UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PC MALL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box, if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

PC MALL, INC.

2555 W. 190th Street, Suite 201

Torrance, California 90504

Notice of Annual Meeting of Stockholders

To Be Held on August 11, 2006

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders of PC Mall, Inc., a Delaware corporation (the “Company”), will be held at the Company’s headquarters, located at 2555 W. 190th Street, Suite 201, Torrance, California 90504 on Friday, August 11, 2006 at 10:00 a.m. local time for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

1. To elect four directors of the Company to serve until the 2007 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

2. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on July 7, 2006 are entitled to notice of and to vote at the meeting or any adjournment thereof. A list of such stockholders will be available for examination by any stockholder at the Annual Meeting, or at the office of the Secretary of the Company, 2555 W. 190th Street, Suite 201, Torrance, California 90504, for a period of ten days prior to the Annual Meeting.

A copy of the Company’s Annual Report for the fiscal year ended December 31, 2005, containing consolidated financial statements, is included with this mailing. Your attention is directed to the accompanying Proxy Statement for the text of the matters to be proposed at the meeting and further information regarding each proposal to be made.

STOCKHOLDERS UNABLE TO ATTEND THE MEETING IN PERSON ARE ASKED TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU WISH.

| By Order of the Board of Directors, |

| /s/ Frank F. Khulusi |

| Frank F. Khulusi |

| Chairman of the Board, President and Chief Executive Officer |

Torrance, California

July 11, 2006

PC MALL, INC.

2555 W. 190th Street, Suite 201

Torrance, California 90504

PROXY STATEMENT

Annual Meeting of Stockholders

To be held on August 11, 2006

INFORMATION CONCERNING SOLICITATION AND VOTING

This proxy statement is furnished by the board of directors of PC Mall, Inc., a Delaware corporation, in connection with the solicitation of proxies to be used at our annual meeting of stockholders to be held on Friday, August 11, 2006, at 10:00 a.m. local time, at our headquarters, located at 2555 W. 190th Street, Suite 201, Torrance, California 90504, and at all adjournments thereof for the purposes described in this proxy statement and in the accompanying notice of annual meeting of stockholders. ANY PROXY IN WHICH NO DIRECTION IS SPECIFIED WILL BE VOTED FOR THE ELECTION OF ALL OF THE DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT AND IN FAVOR OF PROPOSAL 2. This proxy statement and the notice of meeting and proxy are being mailed to stockholders on or about July 11, 2006.

The close of business on July 7, 2006 has been fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the meeting. As of July 7, 2006, our outstanding voting securities consisted of 12,206,693 shares of common stock, par value $0.001 per share. On all matters which will come before the meeting, each stockholder is entitled to one vote for each share of common stock held on the record date.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time prior to its use by:

| • | delivering to our principal office a written notice of revocation; |

| • | filing with us a duly executed proxy bearing a later date; or |

| • | attending the meeting and voting in person. |

The costs of this solicitation, including the expense of preparing and mailing proxy solicitation materials, will be borne by PC Mall. We will request brokerage houses and other nominees, custodians and fiduciaries to forward soliciting material to beneficial owners of our common stock. We will reimburse brokerage firms and other persons representing beneficial owners for their expenses in forwarding solicitation materials to beneficial owners. We may conduct further solicitation personally, telephonically or by facsimile or other electronic communication through our officers, directors and employees, none of whom will receive additional compensation for assisting with the solicitation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership of our common stock as of July 7, 2006 by:

| • | each of the executive officers listed in the Summary Compensation Table in this proxy statement (referred to as the “named executive officers”); |

| • | each director; |

| • | all of our current directors and executive officers as a group; and |

| • | each person known to us to be the beneficial owner of more than 5% of the outstanding shares of our common stock. |

Percentage ownership is based on an aggregate of 12,206,693 shares of our common stock outstanding on July 7, 2006. The table is based upon information provided by officers, directors and principal stockholders. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all of the shares of our common stock beneficially owned by them. Unless otherwise indicated, the address for each person is c/o PC Mall, Inc., 2555 W. 190th Street, Suite 201, Torrance, California 90504.

2

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned | ||||

5% or Greater Stockholders: | ||||||

Wells Fargo & Company (1) | 1,485,296 | 12.2 | % | |||

Boston Avenue Capital, LLC (2) | 1,270,133 | 10.4 | ||||

Jonathan L. Kimerling (3) | 1,143,000 | 9.4 | ||||

Amre A. Youness (4) | 622,000 | 5.1 | ||||

Current Directors and Executive Officers: | ||||||

Frank F. Khulusi | 2,155,409 | (5) | 17.5 | |||

Theodore R. Sanders | 154,592 | (6) | 1.3 | |||

Kristin M. Rogers | 141,792 | (6) | 1.1 | |||

Daniel J. DeVries | 123,777 | (7) | 1.0 | |||

Robert I. Newton | 50,000 | (6) | * | |||

Thomas A. Maloof | 68,500 | (6) | * | |||

Ronald B. Reck | 63,500 | (8) | * | |||

Paul C. Heeschen (9) | 8,727 | (10) | * | |||

All current directors and executive officers as a group (8 persons) | 2,766,297 | (11) | 21.5 | % |

| * | Less than 1%. |

| (1) | Based on information contained in Schedule 13G/A filed on February 3, 2006, by Wells Fargo & Company and Wells Capital Management Incorporated. Wells Fargo & Company has sole voting power with respect to 1,356,896 shares and sole dispositive power with respect to 1,483,296 shares of our common stock, and Wells Capital Management Incorporated has sole voting power with respect to 1,354,896 shares and sole dispositive power with respect to 1,456,796 shares of our common stock. Wells Fargo & Company is the parent holding company of Wells Capital Management Incorporated, which is a registered investment advisor. The address for Wells Fargo & Company is 420 Montgomery Street, San Francisco, California 94104 and the address for Wells Capital Management Incorporated is 525 Market Street, San Francisco, California 94105. |

| (2) | Based on information contained in Schedule 13D/A filed on January 10, 2006, by Boston Avenue Capital, LLC, Value Fund Advisors, LLC and Charles M. Gillman. Boston Avenue Capital, LLC has sole voting and dispositive power with respect to 1,270,133 shares of our common stock. Boston Avenue Capital, LLC is managed by Value Fund Advisors, LLC, which is owned and managed by Charles M. Gillman. The address for Boston Avenue Capital, LLC is 415 South Boston, 9th Floor, Tulsa, Oklahoma 74103. |

| (3) | Based on information contained in Schedule 13D/A filed on May 2, 2006, by Jonathan L. Kimerling and Four Leaf Management, LLC, Jonathan L. Kimerling has sole voting and dispositive power with respect to 120,000 shares (includes all shares held by Mr. Kimerling in an investment retirement account and shares held as custodian on behalf of Joel Kimerling, Victoria Kimerling and Isabella Kimerling) and shared voting and dispositive power with respect to 1,023,000 shares of our common stock. According to the Schedule 13D/A, Four Leaf Management, LLC has sole voting and dispositive power with respect to 1,023,000 shares of our common stock. Mr. Kimerling is the sole managing member of Four Leaf Management, LLC. The address for Mr. Kimerling and Four Leaf Management, LLC is c/o Jonathan L. Kimerling, 2968 Cherokee Road, Birmingham, Alabama 35223. |

| (4) | The address for Mr. Youness is 310 North Lake Avenue, Pasadena, California 91101. |

| (5) | Consists of 1,647,596 shares held by the Khulusi Family Revocable Trust dated November 3, 1993, 400,000 shares held by Frank F. Khulusi, and 107,813 shares underlying options which are presently vested or will vest within 60 days of July 7, 2006. |

| (6) | Consists of shares issuable upon exercise of stock options which are presently vested or will vest within 60 days of July 7, 2006. |

| (7) | Includes 123,177 shares issuable upon exercise of stock options which are presently vested or will vest within 60 days of July 7, 2006. |

| (8) | Includes 38,500 shares issuable upon exercise of stock options which are presently vested or will vest within 60 days of July 7, 2006. |

| (9) | Paul C. Heeschen was elected to become a member of our board of directors on February 6, 2006 to replace the vacancy created by the resignation of Mark C. Layton on February 1, 2006. |

| (10) | Includes 5,000 shares issuable upon exercise of stock options which are presently vested or will vest within 60 days of July 7, 2006. |

| (11) | This figure includes an aggregate of 689,374 shares issuable upon exercise of stock options which are presently vested or will vest within 60 days of July 7, 2006. |

