MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) All statements other than statements of historical facts included in this Supplemental Non-GAAP information that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our expectations for full fiscal year GAAP and non-GAAP 2020 total revenue, product revenue, royalty and other revenues, gross profit/margin, selling, general and administrative operating expenses, research and development operating expenses, litigation settlement, award and/or defense costs, operating expenses, operating income/margin, net income, diluted earnings per share, non- operating income, provision for income taxes, adjusted free cash flow; our long-term outlook; demand for our products; anticipated revenue and earnings growth; our financial condition, results of operations and business generally; expectations regarding our ability to design and deliver innovative new noninvasive technologies and reduce the cost of care; and demand for our technologies. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. For additional information related to the definitions of our Non-GAAP measures, please visit the Investor Relations section of the Company's website at www.masimo.com. Page 1

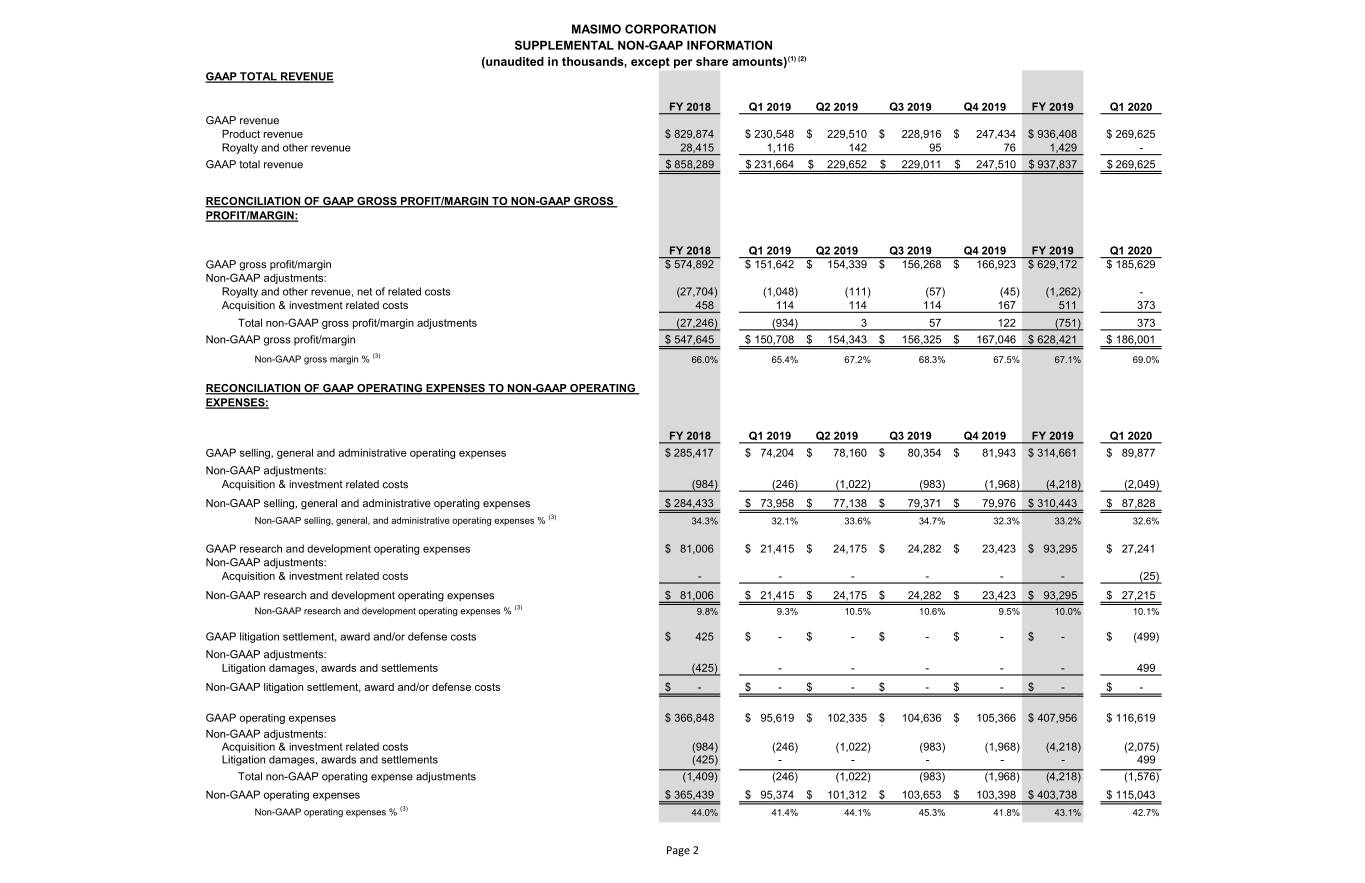

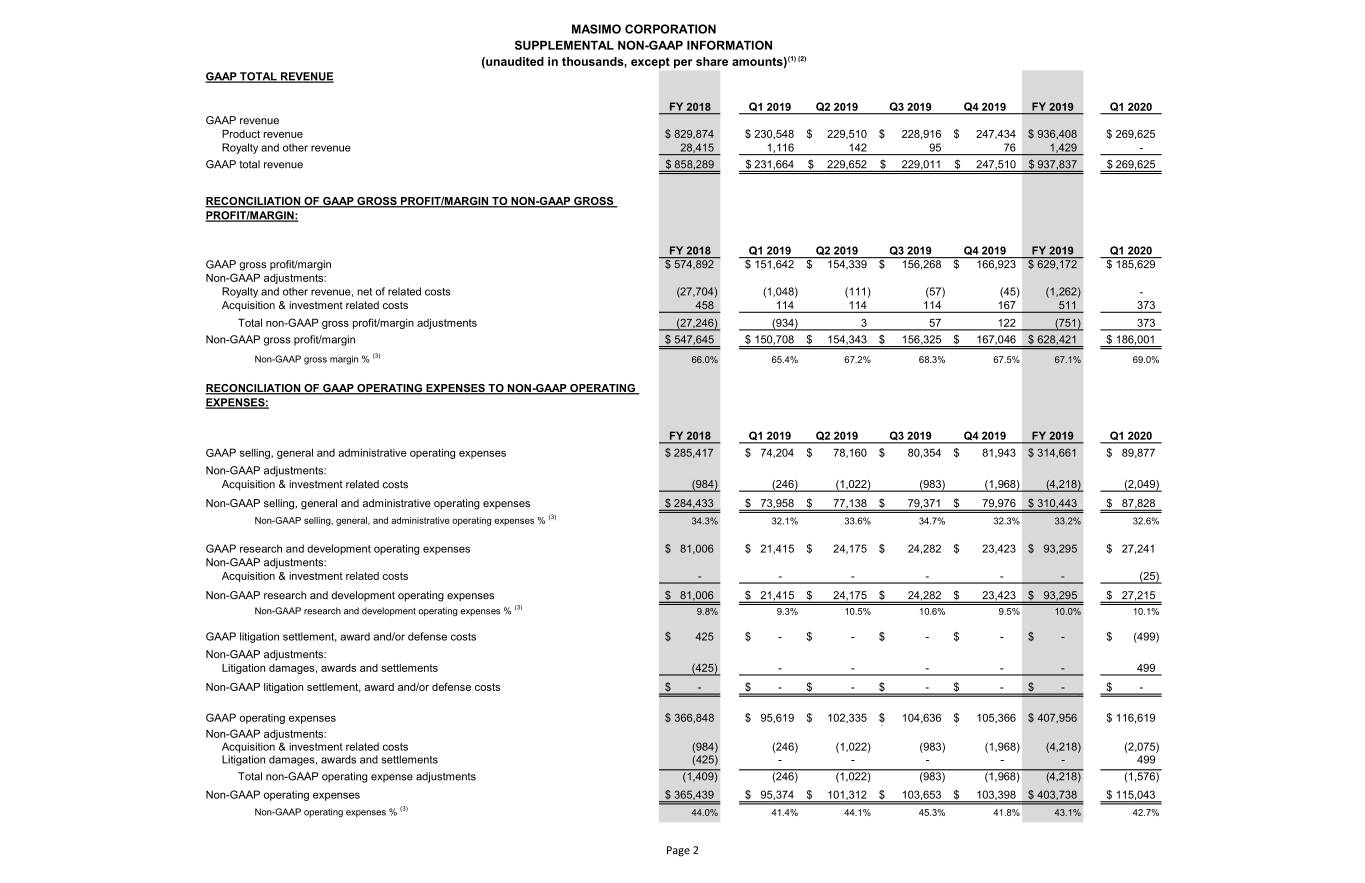

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) GAAP TOTAL REVENUE FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP revenue Product revenue$ 829,874 $ 230,548 $ 229,510 $ 228,916 $ 247,434 $ 936,408 $ 269,625 Royalty and other revenue 28,415 1,116 142 95 76 1,429 - GAAP total revenue $ 858,289 $ 231,664 $ 229,652 $ 229,011 $ 247,510 $ 937,837 $ 269,625 RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP gross profit/margin$ 574,892 $ 151,642 $ 154,339 $ 156,268 $ 166,923 $ 629,172 $ 185,629 Non-GAAP adjustments: Royalty and other revenue, net of related costs (27,704) (1,048) (111) (57) (45) (1,262) - Acquisition & investment related costs 458 114 114 114 167 511 373 Total non-GAAP gross profit/margin adjustments (27,246) (934) 3 57 122 (751) 373 Non-GAAP gross profit/margin $ 547,645 $ 150,708 $ 154,343 $ 156,325 $ 167,046 $ 628,421 $ 186,001 Non-GAAP gross margin % (3) 66.0% 65.4% 67.2% 68.3% 67.5% 67.1% 69.0% RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP selling, general and administrative operating expenses$ 