37th Annual J.P. Morgan Healthcare Conference January 9, 2019

Forward Looking Statements All statements other than statements of historical facts contained herein that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our expectations for full fiscal year 2018 total, product, royalty revenues and other, GAAP earnings per diluted share and our long-term outlook; demand for our products; anticipated revenue and earnings growth; our financial condition, results of operations and business generally; expectations regarding our ability to design and deliver innovative new noninvasive technologies and reduce the cost of care; and demand for our technologies. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property; exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Non-GAAP Financial Measures The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP). The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results and that these items are not indicative of the company’s on-going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has presented the following non- GAAP measures to assist investors in understanding the Company’s core net operating results on an on-going basis: (i) non-GAAP gross margin %, (ii) non-GAAP operating expense %, (iii) non-GAAP earnings per diluted share and (iv) adjusted free cash flow. These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes non-GAAP product revenue, non-GAAP gross profit, non-GAAP net income and non-GAAP net income per diluted share are important measures in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

Agenda The Masimo Story Automating Care Opioid Safety Driving Shareholder Value

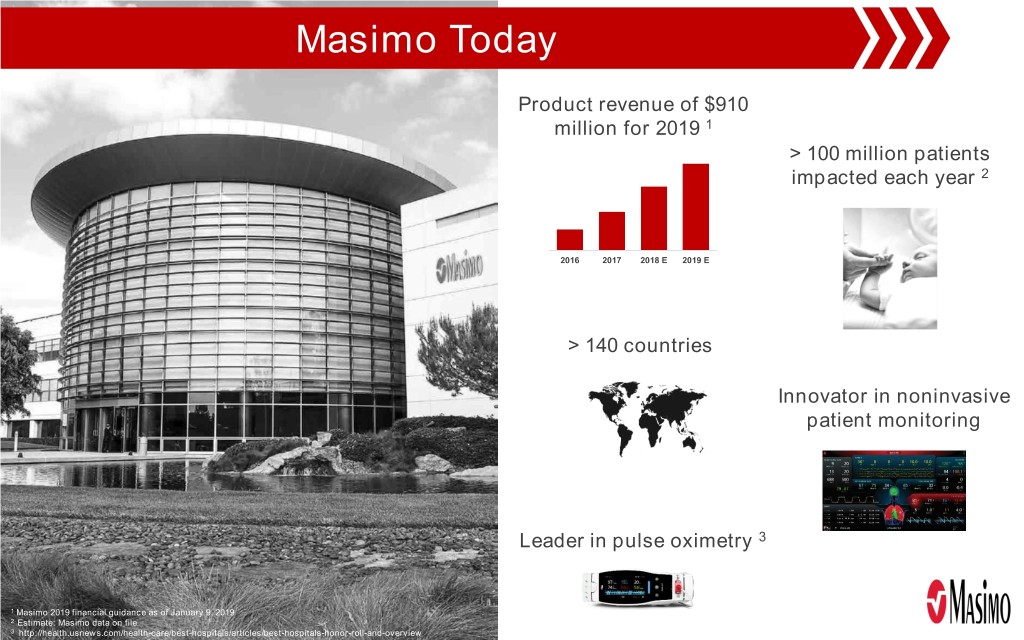

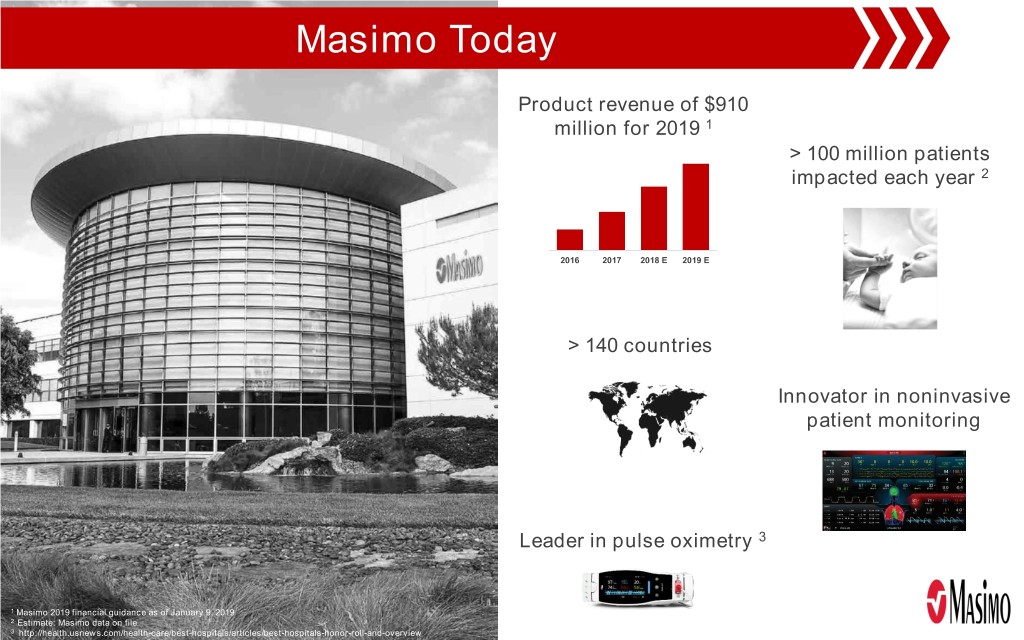

Masimo Today Product revenue of $910 million for 2019 1 > 100 million patients impacted each year 2 > 140 countries Innovator in noninvasive patient monitoring Leader in pulse oximetry 3 1 Masimo 2019 financial guidance as of January 9, 2019 2 Estimate: Masimo data on file 3 http://health.usnews.com/health-care/best-hospitals/articles/best-hospitals-honor-roll-and-overview

Long Term Plan . Improve patient outcomes . Reduce the cost of care . Long-term financial targets . Revenue growth of 8%-10% . Gross margins of 70% . Operating expenses of 40% . Operating margins of 30%

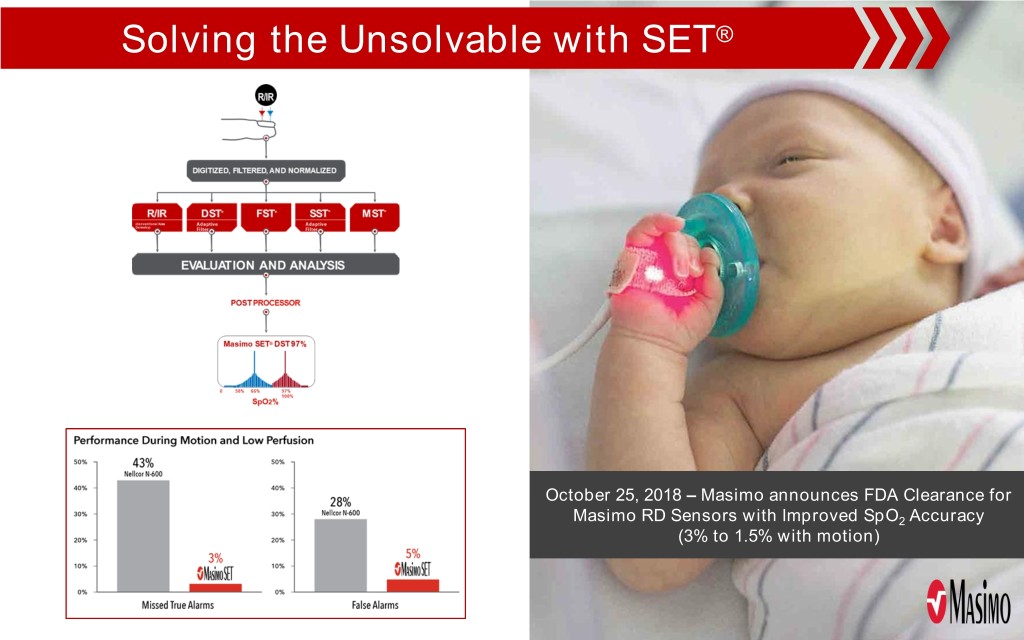

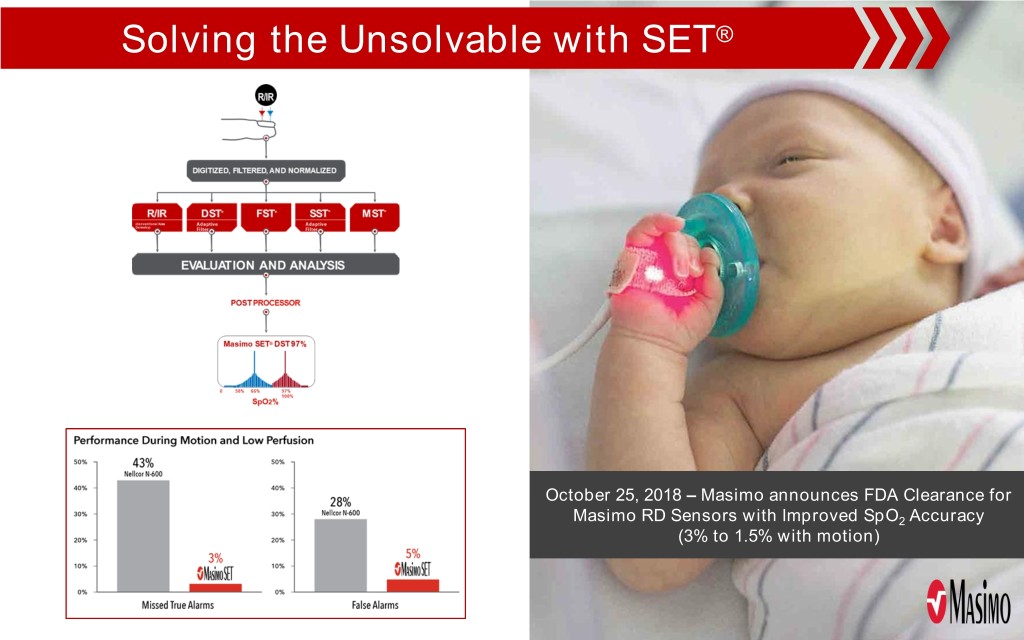

Solving the Unsolvable with SET® October 25, 2018 – Masimo announces FDA Clearance for Masimo RD Sensors with Improved SpO2 Accuracy (3% to 1.5% with motion)

Broad Portfolio of Innovative Technologies * Some products are not yet cleared in the U.S.

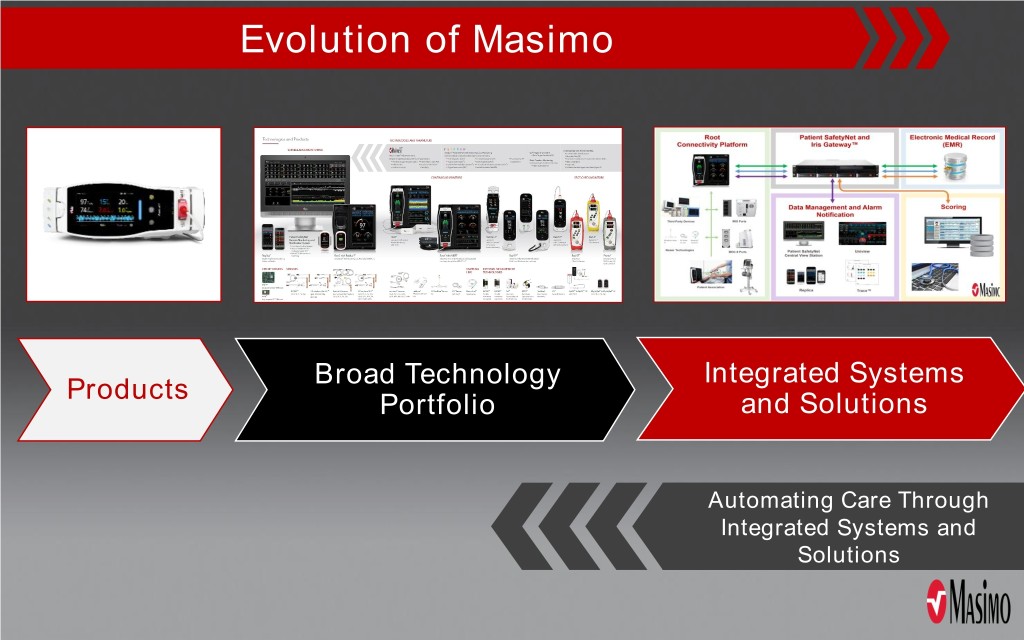

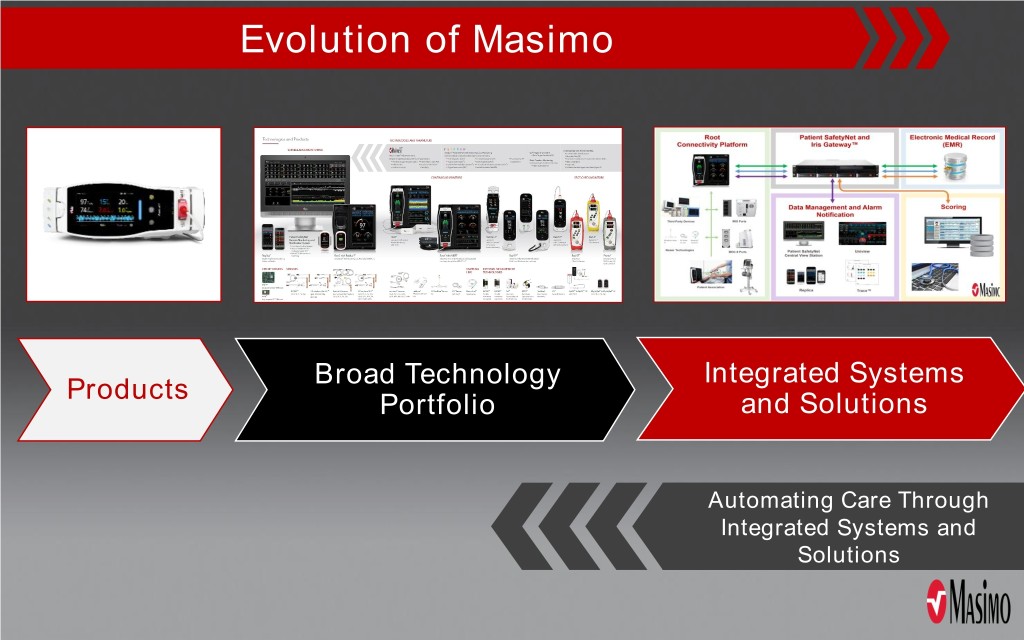

Evolution of Masimo Broad Technology Integrated Systems Products Portfolio and Solutions Automating Care Through Integrated Systems and Solutions

