UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

On June 26, 2024, Masimo Corporation (“Masimo”) issued the following press release in connection with Masimo’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”).

Masimo Files Investor Presentation Highlighting Innovation-Driven Value, Strategic Initiatives to Deliver Robust Growth and Margin Expansion and Risks of Ceding Control to Politan

Masimo’s Strategy Capitalizes on Innovation to Enhance Growth and Create Value for All Stockholders

Politan is Making a Bid for Control Without Paying a Premium or Articulating a Clear Plan

Politan is Seeking to Replace Masimo Founder, Chairman and CEO Joe Kiani with Inferior Politan Nominees

Politan’s Actions are a Threat to Stockholder Value

Masimo Has a Better Plan and Better Nominees

Strongly Encourages Stockholders to Vote FOR Joe Kiani and Christopher Chavez on the GOLD Proxy Card

Visit ProtectMasimosFuture.com for More Information

IRVINE, Calif. – (BUSINESS WIRE) – Masimo Corporation (“Masimo” or the “Company”) (Nasdaq: MASI) today filed an investor presentation with the U.S. Securities and Exchange Commission in connection with its Annual Meeting of Stockholders to be held on July 25, 2024. The presentation lays out in detail:

| ● | The Company’s robust track record of innovation, led by Masimo Founder, Chairman and CEO Joe Kiani, that supports Masimo’s longstanding valuation premium to industry peers; |

| ● | Masimo’s strategic initiatives for sustained growth and margin expansion that are expected to more than double adjusted EPS to ~$8 by 2029; and |

| ● | The Company’s belief that Politan’s value-destructive agenda to oust Mr. Kiani and take control of Masimo without paying a premium or articulating an exercisable plan poses a significant risk to the value of the Company. |

To safeguard stockholders’ investments and ensure continued value creation, the Board strongly recommends that stockholders vote FOR Masimo’s highly qualified director nominees, Joe Kiani and Christopher Chavez.

The presentation is available here.

About Masimo

Masimo (NASDAQ: MASI) is a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins, Denon, Marantz, and Polk Audio. Our mission is to improve life, improve patient outcomes, and reduce the cost of care. Masimo SET® Measure-through Motion and Low Perfusion™ pulse oximetry, introduced in 1995, has been shown in over 100 independent and objective studies to outperform other pulse oximetry technologies.1 Masimo SET® has also been shown to help clinicians reduce severe retinopathy of prematurity in neonates,2 improve CCHD screening in newborns3 and, when used for continuous monitoring with Masimo Patient SafetyNet™ in post-surgical wards, reduce rapid response team activations, ICU transfers, and costs.4-7 Masimo SET® is estimated to be used on more than 200 million patients in leading hospitals and other healthcare settings around the world,8 and is the primary pulse oximetry at 9 of the top 10 hospitals as ranked in the 2022-23 U.S. News and World Report Best Hospitals Honor Roll.9 In 2005, Masimo introduced rainbow® Pulse CO-Oximetry technology, allowing noninvasive and continuous monitoring of blood constituents that previously could only be measured invasively, including total hemoglobin (SpHb®), oxygen content (SpOC™), carboxyhemoglobin (SpCO®), methemoglobin (SpMet®), Pleth Variability Index (PVi®), RPVi™ (rainbow® PVi), and Oxygen Reserve Index (ORi™). In 2013, Masimo introduced the Root® Patient Monitoring and Connectivity Platform, built from the ground up to be as flexible and expandable as possible to facilitate the addition of other Masimo and third-party monitoring technologies; key Masimo additions include Next Generation SedLine® Brain Function Monitoring, O3® Regional Oximetry, and ISA™ Capnography with NomoLine® sampling lines. Masimo’s family of continuous and spot-check monitoring Pulse CO-Oximeters® includes devices designed for use in a variety of clinical and non-clinical scenarios, including tetherless, wearable technology, such as Radius-7®, Radius PPG®, and Radius VSM™, portable devices like Rad-67®, fingertip pulse oximeters like MightySat® Rx, and devices available for use both in the hospital and at home, such as Rad-97® and the Masimo W1® medical watch. Masimo hospital and home automation and connectivity solutions are centered around the Masimo Hospital Automation™ platform, and include Iris® Gateway, iSirona™, Patient SafetyNet, Replica®, Halo ION®, UniView®, UniView :60™, and Masimo SafetyNet®. Its growing portfolio of health and wellness solutions includes Radius Tº®, Masimo W1 Sport, and Masimo Stork™. Additional information about Masimo and its products may be found at www.masimo.com. Published clinical studies on Masimo products can be found at www.masimo.com/evidence/featured-studies/feature/.

RPVi has not received FDA 510(k) clearance and is not available for sale in the United States. The use of the trademark Patient SafetyNet is under license from University HealthSystem Consortium.

References

| 1. | Published clinical studies on pulse oximetry and the benefits of Masimo SET® can be found on our website at http://www.masimo.com. Comparative studies include independent and objective studies which are comprised of abstracts presented at scientific meetings and peer-reviewed journal articles. |

| 2. | Castillo A et al. Prevention of Retinopathy of Prematurity in Preterm Infants through Changes in Clinical Practice and SpO2 Technology. Acta Paediatr. 2011 Feb;100(2):188-92. |

| 3. | de-Wahl Granelli A et al. Impact of pulse oximetry screening on the detection of duct dependent congenital heart disease: a Swedish prospective screening study in 39,821 newborns. BMJ. 2009;Jan 8;338. |

| 4. | Taenzer A et al. Impact of pulse oximetry surveillance on rescue events and intensive care unit transfers: a before-and-after concurrence study. Anesthesiology. 2010:112(2):282-287. |

| 5. | Taenzer A et al. Postoperative Monitoring – The Dartmouth Experience. Anesthesia Patient Safety Foundation Newsletter. Spring-Summer 2012. |

| 6. | McGrath S et al. Surveillance Monitoring Management for General Care Units: Strategy, Design, and Implementation. The Joint Commission Journal on Quality and Patient Safety. 2016 Jul;42(7):293-302. |

| 7. | McGrath S et al. Inpatient Respiratory Arrest Associated With Sedative and Analgesic Medications: Impact of Continuous Monitoring on Patient Mortality and Severe Morbidity. J Patient Saf. 2020 14 Mar. DOI: 10.1097/PTS.0000000000000696. |

| 8. | Estimate: Masimo data on file. |

| 9. | http://health.usnews.com/health-care/best-hospitals/articles/best-hospitals-honor-roll-and-overview. |

Forward-Looking Statements

This press release includes forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo and the potential stockholder approval of the Board’s nominees and the potential separation of Masimo’s consumer business (the “Potential Separation”), Masimo’s expectation that the Potential Separation will maximize shareholder value or be the best path for success, Masimo’s plans to grow consumable and service revenue across all technology platforms, Masimo’s strategic initiatives, Masimo’s estimates, forecasts and expectations for its gross margin, R&D expenses, SG&A expenses and non-GAAP operating margin and Masimo’s long-term revenue growth, operating margin and earnings per share estimates and targets. These forward-looking statements are based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond Masimo’s control and could cause its actual results to differ materially and adversely from those expressed in its forward-looking statements as a result of various risk factors, including, but not limited to (i) uncertainties regarding the Potential Separation, (ii) uncertainties regarding future actions that may be taken by Politan in furtherance of its nomination of director candidates for election at the 2024 Annual Meeting, (iii) the potential cost and management distraction attendant to Politan’s nomination of director nominees at the 2024 Annual Meeting and (iv) factors discussed in the “Risk Factors” section of Masimo’s most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations will prove correct. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of today’s date. Masimo does not undertake any obligation to update, amend or clarify these statements or the “Risk Factors” contained in the Company’s most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable securities laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders and Where to Find It

The Company has filed a definitive proxy statement containing a form of GOLD proxy card with the SEC in connection with its solicitation of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING GOLD PROXY CARD AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers and employees may be deemed to be participants in connection with the solicitation of proxies from the Company’s stockholders in connection with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company is included in the Company’s definitive proxy statement for the 2024 Annual Meeting, which can be found through the SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000937556/000121390024053125/ea0206756-05.htm, and any changes thereto may be found in any amendments or supplements to the proxy statement and other documents as and when filed by the Company with the SEC, which can be found through the SEC’s website at www.sec.gov.

# # #

| Investor Contact: Eli Kammerman | Media Contact: Evan Lamb |

| (949) 297-7077 | (949) 396-3376 |

| ekammerman@masimo.com | elamb@masimo.com |

###

On June 26, 2024, Masimo issued an investor presentation in connection with the 2024 Annual Meeting. A copy of the investor presentation can be found below and is also available at www.ProtectMasimosFuture.com.

