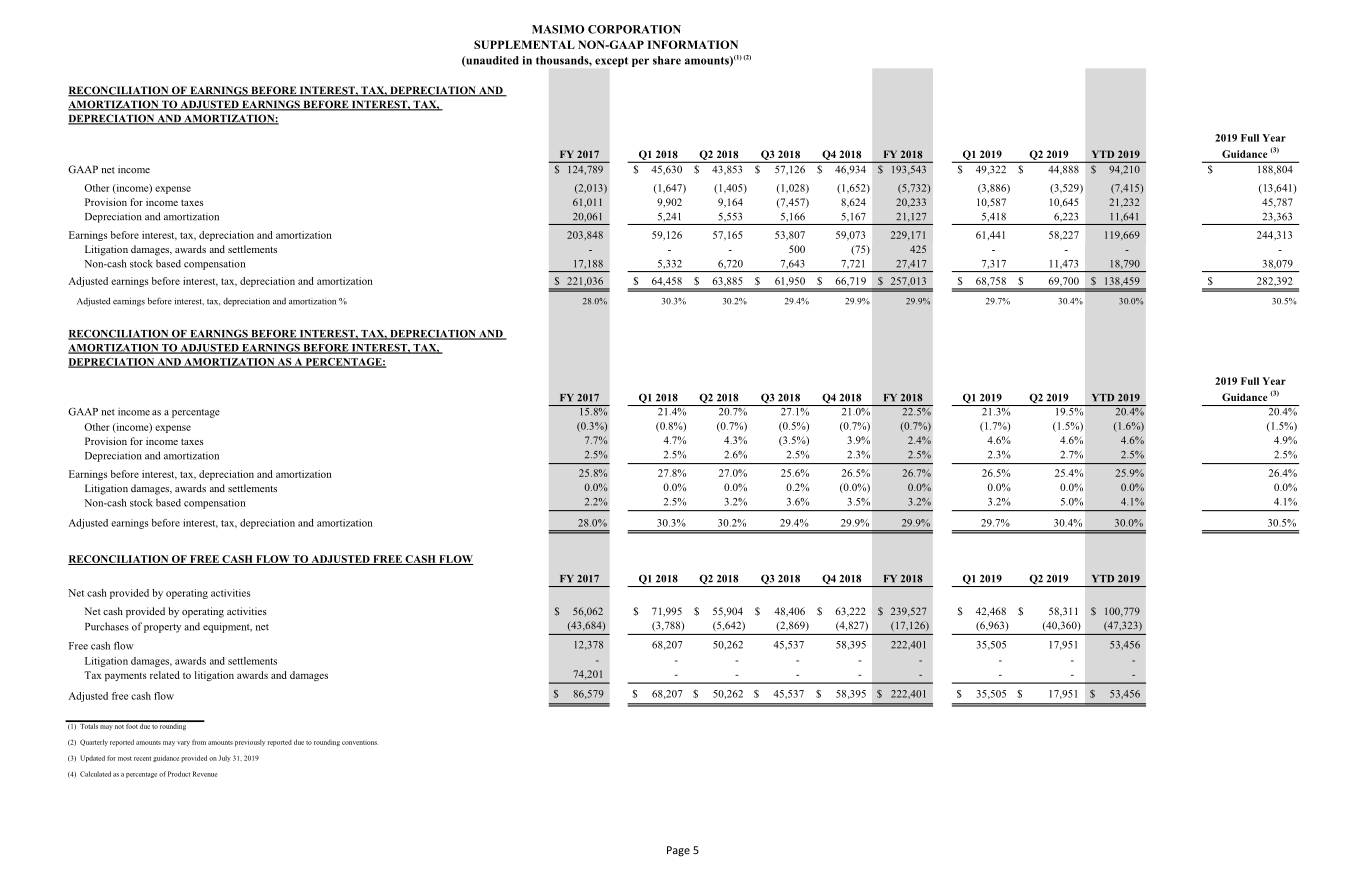

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) All statements other than statements of historical facts included in this Supplemental Non-GAAP information that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our expectations for full fiscal year GAAP and non-GAAP 2019 total revenue, product revenue, royalty and other revenues, gross profit/margin, selling, general and administrative operating expenses, research and development operating expenses, litigation settlement, award and/or defense costs, operating expenses, operating income/margin, net income, diluted earnings per share, non-operating income, provision for income taxes, adjusted EBITDA, adjusted free cash flow; our long-term outlook; demand for our products; anticipated revenue and earnings growth; our financial condition, results of operations and business generally; expectations regarding our ability to design and deliver innovative new noninvasive technologies and reduce the cost of care; and demand for our technologies. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. For additional information related to the definitions of our Non-GAAP measures, please visit the Investor Relations section of the Company's website at www.masimo.com. Page 1

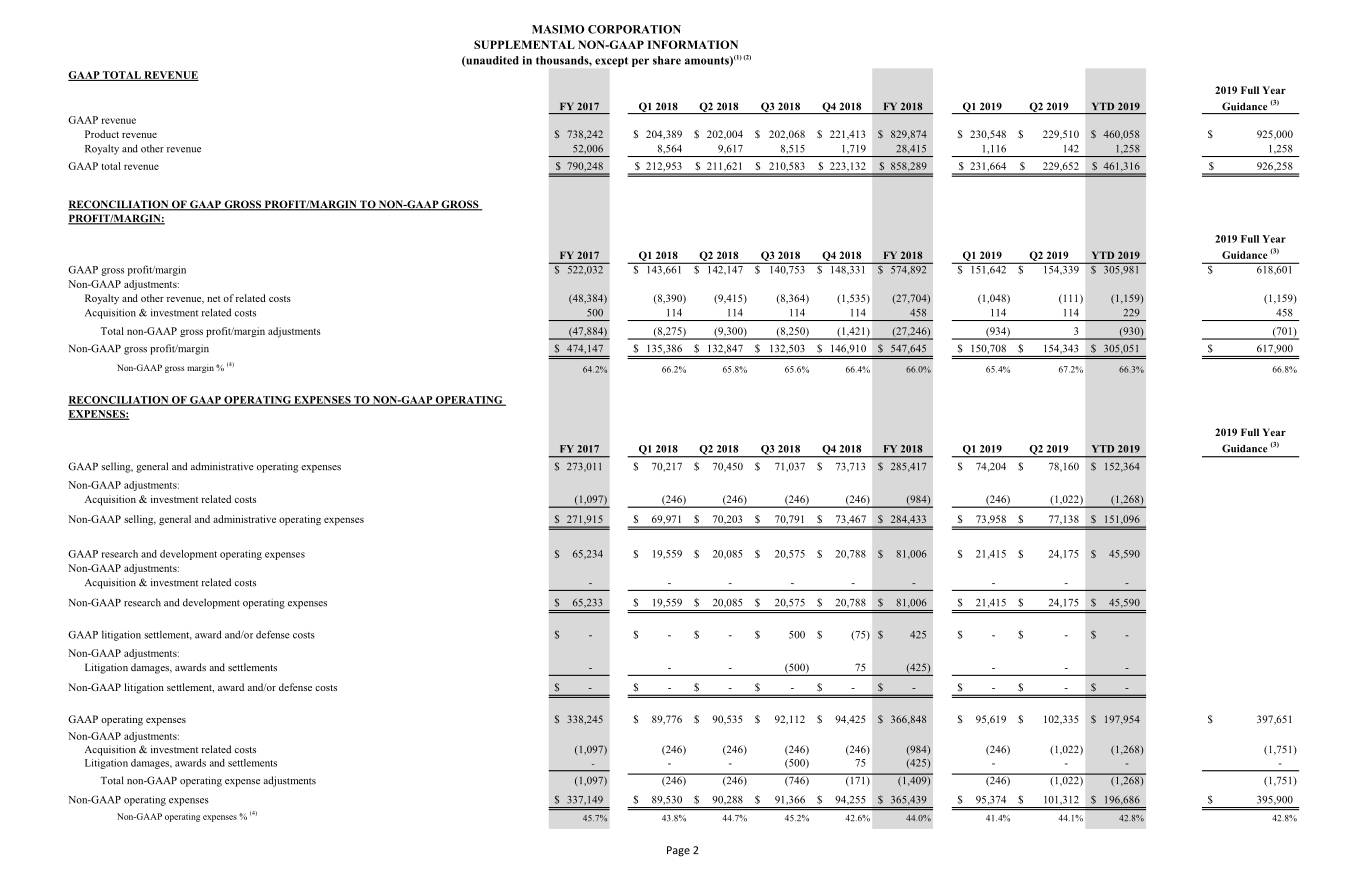

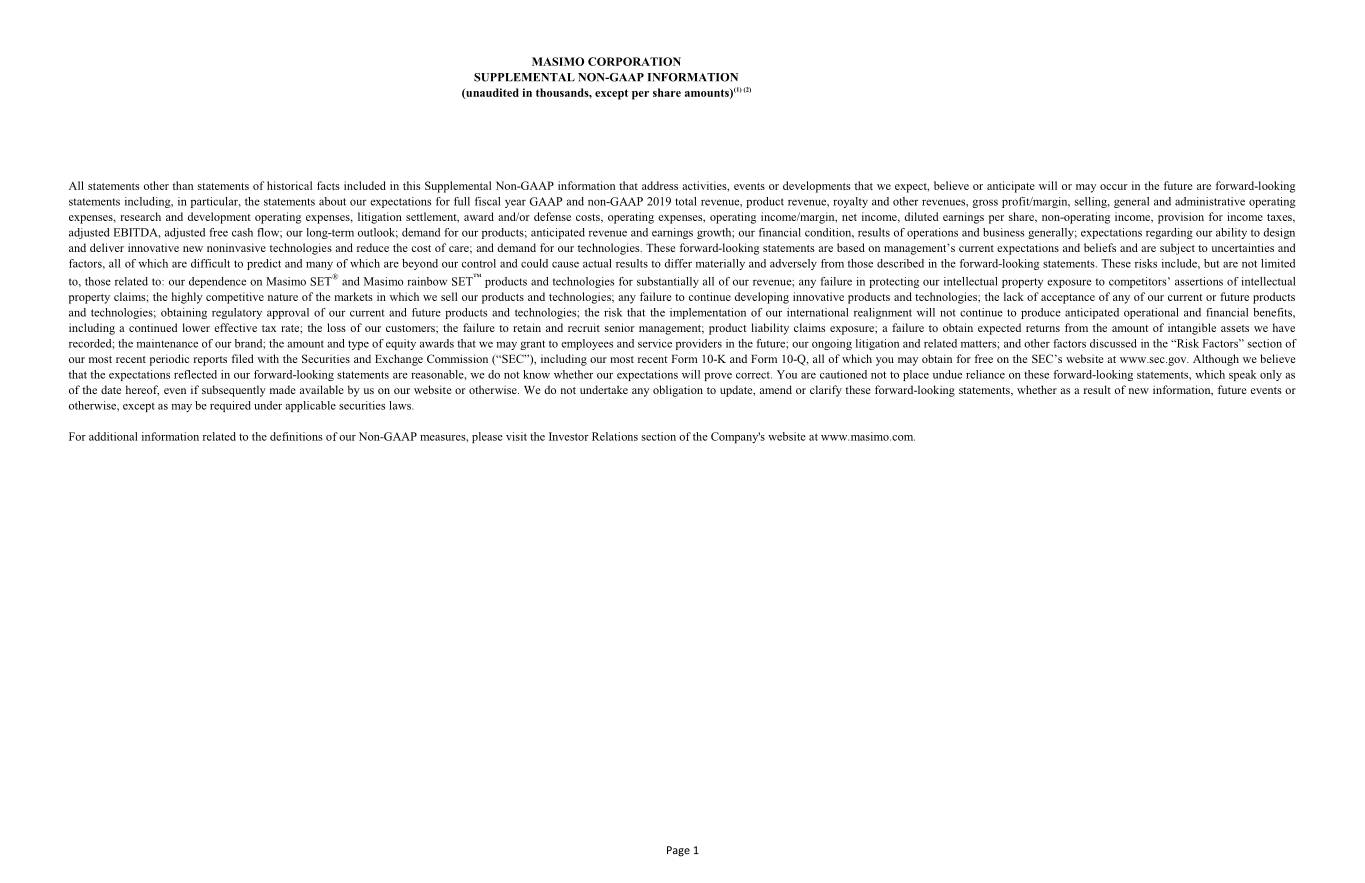

