | | | |

3.000%, 06/26/2027 | | | 1,000,000 | | | | 1,087,314 | |

Clorox Co. | | | | | | | | |

3.100%, 10/01/2027 | | | 500,000 | | | | 544,380 | |

Unilever Capital Corp. | | | | | | | | |

3.500%, 03/22/2028 | | | 1,000,000 | | | | 1,114,430 | |

Clorox Co. | | | | | | | | |

3.900%, 05/15/2028 | | | 1,000,000 | | | | 1,129,458 | |

Estee Lauder Companies Inc., The | | | | | | | | |

2.375%, 12/01/2029 | | | 1,000,000 | | | | 1,031,913 | |

Unilever Capital Corp. | | | | | | | | |

1.375%, 09/14/2030 | | | 500,000 | | | | 475,545 | |

Estee Lauder Companies Inc., The | | | | | | | | |

1.950%, 03/15/2031 | | | 1,000,000 | | | | 982,471 | |

| | | | | | | | |

| | | | | | | 16,959,071 | |

| | | | | | | | |

Consumer Discretionary (0.07%) | | | | |

RELX Capital Inc. | | | | |

4.000%, 03/18/2029 | | | 1,000,000 | | | | 1,121,924 | |

3.000%, 05/22/2030 | | | 500,000 | | | | 524,523 | |

| | | | | | | | |

| | | | | | | 1,646,447 | |

| | | | | | | | |

Electronic/Electrical Manufacturing (0.57%) | |

Emerson Electric Co. | | | | |

2.625%, 12/01/2021 | | | 1,000,000 | | | | 1,010,107 | |

Siemens Financieringsmaatschappij NV (b) | | | | | | | | |

2.900%, 05/27/2022 | | | 500,000 | | | | 513,162 | |

Emerson Electric Co. | | | | | | | | |

2.625%, 02/15/2023 | | | 1,000,000 | | | | 1,035,047 | |

General Electric Co. | | | | | | | | |

3.375%, 03/11/2024 | | | 1,000,000 | | | | 1,075,556 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | |

Electronic/Electrical Manufacturing (Cont.) | |

Siemens Financieringsmaatschappij NV (b) | | | | |

3.250%, 05/27/2025 | | $ | 1,000,000 | | | $ | 1,088,020 | |

Emerson Electric Co. | | | | | | | | |

3.150%, 06/01/2025 | | | 1,000,000 | | | | 1,085,651 | |

Siemens Financieringsmaatschappij NV (b) | | | | | | | | |

2.350%, 10/15/2026 | | | 1,000,000 | | | | 1,049,371 | |

Honeywell International Inc. | | | | | | | | |

2.500%, 11/01/2026 | | | 2,000,000 | | | | 2,137,672 | |

ABB Finance (USA) Inc. | | | | | | | | |

3.800%, 04/03/2028 | | | 1,000,000 | | | | 1,134,063 | |

Rockwell Automation Inc. | | | | | | | | |

3.500%, 03/01/2029 | | | 1,000,000 | | | | 1,116,087 | |

Honeywell International Inc. | | | | | | | | |

1.950%, 06/01/2030 | | | 500,000 | | | | 500,771 | |

Emerson Electric Co. | | | | | | | | |

1.950%, 10/15/2030 | | | 1,000,000 | | | | 991,444 | |

Siemens Financieringsmaatschappij NV (b) | | | | | | | | |

2.150%, 03/11/2031 | | | 1,000,000 | | | | 991,884 | |

| | | | | | | | |

| | | | 13,728,835 | |

| | | | | | | | |

Financial Services (0.40%) | | | | |

Mastercard Inc. | | | | | | | | |

2.000%, 11/21/2021 | | | 500,000 | | | | 503,632 | |

Visa Inc. | | | | | | | | |

2.800%, 12/14/2022 | | | 1,000,000 | | | | 1,035,738 | |

JPMorgan Chase & Co. | | | | | | | | |

3.200%, 01/25/2023 | | | 1,000,000 | | | | 1,049,005 | |

3.625%, 05/13/2024 | | | 500,000 | | | | 545,678 | |

3.125%, 01/23/2025 | | | 1,000,000 | | | | 1,078,437 | |

GE Capital International Funding Co. | | | | | | | | |

3.373%, 11/15/2025 | | | 747,000 | | | | 816,493 | |

Visa Inc. | | | | | | | | |

3.150%, 12/14/2025 | | | 1,000,000 | | | | 1,096,878 | |

JPMorgan Chase & Co. | | | | | | | | |

3.300%, 04/01/2026 | | | 1,000,000 | | | | 1,098,186 | |

Mastercard Inc. | | | | | | | | |

2.950%, 11/21/2026 | | | 500,000 | | | | 545,448 | |

Visa Inc. | | | | | | | | |

1.100%, 02/15/2031 | | | 1,000,000 | | | | 929,846 | |

NTT Finance Corp.(b) | | | | | | | | |

2.065%, 04/03/2031 | | | 1,000,000 | | | | 995,620 | |

| | | | | | | | |

| | | | 9,694,961 | |

| | | | | | | | |

Health Care (1.91%) | | | | | | | | |

Abbott Laboratories | | | | | | | | |

2.550%, 03/15/2022 | | | 1,000,000 | | | | 1,018,711 | |

EMD Finance LLC (b) | | | | |

2.950%, 03/19/2022 | | | 1,000,000 | | | | 1,016,812 | |

Bayer US Finance II LLC (b) | | | | |

2.200%, 07/15/2022 | | | 1,300,000 | | | | 1,317,308 | |

Bristol-Myers Squibb Co. | | | | |

2.000%, 08/01/2022 | | | 1,500,000 | | | | 1,531,503 | |

| | |

| 12 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Health Care (Cont.) | | | | | | | | |

Merck & Co. Inc. | | | | | | | | |

2.400%, 09/15/2022 | | $ | 1,000,000 | | | $ | 1,022,830 | |

Novartis Capital Corp. | | | | | | | | |

2.400%, 09/21/2022 | | | 1,000,000 | | | | 1,029,356 | |

GlaxoSmithKline Capital Inc. | | | | | | | | |

2.800%, 03/18/2023 | | | 1,000,000 | | | | 1,045,276 | |

Merck & Co. Inc. | | | | | | | | |

2.800%, 05/18/2023 | | | 2,000,000 | | | | 2,098,310 | |

Novartis Capital Corp. | | | | | | | | |

3.400%, 05/06/2024 | | | 1,500,000 | | | | 1,633,176 | |

Stryker Corp. | | | | | | | | |

3.375%, 05/15/2024 | | | 1,000,000 | | | | 1,080,616 | |

Pfizer Inc. | | | | | | | | |

3.400%, 05/15/2024 | | | 1,000,000 | | | | 1,091,325 | |

Amgen Inc. | | | | | | | | |

3.625%, 05/22/2024 | | | 1,000,000 | | | | 1,085,240 | |

Bayer U.S. Finance LLC (b) | | | | | | | | |

3.375%, 10/08/2024 | | | 1,000,000 | | | | 1,082,057 | |

Abbott Laboratories | | | | | | | | |

2.950%, 03/15/2025 | | | 1,000,000 | | | | 1,078,710 | |

EMD Finance LLC(b) | | | | | | | | |

3.250%, 03/19/2025 | | | 1,000,000 | | | | 1,080,657 | |

Bayer US Finance II LLC (b) | | | | | | | | |

2.850%, 04/15/2025 | | | 1,000,000 | | | | 1,041,125 | |

Eli Lilly and Co. | | | | | | | | |

2.750%, 06/01/2025 | | | 472,000 | | | | 506,455 | |

AstraZeneca PLC | | | | | | | | |

3.375%, 11/16/2025 | | | 1,000,000 | | | | 1,099,409 | |

Novartis Capital Corp. | | | | | | | | |

3.000%, 11/20/2025 | | | 1,000,000 | | | | 1,089,494 | |

Johnson & Johnson | | | | | | | | |

2.450%, 03/01/2026 | | | 500,000 | | | | 535,465 | |

Stryker Corp. | | | | | | | | |

3.500%, 03/15/2026 | | | 1,000,000 | | | | 1,103,432 | |

Roche Holdings lnc. (b) | | | | | | | | |

2.625%, 05/15/2026 | | | 500,000 | | | | 536,733 | |

Amgen Inc. | | | | | | | | |

2.600%, 08/19/2026 | | | 1,000,000 | | | | 1,063,635 | |

Roche Holdings lnc.(b) | | | | | | | | |

2.375%, 01/28/2027 | | | 1,000,000 | | | | 1,058,610 | |

Eli Lilly and Co. | | | | | | | | |

3.100%, 05/15/2027 | | | 500,000 | | | | 546,988 | |

AstraZeneca PLC | | | | | | | | |

3.125%, 06/12/2027 | | | 1,000,000 | | | | 1,093,029 | |

Amgen Inc. | | | | | | | | |

3.200%, 11/02/2027 | | | 1,000,000 | | | | 1,096,435 | |

Johnson & Johnson | | | | | | | | |

2.900%, 01/15/2028 | | | 2,000,000 | | | | 2,187,042 | |

Stryker Corp. | | | | | | | | |

3.650%, 03/07/2028 | | | 1,000,000 | | | | 1,111,212 | |

GlaxoSmithKline Capital Inc. | | | | | | | | |

3.875%, 05/15/2028 | | | 2,000,000 | | | | 2,272,146 | |

Sanofi | | | | | | | | |

3.625%, 06/19/2028 | | | 1,500,000 | | | | 1,688,250 | |

Merck & Co. Inc. | | | | | | | | |

3.400%, 03/07/2029 | | | 1,000,000 | | | | 1,112,469 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Health Care (Cont.) | | | | | | | | |

