NOTICE OF ANNUAL MEETING

OF THE SHAREHOLDERS OF BRIGUS GOLD CORP.

- and -

MANAGEMENT INFORMATION CIRCULAR

Delta Barrington Hotel

Barrington Room

1875 Barrington Street

Halifax, Nova Scotia B3J 3L6

MAY 29, 2013

11:00 a.m. Halifax Local Time

Circular dated April 19, 2013

BRIGUS GOLD CORP.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual meeting (the "Meeting") of shareholders ("Shareholders") of Brigus Gold Corp. (the "Corporation") will be held at the Delta Barrington Hotel, Barrington Room, 1875 Barrington Street, Halifax, Nova Scotia B3J 3L6, on Wednesday, May 29, 2013 at 11:00 a.m. (Halifax local time) for the following purposes:

| 1. | to receive the annual report and the financial statements for the year ended December 31, 2012 and the report of the auditor thereon; |

| 2. | to re-appoint the Corporation’s auditor and to authorize the directors to fix its remuneration; |

| 3. | to elect directors; and |

| 4. | to transact such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

A form of proxy solicited by management of the Corporation in respect of the Meeting is enclosed herewith.

Shareholders who are unable to be present at the Meeting are requested to sign the enclosed form of proxy and return it in the envelope provided for that purpose. To be effective, the form of proxy must be received at the offices of Canadian Stock Transfer Company, 320 Bay Street, 3rd Floor, Toronto, Ontario M5H 4A6 Canada, or, by facsimile at (416) 368-2502 or toll free fax 1-866-781-3111 or by email to proxy@canstockta.com no later than 5:00 p.m. (EST) on May 27, 2013 or, if the Meeting is adjourned, not later than 48 hours, excluding Saturdays, Sundays and holidays, preceding the time of such adjourned Meeting, or in either case by such later date and time as the Board may determine in its sole discretion. The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting.

DATED this 19th day of April, 2013

| | By Order of the Board |

| | |

| | (signed) Wade K. Dawe |

| | Chairman and Chief Executive Officer |

TABLE OF CONTENTS

| | Page |

| | |

| REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES | 1 |

| SHAREHOLDER PROPOSAL | 2 |

| Part I GENERAL PROXY MATERIALS | 2 |

| | |

| Solicitation of Proxies | 2 |

| Advice to Beneficial Holders | 2 |

| Advice to Registered Holders | 3 |

| Appointment and Revocation of Proxies | 4 |

| Voting Securities and Principal Holders of Voting Securities | 4 |

| | |

| Part II CORPORATE GOVERNANCE OF THE CORPORATION | 4 |

| Part III MATTERS TO BE ACTED UPON | 8 |

| Part IV ADDITIONAL DISCLOSURE | 12 |

| | |

| Statement of Executive Compensation | 12 |

| Compensation Discussion and Analysis | 13 |

| Performance Graph | 19 |

| Summary Compensation Table | 20 |

| Incentive Plan Awards | 21 |

| Termination and Change of Control Benefits | 24 |

| Director Compensation | 26 |

| Indebtedness of Directors and Officers of the Corporation | 31 |

| Directors' and Officers' Insurance | 31 |

| Interest of Certain Persons or Companies in Matters to be Acted Upon | 31 |

| Interest of Informed Persons in Material Transactions | 31 |

| Other Business | 31 |

| | |

| Part V ADDITIONAL INFORMATION | 32 |

| SCHEDULE "A" CORPORATE GOVERNANCE DISCLOSURE | A-1 |

| Brigus Management Information Circular | i |

BRIGUS GOLD CORP.

MANAGEMENT INFORMATION CIRCULAR

This management information circular (the "Information Circular") is furnished to the shareholders (the "Shareholders") of Brigus Gold Corp. ("Brigus" or the "Corporation") in connection with the solicitation of proxies by the management of the Corporation for use at the annual meeting of the Shareholders (the "Meeting") and any adjournment or adjournments thereof.

This Information Circular and the accompanying forms of notice and proxy as well as other related meeting materials are being mailed to Shareholders. Unless otherwise indicated, information in this Information Circular is given as of April 19, 2013.

No person is authorized to give any information or to make any representation not contained in this Information Circular, and if given or made, such information or representation should not be relied upon as having been authorized. This Information Circular does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer or solicitation of any offer or proxy solicitation. Neither delivery of this Information Circular nor any distribution of the securities referred to in this Information Circular shall, under any circumstances, create an implication that there has been no change in the information set forth herein since the date of this Information Circular.

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES

In this Information Circular, unless otherwise indicated, all references to ''$'' ''US$'' or ''U.S. dollars'' refer to United States dollars, and all references to "Cdn$" refer to Canadian dollars.

On April 19, 2013, the exchange rate for one Canadian dollar expressed in United States dollars, based upon the noon buying rates provided by the Bank of Canada, was US$1.0264 (Cdn$1.00 = US$0.9743).

| Brigus Management Information Circular | 1 |

SHAREHOLDER PROPOSAL

TheCanada Business Corporations Act("CBCA"), the Corporation's governing corporate statute, provides that shareholder proposals must be received at least 90 days before the anniversary date of the previous annual meeting of shareholders to be considered for inclusion in the Information Circular and the form of proxy for the Meeting of the Shareholders. The Corporation did not receive any shareholder proposals that are required to be included in this Information Circular.

Part I

GENERAL PROXY MATERIALS

Solicitation of Proxies

This Information Circular is furnished in connection with the solicitation by and on behalf of the management of the Corporation of proxies to be used at the Meeting to be held at the time and place and for the purposes set forth in the accompanying notice of meeting (the "Notice of Meeting"), and at any adjournment or adjournments thereof. In addition to solicitation by mail, certain officers, directors, employees and service providers of the Corporation may solicit proxies by telephone, electronic mail, facsimile or personally. These persons will receive no compensation for such solicitation other than their regular fees or salaries. The cost of solicitation by management will be borne directly by the Corporation. The head office of the Corporation is located at 1969 Upper Water Street, Suite 2001, Purdy's Wharf Tower II, Halifax, Nova Scotia B3J 3R7.

Advice to Beneficial Holders

The information set forth in this section is of significant importance to many public Shareholders as a substantial number of the public Shareholders do not hold common shares of the Corporation (the "CommonShares") in their own names. A shareholder is a non-registered shareholder (referred to in this Information Circular as "Beneficial Shareholders") if (i) an intermediary (such as a bank, trust company, securities dealer or broker, trustee or administrator of a registered retirement savings plan, registered retirement income fund, deferred profit sharing plan, registered education savings plan, registered disability savings plan or tax-free savings account), or (ii) a clearing agency (such as CDS Clearing and Depository Services Inc. or Depository Trust and Clearing Corporation), of which the intermediary is a participant (in each case, an "Intermediary"), holds the shareholder's shares on behalf of the shareholder.

In accordance with National Instrument 54-101 —Communication with Beneficial Owners of Securities of a Reporting Issuerof the Canadian Securities Administrators ("NI 54-101"), the Corporation is distributing copies of materials related to the Meeting to Intermediaries for distribution to Beneficial Shareholders and such Intermediaries are to forward the materials related to the Meeting to each Beneficial Shareholder (unless the Beneficial Shareholder has declined to receive such materials). Applicable regulatory policy requires Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every Intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its Intermediary is identical to the form of proxy provided to registered Shareholders. However, its purpose is limited to instructing the registered Shareholders how to vote on behalf of the Beneficial Shareholder.

| Brigus Management Information Circular | 2 |

Such Intermediaries often use a service company (such as Broadridge Financial Solutions Inc. ("Broadridge")), to permit the Beneficial Shareholders to direct the voting of the Common Shares held by the Intermediary on behalf of the Beneficial Shareholder. The Corporation is paying Broadridge to deliver, on behalf of the Intermediaries, a copy of the materials related to the Meeting to each "non-objecting beneficial owner" and each "objecting beneficial owner" (as those terms are defined in NI 54-101). Broadridge typically applies a decal to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. A Beneficial Shareholder receiving a proxy with a Broadridge decal on it cannot use that proxy to vote shares directly at the Meeting.The proxy must be returned to Broadridge well in advance of the Meeting in order to have the shares voted.

The Corporation is not relying on the notice and access delivery procedures outlined in NI 54-101 to distribute copies of proxy-related materials in connection with this Meeting.

