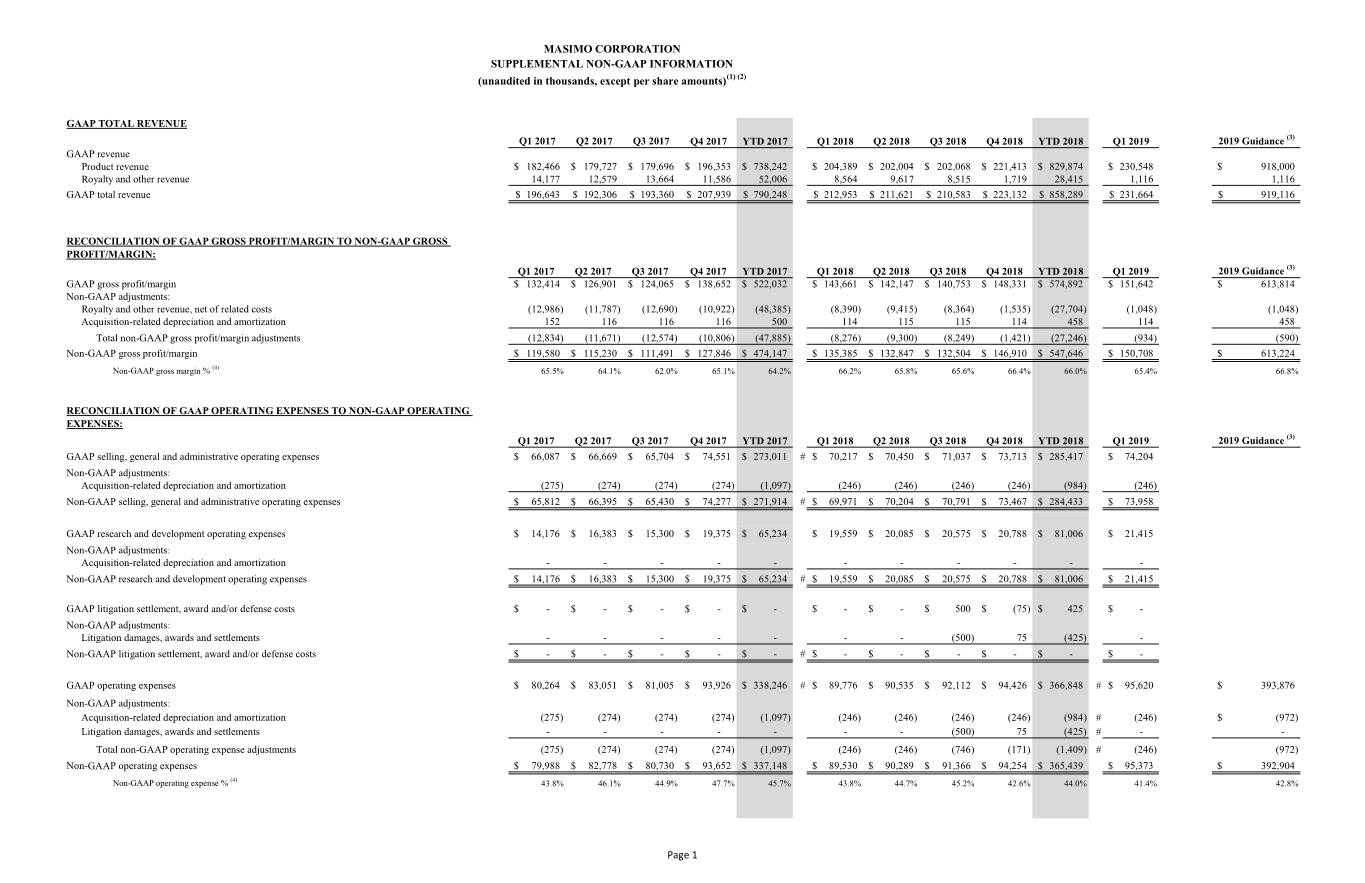

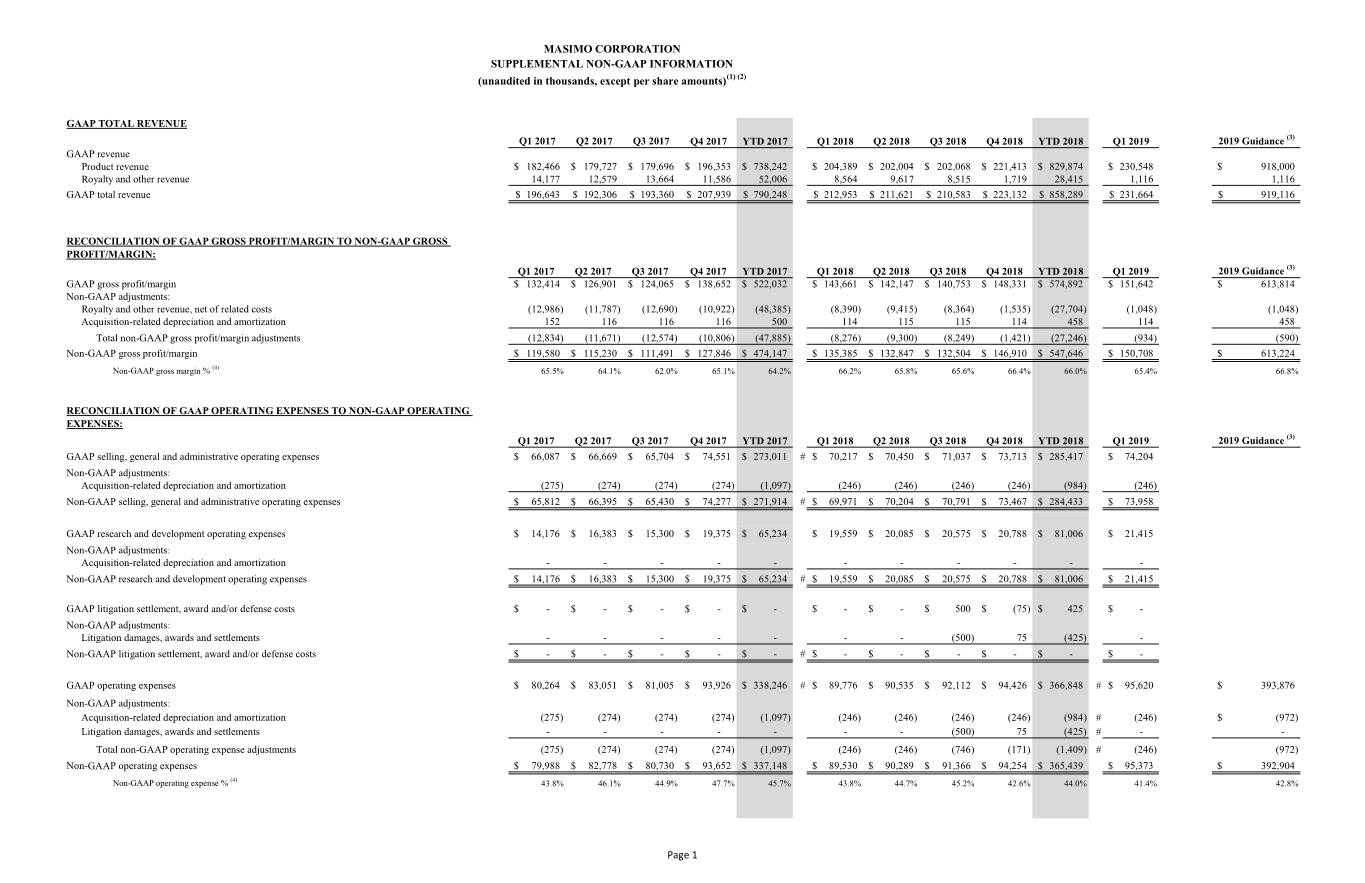

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) GAAP TOTAL REVENUE Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP revenue Product revenue $ 182,466 $ 179,727 $ 179,696 $ 196,353 $ 738,242 $ 204,389 $ 202,004 $ 202,068 $ 221,413 $ 829,874 $ 230,548 $ 918,000 Royalty and other revenue 14,177 12,579 13,664 11,586 52,006 8,564 9,617 8,515 1,719 28,415 1,116 1,116 GAAP total revenue $ 196,643 $ 192,306 $ 193,360 $ 207,939 $ 790,248 $ 212,953 $ 211,621 $ 210,583 $ 223,132 $ 858,289 $ 231,664 $ 919,116 RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP gross profit/margin $ 132,414 $ 126,901 $ 124,065 $ 138,652 $ 522,032 $ 143,661 $ 142,147 $ 140,753 $ 148,331 $ 574,892 $ 151,642 $ 613,814 Non-GAAP adjustments: Royalty and other revenue, net of related costs (12,986) (11,787) (12,690) (10,922) (48,385) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (1,048) Acquisition-related depreciation and amortization 152 116 116 116 500 114 115 115 114 458 114 458 - Total non-GAAP gross profit/margin adjustments (12,834) (11,671) (12,574) (10,806) (47,885) (8,276) (9,300) (8,249) (1,421) (27,246) (934) (590) Non-GAAP gross profit/margin $ 119,580 $ 115,230 $ 111,491 $ 127,846 $ 474,147 $ 135,385 $ 132,847 $ 132,504 $ 146,910 2 $ 547,646 $ 150,708 $ 613,224 Non-GAAP gross margin % (4) 65.5% 64.1% 62.0% 65.1% 64.2% 66.2% 65.8% 65.6% 66.4% 66.0% 65.4% 66.8% RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP selling, general and administrative operating expenses$ 66,087 $ 66,669 $ 65,704 $ 74,551 $ 273,011 #$ 70,217 $ 70,450 $ 71,037 $ 73,713 $ 285,417 $ 74,204 $ 311,016 Non-GAAP adjustments: Acquisition-related depreciation and amortization (275) (274) (274) (274) (1,097) (246) (246) (246) (246) (984) (246) -971.768 Non-GAAP selling, general and administrative operating expenses $ 65,812 $ 66,395 $ 65,430 $ 74,277 $ 271,914 # $ 69,971 $ 70,204 $ 70,791 $ 73,467 $ 284,433 $ 73,958 310044.232 GAAP research and development operating expenses$ 14,176 $ 16,383 $ 15,300 $ 19,375 $ 65,234 $ 19,559 $ 20,085 $ 20,575 $ 20,788 $ 81,006 $ 21,415 82860 Non-GAAP adjustments: Acquisition-related depreciation and amortization - - - - - - - - - - - 0 Non-GAAP research and development operating expenses $ 14,176 $ 16,383 $ 15,300 $ 19,375 $ 65,234 # $ 19,559 $ 20,085 $ 20,575 $ 20,788 $ 81,006 $ 21,415 82860 GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ - $ - $ - $ - $ 500 $ (75) $ 425 $ - 0 Non-GAAP adjustments: Litigation damages, awards and settlements - - - - - - - (500) 75 (425) - 0 Non-GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ - $ - # $ - $ - $ - $ - $ - $ - 0 GAAP operating expenses$ 80,264 $ 83,051 $ 81,005 $ 93,926 $ 338,246 #$ 89,776 $ 90,535 $ 92,112 $ 94,426 $ 366,848 #$ 95,620 $ 393,876 Non-GAAP adjustments: Acquisition-related depreciation and amortization (275) (274) (274) (274) (1,097) (246) (246) (246) (246) (984) # (246) $ (972) Litigation damages, awards and settlements - - - - - - - (500) 75 (425) # - - Total non-GAAP operating expense adjustments (275) (274) (274) (274) (1,097) (246) (246) (746) (171) (1,409) # (246) (972) Non-GAAP