Public ASML 2024 Second-Quarter results Veldhoven, the Netherlands July 17, 2024 ASML reports €6.2 billion total net sales and €1.6 billion net income in Q2 2024 ASML continues to expect 2024 total net sales to be similar to 2023, supported by a strong second half year Exhibit 99.2

Public Page 2July 17, 2024 • Investor key messages • Business summary • Outlook • Financial statements Agenda

Public Page 3July 17, 2024 Investor key messages

Public Page 4July 17, 2024 Investor key messages • Global megatrends in the electronics industry, supported by a highly profitable and fiercely innovative ecosystem, are expected to continue to fuel growth across the semiconductor market • Growth in semiconductor end markets and increasing lithography intensity are driving demand for our products and services • ASML’s comprehensive product portfolio is aligned with our customers’ roadmaps, delivering cost effective solutions in support of all applications from leading edge to mature nodes • Based on different market scenarios1 as presented during our Investor Day in November 2022, we modeled an opportunity to reach annual revenue in 2025 between approximately €30 billion and €40 billion, with a gross margin between approximately 54% and 56% and in 2030 an annual revenue between approximately €44 billion and €60 billion, with a gross margin between approximately 56% and 60% • ASML and its supply chain partners are actively adding and improving capacity to meet current and future customer demand • We continue to execute our ESG Sustainability strategy and shared the latest progress and actions to reach our targets in our integrated Annual Report 2023, published on February 14, 2024 • We expect to continue to return significant amounts of cash to our shareholders through a combination of growing dividends and share buybacks 1 based on third party research and our assumptions

Public Page 5July 17, 2024 Business summary

Public Page 6July 17, 2024 1 Installed Base Management equals our net service and field option sales 2 Income from operations as a percentage of Total net sales 3 Net bookings include all system sales orders and inflation-related adjustments, for which written authorizations have been accepted. Q2 results summary • Total net sales of €6.2 billion, net system sales of €4.8 billion, Installed Base Management1 sales of €1.5 billion • Gross margin of 51.5% • Operating margin2 of 29.4% • Net income as a percentage of total net sales of 25.3% • Earnings per share (basic) of €4.01 • Net bookings3 of €5.6 billion ◦ including EUV bookings of €2.5 billion Numbers have been rounded for readers' convenience.

Public Page 7July 17, 2024 Net system sales breakdown (Quarterly) Q2’24 Net system sales €4,761 million Q1’24 Net system sales €3,966 million

Public Page 8July 17, 2024 Logic Memory Installed Base Management1 1 Installed Base Management equals our net service and field option sales Total net sales € million by End-use

Public Page 9July 17, 2024 Net systems bookings1 activity by End-use Q2’24 net system bookings €5,567 million Q1’24 net system bookings €3,611 million 1 Net bookings include all system sales orders and inflation-related adjustments, for which written authorizations have been accepted.

Public Page 10July 17, 2024 • In Q2, ASML paid a final dividend of €1.75 per ordinary share. Together with the interim dividend paid in 2023 and 2024, this resulted in a total dividend for 2023 of €6.10 per ordinary share • The first quarterly interim dividend over 2024 will be €1.52 per ordinary share and will be made payable on August 7, 2024 • In Q2 2024 we purchased 106 thousand shares for a total amount of €96 million Capital return to shareholders Share buyback Dividend paid Third interim and final dividend for a year are paid in the subsequent year Total dividend Interim dividend

Public Page 11July 17, 2024 Outlook

Public Page 12July 17, 2024 Outlook Q3 • Total net sales between €6.7 billion and €7.3 billion, including ◦ Installed Base Management1 sales of around €1.4 billion • Gross margin between 50% and 51% • R&D costs of around €1,100 million • SG&A costs of around €295 million 2024 • Similar total net sales with a slightly lower gross margin, relative to 2023 • Estimated annualized effective tax rate between 16% and 17% 1 Installed Base Management equals our net service and field option sales

Public Page 13July 17, 2024 Financial Statements

Public Page 14July 17, 2024 Consolidated statements of operations € million Quarter on Quarter Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Total net sales 6,902 6,673 7,237 5,290 6,243 Gross profit 3,544 3,462 3,717 2,697 3,212 Gross margin % 51.3 51.9 51.4 51.0 51.5 R&D costs (1,000) (992) (1,041) (1,032) (1,101) SG&A costs (281) (288) (284) (273) (277) Income from operations 2,263 2,182 2,392 1,392 1,834 Operating income as a % of total net sales 32.8 32.7 33.1 26.3 29.4 Net income 1,942 1,893 2,048 1,224 1,578 Net income as a % of total net sales 28.1 28.4 28.3 23.1 25.3 Earnings per share (basic) € 4.93 4.81 5.21 3.11 4.01 Earnings per share (diluted) € 4.93 4.81 5.20 3.11 4.01 Lithography systems sold (units) 1 113 112 124 70 100 Net bookings 2 4,500 2,602 9,186 3,611 5,567 1 Lithography systems do not include metrology and inspection systems. 2 Net bookings include all system sales orders and inflation-related adjustments, for which written authorizations have been accepted. These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

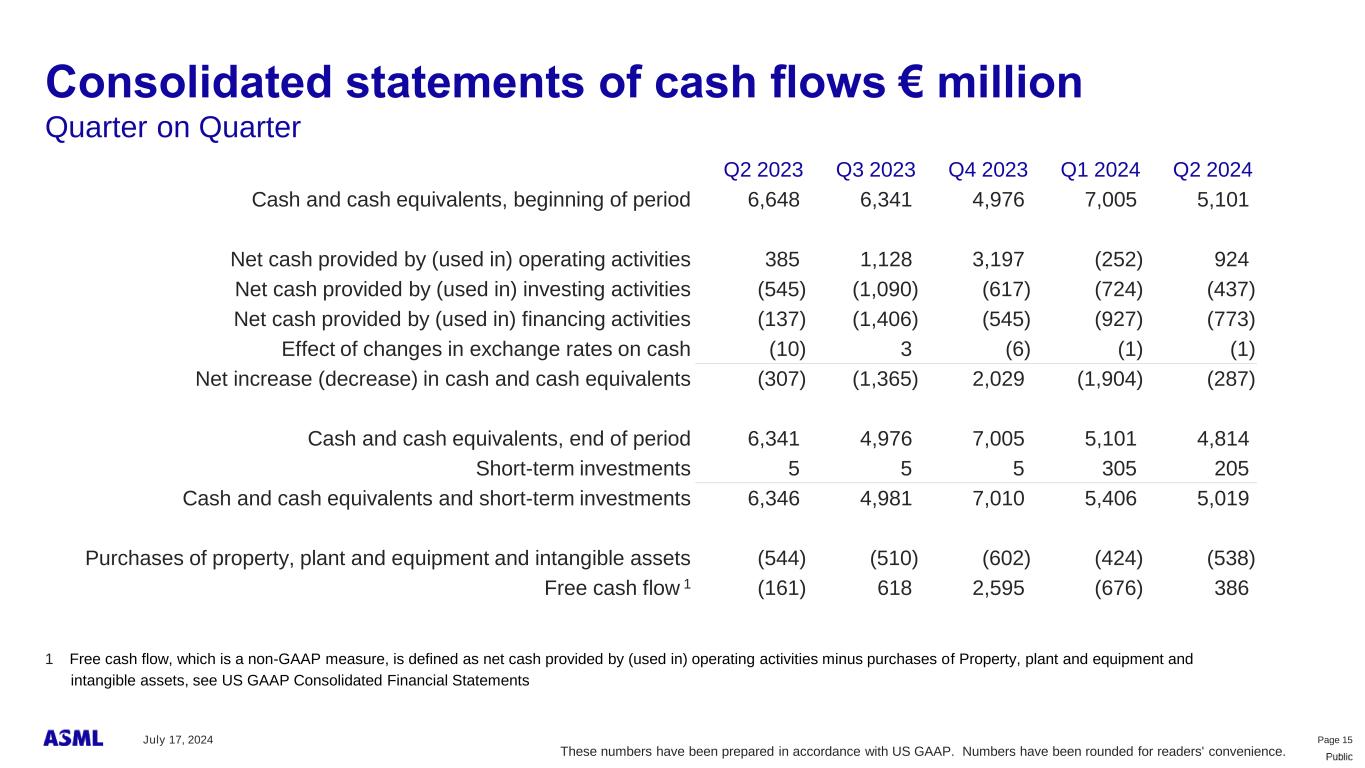

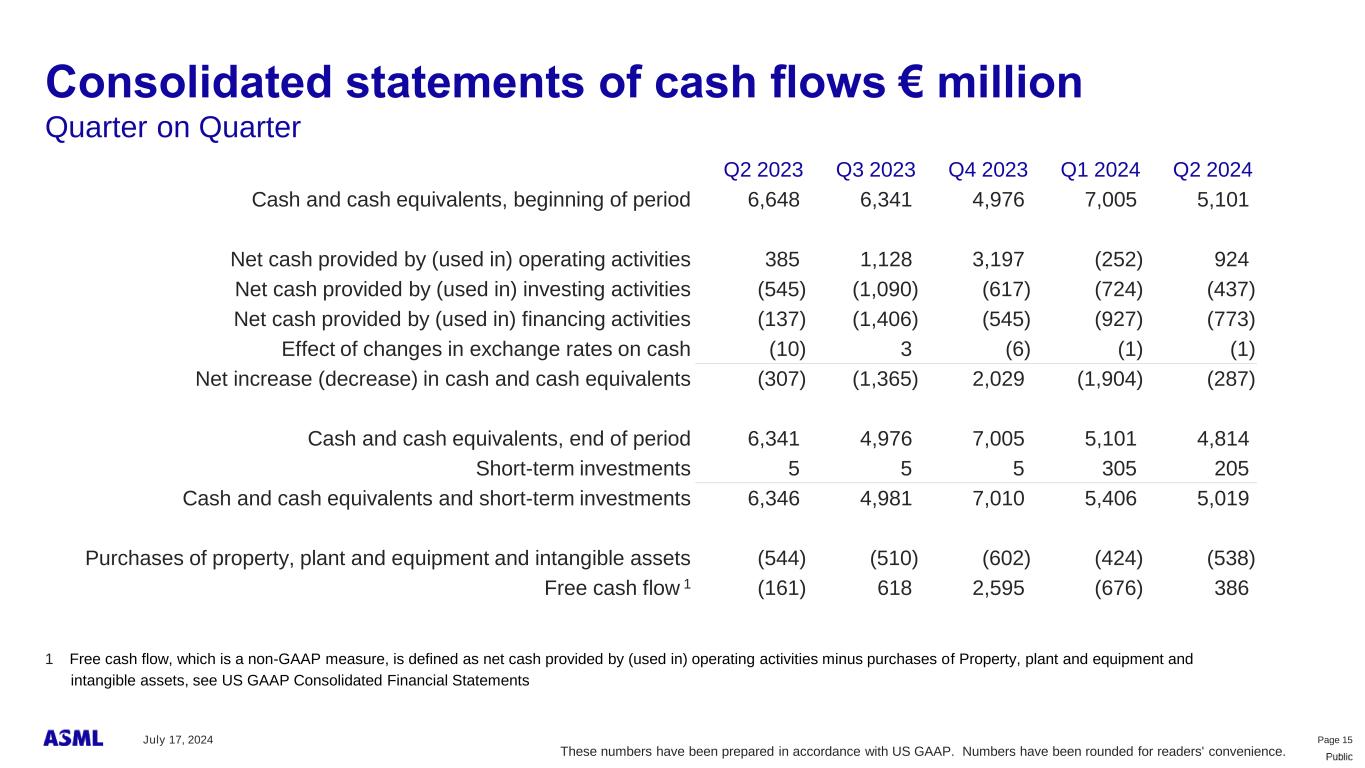

Public Page 15July 17, 2024 Consolidated statements of cash flows € million Quarter on Quarter Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Cash and cash equivalents, beginning of period 6,648 6,341 4,976 7,005 5,101 Net cash provided by (used in) operating activities 385 1,128 3,197 (252) 924 Net cash provided by (used in) investing activities (545) (1,090) (617) (724) (437) Net cash provided by (used in) financing activities (137) (1,406) (545) (927) (773) Effect of changes in exchange rates on cash (10) 3 (6) (1) (1) Net increase (decrease) in cash and cash equivalents (307) (1,365) 2,029 (1,904) (287) Cash and cash equivalents, end of period 6,341 4,976 7,005 5,101 4,814 Short-term investments 5 5 5 305 205 Cash and cash equivalents and short-term investments 6,346 4,981 7,010 5,406 5,019 Purchases of property, plant and equipment and intangible assets (544) (510) (602) (424) (538) Free cash flow 1 (161) 618 2,595 (676) 386 1 Free cash flow, which is a non-GAAP measure, is defined as net cash provided by (used in) operating activities minus purchases of Property, plant and equipment and intangible assets, see US GAAP Consolidated Financial Statements These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Page 16July 17, 2024 Consolidated balance sheets € million Quarter End Assets Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Cash & cash equivalents and short-term investments 6,346 4,981 7,010 5,406 5,019 Net accounts receivable and finance receivables 5,686 5,682 5,774 5,041 5,517 Contract assets 193 267 240 303 435 Inventories, net 7,734 8,379 8,851 9,865 10,972 Loan receivable 364 921 929 930 929 Other assets 2,912 2,776 2,230 2,539 2,592 Tax assets 2,275 2,681 2,873 2,524 2,557 Equity method investments 1,040 1,094 920 951 1,002 Goodwill 4,556 4,583 4,589 4,589 4,589 Other intangible assets 789 757 742 711 687 Property, plant and equipment 4,728 5,093 5,493 5,841 6,084 Right-of-use assets 306 300 307 343 358 Total assets 36,929 37,514 39,958 39,043 40,741 Liabilities and shareholders' equity Current liabilities 16,755 16,310 16,275 15,049 16,132 Non-current liabilities 9,569 9,209 10,231 10,200 9,898 Shareholders' equity 10,605 11,995 13,452 13,794 14,711 Total liabilities and shareholders' equity 36,929 37,514 39,958 39,043 40,741 These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Page 17July 17, 2024 This document and related discussions contain statements that are forward-looking within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements with respect to plans, strategies, expected trends, including trends in the semiconductor industry and end markets and business environment trends, expected demand, lithography tool utilization and intensity, semiconductor inventory levels, bookings, backlog, expected recovery and growth in the semiconductor industry and expected drivers and timing thereof including expected continued industry recovery in the second half of 2024, plans to add and improve capacity, continued investments in both capacity ramp and technology, outlook and expected financial results, including expected results for Q3 2024, including net sales, IBM sales, gross margin, R&D costs, SG&A costs, outlook for the second half and full year 2024, including expected strong second half of 2024 and expectations with respect to full year 2024 total net sales, gross margin and estimated annualized effective tax rate, expectations with respect to sales by market segment and IBM sales and expected drivers thereof, and other full year 2024 expectations, expectations with respect to expected financial performance and growth in 2025 and expected drivers thereof, statements made at our 2022 Investor Day, including revenue and gross margin opportunity for 2025 and 2030, statements with respect to export control policy and regulations and expected impact on us, statements with respect to continued execution of ESG sustainability strategy, our expectation to continue to return significant amounts of cash to shareholders through growing dividends and share buybacks, statements with respect to our share buyback program, including the amount of shares intended to be repurchased thereunder and statements with respect to dividends, statements with respect to expected performance and capabilities of our systems and customer plans and other non-historical statements. You can generally identify these statements by the use of words like “may”, “will”, “could”, “should”, “project”, “believe”, “anticipate”, “expect”, “plan”, “estimate”, “forecast”, “potential”, “intend”, “continue”, “target”, “future”, “progress”, “goal”, “model”, “opportunity” and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions, plans and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve a number of substantial known and unknown risks and uncertainties. These risks and uncertainties include, without limitation, customer demand, semiconductor equipment industry capacity, worldwide demand for semiconductors and semiconductor manufacturing capacity, lithography tool utilization and semiconductor inventory levels, general trends and consumer confidence in the semiconductor industry, the impact of general economic conditions, including the impact of the current macroeconomic environment on the semiconductor industry, uncertainty around a market recovery, the impact of inflation, interest rates, geopolitical developments, the impact of pandemics, the performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products, our production capacity and ability to adjust capacity to meet demand, supply chain capacity, constraints and logistics, timely availability of parts and components, raw materials, critical manufacturing equipment and qualified employees, constraints on our ability to produce systems to meet demand, the number and timing of systems ordered, shipped and recognized in revenue, risks relating to fluctuations in net bookings, the risk of order cancellation or push outs and restrictions on shipments of ordered systems under export controls, risks relating to the trade environment, import/export and national security regulations and orders and their impact on us, including the impact of changes in export regulations and the impact of such regulations on our ability to obtain necessary licenses and to sell our systems and provide services to certain customers, exchange rate fluctuations, changes in tax rates, available liquidity and free cash flow and liquidity requirements, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, the number of shares that we repurchase under our share repurchase programs, our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation, our ability to meet ESG goals and execute our ESG strategy, other factors that may impact ASML’s business or financial results, and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F for the year ended December 31, 2023 and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We undertake no obligation to update any forward-looking statements after the date of this report or to conform such statements to actual results or revised expectations, except as required by law. Forward looking statements

Public