2013 Investor & Analyst Forum February 28, 2013 Positioned for Growth

LIMITED ACCESS Positioned for Growth Agenda 2 Succeeding in a Challenging Environment JOSEPH L. HOOLEY Chairman, President and Chief Executive Officer Driving New Revenue Growth JACK KLINCK Global Head of Corporate Development and Client Relationship Management GEORGE E. SULLIVAN Global Head of Alternative Investment Solutions SCOTT F. POWERS Chief Executive Officer, State Street Global Advisors Leveraging the Power of the Core Franchise CHRISTOPHER PERRETTA Chief Information Officer GUNJAN KEDIA Head of Mutual Fund Services Delivering Shareholder Value EDWARD J. RESCH Chief Financial Officer Core Confidence JOSEPH L. HOOLEY Question & Answer Session

LIMITED ACCESS Forward-Looking Statements 3 This presentation contains forward-looking statements as defined by United States securities laws, including statements relating to our goals and expectations regarding our business, financial and capital condition (including without limitation, our capital ratios under Basel III), results of operations, investment portfolio performance and strategies, the financial and market outlook, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as "plan," "expect," “intend,” “forecast,” "look," "believe," "anticipate," "estimate," "seek,“ "may," "will," "trend," "target,” and "goal," or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to February 28, 2013. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposure, including, for example, the direct and indirect effects on counterparties of the current sovereign-debt risks in Europe and other regions; financial market disruptions or economic recession, whether in the U.S., Europe, Asia or other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other-than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding, and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement the Dodd-Frank Act, the Basel II and Basel III capital and liquidity standards, and European legislation with respect to the levels of regulatory capital we must maintain, our credit exposure to third parties, margin requirements applicable to derivatives, banking and financial activities and other regulatory initiatives in the U.S. and internationally, including regulatory developments that result in changes to our structure or operating model, increased costs or other changes to how we provide services; adverse changes in the regulatory capital ratios that we are required to meet, whether arising under the Dodd-Frank Act, the Basel II or Basel III capital and liquidity standards or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in calculating our capital ratios that cause changes in those ratios as they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other regulators for the use, allocation or distribution of our capital or other specific capital actions or programs, including acquisitions, dividends and equity purchases, without which our growth plans, distributions to shareholders, equity purchase programs or other capital initiatives may be restricted; changes in law or regulation that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations or those of our clients and our regulators; the credit agency ratings of our debt and depository obligations and investor and client perceptions of our financial strength; delays or difficulties in the execution of our previously announced Business Operations and Information Technology Transformation program, which could lead to changes in our estimates of the charges, expenses or savings associated with the planned program and may cause volatility of our earnings; the results of, and costs associated with, government investigations, litigation, and similar claims, disputes, or proceedings; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the valuation of assets underlying those pools; adverse publicity or other reputational harm; dependencies on information technology, complexities and costs of protecting the security of our systems and difficulties with protecting our intellectual property rights; our ability to grow revenue, control expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements; potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation, and perceptions of State Street as a suitable service provider or counterparty; potential changes in how and in what amounts clients compensate us for our services, and the mix of services provided by us that clients choose; the ability to complete acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that acquired businesses and joint ventures will not achieve their anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected disynergies will be experienced, that client and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging needs of our clients and to develop products that are responsive to such trends and profitable to us; the performance of and demand for the products and services we offer; and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; our ability to control operating risks, data security breach risks, information technology systems risks and outsourcing risks, and our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2012 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this news release speak only as of the date hereof, February 28, 2013, and we do not undertake efforts to revise those forward-looking statements to reflect events after that date.

4 Succeeding in a Challenging Environment JOSEPH L. HOOLEY Chairman, President and Chief Executive Officer

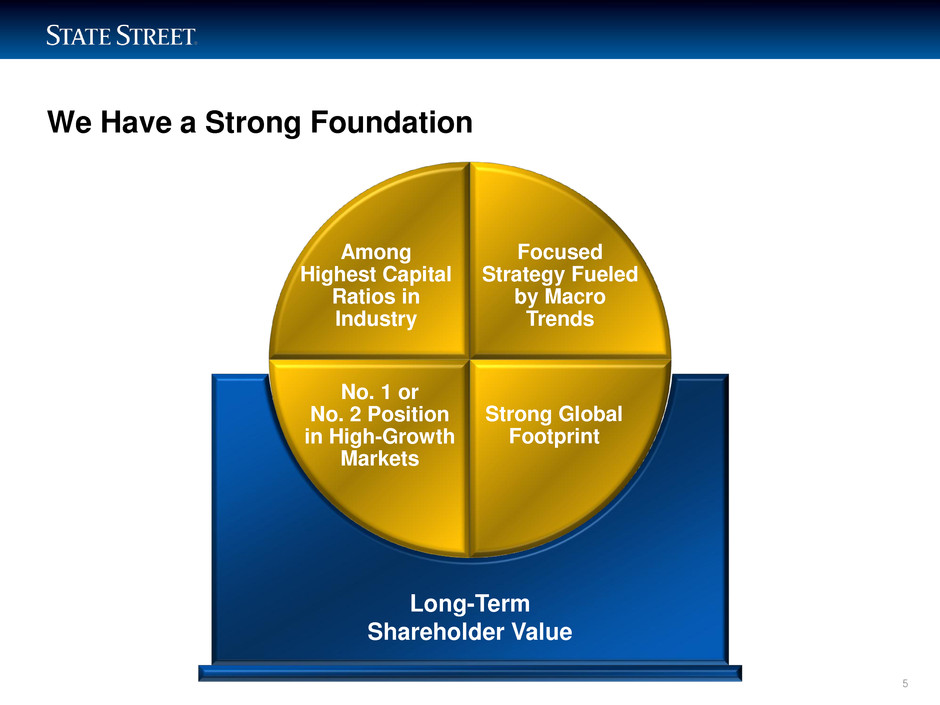

LIMITED ACCESS We Have a Strong Foundation 5 Strong Global Footprint Long-Term Shareholder Value Among Highest Capital Ratios in Industry Focused Strategy Fueled by Macro Trends Strong Global Footprint No. 1 or No. 2 Position in High-Growth Markets

LIMITED ACCESS Our Actions Have Driven Positive Results 6 • Global economic pressures • Client de-risking behavior • Market-driven revenue weakness • Regulatory changes increase costs and capital pressures • Grew core businesses • Prudently controlled expenses • Continued to transform operating model • Managed capital position to address regulatory changes Environment Our Actions • Achieved 6% operating-basis1 EPS growth and positive operating leverage2 in 2012 compared to 2011 • Continued to invest in high-growth areas • Met expense savings targets in Business Operations and IT Transformation program • Returned capital to shareholders in the form of common stock purchases and dividends Results 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis.

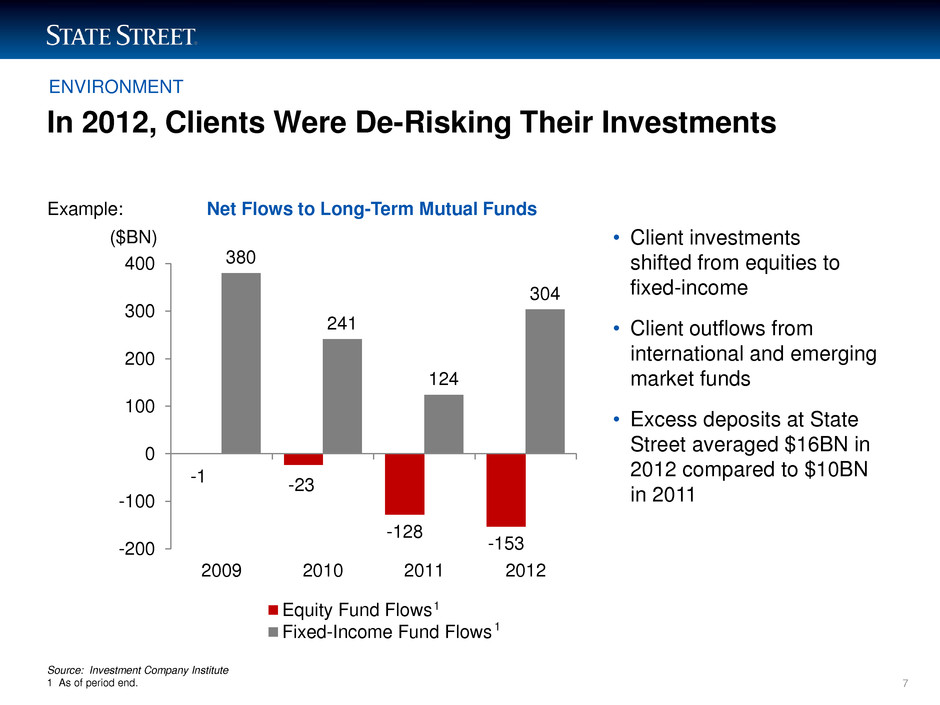

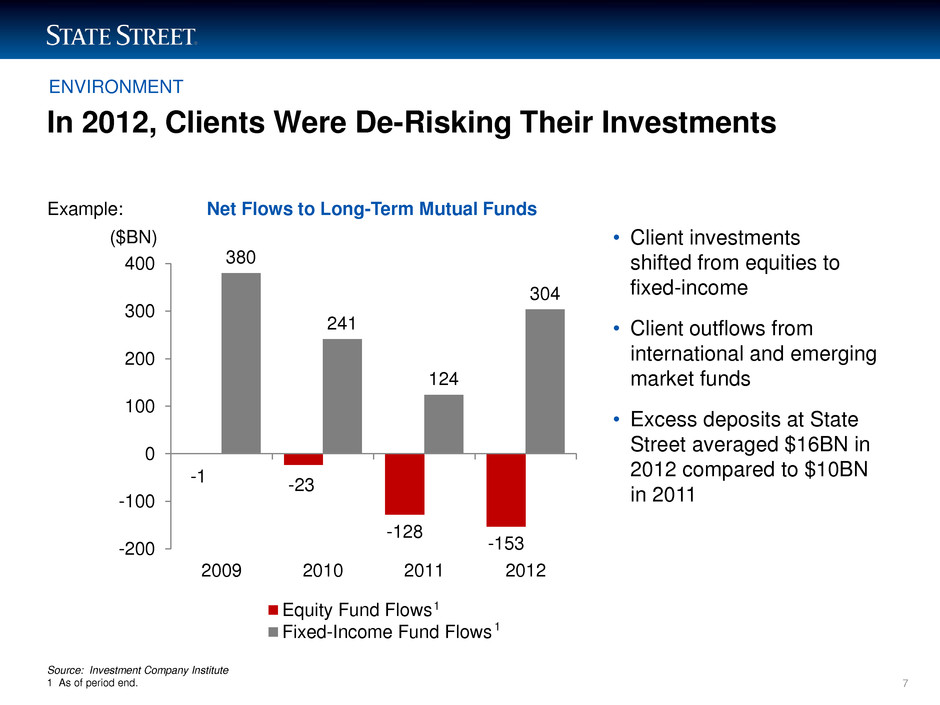

LIMITED ACCESS In 2012, Clients Were De-Risking Their Investments 7 ($BN) • Client investments shifted from equities to fixed-income • Client outflows from international and emerging market funds • Excess deposits at State Street averaged $16BN in 2012 compared to $10BN in 2011 Source: Investment Company Institute 1 As of period end. -1 -23 -128 -153 380 241 124 304 -200 -100 0 100 200 300 400 2009 2010 2011 2012 Equity Fund Flows Fixed-Income Fund Flows 1 1 Net Flows to Long-Term Mutual Funds Example: ENVIRONMENT

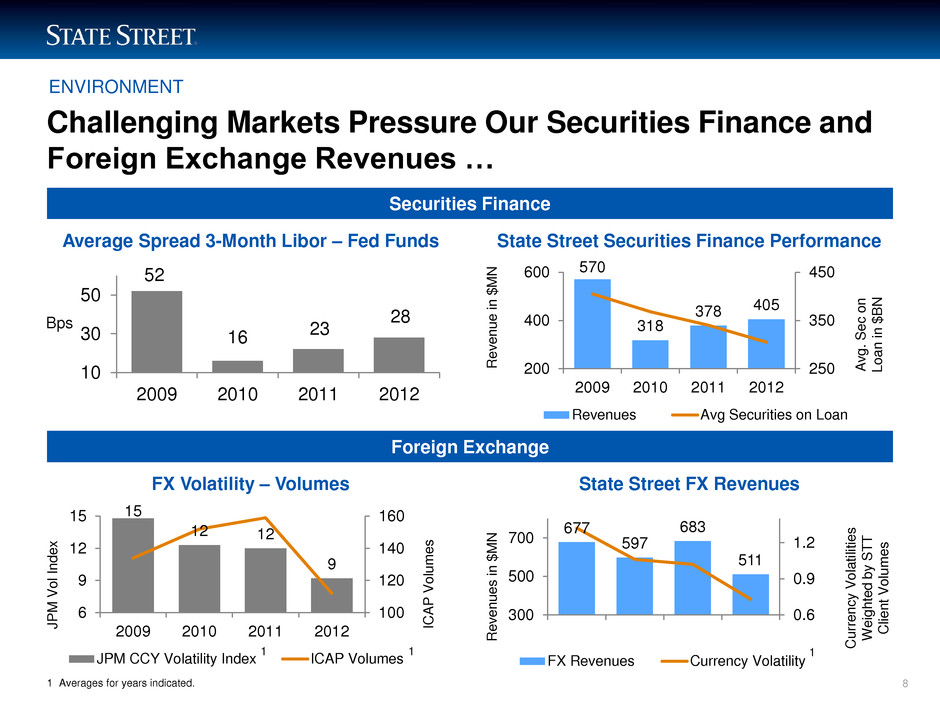

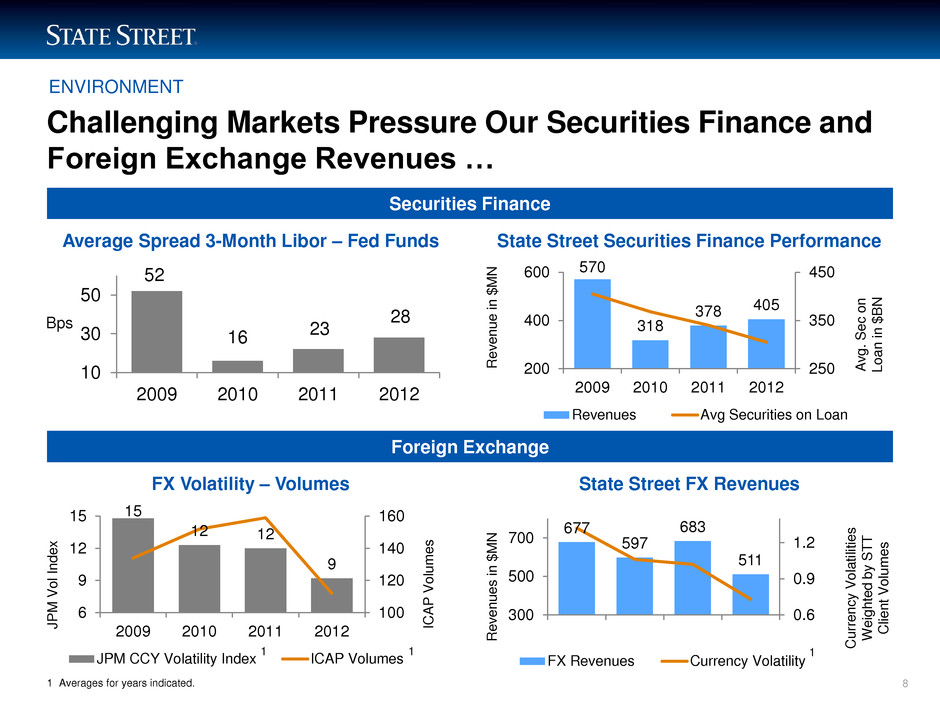

LIMITED ACCESS Challenging Markets Pressure Our Securities Finance and Foreign Exchange Revenues … 8 Securities Finance Foreign Exchange Average Spread 3-Month Libor – Fed Funds 52 16 23 28 10 30 50 2009 2010 2011 2012 State Street Securities Finance Performance FX Volatility – Volumes State Street FX Revenues 570 318 378 405 250 350 450 200 400 600 2009 2010 2011 2012 Revenues Avg Securities on Loan Bps R e venu e i n $M N A vg . S ec on Loa n i n $ B N R e venu e s i n $M N J P M V o l I nde x IC A P V o lu m e s 677 597 683 511 0.6 0.9 1.2 300 500 700 2009 2010 2011 2012 FX Revenues Currency Volatility C ur renc y V o la ti lit ies W e igh ted b y S T T C lien t V o lu m e s 1 Averages for years indicated. 15 12 12 9 100 120 140 160 6 9 12 15 2009 2010 2011 2012 JPM CCY Volatility Index ICAP Volumes 1 1 1 ENVIRONMENT