285,417 $ 74,204 $ 78,160 $ 80,354 $ 81,943 $ 314,661 $ 89,877 Non-GAAP adjustments: Acquisition & investment related costs (984) (246) (1,022) (983) (1,968) (4,218) (2,049) Non-GAAP selling, general and administrative operating expenses$ 284,433 $ 73,958 $ 77,138 $ 79,371 $ 79,976 $ 310,443 $ 87,828 Non-GAAP selling, general, and administrative operating expenses % (3) 34.3% 32.1% 33.6% 34.7% 32.3% 33.2% 32.6% GAAP research and development operating expenses$ 81,006 $ 21,415 $ 24,175 $ 24,282 $ 23,423 $ 93,295 $ 27,241 Non-GAAP adjustments: Acquisition & investment related costs - - - - - - (25) Non-GAAP research and development operating expenses$ 81,006 $ 21,415 $ 24,175 $ 24,282 $ 23,423 $ 93,295 $ 27,215 Non-GAAP research and development operating expenses % (3) 9.8% 9.3% 10.5% 10.6% 9.5% 10.0% 10.1% GAAP litigation settlement, award and/or defense costs$ 425 $ - $ - $ - $ - $ - $ (499) Non-GAAP adjustments: Litigation damages, awards and settlements (425) - - - - - 499 Non-GAAP litigation settlement, award and/or defense costs$ - 4 $ - $ - $ - $ - $ - 4 $ - GAAP operating expenses $ 366,848 $ 95,619 $ 102,335 $ 104,636 - $ 105,366 - $ 407,956 $ 116,619 