Q3 2005 Results

October 12, 2005

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

document may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

Agenda

Accomplishments Q3 2005

Financial summary

Q4 outlook

Company focus

First glance at 2006

/ Slide 3

Accomplishments Q3 2005

/ Slide 4

Financial accomplishments Q3 2005

Solid execution in a light shipment quarter

Revenue of € 533 million

Shipped 39 systems (28 new systems)

Net profit of € 48 million

Gross margin 37%

Operating profit 13%

Cash generation of € 156 million

/ Slide 5

Technology/market accomplishments Q3 2005

Technology

Continued strong ramp of TWINSCANTM XT:1400 for 65-nm

volume manufacturing as we shipped 28 units in 9 months,

strengthening our leadership position in ArF

Significant progress in immersion technology as we delivered 9

units to date and have 10 systems in backlog

First orders taken for new non-critical layer i-line and KrF tools

Market

Strengthened our position in the Memory/Flash sector through

strong shipments, bookings and significant evaluation orders

from new customers

First immersion tool in Japan ordered by a fifth customer

/ Slide 6

Financial summary

/ Slide 7

Total revenues M€

2673

1589

1959

318

1180

830

179

0

500

1000

1500

2000

2500

3000

2000

2001

2002

2003

759

609

351

820

H2

H1

Q1

Q2

Q3

Q4

1493

329

370

526

1543

2004

453

616

2465

785

2005

685

763

1981

611

533

/ Slide 8

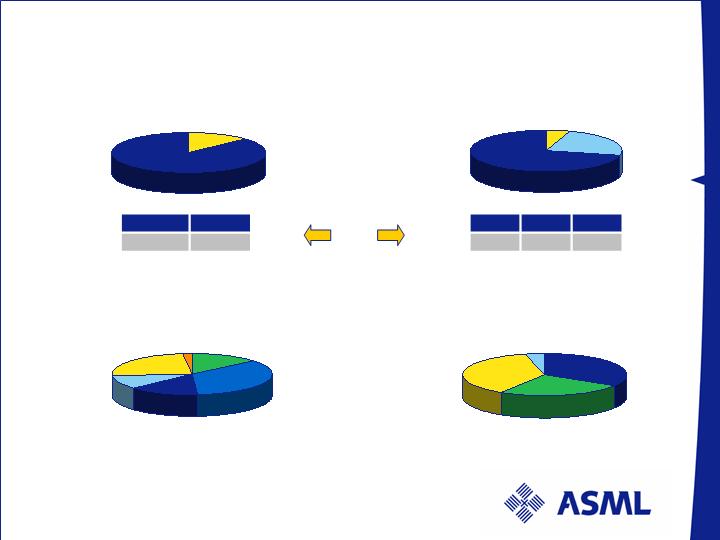

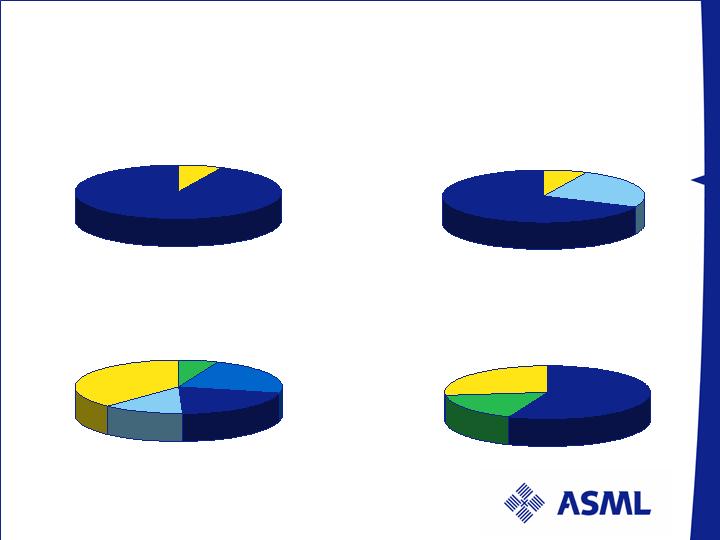

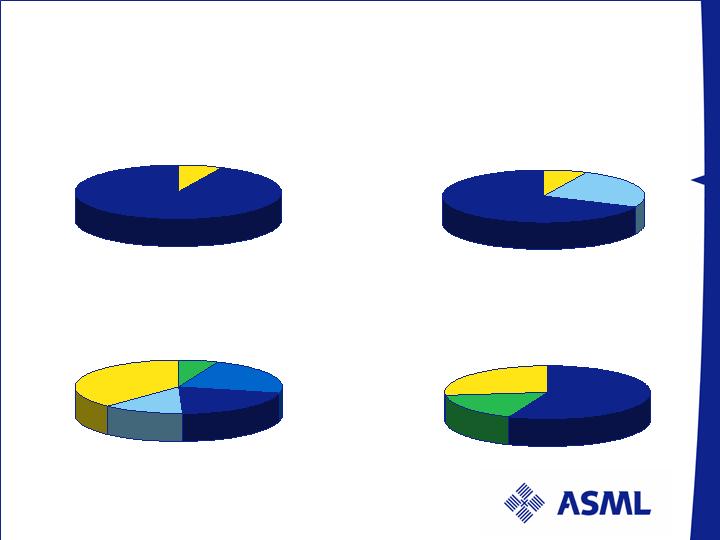

Revenue breakdown: Q3 2005

Value per type

Value per technology

TWINSCAN

87%

Others

13%

Value per region

Value per end-use

Foundry

25%

Memory

34%

IDM

37%

KrF

24%

ArF

71%

i-line

5%

U.S.

35%

Taiwan

14%

Korea

24%

China

14%

Europe

11%

ROW

2%

Numbers have been rounded for readers’ convenience

units

Units

14

25

Others

TWINSCAN

10

12

17

i-line

KrF

ArF

R&D

4%

/ Slide 9

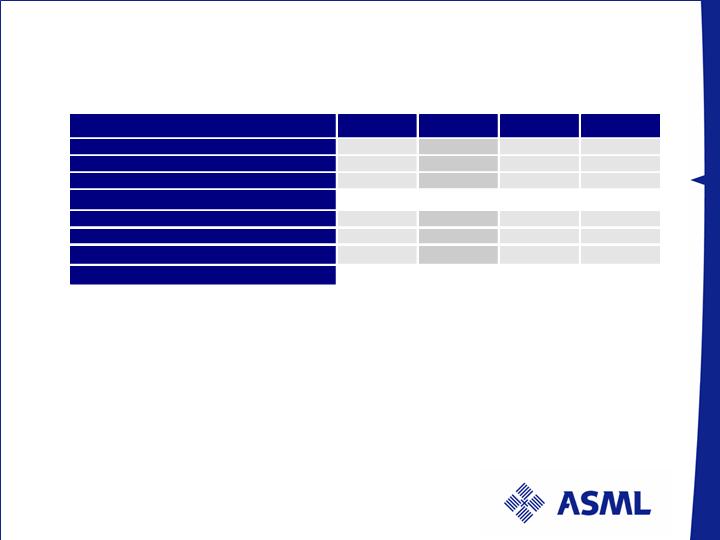

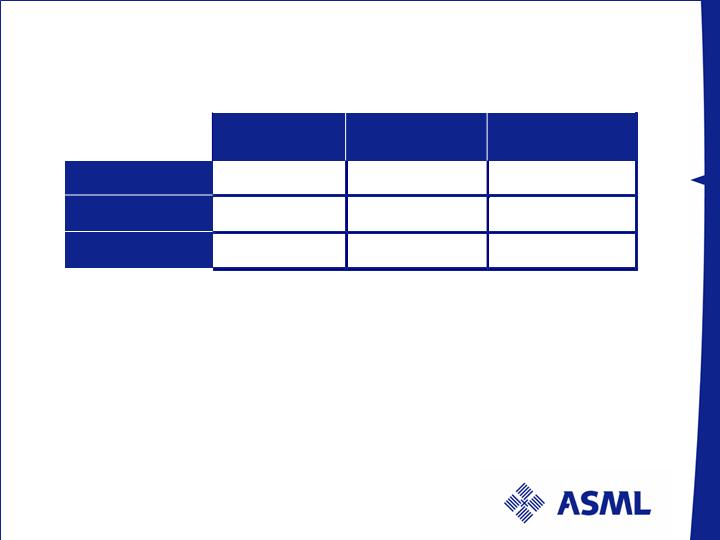

Profit & Loss statement M€

/ Slide 10

1 ASML, Nikon Corporation and Carl Zeiss SMT AG agreed to a comprehensive settlement

of legal proceedings and cross-license of patents related to lithography equipment. This

agreement resulted in:

an increase of M€ 49 in our R&D costs and consequently a decrease in operating

income from continuing operations.

a decrease of M€ 33 in our total net income.

