Exhibit 99.2

Exhibit 99.2

ASML

ASML Q1 2014 sales in line with guidance gross margin above guidance

ASML 2014 First Quarter Results

Veldhoven, the Netherlands

April 16, 2014

ASML

Public

Slide 2

16 April 2014

Forward looking statements

“Safe Harbor” Statement under the US Private Securities Litigation Reform Act of 1995: the matters discussed in this document may include forward-looking statements, including statements made about our outlook, expected sales levels, systems backlog, IC unit demand, expected financial results, gross margin and expenses, and intention to repurchase shares.

These forward looking statements are subject to risks and uncertainties including: economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers’ products, competitive products and pricing, the impact of manufacturing efficiencies and capacity constraints, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products, the number and timing of EUV systems expected to be shipped, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, available cash, distributable reserves for dividend payments and share repurchases, our ability to successfully integrate Cymer, and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission

ASML

Public

Slide 3

16 April 2014

Business summary

Business environment

Outlook

ASML technology status

ASML

Public

Slide 4

16 April 2014

Business summary

ASML

Public

Slide 5

16 April 2014

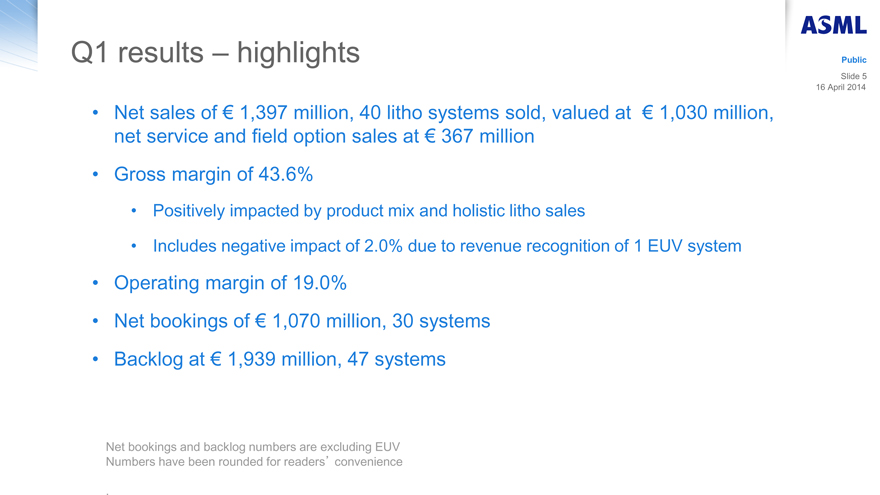

Q1 results – highlights

Net sales of € 1,397 million, 40 litho systems sold, valued at € 1,030 million, net service and field option sales at € 367 million

Gross margin of 43.6%

Positively impacted by product mix and holistic litho sales

Includes negative impact of 2.0% due to revenue recognition of 1 EUV system

Operating margin of 19.0%

Net bookings of € 1,070 million, 30 systems

Backlog at € 1,939 million, 47 systems

Net bookings and backlog numbers are excluding EUV Numbers have been rounded for readers’ convenience