operating expenses $ 79,988 $ 82,778 $ 80,730 $ 93,652 $ 337,148 $ 89,530 $ 90,289 $ 91,366 $ 94,254 $ 365,4394 $ 95,373 $ 392,904 Non-GAAP operating expense % (4) 43.8% 46.1% 44.9% 47.7% 45.7% 43.8% 44.7% 45.2% 42.6% 44.0% 41.4% 42.8% Page 1

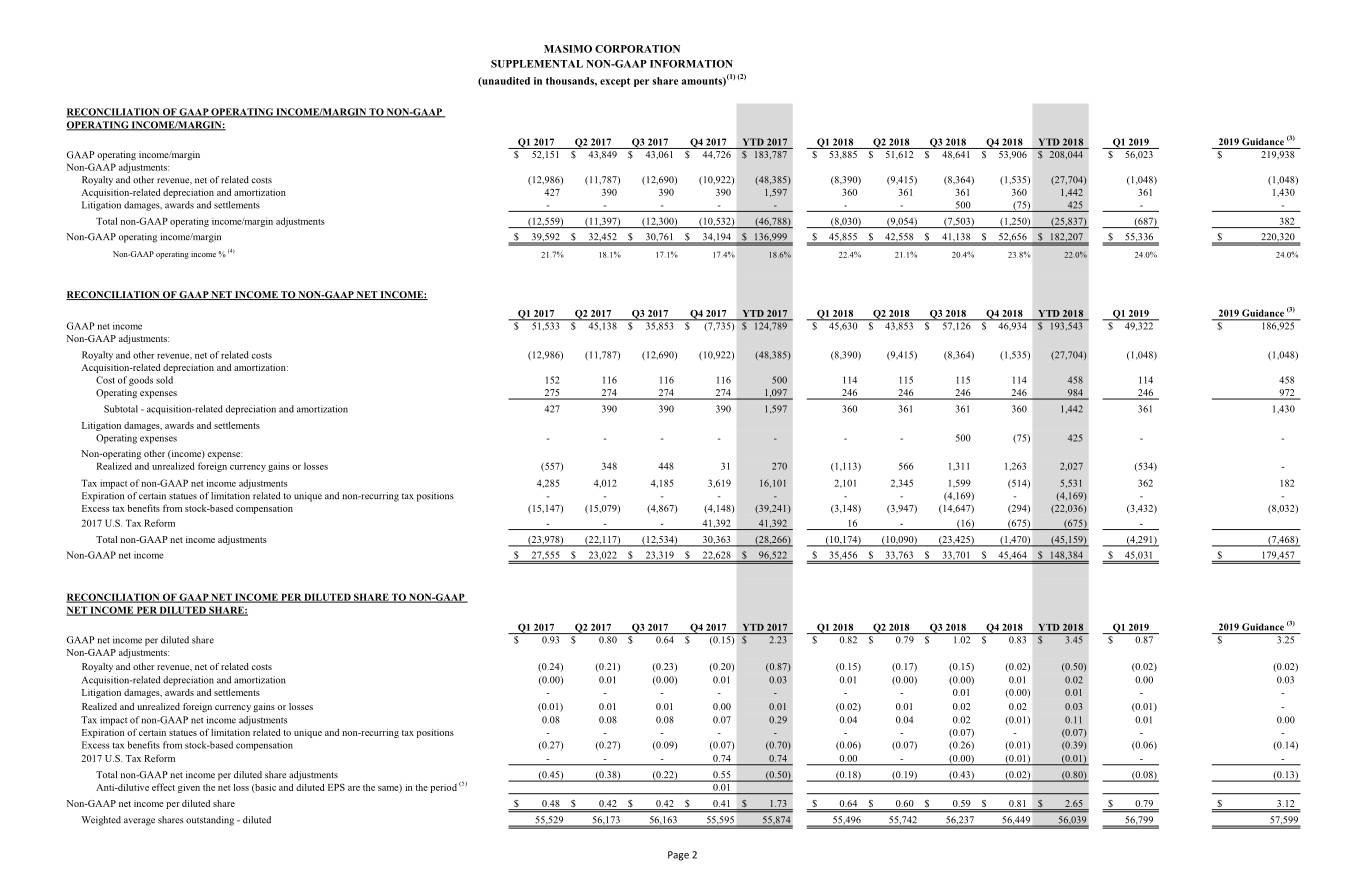

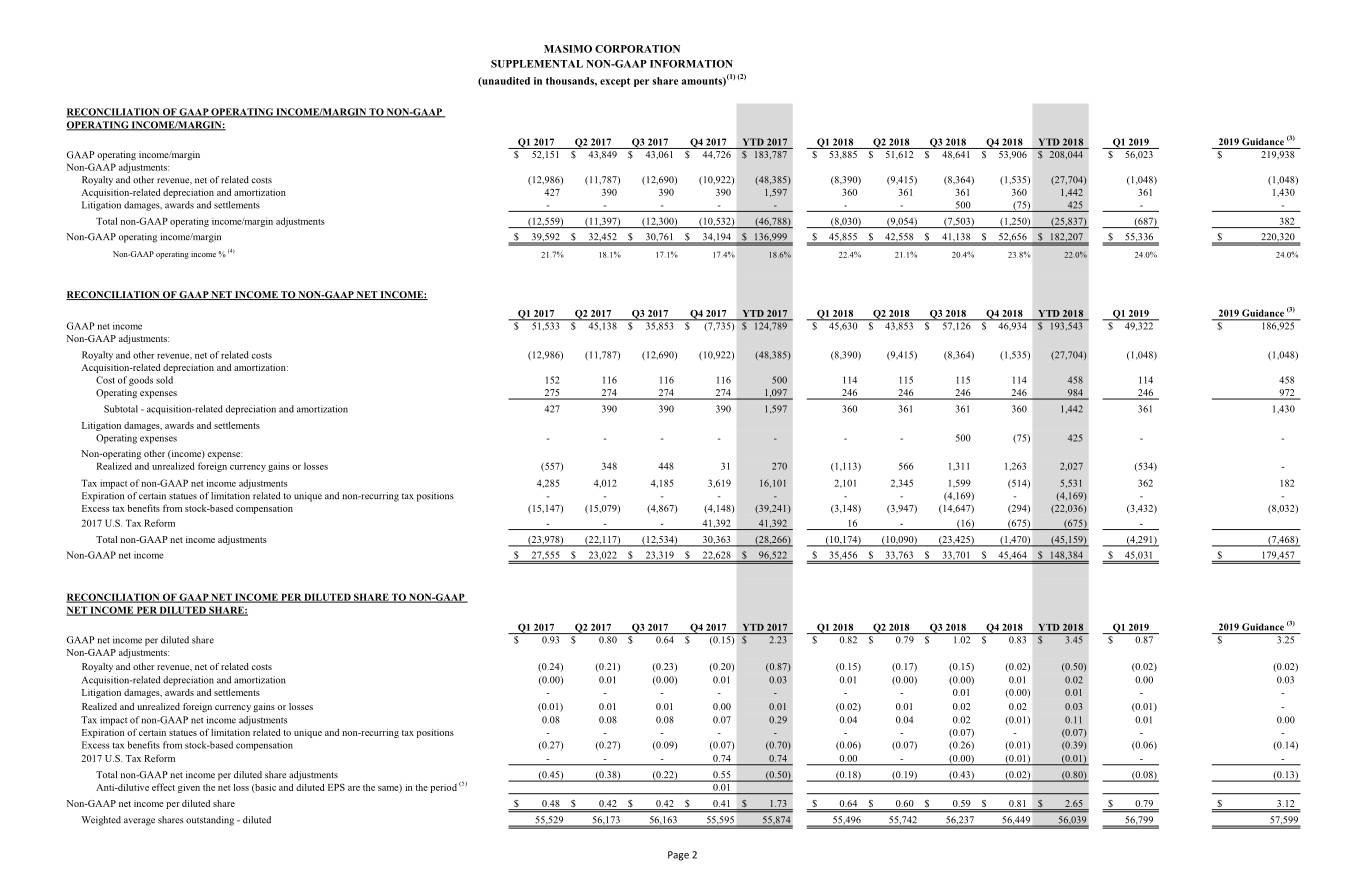

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP operating income/margin $ 52,151 $ 43,849 $ 43,061 $ 44,726 $ 183,787 $ 53,885 $ 51,612 $ 48,641 $ 53,906 $ 208,044 $ 56,023 $ 219,938 Non-GAAP adjustments: Royalty and other revenue, net of related costs (12,986) (11,787) (12,690) (10,922) (48,385) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (1,048) Acquisition-related depreciation and amortization 427 390 390 390 1,597 360 361 361 360 1,442 361 1,430 Litigation damages, awards and settlements - - - - - - - 500 (75) 425 - - Total non-GAAP operating income/margin adjustments (12,559) (11,397) (12,300) (10,532) (46,788) (8,030) (9,054) (7,503) (1,250) (25,837) (687) 382 Non-GAAP operating income/margin $ 39,592 $ 32,452 $ 30,761 $ 34,194 $ 136,999 $ 45,855 $ 42,558 $ 41,138 $ 52,656 $ 182,207 $ 55,336 $ 220,320 Non-GAAP operating income % (4) 21.7% 18.1% 17.1% 17.4% 18.6% 22.4% 21.1% 20.4% 23.8% 22.0% 24.0% 24.0% RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP net income $ 51,533 $ 45,138 $ 35,853 $ (7,735) $ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 $ 49,322 $ 186,925 Non-GAAP adjustments: Royalty and other revenue, net of related costs (12,986) (11,787) (12,690) (10,922) (48,385) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (1,048) Acquisition-related depreciation and amortization: Cost of goods sold 152 116 116 116 500 114 115 115 114 458 114 458 Operating expenses 275 274 274 274 1,097 246 246 246 246 984 246 972 Subtotal - acquisition-related depreciation and amortization 427 390 390 390 1,597 360 361 361 360 1,442 361 1,430 Litigation damages, awards and settlements Operating expenses - - - - - - - 500 (75) 425 - - Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses (557) 348 448 31 270 (1,113) 566 1,311 1,263 2,027 (534) - ## Tax impact of non-GAAP net income adjustments 4,285 4,012 4,185 3,619 16,101 2,101 2,345 1,599 (514) 5,531 362 182 Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - (4,169) - (4,169) - - 9800Excess tax benefits from stock-based compensation (15,147) (15,079) (4,867) (4,148) (39,241) (3,148) (3,947) (14,647) (294) (22,036) (3,432) (8,032) 2017 U.S. Tax Reform - - - 41,392 41,392 16 - (16) (675) (675) - Total non-GAAP net income adjustments (23,978) (22,117) (12,534) 30,363 (28,266) (10,174) (10,090) (23,425) (1,470) (45,159) (4,291) (7,468) Non-GAAP net income $ 27,555 $ 23,022 $ 23,319 $ 22,628 $ 96,522 $ 35,456 $ 33,763 $ 33,701 $ 45,464 $ 148,384 $ 45,031 $ 179,457 RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP NET INCOME PER DILUTED SHARE: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP net income per diluted share $ 0.93 $ 0.80 $ 0.64 $ (0.15) $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 0.83 $ 3.45 $ 0.87 $ 3.25 Non-GAAP adjustments: Royalty and other