Joseph L. Hooley Chairman, President and Chief Executive Officer Barclays America Select Franchise Conference 22 May 2013 Positioned for Growth

LIMITED ACCESS Forward-Looking Statements 2 This presentation contains forward-looking statements as defined by United States securities laws, including statements relating to our goals and expectations regarding our business, financial and capital condition (including without limitation, our capital ratios under Basel III), results of operations, investment portfolio performance and strategies, the financial and market outlook, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as "plan," “strategy,” “priority,” "expect," “intend,” “forecast,” "look," "believe," "anticipate," "estimate," "seek,“ "may," "will," "trend," "target,” and "goal," or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to 22 May 2013. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposure, including, for example, the direct and indirect effects on counterparties of the current sovereign-debt risks in Europe and other regions; financial market disruptions or economic recession, whether in the U.S., Europe, Asia or other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other-than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding, and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement the Dodd-Frank Act, the Basel II and Basel III capital and liquidity standards, and European legislation with respect to the levels of regulatory capital we must maintain, our credit exposure to third parties, margin requirements applicable to derivatives, banking and financial activities and other regulatory initiatives in the U.S. and internationally, including regulatory developments that result in changes to our structure or operating model, increased costs or other changes to how we provide services; adverse changes in the regulatory capital ratios that we are required to meet, whether arising under the Dodd-Frank Act, the Basel II or Basel III capital and liquidity standards or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in calculating our capital ratios that cause changes in those ratios as they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other regulators for the use, allocation or distribution of our capital or other specific capital actions or programs, including acquisitions, dividends and equity purchases, without which our growth plans, distributions to shareholders, equity purchase programs or other capital initiatives may be restricted; changes in law or regulation that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations or those of our clients and our regulators; the credit agency ratings of our debt and depository obligations and investor and client perceptions of our financial strength; delays or difficulties in the execution of our previously announced Business Operations and Information Technology Transformation program, which could lead to changes in our estimates of the charges, expenses or savings associated with the planned program and may cause volatility of our earnings; the results of, and costs associated with, government investigations, litigation, and similar claims, disputes, or proceedings; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the valuation of assets underlying those pools; adverse publicity or other reputational harm; dependencies on information technology, complexities and costs of protecting the security of our systems and difficulties with protecting our intellectual property rights; our ability to grow revenue, control expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements; potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation, and perceptions of State Street as a suitable service provider or counterparty; potential changes in how and in what amounts clients compensate us for our services, and the mix of services provided by us that clients choose; the ability to complete acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that acquired businesses and joint ventures will not achieve their anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected disynergies will be experienced, that client and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging needs of our clients and to develop products that are responsive to such trends and profitable to us, the performance of and demand for the products and services we offer, and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; our ability to control operating risks, data security breach risks, information technology systems risks and outsourcing risks, and our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2012 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this news release speak only as of 20-22 May 2013, and we do not undertake efforts to revise those forward-looking statements to reflect events after 22 May 2013.

LIMITED ACCESS Positioned for Growth Agenda Strong Foundation Trends and Business Strategy Financial Performance Summary 3

LIMITED ACCESS 4 Strong Foundation 4

LIMITED ACCESS 1 Financial information presented on an operating basis, a non-GAAP presentation. See Appendix for a description of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 31 December 2002 to 31 December 2012. Past performance is not a guarantee of future results. 3 As of 15 May 2013. Focused on Solutions for Institutional Investors … • Fiduciary heritage since 1792 • Core business is managing and servicing financial assets • Operations in more than 100 geographic markets worldwide; 30,000 employees • Operating-basis1 revenue growth of 10% compounded annually over the 10 years 2002 – 20122 • Operating-basis1 revenue of $9.7B in 2012; Market capitalisation of more than $29B3 5

LIMITED ACCESS • $2.2 trillion2 in assets under management1 • Approximately $354 billion2 in ETF assets • One of the world’s largest managers of institutional assets • Provider of a comprehensive range of investment strategies across the risk / return spectrum • $25.4 trillion of assets under custody and administration1 • One of the world’s leading investment service providers • Provider of fund accounting, fund administration, custody, investment operations outsourcing, recordkeeping, performance and analytics, and transfer agency services • Global leader in investment research, trading and securities lending • Provider of advanced portfolio strategies, trade execution and global connectivity across multiple asset classes and markets Focused on Solutions for Institutional Investors … 1 As of 31 March 2013. 2 This AUM includes the assets of the SPDR Gold Trust (approximately $63 billion as of 31 March 2013), for which State Street Global Markets, LLC, an affiliate of State Street Global Advisors, acts as the distribution agent. 6

LIMITED ACCESS We Service Some of the World’s Largest and Most Complex Global Institutions 7

LIMITED ACCESS … And We Receive Industry Recognition for Our Solutions and Service 8 Most Recognized ETF Brand, Best ETF Service Provider in Asia Pacific and Europe exchangetradedfunds.com 2012 Global ETF Awards Best Global Custodian for Fund Managers, Best Transition Management Provider AsianInvestor 2012 Service Provider Awards No. 1 Custodian Lender, Most Innovative Provider Global Investor/isf 2013 Beneficial Owners Survey No. 1 Bank by Overall Financial Health Forbes 2012 Best Banks in America Securities Lender of the Year, Property Fund Administrator of the Year Custody Risk 2012 European Awards Outsourcing Provider of the Year Custody Risk 2012 Americas Awards No. 1 in Flow Research for Real Money Clients Euromoney 2012 Foreign Exchange Survey Best Securities Financing House, Best ETF Manager in Asia Asia Asset Management 2012 Best of the Best Awards Global Custody Award Winner aiCIO 2013 European Innovation Awards 2012 Industry Innovation Awards

LIMITED ACCESS Our Long-Term Operating-Basis1 Financial Goals Earnings Per Share Growth of 10% – 15% Revenue Growth of 8% – 12% Return on Equity of 12% – 15% 9 1 Financial information presented on an operating basis, a non-GAAP presentation. See Appendix for a description of our non-GAAP financial measures.

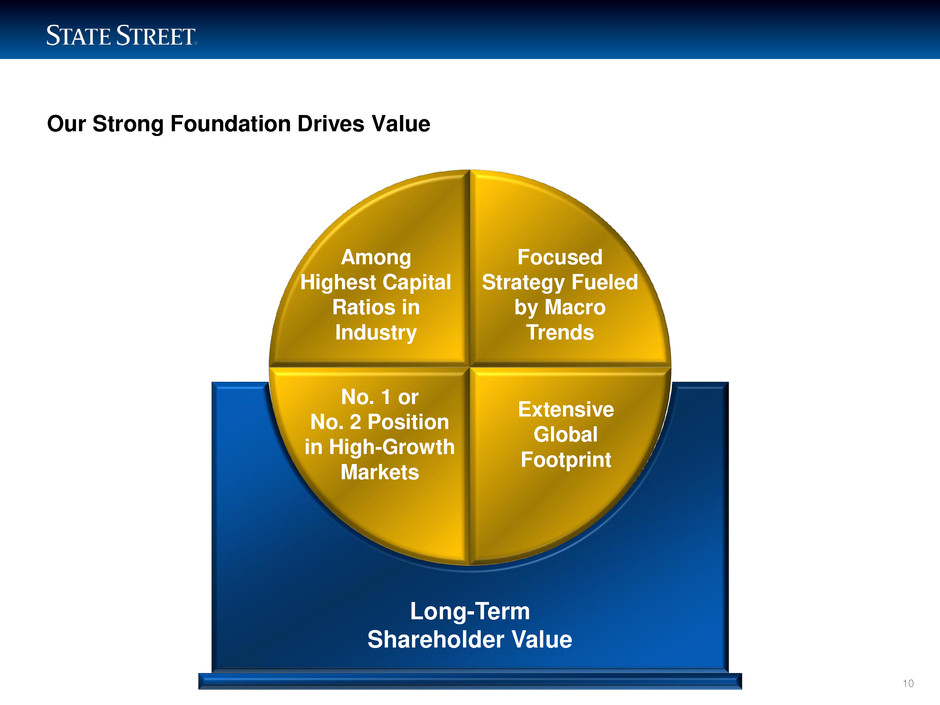

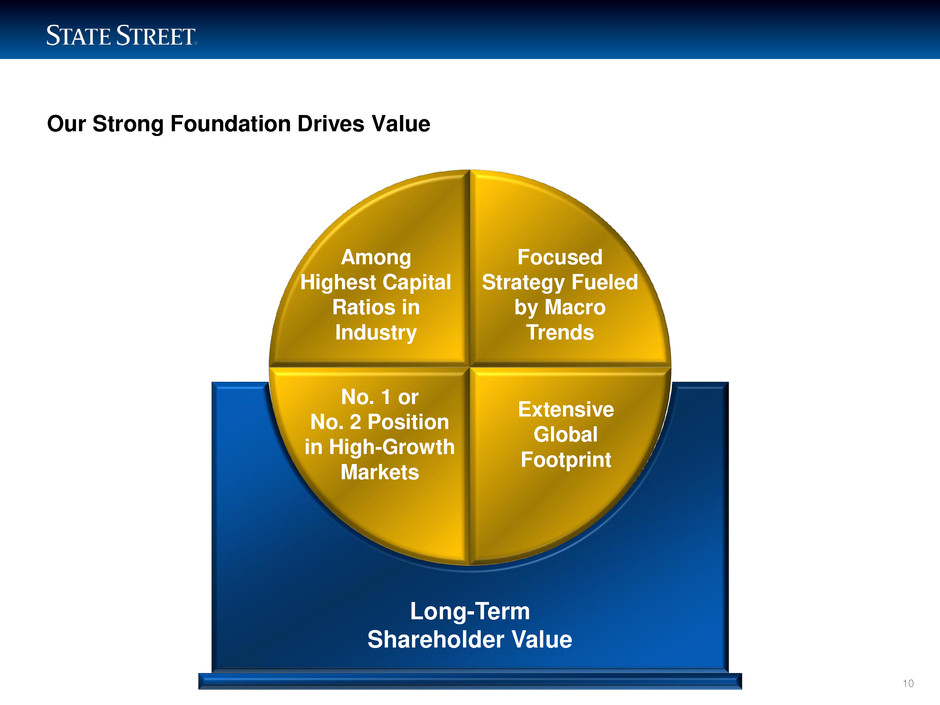

LIMITED ACCESS Our Strong Foundation Drives Value Strong Global Footprint Long-Term Shareholder Value Among Highest Capital Ratios in Industry Focused Strategy Fueled by Macro Trends Extensive Global Footprint No. 1 or No. 2 Position in High-Growth Markets 10

LIMITED ACCESS 11 Trends and Business Strategy 11

LIMITED ACCESS Macro Trends Fuel Our Confidence for Continued Long-Term Growth 12 Trend Driven by Globalisation • Ongoing globalisation of investment and distribution channels • 40% of the growth in financial assets expected to come from emerging markets over the next decade1 Retirement Savings • Evolution of retirement savings schemes: over last decade, defined contribution (DC) grew from 38% to 43% of global pension assets and growth trend is expected to continue2 • 75% of European pension funds think that persistent funding challenges will accelerate the transition to DC3 • Europe ranks as second largest geographic market in the global pension industry, controlling 21% of global assets under management3 Regulation and Complexity • Demand for transparency and increased complexity in operating models of asset owners and asset managers • Growth of alternative assets: global hedge fund AUM reached $2.3T in 20124 1 McKinsey, (Sep. 2012). 2 Towers Watson, Global Pension Assets Study 2012, (Jan. 2012). 3 State Street European Pension Study, January 2013, conducted by the Economist Intelligence Unit. 4 HF Market – Hedge Fund Research, (Jan. 2013).