Numbers have been rounded for readers’ convenience

Q2 05

Q3 05

YTD 04

YTD

05

Net sales

763

533

1680

1981

Gross margin

Gross margin %

299

39.1

%

197

37.0%

598

35.6

%

770

38.9%

R&D costs

82

80

256

1

242

SG&A costs

55

48

144

154

Operating income

Operating income %

162

21.2

%

69

12.9%

198

1

11.8

%

375

18.9%

Net income

Net income %

112

14.6%

48

9.0

%

127

1

7.5

%

260

13.1

%

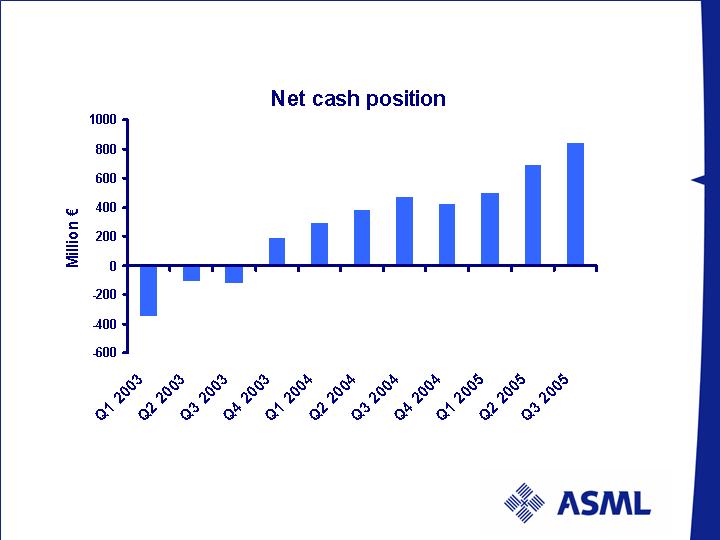

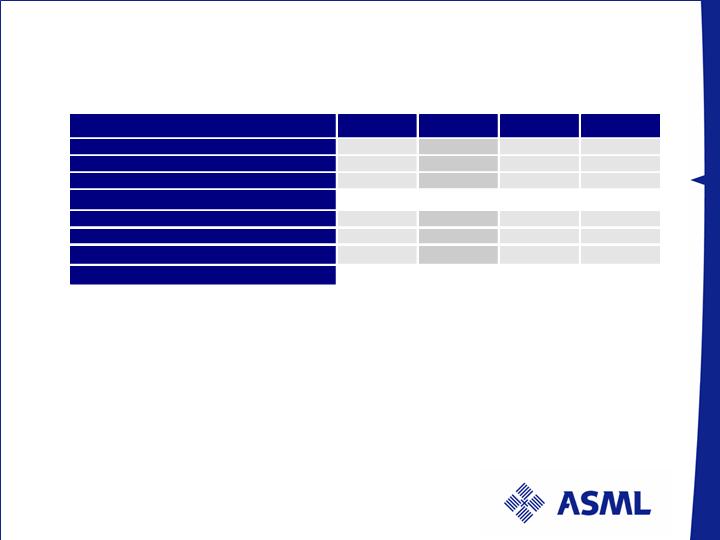

Cash flow M€

/ Slide 11

Numbers have been rounded for readers’ convenience

Q

2

05

Q3

05

YTD

04

YTD

05

Net income

112

48

127

260

Depreciation and amortization

25

22

72

69

Effects of changes in assets and liabilities

88

103

100

173

Cash flow from recurring operations

225

173

299

502

Cash flow from investing activities

(16)

(9

)

(33)

(46)

Cash flow from financing activities

4

(8

)

18

(2)