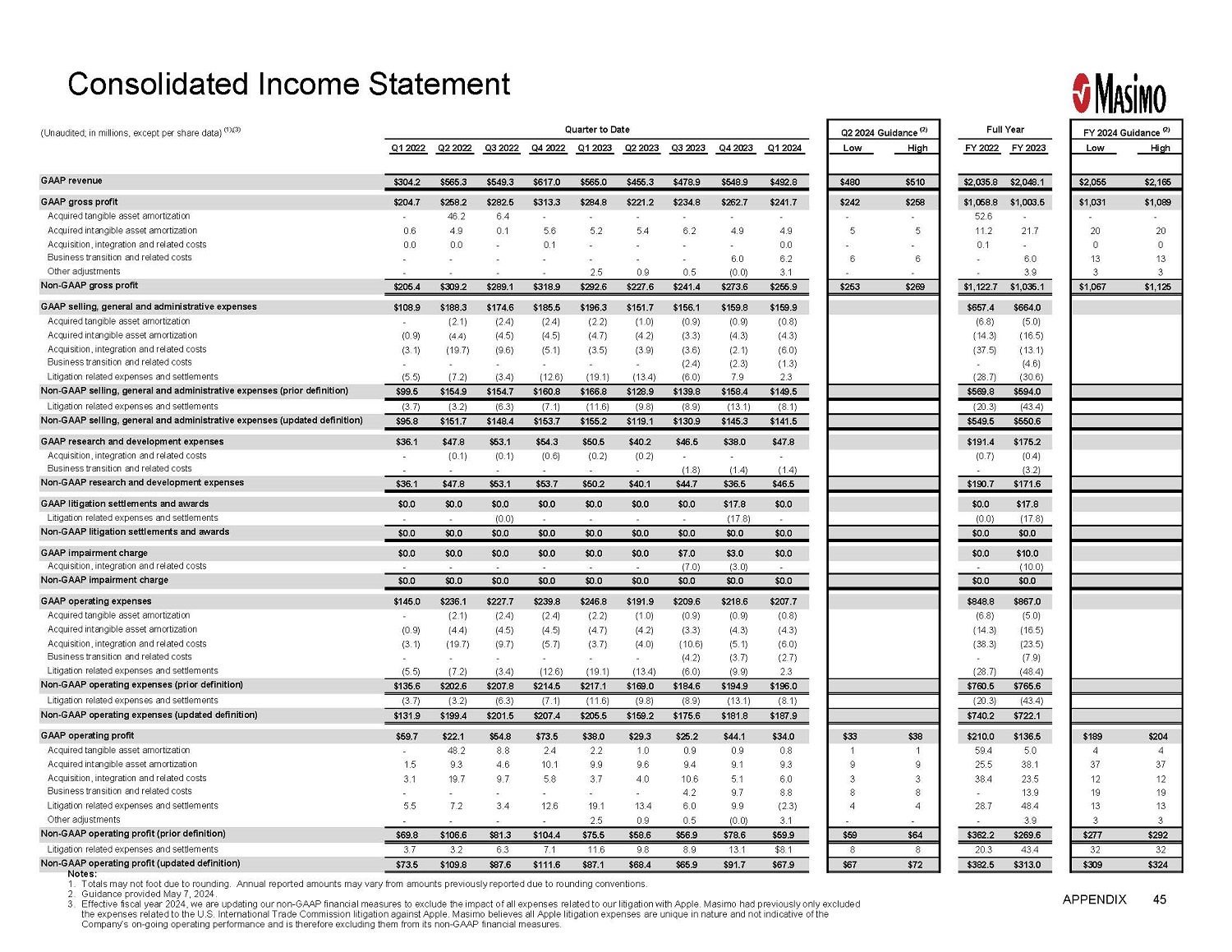

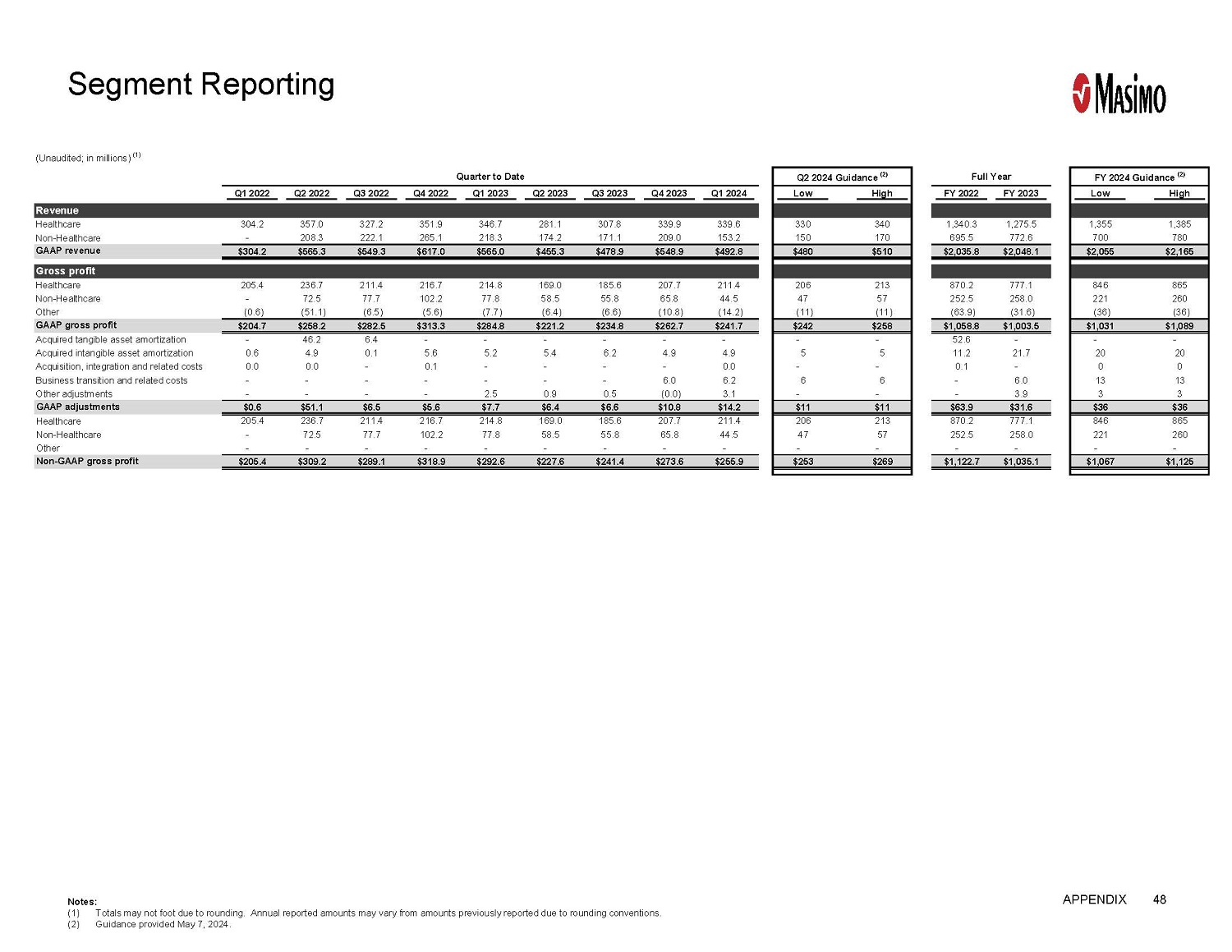

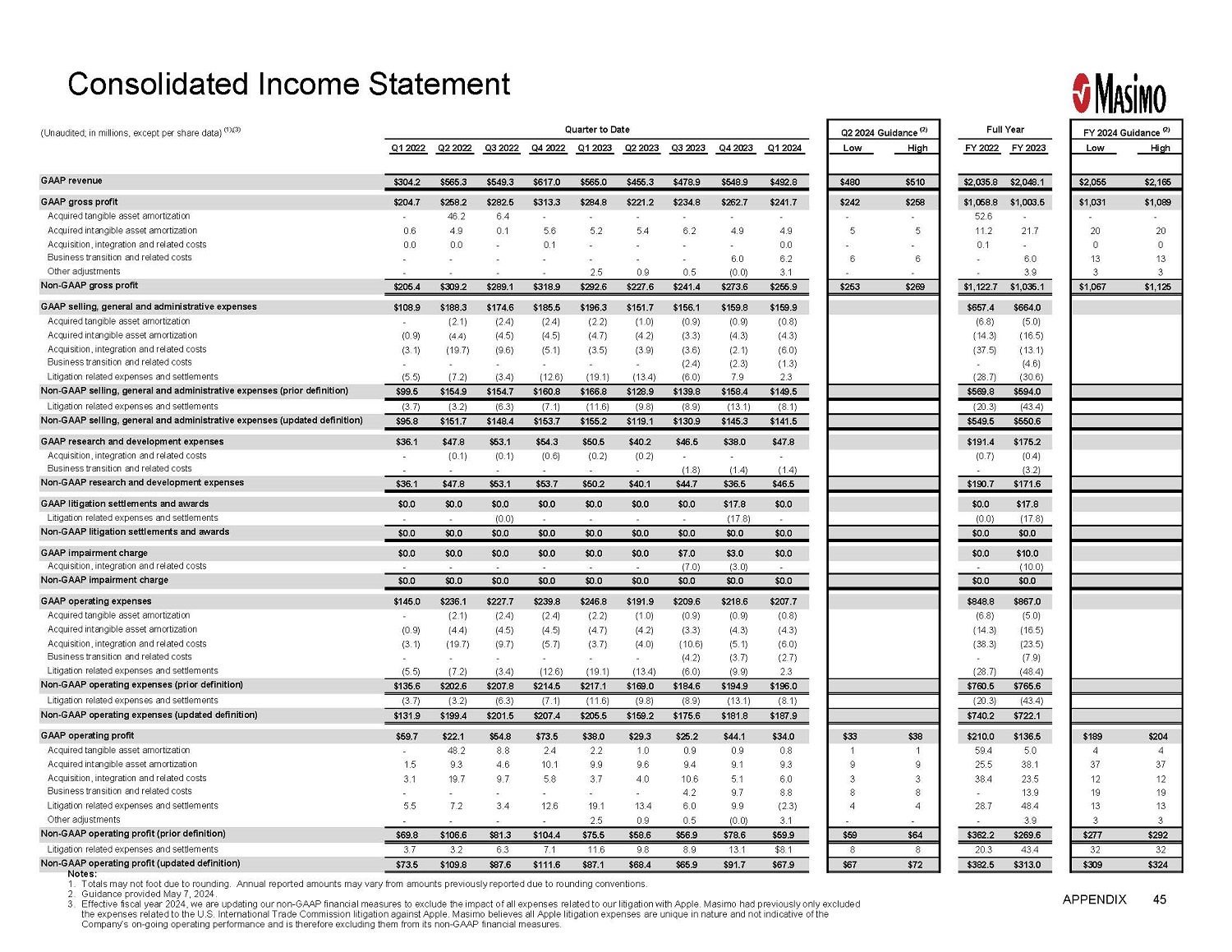

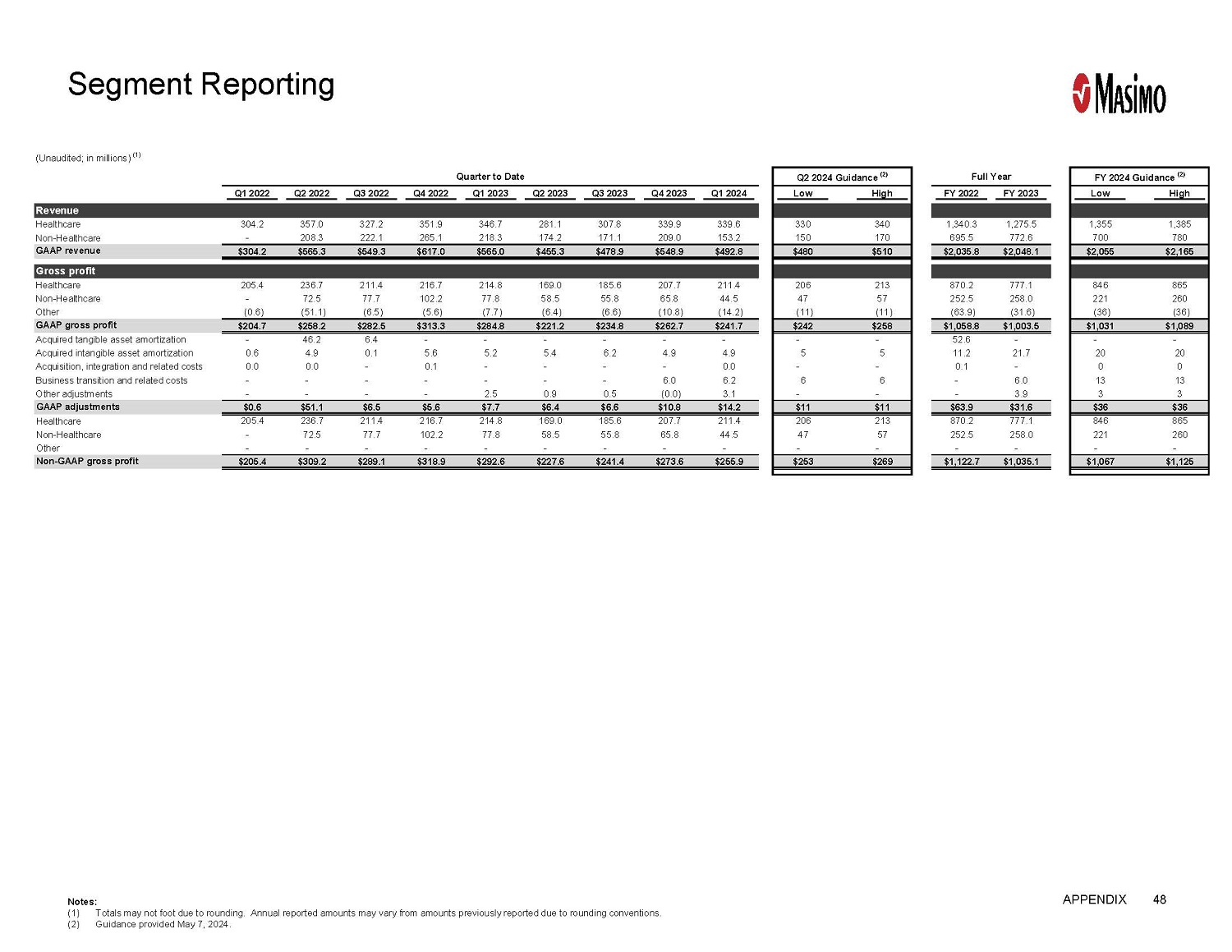

One of the Best MedTech Companies in the World, Built on Innovation, Integrity & Persistence June 2024

2 Disclaimer Masimo Corporation (“Masimo” or the “Company”) has neither sought nor obtained the consent from any third party to use any st ate ments or information contained in this presentation that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be vi ewed as indicating the support of such third parties for the views expressed herein. Forward - Looking Statements This presentation includes forward - looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and S ection 21E of the Securities Exchange Act of 1934, as amended, in connection with the Private Securities Litigation Reform Act of 1995. These forward - looking statements include, among others, st atements regarding the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo and the potential stockholder approval of the Board’s nominees, the proposed separation of M asi mo’s consumer business, including the potential timing and structure thereof and the expectation that the proposed separation will maximize shareholder value or be the best path for su cce ss. These forward - looking statements are based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of which are difficult to p red ict and many of which are beyond Masimo’s control and could cause its actual results to differ materially and adversely from those expressed in its forward - looking statements as a result of various risk factors, including, but not limited to ( i ) uncertainties regarding a potential separation of Masimo’s consumer business, (ii) uncertainties regarding future actions that may be taken by Politan in furtherance of its nomination of director candidates for election at the 2024 Annual Meeting, (iii) the potential cost and management distraction attendant to Politan’s nomination of director nominees at the 2024 Annual Meeting and (iv) factors discussed in the “Risk Factors” section of Masimo’s most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), which ma y b e obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the expectations reflected in its forward - looking statements are reasonable, the Company does not know whet her its expectations will prove correct. All forward - looking statements included in this communication are expressly qualified in their entirety by the foregoing cautionary statements. Y ou are cautioned not to place undue reliance on these forward - looking statements, which speak only as of today’s date. Masimo does not undertake any obligation to update, amend or clarify these s tat ements or the “Risk Factors” contained in the Company’s most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be requi red under the applicable securities laws. The non - GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non - GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these it ems assist investors in making comparisons of period - to - period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on - going core oper ating performance. These non - GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as det ermined in accordance with GAAP. Therefore, investors should consider non - GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance pr epared in accordance with GAAP. The non - GAAP financial measures presented by the Company may be different from the non - GAAP financial measures used by other companies. The Company has present ed the following non - GAAP financial measures to assist investors in understanding the Company’s core net operating results on an on - going basis: non - GAAP revenue (constant currency), pro - forma non - GAAP revenue (constant currency), pro - forma non - GAAP revenue growth (constant currency), non - GAAP gross profit/margin %, non - GAAP SG&A expense (prior definition and updated definition), non - GAAP R&D expense, non - GAAP litigation settlements and awards, non - GAAP impairment charge, non - GAAP operating expense % (prior definition and updated definition), non - GAAP operating profit/margin % (prior definition and updated definition), non - GAAP non - operating income (expense), non - GAAP provision for income taxes (prior definition and updated definiti on), non - GAAP net income (loss) (prior definition and updated definition), non - GAAP net income (loss) per share (prior definition and updated definition). This presentation also includes cer tain preliminary estimated information of a potential separation of the Company’s consumer business for illustrative and informational purposes and further adjusted for separation items. See “Discl aim er Regarding Potential Separation” on the next slide for additional information. These non - GAAP financial measures may also assist investors in making comparisons of the company’s core operating r esults with those of other companies. Management believes these non - GAAP financial measures are important in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non - GAAP reconciliations, please visit the Investor Relations section of the Company’s website at www .masimo.com to access Supplementary Financial Information. Additional Information Regarding the 2024 Annual Meeting of Stockholders and Where to Find It The Company has filed a definitive proxy statement containing a form of GOLD proxy card with the SEC in connection with its s oli citation of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACC OMPANYING GOLD PROXY CARD AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or su ppl ements to the proxy statement and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov. Certain Information Regarding Participants The Company, its directors and certain of its executive officers and employees may be deemed to be participants in connection wi th the solicitation of proxies from the Company’s stockholders in connection with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct and indirect intere sts , by security holdings or otherwise, of the Company’s directors and executive officers in the Company is included in the Company’s definitive proxy statement for the 2024 Annual Meeting, which can be found through the SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000121390024053125/ea0206756 - 05.htm, and any changes thereto may be found in any amendments or supplements to the proxy statement and other documents as and when filed by the Company with the SEC, which can be found through the SEC’s website at www .sec.gov.

3 Disclaimer Regarding Potential Separation On March 22, 2024, Masimo announced that its Board of Directors has authorized management to evaluate a proposed separation o f t he company’s consumer business (the “Potential Separation”). Masimo’s Board of Directors and management are in the process of evaluating the proposed structure o f t he Potential Separation. Slides 17 and 18 of this presentation include estimates and projections of the financial impact of the Potential Separation; however, the estimates an d p rojections are being provided solely for illustrative and informational purposes and do not purport to contain or present all information relating to any Potential Separation. Moreove r, the method, structure, timing and terms of any Potential Separation are still under consideration and have not been determined, approved or finalized, and the final method, st ructure, timing and terms of any Potential Separation, including the separation of assets and liabilities, may differ materially from what is presented and estimated on Slides 5, 9 , 1 0, 17 and 18 (collectively, the “Separation Discussion Slides”). There can be no assurance that any Potential Separation that may be implemented will be similar in structure to the st ructure illustrated or discussed on the Separation Discussion Slides, that any Potential Separation may be effected at all or the timing of any Potential Separation. Additiona lly , the estimates on the Separation Discussion Slides are illustrative projections that were calculated using the midpoint of Masimo’s 2024 consolidated guidance, which is based on ma nag ement’s current expectations and beliefs, but is subject to uncertainty and risks, and also relies on a number of assumptions and adjustments as described on the Separation D isc ussion Slides. Accordingly, all of the information on the Separation Discussion Slides relating to the Potential Separation constitute “forward - looking statements” as described on Slide 2 of this presentation under the heading “Forward - Looking Statements”. Investors are strongly cautioned not to place undue reliance on these forward - looking statements, including in respect of the financial or operating outlook for the potential separated businesses (including, without limitation, the realization of any expected efficiencies o r c ost savings). The forward - looking statements on the Separation Discussion Slides are subject to risks and uncertainties, all of which are diff icult to predict and many of which are beyond our control and could cause the actual results of any Potential Separation to differ materially and adversely from those illustra ted on the Separation Discussion Slides as a result of various risk factors, including, but not limited to: risks related to the ability to effect or complete any Potential Separat ion on the terms described on the Separation Discussion Slides, or at all, and to meet any of the conditions related thereto; the approval of any Potential Separation by Masimo’s Board of D ire ctors; the ability of the separated businesses to be successful; expectations around the financial impact of any Potential Separation; potential uncertainty during the pendency o f a ny Potential Separation that could affect Masimo’s financial performance; the possibility that any Potential Separation will not be completed within the anticipated time period or at all; the possibility that any Potential Separation will not achieve its intended benefits; the possibility of disruption, including changes to existing business relationships, dispu tes , litigation or unanticipated costs in connection with any Potential Separation; the impact that any Potential Separation may have on our employees; the uncertainty of the expected fin anc ial performance of Masimo prior to and following completion of any Potential Separation; negative effects of the announcement or pendency of any Potential Separation on the m ark et price of Masimo’s securities and/or on the financial performance of Masimo; evolving legal, regulatory and tax regimes; changes in general economic and/or industry spec ifi c conditions; actions by third parties, including government agencies; as well as other factors more fully described in Masimo’s reports filed with the U.S. Securities and Exc han ge Commission (SEC), including our most recent Form 10 - K and Form 10 - Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo .com or upon request. Except as required by applicable law, Masimo assumes no obligation to, and expressly disclaims any duty or obligation to, pro vid e any additional or updated information or to update any forward - looking statements, whether as a result of new information, future events or results, or otherwise. Nothing in this presentation will, under any circumstances (including by reason of this presentation remaining available and not being superseded or replaced by any other presentation or publication wi th respect to Masimo or the Potential Separation), create an implication that there has been no change in the affairs of Masimo or any Potential Separation since the date of th is presentation.

