1 NYSE: STT October 18, 2023 Exhibit 99.3

2 This presentation (and the conference call accompanying it) includes certain highlights of, and also material supplemental to, State Street Corporation’s news release announcing its third quarter 2023 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by an Addendum with detailed financial tables. This presentation (and the conference call accompanying it) is designed to be reviewed together with that news release and that Addendum, which are available on State Street’s website, at http://investors.statestreet.com, and are incorporated herein by reference. This presentation (and the conference call accompanying it) contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of the time this presentation is first furnished to the SEC on a Current Report on Form 8-K, and State Street does not undertake efforts to revise forward- looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. Certain financial information in this presentation is presented on both a GAAP basis and on a basis that excludes or adjusts one or more items from GAAP. The latter basis is a non-GAAP presentation. Refer to the Appendix for explanations of our non-GAAP financial measures and to the Addendum for reconciliations of our non-GAAP financial information.

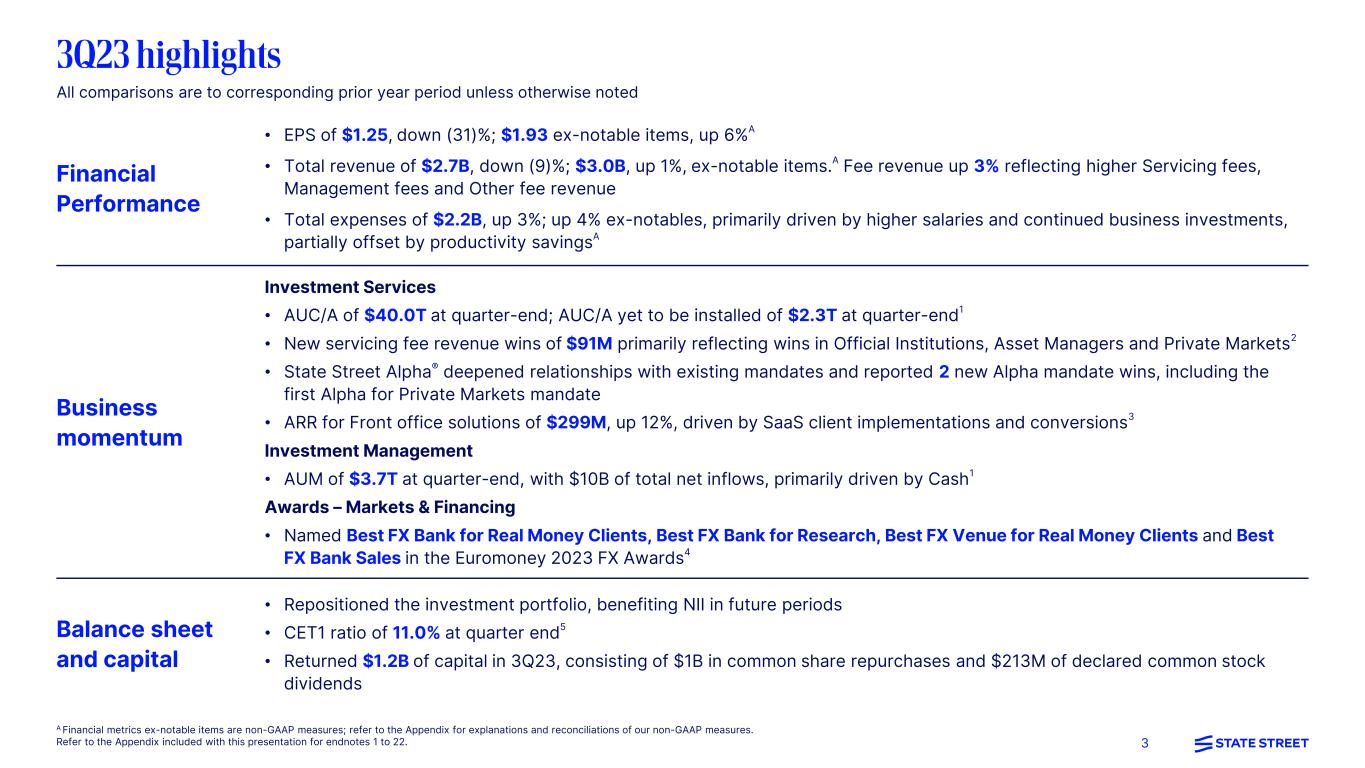

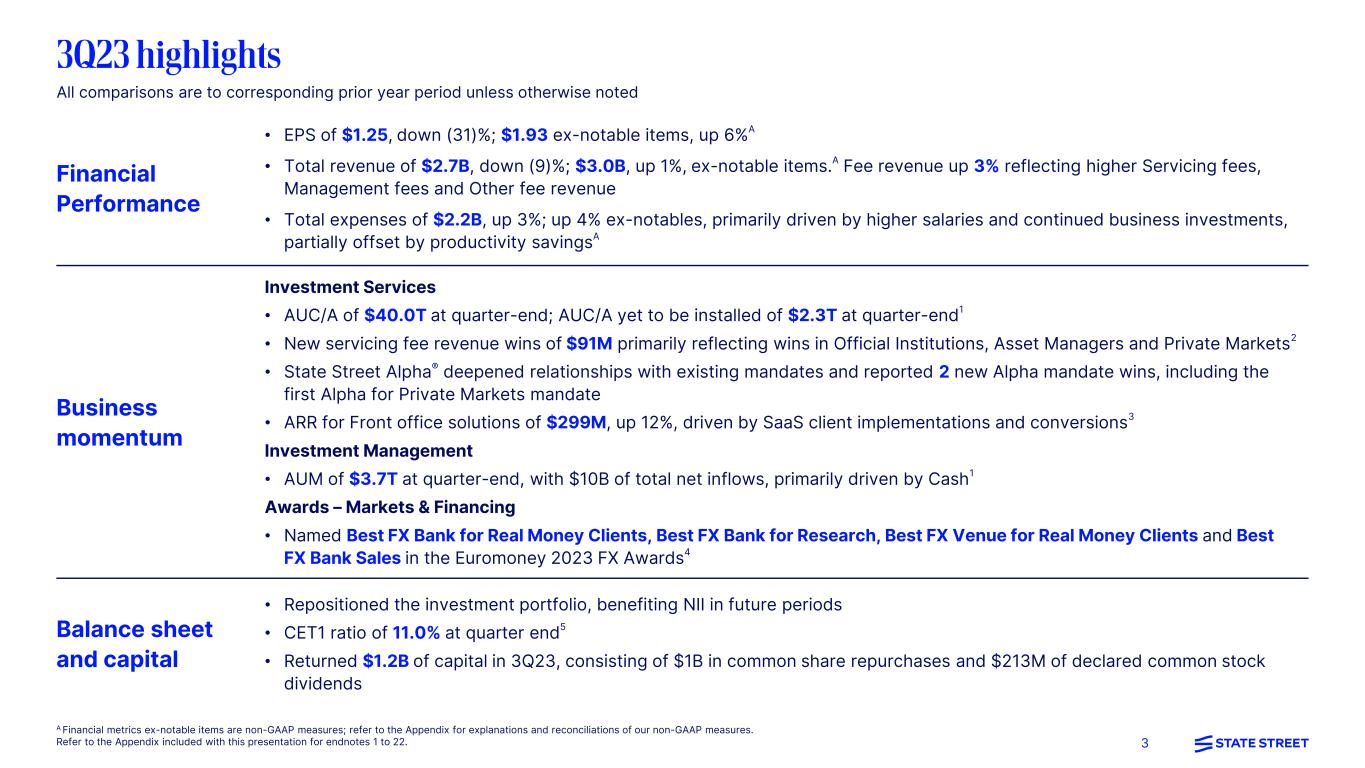

3 All comparisons are to corresponding prior year period unless otherwise noted Financial Performance • EPS of $1.25, down (31)%; $1.93 ex-notable items, up 6%A • Total revenue of $2.7B, down (9)%; $3.0B, up 1%, ex-notable items.A Fee revenue up 3% reflecting higher Servicing fees, Management fees and Other fee revenue • Total expenses of $2.2B, up 3%; up 4% ex-notables, primarily driven by higher salaries and continued business investments, partially offset by productivity savingsA Business momentum Investment Services • AUC/A of $40.0T at quarter-end; AUC/A yet to be installed of $2.3T at quarter-end1 • New servicing fee revenue wins of $91M primarily reflecting wins in Official Institutions, Asset Managers and Private Markets2 • State Street Alpha® deepened relationships with existing mandates and reported 2 new Alpha mandate wins, including the first Alpha for Private Markets mandate • ARR for Front office solutions of $299M, up 12%, driven by SaaS client implementations and conversions3 Investment Management • AUM of $3.7T at quarter-end, with $10B of total net inflows, primarily driven by Cash1 Awards – Markets & Financing • Named Best FX Bank for Real Money Clients, Best FX Bank for Research, Best FX Venue for Real Money Clients and Best FX Bank Sales in the Euromoney 2023 FX Awards4 Balance sheet and capital • Repositioned the investment portfolio, benefiting NII in future periods • CET1 ratio of 11.0% at quarter end5 • Returned $1.2B of capital in 3Q23, consisting of $1B in common share repurchases and $213M of declared common stock dividends A Financial metrics ex-notable items are non-GAAP measures; refer to the Appendix for explanations and reconciliations of our non-GAAP measures. Refer to the Appendix included with this presentation for endnotes 1 to 22.

