|

Exhibit 99.2

|

Public

ASML confirms full-year sales guidance, supported by solid backlog

ASML 2014 Third Quarter Results

Veldhoven, the Netherlands

October 15, 2014

Forward looking statements

Public

Slide 2

15 October 2014

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to our outlook, expected customer demand in specified market segments, expected sales levels and trends, systems backlog, IC unit demand, expected financial results, gross margin and expenses, expected shipment of tools, productivity of our tools and systems performance, including EUV system performance (such as endurance tests), the development of EUV technology and the number of EUV systems expected to be shipped and timing of shipments, dividend policy and intention to repurchase shares.

You can generally identify these statements by the use of words like “may”, “will”, “could”, “should”, “project”, “believe”, “anticipate”, “expect”, “plan”, “estimate”, “forecast”, “potential”, “intend”, “continue” and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers’ products, competitive products and pricing, the impact of manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products, the number and timing of EUV systems expected to be shipped, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, available cash, distributable reserves for dividend payments and share repurchases, risks associated with the Cymer acquisition and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

Public

Slide 3

15 October 2014

Agenda

Public

Slide 4

15 October 2014

Business summary

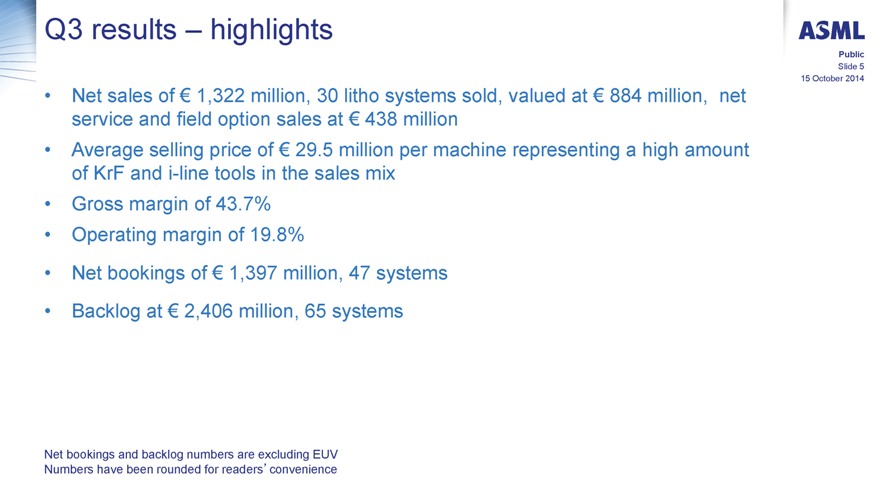

Q3 results – highlights

Public

Slide 5

15 October 2014

• | | Net sales of € 1,322 million, 30 litho systems sold, valued at € 884 million, net service and field option sales at € 438 million |

• | | Average selling price of € 29.5 million per machine representing a high amount of KrF and i-line tools in the sales mix |

• | | Operating margin of 19.8% |

• | | Net bookings of € 1,397 million, 47 systems |

• | | Backlog at € 2,406 million, 65 systems |

Net bookings and backlog numbers are excluding EUV Numbers have been rounded for readers’convenience

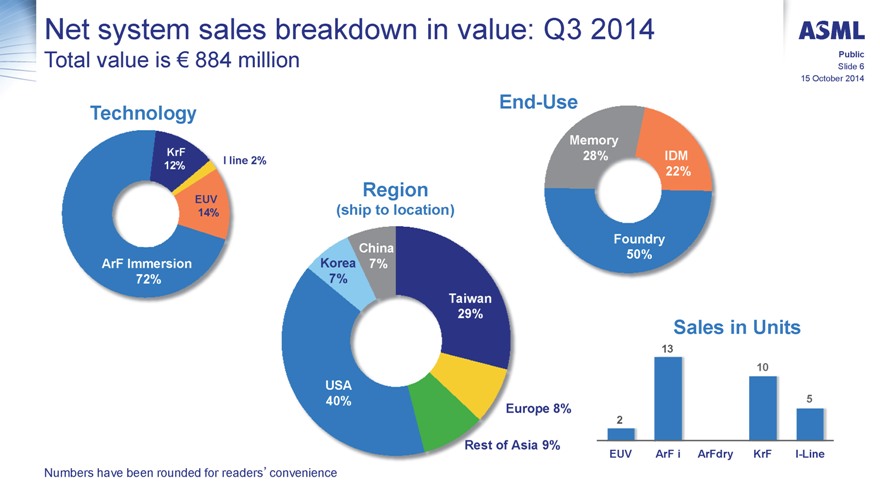

Net system sales breakdown in value: Q3 2014

Total value is € 884 million

Public

Slide 6

15 October 2014

Technology End-Use

Memory

KrF I line 2% 28% IDM

12% 22%

EUV Region

14%(ship to location)