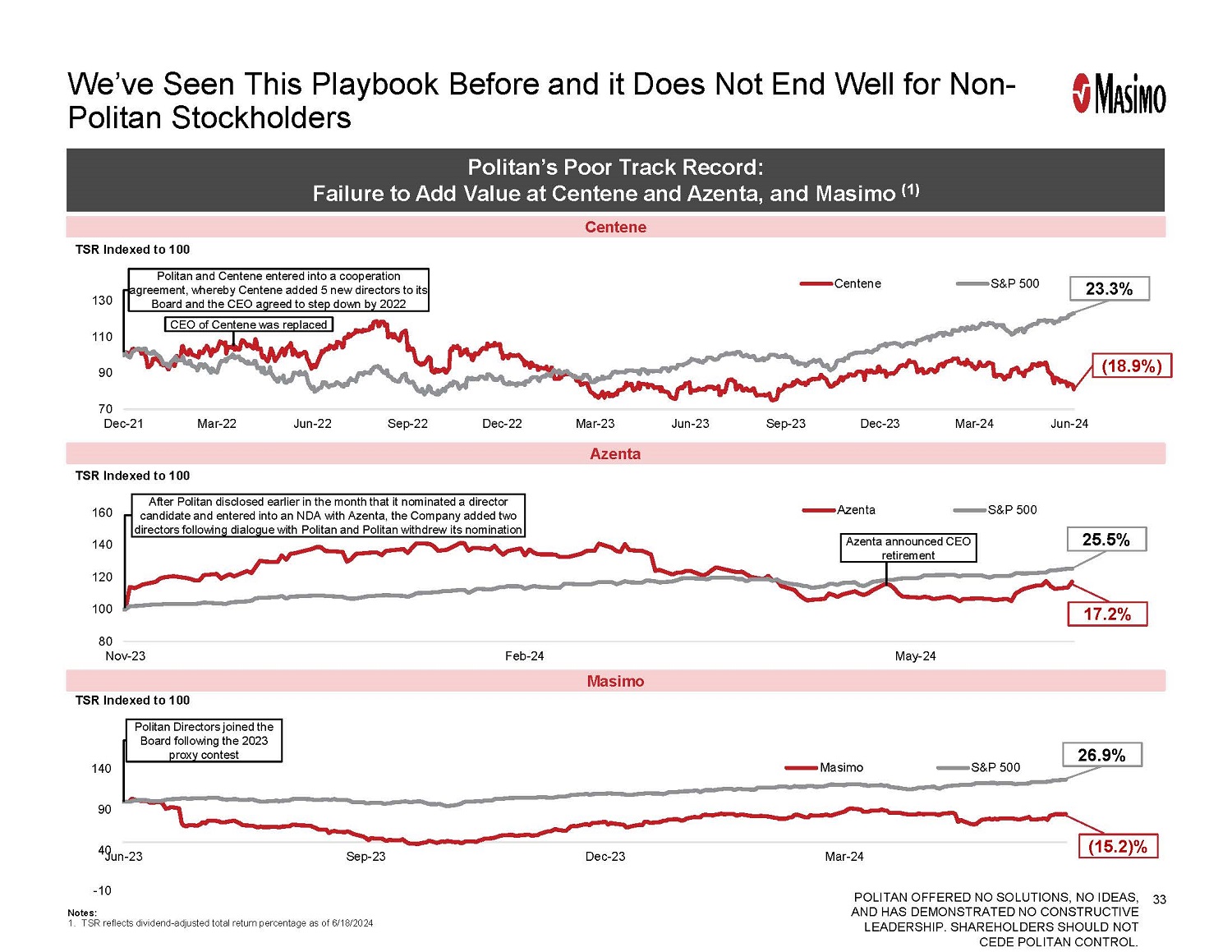

Executive Summary

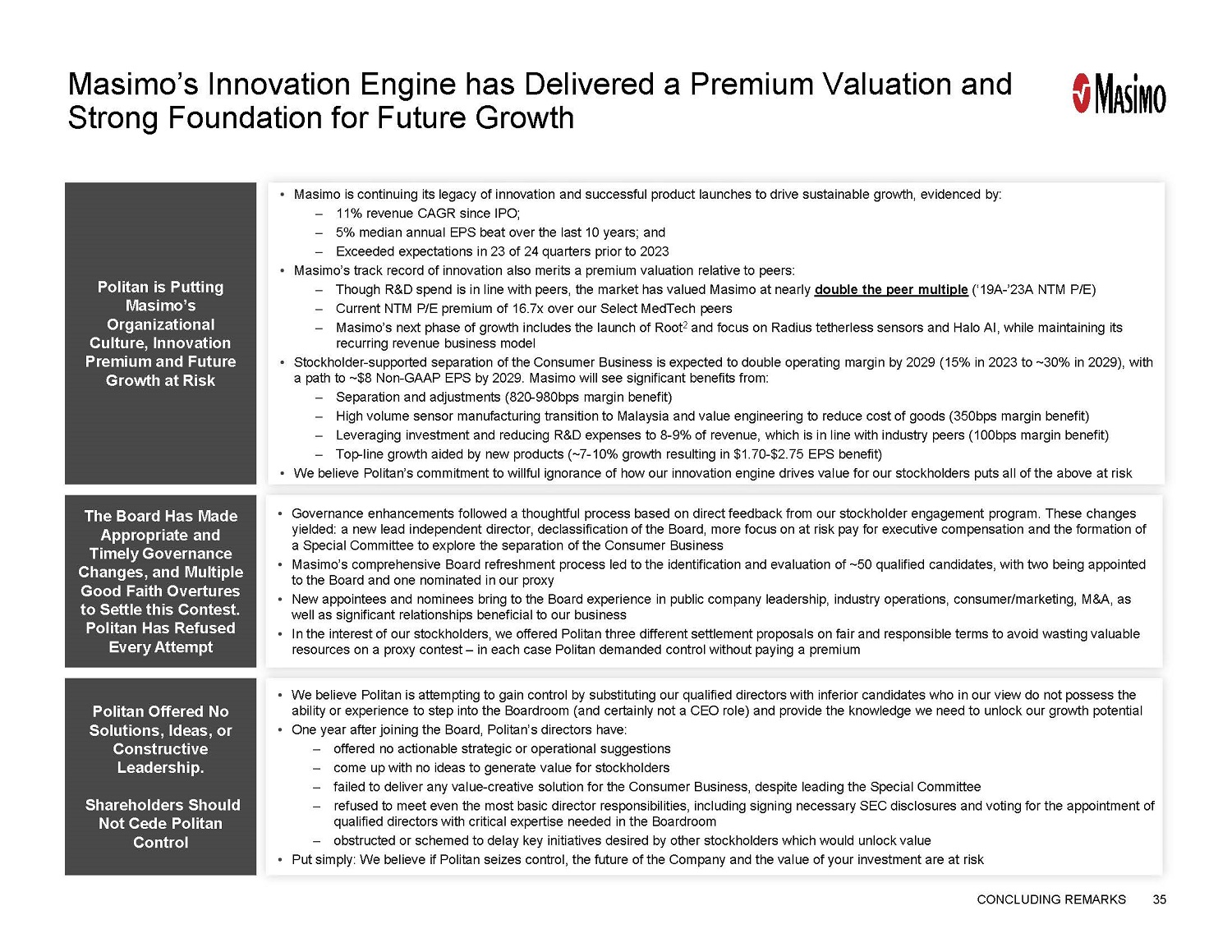

EXECUTIVE SUMMARY 5 Masimo’s Innovation Engine has Delivered a Premium Valuation and Strong Foundation for Future Growth • Masimo is continuing its legacy of innovation and successful product launches to drive sustainable growth, evidenced by: ‒ 11% revenue CAGR since IPO; ‒ 5% median annual EPS beat over the last 10 years; and ‒ Exceeded expectations in 23 of 24 quarters prior to 2023 • Masimo’s track record of innovation also merits a premium valuation relative to peers: ‒ Though R&D spend is in line with peers, the market has valued Masimo at nearly double the peer multiple (’19A - ’23A NTM P/E) ‒ Current NTM P/E premium of 16.7x over our Select MedTech peers ‒ Masimo’s next phase of growth includes the launch of Root 2 and focus on Radius tetherless sensors and Halo AI, while maintaining its recurring revenue business model • Stockholder - supported separation of the Consumer Business is expected to double operating margin by 2029 (15% in 2023 to ~30% in 2029), with a path to ~$8 Non - GAAP EPS by 2029. Masimo will see significant benefits from: ‒ Separation and adjustments (820 - 980bps margin benefit) ‒ High volume sensor manufacturing transition to Malaysia and value engineering to reduce cost of goods (350bps margin benefit) ‒ Leveraging investment and reducing R&D expenses to 8 - 9% of revenue, which is in line with industry peers (100bps margin benefit) ‒ Top - line growth aided by new products (~7 - 10% growth resulting in $1.70 - $2.75 EPS benefit) • We believe Politan’s commitment to willful ignorance of how our innovation engine drives value for our stockholders puts all of the above at risk Politan is Putting Masimo’s Organizational Culture, Innovation Premium and Future Growth at Risk The Board Has Made Appropriate and Timely Governance Changes, and Multiple Good Faith Overtures to Settle this Contest. Politan Has Refused Every Attempt • Governance enhancements followed a thoughtful process based on direct feedback from our stockholder engagement program. These ch anges yielded: a new lead independent director, declassification of the Board, more focus on at risk pay for executive compensation an d the formation of a Special Committee to explore the separation of the Consumer Business • Masimo’s comprehensive Board refreshment process led to the identification and evaluation of ~50 qualified candidates, with t wo being appointed to the Board and one nominated in our proxy • New appointees and nominees bring to the Board experience in public company leadership, industry operations, consumer/marketi ng, M&A, as well as significant relationships beneficial to our business • In the interest of our stockholders, we offered Politan three different settlement proposals on fair and responsible terms to avoid wasting valuable resources on a proxy contest – in each case Politan demanded control without paying a premium Politan Offered No Solutions, Ideas, or Constructive Leadership. Shareholders Should Not Cede Politan Control • We believe Politan is attempting to gain control by substituting our qualified directors with inferior candidates who in our view do not possess t he ability or experience to step into the Boardroom (and certainly not a CEO role) and provide the knowledge we need to unlock o ur growth potential • One year after joining the Board, Politan’s directors have: ‒ offered no actionable strategic or operational suggestions ‒ come up with no ideas to generate value for stockholders ‒ failed to deliver any value - creative solution for the Consumer Business, despite leading the Special Committee ‒ refused to meet even the most basic director responsibilities, including signing necessary SEC disclosures and voting for the ap pointment of qualified directors with critical expertise needed in the Boardroom ‒ obstructed or schemed to delay key initiatives desired by other stockholders which would unlock value • Put simply: We believe if Politan seizes control, the future of the Company and the value of your investment are at risk

EXECUTIVE SUMMARY 6 Politan’s Record In its First Twelve Months On Our Board is a Powerful Argument Against Granting Control to Politan One year after joining the Board, Politan’s directors have… × offered no actionable strategic or operational suggestions × come up with no ideas to generate value for stockholders × Although Koffey seems to share his opinions on Masimo’s direction with stockholders / analysts, he has not expressed these views to our Board. Until the February 13 th Board meeting, he refused to engage in the Boardroom × failed to deliver any value - creative solution for the Consumer Business, despite leading the Special Committee × refused to meet even the most basic director responsibilities, including: × signing the 2023 Annual Report; × approving earnings releases; and × voting for the appointment of qualified directors with critical expertise needed in the Boardroom × remained obstinately unwilling to negotiate in good faith a settlement of this proxy contest × spun false, misleading narratives, which we believe have depressed our stock by at least 9% (1) × obstructed or schemed to delay key initiatives desired by other stockholders which would unlock value × remained committed to willful ignorance of how our innovation engine drives value for our stockholders Despite holding 40% of Board seats and sitting on all Board committees, Politan has offered no ideas, contributed nothing thoughtful to Boardroom discussions, and struck out on any suggestions to drive stockholder value. The non - Politan Directors have continued to push for stockholder value creation, despite Politan’s disruptiveness. If Politan seizes control, however, we believe that the future of the Company and the value of your investment is at risk. Note: 1. See chart titled Politan’s Actions Impacted Sentiment Following a Positive Masimo Announcement on slide 15