Non-GAAP adjustments: Acquisition & investment related costs (984) (246) (1,022) (983) (1,968) (4,218) (2,075) Litigation damages, awards and settlements (425) - - - - - 499 Total non-GAAP operating expense adjustments (1,409) (246) (1,022) (983) (1,968) (4,218) (1,576) Non-GAAP operating expenses$ 365,439 $ 95,374 $ 101,312 $ 103,653 $ 103,398 $ 403,738 $ 115,043 Non-GAAP operating expenses % (3) 44.0% 41.4% 44.1% 45.3% 41.8% 43.1% 42.7% Page 2

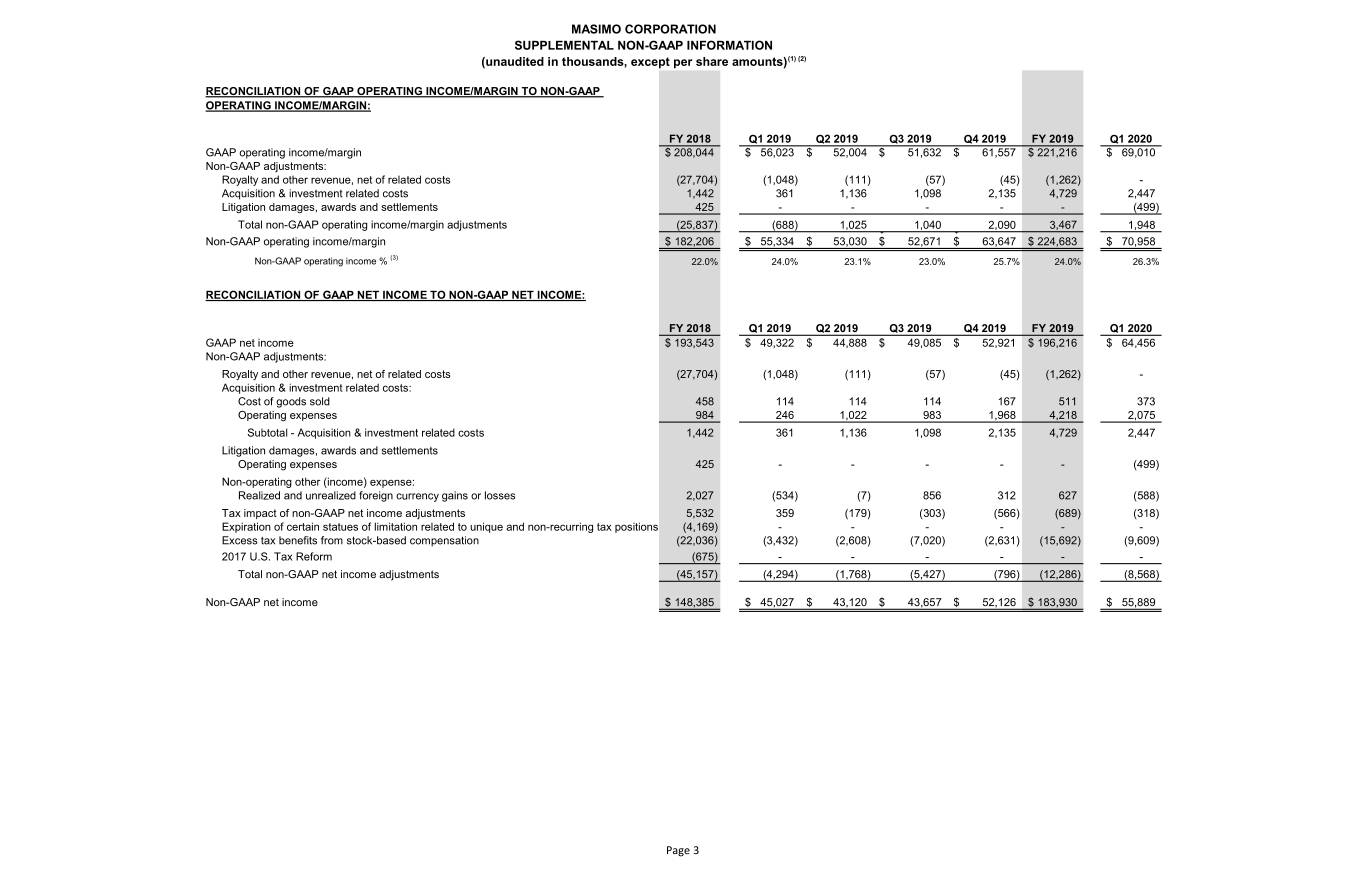

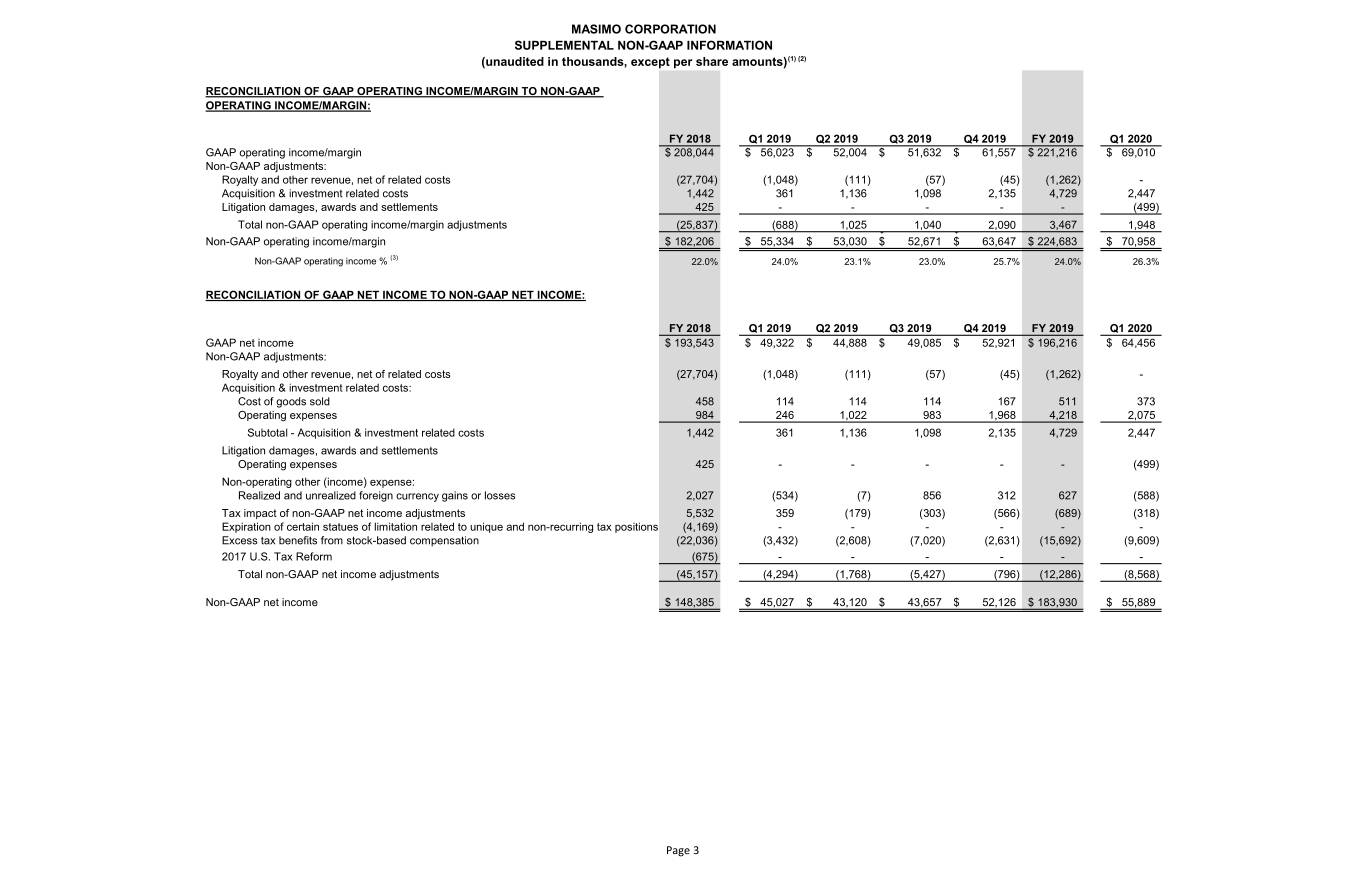

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP operating income/margin$ 208,044 $ 56,023 $ 52,004 $ 51,632 $ 61,557 $ 221,216 $ 69,010 Non-GAAP adjustments: Royalty and other revenue, net of related costs (27,704) (1,048) (111) (57) (45) (1,262) - Acquisition & investment related costs 1,442 361 1,136 1,098 2,135 4,729 2,447 Litigation damages, awards and settlements 425 - - - - - (499) Total non-GAAP operating income/margin adjustments (25,837) (688) 1,025 $ 1,040 - $ 2,090 - 3,467 1,948 Non-GAAP operating income/margin $ 182,206 $ 55,334 $ 53,030 $ 52,671 $ 63,647 $ 224,683 $ 70,958 Non-GAAP operating income % (3) 22.0% 24.0% 