4 A These are non-GAAP presentations; ex-currency translation percentage changes are in reference to the YoY quarterly comparison between 3Q23 and 3Q22 which excludes the impact of changes in foreign currency translation; refer to the Appendix for further explanations of non-GAAP measures. B Loss on sale related to the investment portfolio repositioning recorded in Other income line in 3Q23. Financial results Notable items 3Q22 2Q23 3Q23 2Q23 3Q22 Revenue: Back office servicing fees $1,126 $1,164 $1,138 (2)% 1% (0)% Middle office services 93 95 96 1 3 2 Servicing fees 1,219 1,259 1,234 (2) 1 (0) Management fees 472 461 479 4 1 0 Foreign exchange trading services 319 303 313 3 (2) (2) Securities finance 110 117 103 (12) (6) (6) Front office software and data 127 162 130 (20) 2 2 Lending related and other fees 57 59 58 (2) 2 2 Software and processing fees 184 221 188 (15) 2 2 Other fee revenue (5) 58 44 (24) nm nm Total fee revenue 2,299 2,419 2,361 (2) 3 2 Net interest income 660 691 624 (10) (5) (7) Other income - - (294) nm nm nm Total revenue $2,959 $3,110 $2,691 (13)% (9)% (10)% Provision for credit losses - ($18) - nm nm nm Total expenses $2,110 $2,212 $2,180 (1)% 3% 2% Net income before income taxes $849 $916 $511 (44)% (40)% (41)% Net income $690 $763 $422 (45)% (39)% Diluted earnings per share $1.80 $2.17 $1.25 (42)% (31)% Return on average common equity 11.2% 13.0% 7.3% (5.7)%pts (3.9)%pts Pre-tax margin 28.7% 29.5% 19.0% (10.5)%pts (9.7)%pts Tax rate 18.7% 16.7% 17.4% 0.7%pts (1.3)%pts Ex-notable items, non-GAAP A: Total revenue $2,959 $3,110 $2,985 (4)% 1% (0)% Total expenses $2,097 $2,212 $2,180 (1)% 4% 3% EPS $1.82 $2.17 $1.93 (11)% 6% Pre-tax margin 29.1% 29.5% 27.0% (2.5)%pts (2.1)%pts Tax Rate 18.8% 16.7% 20.9% 4.2%pts 2.1%pts (GAAP; $M, except EPS data, or where otherwise noted) Quarters %∆ 3Q22 %∆ ex-currency translation A 3Q22 2Q23 3Q23 Investment portfolio repositioningB - - ($294) Acquisition and restructuring costs ($13) - - Total notable items (pre-tax) ($13) - ($294) Income tax impact from notable items (3) - (79) EPS impact ($0.02) - ($0.68) ($M, except EPS data) QuartersA

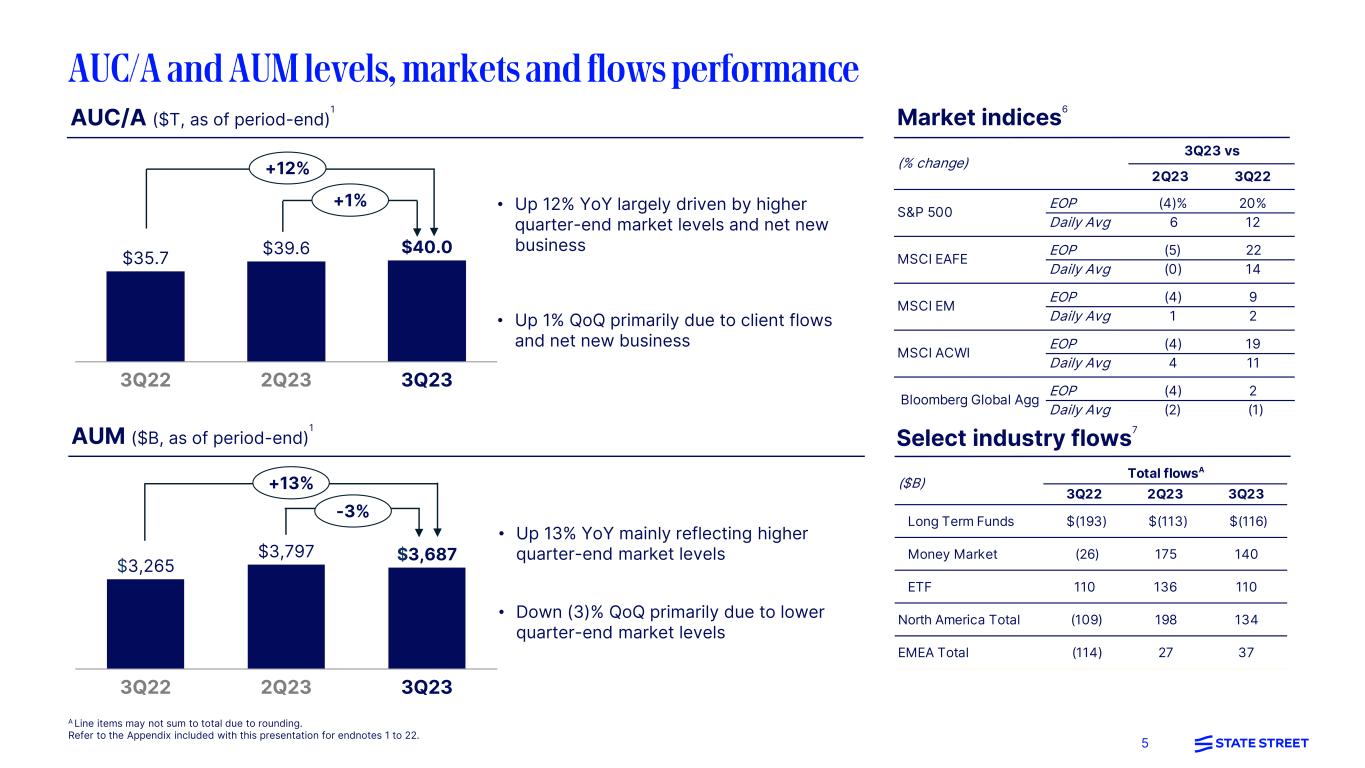

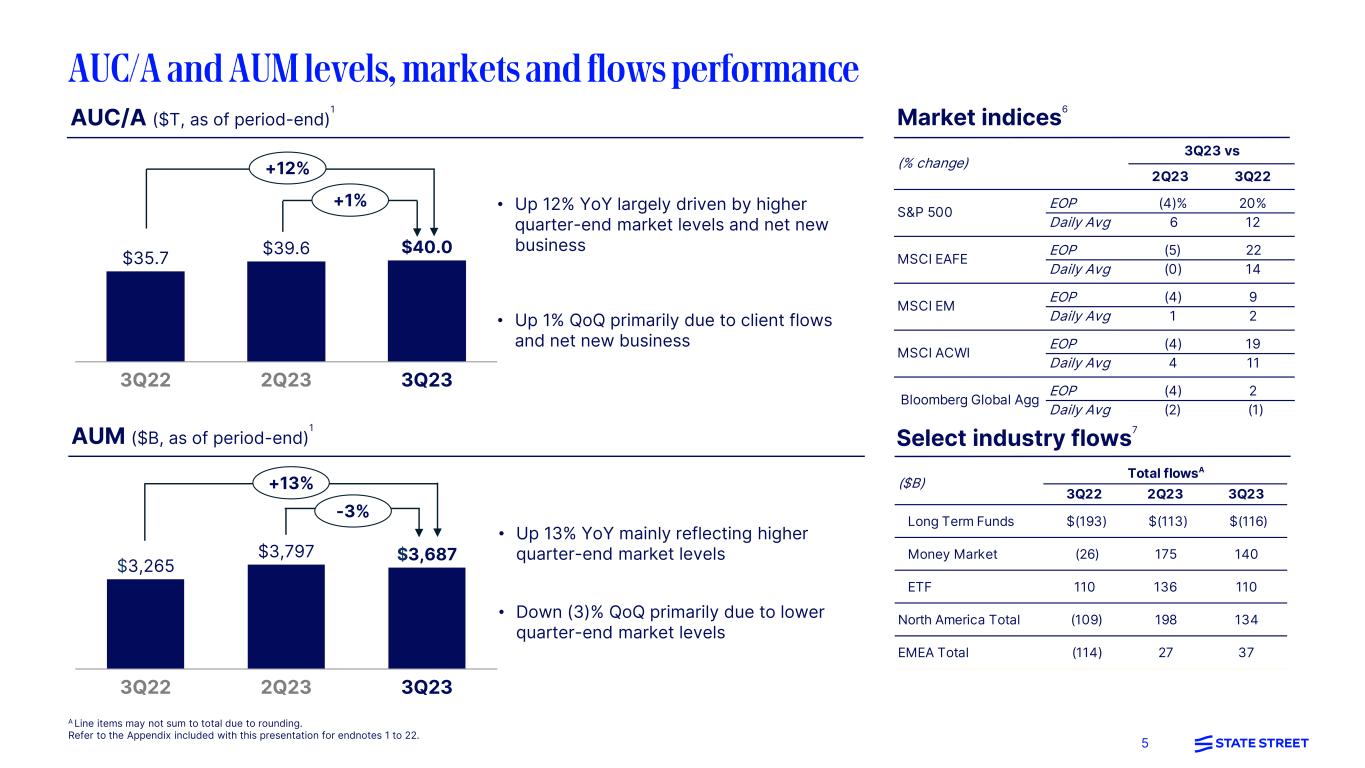

5 AUC/A ($T, as of period-end) 1 Market indices6 • Up 12% YoY largely driven by higher quarter-end market levels and net new business • Up 1% QoQ primarily due to client flows and net new business • Up 13% YoY mainly reflecting higher quarter-end market levels • Down (3)% QoQ primarily due to lower quarter-end market levels AUM ($B, as of period-end) 1 Select industry flows7 -3% +1% $35.7 $39.6 $40.0 3Q22 2Q23 3Q23 3Q22 2Q23 3Q23 $3,265 $3,797 $3,687 +12% +13% A Line items may not sum to total due to rounding. Refer to the Appendix included with this presentation for endnotes 1 to 22. 3Q22 2Q23 3Q23 Long Term Funds $(193) $(113) $(116) Money Market (26) 175 140 ETF 110 136 110 North America Total (109) 198 134 EMEA Total (114) 27 37 ($B) Total flowsA 2Q23 3Q22 EOP (4)% 20% Daily Avg 6 12 EOP (5) 22 Daily Avg (0) 14 EOP (4) 9 Daily Avg 1 2 EOP (4) 19 Daily Avg 4 11 EOP (4) 2 Daily Avg (2) (1) (% change) 3Q23 vs S&P 500 MSCI EAFE MSCI EM Bloomberg Global Agg MSCI ACWI