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) GAAP TOTAL REVENUE 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP revenue Product revenue $ 738,242 $ 204,389 $ 202,004 $ 202,068 $ 221,413 $ 829,874 $ 230,548 $ 229,510 $ 460,058 $ 925,000 Royalty and other revenue 52,006 8,564 9,617 8,515 1,719 28,415 1,116 142 1,258 1,258 GAAP total revenue $ 790,248 $ 212,953 $ 211,621 $ 210,583 $ 223,132 $ 858,289 $ 231,664 $ 229,652 $ 461,316 $ 926,258 RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP gross profit/margin $ 522,032 $ 143,661 $ 142,147 $ 140,753 $ 148,331 $ 574,892 $ 151,642 $ 154,339 $ 305,981 $ 618,601 Non-GAAP adjustments: Royalty and other revenue, net of related costs (48,384) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (111) (1,159) (1,159) Acquisition & investment related costs 500 114 114 114 114 458 114 114 229 #REF! 458 Total non-GAAP gross profit/margin adjustments (47,884) (8,275) (9,300) (8,250) (1,421) (27,246) (934) 3 (930) (701) Non-GAAP gross profit/margin $ 474,147 $ 135,386 $ 132,847 $ 132,503 $ 146,910 2 $ 547,645 $ 150,708 $ 154,343 $ 305,051 $ 617,900 (4) Non-GAAP gross margin % 64.2% 66.2% 65.8% 65.6% 66.4% 66.0% 65.4% 67.2% 66.3% 66.8% RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP selling, general and administrative operating expenses$ 273,011 $ 70,217 $ 70,450 $ 71,037 $ 73,713 $ 285,417 $ 74,204 $ 78,160 $ 152,364 Non-GAAP adjustments: Acquisition & investment related costs (1,097) (246) (246) (246) (246) (984) (246) (1,022) (1,268) Non-GAAP selling, general and administrative operating expenses$ 271,915 $ 69,971 $ 70,203 $ 70,791 $ 73,467 $ 284,433 $ 73,958 $ 77,138 $ 151,096 GAAP research and development operating expenses$ 65,234 $ 19,559 $ 20,085 $ 20,575 $ 20,788 $ 81,006 $ 21,415 $ 