UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting material Pursuant to §240.14a-12 |

Masimo Corporation

(Name of Registrant as Specified In Its Charter)

POLITAN CAPITAL MANAGEMENT LP

POLITAN CAPITAL MANAGEMENT GP LLC

POLITAN CAPITAL PARTNERS GP LLC

POLITAN CAPITAL NY LLC

POLITAN INTERMEDIATE LTD.

POLITAN CAPITAL PARTNERS MASTER FUND LP

POLITAN CAPITAL PARTNERS LP

POLITAN CAPITAL OFFSHORE PARTNERS LP

QUENTIN KOFFEY

MATTHEW HALL

AARON KAPITO

MICHELLE BRENNAN

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | x | No fee required. |

| | | |

| | ¨ | Fee paid previously with preliminary materials. |

| | | |

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

On May 19, 2023, Politan Capital Management LP, a Delaware limited partnership (“Politan”) posted the following material to the website, at www.AdvanceMasimo.com (the “Site”) and such material posted to the Site is filed herewith. Politan or its fellow participants in the proxy solicitation may publish the material, or portions thereof, on the Site relating to Masimo Corporation (the “Company”), and they may otherwise from time to time distribute the material or portions thereof.

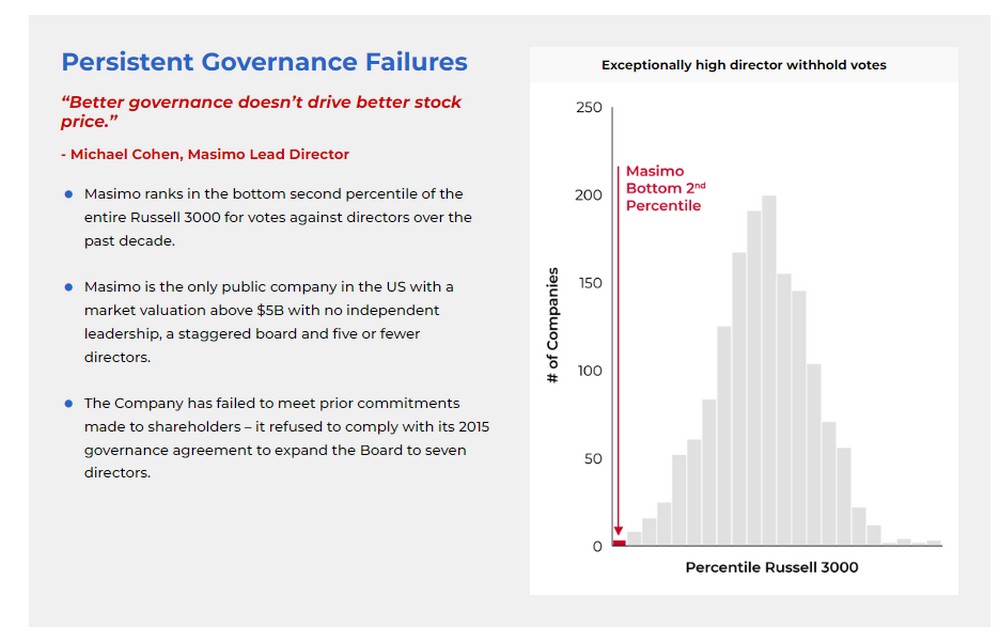

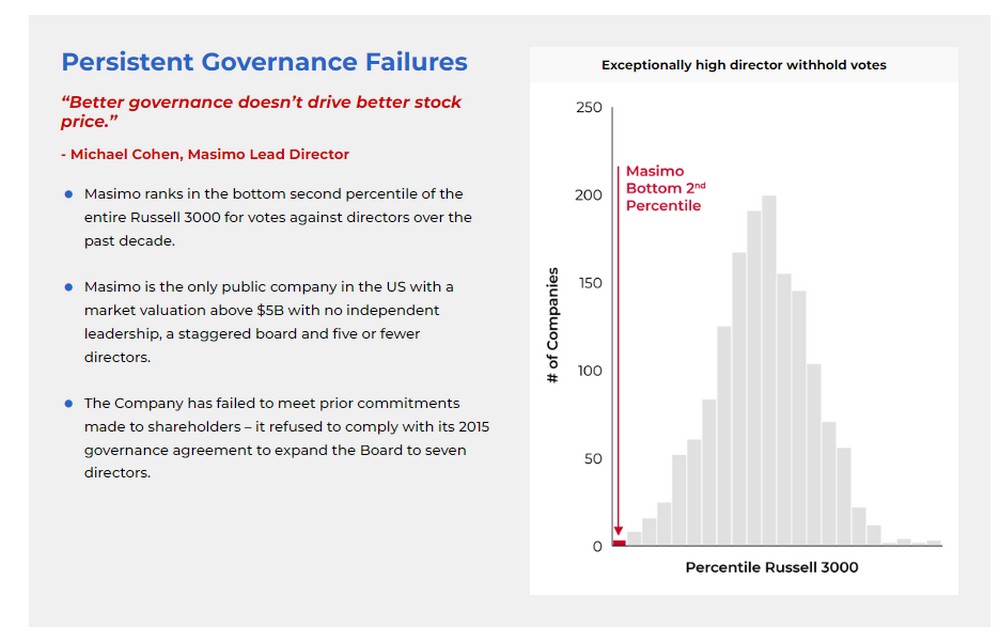

Persistent Governance Failures “Better governance doesn’t drive better stock price.” - Michael Cohen, Masimo Lead Director • Masimo ranks in the bottom second percentile of the entire Russell 3000 for votes against directors over the past decade. • Masimo is the only public company in the US with a market valuation above $5B with no