LIMITED ACCESS We’re Pursuing Key Strategies for Success 13 Priorities Strategy • Extending geographic reach • Opening new vertical high-growth markets – Expanded presence in alternative investment servicing • Broadening our solutions – Continuing to build SSgA with increased ETF and solutions offerings LEVERAGE THE POWER OF THE CORE • Driving operating efficiencies through operational transformation and rigorous expense management • Creating new services from IT transformation OPTIMISE CAPITAL • Returning capital to shareholders • Executing current quarterly common stock dividend and common stock purchase program DRIVE NEW REVENUE

LIMITED ACCESS Why Clients Choose Us Broad Set of Global Servicing Solutions Uniform Global Platform Leader in Middle Office Solutions-Based Asset Management Leader in Technology Transformation Our Extensive Global Footprint and Solutions Set Us Apart in Meeting the Needs of Institutional Investors 14 Data as of 31 December 2012. EUROPE & MIDDLE EAST • AUC/A: $4.8T • Revenue: $2.8B • AUM: $351B ASIA-PACIFIC • AUC/A: $1.1T • Revenue: $766M • AUM: $302B AMERICAS • AUC/A: $18.5T • Revenue: $6.2B • AUM: $1.4T DRIVE NEW REVENUE

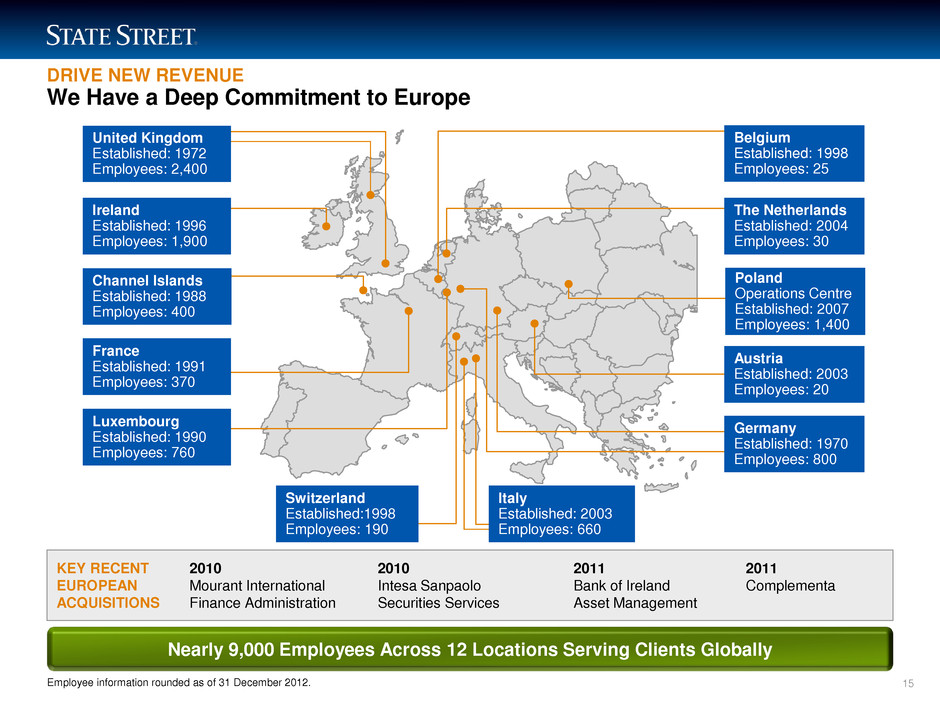

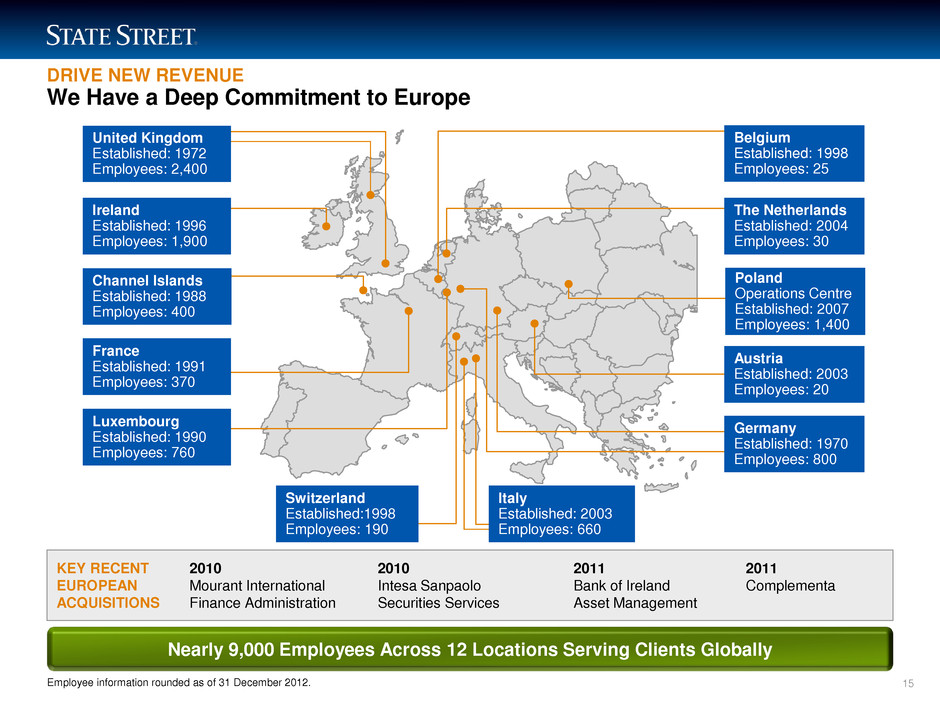

LIMITED ACCESS We Have a Deep Commitment to Europe 15 Switzerland Established:1998 Employees: 190 Luxembourg Established: 1990 Employees: 760 Ireland Established: 1996 Employees: 1,900 Channel Islands Established: 1988 Employees: 400 United Kingdom Established: 1972 Employees: 2,400 Austria Established: 2003 Employees: 20 Belgium Established: 1998 Employees: 25 Germany Established: 1970 Employees: 800 France Established: 1991 Employees: 370 Italy Established: 2003 Employees: 660 Poland Operations Centre Established: 2007 Employees: 1,400 The Netherlands Established: 2004 Employees: 30 KEY RECENT EUROPEAN ACQUISITIONS 2010 Mourant International Finance Administration 2010 Intesa Sanpaolo Securities Services 2011 Bank of Ireland Asset Management 2011 Complementa Employee information rounded as of 31 December 2012. Nearly 9,000 Employees Across 12 Locations Serving Clients Globally DRIVE NEW REVENUE

LIMITED ACCESS We Generate Strong Organic Growth as Our Clients Grow and Diversify 16 AUC/A 0 5 10 15 20 Top 1000 Clients Top 100 Clients Top 25 Clients 9 14 17 Average Number of Products Used by State Street Clients1 2002 2007 2012 Asia-Pacific Americas $4.7T $13.1T $17.2T EMEA Clients Within State Street’s Top 100 That Have Been With Us for 10+ Years2 1 As of 31 December 2012. 2 As of period end. DRIVE NEW REVENUE 80% of 2012 Revenue Growth Came From Existing Clients

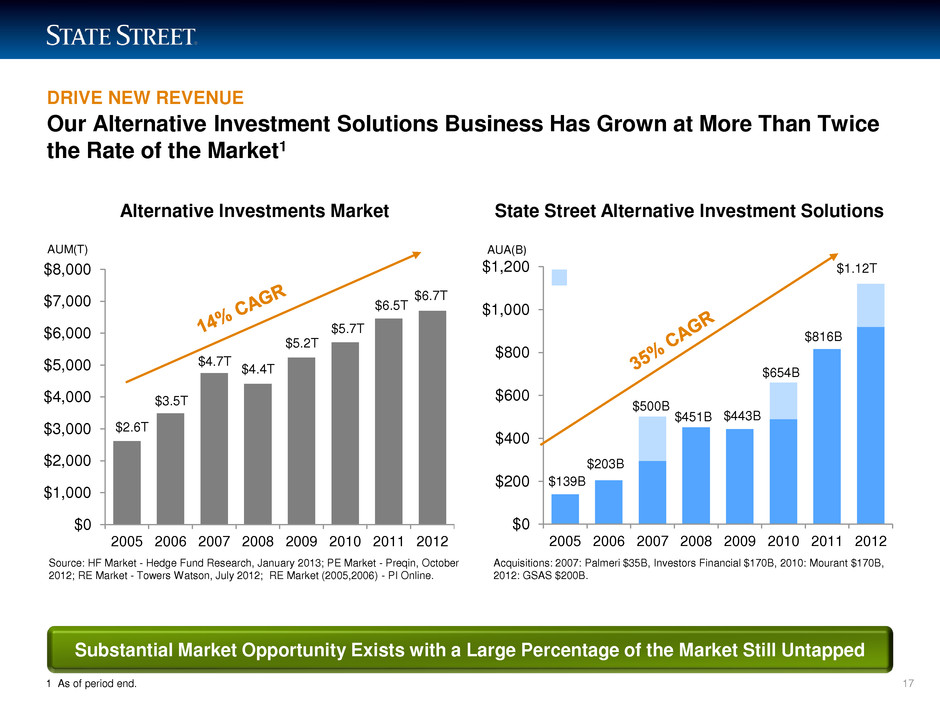

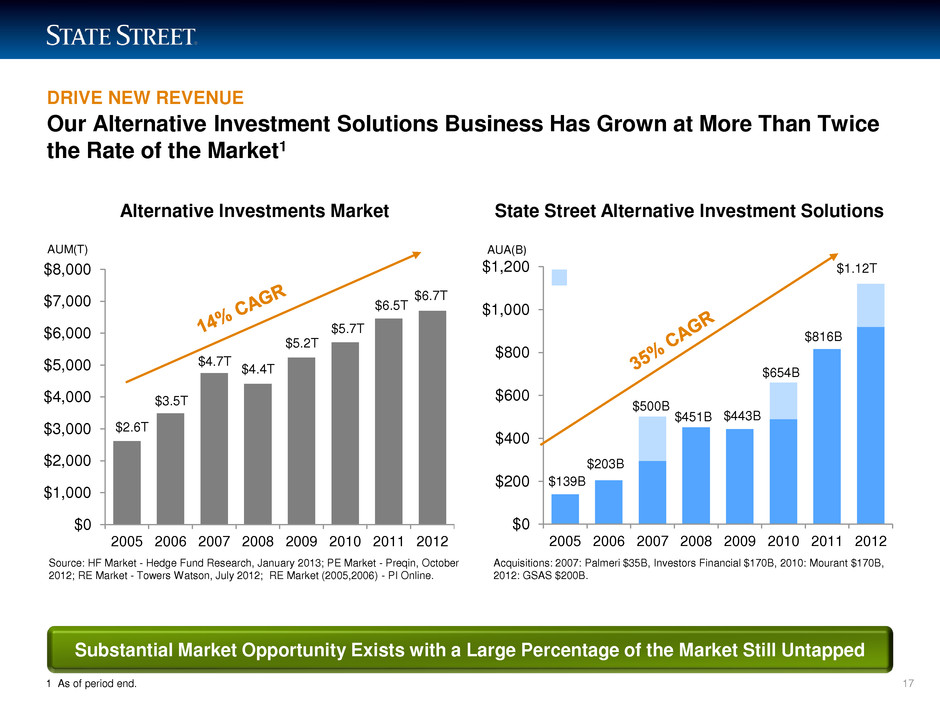

LIMITED ACCESS Our Alternative Investment Solutions Business Has Grown at More Than Twice the Rate of the Market1 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2005 2006 2007 2008 2009 2010 2011 2012 $4.7T Alternative Investments Market $4.4T $5.2T $5.7T $6.5T $6.7T $0 $200 $400 $600 $800 $1,000 $1,200 2005 2006 2007 2008 2009 2010 2011 2012 $500B $451B $443B $654B $816B $1.12T AUM(T) AUA(B) State Street Alternative Investment Solutions $3.5T $2.6T $139B $203B Source: HF Market - Hedge Fund Research, January 2013; PE Market - Preqin, October 2012; RE Market - Towers Watson, July 2012; RE Market (2005,2006) - PI Online. Acquisitions: 2007: Palmeri $35B, Investors Financial $170B, 2010: Mourant $170B, 2012: GSAS $200B. Asset Growth Through Acquisition 1 As of period end. Substantial Market Opportunity Exists with a Large Percentage of the Market Still Untapped 17 DRIVE NEW REVENUE

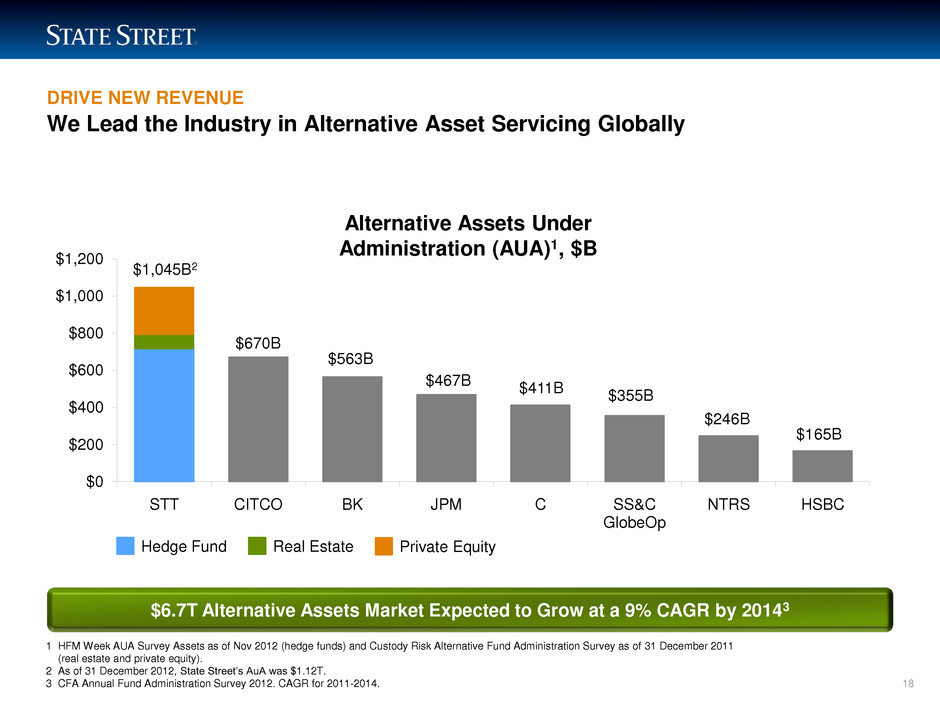

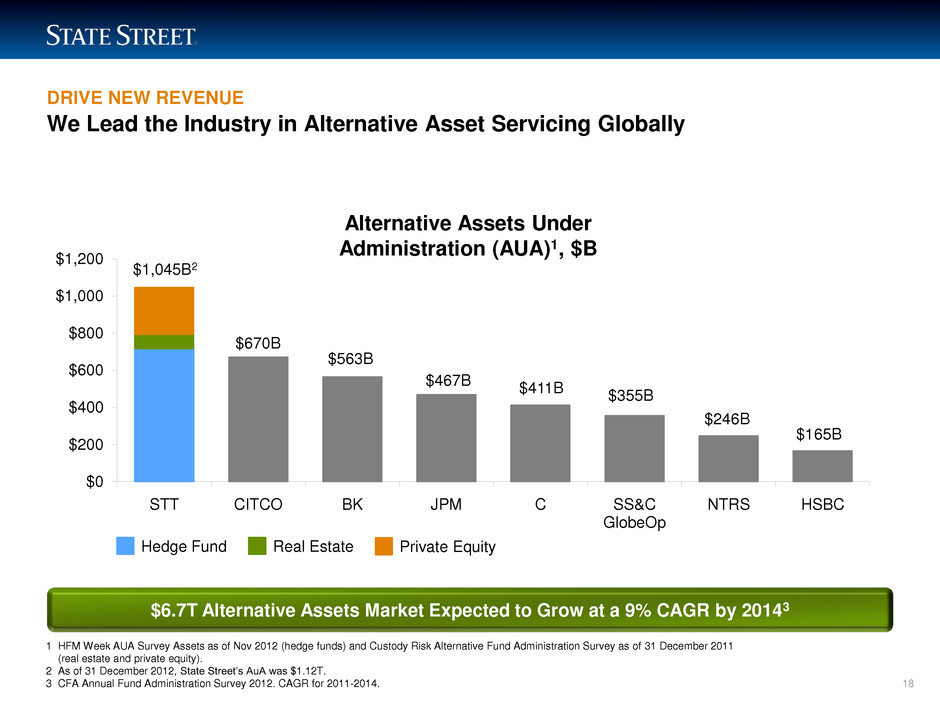

LIMITED ACCESS $1,045B2 $670B $563B $467B $411B $355B $246B $165B $0 $200 $400 $600 $800 $1,000 $1,200 STT CITCO BK JPM C SS&C GlobeOp NTRS HSBC We Lead the Industry in Alternative Asset Servicing Globally 1 HFM Week AUA Survey Assets as of Nov 2012 (hedge funds) and Custody Risk Alternative Fund Administration Survey as of 31 December 2011 (real estate and private equity). 2 As of 31 December 2012, State Street’s AuA was $1.12T. 3 CFA Annual Fund Administration Survey 2012. CAGR for 2011-2014. Alternative Assets Under Administration (AUA)1, $B Hedge Fund Private Equity Real Estate $6.7T Alternative Assets Market Expected to Grow at a 9% CAGR by 20143 18 DRIVE NEW REVENUE