Eli Lilly and Co. | | | | | | | | |

3.375%, 03/15/2029 | | $ | 1,000,000 | | | $ | 1,108,239 | |

Pfizer Inc. | | | | | | | | |

3.450%, 03/15/2029 | | | 1,000,000 | | | | 1,112,582 | |

Bristol-Myers Squibb Co. | | | | | | | | |

3.400%, 07/26/2029 | | | 2,000,000 | | | | 2,217,916 | |

Thermo Fisher Scientific Inc. | | | | | | | | |

2.600%, 10/01/2029 | | | 1,000,000 | | | | 1,036,287 | |

Merck & Co. Inc. | | | | | | | | |

1.450%, 06/24/2030 | | | 500,000 | | | | 480,949 | |

AstraZeneca PLC | | | | | | | | |

1.375%, 08/06/2030 | | | 1,000,000 | | | | 939,108 | |

Johnson & Johnson | | | | | | | | |

1.300%, 09/01/2030 | | | 2,000,000 | | | | 1,916,042 | |

| | | | | | | | |

| | | | | | | 46,164,939 | |

| | | | | | | | |

Machinery & Manufacturing (0.62%) | |

John Deere Capital Corp. | | | | | | | | |

2.750%, 03/15/2022 | | | 500,000 | | | | 509,938 | |

Deere & Co. | | | | | | | | |

2.600%, 06/08/2022 | | | 1,000,000 | | | | 1,018,879 | |

Caterpillar Financial Services Corp. | | | | | | | | |

2.625%, 03/01/2023 | | | 1,000,000 | | | | 1,041,586 | |

Caterpillar Inc. | | | | | | | | |

3.400%, 05/15/2024 | | | 1,000,000 | | | | 1,082,265 | |

John Deere Capital Corp. | | | | | | | | |

3.350%, 06/12/2024 | | | 1,500,000 | | | | 1,627,519 | |

Caterpillar Financial Services Corp. | | | | | | | | |

3.250%, 12/01/2024 | | | 1,000,000 | | | | 1,091,908 | |

3M Co. | | | | | | | | |

3.000%, 08/07/2025 | | | 1,000,000 | | | | 1,092,811 | |

Dover Corp. | | | | | | | | |

3.150%, 11/15/2025 | | | 1,000,000 | | | | 1,079,188 | |

3M Co. | | | | | | | | |

2.250%, 09/19/2026 | | | 500,000 | | | | 531,184 | |

Eaton Corp. | | | | | | | | |

3.103%, 09/15/2027 | | | 1,000,000 | | | | 1,090,140 | |

John Deere Capital Corp. | | | | | | | | |

3.050%, 01/06/2028 | | | 1,000,000 | | | | 1,085,327 | |

3M Co. | | | | | | | | |

3.375%, 03/01/2029 | | | 1,000,000 | | | | 1,109,590 | |

Caterpillar Inc. | | | | | | | | |

2.600%, 09/19/2029 | | | 1,000,000 | | | | 1,056,525 | |

John Deere Capital Corp. | | | | | | | | |

2.450%, 01/09/2030 | | | 1,000,000 | | | | 1,037,485 | |

Equinor ASA | | | | | | | | |

2.375%, 05/22/2030 | | | 500,000 | | | | 509,361 | |

| | | | | | | | |

| | | | | | | 14,963,706 | |

| | | | | | | | |

Media & Broadcasting (0.21%) | |

Comcast Corp. | | | | | | | | |

3.600%, 03/01/2024 | | | 1,000,000 | | | | 1,087,096 | |

2.350%, 01/15/2027 | | | 1,000,000 | | | | 1,049,159 | |

S&P Global Inc. | | | | | | | | |

2.500%, 12/01/2029 | | | 1,000,000 | | | | 1,032,840 | |

| | |

| See accompanying notes to financial statements. | | 13 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Media & Broadcasting (Cont.) | | | | | |