Foundry

China 50%

ArF Immersion Korea 7%

72% 7%

Taiwan

29%

Sales in Units

USA

40% 5

Europe 8%

Rest of Asia 9%

EUV ArF i ArFdry KrF I-Line

Numbers have been rounded for readers’convenience

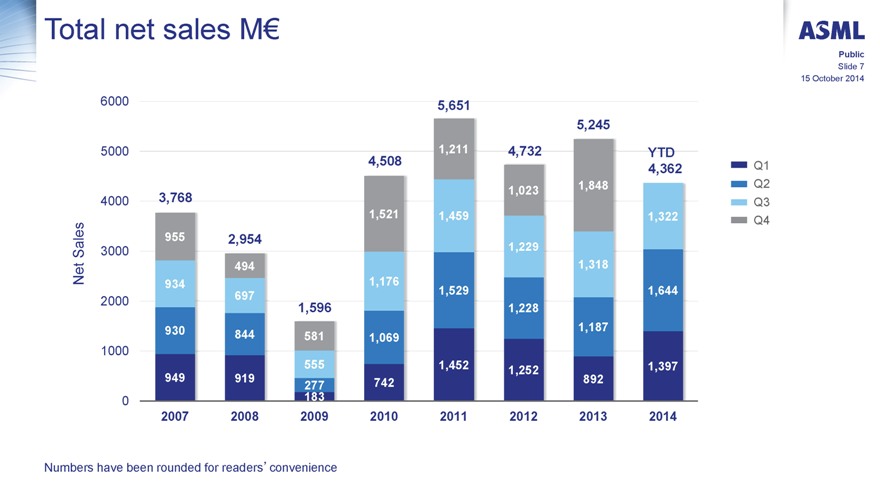

Total net sales M€

Public

Slide 7

15 October 2014

6000 5,651

5,245

5000 1,211 4,732 YTD

4,508 4,362 Q1

1,023 1,848 Q2

4000 3,768 Q3

1,521 1,459 1,322 Q4

ales 955 2,954

S 3000 1,229

494 1,318

Net 934 1,176

2000 697 1,529 1,644

1,596 1,228

930 844 581 1,069 1,187,

1000

555 1,452 1,252 1,397

949 919 277 742 892

0 183

2007 2008 2009 2010 2011 2012 2013 2014

Numbers have been rounded for readers’convenience

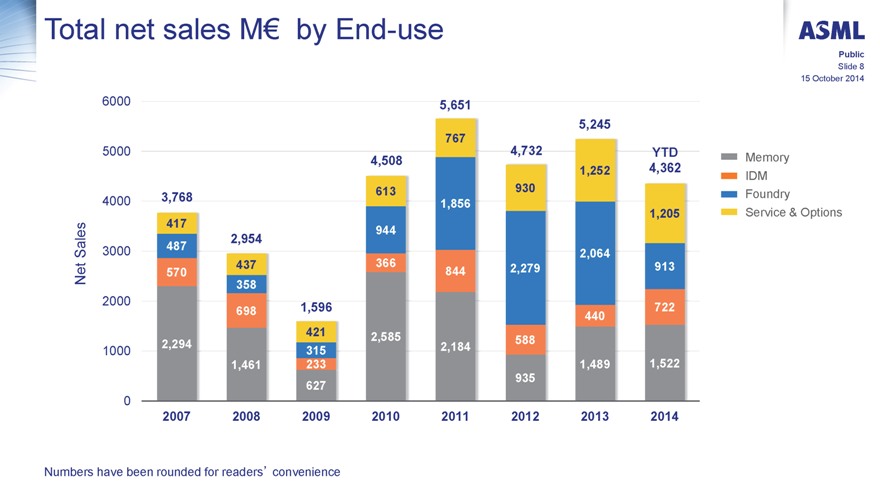

Total net sales M€ by End-use

Public

Slide 8

15 October 2014

15 October

6000 5,651

5,245

767

5000 4,732 YTD

4,508 Memory

1,252 4,362 IDM

4000 3,768 613 1,856 930 Foundry

1,205 Service & Options

417 944

ales 2,954

S 3000 487 2,064

570 437 366 844 2,279 913

Net 358

2000 698 1,596 722

440

421 2,585 588

1000 2,294 315 2,184

1,461 233 1,489 1,522

627 935

0

2007 2008 2009 2010 2011 2012 2013 2014

Numbers have been rounded for readers’convenience

