Filed pursuant to Rule 424(b)(5)

Registration No. 333-265877

The information contained in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 16, 2023

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated June 28, 2022)

$

State Street Corporation

$ Fixed-to-Floating Rate Senior Notes due 2029

$ Fixed-to-Floating Rate Senior Subordinated Notes due 2034

This is an offering of $ aggregate principal amount of fixed-to-floating rate senior notes due 2029 (the “senior notes”) and $ aggregate principal amount of fixed-to-floating rate senior subordinated notes due 2034 (the “subordinated notes” and, together with the senior notes, the “notes”) of State Street Corporation (“State Street”).

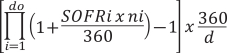

The senior notes will mature on , 2029. The senior notes will bear interest from and including , 2023 to, but excluding, , 2028 at a fixed annual rate of %, payable semiannually in arrears, on and of each year, beginning on , 2024. From and including , 2028, the senior notes will bear interest at a floating rate determined by reference to the Secured Overnight Funding Rate (“SOFR”) compounded daily over a quarterly interest payment period in accordance with the specific formula described in this prospectus supplement plus a spread of %, payable quarterly in arrears.

The subordinated notes will mature on , 2034. The subordinated notes will bear interest from and including , 2023 to, but excluding, , 2033 at a fixed annual rate of %, payable semiannually in arrears, on and of each year, beginning on , 2024. From and including , 2033, the subordinated notes will bear interest at a floating rate determined by reference to SOFR compounded daily over a quarterly interest payment period in accordance with the specific formula described in this prospectus supplement plus a spread of %, payable quarterly in arrears.

We will have the option to redeem each series of notes in whole, but not in part, on, and only on, , 2028, in the case of the senior notes and , 2033, in the case of the subordinated notes, in each case at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date. Any early redemption of the subordinated notes will be subject to the approval of the Board of Governors of the Federal Reserve System (the “Federal Reserve”). In addition, prior to exercising our option to redeem the subordinated notes, or immediately thereafter, we will be required to either replace the redeemed subordinated notes with an equivalent amount of a financial instrument that meets the Federal Reserve’s regulatory capital criteria or demonstrate to the satisfaction of the Federal Reserve that, following redemption, we would continue to hold an amount of capital that is commensurate with our risk.

There is no sinking fund for the notes. The senior notes are unsecured and will rank equally with all other existing and future senior unsecured indebtedness of State Street. The subordinated notes are unsecured and will rank junior and be subordinated to all of our existing and future senior indebtedness, including the senior notes. The subordinated notes will rank equally with all of our existing and future subordinated indebtedness that is not specifically stated to be junior to the subordinated notes.

The notes are not bank deposits, and are not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Investing in the notes involves risks. See “Risk Factors” beginning on page S-10.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, the FDIC or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Per Senior

Note | | | Per

Subordinated

Note | | | Total | |

Public offering price(1) | | | | % | | | | % | | $ | | |

Underwriting discounts | | | | % | | | | % | | $ | | |

Proceeds, before expenses, to State Street Corporation(1) | | | | % | | | | % | | $ | | |

| (1) | Plus accrued interest, if any, from , 2023, if settlement occurs after that date. |

The notes will not be listed on any securities exchange. Currently, there are no public trading markets for the notes. The underwriters expect to deliver the notes to purchasers in book-entry form only through the facilities of The Depository Trust Company and its direct participants, including Euroclear Bank SA/NV, as operator of the Euroclear System, and Clearstream Banking S.A., on or about , 2023.

Joint Book-Running Managers

| | | | | | |

| Citigroup | | HSBC | | Siebert Williams Shank | | UBS Investment Bank |

The date of this prospectus supplement is , 2023.