UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07255

Oppenheimer International Bond Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: September 30

Date of reporting period: 9/30/2018

Item 1. Reports to Stockholders.

An Important Update

On October 18, 2018, Massachusetts Mutual Life Insurance Company, an indirect corporate parent of OppenheimerFunds, Inc. and its subsidiaries OFI Global Asset Management, Inc., OFI SteelPath, Inc. and OFI Advisors, LLC, announced that it has entered into an agreement whereby Invesco Ltd., a global investment management company, will acquire OppenheimerFunds, Inc. As of the date of this report, the transaction is expected to close in the second quarter of 2019, pending necessary regulatory and other third-party approvals. This is subject to change.

Table of Contents

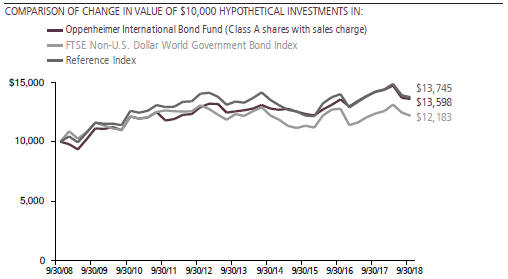

Class A Shares

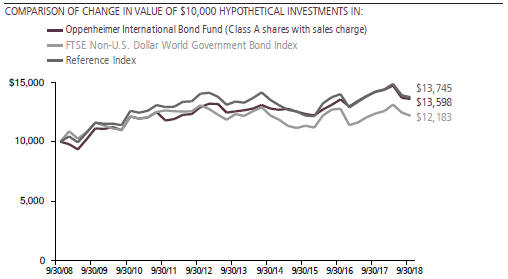

AVERAGE ANNUAL TOTAL RETURNS AT 9/30/18

| | | | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | |

| Class A Shares of the Fund without Sales Charge | | | -4.20 | % | | | 1.61 | % | | | 3.62 | % | | |

| Class A Shares of the Fund with Sales Charge | | | -8.75 | | | | 0.62 | | | | 3.12 | | | |

| FTSE Non-U.S. Dollar World Government Bond Index | | | -1.57 | | | | -0.23 | | | | 1.99 | | | |

| JP Morgan Government Bond Index-Emerging Markets Global Diversified | | | -7.40 | | | | -1.68 | | | | 2.70 | | | |

| JP Morgan Emerging Markets Bond Index Global Diversified | | | -1.92 | | | | 5.38 | | | | 7.54 | | | |

| Reference Index | | | -3.36 | | | | 0.53 | | | | 3.23 | | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 4.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

|

| 3 OPPENHEIMER INTERNATIONAL BOND FUND |

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) returned -4.20% during the reporting period, underperforming the Reference Index (“the Index”), a customized weighted index currently comprised of 50% of the FTSE Non-U.S. Dollar World Government Bond Index, 30% of the JP Morgan Government Bond Index – Emerging Markets Global Diversified, and 20% of the JP Morgan Emerging Markets Bond Index Global Diversified, which returned -3.36%.

MARKET OVERVIEW

After rallying to close 2017, 2018 has been volatile and eventful through September 30, 2018. Central banks were in action led by the Federal Reserve (Fed), which hiked the Fed Funds target rate by 25 basis points (bps) three times in 2018 – in March, June, and September – ending the period in a range of 2.00% - 2.25%. The Fed also eliminated its description of monetary policy as “accommodative” and increased the long-run dot plot. After announcing the end

of quantitative easing (QE) over the second quarter of 2018, the European Central Bank’s (ECB) decision makers’ rhetoric turned mildly hawkish. ECB President Draghi expressed confidence in the Eurozone outlook and highlighted a “relatively vigorous pick-up” in underlying inflation. Italy continued to create negative headlines as the government drafted a budget plan that was not in line with Eurozone fiscal rules. Global trade tensions remain escalated, with the U.S. imposing

|

| 4 OPPENHEIMER INTERNATIONAL BOND FUND |

tariffs on $200 billion of Chinese imports, with the possibility of additional tariffs if negotiations stall. On a positive note, the pending United States-Mexico-Canada Agreement has been agreed upon to replace NAFTA.

Global economic data continued to soften late in the reporting period, but current projections still point to global growth remaining around its historical average for 2018 and 2019. Growth leadership in the developed world changed hands, with the U.S. growth momentum increasing due to fiscal stimulus, while Eurozone growth slowed down a bit. Despite some moderation, we believe that growth in developed markets is above long-term potential, creating jobs, and continuing to reduce the slack in labor and product markets.

Global headwinds are catching up with Asian growth. In the second quarter of 2018, as we expected, Chinese growth started slowing down as a result of earlier tight policies to reduce financial leverage. With the trade dispute taking a turn for the worse, we expect this slowdown to continue and some of the pain to be shared with the rest of Asia’s manufacturing economies through lower exports, exchange rates, and lower profit margins. This impact may take time to show up in the real economy depending on the reach and impact of tariffs on global supply chains. Many countries in the supply chain stand to lose from lower trade, while some are likely to gain from potential relocation of production and from their exports to Chinese

domestic consumers. We think China will mitigate most of the growth impact to its domestic economy by a combination of looser fiscal policy and allowing more adjustment in the foreign exchange rate. However, we believe that the indirect impact through sentiment and investment is likely to spell out further slowdown in Asia, although still resilient capital expenditure demand from developed markets will provide some support to the region. Nonetheless, we see Asian emerging market growth stabilizing by the second half of 2019 due to policy support from China. There are other headwinds to the region besides trade; most notably higher oil prices, especially for current account deficit countries such as India and Indonesia. Hence, we remain cautious and will consider the potential risks especially if trade tensions escalate.

When we look at Latin America, the new outlook with downward growth revisions was driven by the larger economies where domestic and external headwinds are larger, especially in Argentina. The other economies in the region continue to follow cyclical momentum, back toward potential growth. We see the region now growing 1.5% this year, down from 1.7% in 2017 and also below the 2.4% potential. Barring bad political outcomes, the lower current account deficits and historically low inflation are supportive of demand. These are external and domestic factors that, in our view, should help Latin economies in this period of divergent global growth and unstable markets.

|

| 5 OPPENHEIMER INTERNATIONAL BOND FUND |

Argentina was one of the “Fragile Two” economies along with Turkey suffering unsustainable market stress this reporting period. In the absence of tighter fiscal and monetary policies, foreign lending stopped, and Argentina’s currency suffered a mini-crisis, as markets made the adjustment. In turn, the response to the peso plunge was a revised International Monetary Fund (IMF) program. We believe that a more demanding program will inflict strong headwinds in front of economic activity, bringing the economy deeper into recession, and calling into question the resilience of its social fabric and its policy environment. Looking forward, we see both the IMF and the Macri administration fully committed to the success of the program.

Eurozone data weakness seems to have stabilized in the second half of 2018. The underlying forces of growth in the Eurozone, such as job creation and income growth, revival of bank lending, and high levels of confidence, are intact and growth should remain in the 1.5% – 2% range. Japan’s growth rebounded in the second quarter of 2018 due to strong investment expenditures. Growth expectations remain upbeat in several other countries, including Canada, Australia, and Sweden.

The U.S. economy continues to show strong growth momentum. 2018 gross domestic product (GDP) growth is expected to be around 3%, significantly exceeding its 2% trend growth of this expansion. Private consumption, the driving force of the

economy in recent years, is growing at a stable rate. Strong household finances, ongoing job creation, and high levels of consumer confidence point to stable growth in consumption with upside risks to the growth rate. Additionally, fixed business investment gained momentum in the second quarter, broadening across sectors. Forward looking indicators suggest a healthy dose of growth for the business investment outlook. With increasingly less slack in the economy, strong profits, and the corporate tax cuts, we expect investment to support growth and productivity improvements.

The Fed is on track to deliver one more hike this year, as the economy is near the Fed’s dual mandate of full employment and price stability. On the inflation front, the underlying inflation is around the Fed’s 2% target. The unemployment rate is at historical lows; however, the rising labor participation rate and stable wage growth suggest that there may still be some slack in the labor market. The Federal Open Market Committee under Jerome Powell’s leadership signaled that the Fed will remain cautious and tighten policy gradually, giving comfort to the markets. So far, the Fed’s hiking cycle has been orderly.

The U.S. dollar (USD) had mixed returns during the one-year period ending September 30 with developed market and emerging market currencies rising or falling based on specific market news. The Mexican peso (5.6%) performed well as NAFTA’s replacement assuaged concerns and election concerns declined. The South

|

| 6 OPPENHEIMER INTERNATIONAL BOND FUND |

African rand (2.8%) and the Polish zloty (0.66%) performed well due to South Africa’s decreased political concerns and Poland’s integration with the EU. The largest declines vs. USD came from the Turkish lira (-31.1%) which suffered to due lack of credible monetary policy and the Brazilian real (-17.1%) which declined due to concerns regarding the upcoming presidential election and a truckers’ strike that impacted trade.

Government bond yields rose across many markets during the one-year reporting period. U.S. Treasury 10-year rates trended higher during the period and ended at 3.06%. To close the period, German 10-year yields ended at 0.47%, Japanese 10-year yields closed at 0.12% while Indian 10-year yields ended at 8.0%. Brazilian 10-year yields ended the period at 11.8%.