Since the Corporation may not have access to the names of its non-registered Shareholders, if a Beneficial Shareholder attends the Meeting, the Corporation will have no record of the Beneficial Shareholder's shareholdings or of its entitlement to vote unless the Beneficial Shareholder's nominee has appointed the Beneficial Shareholder as proxyholder. Therefore, a Beneficial Shareholder who wishes to vote in person at the Meeting must insert his or her own name in the space provided on the voting instruction form sent to the Beneficial Shareholder by its nominee, and sign and return the voting instruction form by following the signing and returning instructions provided by its nominee. By doing so, the Beneficial Shareholder will be instructing its nominee to appoint the Beneficial Shareholder as proxyholder. The Beneficial Shareholder should not otherwise complete the voting instruction form as his or her vote will be taken at the Meeting.

Advice to Registered Holders

A registered holder of Common Shares can vote their Common Shares in person at the Meeting or by proxy. A registered holder who does not wish to attend the Meeting or does not wish to vote in person should submit their form of proxy. Registered holders who wish to vote in person at the Meeting are encouraged to vote by submitting a proxy. Voting by proxy will not prevent a registered holder from voting in person if they attend the Meeting and duly revoke their previously granted proxy, but will ensure that their vote is counted if they are unable to attend the Meeting.

The Common Shares represented by the accompanying form of proxy (if the same is properly executed in favour of Wade K. Dawe or Jon Legatto, the management nominees, and is received at the offices of Canadian Stock Transfer Company, 320 Bay Street, 3rd Floor, Toronto, Ontario M5H 4A6 Canada, or by facsimile at (416) 368-2502 or toll free fax 1-866-781-3111 or by e-mail at proxy@canstockta.com no later than5:00 p.m. (EST) on May 27, 2013or, if the Meeting is adjourned, not later than 48 hours, excluding Saturdays, Sundays or holidays, preceding the time of such adjourned Meeting, or in either case by such later date and time as the board of directors of the Corporation (the "Board") may determine in its sole discretion) will be voted at the Meeting, and, where a choice is specified in respect of any matter to be acted upon, will be voted in accordance with the specification made.In the absence of such a specification, such Common Shares will be voted in favour of such matter.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to the matters set forth in the accompanying Notice of Meeting, or all other business or matters that may properly come before the Meeting. At the date hereof, management of the Corporation knows of no such amendments, variations or other business or matters to come before the Meeting.

| Brigus Management Information Circular | 3 |

Appointment and Revocation of Proxies

The persons named in the accompanying form of proxy are a director and officer of the Corporation and an officer of the Corporation, respectively.A shareholder desiring to appoint some other person to represent him or her at the Meeting may do so either by inserting such person's name in the blank space provided in the accompanying form of proxy and striking out the names of the management nominees or by duly completing another proper form of proxy and, in either case, depositing the completed proxy at the offices of the Corporation's registrar and transfer agent, CIBC Mellon Trust Company, through its Administrative Agent, Canadian Transfer Company Inc., 320 Bay Street, 3rd Floor, Toronto, Ontario M5H 4A6 Canada, or by facsimile at (416) 368-2502 before the specified time described in the previous section.

A Shareholder giving a proxy has the power to revoke it.Such revocation may be made by the Shareholder attending the Meeting by fully executing another form of proxy bearing a later date and duly depositing the same before the specified time, or by written instrument revoking such proxy duly executed by the Shareholder or his or her attorney authorized in writing or, if the Shareholder is a body corporate, under its corporate seal or by an officer or attorney thereof, duly authorized, and deposited either at the head office of the Corporation or its registrar and transfer agent at any time up to and including the last business day preceding the date of the Meeting or any adjournment thereof, or with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof or in any other manner permitted by law. Such instrument will not be effective with respect to any matter on which a vote has already been cast pursuant to such proxy.

Voting Securities and Principal Holders of Voting Securities

The authorized capital of the Corporation consists of an unlimited number of Common Shares without nominal or par value, of which 231,571,920 Common Shares were issued and outstanding as at the date of this Information Circular.

Each Shareholder is entitled to one vote for each Common Share shown as registered in his or her name on the list of Shareholders, which will be available for inspection at the Meeting. The directors have fixed April 19, 2013 as the record date for the Meeting. Accordingly, pursuant to the CBCA, only Shareholders of record as at the close of business on April 19, 2013 are entitled to receive notice of and to attend and vote at the Meeting.

To the knowledge of the directors and officers of the Corporation, as of the date of this Information Circular, no person beneficially owns, or controls or directs, directly or indirectly, Common Shares carrying more than 10% of the votes attached to Common Shares.

Part II

CORPORATE GOVERNANCE OF THE CORPORATION

Statement of Corporate Governance Practices

National Instrument 58-101 -Disclosure of Corporate Governance Practices(the "Guidelines") requires certain disclosure regarding the corporate governance practices of the Corporation. The Corporation is pleased to make the following disclosure regarding its corporate governance policies. A detailed description of the Corporation's governance practices is provided in Schedule "A" to this Information Circular and the Charter of the Board of Directors (the "Charter") is attached as Appendix "1" to Schedule "A".

| Brigus Management Information Circular | 4 |

Board Composition

The Board of Directors ("Board") is currently composed of seven directors, Messrs. Wade K. Dawe, Harry Burgess, Derrick Gill, Michael Gross, Marvin K. Kaiser, David W. Peat and Charles E. Stott, all of whom are standing for election at the Meeting, with the exception of Charles E. Stott who has decided to retire from the Board (See Part III – Matters to be Acted Upon – Election of Directors). Of the current Board members, six are considered by the Board to be "independent" within the meaning of the Guidelines and Charter, as each does not have a direct or indirect material relationship with the Corporation. For the purposes of the Guidelines, a "material relationship" with the Corporation is a relationship which could, in the view of the Board, reasonably be expected to interfere with the exercise of a director's independent judgment. Mr. Dawe, Chairman and Chief Executive Officer of the Corporation, is not independent within the meaning of the Guidelines, the Charter and the rules and regulations of the NYSE MKT. In deciding whether a particular director is independent, the Board examines the factual circumstances of each director and considers them in the context of many factors. The role of the Chairman is described in the Charter set forth in Appendix "1" of Schedule "A" to this Information Circular. The Board believes that the size and composition of the Board has served the Corporation and its Shareholders well and that all of its directors, including its non-independent director, have made valuable contributions to the Board, the Corporation and its subsidiaries. The Board is of the view that Mr. Dawe possesses an extensive knowledge of the Corporation's business and has extensive business experience, which has proven to be beneficial to the other directors, and his participation as a director has contributed to the effectiveness of the Board. The Board also believes that Mr. Dawe is sensitive to conflicts of interest and excuses himself from deliberations and voting in appropriate circumstances.

Since Mr. Dawe, as Chairman, is not independent within the meaning of the Guidelines, the Board has appointed Dr. Gross as a Lead Independent Director from the ranks of the independent directors. Dr. Gross, as the Lead Independent Director, shall chair meetings of the independent directors and relay comments or recommendations to the Chairman of the Board and Chief Executive Officer. The Lead Independent Director is also responsible for setting procedures for meetings of the independent directors and will act as Chair of the Board at any meeting where the Chair is absent. The Lead Independent Director will also carry out other functions or assignments as requested by the Board.

Board Committees

At December 31, 2012, the Board had three standing committees, namely, the Audit Committee, the Nominations and Compensation Committee ("NCC" or "Nominations and Compensation Committee") and the Health, Safety and Environment Committee ("HSEC" or "Health, Safety and Environment Committee"). In addition, as and when required, the Board can appoint ad hoc committees to deal with specific matters.

On November 9, 2010, the Board adopted a Board of Directors Charter and adopted, revised and updated the NCC Charter. On March 29, 2011, the Board adopted, revised and updated the Audit Committee Charter, HSEC Charter and a Code of Ethics for directors, management and employees of the Corporation.

On March 27, 2013, the Board adopted, revised and updated the Audit Committee Charter.