Automating Care

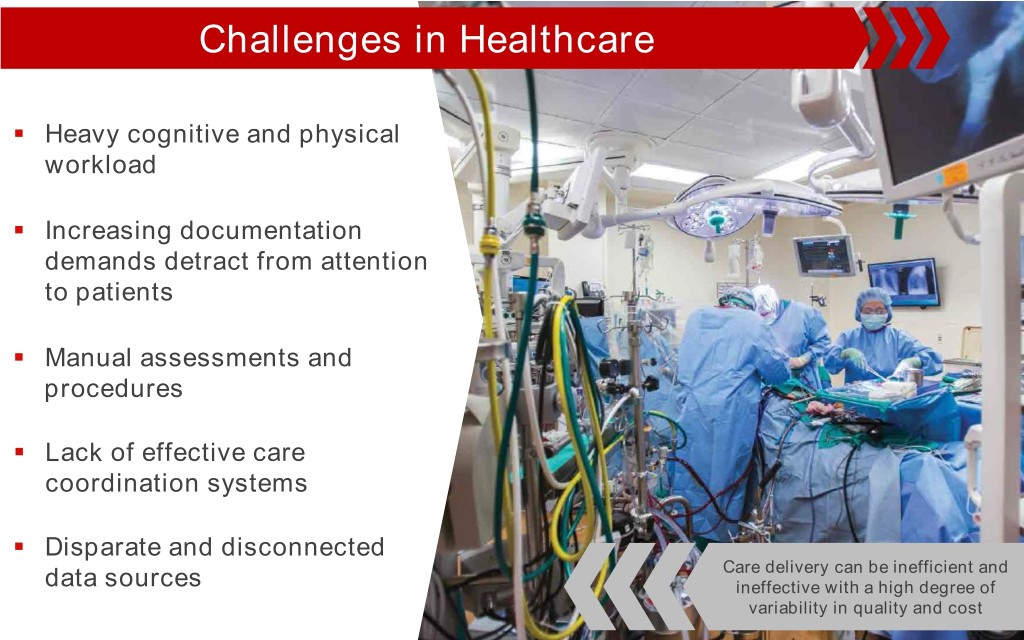

Challenges in Healthcare . Heavy cognitive and physical workload . Increasing documentation demands detract from attention to patients . Manual assessments and procedures . Lack of effective care coordination systems . Disparate and disconnected Care delivery can be inefficient and data sources ineffective with a high degree of variability in quality and cost

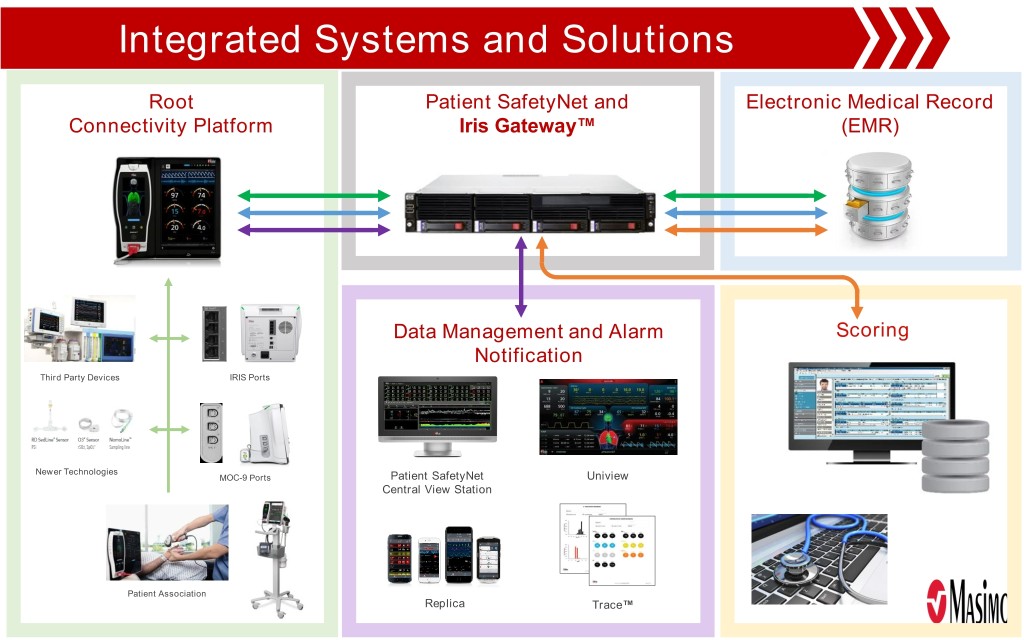

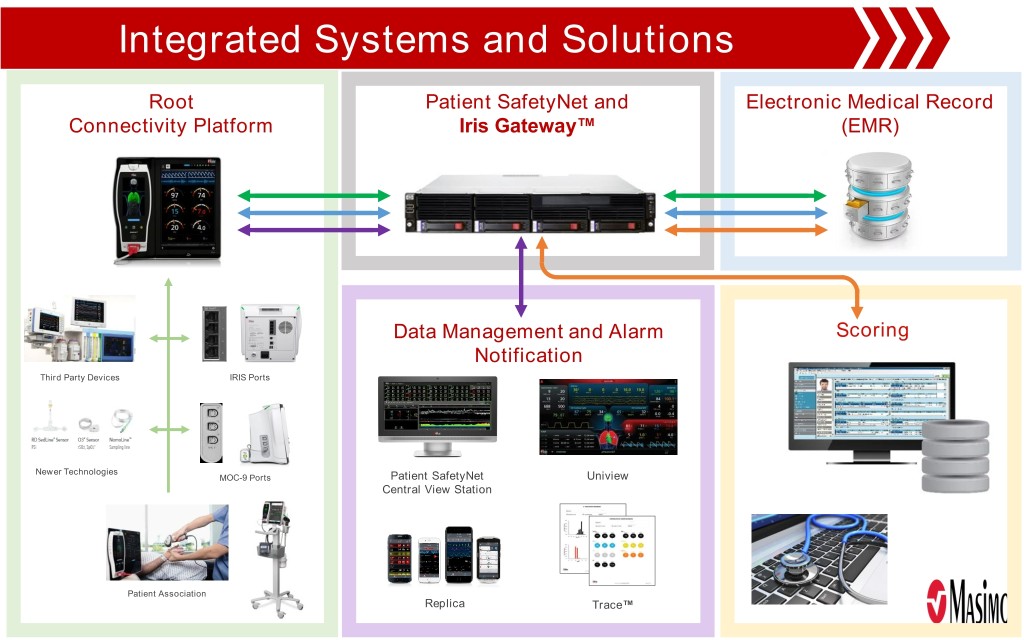

Integrated Systems and Solutions Root Patient SafetyNet and Electronic Medical Record Connectivity Platform Iris Gateway™ (EMR) Data Management and Alarm Scoring Notification Third Party Devices IRIS Ports Newer Technologies MOC-9 Ports Patient SafetyNet Uniview Central View Station Patient Association Replica Trace™

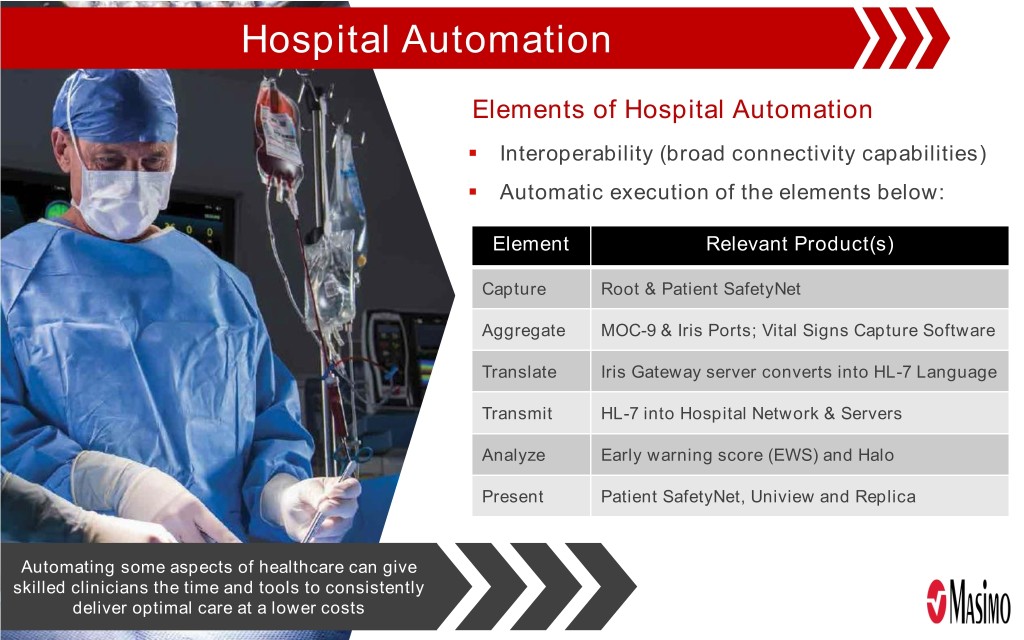

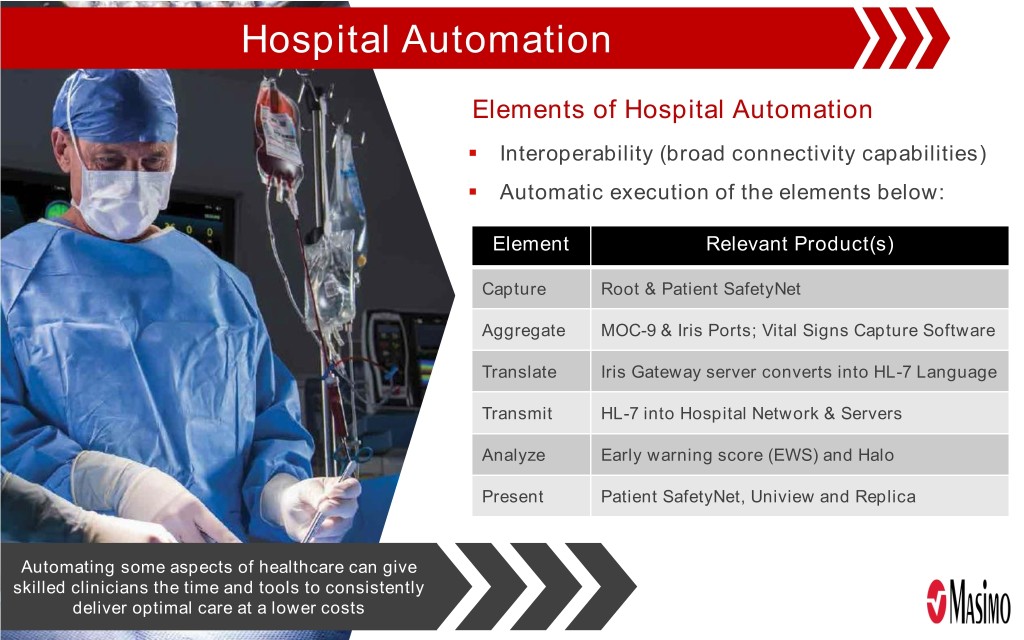

Hospital Automation Elements of Hospital Automation . Interoperability (broad connectivity capabilities) . Automatic execution of the elements below: Element Relevant Product(s) Capture Root & Patient SafetyNet Aggregate MOC-9 & Iris Ports; Vital Signs Capture Software Translate Iris Gateway server converts into HL-7 Language Transmit HL-7 into Hospital Network & Servers Analyze Early warning score (EWS) and Halo Present Patient SafetyNet, Uniview and Replica Automating some aspects of healthcare can give skilled clinicians the time and tools to consistently deliver optimal care at a lower costs