ASML

Public

Slide 6

16 April 2014

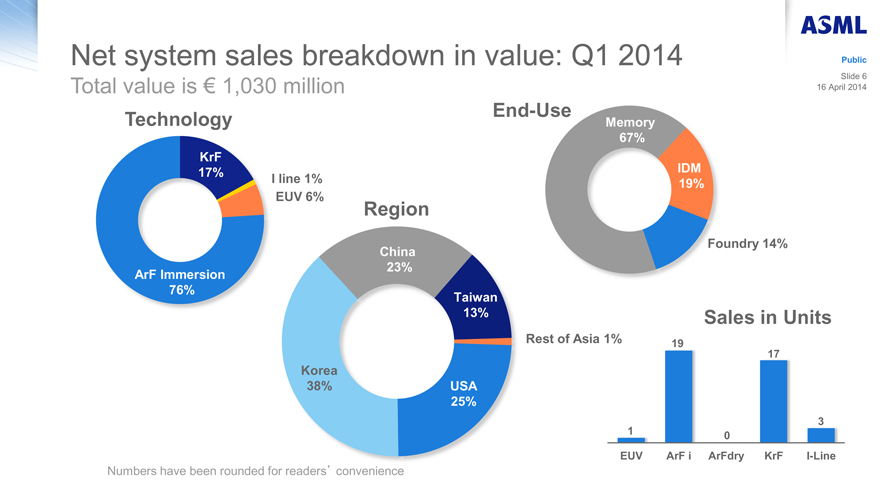

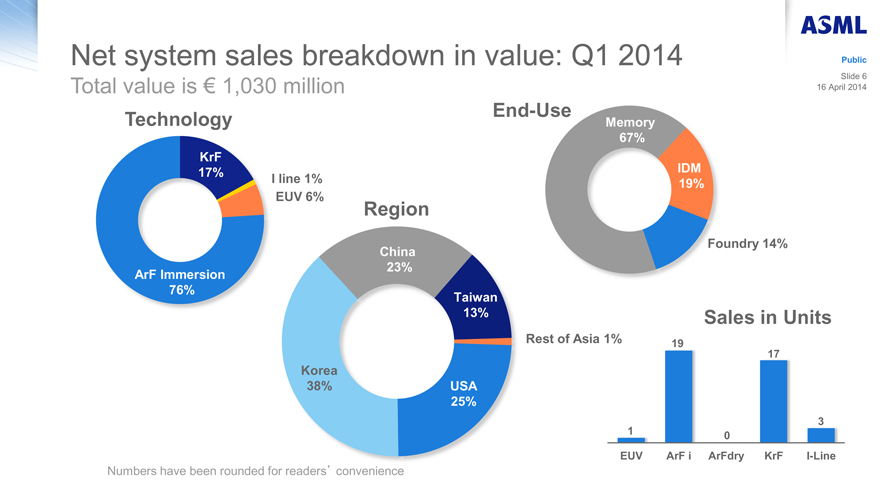

Net system sales breakdown in value: Q1 2014

Total value is € 1,030 million

Technology KrF 17% ArF Immersion 76% I line 1% EUV 6%

Korea 38% Region China 23% Taiwan 13% USA 25% Rest of Asia 1%

End-Use Memory 67% IDM 19% Foundry 14%

1 EUV Sales in Units 19 17 3 0 ArF i ArFdry KrF I-Line

Numbers have been rounded for readers’ convenience

ASML

Public

Slide 7

16 April 2014

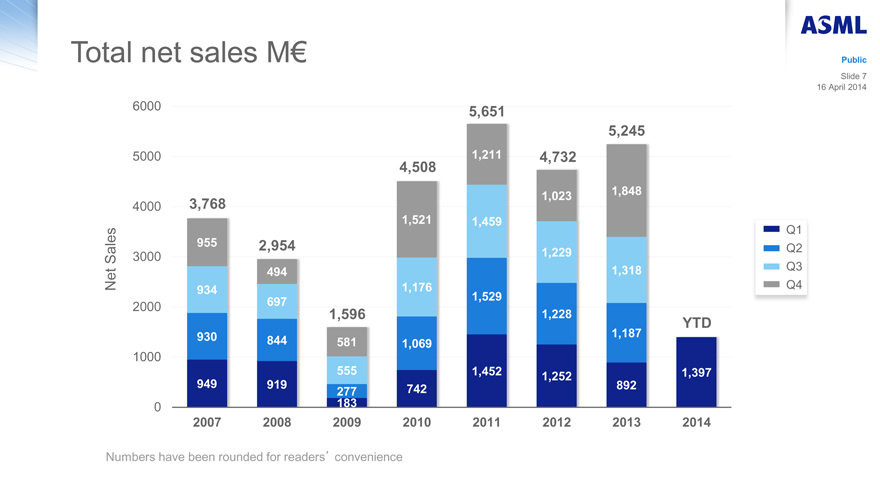

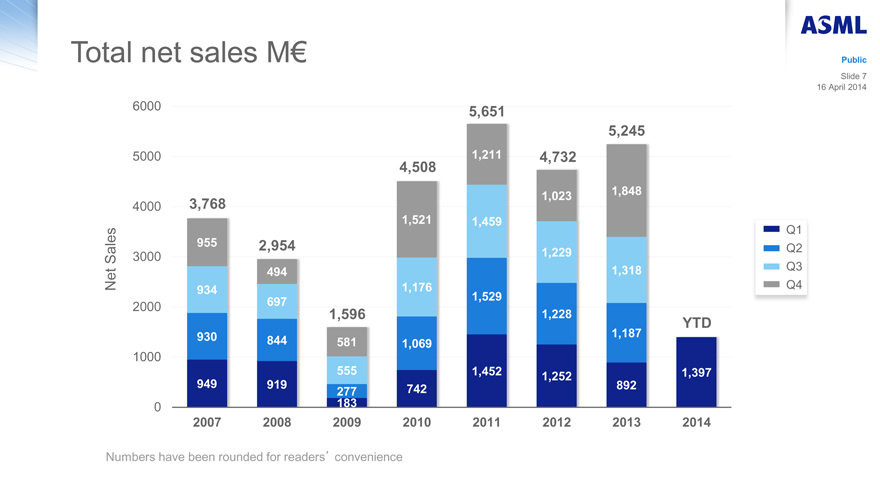

Total net sales M€

6000 3,768 2,954 1,596 4,508 5,651 4,732 5,245 YTD

5000 955 494 1,521 1,176 1,459 1,229 1,318 1,211 1,023 1,848

4000 3000 2000 1000

Q1 Q2 Q3 Q4

Net Sales

934 1,529 697

1,228 930 844 581 1,069 1,187 555