independent leadership, a staggered board and five or fewer directors. • The Company has failed to meet prior commitments made to shareholders – it refused to comply with its 2015 governance agreement to expand the Board to seven directors. Exceptionally high director withhold votes

Longstanding Say on Pay failures Egregious Compensation & Side Payments • Masimo ranks in the bottom one percentile of the entire Russell 3000 for “Say-on-Pay” and has failed its Say-on-Pay vote for six of the last twelve years. • The CEO’s compensation is over 1.6x peers and 2.6x peers as a percentage of revenue. • The Board has permitted a variety of related party payments to Mr. Kiani, including paying $17M/year in royalties to Cercacor (owned and controlled by Mr. Kiani) and permitting Mr. Kiani to use the Masimo Foundation as a personal foundation (with his wife and sister comprising the majority of the foundation’s board for most of its history).

Longstanding Say on Pay failures Egregious Compensation & Side Payments • Masimo ranks in the bottom one percentile of the entire Russell 3000 for “Say-on-Pay” and has failed its Say-on-Pay vote for six of the last twelve years. • The CEO’s compensation is over 1.6x peers and 2.6x peers as a percentage of revenue. • The Board has permitted a variety of related party payments to Mr. Kiani, including paying $17M/year in royalties to Cercacor (owned and controlled by Mr. Kiani) and permitting Mr. Kiani to use the Masimo Foundation as a personal foundation (with his wife and sister comprising the majority of the foundation’s board for most of its history).