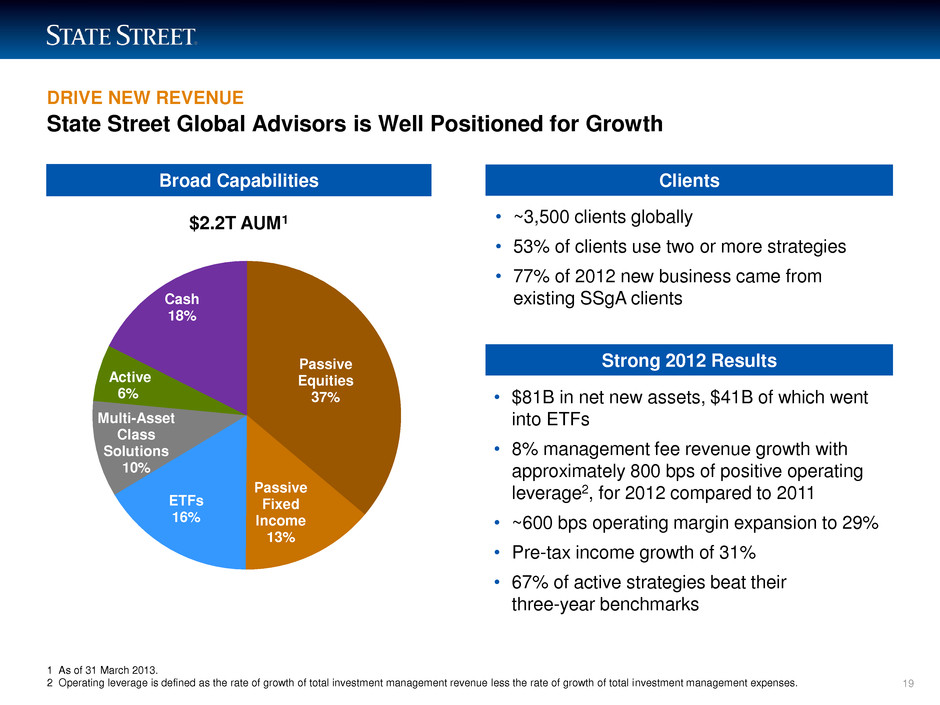

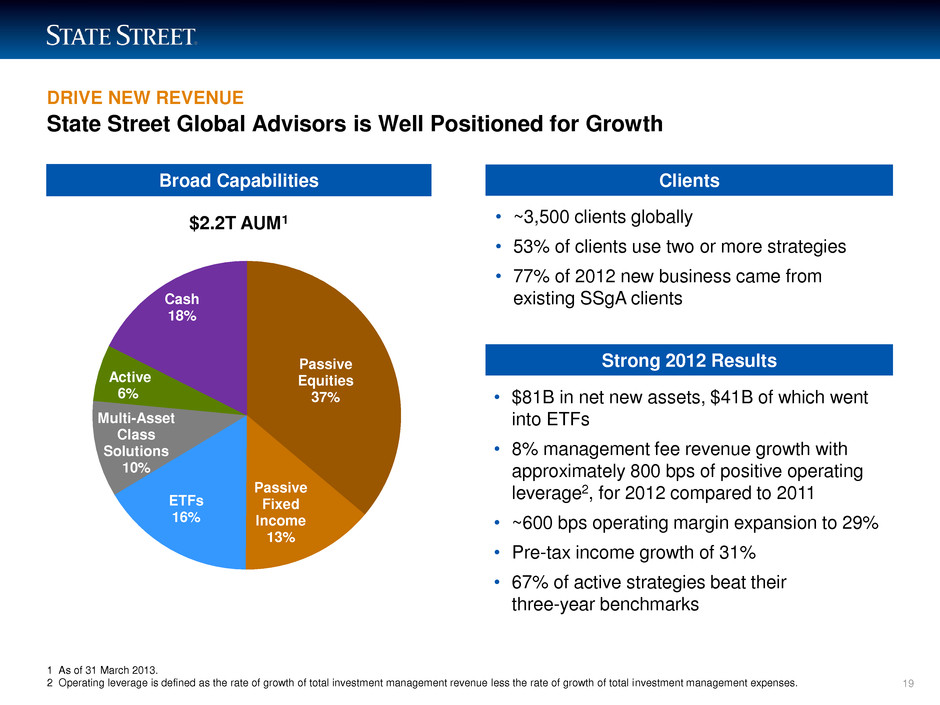

LIMITED ACCESS DRIVE NEW REVENUE State Street Global Advisors is Well Positioned for Growth $2.2T AUM1 1 As of 31 March 2013. 2 Operating leverage is defined as the rate of growth of total investment management revenue less the rate of growth of total investment management expenses. Broad Capabilities Clients • ~3,500 clients globally • 53% of clients use two or more strategies • 77% of 2012 new business came from existing SSgA clients Strong 2012 Results • $81B in net new assets, $41B of which went into ETFs • 8% management fee revenue growth with approximately 800 bps of positive operating leverage2, for 2012 compared to 2011 • ~600 bps operating margin expansion to 29% • Pre-tax income growth of 31% • 67% of active strategies beat their three-year benchmarks Passive Equities 37% Passive Fixed Income 13% ETFs 16% Multi-Asset Class Solutions 10% Active 6% Cash 18% 19

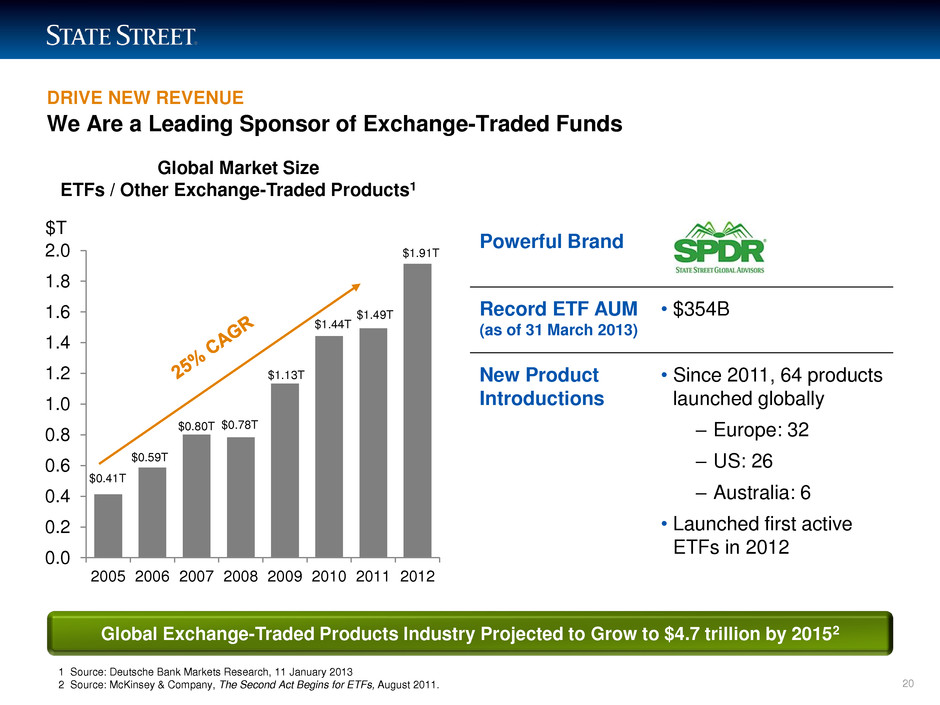

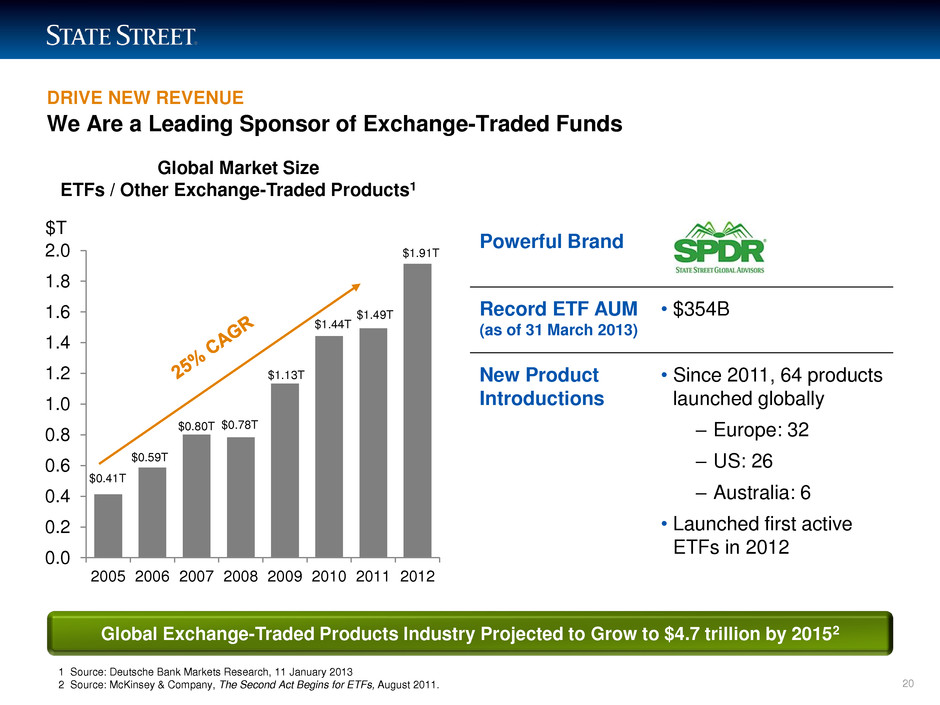

LIMITED ACCESS DRIVE NEW REVENUE 1 1 Source: Deutsche Bank Markets Research, 11 January 2013 2 2 Source: McKinsey & Company, The Second Act Begins for ETFs, August 2011. We Are a Leading Sponsor of Exchange-Traded Funds Global Market Size ETFs / Other Exchange-Traded Products1 $0.41T $0.59T $0.80T $0.78T $1.13T $1.44T $1.49T $1.91T 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2005 2006 2007 2008 2009 2010 2011 2012 Powerful Brand Record ETF AUM (as of 31 March 2013) • $354B New Product Introductions • Since 2011, 64 products launched globally – Europe: 32 – US: 26 – Australia: 6 • Launched first active ETFs in 2012 $T Global Exchange-Traded Products Industry Projected to Grow to $4.7 trillion by 20152 20