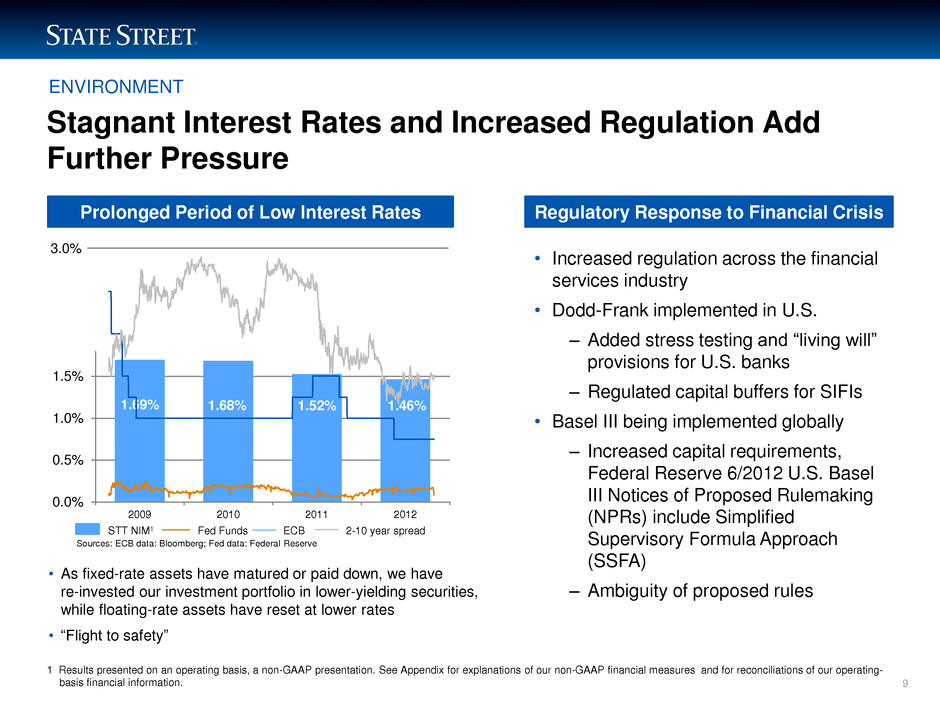

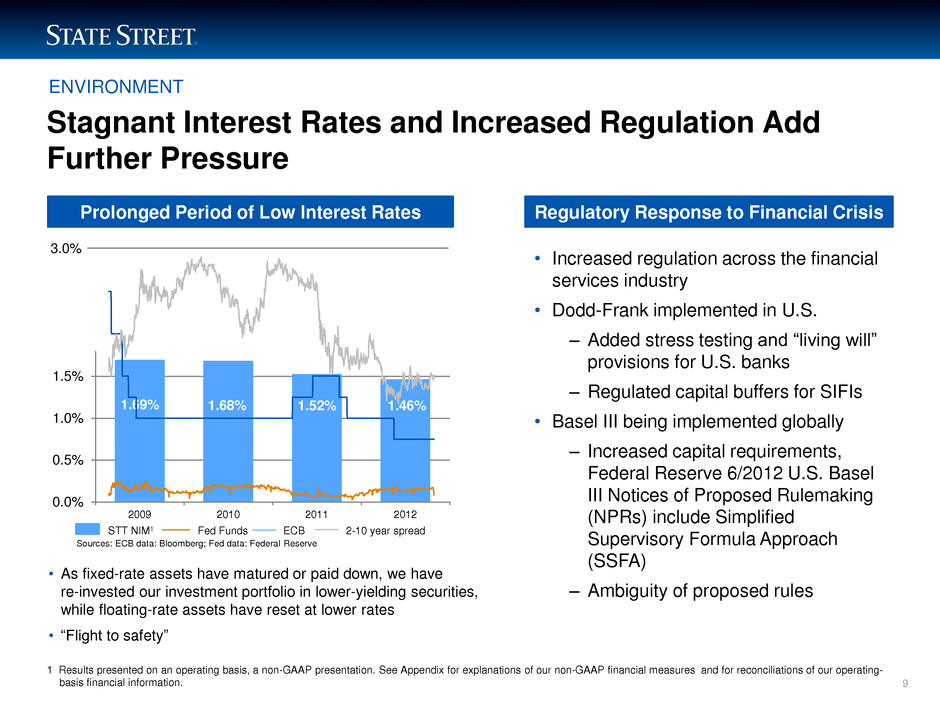

LIMITED ACCESS 1.69% 1.68% 1.52% 1.46% 0.0% 0.5% 1.0% 1.5% 2009 2010 2011 2012 Stagnant Interest Rates and Increased Regulation Add Further Pressure 9 Regulatory Response to Financial Crisis • Increased regulation across the financial services industry • Dodd-Frank implemented in U.S. – Added stress testing and “living will” provisions for U.S. banks – Regulated capital buffers for SIFIs • Basel III being implemented globally – Increased capital requirements, Federal Reserve 6/2012 U.S. Basel III Notices of Proposed Rulemaking (NPRs) include Simplified Supervisory Formula Approach (SSFA) – Ambiguity of proposed rules • As fixed-rate assets have matured or paid down, we have re-invested our investment portfolio in lower-yielding securities, while floating-rate assets have reset at lower rates • “Flight to safety” STT NIM1 Fed Funds ECB 2-10 year spread 3.0% Sources: ECB data: Bloomberg; Fed data: Federal Reserve 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. Prolonged Period of Low Interest Rates ENVIRONMENT

LIMITED ACCESS But, We’ve Built a Strong Foundation for Growth … • Successfully grew our core business and continued to invest in high-growth markets • Continued implementing a multi-year Business Operations and IT Transformation program • Controlled costs, reducing headcount and compensation • Consistently grew our operating-basis1 earnings per share for past the three years • Strategically managed and deployed our capital 10 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information.

LIMITED ACCESS … and Delivered Strong Results 11 Operating-Basis (Non-GAAP) EPS1 Growth from 2009 $3.32 $3.40 $3.73 $3.95 $2.00 $3.00 $4.00 2009 2010 2011 2012 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. '09 '10 '11 '12 -80% -60% -40% -20% 0% 20% 40% 60% Total Return 1/1/2009 – 2/22/2013 Our Total Return Significantly Outperformed Primary Peers STT 52% Bank of New York Mellon Corp. Northern Trust Corp. S&P 500 / Financials State Street Corp. BK 6% NTRS 12% S&P FINL 52% Source: FactSet

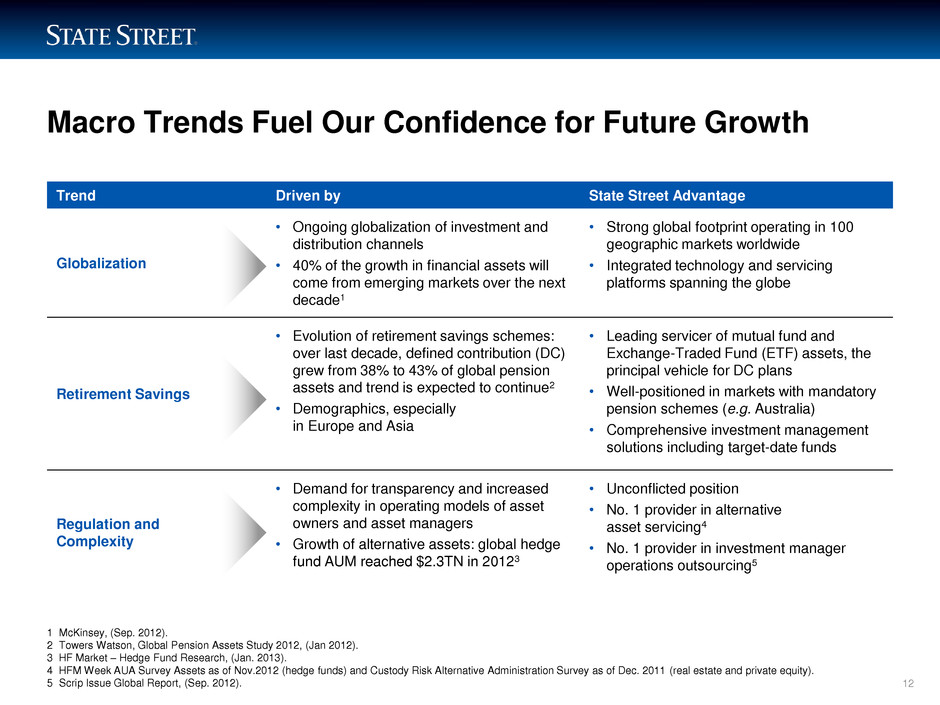

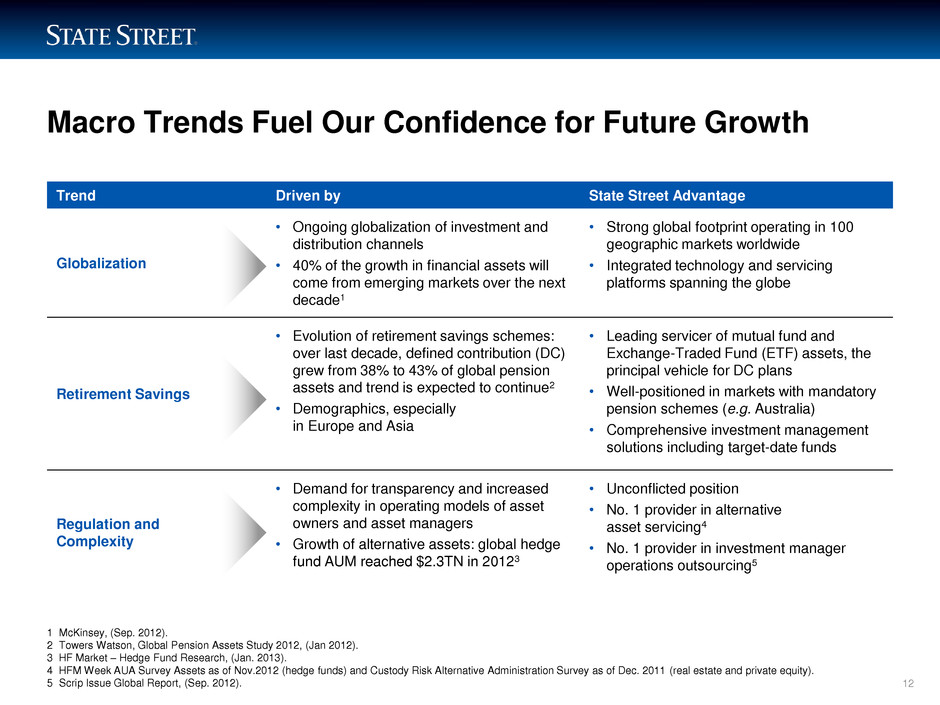

LIMITED ACCESS Macro Trends Fuel Our Confidence for Future Growth 12 Trend Driven by State Street Advantage Globalization • Ongoing globalization of investment and distribution channels • 40% of the growth in financial assets will come from emerging markets over the next decade1 • Strong global footprint operating in 100 geographic markets worldwide • Integrated technology and servicing platforms spanning the globe Retirement Savings • Evolution of retirement savings schemes: over last decade, defined contribution (DC) grew from 38% to 43% of global pension assets and trend is expected to continue2 • Demographics, especially in Europe and Asia • Leading servicer of mutual fund and Exchange-Traded Fund (ETF) assets, the principal vehicle for DC plans • Well-positioned in markets with mandatory pension schemes (e.g. Australia) • Comprehensive investment management solutions including target-date funds Regulation and Complexity • Demand for transparency and increased complexity in operating models of asset owners and asset managers • Growth of alternative assets: global hedge fund AUM reached $2.3TN in 20123 • Unconflicted position • No. 1 provider in alternative asset servicing4 • No. 1 provider in investment manager operations outsourcing5 1 McKinsey, (Sep. 2012). 2 Towers Watson, Global Pension Assets Study 2012, (Jan 2012). 3 HF Market – Hedge Fund Research, (Jan. 2013). 4 HFM Week AUA Survey Assets as of Nov.2012 (hedge funds) and Custody Risk Alternative Administration Survey as of Dec. 2011 (real estate and private equity). 5 Scrip Issue Global Report, (Sep. 2012).

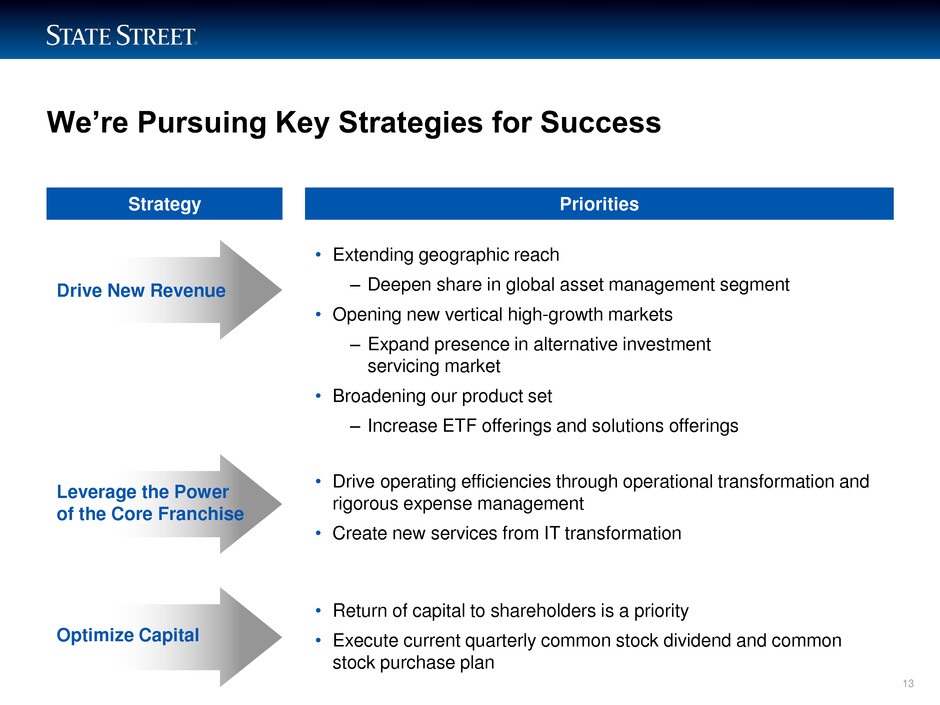

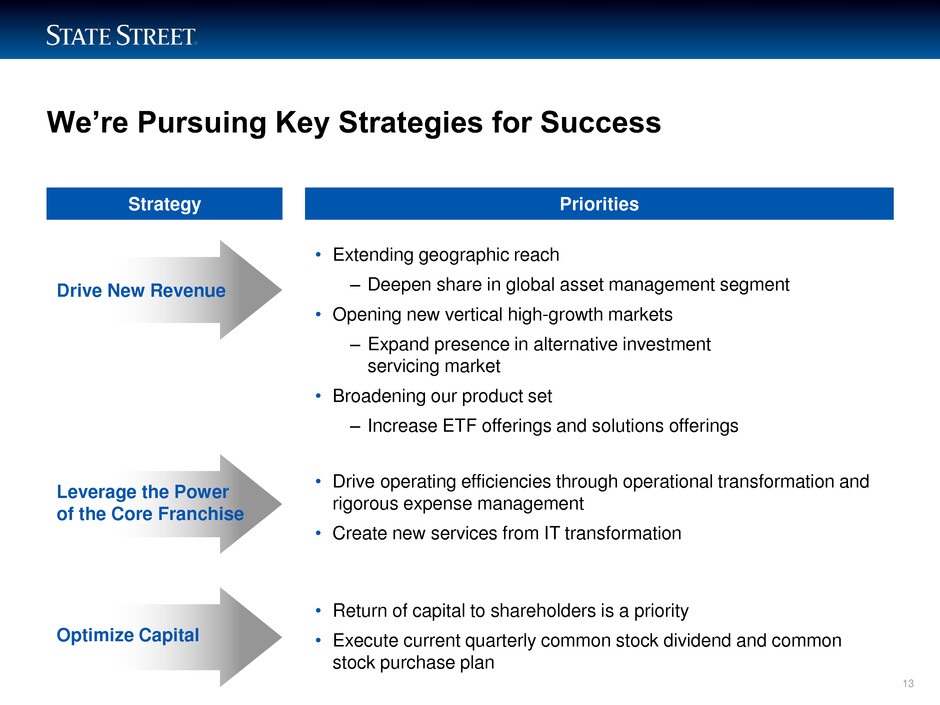

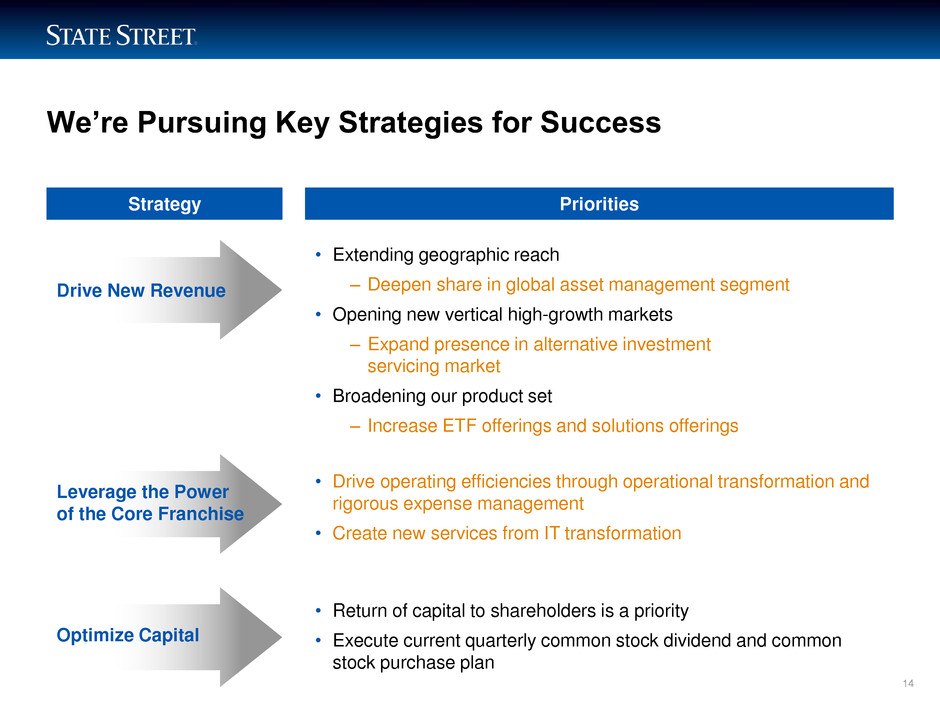

LIMITED ACCESS We’re Pursuing Key Strategies for Success 13 Priorities Strategy • Extending geographic reach – Deepen share in global asset management segment • Opening new vertical high-growth markets – Expand presence in alternative investment servicing market • Broadening our product set – Increase ETF offerings and solutions offerings Leverage the Power of the Core Franchise • Drive operating efficiencies through operational transformation and rigorous expense management • Create new services from IT transformation Optimize Capital • Return of capital to shareholders is a priority • Execute current quarterly common stock dividend and common stock purchase plan Drive New Revenue

LIMITED ACCESS We’re Pursuing Key Strategies for Success 14 Priorities Strategy • Extending geographic reach – Deepen share in global asset management segment • Opening new vertical high-growth markets – Expand presence in alternative investment servicing market • Broadening our product set – Increase ETF offerings and solutions offerings Leverage the Power of the Core Franchise • Drive operating efficiencies through operational transformation and rigorous expense management • Create new services from IT transformation Optimize Capital • Return of capital to shareholders is a priority • Execute current quarterly common stock dividend and common stock purchase plan Drive New Revenue

15 Driving New Revenue Growth JACK KLINCK Global Head of Corporate Development and Client Relationship Management GEORGE E. SULLIVAN Global Head of Alternative Investment Solutions SCOTT F. POWERS Chief Executive Officer, State Street Global Advisors