1.250%, 08/15/2030 | | $ | 1,000,000 | | | $ | 925,978 | |

Comcast Corp. | | | | | | | | |

1.500%, 02/15/2031 | | | 1,000,000 | | | | 930,259 | |

| | | | | | | | |

| | | | | | | 5,025,332 | |

| | | | | | | | |

Mining & Metals (0.09%) | | | | | |

BHP Billiton Finance USA Ltd. | | | | | | | | |

3.250%, 11/21/2021 | | | 1,000,000 | | | | 1,014,394 | |

Rio Tinto Finance USA Ltd. | | | | | | | | |

3.750%, 06/15/2025 | | | 1,000,000 | | | | 1,109,671 | |

| | | | | | | | |

| | | | | | | 2,124,065 | |

| | | | | | | | |

Oil & Gas (1.06%) | | | | | |

Total Capital International SA | | | | | |

2.750%, 06/19/2021 | | | 1,000,000 | | | | 1,001,233 | |

TransCanada PipeLines Ltd. | | | | | | | | |

2.500%, 08/01/2022 | | | 2,000,000 | | | | 2,051,272 | |

Shell International Finance | | | | | | | | |

2.375%, 08/21/2022 | | | 1,000,000 | | | | 1,026,419 | |

Total Capital International SA | | | | | | | | |

2.700%, 01/25/2023 | | | 1,000,000 | | | | 1,040,229 | |

Occidental Petroleum Corp. | | | | | | | | |

2.700%, 02/15/2023 | | | 2,000,000 | | | | 2,010,000 | |

Chevron Corp. | | | | | | | | |

3.191%, 06/24/2023 | | | 1,000,000 | | | | 1,051,323 | |

Total Capital Canada Ltd. | | | | | | | | |

2.750%, 07/15/2023 | | | 500,000 | | | | 526,053 | |

Schlumberger Investment SA | | | | | | | | |

3.650%, 12/01/2023 | | | 1,000,000 | | | | 1,071,610 | |

Exxon Mobil Corp. | | | | | | | | |

3.176%, 03/15/2024 | | | 2,000,000 | | | | 2,142,248 | |

2.709%, 03/06/2025 | | | 1,000,000 | | | | 1,070,748 | |

Shell International Finance | | | | | | | | |

3.250%, 05/11/2025 | | | 1,000,000 | | | | 1,092,049 | |

Occidental Petroleum Corp. | | | | | | | | |

3.500%, 06/15/2025 | | | 500,000 | | | | 499,760 | |

Chevron Corp. | | | | | | | | |

3.326%, 11/17/2025 | | | 1,000,000 | | | | 1,105,587 | |

TransCanada PipeLines Ltd. | | | | | | | | |

4.875%, 01/15/2026 | | | 1,000,000 | | | | 1,155,251 | |

Shell International Finance | | | | | | | | |

2.875%, 05/10/2026 | | | 1,000,000 | | | | 1,085,900 | |

Baker Hughes, a GE Co., LLC / Baker Hughes Co-Obligor, Inc. | | | | | | | | |

3.337%, 12/15/2027 | | | 1,000,000 | | | | 1,096,524 | |

Sabal Trail Transmission

LLC(b) | | | | | | | | |

4.246%, 05/01/2028 | | | 1,000,000 | | | | 1,121,619 | |

TransCanada PipeLines Ltd. | | | | | | | | |

4.250%, 05/15/2028 | | | 1,000,000 | | | | 1,140,579 | |

Total Capital International SA | | | | | | | | |

3.455%, 02/19/2029 | | | 1,000,000 | | | | 1,100,985 | |

Exxon Mobil Corp. | | | | | | | | |

3.482%, 03/19/2030 | | | 1,000,000 | | | | 1,106,078 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Oil & Gas (Cont.) | | | | | |

