Exhibit 99.3 July 17, 2020 2Q 2020 Financial Highlights (NYSE: STT)

Preface and forward-looking statements This presentation includes certain highlights of, and also material supplemental to, State Street Corporation’s news release announcing its second quarter 2020 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by detailed financial tables. This presentation is designed to be reviewed together with that news release, which is available on State Street’s website, at http://investors.statestreet.com, and is incorporated herein by reference. This presentation (and the conference call accompanying it) contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of the time this presentation is first furnished to the SEC on a Current Report on Form 8-K, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. Certain financial information in this presentation is presented on both a GAAP basis and on a basis that excludes or adjusts one or more items from GAAP. The latter basis is a non-GAAP presentation. Refer to the Appendix for explanations of our non-GAAP financial measures and to the Addendum for reconciliations of our non-GAAP financial information. 2

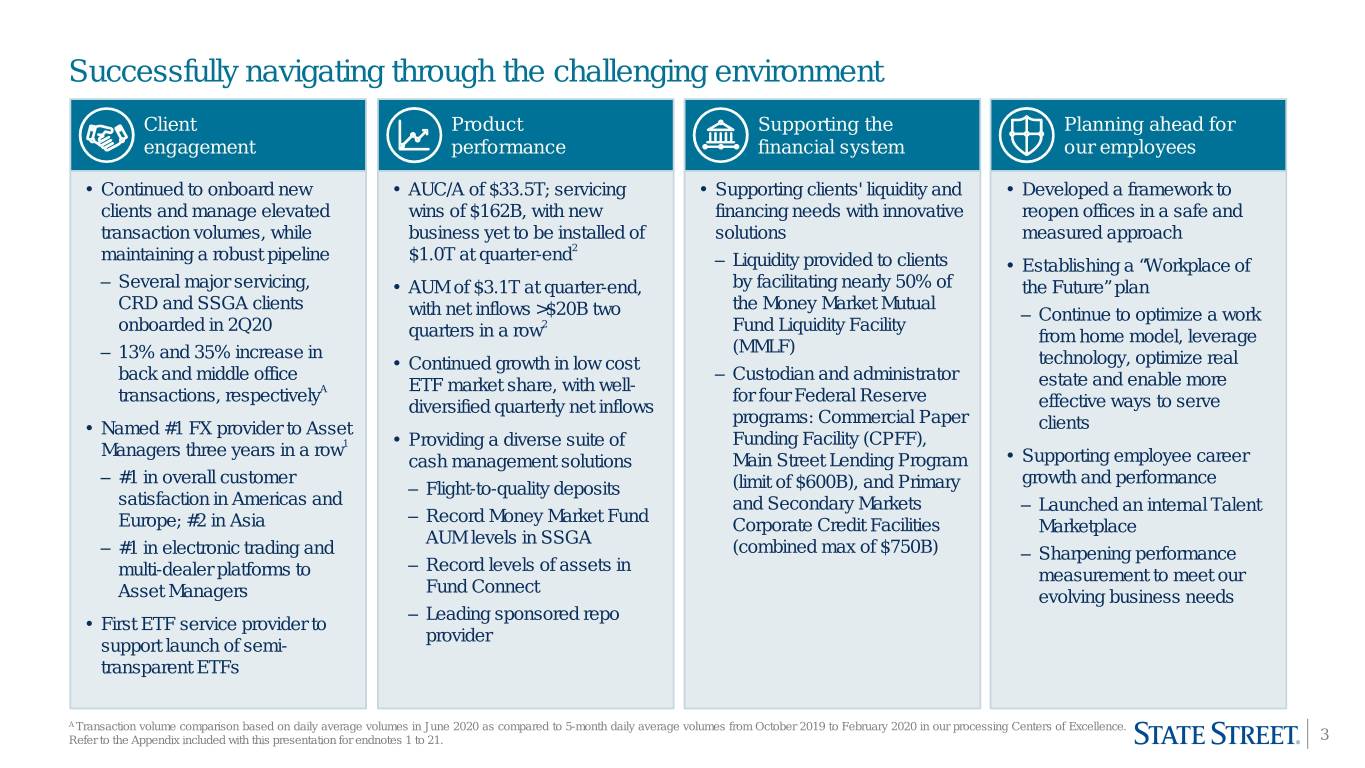

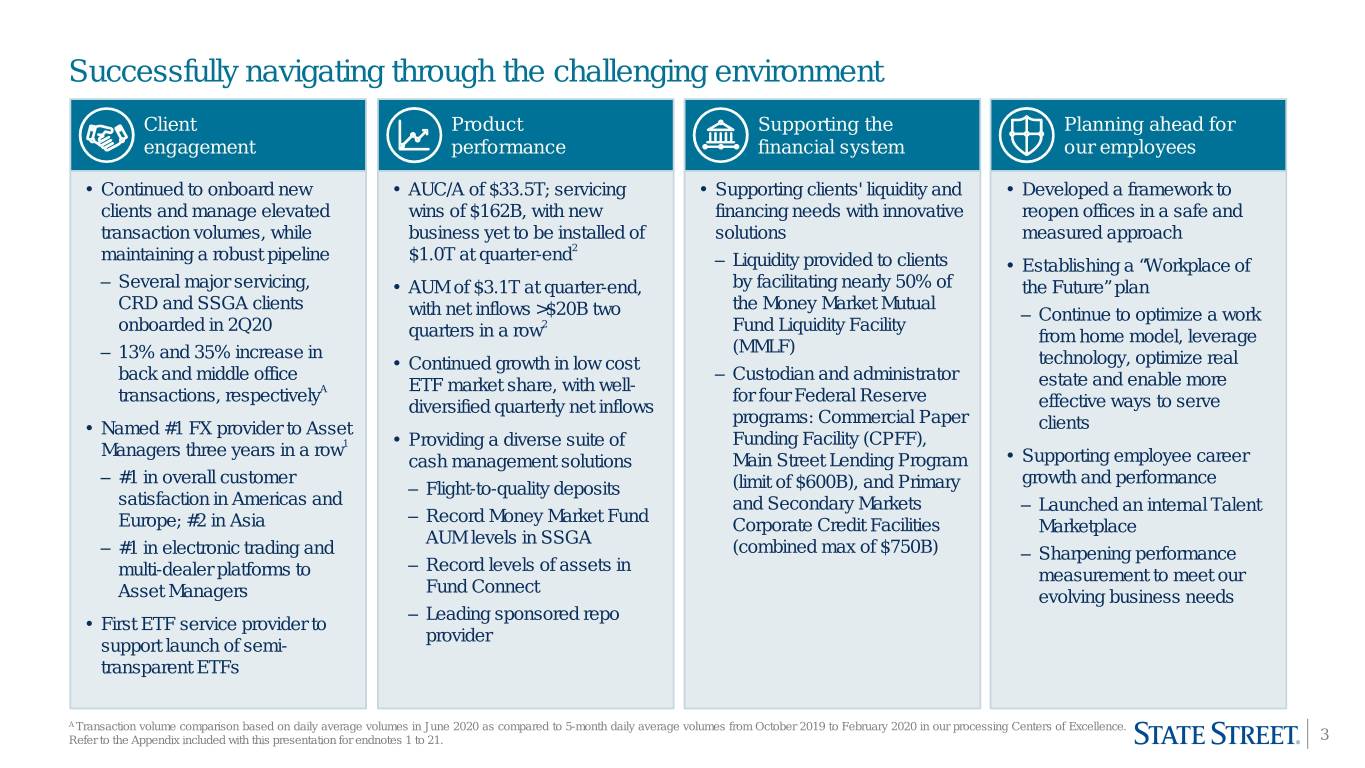

Successfully navigating through the challenging environment Client Product Supporting the Planning ahead for engagement performance financial system our employees • Continued to onboard new • AUC/A of $33.5T; servicing • Supporting clients' liquidity and • Developed a framework to clients and manage elevated wins of $162B, with new financing needs with innovative reopen offices in a safe and transaction volumes, while business yet to be installed of solutions measured approach maintaining a robust pipeline $1.0T at quarter-end2 ‒ Liquidity provided to clients • Establishing a “Workplace of ‒ Several major servicing, • AUM of $3.1T at quarter-end, by facilitating nearly 50% of the Future” plan CRD and SSGA clients the Money Market Mutual with net inflows >$20B two ‒ Continue to optimize a work onboarded in 2Q20 2 Fund Liquidity Facility quarters in a row from home model, leverage ‒ 13% and 35% increase in (MMLF) • Continued growth in low cost technology, optimize real back and middle office ‒ Custodian and administrator A ETF market share, with well- estate and enable more transactions, respectively for four Federal Reserve diversified quarterly net inflows effective ways to serve programs: Commercial Paper • Named #1 FX provider to Asset clients 1 • Providing a diverse suite of Funding Facility (CPFF), Managers three years in a row cash management solutions Main Street Lending Program • Supporting employee career ‒ #1 in overall customer growth and performance ‒ Flight-to-quality deposits (limit of $600B), and Primary satisfaction in Americas and and Secondary Markets ‒ Launched an internal Talent ‒ Record Money Market Fund Europe; #2 in Asia Corporate Credit Facilities Marketplace AUM levels in SSGA ‒ #1 in electronic trading and (combined max of $750B) ‒ Sharpening performance ‒ Record levels of assets in multi-dealer platforms to measurement to meet our Fund Connect Asset Managers evolving business needs ‒ Leading sponsored repo • First ETF service provider to provider support launch of semi- transparent ETFs A Transaction volume comparison based on daily average volumes in June 2020 as compared to 5-month daily average volumes from October 2019 to February 2020 in our processing Centers of Excellence. Refer to the Appendix included with this presentation for endnotes 1 to 21. 3