3

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Four directors are to be elected at the meeting, with each director to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. All of the persons listed below are now serving as members of our board of directors and have consented to serve as directors, if elected. The board of directors proposes for election the nominees listed below.

Name | Age | Position | Director Since | |||

Frank F. Khulusi | 39 | Chairman of the Board, President and Chief Executive Officer | 1987 | |||

Thomas A. Maloof (2) | 54 | Director | 1998 | |||

Ronald B. Reck (1)(2) | 57 | Director | 1999 | |||

Paul C. Heeschen (1)(2)(3) | 48 | Director | 2006 |

| (1) | Member of our compensation committee. |

| (2) | Member of our audit committee. |

| (3) | Elected to become a member of our board of directors and appointed to our audit committee and our compensation committee, effective February 6, 2006, to fill the vacancy caused by Mark C. Layton’s resignation, which was effective February 1, 2006. |

Biographical Information

Frank F. Khulusi is our co-founder (and co-founded our predecessor) and has served as our Chairman of the Board and Chief Executive Officer since our inception in 1987. Mr. Khulusi served as our President from our inception in 1987 until July 1999, and he resumed that office in March 2001. From July 1999 to September 1999, Mr. Khulusi served as President of Toytime, Inc., an online retailer of toys. In July 2000, a petition for involuntary bankruptcy was filed against Toytime under Chapter 11 of the United States Bankruptcy Code, which was dismissed by a federal bankruptcy court in November 2000.

Thomas A. Maloof has served as one of our directors since May 1998. Since January 2001, Mr. Maloof has served as the Chief Financial Officer of HMC, Inc., a hospitality company. From February 1998 to November 2000, Mr. Maloof served as President of Perinatal Practice Management, Inc. From September 1997 until February 1998, Mr. Maloof served as Chief Financial Officer of Prospect Medical Holdings. From January 1995 until September 1997, Mr. Maloof was the Chief Executive Officer of Prime Health of Southern California. From August 2004 through April 2005, Mr. Maloof served on the board of directors of our former subsidiary, eCOST.com, Inc.

Ronald B. Reck has served as one of our directors since April 1999. Mr. Reck was employed by Applebee’s International from 1987 to 1997, serving most recently as Executive Vice President and Chief Administrative Officer. Since 1998, Mr. Reck has served as President and Chief Executive Officer of Joron Properties, LLC, a real estate company.

Paul C. Heeschenhas served as one of our directors since February 2006. Mr. Heeschen has served as a member of the board of directors of Diedrich Coffee, Inc. since January 1996, and was elected to serve as its chairman in February 2001. For the past 13 years, Mr. Heeschen has been a principal of Heeschen & Associates, a private investment firm. Mr. Heeschen was originally identified by Amre A. Youness, a shareholder of the company, as a potential board member and was appointed by the independent directors of the company to become a member of our board of directors to fill the vacancy created by the resignation of Mark C. Layton on February 1, 2006. Mr. Heeschen was recommended as a nominee to the board of directors for election at the Annual Meeting by the independent members of the board of directors.

4

Voting Information and Board Recommendation

A stockholder submitting a proxy may vote for all or any of the nominees for election to the board of directors or may withhold his or her vote from all or any of such nominees. Directors are elected by a plurality of votes. An abstention from voting on this matter by a stockholder, while included for purposes of calculating a quorum for the meeting, has no effect. In addition, although broker “non-votes” will be counted for purposes of attaining a quorum, they will have no effect on the vote. The persons designated in the enclosed proxy will vote your shares FOR each nominee named above unless instructions otherwise are indicated in the enclosed proxy. Should any nominee become unwilling or unable to serve if elected, the proxy agents named in the proxy will exercise their voting power in favor of such other person as our board of directors may recommend. Our Certificate of Incorporation does not provide for cumulative voting in the election of directors.

The board of directors recommends a vote “FOR” the election of each of the nominees named above.

Meetings and Committees of the Board of Directors

During the fiscal year ended December 31, 2005, the board of directors held 15 meetings. Each director attended 100% of the aggregate total number of meetings of the board of directors plus the total number of meetings of all committees of the board on which he served. Mr. Heeschen did not serve on our board of directors until February 6, 2006, and therefore, did not attend any meetings held during fiscal year 2005.

Audit Committee

We have an audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, currently consisting of Thomas A. Maloof, Paul C. Heeschen and Ronald B. Reck. Effective February 6, 2006, Paul C. Heeschen was elected to become a member of the audit committee to fill the vacancy caused by Mark C. Layton’s resignation, which was effective February 1, 2006. The Audit Committee is appointed by the board of directors, which has adopted a charter directing the Audit Committee to oversee our accounting and financial reporting processes and the audits of our financial statements. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any independent registered public accounting firm (including resolution of disagreements between management and the independent registered accounting firm regarding financial reporting). The Audit Committee held seven meetings during the last fiscal year. The board of directors has determined that each current member of the Audit Committee meets the requirements of the Securities and Exchange Commission Rules, including Rule 10A-3(b) under the Securities Exchange Act of 1934, as amended, is independent as defined in Rule 4200(a)(15) of the Nasdaq listing standards, and that Messrs. Maloof and Heeschen qualify as audit committee financial experts as defined by Item 401(h)(2) of Regulation S-K.

Compensation Committee

Messrs. Reck and Layton served as members of our Compensation Committee during the last fiscal year. Effective February 6, 2006, Mr. Heeschen was elected to become a member of the Compensation Committee to fill the vacancy caused by Mr. Layton’s resignation, which was effective February 1, 2006. All members of our compensation committee are independent as defined by Rule 4200(a)(15) of the Nasdaq listing standards. The Compensation Committee held seven meetings during the last fiscal year. The Compensation Committee’s functions include reviewing with management cash and other compensation policies for employees, making recommendations to the board of directors regarding compensation matters and determining compensation for the Chief Executive Officer. In addition, the Compensation Committee administers our stock plans and, within the terms of the respective stock plan, determines the terms and conditions of issuances thereunder.

Director Nominations

The board of directors does not have a nominating committee. Given the size and composition of the board of directors, and as permitted by the Nasdaq listing standards, in lieu of a nominating committee, the board of directors has determined that a candidate for director nominee, in the event of a vacancy or the establishment of a new directorship on the board of directors, shall be presented to the full board of directors for consideration and approval upon the recommendation of no less than a majority of the independent members of the board of directors as defined in Rule 4200(a)(15) of the Nasdaq listing standards.