Opioid Safety

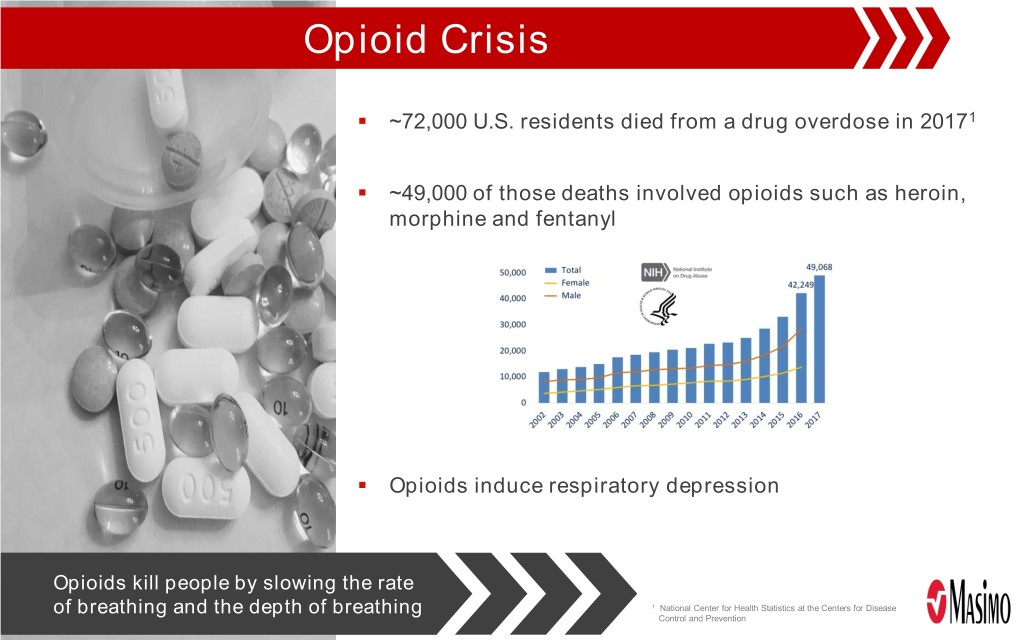

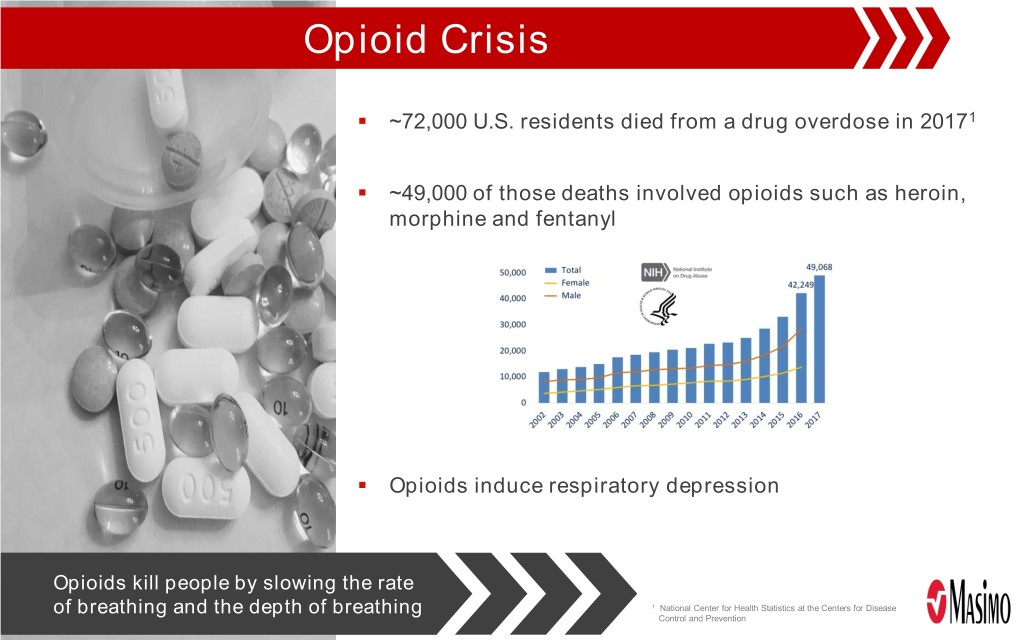

Opioid Crisis . ~72,000 U.S. residents died from a drug overdose in 20171 . ~49,000 of those deaths involved opioids such as heroin, morphine and fentanyl . Opioids induce respiratory depression Opioids kill people by slowing the rate of breathing and the depth of breathing 1 National Center for Health Statistics at the Centers for Disease Control and Prevention

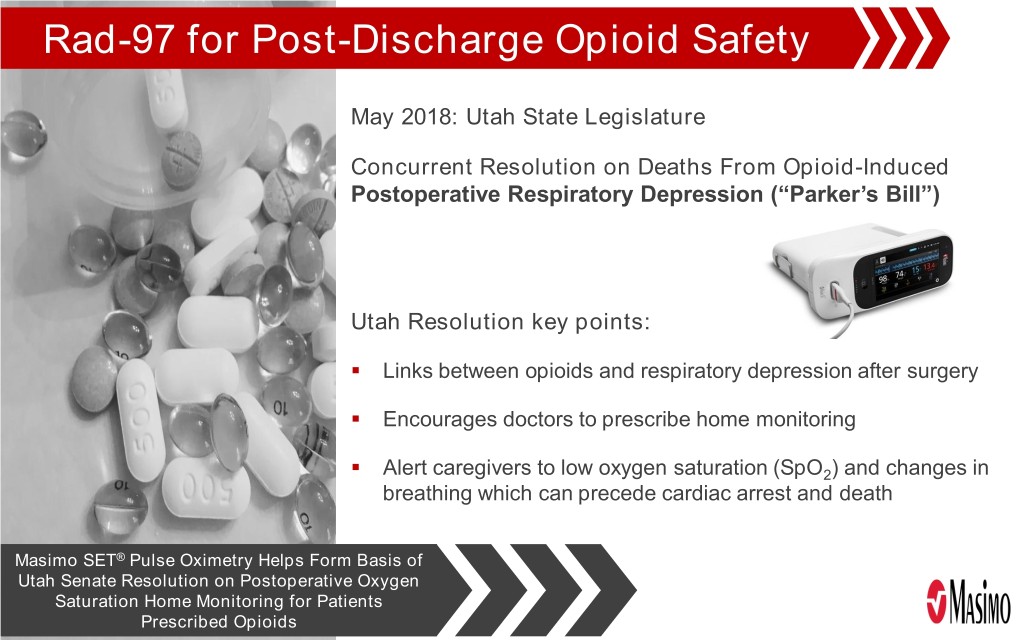

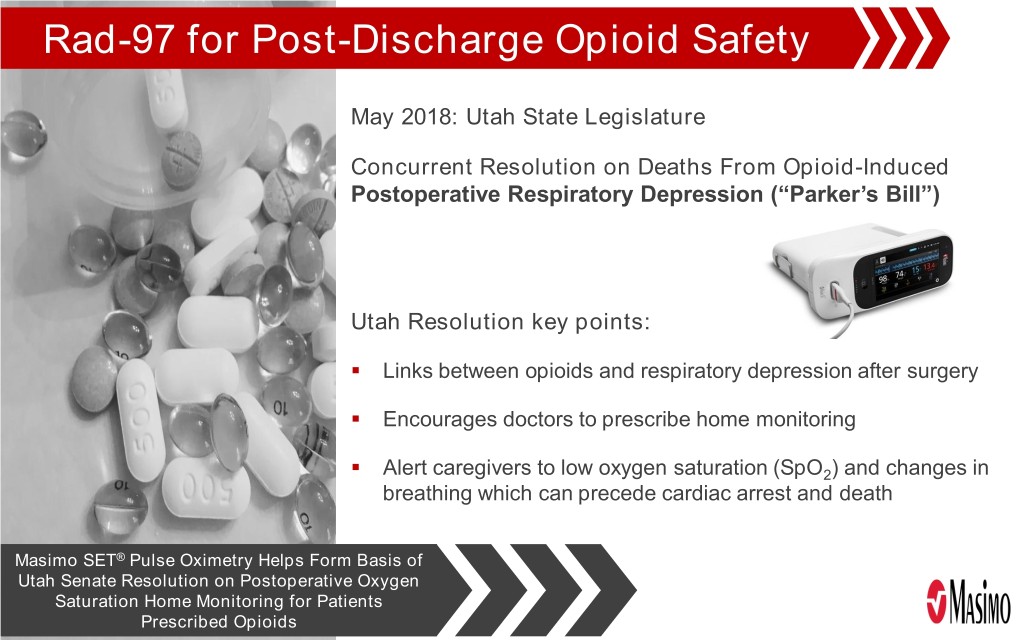

Rad-97 for Post-Discharge Opioid Safety May 2018: Utah State Legislature Concurrent Resolution on Deaths From Opioid-Induced Postoperative Respiratory Depression (“Parker’s Bill”) Utah Resolution key points: . Links between opioids and respiratory depression after surgery . Encourages doctors to prescribe home monitoring . Alert caregivers to low oxygen saturation (SpO2) and changes in breathing which can precede cardiac arrest and death Masimo SET® Pulse Oximetry Helps Form Basis of Utah Senate Resolution on Postoperative Oxygen Saturation Home Monitoring for Patients Prescribed Opioids

FDA Opioid Crisis Challenge . Masimo is 1 of 8 companies selected by the FDA from a group of 250 applicants . FDA review divisions and management will work closely with the companies selected . 90 day collaboration phase with 2 key objectives: 1. Create mutual understanding of the product profile including patient / user needs as well as important risks and benefits 2. Discuss the potential regulatory pathways going forward . Participants will eventually submit one or more formal applications . FDA review will be expedited Specifically Designed Home Use Product In Late Stage Development

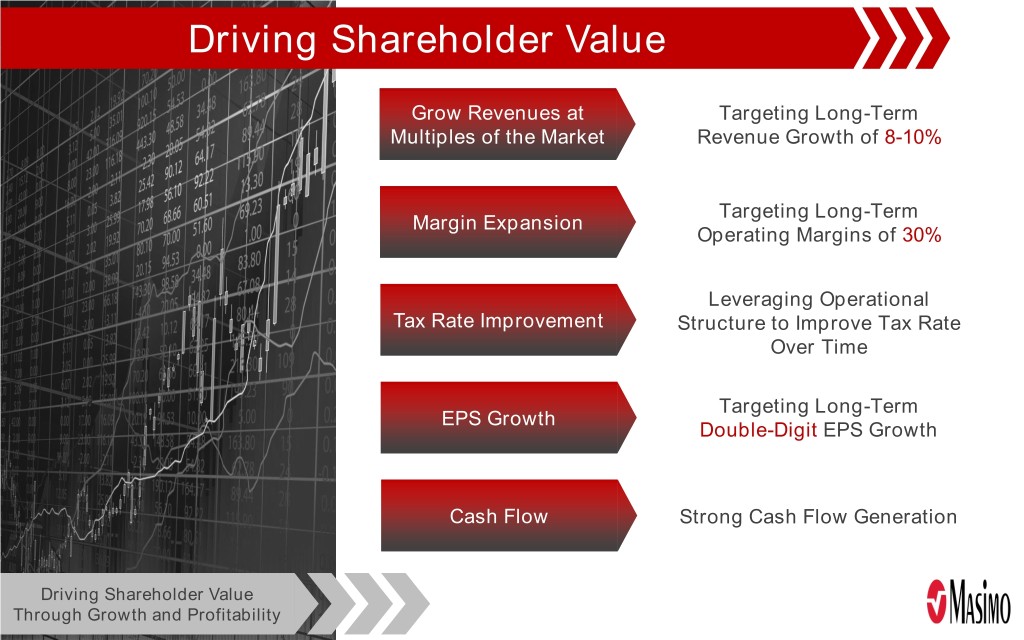

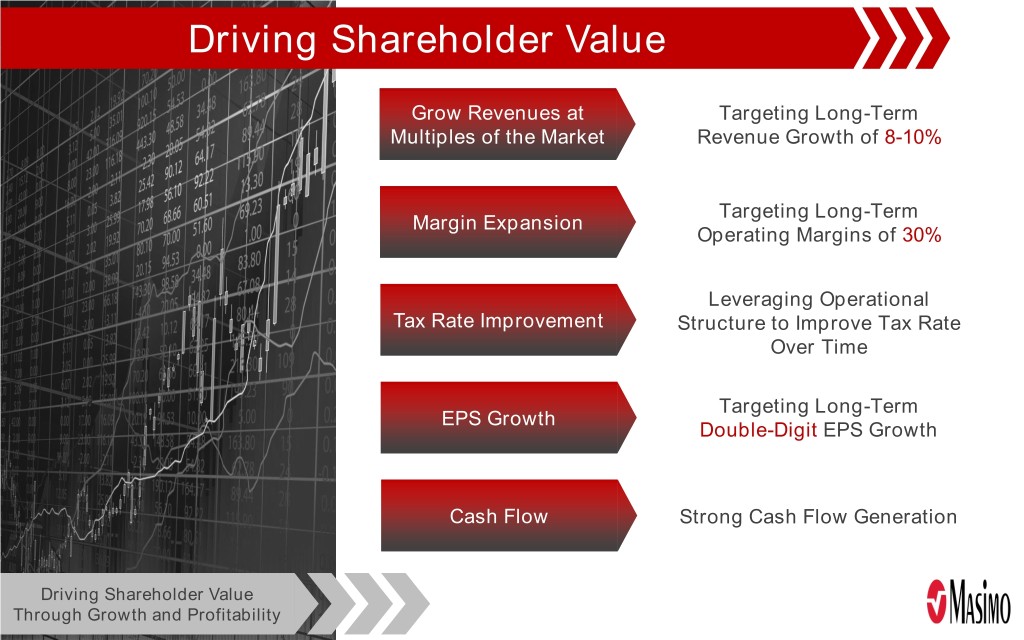

Driving Shareholder Value Grow Revenues at Multiples of the Market Margin Expansion Tax Rate Improvement EPS Growth Cash Flow

Revenue Growth Opportunities . SET growth continues . Large share of pulse oximetry market still available . General Floor expansion . Rainbow expansion opportunities – including partnership with large OEM . Expanding Markets . Nomoline™ capnography . SedLine™ brain function monitoring . O3® regional oximetry . Hospital Automation . Opioid Safety