On May 25, 2012, the Board approved and adopted the Employee Share Purchase Plan and Deferred Share Unit Plan.

| Brigus Management Information Circular | 5 |

Audit Committee

The Audit Committee is composed of the following three independent directors, which is consistent with the recommendations in the Guidelines and the requirements of the TSX: Messrs. Gill, Kaiser and Peat. Mr. Peat is chairman of the Audit Committee. The Board has determined that each of Messrs. Gill, Kaiser and Peat meet the independence and the financial literacy requirements of National Instrument 52-110 -Audit Committees and are "financially sophisticated," as defined in the rules promulgated by the NYSE MKT.

The Audit Committee is responsible for the integrity of the Corporation's internal accounting and control systems. The Committee receives and reviews the financial statements of the Corporation and makes recommendations thereon to the Board prior to their approval by the full Board. The Audit Committee oversees the work of the external auditor and communicates directly with the Corporation's external auditor in order to discuss audit and related matters whenever appropriate. The Annual Information Form ("AIF") of the Corporation filed with the Canadian securities regulatory authorities contains certain information relating to the Audit Committee, as well as the Audit Committee Charter. The AIF can be accessed on SEDAR at www.sedar.com.

Nominations and Compensation Committee

The NCC is currently composed of the following three independent directors: Messrs. Gill, Gross and Stott. Dr. Gross serves as chairman of the NCC and has completed the Rotman Directorship program and is a member of the Institute of Directors. All directors of the NCC bring years of experience from sitting on other mining company boards. Mr. Gill brings specific compensation experience to the Committee through his work as an industry consultant. Mr. Stott has been exposed to several companies’ compensation practices and policies during his career, most notably as President and CEO of Gold Capital Corporation, Horizon Resources and Amax Gold Inc.

The purpose of the NCC is to assist the Board in:

| (1) | developing and implementing the Corporation's governance guidelines; |

| (2) | identifying and recommending to the Board individuals qualified to become directors; |

| (3) | identifying and recommending to the Board individuals qualified to become chief executive officer ("CEO" or "Chief Executive Officer"); |

| (4) | recommending to the Board individuals qualified to become officers based upon recommendations of the CEO; |

| (5) | recommending the composition of the Board and its committees; |

| (6) | developing and overseeing the process to assess the effectiveness of the Board chair, the Board, the Board committees, chairs of committees, and individual directors; |

| (7) | overseeing the Corporation's policies concerning business conduct, ethics and other matters; |

| (8) | its oversight and responsibilities relating to the compensation, evaluation and succession of senior management; and |

| Brigus Management Information Circular | 6 |

| (9) | the compensation of directors. |

The responsibilities of the NCC include: (i) developing and recommending to the Board, the Charter, as well as the disclosure of the Corporation's governance guidelines and principles in the Corporation's public disclosure documents, in accordance with all applicable laws and regulations; (ii) developing and recommending to the Board policies regarding general responsibilities and functions of the Board and its members and the organization and responsibilities of Board committees, including committee charters; (iii) identifying, considering and recommending for approval by the Board, candidates qualified to become new directors and the nominees for election and/or appointment at the next annual meeting of Shareholders; (iv) assisting in the orientation of newly elected or appointed directors, including and becoming acquainted with the Corporation's governance processes, and encouraging continuing education opportunities for all members of the Board; (v) identifying, considering and recommending for approval by the Board, a candidate for the position of CEO; (vi) based upon recommendations of the CEO, considering and recommending for approval by the Board, candidates qualified to become officers of the Corporation; (vii) reviewing, reporting, and where appropriate, providing recommendations to the Board on the Corporation's Disclosure Policy, Code of Business Conduct, Insider Trading Policy, and other governance-related policies and guidelines, and recommend changes as deemed appropriate from time to time; (viii) reviewing and, where appropriate, providing recommendations to the Board on the Corporation's risk management and insurance policies; (ix) reviewing with the CEO management's assessment of existing management resources and making plans for ensuring the qualified personnel will be available as required for succession to senior management positions and to report to the Board on this matter at least once each year; (x) reviewing and assessing annually, in conjunction with the Board, the performance of the CEO against preset corporate and individual goals and objectives approved by the NCC; (xi) reviewing with the CEO the annual performance assessments of senior management, and to report annually to the Board on those assessments; (xii) reviewing and determining director compensation for Board and committee service, (xiii) overseeing and recommending for approval by the Board the Corporation's management compensation policy and specifically considering and recommending annually for approval by the independent directors all forms of compensation for the CEO; (xiv) reviewing the executive compensation disclosure package before the Corporation publicly discloses executive compensation information; and (xv) developing and overseeing a process to allow each director to assess the effectiveness and performance of the Board and the chair, the committees of the Board and their respective chairs, and individual members of the Board, including members of the NCC.

The NCC has the authority to engage outside counsel and other outside advisors as it deems appropriate to assist the NCC in performance of its functions. The Committee did not feel it necessary to retain the help of an advisor in 2012.

Health, Safety and Environment Committee

The HSEC is currently composed of the following three independent directors: Messrs. Burgess, Gross and Stott. Mr. Stott serves as chairman of the HSEC.

The Board has adopted a HSEC Charter, which, among other responsibilities, requires the HSEC to assist the Board in ensuring that the Corporation undertakes and conducts, in compliance with all applicable statutory and regulatory laws, and the Corporation policies, its operations in a safe and responsible manner, with due regard to:

| (1) | the safety and health of its employees; and |

| Brigus Management Information Circular | 7 |

| (2) | the impact of its operations on the natural environment, including the environmental impacts in the local community in which it operates. |

Part III

MATTERS TO BE ACTED UPON

Financial information about the Corporation is included in the financial statements and management's discussion and analysis for the year ended December 31, 2012. These documents are available on SEDAR atwww.sedar.com and have been mailed separately to registered shareholders and to beneficial owners who have requested to have a copy mailed to them, and will be presented to the Shareholders at the Meeting.

| 2. | Re-Appointment of Auditor |

The management of the Corporation recommends the re-appointment of Deloitte Chartered Accountants ("Deloitte"), as the external auditor of the Corporation for the fiscal year 2013. Deloitte has been the auditor for the Corporation since 2002. Unless such authority is withheld, the Common Shares represented by the accompanying form of proxy will be voted in favour of the re-appointment of Deloitte as auditor of the Corporation to hold office until the next annual meeting of shareholders and authorizing the directors of the Corporation to fix their remuneration.

This resolution requires the approval of a simple majority of the votes cast at the Meeting, in person or by proxy, in order to be approved.

In the absence of instructions to the contrary, the Common Shares represented by a properly executed form of proxy in favour of the persons designated by management of the Corporation will be voted FOR the re-appointment of Deloitte Chartered Accountants as auditor of the Corporation.

Directors of the Corporation are elected annually by the Shareholders and will hold office until the next annual general meeting of Shareholders. The constating documents of the Corporation provide that the number of directors to be elected shall be a minimum of three (3) and a maximum of fifteen (15). A Board of six (6) directors is to be elected at the Meeting as Charles E. Stott has decided to retire from the Board.

It is intended that the persons named in the accompanying form of proxy will vote the Common Shares represented thereby in favour of electing as directors the nominees named below. Unless such authority is withheld, the Common Shares represented by the accompanying form of proxy will be voted in favour of the nominees set out below.

The term of office of all present directors of the Corporation expires at the Meeting. Management has been informed by each nominee that he is willing to stand for election or re-election, as applicable, and serve as a director. Each of the directors will be elected on an individual basis.

| Brigus Management Information Circular | 8 |

In the absence of instructions to the contrary, the Common Shares represented by a properly executed form of proxy in favour of the persons designated by management of the Corporation will be voted FOR the election as directors of the nominees whose names are set forth below.