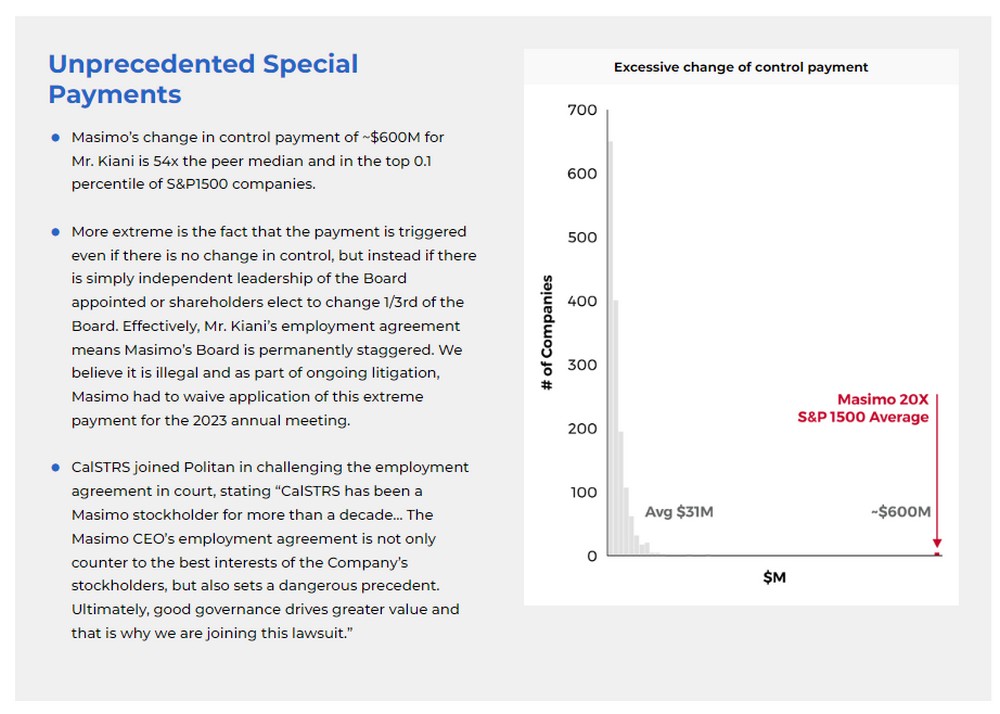

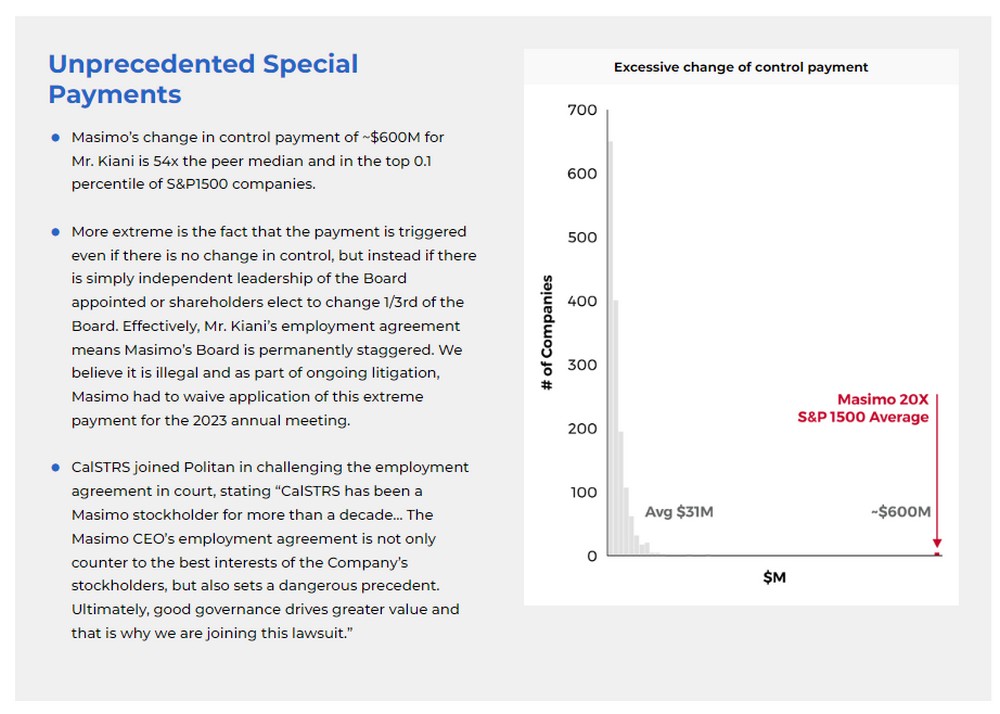

Unprecedented Special Payments • Masimo’s change in control payment of ~$600M for Mr. Kiani is 54x the peer median and in the top 0.1 percentile of S&P1500 companies. • More extreme is the fact that the payment is triggered even if there is no change in control, but instead if there is simply independent leadership of the Board appointed or shareholders elect to change 1/3rd of the Board. Effectively, Mr. Kiani’s employment agreement means Masimo’s Board is permanently staggered. We believe it is illegal and as part of ongoing litigation, Masimo had to waive application of this extreme payment for the 2023 annual meeting. • CalSTRS joined Politan in challenging the employment agreement in court, stating “CalSTRS has been a Masimo stockholder for more than a decade... The Masimo CEO’s employment agreement is not only counter to the best interests of the Company’s stockholders, but also sets a dangerous precedent. Ultimately, good governance drives greater value and that is why we are joining this lawsuit.” Excessive change of control payment

ABOUT POLITAN ABOUT POLITAN Politan Capital Management • Politan owns 8.9% (~$800M) of Masimo Corporation shares — making us one of the company’s largest shareholders. We do not use leverage. • We are long-term focused shareholders with the majority of our capital committed for at least three years. • We conduct extensive due diligence, working with top-tier operating partners, consultants and law firms. • We seek to engage constructively with management teams and Board of Directors to unlock long-term value through strategic, operational and governance changes. • Our firm was started in August 2021 and the investment partners have 35+ years of experience at prior firms including Elliott Management and The D. E. Shaw Group. • We have substantial experience engaging productively for the benefit of all shareholders. We have placed ~30 directors on public boards — nearly all through privately negotiated settlement agreements. “Politan’s style is to amicably and quietly work with management to achieve its objectives. They do not send angry public letters, and they do not seek proxy fights. However, they will also not back down from a proxy fight if their hand is forced…Koffey has created significant value for shareholders at companies like Lowe’s… As board members, Politan could be very helpful to both management and shareholders in pursuing strategic projects. They will listen to management with an open mind, and if they agree with a project their support would give management cover with other shareholders to pursue it. However, at the end of the day they are economic animals and will do what is best for shareholders — if management cannot justify a project, Politan will be there to protect shareholder value.” - Ken Squire, 13D Monitor & CNBC 13D Monitor