FUND REVIEW

The Fund invests in three major risk categories, or levers – interest rates (typically government bonds), currencies, and credit (corporate bonds and other fixed-income instruments containing credit risk). During the reporting period, the Fund’s underperformance versus the Index was largely the result of its currency exposure. Interest rates detracted from performance to a lesser degree, while credit outperformed the Index.

Currencies detracted most from performance, due mainly to out of benchmark position in the Argentine peso. Other detractors from

performance included our underweight position in the South African rand and our underweight position in the Japanese yen. A positive performer was our underweight exposure to the euro.

In interest rates, the primary reason for the Fund’s underperformance included overweight positions in Mexico and India. Positive contributors included an overweight position in the Eurozone and underweight to Turkey.

In credit, notable contributors to performance included our exposure to European financial subordinated debt. Detractors included the off-benchmark exposures to Argentina and India along with our underweight to Mexican peso.

STRATEGY & OUTLOOK

Looking forward, we believe that global growth has peaked, initially led by the current weakness in emerging markets. Over the next nine months we expect that developed market growth will slow down as emerging market growth bottoms somewhere in the second quarter of 2019. In our view, U.S. growth will slow down from its current rapid pace; however, we believe it will remain well above potential for the next two to three quarters with risks that inflation surprises modestly to the upside. We also believe that European growth will remain in the Goldilocks range to 1.5% - 2%. Within emerging markets, we believe dispersion in returns will remain high. We believe that improving domestic fundamentals in some countries and possible

|

| 7 OPPENHEIMER INTERNATIONAL BOND FUND |

fiscal stimulus in China will offset the effect of tariffs, and therefore expect the current slowdown in emerging market countries as an aggregate to abate by the second quarter of 2019. With higher oil prices a risk, those countries with larger import bills and current account deficits such as India and Indonesia could face headwinds, although India is currently growing more strongly than expected.

From an asset valuation perspective, it leaves emerging market assets at historically even cheaper levels versus developed market assets. Currently, emerging market local bonds offer real yields that are at or close to 15-year highs when compared to developed market real yields. In those countries where the central banks have raised rates, we see value in short-term interest rates. In the countries where the central banks have not fully tightened, we see value in long-term bonds, particularly if the yield curves are very steep.

Similarly, emerging market currency levels are back to levels last seen in 2015 near the U.S. dollar high. In credit, we find European financial subordinated debt offers value, as do both emerging market hard currency sovereign debt and corporate debt. On the expensive side of the spectrum are core European rates and U.S. high-yield bonds. We are maintaining our overweight allocations to emerging market debt and European corporate credit. Our currency exposure is slightly tilted more toward developed market currencies, but we still maintain significant exposure to emerging market currencies.

We maintain our view that the U.S. dollar will decline over the medium term. The U.S. dollar’s decline that started towards the ends of 2015 was interrupted by the large fiscal stimulus that impacted the U.S. economy this year. As the effects of this stimulus fade, we expect the dollar to resume its downtrend for the next three to five years.

| | |

| |  |

| | Christopher Kelly, CFA |

| | Portfolio Manager |

|

| 8 OPPENHEIMER INTERNATIONAL BOND FUND |

Top Holdings and Allocations

TOP TEN GEOGRAPHICAL HOLDINGS

| | | | |

| United States | | | 11.4 | % |

| Mexico | | | 9.8 | |

| United Kingdom | | | 8.2 | |

| India | | | 6.7 | |

| Brazil | | | 5.2 | |

| South Africa | | | 4.9 | |

| Canada | | | 4.3 | |

| Spain | | | 4.1 | |

| Portugal | | | 3.6 | |

| Greece | | | 3.2 | |

|

| Portfolio holdings and allocation are subject to change. Percentages are as of September 30, 2018, and are based on total market value of investments. |

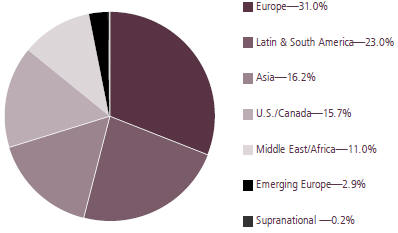

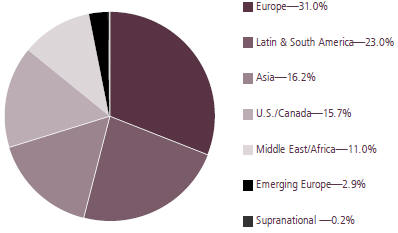

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2018, and are based on the total market value of investments.

For more current Fund holdings, please visit oppenheimerfunds.com.

|

| 9 OPPENHEIMER INTERNATIONAL BOND FUND |

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 9/30/18

| | | | | | | | | | |

| | | Inception Date | | 1-Year | | 5-Year | | 10-Year | | |

| Class A (OIBAX) | | 6/15/95 | | -4.20% | | 1.61% | | 3.62% | | |

| Class C (OIBCX) | | 6/15/95 | | -4.79 | | 0.85 | | 2.88 | | |

| Class I (OIBIX) | | 1/27/12 | | -3.83 | | 2.04 | | 2.01* | | |

| Class R (OIBNX) | | 3/1/01 | | -4.47 | | 1.34 | | 3.27 | | |

| Class Y (OIBYX) | | 9/27/04 | | -3.80 | | 1.86 | | 3.91 | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 9/30/18 | | |

| | | Inception Date | | 1-Year | | 5-Year | | 10-Year | | |

| Class A (OIBAX) | | 6/15/95 | | -8.75% | | 0.62% | | 3.12% | | |

| Class C (OIBCX) | | 6/15/95 | | -5.71 | | 0.85 | | 2.88 | | |

| Class I (OIBIX) | | 1/27/12 | | -3.83 | | 2.04 | | 2.01* | | |

| Class R (OIBNX) | | 3/1/01 | | -4.47 | | 1.34 | | 3.27 | | |

| Class Y (OIBYX) | | 9/27/04 | | -3.80 | | 1.86 | | 3.91 | | |

*Shows performance since inception.

| | | | |

| STANDARDIZED YIELDS | |

|

| For the 30 Days Ended 9/30/18 | |

| Class A | | | 3.78% | |

| Class C | | | 3.22 | |

| Class I | | | 4.36 | |

| Class R | | | 3.73 | |

| Class Y | | | 4.21 | |

| | | | |

| UNSUBSIDIZED STANDARDIZED YIELDS | |

|

| For the 30 Days Ended 9/30/18 | |

| Class A | | | 3.76% | |

| Class C | | | 3.20 | |

| Class I | | | 4.34 | |

| Class R | | | 3.71 | |

| Class Y | | | 4.19 | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 4.75% and for Class C shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I, Class R and Class Y shares. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

Standardized yield is based on an SEC-standardized formula designed to approximate the Fund’s annualized hypothetical current income from securities less expenses for the 30-day period ended September 30, 2018 and that date’s maximum offering price (for Class A shares) or net asset value (for all other share classes). Each result is compounded semiannually and

|

| 10 OPPENHEIMER INTERNATIONAL BOND FUND |

then annualized. Falling share prices will tend to artificially raise yields. The unsubsidized standardized yield is computed under an SEC-standardized formula based on net income earned for the 30-day period ended September 30, 2018. The calculation excludes any expense reimbursements and thus may result in a lower yield.

The Fund’s performance is compared to the FTSE Non-U.S. Dollar World Government Bond Index, JP Morgan Government Bond Index-Emerging Markets Global Diversified, JP Morgan Emerging Markets Bond Index Global Diversified, and the Fund’s Reference Index. The FTSE Non-U.S. Dollar World Government Bond Index is an index of fixed rate government bonds with a maturity of one year or longer and amounts outstanding of at least U.S. $25 million. The JPMorgan Government Bond Index-Emerging Markets Global Diversified is a comprehensive, global local Emerging Markets Index, and consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The JPMorgan Emerging Markets Bond Index Global Diversified is a composite index representing an unleveraged investment in emerging market bonds that is broadly based across the spectrum of emerging market bonds and includes reinvestment of income (to represent real assets). The indices are unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the indices. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio manager(s) and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on September 30, 2018, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

|

| 11 OPPENHEIMER INTERNATIONAL BOND FUND |

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended September 30, 2018.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended September 30, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| 12 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | |

| Actual | | Beginning Account Value April 1, 2018 | | Ending Account Value September 30, 2018 | | Expenses Paid During 6 Months Ended September 30, 2018 |

| Class A | | $ 1,000.00 | | $ 922.60 | | $ 4.69 |

| Class C | | 1,000.00 | | 920.30 | | 8.32 |

| Class I | | 1,000.00 | | 924.20 | | 2.80 |

| Class R | | 1,000.00 | | 921.10 | | 5.89 |

| Class Y | | 1,000.00 | | 925.30 | | 3.48 |

| | | |

Hypothetical (5% return before expenses) | | | | | | |

| Class A | | 1,000.00 | | 1,020.21 | | 4.92 |

| Class C | | 1,000.00 | | 1,016.44 | | 8.73 |

| Class I | | 1,000.00 | | 1,022.16 | | 2.94 |

| Class R | | 1,000.00 | | 1,018.95 | | 6.19 |

| Class Y | | 1,000.00 | | 1,021.46 | | 3.66 |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended September 30, 2018 are as follows:

| | | | |

| Class | | Expense Ratios | |

| Class A | | | 0.97% | |

| Class C | | | 1.72 | |

| Class I | | | 0.58 | |

| Class R | | | 1.22 | |

| Class Y | | | 0.72 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager and Transfer Agent. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Consolidated Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

|

| 13 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS September 30, 2018

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

| Mortgage-Backed Obligations—3.6% | | | | | | | | | | |

| Alba plc, Series 2007-1, Cl. C, 1.087% [BP0003M+29], 3/17/391,2 | | GBP | | | 11,832,600 | | | $ | 14,136,288 | |

| Capital Mortgage Srl, Series 2007-1, Cl. B, 0.00% [EUR003M+22], 1/30/471,2 | | EUR | | | 8,000,000 | | | | 5,913,506 | |

| Eurohome UK Mortgages plc: | | | | | | | | | | |

| Series 2007-1, Cl. B1, 1.697% [BP0003M+90], 6/15/441,2 | | GBP | | | 5,275,000 | | | | 5,580,330 | |

| Series 2007-1, Cl. M2, 1.297% [BP0003M+50], 6/15/441,2 | | GBP | | | 4,000,000 | | | | 4,386,118 | |

| Series 2007-2, Cl. B1, 2.197% [BP0003M+140], 9/15/441,2 | | GBP | | | 4,000,000 | | | | 4,477,789 | |

| Eurosail 2006-3nc plc, Series 2006-3X, Cl. D1C, 1.702% [BP0003M+90], 9/10/441,2 | | GBP | | | 11,000,000 | | | | 11,777,271 | |

| Eurosail UK plc, Series 2007-5X, Cl. A1A, 1.57% [BP0003M+77], 9/13/451,2 | | GBP | | | 10,032,078 | | | | 12,705,346 | |

| Fondo de Titulizacion de Activos Santander Hipotecario 2, Series 2, Cl. E, 1.779% [EUR003M+210], 1/18/491,2 | | EUR | | | 7,700,000 | | | | 7,197,117 | |

| Great Hall Mortgages No 1 plc, Series 2007-1, Cl. DA, 1.58% [BP0003M+78], 3/18/391,2 | | GBP | | | 8,000,000 | | | | 9,144,623 | |

| Grifonas Finance plc: | | | | | | | | | | |

| Series 1, Cl. A, 0.014% [EUR006M+28], 8/28/391,2 | | EUR | | | 19,386,720 | | | | 20,601,340 | |

| Series 1, Cl. B, 0.254% [EUR006M+52], 8/28/391,2 | | EUR | | | 5,000,000 | | | | 4,029,842 | |

| Hipocat 9 Fondo de Titulizacion de Activos, Series HIPO-9, Cl. C, 0.00% [EUR003M+29], 7/15/381,2 | | EUR | | | 17,400,000 | | | | 15,657,365 | |

IM Pastor 4 Fondo de Titulizacion de Activos: Series 4, Cl. A, [EUR003M+14], 3/22/441,2 | | EUR | | | 16,809,849 | | | | 17,638,439 | |

| Series 4, Cl. B, [EUR003M+19], 3/22/441,2 | | EUR | | | 3,000,000 | | | | 1,871,556 | |

| Ludgate Funding plc, Series 2007-1, 0.00%, 1/1/61 | | GBP | | | 207,500,000 | | | | 7,143,541 | |

| Newgate Funding plc: | | | | | | | | | | |

| Series 2006-2, Cl. CB, 0.106% [EUR003M+43], 12/1/501,2 | | EUR | | | 3,781,491 | | | | 3,997,010 | |

| Series 2007-2X, Cl. CB, 0.121% [EUR003M+44], 12/15/501,2 | | EUR | | | 3,484,319 | | | | 3,555,360 | |

| Series 2007-3X, Cl. D, 3.797% [BP0003M+300], 12/15/501,2 | | GBP | | | 4,565,638 | | | | 5,909,690 | |

| Sestante Finance Srl, Series 3, Cl. C1, 0.479% [EUR003M+80], 7/15/451,2 | | EUR | | | 9,700,000 | | | | 5,271,491 | |

| TDA 27 Hipocat 9 Fondo de Titulizacion de Activos, Series 27, Cl. A3, 0.00% [EUR003M+19], 12/28/501,2 | | EUR | | | 35,000,000 | | | | 35,613,803 | |

| Total Mortgage-Backed Obligations (Cost $195,670,122) | | | | | | | | | 196,607,825 | |

| | | | | | | | | | |

| Foreign Government Obligations—56.1% | | | | | | | | | | |

Angola—0.6% | | | | | | | | | | |

| Republic of Angola, 9.375% Sr. Unsec. Nts., 5/8/483 | | | | | 29,425,000 | | | | 31,197,268 | |

| | | | | | | | | | | |

Argentina—2.0% | | | | | | | | | | |

| Argentine Republic: | | | | | | | | | | |

| 5.875% Sr. Unsec. Nts., 1/11/28 | | | | | 27,535,000 | | | | 21,875,464 | |

| 6.875% Sr. Unsec. Nts., 4/22/21 | | | | | 9,775,000 | | | | 9,376,766 | |

| 6.875% Sr. Unsec. Nts., 1/26/27 | | | | | 10,125,000 | | | | 8,631,563 | |

| 6.875% Sr. Unsec. Nts., 1/11/48 | | | | | 11,950,000 | | | | 9,261,250 | |

| 7.50% Sr. Unsec. Nts., 4/22/26 | | | | | 52,980,000 | | | | 47,284,650 | |

| 15.50% Bonds, 10/17/26 | | ARS | | | 135,000,000 | | | | 2,383,371 | |

| 16.00% Bonds, 10/17/23 | | ARS | | | 68,258,140 | | | | 1,341,798 | |

| 18.20% Unsec. Nts., 10/3/21 | | ARS | | | 212,805,000 | | | | 4,172,120 | |

|

| 14 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Argentina (Continued) | | | | | | | | | | |

| Argentine Republic: (Continued) | | | | | | | | | | |

| 41.144% [BADLARPP+375] Unsec. Nts., 4/12/251,2 | | ARS | | | 120,000,000 | | | $ | 2,526,120 | |

| 45.375% [BADLARPP+325] Sr. Unsec. Nts., 3/1/201 | | ARS | | | 180,336,000 | | | | 4,448,379 | |

| | | | | | | | | | |

| | | | | | | | | 111,301,481 | |

| | | | | | | | | | | |

Australia—1.3% | | | | | | | | | | |

| Commonwealth of Australia: | | | | | | | | | | |

| 1.00% Sr. Unsec. Nts., 2/21/502,4 | | AUD | | | 76,000,000 | | | | 53,430,236 | |

| 2.75% Sr. Unsec. Nts., 11/21/292 | | AUD | | | 23,500,000 | | | | 17,071,213 | |

| | | | | | | | | | |

| | | | | | | | | 70,501,449 | |

| | | | | | | | | | | |

Brazil—3.9% | | | | | | | | | | |

| Federative Republic of Brazil: | | | | | | | | | | |

| 6.00% Unsec. Nts., 8/15/224 | | BRL | | | 30,170,000 | | | | 23,917,292 | |

| 6.00% Unsec. Nts., 5/15/454 | | BRL | | | 32,900,000 | | | | 25,703,232 | |

| 10.00% Unsec. Nts., 1/1/21 | | BRL | | | 325,000,000 | | | | 81,279,832 | |

| 10.00% Unsec. Nts., 1/1/27 | | BRL | | | 291,000,000 | | | | 66,111,571 | |

| 10.00% Unsec. Nts., 1/1/29 | | BRL | | | 70,000,000 | | | | 15,784,510 | |

| | | | | | | | | | |

| | | | | | | | | 212,796,437 | |

| | | | | | | | | | | |

Canada—4.2% | | | | | | | | | | |

| Canada Housing Trust No 1: | | | | | | | | | | |

| 1.25% Bonds, 6/15/213 | | CAD | | | 100,000,000 | | | | 75,221,616 | |

| 2.35%, 6/15/233 | | CAD | | | 120,000,000 | | | | 91,796,075 | |

| 2.65%, 3/15/223 | | CAD | | | 80,000,000 | | | | 62,333,914 | |

| | | | | | | | | | |

| | | | | | | | | 229,351,605 | |

| | | | | | | | | | | |

Chile—0.5% | | | | | | | | | | |

| Republic of Chile: | | | | | | | | | | |

| 4.50% Unsec. Nts., 2/28/21 | | CLP | | | 15,335,000,000 | | | | 23,684,943 | |

| 4.50% Bonds, 3/1/21 | | CLP | | | 700,000,000 | | | | 1,081,039 | |

| | | | | | | | | | |

| | | | | | | | | 24,765,982 | |

| | | | | | | | | | | |

Colombia—1.3% | | | | | | | | | | |

| Republic of Colombia: | | | | | | | | | | |

| 3.875% Sr. Unsec. Nts., 4/25/27 | | | | | 3,250,000 | | | | 3,156,563 | |

| 4.00% Sr. Unsec. Nts., 2/26/24 | | | | | 2,980,000 | | | | 2,983,725 | |

| 6.125% Sr. Unsec. Nts., 1/18/41 | | | | | 11,050,000 | | | | 12,541,750 | |

| Series B, 6.25% Sr. Unsec. Nts., 11/26/25 | | COP | | | 80,000,000,000 | | | | 26,692,129 | |

