Exhibit 99.2

Exhibit 99.2

ASML Annual General Meeting 2016 Veldhoven, the Netherlands, 29 April 2016

|

|

Forward looking statements (1) ASML Public Slide 2 29 April 2016 This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to our outlook, expected customer demand in specified market segments including DRAM and logic, expected trends, systems backlog, IC unit demand, expected or indicative financial results, opportunities or targets (including ASML’s financial model), including expected or potential sales, other income, gross margin, gross margin percentage, R&D and SG&A expense, effective tax rate, cash conversion cycle, capex as a percentage of sales, earnings per share, expected sales by end use and expected shipment of tools, productivity of our tools and systems performance, the continuation and affordability of Moore’s law, industry adoption of EUV, benefits of EUV, EUV system performance, targets and priorities(such as endurance tests, availability and demonstrated power source), expected industry trends, expected service sales and expected demand for holistic lithography products, system node enhancement packages and service maintenance revenues, the development of EUV and DUV technology and holistic lithography, expected and target shipments of EUV systems and the timing of shipments, our intention to return excess cash to shareholders through dividends and share buybacks, including our proposed dividend for 2014. You can generally identify these statements by the use of words like “may”, “will”, “could”, “should”, “project”, “believe”, “anticipate”, “expect”, “plan”, “estimate”, “forecast”, “potential”, “intend”, “continue” and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them.

|

|

Forward looking statements (2) ASML Public Slide 3 29 April 2016 Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers’ products, competitive products and pricing, affordability of shrink, the continuation of Moore’s Law, the impact of manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products, market demand for our existing products and for new products, our ability to meet overlay and patterning requirements, the number and timing of EUV systems expected to be shipped, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, EUV system performance and customer adoption, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash, distributable reserves for dividend payments and share repurchases, the risk that key assumptions underlying financial targets and opportunities prove inaccurate, and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

Agenda ASML Public Slide 4 29 April 2016 van de Jaarlijkse Algemene Vergadering van Aandeelhouders van ASML Holding N.V. (de “Vennootschap”), te houden op vrijdag 29 april 2016, om 14.00 uur in het Auditorium, ASML Gebouw 7, De Run 6665, Veldhoven 1. Opening 2. Overzicht van de activiteiten, inclusief de activiteiten op het gebied van maatschappelijk verantwoord ondernemen, en de financiële situatie van de Vennootschap (Discussiepunt)

ASML Public Slide 5 29 April 2016 Agenda ASML at a glance Technology highlights Business highlights Business environment and outlook Capital allocation

ASML Public Slide 6 29 April 2016 ASML at a glance

ASML Public Slide 7 29 April 2016 Vision Mission Corporate Priorities Vision ‘Why?’ Mission ‘What?’ Corporate Priorities ‘How?’

ASML Public Slide 8 29 April 2016 Vision (answering the “why” question) ASML makes possible affordable microelectronics that improve the quality of life

ASML Public Slide 9 29 April 2016 Mission (answering the “What” question) ASML invents, develops and manufactures advanced patterning technology for high-tech lithography, metrology and software solutions for the semiconductor industry. ASML’s guiding principle is continuing Moore’s Law towards ever smaller, cheaper, more powerful and energy-efficient semiconductors.

ASML Public Slide 10 29 April 2016 Corporate Priorities (answering the “How” question”): Five corporate priorities to execute the mission. MAKE IT WORK MAKE IT WELL MAKE IT TOGETHER MAKE IT WORTH IT MAKE US GROW

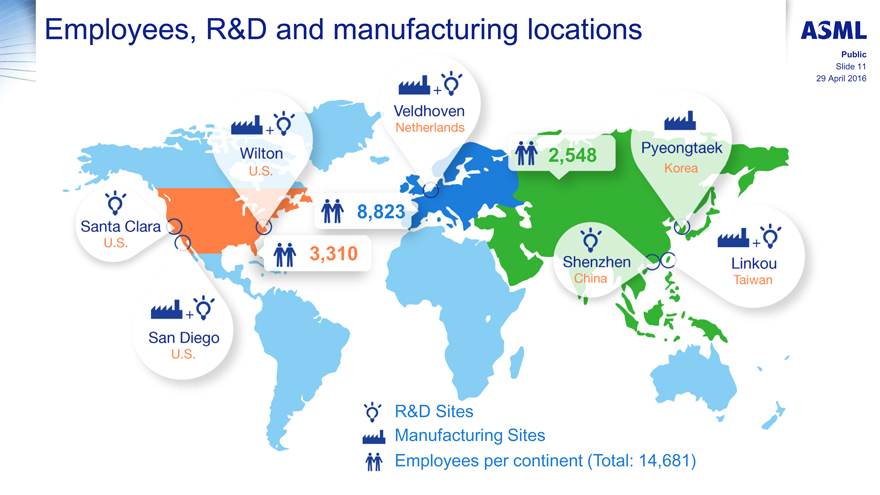

ASML Public Slide 11 29 April 2016 Employees, R&D and manufacturing locations R&D Sites Manufacturing Sites Employees per continent (Total: 14,681) Santa Clara U.S. San Diego U.S. Wilton U.S. 3,310 8,823 2,548 Pyeongtaek Korea Shenzhen China Linkou Taiwan Veldhoven Netherlands

ASML Public Slide 12 29 April 2016 Technology highlights

ASML Public Slide 13 29 April 2016 The three elements of ASML’s holistic shrink roadmap DUV and EUV will co-exist for a long time Extend DUV to support multiple patterning Introduce EUV to volume manufacturing Support both with a suite of process window enhancement, control and calibration products

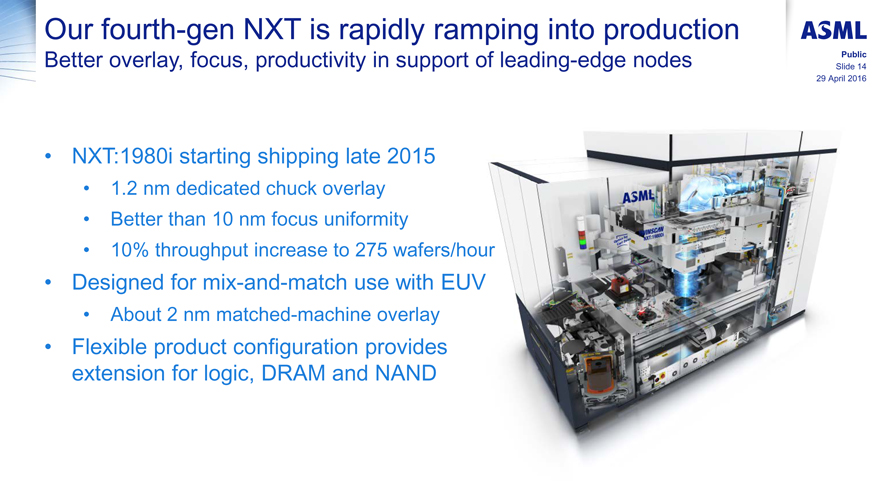

ASML Public Slide 14 29 April 2016 Our fourth-gen NXT is rapidly ramping into production Better overlay, focus, productivity in support of leading-edge nodes NXT:1980i starting shipping late 2015 1.2 nm dedicated chuck overlay Better than 10 nm focus uniformity 10% throughput increase to 275 wafers/hour Designed for mix-and-match use with EUV About 2 nm matched-machine overlay Flexible product configuration provides extension for logic, DRAM and NAND