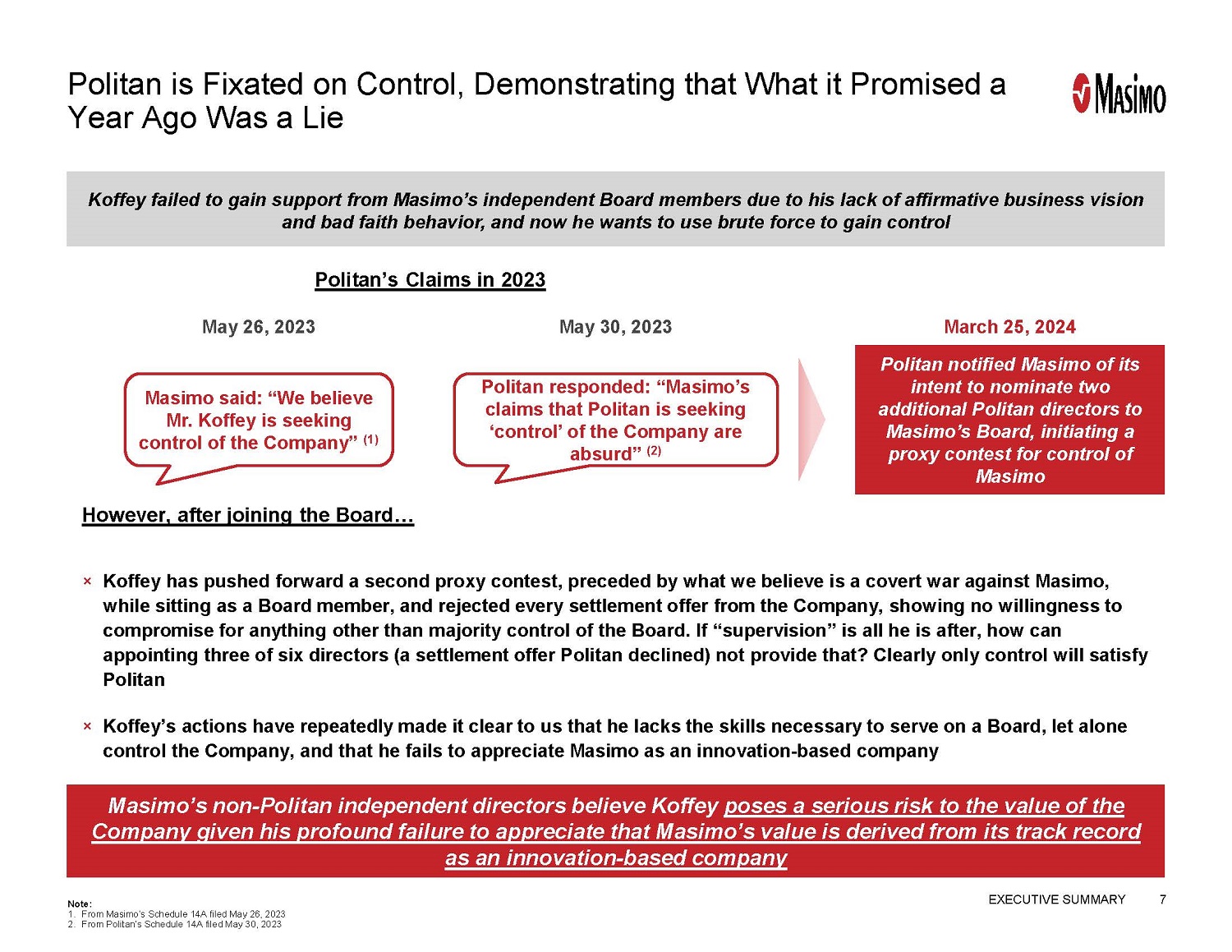

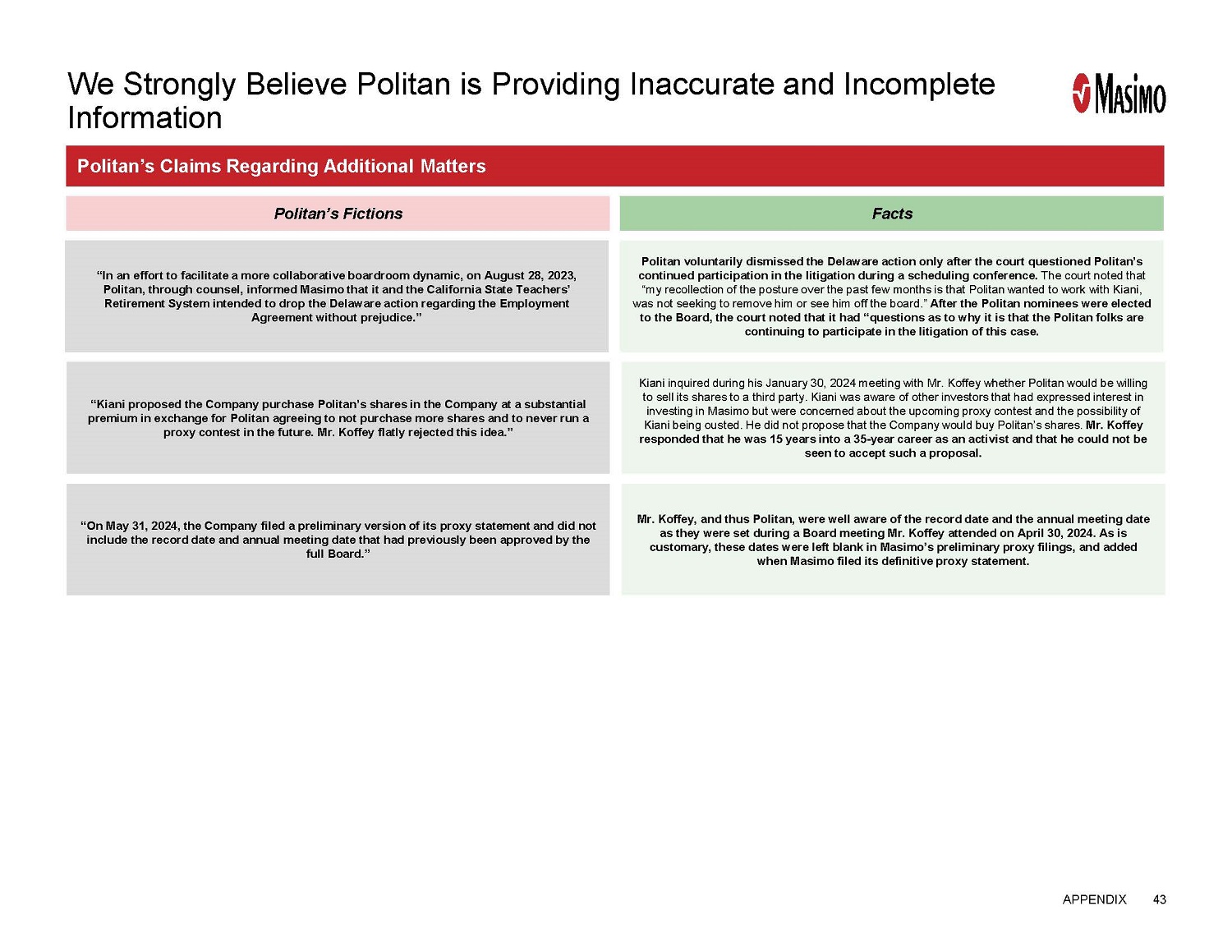

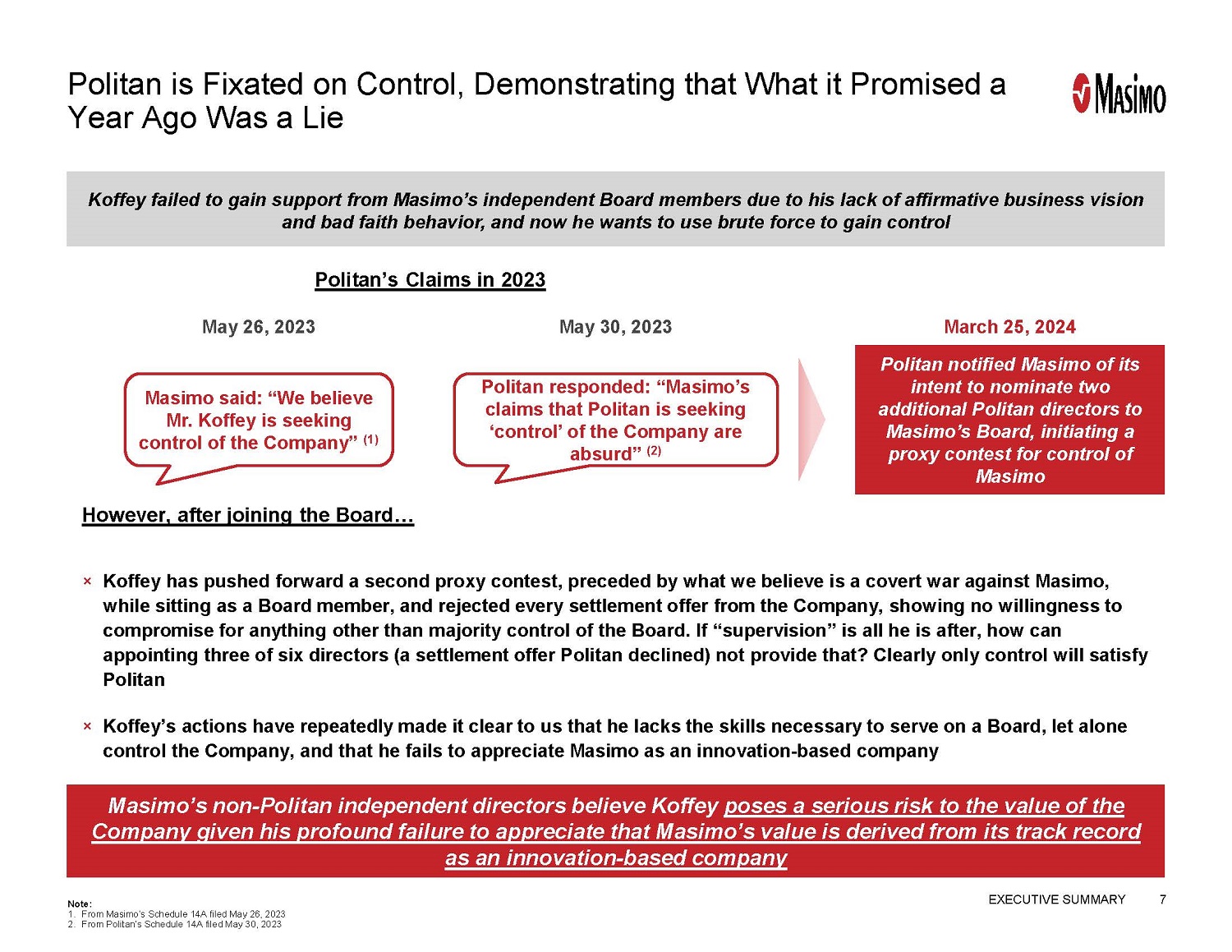

EXECUTIVE SUMMARY 7 Politan is Fixated on Control, Demonstrating that What it Promised a Year Ago Was a Lie Koffey failed to gain support from Masimo’s independent Board members due to his lack of affirmative business vision and bad faith behavior, and now he wants to use brute force to gain control However, after joining the Board… × Koffey has pushed forward a second proxy contest, preceded by what we believe is a covert war against Masimo, while sitting as a Board member, and rejected every settlement offer from the Company, showing no willingness to compromise for anything other than majority control of the Board. If “supervision” is all he is after, how can appointing three of six directors (a settlement offer Politan declined) not provide that? Clearly only control will satisfy Politan × Koffey’s actions have repeatedly made it clear to us that he lacks the skills necessary to serve on a Board, let alone control the Company, and that he fails to appreciate Masimo as an innovation - based company Masimo’s non - Politan independent directors believe Koffey poses a serious risk to the value of the Company given his profound failure to appreciate that Masimo’s value is derived from its track record as an innovation - based company Politan’s Claims in 2023 May 30, 2023 May 26, 2023 March 25, 2024 Politan notified Masimo of its intent to nominate two additional Politan directors to Masimo’s Board, initiating a proxy contest for control of Masimo Note: 1. From Masimo’s Schedule 14A filed May 26, 2023 2. From Politan’s Schedule 14A filed May 30, 2023

Politan is Putting Masimo’s Organizational Culture, Innovation Premium and Future Growth at Risk

9 Masimo is Delivering on a Compelling Strategy to Drive Innovation Note: 1. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such potential separation are still under consideration and have no t been determined, approved or finalized. See Slide 3 entitled “Disclaimer Regarding Potential Separation” for additional factors to consider in evaluating and reviewing the infor mat ion presented on this slide. Separation of Consumer Business • Pursuing a separation that would result in two separate companies (consumer and professional healthcare). • Key objectives of a separation: o Maximize shareholder value as well as give both consumer and professional healthcare the best path for success. o Full deconsolidation of the financial statements for the two businesses. o Improve profitability of the professional healthcare business (2024E: 23.2% to 24.8% operating margin post - separation). (1) o If a separation transaction results in cash proceeds, opportunity to immediately reduce interest expense (2024E: ~$47MM or ~$0.63 per share). (1) Masimo’s Healthcare Business Remains on Track for Growth • Masimo’s successful and aggressive focus on expanding footprint with existing customers and winning new customers has built a solid foundation for resuming strong growth in the professional healthcare business. o Value of incremental new contracts won in 2023 exceeded previous record high set amidst the height of the COVID - 19 pandemic. o As a result of record contracting in 2023 and Q1 2024, unrecognized contract revenue has reached levels that support achieving at least high - single - digit organic revenue growth in 2024. • Driver installed base has increased 60% from 1.6 million drivers in 2017 to 2.6 million as of Q1 2024. • At the same time, consumable revenue per driver has grown from pre - COVID levels, driven by continued strong utilization, increasing adoption of premium rainbow sensors and ongoing development of new applications and use cases. Executing a Multipronged Margin Expansion Strategy • 5 - year goal of ~30% operating margin for the professional healthcare business, up from ~24% for 2024E, driven by: o Increasing gross margin from 62.5% (in line with industry peers) to 66%, contributing 350 bps of margin expansion. o Reducing R&D expenses from ~9% - 10% (in line with industry peers) to ~8 - 9%, contributing ~100 bps of margin improvement. o Reducing SG&A expenses from ~29% (lower than industry peers) to ~28%, contributing ~100 bps of margin improvement. Executing a Plan to Meaningfully Increase Earnings Power • 5 - year goal of ~$8 earnings per share for the professional healthcare business, driven by: o ~7 - 10% revenue growth, attributable to continued share gains for SET pulse oximetry and increasing adoption of high - growth technology platforms (rainbow & hemodynamics, capnography & gas, brain monitoring, hospital automation and telehealth). o ~550 basis points of operating margin expansion. o Strong cash flow generation to retire debt and eliminate interest expense, partially offset by additional share issuances related to equity - based compensation. We are not assuming cash from the separation in this growth to ~$8 per share. POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

Note: 1. Reflects guidance disclosed on May 7, 2024 Q1 earnings call POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK 10 Masimo is Positioned to Generate Significant Value for Stockholders by Leveraging Industry - Leading Technology • Develops, manufactures and markets a variety of noninvasive patient monitoring technologies, hospital automation and connectivity solutions such as remote monitoring devices ‒ Core SET Pulse Oximetry Business (~73% of revenue): measure - through motion and low perfusion pulse oximetry across multiple care settings ‒ Advanced Parameters (~23% of revenue): additional noninvasive measurements (beyond arterial blood oxygen saturation and pulse rate) that create new patient monitoring opportunities • Integrated healthcare technology stack, built on the strength of non - invasive measurement technology, has enabled telehealth and hospital automation solutions that can be applied across the full continuum of care • Growing driver installed base has enabled connected care with a system - wide platform driving superior clinical outcomes ‒ Sticky, long - term customer contracts with hospitals have driven recurring revenue model ‒ Multi - year partnerships with OEM partners such as Philips and GE Healthcare • Company has utilized global health market expansion strategy to address care gaps in developing markets • Leverages Masimo sensor technology and consumer distribution capability that was acquired as part of Sound United • Develops, manufactures, markets, sells and licenses premium and luxury audio, and related integration technologies, including to select automotive manufacturers • Consumer audio products are sold direct - to - consumers or through authorized retailers and wholesalers • Maintain partnerships with certain airlines for bespoke headphones, allowing for the best in - flight audio experience • Target underserved consumers in $50Bn+ wearables market through: – Stork Baby Monitor : Bring hospital - quality baby monitoring into homes. Started limited market release in the US in May 2023, followed by US retail launch in August 2023 (e.g., Target) – Smart Health Wearables (e.g., Freedom Band and Freedom Watch): Provide accurate and continuous health monitoring with seamless data sharing for professional caregivers or loved ones Stork Baby Monitor Freedom Band and Freedom Watch Headphones rainbow® Pulse CO - Oximetry Professional Healthcare New Consumer Company 2024E Revenue (1) : $705MM – $785MM (~35% of Total) 2024E Revenue (1) : $1,350MM – $1,380MM (~65% of Total) SET Technology Telemonitoring Hospital Automation Platform

Total Revenue ($MM) Source: Market estimates based upon internal data, iData & Futuresource 11 Consistent Innovation and Successful Product Launches Drive Sustainable Revenue Growth 108 224 256 307 349 405 439 493 547 587 630 695 798 858 938 1,144 1,239 2,036 2,048 2,105 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 August 2007: Masimo IPO 2007: Patient SafetyNet Powerful user interface with trending, real - time waveform capability at a central station, as well as remote clinician notification 2022: W1 Stork : Baby monitoring ecosystem provides noninvasive way of capturing newborn health data W1: Combines health data in the form of a wearable device 2015: ROOT Intuitive patient monitoring and connectivity platform 1998: MasimoSET Read - through motion and low perfusion pulse oximetry capabilities February 2022: Announced Sound United Acquisition 2018: SedLine Provides bilateral brain monitoring activity 2017: Rad - 97 PulseOx and NomoLine Rad97: Compact form monitor NomoLine: “No moisture” sampling technology Guidance Midpoint 11% Revenue CAGR From IPO in 2007 Through 2023 (1) 1,700+ Healthcare and Consumer Focused Patents 23 of 24 Quarters Exceeding Expectations Prior to 2023 5% Median Annual EPS Beat vs. Guidance Over Last 10 Years 2023: Stork 1989: Company Founded By Joe Kiani Masimo’s Future Growth Drivers AI Focused AI focused AI focused Note: 1. Revenue CAGR excludes impact of Sound United acquisition POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

12 Masimo’s Innovation Engine Continues to Deliver a Leading Healthcare Portfolio Meriting a Premium Valuation Note: 1. Includes telehealth, opioid solutions and other revenues POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Masimo’s Unique Right to Win Masimo LT Growth Market Growth Total Addressable Market Market Segment • Only pulse oximetry with proven clinical outcomes • Best - in - class accuracy • Tetherless sensing technology • Provides a pathway to breakthrough innovation 6 - 8% ~3 – 4% ~$3 Billion SET Pulse Oximetry (~73% Healthcare Revenue Contribution) • Unrivaled clinical outcomes • Innovation continues with the introduction of 12 additional parameters from a single noninvasive sensor • Comprehensive, integrated hemodynamic solution with LiDCO 10%+ N/A ~$2 Billion Rainbow & Hemodynamics (~15% Healthcare Revenue Contribution) • Completion of portfolio of products • Improved patient comfort with more ergonomically designed cannulas • Patented NomoLine moisture wicking technology improves accuracy and extends product life • Third - party compatibility with NomoLine - O sampling lines 10 - 20% ~10 % ~$1 Billion NomoLine Capnography & Gas Monitoring (~4% Healthcare Revenue Contribution) • Complete brain monitoring solution on one platform • Ergonomically designed sensors to allow simultaneous monitoring of both sedation and cerebral oximetry • Continued innovation with new parameters such as ΔcHb and new applications including somatic oximetry • Full range of FDA approved sensors across all patient populations 10 - 20% ~5 – 7% ~$300 Million SedLine & O3 Brain Monitoring (~4% Healthcare Revenue Contribution) • Most advanced wearable and tetherless sensing technology • One platform across the continuum of care with the largest 3rd party interoperability library • Acuity adaptable solutions designed to enhance workflow, improve outcomes and drive better clinician and patient experience • Opioid Halo is the first and only FDA - authorized device to alert you in the event of an opioid overdose 20%+ N/A ~$22.5 Billion Hospital Automation & Telemonitoring (1) (~4% Healthcare Revenue Contribution)