The board of directors has adopted a policy which sets forth the procedures for identifying and evaluating candidates for the board of directors. The policy is posted in the “Investor Relations” section of our website at www.pcmall.com. The policy provides that

5

the board of directors will consider candidates that may be recommended for consideration by our stockholders, provided the information regarding director candidates recommended by our stockholders is submitted to the board of directors in compliance with the policy and other information reasonably requested by us within the timeframe prescribed in Rule 14a-8 of Regulation 14A under the Securities Exchange Act of 1934, as amended, and other applicable rules and regulations, including our bylaws. Such director candidate recommendation materials are required to be sent to our Secretary by writing c/o the Secretary, PC Mall, Inc., 2555 W. 190th Street, Suite 201, Torrance, California 90504. There are no specific minimum qualifications that the board of directors requires to be met by a director nominee recommended for a position on our board, nor are there any specific qualities or skills that are necessary for one or more of our directors to possess, other than as are necessary to meet any requirements under rules and regulations applicable to us. The board of directors considers a potential candidate’s experience, areas of expertise, and other factors relative to the overall composition of the board of directors.

The board of directors considers director candidates that are suggested by members of the board of directors, as well as by management and stockholders. The board of directors may also retain a third-party executive search firm to identify candidates. The process by which the independent members of the board of directors identify and evaluate nominees for director, including nominees recommended by stockholders, involves (with or without the assistance of a retained search firm) compiling names of potentially eligible candidates, conducting background and reference checks, conducting interviews with the candidate and others (as schedules permit), meeting to consider and approve the final candidates and, as appropriate, preparing and presenting to the full board of directors an analysis with regard to particular recommended candidates. During the search process, the independent members of the board of directors endeavor to identify director nominees who have the highest personal and professional integrity, have demonstrated exceptional ability and judgment, and, together with other director nominees and members, are expected to serve the long-term interest of our stockholders and contribute to our overall corporate goals.

Independence of the Board of Directors

Nasdaq listing standards require that a majority of the members of a listed company’s board of directors qualify as “independent,” as affirmatively determined by the board of directors. After review of all of the relevant transactions or relationships between each director (and his family members) and us, our senior management and our independent registered public accounting firm, our board of directors has affirmatively determined that three of our four directors are independent directors within the meaning of the applicable rules. Frank F. Khulusi, our Chairman of the Board of Directors, President and Chief Executive Officer is not independent within the meaning of the applicable rules.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to each of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our Code of Business Conduct and Ethics, including any amendments to, or waivers from such code, is posted in the “Investor Relations” section of our website at www.pcmall.com. We will provide a copy of our Code of Business Conduct and Ethics to any person, without charge, upon receipt of a written request directed to our Secretary at our principal executive offices.

Compensation of Directors

During fiscal year 2005, we paid each non-employee director a quarterly retainer of $6,000, plus $2,500 for each regular board meeting attended in person or telephonically, $1,000 for each special board meeting attended in person or telephonically, $1,000 for each committee meeting attended in person, and $500 for each committee meeting attended telephonically. We also pay each of the chairperson of the Audit Committee and Compensation Committee of our Board of Directors an additional annual retainer of $12,500 (paid quarterly) for serving in such capacity.

Our directors are eligible to participate in our 1994 Stock Incentive Plan, as amended, which is administered by our Compensation Committee under authority delegated by our board of directors. The terms and conditions of option grants to our non-employee directors under our 1994 Stock Incentive Plan, as amended, are determined in the discretion of our Compensation Committee, and must be consistent with the terms of the 1994 Stock Incentive Plan, as amended, which is filed as an exhibit to our original filing of our Annual Report on Form 10-K for the year ended December 31, 2005.

On June 28, 2005, we granted an option to purchase 30,000 shares of our common stock to Mr. Maloof and an option to purchase 20,000 shares of our common stock to each of Messrs. Layton and Reck. Each of the foregoing option grants were made under our 1994 Stock Incentive Plan, as amended, and the options were granted at $4.41 per share (which was the fair market value as of the date of grant), vesting in equal quarterly installments over a two-year period, vesting in full upon a change of control, and expiring 10 years from the date of grant.

6

On February 6, 2006, we granted an option to purchase 20,000 shares of our common stock to Mr. Heeschen, who was elected to fill the vacancy on our board of directors created by the resignation of Mr. Layton on February 1, 2006. The foregoing option grant was made under our 1994 Stock Incentive Plan, as amended, and the option was granted at an exercise price of $5.55 per share (which was the fair market value as of the date of grant), vesting in equal quarterly installments over a two-year period, vesting in full upon a change of control, and expiring 10 years from the date of grant.

Directors who are our employees are not paid any additional compensation for their service on our board of directors. We reimburse each of our directors for reasonable out-of-pocket expenses that they incur in connection with attending board or committee meetings.

Annual Meeting Attendance

We have a adopted a policy for attendance by the board of directors at our annual stockholder meetings which encourages directors, if practicable and time permitting, to attend our annual stockholder meetings, either in person, by telephone or by other similar means of live communication (including video conference or webcast). One of our directors attended our 2005 Annual Meeting of Stockholders.

Communications with Directors

Stockholders may communicate with the board of directors or to one or more individual members of the board of directors by writing c/o the Secretary, PC Mall, Inc., 2555 W. 190th Street, Suite 201, Torrance, California 90504. Communications received from stockholders are forwarded directly to the board of directors, or to any individual member or members, as appropriate, depending on the facts and circumstances outlined in the communication. The board of directors has authorized the Secretary, in his or her discretion, to exclude communications that are patently unrelated to the duties and responsibilities of the board of directors, such as spam, junk mail and mass mailings. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is filtered out by the Secretary pursuant to the policy will be made available to any non-management director upon request.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and non-cash compensation for each of the last three fiscal years awarded to or earned by our Chief Executive Officer and our other four executive officers whose compensation exceeded $100,000 during the 2005 fiscal year. The individuals listed in the following tables are sometimes referred to as the “named executive officers.”

Long-Term Compensation | ||||||||||||||

| Annual Compensation (1) | Awards | |||||||||||||

Name and Principal Position | Fiscal Year | Salary | Bonus | Securities Underlying Options (#) | All Other Compensation (1)(2) | |||||||||

Frank F. Khulusi Chairman of the Board, President and Chief Executive Officer | 2005 2004 2003 | $ | 673,846 645,385 600,000 | $ | 48,574 136,907 190,823 | — 100,000 — | $ | — 656 2,438 | | |||||

Theodore R. Sanders Chief Financial Officer and Treasurer | 2005 2004 2003 | | 300,000 250,451 239,610 | | 15,339 43,234 60,786 | 35,000 40,000 — | | 8,340 8,340 8,340 | (3) (3) (3) | |||||

Daniel J. DeVries Executive Vice President, Marketing | 2005 2004 2003 | | 257,500 259,481 254,904 | | 4,601 16,525 39,606 | 20,000 25,000 — | | 12,950 12,721 11,444 | (3) (4) (5) | |||||

Kristin M. Rogers Executive Vice President, Sales | 2005 2004 2003 | | 257,500 259,481 254,904 | | 28,760 50,884 60,786 | 50,000 40,000 — | | 7,217 3,527 1,915 | (3) (6) | |||||

Robert I. Newton (7) General Counsel and Secretary | 2005 2004 | | 250,000 143,269 | | 37,500 35,135 | 50,000 50,000 | — | |||||||

| (1) | The incremental cost to us of providing perquisites and other personal benefits during any indicated period did not exceed, as to any named executive officer, the lesser of $50,000 or 10% of the total salary and bonus paid to that named executive officer for the indicated period and, accordingly, is omitted from the table. |