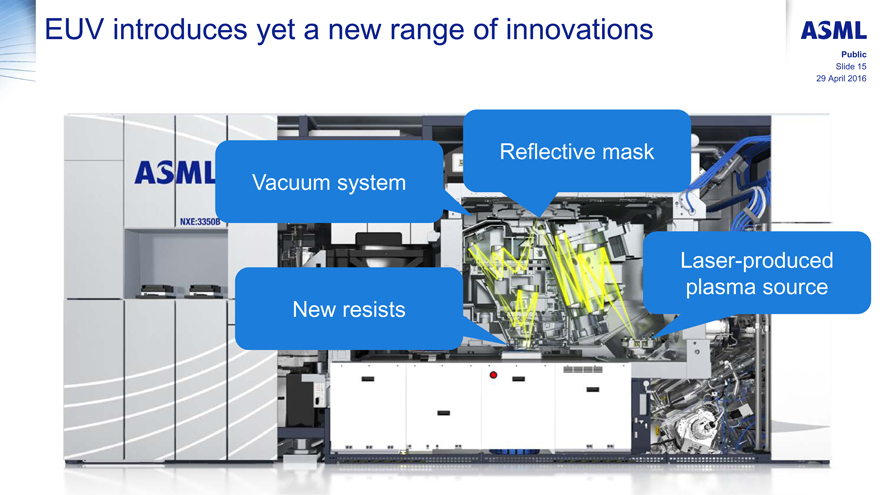

ASML Public Slide 15 29 April 2016 EUV introduces yet a new range of innovations Vacuum system Reflective mask New resists Laser-produced plasma source NXE:3350B

ASML Public Slide 16 29 April 2016 EUV is being prepared for high volume production Customer expressed increased confidence at SPIE Advanced Lithography MIT Technology Review JOURNAL Electronic Engineering HOME DESIGN MARKETS/INDUSTRIES ON DEMAND ARCHIVES COMM Feature Article March 28, 2016 EUV Becomes an Answer Instead of a Question Dramatic Mood Change at SPIE Advanced Litho by Bryon Moyer Computing Moore’s Law’s Ultraviolet Savior Is Finally Ready

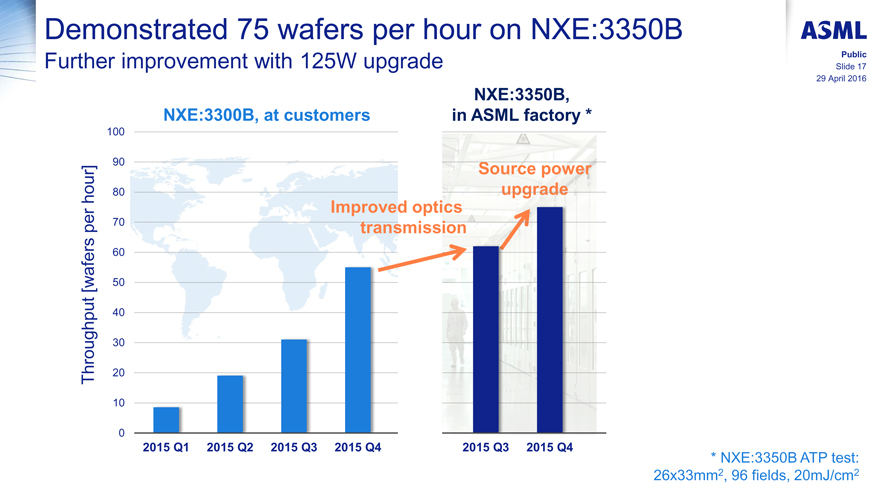

ASML Public Slide 17 29 April 2016 Demonstrated 75 wafers per hour on NXE:3350B Further improvement with 125W upgrade NXE:3300B, at customers NXE:3350B, in ASML factory * Improved optics transmission Source power upgrade 100 90 80 70 60 50 40 30 20 10 0 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q3 2015 Q4 * NXE:3350B ATP test: 26x33mm2, 96 fields, 20mJ/cm2 Throughput [wafers per hour]