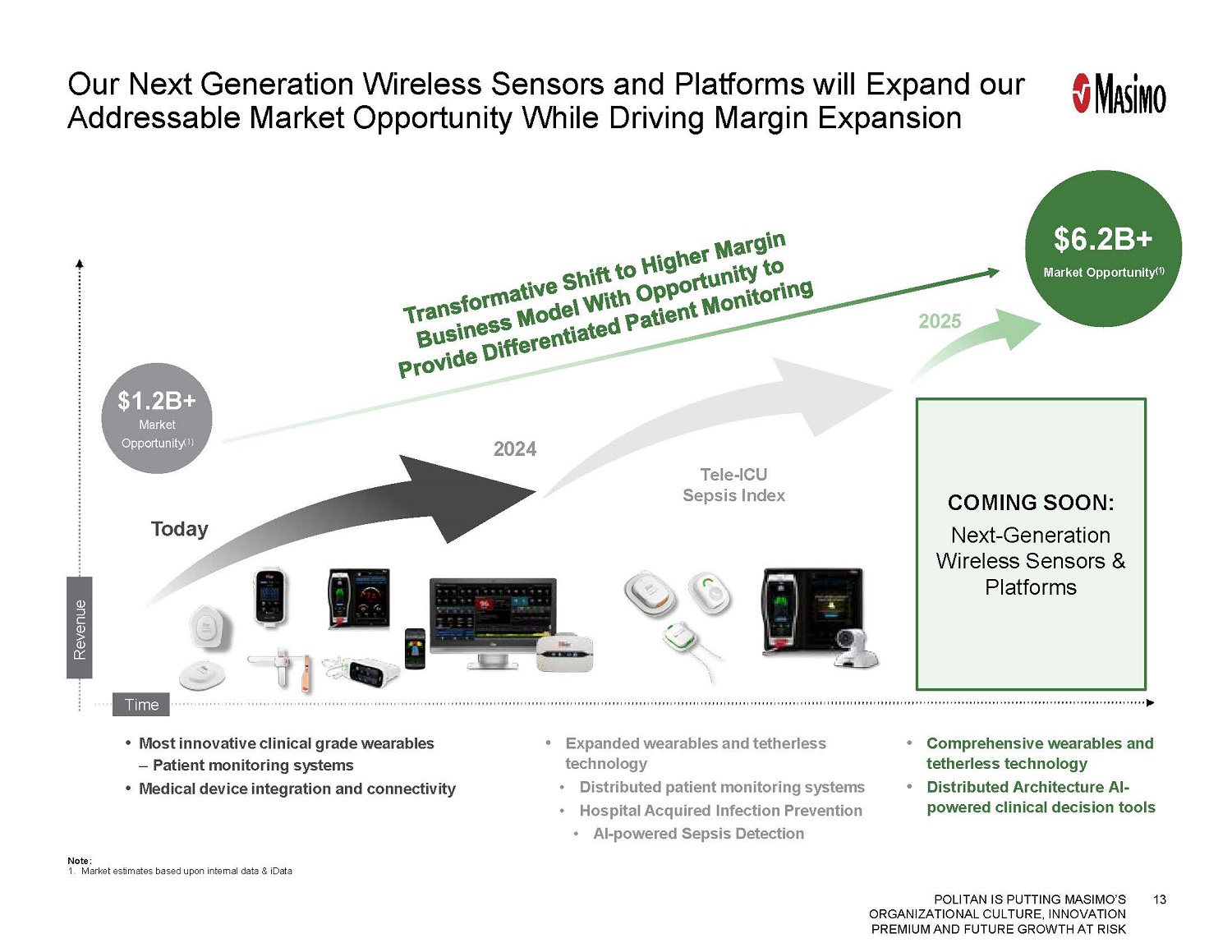

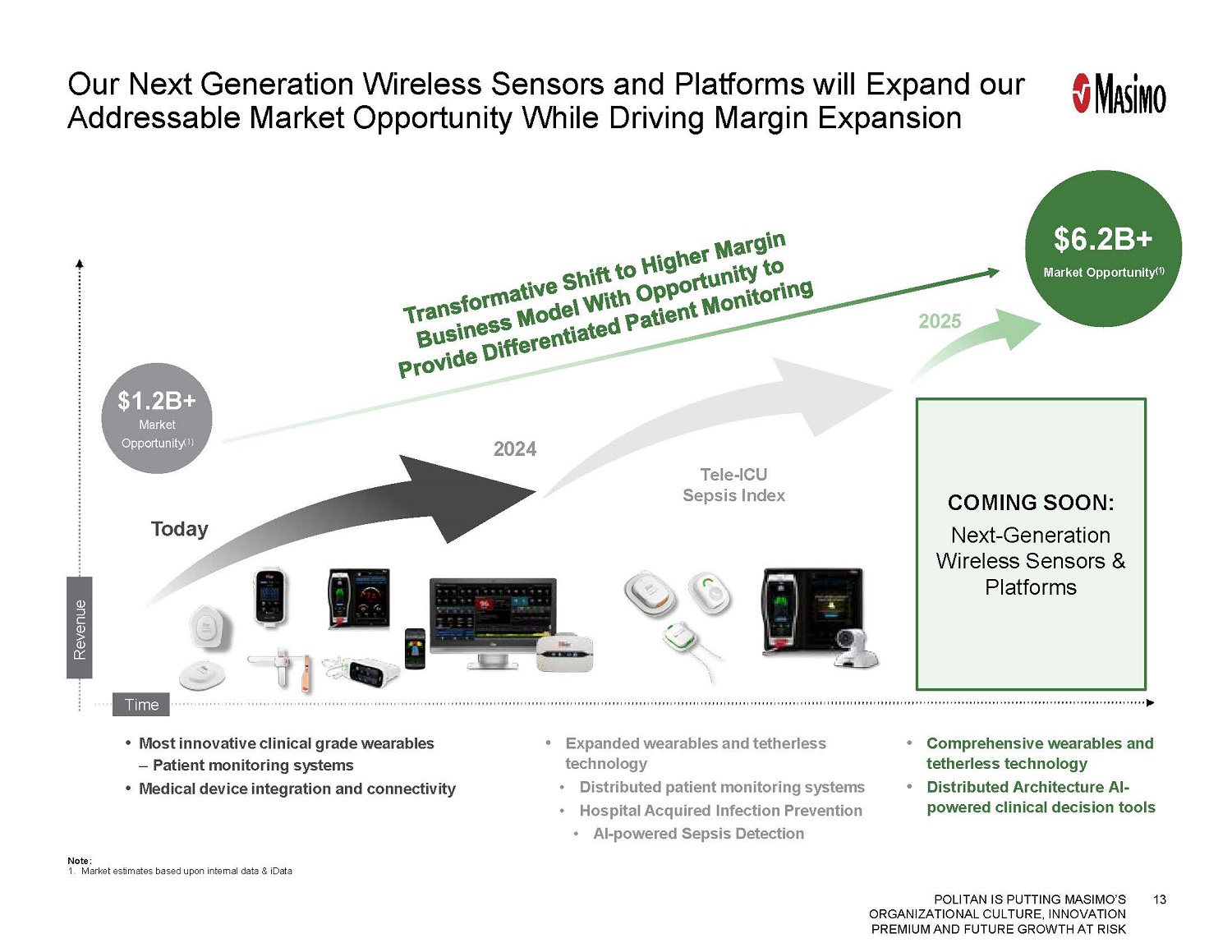

13 Our Next Generation Wireless Sensors and Platforms will Expand our Addressable Market Opportunity While Driving Margin Expansion Note: 1. Market estimates based upon internal data & iData POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Today 2024 2025 • Most innovative clinical grade wearables ‒ Patient monitoring systems • Medical device integration and connectivity Reven u e Time $1.2B+ Market Opportunity (1) $6.2B+ Market Opportunity (1) • Expanded wearables and tetherless technology • Distributed patient monitoring systems • Hospital Acquired Infection Prevention • AI - powered Sepsis Detection Tele - ICU Sepsis Index COMING SOON: Next - Generation Wireless Sensors & Platforms • Comprehensive wearables and tetherless technology • Distributed Architecture AI - powered clinical decision tools

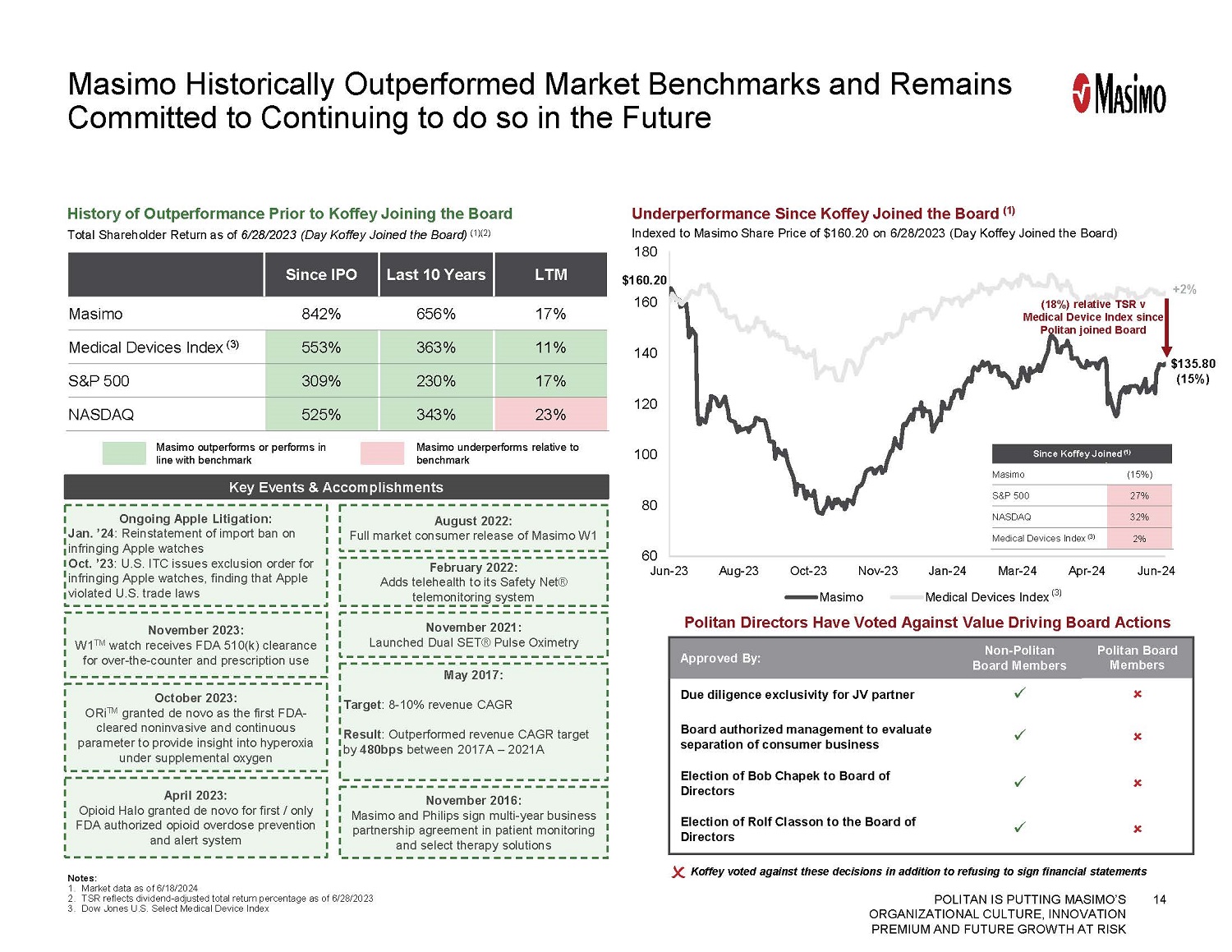

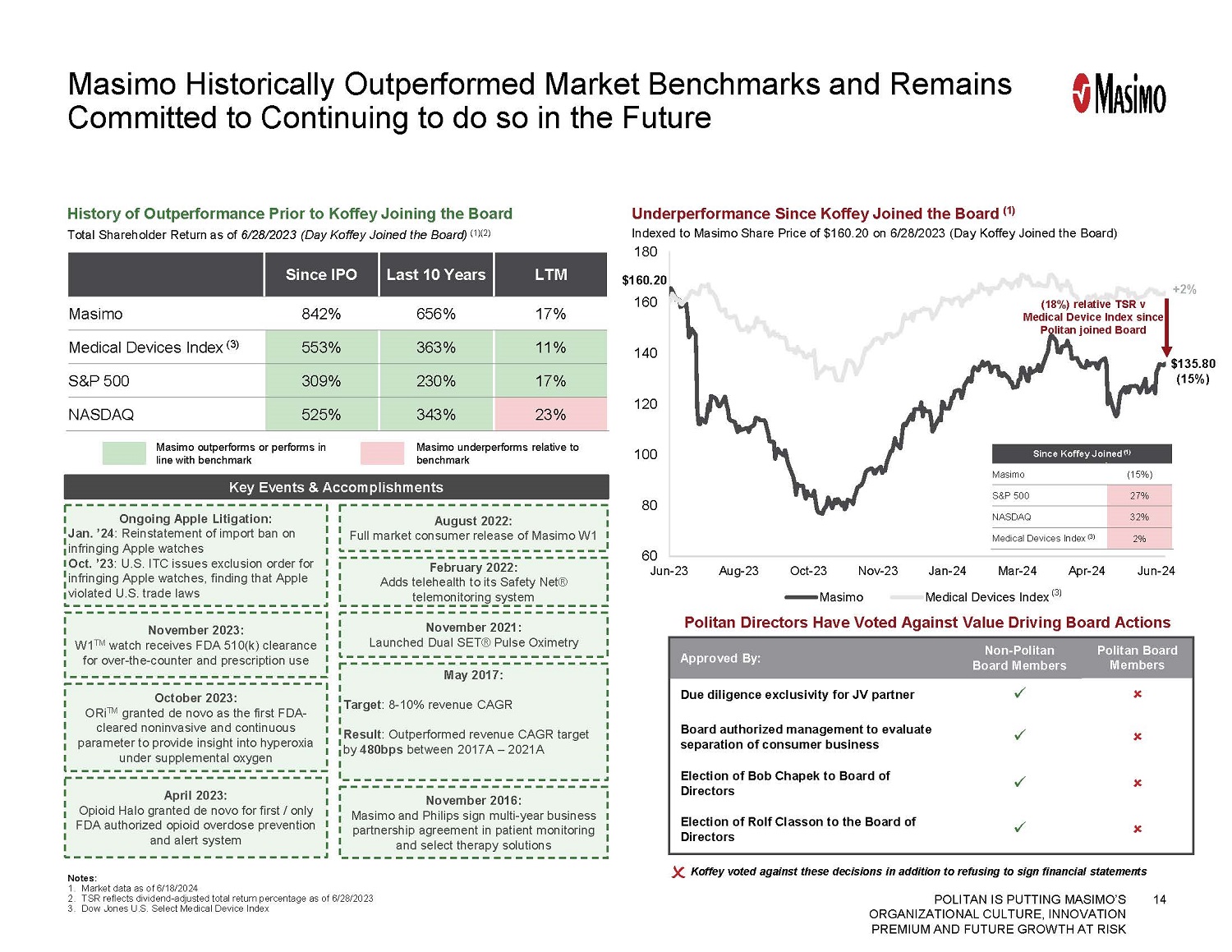

14 Masimo Historically Outperformed Market Benchmarks and Remains Committed to Continuing to do so in the Future 60 80 100 120 140 160 180 Jun-23 Aug-23 Oct-23 Nov-23 Jan-24 Mar-24 Apr-24 Jun-24 Masimo Medical Devices Index Notes: 1. Market data as of 6/18/2024 2. TSR reflects dividend - adjusted total return percentage as of 6/28/2023 3. Dow Jones U.S. Select Medical Device Index History of Outperformance Prior to Koffey Joining the Board Total Shareholder Return as of 6/28/2023 (Day Koffey Joined the Board) (1)(2) Underperformance Since Koffey Joined the Board (1) Indexed to Masimo Share Price of $160.20 on 6/28/2023 (Day Koffey Joined the Board) $135.80 (15%) +2% $160.20 LTM Last 10 Years Since IPO 17% 656% 842% Masimo 11% 363% 553% Medical Devices Index (3) 17% 230% 309% S&P 500 23% 343% 525% NASDAQ Masimo outperforms or performs in line with benchmark Masimo underperforms relative to benchmark (3) November 2021: Launched Dual SET® Pulse Oximetry Koffey voted against these decisions in addition to refusing to sign financial statements Ongoing Apple Litigation: Jan. ’24 : Reinstatement of import ban on infringing Apple watches Oct. ’23 : U.S. ITC issues exclusion order for infringing Apple watches, finding that Apple violated U.S. trade laws August 2022: Full market consumer release of Masimo W1 February 2022: Adds telehealth to its Safety Net® telemonitoring system May 2017: Target : 8 - 10% revenue CAGR Result : Outperformed revenue CAGR target by 480bps between 2017A – 2021A November 2016: Masimo and Philips sign multi - year business partnership agreement in patient monitoring and select therapy solutions Key Events & Accomplishments Since Koffey Joined (1) (15%) Masimo 27% S&P 500 32% NASDAQ 2% Medical Devices Index (3) (18%) relative TSR v Medical Device Index since Politan joined Board November 2023: W1 TM watch receives FDA 510(k) clearance for over - the - counter and prescription use October 2023: ORi TM granted de novo as the first FDA - cleared noninvasive and continuous parameter to provide insight into hyperoxia under supplemental oxygen April 2023: Opioid Halo granted de novo for first / only FDA authorized opioid overdose prevention and alert system Politan Board Members Non - Politan Board Members Approved By: x Due diligence exclusivity for JV partner x Board authorized management to evaluate separation of consumer business x Election of Bob Chapek to Board of Directors x Election of Rolf Classon to the Board of Directors Politan Directors Have Voted Against Value Driving Board Actions POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

TSR – Authorization to Separate Consumer Business 1 - Week Reaction (1) Politan’s Actions Impacted Sentiment Following Separation Announcement Source: Capital IQ Notes: 1. Total Shareholder Return includes dividends 2. Dow Jones U.S. Select Medical Device Index 3. Price change in relation to 3/22/2024 closing price 15 The Public Markets Endorsed the Consumer Separation We Recently Announced (2) Following extensive dialogue with stockholders, we announced the review of a potential separation of our Consumer business to drive value Based on past conversations, we think Masimo’s stock price will fare best if speed is prioritized , as investors seem to care most about clarity, a return to a standalone MedTech business, and minimizing distraction/disruption during the process. Report published March 25, 2024 ” We view the announcement that Masimo is evaluating a proposed separation of its consumer business as a key positive and a step in the right direction. Investors have never come around to the Sound United deal, and we believe a separation will allow Masimo to focus on its core healthcare business. As such, we see potential for multiple expansion over time for Masimo as management works through strategic options.” Report published March 25, 2024 “Friday’s announcement is very roughly a year ahead of our expectations for this review. We’re inclined to think Masimo shares will react positively to the Consumer separation review development. The review highlights the potential to return Masimo’s sole focus to the Healthcare franchise... its innovation pipeline, profitability, and competitive position. Report published March 25, 2024 9% 0% 3% Masimo S&P 500 Medical Devices Index Monday, March 25, 2024 Friday, March 22, 2024 $153.76 $132.92 Open Price $139.43 $134.93 Closing Price - 9.3% 1.5% Closing vs. Open $153.65 After Hours Final Trades 13.9% After Hours vs. Closing Masimo announces the potential separation of Consumer following market close on Friday, boosting the stock ~14% in after - hours trading. Before markets could trade on this announcement, Politan nominates 2 directors for Board control, erasing >9% of value POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

16 Key Business KPI / Metrics Despite Politan’s Obstruction, Masimo has Continued Delivering on its Growth Potential… POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Incremental Value of New Contracts (1) $MM, through the first quarter of each year Driver Installed Base # of Units (MM) Total Consumable & Service Revenue $MM, shown at constant currency (2) Consumable & Service Revenue Per Driver $ / Driver $27 $16 $19 $48 $34 $40 $81 $100 2017 2018 2019 2020 2021 2022 2023 2024 1.60 1.71 1.84 2.16 2.30 2.47 2.56 2.57 2017 2018 2019 2020 2021 2022 2023 Q1 2024 $606 $676 $762 $861 $988 $1,123 $1,085 $1,202 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) $380 $396 $413 $398 $429 $455 $424 $468 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) Notes: 1. Represents total contract revenue over the multi - year term of the contracts. Includes contracts with new customers and incremen tal new contracted business with existing customers. Management uses this information to analyze business trends. 2. The information presented is based on constant currency exchange rates used by management for 2024 financial planning and ana lys is purposes. Management uses this information to analyze business trends. 3. Reflects annualized figures for 2024 based on Q1 2024 consumable & service revenue.

17 Professional Healthcare ( RemainCo ) …Including a Path to ~30% Non - GAAP Operating Margin by 2029E (1) … POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Preliminary Estimate: Financial Impact of a Potential Separation (2) Margin Improvement Initiatives: 520 bps to 580 bps 15.0% 23.2% to 24.8% 600 bps 220 – 380 bps 350 bps 100 bps 70 – 130 bps 29.0% to 30.0% x On track for full transition to Malaysia by end of 2024 x Separation announced Adjustments to remove consumer audio revenue of $740 million and non - GAAP operating profit of $29 million (or ~4% of revenue) Adjustments to remove consumer health revenue, cost of goods sold, and certain operating expenses ($28 to $51 million of improvement to non - GAAP operating profit) Engineering initiatives to reduce product costs Manufacturing initiatives (including transition to Malaysia, which is ~2/3 complete) Leveraging installed base and fixed costs Leveraging investment and reducing R&D expenses to 8% - 9% of revenue, which is in line with industry peers Improving profitability by country and sales territory Increasing revenue per sales rep Increasing productivity and leveraging corporate and administrative costs Represents long - term goal of ~30% non - GAAP operating margins for the professional healthcare business Notes: 1. See Appendix for reconciliation of GAAP and non - GAAP measures, including constant currency and pro forma measures. May not foot due to rounding. 2. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such potential separation are still under consideration and have no t been determined, approved or finalized. See Slide 3 entitled “Disclaimer Regarding Potential Separation” for additional factors to consider in evaluating and reviewing the infor mat ion presented on this slide. 3. Reflects guidance provided May 7, 2024.