Effect of changes in exchange rates on cash

11

0

4

18

Net cash flow

224

156

288

472

Strong cash generation performance

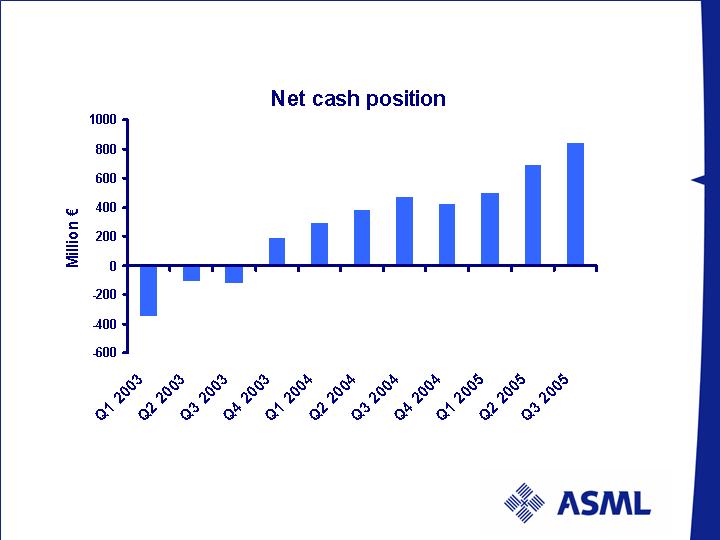

Net cash = Cash and cash equivalents minus Convertible subordinated bonds

/ Slide 12

Balance sheet as of September 25, 2005 M€

/ Slide 13

1 ASML has re-evaluated its tax presentation reported in its earnings release of Q2 2005 and has

concluded that this presentation was not consistent with prior quarters and the current quarter.

The effect of this reclassification on tax assets and liabilities in the aggregate is zero.