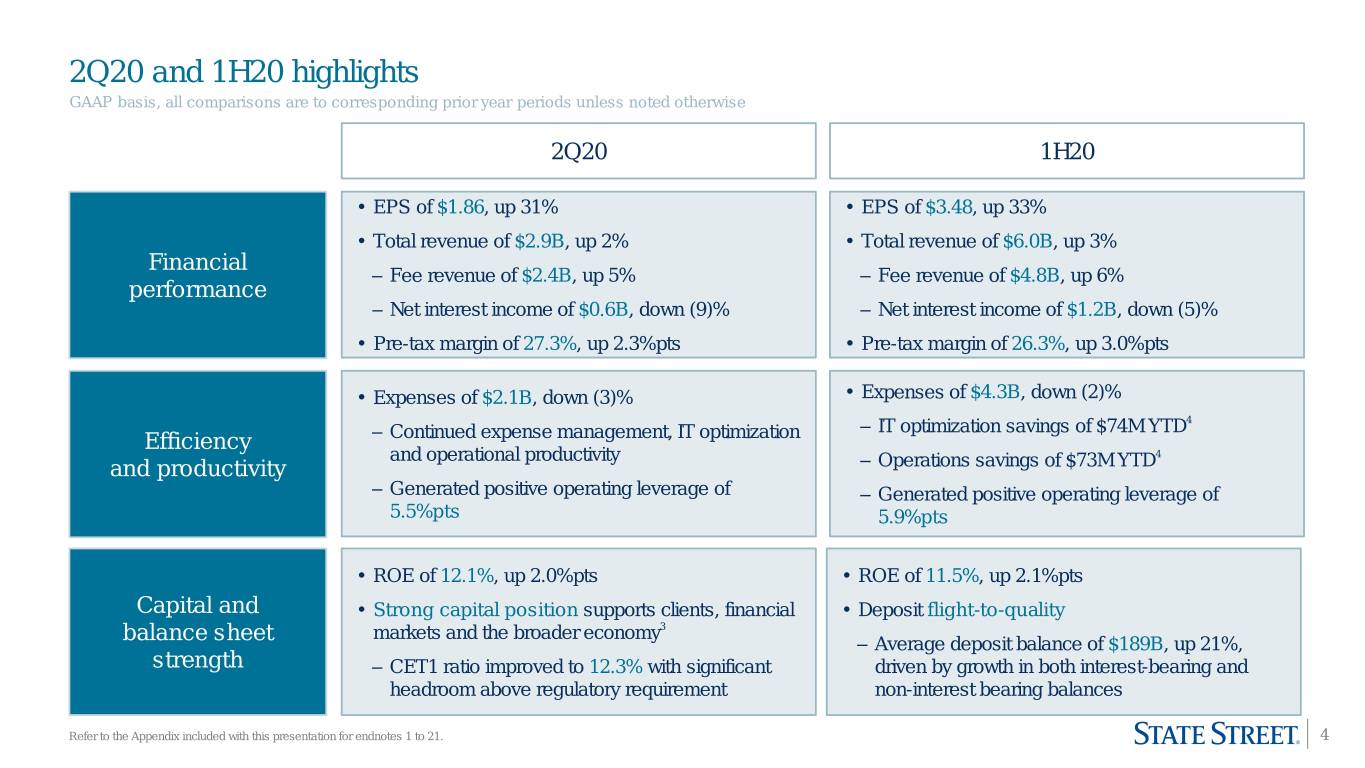

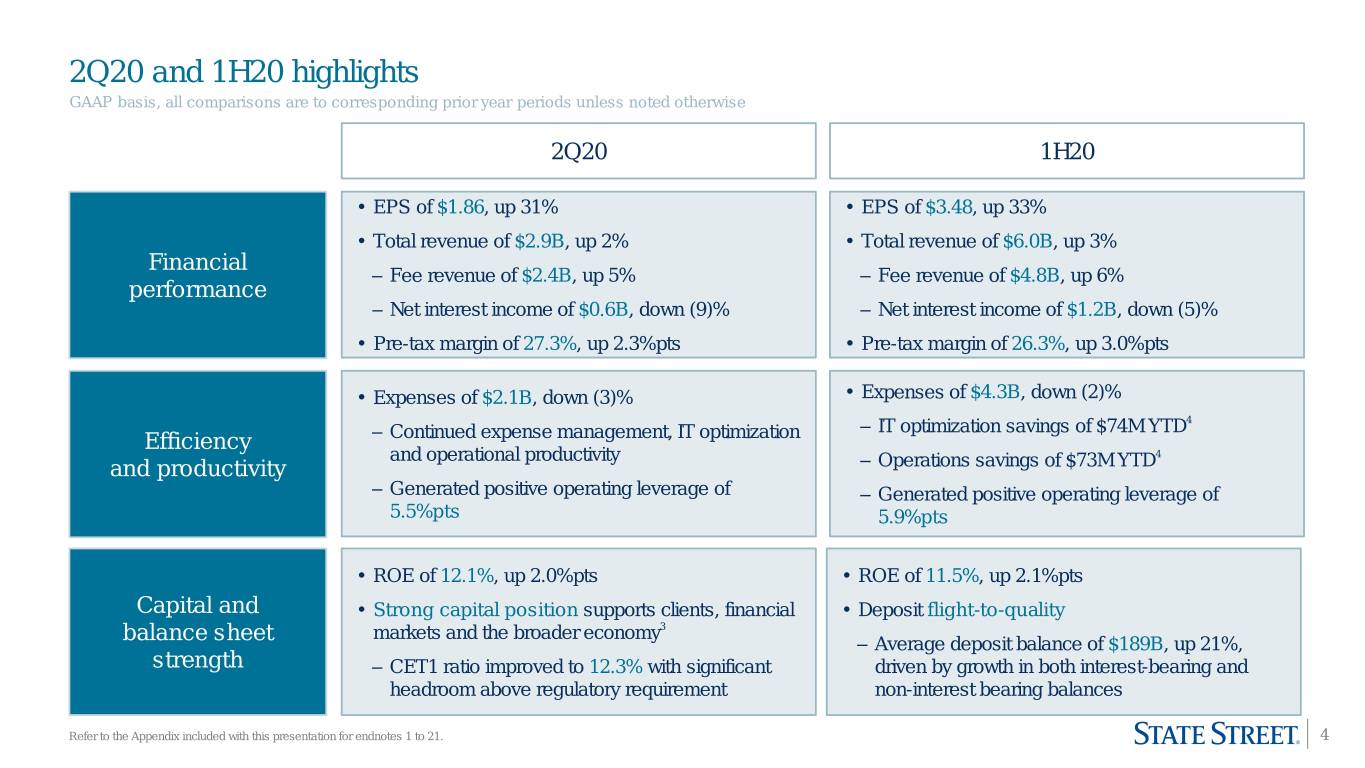

2Q20 and 1H20 highlights GAAP basis, all comparisons are to corresponding prior year periods unless noted otherwise 2Q20 1H20 • EPS of $1.86, up 31% • EPS of $3.48, up 33% • Total revenue of $2.9B, up 2% • Total revenue of $6.0B, up 3% Financial ‒ Fee revenue of $2.4B, up 5% ‒ Fee revenue of $4.8B, up 6% performance ‒ Net interest income of $0.6B, down (9)% ‒ Net interest income of $1.2B, down (5)% • Pre-tax margin of 27.3%, up 2.3%pts • Pre-tax margin of 26.3%, up 3.0%pts • Expenses of $2.1B, down (3)% • Expenses of $4.3B, down (2)% 4 ‒ Continued expense management, IT optimization ‒ IT optimization savings of $74M YTD Efficiency and operational productivity 4 and productivity ‒ Operations savings of $73M YTD ‒ Generated positive operating leverage of ‒ Generated positive operating leverage of 5.5%pts 5.9%pts • ROE of 12.1%, up 2.0%pts • ROE of 11.5%, up 2.1%pts Capital and • Strong capital position supports clients, financial • Deposit flight-to-quality markets and the broader economy3 balance sheet ‒ Average deposit balance of $189B, up 21%, strength ‒ CET1 ratio improved to 12.3% with significant driven by growth in both interest-bearing and headroom above regulatory requirement non-interest bearing balances Refer to the Appendix included with this presentation for endnotes 1 to 21. 4

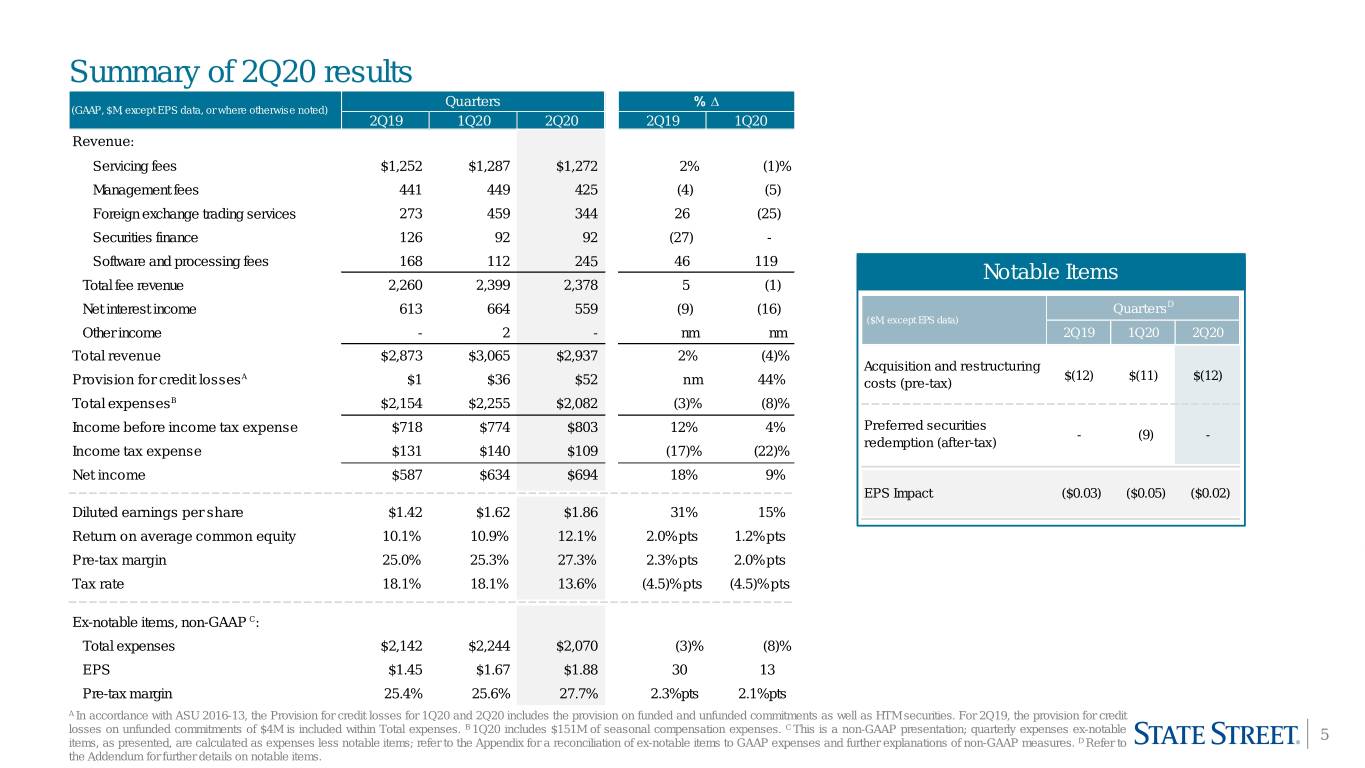

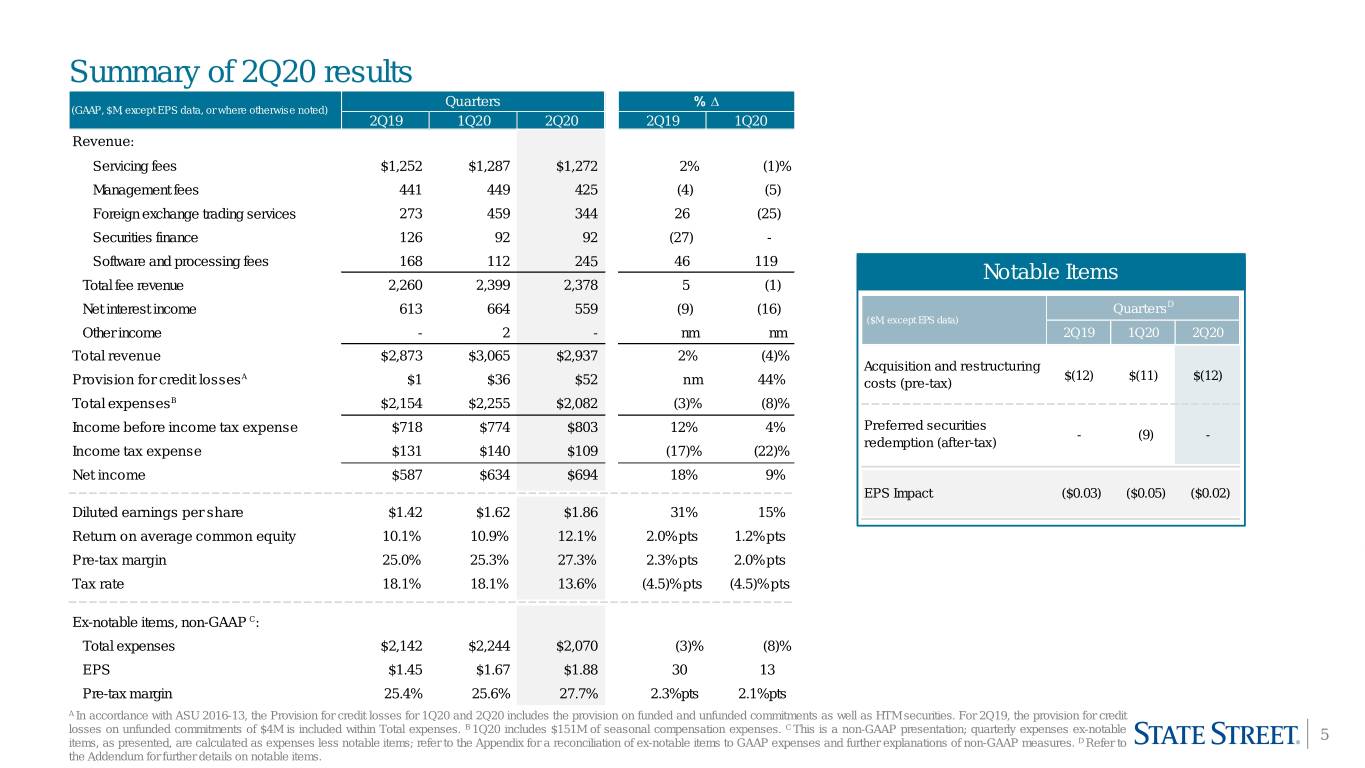

Summary of 2Q20 results Quarters % ∆ (GAAP, $M, except EPS data, or where otherwise noted) 2Q19 1Q20 2Q20 2Q19 1Q20 Revenue: Servicing fees $1,252 $1,287 $1,272 2% (1)% Management fees 441 449 425 (4) (5) Foreign exchange trading services 273 459 344 26 (25) Securities finance 126 92 92 (27) - Software and processing fees 168 112 245 46 119 Notable Items Total fee revenue 2,260 2,399 2,378 5 (1) Net interest income 613 664 559 (9) (16) QuartersD ($M, except EPS data) Other income - 2 - nm nm 2Q19 1Q20 2Q20 Total revenue $2,873 $3,065 $2,937 2% (4)% Acquisition and restructuring A $(12) $(11) $(12) Provision for credit losses $1 $36 $52 nm 44% costs (pre-tax) Total expensesB $2,154 $2,255 $2,082 (3)% (8)% Preferred securities Income before income tax expense $718 $774 $803 12% 4% - (9) - redemption (after-tax) Income tax expense $131 $140 $109 (17)% (22)% Net income $587 $634 $694 18% 9% EPS Impact ($0.03) ($0.05) ($0.02) Diluted earnings per share $1.42 $1.62 $1.86 31% 15% Return on average common equity 10.1% 10.9% 12.1% 2.0%pts 1.2%pts Pre-tax margin 25.0% 25.3% 27.3% 2.3%pts 2.0%pts Tax rate 18.1% 18.1% 13.6% (4.5)% pts (4.5)% pts Ex-notable items, non-GAAP C: Total expenses $2,142 $2,244 $2,070 (3)% (8)% EPS $1.45 $1.67 $1.88 30 13 Pre-tax margin 25.4% 25.6% 27.7% 2.3%pts 2.1%pts A In accordance with ASU 2016-13, the Provision for credit losses for 1Q20 and 2Q20 includes the provision on funded and unfunded commitments as well as HTM securities. For 2Q19, the provision for credit B C losses on unfunded commitments of $4M is included within Total expenses. 1Q20 includes $151M of seasonal compensation expenses. This is a non-GAAP presentation; quarterly expenses ex-notable 5 items, as presented, are calculated as expenses less notable items; refer to the Appendix for a reconciliation of ex-notable items to GAAP expenses and further explanations of non-GAAP measures. D Refer to the Addendum for further details on notable items.