18 Professional Healthcare ( RemainCo ) – Excludes Benefits of Any Cash Proceeds from Potential JV …and ~$8 Non - GAAP Earnings Per Share by 2029E (1) POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Preliminary Estimate: Financial Impact of a Potential Separation (2) Adjustments to remove net income for consumer audio Adjustments to remove net loss for consumer health ~7 – 10% topline growth driven by strong growth in SET and Rainbow & Hemodynamics aided by growth in other new products Driven by the engineering and manufacturing cost saving initiatives and operating leverage Primarily reflects reduction in net interest expense due to retirement of debt (4) Reflects additional share issuance related to equity - based comp. Represents long - term goal of ~$8 non - GAAP EPS for the professional healthcare business $3.62 $3.62 to $3.93 ($0.39) $0.38 - $0.69 $1.70 - $2.75 $1.49 - $1.52 ($0.65) - ($0.76) $7.00 to $8.25 $0.81 - $0.84 Notes: 1. See Appendix for reconciliation of GAAP and non - GAAP measures, including constant currency and pro forma measures. May not foot due to rounding. 2. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such potential separation are still under consideration and have no t been determined, approved or finalized. See Slide 3 entitled “Disclaimer Regarding Potential Separation” for additional factors to consider in evaluating and reviewing the infor mat ion presented on this slide 3. Reflects guidance provided May 7, 2024. 4. Reduction in net interest expense does not include any proceeds from a potential joint venture

19 Masimo’s R&D Spend In - Line with Industry Peers POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK Notes: 1. Masimo figures reflect non - GAAP R&D expense based on company filings; Peer Indexes reflect R&D inclusive of one - time adjustments made by Capital IQ 2. Median of 2019A – 2023A R&D margin calculated on a company - level basis; 25 th percentile to 75 th percentile of medians across the constituents of the Dow Jones U.S. Select Medical Device Index; median chosen to remove impact of any outliers 3. Average of 2019A – 2023A R&D margin calculated on a company - level basis; 25 th percentile to 75 th percentile of averages across Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medtronic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex) R&D Benchmarking vs Peers (Includes Large Cap MedTech, High - Growth MedTech and Hospital Mid - Cap Peers) 2019A – 2023A R&D as % of Total Sales (1) 9.8% 6.0% 5.5% 14.7% 10.6% Masimo (WholeCo) Medical Devices Index Select MedTech Peers 48.0x 25.9x 25.5x Source: Company Filings, Capital IQ (2) (3) 2029E: 8.4% – 8.7% 2024E: 9.4% – 9.7% RemainCo R&D % of Sales 2029E: 8.4% – 8.7% 2024E: 9.4% – 9.7% RemainCo R&D % of Sales Average ’19A - ’23A NTM P/E:

Current… Current Prem. to Select MedTech Peers 16.7x Last 1 Year Prem. to Select MedTech Peers 12.0x Pre-COVID… Last 1 Year Prem. to Select MedTech Peers 20.7x Last 3 Years Prem. to Select MedTech Peers 15.0x Last 5 Years Prem. to Select MedTech Peers 12.1x 0.0x 10.0x 20.0x 30.0x 40.0x 50.0x 60.0x 70.0x 80.0x 90.0x Jun-14 Jun-16 Jun-18 Jun-20 Jun-22 Jun-24 Masimo Select MedTech Peers Stryker Abbott Boston Scientific GE HealthCare Zimmer Baxter J&J Becton Dickinson Medtronic Edwards Lifesciences Intuitive Surgical Philips Omnicell CONMED LivaNova Getinge ICU Medical Teleflex Haemonetics Merit Medical LeMaitre Integra DexCom Insulet ResMed Align Masimo 5x 15x 25x 35x 45x 55x 0.0% 5.0% 10.0% 15.0% 20.0% 2025 P/E vs. 2024E – 2026E Revenue CAGR 2025E P/E 20 Masimo’s R&D Engine Drives Topline Growth and Leads to a Premium Multiple Without an R&D engine to drive topline growth, Masimo falls susceptible to trading below peers 2024E – 2026E Revenue CAGR Correlation: 88.9% NTM P/E (1) (x) Notes: 1. Market data as of 6/18/2024 2. Includes Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medt ron ic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex). Excludes companies for whom P/E Ratios are not meaningful 3. Reflects average of premium/discount of Masimo to Select MedTech peers during select time periods; includes Large Cap MedTech pe ers, Scaled High - Growth MedTech peers and Hospital Mid - Cap peers as defined above 4. WholeCo reflects consolidated financials per latest Street estimates; Healthcare reflects segment as reported by analysts and may not a lign with RemainCo perimeter 5. COVID Pandemic period reflects 3/15/2020, the day states begin to implement shutdowns in order to prevent the spread of COVID - 19 , to 5/5/2023, the day the World Health Organization declared the end of the pandemic phase of COVID - 19 6. Based on Masimo WholeCo Consensus NTM EPS of $3.75 36.3x Δ Today: +16.7x 19.1x 18.1x COVID Pandemic (5) (2) 19.5x This Is The Premium at Risk WholeCo (4) 6.1% Healthcare (4) 8.3% Source: Capital IQ Impact of Losing Masimo’s R&D Engine Premium NTM P/E: 19.5x Implied Share Price: ~$73/share (6) POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

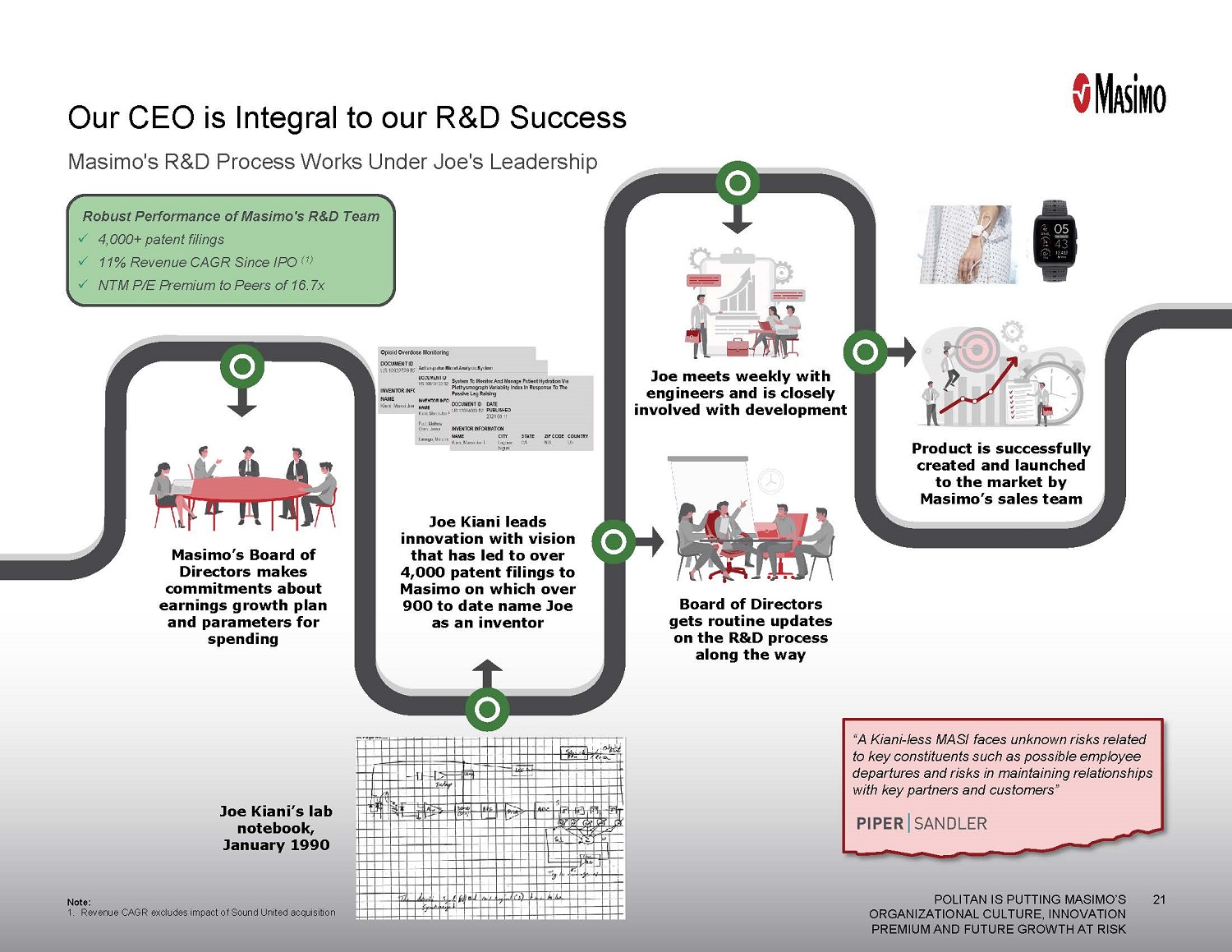

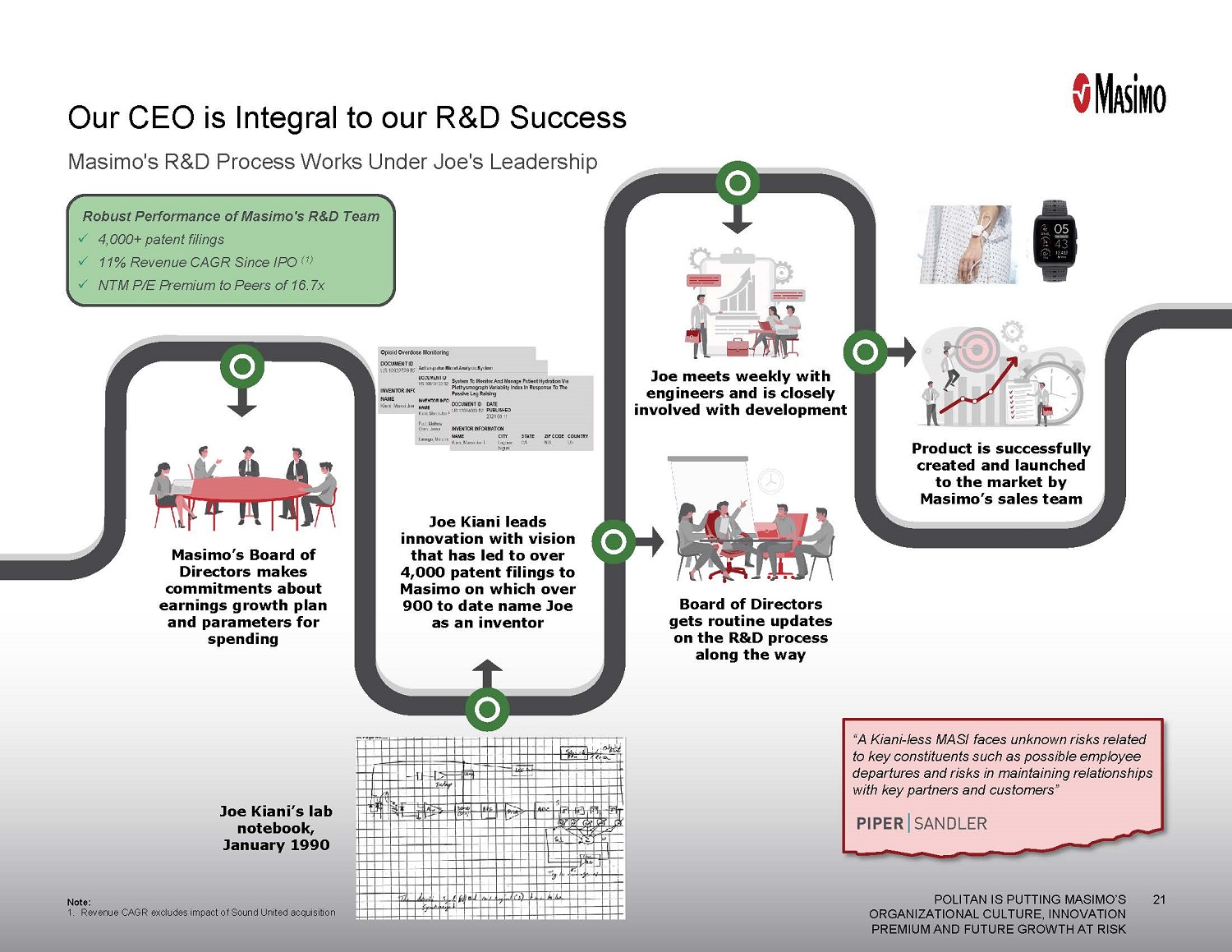

sh 21 Masimo’s R&D Process Works Under Joe’s Leadership Our CEO is Integral to our R&D Success Robust Performance of Masimo’s R&D Team x 4,000+ patent filings x 11% Revenue CAGR Since IPO (1) x NTM P/E Premium to Peers of 16.7x “A Kiani - less MASI faces unknown risks related to key constituents such as possible employee departures and risks in maintaining relationships with key partners and customers” Joe Kiani leads innovation with vision that has led to over 4,000 patent filings to Masimo on which over 9 00 to date name Joe as an inventor Joe meets weekly with engineers and is closely involved with development Board of Directors gets routin e updates on the R&D process along the way Product is successfully created and launched to the market by Masimo’s sales team Masimo’s Board of Directors makes commitments about earnings growth plan and parameters for spending Joe Kiani’s lab notebook, January 1990 Note: 1. Revenue CAGR excludes impact of Sound United acquisition POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

22 Our Game Changing Record of Innovation has Revolutionized the Healthcare Ecosystem Notes: 1. Emphasis added; quotes from Dr. José M. Camacho Alonso translated from Spanish “Having worked with hundreds of medical device vendors over the 47 years that I have been a registered respiratory therapist and leader in the field, I have never had the same relationship with any company leaders like I have had with Joe Kiani . Joe’s unique passion to provide visionary leadership working personally with healthcare professionals who share his vision is a unique opportunity.” (1) – Kim Bennion MsHS , RRT, CHC, FAARC, Enterprise Director of Research, Intermountain Health “We have been working with Masimo and Joe Kiani for over 22 years. The high - quality and innovative products in the areas of pulse oximetry and capnometry gives us confidence in the care of our patients at home and in the medical environment. Especially in the field of outpatient care, the reliability of the technology is the decisive factor . The innovative ideas and development of Joe Kiani and his team, especially in the area of ‘at home’, are now utilized in the medical devices we have developed. The visionary ideas of Joe Kiani and their realization with his team are constantly giving new impetus to medical technology, always taking the world of medicine one step further.” (1) – Andreas Bosch, Vice President, Löwenstein Medical ” Over the years, Masimo has become synonymous with innovation, quality, and excellence in the medical technology field . This reputation is in no small part due to Joe Kiani’s visionary leadership and relentless dedication. His pioneering work in noninvasive monitoring technologies has revolutionized patient care, saved countless lives, and set new standards for the industry. From the development of pulse oximetry to the advancement of Patient SafetyNet, his contributions have not only pushed the boundaries of what is possible but also demonstrated an unwavering commitment to improving patient outcomes . His passion for both technological innovation and patient safety has been a guiding light for Masimo and an inspiration to many within the medical community. As a customer who has benefited from Masimo’s groundbreaking products, I have witnessed firsthand the positive impact of Joe Kiani’s work. The reliability and precision of the devices have provided peace of mind and assurance in critical moments . It is this trust and confidence in Masimo’s products that reinforces my belief in the importance of his continued leadership.” (1) – Dr. José M. Camacho Alonso, H ead of PICU and ED Hospital Provincial de Malaga “My colleagues and I saw a real difference between Joe Kiani and the managers of competing products, as well as a real difference in product quality, which motivated our recommendation for the implementation of Masimo technology in patient monitoring , despite the fact that Masimo was a young company. Since 1995, I have followed the successive improvements of Masimo technology . As a physician involved in patient care, I trust Joe Kiani and I trust Masimo products because I know he runs this company, with real thought about the impact of his products on patients’ safety.” (1) – Dr Mehran MONCHI, Head of the Intensive Care Units of Melun and Fontainebleau Hospitals “The undisputed damages evidence was that an entire industry – other than Philips and one Chinese company – took licenses from M asimo for innovative technology that saved thousands of lives and billions of dollars in healthcare costs. ” (1) – Leonard P. Stark, U.S. District Judge during Masimo Corp. v. Philips Elec. N. Am. Corp., 2015 POLITAN IS PUTTING MASIMO’S ORGANIZATIONAL CULTURE, INNOVATION PREMIUM AND FUTURE GROWTH AT RISK

The Board Has Made Appropriate and Timely Governance Changes, and Multiple Good Faith Overtures to Settle this Contest. Politan Has Refused Every Attempt