949 919 277 742 1,452 1,252 892 1,397 183

0 2007 2008 2009 2010 2011 2012 2013 2014

Numbers have been rounded for readers’ convenience

ASML

Public

Slide 8

16 April 2014

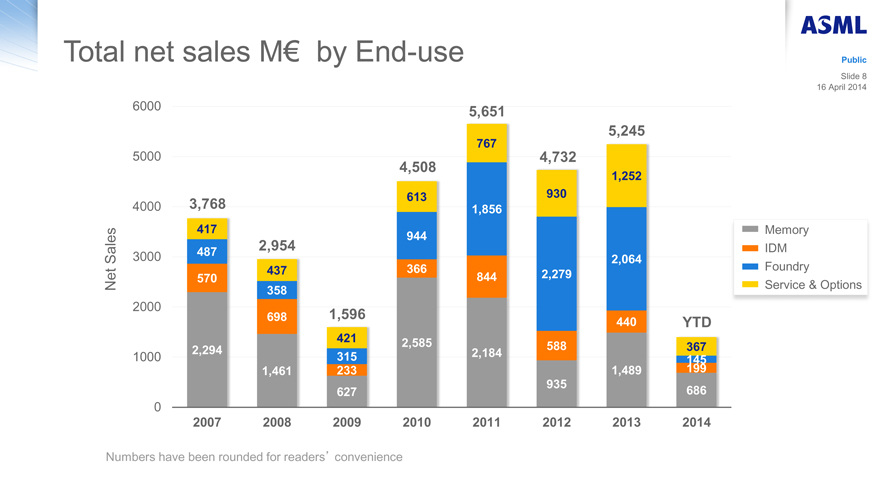

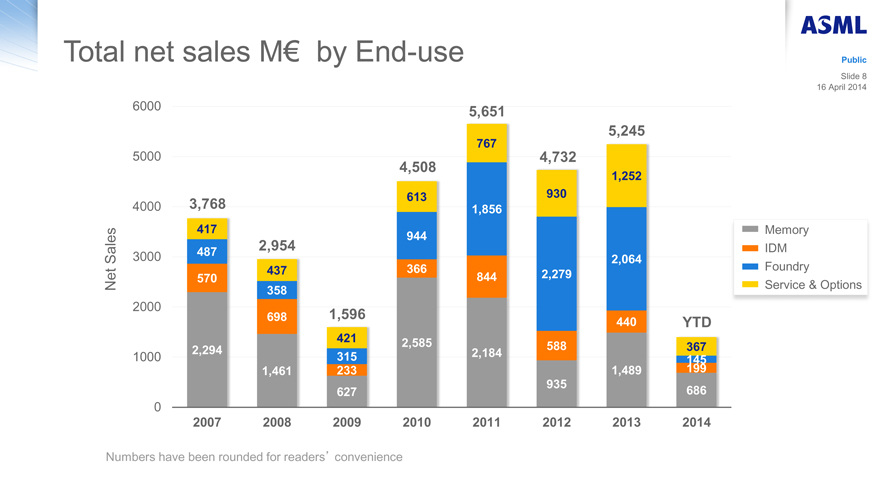

Total net sales M€ by End-use

Net Sales

6000 5000 4000 3000 2000 1000 0

3,768 417 487 570 2,294 2007

2,954 437 358 698 1,461 2008

1,596 421 315 233 627 2009

4,508 613 944 366 2,585 2010

5,651 767 1,856 844 2,184 2011

4,732 930 2,279 588 935 2012

5,245 1,252 2,064 440 1,489 2013

YTD 145 367 199 686 2014

Memory IDM Foundry Service & Options

Numbers have been rounded for readers’ convenience

ASML

Public

Slide 9

16 April 2014

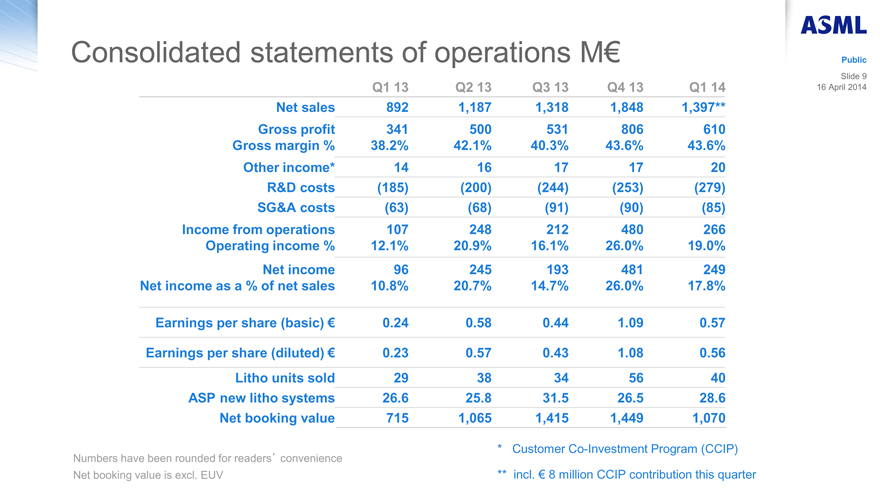

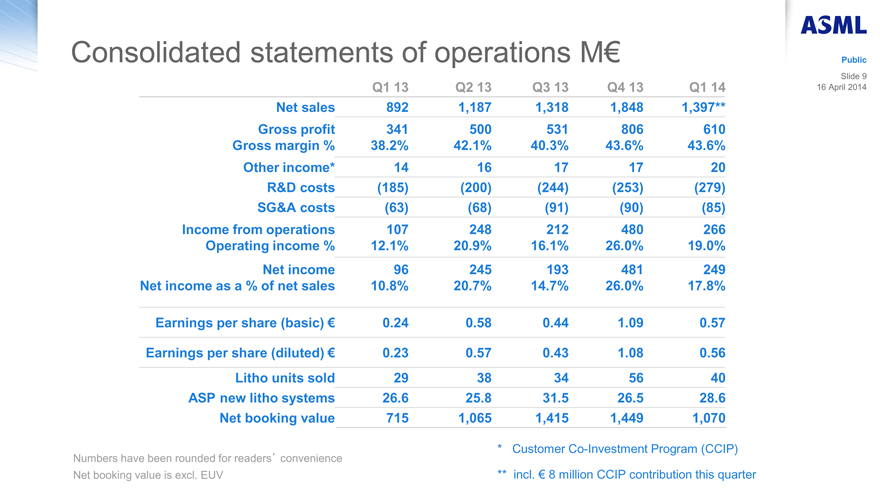

Consolidated statements of operations M€

Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Net sales 892 1,187 1,318 1,848 1,397**

Gross profit 341 500 531 806 610

Gross margin % 38.2% 42.1% 40.3% 43.6% 43.6%

Other income* 14 16 17 17 20

R&D costs (185) (200) (244) (253) (279)

SG&A costs (63) (68) (91) (90) (85)

Income from operations 107 248 212 480 266

Operating income % 12.1% 20.9% 16.1% 26.0% 19.0%

Net income 96 245 193 481 249

Net income as a % of net sales 10.8% 20.7% 14.7% 26.0% 17.8%

Earnings per share (basic) € 0.24 0.58 0.44 1.09 0.57

Earnings per share (diluted) € 0.23 0.57 0.43 1.08 0.56

Litho units sold 29 38 34 56 40

ASP new litho systems 26.6 25.8 31.5 26.5 28.6

Net booking value 715 1,065 1,415 1,449 1,070

Numbers have been rounded for readers’ convenience Net booking value is excl. EUV

* Customer Co-Investment Program (CCIP)