revenue, net of related costs (0.24) (0.21) (0.23) (0.20) (0.87) (0.15) (0.17) (0.15) (0.02) (0.50) (0.02) (0.02) Acquisition-related depreciation and amortization (0.00) 0.01 (0.00) 0.01 0.03 0.01 (0.00) (0.00) 0.01 0.02 0.00 0.03 Litigation damages, awards and settlements - - - - - - - 0.01 (0.00) 0.01 - - Realized and unrealized foreign currency gains or losses (0.01) 0.01 0.01 0.00 0.01 (0.02) 0.01 0.02 0.02 0.03 (0.01) - Tax impact of non-GAAP net income adjustments 0.08 0.08 0.08 0.07 0.29 0.04 0.04 0.02 (0.01) 0.11 0.01 0.00 Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - (0.07) - (0.07) - - 9800Excess tax benefits from stock-based compensation (0.27) (0.27) (0.09) (0.07) (0.70) (0.06) (0.07) (0.26) (0.01) (0.39) (0.06) (0.14) 2017 U.S. Tax Reform - - - 0.74 0.74 0.00 - (0.00) (0.01) (0.01) - - Total non-GAAP net income per diluted share adjustments (0.45) (0.38) (0.22) 0.55 (0.50) (0.18) (0.19) (0.43) (0.02) (0.80) (0.08) (0.13) Anti-dilutive effect given the net loss (basic and diluted EPS are the same) in the period (5) 0.01 Non-GAAP net income per diluted share $ 0.48 $ 0.42 $ 0.42 $ 0.41 $ 1.73 $ 0.64 $ 0.60 $ 0.59 $ 0.81 $ 2.65 $ 0.79 $ 3.12 Weighted average shares outstanding - diluted 55,529 56,173 56,163 55,595 55,874 55,496 55,742 56,237 56,449 56,039 56,799 57,599 Page 2

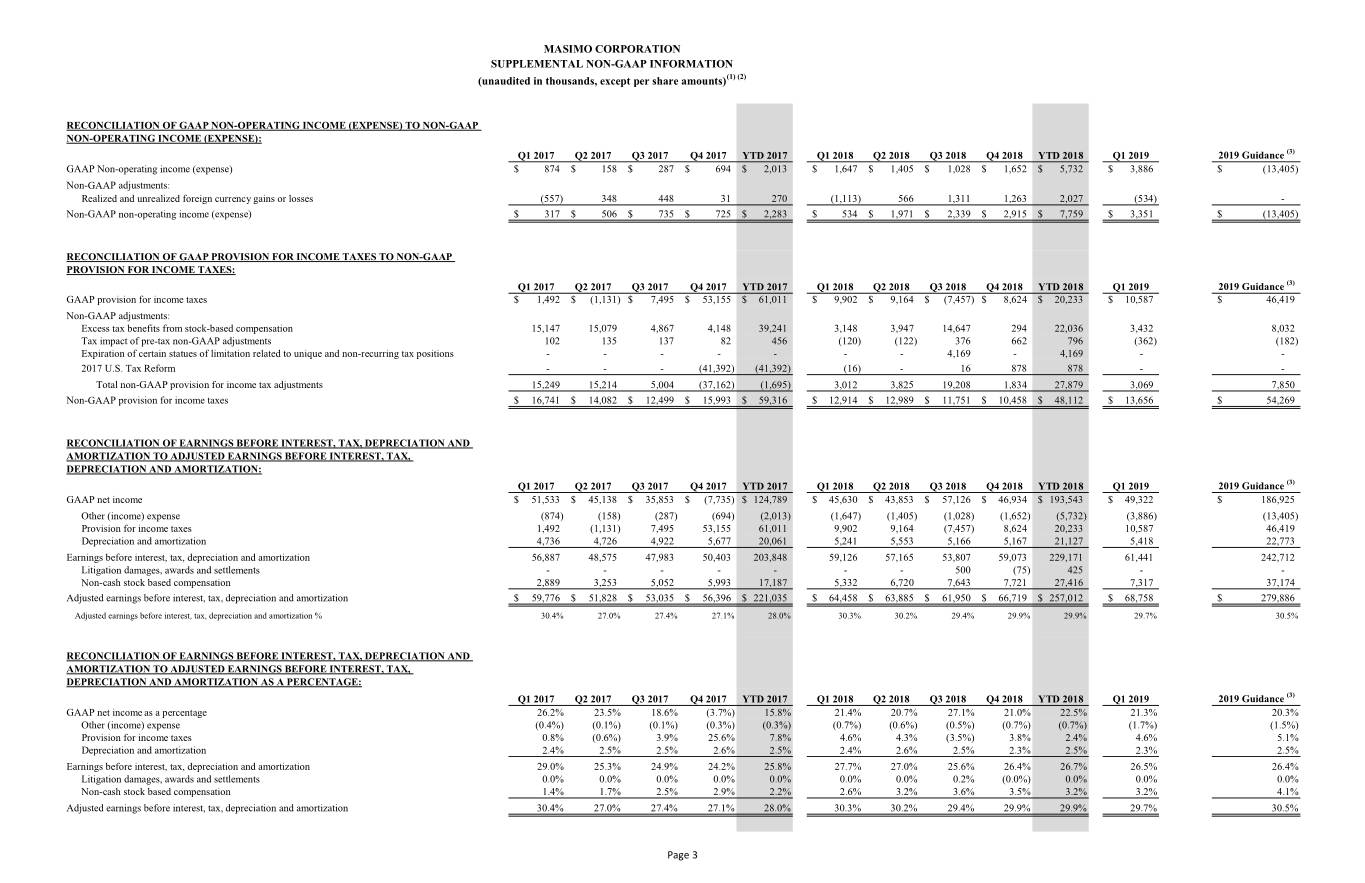

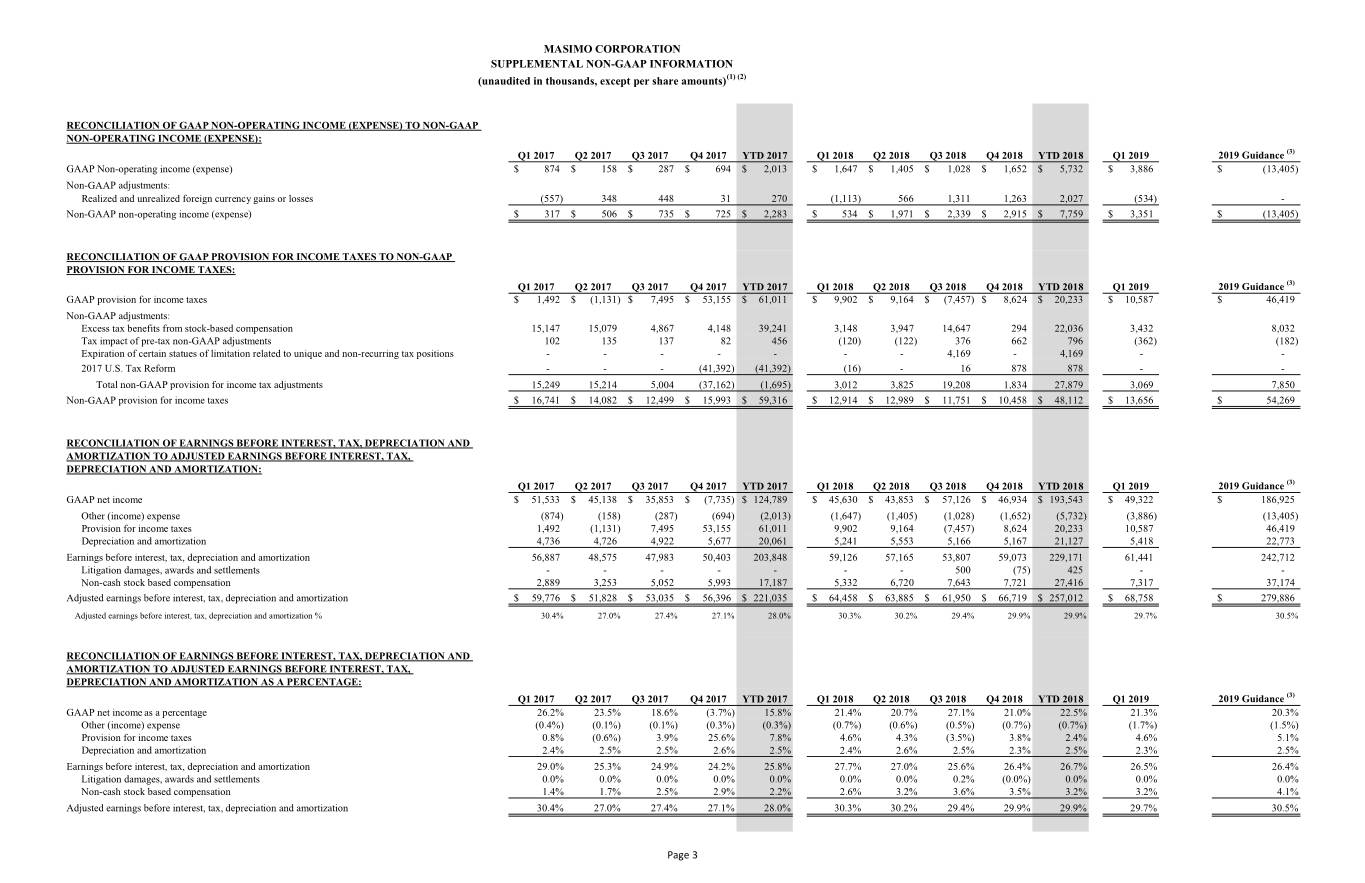