24,175 $ 45,590 Non-GAAP adjustments: Acquisition & investment related costs - - - - - - - - - Non-GAAP research and development operating expenses$ 65,233 $ 19,559 $ 20,085 $ 20,575 $ 20,788 $ 81,006 $ 21,415 $ 24,175 $ 45,590 GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ 500 $ (75) $ 425 $ - $ - $ - Non-GAAP adjustments: Litigation damages, awards and settlements - - - (500) 75 (425) - - - Non-GAAP litigation settlement, award and/or defense costs$ - $ - $ - $ - $ - $ - 4 $ - $ - $ - 4 GAAP operating expenses $ 338,245 $ 89,776 $ 90,535 $ 92,112 $ 94,425 $ 366,848 $ 95,619 $ 102,335 $ 197,954 $ 397,651 Non-GAAP adjustments: Acquisition & investment related costs (1,097) (246) (246) (246) (246) (984) (246) (1,022) (1,268) (1,751) Litigation damages, awards and settlements - - - (500) 75 (425) - - - - Total non-GAAP operating expense adjustments (1,097) (246) (246) (746) (171) (1,409) (246) (1,022) (1,268) (1,751) Non-GAAP operating expenses$ 337,149 $ 89,530 $ 90,288 $ 91,366 $ 94,255 $ 365,439 $ 95,374 $ 101,312 $ 196,686 $ 395,900 (4) Non-GAAP operating expenses % 45.7% 43.8% 44.7% 45.2% 42.6% 44.0% 41.4% 44.1% 42.8% 42.8% Page 2

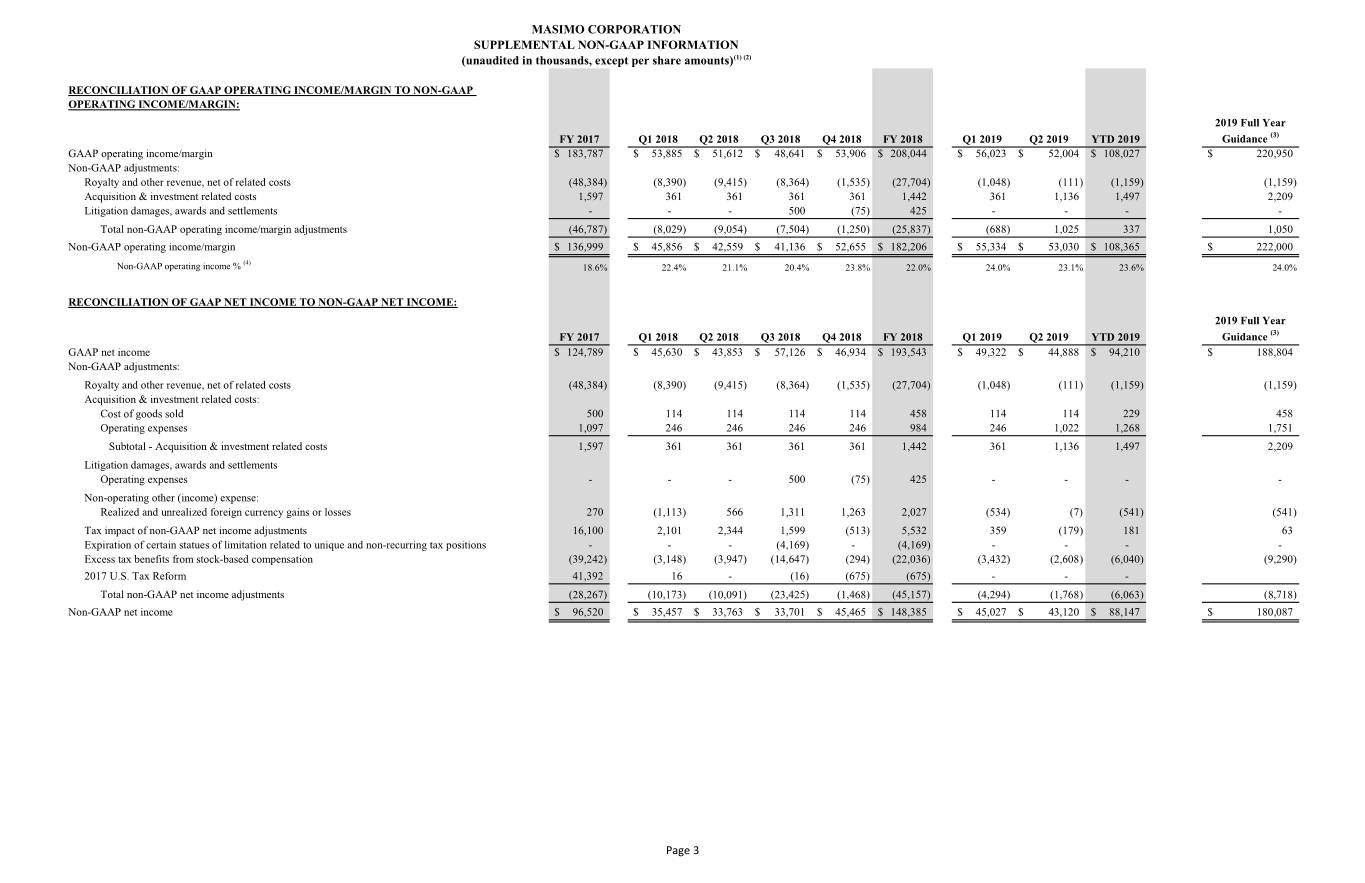

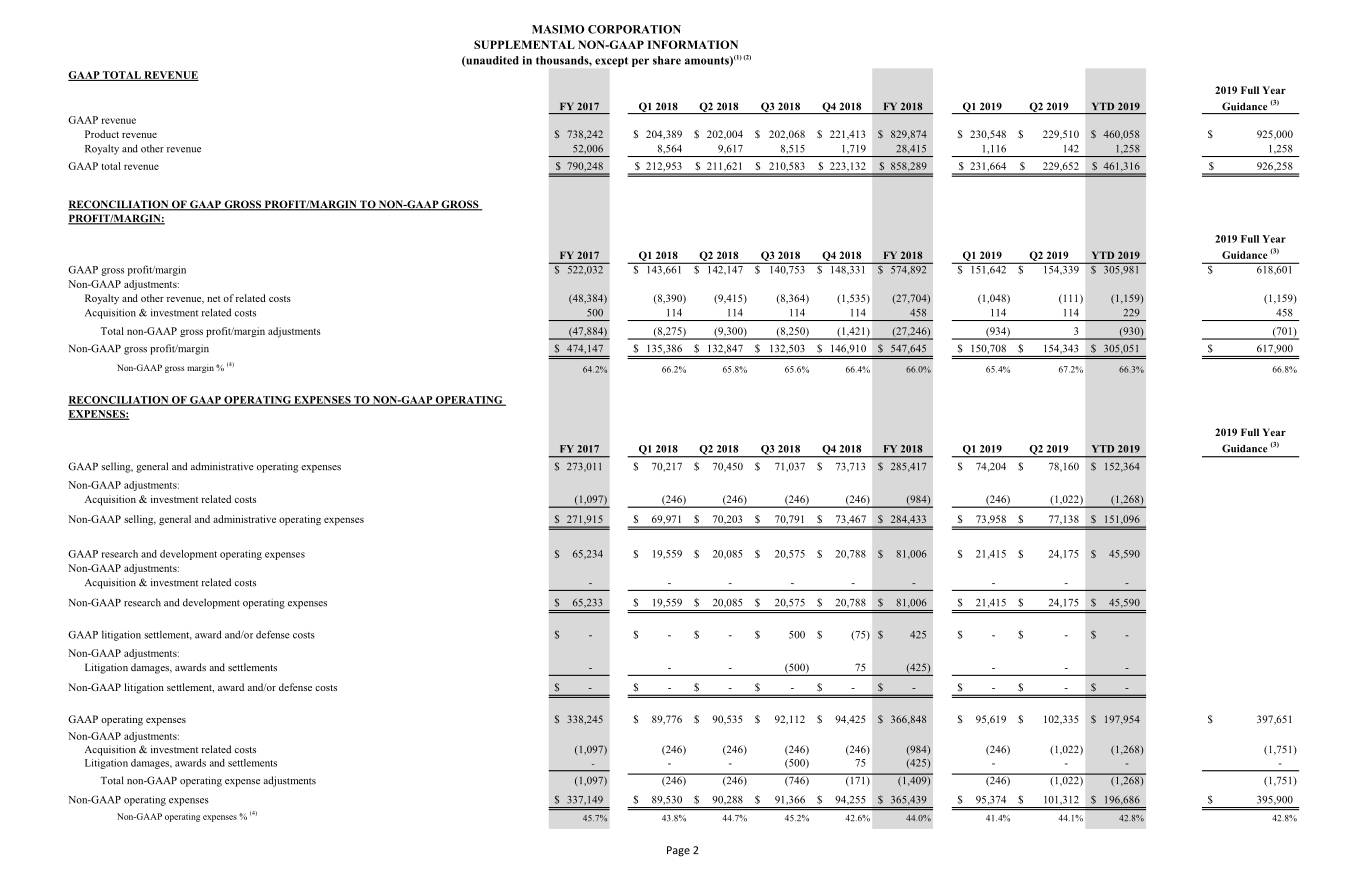

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP operating income/margin $ 183,787 $ 53,885 $ 51,612 $ 48,641 $ 53,906 $ 208,044 $ 56,023 $ 52,004 $ 108,027 $ 220,950 Non-GAAP adjustments: Royalty and other revenue, net of related costs (48,384) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (111) (1,159) (1,159) Acquisition & investment related costs 1,597 361 361 361 361 1,442 361 1,136 1,497 2,209 Litigation damages, awards and settlements - - - 500 (75) 425 - - - - Total non-GAAP operating income/margin adjustments (46,787) (8,029) (9,054) (7,504) (1,250) (25,837) (688) 1,025 337 1,050 Non-GAAP operating income/margin $ 136,999 $ 45,856 $ 42,559 $ 41,136 $ 52,655 $ 182,206 $ 55,334 $ 53,030 $ 108,365 $ 222,000 (4) Non-GAAP operating income % 18.6% 22.4% 21.1% 20.4% 23.8% 22.0% 24.0% 23.1% 23.6% 24.0% RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP net income$ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 $ 49,322 $ 44,888 $ 94,210 $ 188,804 Non-GAAP adjustments: Royalty and other revenue, net of related costs (48,384) (8,390) (9,415) (8,364) (1,535) (27,704) (1,048) (111) (1,159) (1,159) Acquisition & investment related costs: Cost of goods sold 500 114 114 114 114 458 114 114 229 458 Operating expenses 1,097 246 246 246 246 984 246 1,022 1,268 1,751 Subtotal - Acquisition & investment related costs 1,597 361 361 361 361 1,442 361 1,136 1,497 2,209 Litigation damages, awards and settlements Operating expenses - - - 500 (75) 425 - - - - Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses 270 (1,113) 566 1,311 1,263 2,027 (534) (7) (541) (541) ## Tax impact of non-GAAP net income adjustments 16,100 2,101 2,344 1,599 (513) 5,532 359 (179) 181 63 Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - (4,169) - (4,169) - - - - 9800Excess tax benefits from stock-based compensation (39,242) (3,148) (3,947) (14,647) (294) (22,036) (3,432) (2,608) (6,040) (9,290) 