** incl. € 8 million CCIP contribution this quarter

ASML

Public

Slide 10

16 April 2014

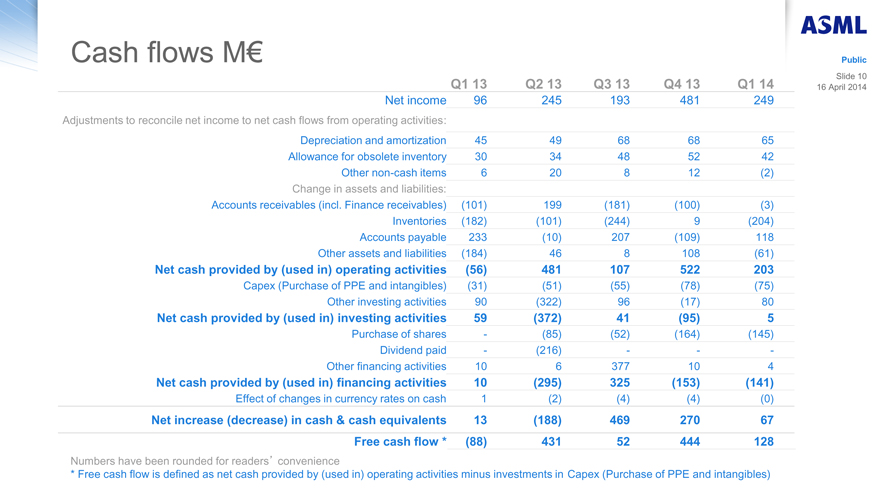

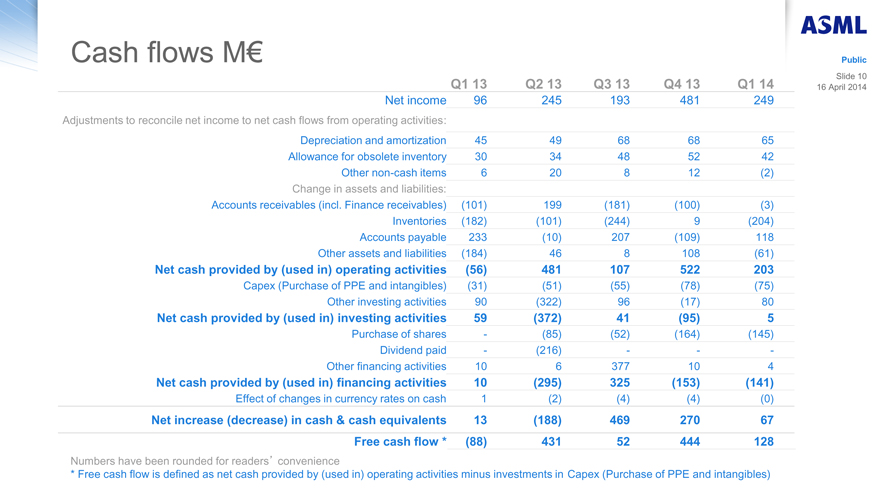

Cash flows M€

Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Net income 96 245 193 481 249

Adjustments to reconcile net income to net cash flows from operating activities:

Depreciation and amortization 45 49 68 68 65

Allowance for obsolete inventory 30 34 48 52 42

Other non-cash items 6 20 8 12 (2)

Change in assets and liabilities:

Accounts receivables (incl. Finance receivables) (101) 199 (181) (100) (3)

Inventories (182) (101) (244) 9 (204)

Accounts payable 233 (10) 207 (109) 118

Other assets and liabilities (184) 46 8 108 (61)

Net cash provided by (used in) operating activities (56) 481 107 522 203

Capex (Purchase of PPE and intangibles) (31) (51) (55) (78) (75)