|

|

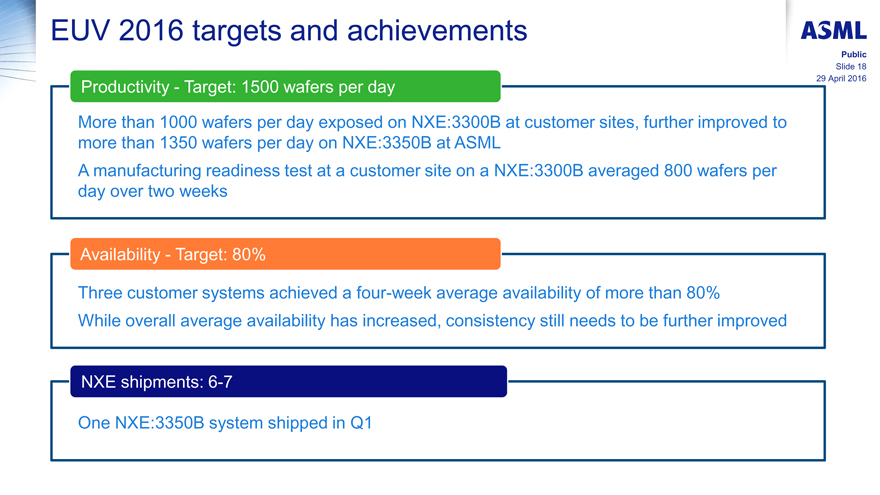

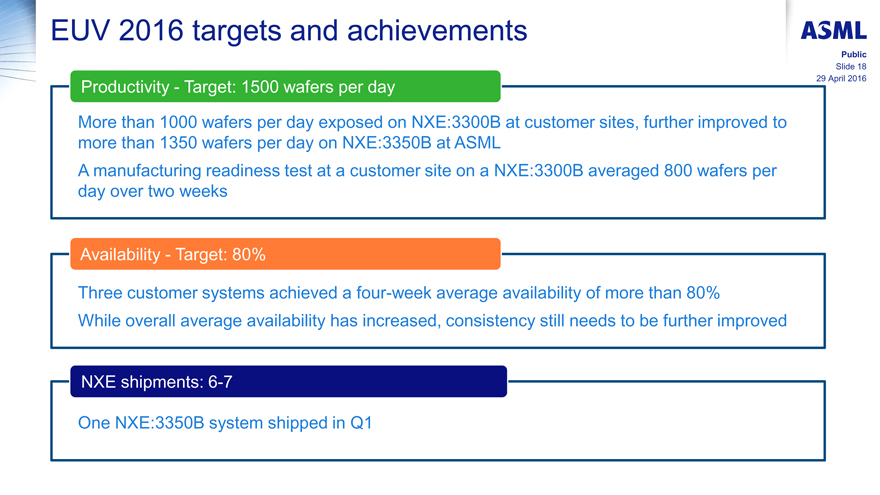

ASML Public Slide 18 29 April 2016 EUV 2016 targets and achievements Productivity - Target: 1500 wafers per day More than 1000 wafers per day exposed on NXE:3300B at customer sites, further improved to more than 1350 wafers per day on NXE:3350B at ASML A manufacturing readiness test at a customer site on a NXE:3300B averaged 800 wafers per day over two weeks Availability - Target: 80% Three customer systems achieved a four-week average availability of more than 80% While overall average availability has increased, consistency still needs to be further improved NXE shipments: 6-7 One NXE:3350B system shipped in Q1

ASML Public Slide 19 29 April 2016 Business highlights

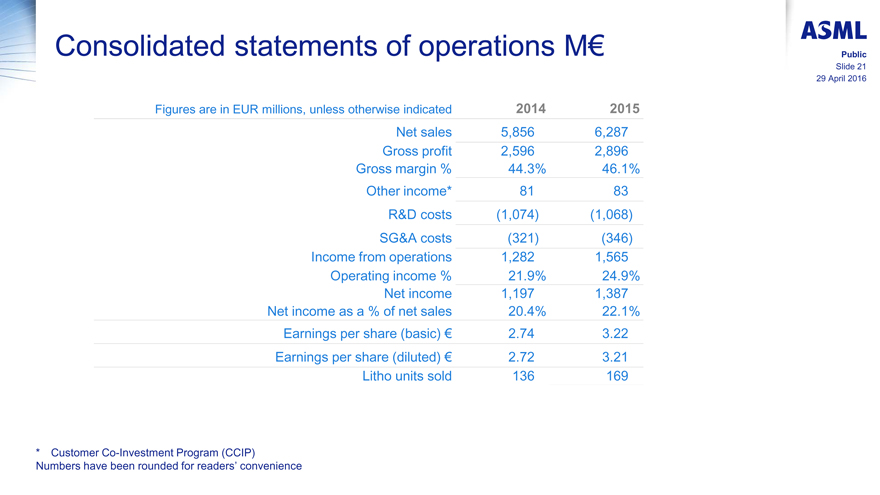

ASML Public Slide 20 29 April 2016 2015 - highlights Record net sales of € 6.3 billion, including record Service and Options sales of € 2 billion, gross margin 46.1%, net income € 1.4 billion and EPS € 3.22 EUV: we met our 2015 productivity and availability targets and successfully started shipping NXE:3350B, our 4th generation EUV system DUV: successful ramping our TWINSCAN NXT:1980, our next generation immersion system, shipped 7 systems Holistic litho: continued adoption of these products with all our major customers Capital return: returned € 867 million cash to shareholders through combined dividend and share buyback

|

|

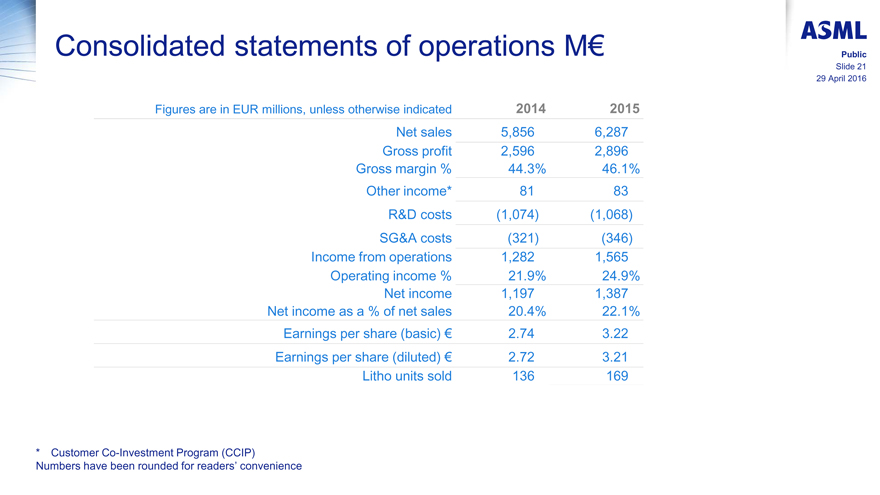

ASML Public Slide 21 29 April 2016 Consolidated statements of operations M€ Figures are in EUR millions, unless otherwise indicated Net sales Gross profit Gross margin % Other income* R&D costs SG&A costs Income from operations Operating income % Net income Net income as a % of net sales Earnings per share (basic) € Earnings per share (diluted) € Litho units sold 2014 5,856 2,596 44.3% 81 (1,074) (321) 1,282 21.9% 1,197 20.4% 2.74 2.72 136 2015 6,287 2,896 46.1% 83 (1,068) (346) 1,565 24.9% 1,387 22.1% 3.22 3.21 169 * Customer Co-Investment Program (CCIP) Numbers have been rounded for readers’ convenience

