Public Exhibit 99.2 ASML reports EUR 2.2 billion sales at 41.6% gross margin in Q1 2019 view unchanged ASML 2019 First-Quarter Results Veldhoven, the Netherlands April 17, 2019

Public Slide 2 April 17, 2019 Agenda • Investor key messages • Business summary • Outlook • Financial statements

Public Slide 3 April 17, 2019 Investor key messages

Public Investor key messages Slide 4 April 17, 2019 • End market volatility due to macroeconomic environment is creating short term industry uncertainty while memory customers digest capacity additions and logic customers ramp their new leading edge nodes • Long term growth opportunity remains driven by end markets growth enabled by major innovation in semiconductors • Shrink is a key industry driver supporting innovation and providing long term industry growth • Holistic Lithography enables affordable shrink and therefore delivers compelling value for our customers • DUV, EUV and Application products are highly differentiated solutions that provide unique value drivers for our customers and ASML • EUV will enable continuation of Moore’s Law and will drive long term value for ASML well into the next decade • ASML models an annual revenue opportunity of € 13 billion in 2020 and an annual revenue between € 15 – 24 billion through 2025 • We expect to continue to return significant amounts of cash to our shareholders through a combination of share buybacks and growing dividends

Public Slide 5 April 17, 2019 Business summary

Public Q1 results summary Slide 6 April 17, 2019 • Net sales of € 2,229 million, net systems sales valued at € 1,689 million, Installed Base Management* sales of € 540 million • Gross margin of 41.6% • Operating margin of 15.0% • Net income as a percentage of net sales of 15.9% • Net bookings of € 1,399 million, including 3 EUV systems * Installed Base Management equals our service and field option sales