| Series B, 7.00% Sr. Unsec. Nts., 9/11/19 | | COP | | | 75,000,000,000 | | | | 25,940,411 | |

| | | | | | | | | | |

| | | | | | | | | 71,314,578 | |

| | | |

| | | | | | | | | | | |

Cyprus—0.5% | | | | | | | | | | |

| Republic of Cyprus, 2.375% Sr. Unsec. Nts., 9/25/282 | | EUR | | | 22,500,000 | | | | 26,346,825 | |

| | | | | | | | | | | |

Dominican Republic—1.0% | | | | | | | | | | |

| Dominican Republic: | | | | | | | | | | |

| 5.95% Sr. Unsec. Nts., 1/25/273 | | | | | 38,480,000 | | | | 39,336,180 | |

|

| 15 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Dominican Republic: (Continued) | | | | | | | | | | |

| Dominican Republic: (Continued) | | | | | | | | | | |

| 6.00% Sr. Unsec. Nts., 7/19/283 | | | | $ | 6,565,000 | | | $ | 6,692,033 | |

| 6.85% Sr. Unsec. Nts., 1/27/453 | | | | | 6,370,000 | | | | 6,473,512 | |

| | | | | | | | | | |

| | | | | | | | | 52,501,725 | |

| | | | | | | | | | | |

Ecuador—0.4% | | | | | | | | | | |

| Republic of Ecuador: | | | | | | | | | | |

| 7.875% Sr. Unsec. Nts., 1/23/283 | | | | | 5,520,000 | | | | 4,983,594 | |

| 8.875% Sr. Unsec. Nts., 10/23/273 | | | | | 11,310,000 | | | | 10,765,141 | |

| 9.65% Sr. Unsec. Nts., 12/13/263 | | | | | 6,545,000 | | | | 6,541,400 | |

| | | | | | | | | | |

| | | | | | | | | 22,290,135 | |

| | | | | | | | | | | |

Egypt—1.0% | | | | | | | | | | |

| Arab Republic of Egypt: | | | | | | | | | | |

| 4.75% Sr. Unsec. Nts., 4/16/263 | | EUR | | | 12,900,000 | | | | 14,423,765 | |

| 5.577% Sr. Unsec. Nts., 2/21/233 | | | | | 4,555,000 | | | | 4,426,658 | |

| 6.125% Sr. Unsec. Nts., 1/31/223 | | | | | 6,530,000 | | | | 6,547,892 | |

| 6.588% Sr. Unsec. Nts., 2/21/283 | | | | | 9,610,000 | | | | 9,217,259 | |

| 7.903% Sr. Unsec. Nts., 2/21/483 | | | | | 1,955,000 | | | | 1,871,545 | |

| 8.50% Sr. Unsec. Nts., 1/31/473 | | | | | 9,480,000 | | | | 9,542,653 | |

| Series 3YR, 15.00% Bonds, 10/3/20 | | EGP | | | 157,150,000 | | | | 8,210,421 | |

| | | | | | | | | | |

| | | | | | | | | 54,240,193 | |

| | | | | | | | | | | |

Gabon—0.2% | | | | | | | | | | |

| Gabonese Republic, 6.375% Bonds, 12/12/243 | | | | | 11,370,000 | | | | 10,788,993 | |

| | | | | | | | | | | |

Ghana—0.5% | | | | | | | | | | |

| Republic of Ghana: | | | | | | | | | | |

| 7.625% Sr. Unsec. Nts., 5/16/293 | | | | | 19,555,000 | | | | 19,647,065 | |

| 8.627% Sr. Unsec. Nts., 6/16/493 | | | | | 9,455,000 | | | | 9,502,275 | |

| | | | | | | | | | |

| | | | | | | | | 29,149,340 | |

| | | | | | | | | | | |

Greece—3.2% | | | | | | | | | | |

| Hellenic Republic: | | | | | | | | | | |

| 0.00% Bonds, 10/15/425 | | EUR | | | 107,000,000 | | | | 411,830 | |

| 3.90% Bonds, 1/30/332 | | EUR | | | 110,212,000 | | | | 117,109,726 | |

| 4.00% Bonds, 1/30/372 | | EUR | | | 35,225,000 | | | | 35,781,648 | |

| 4.375% Sr. Unsec. Nts., 8/1/222,3 | | EUR | | | 20,000,000 | | | | 24,249,713 | |

| | | | | | | | | | |

| | | | | | | | | 177,552,917 | |

| | | | | | | | | | | |

Honduras—0.1% | | | | | | | | | | |

| Republic of Honduras: | | | | | | | | | | |

| 6.25% Sr. Unsec. Nts., 1/19/273 | | | | | 3,160,000 | | | | 3,259,066 | |

| 8.75% Sr. Unsec. Nts., 12/16/203 | | | | | 2,850,000 | | | | 3,123,742 | |

| | | | | | | | | | |

| | | | | | | | | 6,382,808 | |

| | | | | | | | | | | |

Hungary—1.0% | | | | | | | | | | |

| Hungary: | | | | | | | | | | |

| Series 22/A, 7.00% Bonds, 6/24/22 | | HUF | | | 9,600,000,000 | | | | 40,545,648 | |

|

| 16 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | | | |

| | | | | | Principal Amount | | | Value | |

Hungary (Continued) | | | | | | | | | | | | |

| Hungary: (Continued) | | | | | | | | | | | | |

| Series 22/B, 1.75% Bonds, 10/26/22 | | | HUF | | | | 2,750,000,000 | | | $ | 9,732,247 | |

| Series 25/B, 5.50% Bonds, 6/24/25 | | | HUF | | | | 1,550,000,000 | | | | 6,402,222 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 56,680,117 | |

| | | | | | | | | | | | | |

India—5.2% | | | | | | | | | | | | |

| Indian Railway Finance Corp. Ltd., 8.83% Sr. Sec. Nts., 3/25/23 | | | INR | | | | 250,000,000 | | | | 3,431,842 | |

Republic of India: | | | | | | | | | | | | |

| 6.84% Sr. Unsec. Nts., 12/19/22 | | | INR | | | | 1,000,000,000 | | | | 13,226,528 | |

| 7.68% Sr. Unsec. Nts., 12/15/23 | | | INR | | | | 1,300,000,000 | | | | 17,590,584 | |

| 8.15% Sr. Unsec. Nts., 11/24/26 | | | INR | | | | 500,000,000 | | | | 6,904,249 | |

| 8.20% Sr. Unsec. Nts., 2/15/22 | | | INR | | | | 5,650,000,000 | | | | 78,384,572 | |

| 8.20% Sr. Unsec. Nts., 9/24/25 | | | INR | | | | 3,375,000,000 | | | | 46,803,833 | |

| 8.27% Sr. Unsec. Nts., 6/9/20 | | | INR | | | | 3,023,000,000 | | | | 42,010,484 | |

| 8.40% Sr. Unsec. Nts., 7/28/24 | | | INR | | | | 3,997,000,000 | | | | 55,708,222 | |

| State of Gujarat, 7.52% Sr. Unsec. Nts., 5/24/27 | | | INR | | | | 500,000,000 | | | | 6,455,925 | |

| State of Maharastra, 7.99% Sr. Unsec. Nts., 10/28/25 | | | INR | | | | 500,000,000 | | | | 6,704,028 | |

| State of Tamil Nadu, 8.53% Sr. Unsec. Nts., 3/9/26 | | | INR | | | | 500,000,000 | | | | 6,908,229 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 284,128,496 | |

| | | | | | | | | | | | | |

Indonesia—1.9% | | | | | | | | | | | | |

| Perusahaan Penerbit SBSN Indonesia III: | | | | | | | | | | | | |

| 4.35% Sr. Unsec. Nts., 9/10/243 | | | | | | | 3,560,000 | | | | 3,573,350 | |

| 4.55% Sr. Unsec. Nts., 3/29/263 | | | | | | | 5,680,000 | | | | 5,665,800 | |

| Republic of Indonesia: | | | | | | | | | | | | |

| 3.85% Sr. Unsec. Nts., 7/18/273 | | | | | | | 6,030,000 | | | | 5,756,214 | |

| 4.125% Sr. Unsec. Nts., 1/15/253 | | | | | | | 3,050,000 | | | | 3,007,513 | |

| Series FR56, 8.375% Sr. Unsec. Nts., 9/15/26 | | | IDR | | | | 288,430,000,000 | | | | 19,646,242 | |

| Series FR71, 9.00% Sr. Unsec. Nts., 3/15/29 | | | IDR | | | | 359,350,000,000 | | | | 25,381,350 | |