|

|

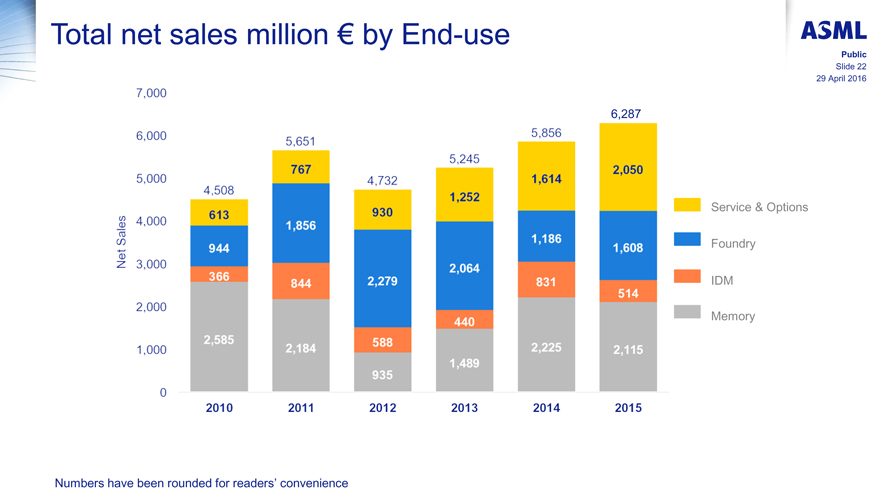

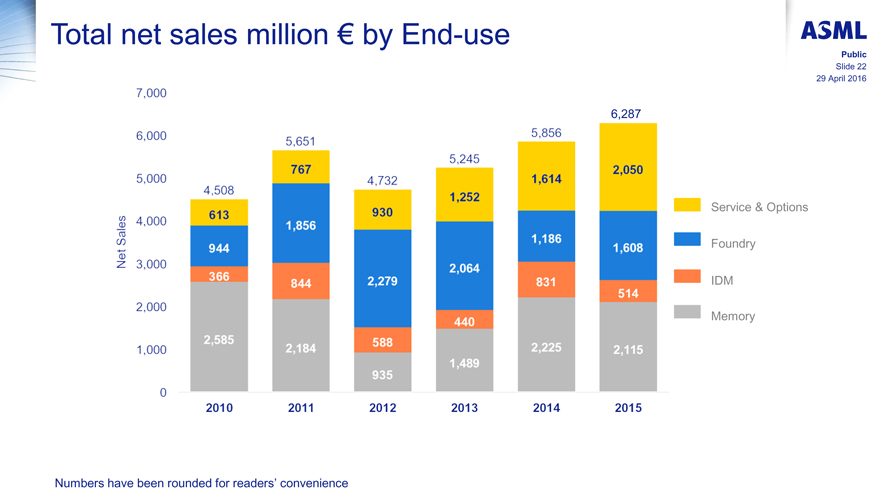

ASML Public Slide 22 29 April 2016 Total net sales million € by End-use Service & Options Foundry IDM Memory Net Sales 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 4,508 613 944 366 2,585 2010 5,651 767 1,856 844 2,184 2011 4,732 930 2,279 588 935 2012 5,245 1,252 2,064 440 1,489 2013 5,856 1,614 1,186 831 2,225 2014 6,287 2,050 1,608 514 2,115 2015 Numbers have been rounded for readers’ convenience

ASML Public Slide 23 29 April 2016 2015 Net system sales breakdown in value Technology Region (ship to location) KrF 18% ArF dry 2% i-line 2% EUV 2% ArF Immersion 76% China 9% Taiwan 29% Korea 31% Japan 11% USA 17% Europe 2% Rest of Asia 1% Sales in Units 74 67 18 1 9 EUV ArF i ArFdry KrF I-Line Numbers have been rounded for readers’convenience

ASML Public Slide 24 29 April 2016 Q1 2016 results summary Q1 sales in line with our guidance Net sales of € 1,333 million, 33 litho systems sold, valued at € 856 million, net service and field option sales at € 477 million Average selling price of € 25.9 million per system Gross margin of 42.6% Operating margin of 17.1% Net bookings of € 835 million Backlog at € 3,018 million Numbers have been rounded for readers’ convenience

|

|

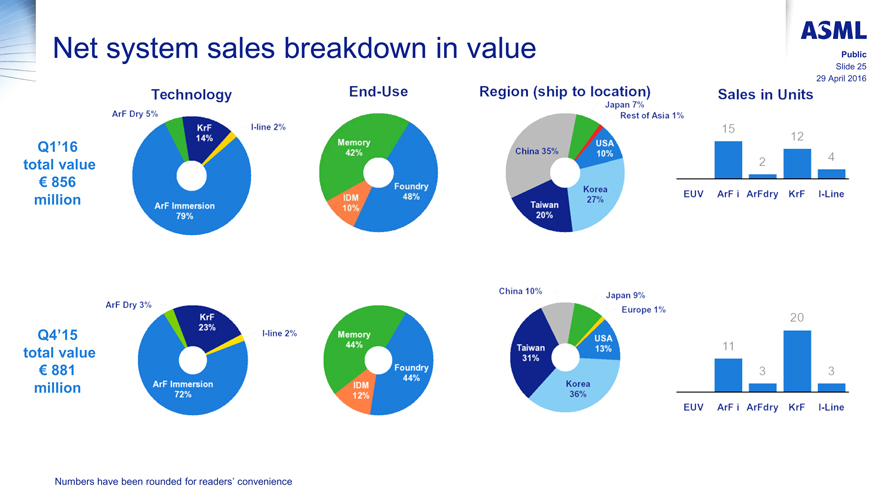

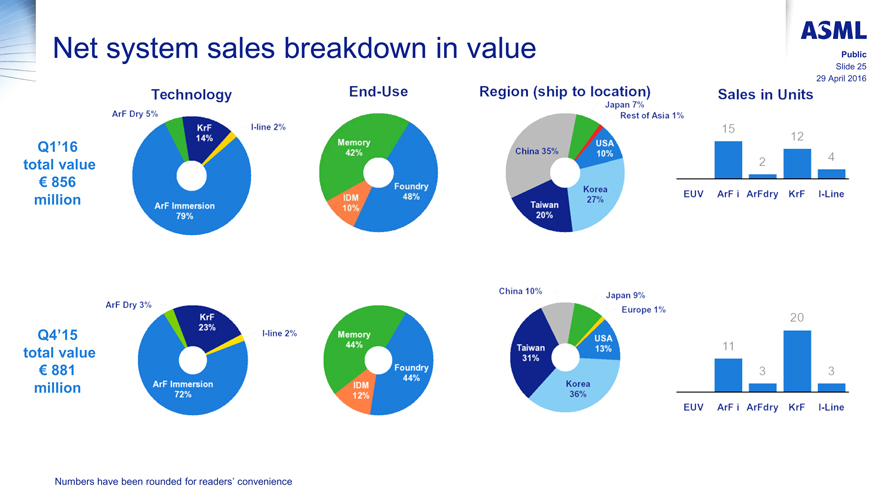

ASML Public Slide 25 29 April 2016 Net system sales breakdown in value Q1’16 total value € 856 million Q4’15 total value € 881 million Numbers have been rounded for readers’ convenience Technology ArF DRY 5% I-line 2% KrF 14% ArF Immersion 79% End-Use Memory 42% Foundry 48% IDM 10% China 35% USA 10% Korea 27% Taiwan 20% Region (ship to location) Japan 7% Rest of Asia 1% ArF DRY 3% I-line 2% KrF 23% ArF Immersion 72% Memory 44% Foundry 44% IDM 12% China 10% USA 13% Korea 36% Taiwan 31% Japan 9% Europe 1% Sales in Units 15 2 12 4 EUV ArF i ArFdry KrF I-Line 11 3 20 3 EUV ArF i ArFdry KrF I-Line