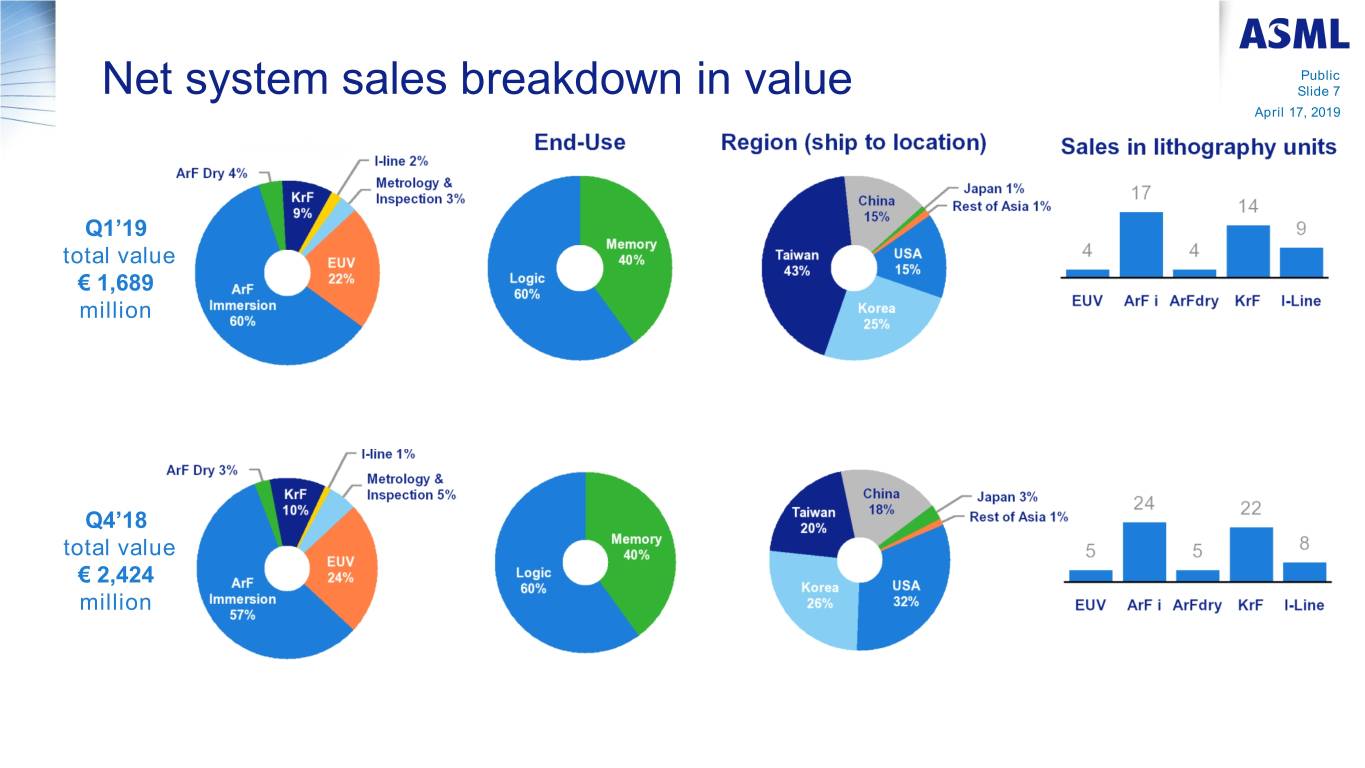

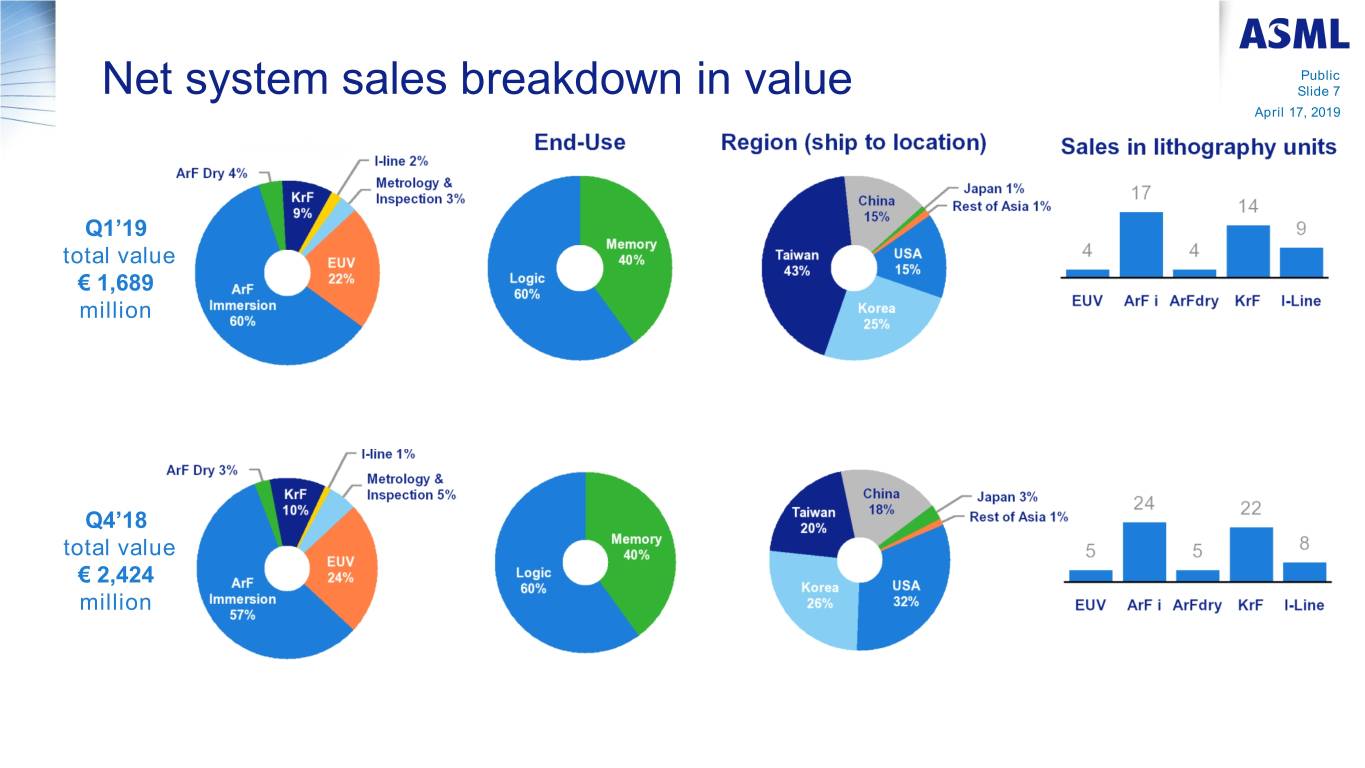

Public Net system sales breakdown in value Slide 7 April 17, 2019 Q1’19 total value € 1,689 million Q4’18 total value € 2,424 million