23.1% 23.0% 25.7% 24.0% 26.3% RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP net income$ 193,543 $ 49,322 $ 44,888 $ 49,085 $ 52,921 $ 196,216 $ 64,456 Non-GAAP adjustments: Royalty and other revenue, net of related costs (27,704) (1,048) (111) (57) (45) (1,262) - Acquisition & investment related costs: Cost of goods sold 458 114 114 114 167 511 373 Operating expenses 984 246 1,022 983 1,968 4,218 2,075 Subtotal - Acquisition & investment related costs 1,442 361 1,136 1,098 2,135 4,729 2,447 Litigation damages, awards and settlements Operating expenses 425 - - - - - (499) Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses 2,027 (534) (7) 856 312 627 (588) # Tax impact of non-GAAP net income adjustments 5,532 359 (179) (303) (566) (689) (318) Expiration of certain statues of limitation related to unique and non-recurring tax positions (4,169) - - - - - - 9800Excess tax benefits from stock-based compensation (22,036) (3,432) (2,608) (7,020) (2,631) (15,692) (9,609) 2017 U.S. Tax Reform (675) - - - - - - Total non-GAAP net income adjustments (45,157) (4,294) (1,768) (5,427) (796) (12,286) (8,568) Non-GAAP net income $ 148,385 $ 45,027 $ 43,120 $ 43,657 $ 52,126 $ 183,930 $ 55,889 Page 3