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP NON-OPERATING INCOME (EXPENSE) TO NON-GAAP NON-OPERATING INCOME (EXPENSE): Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP Non-operating income (expense)$ 874 $ 158 $ 287 $ 694 $ 2,013 $ 1,647 $ 1,405 $ 1,028 $ 1,652 $ 5,732 $ 3,886 $ (13,405) Non-GAAP adjustments: Realized and unrealized foreign currency gains or losses (557) 348 448 31 270 (1,113) 566 1,311 1,263 2,027 (534) - Non-GAAP non-operating income (expense) $ 317 $ 506 $ 735 $ 725 $ 2,283 $ 534 $ 1,971 $ 2,339 $ 2,915 $ 7,759 $ 3,351 $ (13,405) RECONCILIATION OF GAAP PROVISION FOR INCOME TAXES TO NON-GAAP PROVISION FOR INCOME TAXES: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP provision for income taxes $ 1,492 $ (1,131) $ 7,495 $ 53,155 $ 61,011 $ 9,902 $ 9,164 $ (7,457) $ 8,624 $ 20,233 $ 10,587 $ 46,419 Non-GAAP adjustments: Excess tax benefits from stock-based compensation 15,147 15,079 4,867 4,148 39,241 3,148 3,947 14,647 294 22,036 3,432 8,032 Tax impact of pre-tax non-GAAP adjustments 102 135 137 82 456 (120) (122) 376 662 796 (362) (182) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - 4,169 - 4,169 - - 2017 U.S. Tax Reform - - - (41,392) (41,392) (16) - 16 878 878 - - Total non-GAAP provision for income tax adjustments 15,249 15,214 5,004 (37,162) (1,695) 3,012 3,825 19,208 1,834 27,879 3,069 7,850 Non-GAAP provision for income taxes $ 16,741 $ 14,082 $ 12,499 $ 15,993 $ 59,316 $ 12,914 $ 12,989 $ 11,751 $ 10,458 $ 48,112 $ 13,656 $ 54,269 RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP net income$ 51,533 $ 45,138 $ 35,853 $ (7,735) $ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 $ 49,322 $ 186,925 Other (income) expense (874) (158) (287) (694) (2,013) (1,647) (1,405) (1,028) (1,652) (5,732) (3,886) (13,405) Provision