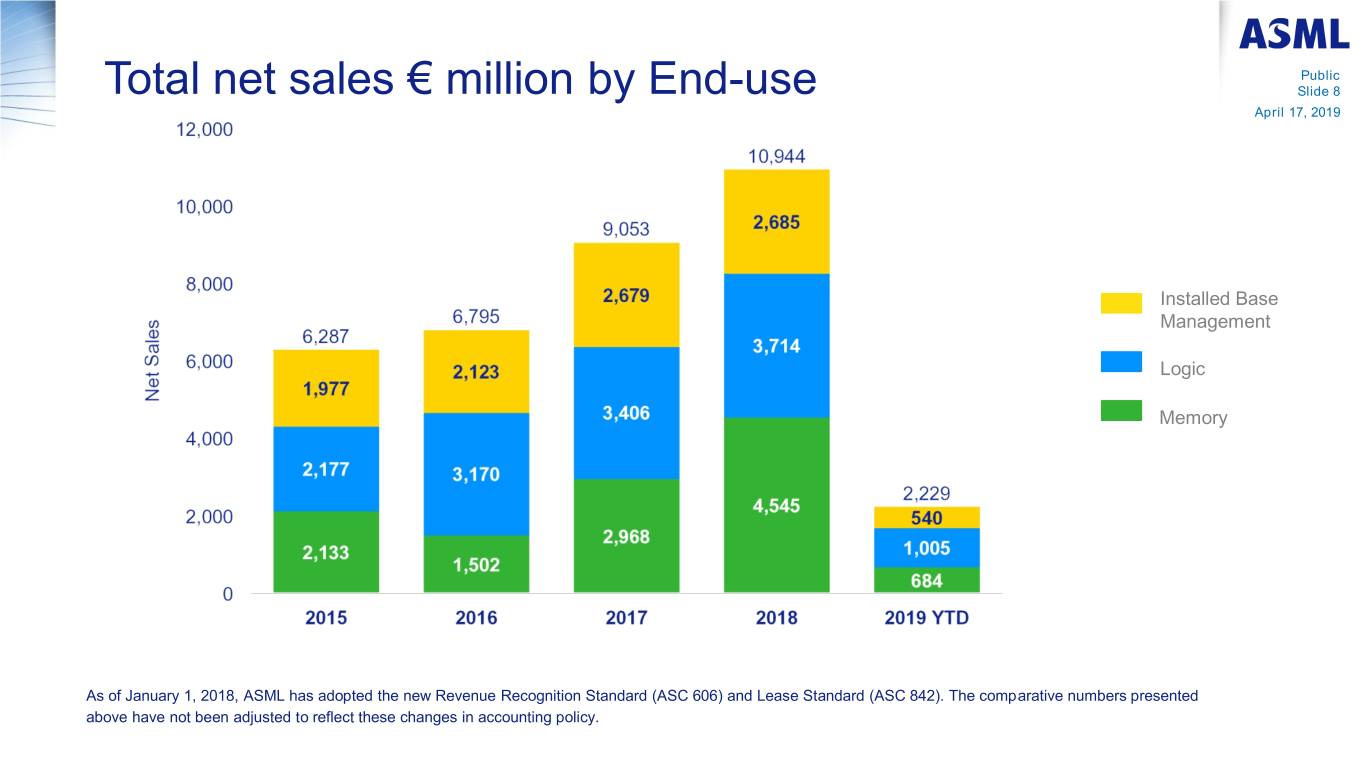

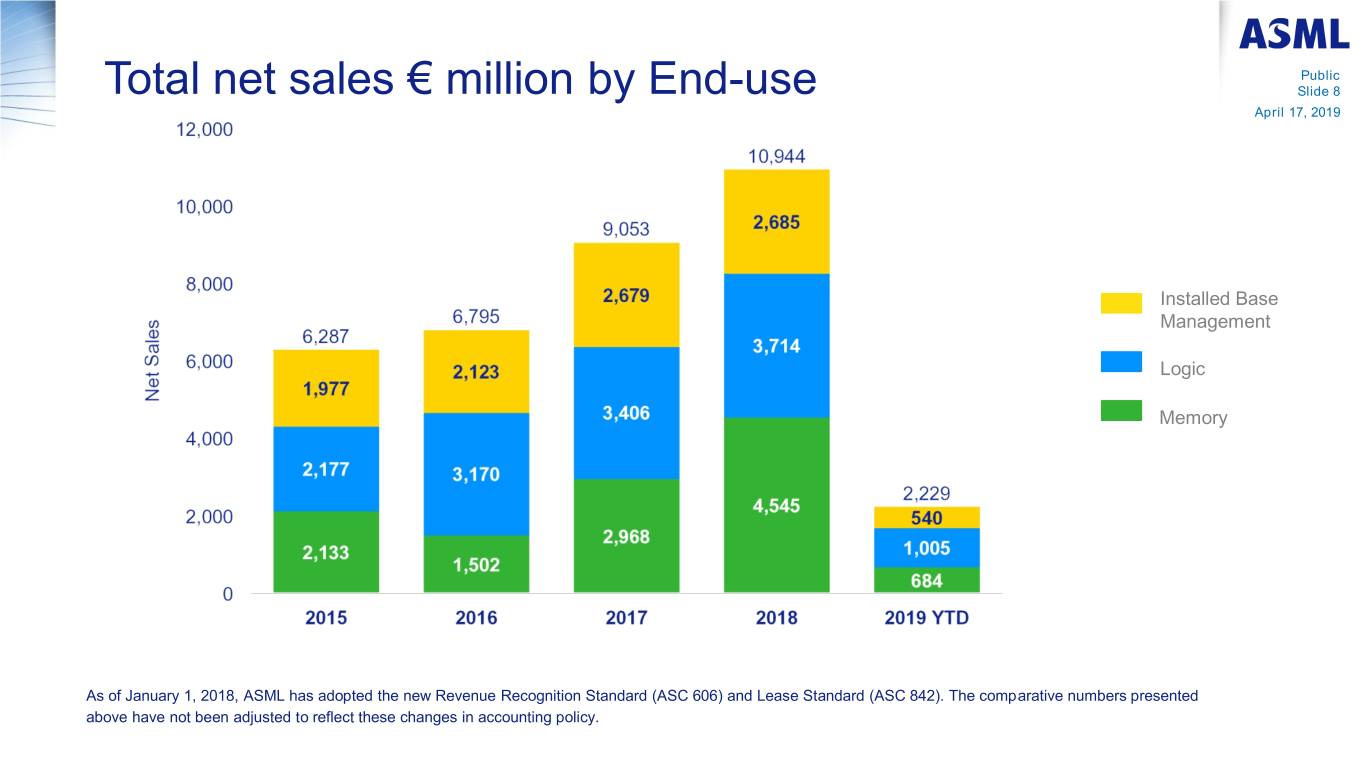

Public Total net sales € million by End-use Slide 8 April 17, 2019 Installed Base Management Logic Memory As of January 1, 2018, ASML has adopted the new Revenue Recognition Standard (ASC 606) and Lease Standard (ASC 842). The comparative numbers presented above have not been adjusted to reflect these changes in accounting policy.