Shell International Finance | | | | | | | | |

2.750%, 04/06/2030 | | $ | 1,000,000 | | | $ | 1,050,931 | |

Schlumberger Investment SA | | | | | | | | |

2.650%, 06/26/2030 | | | 1,000,000 | | | | 1,030,571 | |

| | | | | | | | |

| | | | | | | 25,576,969 | |

| | | | | | | | |

Retailers (0.67%) | | | | | |

Home Depot Inc. | | | | | | | | |

2.625%, 06/01/2022 | | | 500,000 | | | | 511,335 | |

CVS Health Corp. | | | | | | | | |

3.500%, 07/20/2022 | | | 1,000,000 | | | | 1,031,280 | |

Wal-Mart Stores Inc. | | | | | | | | |

2.550%, 04/11/2023 | | | 1,000,000 | | | | 1,038,859 | |

3.300%, 04/22/2024 | | | 500,000 | | | | 538,781 | |

Costco Wholesale Corp. | | | | | | | | |

2.750%, 05/18/2024 | | | 1,000,000 | | | | 1,066,420 | |

McDonald’s Corp. | | | | | | | | |

3.250%, 06/10/2024 | | | 1,000,000 | | | | 1,078,423 | |

Target Corp. | | | | | | | | |

3.500%, 07/01/2024 | | | 1,000,000 | | | | 1,089,738 | |

Home Depot Inc. | | | | | | | | |

3.350%, 09/15/2025 | | | 1,000,000 | | | | 1,100,784 | |

Lowe’s Companies Inc. | | | | | | | | |

3.375%, 09/15/2025 | | | 1,000,000 | | | | 1,097,222 | |

Home Depot Inc. | | | | | | | | |

3.000%, 04/01/2026 | | | 1,000,000 | | | | 1,091,010 | |

Lowe’s Companies Inc. | | | | | | | | |

2.500%, 04/15/2026 | | | 1,000,000 | | | | 1,062,045 | |

Target Corp. | | | | | | | | |

2.500%, 04/15/2026 | | | 1,000,000 | | | | 1,073,213 | |

TJX Companies Inc., The | | | | | | | | |

2.250%, 09/15/2026 | | | 1,000,000 | | | | 1,057,376 | |

Costco Wholesale Corp. | | | | | | | | |

3.000%, 05/18/2027 | | | 1,000,000 | | | | 1,097,906 | |

Amazon.com Inc. | | | | | | | | |

3.150%, 08/22/2027 | | | 1,000,000 | | | | 1,103,625 | |

McDonald’s Corp. | | | | | | | | |

3.800%, 04/01/2028 | | | 1,000,000 | | | | 1,121,036 | |

| | | | | | | | |

| | | | | | | 16,159,053 | |

| | | | | | | | |

Telecom & Telecom Equipment (0.42%) | | | | | |

Cisco Systems Inc. | | | | | | | | |

3.625%, 03/04/2024 | | | 1,000,000 | | | | 1,089,326 | |

Verizon Communications Inc. | | | | | | | | |

4.150%, 03/15/2024 | | | 1,000,000 | | | | 1,090,992 | |

Cisco Systems Inc. | | | | | | | | |

3.500%, 06/15/2025 | | | 500,000 | | | | 553,889 | |

2.950%, 02/28/2026 | | | 500,000 | | | | 545,932 | |

Verizon Communications Inc. | | | | | | | | |

2.625%, 08/15/2026 | | | 1,000,000 | | | | 1,062,889 | |

AT&T Inc. | | | | | | | | |

1.650%, 02/01/2028 | | | 2,000,000 | | | | 1,974,054 | |

Vodafone Group PLC | | | | | | | | |

4.375%, 05/30/2028 | | | 1,000,000 | | | | 1,151,886 | |

Verizon Communications Inc. | | | | | | | | |

4.329%, 09/21/2028 | | | 1,012,000 | | | | 1,163,903 | |

| | |

| 14 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Telecom & Telecom Equipment (Cont.) | | | | | |