Name and

Municipality of

Residence and Date

First Become a

Director | | Present Principal Occupation | | Common Shares

Beneficially

Owned, or

Controlled or

Directed, Directly

or Indirectly(1) at

the date of this

Information

Circular | | | Percentage of

Total

Outstanding

Common Shares

at the date of

this Information

Circular | |

Wade K. Dawe

Halifax, Nova Scotia, Canada

June 25, 2010 | | Chairman and Chief Executive Officer of the Corporation | | | 3,193,711 | (7) | | | 1.379 | % |

Harry Burgess(4)

Toronto, Ontario, Canada

November 18, 2010 | | Senior Associate Mining Engineer of Micon International Limited | | | 20,000 | | | | 0.009 | % |

Derrick Gill(2) (3)

St. John's, NL, Canada

June 25, 2010 | | Executive Vice President and Principal Consultant of Strategic Concepts Inc. | | | 40,000 | | | | 0.017 | % |

Dr. Michael Gross(3)(4)(6)

Halifax, Nova Scotia, Canada

June 25, 2010 | | Professor of Orthopedic Surgery at Dalhousie University | | | 1,578,085 | | | | 0.681 | % |

Marvin K. Kaiser(2) Mayfield, Kentucky, USA May 24, 2006 | | Retired Business Executive | | | 16,250 | | | | 0.007 | % |

David W. Peat(2)(5)

Fernandina Beach, Florida, USA

May 24, 2006 | | Financial Consultant | | | 16,250 | | | | 0.007 | % |

Notes:

| 1) | The information as to Common Shares beneficially owned or over which control or direction is exercised, not being within the knowledge of the Corporation, has been furnished by the respective parties. |

| 2) | Member of the Audit Committee. |

| 3) | Member of the Nominations and Compensation Committee. |

| 4) | Member of the Health, Safety and Environment Committee. |

| 5) | Chairman of the Audit Committee. |

| 6) | Chairman of the Nominations and Compensation Committee. |

| 7) | Mr. Dawe owns 2,085,415 Common Shares directly and 1,108,296 Common Shares indirectly. |

The following are brief profiles of the directors of the Corporation, including a brief description of each individual's principal occupation within the past five years.

| Brigus Management Information Circular | 9 |

Wade K. Dawe — Chairman and Chief Executive Officer

Mr. Dawe is the chairman and CEO of the Corporation, a position he has held since the Corporation’s business combination with Linear Gold Corp. (“Linear”) in June 2010. Mr. Dawe has been an entrepreneur in Canadian mining and venture capital industries since 1994 and has consistently demonstrated strong results for shareholders through strategic planning, quality acquisitions and partnerships, and by retaining and developing industry respected senior management and directors. He is chairman and a director of Stockport Exploration Inc. ("Stockport"), and also serves on the board of directors of ImmunoVaccine Inc. Mr. Dawe has a bachelor of commerce degree from Memorial University of Newfoundland, where he currently serves on the Advisory Board to the Faculty of Business Administration. Mr. Dawe's philanthropic activities include establishing and personally funding the annual James R. Pearcey Entrepreneurial Scholarship at Memorial University. Mr. Dawe, a native of Newfoundland and Labrador, is also a member of the Young Presidents' Organization, an international organization for business leaders.

Harry Burgess — Director

Mr. Burgess is a director and member of the Health, Safety and Environment Committee of the Corporation. He is aSenior Associate Mining Engineer of Micon International Limited ("Micon") of Toronto, Ontario. As a founder of Micon, he has over 30 years experience in the mining industry, including conducting due diligence reviews, operational monitoring and benchmark studies. Prior to his consulting career, he held senior management positions in the copper and gold mining industry in Zambia and South Africa. He is a member of the Professional Engineers of Ontario and the Canadian Institute of Mining and Metallurgy, as well as a fellow of the Institute of Materials, Minerals and Mining and the Australian Institute of Mining and Metallurgy. He is also a director of Guyana Precious Metals and Acme Resources Corp., both TSXV-listed companies, and Tartisan Resources Corp., a CNSX-listed company. Mr. Burgess received his bachelor's degree with honours in mechanical engineering at the Imperial College of Science and Technology, University of London and his bachelor's degree in mining engineering at the Royal School of Mines, University of London. He earned his master's degree in engineering from the University of Witwatersrand, Johannesburg.

Derrick Gill — Director

Mr. Gill is a director, a member of the Audit Committee and of the Nominations and Compensation Committee of the Corporation. Mr. Gill is the Executive Vice President and Principal Consultant of Strategic Concepts Inc., which provides strategic planning, financial modeling and business development consultation to major mining and oil and gas projects in Canada. He is also a member of the advisory board of the Atlantic Canada Opportunities Agency’s Atlantic Innovation Fund.Mr. Gill’s 30-year career has included executive roles at Vale Inco Newfoundland & Labrador Limited (formerly Voisey's Bay Nickel Company), Diamond Fields International Ltd. (formerly Diamond Fields Resources Inc.) and Bristol Communications. Mr. Gill currently serves as the chair of Genesis, a commercial research and development arm of Memorial University in Newfoundland and Labrador. He is also a director of Crosshair Exploration & Mining Corp. Mr. Gill received his undergraduate degree in business administration from Memorial University.

| Brigus Management Information Circular | 10 |

Michael Gross, ICD – Director

Dr. Gross is a director, chairman of the Nominations and Compensation Committee a member of the Health, Safety and Environment Committee, and the independent lead director of the Corporation. He has extensive capital markets experience, having served as either an executive or as a director with a number of venture stage companies. Dr. Gross was a founder and chairman of the board of NWest Energy Corp. prior to its successful initial public offering in 2008. A Professor of Orthopaedic surgery for over 20 years, he consults extensively in design and implantation techniques with the Orthopaedic manufacturing industry. Dr. Gross is also the founder of companies specializing in proprietary medical devices. He received his degree in medicine from the University of Newcastle Upon Tyne in England. He obtained a Fellowship in Surgery in London and a Canadian Fellowship in Orthopaedic Surgery in 1981. He has completed the Rotman Directorship program and is a member of the Institute of Directors.

Marvin K. Kaiser– Director

Mr. Kaiser is a director and member of the Audit Committee of the Corporation. He has over 40 years of experience in the mining industry and is a Certified Public Accountant. At the time of his retirement in 2006, he was Executive Vice President and Chief Administrative Officer of The Doe Run Company ("Doe Run"), an international natural resource company focused on the mining, smelting, recycling and fabrication of metals. Prior to joining Doe Run, Mr. Kaiser was the Chief Financial Officer of Amax Gold Inc from 1989 to 1993. He serves as a director of Gryphon Gold, Inc., Uranium Resources, Inc., and Aurania Resources, Ltd., as well as a privately held exploration companies. Mr. Kaiser received his bachelor's degree in accounting from Southern Illinois University and serves as a director of the Southern Illinois University Foundation.

David W. Peat — Director

Mr. Peat is a director and chairman of the Audit Committee of the Corporation. He has over 25 years of executive experience in financial leadership in support of mining corporations. Mr. Peat has held multiple executive positions including Vice President and Chief Financial Officer of Frontera Copper Corporation from 2006 through 2009; Vice President and Global Controller of Newmont Mining Corporation from 2002 through 2004; and Vice President of Finance and Chief Financial Officer of Homestake Mining Company from 1999 through 2002. Mr. Peat began his career at Price Waterhouse in Toronto and he has been a member of the Institute of Chartered Accountants of Ontario since 1978. He is currently a director and chairman of the Audit Committee of Gabriel Resources Ltd and a director and chairman of the Audit Committee of the Sunshine Silver Mines Corporation, a privately held silver exploration and development company. Mr. Peat received his bachelor's degree in economics from the University of Western Ontario, and a bachelor of commerce, with honours in business administration, from the University of Windsor, Ontario.

Corporate Cease Trade Orders, Penalties and Bankruptcies

To the best of the Corporation's knowledge, no existing or proposed director is, or within the 10 years prior to the date hereof has been, a director or chief executive officer or chief financial officer of any company that, while that person was acting in that capacity,

| (a) | was subject to an order that was issued while the proposed director was acting in the capacity of director, chief executive officer or chief financial officer; or |

| (b) | was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

| Brigus Management Information Circular | 11 |

Bankruptcies

To the Corporation's knowledge, no existing or proposed director of the Corporation has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangements or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

Other than as described below, to the Corporation's knowledge, no existing or proposed director of the Corporation is or has been, within the 10 years before the date of this Information Circular, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Marvin Kaiser was a director of Constellation Copper Corporation, which filed an assignment in bankruptcy under theBankruptcy and Insolvency Act(Canada) in December 2008.

Conflicts of Interest

The directors are required by law to act honestly and in good faith with a view to the best interests of the Corporation and to disclose any interests that they may have in any project or opportunity of the Corporation. If a conflict of interest arises at a meeting of the Board, any director in a conflict will disclose his interest and abstain from voting on such matter.