LIMITED ACCESS Why Clients Choose Us We Operate in More Than 100 Geographic Markets Worldwide Broad Set of Global Servicing Solutions Uniform Global Platform Leader in Middle Office Solutions-Based Asset Management Leader in Technology Transformation Our Powerful Global Franchise Sets Us Apart in Meeting the Needs of the Largest Global Asset Managers 16 Data as of December 31, 2012. EUROPE & MIDDLE EAST • AUC/A: $4.8TN • Revenue: $2.8BN • AUM: $351BN ASIA-PACIFIC • AUC/A: $1.1TN • Revenue: $766MN • AUM: $302BN AMERICAS • AUC/A: $18.5TN • Revenue: $6.2BN • AUM: $1.4TN

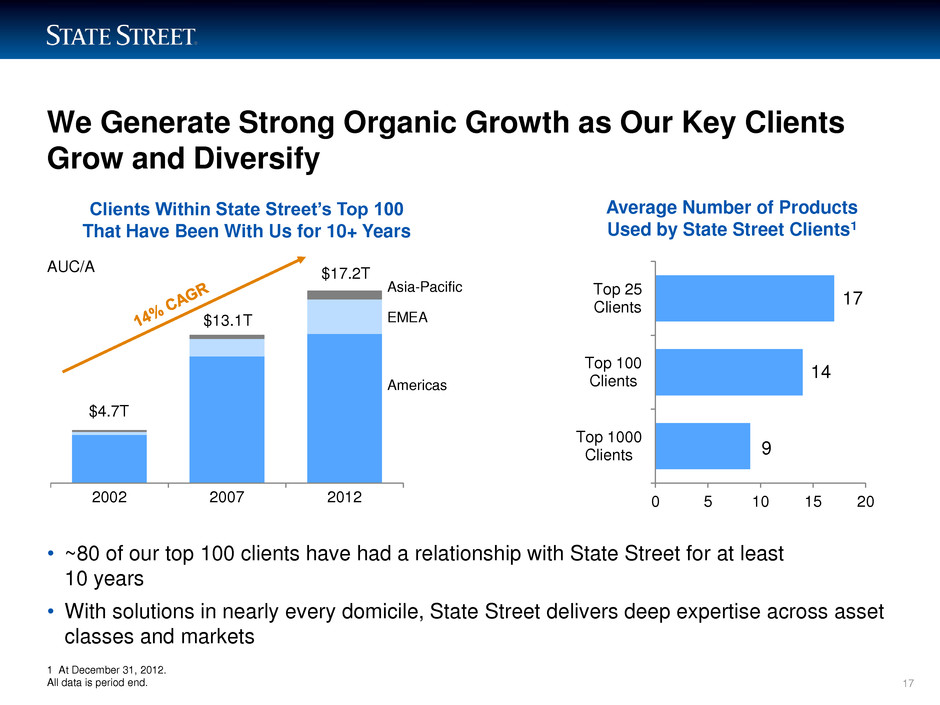

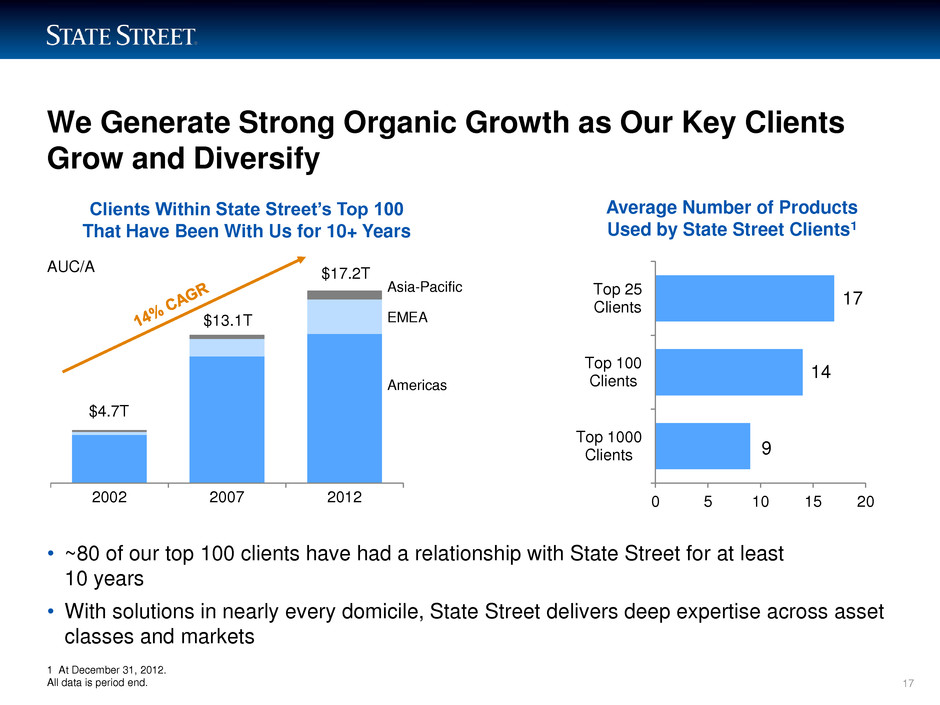

LIMITED ACCESS We Generate Strong Organic Growth as Our Key Clients Grow and Diversify 17 AUC/A • ~80 of our top 100 clients have had a relationship with State Street for at least 10 years • With solutions in nearly every domicile, State Street delivers deep expertise across asset classes and markets 0 5 10 15 20 Top 1000 Clients Top 100 Clients Top 25 Clients 9 14 17 Average Number of Products Used by State Street Clients1 2002 2007 2012 Asia-Pacific Americas $4.7T $13.1T $17.2T EMEA Clients Within State Street’s Top 100 That Have Been With Us for 10+ Years 1 At December 31, 2012. All data is period end.

LIMITED ACCESS Our Core Client Base Includes Some of the Largest and Most Complex Institutions Across the Globe 18

LIMITED ACCESS Our Alternative Investment Solutions Business Has Grown at More Than Twice the Rate of the Market1 19 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2005 2006 2007 2008 2009 2010 2011 2012 $4.7T Alternative Investments Market $4.4T $5.2T $5.7T $6.5T $6.7T $0 $200 $400 $600 $800 $1,000 $1,200 2005 2006 2007 2008 2009 2010 2011 2012 $500B $451B $443B $654B $816B $1.12T AUM(B) AUA(B) State Street Alternative Investment Solutions $3.5T $2.6T $139B $203B Source: HF Market - Hedge Fund Research, January 2013; PE Market - Preqin, October 2012; RE Market - Towers Watson, July 2012; RE Market (2005,2006) - PI Online Acquisitions: 2007: Palmeri $35B, Investors Financial $170B, 2010: Mourant $170B, 2012: GSAS $200B Asset Growth Through Acquisition 1 As of period end.

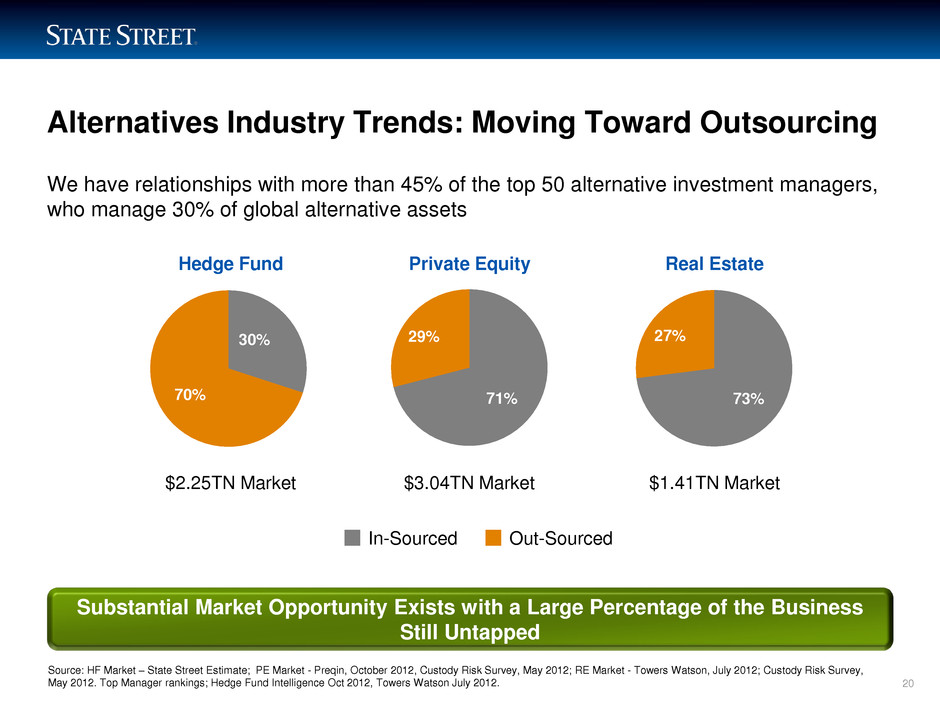

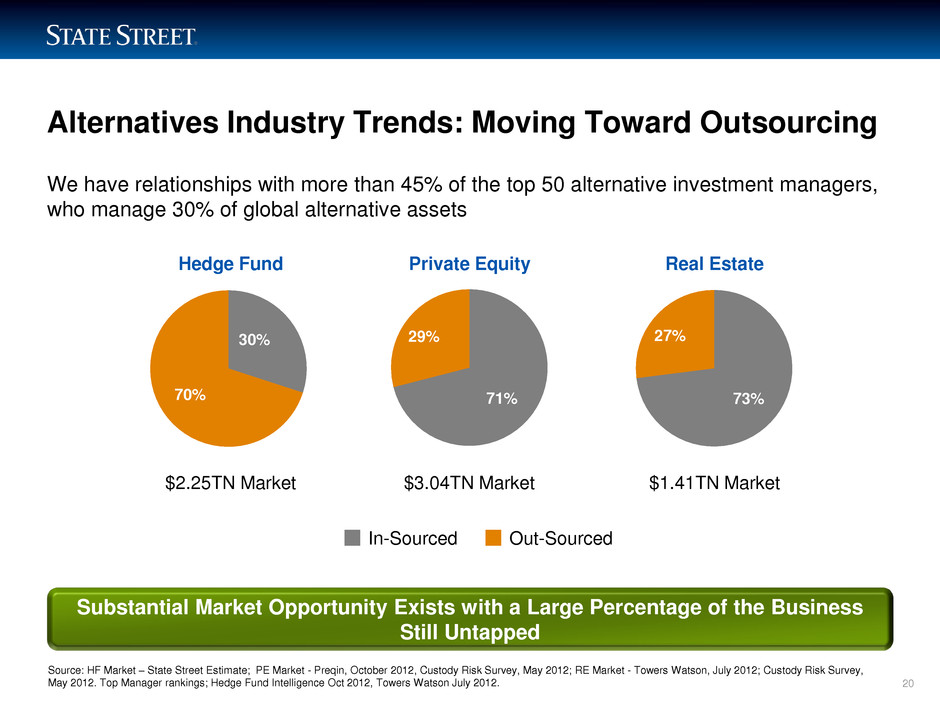

LIMITED ACCESS Substantial Market Opportunity Exists with a Large Percentage of the Business Still Untapped Alternatives Industry Trends: Moving Toward Outsourcing 20 Private Equity Hedge Fund Real Estate Source: HF Market – State Street Estimate; PE Market - Preqin, October 2012, Custody Risk Survey, May 2012; RE Market - Towers Watson, July 2012; Custody Risk Survey, May 2012. Top Manager rankings; Hedge Fund Intelligence Oct 2012, Towers Watson July 2012. 30% 70% $3.04TN Market $2.25TN Market $1.41TN Market 71% 29% 73% 27% In-Sourced Out-Sourced We have relationships with more than 45% of the top 50 alternative investment managers, who manage 30% of global alternative assets

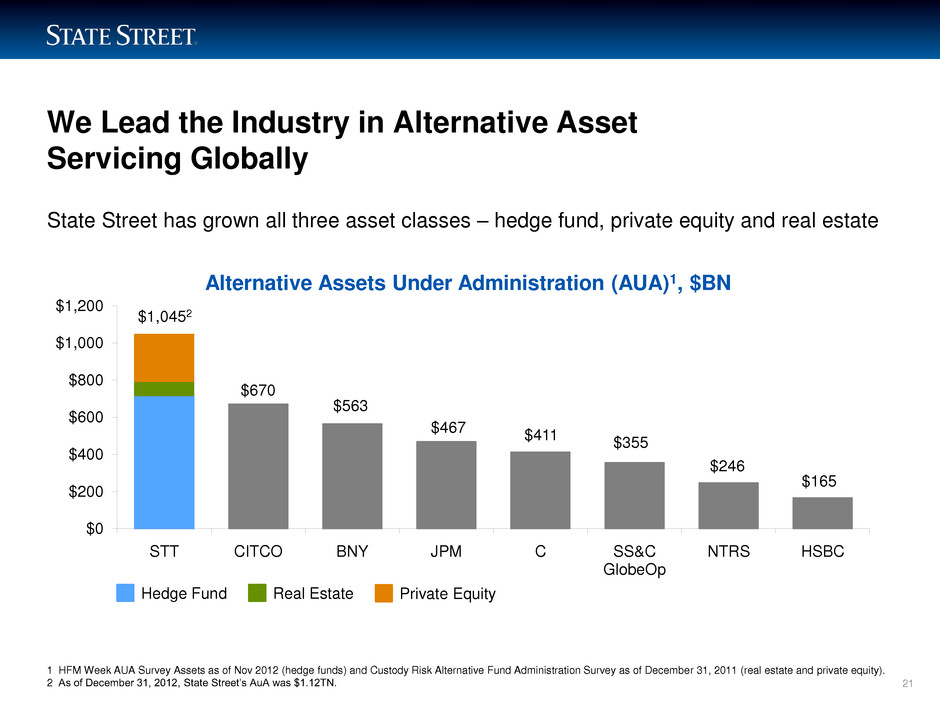

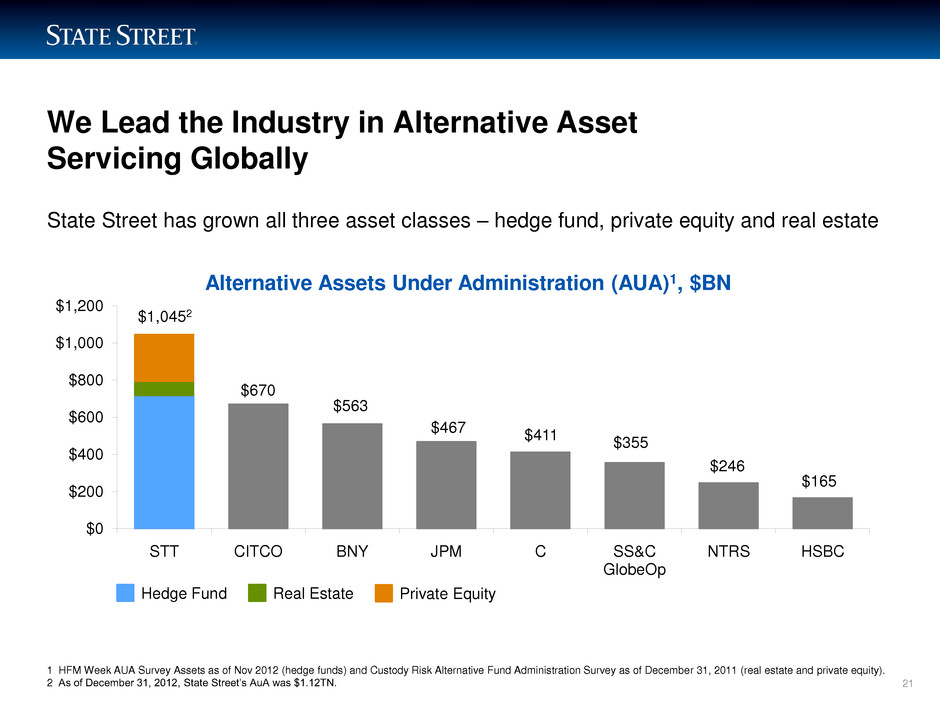

LIMITED ACCESS $1,0452 $670 $563 $467 $411 $355 $246 $165 $0 $200 $400 $600 $800 $1,000 $1,200 STT CITCO BNY JPM C SS&C GlobeOp NTRS HSBC We Lead the Industry in Alternative Asset Servicing Globally 21 1 HFM Week AUA Survey Assets as of Nov 2012 (hedge funds) and Custody Risk Alternative Fund Administration Survey as of December 31, 2011 (real estate and private equity). 2 As of December 31, 2012, State Street’s AuA was $1.12TN. Alternative Assets Under Administration (AUA)1, $BN Hedge Fund Private Equity Real Estate State Street has grown all three asset classes – hedge fund, private equity and real estate

LIMITED ACCESS State Street Global Advisors is Well Positioned for Growth in 2013 and Beyond 22 $2.1TN AUM1 1 As of December 31, 2012. 2 Operating leverage is defined as the rate of growth of total investment management revenue less the rate of growth of total investment management expenses. Broad Capabilities Clients • ~3,500 clients globally • 53% of clients use two or more strategies • 77% of 2012 new business came from existing SSgA clients Strong 2012 Results • $81BN in net new assets, $41BN of which went into ETFs • 8% management fee revenue growth with approximately 800 bps of positive operating leverage2, for the year ended December 31, 2012 compared to 2011 • ~600 bps operating margin expansion to 29% • Pre-tax income growth of 31% • 67% of active strategies beat their three- year benchmarks Passive Equities 36% Passive Fixed Income 14% ETFs 16% Multi-Asset Class Solutions 10% Active 6% Cash 18%