3.875%, 02/08/2029 | | $ | 1,000,000 | | | $ | 1,128,594 | |

AT&T Inc. | | | | | | | | |

4.350%, 03/01/2029 | | | 500,000 | | | | 572,277 | |

| | | | | | | | |

| | | | | | | 10,333,742 | |

| | | | | | | | |

Transportation (0.71%) | |

Burlington Northern Santa Fe | | | | | | | | |

3.050%, 09/01/2022 | | | 500,000 | | | | 513,961 | |

United Parcel Service Inc. | | | | | | | | |

2.450%, 10/01/2022 | | | 1,000,000 | | | | 1,029,836 | |

Burlington Northern Santa Fe | | | | | | | | |

3.000%, 03/15/2023 | | | 1,500,000 | | | | 1,562,452 | |

Union Pacific Corp. | | | | | | | | |

2.750%, 04/15/2023 | | | 500,000 | | | | 519,623 | |

Norfolk Southern Corp. | | | | | | | | |

3.850%, 01/15/2024 | | | 1,000,000 | | | | 1,077,842 | |

Burlington Northern Santa Fe | | | | | | | | |

3.750%, 04/01/2024 | | | 1,000,000 | | | | 1,085,282 | |

Union Pacific Corp. | | | | | | | | |

3.250%, 08/15/2025 | | | 500,000 | | | | 543,904 | |

Canadian National Railway Co. | | | | | | | | |

2.750%, 03/01/2026 | | | 2,000,000 | | | | 2,141,064 | |

Union Pacific Corp. | | | | | | | | |

2.750%, 03/01/2026 | | | 1,000,000 | | | | 1,071,293 | |

Norfolk Southern Corp. | | | | | | | | |

2.900%, 06/15/2026 | | | 500,000 | | | | 539,653 | |

United Parcel Service Inc. | | | | | | | | |

2.400%, 11/15/2026 | | | 500,000 | | | | 534,024 | |

Union Pacific Corp. | | | | | | | | |

3.000%, 04/15/2027 | | | 1,000,000 | | | | 1,083,463 | |

Norfolk Southern Corp. | | | | | | | | |

3.150%, 06/01/2027 | | | 500,000 | | | | 544,650 | |

United Parcel Service Inc. | | | | | | | | |

3.050%, 11/15/2027 | | | 2,000,000 | | | | 2,220,938 | |

Union Pacific Corp. | | | | | | | | |

3.950%, 09/10/2028 | | | 1,000,000 | | | | 1,138,199 | |

3.700%, 03/01/2029 | | | 500,000 | | | | 557,095 | |

United Parcel Service Inc. | | | | | | | | |

2.500%, 09/01/2029 | | | 1,000,000 | | | | 1,045,570 | |

| | | | | | | | |

| | | | | | | 17,208,849 | |

| | | | | | | | |

Utilities & Energy (3.97%) | |

Southern California Edison Co. | | | | | | | | |

3.875%, 06/01/2021 | | | 2,000,000 | | | | 2,000,000 | |

San Diego Gas & Electric Co. | | | | | | | | |

3.000%, 08/15/2021 | | | 500,000 | | | | 502,879 | |

Southern California Edison Co. | | | | | | | | |

2.400%, 02/01/2022 | | | 1,000,000 | | | | 1,010,474 | |

Carolina Power & Light Co. | | | | | | | | |

2.800%, 05/15/2022 | | | 1,000,000 | | | | 1,018,183 | |

Georgia Power Co. | | | | | | | | |

2.850%, 05/15/2022 | | | 1,000,000 | | | | 1,024,971 | |

Detroit Edison Co. | | | | | | | | |

2.650%, 06/15/2022 | | | 500,000 | | | | 509,537 | |

CenterPoint Energy Houston LLC | | | | | | | | |

2.250%, 08/01/2022 | | | 1,000,000 | | | | 1,017,573 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Utilities & Energy (Cont.) | | | | | | | | |

Northern States Power Co. | | | | | | | | |

2.150%, 08/15/2022 | | $ | 500,000 | | | $ | 506,566 | |

Baltimore Gas & Electric Co. | | | | | | | | |

2.800%, 08/15/2022 | | | 1,000,000 | | | | 1,023,464 | |

PPL Electric Utilities | | | | | | | | |

2.500%, 09/01/2022 | | | 1,000,000 | | | | 1,020,782 | |

Ameren Illinois Co. | | | | | | | | |

2.700%, 09/01/2022 | | | 1,000,000 | | | | 1,024,458 | |

Public Service Company of Colorado | | | | | | | | |

2.250%, 09/15/2022 | | | 1,000,000 | | | | 1,015,699 | |

Tampa Electric Co. | | | | | | | | |

2.600%, 09/15/2022 | | | 500,000 | | | | 510,891 | |

NSTAR Electric Co. | | | | | | | | |

2.375%, 10/15/2022 | | | 500,000 | | | | 511,461 | |

Public Service Company of Colorado | | | | | | | | |

2.500%, 03/15/2023 | | | 1,000,000 | | | | 1,028,381 | |

Virginia Electric & Power Co. | | | | | | | | |

2.750%, 03/15/2023 | | | 1,000,000 | | | | 1,038,383 | |

Public Service Electric and Gas Co. | | | | | | | | |

2.375%, 05/15/2023 | | | 2,000,000 | | | | 2,074,348 | |

Florida Power & Light Co. | | | | | | | | |

2.750%, 06/01/2023 | | | 2,000,000 | | | | 2,077,452 | |

Pacificorp | | | | | | | | |

2.950%, 06/01/2023 | | | 1,000,000 | | | | 1,043,828 | |

Pacific Gas & Electric | | | | | | | | |

3.250%, 06/15/2023 | | | 1,000,000 | | | | 1,035,007 | |

Consumers Energy Co. | | | | | | | | |

3.375%, 08/15/2023 | | | 1,000,000 | | | | 1,057,942 | |

Laclede Gas Co. | | | | | | | | |

3.400%, 08/15/2023 | | | 1,000,000 | | | | 1,058,067 | |

San Diego Gas & Electric Co. | | | | | | | | |

3.600%, 09/01/2023 | | | 2,000,000 | | | | 2,122,130 | |

Duke Energy Ohio Inc. | | | | | | | | |

3.800%, 09/01/2023 | | | 1,000,000 | | | | 1,066,762 | |

Public Service Company of New Hampshire | | | | | | | | |

3.500%, 11/01/2023 | | | 500,000 | | | | 533,406 | |

Delmarva Power & Light Co. | | | | | | | | |

3.500%, 11/15/2023 | | | 1,000,000 | | | | 1,069,447 | |

Alabama Power Co. | | | | | | | | |

3.550%, 12/01/2023 | | | 1,000,000 | | | | 1,076,653 | |

Virginia Electric & Power Co. | | | | | | | | |

3.450%, 02/15/2024 | | | 1,000,000 | | | | 1,071,484 | |

Potomac Electric Power Co. | | | | | | | | |

3.600%, 03/15/2024 | | | 1,000,000 | | | | 1,075,406 | |

DTE Electric Co. | | | | | | | | |

3.650%, 03/15/2024 | | | 2,000,000 | | | | 2,154,804 | |

Florida Power & Light Co. | | | | | | | | |

3.250%, 06/01/2024 | | | 1,000,000 | | | | 1,070,474 | |

Interstate Power & Light Co. | | | | | | | | |

3.250%, 12/01/2024 | | | 1,000,000 | | | | 1,079,001 | |

DTE Electric Co. | | | | | | | | |

3.375%, 03/01/2025 | | | 1,000,000 | | | | 1,088,691 | |

Alabama Power Co. | | | | | | | | |

2.800%, 04/01/2025 | | | 1,000,000 | | | | 1,057,692 | |

| | |

| See accompanying notes to financial statements. | | 15 |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Utilities & Energy (Cont.) | | | | | | | | |