Other investing activities 90 (322) 96 (17) 80

Net cash provided by (used in) investing activities 59 (372) 41 (95) 5

Purchase of shares — (85) (52) (164) (145)

Dividend paid — (216) — — —

Other financing activities 10 6 377 10 4

Net cash provided by (used in) financing activities 10 (295) 325 (153) (141)

Effect of changes in currency rates on cash 1 (2) (4) (4) (0)

Net increase (decrease) in cash & cash equivalents 13 (188) 469 270 67

Free cash flow * (88) 431 52 444 128

Numbers have been rounded for readers’ convenience

* Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of PPE and intangibles)

ASML

Public

Slide 11

16 April 2014

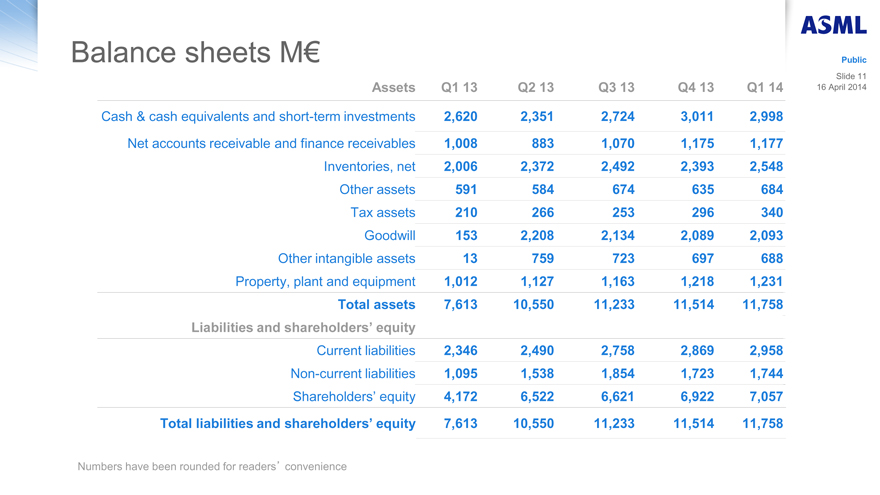

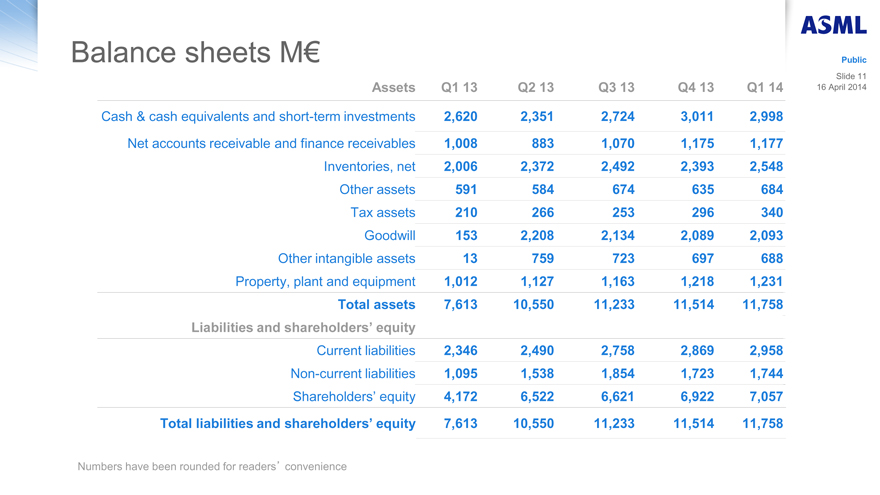

Balance sheets M€

Assets Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Cash & cash equivalents and short-term investments 2,620 2,351 2,724 3,011 2,998