2017 U.S. Tax Reform 41,392 16 - (16) (675) (675) - - - Total non-GAAP net income adjustments (28,267) (10,173) (10,091) (23,425) (1,468) (45,157) (4,294) (1,768) (6,063) (8,718) Non-GAAP net income $ 96,520 $ 35,457 $ 33,763 $ 33,701 $ 45,465 $ 148,385 $ 45,027 $ 43,120 $ 88,147 $ 180,087 Page 3

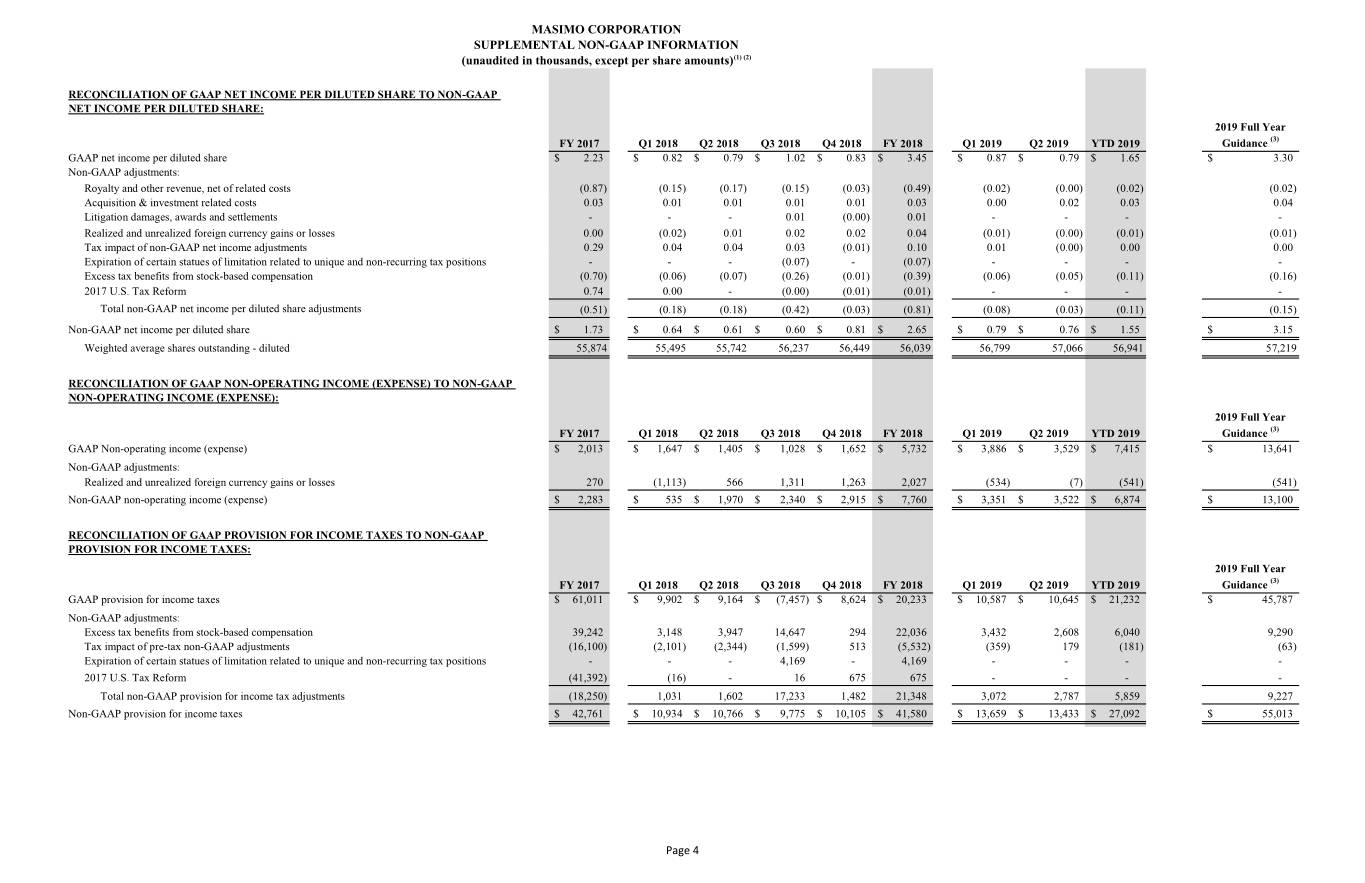

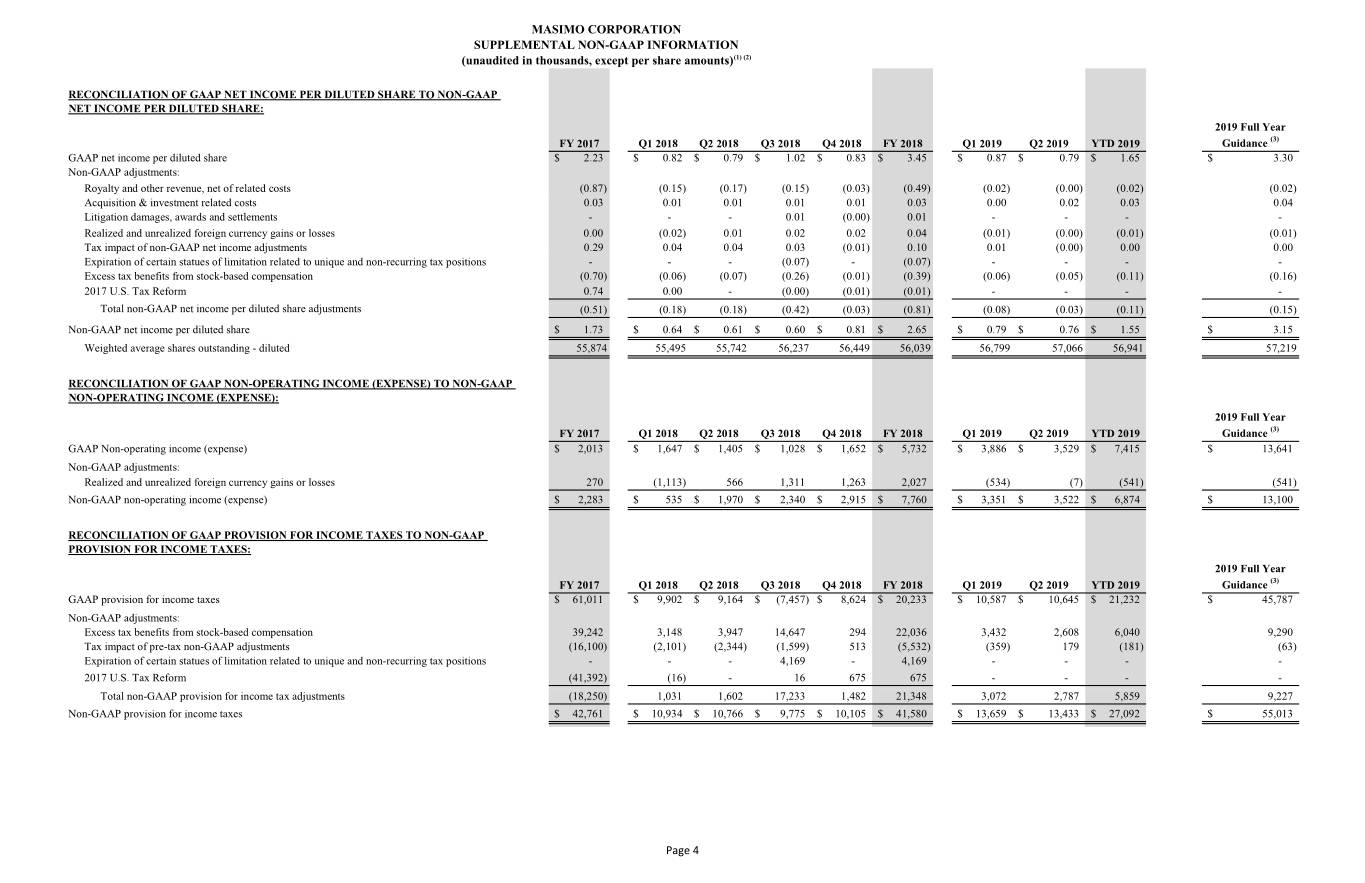

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP NET INCOME PER DILUTED SHARE: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP net income per diluted share $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 0.83 $ 3.45 $ 0.87 $ 0.79 $ 1.65 $ 3.30 Non-GAAP adjustments: Royalty and other revenue, net of related costs (0.87) (0.15) (0.17) (0.15) (0.03) (0.49) (0.02) (0.00) (0.02) (0.02) Acquisition & investment related costs 0.03 0.01 0.01 0.01 0.01 0.03 0.00 0.02 0.03 0.04 Litigation damages, awards and settlements - - - 0.01 (0.00) 0.01 - - - - Realized and unrealized foreign currency gains or losses 0.00 (0.02) 0.01 0.02 0.02 0.04 (0.01) (0.00) (0.01) (0.01) Tax impact of non-GAAP net income adjustments 0.29 0.04 0.04 0.03 (0.01) 0.10 0.01 (0.00) 0.00 0.00 Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - (0.07) - (0.07) - - - - 9800Excess tax benefits from stock-based compensation (0.70) (0.06) (0.07) (0.26) (0.01) (0.39) (0.06) (0.05) (0.11) (0.16) 2017 U.S. Tax Reform 0.74 0.00 - (0.00) (0.01) (0.01) - - - - Total non-GAAP net income per diluted share adjustments (0.51) (0.18) (0.18) (0.42) (0.03) (0.81) (0.08) (0.03) (0.11) (0.15) Non-GAAP