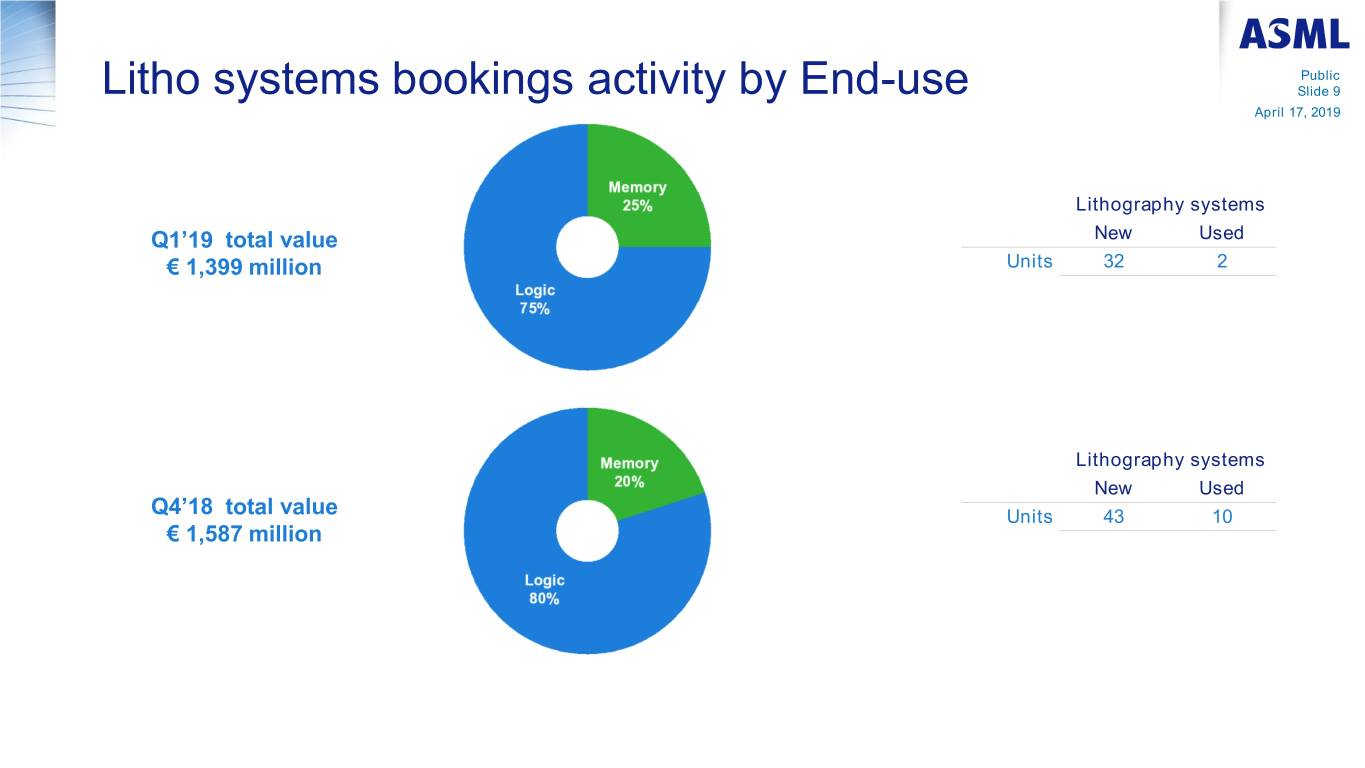

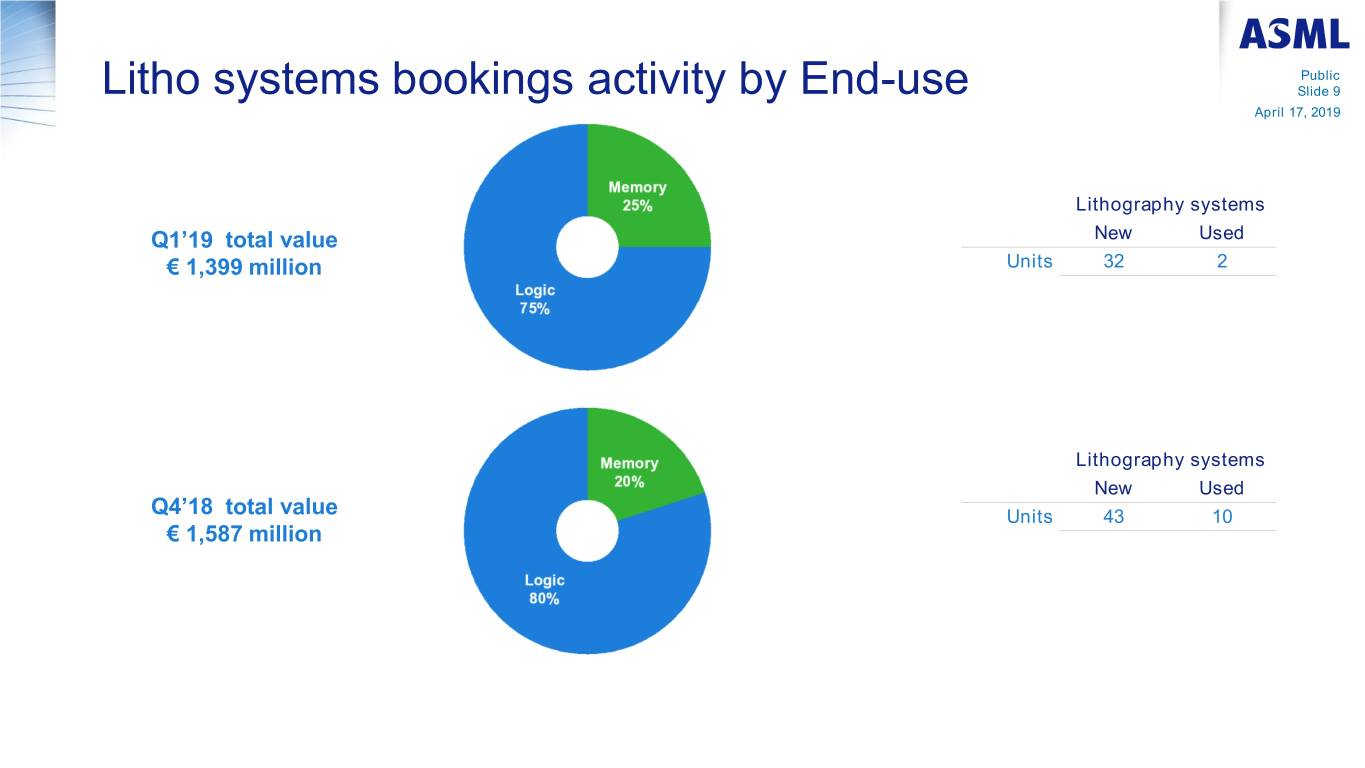

Public Litho systems bookings activity by End-use Slide 9 April 17, 2019 Lithography systems Q1’19 total value New Used € 1,399 million Units 32 2 Lithography systems New Used Q4’18 total value Units 43 10 € 1,587 million