7

| (2) | Unless otherwise specified, the number constitutes our matching contributions under our 401(k) plan. |

| (3) | Represents automobile allowance. |

| (4) | Represents automobile allowance of $12,028 and 401(k) matching contributions of $693. |

| (5) | Represents automobile allowance of $9,259 and 401(k) matching contributions of $2,185. |

| (6) | Represents automobile allowance of $3,007 and 401(k) matching contributions of $520. |

| (7) | Mr. Newton joined our company in June 2004 as General Counsel and Secretary. |

Option Grants in Last Fiscal Year

The following table provides information on option grants in fiscal year 2005 to the named executive officers:

| Individual Grants | |||||||||||||

Name | Number of Securities Underlying Options Granted (#) (1) | Percent of Total Options Granted in Fiscal Year (2) | Exercise or Base Price ($/sh) | Expiration Date | Grant Date Present Value ($)(3) | ||||||||

Frank F. Khulusi | — | — | % | $ | — | — | $ | — | |||||

Theodore R. Sanders | 35,000 | 5.5 | % | 4.41 | 06/28/15 | 120,581 | |||||||

Daniel J. DeVries | 25,000 | 3.2 | % | 4.41 | 06/28/15 | 68,903 | |||||||

Kristin M. Rogers | 50,000 | 7.9 | % | 4.41 | 06/28/15 | 172,258 | |||||||

Robert I. Newton | 50,000 | 7.9 | % | 4.41 | 06/28/15 | 172,258 | |||||||

| (1) | These options vest in equal quarterly installments over a three-year period beginning June 28, 2005. |

| (2) | We granted options to purchase an aggregate of 635,550 shares of our common stock in fiscal 2005. |

| (3) | As suggested by the SEC’s rules on executive compensation disclosure, we used the Black-Scholes model of options valuation to determine grant date present value. We do not advocate or necessarily agree that the Black-Scholes model can properly determine the value of an option. The present value calculations are based on a ten-year option term, an expected life of five years, an interest rate of 3.77% and volatility of 105%. |

Other than the eCOST.com options issued in connection with the adjustment of outstanding PC Mall options in connection with our spin-off of eCOST.com, there were no new grants of options to purchase eCOST.com common stock to our named executive officers during the 2005 fiscal year. For a discussion of the spin-off option adjustments, see “—Effect of eCOST.com Spin-Off on PC Mall Stock Options” below.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table presents information regarding PC Mall options exercised during 2005 and unexercised options to purchase our common stock held at December 31, 2005 by our named executive officers. No options were exercised by the named executive officers in fiscal year 2005.

Number of Securities Underlying at Fiscal Year End (1) | Value of Unexercised In-The-Money Options at Fiscal Year End (1) (2) | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

Frank F. Khulusi | 493,750 | 56,250 | $ | 2,120,000 | $ | — | ||||

Theodore R. Sanders | 143,133 | 51,667 | 570,207 | 36,459 | ||||||

Daniel J. DeVries (3) | 115,155 | 35,417 | 490,140 | 20,834 | ||||||

Kristin M. Rogers | 127,833 | 64,167 | 427,551 | 52,084 | ||||||

Robert I. Newton | 33,333 | 66,667 | 10,416 | 52,084 | ||||||

| (1) | Reflects adjustments made to outstanding options, including the related exercise prices, to purchase our common stock as a result of the eCOST.com spin-off completed in April 2005. See “—Effect of eCOST.com Spin-Off on PC Mall Stock Options” below. |

8

| (2) | Value based on the closing price of our common stock as reported on the Nasdaq National Market on December 30, 2005, which was $5.66, less the exercise price, times the number of shares issuable pursuant to such options. |

| (3) | Exercisable amount for Mr. DeVries excludes options to acquire 17,357 shares that have been transferred pursuant to a divorce settlement. |

Effect of eCOST.com Spin-Off on PC Mall Stock Options

On April 11, 2005, we completed the spin-off of all of the shares of eCOST.com, Inc. we owned to our stockholders. In connection with the spin-off, each holder of our common stock as of the March 28, 2005 record date received a dividend of approximately 1.2071 shares of eCOST.com common stock for every share of our common stock held as of the record date. In addition, and subject to certain limited exceptions, all options to purchase our common stock that were outstanding as of the date of the spin-off were adjusted to become options to purchase shares of both our common stock and eCOST.com common stock. The number of shares of eCOST.com common stock covered by these options is based upon the ratio of the number of shares of eCOST.com common stock distributed to our stockholders in the spin-off, divided by the total number of shares of our common stock outstanding on the record date for the spin-off. In addition, the exercise price for each adjusted option was allocated between the option to purchase our common stock and the option to purchase eCOST.com common stock based on the respective pre- and post-distribution prices of our common stock and eCOST.com common stock on the Nasdaq National Market to preserve the intrinsic value and ratio of exercise to market price of the options both immediately before and immediately after the spin-off. Warrants to purchase our common stock that were outstanding as of the date of the spin-off were adjusted in the same manner. Additional information with respect to the eCOST.com spin-off is set forth in the Information Statement we filed as an exhibit to our Form 8-K filed with the SEC on April 1, 2005.

The following table presents information regarding eCOST.com options exercised during 2005 and unexercised options to purchase eCOST.com common stock held at December 31, 2005 by our named executive officers.

Number of Securities Underlying Unexercised Options at Fiscal Year End (1) | Value of Unexercised In-The-Money Options at Fiscal Year End (1) (2) | ||||||||||||||

Name | Shares Acquired On Exercise (#) | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

Frank F. Khulusi | — | $ | — | 596,006 | 67,899 | $ | 127,953 | $ | — | ||||||

Theodore R. Sanders | 144,000 | 453,533 | 77,733 | 27,160 | 3,261 | — | |||||||||

Daniel J. DeVries (3) | 51,429 | 25,715 | 223,548 | 22,633 | 151,898 | — | |||||||||

Kristin M. Rogers | 48,284 | 20,555 | 95,963 | 27,160 | 996 | — | |||||||||

Robert I. Newton | — | — | 30,177 | 30,178 | — | — | |||||||||

| (1) | Reflects adjustments made to outstanding options, including the related exercise prices, to purchase our common stock as a result of the eCOST.com spin-off completed in April 2005. See “—Effect of eCOST.com Spin-Off on PC Mall Stock Options” above. |

| (2) | Value based on the closing price of eCOST.com common stock as reported on the Nasdaq National Market on December 30, 2005, which was $1.16, less the exercise price, times the number of shares issuable pursuant to such options. |

Effective February 1, 2006, eCOST.com was acquired by PFSweb, Inc. As a result of the acquisition, any unexercised eCOST.com options outstanding on the completion of the acquisition were cancelled.

9

Equity Compensation Plan Information

The following table sets forth information about shares of our common stock that may be issued upon exercise of options under all of our equity compensation plans as of December 31, 2005.