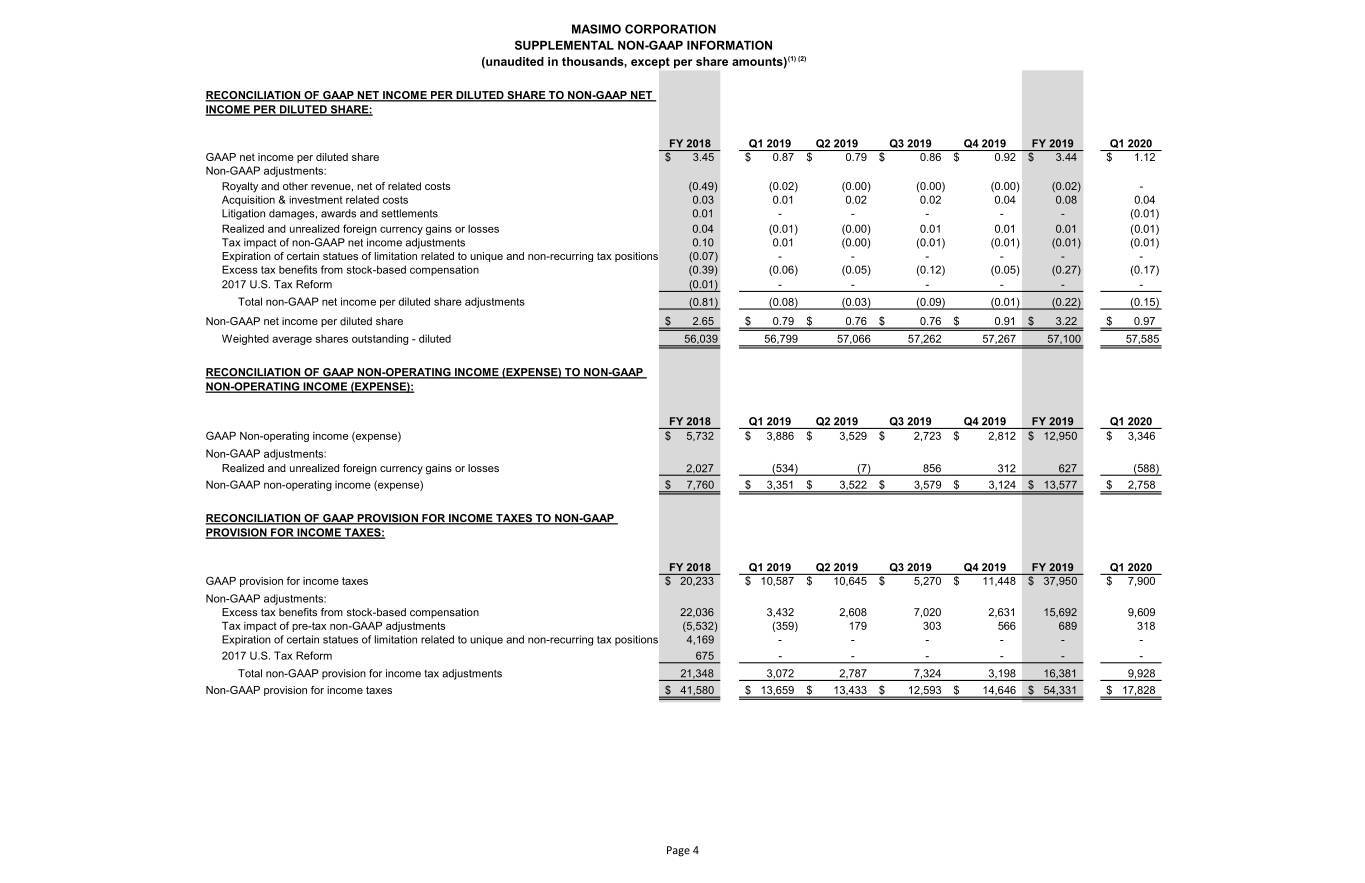

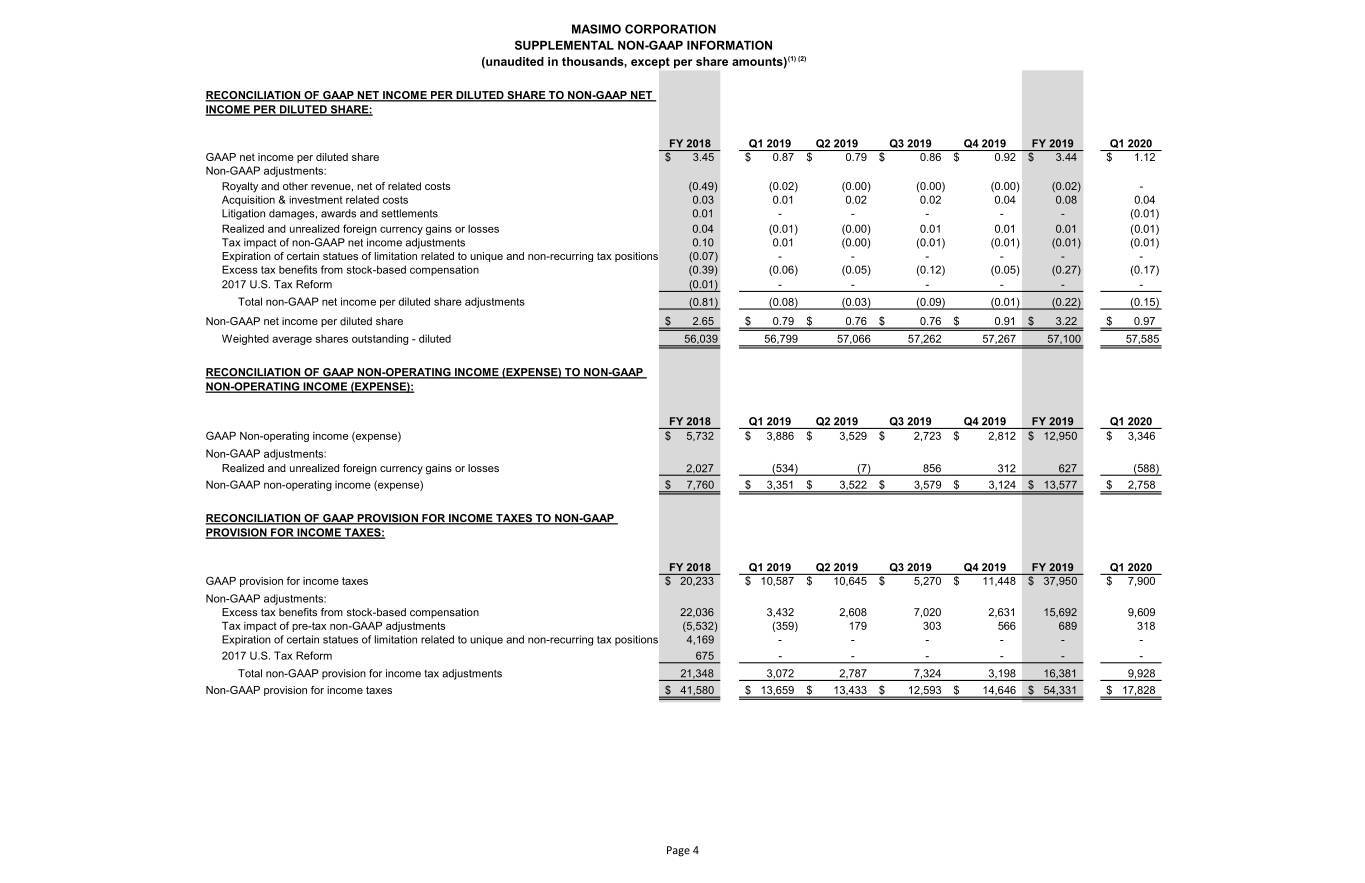

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP NET INCOME PER DILUTED SHARE: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP net income per diluted share $ 3.45 $ 0.87 $ 0.79 $ 0.86 $ 0.92 $ 3.44 $ 1.12 Non-GAAP adjustments: Royalty and other revenue, net of related costs (0.49) (0.02) (0.00) (0.00) (0.00) (0.02) - Acquisition & investment related costs 0.03 0.01 0.02 0.02 0.04 0.08 0.04 Litigation damages, awards and settlements 0.01 - - - - - (0.01) Realized and unrealized foreign currency gains or losses 0.04 (0.01) (0.00) 0.01 0.01 0.01 (0.01) Tax impact of non-GAAP net income adjustments 0.10 0.01 (0.00) (0.01) (0.01) (0.01) (0.01) Expiration of certain statues of limitation related to unique and non-recurring tax positions (0.07) - - - - - - 9800Excess tax benefits from stock-based compensation (0.39) (0.06) (0.05) (0.12) (0.05) (0.27) (0.17) 2017 U.S. Tax Reform (0.01) - - - - - - Total non-GAAP net income per diluted share adjustments (0.81) (0.08) (0.03) (0.09) (0.01) (0.22) (0.15) Non-GAAP net income per diluted share$ 2.65 $ 0.79 $ 0.76 $ 0.76 $ 0.91 $ 3.22 $ 0.97 Weighted average shares outstanding - diluted 56,039 56,799 57,066 57,262 57,267 57,100 57,585 RECONCILIATION OF GAAP NON-OPERATING INCOME (EXPENSE) TO NON-GAAP NON-OPERATING INCOME (EXPENSE): FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP Non-operating income (expense)$ 5,732 $ 3,886 $ 3,529 $ 2,723 $ 2,812 $ 12,950 $ 3,346 Non-GAAP adjustments: Realized and unrealized foreign currency gains or losses 2,027 (534) (7) 856 312 627 (588) Non-GAAP non-operating income (expense) $ 7,760 $ 3,351 $ 3,522 $ 3,579 $ 3,124 $ 13,577 $ 2,758 RECONCILIATION OF GAAP PROVISION FOR INCOME TAXES TO NON-GAAP PROVISION FOR INCOME TAXES: FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 GAAP provision for income taxes$ 20,233 $ 10,587 $ 10,645 $ 5,270 $ 11,448 $ 37,950 $ 7,900 Non-GAAP adjustments: Excess tax benefits from stock-based compensation 22,036 3,432 2,608 7,020 2,631 15,692 9,609 Tax impact of pre-tax non-GAAP adjustments (5,532) (359) 179 303 566 689 318 Expiration of certain statues of limitation related to unique and non-recurring tax positions 4,169 - - - - - - 2017 U.S. Tax Reform 675 - - - - - - Total non-GAAP