|

|

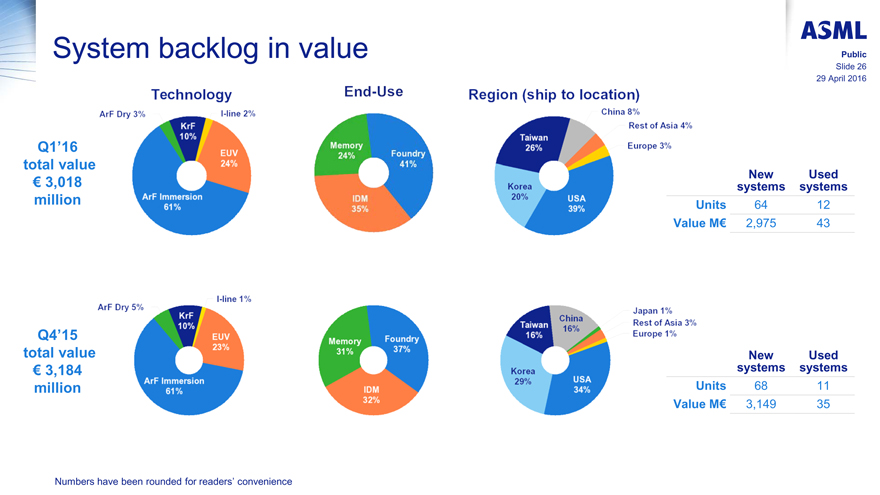

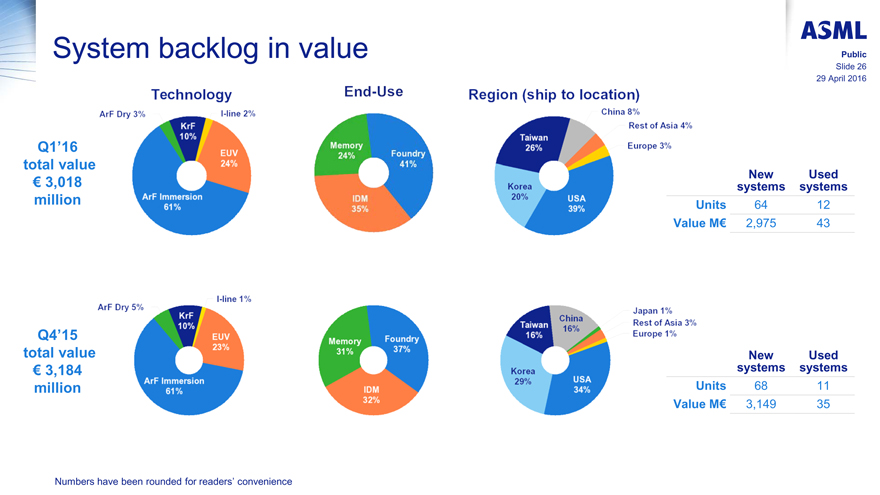

ASML Public Slide 26 29 April 2016 System backlog in value Q1’16 total value € 3,018 million Q4’15 total value € 3,184 million Numbers have been rounded for readers’ convenience New systems Used systems Units 64 12 Value M€ 2,975 43 New systems Used systems Units 68 11 Value M€ 3,149 35 Technology ArF DRY 3% I-line 2% KrF 10% EUV 24% ArF Immersion 61% End-Use Memory 24% Foundry 41% IDM 35% China 8% USA 39% Korea 20% Taiwan 26% Region (ship to location) Rest of Asia 4% Europe 3% ArF DRY 5% I-line 1% KrF 10% EUV 23% ArF Immersion 61% Memory 31% Foundry 37% IDM 32% China 16% USA 34% Korea 29% Taiwan 16% Japan 1% Europe 1% Rest of Asia 3%