net income per diluted share$ 1.73 $ 0.64 $ 0.61 $ 0.60 $ 0.81 $ 2.65 $ 0.79 $ 0.76 $ 1.55 $ 3.15 Weighted average shares outstanding - diluted 55,874 55,495 55,742 56,237 56,449 56,039 56,799 57,066 56,941 57,219 RECONCILIATION OF GAAP NON-OPERATING INCOME (EXPENSE) TO NON-GAAP NON-OPERATING INCOME (EXPENSE): 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP Non-operating income (expense)$ 2,013 $ 1,647 $ 1,405 $ 1,028 $ 1,652 $ 5,732 $ 3,886 $ 3,529 $ 7,415 $ 13,641 Non-GAAP adjustments: Realized and unrealized foreign currency gains or lossesh 270 (1,113) 566 1,311 1,263 2,027 (534) (7) (541) (541) Non-GAAP non-operating income (expense) $ 2,283 $ 535 $ 1,970 $ 2,340 $ 2,915 $ 7,760 $ 3,351 $ 3,522 $ 6,874 $ 13,100 RECONCILIATION OF GAAP PROVISION FOR INCOME TAXES TO NON-GAAP PROVISION FOR INCOME TAXES: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP provision for income taxes $ 61,011 $ 9,902 $ 9,164 $ (7,457) $ 8,624 $ 20,233 $ 10,587 $ 10,645 $ 21,232 $ 45,787 Non-GAAP adjustments: Excess tax benefits from stock-based compensation 39,242 3,148 3,947 14,647 294 22,036 3,432 2,608 6,040 9,290 Tax impact of pre-tax non-GAAP adjustments (16,100) (2,101) (2,344) (1,599) 513 (5,532) (359) 179 (181) (63) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - 4,169 - 4,169 - - - - 2017 U.S. Tax Reform (41,392) (16) - 16 675 675 - - - - Total non-GAAP provision for income tax adjustments (18,250) 1,031 1,602 17,233 1,482 21,348 3,072 2,787 5,859 9,227 Non-GAAP provision for income taxes $ 42,761 $ 10,934 $ 10,766 $ 9,775 $ 10,105 $ 41,580 $ 13,659 $ 13,433 $ 27,092 $ 55,013 Page 4