for income taxes 1,492 (1,131) 7,495 53,155 61,011 9,902 9,164 (7,457) 8,624 20,233 10,587 46,419 Depreciation and amortization 4,736 4,726 4,922 5,677 20,061 5,241 5,553 5,166 5,167 21,127 5,418 22,773 Earnings before interest, tax, depreciation and amortization 56,887 48,575 47,983 50,403 203,848 59,126 57,165 53,807 59,073 229,171 61,441 242,712 Litigation damages, awards and settlements - - - - - - - 500 (75) 425 - - Non-cash stock based compensation 2,889 3,253 5,052 5,993 17,187 5,332 6,720 7,643 7,721 27,416 7,317 37,174 Adjusted earnings before interest, tax, depreciation and amortization $ 59,776 $ 51,828 $ 53,035 $ 56,396 $ 221,035 $ 64,458 $ 63,885 $ 61,950 $ 66,719 $ 257,012 $ 68,758 $ 279,886 Adjusted earnings before interest, tax, depreciation and amortization % 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% 29.7% 30.5% RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION AS A PERCENTAGE: Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 2019 Guidance (3) GAAP net income as a percentage 26.2% 23.5% 18.6% (3.7%) 15.8% 21.4% 20.7% 27.1% 21.0% 22.5% 21.3% 20.3% Other (income) expense (0.4%) (0.1%) (0.1%) (0.3%) (0.3%) (0.7%) (0.6%) (0.5%) (0.7%) (0.7%) (1.7%) (1.5%) Provision for income taxes 0.8% (0.6%) 3.9% 25.6% 7.8% 4.6% 4.3% (3.5%) 3.8% 2.4% 4.6% 5.1% Depreciation and amortization 2.4% 2.5% 2.5% 2.6% 2.5% 2.4% 2.6% 2.5% 2.3% 2.5% 2.3% 2.5% Earnings before interest, tax, depreciation and amortization 29.0% 25.3% 24.9% 24.2% 25.8% 27.7% 27.0% 25.6% 26.4% 26.7% 26.5% 26.4% Litigation damages, awards