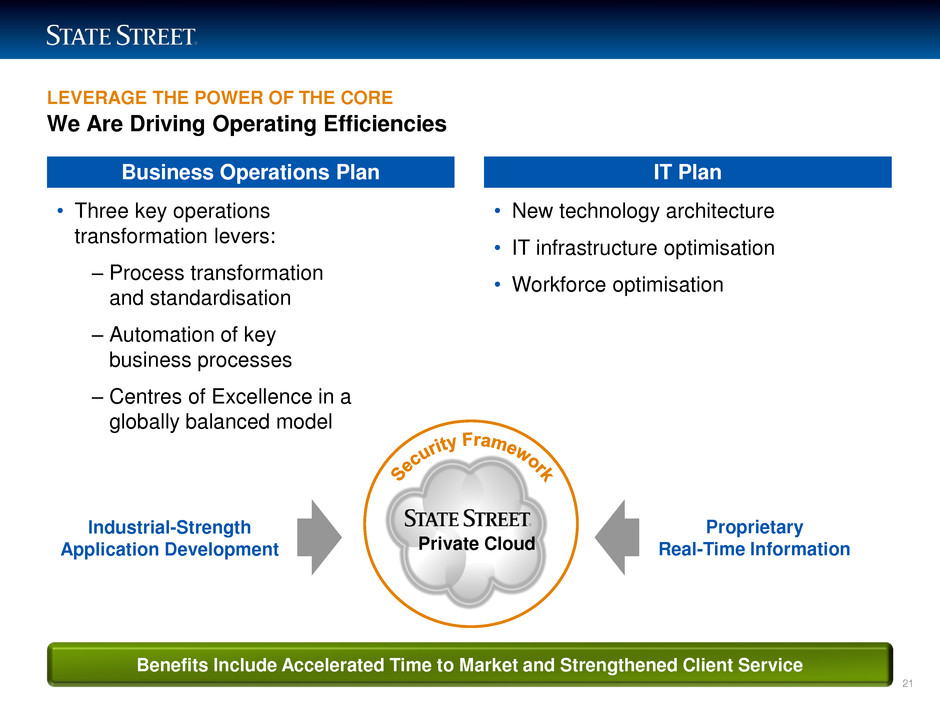

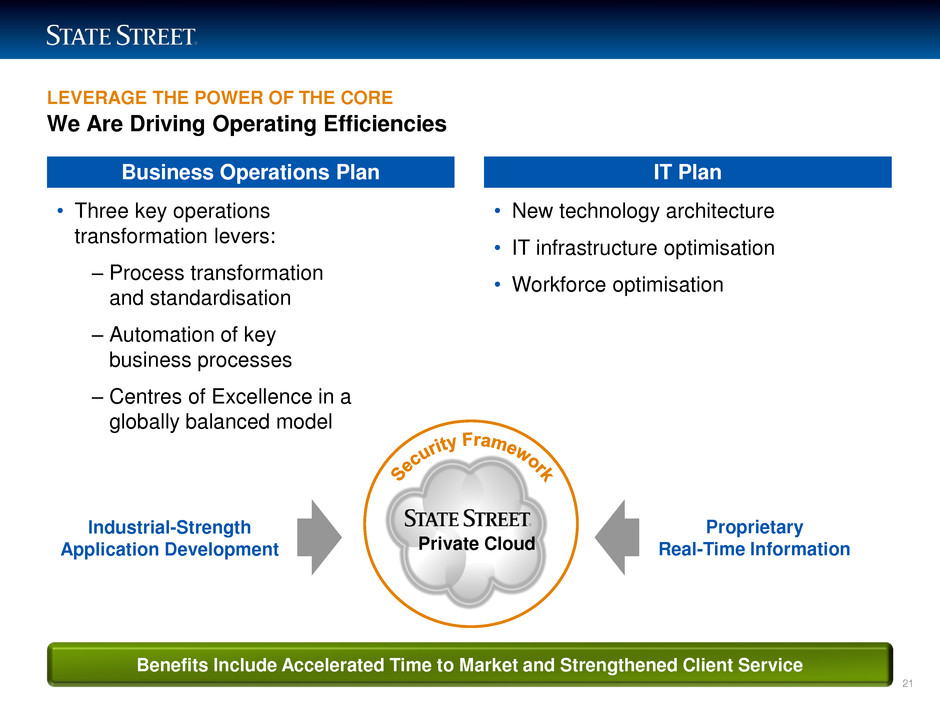

LIMITED ACCESS LEVERAGE THE POWER OF THE CORE We Are Driving Operating Efficiencies • Three key operations transformation levers: – Process transformation and standardisation – Automation of key business processes – Centres of Excellence in a globally balanced model Business Operations Plan • New technology architecture • IT infrastructure optimisation • Workforce optimisation IT Plan Private Cloud Industrial-Strength Application Development Proprietary Real-Time Information 21 Benefits Include Accelerated Time to Market and Strengthened Client Service

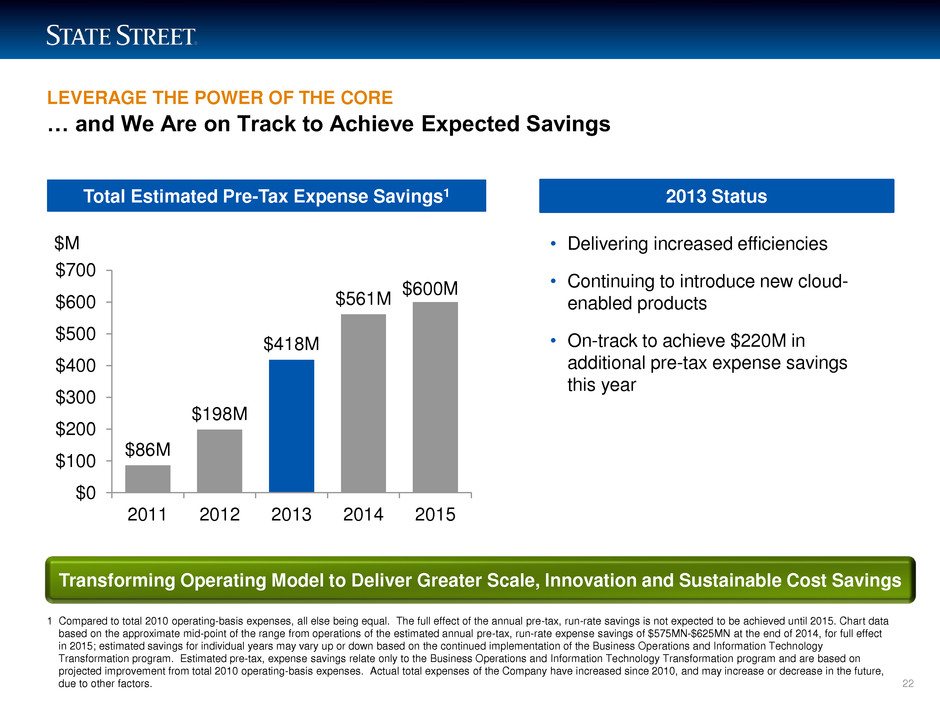

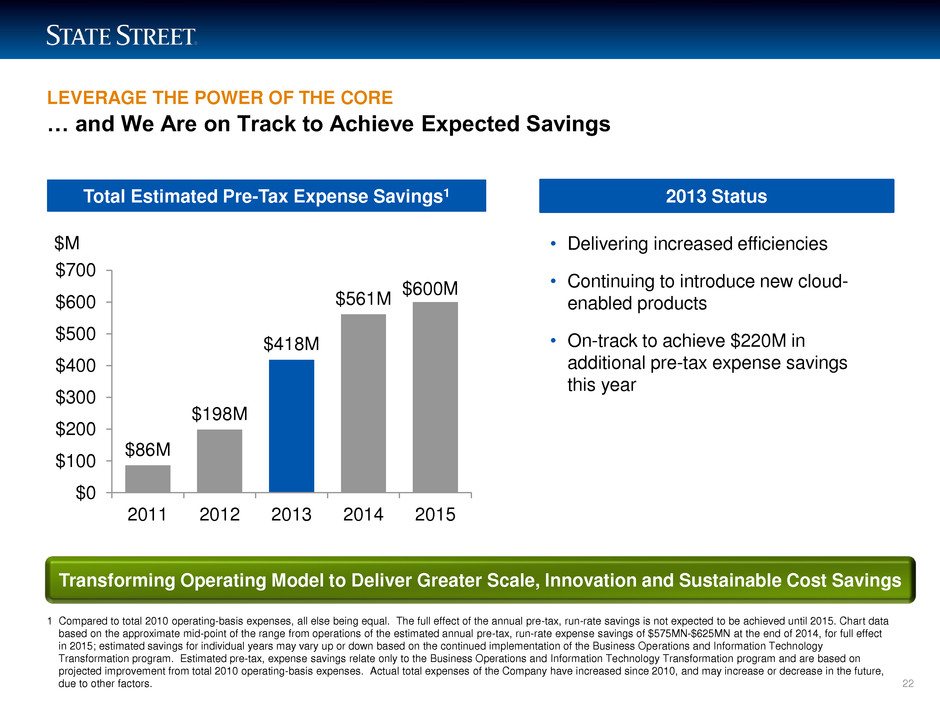

LIMITED ACCESS LEVERAGE THE POWER OF THE CORE Total Estimated Pre-Tax Expense Savings1 … and We Are on Track to Achieve Expected Savings 1 Compared to total 2010 operating-basis expenses, all else being equal. The full effect of the annual pre-tax, run-rate savings is not expected to be achieved until 2015. Chart data based on the approximate mid-point of the range from operations of the estimated annual pre-tax, run-rate expense savings of $575MN-$625MN at the end of 2014, for full effect in 2015; estimated savings for individual years may vary up or down based on the continued implementation of the Business Operations and Information Technology Transformation program. Estimated pre-tax, expense savings relate only to the Business Operations and Information Technology Transformation program and are based on projected improvement from total 2010 operating-basis expenses. Actual total expenses of the Company have increased since 2010, and may increase or decrease in the future, due to other factors. $86M $198M $418M $561M $600M $0 $100 $200 $300 $400 $500 $600 $700 2011 2012 2013 2014 2015 2013 Status • Delivering increased efficiencies • Continuing to introduce new cloud- enabled products • On-track to achieve $220M in additional pre-tax expense savings this year $M Transforming Operating Model to Deliver Greater Scale, Innovation and Sustainable Cost Savings 22

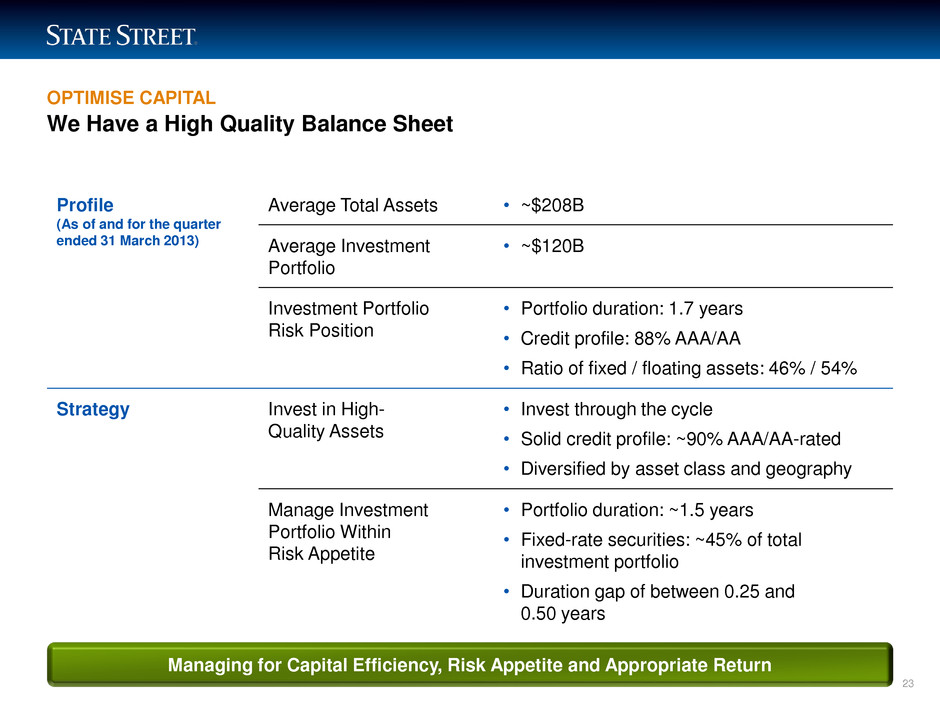

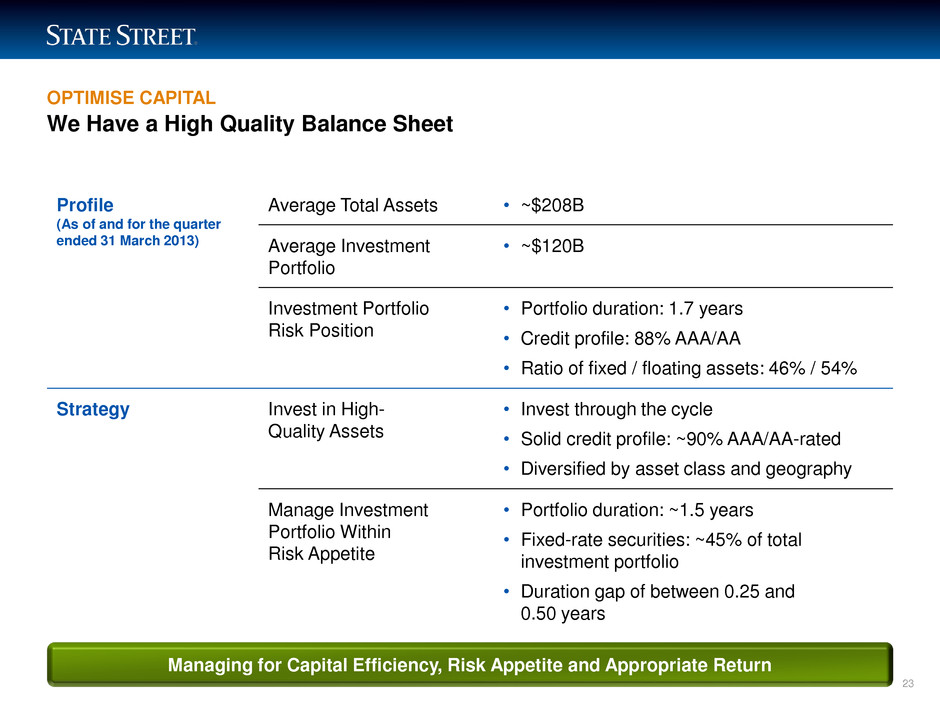

LIMITED ACCESS OPTIMISE CAPITAL We Have a High Quality Balance Sheet 23 Profile (As of and for the quarter ended 31 March 2013) Average Total Assets • ~$208B Average Investment Portfolio • ~$120B Investment Portfolio Risk Position • Portfolio duration: 1.7 years • Credit profile: 88% AAA/AA • Ratio of fixed / floating assets: 46% / 54% Strategy Invest in High- Quality Assets • Invest through the cycle • Solid credit profile: ~90% AAA/AA-rated • Diversified by asset class and geography Manage Investment Portfolio Within Risk Appetite • Portfolio duration: ~1.5 years • Fixed-rate securities: ~45% of total investment portfolio • Duration gap of between 0.25 and 0.50 years Managing for Capital Efficiency, Risk Appetite and Appropriate Return