|

|

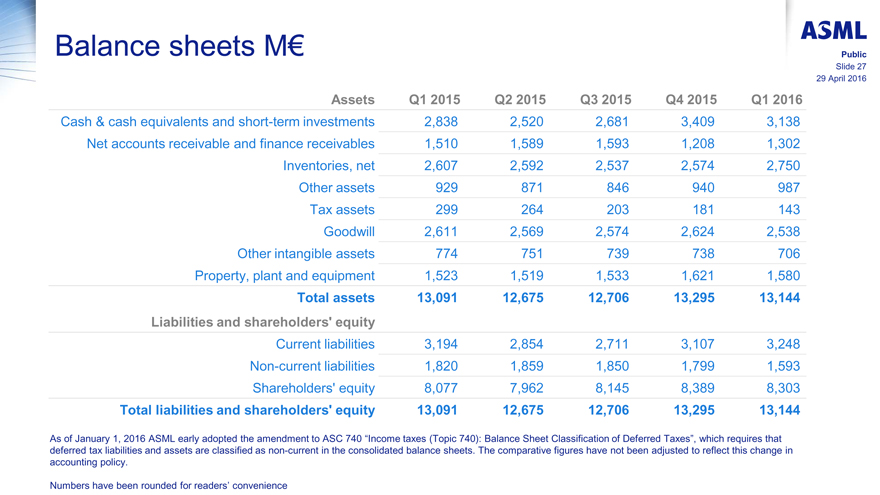

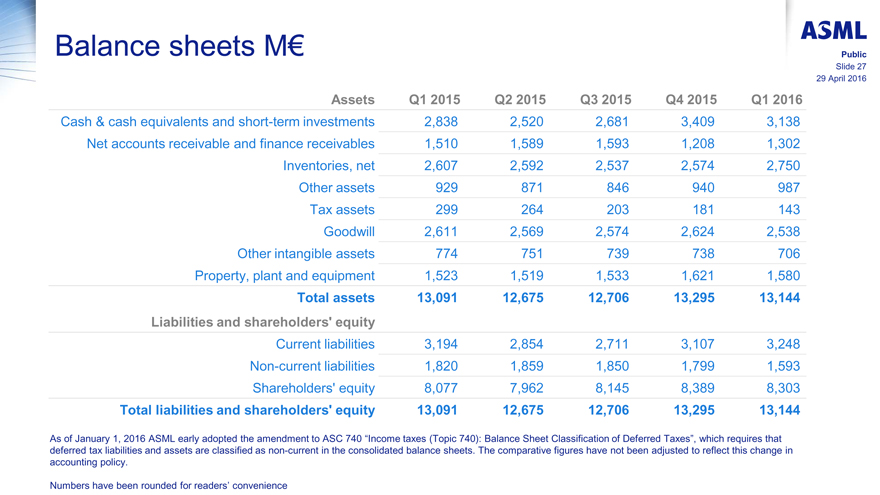

ASML Public Slide 27 29 April 2016 Balance sheets M€ Assets Cash & cash equivalents and short-term investments Net accounts receivable and finance receivables Inventories, net Other assets Tax assets Goodwill Other intangible assets Property, plant and equipment Total assets Liabilities and shareholders’ equity Current liabilities Non-current liabilities Shareholders’ equity Total liabilities and shareholders’ equity Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 2,838 2,520 2,681 3,409 3,138 1,510 1,589 1,593 1,208 1,302 2,607 2,592 2,537 2,574 2,750 929 871 846 940 987 299 264 203 181 143 2,611 2,569 2,574 2,624 2,538 774 751 739 738 706 1,523 1,519 1,533 1,621 1,580 13,091 12,675 12,706 13,295 13,144 3,194 2,854 2,711 3,107 3,248 1,820 1,859 1,850 1,799 1,593 8,077 7,962 8,145 8,389 8,303 13,091 12,675 12,706 13,295 13,144 As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting policy. Numbers have been rounded for readers’ convenience

|

|

ASML Public Slide 28 29 April 2016 Business Environment and Outlook

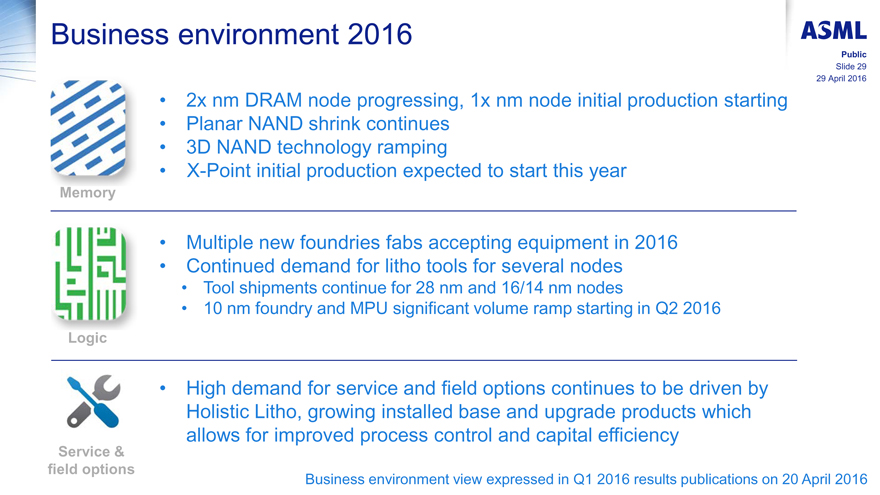

ASML Public Slide 29 29 April 2016 Business environment 2016 2x nm DRAM node progressing, 1x nm node initial production starting Planar NAND shrink continues 3D NAND technology ramping X-Point initial production expected to start this year Multiple new foundries fabs accepting equipment in 2016 Continued demand for litho tools for several nodes Tool shipments continue for 28 nm and 16/14 nm nodes 10 nm foundry and MPU significant volume ramp starting in Q2 2016 High demand for service and field options continues to be driven by Holistic Litho, growing installed base and upgrade products which allows for improved process control and capital efficiency Business environment view expressed in Q1 2016 results publications on 20 April 2016 Service & field options Logic Memory