provision for income tax adjustments 21,348 3,072 2,787 7,324 3,198 16,381 9,928 Non-GAAP provision for income taxes $ 41,580 $ 13,659 $ 13,433 $ 12,593 $ 14,646 $ 54,331 $ 17,828 Page 4

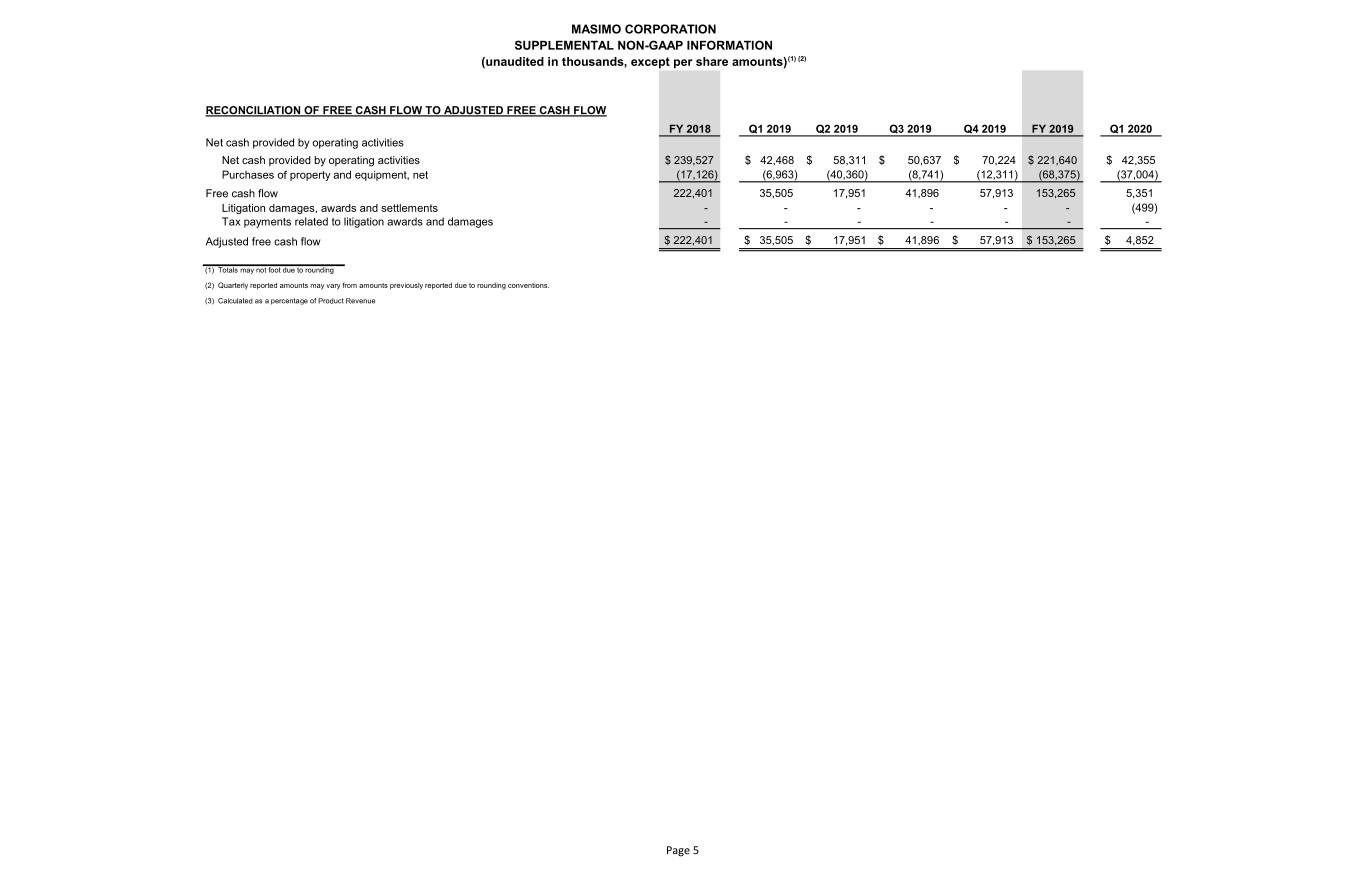

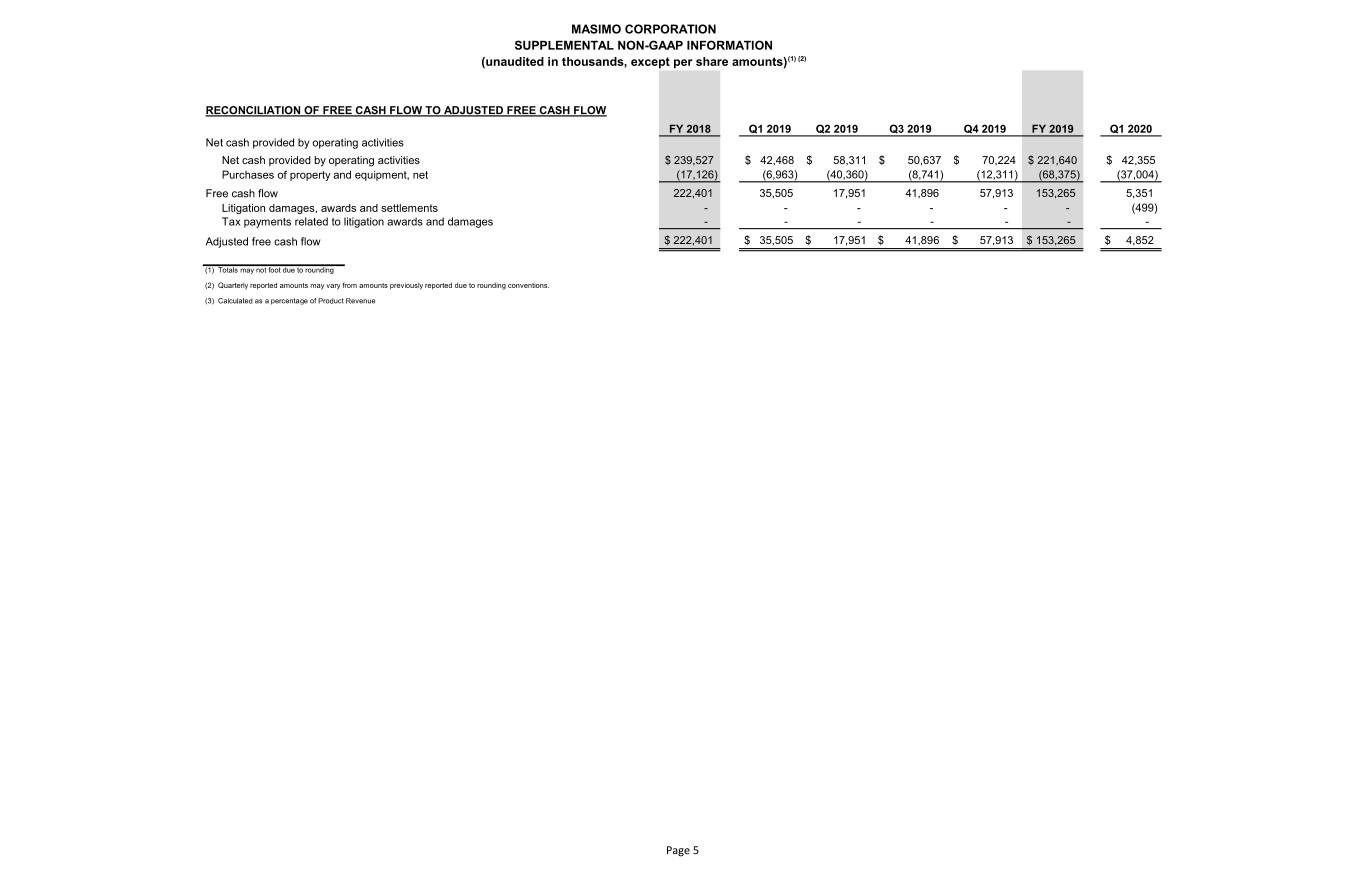

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts)(1) (2) RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW FY 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Net cash provided by operating activities Net cash provided by operating activities$ 239,527 $ 42,468 $ 58,311 $ 50,637 $ 70,224 $ 221,640 $ 42,355 Purchases of property and equipment, net (17,126) (6,963) (40,360) (8,741) (12,311) (68,375) (37,004) Free cash flow 222,401 35,505 17,951 41,896 57,913 153,265 5,351 Litigation damages, awards and settlements - - - - - - (499) Tax payments related to litigation awards and damages - - - - - - - Adjusted free cash flow $ 222,401 $ 35,505 $ 17,951 $ 41,896 $ 57,913 $ 153,265 $ 4,852 (1) Totals may not foot due to rounding (2) Quarterly reported amounts may vary from amounts previously reported due to rounding conventions. (3) Calculated as a percentage of Product Revenue Page 5