Public Service Company of Colorado | | | | | | | | |

2.900%, 05/15/2025 | | $ | 1,000,000 | | | $ | 1,062,925 | |

Arizona Public Service Co. | | | | | | | | |

3.150%, 05/15/2025 | | | 500,000 | | | | 538,363 | |

Wisconsin Electric Power | | | | | | | | |

3.100%, 06/01/2025 | | | 1,000,000 | | | | 1,074,729 | |

Southern California Gas Co. | | | | | | | | |

3.200%, 06/15/2025 | | | 500,000 | | | | 540,921 | |

Pacific Gas & Electric | | | | | | | | |

3.500%, 06/15/2025 | | | 1,000,000 | | | | 1,054,147 | |

3.450%, 07/01/2025 | | | 500,000 | | | | 524,201 | |

Duke Energy Progress LLC | | | | | | | | |

3.250%, 08/15/2025 | | | 1,000,000 | | | | 1,092,855 | |

Interstate Power & Light Co. | | | | | | | | |

3.400%, 08/15/2025 | | | 1,000,000 | | | | 1,083,055 | |

Kentucky Utilities Co. | | | | | | | | |

3.300%, 10/01/2025 | | | 500,000 | | | | 543,133 | |

Louisville Gas & Electric Co. | | | | | | | | |

3.300%, 10/01/2025 | | | 1,000,000 | | | | 1,085,431 | |

PECO Energy Co. | | | | | | | | |

3.150%, 10/15/2025 | | | 1,000,000 | | | | 1,079,306 | |

NSTAR Electric Co. | | | | | | | | |

3.250%, 11/15/2025 | | | 1,000,000 | | | | 1,083,046 | |

Florida Power & Light Co. | | | | | | | | |

3.125%, 12/01/2025 | | | 1,000,000 | | | | 1,091,667 | |

Virginia Electric & Power Co. | | | | | | | | |

3.150%, 01/15/2026 | | | 1,000,000 | | | | 1,093,333 | |

Brooklyn Union Gas Co.,

The (b) | | | | | | | | |

3.407%, 03/10/2026 | | | 1,000,000 | | | | 1,081,799 | |

Georgia Power Co. | | | | | | | | |

3.250%, 04/01/2026 | | | 1,000,000 | | | | 1,081,230 | |

San Diego Gas & Electric Co. | | | | | | | | |

2.500%, 05/15/2026 | | | 1,000,000 | | | | 1,059,666 | |

NSTAR Electric Co. | | | | | | | | |

2.700%, 06/01/2026 | | | 1,000,000 | | | | 1,060,329 | |

Commonwealth Edison Co. | | | | | | | | |

2.550%, 06/15/2026 | | | 1,000,000 | | | | 1,063,705 | |

Southern California Gas Co. | | | | | | | | |

2.600%, 06/15/2026 | | | 1,000,000 | | | | 1,059,952 | |

Westar Energy Inc. | | | | | | | | |

2.550%, 07/01/2026 | | | 1,000,000 | | | | 1,060,803 | |

KeySpan Gas East Corp. (b) | | | | | | | | |

2.742%, 08/15/2026 | | | 1,000,000 | | | | 1,057,394 | |

CenterPoint Energy Houston Electric LLC | | | | | | | | |

2.400%, 09/01/2026 | | | 500,000 | | | | 527,770 | |

Public Service Electric and Gas Co. | | | | | | | | |

2.250%, 09/15/2026 | | | 1,000,000 | | | | 1,053,113 | |

Consolidated Edison Co. of New York | | | | | | | | |

2.900%, 12/01/2026 | | | 500,000 | | | | 537,882 | |

Duke Energy Carolinas | | | | | | | | |

2.950%, 12/01/2026 | | | 1,000,000 | | | | 1,087,210 | |

AEP Transmission Company LLC | | | | | | | | |

3.100%, 12/01/2026 | | | 500,000 | | | | 544,510 | |

Westar Energy Inc. | | | | | | | | |

3.100%, 04/01/2027 | | | 1,000,000 | | | | 1,085,238 | |

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | | | | | | | | |

Utilities & Energy (Cont.) | | | | | | | | |

Public Service Electric and Gas Co. | | | | | | | | |

3.000%, 05/15/2027 | | $ | 500,000 | | | $ | 542,008 | |

NSTAR Electric Co. | | | | | | | | |

3.200%, 05/15/2027 | | | 1,000,000 | | | | 1,096,578 | |

Rochester Gas & Electric Corp. (b) | | | | | | | | |

3.100%, 06/01/2027 | | | 1,000,000 | | | | 1,085,412 | |

Appalachian Power Co. | | | | | | | | |