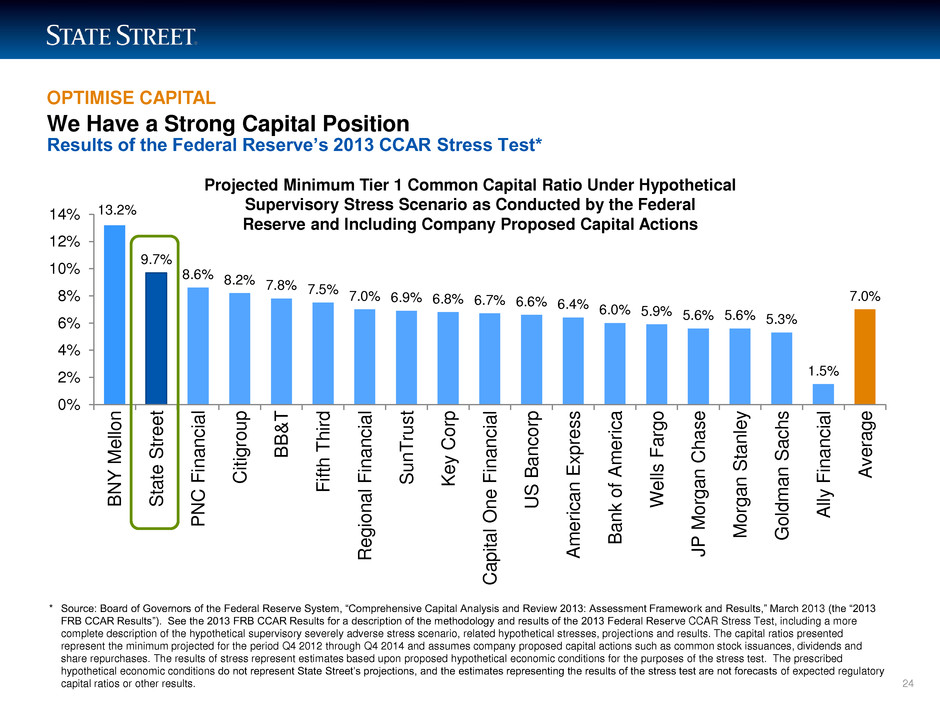

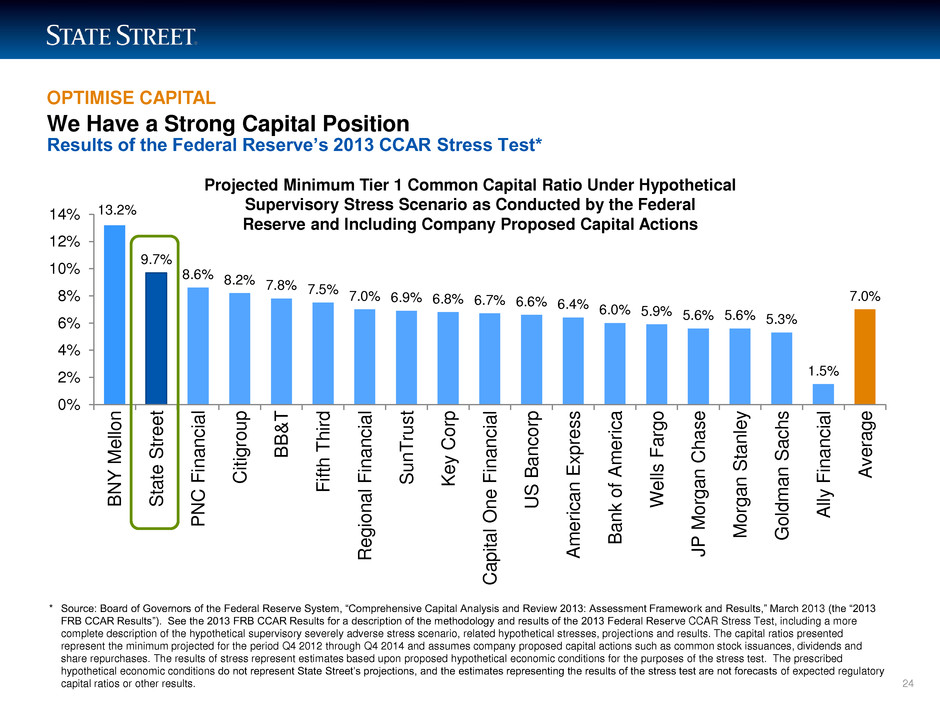

LIMITED ACCESS We Have a Strong Capital Position Results of the Federal Reserve’s 2013 CCAR Stress Test* 13.2% 9.7% 8.6% 8.2% 7.8% 7.5% 7.0% 6.9% 6.8% 6.7% 6.6% 6.4% 6.0% 5.9% 5.6% 5.6% 5.3% 1.5% 7.0% 0% 2% 4% 6% 8% 10% 12% 14% B N Y M e llo n S ta te S tree t PN C Financia l C it ig rou p B B & T F if th T h ir d R egiona l F inan c ia l Sun T ru s t Ke y C o rp C api tal O ne F in a n c ia l U S B an c or p A m eri c an E x pre s s Ban k o f A m eri c a W ell s F ar g o J P M o rgan Cha s e M organ S tanle y Gol d m a n S a c h s All y F in an c ia l A v erag e * Source: Board of Governors of the Federal Reserve System, “Comprehensive Capital Analysis and Review 2013: Assessment Framework and Results,” March 2013 (the “2013 FRB CCAR Results”). See the 2013 FRB CCAR Results for a description of the methodology and results of the 2013 Federal Reserve CCAR Stress Test, including a more complete description of the hypothetical supervisory severely adverse stress scenario, related hypothetical stresses, projections and results. The capital ratios presented represent the minimum projected for the period Q4 2012 through Q4 2014 and assumes company proposed capital actions such as common stock issuances, dividends and share repurchases. The results of stress represent estimates based upon proposed hypothetical economic conditions for the purposes of the stress test. The prescribed hypothetical economic conditions do not represent State Street’s projections, and the estimates representing the results of the stress test are not forecasts of expected regulatory capital ratios or other results. Projected Minimum Tier 1 Common Capital Ratio Under Hypothetical Supervisory Stress Scenario as Conducted by the Federal Reserve and Including Company Proposed Capital Actions 24 OPTIMISE CAPITAL

LIMITED ACCESS Returning Capital to Our Shareholders is a Priority 25 Dividend Payout • Increased 2013 quarterly common stock dividends by $0.02 to $0.26 per share Common Stock Purchase Program • Board approved a common stock purchase program of up to $2.1B through 31 March 2014 OPTIMISE CAPITAL

LIMITED ACCESS 26 Financial Performance 26

LIMITED ACCESS We’re Executing Well Amid a Challenging Economic Environment … 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for a description of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. Operating-Basis (Non-GAAP) EPS1 Growth from 2009 $3.32 $3.40 $3.73 $3.95 $2.00 $3.00 $4.00 2009 2010 2011 2012 • Growing our core business and continuing to invest in high-growth markets • Implementing a multi-year Business Operations and IT Transformation program • Strategically managing and deploying our capital • Constrained GDP growth • Prolonged low interest rates • Client risk aversion 27

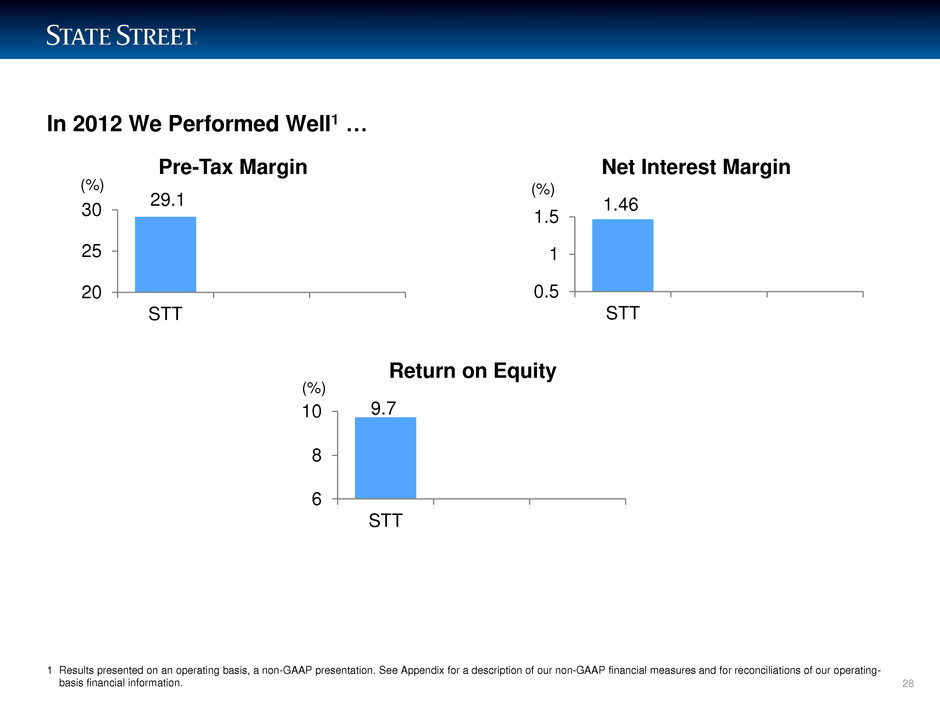

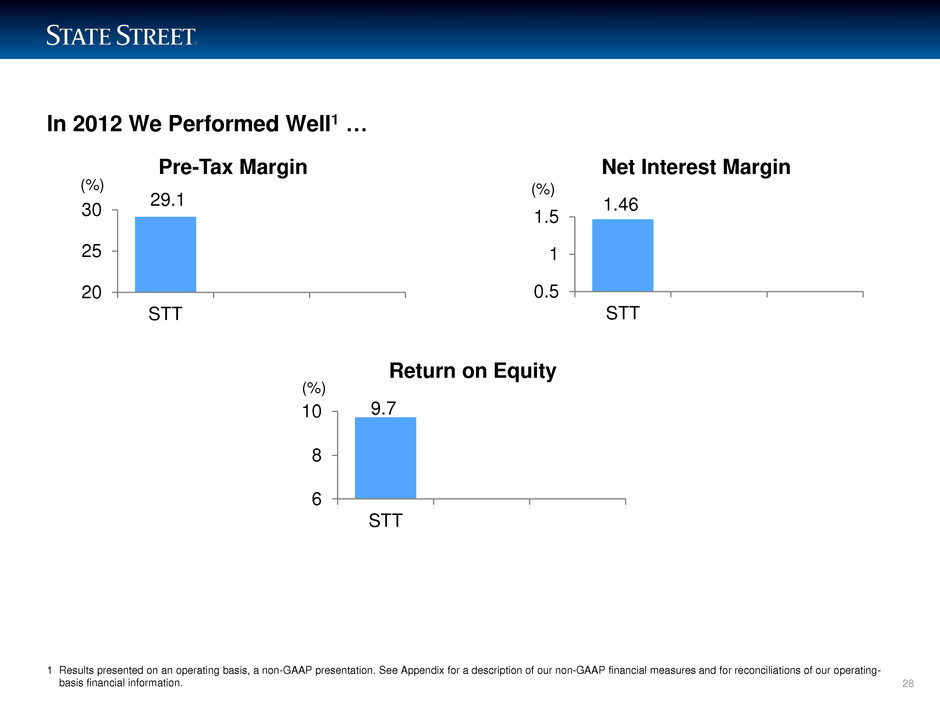

LIMITED ACCESS In 2012 We Performed Well1 … 1 Results presented on an operating basis, a non-GAAP presentation. See Appendix for a description of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. 9.7 6 8 10 STT (%) 1.46 0.5 1 1.5 STT (%) Net Interest Margin Return on Equity 29.1 20 25 30 STT (%) Pre-Tax Margin 28