6 Servicing fees of $1,234M up 1% YoY and down (2)% QoQ • Up 1% YoY primarily from higher average equity markets, net new business and the impact of currency translation, partially offset by lower client activity/adjustments and normal pricing headwinds • Down (2)% QoQ mainly due to lower client activity/adjustments and a previously disclosed client transition, partially offset by higher average equity markets Servicing fees ($M) 3Q23 performance 1,126 1,115 1,131 1,164 1,138 93 3Q22 88 4Q22 86 1Q23 95 2Q23 96 3Q23 $1,219 $1,203 $1,217 $1,259 $1,234 $2,959 $3,155 $3,101 $3,110 $2,691 YoY -9% QoQ -13% Total revenue • Servicing fees were positively impacted by currency translation YoY by $18M Investment Services business momentum1 • New servicing fee revenue wins of $91M primarily reflecting wins in Official Institutions, Asset Managers and Private Markets2 • $255M of servicing fee revenue to be installed2 • $149B in new servicing AUC/A wins, with over two-thirds of new mandates driven by wins from EMEA and APAC Refer to the Appendix included with this presentation for endnotes 1 to 22. +1% -2% Back office servicing fees Middle office services +1% +3% YoY % $233 $434 $112 $141 $149 3,413 3,608 3,647 2,365 2,255 AUC/A sales performance indicators ($B)1 AUC/A wins AUC/A to be installed

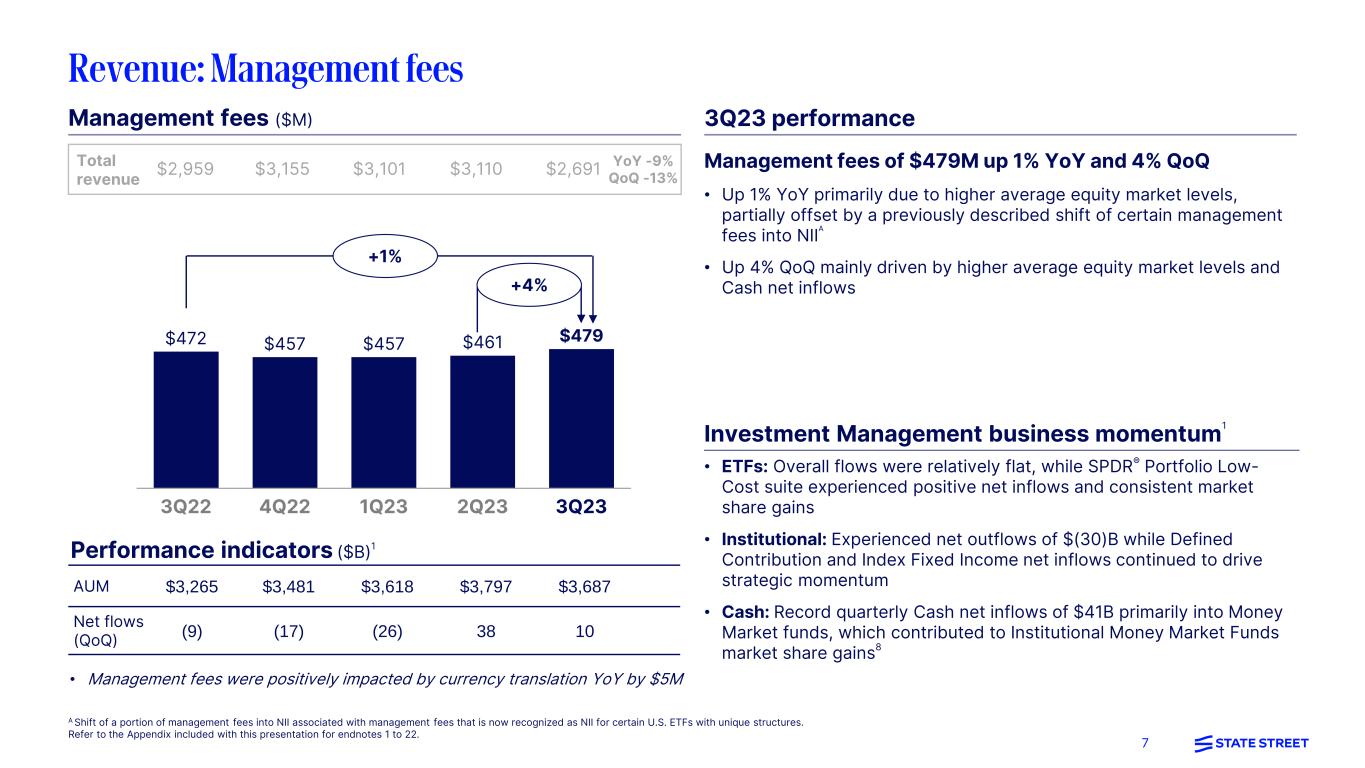

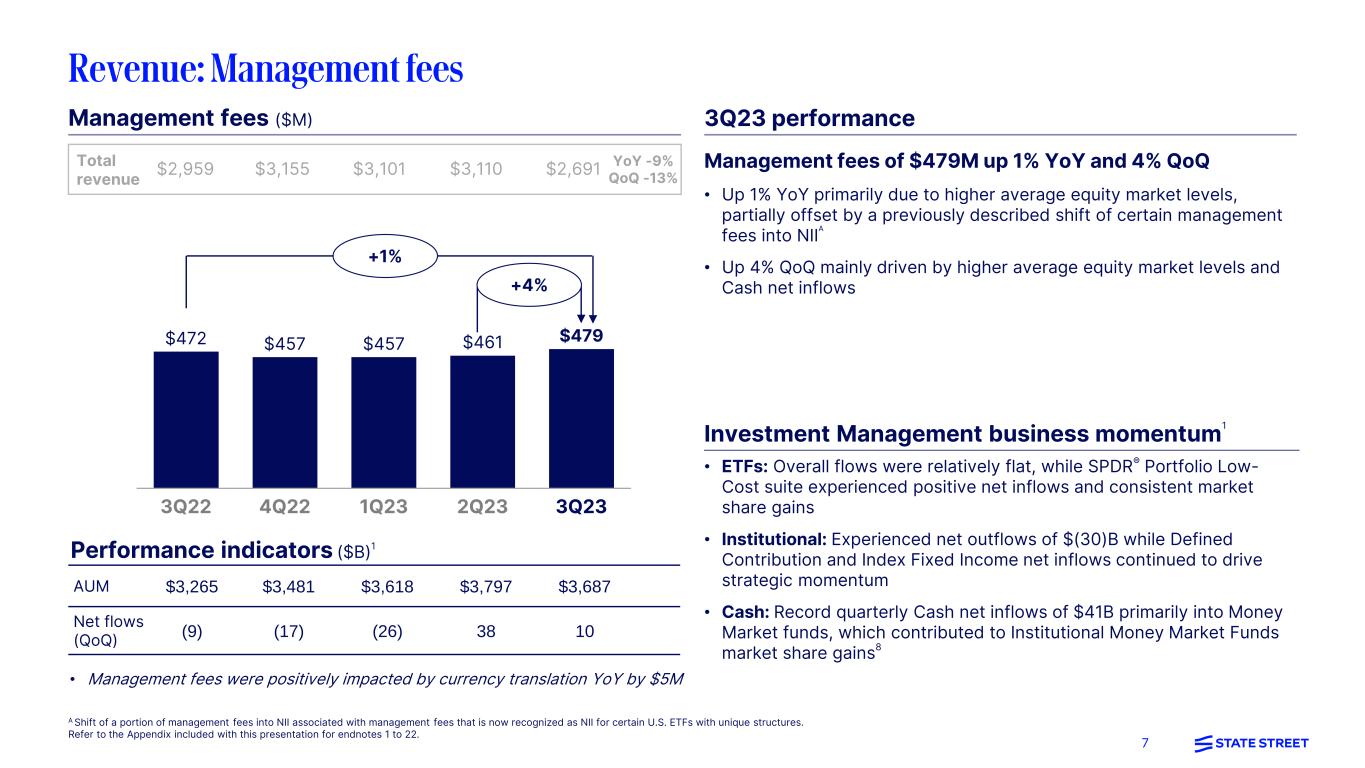

7 • ETFs: Overall flows were relatively flat, while SPDR® Portfolio Low- Cost suite experienced positive net inflows and consistent market share gains • Institutional: Experienced net outflows of $(30)B while Defined Contribution and Index Fixed Income net inflows continued to drive strategic momentum • Cash: Record quarterly Cash net inflows of $41B primarily into Money Market funds, which contributed to Institutional Money Market Funds market share gains8 Management fees ($M) 3Q23 performance Management fees of $479M up 1% YoY and 4% QoQ • Up 1% YoY primarily due to higher average equity market levels, partially offset by a previously described shift of certain management fees into NIIA • Up 4% QoQ mainly driven by higher average equity market levels and Cash net inflows Performance indicators ($B)1 • Management fees were positively impacted by currency translation YoY by $5M 3Q22 4Q22 1Q23 2Q23 3Q23 $472 $457 $457 $461 $479 Investment Management business momentum1 +1% +4% AUM $3,265 $3,481 $3,618 $3,797 $3,687 Net flows (QoQ) (9) (17) (26) 38 10 A Shift of a portion of management fees into NII associated with management fees that is now recognized as NII for certain U.S. ETFs with unique structures. Refer to the Appendix included with this presentation for endnotes 1 to 22. $2,959 $3,155 $3,101 $3,110 $2,691 YoY -9% QoQ -13% Total revenue