3.300%, 06/01/2027 | | | 1,000,000 | | | | 1,087,975 | |

Union Electric Co. | | | | | | | | |

2.950%, 06/15/2027 | | | 1,000,000 | | | | 1,078,594 | |

Atmos Energy Corp. | | | | | | | | |

3.000%, 06/15/2027 | | | 1,000,000 | | | | 1,083,966 | |

Boston Gas Co. (b) | | | | | | | | |

3.150%, 08/01/2027 | | | 500,000 | | | | 537,734 | |

Commonwealth Edison Co. | | | | | | | | |

2.950%, 08/15/2027 | | | 500,000 | | | | 542,437 | |

Wisconsin Power & Light | | | | | | | | |

3.050%, 10/15/2027 | | | 1,000,000 | | | | 1,084,356 | |

Consolidated Edison Co. of New York | | | | | | | | |

3.125%, 11/15/2027 | | | 1,000,000 | | | | 1,085,716 | |

Pacific Gas & Electric | | | | | | | | |

3.300%, 12/01/2027 | | | 1,000,000 | | | | 1,030,211 | |

Southern California Edison Co. | | | | | | | | |

3.650%, 03/01/2028 | | | 1,000,000 | | | | 1,086,785 | |

Southwest Gas Corp. | | | | | | | | |

3.700%, 04/01/2028 | | | 1,000,000 | | | | 1,095,004 | |

Virginia Electric & Power Co. | | | | | | | | |

3.800%, 04/01/2028 | | | 1,000,000 | | | | 1,122,006 | |

Public Service Electric and Gas Co. | | | | | | | | |

3.700%, 05/01/2028 | | | 1,000,000 | | | | 1,122,645 | |

Ameren Illinois Co. | | | | | | | | |

3.800%, 05/15/2028 | | | 1,000,000 | | | | 1,120,489 | |

Consolidated Edison Co. of New York | | | | | | | | |

3.800%, 05/15/2028 | | | 1,000,000 | | | | 1,116,967 | |

Indiana Michigan Power Co. | | | | | | | | |

3.850%, 05/15/2028 | | | 1,000,000 | | | | 1,115,073 | |

AEP Texas Central Co. | | | | | | | | |

3.950%, 06/01/2028 | | | 1,000,000 | | | | 1,115,816 | |

Pacific Gas & Electric | | | | | | | | |

3.750%, 07/01/2028 | | | 500,000 | | | | 520,486 | |

Duke Energy Ohio Inc. | | | | | | | | |

3.650%, 02/01/2029 | | | 1,000,000 | | | | 1,099,900 | |

Brooklyn Union Gas Co., The(b) | | | | | | | | |

3.865%, 03/04/2029 | | | 1,000,000 | | | | 1,102,932 | |

Union Electric Co. | | | | | | | | |

3.500%, 03/15/2029 | | | 1,000,000 | | | | 1,098,988 | |

MidAmerican Energy Co. | | | | | | | | |

3.650%, 04/15/2029 | | | 2,000,000 | | | | 2,244,342 | |

Atmos Energy Corp. | | | | | | | | |

2.625%, 09/15/2029 | | | 1,000,000 | | | | 1,032,317 | |

EVERGY METRO | | | | | | | | |

2.250%, 06/01/2030 | | | 500,000 | | | | 501,264 | |

Interstate Power & Light Co. | | | | | | | | |

2.300%, 06/01/2030 | | | 500,000 | | | | 500,063 | |

Southwest Gas Corp. | | | | | | | | |

2.200%, 06/15/2030 | | | 500,000 | | | | 492,592 | |

| | |

| 16 | | See accompanying notes to financial statements. |

STATE FARM ASSOCIATES’ FUNDS TRUST BALANCED FUND

SCHEDULE OF INVESTMENTS (continued)

May 31, 2021

(Unaudited)

| | | | | | | | |

| | | Principal

amount | | | Value | |

Corporate Bonds (Cont.) | |

Utilities & Energy (Cont.) | |

Alabama Power Co. | | | | | | | | |

1.450%, 09/15/2030 | | $ | 1,500,000 | | | $ | 1,407,108 | |

Public Service Company of Colorado | | | | | | | | |

1.875%, 06/15/2031 | | | 3,000,000 | | | | 2,925,066 | |

| | | | | | | | |

| | | | | | | 95,958,839 | |

| | | | | | | | |

Total Corporate Bonds | | | | | | | | |

(cost $368,056,929) | | | | | | | 391,318,062 | |

| | | | | | | | |

Foreign Government Bonds (0.09%) | |

Province of Ontario | | | | | |

2.500%, 04/27/2026 | | | 1,000,000 | | | | 1,072,440 | |

Province of Quebec | | | | | | | | |