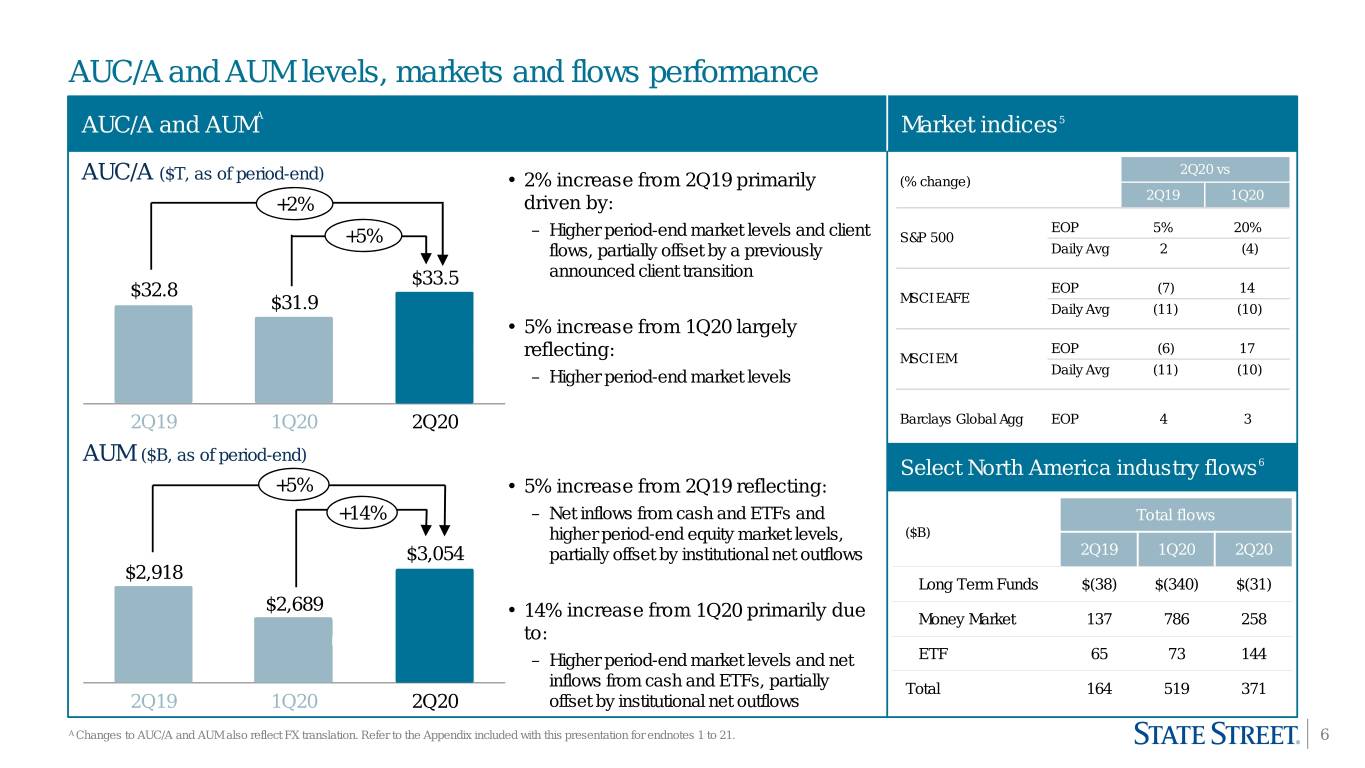

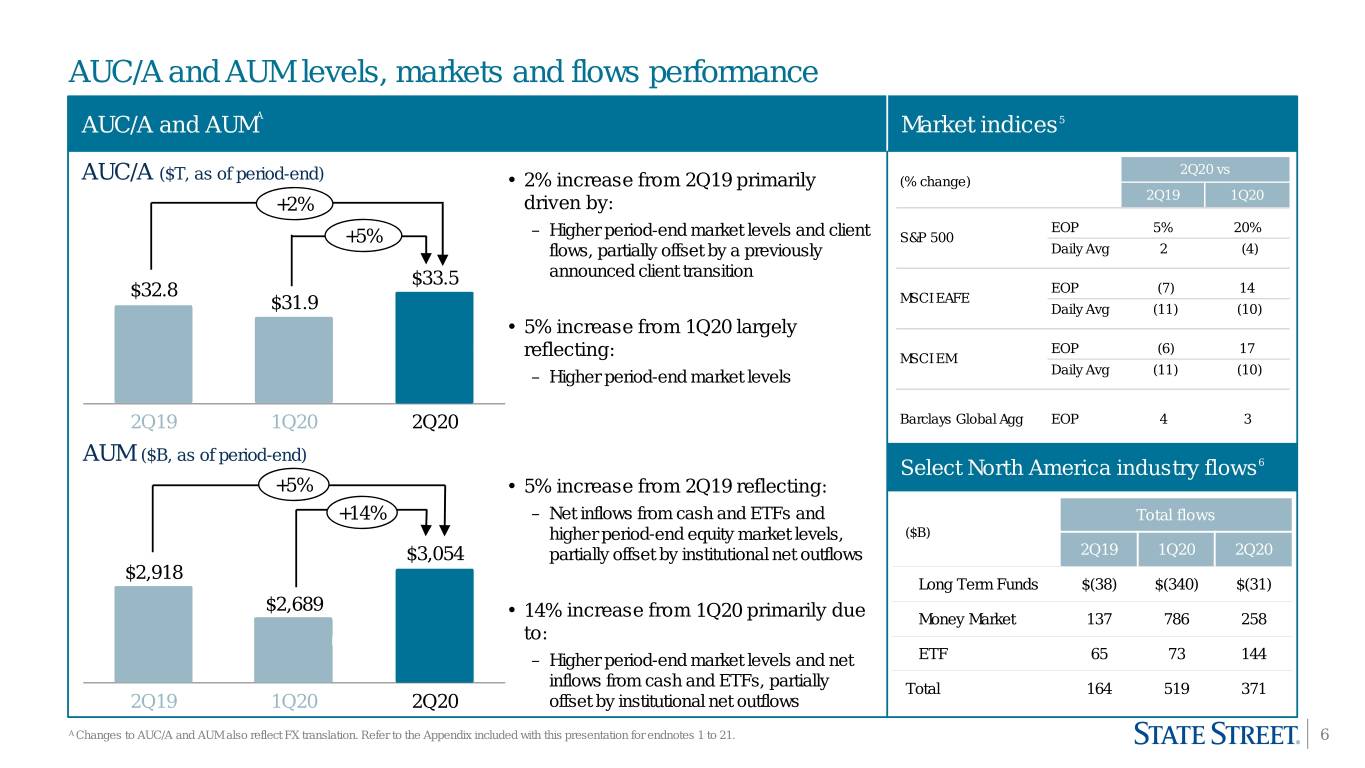

AUC/A and AUM levels, markets and flows performance A AUC/A and AUM Market indices5 ($T, as of period-end) 2Q20 vs AUC/A • 2% increase from 2Q19 primarily (% change) 2Q19 1Q20 +2% driven by: – Higher period-end market levels and client EOP 5% 20% +5% S&P 500 flows, partially offset by a previously Daily Avg 2 (4) announced client transition $33.5 EOP (7) 14 $32.8 MSCI EAFE $31.9 Daily Avg (11) (10) • 5% increase from 1Q20 largely EOP (6) 17 reflecting: MSCI EM – Higher period-end market levels Daily Avg (11) (10) 2Q19 1Q20 2Q20 Barclays Global Agg EOP 4 3 AUM ($B, as of period-end) 6 Select North America industry flows +5% • 5% increase from 2Q19 reflecting: +14% – Net inflows from cash and ETFs and Total flows higher period-end equity market levels, ($B) $3,054 partially offset by institutional net outflows 2Q19 1Q20 2Q20 $2,918 Long Term Funds $(38) $(340) $(31) $2,689 • 14% increase from 1Q20 primarily due Money Market 137 786 258 to: – Higher period-end market levels and net ETF 65 73 144 inflows from cash and ETFs, partially Total 164 519 371 2Q19 1Q20 2Q20 offset by institutional net outflows A Changes to AUC/A and AUM also reflect FX translation. Refer to the Appendix included with this presentation for endnotes 1 to 21. 6

Revenue: Servicing fees Servicing fees ($M) 2Q20 performance Servicing fees of $1,272M up 2% YoY, down (1)% QoQ Total YoY +2% $2,873 $2,903 $3,048 $3,065 $2,937 revenue QoQ -4% • Up 2% YoY primarily driven by higher client activity and net new business, partially offset by moderating pricing headwinds +2% • Down (1)% QoQ largely due to lower average market levels, -1% partially offset by higher client activity • Continued strong client pipeline in the front-to-back Alpha platform $1,299 $1,287 Servicing $1,252 $1,272 $1,272 fees • Total revenue and servicing fees were negatively impacted by FX translation when compared to 2Q19 by $16M and $10M, respectivelyA Mgmt fees, FX, SF AUC/A sales performance indicators Software & proc. ($B) 2Q19 3Q19 4Q19 1Q20 2Q20 NII AUC/A wins $390 $1,031 $294 $171 $162 2Q19 3Q19 4Q19 1Q20 2Q20 AUC/A to be installed 575 1,165 1,167 1,063 1,037 A Total revenue and servicing fees were negatively impacted by FX translation when compared to 1Q20 by $6M and $3M, respectively. 7

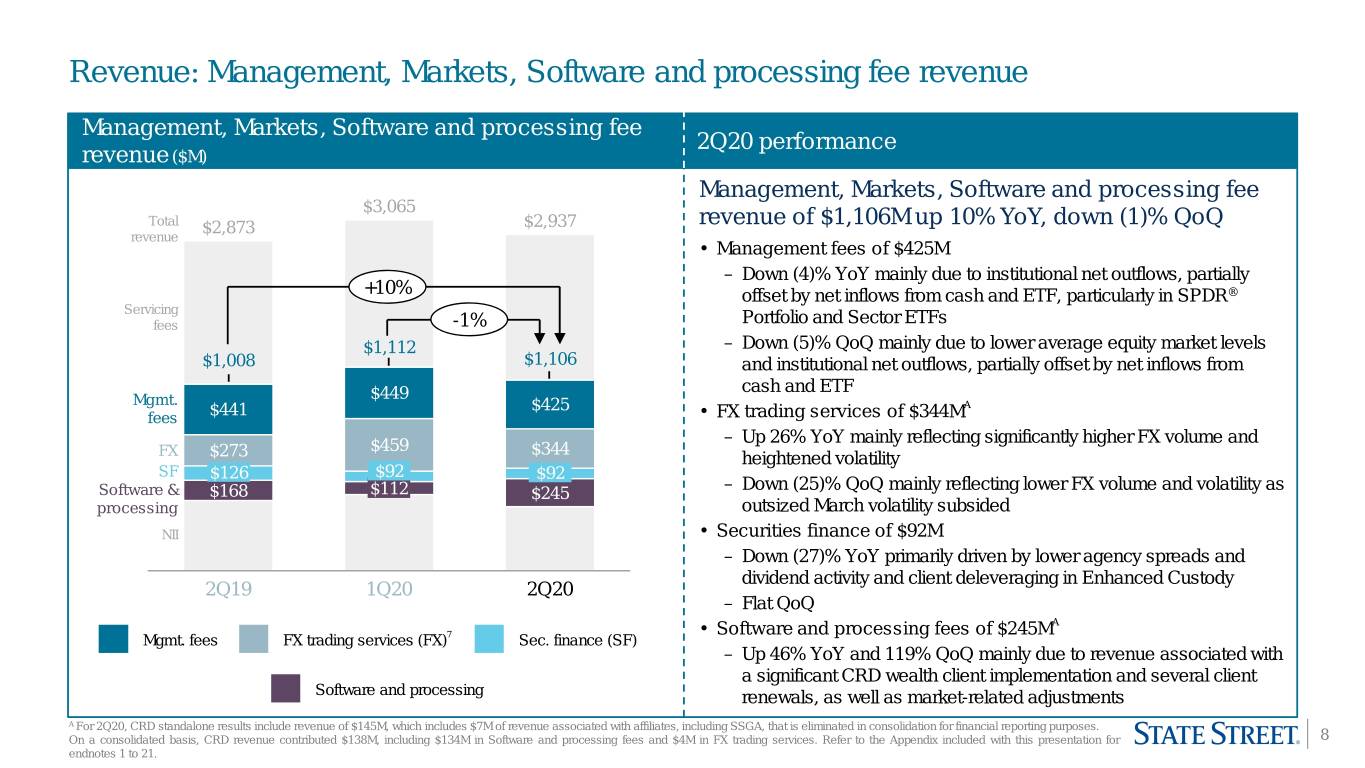

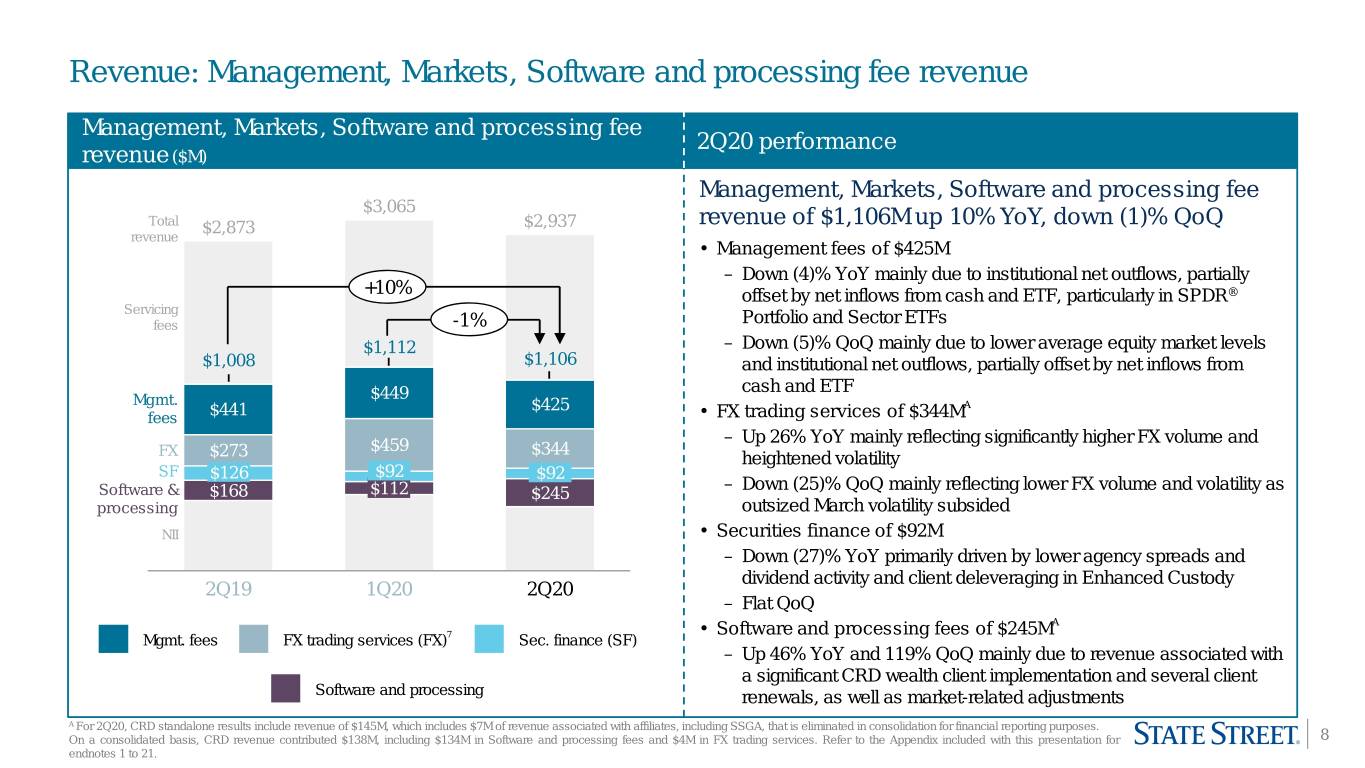

Revenue: Management, Markets, Software and processing fee revenue Management, Markets, Software and processing fee 2Q20 performance revenue ($M) Management, Markets, Software and processing fee $3,065 Total $2,873 $2,937 revenue of $1,106M up 10% YoY, down (1)% QoQ revenue • Management fees of $425M – Down (4)% YoY mainly due to institutional net outflows, partially +10% offset by net inflows from cash and ETF, particularly in SPDR® Servicing fees -1% Portfolio and Sector ETFs $1,112 – Down (5)% QoQ mainly due to lower average equity market levels $1,008 $1,106 and institutional net outflows, partially offset by net inflows from cash and ETF Mgmt. $449 $441 $425 A fees • FX trading services of $344M $459 – Up 26% YoY mainly reflecting significantly higher FX volume and FX $273 $344 heightened volatility SF $126 $92 $92 – Down (25)% QoQ mainly reflecting lower FX volume and volatility as Software & $168 $112 $245 processing outsized March volatility subsided NII • Securities finance of $92M – Down (27)% YoY primarily driven by lower agency spreads and dividend activity and client deleveraging in Enhanced Custody 2Q19 1Q20 2Q20 – Flat QoQ A 7 • Software and processing fees of $245M Mgmt. fees FX trading services (FX) Sec. finance (SF) – Up 46% YoY and 119% QoQ mainly due to revenue associated with a significant CRD wealth client implementation and several client Software and processing renewals, as well as market-related adjustments A For 2Q20, CRD standalone results include revenue of $145M, which includes $7M of revenue associated with affiliates, including SSGA, that is eliminated in consolidation for financial reporting purposes. On a consolidated basis, CRD revenue contributed $138M, including $134M in Software and processing fees and $4M in FX trading services. Refer to the Appendix included with this presentation for 8 endnotes 1 to 21.