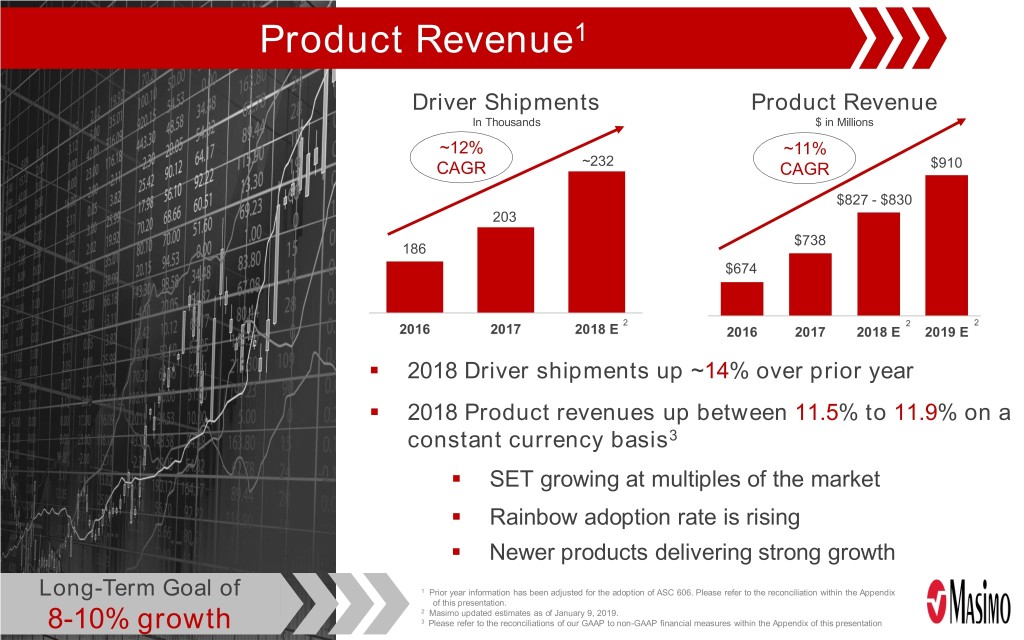

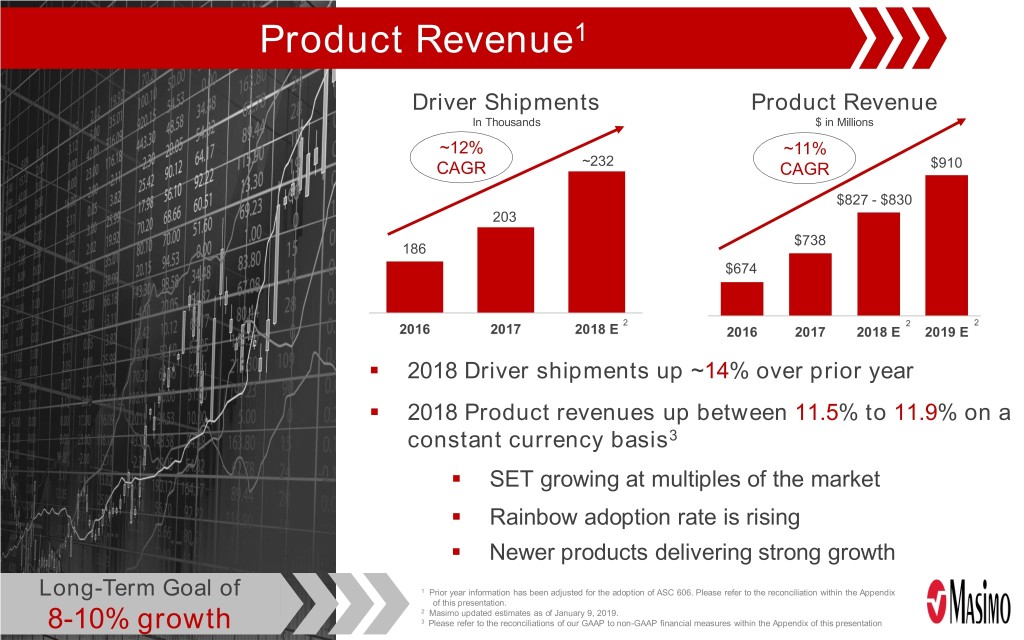

Product Revenue1 Driver Shipments Product Revenue In Thousands $ in Millions ~12% ~11% CAGR ~232 CAGR $910 $827 - $830 203 $738 186 $674 2 2 2 . 2018 Driver shipments up ~14% over prior year . 2018 Product revenues up between 11.5% to 11.9% on a constant currency basis3 . SET growing at multiples of the market . Rainbow adoption rate is rising . Newer products delivering strong growth Long-Term Goal of 1 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the Appendix of this presentation. 2 Masimo updated estimates as of January 9, 2019. 8-10% growth 3 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation

Non-GAAP Gross Margin %1 Total Gross Margin % Product Gross Margin % (Including Royalty & NRE) (Excluding Royalty & NRE) 67.2% 130 bps 66.8% 66.8% 66.8% improvement 1.7% 66.1% 1.0% 65.8% 65.5% 1.9% 66.8% 65.5% 65.8% 64.2% 64.2% 2 3 2 3 Royalty & NRE . RD sensor line conversion . Asset efficiencies . Design for manufacturing . Supply chain efficiencies . Manufacturing scale . Freight cost reductions Long-Term Goal of 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation. 2 Masimo 2018 financial guidance as of October 31, 2018. 70% 3 Masimo updated estimates as of January 9, 2019.

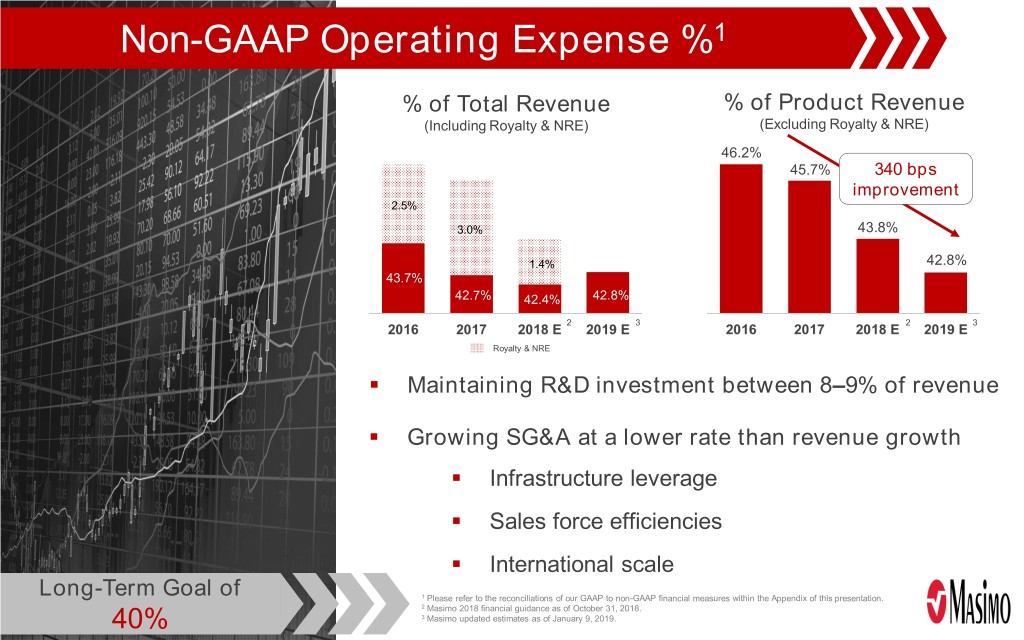

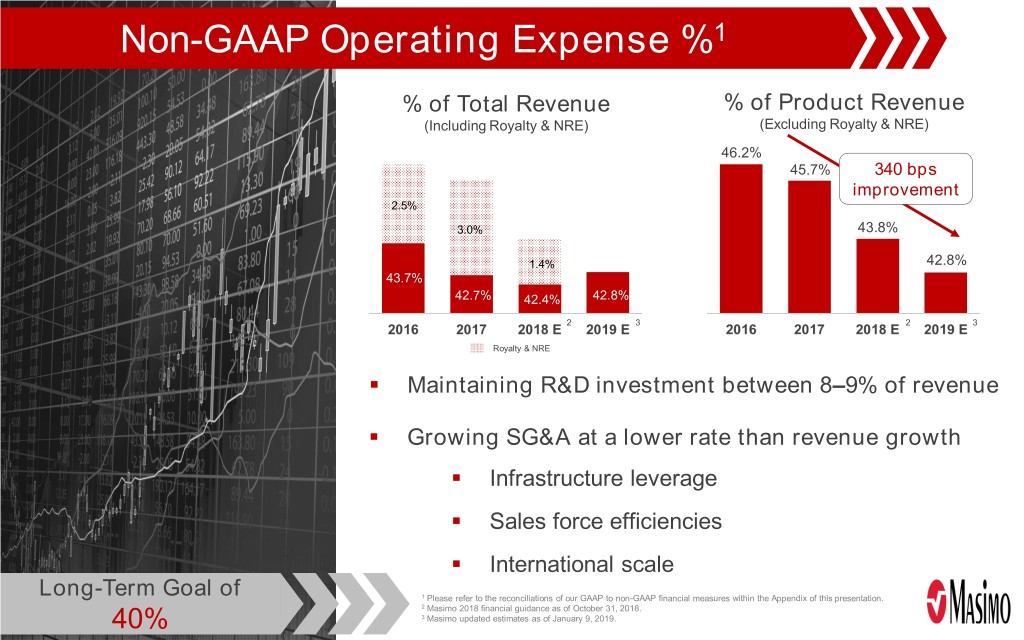

Non-GAAP Operating Expense %1 % of Total Revenue % of Product Revenue (Including Royalty & NRE) (Excluding Royalty & NRE) 46.2% 45.7% 340 bps improvement 2.5% 3.0% 43.8% 1.4% 42.8% 43.7% 42.7% 42.4% 42.8% 2 3 2 3 Royalty & NRE . Maintaining R&D investment between 8–9% of revenue . Growing SG&A at a lower rate than revenue growth . Infrastructure leverage . Sales force efficiencies . International scale Long-Term Goal of 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation. 2 Masimo 2018 financial guidance as of October 31, 2018. 40% 3 Masimo updated estimates as of January 9, 2019.

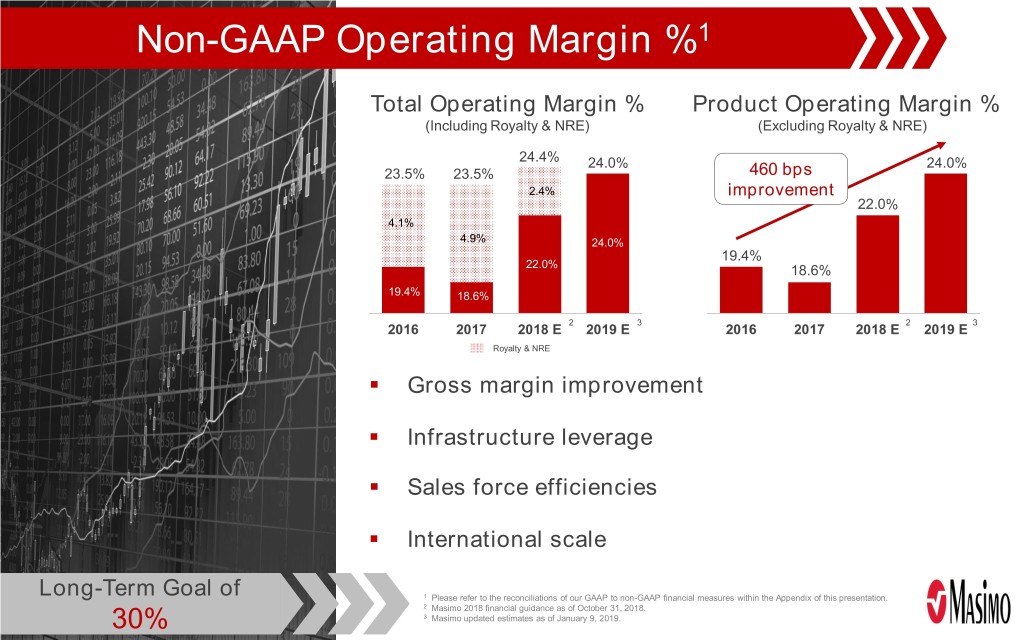

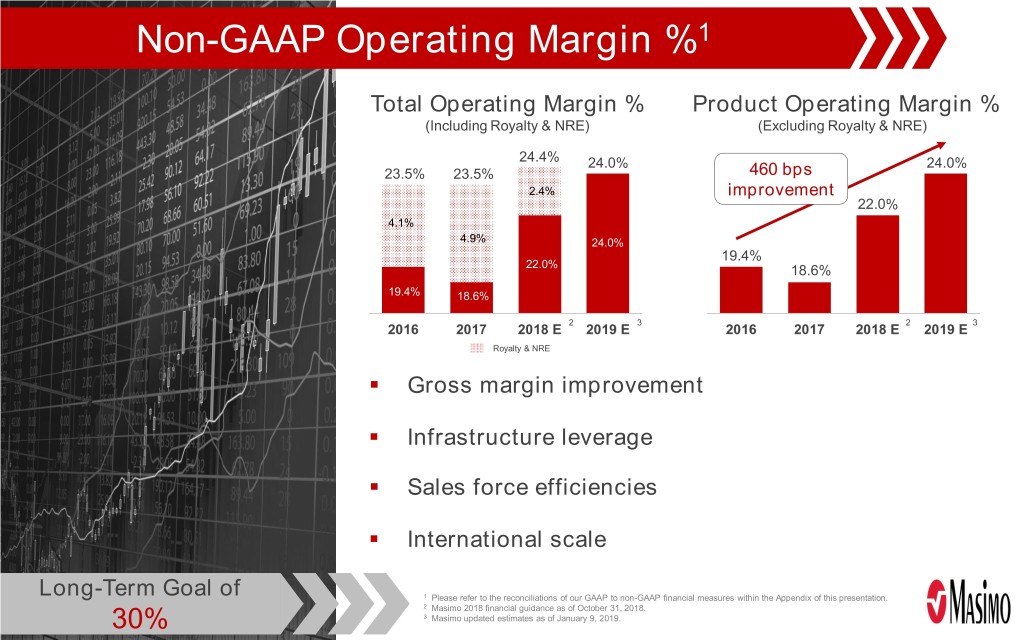

Non-GAAP Operating Margin %1 Total Operating Margin % Product Operating Margin % (Including Royalty & NRE) (Excluding Royalty & NRE) 24.4% 24.0% 24.0% 23.5% 23.5% 460 bps 2.4% improvement 22.0% 4.1% 4.9% 24.0% 19.4% 22.0% 18.6% 19.4% 18.6% 2 3 2 3 Royalty & NRE . Gross margin improvement . Infrastructure leverage . Sales force efficiencies . International scale Long-Term Goal of 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation. 2 Masimo 2018 financial guidance as of October 31, 2018. 30% 3 Masimo updated estimates as of January 9, 2019.