| Series FR73, 8.75% Sr. Unsec. Nts., 5/15/31 | | | IDR | | | | 560,080,000,000 | | | | 38,713,042 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 101,743,511 | |

| | | | | | | | | | | | | |

Iraq—0.2% | | | | | | | | | | | | |

| Republic of Iraq: | | | | | | | | | | | | |

| 5.80% Unsec. Nts., 1/15/283 | | | | | | | 3,695,000 | | | | 3,511,562 | |

| 6.752% Sr. Unsec. Nts., 3/9/233 | | | | | | | 6,035,000 | | | | 6,046,225 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,557,787 | |

| | | | | | | | | | | | | |

Ivory Coast—0.1% | | | | | | | | | | | | |

| Republic of Cote d’Ivoire, 6.625% Sr. Unsec. Nts., 3/22/483 | | | EUR | | | | 2,442,000 | | | | 2,659,014 | |

| | | | | | | | | | | | | |

Kenya—0.1% | | | | | | | | | | | | |

| Republic of Kenya, 8.25% Sr. Unsec. Nts., 2/28/483 | | | | | | | 3,280,000 | | | | 3,176,057 | |

| | | | | | | | | | | | | |

Malaysia—0.4% | | | | | | | | | | | | |

| Federation of Malaysia, Series 0116, 3.80% Sr. Unsec. Nts., 8/17/23 | | | MYR | | | | 80,000,000 | | | | 19,320,952 | |

|

| 17 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Mexico—9.1% | | | | | | | | | | |

| United Mexican States: | | | | | | | | | | |

| 3.75% Sr. Unsec. Nts., 1/11/28 | | | | $ | 6,395,000 | | | $ | 6,102,429 | |

| 4.00% Bonds, 6/13/194 | | MXN | | | 1,630,809,300 | | | | 87,200,020 | |

| Series M, 5.00% Sr. Unsec. Nts., 12/11/19 | | MXN | | | 1,320,000,000 | | | | 68,270,535 | |

| Series M, 6.50% Bonds, 6/10/21 | | MXN | | | 400,000,000 | | | | 20,743,401 | |

| Series M, 8.00% Sr. Unsec. Nts., 12/7/23 | | MXN | | | 2,050,000,000 | | | | 110,697,152 | |

| Series M10, 8.50% Bonds, 12/13/18 | | MXN | | | 2,890,000,000 | | | | 154,581,180 | |

| Series M20, 8.50% Sr. Unsec. Nts., 5/31/29 | | MXN | | | 240,000,000 | | | | 13,318,243 | |

| Series M20, 10.00% Bonds, 12/5/24 | | MXN | | | 698,700,000 | | | | 41,417,221 | |

| | | | | | | | | | |

| | | | | | | | | 502,330,181 | |

| | | | | | | | | | | |

Mongolia—0.2% | | | | | | | | | | |

| Mongolia, 5.625% Sr. Unsec. Nts., 5/1/233 | | | | | 9,690,000 | | | | 9,432,663 | |

| | | | | | | | | | | |

New Zealand—0.4% | | | | | | | | | | |

| New Zealand, 3.00% Sr. Unsec. Nts., 4/20/29 | | NZD | | | 30,000,000 | | | | 20,596,463 | |

| | | | | | | | | | | |

Nigeria—0.4% | | | | | | | | | | |

| Federal Republic of Nigeria: | | | | | | | | | | |

| 7.143% Sr. Unsec. Nts., 2/23/303 | | | | | 14,260,000 | | | | 13,972,661 | |

| 7.696% Sr. Unsec. Nts., 2/23/383 | | | | | 10,770,000 | | | | 10,582,817 | |

| | | | | | | | | | |

| | | | | | | | | 24,555,478 | |

| | | | | | | | | | | |

Oman—0.4% | | | | | | | | | | |

| Sultanate of Oman, 6.75% Sr. Unsec. Nts., 1/17/483 | | | | | 24,235,000 | | | | 23,658,716 | |

| | | | | | | | | | | |

Peru—0.8% | | | | | | | | | | |

| Republic of Peru: | | | | | | | | | | |

| 6.35% Sr. Unsec. Nts., 8/12/283 | | PEN | | | 112,140,000 | | | | 35,766,690 | |

| 8.20% Sr. Unsec. Nts., 8/12/263 | | PEN | | | 29,000,000 | | | | 10,381,071 | |

| | | | | | | | | | |

| | | | | | | | | 46,147,761 | |

| | | | | | | | | | | |

Poland—0.3% | | | | | | | | | | |

| Republic of Poland: | | | | | | | | | | |

| Series 0725, 3.25% Bonds, 7/25/25 | | PLN | | | 30,000,000 | | | | 8,295,177 | |

| Series 0726, 2.50% Bonds, 7/25/26 | | PLN | | | 35,900,000 | | | | 9,337,038 | |

| | | | | | | | | | |

| | | | | | | | | 17,632,215 | |

| | | | | | | | | | | |

Portugal—2.9% | | | | | | | | | | |

| Portuguese Republic, 2.875% Sr. Unsec. Nts., 10/15/252,3 | | EUR | | | 125,500,000 | | | | 160,362,363 | |

| | | | | | | | | | | |

Russia—0.1% | | | | | | | | | | |

| Russian Federation, Series 6209, 7.60% Bonds, 7/20/22 | | RUB | | | 394,000,000 | | | | 5,948,078 | |

| | | | | | | | | | | |

Senegal—0.1% | | | | | | | | | | |

| Republic of Senegal: | | | | | | | | | | |

| 6.25% Unsec. Nts., 5/23/333 | | | | | 3,170,000 | | | | 2,967,361 | |

|

| 18 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Senegal (Continued) | | | | | | | | | | |

| Republic of Senegal: (Continued) | | | | $ | 5,690,000 | | | $ | 5,102,223 | |

| | | | | | | | | | |

| 6.75% Sr. Unsec. Nts., 3/13/483 | | | | | | | | | 8,069,584 | |

| | | | | | | | | | | |

Serbia—0.2% | | | | | | | | | | |

| Republic of Serbia, 5.875% Unsec. Nts., 12/3/183 | | | | | 12,245,000 | | | | 12,303,482 | |

| | | | | | | | | | | |

Singapore—0.3% | | | | | | | | | | |

| Republic of Singapore, 2.25% Sr. Unsec. Nts., 6/1/21 | | SGD | | | 25,000,000 | | | | 18,386,288 | |

| | | | | | | | | | | |

South Africa—4.2% | | | | | | | | | | |

| Republic of South Africa: | | | | | | | | | | |

| 4.30% Sr. Unsec. Nts., 10/12/28 | | | | | 14,685,000 | | | | 13,201,624 | |

| 5.375% Sr. Unsec. Nts., 7/24/44 | | | | | 4,545,000 | | | | 4,080,960 | |

| 5.65% Sr. Unsec. Nts., 9/27/47 | | | | | 3,920,000 | | | | 3,585,546 | |

| Series 2023, 7.75% Bonds, 2/28/23 | | ZAR | | | 311,100,000 | | | | 21,498,982 | |

| Series 2030, 8.00% Bonds, 1/31/30 | | ZAR | | | 260,000,000 | | | | 16,629,152 | |

| Series 2037, 8.50% Bonds, 1/31/37 | | ZAR | | | 181,800,000 | | | | 11,450,832 | |

| Series 2048, 8.75% Bonds, 2/28/48 | | ZAR | | | 452,000,000 | | | | 28,423,876 | |

| Series R186, 10.50% Bonds, 12/21/26 | | ZAR | | | 1,059,700,000 | | | | 81,253,671 | |

| Series R208, 6.75% Sr. Unsec. Nts., 3/31/21 | | ZAR | | | 514,540,000 | | | | 35,479,964 | |

| Series R214, 6.50% Bonds, 2/28/41 | | ZAR | | | 255,000,000 | | | | 12,564,618 | |

| | | | | | | | | | |

| | | | | | | | | 228,169,225 | |

| | | | | | | | | | | |

Sri Lanka—0.7% | | | | | | | | | | |

| Democratic Socialist Republic of Sri Lanka: | | | | | | | | | | |

| 5.75% Sr. Unsec. Nts., 4/18/233 | | | | | 9,690,000 | | | | 9,452,120 | |

| 5.875% Sr. Unsec. Nts., 7/25/223 | | | | | 8,995,000 | | | | 8,860,354 | |

| 6.00% Sr. Unsec. Nts., 1/14/193 | | | | | 9,430,000 | | | | 9,449,888 | |

| 6.25% Sr. Unsec. Nts., 10/4/203 | | | | | 2,955,000 | | | | 2,980,936 | |

| 6.75% Sr. Unsec. Nts., 4/18/283 | | | | | 6,490,000 | | | | 6,294,820 | |

| | | | | | | | | | |

| | | | | | | | | 37,038,118 | |

| | | | | | | | | | | |

Thailand—1.3% | | | | | | | | | | |

| Kingdom of Thailand: | | | | | | | | | | |

| 1.875% Sr. Unsec. Nts., 6/17/22 | | THB | | | 1,120,000,000 | | | | 34,219,602 | |