To the best of the Corporation's knowledge, and other than disclosed herein, there are no known existing or potential conflicts of interest among the Corporation, its promoters, directors and officers or other members of management of the Corporation or of any proposed promoter, director, officer or other member of management as a result of their outside business interests, except that certain of the directors and officers serve as directors and officers of other companies, and therefore it is possible that a conflict may arise between their duties to the Corporation and their duties as a director or officer of such other companies.

Part IV

ADDITIONAL DISCLOSURE

Statement of Executive Compensation

Securities laws require that a "Statement of Executive Compensation" in accordance with Form 51-102F6 be included in this Information Circular. Form 51-102F6 prescribes the disclosure requirements in respect of the compensation of executive officers and directors of reporting issuers. Form 51-102F6 provides that compensation disclosure must be provided for the Chief Executive Officer and the Chief Financial Officer of an issuer and each of the issuer's three mostly highly compensated executive officers whose total compensation exceeds Cdn$150,000. Based on these requirements, the executive officers of the Corporation for whom disclosure is required under Form 51-102F6 are Wade K. Dawe (Chairman and CEO), Jon Legatto (CFO), Dana Hatfield (former CFO), Daniel Racine (President and COO), Howard Bird (Sr. Vice President of Exploration), and Jennifer Nicholson (Former Executive Vice President), who are collectively referred to as the "Named Executive Officers".

| Brigus Management Information Circular | 12 |

On September 4, 2012, Jon Legatto was appointed as Brigus’ new Chief Financial Officer, effective in the third quarter of 2012, following the resignation of Dana Hatfield. Daniel Racine joined Brigus as COO on August 21, 2012 and was promoted to President and COO on January 1, 2013.

Compensation Discussion and Analysis

Compensation Philosophy and Objectives

The Nominations and Compensation Committee of the Board (for the purposes of this discussion, the "Committee") has responsibility for approving the compensation program for the Named Executive Officers. The Committee acts pursuant to the Nominations and Compensation Committee Charter that has been approved by the Board.

The compensation program for the Named Executive Officers is designed to attract, retain and reward talented executives who can contribute to the Corporation's long-term success and thereby build value for the Corporation's Shareholders. The program is organized around four fundamental principles:

A Substantial Portion of the Corporation's Named Executive Officer Compensation Program Should Be Performance-Based. The Corporation's compensation program is designed to reward superior performance. It accomplishes this in a number of ways. In terms of cash compensation, target award opportunities provided to each Named Executive Officer under the Corporation's bonus plan (which pays bonuses on the basis of performance over a one-year period) are expressed as a percentage of base salary, generally in the range of 40% - 50% for vice presidents, executive vice presidents and the chief financial officer, at target performance, with the performance target being a median of the range of possible outcomes. Actual performance will result in a cash bonus that is most often a greater or lesser percentage of salary than that set for achieving target performance. The cash bonus award for the CEO is left to the discretion of the Board. Whether and to what extent bonuses under the bonus plan are paid depends entirely on the extent to which the corporate, operating and individual goals set by the Committee pursuant to the bonus plan are attained.

A Substantial Portion of Named Executive Officer Compensation Should Be Delivered in the Form of Equity Awards. The Committee believes that a substantial portion of total compensation should be delivered in the form of equity in order to align the interests of the Named Executive Officers with the interests of the Shareholders. In terms of equity awards, the target award opportunities provided to each Named Executive Officer are set at the discretion of the Board of Directors. Whether and to what extent equity awards are made depends entirely on the extent to which the corporate, operating and individual goals set by the Committee are attained.

The Corporation's Compensation Program for Named Executive Officers Should Enable the Corporation to Compete for Executive Talent. The Corporation's Shareholders are best served when the Corporation can attract and retain talented executives with compensation packages that are competitive and fair. The Committee has historically strived to create a compensation package for Named Executive Officers that delivers total compensation that is competitive in comparison to the average of the total compensation delivered by certain peer companies with which the Corporation competes for executive talent (the "Peer Group"). In 2012, the Peer Group selected by the Committee consisted of the following companies:

| Brigus Management Information Circular | 13 |

| Lake Shore Gold Corp. | Argonaut Gold Inc. |

| | |

| Aurizon Mines Ltd. | San Gold Corp. |

| | |

| St Andrews Goldfields Ltd. | Kirkland Lake Gold Inc. |

The Corporation's Compensation Program for Named Executive Officers Should Be Fair, and Perceived as Such, Both Internally and Externally. The Committee strives to create a compensation program that will be perceived as fair, both internally and externally. It accomplishes this by comparing the compensation that is provided to the Named Executive Officers:

| (1) | to the compensation, as described above, provided to officers of the companies included in the Peer Group, as a means to measure external fairness; and |

| (2) | to other senior employees of the Corporation, as a means to measure internal fairness. |

Total Compensation

Total compensation for Named Executive Officers is based on the following components: (i) cash compensation, which includes base salary and bonuses; (ii) performance-based compensation; and (iii) other compensation.

Cash Compensation

The Corporation's compensation program for Named Executive Officers is designed so that a percentage of each Named Executive Officer's total compensation is paid in cash. Cash compensation paid is composed of salary and, if earned, a cash bonus pursuant to the Corporation's bonus plan. The percentage of cash compensation paid relative to a Named Executive Officer's total compensation is generally set at up to 50% of total compensation. Salary is included in the Corporation's Named Executive Officer compensation package because the Committee believes it is appropriate that some portion of the compensation that is provided to Named Executive Officers be in a form that is fixed and liquid. Performance-based bonuses are included to incent the Named Executive Officers to attain particular objectives that the Committee believes are consistent with the overall goals set for the Corporation by its Board. The components comprising the cash portion of total compensation are described below.

Salary. Base salary for Named Executive Officers for any given year is generally fixed by the Committee. Increases or decreases in base salary on a year-over-year basis are dependent on the Committee's assessment of the performance of the Corporation overall, the Corporation's mining projects and the particular individual. Other than the fact that executive officers have employment agreements with a minimum level of salary specified within the agreement, the Committee is free to set Named Executive Officer salary at any level it deems appropriate. In fixing salaries, the Committee is generally mindful of its overall goal to keep cash compensation for its executive officers within the range of cash compensation paid by companies in the Peer Group. The amount of salary that is provided in the form of compensation is generally less, assuming threshold performance levels are met, than the amount that is provided in the form of bonuses and equity awards under the Corporation's short and long-term bonus plans, each of which is described below. This weighting reflects the Committee's objective of ensuring that a substantial amount of each Named Executive Officer’s total compensation is tied to company-wide, mine and project results and individual performance goals.

Bonus Plans. The Corporation has a cash bonus plan in which Named Executive Officers participate. This plan, which is described below, provides cash compensation to Named Executive Officers only if, and to the extent that, performance conditions set by the Committee are met. Bonus targets are set annually based on the Corporation's plan and budget for such fiscal year and are set at levels that the Corporation believes will be reasonably difficult to achieve.

| Brigus Management Information Circular | 14 |

In determining the amount of target bonuses under the bonus plan, the Committee considers several factors, including:

| (1) | the target bonuses set, and actual bonuses paid, in recent years; |

| (2) | the desire to ensure, as described above, that a substantial portion of total compensation is performance-based; |

| (3) | the relative importance, in any given year, of the long and short-term performance goals established pursuant to the bonus plan; and |

| (4) | the compensation practices of the Peer Group. |

Performance objectives for the bonus plan are developed through an iterative process. Based on a review of business plans, management, which includes the Named Executive Officers, develops preliminary recommendations for Committee review. The Committee reviews management's preliminary recommendations and establishes final goals. In establishing final goals, the Committee strives to ensure that the incentives provided pursuant to the bonus plan are consistent with the strategic goals set by the Board, that the goals set provide a meaningful incentive and that bonus payments, assuming target levels of performance are attained, will be consistent with the overall Named Executive Officer compensation program established by the Committee. The Committee reserves the discretion to reduce or not pay bonuses under the bonus plan even if the relevant performance targets are met, and to award bonuses in excess of the targets if the relevant performance targets are exceeded.