and settlements 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.2% (0.0%) 0.0% 0.0% 0.0% Non-cash stock based compensation 1.4% 1.7% 2.5% 2.9% 2.2% 2.6% 3.2% 3.6% 3.5% 3.2% 3.2% 4.1% Adjusted earnings before interest, tax, depreciation and amortization 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% 29.7% 30.5% Page 3

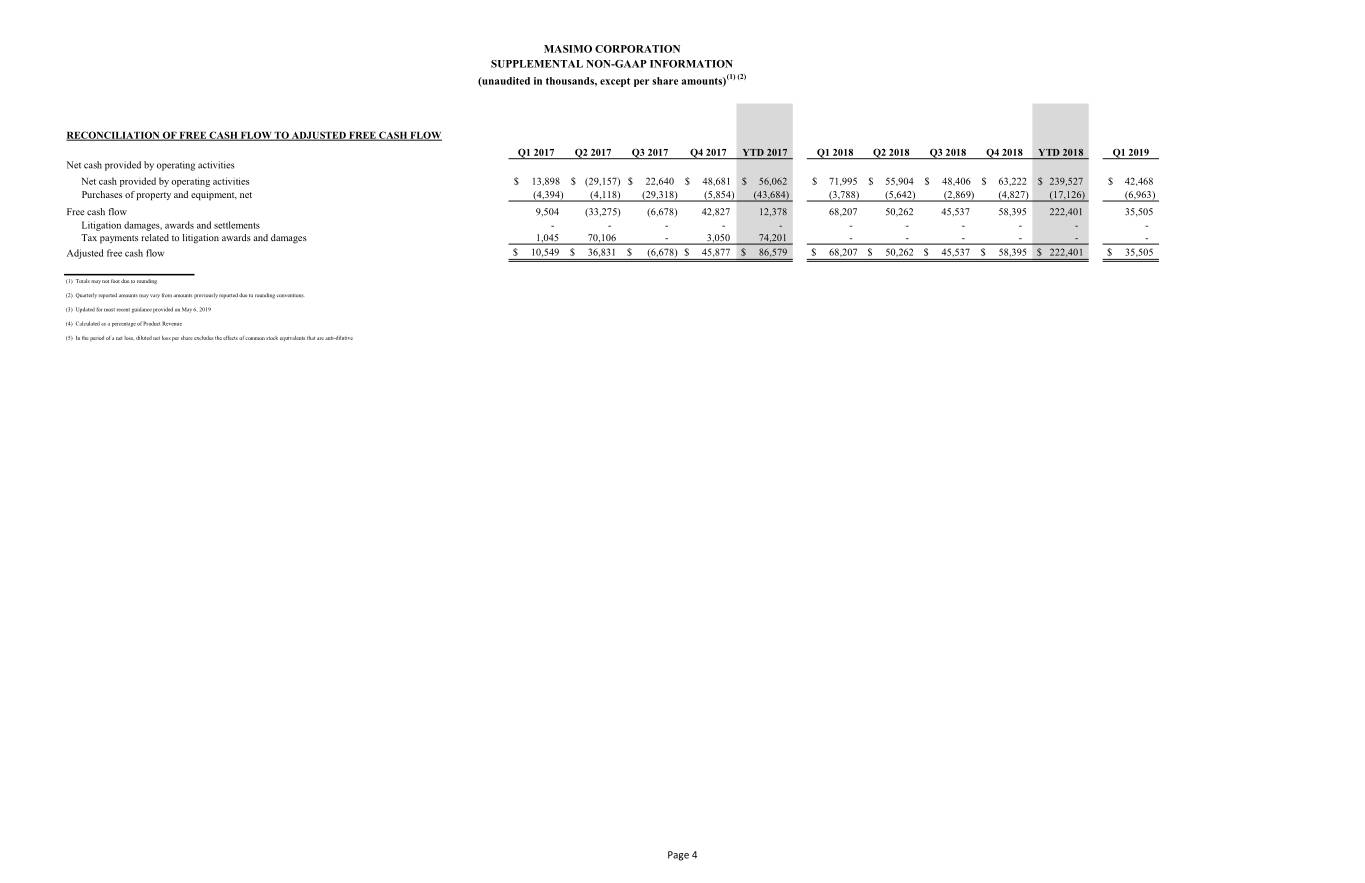

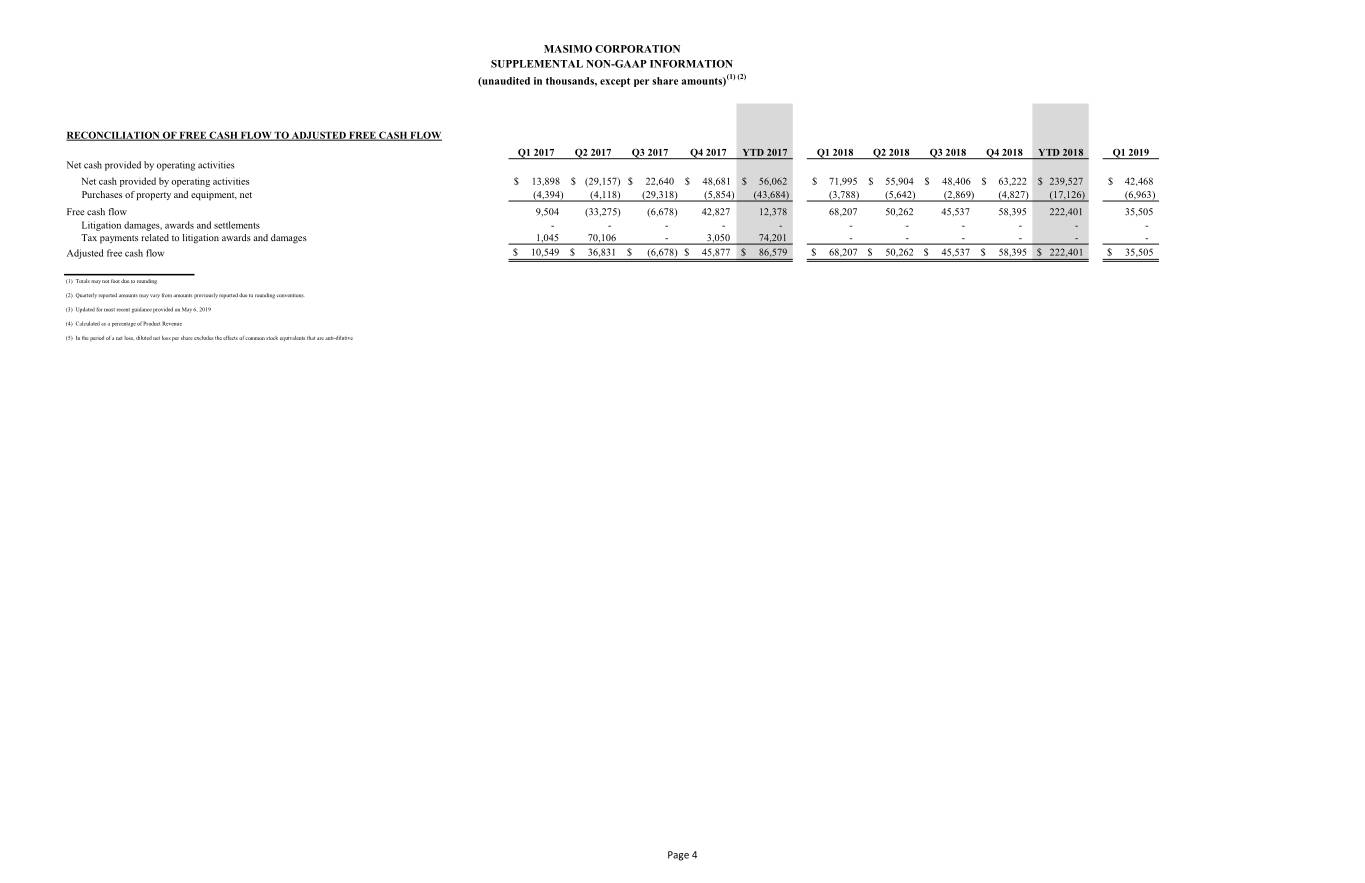

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 YTD 2018 Q1 2019 Net cash provided by operating activities Net cash provided by operating activities $ 13,898 $ (29,157) $ 22,640 $ 48,681 $ 56,062 $ 71,995 $ 55,904 $ 48,406 $ 63,222 $ 239,527 $ 42,468 Purchases of property and equipment, net (4,394) (4,118) (29,318) (5,854) (43,684) (3,788) (5,642) (2,869) (4,827) (17,126) (6,963) Free cash flow 9,504 (33,275) (6,678) 42,827 12,378 68,207 50,262 45,537 58,395 222,401 35,505 Litigation damages, awards and settlements - - - - - - - - - - - Tax payments related to litigation awards and damages 1,045 70,106 - 3,050 74,201 - - - - - - Adjusted free cash flow $ 10,549 $ 36,831 $ (6,678) $ 45,877 $ 86,579 $ 68,207 $ 50,262 $ 45,537 $ 58,395 $ 222,401 $ 35,505 (1) Totals may not foot due to rounding (2) Quarterly reported amounts may vary from amounts previously reported due to rounding conventions. (3) Updated for most recent guidance provided on May 6, 2019 (4) Calculated as a percentage of Product Revenue (5) In the period of a net loss, diluted net loss per share excludes the effects of common stock equivalents that are anti-dilutive Page 4