| 2.125% Sr. Unsec. Nts., 12/17/26 | | THB | | | 650,000,000 | | | | 19,340,675 | |

| 3.775% Sr. Unsec. Nts., 6/25/32 | | THB | | | 600,000,000 | | | | 19,862,653 | |

| | | | | | | | | | |

| | | | | | | | | 73,422,930 | |

| | | | | | | | | | | |

Turkey—1.0% | | | | | | | | | | |

| Republic of Turkey: | | | | | | | | | | |

| 8.50% Bonds, 7/10/19 | | TRY | | | 45,000,000 | | | | 6,758,463 | |

| 8.80% Bonds, 11/14/18 | | TRY | | | 73,165,000 | | | | 11,886,843 | |

| 10.70% Bonds, 2/17/21 | | TRY | | | 155,600,000 | | | | 19,646,269 | |

| 11.00% Bonds, 2/24/27 | | TRY | | | 14,900,000 | | | | 1,728,223 | |

| 12.40% Bonds, 3/8/28 | | TRY | | | 103,000,000 | | | | 13,346,258 | |

| | | | | | | | | | |

| | | | | | | | | 53,366,056 | |

|

| 19 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Ukraine—1.1% | | | | | | | | | | |

| Ukraine: | | | | | | | | | | |

| 7.75% Sr. Unsec. Nts., 9/1/202 | | | | $ | 5,905,000 | | | $ | 5,964,050 | |

| 7.75% Sr. Unsec. Nts., 9/1/232 | | | | | 13,840,000 | | | | 13,620,290 | |

| 7.75% Sr. Unsec. Nts., 9/1/242 | | | | | 8,880,000 | | | | 8,637,318 | |

| 7.75% Sr. Unsec. Nts., 9/1/252 | | | | | 5,900,000 | | | | 5,631,226 | |

| 7.75% Sr. Unsec. Nts., 9/1/262 | | | | | 19,825,000 | | | | 18,696,561 | |

| 7.75% Sr. Unsec. Nts., 9/1/272 | | | | | 11,175,000 | | | | 10,421,827 | |

| | | | | | | | | | |

| | | | | | | | | 62,971,272 | |

| | | | | | | | | | | |

United Kingdom—2.6% | | | | | | | | | | |

| United Kingdom, 3.25% Bonds, 1/22/442 | | GBP | | | 88,000,000 | | | | 144,681,109 | |

| | | | | | | | | | | |

Uruguay—0.4% | | | | | | | | | | |

| Oriental Republic of Uruguay: | | | | | | | | | | |

| 5.10% Sr. Unsec. Nts., 6/18/50 | | | | | 17,730,000 | | | | 18,151,088 | |

| 9.875% Sr. Unsec. Nts., 6/20/223 | | UYU | | | 176,475,000 | | | | 5,280,328 | |

| | | | | | | | | | |

| | | | | | | | | 23,431,416 | |

| | | | | | | | | | |

| Total Foreign Government Obligations (Cost $3,347,878,421) | | | | | | | | | 3,080,251,068 | |

| | | | | | | | | | | |

| Corporate Bonds and Notes—27.9% | | | | | | | | | | |

| Consumer Discretionary—0.6% | | | | | | | | | | |

| Automobiles—0.1% | | | | | | | | | | |

| Aston Martin Capital Holdings Ltd., 6.50% Sr. Sec. Nts., 4/15/223 | | | | | 3,500,000 | | | | 3,594,080 | |

| Jaguar Land Rover Automotive plc, 4.50% Sr. Unsec. Nts., 10/1/273 | | | | | 1,900,000 | | | | 1,567,120 | |

| | | | | | | | | | |

| | | | | | | | | 5,161,200 | |

| | | | | | | | | | | |

| Hotels, Restaurants & Leisure—0.2% | | | | | | | | | | |

| Melco Resorts Finance Ltd., 4.875% Sr. Unsec. Nts., 6/6/253 | | | | | 8,220,000 | | | | 7,798,892 | |

| Sands China Ltd., 5.125% Sr. Unsec. Nts., 8/8/253 | | | | | 3,280,000 | | | | 3,276,707 | |

| | | | | | | | | | |

| | | | | | | | | 11,075,599 | |

| | | | | | | | | | | |

| Household Durables—0.0% | | | | | | | | | | |

| Arcelik AS, 5.00% Sr. Unsec. Nts., 4/3/233 | | | | | 3,245,000 | | | | 2,964,979 | |

| | | | | | | | | | | |

| Media—0.3% | | | | | | | | | | |

| Altice Luxembourg SA, 6.25% Sr. Unsec. Nts., 2/15/252 | | EUR | | | 5,475,000 | | | | 5,951,862 | |

| Ziggo BV, 4.25% Sr. Sec. Nts., 1/15/273 | | EUR | | | 8,000,000 | | | | 9,311,992 | |

| | | | | | | | | | |

| | | | | | | | | 15,263,854 | |

| | | | | | | | | | | |

| Consumer Staples—0.3% | | | | | | | | | | |

| Beverages—0.1% | | | | | | | | | | |

| Coca-Cola Icecek AS, 4.215% Sr. Unsec. Nts., 9/19/243 | | | | | 3,010,000 | | | | 2,837,726 | |

| | | | | | | | | | | |

| Food Products—0.2% | | | | | | | | | | |

| BRF SA, 3.95% Sr. Unsec. Nts., 5/22/233 | | | | | 3,240,000 | | | | 2,948,400 | |

| MARB BondCo plc, 6.875% Sr. Unsec. Nts., 1/19/253 | | | | | 3,255,000 | | | | 3,037,322 | |

| MHP Lux SA, 6.95% Sr. Unsec. Nts., 4/3/263 | | | | | 3,370,000 | | | | 3,153,814 | |

|

| 20 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | | | |

| | | | | | Principal Amount | | | Value | |

Food Products (Continued) | | | | | | | | | | | | |

| Minerva Luxembourg SA, 6.50% Sr. Unsec. Nts., 9/20/263 | | | | | | $ | 3,240,000 | | | $ | 3,049,650 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,189,186 | |

| | | | | | | | | | | | | |

| Energy—3.4% | | | | | | | | | | | | |

| Energy Equipment & Services—0.8% | | | | | | | | | | | | |

| Eterna Capital Pte Ltd.: | | | | | | | | | | | | |

| 7.50% Sr. Sec. Nts., 12/11/222,6 | | | | | | | 5,826,974 | | | | 5,800,429 | |

| 8.00% Sr. Sec. Nts., 12/11/226 | | | | | | | 19,152,906 | | | | 18,534,401 | |

| Pertamina Persero PT, 5.625% Sr. Unsec. Nts., 5/20/433 | | | | | | | 16,495,000 | | | | 16,314,495 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 40,649,325 | |

| | | | | | | | | | | | | |

| Oil, Gas & Consumable Fuels—2.6% | | | | | | | | | | | | |

| Frontera Energy Corp., 9.70% Sr. Unsec. Nts., 6/25/233 | | | | | | | 3,040,000 | | | | 3,199,600 | |

| Indika Energy Capital III Pte Ltd., 5.875% Sr. Sec. Nts., 11/9/243 | | | | | | | 5,005,000 | | | | 4,717,628 | |

| KazMunayGas National Co. JSC: | | | | | | | | | | | | |

| 4.75% Sr. Unsec. Nts., 4/24/253 | | | | | | | 6,680,000 | | | | 6,767,341 | |

| 5.375% Sr. Unsec. Nts., 4/24/303 | | | | | | | 12,955,000 | | | | 13,205,031 | |

| 6.375% Sr. Unsec. Nts., 10/24/483 | | | | | | | 11,515,000 | | | | 12,120,459 | |

| KazTransGas JSC, 4.375% Sr. Unsec. Nts., 9/26/273 | | | | | | | 7,590,000 | | | | 7,254,211 | |

| Medco Platinum Road Pte Ltd., 6.75% Sr. Sec. Nts., 1/30/253 | | | | | | | 14,095,000 | | | | 13,359,833 | |

| Petrobras Global Finance BV: | | | | | | | | | | | | |

| 5.299% Sr. Unsec. Nts., 1/27/25 | | | | | | | 9,755,000 | | | | 9,135,557 | |

| 5.75% Sr. Unsec. Nts., 2/1/29 | | | | | | | 9,750,000 | | | | 8,728,688 | |

| 6.85% Sr. Unsec. Nts., 6/5/15 | | | | | | | 3,255,000 | | | | 2,799,300 | |

| Petroleos Mexicanos: | | | | | | | | | | | | |

| 3.75% Sr. Unsec. Nts., 2/21/242 | | | EUR | | | | 2,975,000 | | | | 3,566,514 | |

| 3.75% Sr. Unsec. Nts., 4/16/262 | | | EUR | | | | 6,495,000 | | | | 7,564,631 | |

| 6.75% Sr. Unsec. Nts., 9/21/47 | | | | | | | 4,880,000 | | | | 4,668,647 | |

| Puma International Financing SA, 5.00% Sr. Unsec. Nts., 1/24/263 | | | | | | | 7,005,000 | | | | 5,934,650 | |