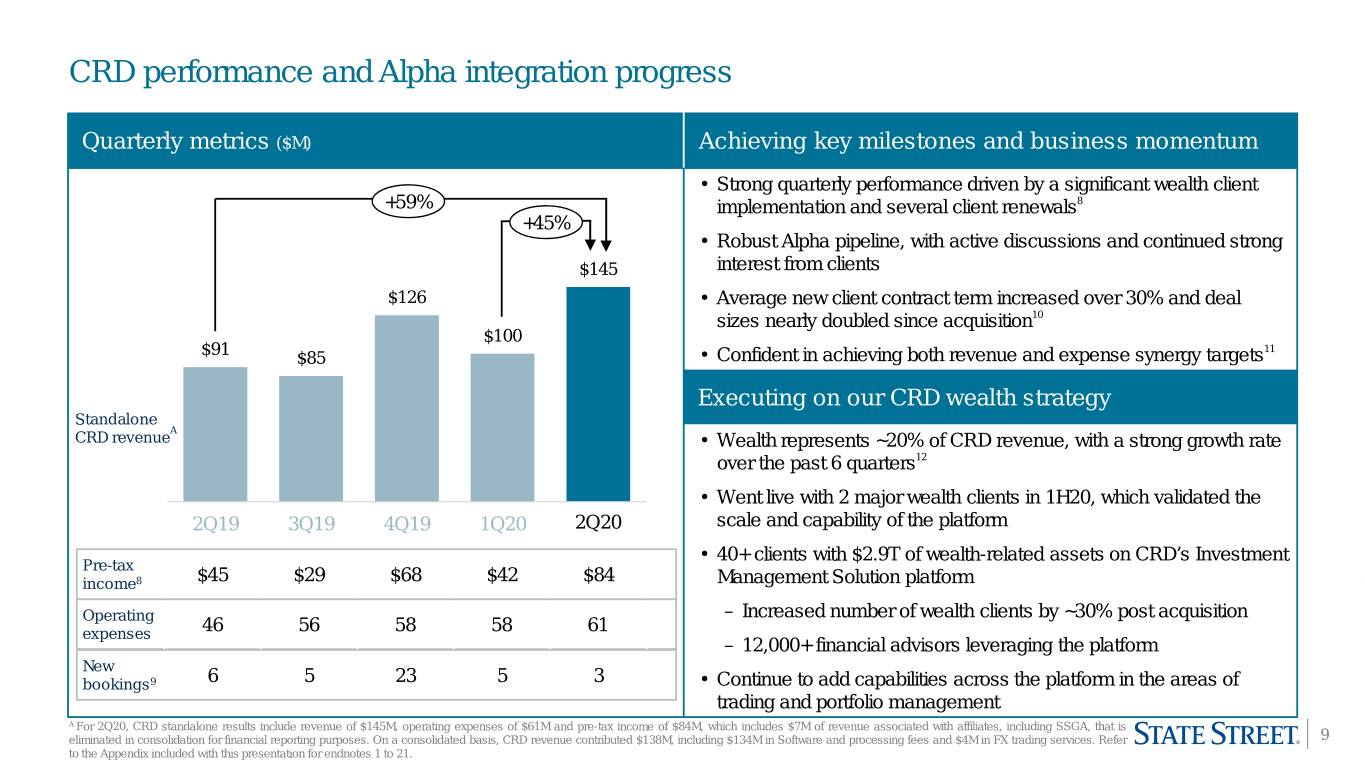

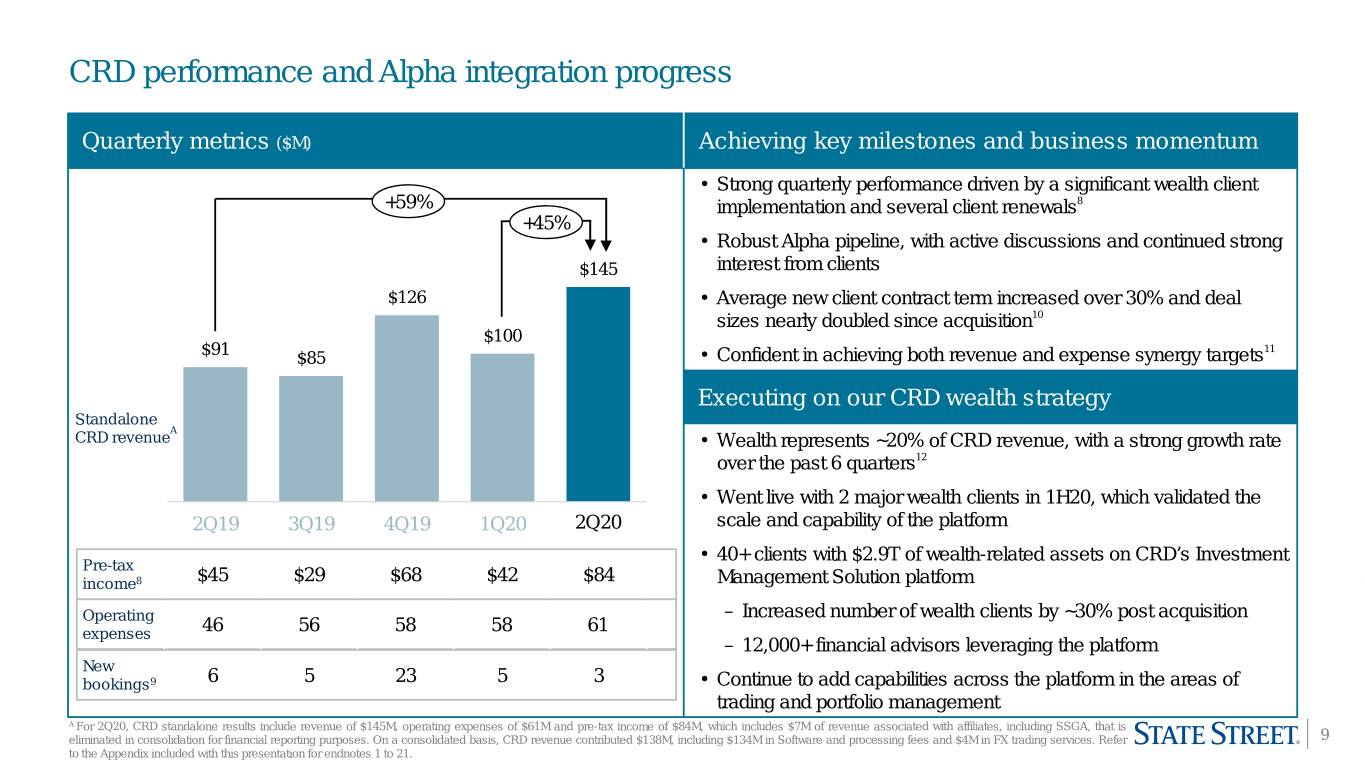

CRD performance and Alpha integration progress Quarterly metrics ($M) Achieving key milestones and business momentum • Strong quarterly performance driven by a significant wealth client +59% implementation and several client renewals8 +45% • Robust Alpha pipeline, with active discussions and continued strong $145 interest from clients $126 • Average new client contract term increased over 30% and deal sizes nearly doubled since acquisition10 $100 $91 11 $85 • Confident in achieving both revenue and expense synergy targets Executing on our CRD wealth strategy Standalone A CRD revenue • Wealth represents ~20% of CRD revenue, with a strong growth rate over the past 6 quarters12 • Went live with 2 major wealth clients in 1H20, which validated the 2Q19 3Q19 4Q19 1Q20 2Q20 scale and capability of the platform • 40+ clients with $2.9T of wealth-related assets on CRD’s Investment Pre-tax income8 $45 $29 $68 $42 $84 Management Solution platform Operating – Increased number of wealth clients by ~30% post acquisition expenses 46 56 58 58 61 – 12,000+ financial advisors leveraging the platform New bookings9 6 5 23 5 3 • Continue to add capabilities across the platform in the areas of trading and portfolio management A For 2Q20, CRD standalone results include revenue of $145M, operating expenses of $61M and pre-tax income of $84M, which includes $7M of revenue associated with affiliates, including SSGA, that is eliminated in consolidation for financial reporting purposes. On a consolidated basis, CRD revenue contributed $138M, including $134M in Software and processing fees and $4M in FX trading services. Refer 9 to the Appendix included with this presentation for endnotes 1 to 21.

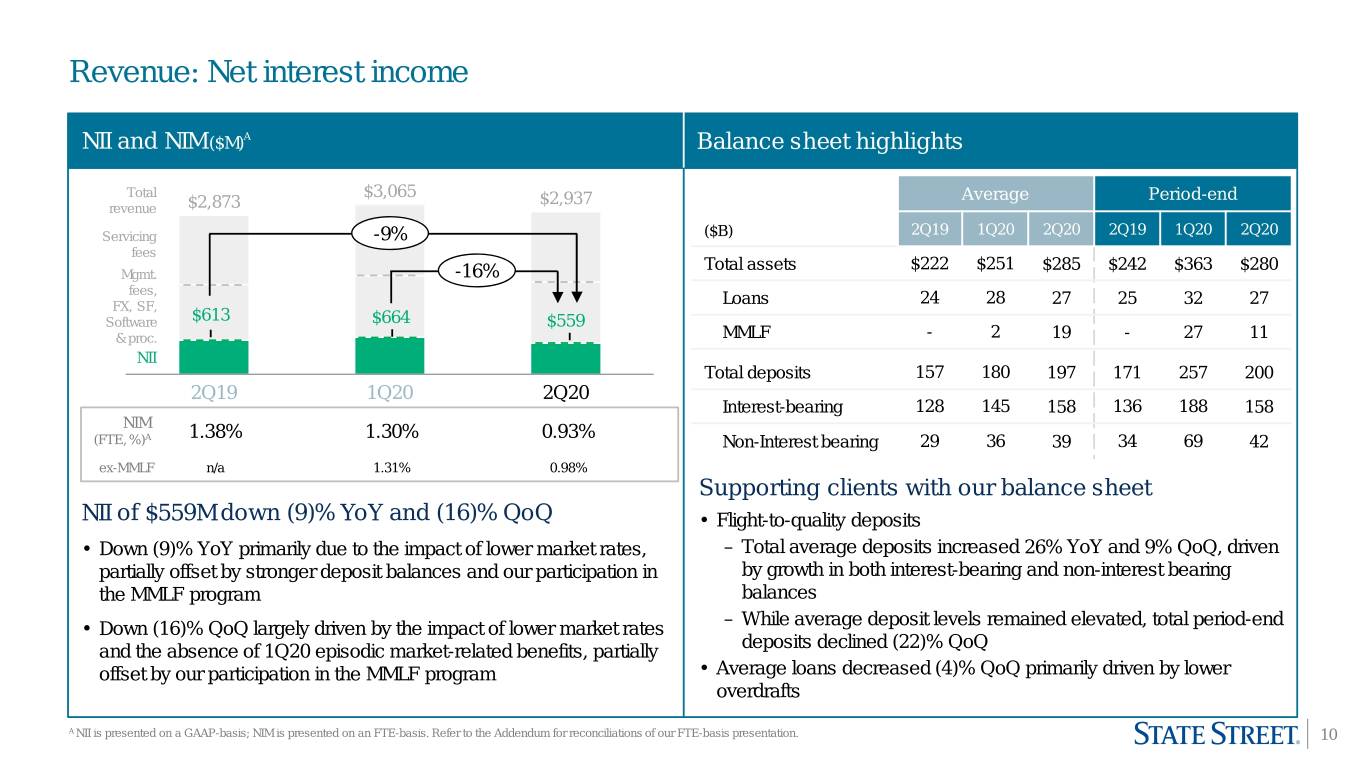

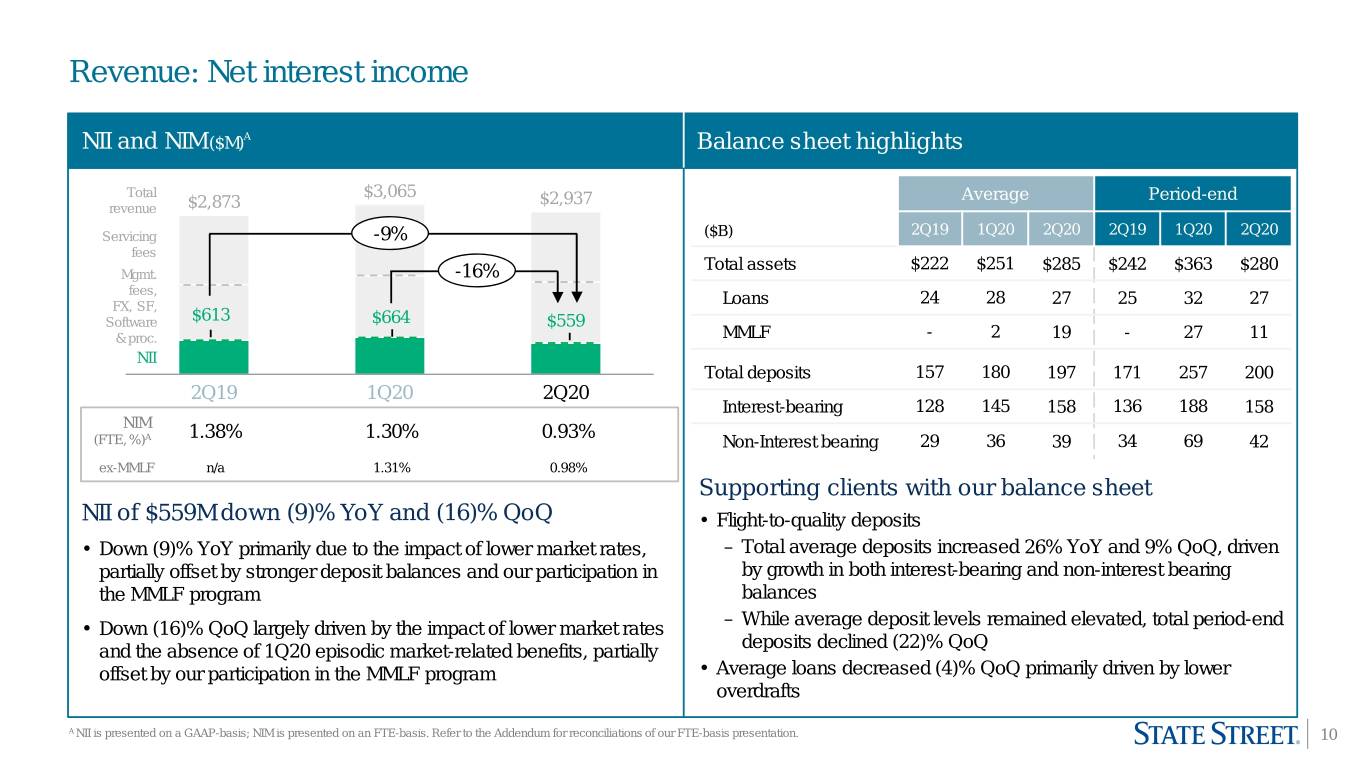

Revenue: Net interest income NII and NIM ($M)A Balance sheet highlights Total $3,065 $2,937 Average Period-end revenue $2,873 2Q19 1Q20 2Q19 1Q20 Servicing -9% ($B) 2Q20 2Q20 fees Total assets $222 $251 $285 $242 $363 $280 Mgmt. -16% fees, FX, SF, Loans 24 28 27 25 32 27 Software $613 $664 $559 & proc. MMLF - 2 19 - 27 11 NII Total deposits 157 180 197 171 257 200 2Q19 1Q20 2Q20 Interest-bearing 128 145 158 136 188 158 NIM A 1.38% 1.30% 0.93% (FTE, %) Non-Interest bearing 29 36 39 34 69 42 ex-MMLF n/a 1.31% 0.98% Supporting clients with our balance sheet NII of $559M down (9)% YoY and (16)% QoQ • Flight-to-quality deposits • Down (9)% YoY primarily due to the impact of lower market rates, – Total average deposits increased 26% YoY and 9% QoQ, driven partially offset by stronger deposit balances and our participation in by growth in both interest-bearing and non-interest bearing the MMLF program balances – While average deposit levels remained elevated, total period-end • Down (16)% QoQ largely driven by the impact of lower market rates deposits declined (22)% QoQ and the absence of 1Q20 episodic market-related benefits, partially offset by our participation in the MMLF program • Average loans decreased (4)% QoQ primarily driven by lower overdrafts A NII is presented on a GAAP-basis; NIM is presented on an FTE-basis. Refer to the Addendum for reconciliations of our FTE-basis presentation. 10