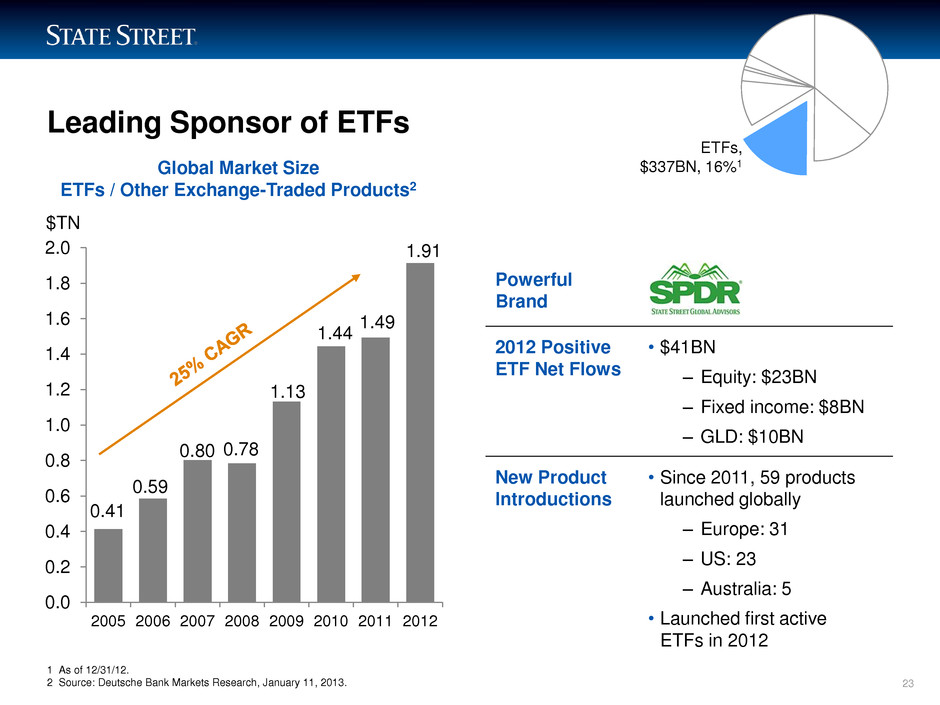

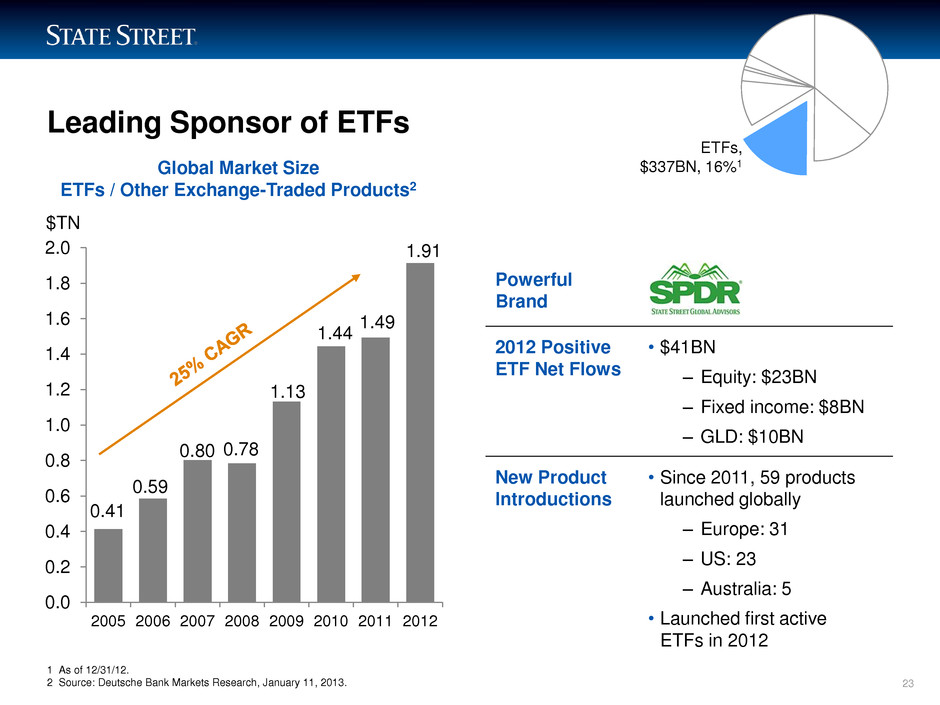

LIMITED ACCESS 1 As of 12/31/12. 2 Source: Deutsche Bank Markets Research, January 11, 2013. Leading Sponsor of ETFs 23 $TN Global Market Size ETFs / Other Exchange-Traded Products2 ETFs, $337BN, 16%1 0.41 0.59 0.80 0.78 1.13 1.44 1.49 1.91 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2005 2006 2007 2008 2009 2010 2011 2012 Powerful Brand 2012 Positive ETF Net Flows • $41BN – Equity: $23BN – Fixed income: $8BN – GLD: $10BN New Product Introductions • Since 2011, 59 products launched globally – Europe: 31 – US: 23 – Australia: 5 • Launched first active ETFs in 2012

LIMITED ACCESS Our Investment Solutions Group Meets Growing Investor Demand 24 Growing Demand Example Strategies • Rapidly increasing market demand – Projected to represent one-quarter of flows and 15% of asset management profits by 20152 – More than 85% of asset managers consider Solutions one of their top three priorities2 1 As of 12/31/12. 2 Source: McKinsey Analysis: The Asset Management Industry: Outcomes are the New Alpha, October 2012. Pension Plans Defined Contribution Plans Pension Plans, Sovereign Wealth Funds, Endowments and Foundations Engagement with diverse clients to develop strategies that help meet their specific investment objectives Liability Driven Investments Target-Date Funds Overlay Strategies Client-Tailored Strategies Multi-Asset Class Solutions $211BN, 10%1

LIMITED ACCESS Q&A 25 Leader in Investment Solutions Leader in Alternative Asset Servicing Deep Global Client Relationships

26 Leveraging the Power of the Core Franchise CHRISTOPHER PERRETTA Chief Information Officer GUNJAN KEDIA Head of Mutual Fund Services

LIMITED ACCESS Business Operations and IT Transformation Program on Track1 27 1 The full effect of the annual pre-tax, run-rate savings is not expected to be experienced until 2015. Data based on the approximate mid-point of the range of the estimated annual pre-tax, run-rate expense savings of $575MN-$625MN at the end of 2014, for full effect in 2015. Estimated annual pre-tax expense savings relate only to the Business Operations and Information Technology Transformation program and are based on projected improvement from total 2010 operating expenses. Actual total expenses of the Company have increased since 2010, and may in the future increase or decrease, due to other factors. Approach • More than two hundred projects managed under unified program structure • Independent oversight of financial benefit realization • Formal restructuring mechanisms to harvest automation benefits BUSINESS OPERATIONS LEVERS INFORMATION TECHNOLOGY LEVERS • Process transformation and standardization • Automation of key business processes • Centers of Excellence in a globally balanced model • New technology architecture • Private cloud • Workforce optimization

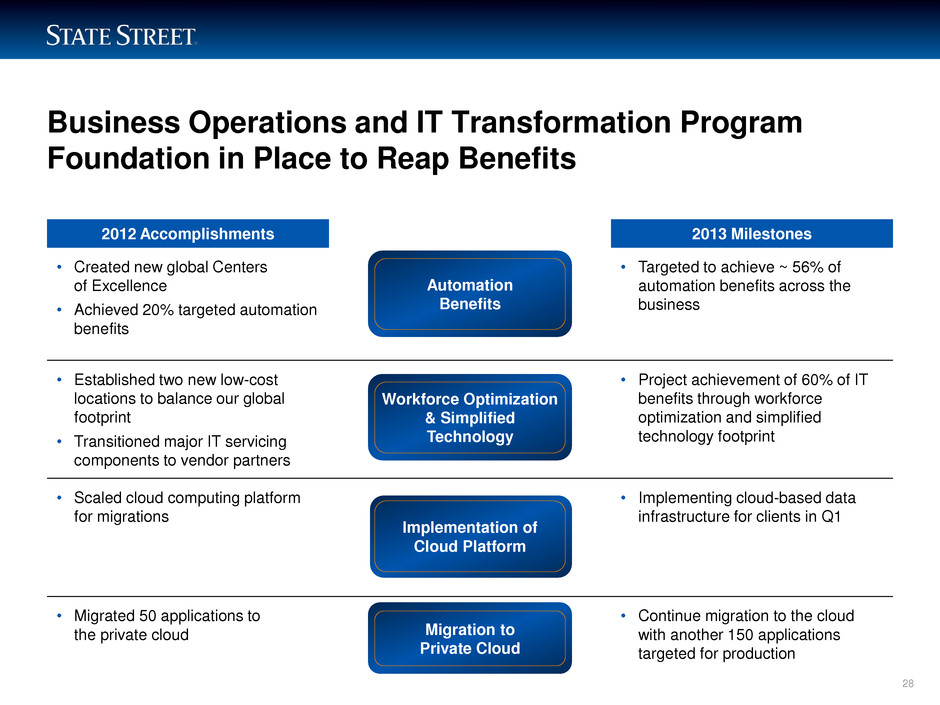

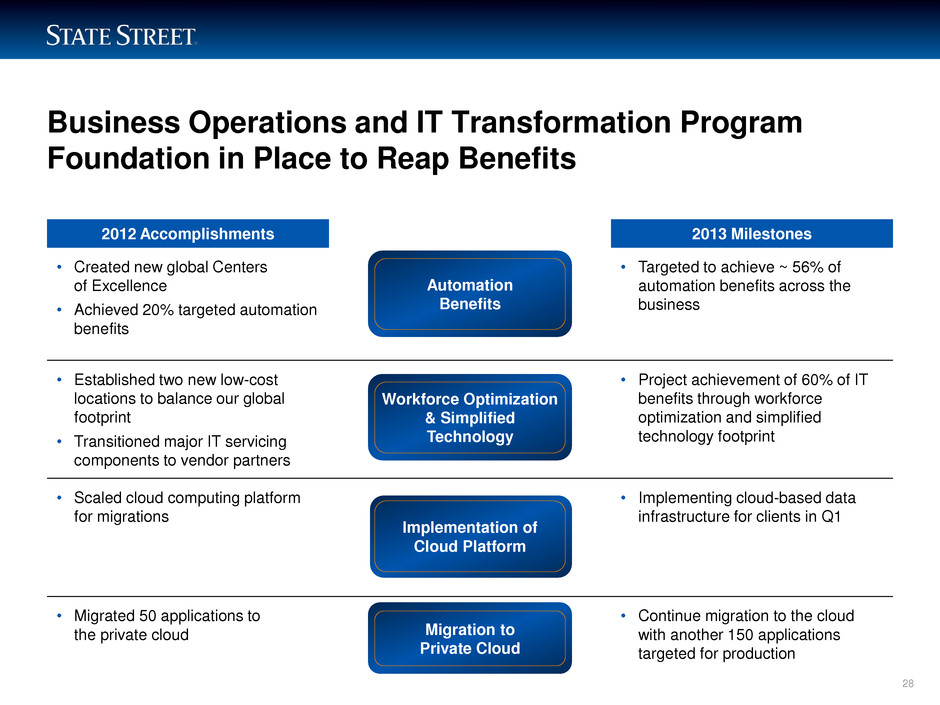

LIMITED ACCESS 2012 Accomplishments 2013 Milestones • Created new global Centers of Excellence • Achieved 20% targeted automation benefits • Targeted to achieve ~ 56% of automation benefits across the business • Established two new low-cost locations to balance our global footprint • Transitioned major IT servicing components to vendor partners • Project achievement of 60% of IT benefits through workforce optimization and simplified technology footprint • Scaled cloud computing platform for migrations • Implementing cloud-based data infrastructure for clients in Q1 • Migrated 50 applications to the private cloud • Continue migration to the cloud with another 150 applications targeted for production Business Operations and IT Transformation Program Foundation in Place to Reap Benefits 28 Automation Benefits Workforce Optimization & Simplified Technology Implementation of Cloud Platform Migration to Private Cloud

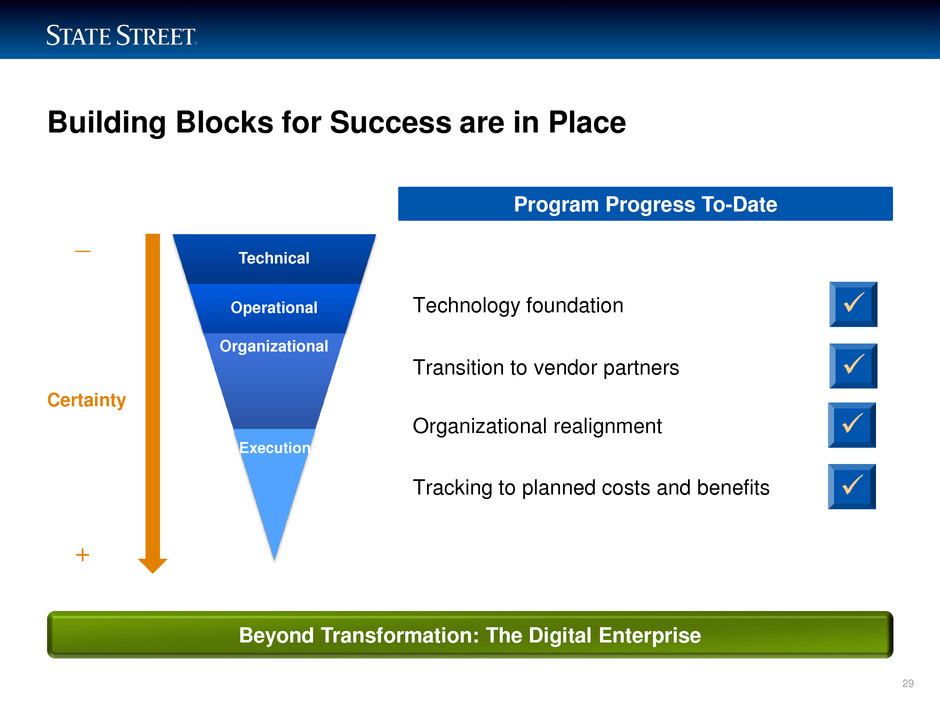

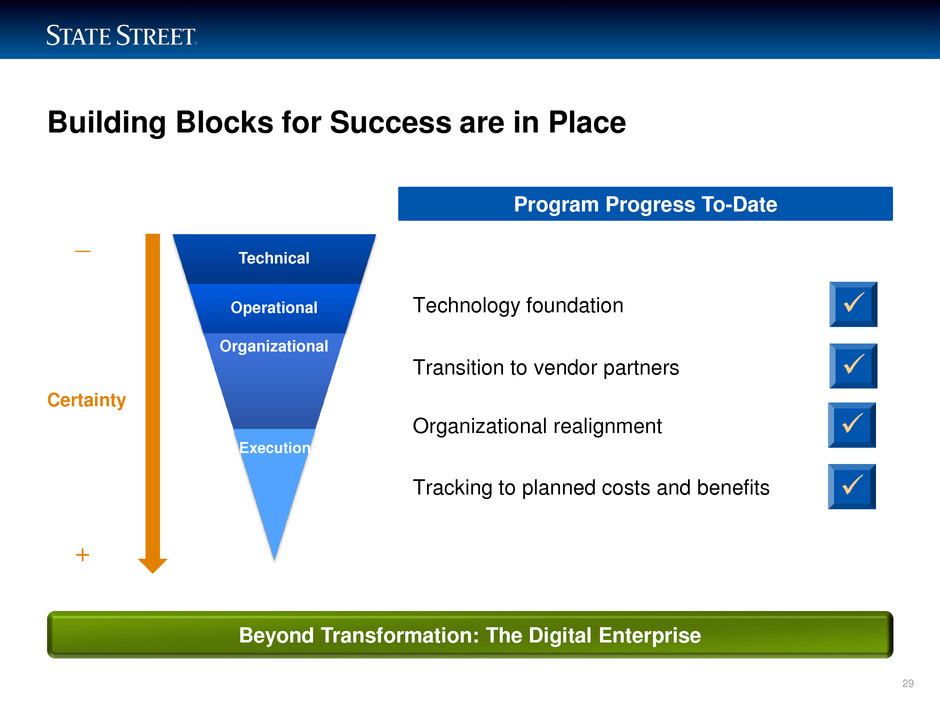

LIMITED ACCESS Building Blocks for Success are in Place 29 Program Progress To-Date Technology foundation Transition to vendor partners Organizational realignment Tracking to planned costs and benefits Technical Operational Beyond Transformation: The Digital Enterprise + _ Certainty Organizational Execution

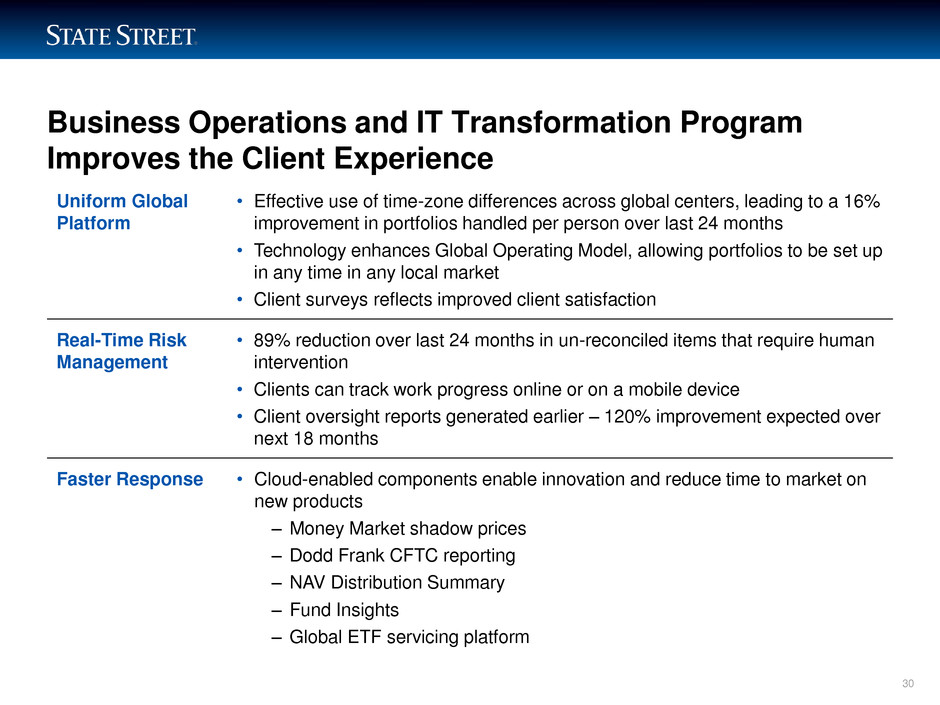

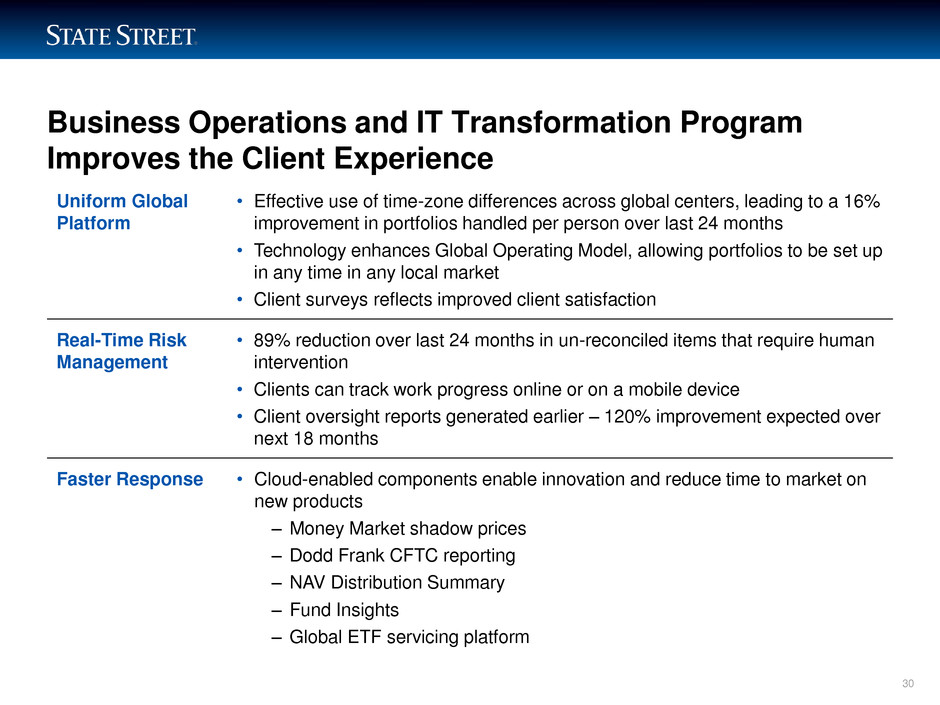

LIMITED ACCESS Business Operations and IT Transformation Program Improves the Client Experience 30 Uniform Global Platform • Effective use of time-zone differences across global centers, leading to a 16% improvement in portfolios handled per person over last 24 months • Technology enhances Global Operating Model, allowing portfolios to be set up in any time in any local market • Client surveys reflects improved client satisfaction Real-Time Risk Management • 89% reduction over last 24 months in un-reconciled items that require human intervention • Clients can track work progress online or on a mobile device • Client oversight reports generated earlier – 120% improvement expected over next 18 months Faster Response • Cloud-enabled components enable innovation and reduce time to market on new products – Money Market shadow prices – Dodd Frank CFTC reporting – NAV Distribution Summary – Fund Insights – Global ETF servicing platform