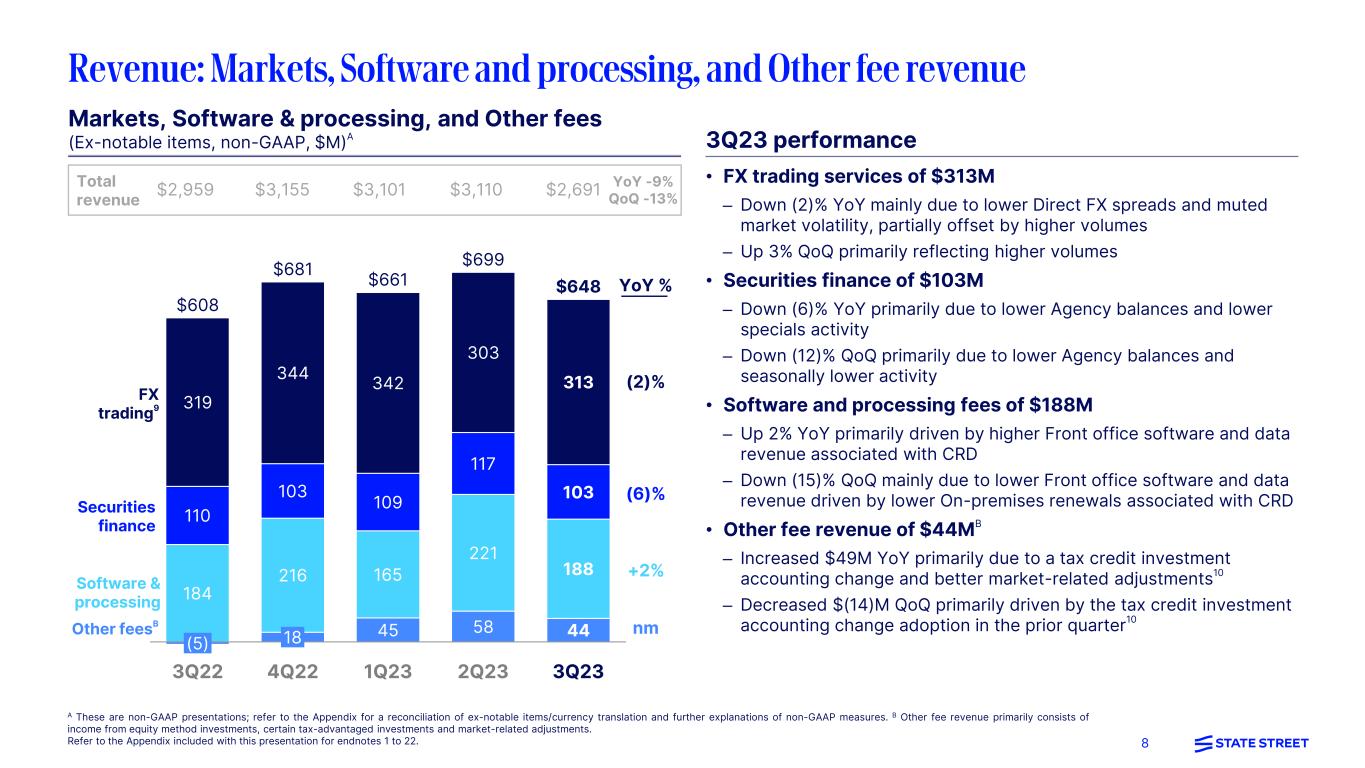

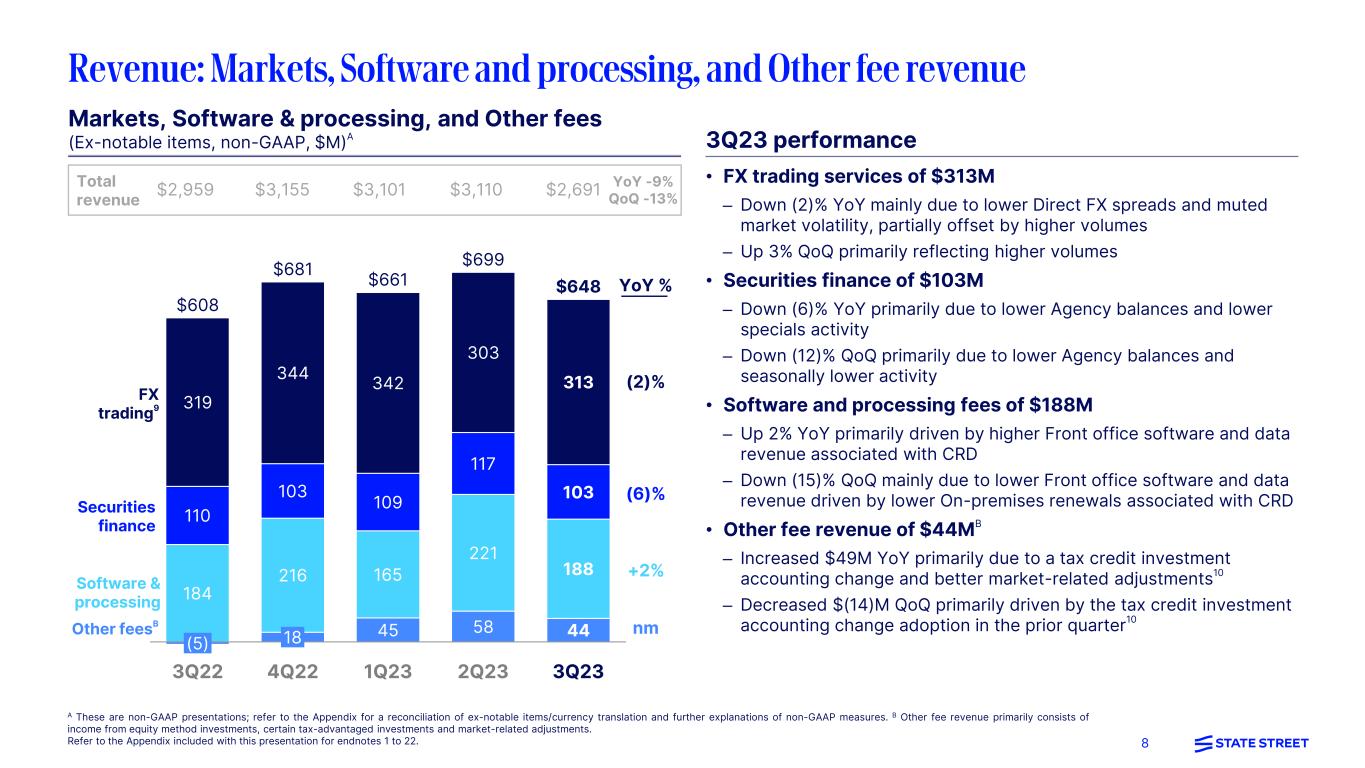

8 A These are non-GAAP presentations; refer to the Appendix for a reconciliation of ex-notable items/currency translation and further explanations of non-GAAP measures. B Other fee revenue primarily consists of income from equity method investments, certain tax-advantaged investments and market-related adjustments. Refer to the Appendix included with this presentation for endnotes 1 to 22. Markets, Software & processing, and Other fees (Ex-notable items, non-GAAP, $M)A 184 45 58 44 110 216 165 221 188 319 103 109 117 103 344 342 303 313 (5) 3Q22 18 4Q22 1Q23 2Q23 3Q23 $681 $661 $699 $648 $608 FX trading9 Securities finance Software & processing (2)% (6)% +2% YoY % Other feesB nm • FX trading services of $313M – Down (2)% YoY mainly due to lower Direct FX spreads and muted market volatility, partially offset by higher volumes – Up 3% QoQ primarily reflecting higher volumes • Securities finance of $103M – Down (6)% YoY primarily due to lower Agency balances and lower specials activity – Down (12)% QoQ primarily due to lower Agency balances and seasonally lower activity • Software and processing fees of $188M – Up 2% YoY primarily driven by higher Front office software and data revenue associated with CRD – Down (15)% QoQ mainly due to lower Front office software and data revenue driven by lower On-premises renewals associated with CRD • Other fee revenue of $44MB – Increased $49M YoY primarily due to a tax credit investment accounting change and better market-related adjustments10 – Decreased $(14)M QoQ primarily driven by the tax credit investment accounting change adoption in the prior quarter10 3Q23 performance $2,959 $3,155 $3,101 $3,110 $2,691 YoY -9% QoQ -13% Total revenue

9 • 3Q23 ARR increased 12% YoY driven by 20+ SaaS client implementations and conversions since 3Q22 • Reported 2 new Alpha mandate wins, including the first win associated with Alpha for Private Markets, as Alpha continued to drive core servicing fee wins • Meaningfully advanced CRD’s institutional Fixed Income capabilities 78 81 78 82 85 20 16 22 29 27 26 59 47 3Q22 4Q22 1Q23 2Q23 14 3Q23 $127 $159 $109 $162 $130 A Front office software and data revenue primarily includes revenue from CRD, Alpha Data Platform and Alpha Data Services. Includes Other revenue of $3M in each quarter from 3Q22 through 1Q23 and $4M in 2Q23 and 3Q23. Revenue line items may not sum to total due to rounding. Refer to the Appendix included with this presentation for endnotes 1 to 22. -20% +2% • Up 2% YoY primarily driven by higher Software-enabled and Professional services revenues, partially offset by lower On-premises revenues • Down (20)% QoQ primarily driven by lower On-premises renewals, partially offset by higher Software-enabled revenues ($M) 3Q22 2Q23 3Q23 Front office metrics New bookings12 $14 $4 $10 ARR3 267 281 299 Uninstalled revenue backlog13 90 88 88 Middle office metric Uninstalled revenue backlog14 101 82 83 Alpha metrics # of mandate wins - - 2 Live mandates to-date 12 15 15 Professional services Software- enabled (incl. SaaS)11 On-premises11 14% YoY Growth Business momentum Front office software and data ($M)A Future growth driven by Front, Middle and Alpha 3Q23 performance 6 $2,959 $3,155 $3,101 $3,110 $2,691 YoY -9% QoQ -13% Total revenue

10 NII and NIM ($M)15 Average balance sheet highlights ($B)A A Line items are rounded. B Includes Cash and due from banks and Interest-bearing deposits with banks. C Calculated as Operational deposits divided by Total deposits, in the respective periods. Refer to the Appendix included with this presentation for endnotes 1 to 22. 3Q22 4Q22 1Q23 2Q23 3Q23 Total assets $275 $284 $277 $275 $268 CashB 72 87 81 73 66 Investment portfolio 109 106 107 108 105 HTM % (EOP) 61% 61% 60% 60% 60% Duration (EOP) 16 2.7 2.6 2.8 2.7 2.7 Loans 35 35 34 34 35 Total deposits $213 $217 $210 $206 $198 % Operational C 76% 73% 75% 75% 75%NIM15 (FTE, %) 1.11% 1.29% 1.31% 1.19% 1.12% 3Q22 4Q22 1Q23 2Q23 3Q23 $660 $791 $766 $691 $624 -10% -5% • Average assets declined (3)% YoY and QoQ • Average deposits declined (7)% YoY and (4)% QoQ • Repositioned the investment portfolio, benefiting NII in future periods • Down (5)% YoY largely due to lower average deposit balances and deposit mix shift, partially offset by the impact of higher interest rates • Down (10)% QoQ primarily driven by lower average deposit balances and deposit mix shift, partially offset by the impact of higher interest rates, including international central bank hikes, and the investment portfolio repositioning Assets and liabilities3Q23 performance $2,959 $3,155 $3,101 $3,110 $2,691 YoY -9% QoQ -13% Total revenue