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Politan’s (defined below) underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Politan that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein have been sourced from third parties. Politan does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Politan Capital Management LP (“Politan”) and the other Participants (as defined below) have filed a preliminary proxy statement and accompanying BLUE universal proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2023 annual stockholders meeting (the “2023 Annual Meeting”) of Masimo Corporation, a Delaware corporation (“Masimo”). Promptly after filing its definitive proxy statement with the SEC, Politan will mail the definitive proxy statement and accompanying BLUE universal proxy card to each stockholder entitled to vote at the 2023 Annual Meeting.

The participants in the proxy solicitation are Politan, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, Politan Capital NY LLC, Politan Intermediate Ltd., Politan Capital Partners Master Fund LP (“Politan Master Fund”), Politan Capital Partners LP (“Politan LP”), Politan Capital Offshore Partners LP (“Politan Offshore” and collectively with Politan Master Fund and Politan LP, the “Politan Funds”), Quentin Koffey, Matthew Hall, Aaron Kapito and Michelle Brennan (collectively, the “Participants”).

As of the date hereof, (i) Politan Master Fund directly owns 4,712,518 shares of common stock, par value $0.001 per share, of Masimo (the “Common Stock”), and (ii) Politan Capital NY LLC is the direct and record owner of 1,000 shares of Common Stock.

Politan, as the investment adviser to the Politan Funds, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) 4,713,518 shares of Common Stock (the “Politan Shares”) and, therefore, Politan may be deemed to be the beneficial owner of all of the Politan Shares. The Politan Shares collectively represent approximately 8.9% of the outstanding shares of Common Stock based on 52,779,770 shares of Common Stock outstanding as of April 1, 2023, as reported in Masimo’s Quarterly Report on Form 10-Q filed on May 10, 2023. As the general partner of Politan, Politan Capital Management GP LLC may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Politan Capital Management GP LLC may be deemed to be the beneficial owner of all of the Politan Shares. As the general partner of the Politan Funds, Politan Capital Partners GP LLC may be deemed to have the shared power to vote or to direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Politan Capital Partners GP LLC may be deemed to be the beneficial owner of all of the Politan Shares. By virtue of Mr. Koffey’s position as the managing partner and chief investment officer of Politan and as the managing member of Politan Capital Management GP LLC and Politan Capital Partners GP LLC, Mr. Koffey may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Mr. Koffey may be deemed to be the beneficial owner of all of the Politan Shares. As of the date hereof, none of Mr. Hall, Mr. Kapito or Ms. Brennan own beneficially or of record any shares of Common Stock.

IMPORTANT INFORMATION AND WHERE TO FIND IT

POLITAN STRONGLY ADVISES ALL STOCKHOLDERS OF MASIMO TO READ THE PRELIMINARY PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT, THE DEFINITIVE PROXY STATEMENT, AND OTHER PROXY MATERIALS FILED BY POLITAN WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT, WHEN FILED, AND OTHER RELEVANT DOCUMENTS, WILL ALSO BE AVAILABLE ON WWW.ADVANCEMASIMO.COM AND THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING & CO., INC., 48 WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005 (STOCKHOLDERS CAN CALL TOLL-FREE: +1 (866) 620-9554).

Longstanding Say on Pay failures Egregious Compensation & Side Payments • Masimo ranks in the bottom one percentile of the entire Russell 3000 for “Say-on-Pay” and has failed its Say-on-Pay vote for six of the last twelve years. • The CEO’s compensation is over 1.6x peers and 2.6x peers as a percentage of revenue. • The Board has permitted a variety of related party payments to Mr. Kiani, including paying $17M/year in royalties to Cercacor (owned and controlled by Mr. Kiani) and permitting Mr. Kiani to use the Masimo Foundation as a personal foundation (with his wife and sister comprising the majority of the foundation’s board for most of its history).

Longstanding Say on Pay failures Egregious Compensation & Side Payments • Masimo ranks in the bottom one percentile of the entire Russell 3000 for “Say-on-Pay” and has failed its Say-on-Pay vote for six of the last twelve years. • The CEO’s compensation is over 1.6x peers and 2.6x peers as a percentage of revenue. • The Board has permitted a variety of related party payments to Mr. Kiani, including paying $17M/year in royalties to Cercacor (owned and controlled by Mr. Kiani) and permitting Mr. Kiani to use the Masimo Foundation as a personal foundation (with his wife and sister comprising the majority of the foundation’s board for most of its history).