LIMITED ACCESS Q&A 31 Transforming Operations Improving Client Experience

32 Delivering Shareholder Value EDWARD J. RESCH Chief Financial Officer

LIMITED ACCESS Delivering Shareholder Value • Solid Performance in 2012 • Outlook for 2013 – Economic and market assumptions – Revenue and expense drivers – Balance sheet – Operating-basis net interest margin (NIM) • Summary Agenda 33

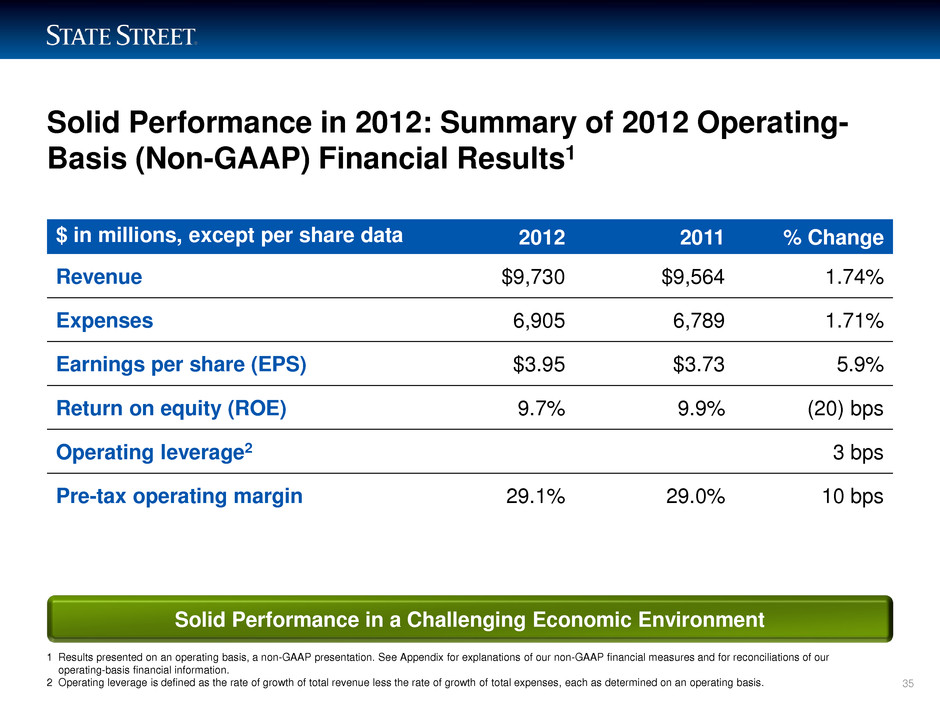

LIMITED ACCESS Solid Performance in 2012: Growth Drivers 34 Revenue • Solid new asset servicing wins of $1.2TN • Net new business of $81BN at State Street Global Advisors • Excess client deposits slightly increased net interest revenue (NIR), but reduced net interest margin • Clients de-risked investments away from international and emerging markets, affecting servicing fees • Low volatility depressed foreign exchange revenue Expense • Continued execution of Business Operations and Information Technology Transformation program • Controlled headcount and compensation • Increased regulatory costs impacted “other expenses” • Targeted staff reductions 1 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis. Achieved Positive Operating Leverage Compared to 20111

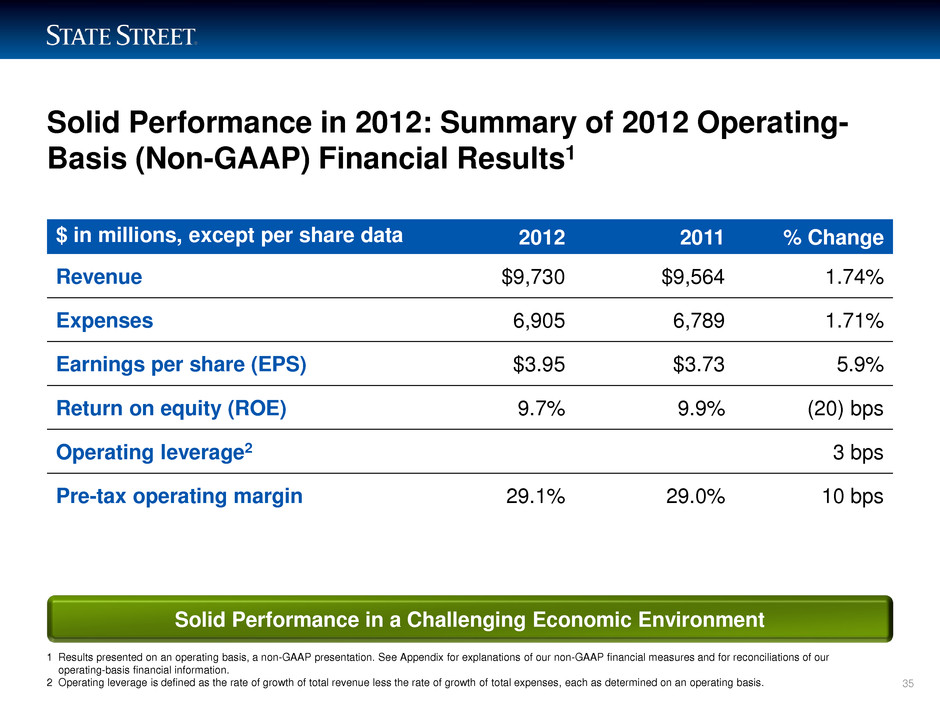

LIMITED ACCESS Solid Performance in 2012: Summary of 2012 Operating- Basis (Non-GAAP) Financial Results1 35 $ in millions, except per share data 2012 2011 % Change Revenue $9,730 $9,564 1.74% Expenses 6,905 6,789 1.71% Earnings per share (EPS) $3.95 $3.73 5.9% Return on equity (ROE) 9.7% 9.9% (20) bps Operating leverage2 3 bps Pre-tax operating margin 29.1% 29.0% 10 bps 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis. Solid Performance in a Challenging Economic Environment

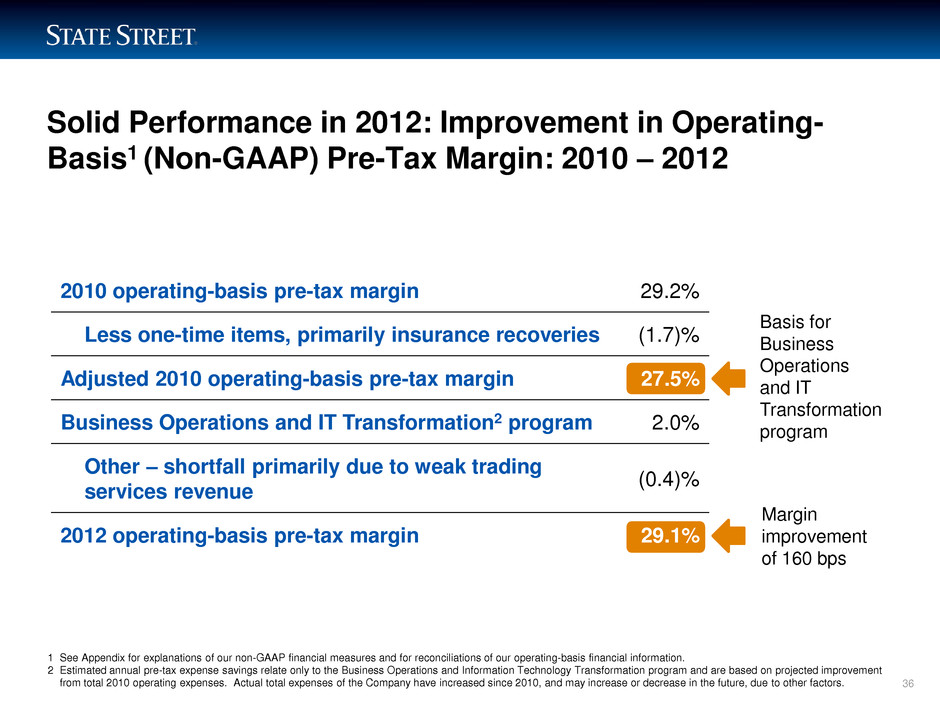

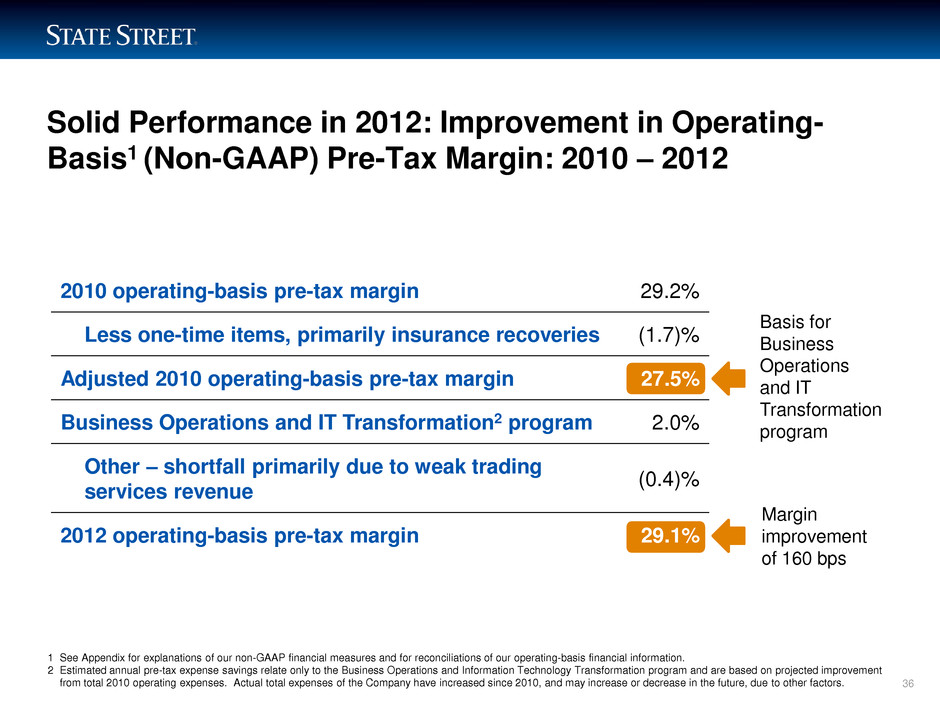

LIMITED ACCESS Solid Performance in 2012: Improvement in Operating- Basis1 (Non-GAAP) Pre-Tax Margin: 2010 – 2012 36 Basis for Business Operations and IT Transformation program Margin improvement of 160 bps 1 See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Estimated annual pre-tax expense savings relate only to the Business Operations and Information Technology Transformation program and are based on projected improvement from total 2010 operating expenses. Actual total expenses of the Company have increased since 2010, and may increase or decrease in the future, due to other factors. 2010 operating-basis pre-tax margin 29.2% Less one-time items, primarily insurance recoveries (1.7)% Adjusted 2010 operating-basis pre-tax margin 27.5% Business Operations and IT Transformation2 program 2.0% Other – shortfall primarily due to weak trading services revenue (0.4)% 2012 operating-basis pre-tax margin 29.1%

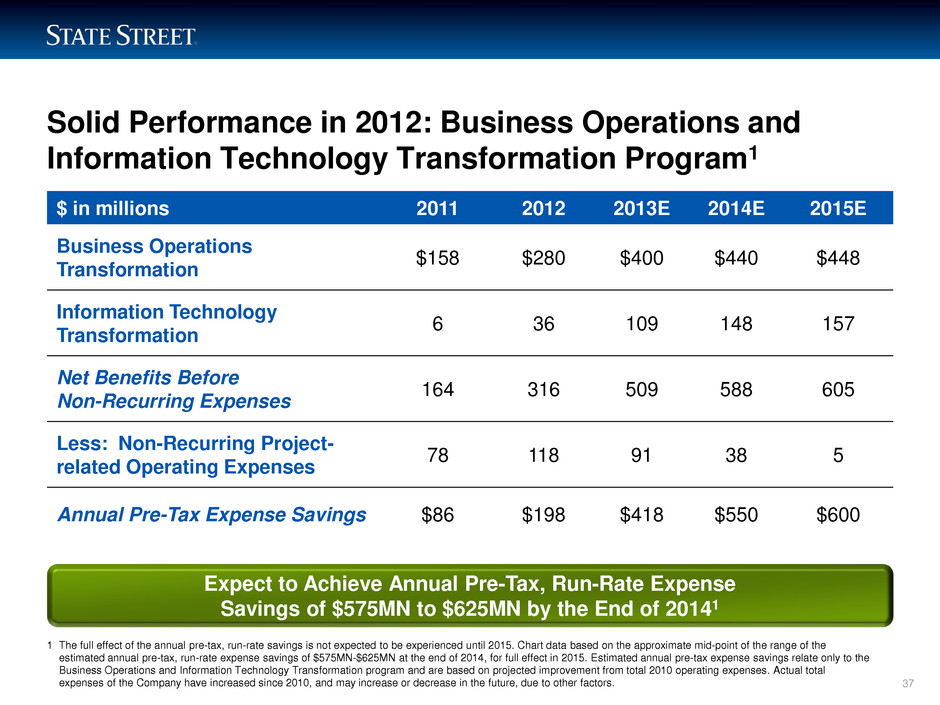

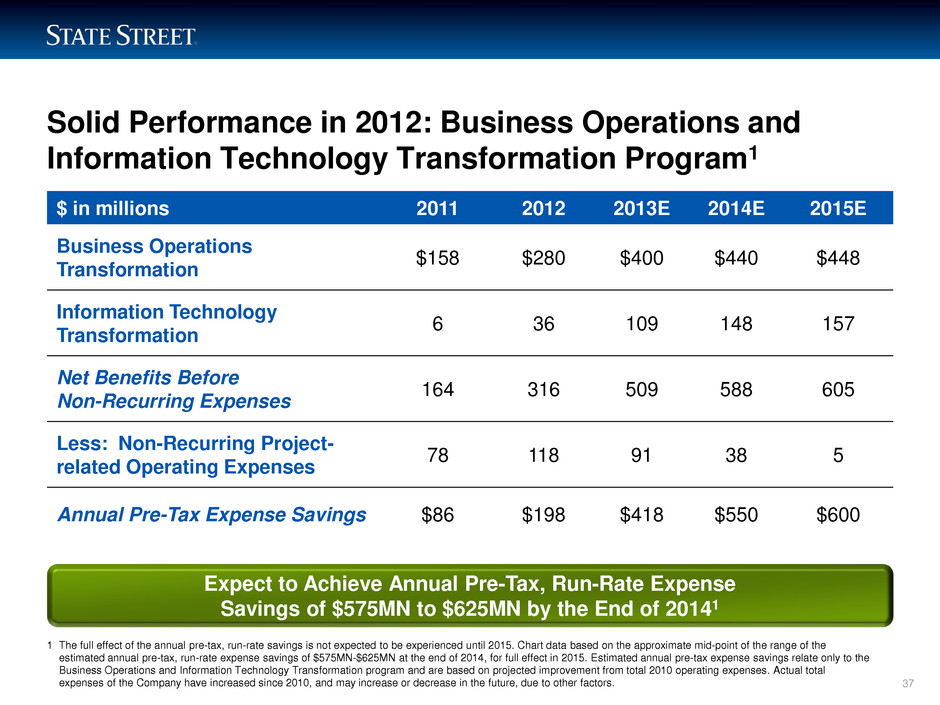

LIMITED ACCESS Solid Performance in 2012: Business Operations and Information Technology Transformation Program1 37 $ in millions 2011 2012 2013E 2014E 2015E Business Operations Transformation $158 $280 $400 $440 $448 Information Technology Transformation 6 36 109 148 157 Net Benefits Before Non-Recurring Expenses 164 316 509 588 605 Less: Non-Recurring Project- related Operating Expenses 78 118 91 38 5 Annual Pre-Tax Expense Savings $86 $198 $418 $550 $600 1 The full effect of the annual pre-tax, run-rate savings is not expected to be experienced until 2015. Chart data based on the approximate mid-point of the range of the estimated annual pre-tax, run-rate expense savings of $575MN-$625MN at the end of 2014, for full effect in 2015. Estimated annual pre-tax expense savings relate only to the Business Operations and Information Technology Transformation program and are based on projected improvement from total 2010 operating expenses. Actual total expenses of the Company have increased since 2010, and may increase or decrease in the future, due to other factors. Expect to Achieve Annual Pre-Tax, Run-Rate Expense Savings of $575MN to $625MN by the End of 20141