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (1) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |||||

Equity Compensation Plans Approved by Security Holders | 2,597,608 | $ | 3.29 | 1,109,899 | (2) | |||

Equity Compensation Plans Not Approved by Security Holders (3) | 30,000 | 1.59 | — | |||||

Total | 2,627,608 | 3.27 | 1,109,899 | |||||

| (1) | Reflects adjustments made to outstanding options to purchase our common stock, including related exercise prices, as a result of the eCOST.com spin-off completed in April 2005. See “—Effect of eCOST.com Spin-Off on PC Mall Stock Options” above. |

| (2) | Represents shares available for issuance under our 1994 Stock Incentive Plan, as amended, as of December 31, 2005. The 1994 Stock Incentive Plan, as amended, contains an evergreen provision pursuant to which on January 1 of each year, the aggregate number of shares reserved for issuance under the 1994 Stock Incentive Plan, as amended, will increase by a number of shares equal to 3% of the outstanding shares on December 31 of the preceding year. On January 1, 2006, an additional 351,643 shares became available under this Plan pursuant to the evergreen provision. |

| (3) | Represents a warrant to purchase 30,000 shares of our common stock issued in June 2003 to a consulting firm for investor and public relations services. The warrant was issued at an exercise price of $3.99 with a five year term, and vested monthly over a one year period from the date of grant. As a result of the adjustments made to outstanding options and warrants in connection with the spin-off of eCOST.com, the exercise price of these warrants was adjusted to $1.59. See “—Effect of eCOST.com Spin-Off on PC Mall Stock Options” above. |

Compensation Committee Interlocks and Insider Participation

Messrs. Reck and Layton served as members of our Compensation Committee during the last fiscal year. In February 2006, Mr. Heeschen was elected by our board of directors to fill the vacancy on our board of directors, audit committee and compensation committee created by the resignation of Mr. Layton. There are no Compensation Committee interlocks between us and other entities involving our executive officers and board members who serve as executive officers of such companies.

Employment Agreements and Change-in-Control Arrangements

In January 1995, we entered into an employment agreement with Frank F. Khulusi, our Chairman, President and Chief Executive Officer. Mr. Khulusi’s employment agreement provides for one-year extensions unless it is terminated by us or Mr. Khulusi. Mr. Khulusi’s annual salary pursuant to his employment agreement has been increased periodically, and was most recently increased by our Compensation Committee, effective March 1, 2006, from $600,000 to $800,000. Previously, in May 2005, Mr. Khulusi voluntarily elected to reduce his annual base compensation from $800,000 to $600,000. Mr. Khulusi’s employment agreement provides that he is entitled to certain severance benefits in the event that his employment is terminated by us “without cause” or by Mr. Khulusi for “good reason” or following a “change of control” (all as defined in the employment agreement, as amended). In such cases, Mr. Khulusi would receive two times his salary and bonus for the preceding twelve months in a lump sum distribution following notice of termination. In December 2005, Mr. Khulusi’s employment agreement was amended to address certain changes in the tax law, specifically providing that upon a change in control, Mr. Khulusi’s employment agreement will automatically be terminated and Mr. Khulusi will receive such change of control payments upon the consummation of any such transaction. Mr. Khulusi is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

10

In January 2000, we entered into an employment agreement with Kristin M. Rogers, our Executive Vice President, Sales. Pursuant to Ms. Rogers’ employment agreement, her compensation includes (i) an annual base salary and (ii) an annual bonus based upon the achievement of goals mutually agreed upon by us and Ms. Rogers. Pursuant to the terms of our agreement with Ms. Rogers, she is an “at will” employee and is currently entitled to an annual base salary of $300,000, which the Compensation Committee increased from $257,500, effective February 1, 2006. Ms. Rogers’ employment agreement also provides that in the event she is terminated by us without cause (as defined in her employment agreement), upon the execution of a separation agreement satisfactory to us, Ms. Rogers is entitled to receive a severance payment equal to six months of her base compensation. Instead of receiving an annual bonus as set forth in her employment agreement, Ms. Rogers participates, in the discretion of our Compensation Committee, in our executive bonus plan, which provides for bonus awards based upon the achievement of specified goals established depending upon the participant’s function in the organization. Ms. Rogers is entitled to receive a monthly automobile allowance, and is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

In June 2004, we entered into an employment agreement with Robert I. Newton, our General Counsel and Secretary. Mr. Newton’s employment agreement was amended in February 2005. Pursuant to the terms of our agreement with Mr. Newton, he is an “at will” employee and is currently entitled to an annual base salary of $250,000. Mr. Newton is eligible to receive an annual bonus of up to $50,000, and is entitled to severance pay equal to six months of his annual base salary in the event his employment is terminated without cause (as defined in his employment agreement). Mr. Newton is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

In March 2005, we entered into a written employment agreement with Theodore R. Sanders, our Chief Financial Officer. Prior to that time, our employment arrangements with Mr. Sanders were not memorialized in a written agreement. Pursuant to the terms of our agreement with Mr. Sanders, he is an “at will” employee and is currently entitled to an annual base salary of $300,000. Mr. Sanders is eligible to participate in our executive bonus plan in the discretion of our Compensation Committee, as well as to receive discretionary bonuses from time to time in the discretion of our Compensation Committee and our Chief Executive Officer. Mr. Sanders is entitled to severance pay equal to six months of his annual base salary in the event his employment is terminated without cause (as defined in his employment agreement). Mr. Sanders is also entitled to receive a monthly automobile allowance, and is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

In January 2004, we entered into a written employment agreement with Dan DeVries, our Executive Vice President, Marketing. Pursuant to the terms of our agreement with Mr. DeVries, he is an “at will” employee and is currently entitled to an annual base salary of $257,000. Mr. DeVries is eligible to participate in our executive bonus plan in the discretion of our Compensation Committee, as well as to receive discretionary bonuses from time to time in the discretion of our Compensation Committee and our Chief Executive Officer. In January 2006, we entered into a severance agreement with Mr. DeVries, which agreement was approved by our Compensation Committee, pursuant to which Mr. DeVries is entitled to severance pay equal to six months of his annual base salary in the event his employment is terminated without cause (as defined in his severance agreement) and upon execution of a separation agreement satisfactory to us. Mr. DeVries is also entitled to receive a monthly automobile allowance, and is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

Upon the occurrence of (i) certain events resulting in a change of control of our company or (ii) certain major corporate transactions, all of the unvested stock options we have granted to our named executive officers will become fully vested and exercisable, subject to certain exceptions and limitations.

Copies of each of the above-referenced employment agreements, as well as a summary of our executive bonus plan, are filed as exhibits to the original filing of our Annual Report on Form 10-K filed with the SEC on March 31, 2006.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership on Form 3 and changes in ownership on Forms 4 or 5 with the SEC. Those officers, directors and ten percent stockholders are also required by the SEC’s rules to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of the forms we received, or representations from certain reporting persons that no Forms 5 were required for such persons, we believe that during the fiscal year ended December 31, 2005, all Section 16(a) filing requirements applicable to our officers, directors and ten percent stockholders were complied with.

* * *

11

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Report of the Compensation Committee on Executive Compensation, the Stock Performance Graph and the Report of the Audit Committee which follow shall not be deemed to be incorporated by reference into any such filings except to the extent that we specifically incorporate any such information into any such future filings.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors of PC Mall, Inc. is currently composed of two independent directors, Ronald B. Reck (Chair) and Paul C. Heeschen. Mr. Heeschen was appointed to the Compensation Committee on February 6, 2006 to fill the vacancy caused by Mark C. Layton’s resignation, which was effective February 1, 2006. Mr. Heeschen did not participate in any of the meetings of the Compensation Committee prior to that date. Consequently, Mr. Heeschen is not a signatory to this report. Mr. Reck was a member of the Compensation Committee for all of 2005.