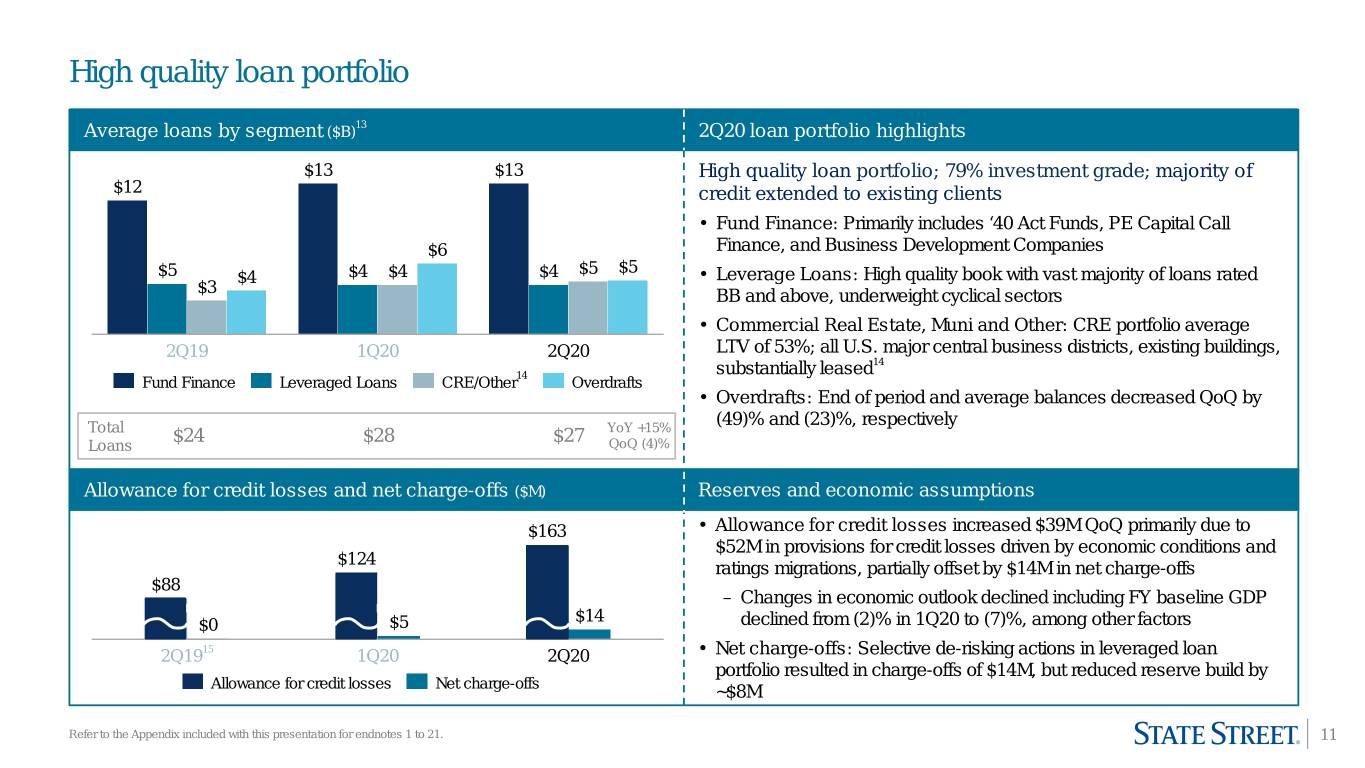

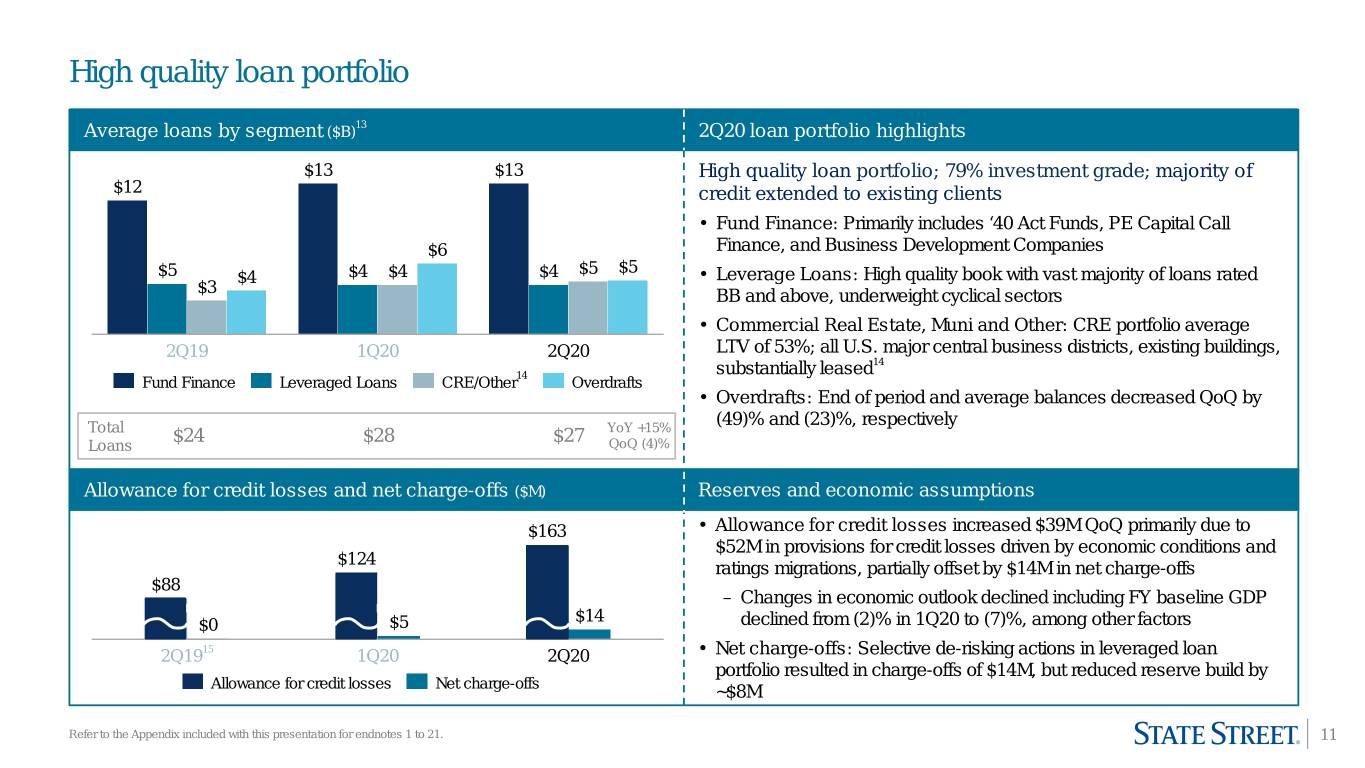

High quality loan portfolio 13 Average loans by segment ($B) 2Q20 loan portfolio highlights $13 $13 High quality loan portfolio; 79% investment grade; majority of $12 credit extended to existing clients 19% 81% 84% 84% • Fund Finance: Primarily includes ‘40 Act Funds, PE Capital Call $6 Finance, and Business Development Companies $5 $5 $4 $4 $4 $4 $5 • Leverage Loans: High quality book with vast majority of loans rated $3 BB and above, underweight cyclical sectors • Commercial Real Estate, Muni and Other: CRE portfolio average 2Q19 1Q20 2Q20 LTV of 53%; all U.S. major central business districts, existing buildings, 14 14 substantially leased Fund Finance Leveraged Loans CRE/Other Overdrafts • Overdrafts: End of period and average balances decreased QoQ by (49)% and (23)%, respectively Total $24 $28 YoY +15% Loans $27 QoQ (4)% Allowance for credit losses and net charge-offs ($M) Reserves and economic assumptions $163 • Allowance for credit losses increased $39M QoQ primarily due to $52M in provisions for credit losses driven by economic conditions and $124 ratings migrations, partially offset by $14M in net charge-offs $88 – Changes in economic outlook declined including FY baseline GDP $0 $5 $14 declined from (2)% in 1Q20 to (7)%, among other factors 15 2Q19 1Q20 2Q20 • Net charge-offs: Selective de-risking actions in leveraged loan portfolio resulted in charge-offs of $14M, but reduced reserve build by Allowance for credit losses Net charge-offs ~$8M Refer to the Appendix included with this presentation for endnotes 1 to 21. 11