11 $2,110 $2,212 $2,180 41,354 42,688 42,352 Expenses of $2,180M up 4% YoY and down (1)% QoQ • Compensation and employee benefits of $1,082M – Up 4% YoY mainly due to higher salaries, headcount and the impact of currency translation, partially offset by lower performance-based incentive compensation and contractor spend – Down (4)% QoQ largely driven by lower performance-based incentive compensation, higher salary deferrals and lower headcount • Information systems and communications of $411M – Up 3% YoY primarily due to higher technology and infrastructure investments, partially offset by optimization savings, insourcing and vendor savings initiatives • Transaction processing services of $241M – Up 6% YoY mainly reflecting higher sub-custody costs – Up 3% QoQ primarily due to the absence of sub-custody vendor credits • Occupancy of $101M – Up 4% YoY mainly due to increased real estate costs – Down (2)% QoQ due to one-time vendor credits • Other of $345M18 – Up 4% YoY largely reflecting higher marketing spend and professional fees GAAP Expenses Headcount 332 346 345 227 235 241 399 405 411 1,042 1,123 1,082 3Q22 2Q23 3Q23 $2,097 $2,212 $2,180 A These are non-GAAP presentations; refer to the Appendix for a reconciliation of ex-notable items/currency translation and further explanations of non-GAAP measures. Refer to the Appendix included with this presentation for endnotes 1 to 22. Comp. & benefitsB Info. sys. Tran. processing Other17,18 Occupancy • Total expenses on both a GAAP and ex-notables basis were negatively impacted by currency translation YoY by $28M 10110397 YoY +3% QoQ -1% +4% -1% YoY +2% QoQ -1% Expenses (Ex-notable items, non-GAAP, $M)A 3Q23 performance (Ex-notable items, non-GAAP, $M)A

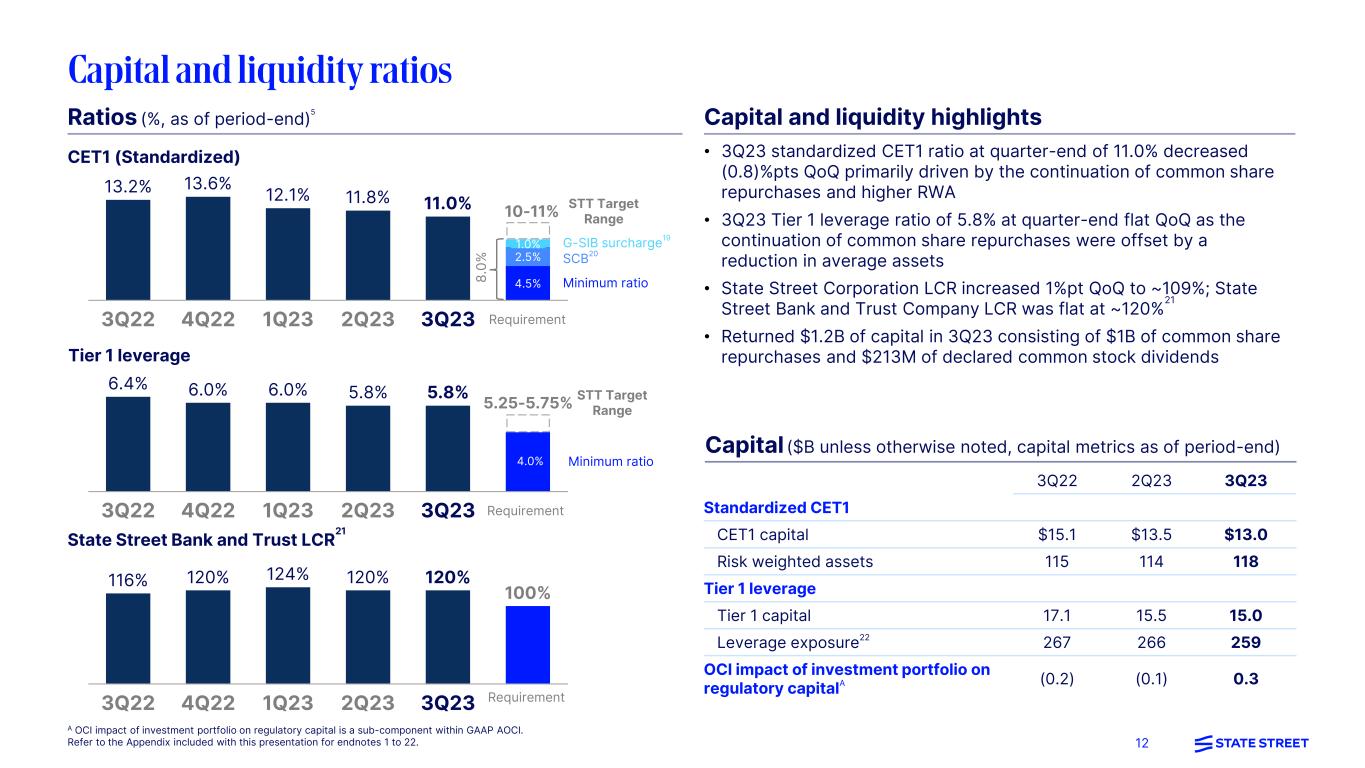

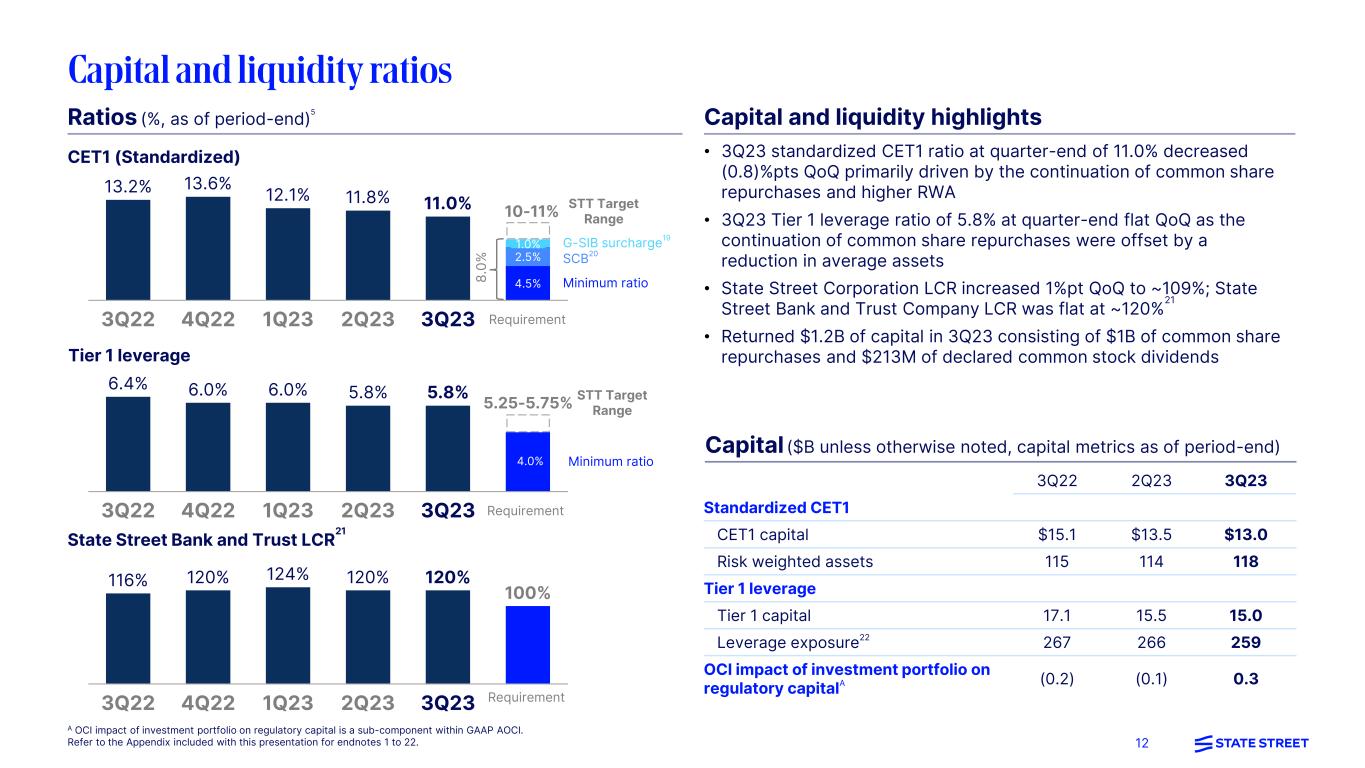

12 Capital and liquidity highlights Capital ($B unless otherwise noted, capital metrics as of period-end) 3Q22 2Q23 3Q23 Standardized CET1 CET1 capital $15.1 $13.5 $13.0 Risk weighted assets 115 114 118 Tier 1 leverage Tier 1 capital 17.1 15.5 15.0 Leverage exposure22 267 266 259 OCI impact of investment portfolio on regulatory capitalA (0.2) (0.1) 0.3 Tier 1 leverage 6.4% 6.0% 6.0% 5.8% 5.8% 3Q22 4Q22 1Q23 2Q23 3Q23 Minimum ratio4.0% STT Target Range5.25-5.75% • 3Q23 standardized CET1 ratio at quarter-end of 11.0% decreased (0.8)%pts QoQ primarily driven by the continuation of common share repurchases and higher RWA • 3Q23 Tier 1 leverage ratio of 5.8% at quarter-end flat QoQ as the continuation of common share repurchases were offset by a reduction in average assets • State Street Corporation LCR increased 1%pt QoQ to ~109%; State Street Bank and Trust Company LCR was flat at ~120% 21 • Returned $1.2B of capital in 3Q23 consisting of $1B of common share repurchases and $213M of declared common stock dividends A OCI impact of investment portfolio on regulatory capital is a sub-component within GAAP AOCI. Refer to the Appendix included with this presentation for endnotes 1 to 22. CET1 (Standardized) 13.2% 13.6% 12.1% 11.8% 11.0% 4.5% 2.5% 3Q22 4Q22 1Q23 2Q23 3Q23 SCB20 Minimum ratio8 .0 % 10-11% G-SIB surcharge19 1.0% Ratios (%, as of period-end)5 State Street Bank and Trust LCR 21 Requirement Requirement Requirement 116% 120% 124% 120% 120% 100% 3Q22 4Q22 1Q23 2Q23 3Q23 STT Target Range

13

14 3Q23 line of business performance 15 Reconciliation of notable items 16 Reconciliation of constant currency impacts 17 Endnotes 18 Forward-looking statements 19 Non-GAAP measures 20 Definitions 21