Net accounts receivable and finance receivables 1,008 883 1,070 1,175 1,177

Inventories, net 2,006 2,372 2,492 2,393 2,548

Other assets 591 584 674 635 684

Tax assets 210 266 253 296 340

Goodwill 153 2,208 2,134 2,089 2,093

Other intangible assets 13 759 723 697 688

Property, plant and equipment 1,012 1,127 1,163 1,218 1,231

Total assets 7,613 10,550 11,233 11,514 11,758

Liabilities and shareholders’ equity

Current liabilities 2,346 2,490 2,758 2,869 2,958

Non-current liabilities 1,095 1,538 1,854 1,723 1,744

Shareholders’ equity 4,172 6,522 6,621 6,922 7,057

Total liabilities and shareholders’ equity 7,613 10,550 11,233 11,514 11,758

Numbers have been rounded for readers’ convenience

ASML

Public

Slide 12

16 April 2014

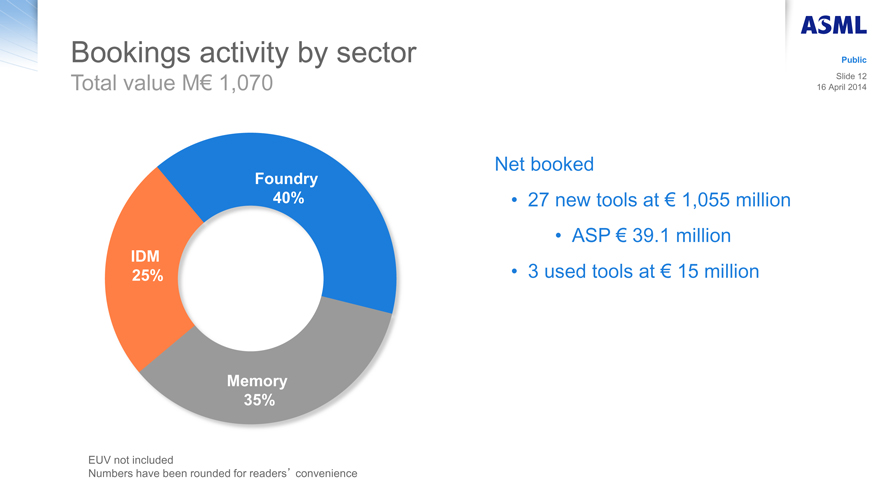

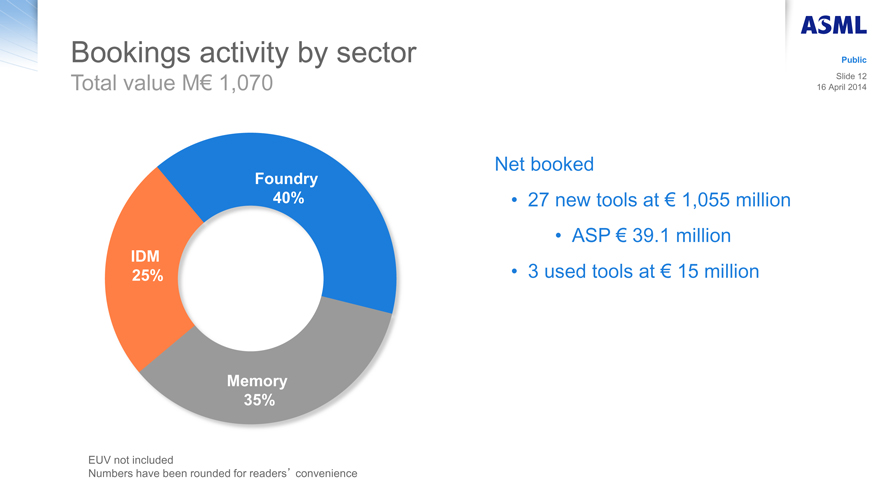

Bookings activity by sector

Total value M€ 1,070

Foundry

40%

IDM

25%

Memory

35%

EUV not included

Numbers have been rounded for readers’ convenience

Net booked

27 new tools at € 1,055 million

ASP € 39.1 million

3 used tools at € 15 million

ASML

Public

Slide 13

16 April 2014

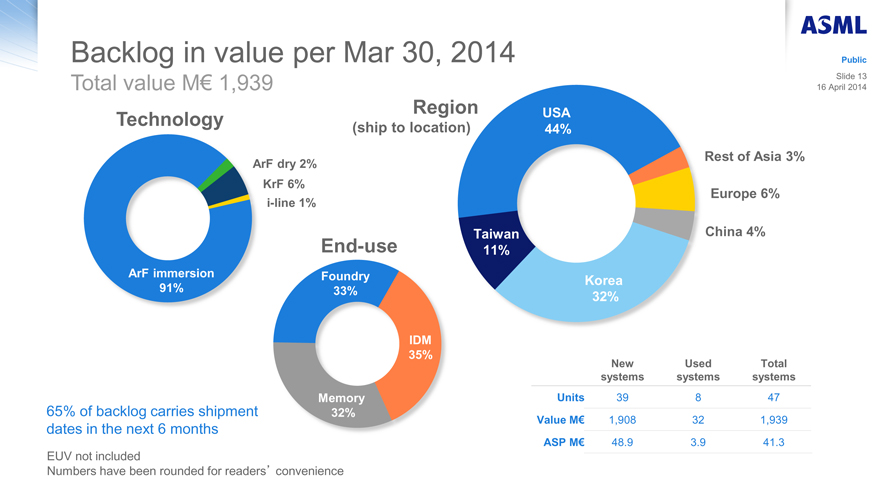

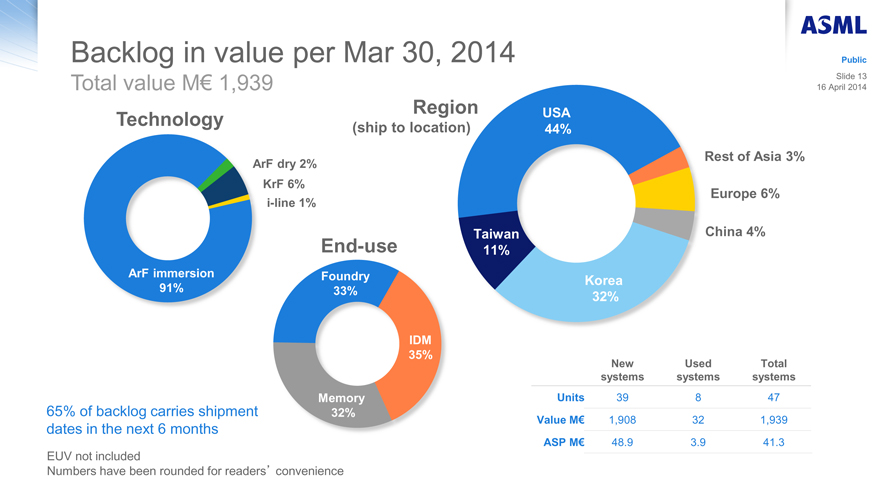

Backlog in value per Mar 30, 2014

Total value M€ 1,939

Technology

ArF dry 2%

KrF 6%

i-line 1%

ArF immersion

91%

End-use

Foundry

33%

IDM

35%

Memory

32%

Region USA 44%

(ship to location)