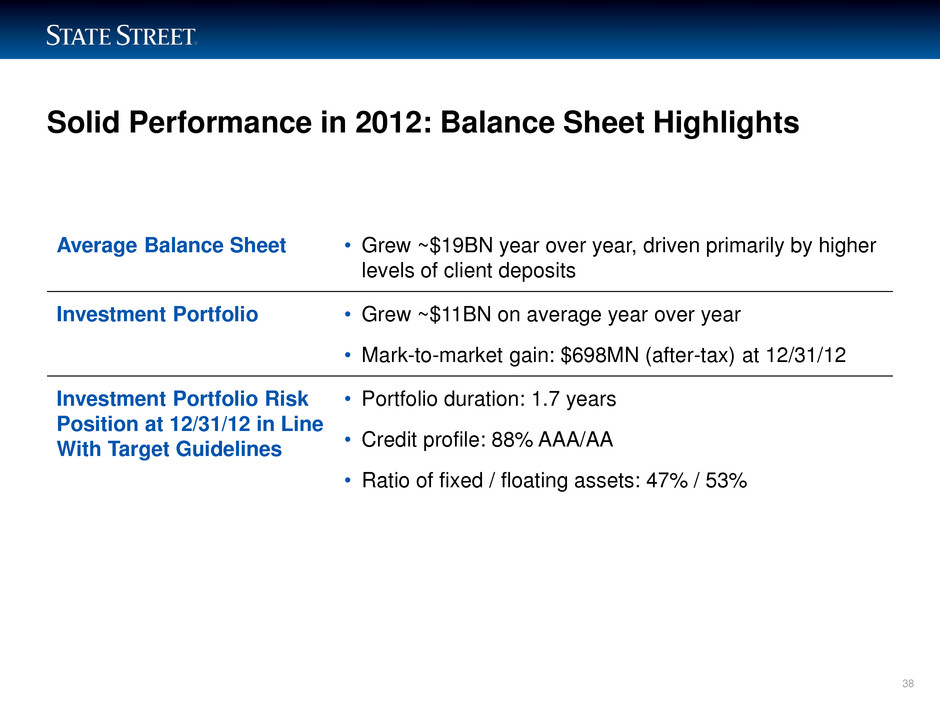

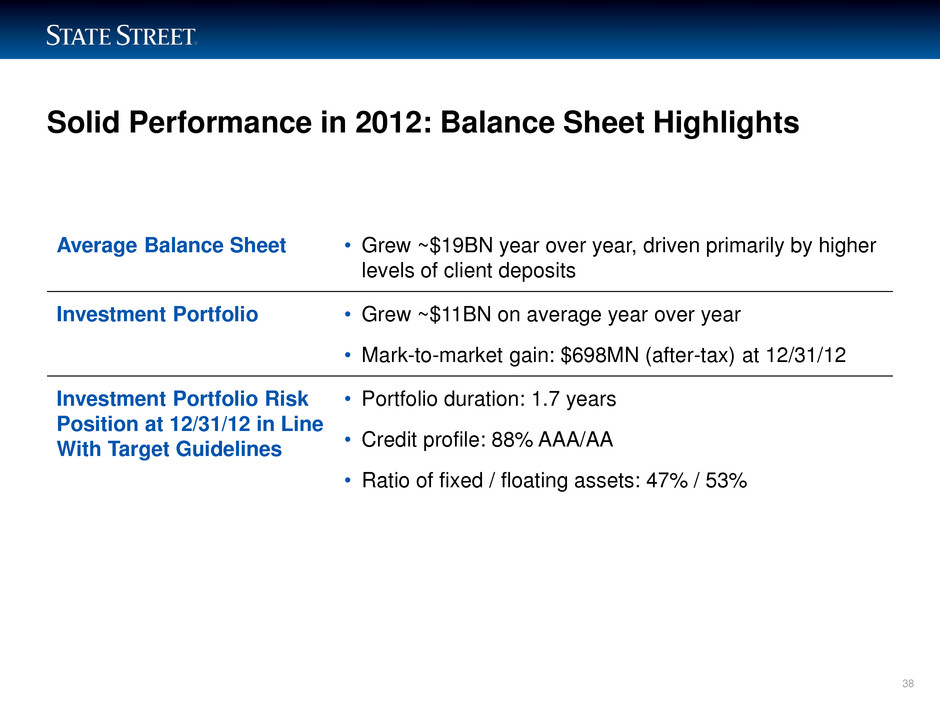

LIMITED ACCESS Solid Performance in 2012: Balance Sheet Highlights 38 Average Balance Sheet • Grew ~$19BN year over year, driven primarily by higher levels of client deposits Investment Portfolio • Grew ~$11BN on average year over year • Mark-to-market gain: $698MN (after-tax) at 12/31/12 Investment Portfolio Risk Position at 12/31/12 in Line With Target Guidelines • Portfolio duration: 1.7 years • Credit profile: 88% AAA/AA • Ratio of fixed / floating assets: 47% / 53%

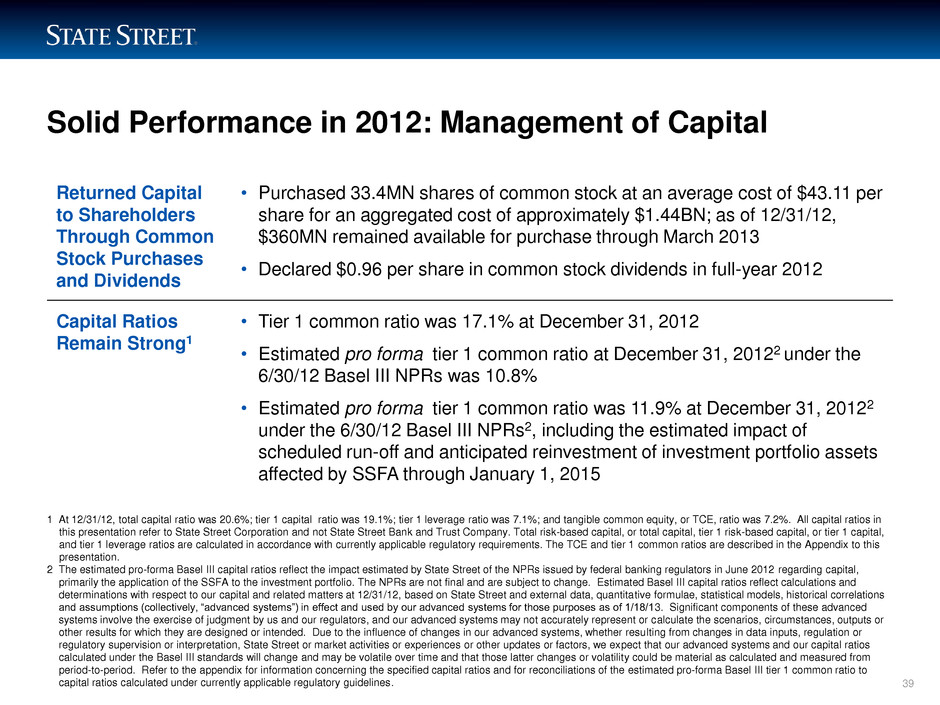

LIMITED ACCESS Solid Performance in 2012: Management of Capital 39 Returned Capital to Shareholders Through Common Stock Purchases and Dividends • Purchased 33.4MN shares of common stock at an average cost of $43.11 per share for an aggregated cost of approximately $1.44BN; as of 12/31/12, $360MN remained available for purchase through March 2013 • Declared $0.96 per share in common stock dividends in full-year 2012 Capital Ratios Remain Strong1 • Tier 1 common ratio was 17.1% at December 31, 2012 • Estimated pro forma tier 1 common ratio at December 31, 20122 under the 6/30/12 Basel III NPRs was 10.8% • Estimated pro forma tier 1 common ratio was 11.9% at December 31, 20122 under the 6/30/12 Basel III NPRs2, including the estimated impact of scheduled run-off and anticipated reinvestment of investment portfolio assets affected by SSFA through January 1, 2015 1 At 12/31/12, total capital ratio was 20.6%; tier 1 capital ratio was 19.1%; tier 1 leverage ratio was 7.1%; and tangible common equity, or TCE, ratio was 7.2%. All capital ratios in this presentation refer to State Street Corporation and not State Street Bank and Trust Company. Total risk-based capital, or total capital, tier 1 risk-based capital, or tier 1 capital, and tier 1 leverage ratios are calculated in accordance with currently applicable regulatory requirements. The TCE and tier 1 common ratios are described in the Appendix to this presentation. 2 The estimated pro-forma Basel III capital ratios reflect the impact estimated by State Street of the NPRs issued by federal banking regulators in June 2012 regarding capital, primarily the application of the SSFA to the investment portfolio. The NPRs are not final and are subject to change. Estimated Basel III capital ratios reflect calculations and determinations with respect to our capital and related matters at 12/31/12, based on State Street and external data, quantitative formulae, statistical models, historical correlations and assumptions (collectively, “advanced systems”) in effect and used by our advanced systems for those purposes as of 1/18/13. Significant components of these advanced systems involve the exercise of judgment by us and our regulators, and our advanced systems may not accurately represent or calculate the scenarios, circumstances, outputs or other results for which they are designed or intended. Due to the influence of changes in our advanced systems, whether resulting from changes in data inputs, regulation or regulatory supervision or interpretation, State Street or market activities or experiences or other updates or factors, we expect that our advanced systems and our capital ratios calculated under the Basel III standards will change and may be volatile over time and that those latter changes or volatility could be material as calculated and measured from period-to-period. Refer to the appendix for information concerning the specified capital ratios and for reconciliations of the estimated pro-forma Basel III tier 1 common ratio to capital ratios calculated under currently applicable regulatory guidelines.

LIMITED ACCESS A CONSISTENT EARNER Operating-basis EPS Growth of 10% – 15% Our Long-Term Operating-Basis Financial Goals 40 A TOP-LINE REVENUE GENERATOR Operating-basis Revenue Growth of 8% – 12% A PRUDENT ALLOCATOR OF CAPITAL Operating-basis ROE of 12% – 15%

LIMITED ACCESS Outlook for 2013: Economic and Market Assumptions • U.S. and Eurozone GDP growth to be about 2% and 0.7%, respectively • U.S. fiscal debate to be resolved • Worldwide administered rates to remain low • S&P 500 to increase on average 5% to 1448 and MSCI EAFE® to increase on average 2% to 1519 • Further clarity in regulations as year evolves 41

LIMITED ACCESS Outlook for 2013: Revenue Drivers 42 Revenue • $551BN in 2012 wins scheduled to be installed in 2013 • Early signs of re-risking by investors, if continued, is expected to benefit servicing and asset management fee revenues • Decline expected in NIR, with an operating-basis1 NIM of 130-140 bps, assuming interest rates and pre-payment speeds remain at current levels with modest balance sheet growth • Expect foreign exchange and securities finance revenues to be constrained 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures.

LIMITED ACCESS Outlook for 2013: Expense Drivers 43 Expenses • Expect to achieve incremental pre-tax expense savings from Business Operations and IT program of $220MN1 • Expect information systems and communications expenses to increase modestly from Q4 run rate as Business Operations and IT Transformation program continues • Estimated cost of accounting treatment of equity compensation for retirement-eligible employees, as well as payroll taxes, to be about $125MN in Q1 ’13 • Impact of the recent reduction in force expected to be $90MN annualized and realized over the next 18 months Target Positive Operating Leverage2 on an Annual Basis for 2013 1 The full effect of the annual pre-tax, run-rate savings is not expected to be experienced until 2015. Data based on the approximate mid-point of the range of the estimated annual pre-tax, run-rate expense savings of $575MN-$625MN at the end of 2014, for full effect in 2015. Estimated annual pre-tax expense savings relate only to the Business Operations and Information Technology Transformation program, and are based on the projected improvement from 2010 operating expenses. Actual total expenses of the Company have increased since 2010, and may increase or decrease in the future, due to other factors. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis.

LIMITED ACCESS Outlook for 2013: Balance Sheet 44 Strategy Invest in High-Quality Assets • Invest through the cycle • Solid credit profile: ~90% AAA/AA-rated • Diversified by asset class and geography Manage Investment Portfolio Within Risk Appetite • Portfolio duration: ~1.5 years • Fixed-rate securities: ~45% of total investment portfolio • Target duration gap of between 0.25 and 0.50 years Maintain a Strong Capital Position • Manage the investment portfolio for capital efficiency, risk appetite and appropriate return Ongoing Management Expected Growth • 1% to 4% growth in earning assets Implications of Basel III • Given potential changes in Basel III rules, we continue to explore balance sheet and risk-management optimization, including investing in asset classes closely adjacent to our core business

LIMITED ACCESS Outlook for 2013: Operating-Basis1 (Non-GAAP) NIM 45 Interest-Rate Assumptions • Worldwide administered rates remain unchanged through 2013 • Yield curves retain current shapes Investment Portfolio • To be managed in line with our balance sheet strategy Reinvestment Strategy • Expect about $20BN to mature or pay down for full-year 2013 • Reinvestment concentrated in capital-efficient asset classes, including mortgage- backed securities, U.S. and foreign asset-backed securities • NIM expected to be in range of 130 to 140 basis points NIR/NIM Sensitivities to Interest Rates • Lower interest rates: If interest rates decline 25 bps, NIR is expected to decline ~$50MN annually • Higher interest rates: Slowly rising rates modestly positive (~$39MN) assuming no change in client deposit behavior; If client deposit levels decline, the impact could be modestly negative; during the period of rising rates • “Normalized” interest rates: Structural NIM2 (3% Fed Funds, 5% 10yr U.S. Treasury) expected to be around 1.75% to 1.85% 2013 Operating-Basis NIM Expected to be in Range of 130 to 140 bps 1 Estimate presented on an operating basis, a non-GAAP presentation. Refer to the appendix included with this presentation for explanations of our non-GAAP financial measures. 2 Structural NIM assumes a normalized balance sheet.

LIMITED ACCESS Summary: 2013 Expectations • Grow servicing and management fee revenue • Assume continued softness in market-driven revenue • Work through low interest-rate environment • Continue to execute Business Operations and IT Transformation program and manage expenses diligently • Achieve positive operating leverage1 on an annual basis for 2013 • Return capital to shareholders in a plan consistent with State Street’s strong capital and earnings capacity 46 1 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis.

47 Core Confidence

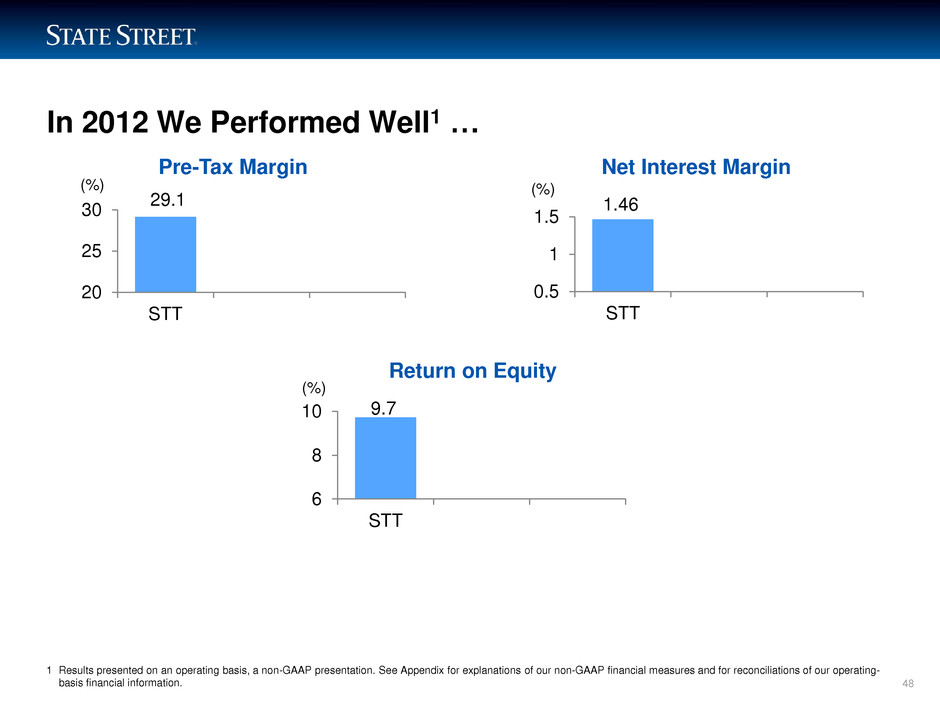

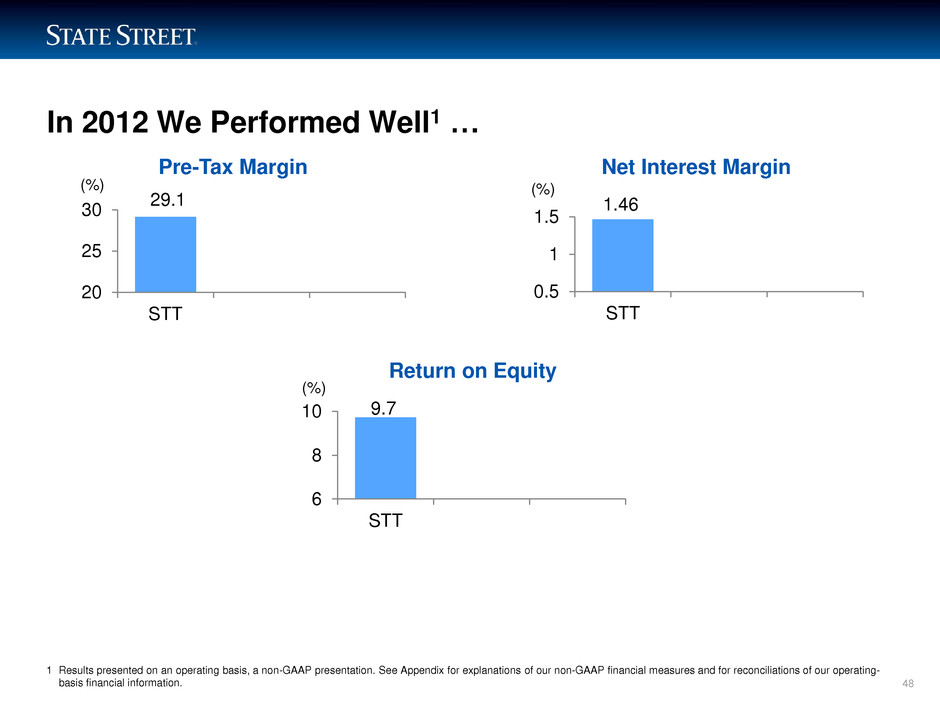

LIMITED ACCESS In 2012 We Performed Well1 … 48 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. 9.7 6 8 10 STT (%) 1.46 0.5 1 1.5 STT (%) Net Interest Margin Return on Equity 29.1 20 25 30 STT (%) Pre-Tax Margin