15 1,839 State StreetAInvestment Servicing Total revenue 663 620 1,813 , 3Q22 3Q23 $2,476M $2,459M Pre-tax income Fee revenue NII Pre-tax margin 28.9% 26.9% -2.0%pts YoY % ∆ +1% -6% -1% -8% Investment Management Total revenueB 3Q22 3Q23 $483M $526M Pre-tax income Pre-tax margin 30.6% 27.9% -2.7%pts 3Q22 3Q23 $148M $147M YoY % ∆ +9% -1% Total revenue ex-notable items C 660 624 2,299 2,361 3Q22 3Q23 $2,959M $2,985M Pre-tax income ex-notable itemsC Fee revenue NII Pre-tax margin ex-notable items C 29.1% 27.0% -2.1%pts YoY % ∆ +3% -5% +1% -7% A State Street includes line of business results from Investment Servicing, Investment Management, and Other. Refer to the Addendum for further line of business information. B 3Q23 and 3Q22 Total revenue includes $4M and $(3)M in NII, respectively. C This is a non-GAAP presentation; refer to the Appendix for a reconciliation of ex-notable items and further explanations of non-GAAP measures. 3Q22 3Q23 $716M $661M 3Q22 3Q23 $862M $805M

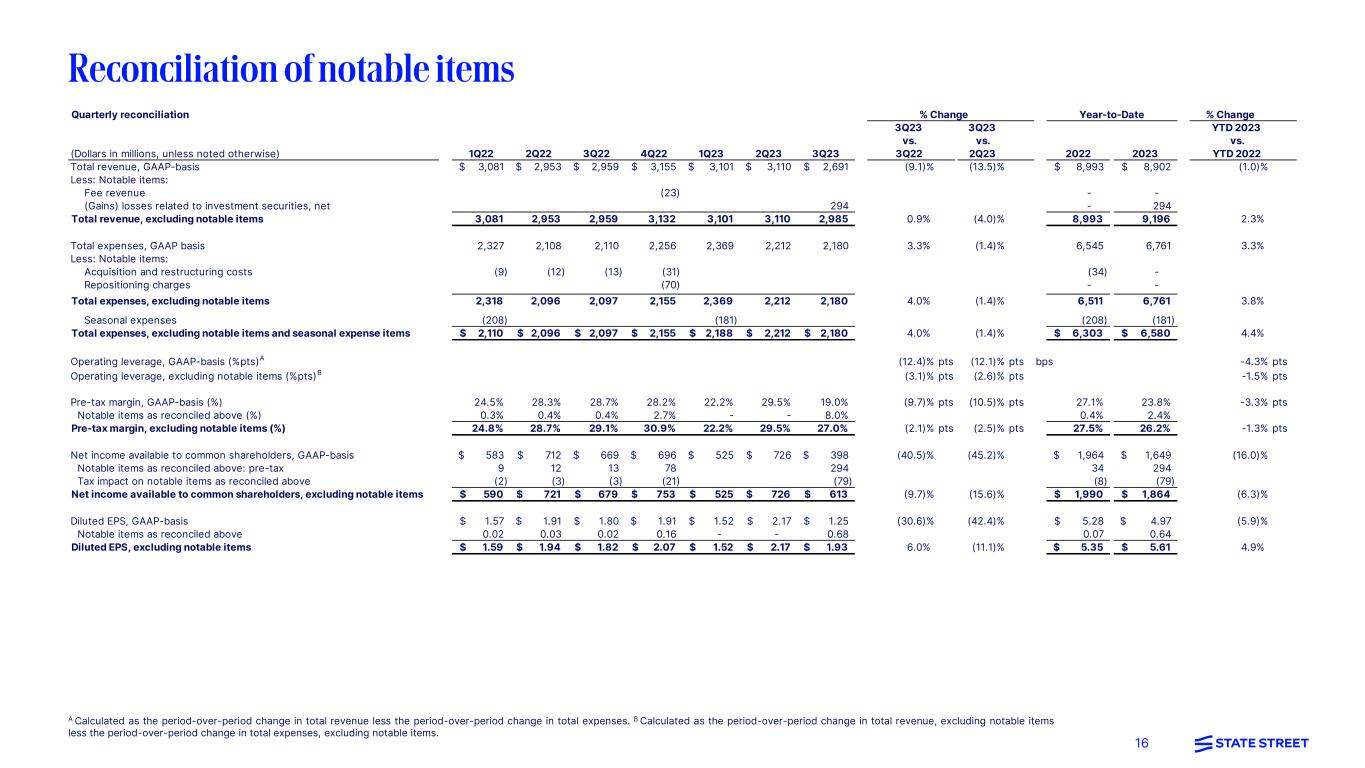

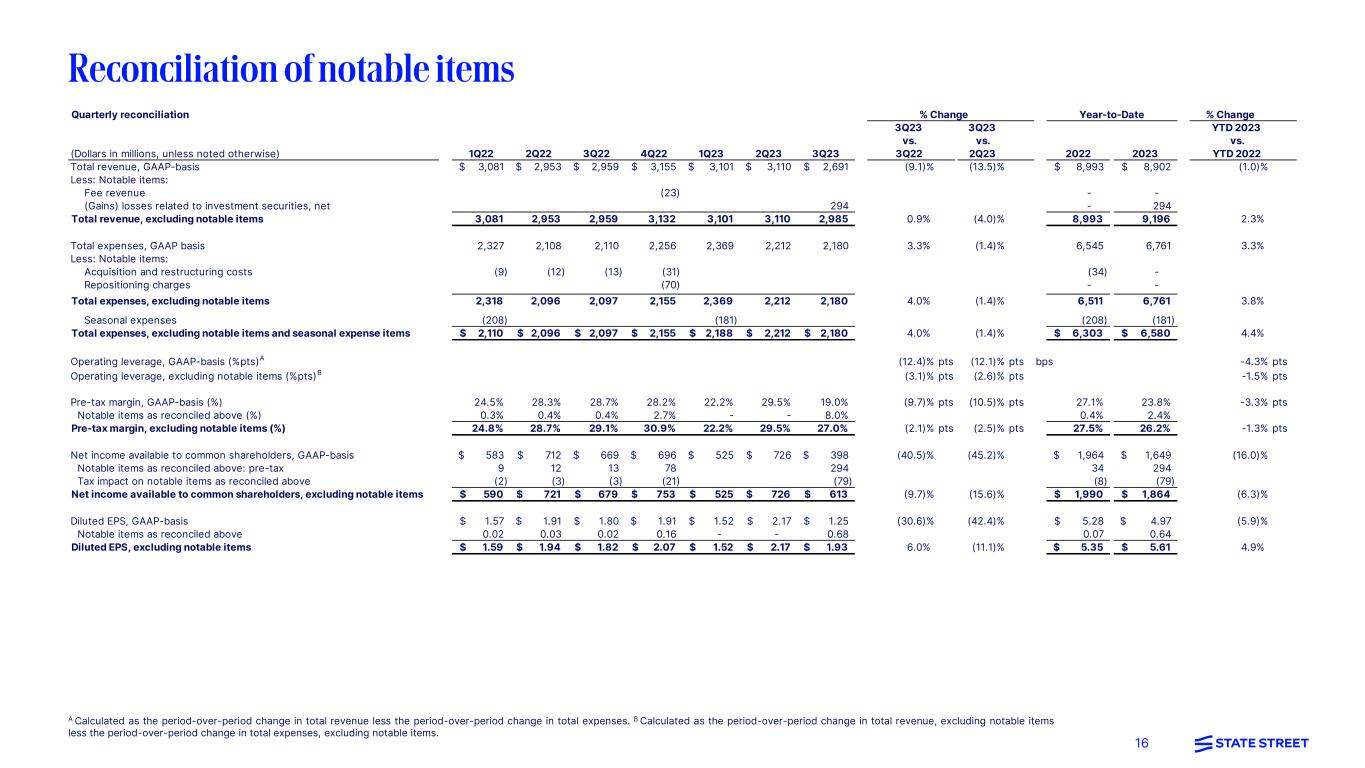

16 A Calculated as the period-over-period change in total revenue less the period-over-period change in total expenses. B Calculated as the period-over-period change in total revenue, excluding notable items less the period-over-period change in total expenses, excluding notable items. Quarterly reconciliation % Change (Dollars in millions, unless noted otherwise) 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 3Q23 vs. 3Q22 3Q23 vs. 2Q23 2022 2023 YTD 2023 vs. YTD 2022 Total revenue, GAAP-basis 3,081$ 2,953$ 2,959$ 3,155$ 3,101$ 3,110$ 2,691$ (9.1)% (13.5)% 8,993$ 8,902$ (1.0)% Less: Notable items: Fee revenue (23) - - (Gains) losses related to investment securities, net 294 - 294 Total revenue, excluding notable items 3,081 2,953 2,959 3,132 3,101 3,110 2,985 0.9% (4.0)% 8,993 9,196 2.3% Total expenses, GAAP basis 2,327 2,108 2,110 2,256 2,369 2,212 2,180 3.3% (1.4)% 6,545 6,761 3.3% Less: Notable items: Acquisition and restructuring costs (9) (12) (13) (31) (34) - Repositioning charges (70) - - Total expenses, excluding notable items 2,318 2,096 2,097 2,155 2,369 2,212 2,180 4.0% (1.4)% 6,511 6,761 3.8% Seasonal expenses (208) (181) (208) (181) Total expenses, excluding notable items and seasonal expense items 2,110$ 2,096$ 2,097$ 2,155$ 2,188$ 2,212$ 2,180$ 4.0% (1.4)% 6,303$ 6,580$ 4.4% Operating leverage, GAAP-basis (%pts)A (12.4)% pts (12.1)% pts bps -4.3% pts Operating leverage, excluding notable items (%pts)B (3.1)% pts (2.6)% pts -1.5% pts Pre-tax margin, GAAP-basis (%) 24.5% 28.3% 28.7% 28.2% 22.2% 29.5% 19.0% (9.7)% pts (10.5)% pts 27.1% 23.8% -3.3% pts Notable items as reconciled above (%) 0.3% 0.4% 0.4% 2.7% - - 8.0% 0.4% 2.4% Pre-tax margin, excluding notable items (%) 24.8% 28.7% 29.1% 30.9% 22.2% 29.5% 27.0% (2.1)% pts (2.5)% pts 27.5% 26.2% -1.3% pts Net income available to common shareholders, GAAP-basis 583$ 712$ 669$ 696$ 525$ 726$ 398$ (40.5)% (45.2)% 1,964$ 1,649$ (16.0)% Notable items as reconciled above: pre-tax 9 12 13 78 294 34 294 Tax impact on notable items as reconciled above (2) (3) (3) (21) (79) (8) (79) Net income available to common shareholders, excluding notable items 590$ 721$ 679$ 753$ 525$ 726$ 613$ (9.7)% (15.6)% 1,990$ 1,864$ (6.3)% Diluted EPS, GAAP-basis 1.57$ 1.91$ 1.80$ 1.91$ 1.52$ 2.17$ 1.25$ (30.6)% (42.4)% 5.28$ 4.97$ (5.9)% Notable items as reconciled above 0.02 0.03 0.02 0.16 - - 0.68 0.07 0.64 Diluted EPS, excluding notable items 1.59$ 1.94$ 1.82$ 2.07$ 1.52$ 2.17$ 1.93$ 6.0% (11.1)% 5.35$ 5.61$ 4.9% % Change Year-to-Date