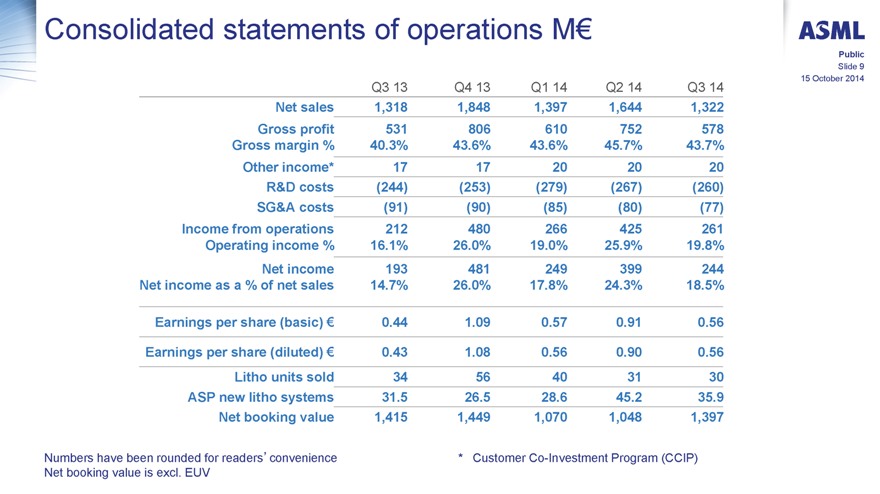

Consolidated statements of operations M€

Public

Slide 9

15 October 2014

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14

Net sales 1,318 1,848 1,397 1,644 1,322

Gross profit 531 806 610 752 578

Gross margin % 40.3% 43.6% 43.6% 45.7% 43.7%

Other income* 17 17 20 20 20

R&D costs (244) (253) (279) (267) (260)

SG&A costs (91) (90) (85) (80) (77)

Income from operations 212 480 266 425 261

Operating income % 16.1% 26.0% 19.0% 25.9% 19.8%

Net income 193 481 249 399 244

Net income as a % of net sales 14.7% 26.0% 17.8% 24.3% 18.5%

Earnings per share (basic) € 0.44 1.09 0.57 0.91 0.56

Earnings per share (diluted) € 0.43 1.08 0.56 0.90 0.56

Litho units sold 34 56 40 31 30

ASP new litho systems 31.5 26.5 28.6 45.2 35.9

Net booking value 1,415 1,449 1,070 1,048 1,397

Numbers have been rounded for readers’convenience Net booking value is excl. EUV

* | | Customer Co-Investment Program (CCIP) |

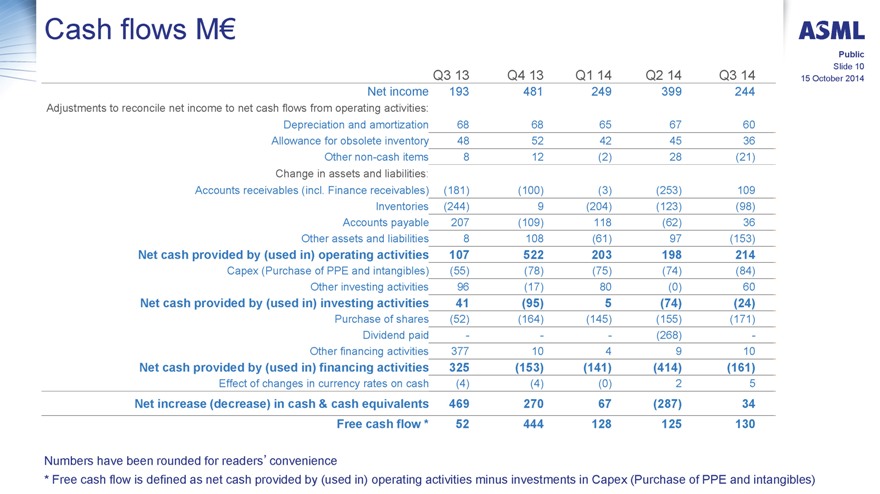

Cash flows M€

Public

Slide 10

15 October 2014

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14

Net income 193 481 249 399 244

Adjustments to reconcile net income to net cash flows from operating activities:

Depreciation and amortization 68 68 65 67 60

Allowance for obsolete inventory 48 52 42 45 36

Other non-cash items 8 12 (2) 28 (21)

Change in assets and liabilities:

Accounts receivables (incl. Finance receivables) (181) (100) (3) (253) 109

Inventories (244) 9 (204) (123) (98)

Accounts payable 207 (109) 118 (62) 36

Other assets and liabilities 8 108 (61) 97 (153)

Net cash provided by (used in) operating activities 107 522 203 198 214

Capex (Purchase of PPE and intangibles) (55) (78) (75) (74) (84)

Other investing activities 96 (17) 80 (0) 60

Net cash provided by (used in) investing activities 41 (95) 5 (74) (24)

Purchase of shares (52) (164) (145) (155) (171)

Dividend paid ——— (268) -

Other financing activities 377 10 4 9 10

Net cash provided by (used in) financing activities 325 (153) (141) (414) (161)

Effect of changes in currency rates on cash (4) (4) (0) 2 5

Net increase (decrease) in cash & cash equivalents 469 270 67 (287) 34

Free cash flow * 52 444 128 125 130

Numbers have been rounded for readers’convenience

* Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of PPE and intangibles)

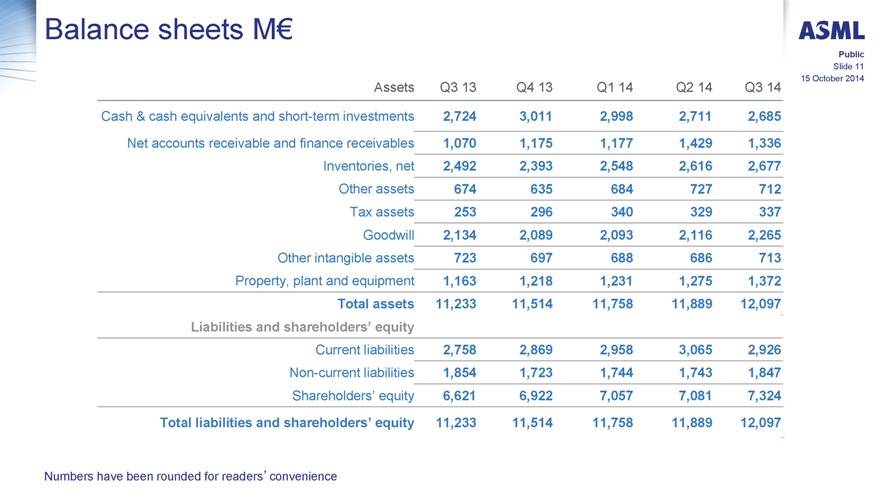

Balance sheets M€

Public

Slide 11

15 October 2014

Assets Q3 13 Q4 13 Q1 14 Q2 14 Q3 14

Cash & cash equivalents and short-term investments 2,724 3,011 2,998 2,711 2,685

Net accounts receivable and finance receivables 1,070 1,175 1,177 1,429 1,336

Inventories, net 2,492 2,393 2,548 2,616 2,677