For the fiscal year ended December 31, 2012, the bonus targets upon which cash bonuses were based included the following objectives:

Operations:

| · | Maintain compliance with all safety and environmental regulations and maintain the Company’s emphasis on safety in the work-place. |

| o | Met. There were no lost time incidents during 2012 and no material safety or environmental violations. |

| · | Achieve production within guidance of 77,000 to 85,000 ounces. |

| o | Met. Annual production reached a record 77,374 ounces in 2012. |

| · | Achieve cash costs within guidance of $775-$850 per ounce. |

| o | Met. Cash costs for 2012 totaled $762 per ounce. |

| · | Adhere to capital budget of $60 million. |

| o | Met. Capital spending in 2012 totaled $53.5 million, and all major capital projects were completed as scheduled. |

| Brigus Management Information Circular | 15 |

| · | Increase operational performance in the underground mine. |

| o | Met. Production from the underground materially increased in 2012. The average grade from the underground increased from 2.7 gpt in 2011 to 6.5 gpt in 2012, and the tonnes mined per day increased on a quarter over quarter basis. |

Corporate:

| · | Increase analyst coverage of the Company, including at least one major chartered bank. |

| o | Met. Three new analysts initiated coverage on the Company in 2012. |

| · | Recruit an experienced Chief Operating Officer to oversee the continued development of the Black Fox mine and the development of the Grey Fox mine. |

| o | Met. Daniel Racine, a well-respected mining executive with over 25 years in the industry, joined the Company in August of 2012. |

Finance

| · | Obtain financing to repurchase all or a portion of the Goldstream prior to the expiry of the option on December 31, 2012. |

| o | Met. The Company raised $30 million in senior secured notes in November of 2012 which was used to reduce the Goldstream from 12% to 8%. |

| · | Ensure that sufficient capital is available to fund the Company’s current and forecasted operating requirements by liquidating non-core assets and obtaining financing as and when needed. |

| o | Met. The Company generated $5.8 million in cash from the sale of the notes receivable obtained in 2010. The Company also successfully raised $10 million in flow-through funds in November of 2012 to fund the 2013 exploration program. Additionally, the Company completed a $15 million equity offering and a $15 million lease financing in March of 2012 to support operations during the year. The Company has ended the year with $29.8 million in cash, which is sufficient to fund the Company’s goals and objectives for 2013. |

Exploration

| · | Issue an updated 43-101 report on the Grey Fox mine, with a significant increase in the number of indicated ounces. |

| o | Met. The Company issued a revised National Instrument 43-101 report in September of 2012 which increased the Indicated reserves at Grey Fox by 364,140 ounces. |

| · | Commence an underground exploration program at the Black Fox mine. |

| o | Met. The first results of the Company’s underground exploration program at Black Fox were issued in October of 2012. |

| Brigus Management Information Circular | 16 |

| · | Adhere to the exploration budget. |

| o | Met. Spending on the exploration program in 2012 remained within budget. |

Performance-Based Compensation

As described above, the Committee believes that a portion of each Named Executive Officer's compensation should be in the form of equity awards, because the Committee believes that such awards serve to align the interests of Named Executive Officers and the Corporation's Shareholders. Equity awards to the Corporation's Named Executive Officers are made pursuant to the Corporation's Plan. The Plan provides for awards in the form of stock options and deferred share units.

The amount of equity compensation that is provided to each Named Executive Officer in a given year is at the discretion of the Committee. The number of options or deferred share units that the Committee selects is dependent on the Committee's assessment, for that year, of the appropriate balance between cash and equity compensation. In making that assessment, the Committee considers factors such as the relative merits of cash and equity as a device for retaining and incentivizing Named Executive Officers.

Summary of Stock Option Plan

The stock option plan was established by the Corporation to align employee and board of directors’ goals with long-term corporative objectives. The stock option plan allows eligible persons to purchase the awarded options at the market price on the day the option was granted as long as it’s outside the vesting period and before the expiration date.

The number of Common Shares reserved for issuance, set aside and made available to the Board or Committee for the granting of Options to eligible grantees shall not exceed 10% of the issued and outstanding Common Shares. From time to time, provided that in any fiscal year, the Company shall limit the number of Options granted to a maximum of 3.33% of its issued and outstanding Common Shares at the beginning of the fiscal year such that the maximum is based on the number of Common Shares outstanding at the previous fiscal year end.

The Committee has generally followed a practice of making all option grants to its executive officers during the first quarter of each year based on the previous year's performance. For the last six years, the Committee has granted these annual awards. The Corporation does not otherwise have any program, plan or practice to time annual option grants to its executives in coordination with the release of material non-public information.

While the bulk of the Corporation's option awards to Named Executive Officers have historically been made pursuant to the Corporation's annual grant program, the Committee retains the discretion to make additional awards to Named Executive Officers at other times, in connection with the initial hiring of a new officer, for retention purposes or otherwise. The Committee has generally followed the practice of making awards only during a time when the Corporation's Named Executive Officers would be permitted, pursuant to the Corporation's insider trading policy, to trade in the Corporation's securities. Other than in this respect, the Corporation does not have any program, plan or practice to time ad hoc awards in coordination with the release of material non-public information.

| Brigus Management Information Circular | 17 |

Summary of Deferred Share Unit Plan

The deferred share unit plan was established by the Corporation to align executive and board of directors’ goals with long-term corporative objectives. The deferred share units plan allows eligible persons to receive securities, for no additional cash consideration, based on the achievement of certain milestones. The maximum number of shares which could be issued under the deferred share units plan is 5 million.

The process for granting deferred share units is consistent with the process for the granting of stock options. Deferred share unit grants to executive officers and directors are made during the first quarter of each year based on the previous year's performance. 2012 was the first year that the Committee granted deferred share unit awards. The Corporation does not otherwise have any program, plan or practice to time annual deferred share unit grants to its executives in coordination with the release of material non-public information.

While the bulk of the Corporation's deferred share unit awards to Named Executive Officers will be made pursuant to the Corporation's annual grant program, the Committee retains the discretion to make additional awards to Named Executive Officers at other times, in connection with the initial hiring of a new officer, for retention purposes or otherwise. The Committee has generally followed the practice of making awards only during a time when the Corporation's Named Executive Officers would be permitted, pursuant to the Corporation's insider trading policy, to trade in the Corporation's securities. Other than in this respect, the Corporation does not have any program, plan or practice to time ad hoc awards in coordination with the release of material non-public information.

Summary of Employee Share Purchase Plan

The employee share purchase plan was established by the Corporation to encourage equity participation in the Corporation by its employees through the acquisition of shares of the Corporation. The employee share purchase plan allows eligible persons to elect to contribute up to 10% of such person’s basic annual salary towards the purchase of common shares of the Corporation, with the Corporation matching 75% of such contribution. The maximum number of shares which could be issued under the employee share purchase plan is 5 million.

Peer Comparisons

In its annual evaluation of the compensation of the Corporation's executive officers, the Committee uses peer comparisons to obtain a general understanding of current compensation practices for the market in which the Corporation competes. The Committee does not benchmark executive compensation at a certain level or percentile based on peer comparison data. Rather, this data is only one of the components considered when setting executive compensation. Other factors include, but are not necessarily limited to, level of responsibility, individual performance, and budget constraints.

Risk Assessment

The Nominations and Compensation Committee has concluded that the risks associated with executive compensation are not reasonably likely to have a material adverse effect on the Company. In addition, the Committee has extensively reviewed the elements of executive compensation and find it to be balanced between risk and reward and does not motivate imprudent risk taking for the following reasons:

| Brigus Management Information Circular | 18 |

| (a) | significant weighting towards long-term incentive compensation discourages short-term risk taking; |

| (b) | goals are appropriately set to avoid targets that, if not achieved, result in a large percentage loss of compensation; |

| (c) | incentive awards are capped by the Compensation Committee; and |

| (d) | equity ownership discourages excessive risk taking by putting in place safe guards like multi-year vesting periods and prevention to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities. |