17 A Other includes Other expenses and Amortization of intangible assets. Reconciliation of Constant Currency FX Impacts (Dollars in millions) 3Q22 2Q23 3Q23 3Q23 vs. 3Q22 3Q23 vs. 2Q23 3Q23 vs. 3Q22 3Q23 vs. 2Q23 3Q23 vs. 3Q22 3Q23 vs. 2Q23 Non-GAAP basis Total revenue, excluding notable items $ 2,959 $ 3,110 $ 2,985 $ 36 $ (1) $ 2,949 $ 2,986 (0.3)% (4.0)% Compensation and employee benefits, excluding notable items $ 1,042 $ 1,123 $ 1,082 $ 17 $ (2) $ 1,065 $ 1,084 2.2% (3.5)% Information systems and communications, excluding notable items 399 405 411 2 - 409 411 2.5% 1.5% Transaction processing services, excluding notable items 227 235 241 3 - 238 241 4.8% 2.6% Occupancy, excluding notable items 97 103 101 2 - 99 101 2.1% (1.9)% Other expenses, excluding notable itemsA 332 346 345 4 - 341 345 2.7% (0.3)% Total expenses, excluding notable items $ 2,097 $ 2,212 $ 2,180 $ 28 $ (2) $ 2,152 $ 2,182 2.6% (1.4)% Reported Currency Translation Impact Excluding Currency Impact % Change Constant Currency

18 1. New asset servicing mandates, including announced Alpha front-to-back investment servicing clients, may be subject to completion of definitive agreements, approval of applicable boards and shareholders and customary regulatory approvals. New asset servicing mandates and servicing assets remaining to be installed in future periods exclude new business which has been contracted, but for which the client has not yet provided permission to publicly disclose and is not yet installed. These excluded assets, which from time to time may be significant, will be included in new asset servicing mandates and reflected in servicing assets remaining to be installed in the period in which the client provides its permission. Servicing mandates and servicing assets remaining to be installed in future periods are presented on a gross basis and therefore also do not include the impact of clients who have notified us during the period of their intent to terminate or reduce their relationship with State Street, which from time to time may be significant. New business in assets to be serviced is reflected in our AUC/A after we begin servicing the assets, and new business in assets to be managed is reflected in our AUM after we begin managing the assets. As such, only a portion of any new asset servicing and asset management mandates may be reflected in our AUC/A and AUM as of any particular date specified. Consistent with past practice, AUC/A values for certain asset classes are based on a lag, typically one-month. Generally, our servicing fee revenues are affected by several factors, and we provide varied services from our full suite of offerings to different clients. The basis for fees will also differ across regions and clients and can reflect pricing pressures traditionally experienced in our industry. Consequently, no assumption should be drawn as to future revenue run rate from announced servicing wins or new servicing business yet to be installed, as the amount of revenue associated with AUC/A can vary materially. Management fees also are generally affected by various factors, including investment product type and strategy and relationship pricing for clients, and are more sensitive to market valuations than are servicing fees. Therefore, no assumption should be drawn from management fees associated with changes in AUM levels. 2. Servicing fee revenue wins/backlog represents estimates of future annual revenue associated with new servicing engagements contracted for during the current reporting period based upon factors assessed at time of servicing contract execution, including asset volumes, number of transactions, accounts and holdings, terms and expected strategy. These and other relevant factors influencing projected servicing fees upon asset implementation/onboarding will change from time to time prior to, upon and following asset implementation/onboarding, among other reasons, due to varying market levels and factors and client and investor activity and preferences. Servicing fee/backlog estimates are not updated to reflect those changes, regardless of the magnitude or direction of, or reason for, any change. Servicing fee revenue wins in any period are highly variable and include estimated fees attributable to both (1) services to be provided for new estimated AUC/A reflected in new asset servicing wins for the period (with AUC/A to be onboarded in the future) and (2) additional services to be provided for AUC/A already included in our end-of period AUC/A (i.e., for which other services are currently provided); and the magnitude of one source of servicing fee revenue wins relative to the other (i.e., (1) relative to (2)) will vary from period to period. Therefore, for these and other reasons, comparisons of estimated servicing fee revenue wins to estimated new asset servicing AUC/A wins for any period will not produce reliable fee per AUC/A estimates. No servicing fees are recognized until the point in the future when we begin performing the associated services with respect to the relevant AUC/A. See also endnote 1 above in reference to considerations applicable to pending servicing engagements, which similarly apply to engagements for which reported servicing fee revenue wins/backlog are attributable. 3. Front office software and data annual recurring revenue (ARR), an operating metric, is calculated by annualizing current quarter revenue for CRD and Mercatus and includes the annualized amount of most software-enabled revenue, including revenue generated from SaaS, maintenance and support revenue, FIX, and value-added services, which are all expected to be recognized ratably over the term of client contracts. Front office software and data ARR does not include software-enabled brokerage revenue, revenue from affiliates and licensing fees (excluding the portion allocated to maintenance and support) from On-premises software. 4. State Street was recognized in Euromoney Magazine’s 2023 FX Awards across four categories: Best FX Bank for Real Money Clients, Best FX Bank for Research, Best FX Venue for Real Money Clients and Best FX Bank Sales. 5. Unless otherwise noted, all capital ratios referenced on this slide and elsewhere in this presentation refer to State Street Corporation, or State Street, and not State Street Bank and Trust Company. All capital ratios are as of quarter end. The lower of capital ratios calculated under the Basel III advanced approaches and under the Basel III standardized approach are applied in the assessment of our capital adequacy for regulatory purposes. Standardized approach ratios were binding for 3Q22 to 3Q23. Refer to the Addendum for descriptions of these ratios. September 30, 2023 capital ratios are presented as of quarter-end and are preliminary estimates. 6. The index names listed are service marks of their respective owners. 7. Data presented for indicative purposes. Morningstar data includes long-term mutual funds, ETFs and Money Market funds. Mutual fund data represents estimates of net new cash flow, which is new sales minus redemptions combined with net exchanges, while ETF data represents net issuance, which is gross issuance less gross redemptions. Data for Fund of Funds, Feeder funds and Obsolete funds were excluded from the series to prevent double counting. Data is from the Morningstar Direct Asset Flows database. The long-term fund flows reported by Morningstar in North America are composed of U.S. domiciled Market flows mainly in Equities, Allocation and Fixed Income asset classes. 3Q23 data for North America (U.S. domiciled) includes Morningstar actuals for July and August 2023 and Morningstar estimates for September 2023. 3Q23 data for EMEA is on a rolling three month basis for June 2023 through August 2023. 8. Quartile performance data provided by iMoneyNet. Market share based on Global Institutional Money Market Funds and sourced from Money Fund Analyzer, a service provided by iMoneyNet as of the end of September 2023. 9. FX trading services in 4Q22 included notable items related to a revenue-related recovery of $23M. 10. In March 2023, the Financial Accounting Standards Board issued new accounting guidance that expands the use of proportional amortization accounting to other types of tax credit investments regardless of the tax credit program from which the income tax credits are received. We adopted the new standard in the second quarter of 2023, effective January 1, 2023 for renewable energy production tax credit investments under the modified retrospective approach. The impact of adoption resulted in an increase in Other fee revenue, an increase in Tax expense and was not material to net income. 11. On-premises revenue is revenue derived from locally installed software. Software-enabled revenue includes SaaS, maintenance and support revenue, FIX, brokerage, and value-add services. The revenue recognition pattern for On-premises installations differs from software- enabled revenue. 12. Front office bookings represent signed ARR contract values for CRD, Mercatus, Alpha Data Platform, and Alpha Data Services excluding bookings with affiliates, including SSGA. Front office revenue derived from affiliate agreements is eliminated in consolidation for financial reporting purposes. 13. Represents expected ARR from signed client contracts that are scheduled to be largely installed over the next 24 months for CRD, Mercatus and Alpha Data Services. It includes SaaS revenue, as well as maintenance and support revenue, and excludes the one-time impact of On-premises license revenue, revenue generated from FIX, brokerage, value-add services, and professional services as well as revenue from affiliates. 14. Represents expected annual revenue from signed client contracts that are scheduled to be largely installed over the next 24 months. This amount of expected revenue is estimated based on factors present on or about the time the contract was signed (and is not updated based on subsequent developments, including changes in assets, market valuations and scope). It does not include professional services revenue or revenue from affiliates. 15. NII is presented on a GAAP-basis. NIM is presented on a fully taxable-equivalent (FTE) basis, and is calculated by dividing FTE NII by average total interest-earning assets. Refer to the Addendum for reconciliations of NII FTE-basis to NII GAAP-basis on the Average Statement of Condition. 16. Duration as of period end and based on the total investment portfolio. 17. Other, excluding notable items, includes Other expenses and Amortization of intangible assets. 18. Other expenses in 3Q22 included a notable item related to acquisition and restructuring costs of $13M. Excluding this notable item, 3Q23 adjusted Other expenses of $345M was up 4% compared to 3Q22 adjusted Other expenses of $332M. 19. State Street received a regulatory exemption to maintain its 1.0% G-SIB capital surcharge until January 1, 2024. 20. The SCB of 2.5% effective on October 1, 2023 is calculated based upon the results of the CCAR 2023 exam. 21. State Street Bank and Trust's (SSBT) LCR is significantly higher than State Street Corporation's (SSC) LCR, primarily due to application of the transferability restriction in the U.S. LCR Final Rule to the calculation of SSC’s LCR. This restriction limits the amount of HQLA held at SSC’s principal banking subsidiary, SSBT and available for the calculation of SSC’s LCR to the amount of net cash outflows of SSBT. This transferability restriction does not apply in the calculation of SSBT’s LCR, and therefore SSBT’s LCR reflects the full benefit of all of its HQLA holdings. LCR for 4Q22, as presented, was revised in 1Q23 from prior reporting to reflect corrections to maturity dates, increasing the amount of encumbered securities collateral associated with certain repurchase agreements. 22. Leverage exposure is equal to average consolidated assets less applicable Tier 1 leverage capital reductions under regulatory standards.