|

|

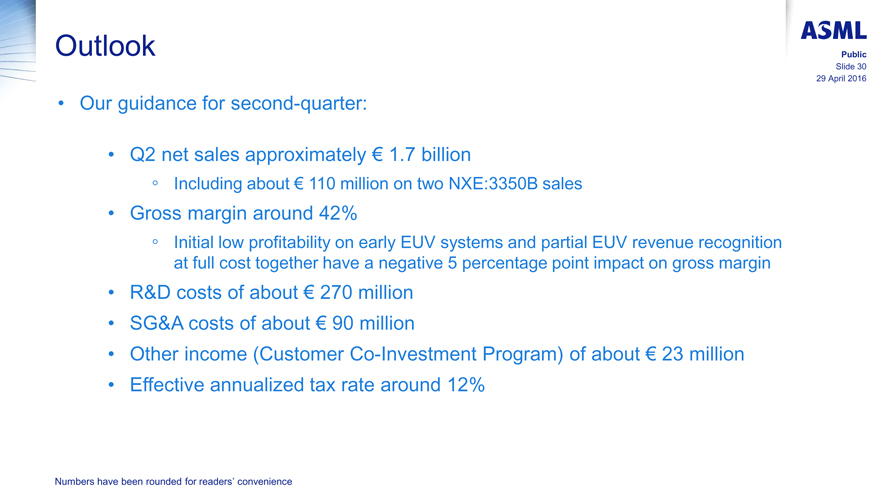

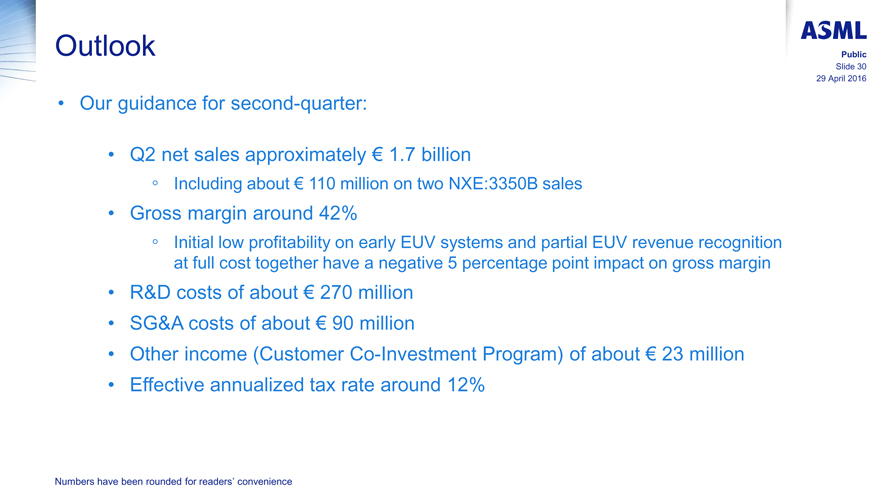

ASML Public Slide 30 29 April 2016 Outlook Our guidance for second-quarter: Q2 net sales approximately € 1.7 billion Including about € 110 million on two NXE:3350B sales Gross margin around 42% Initial low profitability on early EUV systems and partial EUV revenue recognition at full cost together have a negative 5 percentage point impact on gross margin R&D costs of about € 270 million SG&A costs of about € 90 million Other income (Customer Co-Investment Program) of about € 23 million Effective annualized tax rate around 12% Numbers have been rounded for readers’ convenience

|

|

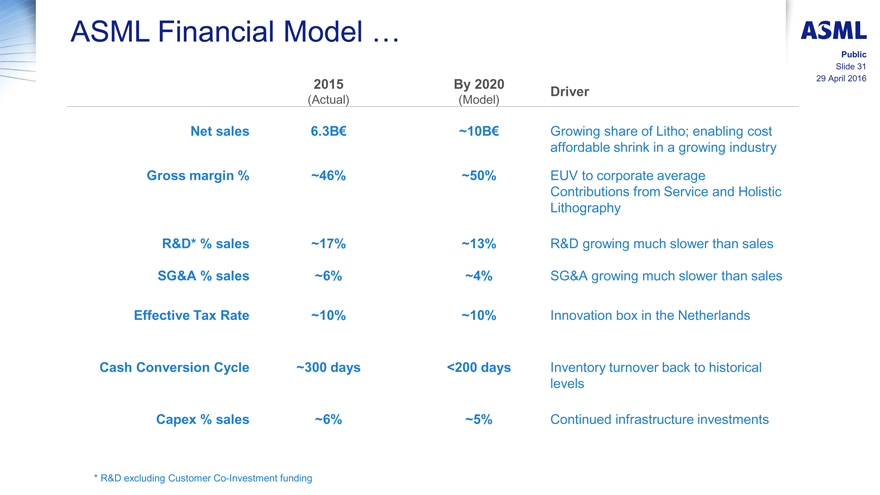

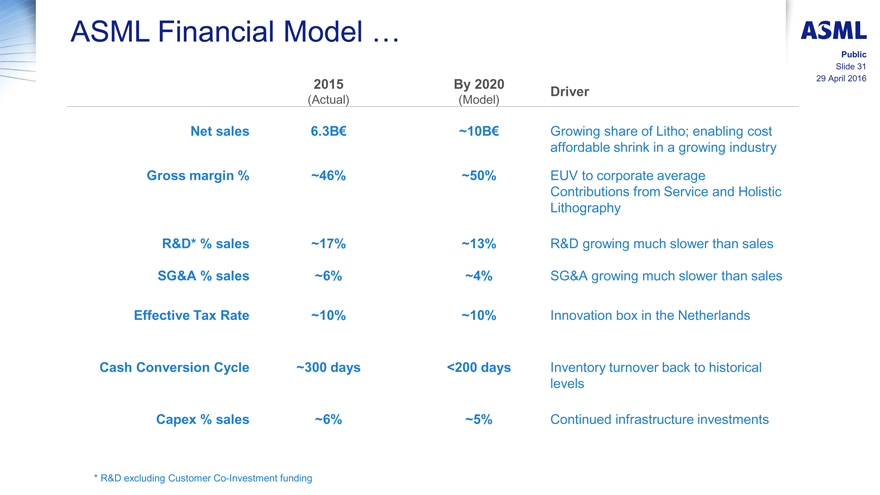

ASML Public Slide 31 29 April 2016 ASML Financial Model … Net sales Gross margin % R&D* % sales SG&A % sales Effective Tax Rate Cash Conversion Cycle Capex % sales 2015 (Actual) 6.3B€ ~46% ~17% ~6% ~10% ~300 days ~6% By 2020 (Model) ~10B€ ~50% ~13% ~4% ~10% <200 days ~5% Driver Growing share of Litho; enabling cost affordable shrink in a growing industry EUV to corporate average Contributions from Service and Holistic Lithography R&D growing much slower than sales SG&A growing much slower than sales Innovation box in the Netherlands Inventory turnover back to historical levels Continued infrastructure investments * R&D excluding Customer Co-Investment funding

ASML Public Slide 32 29 April 2016 Capital Returns

ASML Public Slide 33 29 April 2016 Capital return to shareholders Paid € 302 million in dividend and purchased € 565 million worth of our own shares in 2015 In January 2016 we announced a new plan for a share buyback program of € 1.5 billion over 2016/2017, which includes approx. € 500 million remaining of our prior program Purchased € 223 million worth of our own shares in 2016, through April 3 Proposed dividend increase to € 1.05 per ordinary share Dividend Share buyback The dividend for a year is paid in the subsequent year Numbers have been rounded for readers’ convenience proposed YTD Divided history Cumulative capital return Dividend (euro) € million 1.2 1.0 0.8 0.6 0.4 0.2 0.0 2008 2009 2010 2011 2012 2013 2014 2015 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 2008 2009 2010 2011 2012 2013 2014 2015 2016

|

|

ASML Public Slide 34 29 April 2016 Summarizing our investor key messages Shrink is the key industry driver supporting innovation and providing long term industry growth Moore’s Law will continue and be affordable Lithography enables affordable shrink and therefore delivers compelling value for our customers ASML’s strategy of large R&D investments in lithography product roadmaps supports future industry needs DUV product improvement roadmaps and Holistic Litho enable multi-pass immersion patterning today, with Holistic Litho supporting EUV in the future. These highly differentiated products provide unique value drivers for us and our customers EUV faces new technology introduction challenges but its adoption is now a matter of WHEN not IF. EUV will continue to enable Moore’s Law and will drive long term value for ASML ASML models an annual revenue opportunity of €10 billion by 2020 and given the significant leverage in our financial model this will allow a potential tripling of EPS by the end of this decade, compared to calendar year 2014, thereby creating significant value for all stakeholders We expect to continue to return excess cash to our shareholders through dividends that are stable or growing and regularly timed share buybacks in line with our policy

|

|

ASML

ASML Public Slide 36 29 April 2016 Agenda Proefstemming “ASML zou vitaminedrankjes moeten aanbieden op de borrel na de aandeelhoudersvergadering.”