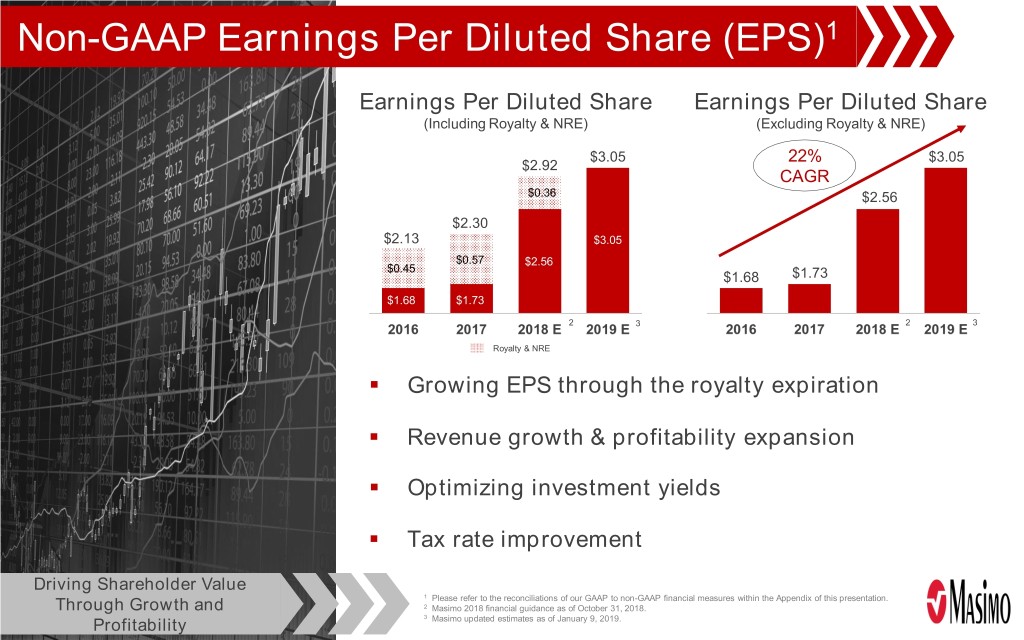

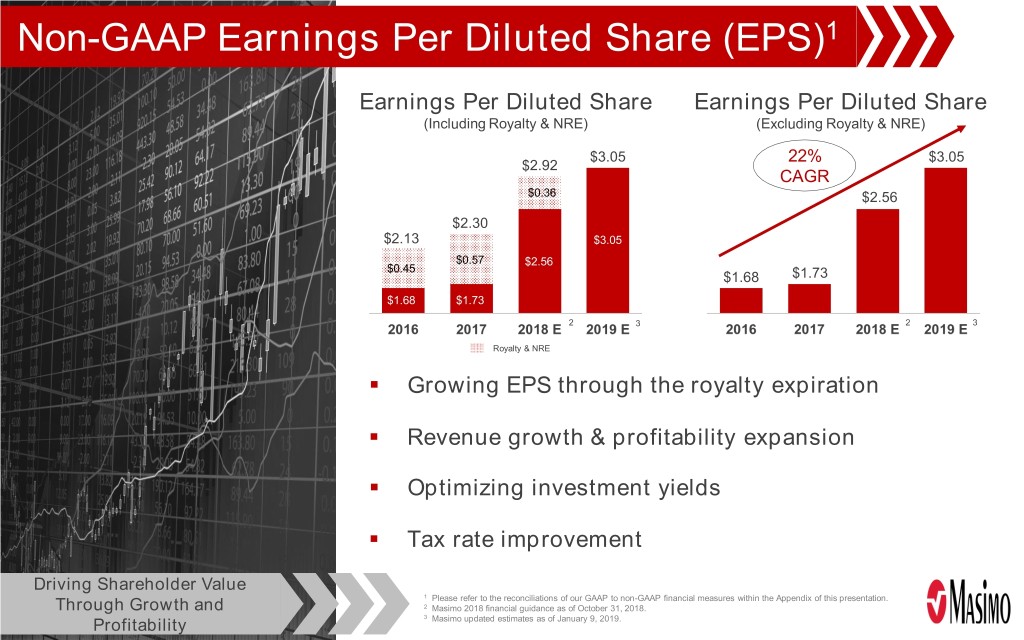

Non-GAAP Earnings Per Diluted Share (EPS)1 Earnings Per Diluted Share Earnings Per Diluted Share (Including Royalty & NRE) (Excluding Royalty & NRE) $3.05 22% $3.05 $2.92 CAGR $0.36 $2.56 $2.30 $2.13 $3.05 $0.57 $2.56 $0.45 $1.68 $1.73 $1.68 $1.73 2 3 2 3 Royalty & NRE . Growing EPS through the royalty expiration . Revenue growth & profitability expansion . Optimizing investment yields . Tax rate improvement Driving Shareholder Value 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation. Through Growth and 2 Masimo 2018 financial guidance as of October 31, 2018. 3 Profitability Masimo updated estimates as of January 9, 2019.

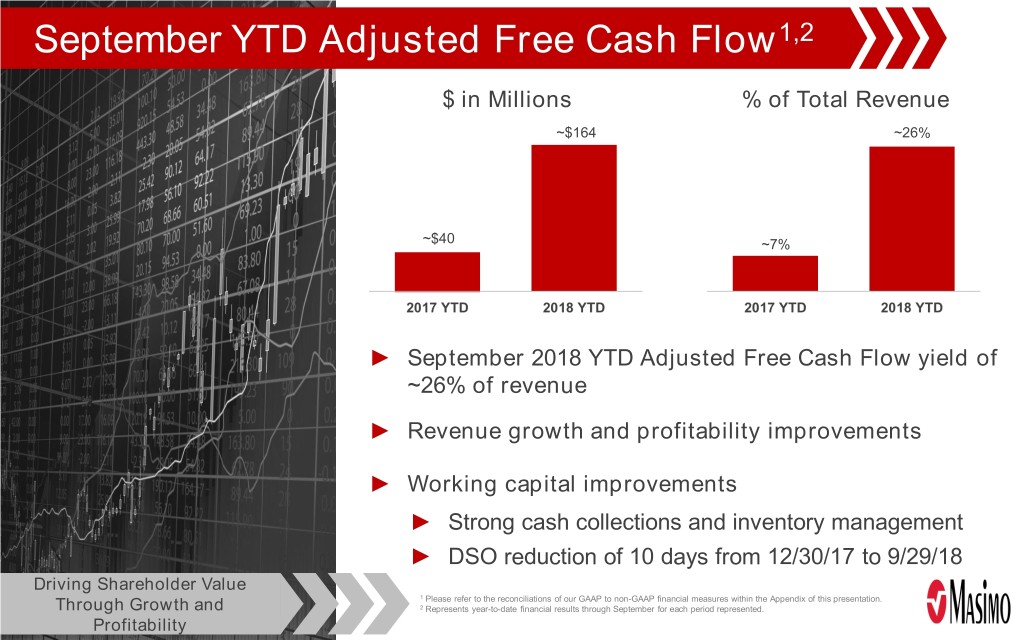

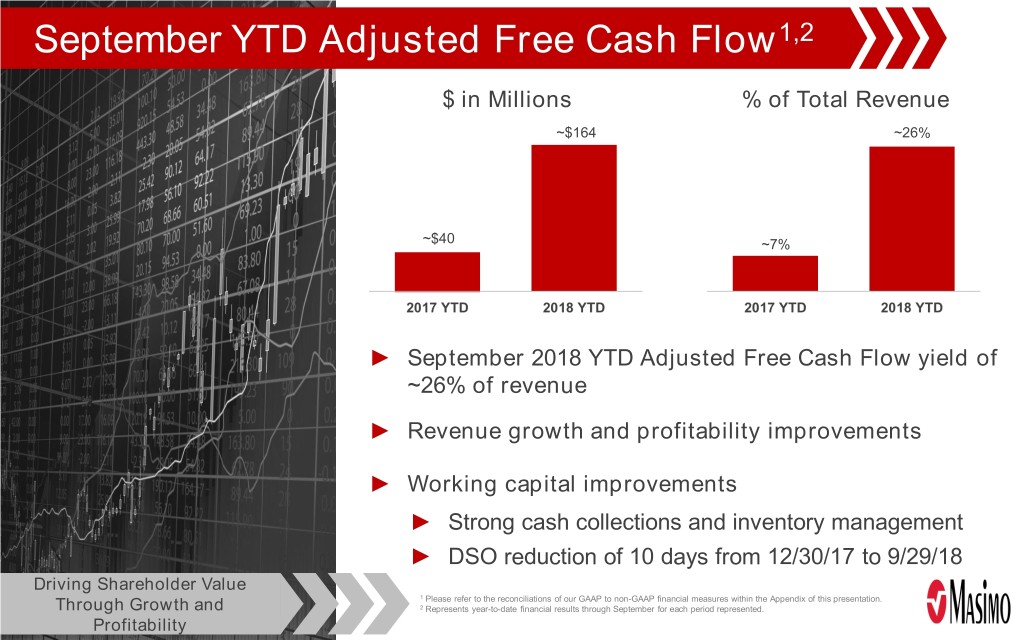

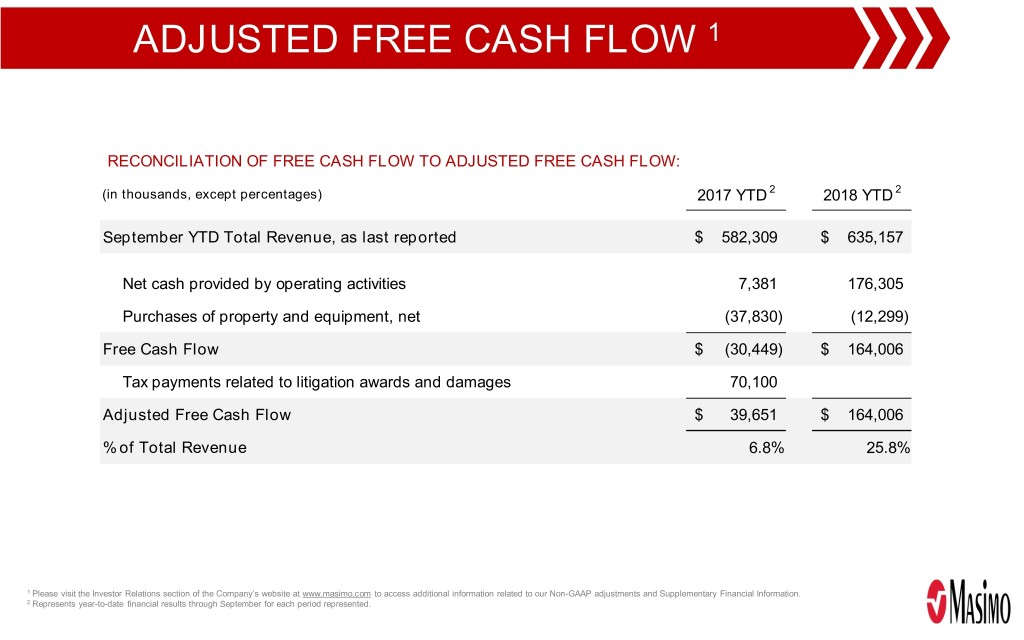

September YTD Adjusted Free Cash Flow1,2 $ in Millions % of Total Revenue ~$164 ~26% ~$40 ~7% ► September 2018 YTD Adjusted Free Cash Flow yield of ~26% of revenue ► Revenue growth and profitability improvements ► Working capital improvements ► Strong cash collections and inventory management ► DSO reduction of 10 days from 12/30/17 to 9/29/18 Driving Shareholder Value 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the Appendix of this presentation. Through Growth and 2 Represents year-to-date financial results through September for each period represented. Profitability

Driving Shareholder Value Grow Revenues at Targeting Long-Term Multiples of the Market Revenue Growth of 8-10% Targeting Long-Term Margin Expansion Operating Margins of 30% Leveraging Operational Tax Rate Improvement Structure to Improve Tax Rate Over Time Targeting Long-Term EPS Growth Double-Digit EPS Growth Cash Flow Strong Cash Flow Generation Driving Shareholder Value Through Growth and Profitability

THANK YOU!

