ASML to acquire Brion Technologies Inc.

19 December 2006

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities Litigation Reform Act of 1995:

This document contains forward-looking statements that involve risks and uncertainties

concerning ASML's proposed acquisition of Brion Technologies, Inc., ASML's strategic and

operational plans, anticipated customer benefits, and the future performance of ASML.

Such statements are based on estimates, intentions, beliefs and assumptions. Actual

events or results may differ materially from those described in this press release due to a

number of risks and uncertainties. The potential risks and uncertainties include, among

others, the possibility that the transaction will not close or that the closing may be delayed;

the reaction of customers of ASML and Brion Technologies to the transaction; and ASML's

ability to successfully integrate Brion's operations and employees. Additional factors that

could affect future results include economic conditions; product demand and semiconductor

equipment industry capacity; worldwide demand and manufacturing capacity utilization for

semiconductors (the principal product of our customer base); competitive products and

pricing; manufacturing efficiencies; new product development; ability to enforce patents; the

outcome of intellectual property litigation; availability of raw materials and critical

manufacturing equipment; and the prevailing trade environment. More information about

potential factors that could affect ASML's business and financial results is included in

ASML’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange

Commission, available at the SEC's website at www.sec.gov

/ Slide 2

ASML to acquire Brion

Payment of USD 270 million (approx. EUR 203 million) in cash

Notwithstanding the operational results of Brion during 2007,

ASML estimates non-cash acquisition accounting related

charges of approximately EUR 29 million after tax in 2007

ASML also expects Brion to be cash positive in 2007

Acquisition is subject to approval by regulatory authorities

Closing is expected in Q1 2007

After closing, Brion will operate as wholly owned subsidiary of

ASML

It is anticipated that current management and technical staff at

Brion will remain unchanged

/ Slide 3

Profile of Brion

Brion is a venture-backed startup based in Santa Clara,

California

Field operations at multiple locations in USA, Europe, Japan,

Korea, Taiwan, and China

Founded in 2002

More than 120 employees

8 out of top 10 chip makers are Brion customers

Brion is the largest, fastest growing pure-play in computational

lithography

/ Slide 4

Brion’s core competencies and industry experience

Physics-driven computer simulation of optical

systems and image processing, encompassing

applications, software, and hardware capabilities

Lithography-driven design and manufacturing

Current products for computational lithography:

Litho printability verification to reduce reticle and

wafer costs of defective chip layout, which also saves

significant time to market for customers

Mask-Pattern Design Optimization (known as

RET/OPC*) for optimization of chip layouts and reticle

designs to improve chip yield in manufacturing

* RET = Reticle Enhancement Technology

OPC = Optical Proximity Correction

/ Slide 5

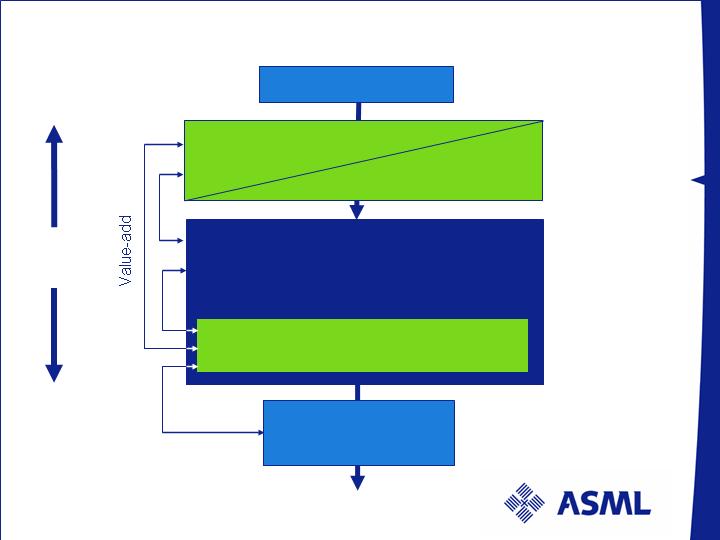

Higher wafer yield

Lithography

Inspection &

metrology

Chip design

Mask-Pattern Design

Optimization

Litho verification

In-situ metrology

ASML’s vision for extended lithography

Extended

Lithography

Mask to

manufacturing

optimization

Manufacturing

Manufacturing

feedback and

correction

/ Slide 6

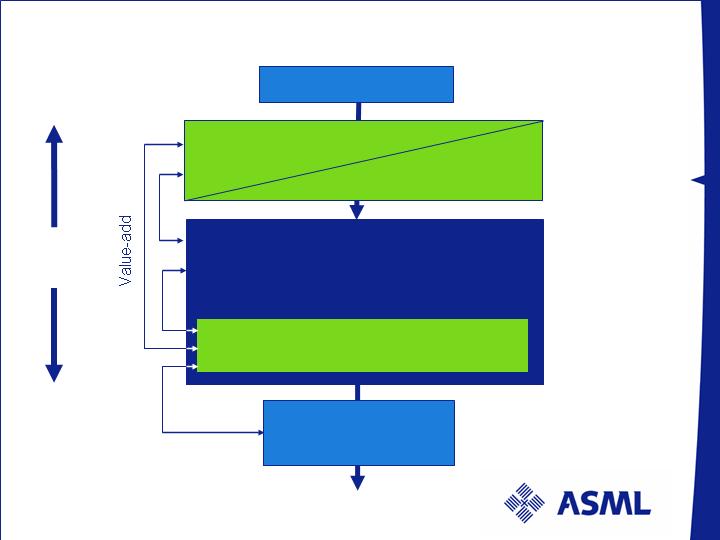

ASML & Brion: Offering a comprehensive product

portfolio for a broader market

Brion

ASML MaskTools’ Reticle

Enhancement Technologies

LithoCruiser: ASML Scanner

& Mask Optimization

Chrome-less

Phase-shift

technology (CPL)

Scattering Bars

placement

technology

Production Litho

Verification

Production

RET/OPC

Process Window

Coverage

Scanner data and settings

Tachyon

Platform

/ Slide 7

ASML and Brion: an unprecedented combination

With semiconductors shrinking further, improved mask-pattern

design optimization and litho printability verification are needed

to maximize chip yield. This requires:

In-depth knowledge of the processes inside leading-edge

lithography equipment

Control of scanner settings to optimize the scanner for specific

chip designs

Lithography equipment manufacturers can add their expertise

of the scanner to adjust the lithographic processes to specific

customer applications

ASML and Brion will leverage each other’s know-how to bring

lithography to a higher level

ASML and Brion will continue to support their current product

offerings

/ Slide 8

Value to ASML customers

Improved semiconductor manufacturability through:

Mask-pattern design optimization, specifically for manufacturing

Tuning of the lithography system for specific applications

In-situ metrology feedback to provide reality-check and to help

calibrate mask-pattern optimization, verification, and lithography

manufacturing processes

Leading to

More first-time-right reticle optimization:

Reduced costs associated with faulty mask manufacturing cycles

Faster time-to-market

Better printability-optimized reticles:

Higher chip yield opportunity at the most advanced nodes

Faster production ramp of new semiconductor designs

/ Slide 9

Value to ASML shareholders

Products that enhance chip-makers’ ability to deploy low-k1

manufacturing processes, like reticle enhancement, litho

verification, and scanner-tuning, are a fast-growing market

opportunity

Playing a direct role in that market will give us access to new

revenue streams

Current and new products that ASML and Brion create

together will further accelerate the migration of new chip

designs to the most advanced technology nodes…

…accelerating market demand for our leading-edge scanners

Integrated litho manufacturing with computational

lithography and in-situ metrology will differentiate ASML

systems even more in a strong growing market

/ Slide 10

Summary

Brion and ASML are complementary partners

Brion and ASML are leaders in their respective fields

The merger will create significant customer value,

leading to business growth, while staying close to core

competencies

/ Slide 11

Commitment