Other assets 674 635 684 727 712

Tax assets 253 296 340 329 337

Goodwill 2,134 2,089 2,093 2,116 2,265

Other intangible assets 723 697 688 686 713

Property, plant and equipment 1,163 1,218 1,231 1,275 1,372

Total assets 11,233 11,514 11,758 11,889 12,097

Liabilities and shareholders’ equity

Current liabilities 2,758 2,869 2,958 3,065 2,926

Non-current liabilities 1,854 1,723 1,744 1,743 1,847

Shareholders’ equity 6,621 6,922 7,057 7,081 7,324

Total liabilities and shareholders’ equity 11,233 11,514 11,758 11,889 12,097

Numbers have been rounded for readers’convenience

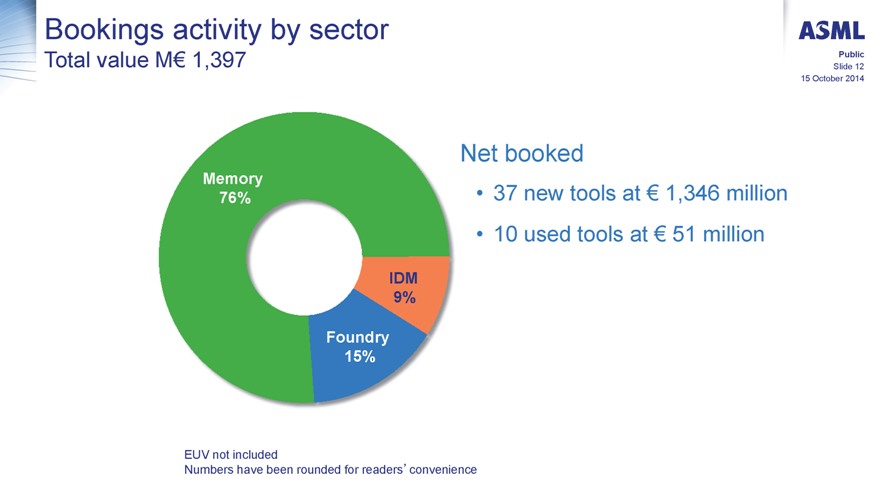

Bookings activity by sector

Total value M€ 1,397

Public

Slide 12

15 October 2014

Net booked

37 new tools at € 1,346 million

10 used tools at € 51 million

Memory 76%

IDM 9%

Foundry 15%EUV not included

Numbers have been rounded for readers’convenience

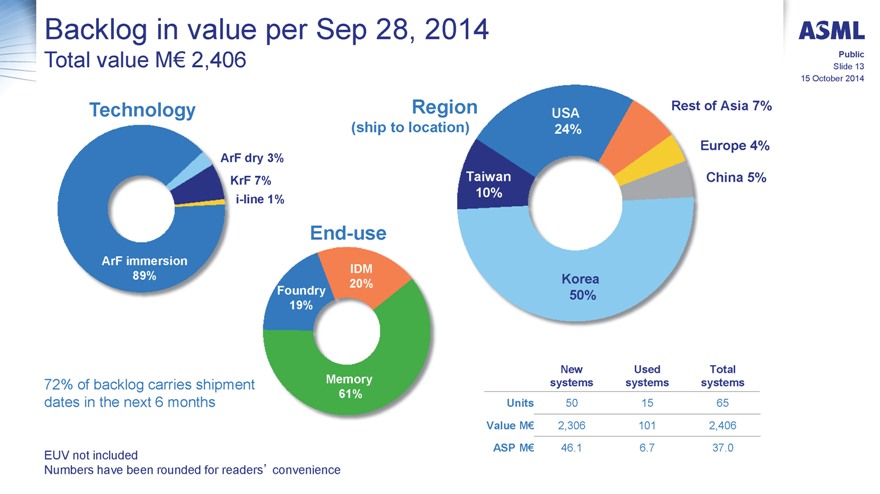

Backlog in value per Sep 28, 2014

Total value M€ 2,406

Public

Slide 13

15 October 2014

Technology Region USA Rest of Asia 7%

(ship to location) 24%

Europe 4%

ArF dry 3%

KrF 7% Taiwan China 5%

i-line 1% 10%

End-use

ArF immersion IDM

89% 20% Korea

Foundry 50%

19%

New Used Total

72% of backlog carries shipment Memory systems systems systems

61%

dates in the next 6 months Units 50 15 65

Value M€ 2,306 101 2,406

EUV not included ASP M€ 46.1 6.7 37.0

Numbers have been rounded for readers’ convenience