APPENDIX RECONCILIATIONS: ► Adjustments related to the Adoption of ASC 606 ► GAAP to Non-GAAP Financial Measures

Description of Non-GAAP Adjustments The non-GAAP financial measures reflect adjustments for the following items, as well as the related income tax effects thereof: Constant currency adjustments. Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period to period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our product revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our product revenue growth rate will continue to occur in future periods. Acquisition-related costs, including depreciation and amortization. Depreciation and amortization related to the revaluation of assets and liabilities (primarily intangible assets, property, plant and equipment adjustments, inventory revaluation, lease liabilities, etc.) to fair value through purchase accounting related to value created by the seller prior to the acquisition rather than ongoing costs of operating our core business. As a result, we believe that exclusion of these costs in presenting non-GAAP financial measures provides management and investors a more effective means of evaluating historical performance and projected costs and the potential for realizing cost efficiencies within our core business. Depreciation and amortization related to the revaluation of acquisition related assets and liabilities will generally recur in future periods. Litigation damages, awards and settlements. In connection with litigation proceedings arising in the course of our business, we have recorded expenses as a defendant in such proceedings in the form of damages, as well as gains as a plaintiff in such proceedings in the form of litigation awards and settlement proceeds; most recently in connection with our November 2016 settlement agreement with Koninklijke Philips N.V. We believe that exclusion of these gains and losses is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these expenses and gains are generally unrelated to our core business and/or infrequent in nature.

Description of Non-GAAP Adjustments (cont.) Realized and unrealized gains or losses from foreign currency transactions. We are exposed to foreign currency gains or losses on outstanding foreign currency denominated receivables and payables related to certain customer sales agreements, product costs and other operating expenses. As the Company does not actively hedge these currency exposures, changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Since such realized and unrealized foreign currency gains and losses are the result of macro-economic factors and can vary significantly from one period to the next, we believe that exclusion of such realized and unrealized gains and losses are useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Realized and unrealized foreign currency gains and losses are likely to recur in future periods. Excess tax benefits from stock-based compensation. Current authoritative accounting guidance requires that excess tax benefits or costs recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. Since we cannot control or predict when stock option awards will be exercised or the price at which such awards will be exercised, the impact of such guidance can create significant volatility in our effective tax rate from one period to the next. We believe that exclusion of these excess tax benefits or costs is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. These excess tax benefits or costs will generally recur in future periods as long as we continue to issue equity awards to our employees. Tax impacts that may not be representative of the ongoing results of our core operations. The Tax Cuts and Jobs Act of 2017 (2017 Tax Act) was signed into law in December 2017, and became effective January 1, 2018. The 2017 Tax Act included a number of changes to existing U.S. federal tax law impacting businesses including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21%, a one-time transition tax on the “deemed repatriation” of cumulative undistributed foreign earnings as of December 31, 2017 and changes in the prospective taxation of the foreign operations of U.S. multinational companies. From time to time, we record tax benefits relating to the derecognition of uncertain tax positions due to the expiration of the statutes of limitations. During the twelve months ended December 29, 2018, we recorded a significant tax benefit due to the expiration of the applicable statutes of limitations related to certain non-recurring transactions. We believe that exclusion of the tax charges related to the 2017 Tax Act and the tax benefit resulting from the expiration of certain statutes of limitations related to non-recurring transactions is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these tax items are unrelated to our core business and non-recurring in nature.

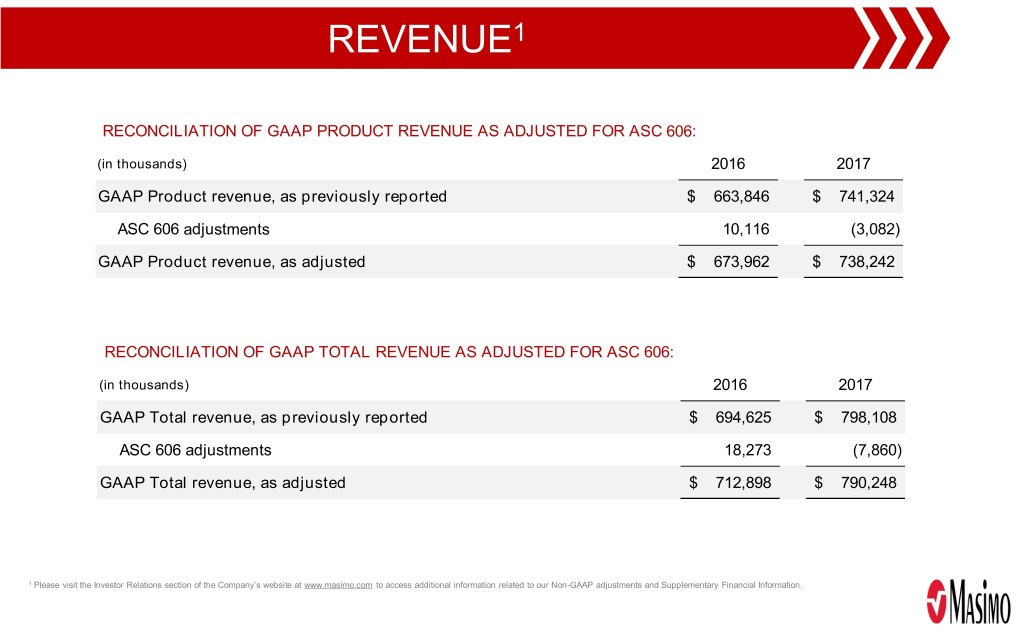

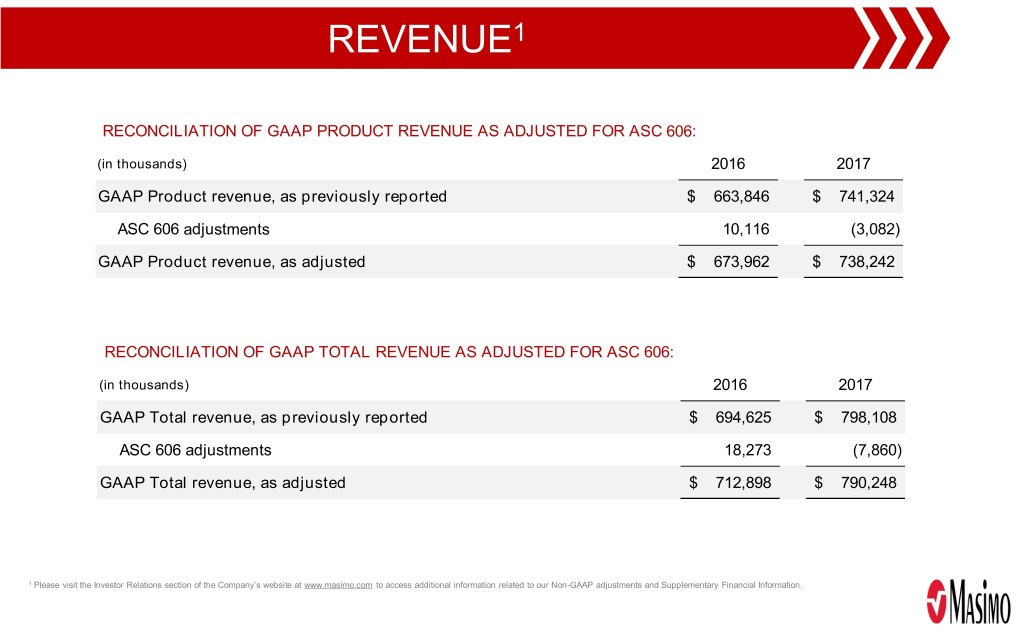

REVENUE1 RECONCILIATION OF GAAP PRODUCT REVENUE AS ADJUSTED FOR ASC 606: (in thousands) 2016 2017 GAAP Product revenue, as previously reported $ 663,846 $ 741,324 ASC 606 adjustments 10,116 (3,082) GAAP Product revenue, as adjusted $ 673,962 $ 738,242 RECONCILIATION OF GAAP TOTAL REVENUE AS ADJUSTED FOR ASC 606: (in thousands) 2016 2017 GAAP Total revenue, as previously reported $ 694,625 $ 798,108 ASC 606 adjustments 18,273 (7,860) GAAP Total revenue, as adjusted $ 712,898 $ 790,248 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

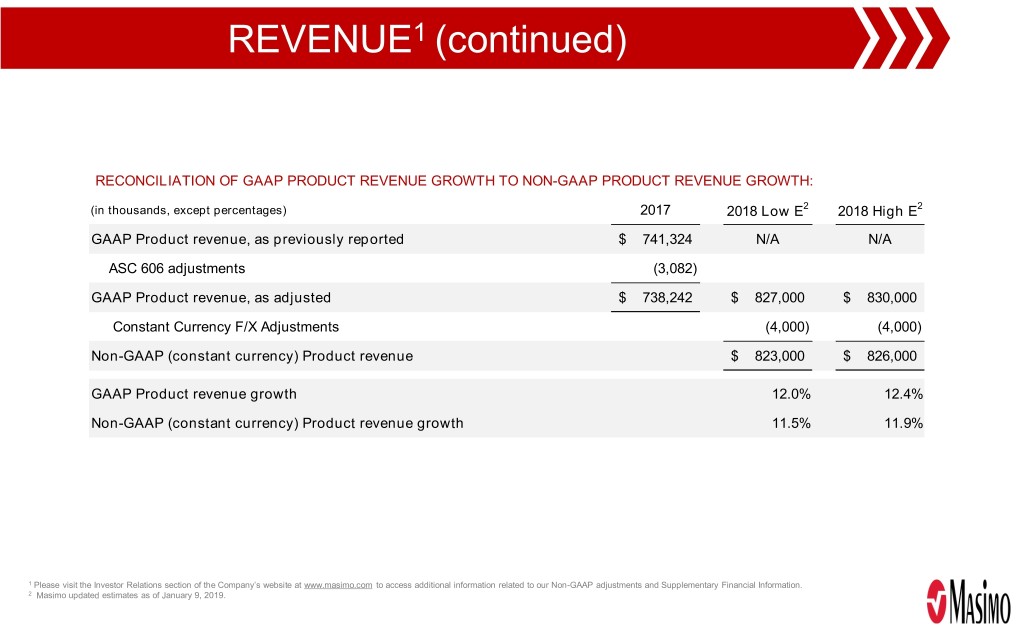

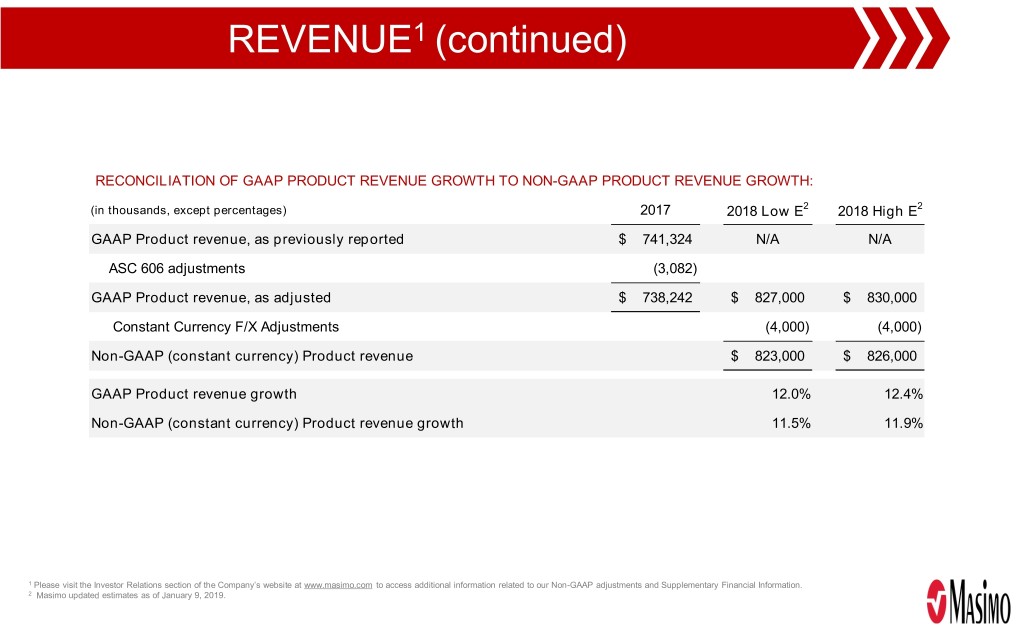

REVENUE1 (continued) RECONCILIATION OF GAAP PRODUCT REVENUE GROWTH TO NON-GAAP PRODUCT REVENUE GROWTH: (in thousands, except percentages) 2017 2018 Low E2 2018 High E2 GAAP Product revenue, as previously reported $ 741,324 N/A N/A ASC 606 adjustments (3,082) GAAP Product revenue, as adjusted $ 738,242 $ 827,000 $ 830,000 Constant Currency F/X Adjustments (4,000) (4,000) Non-GAAP (constant currency) Product revenue $ 823,000 $ 826,000 GAAP Product revenue growth 12.0% 12.4% Non-GAAP (constant currency) Product revenue growth 11.5% 11.9% 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. 2 Masimo updated estimates as of January 9, 2019.