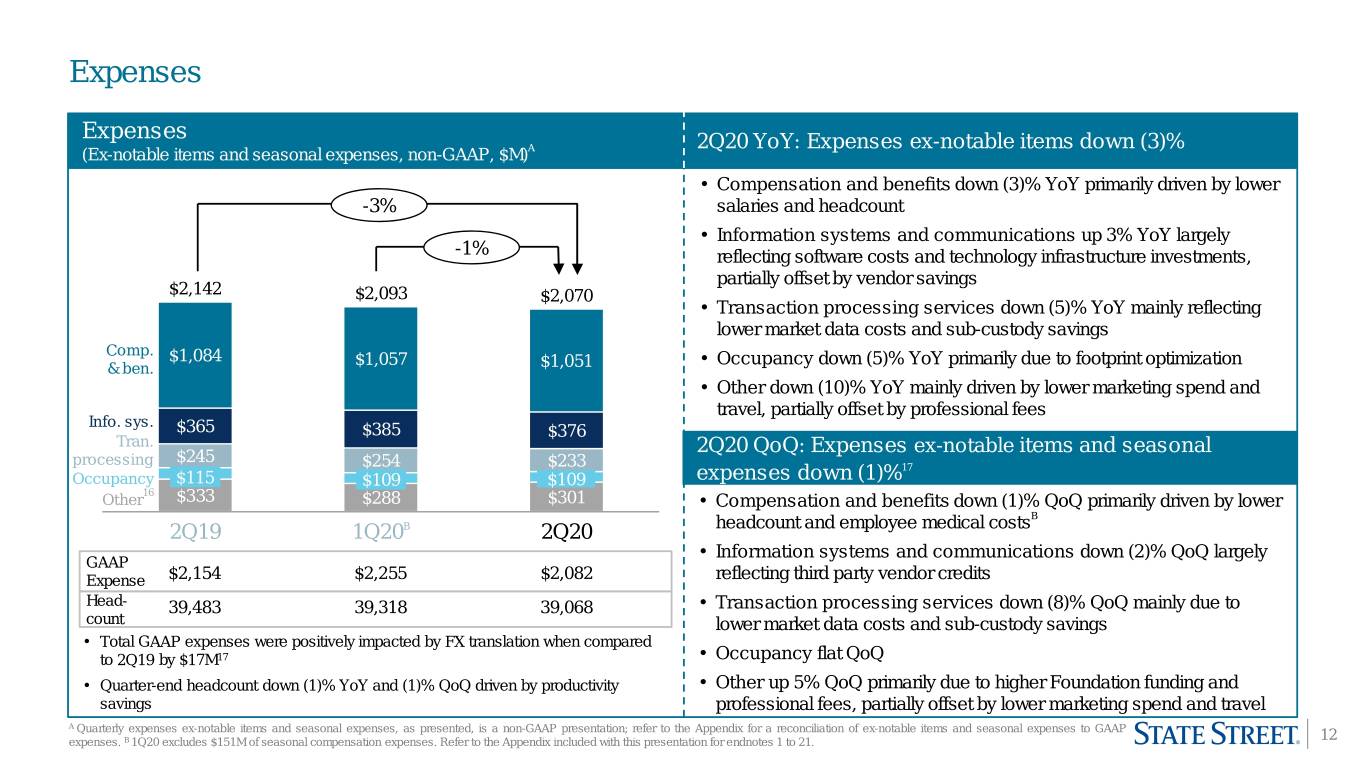

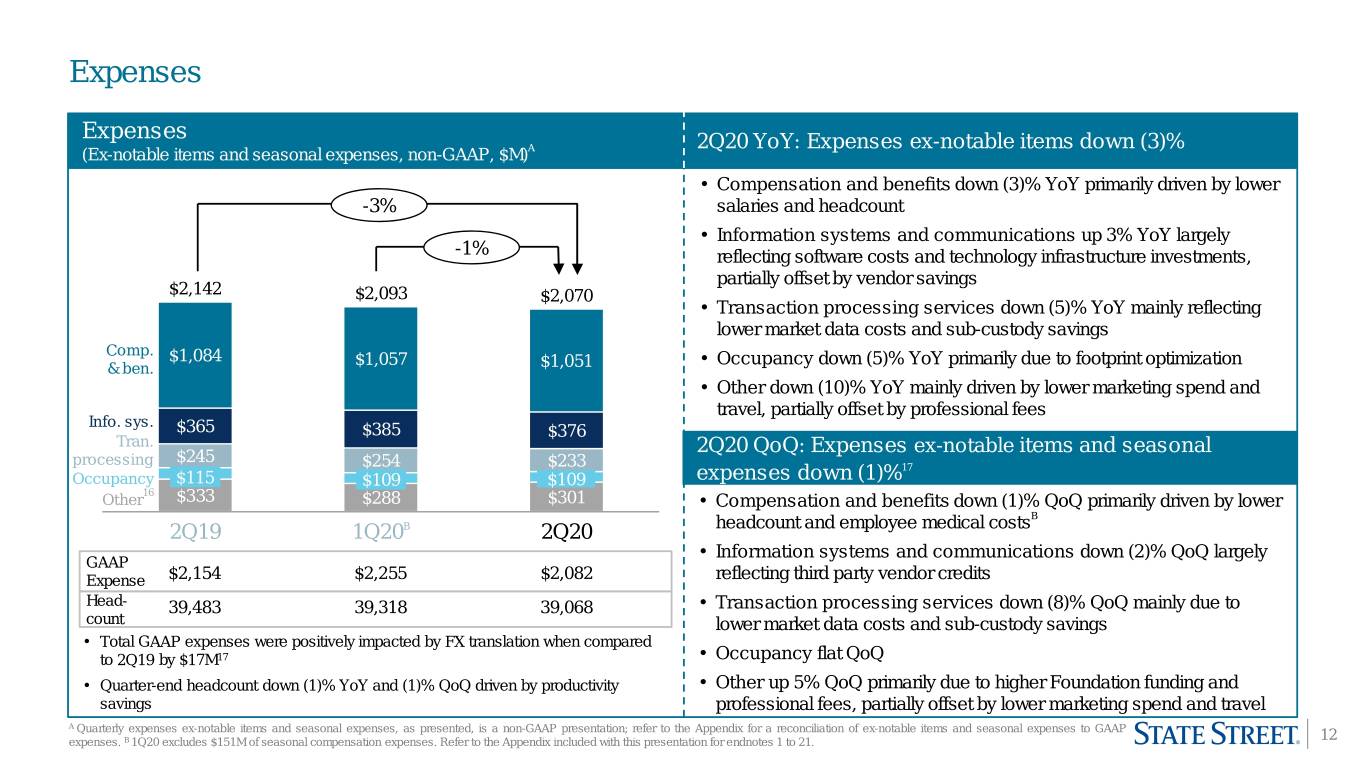

Expenses Expenses A 2Q20 YoY: Expenses ex-notable items down (3)% (Ex-notable items and seasonal expenses, non-GAAP, $M) • Compensation and benefits down (3)% YoY primarily driven by lower -3% salaries and headcount • Information systems and communications up 3% YoY largely -1% reflecting software costs and technology infrastructure investments, partially offset by vendor savings $2,142 $2,093 $2,070 • Transaction processing services down (5)% YoY mainly reflecting lower market data costs and sub-custody savings Comp. $1,084 $1,057 • Occupancy down (5)% YoY primarily due to footprint optimization & ben. $1,051 • Other down (10)% YoY mainly driven by lower marketing spend and travel, partially offset by professional fees Info. sys. $365 $385 $376 Tran. $245 2Q20 QoQ: Expenses ex-notable items and seasonal processing $254 $233 17 Occupancy $115 $109 $109 expenses down (1)% 16 Other $333 $288 $301 • Compensation and benefits down (1)% QoQ primarily driven by lower B B headcount and employee medical costs 2Q19 1Q20 2Q20 • Information systems and communications down (2)% QoQ largely GAAP Expense $2,154 $2,255 $2,082 reflecting third party vendor credits Head- 39,483 39,318 39,068 • Transaction processing services down (8)% QoQ mainly due to count lower market data costs and sub-custody savings • Total GAAP expenses were positively impacted by FX translation when compared to 2Q19 by $17M17 • Occupancy flat QoQ • Quarter-end headcount down (1)% YoY and (1)% QoQ driven by productivity • Other up 5% QoQ primarily due to higher Foundation funding and savings professional fees, partially offset by lower marketing spend and travel A Quarterly expenses ex-notable items and seasonal expenses, as presented, is a non-GAAP presentation; refer to the Appendix for a reconciliation of ex-notable items and seasonal expenses to GAAP expenses. B 1Q20 excludes $151M of seasonal compensation expenses. Refer to the Appendix included with this presentation for endnotes 1 to 21. 12

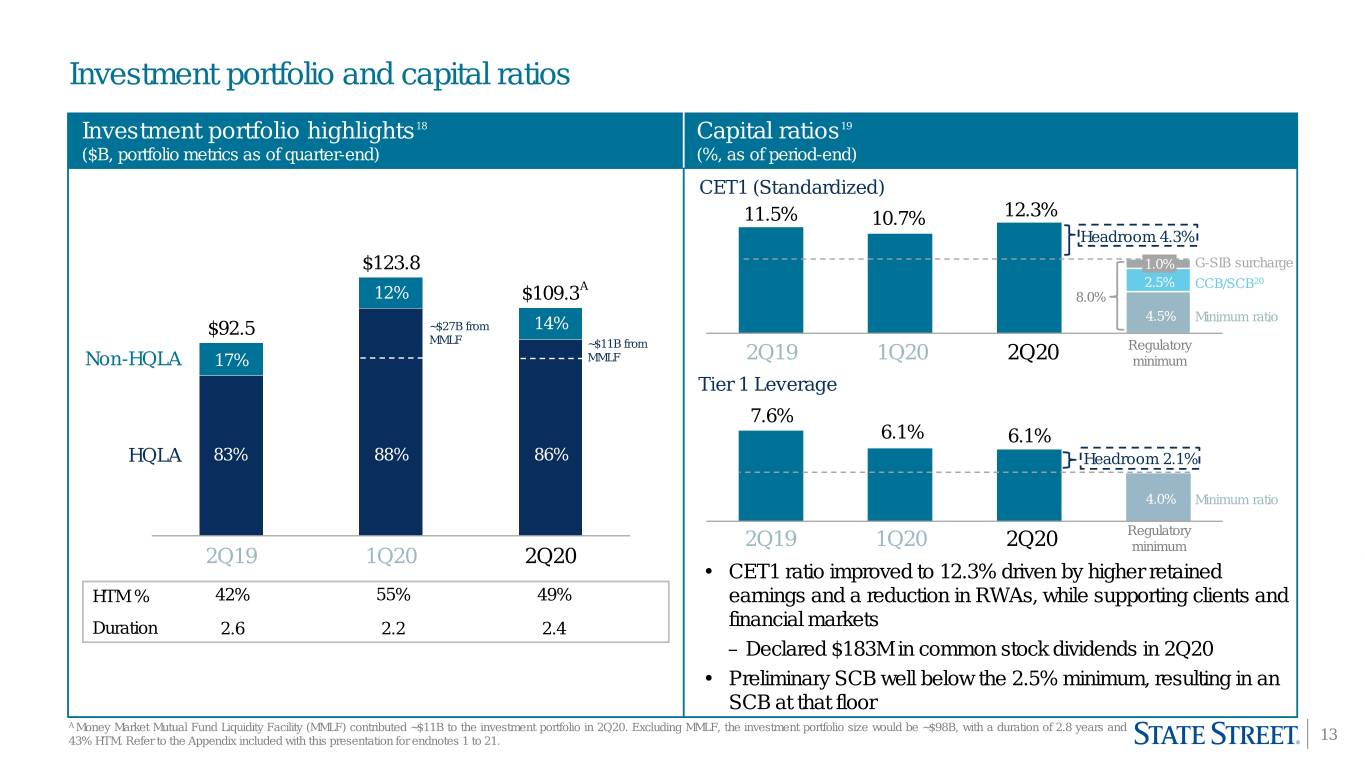

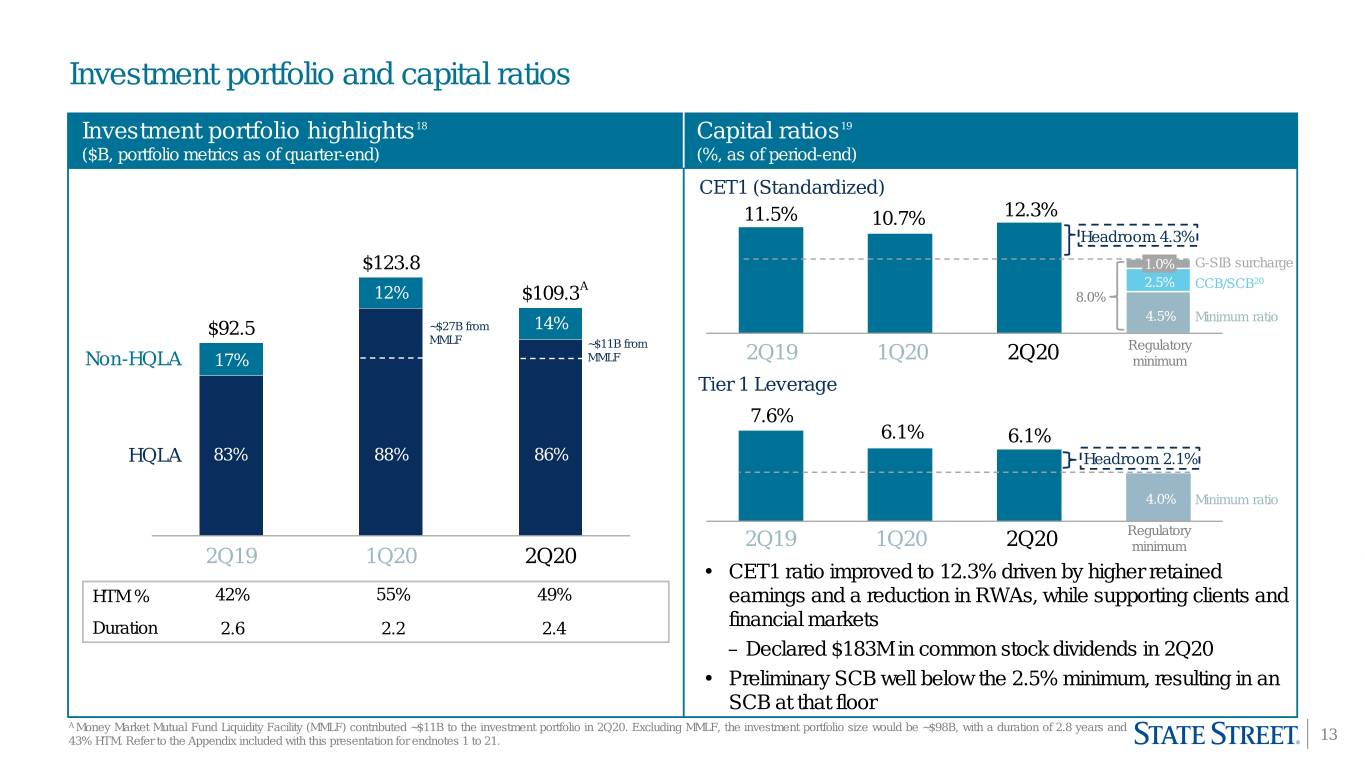

Investment portfolio and capital ratios Investment portfolio highlights18 Capital ratios19 ($B, portfolio metrics as of quarter-end) (%, as of period-end) CET1 (Standardized) 11.5% 10.7% 12.3% Headroom 4.3% $123.8 1.0% G-SIB surcharge A 2.5% CCB/SCB20 12% $109.3 8.0% 4.5% Minimum ratio $92.5 ~$27B from 14% MMLF ~$11B from Regulatory Non-HQLA 17% MMLF 2Q19 1Q20 2Q20 minimum Tier 1 Leverage 7.6% 6.1% 6.1% HQLA 83% 88% 86% Headroom 2.1% 4.0% Minimum ratio Regulatory 2Q19 1Q20 2Q20 minimum 2Q19 1Q20 2Q20 • CET1 ratio improved to 12.3% driven by higher retained HTM % 42% 55% 49% earnings and a reduction in RWAs, while supporting clients and Duration 2.6 2.2 2.4 financial markets – Declared $183M in common stock dividends in 2Q20 • Preliminary SCB well below the 2.5% minimum, resulting in an SCB at that floor A Money Market Mutual Fund Liquidity Facility (MMLF) contributed ~$11B to the investment portfolio in 2Q20. Excluding MMLF, the investment portfolio size would be ~$98B, with a duration of 2.8 years and 43% HTM. Refer to the Appendix included with this presentation for endnotes 1 to 21. 13

Summary 2Q20 financial performance • EPS of $1.86, up 31% YoY; ROE of 12.1% – Fee revenue increased 5% YoY largely due to elevated FX volume and volatility, stronger CRD activity and improving servicing fees, partially offset by a decline in securities finance revenue and lower average international equity market levels – NII decreased (9)% YoY as lower interest rates were partially offset by higher deposit balances and our participation in the MMLF program – Expenses down (3)% YoY, reflecting ongoing expense management initiatives • Strong capital ratios, with CET1 of 12.3%, and significant headroom above regulatory requirement3 Continuing to support clients and the financial system through challenging times • Meeting client demands and handled elevated transaction volumes – Named #1 FX provider to Asset Managers three years in a row1 – Providing a diverse suite of cash management products • Supporting clients' liquidity and financing needs with innovative solutions – Providing liquidity to clients by facilitating the Money Market Mutual Fund Liquidity Facility – Providing custodial and administrative services to four Federal Reserve programs: Commercial Paper Funding Facility (CPFF), Main Street Lending Program, and Primary and Secondary Markets Corporate Credit Facilities Refer to the Appendix included with this presentation for endnotes 1 to 21. 14

Medium-term financial targets 16 Reconciliation of notable items 17 Endnotes 18 Appendix Forward-looking statements 19 Non-GAAP measures 20 Definitions 21 15