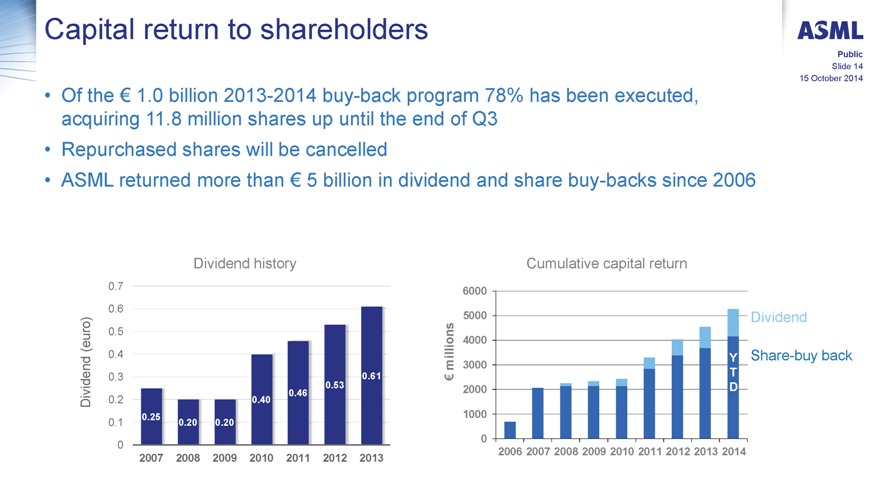

Capital return to shareholders

Of the € 1.0 billion 2013-2014 buy-back program 78% has been executed, acquiring 11.8 million shares up until the end of Q3

Repurchased shares will be cancelled

ASML returned more than € 5 billion in dividend and share buy-backs since 2006

Public

Slide 14

15 October 2014

Dividend history Cumulative capital return

0.7 6000

0.6

o) s 5000 Dividend

0.5

(eur 4000

0.4 Y Share-buy back

million 3000

0.3 0.61 € T

0.46 0.53 2000 D

Dividend 0.2 0.40

0.25 1000

0.1 0.20 0.20

0 0

2007 2008 2009 2010 2011 2012 2013 2006 2007 2008 2009 2010 2011 2012 2013 2014

Public

Slide 15

15 October 2014

Business environment

Business environment

Public

Slide 16

15 October 2014

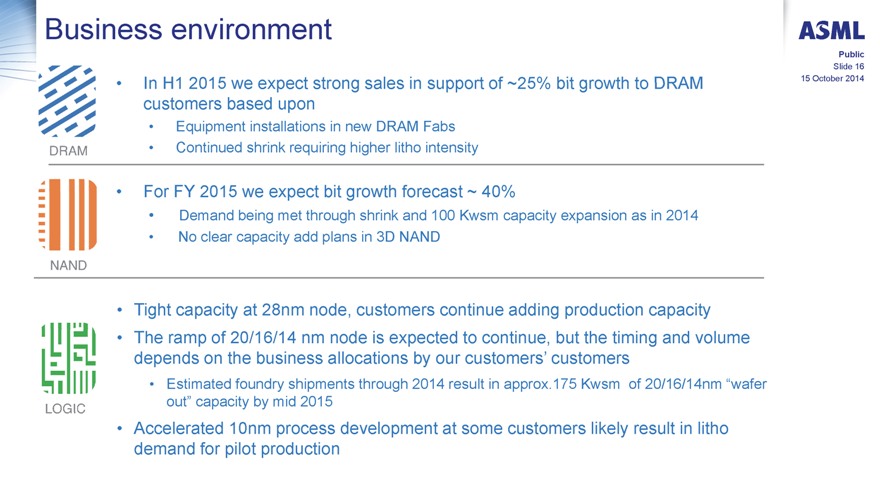

In H1 2015 we expect strong sales in support of ~25% bit growth to DRAM

customers based upon

Equipment installations in new DRAM Fabs

Continued shrink requiring higher litho intensity

For FY 2015 we expect bit growth forecast ~ 40%

Demand being met through shrink and 100 Kwsm capacity expansion as in 2014

No clear capacity add plans in 3D NAND

Tight capacity at 28nm node, customers continue adding production capacity

The ramp of 20/16/14 nm node is expected to continue, but the timing and volume

depends on the business allocations by our customers’ customers

Estimated foundry shipments through 2014 result in approx.175 Kwsm of 20/16/14nm “wafer