Rest of Asia 3%

Europe 6%

Taiwan 11% China 4%

Korea

32%

65% of backlog carries shipment dates in the next 6 months

EUV not included

Numbers have been rounded for readers’ convenience

New systems Used systems Total systems

Units 39 8 47

Value M€ 1,908 32 1,939

ASP M€ 48.9 3.9 41.3

ASML

Public

Slide 14

16 April 2014

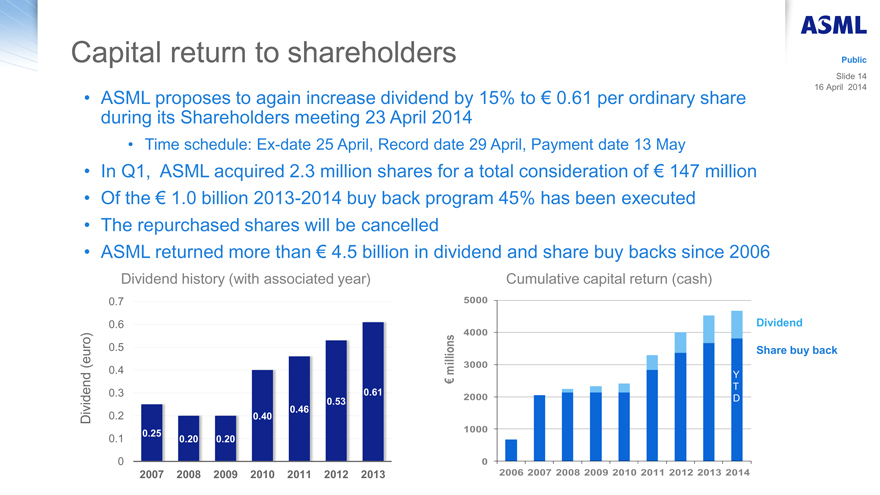

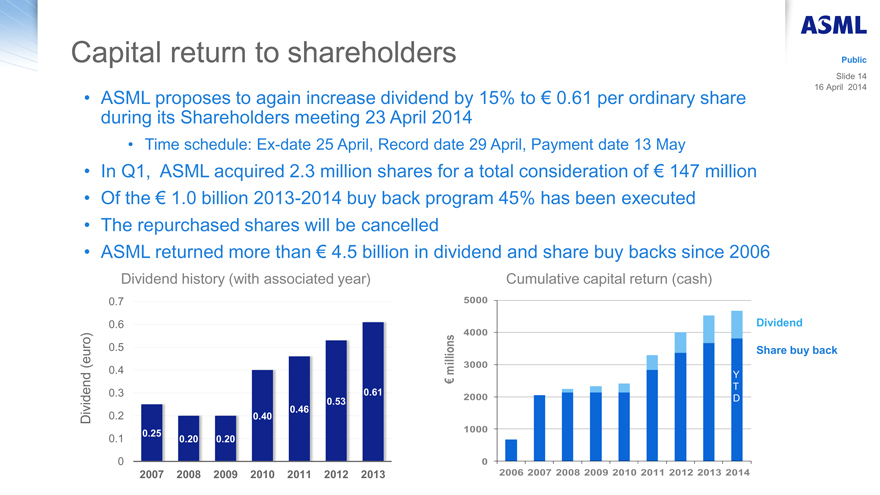

Capital return to shareholders

ASML proposes to again increase dividend by 15% to € 0.61 per ordinary share during its Shareholders meeting 23 April 2014

Time schedule: Ex-date 25 April, Record date 29 April, Payment date 13 May

In Q1, ASML acquired 2.3 million shares for a total consideration of € 147 million

Of the € 1.0 billion 2013-2014 buy back program 45% has been executed

The repurchased shares will be cancelled

ASML returned more than € 4.5 billion in dividend and share buy backs since 2006

Dividend history (with associated year)

Dividend (euro)

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

0.25

0.20

0.20

0.40

0.46

0.53

0.61

2007 2008 2009 2010 2011 2012 2013

Cumulative capital return (cash)

€ millions

5000

4000

3000

2000

1000

0

2006 2007 2008 2009 2010 2011 2012 2013 2014

Dividend

Share buy back

Y

T

D

ASML

Public

Slide 15

16 April 2014

Business environment

ASML

Public

Slide 16

16 April 2014

Business environment for 2014

Bit growth forecast mid 40s% driven by SSD drives and smartphones

Demand being met through shrink and capacity expansion

Challenges in qualification of vertical NAND and future node planar technologies, creating litho demand timing uncertainty

NAND

Bit growth forecast of 20 - 30%

Bits supplied by planned technology transitions meet bit demand forecast

Litho process intensity increases due to node transition and mobile DRAM process complexity

DRAM

Customers are installing capacity for their 20/16/14 nm nodes

Timing uncertainty in next generation device designs and production ramps

Market growth uncertainty around PCs, high-end smartphones and tablets

LOGIC

ASML

Public

Slide 17

16 April 2014

ASML business status

Net sales in Q2 is expected to be affected by:

Adjustment for system demand from some Logic customers

This means H1 2014 net sales will be around € 3 billion including EUV

ASML

Public

Slide 18

16 April 2014

Outlook

ASML

Public

Slide 19

16 April 2014

Outlook

Q2 net sales around € 1.6 billion, including EUV

Gross margin around 44 - 45%, including EUV

R&D costs of about € 270 million

SG&A costs of about € 85 million

Other income (Customer Co-Investment Program) of about € 20 million

Q3 net sales around € 1.4 billion, including EUV

3 EUV systems to be revenue recognized in Q2 + Q3 combined

ASML

Public

Slide 20

16 April 2014

ASML technology status

ASML

Public

Slide 21

16 April 2014

EUV – progress toward production insertion

Multiple customers are qualifying EUV for insertion at the 10 nm logic node

For process development, customers typically require 100 wafers per day, increasing to 500 wafers per day on average for production qualification

We have provided customers with process development capability

In 2016 we will provide our customers with the productivity needed for volume production

Our target is to recognize a total of 8 EUV systems in revenue this year

ASML

Public

Slide 22

16 April 2014

Product highlights

We shipped our fourth NXE:3300B EUV system to the fourth customer and recognized 1 EUV system in Q1 sales

Shipments of our TWINSCAN NXT:1970Ci immersion system continue to ramp, with 24 systems in the backlog at the end of Q1, underscoring the rapid customer adoption

We have expanded our TWINSCAN NXT portfolio to include the NXT:1965Ci, which will provide the optimum cost of ownership on a common platform and which will be upgradeable to the performance of the NXT:1970Ci and its successor

Adoption of YieldStar as well as the associated Holistic Lithography products is broadening in 20 nm logic manufacturing and is now also expanding to memory manufacturers

ASML