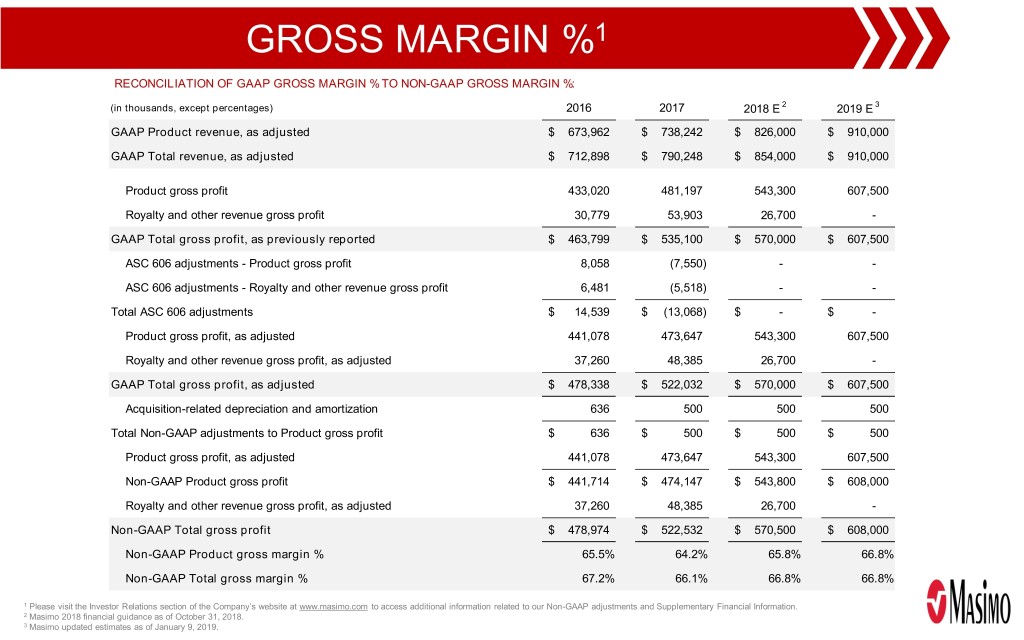

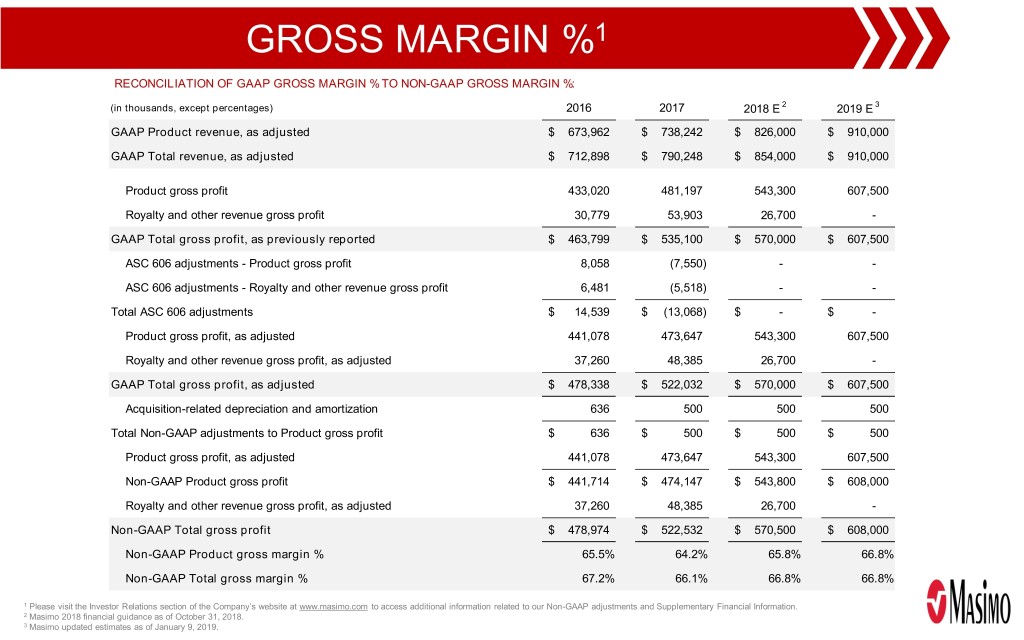

GROSS MARGIN %1 RECONCILIATION OF GAAP GROSS MARGIN % TO NON-GAAP GROSS MARGIN %: 2 3 (in thousands, except percentages) 2016 2017 2018 E 2019 E GAAP Product revenue, as adjusted $ 673,962 $ 738,242 $ 826,000 $ 910,000 GAAP Total revenue, as adjusted $ 712,898 $ 790,248 $ 854,000 $ 910,000 Product gross profit 433,020 481,197 543,300 607,500 Royalty and other revenue gross profit 30,779 53,903 26,700 - GAAP Total gross profit, as previously reported $ 463,799 $ 535,100 $ 570,000 $ 607,500 ASC 606 adjustments - Product gross profit 8,058 (7,550) - - ASC 606 adjustments - Royalty and other revenue gross profit 6,481 (5,518) - - Total ASC 606 adjustments $ 14,539 $ (13,068) $ - $ - Product gross profit, as adjusted 441,078 473,647 543,300 607,500 Royalty and other revenue gross profit, as adjusted 37,260 48,385 26,700 - GAAP Total gross profit, as adjusted $ 478,338 $ 522,032 $ 570,000 $ 607,500 Acquisition-related depreciation and amortization 636 500 500 500 Total Non-GAAP adjustments to Product gross profit $ 636 $ 500 $ 500 $ 500 Product gross profit, as adjusted 441,078 473,647 543,300 607,500 Non-GAAP Product gross profit $ 441,714 $ 474,147 $ 543,800 $ 608,000 Royalty and other revenue gross profit, as adjusted 37,260 48,385 26,700 - Non-GAAP Total gross profit $ 478,974 $ 522,532 $ 570,500 $ 608,000 Non-GAAP Product gross margin % 65.5% 64.2% 65.8% 66.8% Non-GAAP Total gross margin % 67.2% 66.1% 66.8% 66.8% 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. 2 Masimo 2018 financial guidance as of October 31, 2018. 3 Masimo updated estimates as of January 9, 2019.

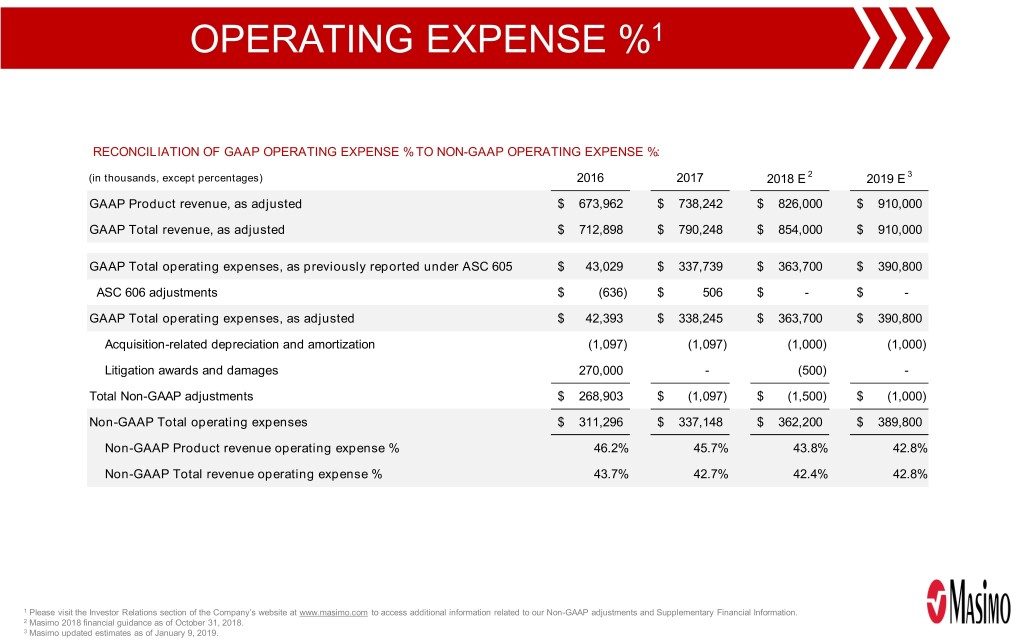

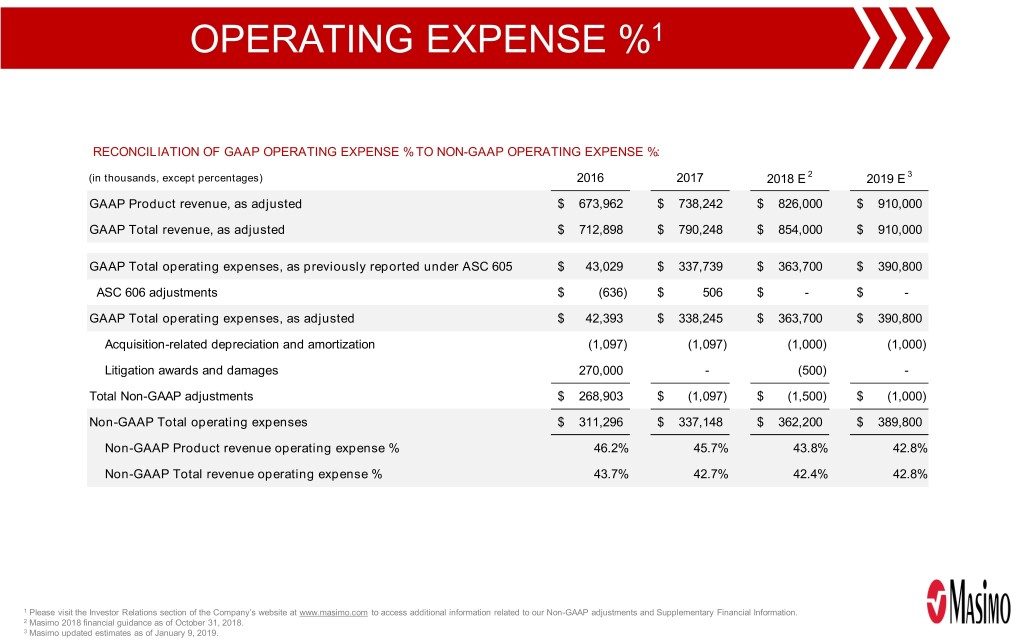

OPERATING EXPENSE %1 RECONCILIATION OF GAAP OPERATING EXPENSE % TO NON-GAAP OPERATING EXPENSE %: 2 3 (in thousands, except percentages) 2016 2017 2018 E 2019 E GAAP Product revenue, as adjusted $ 673,962 $ 738,242 $ 826,000 $ 910,000 GAAP Total revenue, as adjusted $ 712,898 $ 790,248 $ 854,000 $ 910,000 GAAP Total operating expenses, as previously reported under ASC 605 $ 43,029 $ 337,739 $ 363,700 $ 390,800 ASC 606 adjustments $ (636) $ 506 $ - $ - GAAP Total operating expenses, as adjusted $ 42,393 $ 338,245 $ 363,700 $ 390,800 Acquisition-related depreciation and amortization (1,097) (1,097) (1,000) (1,000) Litigation awards and damages 270,000 - (500) - Total Non-GAAP adjustments $ 268,903 $ (1,097) $ (1,500) $ (1,000) Non-GAAP Total operating expenses $ 311,296 $ 337,148 $ 362,200 $ 389,800 Non-GAAP Product revenue operating expense % 46.2% 45.7% 43.8% 42.8% Non-GAAP Total revenue operating expense % 43.7% 42.7% 42.4% 42.8% 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. 2 Masimo 2018 financial guidance as of October 31, 2018. 3 Masimo updated estimates as of January 9, 2019.