Numbers have been rounded for readers’ convenience

ASSETS

June 2005

Sep

2005

Cash and cash equivalents

1544

43.9

%

1700

48

.2

%

Accounts receivable, net

485

13.8

%

403

11.4

%

Inventories, net

695

19.8

%

653

18.5

%

Other assets

193

5.4

%

198

5.6

%

Tax assets

26

7

1

7.6

%

255

7.3

%

Fixed assets

335

9.5

%

318

9.0

%

T

OTAL ASSETS

3519

100%

3527

100%

LIABILITIES and SHAREHOLDERS’ EQUITY

Current liabilities

768

21.8

%

729

20.7

%

Tax liability

275

1

7.8

%

279

7.9

%

Long term debts

885

25.2

%

882

25.0

%

Shareholders’ equity

1591

45.2

%

1637

46.4

%

TOTAL LIABILITIES &

SHAREHOLDERS’ EQUITY

3519

100%

3527

100%

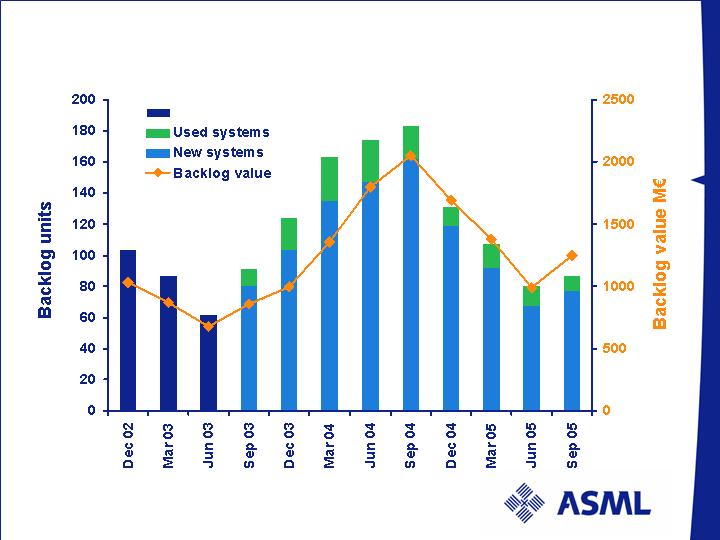

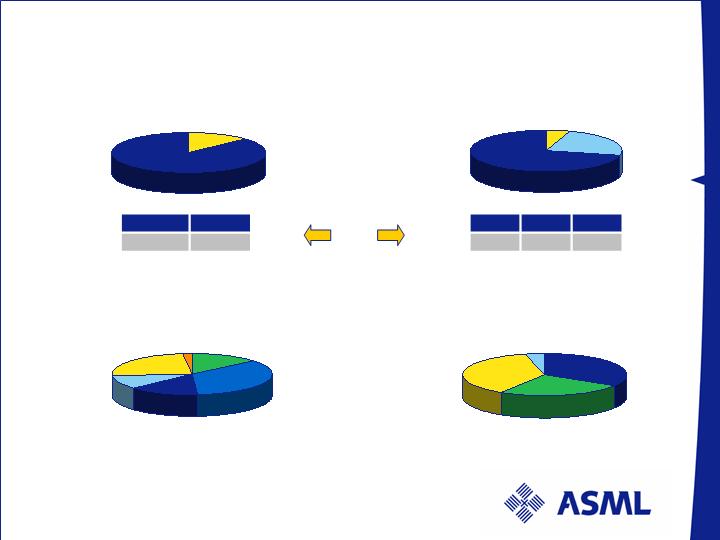

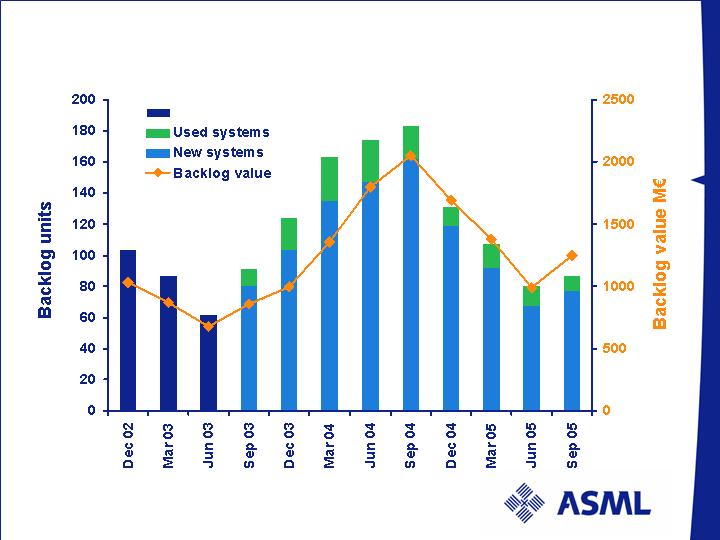

Backlog: litho units vs. value

New and used systems

/ Slide 14

Backlog as of September 25, 2005

New Systems

Used Systems

Total Backlog

Units

Value

M€ 1,216

M€ 29

M€ 1,245

ASP

M€ 15.8

M€ 2.9

M€ 14.3

Numbers have been rounded for readers’ convenience

Backlog

Backlog

83% of unit backlog carry Q4 05 + Q1 06 shipment dates

Q3 net bookings of 46 systems (38 new) with record ASP of M€ 15.8

Note: Due to possible customer changes in delivery schedules and to cancellation of orders, our

backlog at any particular date is not necessarily indicative of actual sales for any succeeding period.

77

10

87

/ Slide 15

Backlog lithography per September 25, 2005

Total value M€ 1,245

Value per type

Value per technology

TWINSCAN

93%

Others

7%

I-line

7%

ArF

68 %

Value per region

Value per end-use

U.S.

22%

Foundry

17%

Memory

56%

Taiwan

20%

IDM

27%

Korea

37%

KrF

25%

ROW

9%

Europe

12%

Numbers have been rounded for readers’ convenience

/ Slide 16

Q4 outlook

ASML expects to ship 40 systems in Q4 2005

Backlog supports new tool ASP of M€ 13.0 as product mix

favors 300-mm KrF systems. New plus refurbished tool ASP is

M€ 10.0

Backlog supports gross margin of 36-38% for Q4

Q4 bookings at about the same level as Q3 assuming foundry

customers re-start ordering for 2006 capacity additions

/ Slide 17

Company focus 2005

Technology leadership

Increase R&D budget to M€ 85 level, net of credit, early in 2006

to support ASML’s commitment to technology leadership

Deliver 4th generation immersion TWINSCAN XT:1700i starting

Q1 2006 for ramp in Q2

Ramp non-critical layer tools for delivery in Q4 2005

Lead-time reduction

Reduce lead times by 30% on volume manufacturing tools

Cost control programs

Bring Q4 2005 SG&A costs lower than Q3 level

Achieve 10% cost of goods reduction on improved generation

TWINSCAN XT platform

/ Slide 18

First glance at 2006

Market trends

Single digit growth of semiconductor revenue expected

by industry analysts in 2006

Current booking trend confirms:

Foundry: Cautious ordering awaiting improved visibility

Memory: Strong ordering to support shrink roadmap (45 nm

for Flash) and production capacity ramps

IDM: Good ordering of leading-edge equipment for advanced

process development and sub 100-nm production

/ Slide 19

First glance at 2006 - continued

Opportunities for ASML

Immersion technology implementation at 45-nm volume

manufacturing with TWINSCAN XT:1700i

Market share gains through realization of production

ramps at new customers

Semiconductor growth above the base case scenario

ASML 2006 baseline revenues at same level as 2005 with

expected upside from above mentioned opportunities

/ Slide 20

Commitment