THE BOARD HAS MADE APPROPRIATE AND TIMELY GOVERNANCE CHANGES, AND MULTIPLE GOOD FAITH OVERTURES TO SETTLE THIS CONTEST. POLITAN HAS REFUSED EVERY ATTEMPT 24 The Independent Directors Have Meaningfully Refreshed the Board and Enhanced Corporate Governance We have continued to make governance and Board enhancements through an independent, thoughtful refreshment process and new policies based on direct feedback from our robust stockholder engagement program Board Refreshment Other Governance Enhancements Legend: 2023 2024 November 2023 Appointed Healthcare and MedTech veteran Rolf Classon to the Board Rolf Classon Appointed January 2024 Appointed Bob Chapek, former CEO of The Walt Disney Company, to the Board Bob Chapek Appointed February 2024 Adam Mikkelson stepped down from the Board Director Resigned May 2024 Chris Chavez, former CEO of TriVascular, nominated to Board; Rolf Classon abruptly resigned Chris Chavez Nominated As Rolf Classon Resigned June 2023 Stockholders elected to appoint 2 Politan nominees and expand the Board Two Politan Directors Elected Q1 2023 Engaged with stockholders pre - AGM to introduce relative TSR and a 3 - year LTI performance - period in 2023 compensation program Compensation Program Enhancements March 2023 H Michael Cohen named LID, search for 2 new directors initiated through a third - party search process, and rights plan terminated New Lead Ind. Director; Governance Enhancements February 2024 Formed a Special Committee to Explore Consumer Business Separation Special Committee Formed Q1 2024 Increased 2024 PSU relative TSR weighting 20% 50%; removed metric overlap for annual cash incentive / PSUs Compensation Program Enhancements June 2023 Began phased - in declassification of the Board Phased - in Declassification Began

THE BOARD HAS MADE APPROPRIATE AND TIMELY GOVERNANCE CHANGES, AND MULTIPLE GOOD FAITH OVERTURES TO SETTLE THIS CONTEST. POLITAN HAS REFUSED EVERY ATTEMPT 25 Thoughtful Nomination Process Identified Three New Independent, Highly Qualified Board Additions since Last Year’s AGM Politan Directors’ opposition to highly qualified Board candidates makes it clear to us that they view any process not deliberately designed by them – despite how independent it is – as inadequate corporate governance Retention of a third - party independent search firm Heidrick & Struggles (“Heidrick”) to identify qualified and skilled director candidates who previously served in a CEO position with experience in the healthcare industry or expertise in consumer markets, or who had payor/provider busines s m odel or audit experience Our Comprehensive Director Nomination Process Exhibited Fairness and Efficiency Deep and relevant operational expertise with strong M&A background Profound public company leadership and unique consumer experience Strong healthcare / medical device industry expertise with public company leadership experience Key Skillsets • Public Company CEO and Director (Disney) • Robust Public Company Leadership and Unique Consumer Experience • Technology and Innovation Experience • Mergers & Acquisitions Knowledge • Global Operations Experience in the Consumer Industry Key Skillsets • Public company CEO and Director (TriVascular) • Public Company Director of Nuvectra, Advance Neuromodulation Systems • Healthcare Industry and Operations • Former Chairman of the Medical Device Manufacturers Association Key Skillsets • Public Company Director (BICO Group, Catalent, Perrigo, Hill - Rom) • Mergers & Acquisitions Knowledge • Global Operations Experience in the Healthcare Industry Rolf Classon Appointed Nov. 2023 (1) Appointed Jan. 2024 Bob Chapek Nominee Up for Election at 2024 AGM Chris Chavez Notes: 1. Rolf Classon resigned from our Board in May 2024 for health reasons Heidrick presented the Nominating Committee with 50+ quality candidates with relevant experience The Nominating Committee interviewed a number of the candidates After a call with Koffey , the Nominating Committee modified the director search specifications and invited Koffey to attend future Nominating Committee meetings and to participate in candidate interviews; Nominating Committee interviewed and evaluated multiple candidates propo sed by Koffey Classon and Chapek were each interviewed several times by five different independent directors, including Koffey and Brennan However, despite thorough attempts to include two Politan directors in the process, Koffey and Brennan ultimately voted against both candidates and showed no willingness to cooperate

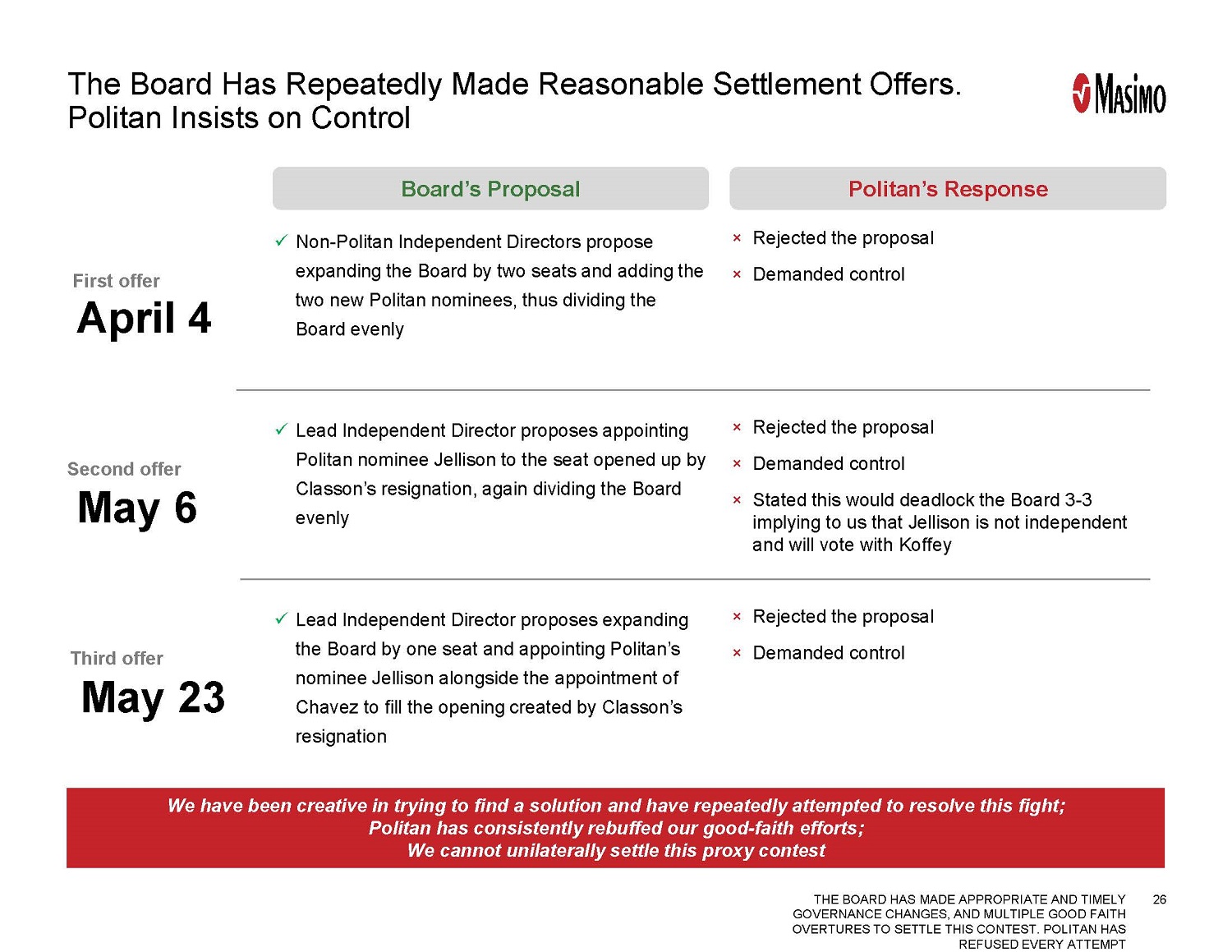

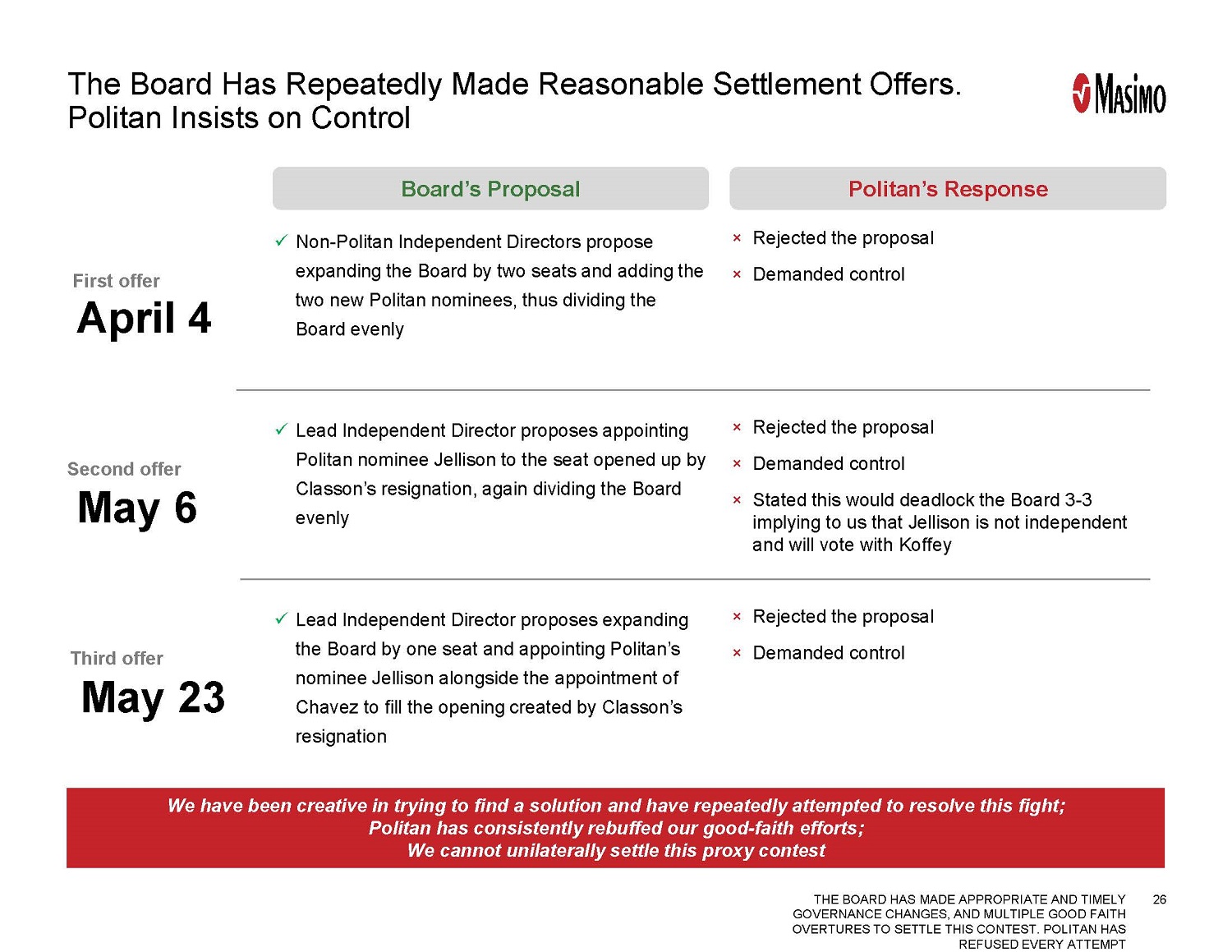

THE BOARD HAS MADE APPROPRIATE AND TIMELY GOVERNANCE CHANGES, AND MULTIPLE GOOD FAITH OVERTURES TO SETTLE THIS CONTEST. POLITAN HAS REFUSED EVERY ATTEMPT 26 The Board Has Repeatedly Made Reasonable Settlement Offers. Politan Insists on Control We have been creative in trying to find a solution and have repeatedly attempted to resolve this fight; Politan has consistently rebuffed our good - faith efforts; We cannot unilaterally settle this proxy contest Politan’s Response Board’s Proposal x Lead Independent Director proposes expanding the Board by one seat and appointing Politan’s nominee Jellison alongside the appointment of Chavez to fill the opening created by Classon’s resignation × Rejected the proposal × Demanded control x Lead Independent Director proposes appointing Politan nominee Jellison to the seat opened up by Classon’s resignation, again dividing the Board evenly × Rejected the proposal × Demanded control × Stated this would deadlock the Board 3 - 3 implying to us that Jellison is not independent and will vote with Koffey x Non - Politan Independent D irectors propose expanding the Board by two seats and adding the two new Politan nominees, thus dividing the Board evenly × Rejected the proposal × Demanded control April 4 First offer May 6 Second offer May 23 Third offer