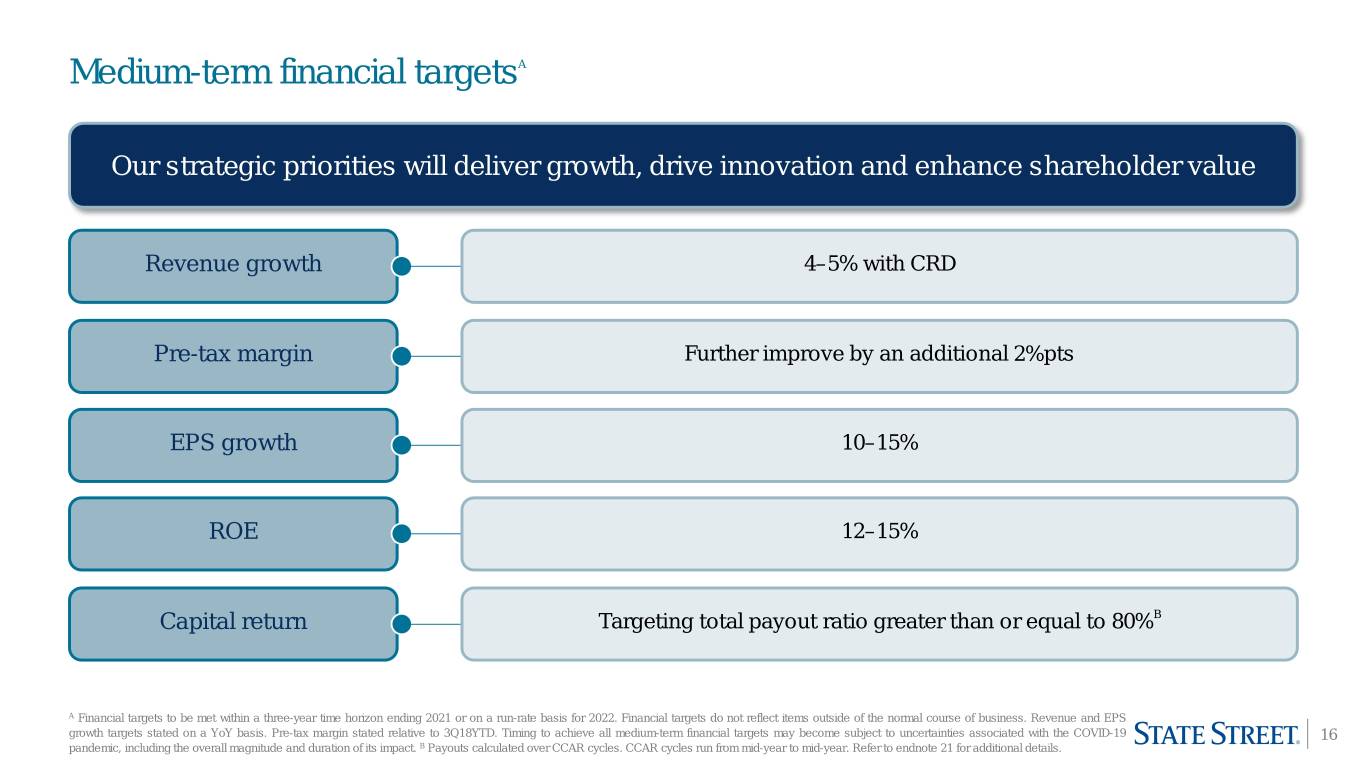

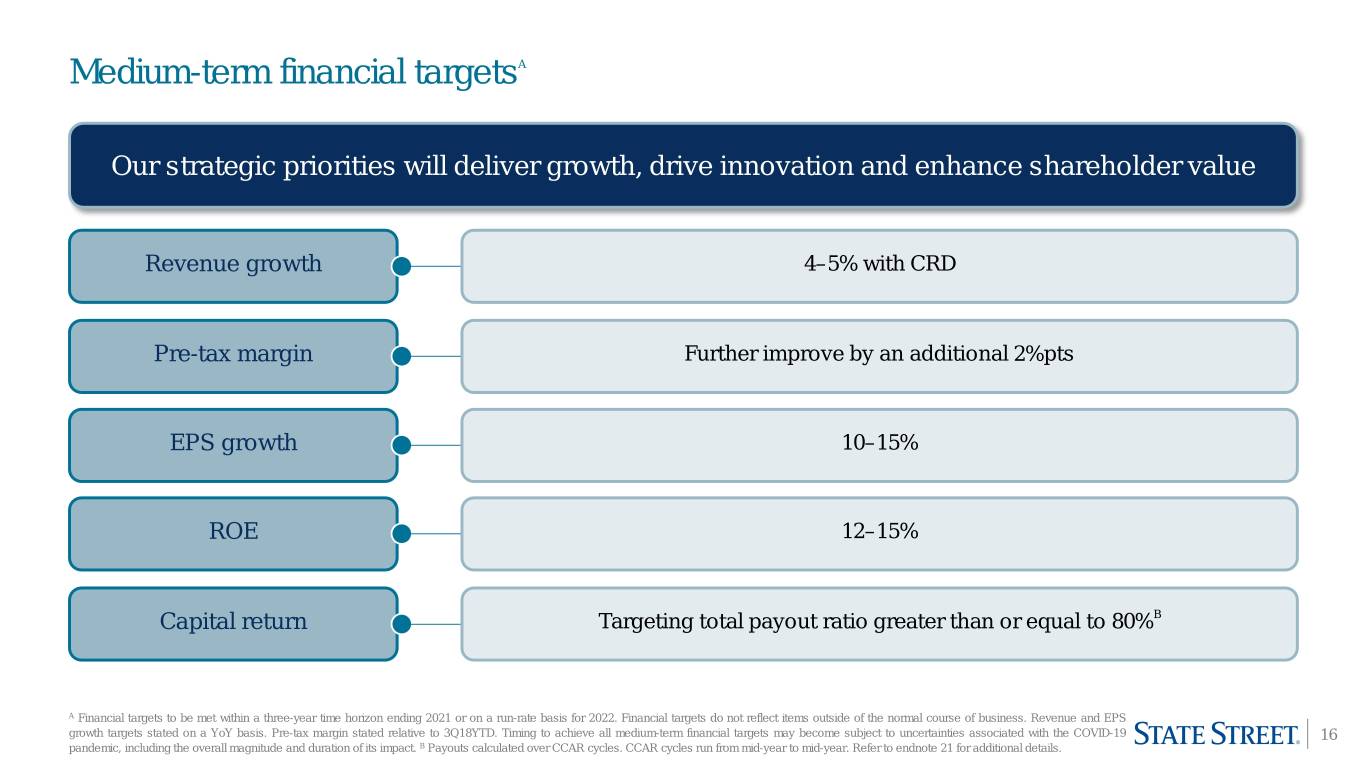

Medium-term financial targetsA Our strategic priorities will deliver growth, drive innovation and enhance shareholder value Revenue growth 4–5% with CRD Pre-tax margin Further improve by an additional 2%pts EPS growth 10–15% ROE 12–15% Capital return Targeting total payout ratio greater than or equal to 80%B A Financial targets to be met within a three-year time horizon ending 2021 or on a run-rate basis for 2022. Financial targets do not reflect items outside of the normal course of business. Revenue and EPS growth targets stated on a YoY basis. Pre-tax margin stated relative to 3Q18YTD. Timing to achieve all medium-term financial targets may become subject to uncertainties associated with the COVID-19 16 pandemic, including the overall magnitude and duration of its impact. B Payouts calculated over CCAR cycles. CCAR cycles run from mid-year to mid-year. Refer to endnote 21 for additional details.

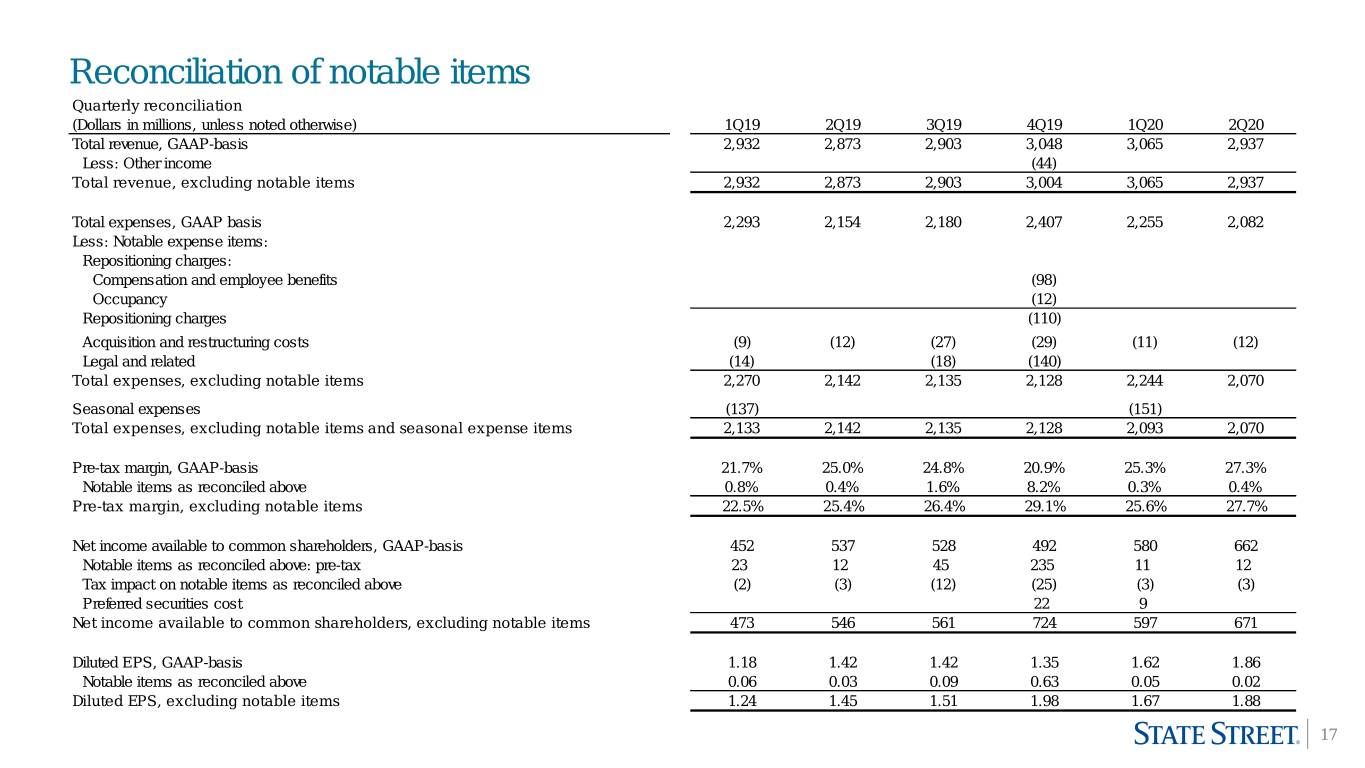

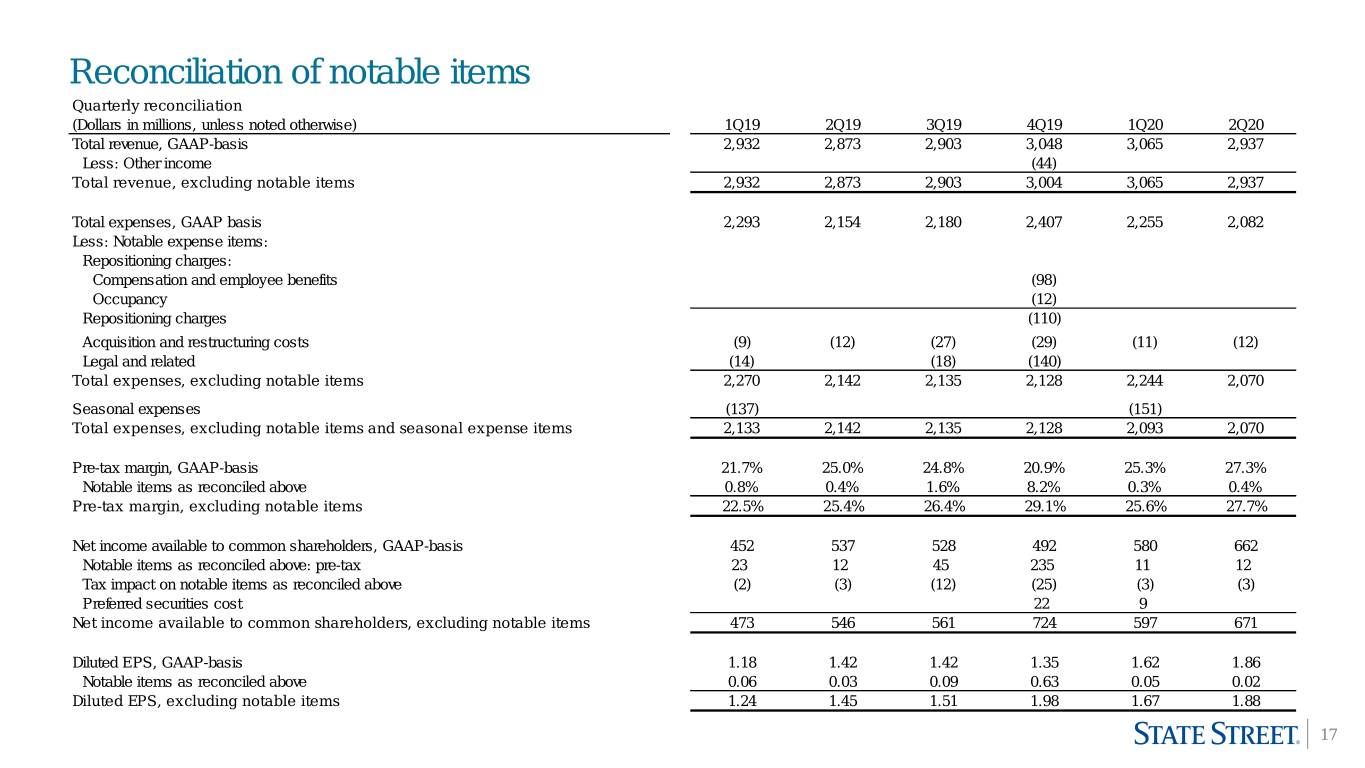

Reconciliation of notable items Quarterly reconciliation (Dollars in millions, unless noted otherwise) 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Total revenue, GAAP-basis 2,932 2,873 2,903 3,048 3,065 2,937 Less: Other income (44) Total revenue, excluding notable items 2,932 2,873 2,903 3,004 3,065 2,937 Total expenses, GAAP basis 2,293 2,154 2,180 2,407 2,255 2,082 Less: Notable expense items: Repositioning charges: Compensation and employee benefits (98) Occupancy (12) Repositioning charges (110) Acquisition and restructuring costs (9) (12) (27) (29) (11) (12) Legal and related (14) (18) (140) Total expenses, excluding notable items 2,270 2,142 2,135 2,128 2,244 2,070 Seasonal expenses (137) (151) Total expenses, excluding notable items and seasonal expense items 2,133 2,142 2,135 2,128 2,093 2,070 Pre-tax margin, GAAP-basis 21.7% 25.0% 24.8% 20.9% 25.3% 27.3% Notable items as reconciled above 0.8% 0.4% 1.6% 8.2% 0.3% 0.4% Pre-tax margin, excluding notable items 22.5% 25.4% 26.4% 29.1% 25.6% 27.7% Net income available to common shareholders, GAAP-basis 452 537 528 492 580 662 Notable items as reconciled above: pre-tax 23 12 45 235 11 12 Tax impact on notable items as reconciled above (2) (3) (12) (25) (3) (3) Preferred securities cost 22 9 Net income available to common shareholders, excluding notable items 473 546 561 724 597 671 Diluted EPS, GAAP-basis 1.18 1.42 1.42 1.35 1.62 1.86 Notable items as reconciled above 0.06 0.03 0.09 0.63 0.05 0.02 Diluted EPS, excluding notable items 1.24 1.45 1.51 1.98 1.67 1.88 17