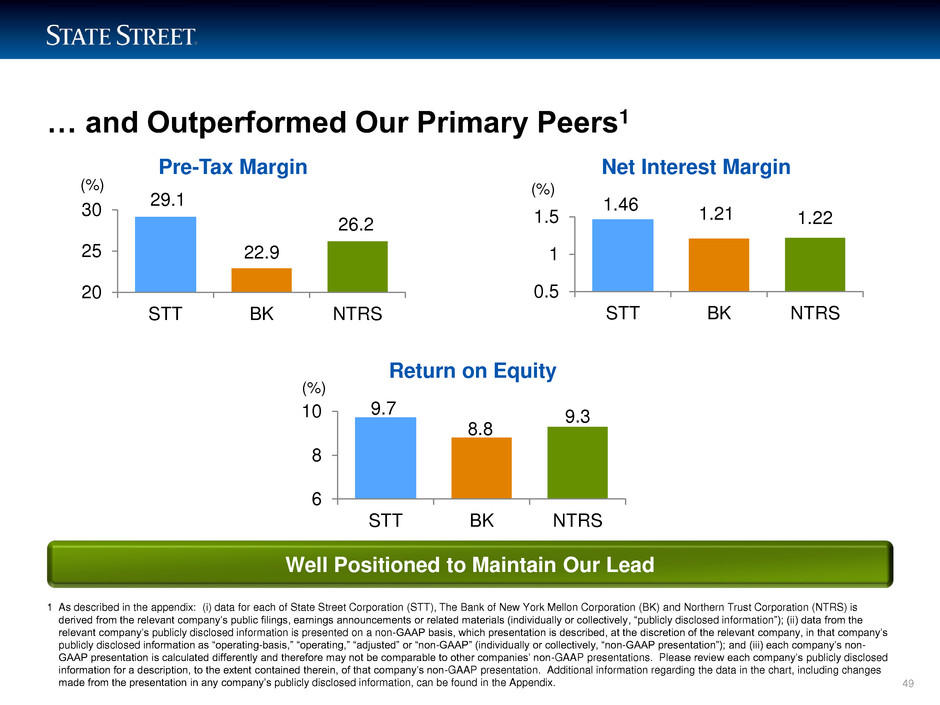

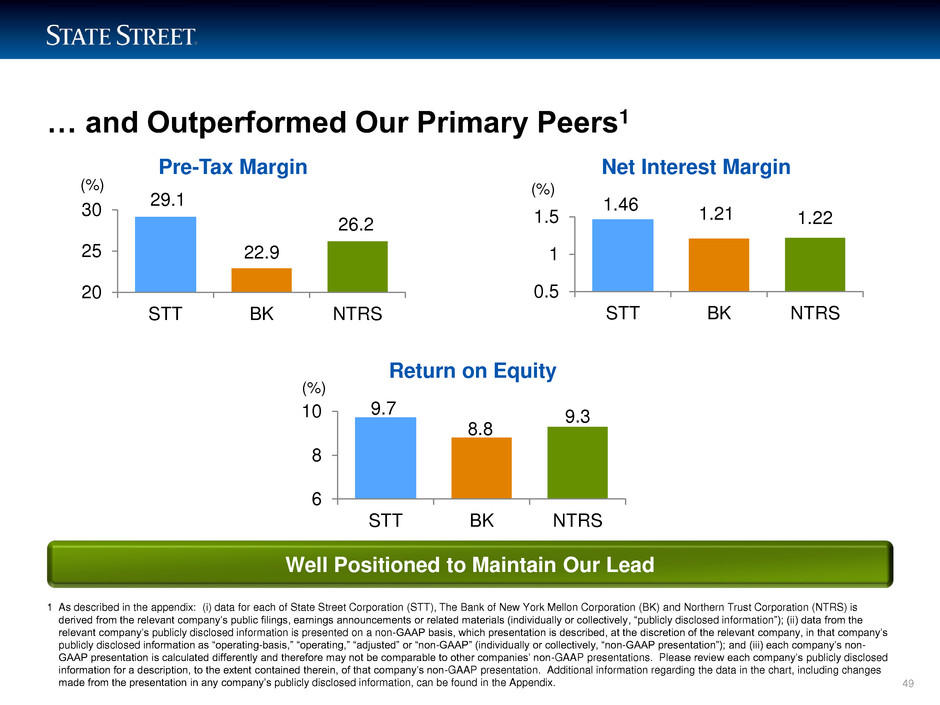

LIMITED ACCESS … and Outperformed Our Primary Peers1 49 Well Positioned to Maintain Our Lead 9.7 8.8 9.3 6 8 10 STT BK NTRS (%) 1.46 1.21 1.22 0.5 1 1.5 STT BK NTRS (%) Net Interest Margin Return on Equity 29.1 22.9 26.2 20 25 30 STT BK NTRS (%) Pre-Tax Margin 1 As described in the appendix: (i) data for each of State Street Corporation (STT), The Bank of New York Mellon Corporation (BK) and Northern Trust Corporation (NTRS) is derived from the relevant company’s public filings, earnings announcements or related materials (individually or collectively, “publicly disclosed information”); (ii) data from the relevant company’s publicly disclosed information is presented on a non-GAAP basis, which presentation is described, at the discretion of the relevant company, in that company’s publicly disclosed information as “operating-basis,” “operating,” “adjusted” or “non-GAAP” (individually or collectively, “non-GAAP presentation”); and (iii) each company’s non- GAAP presentation is calculated differently and therefore may not be comparable to other companies’ non-GAAP presentations. Please review each company’s publicly disclosed information for a description, to the extent contained therein, of that company’s non-GAAP presentation. Additional information regarding the data in the chart, including changes made from the presentation in any company’s publicly disclosed information, can be found in the Appendix.

LIMITED ACCESS Heading in the Right Direction 50 Managing Through the Short Term Delivering Value Today and for the Future Well Positioned for the Long Term

LIMITED ACCESS 51

52 Appendix

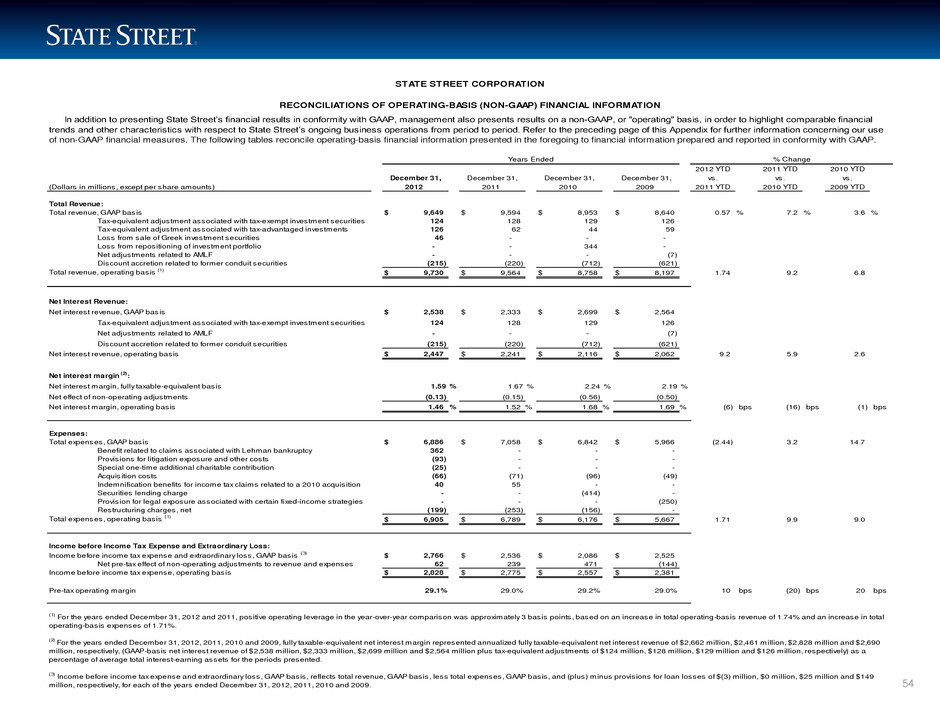

LIMITED ACCESS Appendix 53 The foregoing presentation includes financial information presented on a GAAP basis as well as on a non-GAAP, or “operating basis,” in addition to other measures not presented in accordance with GAAP and used in the calculation of identified capital ratios. Management measures and compares certain financial information on an operating basis, as it believes that this presentation supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to State Street’s normal ongoing business operations. Management believes that operating-basis financial information, which reports revenue from non-taxable sources, such as interest revenue from tax-exempt investment securities and processing fees and other revenue associated with tax-advantaged investments, on a fully taxable-equivalent basis and excludes the impact of revenue and expenses outside of the normal course of business, facilitates an investor’s understanding and analysis of State Street’s underlying financial performance and trends in addition to financial information prepared and reported in accordance with GAAP. Management also believes that the use of other non-GAAP financial measures in the calculation of identified capital ratios is useful to understanding State Street’s capital position and is of interest to investors. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP.

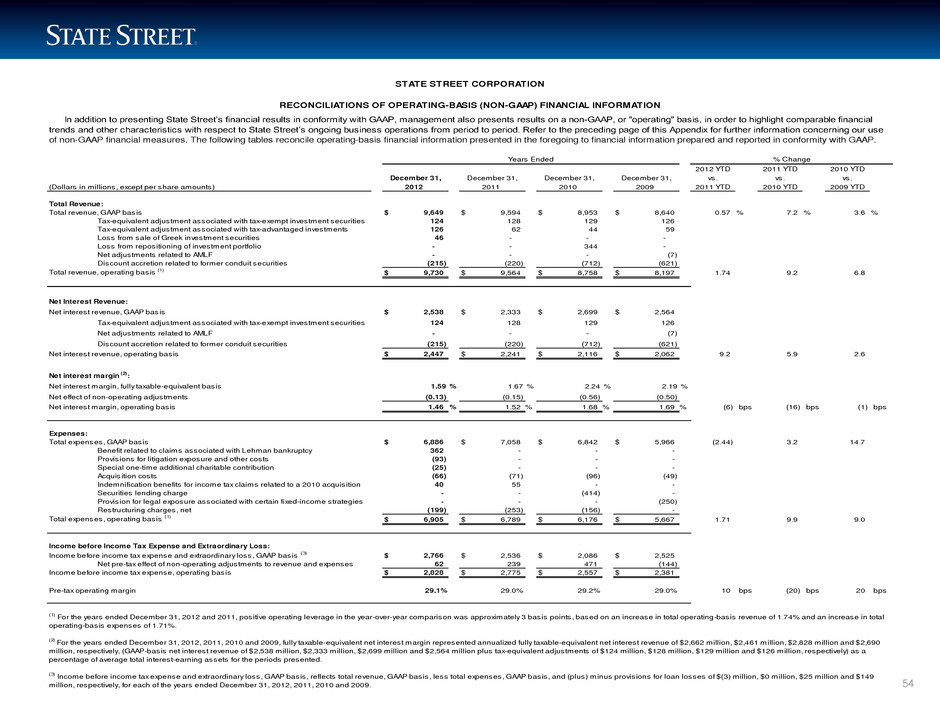

LIMITED ACCESS 54 2012 YTD 2011 YTD 2010 YTD vs. vs. vs. (Dollars in millions, except per share amounts) 2011 YTD 2010 YTD 2009 YTD Total Revenue: Total revenue, GAAP basis $ 9,649 $ 9,594 $ 8,953 $ 8,640 0.57 % 7.2 % 3.6 % Tax-equivalent adjustment associated with tax-exempt investment securities 124 128 129 126 Tax-equivalent adjustment associated with tax-advantaged investments 126 62 44 59 Loss from sale of Greek investment securities 46 - - - Loss from repositioning of investment portfolio - - 344 - Net adjustments related to AMLF - - - (7) Discount accretion related to former conduit securities (215) (220) (712) (621) Total revenue, operating basis (1) $ 9,730 $ 9,564 $ 8,758 $ 8,197 1.74 9.2 6.8 Net Interest Revenue: Net interest revenue, GAAP basis $ 2,538 $ 2,333 $ 2,699 $ 2,564 Tax-equivalent adjustment associated with tax-exempt investment securities 124 128 129 126 Net adjustments related to AMLF - - - (7) Discount accretion related to former conduit securities (215) (220) (712) (621) Net interest revenue, operating basis $ 2,447 $ 2,241 $ 2,116 $ 2,062 9.2 5.9 2.6 Net interest margin (2) : Net interest margin, fully taxable-equivalent basis 1.59 % 1.67 % 2.24 % 2.19 % Net effect of non-operating adjustments (0.13) (0.15) (0.56) (0.50) Net interest margin, operating basis 1.46 % 1.52 % 1.68 % 1.69 % (6) bps (16) bps (1) bps Expenses: Total expenses, GAAP basis $ 6,886 $ 7,058 $ 6,842 $ 5,966 (2.44) 3.2 14.7 Benefit related to claims associated with Lehman bankruptcy 362 - - - Provisions for litigation exposure and other costs (93) - - - Special one-time additional charitable contribution (25) - - - Acquisition costs (66) (71) (96) (49) Indemnification benefits for income tax claims related to a 2010 acquisition 40 55 - - Securities lending charge - - (414) - Provision for legal exposure associated with certain fixed-income strategies - - - (250) Restructuring charges, net (199) (253) (156) - Total expenses, operating basis (1) $ 6,905 $ 6,789 $ 6,176 $ 5,667 1.71 9.9 9.0 Income before Income Tax Expense and Extraordinary Loss: Income before income tax expense and extraordinary loss, GAAP basis (3) $ 2,766 $ 2,536 $ 2,086 $ 2,525 Net pre-tax effect of non-operating adjustments to revenue and expenses 62 239 471 (144) Income before income tax expense, operating basis $ 2,828 $ 2,775 $ 2,557 $ 2,381 Pre-tax operating margin 29.1% 29.0% 29.2% 29.0% 10 bps (20) bps 20 bps December 31, 2009 Years Ended STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. % Change December 31, December 31, December 31, 2010 (2) For the years ended December 31, 2012, 2011, 2010 and 2009, fully taxable-equivalent net interest margin represented annualized fully taxable-equivalent net interest revenue of $2,662 million, $2,461 million, $2,828 million and $2,690 million, respectively, (GAAP-basis net interest revenue of $2,538 million, $2,333 million, $2,699 million and $2,564 million plus tax-equivalent adjustments of $124 million, $128 million, $129 million and $126 million, respectively) as a percentage of average total interest-earning assets for the periods presented. (3) Income before income tax expense and extraordinary loss, GAAP basis, reflects total revenue, GAAP basis, less total expenses, GAAP basis, and (plus) minus provisions for loan losses of $(3) million, $0 million, $25 million and $149 million, respectively, for each of the years ended December 31, 2012, 2011, 2010 and 2009. 2012 2011 (1) For the years ended December 31, 2012 and 2011, positive operating leverage in the year-over-year comparison was approximately 3 basis points, based on an increase in total operating-basis revenue of 1.74% and an increase in total operating-basis expenses of 1.71%.