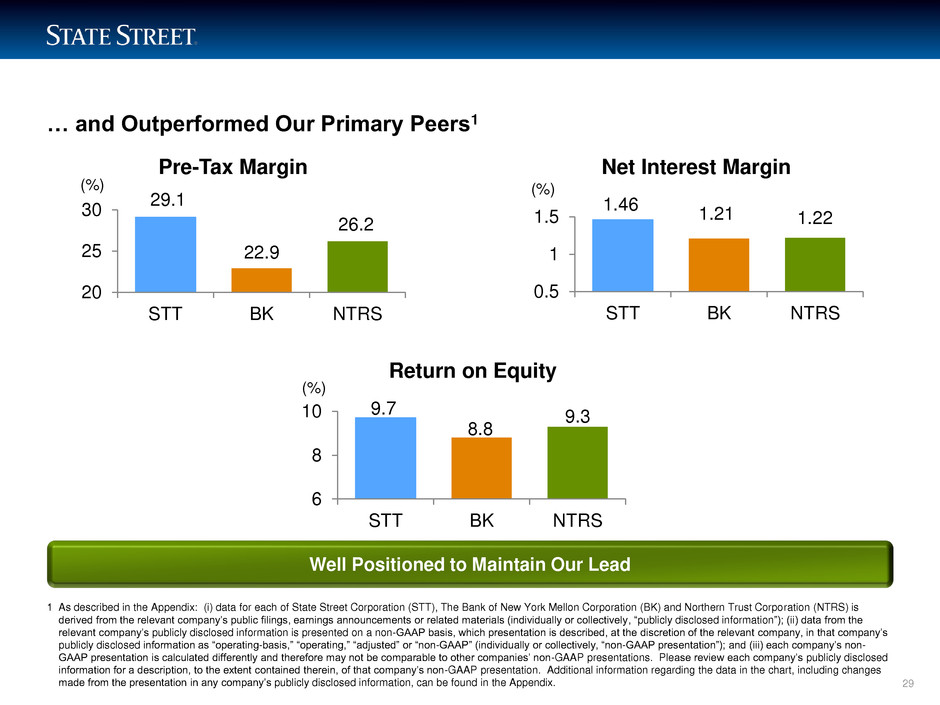

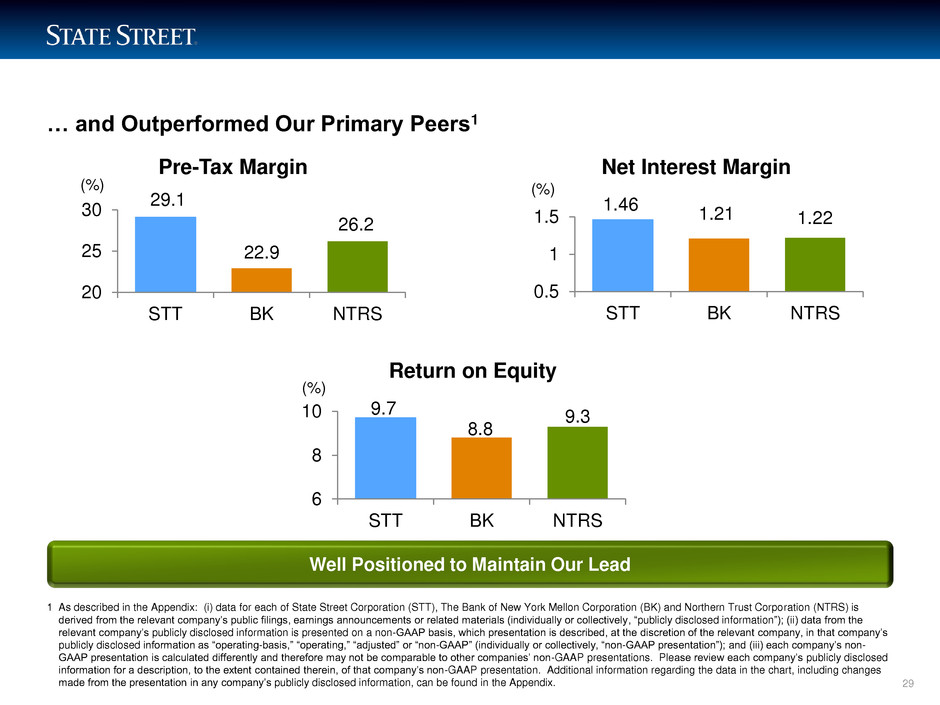

LIMITED ACCESS … and Outperformed Our Primary Peers1 Well Positioned to Maintain Our Lead 9.7 8.8 9.3 6 8 10 STT BK NTRS (%) 1.46 1.21 1.22 0.5 1 1.5 STT BK NTRS (%) Net Interest Margin Return on Equity 29.1 22.9 26.2 20 25 30 STT BK NTRS (%) Pre-Tax Margin 1 As described in the Appendix: (i) data for each of State Street Corporation (STT), The Bank of New York Mellon Corporation (BK) and Northern Trust Corporation (NTRS) is derived from the relevant company’s public filings, earnings announcements or related materials (individually or collectively, “publicly disclosed information”); (ii) data from the relevant company’s publicly disclosed information is presented on a non-GAAP basis, which presentation is described, at the discretion of the relevant company, in that company’s publicly disclosed information as “operating-basis,” “operating,” “adjusted” or “non-GAAP” (individually or collectively, “non-GAAP presentation”); and (iii) each company’s non- GAAP presentation is calculated differently and therefore may not be comparable to other companies’ non-GAAP presentations. Please review each company’s publicly disclosed information for a description, to the extent contained therein, of that company’s non-GAAP presentation. Additional information regarding the data in the chart, including changes made from the presentation in any company’s publicly disclosed information, can be found in the Appendix. 29

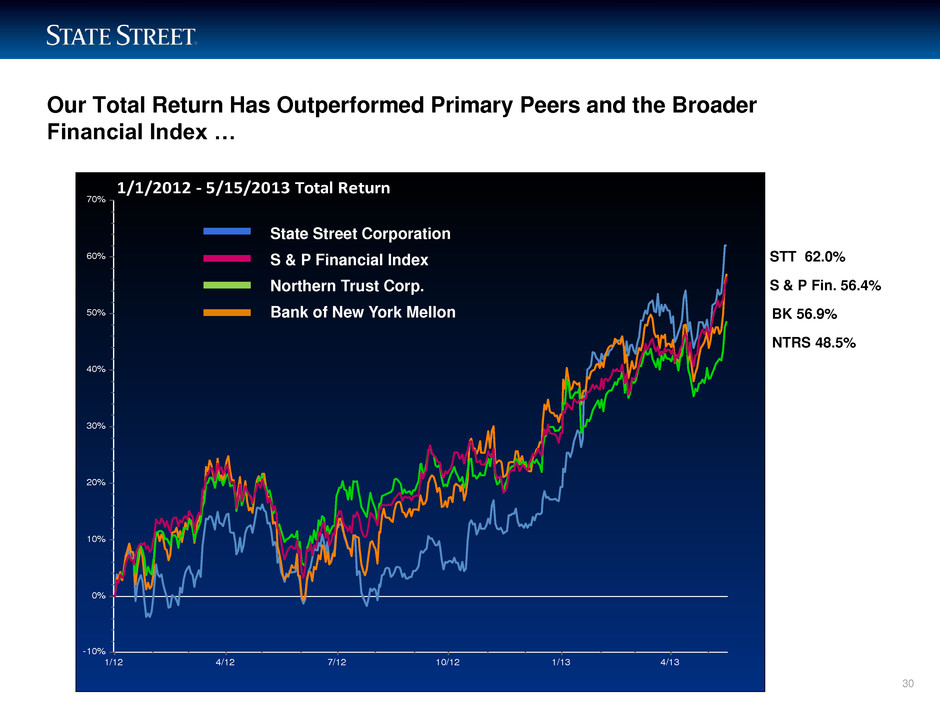

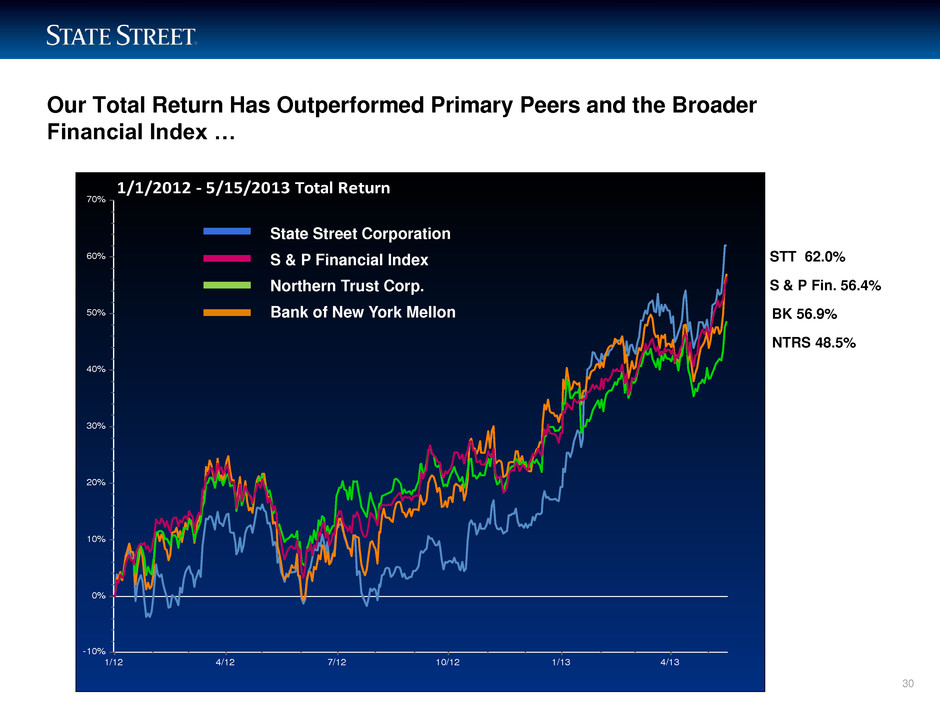

LIMITED ACCESS Our Total Return Has Outperformed Primary Peers and the Broader Financial Index … 30 1/12 4/12 7/12 10/12 1/13 4/13 -10% 0% 10% 20% 30% 40% 50% 60% 70% 1/1/2012 - 5/15/2013 Total Return STT 62.0% S & P Fin. 56.4% NTRS 48.5% BK 56.9% State Street Corporation S & P Financial Index Northern Trust Corp. Bank of New York Mellon

LIMITED ACCESS 31 Well Positioned for the Long Term Managing Through the Short Term Delivering Value Today and for the Future Summary

Appendix 32 The foregoing presentation includes financial information presented on a GAAP basis as well as on a non-GAAP, or “operating basis.” Management measures and compares certain financial information on an operating basis, as it believes that this presentation supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to State Street’s normal ongoing business operations. Management believes that operating-basis financial information, which reports revenue from non-taxable sources, such as interest revenue from tax- exempt investment securities and processing fees and other revenue associated with tax-advantaged investments, on a fully taxable-equivalent basis and excludes the impact of revenue and expenses outside of the normal course of business, facilitates an investor’s understanding and analysis of State Street’s underlying financial performance and trends in addition to financial information prepared and reported in accordance with GAAP. Non- GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. References in the presentation to “GAAP” are to U.S. Generally Accepted Accounting Principles.

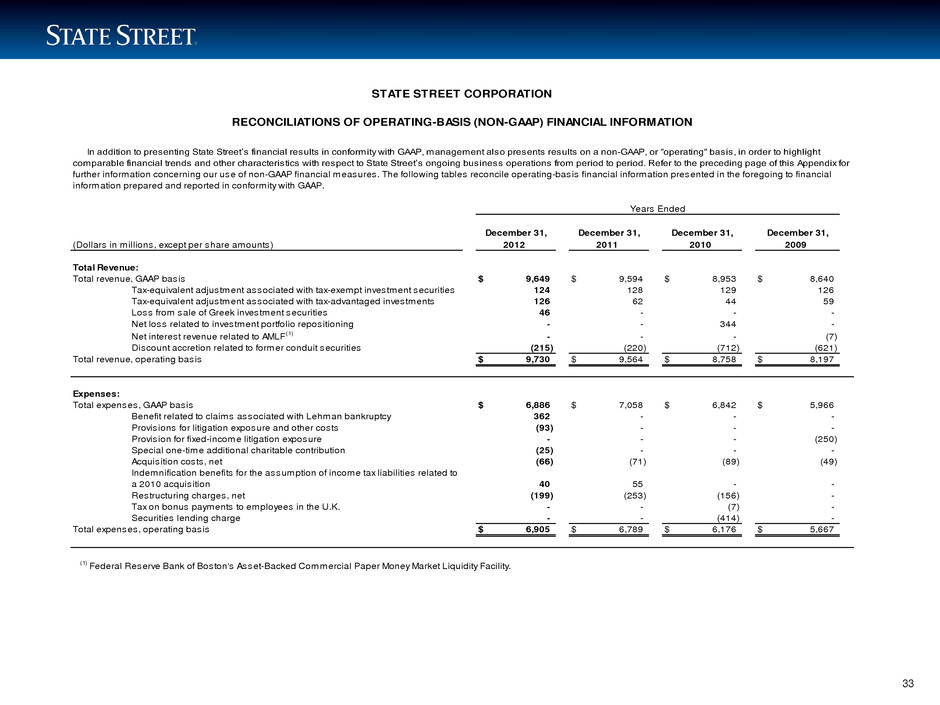

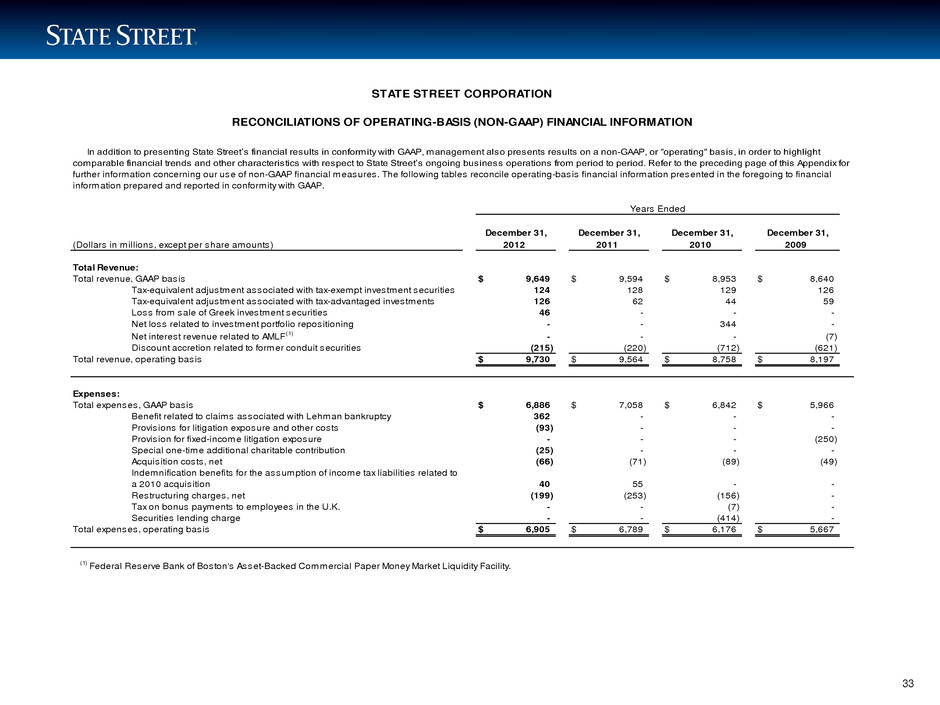

33 (Dollars in millions, except per share amounts) Total Revenue: Total revenue, GAAP basis $ 9,649 $ 9,594 $ 8,953 $ 8,640 Tax-equivalent adjustment associated with tax-exempt investment securities 124 128 129 126 Tax-equivalent adjustment associated with tax-advantaged investments 126 62 44 59 Loss from sale of Greek investment securities 46 - - - Net loss related to investment portfolio repositioning - - 344 - Net interest revenue related to AMLF (1) - - - (7) Discount accretion related to former conduit securities (215) (220) (712) (621) Total revenue, operating basis $ 9,730 $ 9,564 $ 8,758 $ 8,197 Expenses: Total expenses, GAAP basis $ 6,886 $ 7,058 $ 6,842 $ 5,966 Benefit related to claims associated with Lehman bankruptcy 362 - - - Provisions for litigation exposure and other costs (93) - - - Provision for fixed-income litigation exposure - - - (250) Special one-time additional charitable contribution (25) - - - Acquisition costs, net (66) (71) (89) (49) Indemnification benefits for the assumption of income tax liabilities related to a 2010 acquisition 40 55 - - Restructuring charges, net (199) (253) (156) - Tax on bonus payments to employees in the U.K. - - (7) - Securities lending charge - - (414) - Total expenses, operating basis $ 6,905 $ 6,789 $ 6,176 $ 5,667 (1) Federal Reserve Bank of Boston's Asset-Backed Commercial Paper Money Market Liquidity Facility. STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. Years Ended 2012 2011 2010 2009 December 31, December 31, December 31, December 31,