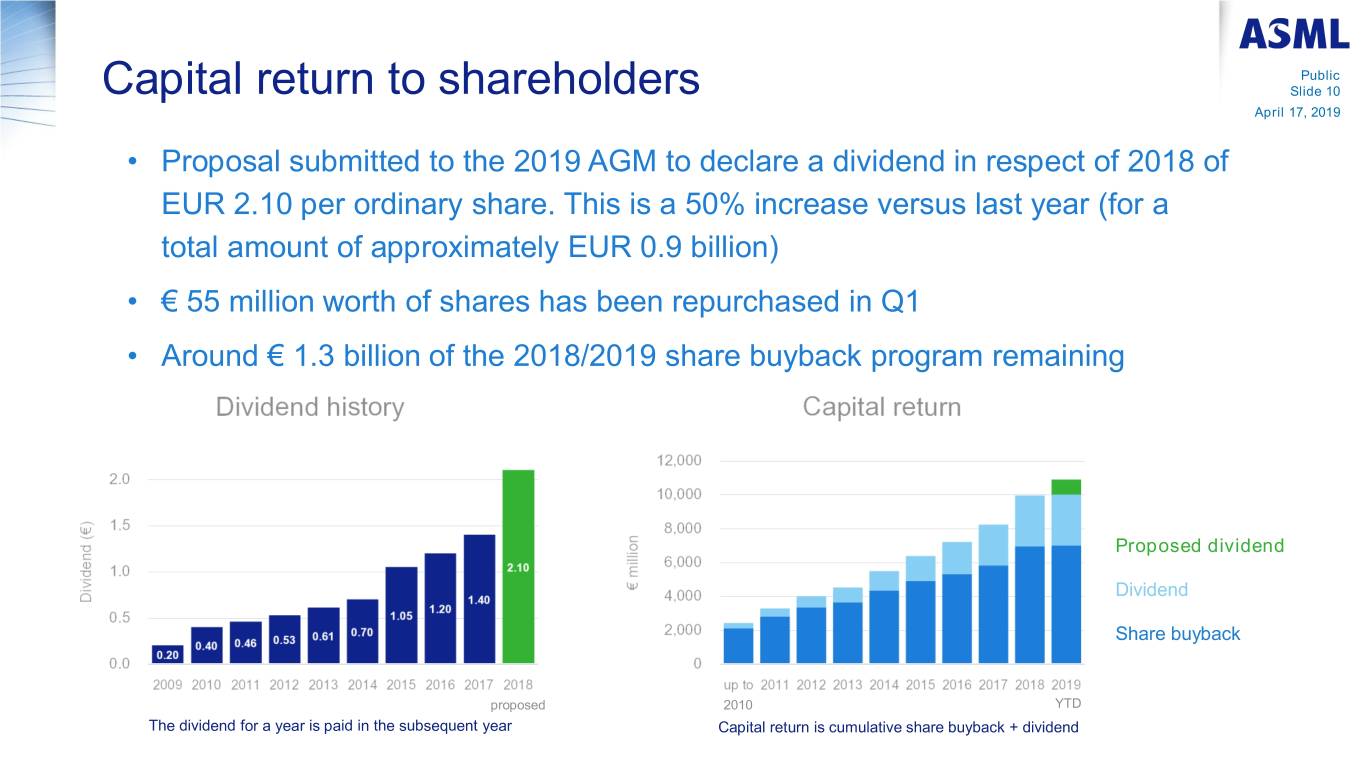

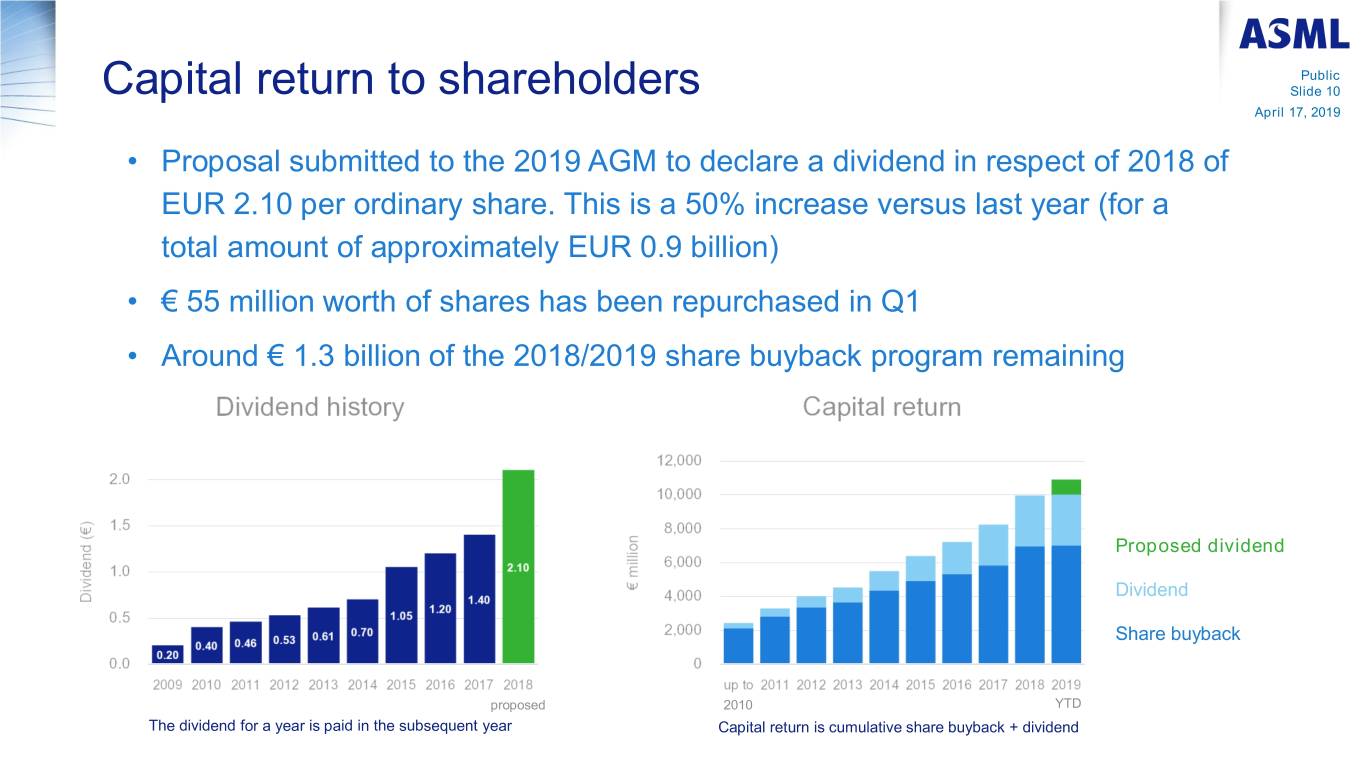

Public Capital return to shareholders Slide 10 April 17, 2019 • Proposal submitted to the 2019 AGM to declare a dividend in respect of 2018 of EUR 2.10 per ordinary share. This is a 50% increase versus last year (for a total amount of approximately EUR 0.9 billion) • € 55 million worth of shares has been repurchased in Q1 • Around € 1.3 billion of the 2018/2019 share buyback program remaining Proposed dividend Dividend Share buyback proposed 2010 YTD The dividend for a year is paid in the subsequent year Capital return is cumulative share buyback + dividend

Public Slide 11 April 17, 2019 Outlook

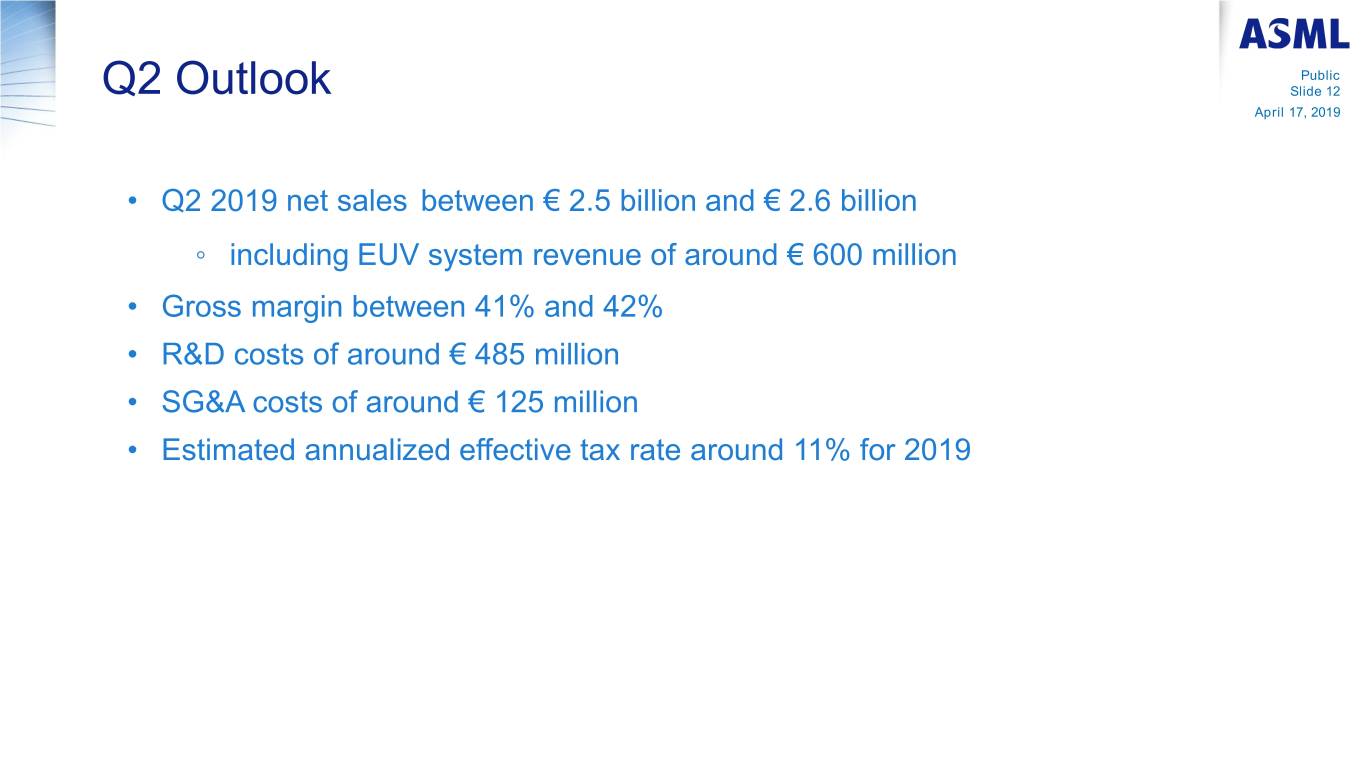

Public Q2 Outlook Slide 12 April 17, 2019 • Q2 2019 net sales between € 2.5 billion and € 2.6 billion ◦ including EUV system revenue of around € 600 million • Gross margin between 41% and 42% • R&D costs of around € 485 million • SG&A costs of around € 125 million • Estimated annualized effective tax rate around 11% for 2019

Public Slide 13 April 17, 2019 Financial statements

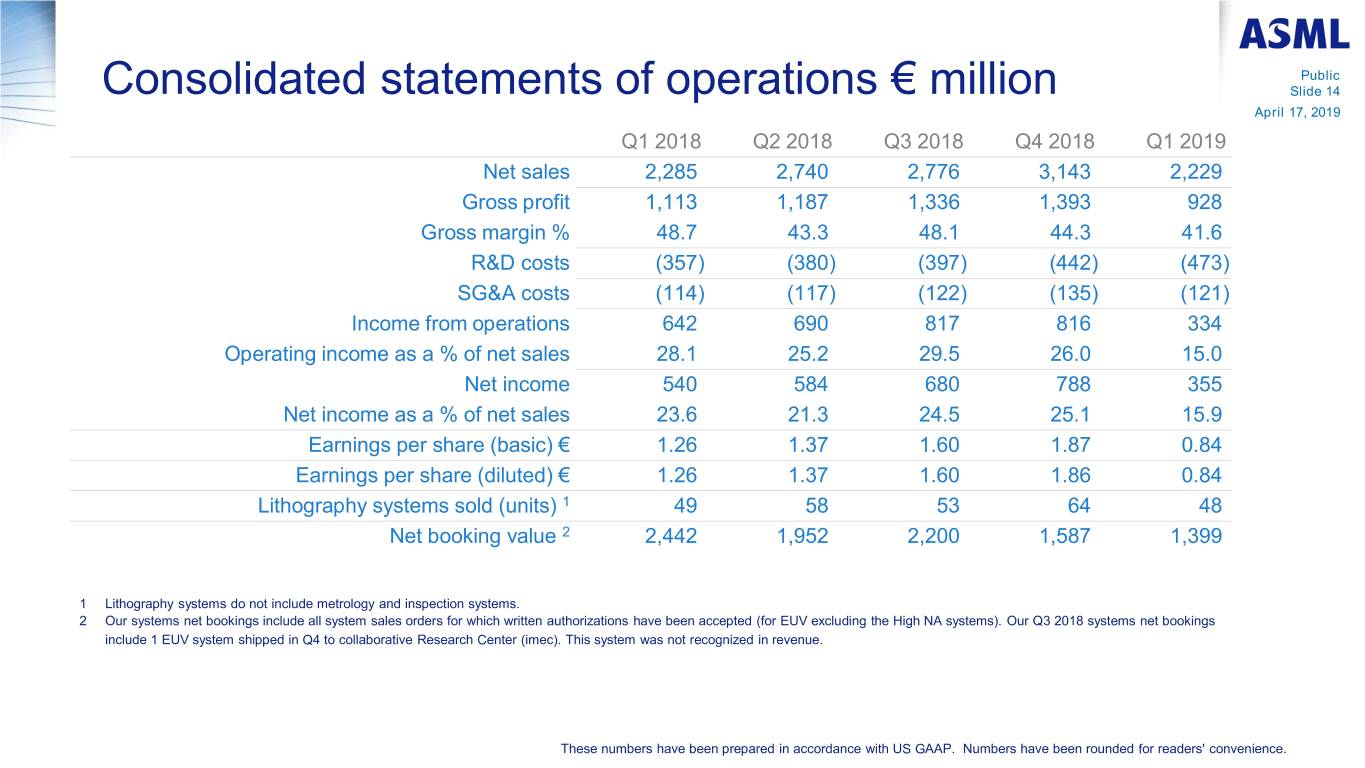

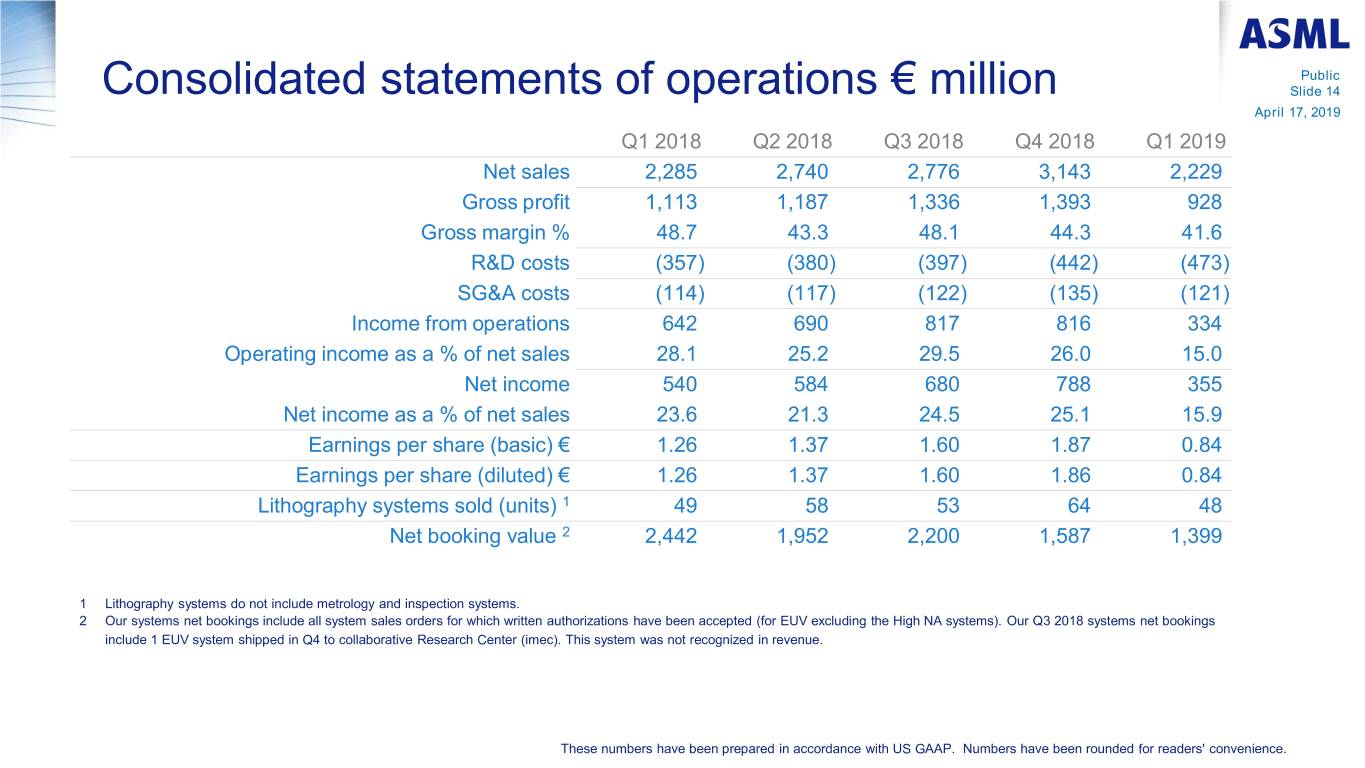

Public Consolidated statements of operations € million Slide 14 April 17, 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Net sales 2,285 2,740 2,776 3,143 2,229 Gross profit 1,113 1,187 1,336 1,393 928 Gross margin % 48.7 43.3 48.1 44.3 41.6 R&D costs (357) (380) (397) (442) (473) SG&A costs (114) (117) (122) (135) (121) Income from operations 642 690 817 816 334 Operating income as a % of net sales 28.1 25.2 29.5 26.0 15.0 Net income 540 584 680 788 355 Net income as a % of net sales 23.6 21.3 24.5 25.1 15.9 Earnings per share (basic) € 1.26 1.37 1.60 1.87 0.84 Earnings per share (diluted) € 1.26 1.37 1.60 1.86 0.84 Lithography systems sold (units) 1 49 58 53 64 48 Net booking value 2 2,442 1,952 2,200 1,587 1,399 1 Lithography systems do not include metrology and inspection systems. 2 Our systems net bookings include all system sales orders for which written authorizations have been accepted (for EUV excluding the High NA systems). Our Q3 2018 systems net bookings include 1 EUV system shipped in Q4 to collaborative Research Center (imec). This system was not recognized in revenue. These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

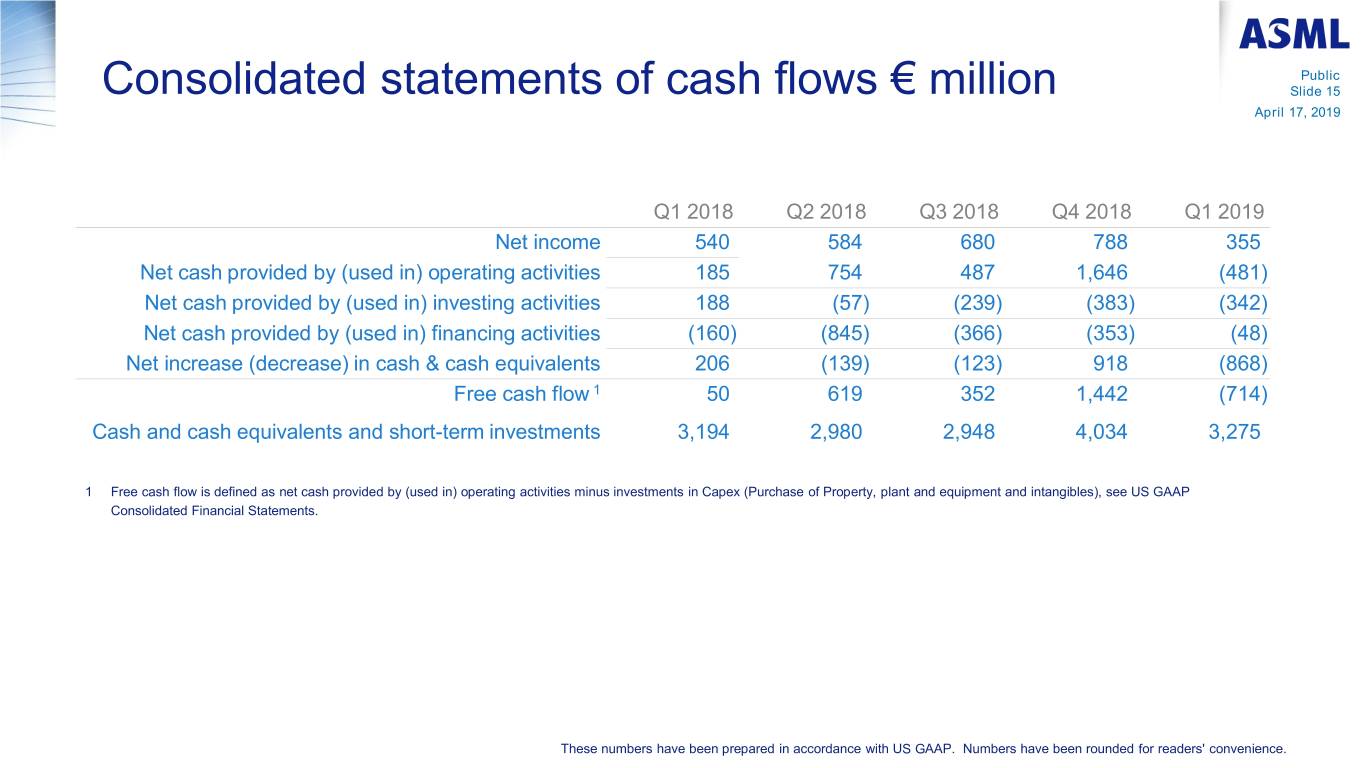

Public Consolidated statements of cash flows € million Slide 15 April 17, 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Net income 540 584 680 788 355 Net cash provided by (used in) operating activities 185 754 487 1,646 (481) Net cash provided by (used in) investing activities 188 (57) (239) (383) (342) Net cash provided by (used in) financing activities (160) (845) (366) (353) (48) Net increase (decrease) in cash & cash equivalents 206 (139) (123) 918 (868) Free cash flow 1 50 619 352 1,442 (714) Cash and cash equivalents and short-term investments 3,194 2,980 2,948 4,034 3,275 1 Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of Property, plant and equipment and intangibles), see US GAAP Consolidated Financial Statements. These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