The Compensation Committee reviews and approves the Company’s corporate goals and objectives relevant to Chief Executive Officer compensation, evaluates the Chief Executive Officer’s performance in light of such goals and objectives and either as a committee, as was the case in 2005, or together with the other independent directors (as directed by the Board), determines and approves the Chief Executive Officer’s compensation level based on this evaluation. The Compensation Committee reviews and approves non-CEO executive compensation, incentive-compensation plans and equity based plans including annual base salary levels, annual incentive compensation levels, long-term incentive compensation levels, employment agreements, severance agreements, change of control agreements/provisions, and any supplemental or special benefits. Based on such review, the members of the Compensation Committee approved the Chief Executive Officer’s recommendation regarding the compensation of the other executive officers of the Company, including the other named executive officers. The Committee also reviews with management cash, stock option and other compensation policies for the Company’s employees.

Compensation Policies

The Compensation Committee’s executive compensation policies are designed to provide competitive levels of compensation that link pay with the Company’s annual objectives and long-term goals, reward above-average corporate performance, recognize individual initiative and achievements and assist the Company in attracting and retaining qualified executives. The compensation of the Company’s executive officers and the Chief Executive Officer are set at levels that the Compensation Committee believes to be reasonable in comparison to other companies the Compensation Committee believes are comparables, including companies in the computer hardware, software, peripherals, electronics and consumer product rapid response direct marketing industry, based on public information and compensation surveys obtained by the Compensation Committee with respect to such companies. Comparison companies were selected on the basis of a number of factors relative to the Company, such as their size and complexity, the industry and nature of their businesses, the regions in which they operate, the structure of their compensation programs and the availability of compensation information.

There are three primary elements in the Company’s executive compensation program:

| • | base salary; |

| • | quarterly bonuses; and |

| • | stock options. |

Individual base salaries are established based on an executive officer’s historical contribution and future importance to the Company. Salaries are reviewed annually and adjusted from time to time to recognize individual performance, promotions and competitive compensation levels and other subjective factors, without assigning a specific weight to individual factors.

Bonuses are paid to executive officers quarterly pursuant to the February 9, 2005 executive bonus plan, under which five eligible officers participate, including all named executive officers except the Company’s General Counsel, who is paid bonuses pursuant to his employment contract and in the discretion of the Compensation Committee based on recommendations from the Chief Executive Officer. In 2005, the executive bonus plan provided for a bonus pool for eligible executive officers of up to ten percent of any amount by which the Company’s quarterly “adjusted income” for the relevant quarter exceeds the Company’s

12

“adjusted income” for the same quarter of the prior year. For purposes of the executive bonus plan, “adjusted income” is the aggregate pre-tax income for the quarter for the Company’s core business segment (i.e. excluding the OnSale.com segment and the Company’s former eCOST.com segment), less certain costs that are determined on a quarterly basis by the Compensation Committee in its sole discretion. Under this executive bonus plan, the Compensation Committee allocates amounts to eligible participants based on factors identified by the Compensation Committee, including the achievement of specified individual performance targets.

The award of bonuses is dependent on the achievement of specified goals. In addition, the Chief Executive Officer has been given the authority by, and acts under the oversight of, the Compensation Committee to make recommendations regarding the amount of payments to be made to specific executives under the executive bonus plan. Based in part on these recommendations, the Compensation Committee approves bonuses under the executive bonus plan. Under this plan, in 2005, bonuses were paid to the executive officers, including named executive officers, who participate in the plan.

The Committee believes that an important component of the compensation paid to the Company’s executives should be derived from stock options. The Committee believes that stock price appreciation and stock ownership in the Company are a valuable incentive to executives and that the grant of stock options to them serves to align their interests with the interests of the stockholders as a whole and encourages them to manage the Company in its best long-term interests. The Compensation Committee determines whether to grant stock options to executive officers based on recommendations from the Chief Executive Officer after consideration of the amount of the grants, the executive’s position within the Company, time of service and importance of the executive to the future of the Company.

In addition, the Company provides certain senior executive officers with perquisites, including paid medical benefits and car allowances that it believes are reasonable, competitive and consistent with other comparable companies. The Company believes that its perquisites help it to hire and retain the best executives.

Compensation of the Chief Executive Officer

In establishing the overall compensation of the Chief Executive Officer, the Compensation Committee reviewed all components of his compensation, including base salary, bonuses and equity compensation including accumulated realized and unrealized stock option gains, as well as the dollar value to the executive and the cost to the Company of any perquisites. In addition, the Compensation Committee considered a number of factors, including the record of leadership and vision provided by the Chief Executive Officer since co-founding the Company in 1987; the identification of the Company with the Chief Executive Officer by the Company’s employees, the financial community and the general public; and the recognition by the Compensation Committee and others in the Company’s industry of the importance of his leadership, creativity and other personal attributes to the Company’s continued success. The importance of these attributes as they relate to the Company’s current Chief Executive Officer are deemed critical to the success of the Company and thereby warrant individual consideration. The Compensation Committee has not found it practicable to, and has not attempted to, assign relative weights to the specific factors considered in determining the compensation of the Chief Executive Officer. Consistent with the Company’s overall executive compensation program, the compensation of the Chief Executive Officer is composed of base salary, bonuses and equity compensation awards such as stock options. The Chief Executive Officer received an increase in base salary effective October 28, 2004 from an annual rate of $600,000 to an annual rate of $800,000. Effective as of May 10, 2005, at his request, Mr. Khulusi’s annual base salary rate was reduced from $800,000 to the prior annual rate of $600,000. On March 1, 2006, the Compensation Committee restored the annual base salary of Mr. Khulusi back to $800,000. No other terms of Mr. Khulusi’s employment arrangement were modified.

The Chief Executive Officer participates in the executive bonus plan. Mr. Khulusi received aggregate bonuses during the twelve months ended December 31, 2005 of $48,574 under the plan.

The Company also provides the Chief Executive Officer with perquisites that it believes are reasonable, competitive and consistent with comparable companies and the Company’s overall executive compensation program, including the use of a Company car and paid medical benefits. The Chief Executive Officer is required to cover incidental out-of-pocket costs attributed to such use.

The Compensation Committee’s Conclusion

Based on the review discussed in this report, the Compensation Committee finds the Chief Executive Officer’s and the named executive officers’ total compensation in the aggregate to be reasonable and not excessive.

13

Policy Regarding Deductibility of Compensation

Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to public companies for compensation over $1.0 million paid to the Chief Executive Officer or any of the other four most highly compensated executive officers. However, certain compensation meeting a tax law definition of “performance-based” is generally exempt from this deduction limit. We do not currently have a policy regarding qualification of cash compensation, such as salary and bonuses, for deductibility under Section 162(m). We have included provisions in the 1994 Stock Incentive Plan designed to enable grants of options and stock appreciation rights to executives affected by Section 162(m) to qualify as “performance-based” compensation. Such grants cannot qualify until they are made by a committee consisting of “outside directors” under Section 162(m). Prior to March 1999, the Compensation Committee did not meet this requirement. Our executives have not received compensation at a level that exceeds the $1 million limit. However, the Compensation Committee believes that in certain circumstances factors other than tax deductibility take precedence when determining the forms and levels of executive compensation most appropriate and in the best interests of the Company and its stockholders. Given the Company’s changing industry and business, as well as the competitive market for outstanding executives, the Compensation Committee believes that it is important for such committee to retain the flexibility to design compensation programs consistent with its overall executive compensation program, even if some executive compensation is not fully deductible. Accordingly, the Compensation Committee may from time to time approve elements of compensation for certain officers that are not fully deductible, and reserves the right to do so in the future when it deems such an approval to be appropriate.