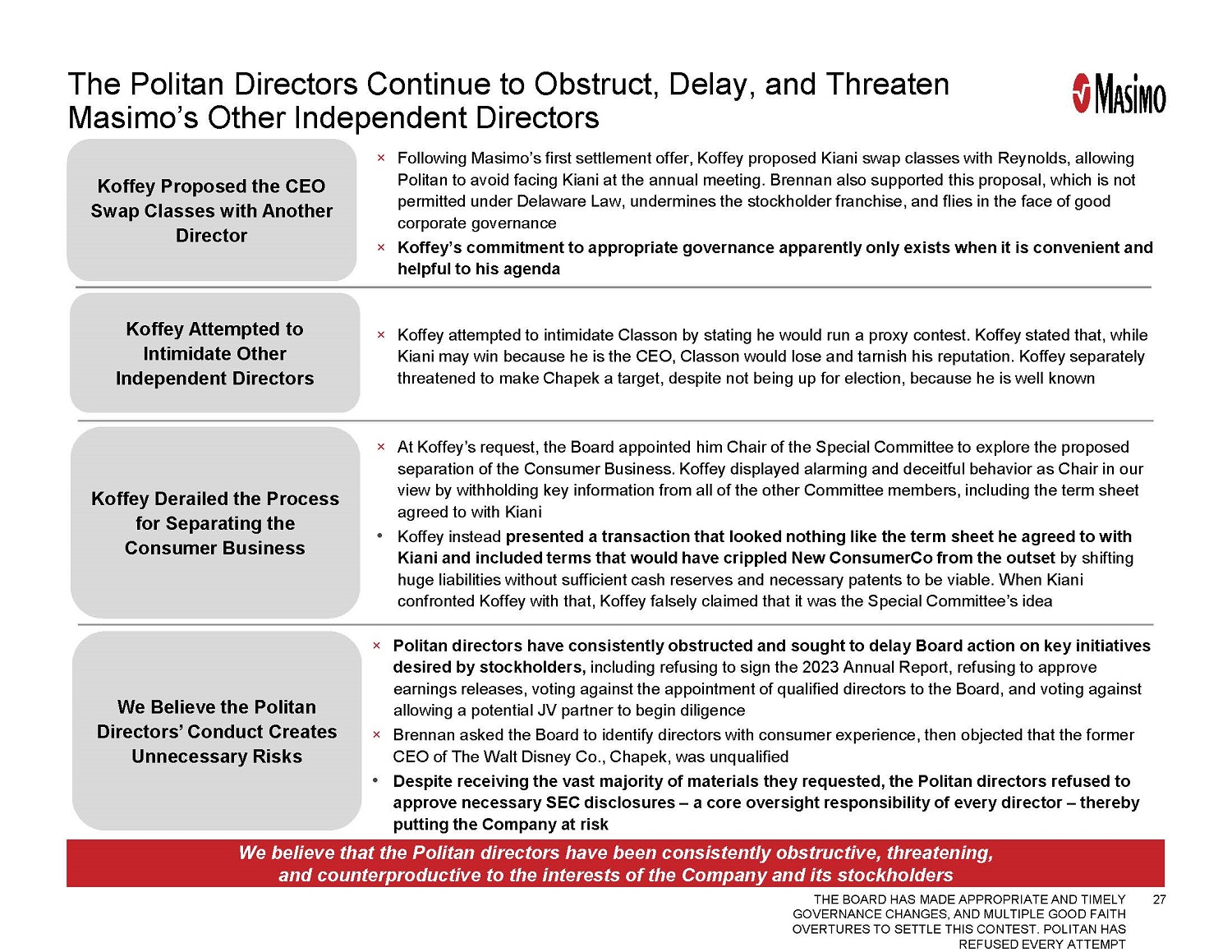

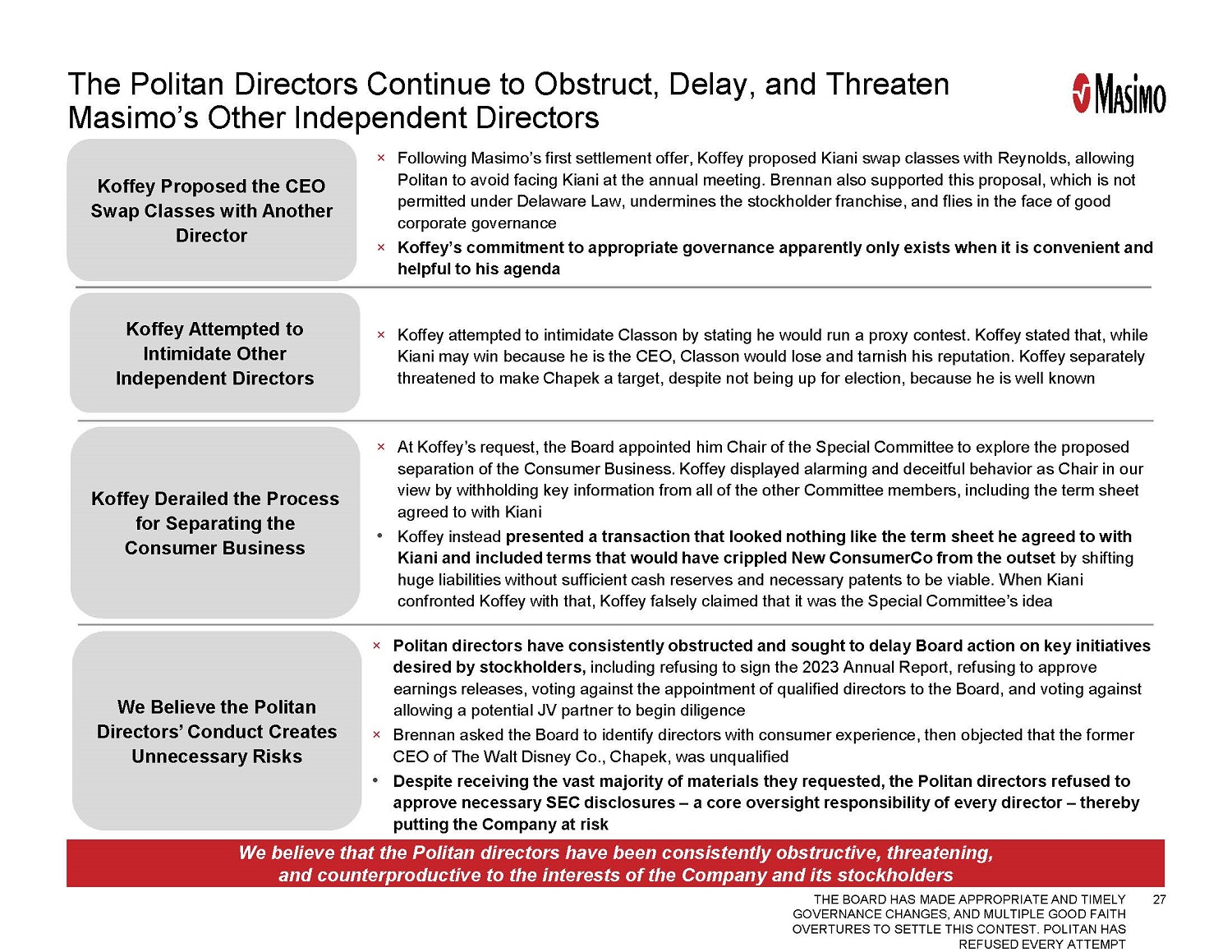

THE BOARD HAS MADE APPROPRIATE AND TIMELY GOVERNANCE CHANGES, AND MULTIPLE GOOD FAITH OVERTURES TO SETTLE THIS CONTEST. POLITAN HAS REFUSED EVERY ATTEMPT 27 The Politan Directors Continue to Obstruct, Delay, and Threaten Masimo’s Other Independent Directors We believe that the Politan directors have been consistently obstructive, threatening, and counterproductive to the interests of the Company and its stockholders × Following Masimo’s first settlement offer, Koffey proposed Kiani swap classes with Reynolds, allowing Politan to avoid facing Kiani at the annual meeting. Brennan also supported this proposal, which is not permitted under Delaware Law, undermines the stockholder franchise, and flies in the face of good corporate governance × Koffey’s commitment to appropriate governance apparently only exists when it is convenient and helpful to his agenda Koffey Proposed the CEO Swap Classes with Another Director Koffey Attempted to Intimidate Other Independent Directors × Koffey attempted to intimidate Classon by stating he would run a proxy contest. Koffey stated that, while Kiani may win because he is the CEO, Classon would lose and tarnish his reputation. Koffey separately threatened to make Chapek a target, despite not being up for election, because he is well known Koffey Derailed the Process for Separating the Consumer Business × At Koffey’s request, the Board appointed him Chair of the Special Committee to explore the proposed separation of the Consumer Business. Koffey displayed alarming and deceitful behavior as Chair in our view by withholding key information from all of the other Committee members, including the term sheet agreed to with Kiani • Koffey instead presented a transaction that looked nothing like the term sheet he agreed to with Kiani and included terms that would have crippled New ConsumerCo from the outset by shifting huge liabilities without sufficient cash reserves and necessary patents to be viable. When Kiani confronted Koffey with that, Koffey falsely claimed that it was the Special Committee’s idea We Believe the Politan Directors’ Conduct Creates Unnecessary Risks × Politan directors have consistently obstructed and sought to delay Board action on key initiatives desired by stockholders, including refusing to sign the 2023 Annual Report, refusing to approve earnings releases, voting against the appointment of qualified directors to the Board, and voting against allowing a potential JV partner to begin diligence × Brennan asked the Board to identify directors with consumer experience, then objected that the former CEO of The Walt Disney Co., Chapek , was unqualified • Despite receiving the vast majority of materials they requested, the Politan directors refused to approve necessary SEC disclosures – a core oversight responsibility of every director – thereby putting the Company at risk

Politan Offered No Solutions, Ideas, or Constructive Leadership Shareholders Should Not Cede Politan Control

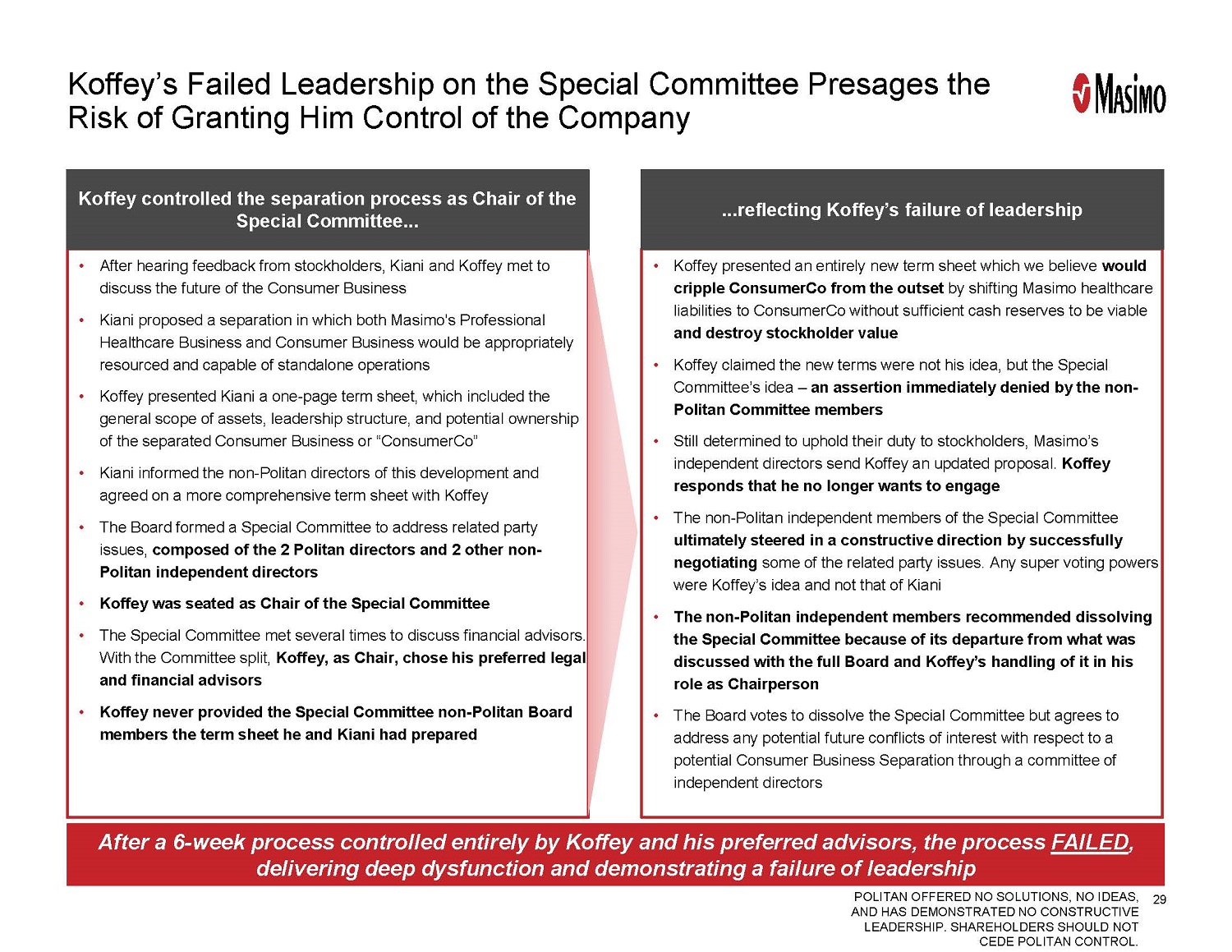

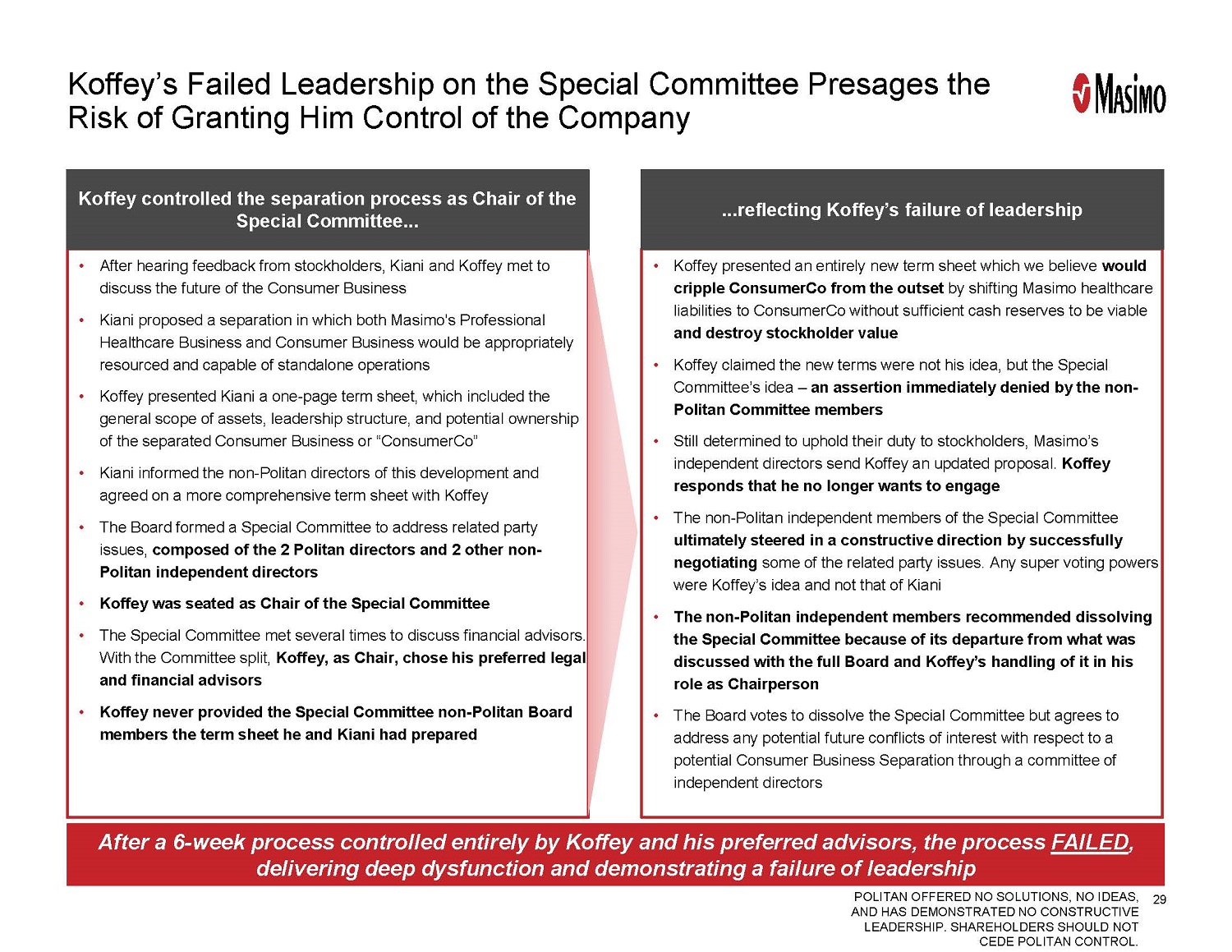

29 Koffey’s Failed Leadership on the Special Committee Presages the Risk of Granting Him Control of the Company • After hearing feedback from stockholders, Kiani and Koffey met to discuss the future of the Consumer Business • Kiani proposed a separation in which both Masimo’s Professional Healthcare Business and Consumer Business would be appropriately resourced and capable of standalone operations • Koffey presented Kiani a one - page term sheet, which included the general scope of assets, leadership structure, and potential ownership of the separated Consumer Business or ” ConsumerCo ” • Kiani informed the non - Politan directors of this development and agreed on a more comprehensive term sheet with Koffey • The Board formed a Special Committee to address related party issues, composed of the 2 Politan directors and 2 other non - Politan independent directors • Koffey was seated as Chair of the Special Committee • The Special Committee met several times to discuss financial advisors. With the Committee split, Koffey , as Chair, chose his preferred legal and financial advisors • Koffey never provided the Special Committee non - Politan Board members the term sheet he and Kiani had prepared Koffey controlled the separation process as Chair of the Special Committee... • Koffey presented an entirely new term sheet which we believe would cripple ConsumerCo from the outset by shifting Masimo healthcare liabilities to ConsumerCo without sufficient cash reserves to be viable and destroy stockholder value • Koffey claimed the new terms were not his idea, but the Special Committee’s idea – an assertion immediately denied by the non - Politan Committee members • Still determined to uphold their duty to stockholders, Masimo’s independent directors send Koffey an updated proposal. Koffey responds that he no longer wants to engage • The non - Politan independent members of the Special Committee ultimately steered in a constructive direction by successfully negotiating some of the related party issues. Any super voting powers were Koffey’s idea and not that of Kiani • The non - Politan independent members recommended dissolving the Special Committee because of its departure from what was discussed with the full Board and Koffey’s handling of it in his role as Chairperson • The Board votes to dissolve the Special Committee but agrees to address any potential future conflicts of interest with respect to a potential Consumer Business Separation through a committee of independent directors ...reflecting Koffey’s failure of leadership After a 6 - week process controlled entirely by Koffey and his preferred advisors, the process FAILED , delivering deep dysfunction and demonstrating a failure of leadership

30 Politan Seeks to Eliminate Substantial Experience and Relevant Expertise from the Masimo Boardroom Christopher Chavez Joe Kiani x Profound experience and understanding of the field spanning over three decades in the medical device industry, including Chairman and/or CEO roles at TriVascular and Advanced Neuromodulation Systems, and 15 years in leadership roles with Johnson & Johnson x Deep industry connection and leadership through his role as the former Chairman of the Medical Device Manufacturers Association x Experience leading a company during a phase of transformation and M&A transaction through his role as a Chairman and CEO of TriVascular during its merger with Endologix x Multiple former public company Board experience at Nuvectra, TriVascular, and Advanced Neuromodulation Systems, Advanced Medical Optics, and Endologix x Offers financial and audit expertise through his CPA certification x Deep understanding of Masimo’s business, history, culture, and technology as the founder / CEO since inception in 1989 x Disruptor and innovator in the industry with more than 500 patents related to signal processing, sensors and patent monitoring, including patents for the invention of measure - through motion and low - perfusion pulse oximetry x Provides wealth of industry knowledge and expertise with more than 35 years of experience of founding Masimo and Patient Safety Movement Foundation x Broad experience in a wide range of functional areas, including strategic planning, strategic investments, engineering and development, and legal and government affairs x Revered by employees, customers, partners and respected even by competitors. Former Chairman of Medical Device Manufacturers Association x Has experience serving on another public company Board (Stereotaxis) • Unmatched invaluable insight from the founder / CEO who has the most comprehensive knowledge and experience with Masimo and its strategy, culture, and technology • 70+ years of combined industry experience in the medical device industry • Board will be left with only one independent director who had previously served as a medical device company CEO, Craig Reynolds • Extensive M&A and transformation experience • Relationships with 100s of key employees, customers, hospitals and healthcare providers Experience That Would Be Lost by Replacing our Highly Qualified Director Nominees with Politan Slate

31 Politan Seeks to Gain Control by Substituting Inferior Candidates 4/6 5/6 x x x x x x Medical Device or Consumer Experience 2/6 4/6 x x x x Ability to Oversee a Large Complex Company 2/6 4/6 x x x x Public Company CEO 1/6 3/6 x x x Medical Device CEO Despite having a year to plan, Politan has nominated underqualified candidates with no prior public company CEO experience or ability to step into the CEO role and with poor track records at past directorships ‒ During Jellison’s tenure as a director, Avient Corp. underperformed the S&P 500 by (165.0%) (1) ‒ During Solomon’s tenure as a director, Novanta and Materion both underperformed the S&P 500 by (15.1%) (1) and (247.2%) (1) , respectively Notes: 1. For cases where Jellison or Solomon is a current Board member, TSR reflects dividend - adjusted total return percentage as of 6/18 /2024 If both Politan nominees are elected, Politan will control the Board with 4 of 6 Board members and the Board will lose critical industry experience and executive leadership needed to unlock our growth potential POLITAN OFFERED NO SOLUTIONS, NO IDEAS, AND HAS DEMONSTRATED NO CONSTRUCTIVE LEADERSHIP. SHAREHOLDERS SHOULD NOT CEDE POLITAN CONTROL. Current Independent Members Current Politan Members