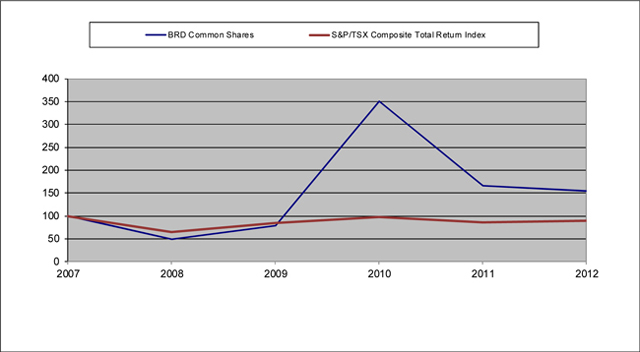

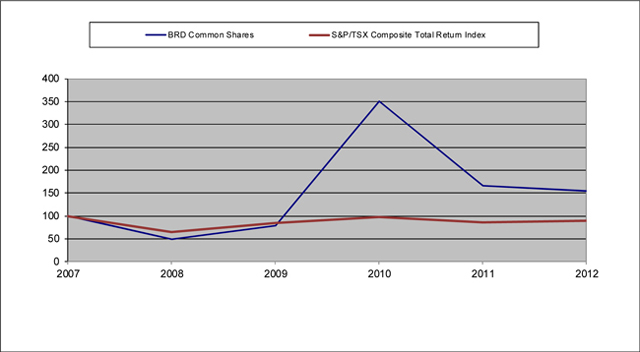

Performance Graph

The following line graph compares the Corporation's five year cumulative shareholder return (based on the closing price of the Common Shares on the TSX at the end of each financial year and using an initial investment of Cdn$100 on December 31, 2007) to the S&P/TSX Composite Index. The Corporation did not pay any dividends during the subject period.

| | | Dec-07 | | | Dec-08 | | | Dec-09 | | | Dec-10 | | | Dec-11 | | | Dec-12 | |

| Brigus Gold Corp. | | | 100.00 | | | | 48.33 | | | | 78.33 | | | | 350.00 | | | | 166.67 | | | | 155.00 | |

| S&P/TSX Composite Index | | | 100.00 | | | | 64.97 | | | | 84.91 | | | | 97.11 | | | | 86.42 | | | | 89.88 | |

| Brigus Management Information Circular | 19 |

Summary Compensation Table

The following table discloses compensation paid to or awarded to the Named Executive Officers. Securities legislation provides that the Named Executive Officers are determined on the basis of total compensation earned in the 2012 fiscal year. All dollar amounts outlined in the table below are in U.S. dollars.

Name and

principal

position | | Year | | | Salary | | | Share-

based

awards(1) | | | Option-

based

awards(2) | | | Non-equity

incentive plan

compensation | | | Pension

value | | | All other

compensation

(3) | | | Total

compensation | |

| | | | | | | | | | | | | | | Annual | | | Long

-term | | | | | | | | | | |

| Wade K. | | | 2012 | | | | 427,323 | | | | 260,966 | | | | 792,000 | | | | 450,200 | | | | Nil | | | | 11,914 | | | | Nil | | | | 1,942,403 | |

| Dawe | | | 2011 | | | | 378,000 | | | | Nil | | | | 522,000 | | | | 317,500 | (8) | | | Nil | | | | Nil | | | | Nil | | | | 1,217,500 | |

| Chairman | | | 2010 | | | | 185,727 | | | | 330,000 | (9) | | | 554,842 | | | | 272,000 | | | | Nil | | | | Nil | | | | 551,606 | (9) | | | 1,894,175 | |

| & CEO | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Daniel Racine(4) President & COO | | | 2012 | | | | 163,355 | | | | 105,797 | | | | 480,000 | | | | 110,033 | | | | Nil | | | | 6,534 | | | | Nil | | | | 865,719 | |

Jon Legatto(5) CFO | | | 2012 | | | | 181,721 | | | | 56,425 | | | | 255,000 | | | | 95,029 | | | | Nil | | | | 7,269 | | | | Nil | | | | 595,444 | |

| Dana | | | 2012 | | | | 186,723 | | | | 265,280 | (10) | | | 297,000 | | | | Nil | | | | Nil | | | | 7,469 | | | | 285,233 | | | | 1,041,705 | |

Hatfield(6) | | | 2011 | | | | 200,418 | | | | Nil | | | | 609,000 | | | | 34,608 | | | | Nil | | | | 5,142 | | | | Nil | | | | 849,168 | |

| Former CFO | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Howard Bird | | | 2012 | | | | 240,072 | | | | 84,638 | | | | 297,000 | | | | 100,033 | | | | Nil | | | | 9,603 | | | | Nil | | | | 731,346 | |

| Sr. Vice | | | 2011 | | | | 224,128 | | | | Nil | | | | 261,000 | | | | 89,104 | (8) | | | Nil | | | | 4,615 | | | | Nil | | | | 578,847 | |

| President of Exploration | | | 2010 | | | | 113,268 | | | | Nil | | | | 197,031 | | | | 97,891 | | | | Nil | | | | Nil | | | | Nil | | | | 408,190 | |

Jennifer | | | 2012 | | | | 210,063 | | | | 70,531 | | | | 297,000 | | | | 65,027 | | | | Nil | | | | 2,801 | | | | 212,434 | | | | 857,856 | |

| Nicholson(7)Executive Vice President | | | 2011 | | | | 161,610 | | | | Nil | | | | 413,250 | | | | 59,608 | (8) | | | Nil | | | | 3,955 | | | | Nil | | | | 638,423 | |

Notes:

| (1) | Share-based awards represent the value of deferred share units granted, measured at the common share price as at the date of grant. |

| (2) | The fair value of each option granted is estimated at the time of grant using the Black-Scholes option-pricing model with weighted average assumptions for grants as follows: |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Risk-free interest rate | | | 1.3 | % | | | 1.7 | % | | | 1.8 | % | | | 1.9 | % | | | 2.9 | % |

| Dividend yield | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| Volatility | | | 69 | % | | | 72 | % | | | 74 | % | | | 78 | % | | | 73 | % |

| Expected life in years | | | 4.6 | | | | 4.3 | | | | 3.3 | | | | 6.0 | | | | 6.0 | |

| Weighted average grant-date fair value of stock options | | $ | 0.61 | | | $ | 0.85 | | | $ | 0.64 | | | $ | 0.87 | | | $ | 1.75 | |

| Brigus Management Information Circular | 20 |

| (3) | The value of perquisites and benefits that do not exceed the lesser of Cdn$50,000 and 10% of the total salary are not reported herein. |

| (4) | Mr. Racine joined the company as COO on August 21, 2012 and was promoted to President and COO on January 1, 2013. |

| (5) | Mr. Legatto was promoted to CFO on September 4, 2012. Prior to this role, he served as Brigus’ Vice President of Finance since April 2011. |

| (6) | Mr. Hatfield resigned from the Company on September 4, 2012 and amounts in all other compensation reflect severance payments made. |

| (7) | Ms. Nicholson resigned from the Company on December 31, 2012 and amounts in all other compensation reflect severance payments made. |

| (8) | A payment related to 2011 non-equity compensation was made in July 2012. |

| (9) | Upon the June 2010 merger, these amounts were paid in accordance with employment contracts. |

| (10) | Mr. Hatfield’s deferred share units vested during the year. The share-based award listed above is the value on the date the units were exercised. |

Incentive Plan Awards

Option-Based Awards Outstanding at the end of the Most Recently Completed Financial Year

The table below reflects all option-based and share-based awards for each Named Executive Officer outstanding as at December 31, 2012 (including option-based awards granted to a Named Executive Officer before fiscal 2012).

| | | OPTION–BASED AWARDS | | | SHARE–BASED AWARDS (DSUs) |

Named

Executive

Officer | | Number of

Securities

Underlying

Unexercised

Options(1) | | | Option

Exercise

Price

(/Security) | | | Option

Expiration

Date(2) (3) | | Value of

Unexercised

In-the-

Money

Options(4) | | | Number of

Share-based

Awards that

Have Not Yet

Vested | | Market or

Payout Value

of Share-

Based

Awards That

Have Not Yet

Vested

(US$)(9) | | | Market or

Payout Value of

Vested Share-

Based Awards

Not Paid Out or

Distributed

(US$) |

| | | | | | | | | | | | | | | | | | | |

| Wade K. Dawe | | | 342,138 | (5) | | | Cdn$2.192 | | | January 9, 2013 | | | Nil | | | 370,000 | | | 314,736 | | | Nil |

| | | | 376,351 | (5) | | | Cdn$0.767 | | | February 6, 2014 | | | Cdn$61,257 | | | | | | | | | |

| | | | 177,912 | (5) | | | Cdn$1.001 | | | July 29, 2014 | | | Nil | | | | | | | | | |

| | | | 750,000 | | | | Cdn$1.135 | | | August 5, 2015 | | | Nil | | | | | | | | | |