Compensation Committee

Ronald B. Reck,Chair

***

14

STOCK PERFORMANCE GRAPH

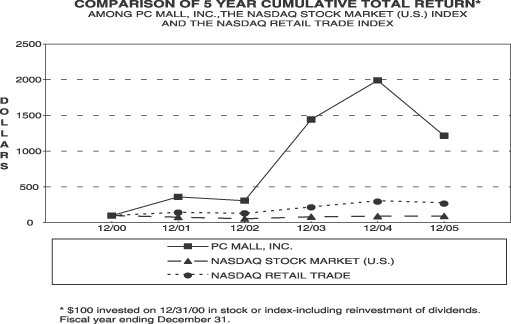

The performance graph below compares the cumulative total stockholder return of our company with the cumulative total return of the Nasdaq Stock Market—U.S. Companies Index and the Nasdaq Retail Trade Index. The graph assumes $100 invested at the per-share closing price of our common stock and each of the indices on December 31, 2000. The stock price performance shown in this graph is neither necessarily indicative of nor intended to suggest future stock price performance. On April 11, 2005, PC Mall spun-off all of its shares of common stock of eCOST.com, to its stockholders. For each share of PC Mall common stock owned, stockholders received approximately 1.2071 shares of eCOST.com common stock. For purposes of the graph below, it is assumed that each share of eCOST.com common stock received in the distribution was immediately sold for its market value and the proceeds reinvested in additional shares of PC Mall common stock. The value of PC Mall common stock at December 31, 2005 therefore includes the value of the spin-off shares but not the separate performance of those securities since the date of the spin-off.

Measurement period (fiscal year covered) | PC MALL, INC. | NASDAQ MARKET | NASDAQ TRADE | ||||||

Measurement Date | |||||||||

12/31/00 | $ | 100 | $ | 100 | $ | 100 | |||

FYE 12/01 | 361 | 80 | 141 | ||||||

FYE 12/02 | 307 | 56 | 129 | ||||||

FYE 12/03 | 1,443 | 84 | 214 | ||||||

FYE 12/04 | 1,989 | 91 | 294 | ||||||

FYE 12/05 | 1,215 | 93 | 266 | ||||||

15

REPORT OF THE AUDIT COMMITTEE

To the Board of Directors:

The Audit Committee of the Board of Directors of PC Mall, Inc. is currently composed of three independent directors and operate under a written charter adopted by the Board of Directors. The members of the Audit Committee are Thomas A. Maloof (Chair), Ronald B. Reck and Paul C. Heeschen. Mr. Heeschen was appointed to the Audit Committee on February 6, 2006 to fill the vacancy caused by Mr. Mark C. Layton’s resignation, which was effective February 1, 2006. Mr. Heeschen did not participate in any of the meetings of the Audit Committee prior to that date. Consequently, Mr. Heeschen is not a signatory to this report. The other two members were members of the Audit Committee for all of 2005.

We have reviewed and discussed with management and PricewaterhouseCoopers LLP, the Company’s independent auditors, the Company’s audited financial statements as of and for the fiscal year ended December 31, 2005.

We have discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, issued by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as amended, issued by the Independence Standards Board, and have discussed with PricewaterhouseCoopers LLP their independence.

We have also considered whether the provision of services by PricewaterhouseCoopers LLP, other than services related to the audit of the financial statements referred to above and the review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q for the most recent fiscal year, is compatible with maintaining the independence of PricewaterhouseCoopers LLP.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, which the Company filed with the SEC on March 31, 2006.

Audit Committee

Thomas A. Maloof, Chair

Ronald B. Reck

* * *

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We have entered into indemnification agreements with each of our current directors and executive officers that provide the maximum indemnity available to directors and officers under Section 145 of the Delaware General Corporation Law and our amended and restated certificate of incorporation, as well as certain procedural protections. We have also entered into transactions with certain of our directors and officers, as described under the heading “Executive Compensation.”

Sam U. Khulusi, the brother of Frank F. Khulusi, was employed by Onsale, Inc. and AF Services, LLC, each a wholly owned subsidiary of PC Mall, in fiscal year 2005 and earned and/or received compensation in the amount of $200,000. On June 28, 2005, we granted Sam U. Khulusi an option to purchase 40,000 shares of our common stock at an exercise price of $4.41 per share. Sam U. Khulusi is eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

Simon M. Abuyounes, the brother-in-law of Frank F. Khulusi, was employed by AF Services, LLC in fiscal year 2005 and earned and/or received compensation in the amount of $260,339, which includes $15,339 of bonus. Mr. Abuyounes is entitled to six months’ severance based on his base salary in the event his employment is terminated by us without cause. On March 23, 2005, we granted Mr. Abuyounes an option to purchase 30,000 shares of our common stock at an exercise price of $4.70 per share, and increased his annual salary to $250,000. On June 24, 2005, we granted Mr. Abuyounes an additional option to purchase 50,000 shares of our common stock at an exercise price of $4.40 per share. Mr. Abuyouness is also eligible to participate in our employee benefit plans that are generally available to similarly situated employees.

Relationships with eCOST.com

Prior to its initial public offering in September 2004, eCOST.com was a wholly owned subsidiary of PC Mall. In connection with eCOST.com’s initial public offering and separation from PC Mall, we entered into a Master Separation and Distribution Agreement with eCOST.com that contains many of the key provisions related to its initial public offering and spin-off from us. The other agreements referenced in the Master Separation and Distribution Agreement govern certain aspects relating to the separation and various interim and ongoing relationships between us and eCOST.com following the completion of the initial public offering. Frank F. Khulusi is the principal stockholder, President and Chief Executive Officer of PC Mall. As a result of the distribution, at that time, Mr. Khulusi became the beneficial owner of approximately 14.2% of eCOST.com’s common stock. Thomas A. Maloof, one of our directors, served as a director of eCOST.com until his resignation from the eCOST.com board in April 2005.

Prior to the completion of eCOST.com’s initial public offering, eCOST.com declared a dividend of $2.5 million to us, which amount was paid by the non-cash settlement of the capital contribution due from PC Mall outstanding as of the date the initial public offering was completed.

On April 11, 2005, we completed the distribution of all outstanding common stock of eCOST.com that we owned to our stockholders, which we refer to as the distribution or spin-off. On February 1, 2006, eCOST.com was acquired by PFSweb, Inc. Mark C. Layton, who served on our board of directors until the completion of the acquisition, is the Chairman, President and Chief Executive Officer of PFSweb.

The following is a summary of the material terms of the Master Separation and Distribution Agreement and other key agreements relating to the separation of eCOST.com from us and our ongoing relationships following eCOST.com’s initial public offering and spin-off. For a complete description of these agreements, you should refer to the full text of these agreements, which have been filed with the SEC.

The Master Separation and Distribution Agreement contains the key provisions related to our separation from, and our ongoing relationship with eCOST.com, its initial public offering and our divestiture of eCOST.com through the distribution. Other agreements referenced in the Master Separation and Distribution Agreement govern various prior, interim and ongoing relationships between us and eCOST.com. These agreements include:

| ��� | the Tax Allocation and Indemnification Agreement; |

| • | the Employee Benefit Matters Agreement; |

| • | the Administrative Services Agreement; |

| • | the Product Sales, Inventory Management and Order Fulfillment Agreement; |

| • | the Information Technology Systems Usage and Services Agreement; |

17

| • | the License Agreements; |

| • | the Sublease Agreement; |

| • | the Registration Rights Agreement between us and eCOST.com; |

| • | the Registration Rights Agreement between eCOST.com and Frank F. Khulusi; and |

| • | the Product Sales Agreement, and Consignment and Product Sales Agreement. |

Master Separation and Distribution Agreement

The Master Separation and Distribution Agreement contains the key provisions relating to the separation of the eCOST.com business from our other businesses, the general terms and conditions and corporate transactions required to effect eCOST.com’s initial public offering and the distribution and the general intent of the parties as to how these matters would be undertaken and completed.