Endnotes 1. Recognized Global Markets as the #1 FX provider to asset managers in the 2020 Euromoney (Real Money) FX Survey. 2. New asset servicing mandates, including announced front-to-back investment servicing clients, may be subject to completion of definitive agreements, approval of applicable boards and shareholders and customary regulatory approvals. New asset servicing mandates and servicing assets remaining to be installed in future periods exclude new business which has been contracted, but for which the client has not yet provided permission to publicly disclose and is not yet installed. These excluded assets, which from time to time may be significant, will be included in new asset servicing mandates and reflected in servicing assets remaining to be installed in the period in which the client provides its permission. Servicing mandates and servicing assets remaining to be installed in future periods are presented on a gross basis and therefore also do not include the impact of clients who have notified us during the period of their intent to terminate or reduce their relationship with State Street, which from time to time may be significant. New business in assets to be serviced is reflected in our AUC/A after we begin servicing the assets, and new business in assets to be managed is reflected in our AUM after we begin managing the assets. As such, only a portion of any new asset servicing and asset management mandates may be reflected in our AUC/A and AUM as of any particular date specified. Generally, our servicing fee revenues are affected by several factors including changes in market valuations, client activity and asset flows, net new business and the manner in which we price our services. We provide a range of services to our clients, including core custody services, accounting, reporting and administration and middle office services, and the nature and mix of services provided affects our servicing fees. The basis for fees will differ across regions and clients. The industry in which we operate has historically faced pricing pressure, and our servicing fee revenues are also affected by such pressures today. Consequently, no assumption should be drawn as to future revenue run rate from announced servicing wins or new servicing business yet to be installed, as the amount of revenue associated with AUC/A can vary materially. Management fees generally are affected by our level of AUM and differ based upon the nature, type and investment strategy of the investment product. Management fee revenue is more sensitive to market valuations than servicing fee revenue, as a higher proportion of the underlying services provided, and the associated management fees earned, are dependent on equity and fixed-income security valuations. Additional factors, such as the relative mix of assets managed, may have a significant effect on our management fee revenue. While certain management fees are directly determined by the values of AUM and the investment strategies employed, management fees may reflect other factors, including performance fee arrangements, as well as our relationship pricing for clients. 3. State Street’s common stock and other stock dividends, including the declaration, timing and amount, remain subject to consideration and approval by State Street’s Board of Directors at the relevant times. 4. Savings are stated on a gross basis. 5. The index names listed are service marks of their respective owners. 6. Industry data is provided for illustrative purposes only. It is not intended to reflect State Street’s or its clients' activity and is indicative of only selected segments of the entire industry. Source: Investment Company Institute (ICI). ICI data includes long term funds, ETFs and money market funds, as well as funds not registered under the Investment Company Act of 1940. Mutual fund data represents estimates of net new cash flow, which is new sales minus redemptions combined with net exchanges, while exchange-traded fund (ETF) data represents net issuance, which is gross issuance less gross redemptions. Data for mutual funds that invest primarily in other mutual funds and ETFs that invest primarily in other ETFs were excluded from the series. ICI classifies mutual funds and ETFs based on language in the fund prospectus. The long term fund flows reported by ICI are composed of North America Market flows mainly in Equities, Hybrids and Fixed Income Asset Classes. 2Q20 represents the three month period from April 2020 through June 2020, the last date for which information is available with June 2020 estimates. 7. FX trading services includes Brokerage and other revenue. 8. Revenue and pre-tax income reflects the application of ASC 606. Revenue recognition under ASC 606 results in the acceleration of a significant portion of revenues for on-premise software agreements when a client goes live or renews their contract with us. The amount of revenue recognized in any given quarter will be driven in large part by client activity, including agreements that renew or are installed in that quarter. 9. CRD annual contract value bookings, as presented in this presentation, represent signed annual recurring revenue contract value excluding bookings with affiliates, including SSGA. CRD revenue derived from affiliate agreements is eliminated in consolidation for financial reporting purposes. 10. Average contract term and deal size comparison based on new contracts between FY2017 to 3Q18 (CRD pre-acquisition) and 4Q18 to 2Q20 (CRD post-acquisition). Contracts exclude affiliates. 11. Revenue synergy target of $75-85M in 2021 mainly represents opportunities to enhance the distribution of State Street products and capabilities to CRD clients, cross sell CRD into State Street client base, expand share of wallet across our combined client base, bundle services to clients seeking an integrated experience and expand combined and integrated capabilities into new client segments. Cost synergy target of ~$55-65M in 2021 is net of expenses and cost to achieve, excluding restructuring charges, on a pre-tax basis. All targets as announced on July 20, 2018. 12. On a trailing 12-month basis. 13. Includes drawn loans, gross. Line items may not sum to total due to rounding 14. CRE and Other category includes Commercial Real Estate, Alternative Financing, Municipal Loans, and other. 15. Calculated under the incurred loss methodology. 16. Other includes other expenses and amortization of intangible assets. 17. Total GAAP expenses were positively impacted by FX translation when compared to 1Q20 by $7M. 18. For purposes of this presentation, prior period balances have been revised to reflect the carrying value of the securities, including available-for-sale securities at fair value, rather than amortized cost. 19. Unless otherwise noted, all capital ratios referenced on this slide and elsewhere in this presentation refer to State Street Corporation, or State Street, and not State Street Bank and Trust Company, or State Street Bank. The lower of capital ratios calculated under the Basel III advanced approaches and under the Basel III standardized approach are applied in the assessment of our capital adequacy for regulatory purposes. Standardized approach ratios were binding for 2Q19, 1Q20 and 2Q20. Refer to the Addendum included with this presentation for a further description of these ratios. June 30, 2020 capital ratios are presented as of quarter-end and are preliminary estimates. 20. State Street received a preliminary SCB of 2.5%. The SCB requirement will be effective in 4Q20. 21. Subject to annual CCAR process conducted by the Board of Governors of the Federal Reserve System. CCAR cycles run from mid-year to mid-year. 18

Forward-looking statements This presentation (and the conference call referenced herein) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, expense reduction programs, new client business, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “outlook,” “guidance,” “expect,” “priority,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposures or to which our clients have such exposures as a result of our acting as agent, including as an asset manager or securities lending agent; the significant risks and uncertainties for our business, results of operations and financial condition, as well as our regulatory capital and liquidity ratios and other regulatory requirements in the United States and internationally, caused by the COVID-19 pandemic, which will depend on several factors, including the scope and duration of the pandemic, its influence on the economy and financial markets, the effectiveness of our work from home arrangements and staffing levels in operational facilities, the impact of market participants on which we rely and actions taken by governmental authorities and other third parties in response to the pandemic and the impact of lower equity market valuations on our service and management fee revenue; increases in the volatility of, or declines in the level of, our NII; changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities); and changes in the manner in which we fund those assets; the volatility of servicing fee, management fee, trading fee and securities finance revenues due to, among other factors, the value of equity and fixed-income markets, market interest and FX rates, the volume of client transaction activity, competitive pressures in the investment servicing and asset management industries, and the timing of revenue recognition with respect to software and processing fees revenues; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits; the liquidity of the assets on our balance sheet and changes or volatility in the sources of such funding, particularly the deposits of our clients; and demands upon our liquidity, including the liquidity demands and requirements of our clients; the level, volatility and uncertainty of interest rates; the expected discontinuation of Interbank Offered Rates including London Interbank Offered Rate (LIBOR); the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses; the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; and the impact of monetary and fiscal policy in the U.S. and internationally on prevailing rates of interest and currency exchange rates in the markets in which we provide services to our clients; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to impairment of such securities and the recognition of a provision for credit losses in our consolidated statement of income; our ability to attract and retain deposits and other low-cost, short-term funding; our ability to manage the level and pricing of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines; our ability to deploy deposits in a profitable manner consistent with our liquidity needs, regulatory requirements and risk profile; and the risks associated with the potential liquidity mismatch between short-term deposit funding and longer term investments; the manner and timing with which the Federal Reserve and other U.S. and non-U.S. regulators implement or reevaluate the regulatory framework applicable to our operations (as well as changes to that framework), including implementation or modification of the Dodd-Frank Act and related stress testing and resolution planning requirements and implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee and European legislation (such as Undertakings for Collective Investments in Transferable Securities (UCITS) V, the Money Market Fund Regulation and the Markets in Financial Instruments Directive II/Markets in Financial Instruments Regulation); among other consequences, these regulatory changes impact the levels of regulatory capital, long-term debt and liquidity we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, restrictions on banking and financial activities and the manner in which we structure and implement our global operations and servicing relationships. In addition, our regulatory posture and related expenses have been and will continue to be affected by heightened standards and changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning, cyber-security, resiliency, resolution planning and compliance programs, as well as changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory ratios that we are, or will be, required to meet, whether arising under the Dodd-Frank Act or implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital or liquidity ratios that cause changes in those ratios as they are measured from period to period; requirements to obtain the prior approval or non-objection of the Federal Reserve or other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or corporate activities, including, without limitation, acquisitions, investments in subsidiaries, dividends and stock repurchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital or corporate initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including, without limitation, additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to our operating model and the adequacy and resiliency of our controls or compliance programs; a cyber-security incident, or a failure to protect our systems and our, our clients' and others' information against cyber-attacks, could result in the theft, loss, unauthorized access to, disclosure, use or alteration of information, system failures, or loss of access to information; any such incident or failure could adversely impact our ability to conduct our businesses, damage our reputation and cause losses, potentially materially; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology; to replace and consolidate systems, particularly those relying upon older technology, and to adequately incorporate cyber-security, resiliency and business continuity into our operations, information technology infrastructure and systems management; to implement robust management processes into our technology development and maintenance programs; and to control risks related to use of technology, including cyber-crime and inadvertent data disclosures; our ability to identify and address threats to our information technology infrastructure and systems (including those of our third-party service providers); the effectiveness of our and our third party service providers' efforts to manage the resiliency of the systems on which we rely; controls regarding the access to, and integrity of, our and our clients' data; and complexities and costs of protecting the security of such systems and data; our ability to control operational and resiliency risks, data security breach risks and outsourcing risks; our ability to protect our intellectual property rights; the possibility of errors in the quantitative models we use to manage our business; and the possibility that our controls will prove insufficient, fail or be circumvented; economic or financial market disruptions in the U.S. or internationally, including those which may result from recessions or political instability; for example, the United Kingdom's (U.K.) exit from the European Union or actual or potential changes in trade policy, such as tariffs or bilateral and multilateral trade agreements; our ability to create cost efficiencies through changes in our operational processes and to further digitize our processes and interfaces with our clients, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight, ethical behavior and governance that meets our expectations and those of our clients and our regulators, and the financial, regulatory, reputational and other consequences of our failure to meet such expectations; the impact on our compliance and controls enhancement programs associated with the appointment of a monitor under the deferred prosecution agreement with the DOJ and compliance consultant appointed under a settlement with the SEC, including the potential for such monitor and compliance consultant to require changes to our programs or to identify other issues that require substantial expenditures, changes in our operations, payments to clients or reporting to U.S. authorities; the results of our review of our billing practices, including additional findings or amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships or our reputation, adverse actions or penalties imposed by governmental authorities and costs associated with remediation of identified deficiencies; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; the large institutional clients on which we focus are often able to exert considerable market influence and have diverse investment activities, and this, combined with strong competitive market forces, subjects us to significant pressure to reduce the fees we charge, to potentially significant changes in our AUC/A or our AUM in the event of the acquisition or loss of a client, in whole or in part, and to potentially significant changes in our revenue in the event a client re-balances or changes its investment approach, re-directs assets to lower- or higher-fee asset classes or changes the mix of products or services that it receives from us; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent; the possibility of significant reductions in the liquidity or valuation of assets underlying those pools and the potential that clients will seek to hold us liable for such losses; and the possibility that our clients or regulators will assert claims that our fees, with respect to such investment products, are not appropriate; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to us or regarding other industry participants or industry-wide factors, or other reputational harm; changes or potential changes to the competitive environment, due to, among other things, regulatory and technological changes, the effects of industry consolidation and perceptions of us, as a suitable service provider or counterparty; our ability to complete acquisitions, joint ventures and divestitures, including, without limitation, our ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses, including, without limitation, our acquisition of CRD, and joint ventures will not achieve their anticipated financial, operational and product innovation benefits or will not be integrated successfully, or that the integration will take longer than anticipated; that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced; that client and deposit retention goals will not be met; that other regulatory or operational challenges will be experienced; and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to integrate CRD's front office software solutions with our middle and back office capabilities to develop our front-to-middle-to-back office State Street Alpha that is competitive, generates revenues in line with our expectations and meets our clients' requirements; the dependency of State Street Alpha on enhancements to our data management and the risks to our servicing model associated with increased exposure to client data; our ability to recognize evolving needs of our clients and to develop products that are responsive to such trends and profitable to us; the performance of and demand for the products and services we offer; and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes in accounting standards and practices; and the impact of the U.S. tax legislation enacted in 2017, and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2019 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time. 19

Non-GAAP measures In addition to presenting State Street's financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents certain financial information on a basis that excludes or adjusts one or more items from GAAP. This latter basis is a non-GAAP presentation. In general, our non- GAAP financial results adjust selected GAAP-basis financial results to exclude the impact of revenue and expenses outside of State Street’s normal course of business or other notable items, such as acquisition and restructuring charges, repositioning charges, gains/losses on sales, as well as, for selected comparisons, seasonal items. For example, we sometimes present expenses on a basis we may refer to as “expenses ex-notable items", which exclude notable items and, to provide additional perspective on both prior year quarter and sequential quarter comparisons, also exclude seasonal items. Management believes that this presentation of financial information facilitates an investor's further understanding and analysis of State Street's financial performance and trends with respect to State Street’s business operations from period-to-period, including providing additional insight into our underlying margin and profitability. In addition, Management may also provide additional non-GAAP measures. For example, we present capital ratios, calculated under regulatory standards scheduled to be effective in the future or other standards, that management uses in evaluating State Street’s business and activities and believes may similarly be useful to investors. Additionally, we may present revenue and expense measures on a constant currency basis to identify the significance of changes in foreign currency exchange rates (which often are variable) in period-to-period comparisons. This presentation represents the effects of applying prior period weighted average foreign currency exchange rates to current period results. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. Refer to the Addendum for reconciliations of our non-GAAP financial information. To access the Addendum go to http://investors.statestreet.com and click on “Filings & Reports – Quarterly Earnings”. 20

Definitions AUC/A Assets under custody and/or administration AUM Assets under management Barclays Agg Barclays Agg represents Barclays Global Aggregate Bond Index Bps Basis points, with one basis point representing one hundredth of one percent CCAR Comprehensive Capital Analysis and Review CCB Capital conservation buffer CET1 Common equity tier 1 ratio CRD Charles River Development Diluted earnings per share (EPS) Net income available to common shareholders divided by diluted average common shares outstanding for the noted period EM Emerging markets EOP End of period ETF Exchange-traded fund FX Foreign exchange FY Full-year GAAP Generally accepted accounting principles in the United States GDP Gross domestic product G-SIB Global systemically important bank HTM Held-to-maturity HQLA High quality liquid assets LTV Loan-to-value ratio Net interest income (NII) Income earned on interest bearing assets less interest paid on interest bearing liabilities Net interest margin (NIM) Net interest income divided by average interest-earning assets nm Not meaningful Operating leverage Rate of growth of total revenue less the rate of growth of total expenses, relative to the successive prior year period, as applicable Payout ratio Total payout ratio is equal to common stock dividends and common stock purchases as a percentage of net income available to common shareholders Pre-tax operating margin Income before income tax expense divided by total revenue %P ts Percentage points is the difference from one percentage value subtracted from another Quarter-over-quarter (QoQ) Sequential quarter comparison Return on equity (ROE) Net income less dividends on preferred stock divided by average common equity SCB Stress capital buffer Seasonal Expenses Seasonal deferred incentive compensation expenses for retirement-eligible employees and payroll taxes SSGA State Street Global Advisors T1L Tier 1 leverage ratio Year-over-year (YoY) Current period compared to the same period a year ago 21