34 (Dollars in millions, except per share amounts) Diluted Earnings per Common Share: Diluted earnings per common share, GAAP basis $ 4.20 $ 3.79 $ 3.09 $ 3.46 Benefit related to claims associated with Lehman bankruptcy (.46) - - - Loss from sale of Greek investment securities .06 - - - Net loss related to investment portfolio repositioning - - .67 - Provisions for litigation exposure and other costs .12 - - - Provision for fixed-income litigation exposure - - - .38 Special one-time additional charitable contribution .04 - - - Acquisition costs, net .09 .10 .13 .28 Tax effect of audit settlement associated with a 2010 acquisition (.10) - - - Restructuring charges, net .27 .32 .21 - Tax on bonus payments to employees in the U.K. - - .01 - Securities lending charge - - .51 - Net interest revenue related to AMLF (1) - - - (.01) Discount accretion related to former conduit securities (.27) (.27) (.86) (.79) Discrete tax benefit related to former conduit securities - (.21) (.36) - Diluted earnings per common share, operating basis (2) $ 3.95 $ 3.73 $ 3.40 $ 3.32 Return on Average Common Equity: Return on average common equity, GAAP basis 10.3 % 10.0 % 9.5 % 13.2 % Benefit related to claims associated with Lehman bankruptcy (1.1) - - - Loss from sale of Greek investment securities 0.1 - - - Net loss related to investment portfolio repositioning - - 2.1 - Provisions for litigation exposure and other costs 0.3 - - - Provision for fixed-income litigation exposure - - - 1.4 Special one-time additional charitable contribution 0.1 - - - Acquisition costs, net 0.2 0.3 0.4 0.2 Tax effect of audit settlement associated with a 2010 acquisition (0.2) - - - Restructuring charges, net 0.7 0.8 0.6 - Tax on bonus payments to employees in the U.K. - - - - Securities lending charge - - 1.5 - Prepayment of discount on TARP (3) preferred stock - - - 0.8 Discount accretion related to former conduit securities (0.7) (0.7) (2.6) (3.0) Discrete tax benefit related to former conduit securities - (0.5) (1.1) - Return on average common equity, operating basis 9.7 % 9.9 % 10.4 % 12.6 % (1) Federal Reserve Bank of Boston's Asset-Backed Commercial Paper Money Market Liquidity Facility. (2) The compound annual growth rate for diluted earnings per share for the four years in the period ended December 31, 2012 was 6%. (3) U.S. Treasury's Troubled Asset Relief Program. December 31, December 31, December 31, December 31, 2012 2011 2010 2009 STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. Years Ended

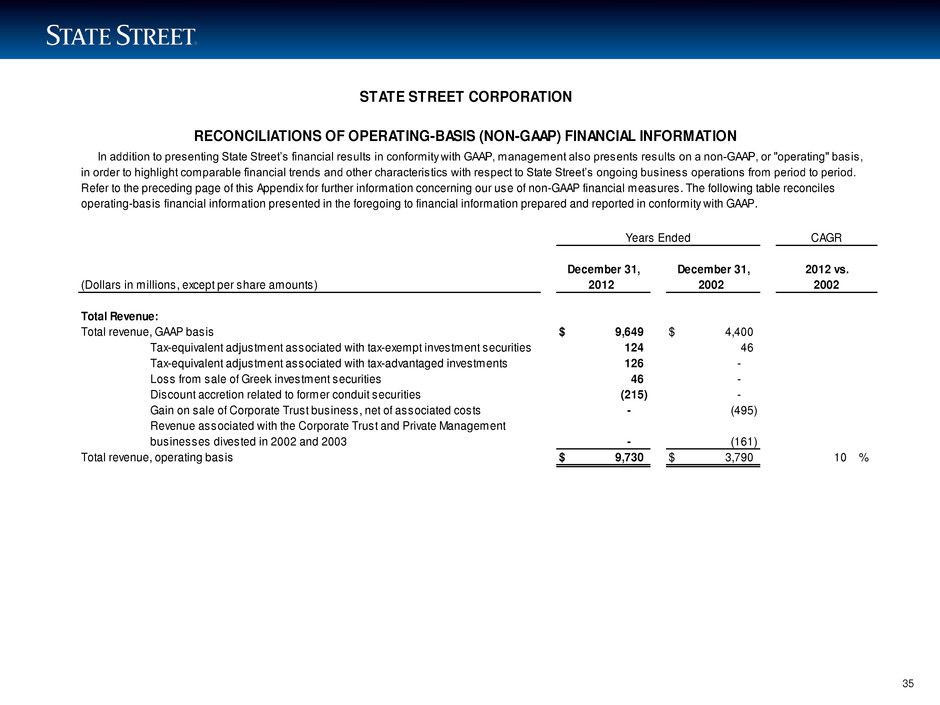

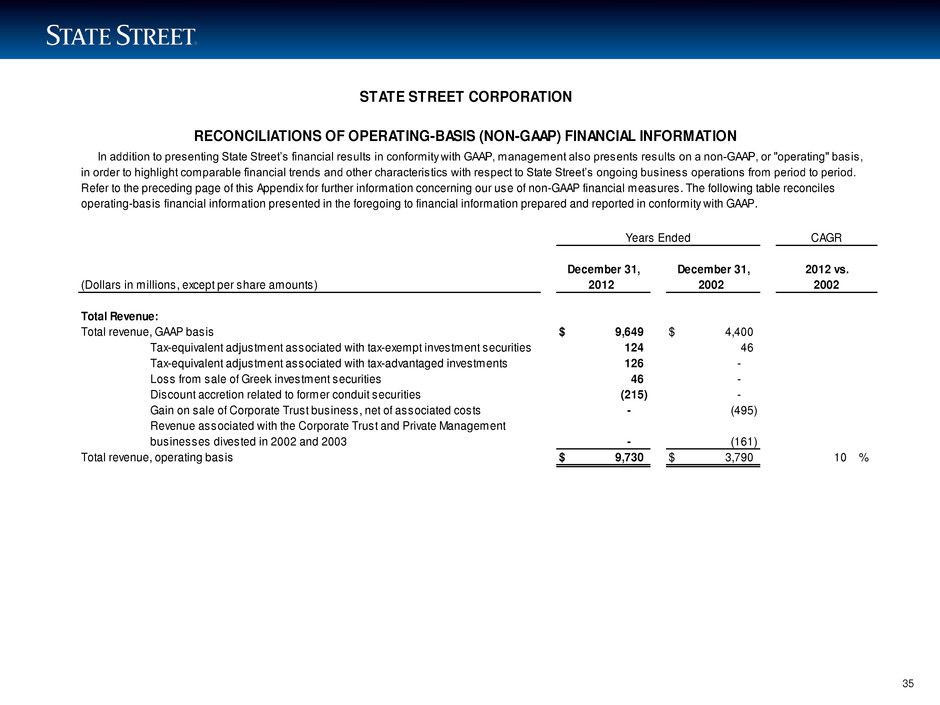

35 (Dollars in millions, except per share amounts) Total Revenue: Total revenue, GAAP basis $ 9,649 $ 4,400 Tax-equivalent adjustment associated with tax-exempt investment securities 124 46 Tax-equivalent adjustment associated with tax-advantaged investments 126 - Loss from sale of Greek investment securities 46 - Discount accretion related to former conduit securities (215) - Gain on sale of Corporate Trust business, net of associated costs - (495) Revenue associated with the Corporate Trust and Private Management businesses divested in 2002 and 2003 - (161) Total revenue, operating basis $ 9,730 $ 3,790 10 % December 31, Years Ended STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION CAGR 2012 vs. 2002 In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following table reconciles operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. 2012 December 31, 2002

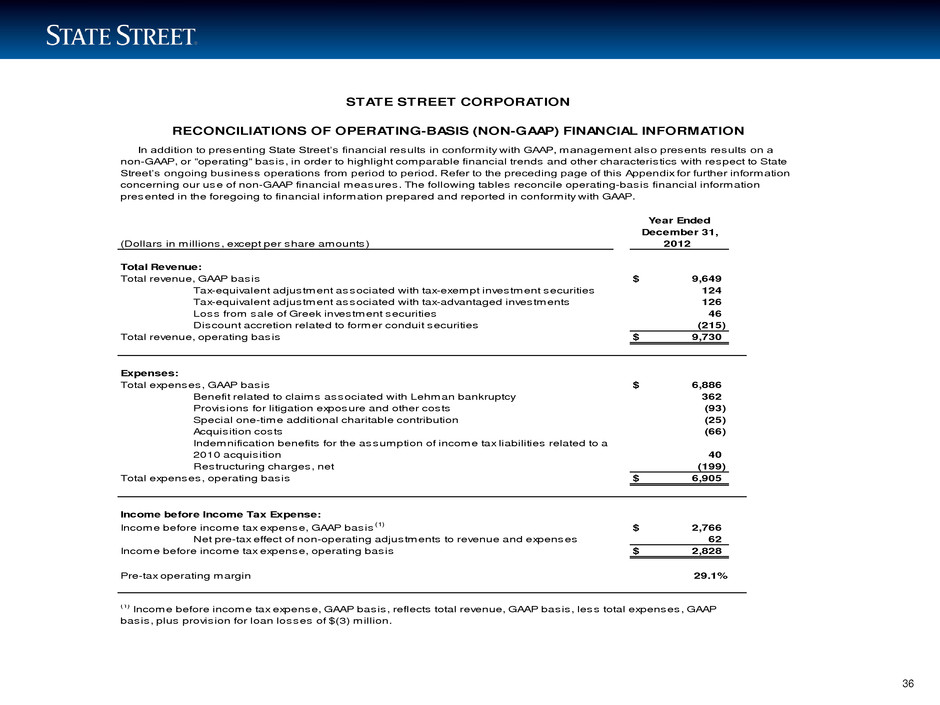

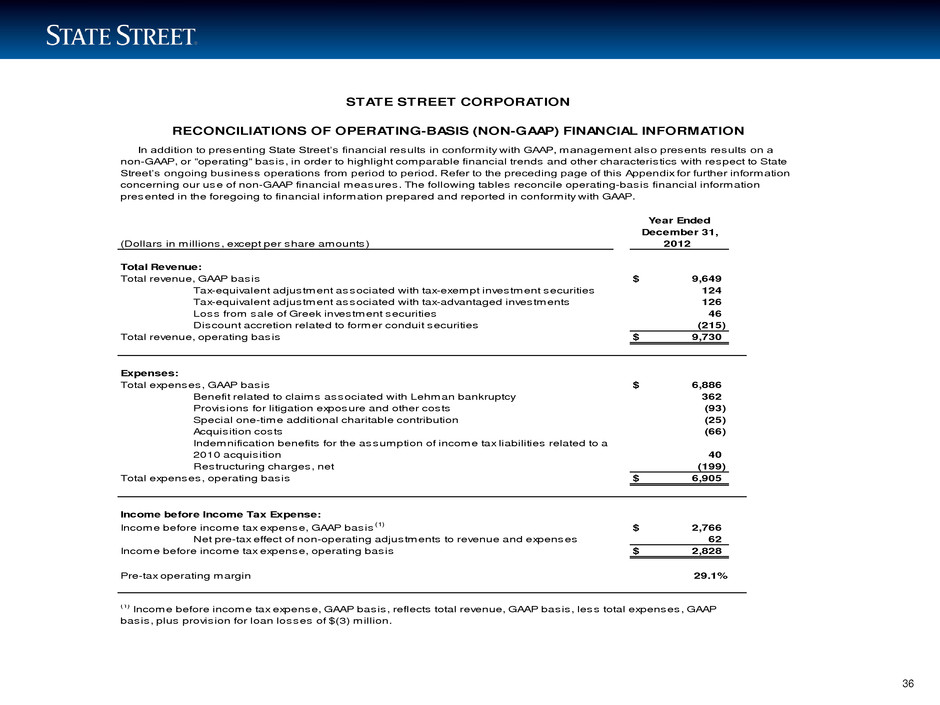

36 (Dollars in millions, except per share amounts) Total Revenue: Total revenue, GAAP basis $ 9,649 Tax-equivalent adjustment associated with tax-exempt investment securities 124 Tax-equivalent adjustment associated with tax-advantaged investments 126 Loss from sale of Greek investment securities 46 Discount accretion related to former conduit securities (215) Total revenue, operating basis $ 9,730 Expenses: Total expenses, GAAP basis $ 6,886 Benefit related to claims associated with Lehman bankruptcy 362 Provisions for litigation exposure and other costs (93) Special one-time additional charitable contribution (25) Acquisition costs (66) Indemnification benefits for the assumption of income tax liabilities related to a 2010 acquisition 40 Restructuring charges, net (199) Total expenses, operating basis $ 6,905 Income before Income Tax Expense: Income before income tax expense, GAAP basis (1) $ 2,766 Net pre-tax effect of non-operating adjustments to revenue and expenses 62 Income before income tax expense, operating basis $ 2,828 Pre-tax operating margin 29.1% STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. (1) Income before income tax expense, GAAP basis, reflects total revenue, GAAP basis, less total expenses, GAAP basis, plus provision for loan losses of $(3) million. December 31, 2012 Year Ended