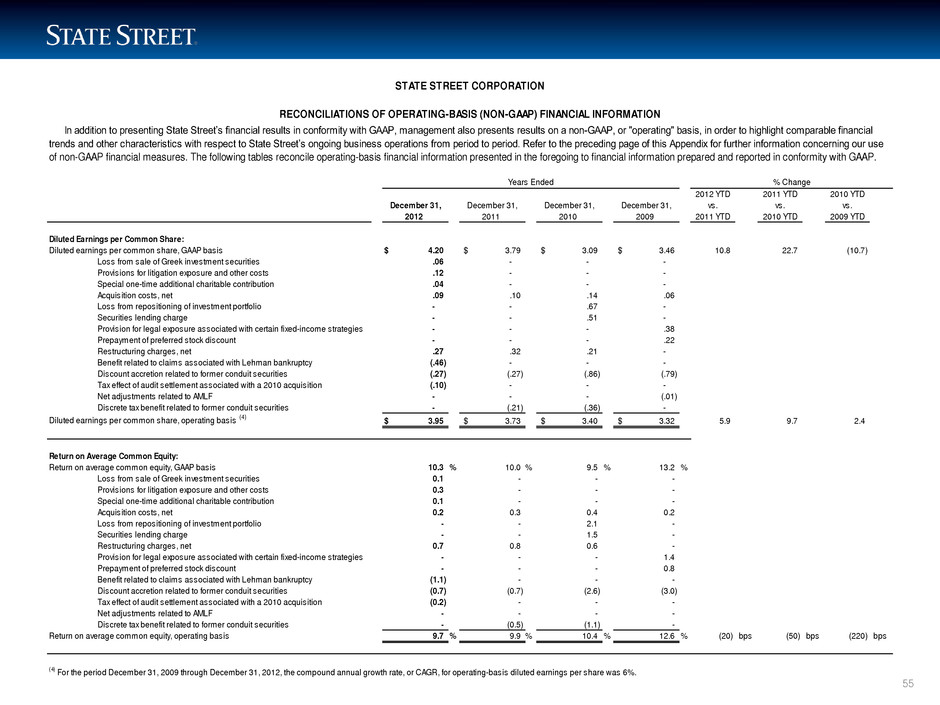

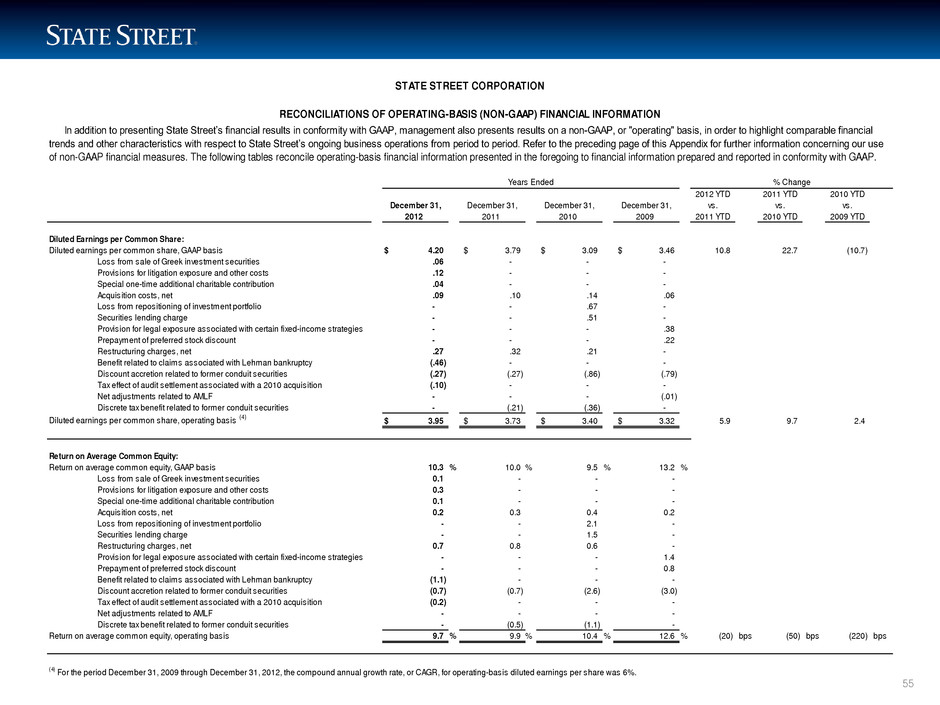

LIMITED ACCESS 55 2012 YTD 2011 YTD 2010 YTD vs. vs. vs. 2011 YTD 2010 YTD 2009 YTD Diluted Earnings per Common Share: Diluted earnings per common share, GAAP basis $ 4.20 $ 3.79 $ 3.09 $ 3.46 10.8 22.7 (10.7) Loss from sale of Greek investment securities .06 - - - Provisions for litigation exposure and other costs .12 - - - Special one-time additional charitable contribution .04 - - - Acquisition costs, net .09 .10 .14 .06 Loss from repositioning of investment portfolio - - .67 - Securities lending charge - - .51 - Provision for legal exposure associated with certain fixed-income strategies - - - .38 Prepayment of preferred stock discount - - - .22 Restructuring charges, net .27 .32 .21 - Benefit related to claims associated with Lehman bankruptcy (.46) - - - Discount accretion related to former conduit securities (.27) (.27) (.86) (.79) Tax effect of audit settlement associated with a 2010 acquisition (.10) - - - Net adjustments related to AMLF - - - (.01) Discrete tax benefit related to former conduit securities - (.21) (.36) - Diluted earnings per common share, operating basis (4) $ 3.95 $ 3.73 $ 3.40 $ 3.32 5.9 9.7 2.4 Return on Average Common Equity: Return on average common equity, GAAP basis 10.3 % 10.0 % 9.5 % 13.2 % Loss from sale of Greek investment securities 0.1 - - - Provisions for litigation exposure and other costs 0.3 - - - Special one-time additional charitable contribution 0.1 - - - Acquisition costs, net 0.2 0.3 0.4 0.2 Loss from repositioning of investment portfolio - - 2.1 - Securities lending charge - - 1.5 - Restructuring charges, net 0.7 0.8 0.6 - Provision for legal exposure associated with certain fixed-income strategies - - - 1.4 Prepayment of preferred stock discount - - - 0.8 Benefit related to claims associated with Lehman bankruptcy (1.1) - - - Discount accretion related to former conduit securities (0.7) (0.7) (2.6) (3.0) Tax effect of audit settlement associated with a 2010 acquisition (0.2) - - - Net adjustments related to AMLF - - - - Discrete tax benefit related to former conduit securities - (0.5) (1.1) - Return on average common equity, operating basis 9.7 % 9.9 % 10.4 % 12.6 % (20) bps (50) bps (220) bps (4) For the period December 31, 2009 through December 31, 2012, the compound annual growth rate, or CAGR, for operating-basis diluted earnings per share was 6%. December 31, December 31, December 31, December 31, 2012 2011 2010 2009 STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. Years Ended % Change

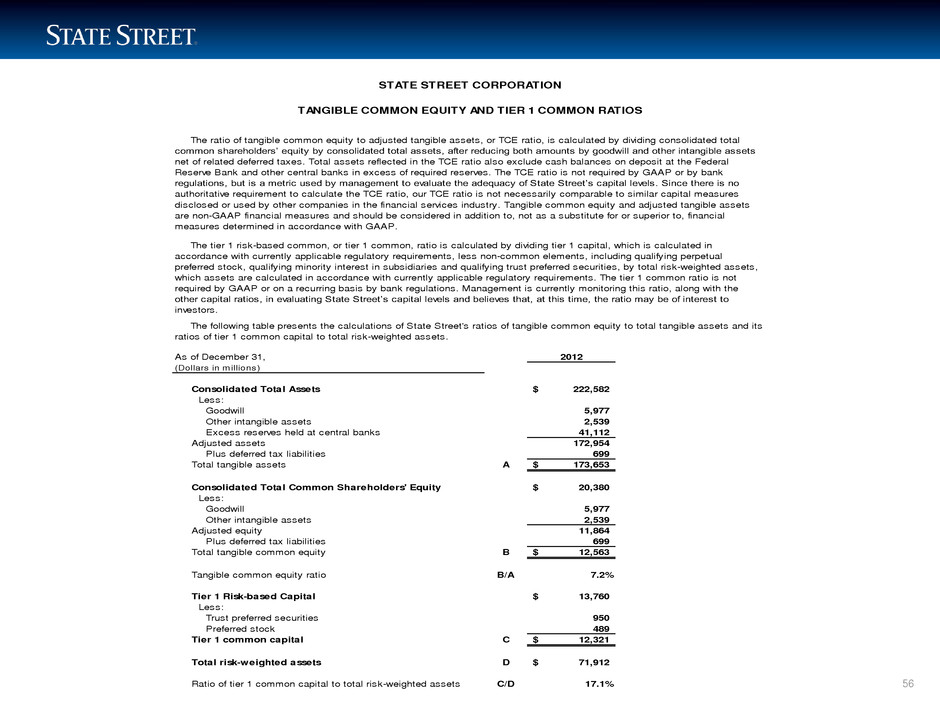

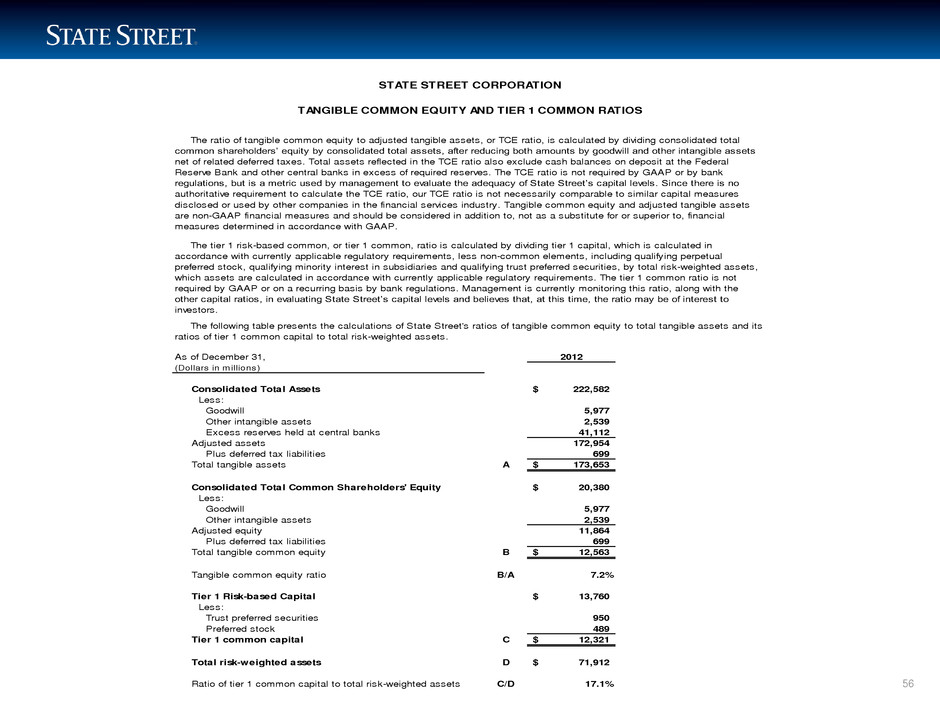

LIMITED ACCESS 56 As of December 31, 2012 (Dollars in millions) Consolidated Total Assets 222,582$ Less: Goodwill 5,977 Other intangible assets 2,539 Excess reserves held at central banks 41,112 Adjusted assets 172,954 Plus deferred tax liabilities 699 Total tangible assets A 173,653$ Consolidated Total Common Shareholders' Equity 20,380$ Less: Goodwill 5,977 Other intangible assets 2,539 Adjusted equity 11,864 Plus deferred tax liabilities 699 Total tangible common equity B 12,563$ Tangible common equity ratio B/A 7.2% Tier 1 Risk-based Capital 13,760$ Less: Trust preferred securities 950 Preferred stock 489 Tier 1 common capital C 12,321$ Total risk-weighted assets D 71,912$ Ratio of tier 1 common capital to total risk-weighted assets C/D 17.1% The ratio of tangible common equity to adjusted tangible assets, or TCE ratio, is calculated by dividing consolidated total common shareholders’ equity by consolidated total assets, after reducing both amounts by goodwill and other intangible assets net of related deferred taxes. Total assets reflected in the TCE ratio also exclude cash balances on deposit at the Federal Reserve Bank and other central banks in excess of required reserves. The TCE ratio is not required by GAAP or by bank regulations, but is a metric used by management to evaluate the adequacy of State Street’s capital levels. Since there is no authoritative requirement to calculate the TCE ratio, our TCE ratio is not necessarily comparable to similar capital measures disclosed or used by other companies in the financial services industry. Tangible common equity and adjusted tangible assets are non-GAAP financial measures and should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. The tier 1 risk-based common, or tier 1 common, ratio is calculated by dividing tier 1 capital, which is calculated in accordance with currently applicable regulatory requirements, less non-common elements, including qualifying perpetual preferred stock, qualifying minority interest in subsidiaries and qualifying trust preferred securities, by total risk-weighted assets, which assets are calculated in accordance with currently applicable regulatory requirements. The tier 1 common ratio is not required by GAAP or on a recurring basis by bank regulations. Management is currently monitoring this ratio, along with the other capital ratios, in evaluating State Street’s capital levels and believes that, at this time, the ratio may be of interest to investors. STATE STREET CORPORATION TANGIBLE COMMON EQUITY AND TIER 1 COMMON RATIOS The following table presents the calculations of State Street's ratios of tangible common equity to total tangible assets and its ratios of tier 1 common capital to total risk-weighted assets.

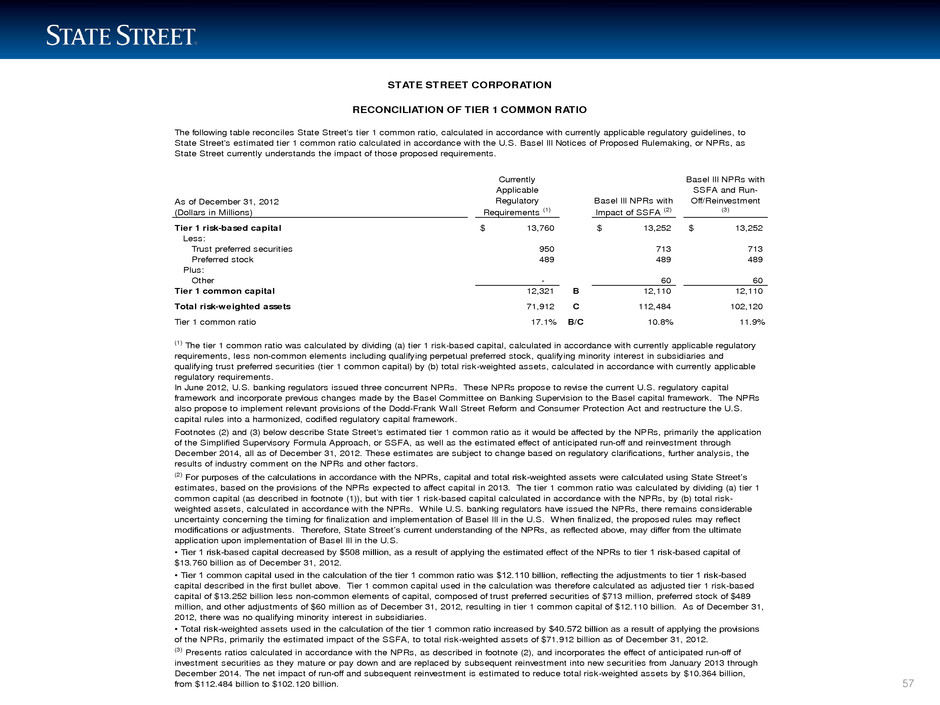

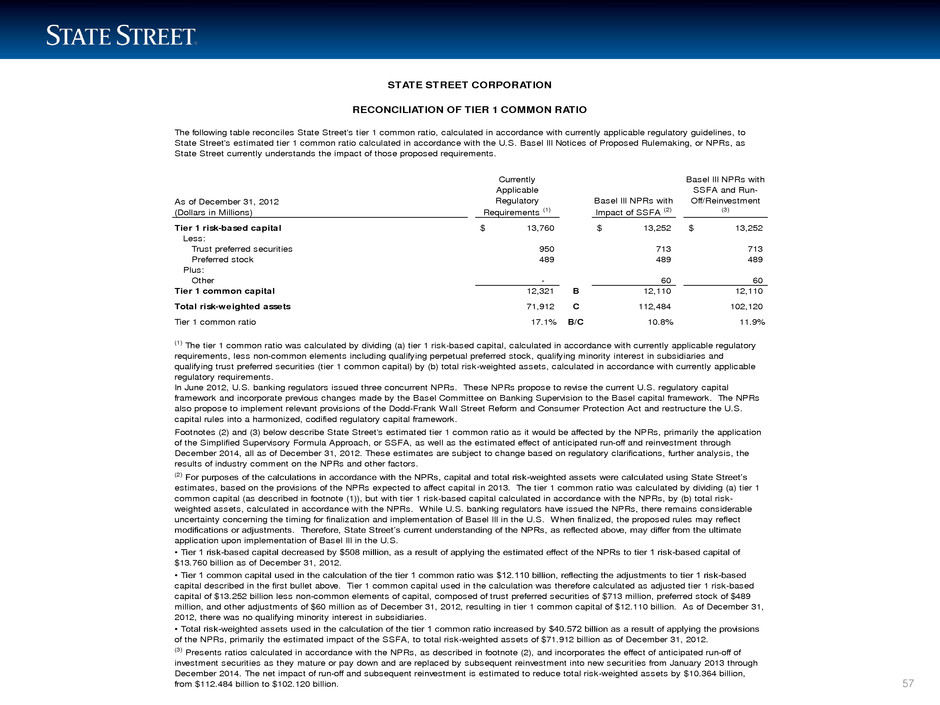

LIMITED ACCESS 57 As of December 31, 2012 (Dollars in Millions) Currently Applicable Regulatory Requirements (1) Basel III NPRs with Impact of SSFA (2) Basel III NPRs with SSFA and Run- Off/Reinvestment (3) Tier 1 risk-based capital 13,760$ 13,252$ 13,252$ Less: Trust preferred securities 950 713 713 Preferred stock 489 489 489 Plus: Other - 60 60 Tier 1 common capital 12,321 B 12,110 12,110 Total risk-weighted assets 71,912 C 112,484 102,120 Tier 1 common ratio 17.1% B/C 10.8% 11.9% (1) The tier 1 common ratio was calculated by dividing (a) tier 1 risk-based capital, calculated in accordance with currently applicable regulatory requirements, less non-common elements including qualifying perpetual preferred stock, qualifying minority interest in subsidiaries and qualifying trust preferred securities (tier 1 common capital) by (b) total risk-weighted assets, calculated in accordance with currently applicable regulatory requirements. The following table reconciles State Street's tier 1 common ratio, calculated in accordance with currently applicable regulatory guidelines, to State Street's estimated tier 1 common ratio calculated in accordance with the U.S. Basel III Notices of Proposed Rulemaking, or NPRs, as State Street currently understands the impact of those proposed requirements. STATE STREET CORPORATION RECONCILIATION OF TIER 1 COMMON RATIO (3) Presents ratios calculated in accordance with the NPRs, as described in footnote (2), and incorporates the effect of anticipated run-off of investment securities as they mature or pay down and are replaced by subsequent reinvestment into new securities from January 2013 through December 2014. The net impact of run-off and subsequent reinvestment is estimated to reduce total risk-weighted assets by $10.364 billion, from $112.484 billion to $102.120 billion. In June 2012, U.S. banking regulators issued three concurrent NPRs. These NPRs propose to revise the current U.S. regulatory capital framework and incorporate previous changes made by the Basel Committee on Banking Supervision to the Basel capital framework. The NPRs also propose to implement relevant provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act and restructure the U.S. capital rules into a harmonized, codified regulatory capital framework. Footnotes (2) and (3) below describe State Street's estimated tier 1 common ratio as it would be affected by the NPRs, primarily the application of the Simplified Supervisory Formula Approach, or SSFA, as well as the estimated effect of anticipated run-off and reinvestment through December 2014, all as of December 31, 2012. These estimates are subject to change based on regulatory clarifications, further analysis, the results of industry comment on the NPRs and other factors. (2) For purposes of the calculations in accordance with the NPRs, capital and total risk-weighted assets were calculated using State Street’s estimates, based on the provisions of the NPRs expected to affect capital in 2013. The tier 1 common ratio was calculated by dividing (a) tier 1 common capital (as described in footnote (1)), but with tier 1 risk-based capital calculated in accordance with the NPRs, by (b) total risk- weighted assets, calculated in accordance with the NPRs. While U.S. banking regulators have issued the NPRs, there remains considerable uncertainty concerning the timing for finalization and implementation of Basel III in the U.S. When finalized, the proposed rules may reflect modifications or adjustments. Therefore, State Street’s current understanding of the NPRs, as reflected above, may differ from the ultimate application upon implementation of Basel III in the U.S. • Tier 1 risk-based capital decreased by $508 million, as a result of applying the estimated effect of the NPRs to tier 1 risk-based capital of $13.760 billion as of December 31, 2012. • Tier 1 common capital used in the calculation of the tier 1 common ratio was $12.110 billion, reflecting the adjustments to tier 1 risk-based capital described in the first bullet above. Tier 1 common capital used in the calculation was therefore calculated as adjusted tier 1 risk-based capital of $13.252 billion less non-common elements of capital, composed of trust preferred securities of $713 million, preferred stock of $489 million, and other adjustments of $60 million as of December 31, 2012, resulting in tier 1 common capital of $12.110 billion. As of December 31, 2012, there was no qualifying minority interest in subsidiaries. • Total risk-weighted assets used in the calculation of the tier 1 common ratio increased by $40.572 billion as a result of applying the provisions of the NPRs, primarily the estimated impact of the SSFA, to total risk-weighted assets of $71.912 billion as of December 31, 2012.