out” capacity by mid 2015

Accelerated 10nm process development at some customers likely result in litho

demand for pilot production

Public

Slide 17

15 October 2014

Outlook

Outlook

Public

Slide 18

15 October 2014

Q4 net sales around € 1.3 billion, including 1 EUV system

Gross margin around 43%, including EUV

R&D costs of about € 260 million

SG&A costs of about € 80 million

Other income (Customer Co-Investment Program) of about € 20 million

ASML expects full-year 2014 net sales of at least € 5.6 billion

Public

Slide 19

15 October 2014

ASML technology status

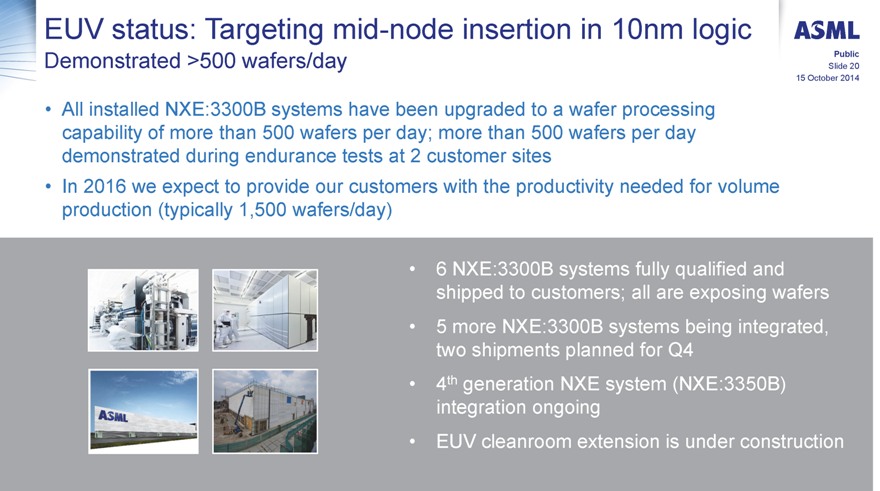

EUV status: Targeting mid-node insertion in 10nm logic

Demonstrated >500 wafers/day

All installed NXE:3300B systems have been upgraded to a wafer processing capability of more than 500 wafers per day; more than 500 wafers per day demonstrated during endurance tests at 2 customer sites

In 2016 we expect to provide our customers with the productivity needed for volume production (typically 1,500 wafers/day)