| | | | 250,000 | | | | Cdn$1.675 | | | November 9, 2015 | | | Nil | | | | | | | | | |

| | | | 453,333 | | | | Cdn$1.465 | | | April 5, 2016 | | | Nil | | | | | | | | | |

| | | | 600,000 | | | | Cdn$1.545 | | | August 31, 2016 | | | Nil | | | | | | | | | |

| | | | 1,200,000 | | | | Cdn$1.180 | | | January 25, 2017 | | | Nil | | | | | | | | | |

| Brigus Management Information Circular | 21 |

| | | OPTION–BASED AWARDS | | | SHARE–BASED AWARDS (DSUs) |

Named

Executive

Officer | | Number of

Securities

Underlying

Unexercised

Options(1) | | | Option

Exercise

Price

(/Security) | | | Option

Expiration

Date(2) (3) | | Value of

Unexercised

In-the-

Money

Options(4) | | | Number of

Share-based

Awards that

Have Not Yet

Vested | | | Market or

Payout Value

of Share-

Based

Awards That

Have Not Yet

Vested

(US$)(9) | | | Market or

Payout Value of

Vested Share-

Based Awards

Not Paid Out or

Distributed

(US$) |

| | | | | | | | | | | | | | | | | | | | |

| Daniel Racine(6) | | | 1,000,000 | | | | Cdn$0.830 | | | August 21, 2017 | | | Cdn$100,000 | | | | 150,000 | | | | 127,596 | | | Nil |

| Jon Legatto(7) | | | 75,000 | | | | Cdn$1.465 | | | April 5, 2016 | | | Nil | | | | 80,000 | | | | 68,051 | | | Nil |

| | | | 250,000 | | | | Cdn$1.545 | | | August 31, 2016 | | | Nil | | | | | | | | | | | |

| | | | 300,000 | | | | Cdn$1.180 | | | January 25, 2017 | | | Nil | | | | | | | | | | | |

| | | | 100,000 | | | | Cdn$0.990 | | | September 24, 2017 | | | Nil | | | | | | | | | | | |

Dana

Hatfield(8) | | | 350,000 | | | | Cdn$1.465 | | | March 13, 2013 | | | Nil | | | | Nil | | | | Nil | | | Nil |

| | | | 350,000 | | | | Cdn$1.545 | | | March 13, 2013 | | | Nil | | | | | | | | | | | |

| | | | 450,000 | | | | Cdn$1.180 | | | March 13, 2013 | | | Nil | | | | | | | | | | | |

| Howard Bird | | | 273,710 | (5) | | | Cdn$2.192 | | | January 9, 2013 | | | Nil | | | | 120,000 | | | | 102,077 | | | Nil |

| | | | 191,597 | (5) | | | Cdn$0.767 | | | February 6, 2014 | | | Cdn$31,185 | | | | | | | | | | | |

| | | | 95,799 | (5) | | | Cdn$1.001 | | | July 29, 2014 | | | Nil | | | | | | | | | | | |

| | | | 250,000 | | | | Cdn$1.135 | | | August 5, 2015 | | | Nil | | | | | | | | | | | |

| | | | 83,333 | | | | Cdn$1.675 | | | November 10, 2015 | | | Nil | | | | | | | | | | | |

| | | | 165,000 | | | | Cdn$1.465 | | | April 5, 2016 | | | Nil | | | | | | | | | | | |

| | | | 300,000 | | | | Cdn$1.545 | | | August 31, 2016 | | | Nil | | | | | | | | | | | |

| Brigus Management Information Circular | 22 |

| | | OPTION–BASED AWARDS | | | SHARE–BASED AWARDS (DSUs) |

Named

Executive

Officer | | Number of

Securities

Underlying

Unexercised

Options(1) | | | Option

Exercise

Price

(/Security) | | | Option

Expiration

Date(2) (3) | | Value of

Unexercised

In-the-

Money

Options(4) | | | Number of

Share-based

Awards that

Have Not Yet

Vested | | Market or

Payout Value

of Share-

Based

Awards That

Have Not Yet

Vested

(US$)(9) | | Market or

Payout Value of

Vested Share-

Based Awards

Not Paid Out or

Distributed

(US$) | |

| | | | | | | | | | | | | | | | | | | |

| | | | 450,000 | | | | Cdn$1.180 | | | January 25, 2017 | | | Nil | | | | | | | | | |

Jennifer

Nicholson(8) | | | 225,000 | | | | Cdn$1.465 | | | December 31, 2013 | | | Nil | | | Nil | | Nil | | | 93,528 | |

| | | | 250,000 | | | | Cdn$1.545 | | | December 31, 2013 | | | Nil | | | | | | | | | |

| | | | 450,000 | | | | Cdn$1.180 | | | December 31, 2013 | | | Nil | | | | | | | | | |

Notes:

| 1) | Each option entitles the holder to purchase one Common Share. |

| 2) | For all options granted prior to April 2011, 50% vest after the first year from the grant date and 50% after the second year from the grant date. |

| 3) | For all options granted after April 2011, 33.3% vest after the first year from the grant date, 33.3% vest after the second year from the grant date and 33.4% vest after the third year from the grant date. |

| 4) | For US dollar grants, the value is based on the closing price of Common Shares of the Corporation on the TSX at December 31, 2012 (Cdn$0.930) and converted to equivalent U.S. dollars at the Bank of Canada average annual exchange rate of 0.9996 for 2012 for an equivalent closing price of US$0.930. The value is calculated based on the difference between the closing price and the exercise price of the options, multiplied by the number of options. Canadian dollar grants used the Canadian dollar closing price and U.S. dollar grants used the US$0.930 equivalent closing price. |

| 5) | Mr. Dawe and Mr. Bird were granted options as former officers of Linear Gold Corp., which were exchanged for options of the Corporation on the closing of the business combination with Linear on June 25, 2010. |

| 6) | Mr. Racine was hired as COO on August 21, 2012 and was appointed President and COO on January 1, 2013. |

| 7) | Mr. Legatto was appointed to CFO on September 4, 2012. Prior to this role, he served as Brigus’ VP of Finance since April 2011. |

| 8) | Mr. Hatfield and Ms. Nicholson resigned from the Corporation on September 4, 2012 and December 31, 2012, respectively, and option expiry dates were changed in accordance with the separation agreements. |

| 9) | The market value of share-based awards not vested was calculated on the closing price per Common Share on the TSX as of December 31, 2012. |

Incentive Plan Awards – Value Vested or Earned during the Most Recently Completed Financial Year

The following table provides information concerning the incentive award plans of the Corporation with respect to each Named Executive Officer during the fiscal year ended December 31, 2012.

| Brigus Management Information Circular | 23 |

INCENTIVE PLAN AWARDS – VALUE VESTED OR EARNED DURING THE FISCAL YEAR ENDED

DECEMBER 31, 2012 |

| Named Executive Officer | | Unit-Based Awards –

Value Vested During

Fiscal 2012 ($)(1) | | | Option-Based Awards –

Value Vested During

Fiscal 2012 ($)(2) | | Non-Equity Incentive Plan

Compensation –

Value Earned During Fiscal

2012 ($) | |

| Wade K. Dawe | | | Nil | | | Nil | | | 450,200 | |

| Daniel Racine | | | Nil | | | Nil | | | 110,033 | |

| Jon Legatto | | | Nil | | | Nil | | | 95,029 | |

| Dana Hatfield | | | 265,280 | | | Nil | | | Nil | |

| Howard Bird | | | Nil | | | Nil | | | 100,033 | |

| Jennifer Nicholson | | | 93,528 | | | Nil | | | 65,027 | |

Notes:

| (1) | The Deferred Share Unit Plan was implemented in 2012 and the first grant occurred on July 9, 2012. |

| (2) | Calculated using the closing price per Common Share on the TSX on the applicable vesting date less the exercise price of the applicable stock options. |

Termination and Change of Control Benefits

Each of the Named Executive Officers has employment agreements with the Corporation or a subsidiary thereof, that contain termination payment provisions. These agreements are reviewed from time to time and amended accordingly subject to the Board approval. The Named Executive Officers have "change of control" payment provisions in their employment agreements that may be triggered in certain circumstances. The terms of the specific agreements between the Corporation and each of the Named Executive Officers is set out below.

Wade K. Dawe, Chairman - Chief Executive Officer and President