| Reliance Industries Ltd., 6.78% Unsec. Nts., 9/16/20 | | | INR | | | | 500,000,000 | | | | 6,717,692 | |

| Repsol International Finance BV, 4.50% [EUSA10+420] Jr. Sub. Nts., 3/25/751,2 | | | EUR | | | | 5,000,000 | | | | 6,237,712 | |

| Rio Oil Finance Trust Series 2018-1, 8.20% Sr. Sec. Nts., 4/6/283 | | | | | | | 4,835,000 | | | | 4,955,875 | |

| Saka Energi Indonesia PT, 4.45% Sr. Unsec. Nts., 5/5/243 | | | | | | | 4,110,000 | | | | 3,843,960 | |

| Southern Gas Corridor CJSC, 6.875% Sr. Unsec. Nts., 3/24/263 | | | | | | | 6,525,000 | | | | 7,266,553 | |

| Topaz Marine SA, 9.125% Sr. Unsec. Nts., 7/26/223 | | | | | | | 3,225,000 | | | | 3,332,102 | |

| YPF SA: | | | | | | | | | | | | |

| 8.50% Sr. Unsec. Nts., 7/28/253 | | | | | | | 5,200,000 | | | | 5,089,552 | |

| 36.75% [BADLARPP+400] Sr. Unsec. Nts., 7/7/201,3 | | | | | | | 8,000,000 | | | | 3,210,800 | |

| | | | | | | | | | | 143,676,336 | |

| | | | | | | | | | | | | |

| Financials—18.6% | | | | | | | | | | | | |

| Capital Markets—1.7% | | | | | | | | | | | | |

| Credit Suisse Group AG, 7.50% [USSW5+459.8] Jr. Sub. | | | | | | | | | | | | |

| Perpetual Bonds1,2,7 | | | | | | | 35,000,000 | | | | 36,924,300 | |

|

| 21 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | | | |

| | | | | | Principal Amount | | | Value | |

| Capital Markets (Continued) | | | | | | | | | | | | |

| Huarong Finance 2017 Co. Ltd., 4.25% Sr. Unsec. Nts., 11/7/272 | | | | | | $ | 6,515,000 | | | $ | 5,973,317 | |

| Morgan Stanley, 7.50% Sr. Unsec. Nts., 4/2/325 | | | | | | | 25,000,000 | | | | 19,318,100 | |

| Seven & Seven Ltd., 3.542% [US0006M+100] Sr. Unsec. Nts., 9/11/191,3 | | | | | | | 1,000,000 | | | | 995,225 | |

| UBS AG (Stamford CT), 7.625% Sub. Nts., 8/17/22 | | | | | | | 10,000,000 | | | | 11,165,000 | |

| UBS Group Funding Switzerland AG: | | | | | | | | | | | | |

| 6.875% [USISDA05+549.65] Jr. Sub. Perpetual Bonds1,2,7 | | | | | | | 4,595,000 | | | | 4,740,960 | |

| 7.00% [USSW5+486.6] Jr. Sub. Perpetual Bonds1,2,7 | | | | | | | 8,000,000 | | | | 8,513,504 | |

| 7.125% [USSW5+546.4] Jr. Sub. Perpetual Bonds1,2,7 | | | | | | | 5,000,000 | | | | 5,130,175 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 92,760,581 | |

| | | | | | | | | | | | | |

| Commercial Banks—13.0% | | | | | | | | | | | | |

| Adler Pelzer Holding GmbH, 4.125% Sr. Sec. Nts., 4/1/242 | | | EUR | | | | 1,300,000 | | | | 1,516,053 | |

| Allied Irish Banks plc, 4.125% [EUSA5+395] Sub. Nts., 11/26/251,2 | | | EUR | | | | 12,000,000 | | | | 14,784,467 | |

| Astana Finance JSC, 9.16% Sr. Unsec. Nts., 12/22/248,9 | | | | | | | 612,810 | | | | — | |

| Banca Monte dei Paschi di Siena SpA, 5.375% [EUSA5+500.5] Sub. Nts., 1/18/281,2 | | | EUR | | | | 15,000,000 | | | | 14,187,410 | |

| Banco Bilbao Vizcaya Argentaria SA: | | | | | | | | | | | | |

| 5.875% [EUSA5+577.9] Jr. Sub. Perpetual Bonds1,2,7,11 | | | EUR | | | | 22,500,000 | | | | 26,374,855 | |

| 6.75% [EUSA5+660.4] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 3,000,000 | | | | 3,629,589 | |

| 8.875% [EUSA5+917.7] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 27,200,000 | | | | 35,370,227 | |

| Banco do Brasil SA (Cayman), 3.875% Sr. Unsec. Nts., 10/10/22 | | | | | | | 14,625,000 | | | | 13,758,469 | |

| Banco Hipotecario SA, 36.333% [BADLARPP+250] Sr. Unsec. Nts., 1/12/201,3 | | | ARS | | | | 75,979,000 | | | | 1,665,920 | |

| Banco Mercantil del Norte SA (Grand Cayman), 7.625% [H15T10Y+535.3] Jr. Sub. Perpetual Bonds1,3,7 | | | | | | | 2,316,000 | | | | 2,350,740 | |

| Banco Santander SA, 6.75% [EUSA5+680.3] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 14,500,000 | | | | 18,181,369 | |

| Bank of Ireland, 10.00% Sub. Nts., 12/19/222 | | | EUR | | | | 9,500,000 | | | | 14,811,513 | |

| Bank of Scotland plc, 4.875% Sec. Nts., 12/20/24 | | | GBP | | | | 8,675,000 | | | | 13,292,198 | |

| Barclays Bank plc, 6.278% [US0003M+155] Jr. Sub. Perpetual Bonds1,7 | | | | | | | 4,000,000 | | | | 4,080,020 | |

| Barclays plc: | | | | | | | | | | | | |

| 6.50% [EUSA5+587.5] Jr. Sub. Perpetual Bonds1,7 | | | EUR | | | | 6,500,000 | | | | 7,792,097 | |

| 7.25% [BPSW5+646.2] Jr. Sub. Perpetual Bonds1,2,7 | | | GBP | | | | 5,000,000 | | | | 6,748,653 | |

| 7.75% [USSW5+484.2] Jr. Sub. Perpetual Bonds1,7 | | | | | | | 5,975,000 | | | | 6,004,875 | |

| 8.00% [EUSA5+675] Jr. Sub. Perpetual Bonds1,7 | | | EUR | | | | 11,105,000 | | | | 14,237,487 | |

| BBVA Bancomer SA, 5.35% [H15T5Y+300] Sub. Nts., 11/12/291,3 | | | | | | | 5,765,000 | | | | 5,548,813 | |

| BNP Paribas SA, 7.625% [USSW5+631.4] Jr. Sub. Perpetual Bonds1,3,7 | | | | | | | 24,000,000 | | | | 25,260,000 | |

| Caixa Geral de Depositos SA: | | | | | | | | | | | | |

| 1.00% Sec. Nts., 1/27/222 | | | EUR | | | | 3,000,000 | | | | 3,556,195 | |

| 5.75% [EUSA5+550] Sub. Nts., 6/28/281,2 | | | EUR | | | | 8,000,000 | | | | 9,800,655 | |

| 10.75% [EUSA5+1,092.5] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 7,000,000 | | | | 9,215,846 | |

|

| 22 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | | | |

| | | | | | Principal Amount | | | Value | |

| Commercial Banks (Continued) | | | | | | | | | | | | |

| CaixaBank SA, 6.75% [EUSA5+649.8] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 20,000,000 | | | $ | 25,128,489 | |

| Cooperatieve Rabobank UA, 5.50% [EUSA5+525] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 5,090,000 | | | | 6,236,612 | |

| Credit Agricole SA: | | | | | | | | | | | | |

| 6.625% [USSW5+469.7] Jr. Sub. Perpetual Bonds1,2,7 | | | | | | | 4,000,000 | | | | 4,045,588 | |

| 8.125% [USSW5+618.5] Jr. Sub. Perpetual Bonds1,3,7 | | | | | | | 4,405,000 | | | | 4,856,451 | |

| Credit Suisse AG, 6.50% Sub. Nts., 8/8/232 | | | | | | | 15,010,000 | | | | 16,061,315 | |

| Dresdner Funding Trust I, 8.151% Jr. Sub. Nts., 6/30/313 | | | | | | | 9,900,000 | | | | 12,256,200 | |

| EUROFIMA, 6.25% Sr. Unsec. Nts., 12/28/182 | | | AUD | | | | 5,270,000 | | | | 3,845,285 | |

| Export-Import Bank of India: | | | | | | | | | | | | |

| 9.50% Sr. Unsec. Nts., 10/9/18 | | | INR | | | | 175,000,000 | | | | 2,412,419 | |

| 9.70% Sr. Unsec. Nts., 11/21/18 | | | INR | | | | 200,000,000 | | | | 2,773,293 | |

| Fidelity Bank plc, 10.50% Sr. Unsec. Nts., 10/16/223 | | | | | | | 3,780,000 | | | | 3,870,153 | |