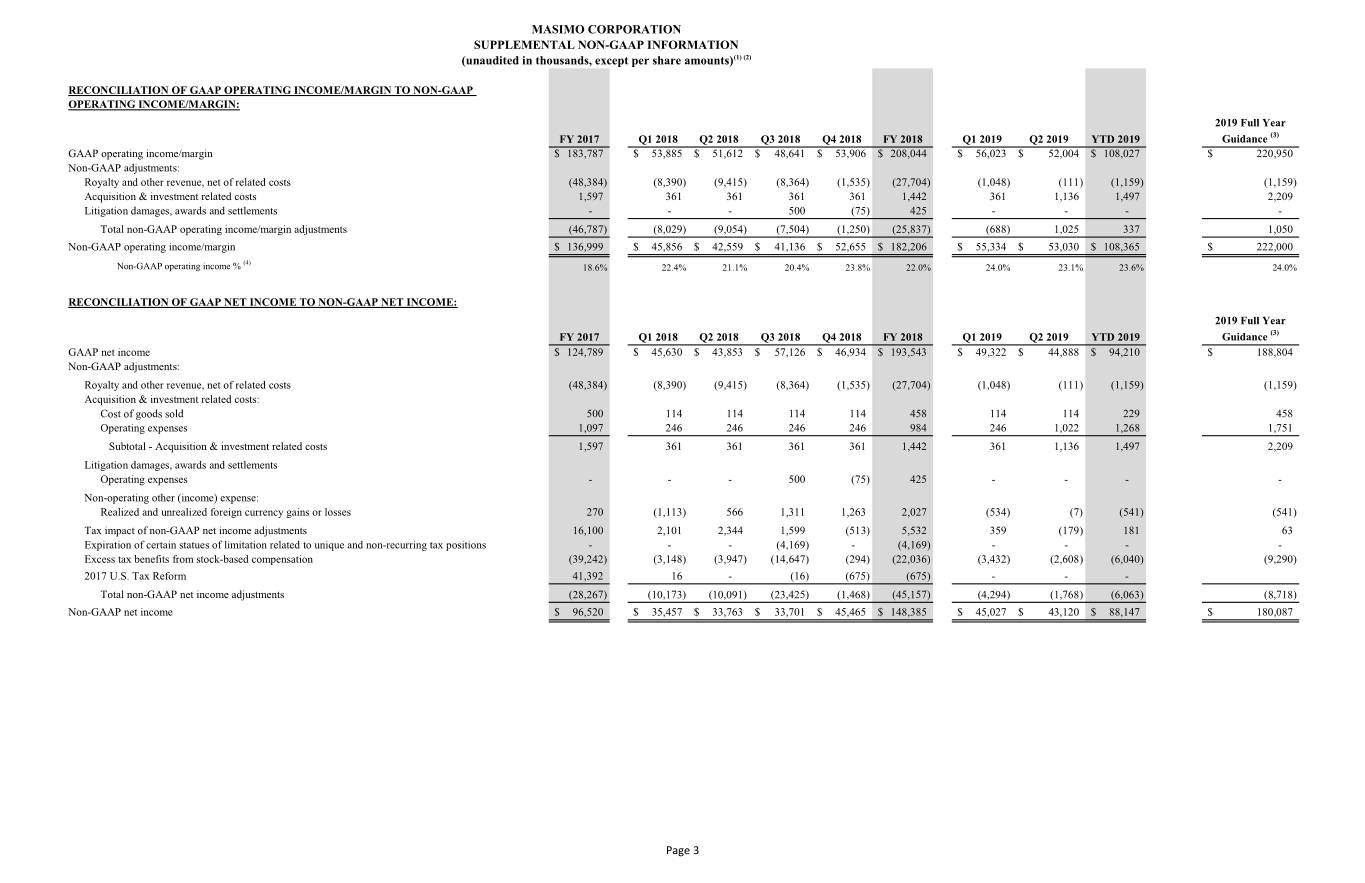

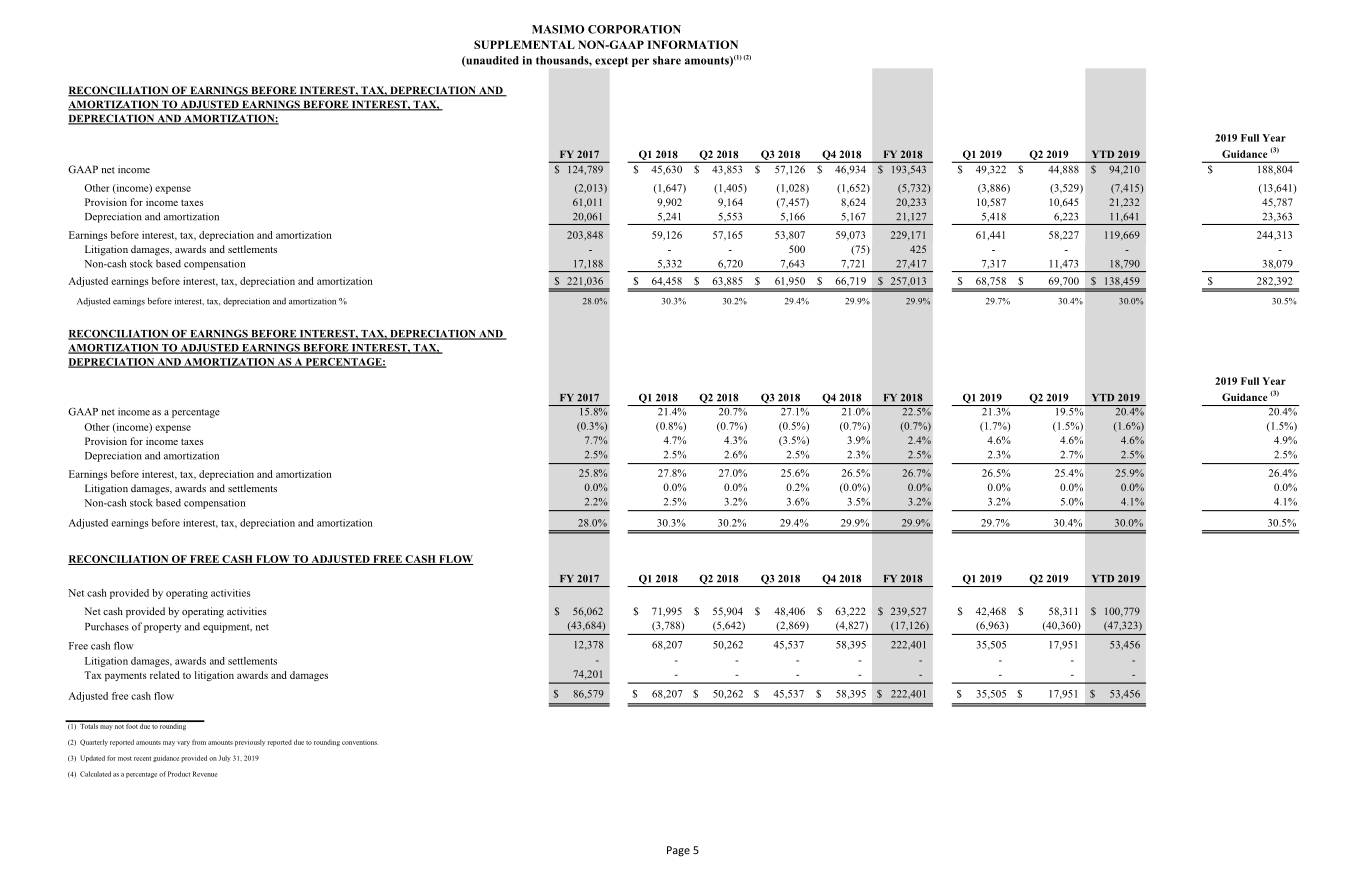

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP net income$ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 $ 49,322 $ 44,888 $ 94,210 $ 188,804 Other (income) expense (2,013) (1,647) (1,405) (1,028) (1,652) (5,732) (3,886) (3,529) (7,415) (13,641) Provision for income taxes 61,011 9,902 9,164 (7,457) 8,624 20,233 10,587 10,645 21,232 45,787 Depreciation and amortization 20,061 5,241 5,553 5,166 5,167 21,127 5,418 6,223 11,641 23,363 Earnings before interest, tax, depreciation and amortization 203,848 59,126 57,165 53,807 59,073 229,171 61,441 58,227 119,669 244,313 Litigation damages, awards and settlements - - - 500 (75) 425 - - - - Non-cash stock based compensation 17,188 5,332 6,720 7,643 7,721 27,417 7,317 11,473 18,790 38,079 Adjusted earnings before interest, tax, depreciation and amortization $ 221,036 $ 64,458 $ 63,885 $ 61,950 $ 66,719 $ 257,013 $ 68,758 $ 69,700 $ 138,459 $ 282,392 Adjusted earnings before interest, tax, depreciation and amortization % 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% 29.7% 30.4% 30.0% 30.5% RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION AS A PERCENTAGE: 2019 Full Year FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Guidance (3) GAAP net income as a percentage 15.8% 21.4% 20.7% 27.1% 21.0% 22.5% 21.3% 19.5% 20.4% 20.4% Other (income) expense (0.3%) (0.8%) (0.7%) (0.5%) (0.7%) (0.7%) (1.7%) (1.5%) (1.6%) (1.5%) Provision for income taxes 7.7% 4.7% 