The Contribution. The Master Separation and Distribution Agreement describes generally the assets that were contributed and transferred by us to eCOST.com and the liabilities assumed by eCOST.com from us, which we refer to as the contribution. These assets include substantially all of the assets, properties and rights exclusively used or held for use exclusively in the operation of the eCOST.com business. The liabilities include substantially all debts, liabilities, commitments and obligations of any nature, whether known, unknown, contingent or otherwise, to the extent arising out of or relating to the eCOST.com business prior to, on or after the contribution date.

Mutual Release of Pre-Offering Claims. The agreement generally provides for a full release and discharge of all liabilities existing or arising from all acts and events prior to the eCOST.com initial public offering. The liabilities released or discharged include liabilities arising under any contractual agreements or arrangements existing or alleged to exist between us and eCOST.com, and our respective affiliates, on or before the eCOST.com initial public offering.

Indemnification. Under the Master Separation and Distribution Agreement, eCOST.com indemnifies us and our representatives and affiliates from all losses suffered by us or our representatives or affiliates arising out of or related to any of the following:

| • | eCOST.com’s failure to pay, perform or discharge in due course any of its liabilities; |

| • | eCOST.com’s business or liabilities related to its business; |

| • | eCOST.com’s failure to comply with the terms of the Master Separation and Distribution Agreement or any of the ancillary agreements; or |

| • | any untrue statement of a material fact or material omission in the initial public offering prospectus or any similar documents relating to eCOST.com’s initial public offering or the distribution to our stockholders. |

We indemnify eCOST.com and its representatives and affiliates from any and all losses suffered by eCOST.com and its representatives or affiliates arising out of or related to any of the following:

| • | our failure to pay, perform or discharge in due course our liabilities that are not assumed by eCOST.com in connection with the distribution or separation; |

| • | the operation of our business or liabilities relating to our business, other than the eCOST.com business; or |

| • | our failure to comply with the terms of the Master Separation and Distribution Agreement or any of the other agreements between us and eCOST.com entered into in connection with the separation and the distribution. |

Any rights to indemnification for tax liabilities are governed solely by the Tax Allocation and Indemnification Agreement.

18

Access to Information. Under the Master Separation and Distribution Agreement, we and eCOST.com are obligated to provide each other access to information as follows:

| • | subject to applicable confidentiality obligations and other restrictions, we will give each other any information within each other’s possession that the requesting party reasonably needs to comply with requirements imposed on the requesting party by a governmental authority, for use in any proceeding or to satisfy audit, accounting or similar requirements, or to comply with its obligations under the Master Separation and Distribution Agreement or any ancillary agreement; |

| • | for so long as we are required to consolidate our results of operation and financial position or account for our investment in eCOST.com on the equity method of accounting, eCOST.com will provide us, at no charge, all financial and other data and information that we determine necessary or advisable in order to prepare our financial statements and reports or filings with any governmental authority, including copies of all quarterly and annual financial information and other reports and documents eCOST.com intends to file with the SEC prior to such filings (as well as final copies upon filing), and copies of eCOST.com’s budgets and financial projections; |

| • | we will use reasonable efforts to make available to each other our past and present directors, officers, other employees and agents as witnesses in any legal, administrative or other proceedings in which the other party may become involved; |

| • | the company providing information, consultant or witness services under the Master Separation and Distribution Agreement will be entitled to reimbursement from the other for reasonable expenses incurred in providing this assistance; |

| • | eCOST.com will have access to documents and objects relating to our business that are contained within PC Mall’s records; and |

| • | we each agree to hold in strict confidence all information concerning or belonging to the other party. |

Termination. The Master Separation and Distribution Agreement may be terminated by the mutual consent of eCOST.com and us.

Expenses. In general, we and eCOST.com are each responsible for our own costs (including all associated third-party costs) incurred in connection with the transactions contemplated by the Master Separation and Distribution Agreement. However, eCOST.com paid all costs and expenses relating to its initial public offering, including the underwriting discounts and all financial, legal, accounting and other expenses. Each party bears its own costs (including all associated third-party costs) and expenses relating to the distribution.

Tax Allocation and Indemnification Agreement

We entered into a Tax Allocation and Indemnification Agreement, which governs the respective rights, responsibilities, and obligations of PC Mall and eCOST.com after eCOST.com’s initial public offering with respect to tax liabilities and benefits, tax attributes, tax contests and other matters regarding income taxes, non-income taxes and related tax returns.

In general, under the Tax Allocation and Indemnification Agreement:

| • | PC Mall is responsible for any U.S. federal, state or local income taxes that are determined on a consolidated, combined or unitary basis on a return that includes PC Mall (and/or one or more of its subsidiaries), on the one hand, and eCOST.com (and/or one or more of its subsidiaries), on the other hand. However, in the event that eCOST.com or one of its subsidiaries are included in such a return for a period (or portion thereof) beginning after the date of its initial public offering, eCOST.com is responsible for its portion of the income tax liability in respect of the period as if eCOST.com and its subsidiaries had filed a separate tax return that included only eCOST.com and its subsidiaries for that period (or portion thereof); |

| • | PC Mall is responsible for any U.S. federal, state or local income taxes due with respect to returns that include only PC Mall and/or its subsidiaries (excluding us and our subsidiaries), and eCOST.com is responsible for any U.S. federal, state or local income taxes due with respect to returns that include only eCOST.com and/or its subsidiaries; |

| • | PC Mall is responsible for any foreign income taxes of PC Mall and its subsidiaries (excluding eCOST.com and its subsidiaries), and eCOST.com is responsible for any foreign income taxes of eCOST.com and its subsidiaries; and |

19

| • | We are responsible for any non-income taxes attributable to our own business for any period. eCOST.com is responsible for any non-income taxes attributable to its own business for any period. |

The Tax Allocation and Indemnification Agreement assigns responsibilities for administrative matters, such as the filing of returns, payment of taxes due, retention of records and conduct of audits, examinations or similar proceedings. In addition, the Tax Allocation and Indemnification Agreement provides for cooperation and information sharing with respect to tax matters. Finally, the Tax Allocation and Indemnification Agreement provides that all tax refunds for periods in which eCOST.com is included in the PC Mall consolidated, combined or unitary group shall be paid to us, including tax refunds attributable to taxes which eCOST.com initially paid.

Preservation of the Tax-Free Status of the Distribution. PC Mall and eCOST.com intend that the contribution of assets by us to eCOST.com and the distribution, taken together, will qualify as a reorganization pursuant to which no gain or loss is recognized by PC Mall or its stockholders for federal income tax purposes under Sections 355, 368(a)(1)(D) and related provisions of the Internal Revenue Code. We received an opinion from our tax counsel to such effect. In either case, eCOST.com made certain representations regarding its company and business and we made certain representations regarding us and our business. eCOST.com is subject to certain restrictions for a three year period after the distribution that are intended to preserve the tax-free status of the contribution and the distribution. eCOST.com may take a certain action or certain actions otherwise prohibited by these covenants if, prior to taking any such action, it has obtained (and provided to us) a written opinion of tax counsel reasonably acceptable to us, or a ruling from the Internal Revenue Service, that such action or actions would not jeopardize the tax-free status of the contribution and the distribution. These covenants include restrictions on eCOST.com’s ability to: