BRIGUS GOLD CORP.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED

DECEMBER 31, 2012

DATED MARCH 28, 2013

TABLE OF CONTENTS

| | Page |

| | |

| PRELIMINARY NOTES | 1 |

| | |

| FINANCIAL STATEMENTS | 1 |

| | |

| CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION | 1 |

| | |

| CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF INDICATED AND INFERRED RESOURCES | 3 |

| | |

| GLOSSARY OF TECHNICAL INFORMATION | 3 |

| | |

| INFORMATION INCORPORATED BY REFERENCE | 4 |

| | |

| CORPORATE STRUCTURE | 4 |

| | |

| Name, Address and Incorporation | 4 |

| | |

| Inter-Corporate Relationships | 5 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 6 |

| | |

| Three Year History and Significant Acquisitions | 6 |

| | |

| DESCRIPTION OF THE BUSINESS | 13 |

| | |

| General | 13 |

| | |

| Map of the Properties | 14 |

| | |

| Map of the Black Fox Complex and Mill | 15 |

| | |

| Map of the Black Fox Complex | 15 |

| | |

| Goldfields Project, Saskatchewan | 26 |

| | |

| Map of Drill Targets from Known Gold Occurrences at the Goldfields Project | 33 |

| | |

| Ixhuatán Project, Mexico | 34 |

| | |

| Dominican Republic Projects | 34 |

| | |

| Huizopa Project, Mexico | 35 |

| | |

| Competitive Conditions | 36 |

| | |

| Employees | 36 |

| DESCRIPTION OF CAPITAL STRUCTURE | 36 |

| | |

| Dividends | 37 |

| | |

| Shareholder Rights Plan | 37 |

| | |

| MARKET FOR SECURITIES | 42 |

| | |

| OFFICERS AND DIRECTORS OF BRIGUS GOLD | 45 |

| | |

| Name, Address, Occupation and Security Holding | 45 |

| | |

| Corporate Cease Trade Orders or Bankruptcies | 48 |

| | |

| Penalties or Sanctions | 48 |

| | |

| Personal Bankruptcies | 48 |

| | |

| Conflicts of Interest | 48 |

| | |

| Corporate Governance | 49 |

| | |

| Audit Committee | 49 |

| | |

| RISK FACTORS | 50 |

| | |

| LEGAL PROCEEDINGS | 61 |

| | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 62 |

| | |

| TRANSFER AGENT AND REGISTRAR | 62 |

| | |

| MATERIAL CONTRACTS | 62 |

| | |

| INTERESTS OF EXPERTS | 62 |

| | |

| ADDITIONAL INFORMATION | 63 |

| | |

| GLOSSARY OF NON-TECHNICAL TERMS | 63 |

| | |

| GLOSSARY OF TECHNICAL TERMS | 63 |

| | |

| SCHEDULE A SUMMARY OF 2011 BLACK FOX TECHNICAL REPORT | A-1 |

| | |

| SCHEDULE B SUMMARY OF 147 AND CONTACT ZONES 2012 TECHNICAL REPORT | B-1 |

| | |

| SCHEDULE C BRIGUS GOLD CORP. AUDIT COMMITTEE CHARTER | C-1 |

PRELIMINARY NOTES

In this Annual Information Form ("AIF"), Brigus Gold Corp. is referred to as "Brigus"orthe "Company"orthe"Corporation". Unless otherwise noted, the information given herein is as of December 31, 2012.

FINANCIAL STATEMENTS

This AIF should be read in conjunction with the Company's audited Consolidated Financial Statements and Management's Discussion and Analysis for the year ended December 31, 2012. The financial statements and management's discussion and analysis are available under the Company's profile on the SEDAR website at www.sedar.com and on the Company's website at www.brigusgold.com. All financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accountants Standards Board ("IFRS").

CURRENCY

All currency references in this AIF are to United States dollars unless otherwise indicated.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This AIF contains "forward-looking information", as such term is defined in applicable Canadian securities legislation, and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward looking statements and information are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. All statements other than statements which are reporting results as well as statements of historical fact set forth or incorporated herein by reference, are forward looking statements and information that may involve a number of known and unknown risks, uncertainties and other factors, many of which are beyond the Company's ability to control or predict. Forward-looking statements and information can be identified by the use of words such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue," or the negative of such terms, or other comparable terminology. These statements include, but are not limited to comments regarding:

| · | plans for the development of and production at the Black Fox Mine including, without limitation, the timing of the development of, and future production quantities from, the underground and open pit mines; |

| · | estimates from the Black Fox technical report dated January 6, 2011, including mine life, processing rate, recovery rate, average annual production, cash operating costs, capital costs, net present value and discounted cash flow value of Black Fox; |

| · | timing and costs associated with the completion of capital projects; |

| · | repayments of indebtedness and the Company’s ability to meet its obligations in connection with the Senior Secured Notes maturing October 31, 2015 and the 6.5% senior unsecured Convertible Debentures due March 31, 2016; |

| · | the Company’s exploration and development plans for the Company’s Grey Fox and Goldfields projects ; |

| · | the sale of the Huizopa, Ixhuatán and Dominican Republic projects; |

| · | liquidity to support operations and debt repayment; |

| · | completion of a Canadian National Instrument 43-101 report for any of the Company’s exploration properties; |

| Page 1 | | Brigus Annual Information Form 2012 |

| · | the establishment and estimates of additional mineral reserves and resources; |

| · | future production, mineral recovery rates and costs, strip ratios and mill throughput rates; |

| · | projected total production costs, cash operating costs and total cash costs; |

| · | grade of ore mined and milled from Black Fox and cash flows derived therefrom; |

| · | future processing capacity of the Black Fox Mine; |

| · | anticipated expenditures for development, exploration, and corporate overhead, including expenditures for surface drilling at Black Fox and Goldfields; |

| · | timing and issuance of permits; |

| · | estimates of closure costs and reclamation liabilities; |

| · | the Company’s ability to obtain financing to fund future expenditure and capital requirements; and |

| · | the impact of adoption of new accounting standards. |

Although the Company believes that the plans, intentions and expectations reflected in these forward-looking statements are reasonable, the Company cannot be certain that these plans, intentions or expectations will be achieved. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements and information contained in this report. Disclosure of important factors that could cause actual results to differ materially from the Company's plans, intentions or expectations are included under the heading "Risk Factors" in this report.

Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements and information. Factors that could cause or contribute to such differences include, but are not limited to: unexpected changes in business and economic conditions, including the global financial and capital markets; significant increases or decreases in gold prices; changes in interest and currency exchange rates; timing and amount of production; unanticipated changes in grade of ore; unanticipated recovery or production problems; changes in operating costs; operational problems at the Company's mining properties; metallurgy, processing, access, availability of materials, equipment, supplies and water; determination of reserves; costs and timing of development of new reserves; results of current and future exploration and development activities; results of future feasibility studies; joint venture relationships; political or economic instability, either globally or in the countries in which the Company operates; local and community impacts and issues; timing of receipt of government approvals; accidents and labour disputes; environmental costs and risks; competitive factors, including competition for property acquisitions; availability of external financing at reasonable rates or at all; and the factors discussed in this report under the heading "Risk Factors;" and other risks and uncertainties set forth the Company's periodic report filings with Canadian securities authorities and the United States Securities and Exchange Commission ("SEC").

Many of these factors are beyond the Company's ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. The Company may note additional factors elsewhere in this report. All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to the Company, or persons acting on the Company's behalf, are expressly qualified in their entirety by these cautionary statements. Except as required by law, the Company undertakes no obligation to update any forward-looking statement or information.

| Page 2 | | Brigus Annual Information Form 2012 |

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF INDICATED AND INFERRED RESOURCES

This AIF uses the terms "Measured", "Indicated" and "Inferred" Mineral Resources. United States investors are advised that while such terms are recognized and required by Canadian securities regulations, the United States Securities and Exchange Commission does not recognize them. "Inferred Resources" have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category of Mineral Resources or converted into Mineral Reserves. United States investors are cautioned not to assume that all or any part of Inferred Mineral Resources exists, or is economically or legally mineable.

GLOSSARY OF TECHNICAL INFORMATION

The estimated Mineral Reserves and Mineral Resources discussed herein have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") – Definitions Adopted by CIM Council on November 27, 2010 (the "CIM Standards") which were adopted by the Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). The following definitions are reproduced from the CIM Standards:

The term "Mineral Reserves" means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economics and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. A "Proven Mineral Reserve" is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economics and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. A "Probable Mineral Reserve" is the economically mineable part of an Indicated, and in some circumstances a Measured Mineral Resource, demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economics and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term "Mineral Resources" means a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. A "Measured Mineral Resource" is that part of a mineral resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. An "Indicated Mineral Resource" is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and test information gathered through appropriate techniques from location such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. An "Inferred Mineral Resource" is that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

| Page 3 | | Brigus Annual Information Form 2012 |

A glossary of defined and technical terms used herein is located towards the end of the AIF.

INFORMATION INCORPORATED BY REFERENCE

The technical report entitled "Brigus Gold Corp. Black Fox Project National Instrument 43-101 Technical Report" dated January 6, 2011 prepared by Tetra Tech, Toronto, Ontario and filed on SEDAR on January 7, 2011 (the "2011 Black Fox Technical Report"), is incorporated herein by reference.

The technical report entitled "Technical Report on the 147 and Contact Zones of the Black Fox Complex, Ontario, Canada" dated October 26, 2012 prepared by Tetra Tech, Toronto, Ontario and filed on SEDAR on November 1, 2012 (the "147 and Contact Zones 2012 Technical Report"), is incorporated herein by reference.

CORPORATE STRUCTURE

Name, Address and Incorporation

Brigus was formed pursuant to Articles of Arrangement dated June 25, 2002 under the Business Corporations Act (Ontario) (the "OBCA'') as the result of a plan of arrangement (the "Plan of Arrangement'') in accordance with the terms of an arrangement agreement (the "Arrangement Agreement'') dated June 24, 2002 between International Pursuit Corporation ("Pursuit'') and Nevoro Gold Corporation ("Nevoro''). The Plan of Arrangement provided for, among other things, the amalgamation of Pursuit and Nevoro to continue as Apollo Gold Corporation ("Apollo"). Apollo was continued under the Business Corporations Act (Yukon) pursuant to articles of continuance dated May 28, 2003. Pursuant to articles of amendment date June 25, 2010, and following an acquisition of Linear Gold Corp. ("Linear"), the Corporation changed its name from Apollo Gold Corporation to Brigus Gold Corp. and consolidated its issued and outstanding common shares on the basis of one new common share for each four old common shares. Brigus was continued under theCanada Business Corporations Actpursuant to articles of continuance dated June 9, 2011. The head office of the Company is located at Suite 2001, 1969 Upper Water Street, Purdy's Wharf Tower II, Halifax, Nova Scotia, B3J 3R7 and its registered office is located at Purdy's Wharf Tower 1, 1100-1959 Upper Water Street, Halifax, NS, B3J 3E5.

Pursuit was incorporated under the laws of the Province of Ontario under the name Brownlee Mines (1936) Limited on June 30, 1936. By Supplementary Letters Patent dated January 7, 1939, July 5, 1944 and June 5, 1946, it changed its name to Joliet-Québec Mines, Limited and subsequently made certain increases to its authorized capital. Under Articles of Amendment dated July 20, 1972, November 28, 1975, August 14, 1978, July 15, 1983, July 7, 1986 and August 6, 1987, it made various further changes to its capital and corporate governance structure and ultimately changed its name to "International Pursuit Corporation''.

Nevoro was a private company incorporated under the Canada Business Corporations Act on February 1, 2002 and continued under the OBCA pursuant to articles of continuance dated May 30, 2002.

| Page 4 | | Brigus Annual Information Form 2012 |

Inter-Corporate Relationships

Black Fox Complex

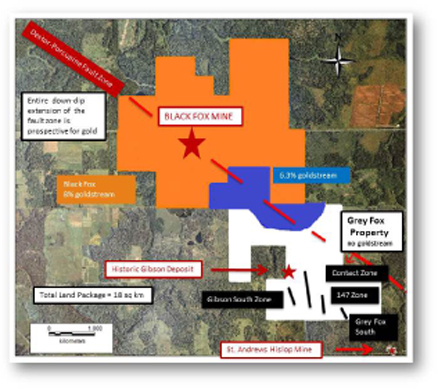

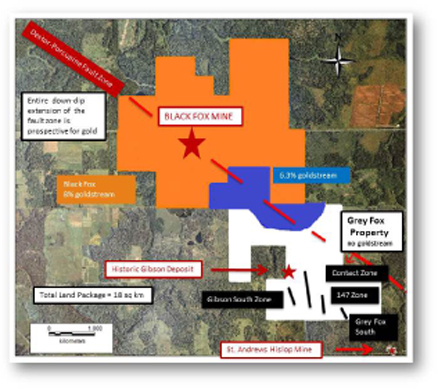

The Company owns a 100% interest in the Black Fox Complex ("Black Fox Complex"), an open pit and underground mine and associated exploration property, and the Black Fox mill. Both the Black Fox Complex and Black Fox mill properties are located in the Timmins Mining District in the Province of Ontario. The Black Fox mine site is situated 11 kilometres ("km") east of Matheson, Ontario and the Black Fox mill is 20 km west of Matheson, Ontario. The open pit mine and the Black Fox mill have been in operation since May 2009, and commercial production from the underground mine commenced in October 2011. Brigus owns two exploration properties adjacent to the Black Fox mine site, Grey Fox and Pike River. The mine land package is 18 square km which extends over a 6.5 km strike of the Destor-Porcupine Fault Zone. The Black Fox mill property covers 24.7 square km.

In 2012, the Company conducted an extensive surface exploration project on the Grey Fox property and released a National Instrument 43-101 Technical Report on the 147 and Contact zones in October 2012. A summary of the report findings can be found in Schedule B. Exploration efforts will continue on the Grey Fox property and other high potential areas on the Black Fox Complex in 2013.

Other Properties

The Company holds a 100% interest in the Goldfields development project in the Lake Athabasca region of Saskatchewan, Canada, which includes a 100% interest in the Box and Athona gold deposits, subject to certain royalties and other interests.

In Mexico, the Company owns a 100% interest in the Ixhuatán Property located in the state of Chiapas. The Company has signed an agreement to sell two of its subsidiaries, Minera Sol de Oro and Minas de Argonautas, which hold the Huizopa Project (collectively, "Huizopa") located in the state of Chihuahua, to Cormack Capital Group, LLC ("Cormack"). In the Dominican Republic, Brigus and Everton Resources Inc. have signed an agreement to sell Brigus' remaining interest in three mineral exploration projects (Ampliacion Pueblo Viejo ("APV"), Ponton and La Cueva).

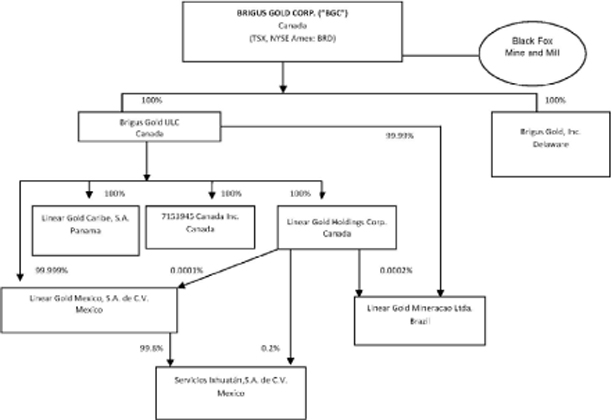

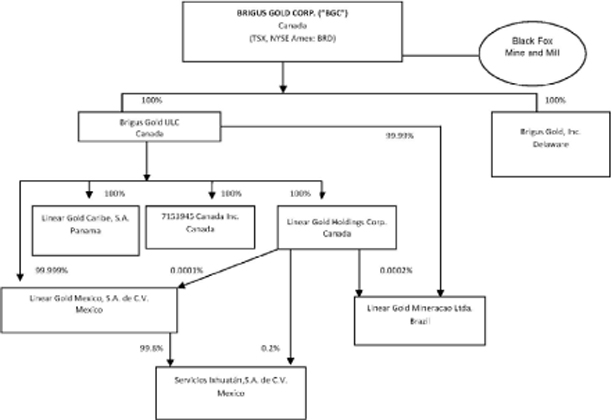

The following chart shows the subsidiaries of the Company, their jurisdiction of incorporation and the Company's direct or indirect percentage ownership interest in each corporation.

| Page 5 | | Brigus Annual Information Form 2012 |

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History and Significant Acquisitions

Year Ended December 31, 2010 ("Fiscal 2010" or "2010")

On February 1, 2010, Apollo Gold, Inc. (now Brigus Gold, Inc.) (the "Seller"), a direct wholly owned subsidiary of the Company and the sole shareholder of Montana Tunnels Mining, Inc. ("Montana Tunnels"), which was the owner of the Montana Tunnels open pit mine and mill (a 50/50 joint venture with Elkhorn Tunnels, an affiliate of Elkhorn Goldfields), the Diamond Hill mine and mill and assets ancillary thereto, entered into a definitive purchase agreement with Elkhorn Goldfields and Calais Resources, Inc. ("Calais") (the "Purchase Agreement"). The Montana Tunnels mine had been on care and maintenance since May 1, 2009. Pursuant to the terms of the Purchase Agreement, the Seller sold all of the capital stock of Montana Tunnels in exchange for (i) promissory notes held by Elkhorn Goldfields and certain investors in Elkhorn Goldfields or its affiliates (the "Lenders") from Calais and Aardvark Agencies, Inc. ("Aardvark") with an outstanding balance of approximately $7,700,000 (the "Original Notes"), (ii) Elkhorn's and the Lenders' rights with respect to an additional amount of approximately $1,382,091 loaned to Calais, (the "Additional Caribou Loan") and (iii) a promissory note held by Elkhorn Goldfields and the Lenders from Calais with an outstanding balance of approximately $380,000 (the "Congo Chief Note" and, together with the Original Notes and the Additional Caribou Loan, the "Notes"). The Elkhorn Goldfields' and the Lenders' security interests in the properties against which the Original Notes and the Congo Chief Note are secured were transferred to the Seller as part of the transaction. The Original Notes matured on July 31, 2005 (although they were never repaid) and bore interest at the rate of 12.9% per annum. The Congo Chief Note matured on February 21, 2006 (although it was never repaid) and bore interest at the rate of 12% per annum. Pursuant to the Purchase Agreement, the Seller agreed to forebear on the Original Notes and the Congo Chief Note (each of which, as noted above, was past due) until February 1, 2011. In connection with the Purchase Agreement, Calais agreed to execute and deliver a promissory note to the Company evidencing the Additional Caribou Loan (the "Additional Unsecured Note"). The Additional Unsecured Note bore interest at the rate of eight percent per annum and had a maturity date of February 1, 2011. In January 2011, the Company extended the forbearance period of the Notes from February 1, 2011 to the earlier of June 30, 2011 or the occurrence of certain events, including insolvency or bankruptcy of Calais, the borrower. During this extended forbearance period, the Notes accrued interest at 8% per annum.

| Page 6 | | Brigus Annual Information Form 2012 |

On March 9, 2010, the Company and Linear Gold Corp. ("Linear") entered into a binding letter of intent (the "Letter of Intent") pursuant to which (i) the businesses of the Company and Linear would be combined by way of a court-approved plan of arrangement (the "Arrangement") and (ii) Linear would subscribe for approximately 62,500,000 Common Shares at a price of $0.40 per common share for aggregate proceeds of Cdn$25,000,000. Pursuant to the Arrangement: each outstanding Linear common share would be exchanged for 5.4742 Common Shares (the "Exchange Ratio"); each outstanding Common Share purchase warrant of Linear would be exchanged for Common Share purchase warrants of the Company on the basis of the Exchange Ratio and the exercise price of the Linear warrants would be adjusted as provided for in the certificates representing the Linear warrants; each outstanding option to purchase a Linear common share granted under Linear's Stock Option Plan would be exchanged for options of the Company granted under the Stock Option Plan on the basis of the Exchange Ratio and the exercise price of the Linear options would be adjusted on the same basis as the exercise price of the Linear warrants. Upon consummation of the Arrangement, Linear would become a wholly owned subsidiary of the Company and the shareholders of Linear immediately prior to the Arrangement were expected to own approximately 42.9% of the outstanding Common Shares of the Corporation (calculated on a fully-diluted basis). The Letter of Intent contemplated that Linear and the Company would enter into a definitive arrangement agreement (the "Definitive Agreement") governing the Arrangement on or before March 31, 2010 to implement the Arrangement to provide for the business combination of Linear and the Company.

On March 19, 2010, the Company and Linear announced the closing of the private placement whereby Linear acquired 62,500,000 common shares of the Company at a price of Cdn$0.40 per share for gross proceeds of Cdn$25,000,000. The common shares of the Company were issued from treasury under the terms of a subscription agreement between Linear and the Company dated March 9, 2010. A portion of the proceeds of the private placement was used to reduce the Company's project facility (the "Project Facility") with RMB Australia Holdings Limited, an Australian corporation ("RMBAH"), RMB Resources Inc., a Delaware corporation ("RMBR"), and Macquarie Bank Limited, an Australian corporation ("Macquarie" and together with RMBAH, the "Financiers") pursuant to a project facility agreement dated February 20, 2009 (the "Facility Agreement"). The Project Facility was reduced from $70,000,000 to $60,000,000 as a result of the Company making a payment of $10 million to the Financiers from the proceeds of the private placement with Linear.

On March 31, 2010, Linear and the Company entered into the Definitive Agreement as per the Letter of Intent.

On April 23, 2010, the Company announced that it unwound its Canadian dollar currency hedges that were originally entered into in connection with the Facility Agreement. As a result of this action, the Corporation received gross proceeds of approximately $8.2 million, which was used to reduce the debt outstanding under the Facility Agreement from $60,000,000 down to $51,800,000.

| Page 7 | | Brigus Annual Information Form 2012 |

On May 18, 2010, the Company issued a press release announcing a proposed new corporate identity and name, Brigus Gold Corp., which was to take effect following shareholder approval of the same and the closing of the Arrangement with Linear.

On June 25, 2010, the Company announced that the Arrangement had closed and the new combined company began operating as Brigus effective June 25, 2010. On June 25, 2010, the Corporation filed articles of amendment which, among other things, changed the name of the Company to Brigus Gold Corp., consolidated the Common Shares, including those issued to Linear shareholders, on the basis of one (1) post-consolidation Brigus share for every four (4) Brigus shares outstanding immediately prior to such consolidation. The business combination was structured as a court-approved plan of arrangement under theBusiness Corporations Act(Alberta) pursuant to which the Company acquired all of the issued and outstanding Linear shares and Linear amalgamated with 1526753 Alberta ULC. Under the terms of the Arrangement, former shareholders of Linear received, after giving effect to the share consolidation described above, 1.37 Brigus Gold shares for each common share of Linear, subject to adjustment for fractional shares. Brigus also announced that its new headquarters would be located in Halifax, Nova Scotia.

On June 26, 2010 the Company further reduced the debt outstanding under the Facility Agreement from $51,800,000 down to $41,800,000.

On July 29, 2010, Brigus completed a private placement of 10,000,000 Common Shares at Cdn$1.40 per share on a "flow through" basis pursuant to theIncome Tax Act(Canada) for total gross proceeds equal to Cdn$14,000,000.

On August 24, 2010, Brigus announced that it retired its outstanding, unsecured convertible debentures by paying $4.68 million in principal and interest on August 23, 2010.

On October 19, 2010, Brigus announced that it had completed an offering of 34,500,000 units and 3,382,353 Common Shares designated as flow-through common shares for purposes of theIncome Tax Act(Canada) at a price of Cdn$1.50 per unit and Cdn$1.70 per flow-through share, for gross proceeds to the Corporation of Cdn$57,500,000.

On October 20, 2010, the Company used $20.7 million of the proceeds raised from the Cdn$57.5 million financing completed on October 19, 2010 to reduce the principal outstanding on the Project Facility from $41.8 million down to $21.1 million, $14.1 million of which was owed to Macquarie and $7.0 million was owed to RMBAH. On November 21, 2010, the Company consolidated its Project Facility debt by increasing the debt owed to RMB Australia Holdings Limited (RMBAH) from $7.0 million to $22.0 million, repaying the full amount owed to Macquarie Bank of $14.1 million, thus leaving RMBAH as the one remaining lender.

On November 2, 2010, the Company used a portion of the proceeds raised from the Cdn$57.5 million financing completed on October 19, 2010 to reduce its forward gold sales contract obligations (the "Hedge") by 43,276 ounces, representing 79% of the sales contracts deliverable in 2011, at a cost of $21.0 million.

| Page 8 | | Brigus Annual Information Form 2012 |

On November 9, 2010, Brigus Gold announced that it had entered into a gold stream agreement (the "Gold Stream Agreement") with Sandstorm Resources Ltd. ("Sandstorm") pursuant to which Sandstorm agreed to purchase 12% of the gold production from the Black Fox mine beginning in January 2011 and 10% of future production from the Black Fox extension covering a portion of the adjoining Pike River property (the "Gold Stream"). Sandstorm made an upfront payment of $56.3 million and will also pay Brigus ongoing per ounce payments of $500 subject to an inflationary adjustment beginning in 2013, not to exceed 2% per annum. Brigus Gold had the option until December 31, 2012 to reduce the Gold Stream to 6% of production from the Black Fox mine and 4.5% of production from the Black Fox extension for a payment of $36.6 million (which it partially exercised in November 2012 and reduced the Gold Stream to 8% of production from the Black Fox mine and 6.3% of production from the Black Fox extension). Brigus Gold also announced that it intended to eliminate 100% of the Hedge effective January 2011 and used some of the proceeds received from the Sandstorm Gold Stream agreement to unwind the balance of its gold forward gold sales contracts eliminating the obligation to deliver 99,409 ounces from October 2011 to March 2013. This transaction left only 1,518 ounces of gold to be delivered into the gold forward contracts for December 2010 following which the Corporation had no remaining gold forward sales contracts.

On December 21, 2010, Brigus closed a private placement of 2,727,000 Common Shares designated as flow-through shares for purposes of theIncome Tax Act(Canada) at a price of Cdn$2.07 per flow-through share for total gross proceeds to the Corporation of Cdn$5,644,890.

On December 23, 2010, the Company entered into a settlement agreement in connection with its Huizopa exploration project (the "Huizopa Project"), which is located in the Sierra Madre Occidental mountains in Chihuahua, Mexico. The settlement related to a dispute over a joint venture relationship that the Company's Mexican subsidiary, Minera Sol de Oro, S.A. de C.V. ("MSO"), had covering the Huizopa Project. In connection with the settlement agreement, the Company entered into a related acquisition agreement pursuant to which the Company sold its 100% interest in MSO to Cormack Capital Group, LLC ("Cormack") for proceeds of $3.5 million, payable over a five-year term, while retaining a 3% net smelter return royalty ("NSR") over future production from the Huizopa Project. Cormack can reduce the Company's NSR to 2% by making a $1.0 million payment to the Company and may also elect to pay up to 40% of the purchase price through the issuance of common shares in a publicly traded company listed on a recognized U.S. or Canadian national stock exchange. In addition, the Company will receive a production bonus payment of $5.0 million within one year of the commencement of commercial production at the Huizopa Project.

Year Ended December 31, 2011 ("Fiscal 2011" or "2011")

On January 6, 2011, Brigus Gold announced the results from the 2011 Black Fox Technical Report, which was based on the mine operations and reserves as of October 31, 2010 and included a Net Present Value of $359.4 million for the Black Fox mine using a 5% discount rate. Highlights from the 2011 Black Fox Technical Report include:

| · | Mine life of 8.6 years based on existing reserves of 906,375 ounces of gold within 6.5 million tonnes at an average gold grade of 4.4 grams per tonne ("gpt"). |

| · | Processing rate of 730,000 tonnes per annum (2,000 tonnes per day ("tpd")) and a recovery rate of 94%. |

| · | Average cash operating costs of $502 per ounce ($66.94 per tonne milled) with a break even gold price of $602 per ounce. |

| · | Capital costs, including sustaining capital, of $74.8 million. |

| · | The Net Present Value of Black Fox, at a 5% discount rate, is $359.4 million with pretax undiscounted cash flow of the project of $439.0 million from revenues of $932.1 million based on a gold price of $1,200 per ounce for 88% of the ounces produced and $500 per ounce for the remaining 12% of production ounces (in accordance with the gold stream agreement with Sandstorm). |

| · | Average annual production of 104,000 ounces of gold over the next five years of production. |

| Page 9 | | Brigus Annual Information Form 2012 |

The 2011 Black Fox Technical Report contains the expression of the professional opinions of the Qualified Person based upon information available at the time of preparation of the 2011 Black Fox Technical Report. The foregoing summary, which is derived from the 2011 Black Fox Technical Report, is subject to the assumptions and qualifications contained in the 2011 Black Fox Technical Report. Readers are directed to the 2011 Black Fox Technical Report which can be reviewed in its entirety by accessing the SEDAR database at www.sedar.com and which qualifies the disclosure above.

On January 27, 2011, the Company and GLR Resources Inc. ("GLR") announced that they had reached an agreement regarding the reimbursement by the Company to GLR in connection with certain equipment originally ordered by GLR. This equipment was related to the Company's wholly owned Goldfields Project in Saskatchewan, Canada. Linear had acquired the Goldfields Project from GLR. Pursuant to the agreement, the Company issued to GLR 1,396,134 common shares of the Company valued at Cdn$2,443,235 based on a deemed price of Cdn$1.75 per share and will make cash payments aggregating US$60,000.

On February 9, 2011, Brigus Gold announced the appointment of Dana Hatfield to Chief Financial Officer following the retirement of Melvyn Williams, the Company's former Senior Vice President and Chief Financial Officer. Mr. Williams remained with the Company through the transition period which ended on June 30, 2011. Mr. Hatfield joined the Company after serving as Senior Vice President, Finance, at Gammon Gold Inc.

On March 9, 2011, the Company entered into an underwriting agreement with a syndicate of underwriters led by BMO Capital Markets, including Haywood Securities Inc., CIBC World Markets Inc., Cormark Securities Inc. and Paradigm Capital Inc., collectively (the "Underwriters"). Pursuant to the Underwriting Agreement, the Company agreed to sell and the Underwriters agreed to purchase $50,000,000 principal amount of senior unsecured convertible debentures (the "Convertible Debentures"). The main features of the unsecured convertible debentures are (1) an interest rate of 6.5% per year, payable semi-annually in arrears on the last day of March and September commencing September 30, 2011 (2) a maturity date: March 31, 2016 (five years) (3) redemption right after 3 years (4) a conversion price of $2.45 per Brigus common share, and (5) an Issue price of $1,000 per Convertible Debenture.

On March 16, 2011, the Company announced that it had filed a final short form prospectus in respect of the previously announced bought deal offering for the $50.0 million principal amount of Convertible Debentures.

On March 23, 2011, the Company announced the closing of the Convertible Debenture bought deal for $50.0 million. The net proceeds were used to completely repay the existing Project Facility debt of $22.0 million held by RMBAH with the balance to be used to accelerate exploration drilling at the Company's Black Fox Complex, for continuing development of the Black Fox Complex, to undertake an engineering study on the expansion of the Black Fox mill, and for general working capital purposes. On March 23, 2011, the Convertible Debentures were listed for trading on the Toronto Stock Exchange under the symbol "BRD.DB.U".

On May 25, 2011, the Company announced that it had signed a letter of intent with Everton Resources Inc. ("Everton") whereby Everton can acquire the Company's remaining interest in the Ampliación Pueblo Viejo, Ponton and La Cueva concessions in the Dominican Republic (the "Concessions").

| Page 10 | | Brigus Annual Information Form 2012 |

On September 29, 2011, the Company announced that it agreed to revised terms with Everton whereby Everton can acquire the Company's remaining interest in the Concessions. The agreement requires Everton to issue 15.0 million treasury common shares to Brigus to acquire the option. Pursuant to the option, Everton can acquire Brigus' remaining interest in the Concessions by paying Brigus Cdn$0.5 million in four installments and an additional Cdn$0.5 million in cash or common shares with a value of $0.5 million by May 31, 2012. Brigus will also receive a sliding Net Smelter Return royalty on the Concessions equal to 1.0% when the price of gold is less than US$1,000 per ounce, 1.5% when the price of gold is between US$1,000 and US$1,400 per ounce and 2% when the price of gold is above US$1,400 per ounce. Everton will also issue Brigus a promissory note equal to the greater of Cdn$5.0 million or 5.0 million common shares of Everton. The promissory note will be subject to the completion of a NI 43-101 compliant measured and indicated resource estimate on the Concessions of a minimum of one million ounces of gold equivalent (at an average grade of 2.5 gpt or higher for Ampliación Pueblo Viejo and 1.5 gpt or higher for Ponton and La Cueva) or actual gold production from the Concessions plus a NI 43-101 compliant measured and indicated resource estimate on the Concessions (at an average grade of 2.5 gpt gold equivalent for APV and 1.5 gpt gold equivalent or higher for Ponton and La Cueva) exceeding one million ounces of gold equivalent.

On October 5, 2011, Brigus reported results from an independent Technical Report on its wholly owned Goldfields development project. The pre-feasibility study indicates a Net Present Value of $144.3 million at a 5% discount rate with an internal rate of return of 19.6% assuming a gold price of $1,250 per ounce. Report highlights include:

| · | Mine life of 13 years (including both Box and Athona deposits) based on existing reserves of 1,020,000 ounces of gold at an average gold grade of 1.97 grams per tonne (gpt) over the first 7 years and 1.42 gpt over the life of the mine. |

| · | Processing rate of 1,825,000 tonnes per year (5,000 tonnes per day (tpd)) and a recovery rate of 91% for the Box deposit and 89% for the Athona deposit. |

| · | Average cash operating costs of $601 per ounce with a break-even gold price of approximately $1,000 per ounce. |

| · | Capital costs of approximately $160 million (leased mining fleet not included). |

| · | NPV of $144.3 million at a 5% discount rate with an IRR of 19.6% and a payback period of five years assuming a gold price of $1,250 per ounce. |

| · | At $1,500 per ounce of gold, the NPV for the project increases to $300 million with an IRR of 32%. |

| · | Average annual production of approximately 100,000 ounces per year during the first seven years. |

| · | The Environmental Impact Statement (EIS) has been submitted and approved. Therefore no permitting delays are anticipated. |

The 2011 Goldfields Technical Report contains the expression of the professional opinions of the Qualified Person based upon information available at the time of preparation of the 2011 Goldfields Technical Report. The foregoing summary, which is derived from the 2011 Goldfields Technical Report, is subject to the assumptions and qualifications contained in the 2011 Goldfields Technical Report. Readers are directed to the 2011 Goldfields Technical Report which can be reviewed in its entirety by accessing the SEDAR database at www.sedar.com and which qualifies the disclosure above.

On December 8, 2011, Brigus closed a private placement of 4,805,833 Common Shares designated as flow-through shares for purposes of the Income Tax Act (Canada) at a price of Cdn$1.70 per flow-through share for total gross proceeds to the Corporation of Cdn$8,170,000.

| Page 11 | | Brigus Annual Information Form 2012 |

On December 13, 2011, the Company announced the Board of Directors' adopted a new Shareholder Rights Plan that takes effect immediately following the expiry of the existing shareholder rights plan on January 18, 2012. The Rights Plan's purpose is to ensure the fair treatment of all shareholders in connection with any take-over bid for Brigus common shares. It is also intended to provide the Board of Directors (the "Board") with more time to fully consider an unsolicited take-over bid and, if applicable, to explore other alternatives to maximize shareholder value.

On December 15, 2011, Brigus announced an initial National Instrument 43-101 compliant, independent mineral resource estimate for the 147 and Contact zones on the Black Fox Complex. The report concluded that the 147 and Contacts zones host 116,710 Indicated ounces and 459,420 Inferred ounces. There are another 95 drill holes, with assays pending, that have not been included in the initial resource calculation and will increase the resource area drill hole data by 37% upon receipt of final assays.

The 147 and Contact Zones 2011 Technical Report contains the expression of the professional opinions of the Qualified Person based upon information available at the time of preparation of the 147 and Contact Zones 2011 Technical Report. The foregoing summary, which is derived from the 147 and Contact Zones 2011 Technical Report, is subject to the assumptions and qualifications contained in the 147 and Contact Zones 2011 Technical Report. Readers are directed to the 147 and Contact Zones 2011 Technical Report which can be reviewed in its entirety by accessing the SEDAR database at www.sedar.com and which qualifies the disclosure above.

Year Ended December 31, 2012 ("Fiscal 2012" or "2012")

On January 3, 2012, Brigus announced the departure of the Company's Vice President and Chief Operating Officer, Rick Allan, effective January 1, 2013. At the same time, Jennifer Nicholson was promoted to Executive Vice President, with responsibility for investor relations, communications, human resources and operations support.

On February 21, 2012, Brigus revised its annual production target with a range of 77,000 – 85,000 gold ounces for 2012.

On March 15, 2012, Brigus Gold and a syndicate of underwriters led by Cormark Securities Inc. and including Haywood Securities Inc., BMO Capital Markets, Fraser Mackenzie Limited, Casimir Capital Ltd., and Global Hunter Securities (collectively, the "Underwriters") bought and sold to the public 15,790,000 common shares of the Company at a price of $0.95 per Common Share for gross proceeds to the Company of approximately $15 million.

On May 25, 2012, the Company reported that severe forest fires caused a power disruption which temporarily suspended milling operations. On May 28, 2012, Brigus announced that power had been restored and that mining operations were not affected by the fire and that there was no damage to the Company's assets.

On July 25, 2012, Brigus announced that Daniel Racine joined the Company as Chief Operating Officer.

On August 31, 2012, the Notes acquired by the Company pursuant to the sale of Montana Tunnels and related transactions were sold by the Company to New West Capital for gross proceeds to Brigus totalling $6 million.

On September 6, 2012, Dana Hatfield resigned as Brigus' Chief Financial Officer and Jon Legatto, Brigus' Vice President of Finance, was appointed to CFO. The Company eliminated the VP Finance position and consolidated all related duties in the CFO role.

| Page 12 | | Brigus Annual Information Form 2012 |

On September 11, 2012 Cangold Limited terminated its option agreement with Brigus Gold on the Ixhuatan Gold Project in Chiapas, Mexico.

On September 20, 2012, the Company released a new National Instrument 43-101 mineral resource estimate on the 147 and Contact zones on the Grey Fox property of the Black Fox Complex. The report stated that 480,850 indicated ounces and 91,061 inferred ounces were contained in these two zones. Approximately 84% of the new resource occurs within 200 m from surface and therefore has open pit mining potential. Brigus is focused on extending and expanding both the 147 and Contact zones through systematic drilling below the 200 m level and along strike to build a resource suitable for underground mining.

On October 23, 2012, Everton and Brigus revised the agreement relating to the sale of the Concessions. Under the revised agreement, Everton will acquire Brigus' remaining interest in the Concessions by paying Brigus Cdn$0.5 million in two installments and an additional Cdn$0.5 million in cash or common shares with a value of $0.5 million. All other terms remained the same.

On October 30, 2012, Brigus announced the completion of a $30 million bought deal debt financing with Casimir Capital. The $30 million in senior secured debt notes (the "Senior Secured Notes") with a three year term were secured by a lien against the Company's Black Fox Complex and the Goldfields properties. Principal payments of $2 million will be paid quarterly, commencing on June 30, 2013. The Company used $24.4 million of the debt proceeds to repurchase 4% of the existing 12% Gold Stream with Sandstorm Gold Ltd.

On November 1, 2012, the Company announced a private placement of 8,304,500 flow-through shares of Brigus at a price of $1.21 per share for aggregate gross proceeds of $10,048,445. The syndicate of underwriters was led by Cormark Securities Inc. and included Haywood Securities Inc., Fraser Mackenzie Limited, Primary Capital Inc., and Casimir Capital Ltd.

On December 13, 2012, Brigus announced Daniel Racine's promotion to President and Chief Operating Officer of the Company effective January 1, 2013. Wade Dawe remains Chairman and Chief Executive Officer. The Company also announced its plans to relocate the investor relations function to Toronto, Ontario.

DESCRIPTION OF THE BUSINESS

General

Brigus is a Canadian-based mining company which is principally engaged in the extraction, processing, and refining of gold deposits as well as related activities including the acquisition, exploration and development of mineral properties principally located in North America. Brigus' current sole mining operation is the Black Fox mine.

The Company is also evaluating the Goldfields Project, in Saskatchewan, which hosts the Box and Athona gold deposits. In Mexico, Brigus owns 100% interest in the Ixhuatán gold-silver advanced exploration project. In the Dominican Republic, Brigus and Everton Resources have signed an agreement to sell Brigus' remaining interest in three mineral exploration projects (Ampliacion Pueblo Viejo ("APV"), Ponton and La Cueva).

| Page 13 | | Brigus Annual Information Form 2012 |

Map of the Properties

| Page 14 | | Brigus Annual Information Form 2012 |

Map of the Black Fox Complex and Mill

Black Fox Complex – Property Description and Location

The Company wholly owns and operates the Black Fox mine, an open pit and underground mining operation located in the Timmins Mining District in the Province of Ontario. The Black Fox mine site is situated 11 kilometres ("km") east of Matheson, Ontario and the Black Fox mill is 20 km west of Matheson, Ontario. The Black Fox open pit mine and the Black Fox mill have been in operation since May 2009 and commercial production from underground mine commenced in October 2011.

Brigus is an unhedged gold producer with no gold derivative positions. On January 1, 2011, the Company began selling 12% of its Black Fox gold production at a current price of $500 per ounce under the Gold Stream Agreement with Sandstorm. The Company entered in the Goldstream Agreement and received $56.3 million as an upfront payment in November 2010. Brigus had the option until December 31, 2012 to reduce the Goldstream Agreement to 6% of production from the Black Fox mine and 4.5% of production from the Black Fox Extension for a payment of US$36.6 million. On November 5, 2012, the Company elected to partially exercise the option and repurchased 4% of the Goldstream for $24.4 million. This reduced Sandstorm's portion of future production at Black Fox to 8% and the Black Fox Extension to 6.3%. (See "Sandstorm Goldstream Agreement" below.)

Brigus owns two exploration properties adjacent to the Black Fox mine site, Grey Fox and Pike River, which together with the Black Fox mine site, comprise the Black Fox Complex. The Black Fox Complex has a contiguous land package of 18 square km extending over a 6.5 km strike of the Destor-Porcupine Fault Zone. The Black Fox mill property, which hosts the historic Stock Mine deposit, covers 24.7 square km and is located 31 km west of the Black Fox mine. The mill property extends over 6.0 km of the Destor-Porcupine Fault Zone.

| Page 15 | | Brigus Annual Information Form 2012 |

Brigus' exploration program continues to confirm the potential for new gold discoveries within the Black Fox Complex. In September 2012 the Company released a National Instrument 43-101 Technical Report and Resource Estimate on the 147 and Contact zones. The report concluded that the zones hosted 480,850 Indicated gold ounces and 91,061 Inferred gold ounces. Approximately 84 percent of the new resource occurs within 200 m from surface and therefore has open pit mining potential. Brigus is focused on extending and expanding both the 147 and Contact zones through systematic drilling below the 200 m level and along strike to build a resource suitable for underground mining as well.

The Destor-Porcupine Fault Zone is the known host structure of the Black Fox deposit, the historic Stock Mine deposit and many other occurrences of gold and gold mines in the Timmins Mining District. The Destor-Porcupine Fault Zone is a deep break in the Precambrian rocks of the Abitibi Greenstone Belt. The system regionally strikes east-west and dips variably to the south. Black Fox lies on the southern limb of a large scale fold on a flexure in the Destor-Porcupine Fault where the strike changes from east-west to southeast. Folded and altered ultra mafic and mafic are the host rocks for mineralization. Gold occurs as free gold in quartz veining and stockworks in altered ultra mafics and in gold associated with pyrite in altered tholeiitic basalts. The Timmins Mining District was first discovered in the early 1900s and has been a prolific producer of gold and other metals.

The Black Fox Complex, including the Grey Fox-Pike River properties, consists of 1,761.4 hectares of which: 356.4 hectares are leasehold patents, 733.6 hectares are owned by Brigus, 129.2 hectares are leased by Brigus, 360.8 hectares where Brigus has surface rights only and 123.3 hectares where Brigus has mineral rights but no surface rights.

None of the currently defined reserves are subject to production royalties (although a portion of future production was sold pursuant to the Gold Stream Agreement). However, the Company owns properties within the Black Fox Complex totalling 890.5 hectares that are subject to net smelter return royalties, ranging from 2.0% to 3.25%, if there is production in the future from any reserves found on those properties.

Access to both the Black Fox Complex and the mill is via Highway 101 East. The Black Fox Complex and its facilities are located on the south side of Highway 101 East 11 km east of Matheson and the Black Fox mill is located on the North side of Highway 101 20 km west of Matheson. Supplies and services are available in Matheson or Timmins and can be delivered with a 12-hour turnaround. The primary industries are forestry and mining, and Black Fox is located in a well-established mining camp. Because of this, mining and exploration personnel as well as equipment can be found locally for projects in the area. The historic Glimmer underground mine, formerly operated by Exall Resources Ltd. ("Exall"), is located within the property boundaries. From 1997 until 2001, the Glimmer mine produced approximately 210,000 ounces of gold from underground workings.

Much of the old mine infrastructure was upgraded in 2010 to facilitate mine development. New infrastructure to support open pit and underground mine operations include a truck shop, laboratory, administration building, the firewater/ freshwater pump house, and ancillary buildings.

The Black Fox mill is fed from an existing 27 kilovolt (kV) power line to the mill site. Power is distributed at the plant site from this 27 kV power line, a 5 mega volt ampere (MVA), 4,160 volt (V), 3 phase, 60 hertz (Hz) distribution transformer.

Fresh water at the Black Fox Complex is being supplied from a fresh water well. Water from dewatering of the complex is channelled to the mine's holding pond for recycling and /or discharge through the Black Fox water treatment facility. Excess water is treated during the spring and summer months for discharge to the environment through the water treatment system.

| Page 16 | | Brigus Annual Information Form 2012 |

Black Fox – History

The Black Fox Complex was first explored by Dominion Gulf in 1952 and then by Hollinger in 1962. In 1988, Glimmer Mine Inc. put together the property package using a combination of crown (i.e. lands owned by the Canadian government) and private lands. In 1989, Noranda Exploration Company Ltd. ("Noranda") entered into a joint venture agreement with Glimmer. As a result of this agreement, Noranda held a 60% interest in the property. During their ownership, Noranda merged with Hemlo Gold Mines Inc. ("Hemlo"). Exall purchased the property from Hemlo in April 1996, obtaining an approximately 60% interest in the property with Glimmer retaining 40%.

In September 2002, the Company purchased all of the real estate and related assets of the mine, which ceased operations in May 2001, from Exall and Glimmer Resource Inc. ("Glimmer") and renamed it "Black Fox". The Company paid Exall and Glimmer an aggregate purchase price consisting of Cdn$3.0 million in cash and an aggregate of 520,000 Common Shares (adjusted from the former Apollo common shares). Pursuant to the terms of the acquisition, an additional Cdn$3.0 million was paid to Exall and Glimmer on January 6, 2006.

On July 28, 2008, the Company completed the acquisition from St. Andrew Goldfields Ltd (“St. Andrews”) of the former Stock mine and mill and related equipment, infrastructure, property rights, laboratory and tailings facilities, located near Timmins, Ontario for a purchase price of Cdn$20.0 million and the refund to St Andrew of its bonding commitment at the mill complex in the amount of approximately Cdn$1.2 million.

On November 6, 2007, the Company leased from the Frederick William Schumacher estate the surface and mining rights to lease parcels 16262, 16265 and 16266, all in the township of Hislop. The properties were renamed Grey Fox. The terms of the lease are as follows:

| (i) | Term of 20 years, with extensions of 20 year period at the discretion of the Company |

| (ii) | Work commitment in the first 2 years of Cdn$1.0 million, which was fulfilled |

| (iii) | Annual lease payments of Cdn$100,000, until commercial production royalties exceed Cdn$100,000 per annum |

| (iv) | The royalty is a 3% net smelter return |

On September 9, 2009, the Company completed the acquisition of the Pike River property, contiguous to the southeast boundary of the Black Fox mine and the northwest boundary of the Grey Fox property. The Pike River property was acquired from Newmont Canada Corporation ("Newmont"). Brigus paid Cdn$100,000 to Newmont and granted a perpetual 2.5% net smelter production royalty to Newmont from the sale or other disposition of all materials produced from the Pike River property pursuant to a royalty agreement, dated March 25, 2009, between Newmont and Brigus. In addition, as further consideration, within 30 days following the earlier of (i) the date that at least 500,000 ounces of gold equivalent minerals sufficient to be reported pursuant to Canadian National Instrument 43-101 combined reserves (proven and probable) and resources (measured, indicated and inferred) are determined to exist within the Pike River property, or (ii) the commencement of commercial production from any portion of the Pike River property, Brigus shall pay an additional sum of Cdn$1 million to Newmont. The royalty agreement also contains a first right to negotiate in favour of Newmont pursuant to which, if Brigus wishes to option, joint venture, assign, transfer, convey or otherwise dispose of its rights or interests in and to its Black Fox property (but excluding a corporate merger transaction), Brigus must first notify Newmont of its intentions so that Newmont may consider a possible acquisition from Brigus of a portion or all of its interest in the Black Fox property.

| Page 17 | | Brigus Annual Information Form 2012 |

Map of the Black Fox Complex

Black Fox – Mine and Mill Operations

Open Pit:

Open pit mining of ore and waste at Black Fox is conducted 24 hours a day seven days a week, subject to weather conditions, and scheduled maintenance. The mining of ore, waste and overburden is performed by three excavators, six CAT 777 90-tonne haul trucks and three drills in addition to ancillary equipment. The mining fleet averages approximately 30,000 tonnes per day ("tpd") ore and waste. The mining of ore is only done during daylight hours. Phase 3 of overburden removal will be completed in during the first half of 2013. Mining of Phase 2 and 3 of the open pit will continue up until the end of 2016.

During the year ended December 31, 2012, 9,402,994 tonnes of material was mined from the open pit of which 907,077 tonnes were ore tonnes, 5,008,332 tonnes were waste rock, 2,300,545 tonnes were related to production stripping and 1,187,040 tonnes were related to Phase 3 overburden removal. This resulted in an operating strip ratio of 5.5:1. For the year ended December 31, 2011, 10,220,532 tonnes were mined from Phase 1 and 2, of which 433,267 tonnes was ore, 4,849,506 tonnes were waste rock, 4,644,079 tonnes were related to production stripping and 293,680 tonnes were related to the Phase 2 overburden removal, resulting in a strip ratio of 10.4:1. In 2012, $7.3 million of production stripping costs were capitalized, compared to $13.5 million in 2011.

| Page 18 | | Brigus Annual Information Form 2012 |

Underground:

During the year 2012, a total of 9,061 metres of development, ramp, lateral and access to ore was done by on site underground development crews. J.S. Redpath, underground development contractor, was retained in April 2011 to help expedite development on both the East and West ramps. The contract was completed in November 2012.

Underground infrastructure:

In October of 2012, the surface to underground electrical distribution was completed. This work was necessary for electrical distribution requirements underground on the East and West sides of the mine.

Underground mining as expected reached the production rate of 800 tpd of ore in December 2012. The underground production rate is expected to continually increase up to 1,000 tpd of ore by Q4 of 2013. Mining of underground ore is performed using all company owned equipment and employees including four LHD units, two 50-tonne haul trucks, three 30-tonne push box trucks, three jumbo drills, four scissor lifts for ground control installations and several pieces of support equipment.

Underground ore was produced using long hole, cut and fill, and narrow vein mining methods. The ore was accessed from a series of declines off of the main ramp to surface. The underground portion of the Black Fox mine is expected to extend from below the existing open pit mine (near 200 m depth below surface) to approximately 800 m in depth below surface.

Backfill:

Current backfill is a combination of mine waste rock mixed with a Portland slurry mix done underground. The Company is currently evaluating new backfill systems and will select and install a new system by Q2 2013. Waste rock is also used as backfill in mined out areas where cement is not needed.

Ore Haulage:

Ore from the open pit and underground mine is crushed to -150 mm at the mine site and is transported to the Black Fox mill by a fleet of highway haulage trucks.

Mill:

The ore is stockpiled at the mill site and fed via a conveyor system to the crushing circuit, with a crushing capacity to a maximum of 160 tonnes per hour, where it is reduced from -150mm through three stages of crushing to -10mm. This crushed product is transferred to a 1,500 tonne fine ore surge bin. The ore is then fed into a grinding circuit at a planned rate of 2,200 tonnes per day through two stages of closed circuit ball milling. Soluble gold is recovered by adsorption upon granular activated carbon in CIC, CIL, and CIP trains at an efficiency of 90% to 95%. Gold is removed from the carbon in a high temperature strip vessel in a closed circuit with electro-winning deposition. Gold plate is further refined by induction smelting and cast in 1,000 ounce molds before shipment to the refinery. After extraction of the gold, the residue is discharged into the tailing impoundment area.

| Page 19 | | Brigus Annual Information Form 2012 |

Facilities:

Property, plant and equipment at the Black Fox mine consists of an administration office, change house facilities, workshop facilities, core sheds and surface infrastructure for the underground mine (pumps, heating, etc). Property, plant and equipment at the Black Fox mill consists of an administrative office, electrical and mechanical shops, laboratory and a 2,200 tonnes per day mill for processing ore.

All mill facilities and equipment are in good working order. Within the mill property, there is also a permitted tailings compound. Both the Black Fox mine and mill use power supplied by Hydro One.

Safety and Environment:

Brigus is committed to providing a safe work environment for its employees, and the responsible stewardship of its environment. During 2012, the Black Fox mine and mill marked a milestone of 1,130 days without a lost time injury.

Brigus Gold and the Black Fox mine have been recognized by the Porcupine Northern Ontario Mines Safety Group with the Angus D. Campbell Trophy for the member mining company with the lowest lost time accident frequency record in North Eastern Ontario. This is the third time Brigus has received this award.

Black Fox – Gold Sales and Production

During the year ended December 31, 2012, 65,275 ounces were sold at spot prices at an average realized price of $1,665 per ounce and 8,416 ounces were delivered against the Goldstream Agreement (the “Goldstream”) with Sandstorm Resources Ltd. (“Sandstorm”). On November 5, 2012, the Company exercised its option to repurchase a portion of the Goldstream from Sandstorm. The Company repurchased 4% of the Goldstream relating to production from the Black Fox Mine and 3.7% of the production from the Black Fox Extension. Sandstorm is now entitled to 8% of the production from the Black Fox Mine and 6.3% of the production from the Black Fox Extension. The average realized price for sales under the Goldstream, prior to the repurchase, was $1,072 per ounce, consisting of cash proceeds of $500 per ounce and deferred revenue of $572 per ounce. As a result of the repurchase, the average realized price for sales under the Goldstream is $982 per ounce, consisting of $500 per ounce and deferred revenue of $482 per ounce. For the year ended December 31, 2012, the average realized price per ounce for gold sold to Sandstorm was $1,068. For the year ended December 31, 2011, 50,897 ounces were sold at spot prices at an average realized sales price of $1,589 per ounce and the remaining 6,104 ounces were delivered against the Goldstream at an average realized price of $1,072 per ounce. The total cash cost per ounce of gold sold for the year ended December 31, 2012 was $762 per ounce compared to $958 per ounce for the year ended December 31, 2011.

During the year ended December 31, 2012 the mill processed 735,573 tonnes of ore (2,010 tonnes per day), at an average grade of 3.43 gpt and a recovery rate of 95% achieving total gold production of 77,374 ounces. During the year ended December 31, 2011, the Black Fox mill processed 725,541 tonnes of ore (1,988 tonnes per day), at an average grade of 2.54 grams of gold per tonne and a recovery rate of 94%, achieving total gold production of 55,756 ounces.

| Page 20 | | Brigus Annual Information Form 2012 |

Black Fox – Sandstorm Goldstream Agreement

On November 9, 2010, Brigus entered into the Goldstream Agreement with Sandstorm pursuant to which Sandstorm agreed to purchase 12% of the gold production from the Black Fox mine beginning in January 2011 and 10% of future production from the Black Fox Extension covering a portion of the adjoining Pike River property. Sandstorm made an upfront payment of $56.3 million of which Brigus used a portion to effectively settle the balance of its forward gold sales contracts eliminating the obligation to deliver 99,409 ounces from October 2011 to March 2013 and as a result Brigus is an unhedged gold producer with no gold derivative contracts. Sandstorm will also pay Brigus ongoing per ounce payments of $500 subject to an inflationary adjustment beginning in 2013, not to exceed 2% per annum. Brigus had the option, for a 24 month period, to reduce the Goldstream Agreement to 6% of production from the Black Fox mine and 4.5% of production from the Black Fox Extension for a payment of US$36.6 million.

On November 5, 2012, the Company elected to exercise the option and repurchased 4% of the Goldstream for $24.4 million. This reduced Sandstorm's portion of future production at Black Fox to 8% and the Black Fox Extension to 6.3%.

Black Fox – Mineral Reserves and Resources

The 2011 Black Fox Technical Report also included the estimated reserves and resources statement for Black Fox at October 31, 2010, which was since updated to reflect depletion from production from the end of October to December 31, 2010 and from December 31, 2010 to December 31, 2011 and December 31, 2011 to December 31, 2012. The year-end 2012 reserves and resources for Black Fox and consolidated totals are shown in the tables below.

At December 31, 2012, Black Fox had approximately 0.76 million ounces of gold contained within 5.22 million tonnes at an average gold grade of 4.6 gpt in Proven and Probable Reserves. The Company's consolidated total Proven and Probable Reserves, including Black Fox and the Goldfields Project, total 1.78 million ounces of gold contained within 27.55 million tonnes at an average gold grade of 2.0 gpt.

The Qualified Person who reviewed the Reserve tables and footnotes for the Black Fox mine is Mike Wereszczynsky, P.Eng. of Brigus Gold Corp. Paul Daigle, P.Geo. of Tetra Tech is the Qualified Person for the Black Fox mine Resource and the Grey Fox Resource tables and footnotes. Tim Maunula, P.Geo. formerly of Tetra Tech is the Qualified Person for the Goldfields Box and Athona Resources. Kyle Krushelniski, P. Eng. of March Consulting Associates is the Qualified Person for the Goldfields Box Reserve table and footnotes.

Estimated Gold Mineral Proven and Probable Reserves, as of December 31, 2012

| Property | | Proven Reserves | | | Probable Reserves | | | Proven & Probable Reserves | |

| | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | |

| Black Fox Mine1,2 |

| Open Pit | | | | | | | | | | | | | | | 2,120,000 | | | | 3.5 | | | | 236,400 | | | | 2,120,000 | | | | 3.5 | | | | 236,400 | |

| Underground | | | | | | | | | | | | | | | 2,602,000 | | | | 6.1 | | | | 509,000 | | | | 2,602,000 | | | | 6.1 | | | | 509,000 | |

| Stockpile | | | 500,000 | | | | 1.2 | | | | 18,968 | | | | - | | | | - | | | | - | | | | 500,000 | | | | 1.2 | | | | 18,968 | |

| Goldfields1,3 |

| Box | | | 1,228,000 | | | | 1.9 | | | | 75,000 | | | | 15,274,000 | | | | 1.5 | | | | 725,000 | | | | 16,502,000 | | | | 1.5 | | | | 800,000 | |

| Athona | | | | | | | | | | | | | | | 5,831,000 | | | | 1.2 | | | | 220,000 | | | | 5,831,000 | | | | 1.2 | | | | 220,000 | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,784,368 | |

| Page 21 | | Brigus Annual Information Form 2012 |

Estimated Gold Mineral Measured and Indicated Resources, Including Reserves, as of December 31, 2012

| Property | | Measured Resource | | | Indicated Resource | | | Measured & Indicated Resource | |

| | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | | | Tonnes | | | Gold

Grade

(gpt) | | | Gold

(oz)5 | |

| Black Fox Mine1,2 |

| Open Pit | | | | | | | | | | | | | | | 2,536,456 | | | | 4.3 | | | | 353,617 | | | | 2,536,456 | | | | 4.3 | | | | 353,617 | |

| Underground | | | | | | | | | | | | | | | 2,435,280 | | | | 7.1 | | | | 552,025 | | | | 2,435,280 | | | | 7.1 | | | | 552,025 | |

| Stockpile | | | 500,000 | | | | 1.2 | | | | 18,968 | | | | - | | | | - | | | | - | | | | 500,000 | | | | 1.2 | | | | 18,968 | |

| Grey Fox1,4 |

| 147 Zone | | | | | | | | | | | | | | | 4,140,000 | | | | 2.1 | | | | 279,244 | | | | 4,140,000 | | | | 2.1 | | | | 279,244 | |

| Contact Zone | | | | | | | | | | | | | | | 2,965,000 | | | | 2.1 | | | | 201,605 | | | | 2,965,000 | | | | 2.1 | | | | 201,605 | |

| Goldfields1,3 |

| Box | | | 858,000 | | | | 2.0 | | | | 56,000 | | | | 12,966,000 | | | | 1.6 | | | | 681,000 | | | | 13,824,000 | | | | 1.7 | | | | 737,000 | |

| Athona | | | | | | | | | | | | | | | 7,036,400 | | | | 1.3 | | | | 289,600 | | | | 7,036,400 | | | | 1.3 | | | | 289,600 | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,432,059 | |

Estimated Gold Mineral Resource as of December 31, 2012

| Property | | Inferred Resource | |

| | | Tonnes | | | Gold Grade

(gpt) | | | Gold

(oz)5 | |

| Black Fox Mine2 |

| Open Pit | | | 319,164 | | | | 3.1 | | | | 31,620 | |

| Underground | | | 146,178 | | | | 5.6 | | | | 26,167 | |

| Grey Fox4 |

| 147 Zone | | | 1,040,266 | | | | 1.5 | | | | 51,261 | |

| Contact Zone | | | 652,000 | | | | 1.9 | | | | 39,800 | |

| Goldfields3 |

| Box | | | 3,158,000 | | | | 1.7 | | | | 176,000 | |

| Athona | | | 1,406,000 | | | | 1.1 | | | | 49,700 | |

| Total | | | | | | | | | | | 374,548 | |

1. The average gold grade for Proven and Probable Reserves is adjusted for dilution while Measured and Indicated Resources is not. Contained metal in estimated reserves remains subject to metallurgical recovery losses.

2. Black Fox reserves and resources are based on US$1,150/oz Au for 88% of production and US$500/oz Au for gold sold through the gold stream agreement from the NI 43-101 Technical Report prepared by Tetra Tech dated January 2011. The Black Fox open pit reserves and resources are reported at a 0.88 gpt cutoff and the underground reserves and resources are reported at a 2.54 gpt cutoff. Estimated Black Fox reserves and resources are shown as at December 31, 2012, net of mining depletion from the October 31, 2010 independent Technical Report.

3. Goldfields reserves and resources are based on CAD$1,250/oz Au and 2% NSR. Goldfields' Box and Athona deposits’ resources reflect a gold cut off grade (COG) of 0.50 gpt and reserves reflect a COG of 0.72 gpt with a marginal COG of 0.33 gpt. The NI 43-101 Technical Reports for the Box and Athona deposits, which comprise the Goldfields Project, were prepared by March Consulting Associates Inc., October 2011.

4. A gold price of US$1,250/oz and an exchange rate of US$1.00=C$1.00 was utilized in the gold cut-off grade calculations of 2.63 gpt for potential underground at the Contact Zone and 0.65 gpt for potential open-pit 147 Zone mineral resources. Underground and open-pit mining costs, process costs and G&A costs were estimated using experience gained from Brigus' Black Fox mine. Process recovery was assumed at 95%.

5. Disclosure of "contained ounces" is permitted under Canadian Regulations; however, the SEC permits resources to be reported only as in place tonnage and grade.

| Page 22 | | Brigus Annual Information Form 2012 |

Black Fox – Geology

The Black Fox deposit sits astride the Destor-Porcupine Fault Zone and is open at depth and along strike to the southeast. Black Fox is being mined as an open pit and underground mining operation. Black Fox commenced mining from the open pit in May 2009 and achieved commercial production from the underground operations in October 2011.

The former Glimmer underground gold mine operated on the Black Fox property over the period 1997-2001, and produced approximately 211,000 oz of gold by contract milling. Underground mining extended to depths of approximately 200 m to 215 m below the surface before operations were suspended due to low gold prices in May of 2001.

The Black Fox mineralization is subdivided into three main domains based on the continuity and style of the mineralization. The first is called the "Main Zone" and is delineated by the primary domain of shearing and mineralization. It is broader near surface reaching a maximum true width of 150 m normal to strike and dip and narrows at depth. It averages approximately 80 m normal to strike and dip and has currently been drill tested to 600 m below surface. Within the "Main Zone", the mineralization occurs along both a foliated fabric cut by discrete shear zones and as stockwork carbonate veining.

The second mineralization domain is called the "Flow Zones". This mineralization occurs as numerous sigmoid and lens shaped bodies completely hosted within or adjacent to the "Main Zone". The gold mineralization within these bodies has good geologic and grade continuity. The rock is distinctive with strong foliation, pervasive shearing and can be correlated reasonably well between adjacent drill holes.

The third mineralization domain is High Grade ("HG") Indicator Zone. This was a probabilistic approach to define the zones of mineralization over an average gold grade of 2 grams per tonne ("gpt"). This HG Indicator Zone was constrained within the Main Zone and overlapped at times on the Flow Zone. Each of the three mineralization domains was modeled independently.

Black Fox – Exploration

Beyond the known mineral reserves and resources, upside potential exists for resource additions from ongoing exploration drilling at the Black Fox Complex and Black Fox mill property. The Black Fox ore body remains open at depth and along strike.

The Company began exploration of the Black Fox mine site in 2003. The exploration drilling programs intersected significant gold mineralization in both near surface and down-dip of the former Glimmer mine as well as along strike.

From 2003 to 2007, the Company conducted a drilling program, during which 504 surface core drill holes totalling 149,548 m and 396 underground holes totalling 78,644 m were completed. The Company's drilling supplemented the data from the 286 surface and 707 underground drill holes drilled by the previous owners. In 2008 and 2009, the Company drilled 69 holes for a total of 13,651 m on the Grey Fox and Pike River properties, which are adjacent to the Black Fox mine site.

The 2008 drilling program of 16 core holes was successful in intersecting gold mineralization in rocks similar to the host rocks of the Black Fox ore on the Destor-Porcupine Fault Zone. The Company called this north-south mineral structure the Contact Zone. The 2008 drilling program also hit very high grade gold mineralization in a silicified breccia within the Contact Zone.

| Page 23 | | Brigus Annual Information Form 2012 |

The 2009 drilling program completed 53 holes at the Contact Zone and the Grey Fox and Pike River properties. Drilling results continued to show gold mineralization continuity in multiple shallow, mineralized zones.