19 This presentation (and the conference call referenced herein) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our strategy, growth and sales prospects, capital management, business, financial and capital condition, results of operations, the financial and market outlook and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “outlook,” “priority,” “will,” “expect,” "intend," "aim," "outcome," "future," “strategy,” "pipeline," “trajectory,” "target," “guidance,” “objective,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “trend,” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this Presentation is first issued. Important factors that may affect future results and outcomes include, but are not limited to: We are subject to intense competition, which could negatively affect our profitability; We are subject to significant pricing pressure and variability in our financial results and our AUC/A and AUM; We could be adversely affected by geopolitical, economic and market conditions, including, for example, as a result of liquidity or capital deficiencies (actual or perceived) by other financial institutions and related market and government actions, the Israel-Hamas War, ongoing war in Ukraine, actions taken by central banks to address inflationary pressures, challenging conditions in global equity markets, periods of significant volatility in valuations and liquidity or other disruptions in the markets for equity, fixed income and other asset classes globally or within specific markets such as those that impacted the UK gilts in the fourth quarter of 2022; Our development and completion of new products and services, including State Street Alpha® or State Street Digital®, and the enhancement of our infrastructure required to meet increased regulatory and client expectations for resiliency and the systems and process re-engineering necessary to achieve improved productivity and reduced operating risk, involve costs, risks and dependencies on third parties; Our business may be negatively affected by our failure to update and maintain our technology infrastructure or as a result of a cyber-attack or similar vulnerability in our or business partners' infrastructure; Acquisitions, strategic alliances, joint ventures and divestitures, and the integration, retention and development of the benefits of these transactions, including the consolidation of one of our operations joint ventures in India, pose risks for our business; Competition for qualified members of our workforce is intense, and we may not be able to attract and retain the highly skilled people we need to support our business; We have significant international operations and clients that can be adversely impacted by developments in European and Asian economies, including local, regional and geopolitical developments affecting those economies; Our investment securities portfolio, consolidated financial condition and consolidated results of operations could be adversely affected by changes in the financial markets, governmental action or monetary policy. For example, among other risks, increases in prevailing interest rates could lead to reduced levels of client deposits and resulting decreases in our NII; Our business activities expose us to interest rate risk; We assume significant credit risk of counterparties, who may also have substantial financial dependencies on other financial institutions, and these credit exposures and concentrations could expose us to financial loss; Our fee revenue represents a significant portion of our revenue and is subject to decline based on, among other factors, market and currency declines, investment activities and preferences of our clients and their business mix; If we are unable to effectively manage our capital and liquidity, our financial condition, capital ratios, results of operations and business prospects could be adversely affected; We may need to raise additional capital or debt in the future, which may not be available to us or may only be available on unfavorable terms; If we experience a downgrade in our credit ratings, or an actual or perceived reduction in our financial strength, our borrowing and capital costs, liquidity and reputation could be adversely affected; Our business and capital-related activities, including common share repurchases, may be adversely affected by regulatory capital, credit (counterparty and otherwise) and liquidity standards and considerations; We face extensive and changing governmental regulation in the jurisdictions in which we operate, which may increase our costs and compliance risks and may affect our business activities and strategies; We are subject to enhanced external oversight as a result of the resolution of prior regulatory or governmental matters; Our businesses may be adversely affected by government enforcement and litigation; Our businesses may be adversely affected by increased political and regulatory scrutiny of asset management stewardship and corporate ESG practices; Our efforts to improve our billing processes and practices are ongoing and may result in the identification of additional billing errors; Any misappropriation of the confidential information we possess could have an adverse impact on our business and could subject us to regulatory actions, litigation and other adverse effects; Our calculations of risk exposures, total RWA and capital ratios depend on data inputs, formulae, models, correlations and assumptions that are subject to change, which could materially impact our risk exposures, our total RWA and our capital ratios from period to period; Changes in accounting standards may adversely affect our consolidated results of operations and financial condition; Changes in tax laws, rules or regulations, challenges to our tax positions and changes in the composition of our pre-tax earnings may increase our effective tax rate; We could face liabilities for withholding and other non-income taxes, including in connection with our services to clients, as a result of tax authority examinations; Our internal control environment may be inadequate, fail or be circumvented, and operational risks could adversely affect our business and consolidated results of operations; Shifting operational activities to non- U.S. jurisdictions, changing our operating model and outsourcing to, or insourcing from, third parties portions of our operations may expose us to increased operational risk, geopolitical risk and reputational harm and may not result in expected cost savings or operational improvements; Attacks or unauthorized access to our or our business partners' information technology systems or facilities, or disruptions to our or their operations, could result in significant costs, reputational damage and impacts on our business activities; Long-term contracts and customizing service delivery for clients expose us to pricing and performance risk; Our businesses may be negatively affected by adverse publicity or other reputational harm; We may not be able to protect our intellectual property or may infringe upon the rights of third parties; The quantitative models we use to manage our business may contain errors that could adversely impact our business and regulatory compliance; Our reputation and business prospects may be damaged if our clients incur substantial losses or are restricted in redeeming their interests in investment pools that we sponsor or manage; The impacts of climate change, and regulatory responses to such risks, could adversely affect us; We may incur losses as a result of unforeseen events including terrorist attacks, natural disasters, the emergence of a new pandemic or acts of embezzlement; and the transition away from LIBOR may result in additional costs and increased risk exposure. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2022 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this Presentation should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this Presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time.

20 In addition to presenting State Street's financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents certain financial information on a basis that excludes or adjusts one or more items from GAAP. This latter basis is a non-GAAP presentation. In general, our non-GAAP financial results adjust selected GAAP-basis financial results to exclude the impact of revenue and expenses outside of State Street’s normal course of business or other notable items, such as acquisition and restructuring charges, repositioning charges, gains/losses on sales, as well as, for selected comparisons, seasonal items. For example, we sometimes present expenses on a basis we may refer to as “expenses ex-notable items", which exclude notable items and, to provide additional perspective on both prior year quarter and sequential quarter comparisons, may also exclude seasonal items. Management believes that this presentation of financial information facilitates an investor's further understanding and analysis of State Street's financial performance and trends with respect to State Street’s business operations from period-to-period, including providing additional insight into our underlying margin and profitability. In addition, Management may also provide additional non-GAAP measures. For example, we may present revenue and expense measures on a constant currency basis to identify the significance of changes in foreign currency exchange rates (which often are variable) in period-to-period comparisons. This presentation represents the effects of applying prior period weighted average foreign currency exchange rates to current period results. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. Refer to the Addendum for reconciliations of our non-GAAP financial information. To access the Addendum go to http://investors.statestreet.com and click on “Filings & Reports – Quarterly Earnings”.

21 ACWI All Country World Index AOCI Accumulated other comprehensive income APAC Asia-Pacific ARR Annual recurring revenue AUC/A Assets under custody and/or administration AUM Assets under management Bloomberg Global Aggregate Bloomberg Global Aggregate represents Bloomberg Global Aggregate Bond Index Bps Basis points, with one basis point representing one hundredth of one percent CCAR Comprehensive Capital Analysis and Review CET1 ratio Common equity tier 1 ratio CRD Charles River Development Diluted earnings per share (EPS) Net income available to common shareholders divided by diluted average common shares outstanding for the noted period EAFE Europe, Australia, and Far East EM Emerging markets EMEA Europe, Middle East and Africa EOP End of period EPS Earnings per share ESG Environmental, Social, and Governance ETF Exchange-traded fund FIX The Charles River Network's FIX Network Service (CRN) is an end-to-end trade execution and support service facilitating electronic trading between Charles River's asset management and broker clients Front office uninstalled revenue backlog Represents the annualized recurring revenue from signed client contracts that are scheduled to be fully installed over the next 24 months for CRD, Mercatus and Alpha Data Services. It includes SaaS revenue as well as maintenance and support revenue and excludes the one-time impact of on-premises license revenue, revenue generated from FIX, brokerage, value-add services, and professional services as well as revenue from affiliates FTE Fully taxable-equivalent FX Foreign exchange GAAP Generally accepted accounting principles in the United States G-SIB Global systemically important bank HQLA High Quality Liquid Assets HTM Held-to-maturity LIBOR London Inter-Bank Offered Rate LCR Liquidity Coverage Ratio Lending related and other Lending related and other fees primarily consist of fee revenue associated with State Street’s fund finance, leveraged loans, municipal finance, insurance and stable value wrap businesses Middle office uninstalled revenue backlog Represents the annualized recurring revenue from signed client contracts that are scheduled to be fully installed over the next 24 months. It does not include professional services revenue or revenue from affiliates MSCI Morgan Stanley Capital International Net income before income taxes (NIBT) Income before income tax expense Net interest income (NII) Income earned on interest bearing assets less interest paid on interest bearing liabilities Net interest margin (NIM) (FTE) Fully taxable-equivalent (FTE) Net interest income divided by average total interest-earning assets nm Not meaningful NYSE New York Stock Exchange OCI Other comprehensive income On-premises On-premises revenue as recognized in Front office software and data Operating leverage Rate of growth of total revenue less the rate of growth of total expenses, relative to the corresponding prior year period, as applicable Pre-tax margin Income before income tax expense divided by total revenue Operational deposits Client cash deposits that are required for or related to the underlying transaction activity of their accounts, and accordingly, are historically more stable than other transient cash deposits %Pts Percentage points is the difference from one percentage value subtracted from another Quarter-over-Quarter (QoQ) Sequential quarter comparison RWA Risk weighted assets SaaS Software as a service SCB Stress capital buffer Seasonal expenses Seasonal deferred incentive compensation expenses for retirement-eligible employees and payroll taxes SEC Securities Exchange Commission SPDR Standard and Poor's Depository Receipt SSGA State Street Global Advisors Year-over-Year (YoY) Current period compared to the same period a year ago