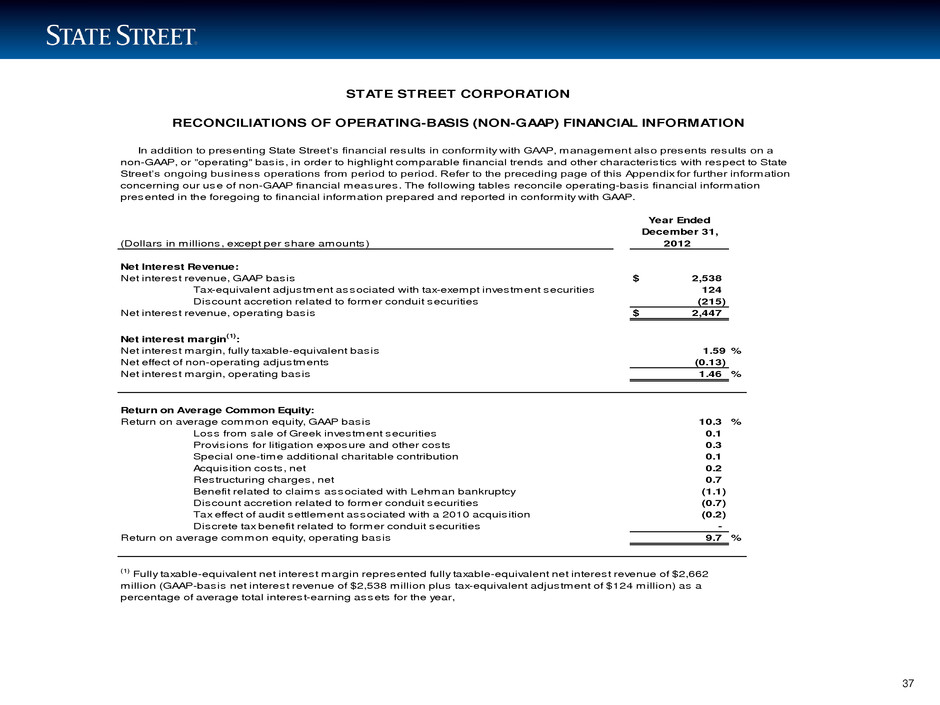

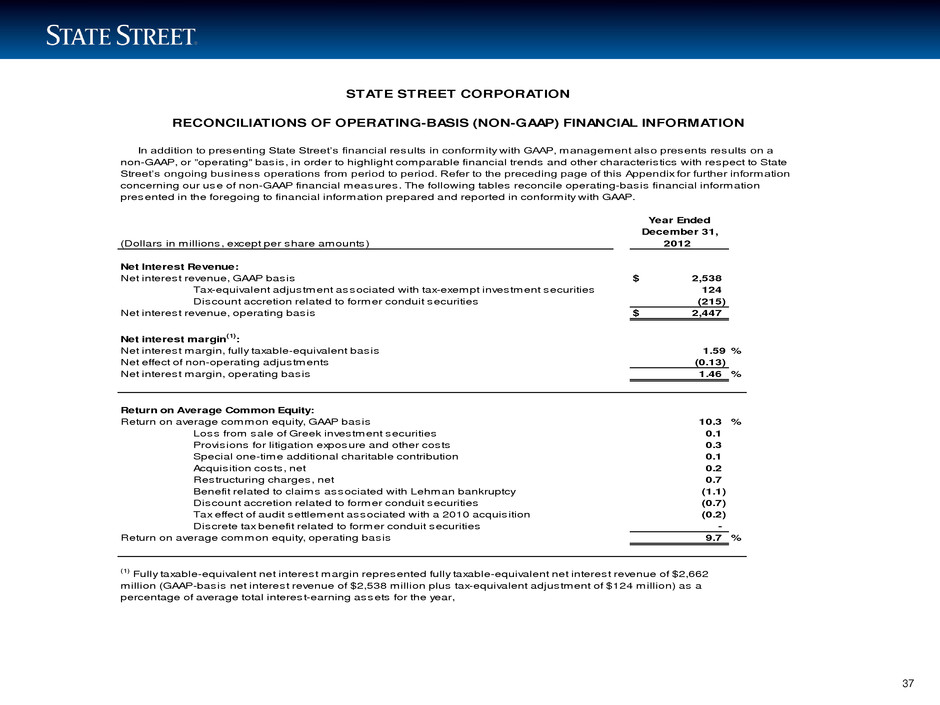

37 (Dollars in millions, except per share amounts) Net Interest Revenue: Net interest revenue, GAAP basis $ 2,538 Tax-equivalent adjustment associated with tax-exempt investment securities 124 Discount accretion related to former conduit securities (215) Net interest revenue, operating basis $ 2,447 Net interest margin (1) : Net interest margin, fully taxable-equivalent basis 1.59 % Net effect of non-operating adjustments (0.13) Net interest margin, operating basis 1.46 % Return on Average Common Equity: Return on average common equity, GAAP basis 10.3 % Loss from sale of Greek investment securities 0.1 Provisions for litigation exposure and other costs 0.3 Special one-time additional charitable contribution 0.1 Acquisition costs, net 0.2 Restructuring charges, net 0.7 Benefit related to claims associated with Lehman bankruptcy (1.1) Discount accretion related to former conduit securities (0.7) Tax effect of audit settlement associated with a 2010 acquisition (0.2) Discrete tax benefit related to former conduit securities - Return on average common equity, operating basis 9.7 % 2012 (1) Fully taxable-equivalent net interest margin represented fully taxable-equivalent net interest revenue of $2,662 million (GAAP-basis net interest revenue of $2,538 million plus tax-equivalent adjustment of $124 million) as a percentage of average total interest-earning assets for the year, STATE STREET CORPORATION RECONCILIATIONS OF OPERATING-BASIS (NON-GAAP) FINANCIAL INFORMATION In addition to presenting State Street’s financial results in conformity with GAAP, management also presents results on a non-GAAP, or "operating" basis, in order to highlight comparable financial trends and other characteristics with respect to State Street’s ongoing business operations from period to period. Refer to the preceding page of this Appendix for further information concerning our use of non-GAAP financial measures. The following tables reconcile operating-basis financial information presented in the foregoing to financial information prepared and reported in conformity with GAAP. Year Ended December 31,

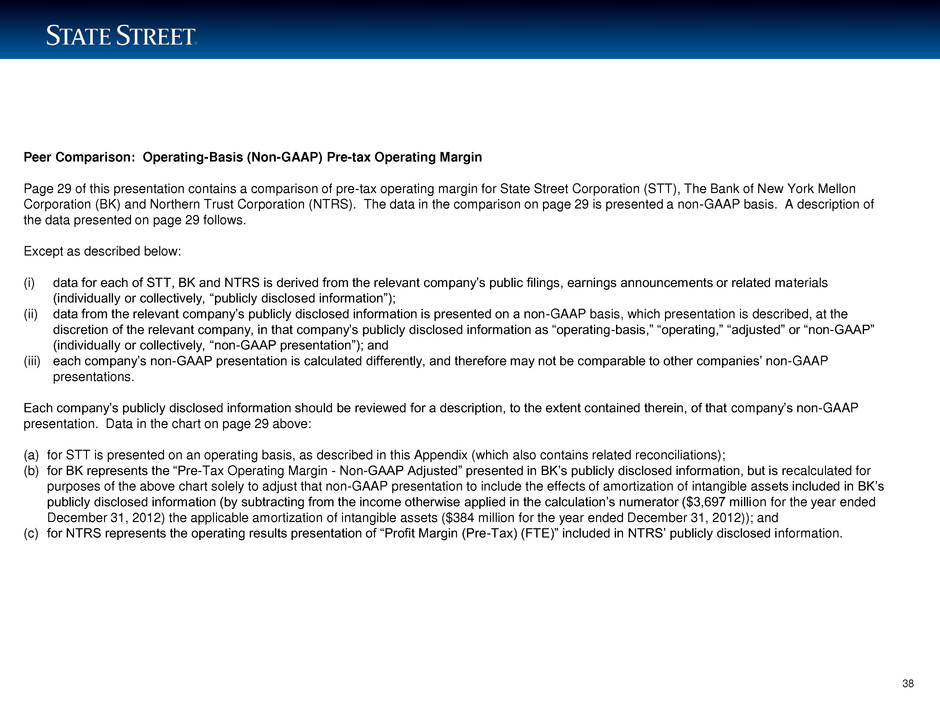

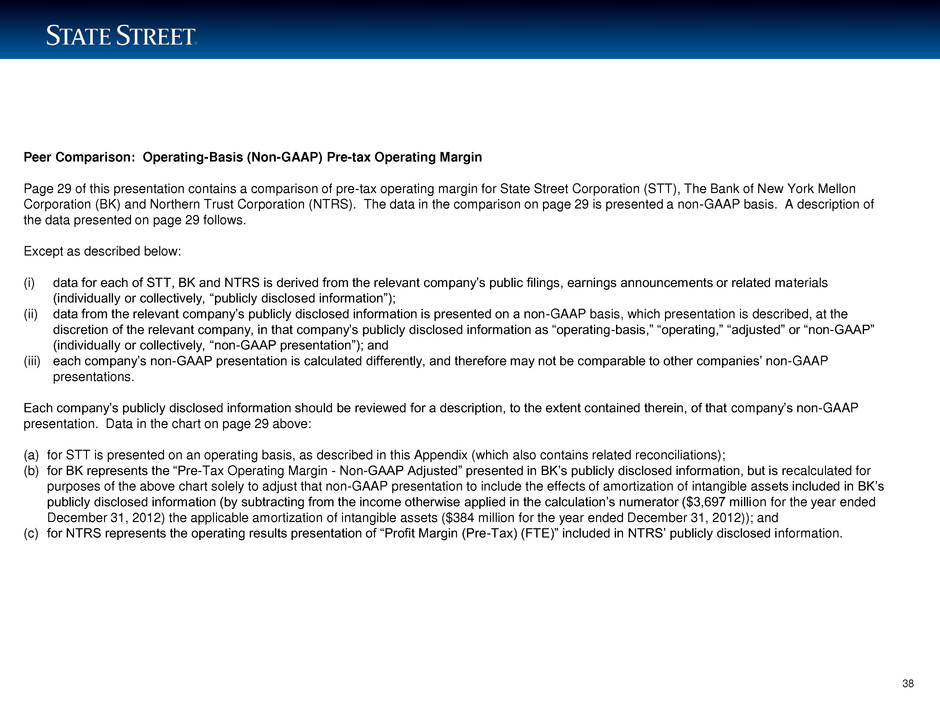

38 Peer Comparison: Operating-Basis (Non-GAAP) Pre-tax Operating Margin Page 29 of this presentation contains a comparison of pre-tax operating margin for State Street Corporation (STT), The Bank of New York Mellon Corporation (BK) and Northern Trust Corporation (NTRS). The data in the comparison on page 29 is presented a non-GAAP basis. A description of the data presented on page 29 follows. Except as described below: (i) data for each of STT, BK and NTRS is derived from the relevant company’s public filings, earnings announcements or related materials (individually or collectively, “publicly disclosed information”); (ii) data from the relevant company’s publicly disclosed information is presented on a non-GAAP basis, which presentation is described, at the discretion of the relevant company, in that company’s publicly disclosed information as “operating-basis,” “operating,” “adjusted” or “non-GAAP” (individually or collectively, “non-GAAP presentation”); and (iii) each company’s non-GAAP presentation is calculated differently, and therefore may not be comparable to other companies’ non-GAAP presentations. Each company’s publicly disclosed information should be reviewed for a description, to the extent contained therein, of that company’s non-GAAP presentation. Data in the chart on page 29 above: (a) for STT is presented on an operating basis, as described in this Appendix (which also contains related reconciliations); (b) for BK represents the “Pre-Tax Operating Margin - Non-GAAP Adjusted” presented in BK’s publicly disclosed information, but is recalculated for purposes of the above chart solely to adjust that non-GAAP presentation to include the effects of amortization of intangible assets included in BK’s publicly disclosed information (by subtracting from the income otherwise applied in the calculation’s numerator ($3,697 million for the year ended December 31, 2012) the applicable amortization of intangible assets ($384 million for the year ended December 31, 2012)); and (c) for NTRS represents the operating results presentation of “Profit Margin (Pre-Tax) (FTE)” included in NTRS’ publicly disclosed information.