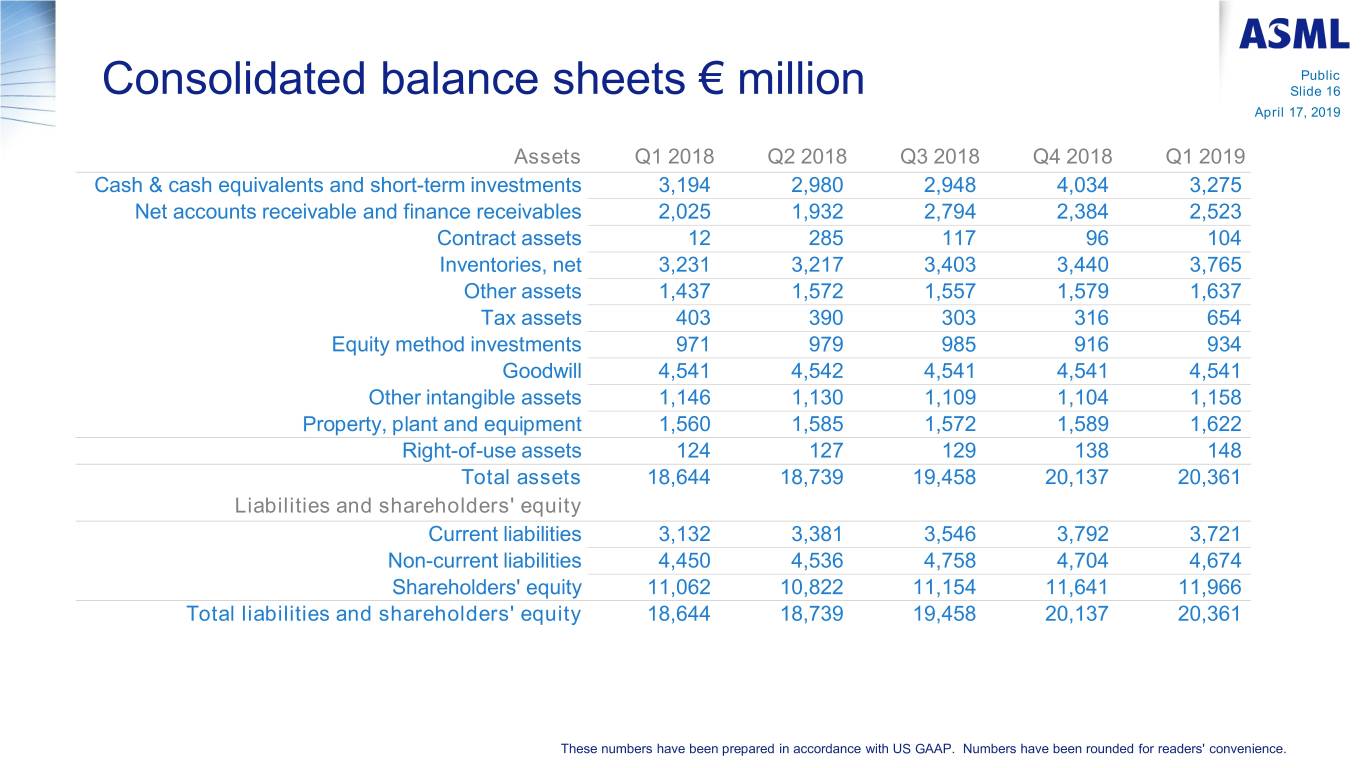

Public Consolidated balance sheets € million Slide 16 April 17, 2019 Assets Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Cash & cash equivalents and short-term investments 3,194 2,980 2,948 4,034 3,275 Net accounts receivable and finance receivables 2,025 1,932 2,794 2,384 2,523 Contract assets 12 285 117 96 104 Inventories, net 3,231 3,217 3,403 3,440 3,765 Other assets 1,437 1,572 1,557 1,579 1,637 Tax assets 403 390 303 316 654 Equity method investments 971 979 985 916 934 Goodwill 4,541 4,542 4,541 4,541 4,541 Other intangible assets 1,146 1,130 1,109 1,104 1,158 Property, plant and equipment 1,560 1,585 1,572 1,589 1,622 Right-of-use assets 124 127 129 138 148 Total assets 18,644 18,739 19,458 20,137 20,361 Liabilities and shareholders' equity Current liabilities 3,132 3,381 3,546 3,792 3,721 Non-current liabilities 4,450 4,536 4,758 4,704 4,674 Shareholders' equity 11,062 10,822 11,154 11,641 11,966 Total liabilities and shareholders' equity 18,644 18,739 19,458 20,137 20,361 These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Forward looking statements Slide 17 April 17, 2019 This document contains statements relating to certain projections, business trends and other matters that are forward-looking, including statements with respect to expected trends and outlook, bookings, expected financial results and trends, including expected sales, EUV revenue, gross margin, R&D and SG&A expenses, and estimated annualized effective tax rate for the second quarter of 2019, and expected financial results and trends for the full year 2019, including the expectation for continued growth in sales in 2019, annual revenue opportunity in 2020 and annual revenue through 2025, outlook for 2020 and beyond, including ASML's positive view on technology drivers such as 5G communications, automotive, artificial intelligence and data centers, trends in DUV systems revenue and Holistic Lithography and installed based management and Applications revenues, expected industry trends and expected trends in the business environment, including expected short term volatility in the market due to macroeconomics, including added capacity in memory and new leading edge nodes in logic, drivers of long-term growth opportunity, statements with respect to the expected benefits of the introduction of the new DUV system and expected demand for such system, statements with respect to film head manufacturing, where ASML is expected to enable the shrink roadmap with a special version of the XT:1460K scanner, expected support of technology transitions through the higher productivity NXE:3400C, including its expected availability date and the expectation that such scanner will drive adoption in the DRAM memory segment, expected throughput of higher transmission optics and the expectation that this will deliver cost effective shrink for both Logic and DRAM, statements with respect to the continued DUV innovation, to support future nodes and new applications, including the expectation that DUV Dry products will be brought to the NTX platform and the expected timing of delivery of NXT:1470, the expected deliver of a multi-beam system in 2019 for R&D and expected timing of commercial product shipment of e-beam products , shrink being a key industry driver supporting innovation and providing long-term industry growth, Holistic Lithography enabling affordable shrink and delivering value to customers, DUV, EUV and Application products providing unique value drivers for ASML and its customers, the expected continuation of Moore’s law and that EUV will continue to enable Moore’s law and drive long term value for ASML well into the next decade, the intention to continue to return excess cash to shareholders through a combination of share buybacks and growing dividends in line with ASML’s policy, and statements with respect to the proposed dividend for the 2019 Annual General Meeting of Shareholders and the share repurchase plan for 2018-2019, including the intention to use certain shares to cover employee share plans and cancel the rest of the shares upon repurchase. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "targets", "commits to secure" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors, including the impact of general economic conditions on consumer confidence and demand for our customers’ products, competitive products and pricing, the impact of any manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of and demand for new products including EUV and DUV, the number and timing of EUV and DUV systems shipped and recognized in revenue, timing of EUV orders and the risk of order cancellation or push out, EUV production capacity, delays in EUV systems production and development and volume production by customers, including meeting development requirements for volume production, demand for EUV systems being sufficient to result in utilization of EUV facilities in which ASML has made significant investments, potential inability to successfully integrate acquired businesses to create value for our customers, our ability to enforce patents and protect intellectual property rights, the outcome of intellectual property litigation, availability of raw materials, critical manufacturing equipment and qualified employees, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases, results of the share repurchase plan and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.