Filed Pursuant to Rule 424(b)(5)

Registration No. 333-265877

The information contained in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 14, 2024

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated June 28, 2022)

$

State Street Corporation

Fixed-to-Floating Rate Senior Notes due 2029

This is an offering of $ aggregate principal amount of fixed-to-floating rate senior notes due 2029 (the “notes”) of State Street Corporation (“State Street”).

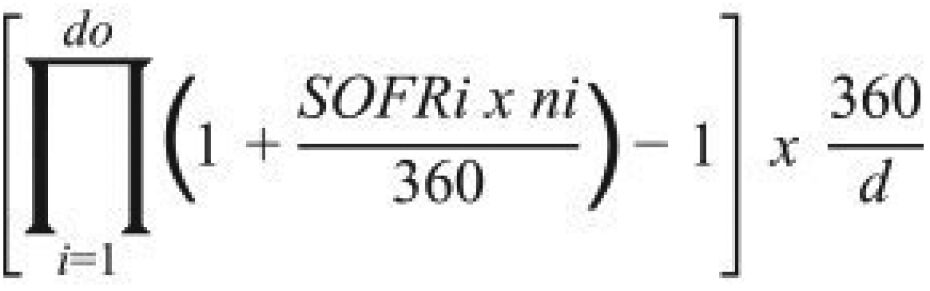

The notes will mature on , 2029. The notes will bear interest from and including , 2024 to, but excluding, , 2028 at a fixed annual rate of %, payable semiannually in arrears, on and of each year, beginning on , 2025. From and including , 2028, the notes will bear interest at a floating rate determined by reference to the Secured Overnight Funding Rate (“SOFR”) compounded daily over a quarterly interest payment period in accordance with the specific formula described in this prospectus supplement plus a spread of %, payable quarterly in arrears.

We will have the option to redeem the notes in whole, but not in part, on, and only on, , 2028, at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date.

There is no sinking fund for the notes. The notes are unsecured and will rank equally with all other existing and future senior unsecured indebtedness of State Street.

The notes are not bank deposits, and are not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Investing in the notes involves risks. See “Risk Factors” beginning on page S-10.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, the FDIC or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Note | | | Total | |

Public offering price(1) | | | | % | | $ | | |

Underwriting discount | | | | % | | $ | | |

Proceeds, before expenses, to State Street Corporation(1) | | | | % | | $ | | |

| (1) | Plus accrued interest, if any, from , 2024, if settlement occurs after that date. |

The notes will not be listed on any securities exchange. Currently, there is no public trading market for the notes. The underwriters expect to deliver the notes to purchasers in book-entry form only through the facilities of The Depository Trust Company and its direct participants, including Euroclear Bank SA/NV, as operator of the Euroclear System, and Clearstream Banking S.A., on or about , 2024.

| | | | | | |

| Joint Book-Running Managers |

| | | |

| HSBC | | BofA Securities | | Deutsche Bank Securities | | R. Seelaus & Co., LLC |

The date of this prospectus supplement is , 2024.