4.3% (3.5%) 3.9% 2.4% 4.6% 4.6% 4.6% 4.9% Depreciation and amortization 2.5% 2.5% 2.6% 2.5% 2.3% 2.5% 2.3% 2.7% 2.5% 2.5% Earnings before interest, tax, depreciation and amortization 25.8% 27.8% 27.0% 25.6% 26.5% 26.7% 26.5% 25.4% 25.9% 26.4% Litigation damages, awards and settlements 0.0% 0.0% 0.0% 0.2% (0.0%) 0.0% 0.0% 0.0% 0.0% 0.0% Non-cash stock based compensation 2.2% 2.5% 3.2% 3.6% 3.5% 3.2% 3.2% 5.0% 4.1% 4.1% Adjusted earnings before interest, tax, depreciation and amortization 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% 29.7% 30.4% 30.0% 30.5% RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW FY 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Q1 2019 Q2 2019 YTD 2019 Net cash provided by operating activities Net cash provided by operating activities $ 56,062 $ 71,995 $ 55,904 $ 48,406 $ 63,222 $ 239,527 $ 42,468 $ 58,311 $ 100,779 Purchases of property and equipment, net (43,684) (3,788) (5,642) (2,869) (4,827) (17,126) (6,963) (40,360) (47,323) Free cash flow 12,378 68,207 50,262 45,537 58,395 222,401 35,505 17,951 53,456 Litigation damages, awards and settlements - - - - - - - - - Tax payments related to litigation awards and damages 74,201 - - - - - - - - Adjusted free cash flow $ 86,579 $ 68,207 $ 50,262 $ 45,537 $ 58,395 $ 222,401 $ 35,505 $ 17,951 $ 53,456 (1) Totals may not foot due to rounding (2) Quarterly reported amounts may vary from amounts previously reported due to rounding conventions. (3) Updated for most recent guidance provided on July 31, 2019 (4) Calculated as a percentage of Product Revenue Page 5