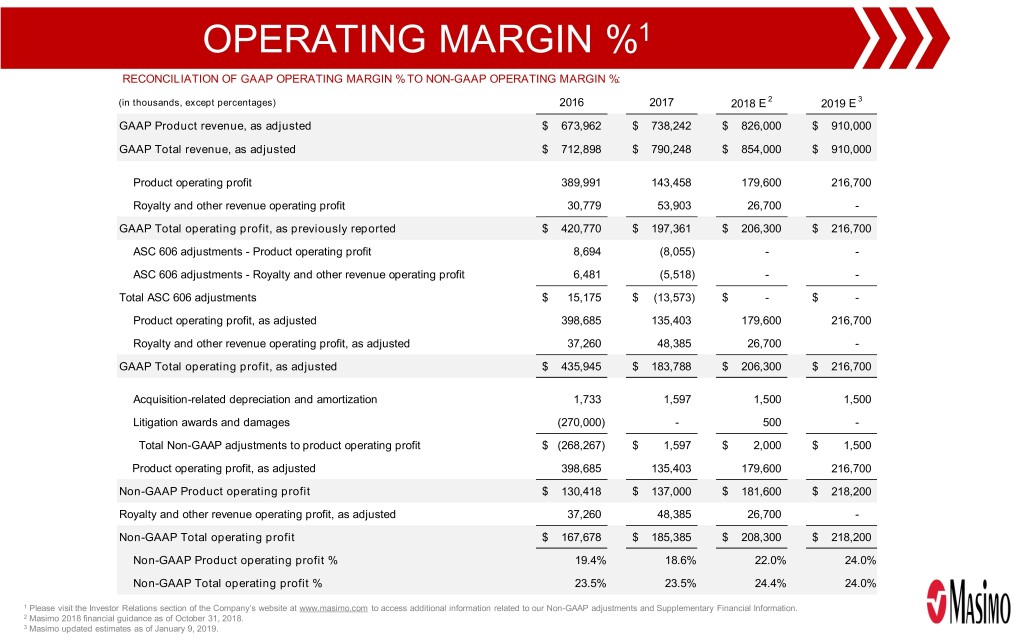

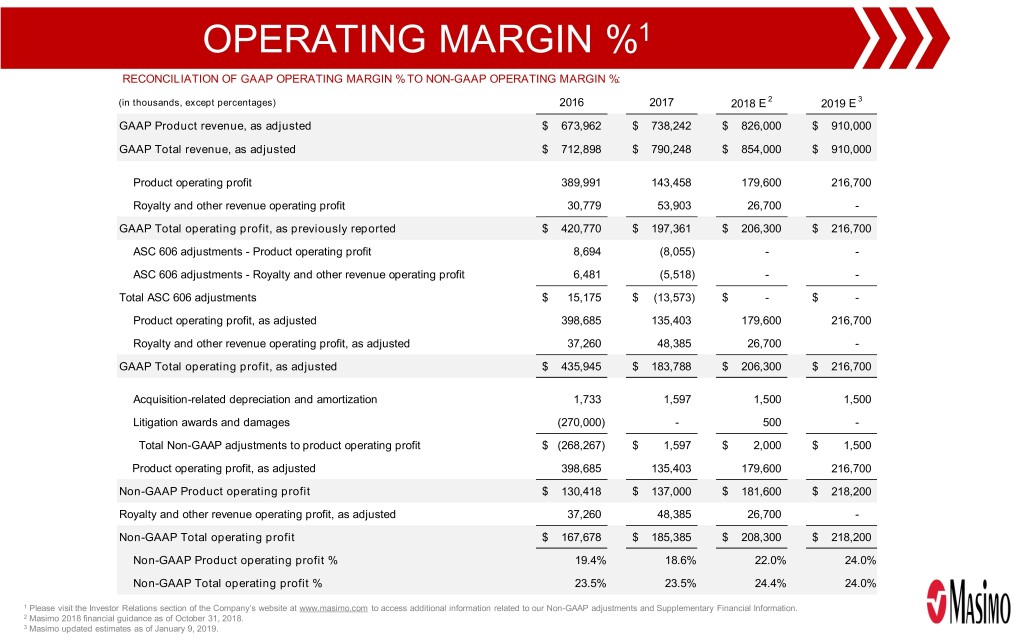

OPERATING MARGIN %1 RECONCILIATION OF GAAP OPERATING MARGIN % TO NON-GAAP OPERATING MARGIN %: 2 3 (in thousands, except percentages) 2016 2017 2018 E 2019 E GAAP Product revenue, as adjusted $ 673,962 $ 738,242 $ 826,000 $ 910,000 GAAP Total revenue, as adjusted $ 712,898 $ 790,248 $ 854,000 $ 910,000 Product operating profit 389,991 143,458 179,600 216,700 Royalty and other revenue operating profit 30,779 53,903 26,700 - GAAP Total operating profit, as previously reported $ 420,770 $ 197,361 $ 206,300 $ 216,700 ASC 606 adjustments - Product operating profit 8,694 (8,055) - - ASC 606 adjustments - Royalty and other revenue operating profit 6,481 (5,518) - - Total ASC 606 adjustments $ 15,175 $ (13,573) $ - $ - Product operating profit, as adjusted 398,685 135,403 179,600 216,700 Royalty and other revenue operating profit, as adjusted 37,260 48,385 26,700 - GAAP Total operating profit, as adjusted $ 435,945 $ 183,788 $ 206,300 $ 216,700 Acquisition-related depreciation and amortization 1,733 1,597 1,500 1,500 Litigation awards and damages (270,000) - 500 - Total Non-GAAP adjustments to product operating profit $ (268,267) $ 1,597 $ 2,000 $ 1,500 Product operating profit, as adjusted 398,685 135,403 179,600 216,700 Non-GAAP Product operating profit $ 130,418 $ 137,000 $ 181,600 $ 218,200 Royalty and other revenue operating profit, as adjusted 37,260 48,385 26,700 - Non-GAAP Total operating profit $ 167,678 $ 185,385 $ 208,300 $ 218,200 Non-GAAP Product operating profit % 19.4% 18.6% 22.0% 24.0% Non-GAAP Total operating profit % 23.5% 23.5% 24.4% 24.0% 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. 2 Masimo 2018 financial guidance as of October 31, 2018. 3 Masimo updated estimates as of January 9, 2019.

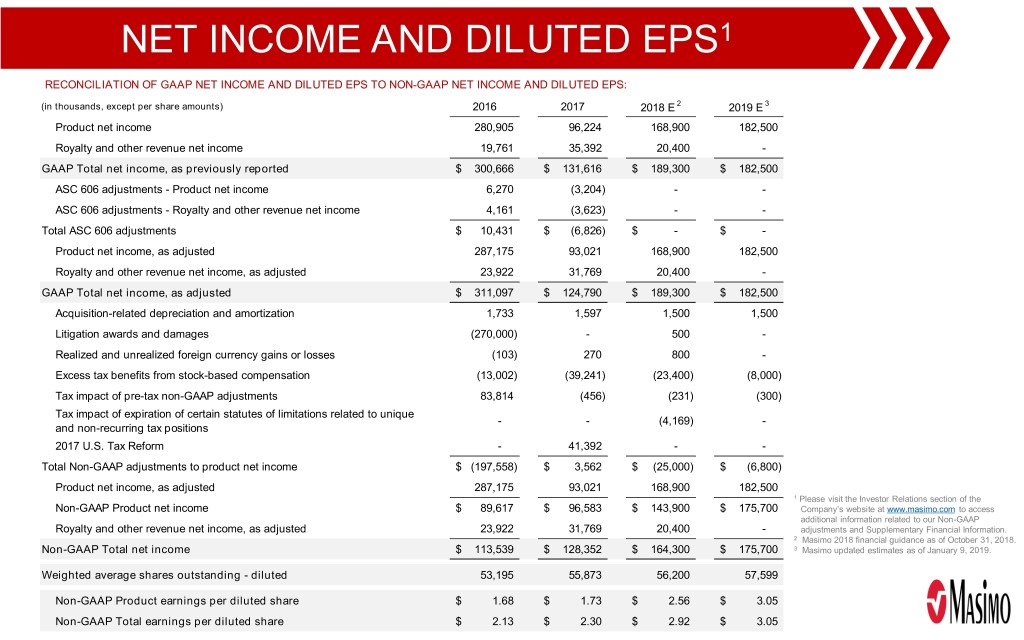

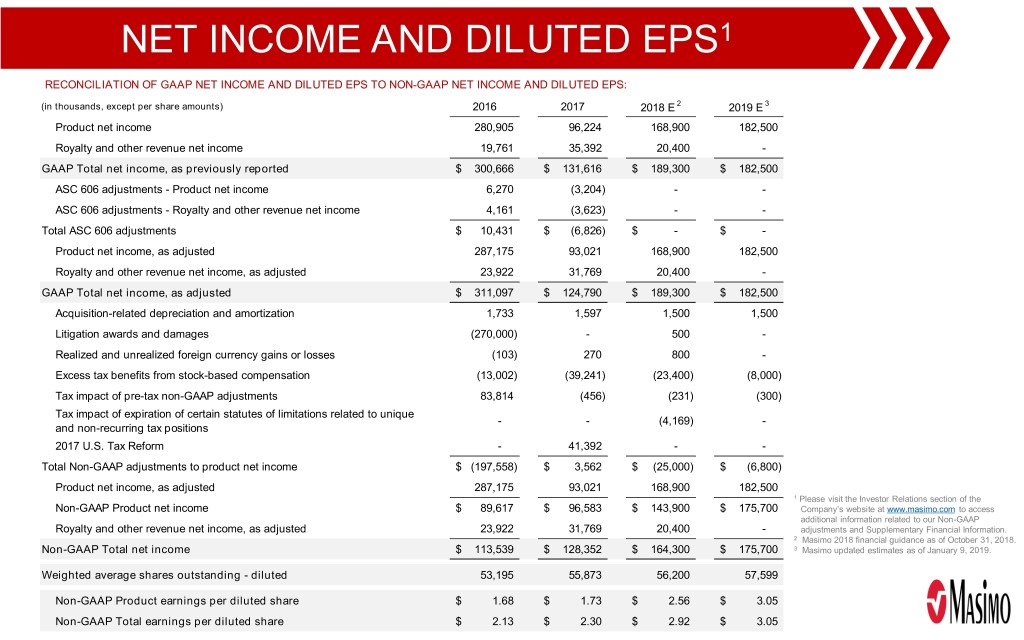

NET INCOME AND DILUTED EPS1 RECONCILIATION OF GAAP NET INCOME AND DILUTED EPS TO NON-GAAP NET INCOME AND DILUTED EPS: 2 3 (in thousands, except per share amounts) 2016 2017 2018 E 2019 E Product net income 280,905 96,224 168,900 182,500 Royalty and other revenue net income 19,761 35,392 20,400 - GAAP Total net income, as previously reported $ 300,666 $ 131,616 $ 189,300 $ 182,500 ASC 606 adjustments - Product net income 6,270 (3,204) - - ASC 606 adjustments - Royalty and other revenue net income 4,161 (3,623) - - Total ASC 606 adjustments $ 10,431 $ (6,826) $ - $ - Product net income, as adjusted 287,175 93,021 168,900 182,500 Royalty and other revenue net income, as adjusted 23,922 31,769 20,400 - GAAP Total net income, as adjusted $ 311,097 $ 124,790 $ 189,300 $ 182,500 Acquisition-related depreciation and amortization 1,733 1,597 1,500 1,500 Litigation awards and damages (270,000) - 500 - Realized and unrealized foreign currency gains or losses (103) 270 800 - Excess tax benefits from stock-based compensation (13,002) (39,241) (23,400) (8,000) Tax impact of pre-tax non-GAAP adjustments 83,814 (456) (231) (300) Tax impact of expiration of certain statutes of limitations related to unique - - (4,169) - and non-recurring tax positions 2017 U.S. Tax Reform - 41,392 - - Total Non-GAAP adjustments to product net income $ (197,558) $ 3,562 $ (25,000) $ (6,800) Product net income, as adjusted 287,175 93,021 168,900 182,500 1 Please visit the Investor Relations section of the Non-GAAP Product net income $ 89,617 $ 96,583 $ 143,900 $ 175,700 Company’s website at www.masimo.com to access additional information related to our Non-GAAP Royalty and other revenue net income, as adjusted 23,922 31,769 20,400 - adjustments and Supplementary Financial Information. 2 Masimo 2018 financial guidance as of October 31, 2018. Non-GAAP Total net income $ 113,539 $ 128,352 $ 164,300 $ 175,700 3 Masimo updated estimates as of January 9, 2019. Weighted average shares outstanding - diluted 53,195 55,873 56,200 57,599 Non-GAAP Product earnings per diluted share $ 1.68 $ 1.73 $ 2.56 $ 3.05 Non-GAAP Total earnings per diluted share $ 2.13 $ 2.30 $ 2.92 $ 3.05

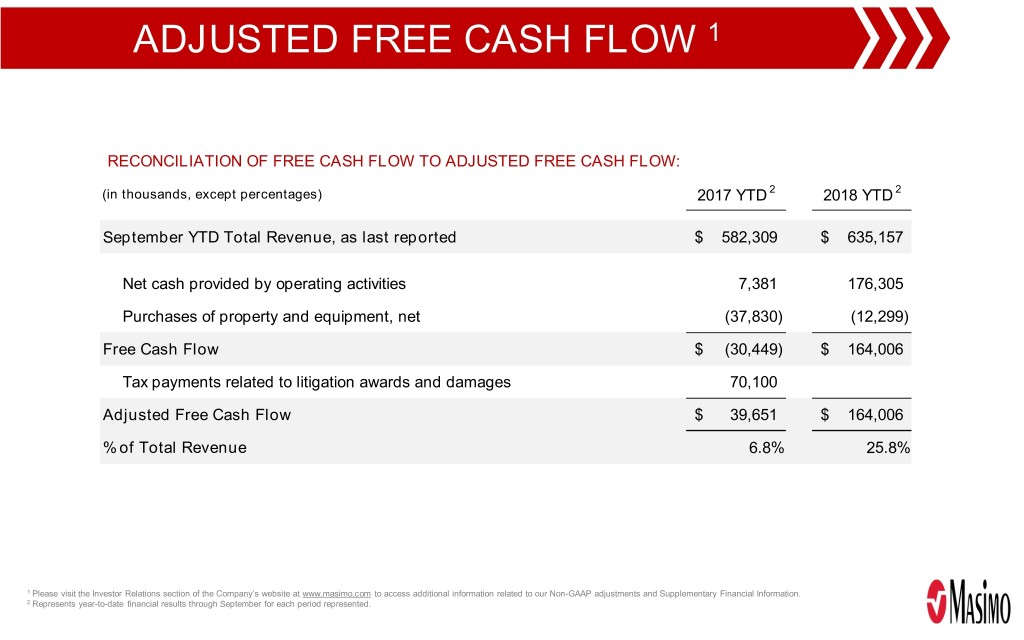

ADJUSTED FREE CASH FLOW 1 RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW: 2 2 (in thousands, except percentages) 2017 YTD 2018 YTD September YTD Total Revenue, as last reported $ 582,309 $ 635,157 Net cash provided by operating activities 7,381 176,305 Purchases of property and equipment, net (37,830) (12,299) Free Cash Flow $ (30,449) $ 164,006 Tax payments related to litigation awards and damages 70,100 Adjusted Free Cash Flow $ 39,651 $ 164,006 % of Total Revenue 6.8% 25.8% 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. 2 Represents year-to-date financial results through September for each period represented.