Public

Slide 20

15 October 2014

6 NXE:3300B systems fully qualified and shipped to customers; all are exposing wafers

5 more NXE:3300B systems being integrated, two shipments planned for Q4

4th generation NXE system (NXE:3350B) integration ongoing

EUV cleanroom extension is under construction

Wafers per day program: Progress in major areas

Public

Slide 21

15 October 2014

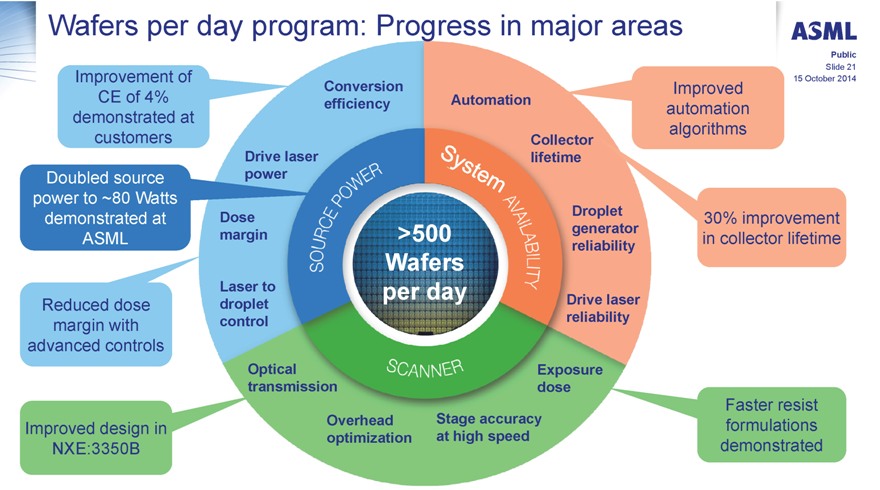

Improvement of

Conversion Improved

CE of 4% efficiency Automation automation

demonstrated at

customers Collector algorithms

Drive laser lifetime

Doubled source power

power to ~80 Watts

demonstrated at Dose Droplet 30% improvement

ASML margin >500 generator in collector lifetime

reliability

Wafers

Laser to per day

Reduced dose droplet Drive laser

margin with control reliability

advanced controls

Optical Exposure

transmission dose

Faster resist

Improved design in Overhead Stage accuracy formulations

optimization at high speed

NXE:3350B demonstrated

EUV towards production insertion

Public

Slide 22

15 October 2014

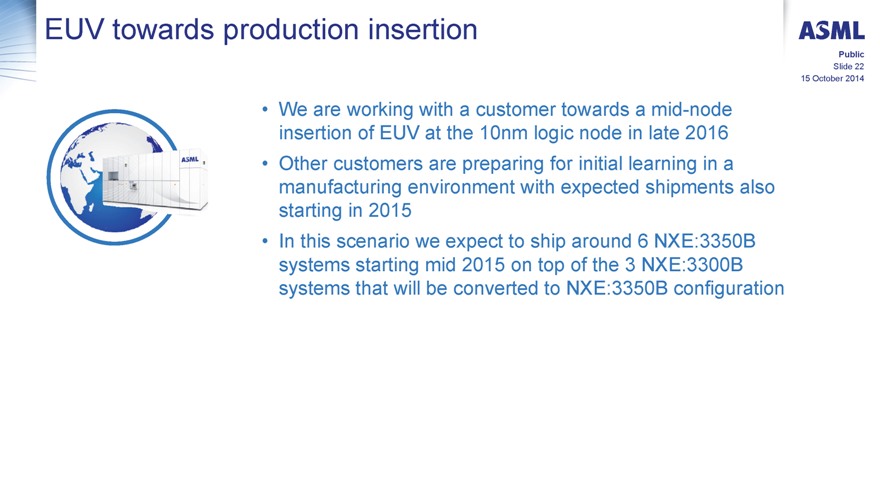

We are working with a customer towards a mid-node insertion of EUV at the 10nm logic node in late 2016

Other customers are preparing for initial learning in a manufacturing environment with expected shipments also starting in 2015

In this scenario we expect to ship around 6 NXE:3350B systems starting mid 2015 on top of the 3 NXE:3300B systems that will be converted to NXE:3350B configuration

EUV shipments and revenue recognition

Public

Slide 23

15 October 2014

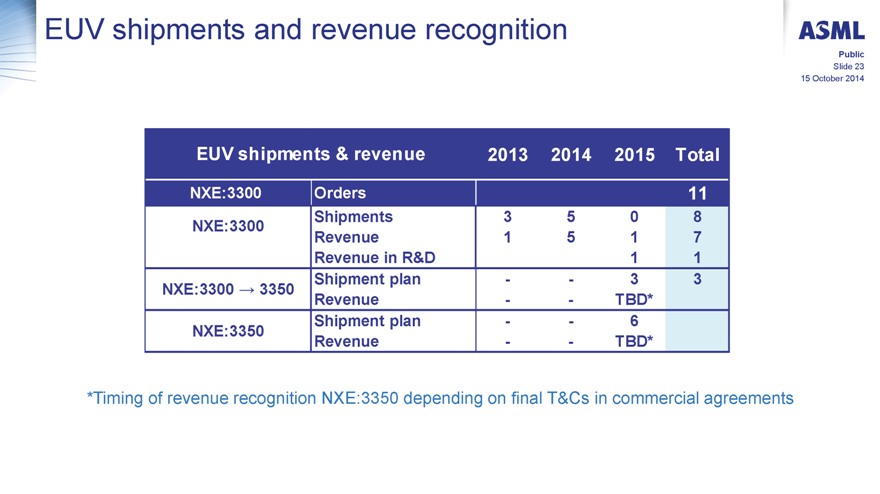

EUV shipments & revenue 2013 2014 2015 Total

NXE:3300 Orders 11

NXE:3300 Shipments 3 5 0 8

Revenue 1 5 1 7

Revenue in R&D 1 1

NXE:3300 ? 3350 Shipment plan — 3 3

Revenue — TBD*

Shipment plan — 6

NXE:3350 Revenue — TBD*

*Timing of revenue recognition NXE:3350 depending on final T&Cs in commercial agreements

Product highlights

Public

Slide 24

15 October 2014

We shipped 12 of our most advanced immersion lithography systems, the

TWINSCAN NXT:1970Ci, bringing the total to 42 and marking our fastest ramp of

any new major product and customer recognition of the value offered by the

scanner

A TWINSCAN system in operation at a memory manufacturer imaged more than

1.5 million wafers within one year, making it the second system to achieve that

milestone

With 11 shipments in Q3, the YieldStar 250D is now in operation at all key logic

and memory customers

Our integrated metrology solution, which substantially shortens metrology cycle

time and enhances manufacturing yield through feedback loops, was released to

high-volume manufacturing at a large foundry customer

ASML