ASML Public Slide 37 29 April 2016 Agenda 3. Bespreking van de implementatie van het beloningsbeleid van de Vennootschap (Discussiepunt)

|

|

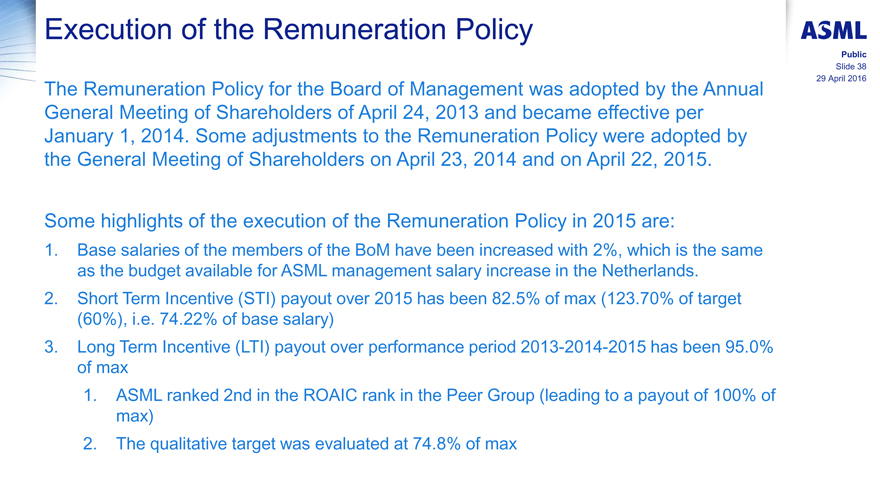

ASML Public Slide 38 29 April 2016 Execution of the Remuneration Policy The Remuneration Policy for the Board of Management was adopted by the Annual General Meeting of Shareholders of April 24, 2013 and became effective per January 1, 2014. Some adjustments to the Remuneration Policy were adopted by the General Meeting of Shareholders on April 23, 2014 and on April 22, 2015. Some highlights of the execution of the Remuneration Policy in 2015 are: 1. Base salaries of the members of the BoM have been increased with 2%, which is the same as the budget available for ASML management salary increase in the Netherlands. 2. Short Term Incentive (STI) payout over 2015 has been 82.5% of max (123.70% of target (60%), i.e. 74.22% of base salary) 3. Long Term Incentive (LTI) payout over performance period 2013-2014-2015 has been 95.0% of max 1. ASML ranked 2nd in the ROAIC rank in the Peer Group (leading to a payout of 100% of max) 2. The qualitative target was evaluated at 74.8% of max

|

|

ASML Public Slide 39 29 April 2016 Agenda 3. Bespreking van de implementatie van het beloningsbeleid van de Vennootschap (Discussiepunt)

ASML Public Slide 40 29 April 2016 Agenda 4. Voorstel tot vaststelling van de overeenkomstig de Nederlandse wet opgestelde jaarrekening over het boekjaar 2015 (Stempunt)

ASML Public Slide 41 29 April 2016 Agenda 5. Voorstel tot verlening van decharge aan de leden van de Directie voor de uitoefening van hun functie in het boekjaar 2015 (Stempunt)

ASML Public Slide 42 29 April 2016 Agenda 6. Voorstel tot verlening van decharge aan de leden van de Raad van Commissarissen voor de uitoefening van hun functie in het boekjaar 2015 (Stempunt)

ASML Public Slide 43 29 April 2016 Agenda 7. Toelichting op het reserverings- en dividendbeleid van de Vennootschap (Discussiepunt)

ASML Public Slide 44 29 April 2016 Agenda 8. Voorstel tot vaststelling van een dividend van EUR 1,05 per gewoon aandeel (Stempunt)

ASML Public Slide 45 29 April 2016 Agenda 9. Voorstel tot goedkeuring van het aantal aandelen toe te kennen aan de Directie (Stempunt)

ASML Public Slide 46 29 April 2016 Agenda 10. Voorstel tot goedkeuring van het aantal opties en/of aandelen toe te kennen aan werknemers (Stempunt)

ASML Public Slide 47 29 April 2016 Agenda 11. Samenstelling van de Raad van Commissarissen (Discussiepunt)

ASML Public Slide 48 29 April 2016 Agenda 12. Voorstel tot benoeming van KPMG als externe accountant voor het rapportagejaar 2017 (Stempunt)

ASML Public Slide 49 29 April 2016 Agenda 13. Voorstellen om de Directie aan te wijzen als het orgaan dat bevoegd is tot uitgifte van gewone aandelen of tot toekenning van rechten tot het verwerven van gewone aandelen, alsmede tot het beperken of uitsluiten van het aan de aandeelhouders toekomende voorkeursrecht (Stempunten)

ASML Public Slide 50 29 April 2016 Agenda 13a. Aanwijzing tot uitgifte van gewone aandelen of tot toekenning van rechten tot het verwerven van gewone aandelen (5%) (Stempunt)

ASML Public Slide 51 29 April 2016 Agenda 13b. Aanwijzing tot het beperken of uitsluiten van voorkeursrechten (Stempunt)

ASML Public Slide 52 29 April 2016 Agenda 13c. Aanwijzing tot uitgifte van gewone aandelen of tot toekenning van rechten tot het verwerven van gewone aandelen in verband met of ter gelegenheid van fusies, acquisities en/of (strategische) allianties (5%) (Stempunt)

ASML Public Slide 53 29 April 2016 Agenda 13d. Aanwijzing tot het beperken of uitsluiten van voorkeursrechten (Stempunt)

ASML Public Slide 54 29 April 2016 Agenda 14. Voorstellen om de Directie te machtigen om gewone aandelen te verwerven (Stempunten)

ASML Public Slide 55 29 April 2016 Agenda 14a. Machtiging om gewone aandelen in te kopen tot een maximum van 10% van het geplaatste kapitaal (Stempunt)

ASML Public Slide 56 29 April 2016 Agenda 14b. Machtiging om additioneel gewone aandelen in te kopen tot een maximum van 10% van het geplaatste kapitaal (Stempunt)

ASML Public Slide 57 29 April 2016 Agenda 15. Voorstel tot intrekking van gewone aandelen (Stempunt)

ASML Public Slide 58 29 April 2016 Agenda 16. Rondvraag 17. Sluiting

ASML