| HSBC Bank Capital Funding Sterling 1 LP, 5.844% [BP0006M+176] Jr. Sub. Perpetual Bonds1,2,7 | | | GBP | | | | 3,100,000 | | | | 4,859,145 | |

| HSBC Holdings plc: | | | | | | | | | | | | |

| 5.25% [EUSA5+438.3] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 21,000,000 | | | | 25,788,260 | |

| 6.25% [USISDA05+345.3] Jr. Sub. Perpetual Bonds1,7 | | | | | | | 15,000,000 | | | | 14,962,500 | |

| IDBI Bank Ltd. (GIFT-IFC), 5.00% Sr. Unsec. Nts., 9/25/192 | | | | | | | 2,530,000 | | | | 2,542,751 | |

| ING Groep NV, 6.875% [USSW5+512.4] Jr. Sub. Perpetual Bonds1,2,7 | | | | | | | 5,000,000 | | | | 5,087,410 | |

| Inter-American Development Bank, 24.539% Sr. Unsec. Nts., 9/28/2014 | | | TRY | | | | 57,100,000 | | | | 5,981,379 | |

| Intesa Sanpaolo SpA: | | | | | | | | | | | | |

| 4.375% Sr. Unsec. Nts., 1/12/483 | | | | | | | 10,000,000 | | | | 7,576,526 | |

| 5.017% Sub. Nts., 6/26/243 | | | | | | | 10,825,000 | | | | 9,777,698 | |

| 5.71% Sub. Nts., 1/15/263 | | | | | | | 2,000,000 | | | | 1,826,392 | |

| Intrum AB, 3.125% Sr. Unsec. Nts., 7/15/242 | | | EUR | | | | 7,655,000 | | | | 8,464,625 | |

| KBC Group NV, 5.625% [EUSA5+475.9] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 7,500,000 | | | | 8,835,193 | |

| Lloyds Bank plc: | | | | | | | | | | | | |

| 7.50% Sr. Unsec. Nts., 4/2/322,5 | | | | | | | 10,000,000 | | | | 7,740,490 | |

| 13.00% [GUKG5+1,340] Jr. Sub. Perpetual Bonds1,7 | | | GBP | | | | 5,000,000 | | | | 11,093,022 | |

| Lloyds Banking Group plc: | | | | | | | | | | | | |

| 6.375% [EUSA5+529] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 18,000,000 | | | | 22,144,370 | |

| 6.657% [US0003M+127] Jr. Sub. Perpetual Bonds1,7,10 | | | | | | | 12,000,000 | | | | 12,262,560 | |

| NN Group NV, 4.625% [EUR003M+395] Sub. Nts., 4/8/441,2 | | | EUR | | | | 5,000,000 | | | | 6,349,225 | |

| Novo Banco SA (Luxembourg): | | | | | | | | | | | | |

| 3.50% Sr. Unsec. Nts., 1/23/43 | | | EUR | | | | 10,000,000 | | | | 10,001,656 | |

| 3.50% Sr. Unsec. Nts., 2/19/432 | | | EUR | | | | 1,700,000 | | | | 1,701,987 | |

| 3.50% Sr. Unsec. Nts., 3/18/432 | | | EUR | | | | 2,300,000 | | | | 2,296,447 | |

| Rabobank Capital Funding Trust IV, 5.556% [BP0006M+146] Jr. Sub. Perpetual Bonds1,3,7 | | | GBP | | | | 8,005,000 | | | | 10,823,760 | |

| Societe Generale SA: | | | | | | | | | | | | |

| 6.75% [USSW5+392.9] Jr. Sub. Perpetual Bonds1,3,7 | | | | | | | 10,000,000 | | | | 9,342,500 | |

| 6.75% [EUSA5+553.8] Jr. Sub. Perpetual Bonds1,2,7 | | | EUR | | | | 10,000,000 | | | | 12,539,920 | |

| 7.375% [USSW5+623.8] Jr. Sub. Perpetual Bonds1,3,7 | | | | | | | 13,000,000 | | | | 13,438,750 | |

|

| 23 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

| Commercial Banks (Continued) | | | | | | | | | | |

| Stadshypotek AB: | | | | | | | | | | |

| 1.50% Sec. Nts., 3/17/212 | | SEK | | | 600,000,000 | | | $ | 69,893,850 | |

| 1.50% Sec. Nts., 12/15/212 | | SEK | | | 400,000,000 | | | | 46,699,237 | |

| Standard Chartered Bank, 5.375% [BP0003M+189] Jr. Sub. Perpetual Bonds1,7 | | GBP | | | 4,000,000 | | | | 5,367,698 | |

| Standard Chartered plc, 7.014% [US0003M+146] Jr. Sub. Perpetual Bonds1,3,7 | | | | | 5,460,000 | | | | 5,678,400 | |

| Swiss Insured Brazil Power Finance Sarl, 9.85% Sr. Sec. Nts., 7/16/32 | | BRL | | | 17,500,000 | | | | 4,019,079 | |

| UBS Group Funding Switzerland AG: | | | | | | | | | | |

| 5.00% [USSW5+243.2] Jr. Sub. Perpetual Bonds1,2,7 | | | | | 6,470,000 | | | | 5,734,232 | |

| 5.75% [EUSA5+528.7] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 11,000,000 | | | | 14,175,909 | |

| Westpac Banking Corp., 1.50% Sec. Nts., 3/24/212 | | EUR | | | 5,000,000 | | | | 6,025,623 | |

| Zenith Bank plc, 7.375% Sr. Unsec. Nts., 5/30/223 | | | | | 3,930,000 | | | | 3,978,457 | |

| | | | | | | | | | |

| | | | | | | | | 710,662,307 | |

| | | | | | | | | | | |

| Consumer Finance—0.3% | | | | | | | | | | |

| Minejesa Capital BV, 4.625% Sr. Sec. Nts., 8/10/303 | | | | | 17,770,000 | | | | 16,375,571 | |

| | | | | | | | | | | |

| Diversified Financial Services—0.4% | | | | | | | | | | |

| JPMorgan Hipotecaria su Casita, 6.47% Sec. Nts., 8/26/359,10 | | MXN | | | 34,101,099 | | | | 167,417 | |

| Power Finance Corp. Ltd., 7.99% Sr. Unsec. Nts., 12/20/22 | | INR | | | 400,000,000 | | | | 5,342,188 | |

| Rural Electrification Corp. Ltd.: | | | | | | | | | | |

| 8.36% Sr. Unsec. Nts., 9/22/20 | | INR | | | 850,000,000 | | | | 11,714,956 | |

| 9.04% Sr. Unsec. Nts., 10/12/19 | | INR | | | 250,000,000 | | | | 3,455,276 | |

| | | | | | | | | | |

| | | | | | | | | 20,679,837 | |

| | | | | | | | | | | |

| Insurance—2.4% | | | | | | | | | | |

| Aquarius & Investments plc for Swiss Reinsurance Co. Ltd., 6.375% [USSW5+521] Sub. Nts., 9/1/241,2 | | | | | 5,000,000 | | | | 5,110,580 | |

| ASR Nederland NV, 5.125% Sub. Nts., 9/29/452 | | EUR | | | 10,000,000 | | | | 12,830,148 | |

| Aviva plc: | | | | | | | | | | |

| 3.875% [EUSA5+348] Sub. Nts., 7/3/441,2 | | EUR | | | 7,000,000 | | | | 8,598,208 | |

| 6.125% [EUSA5+513] Sub. Nts., 7/5/431,2 | | EUR | | | 5,000,000 | | | | 6,778,250 | |

| 6.125% [GUKG5+240] Jr. Sub. Perpetual Bonds1,7 | | GBP | | | 6,560,000 | | | | 9,288,281 | |

| AXA SA: | | | | | | | | | | |

| 3.875% [EUSA11+325] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 10,500,000 | | | | 12,804,794 | |

| 8.60% Sub. Nts., 12/15/30 | | | | | 5,000,000 | | | | 6,512,500 | |

| Credit Agricole Assurances SA, 4.75% [EUSA5+535] Sub. Nts., 9/27/481,2 | | EUR | | | 18,000,000 | | | | 22,962,143 | |

| Credivalores-Crediservicios SAS: | | | | | | | | | | |

| 9.75% Sr. Unsec. Nts., 7/27/223 | | | | | 790,000 | | | | 790,987 | |

| 9.75% Sr. Unsec. Nts., 7/27/222,11 | | | | | 4,535,000 | | | | 4,540,669 | |

| NN Group NV, 4.375% [EUR003M+390] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 8,000,000 | | | | 9,814,588 | |

| Power Finance Corp. Ltd.: | | | | | | | | | | |

| 7.42% Sr. Unsec. Nts., 6/26/20 | | INR | | | 700,000,000 | | | | 9,535,634 | |

| 8.53% Sr. Unsec. Nts., 7/24/20 | | INR | | | 330,000,000 | | | | 4,569,614 | |

|

| 24 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

| Insurance (Continued) | | | | | | | | | | |

| UNIQA Insurance Group AG, 6.875% [EUR003M+598.6] Sub. Nts., 7/31/431,2 | | EUR | | | 9,300,000 | | | $ | 12,808,417 | |

| VIVAT NV, 2.375% Sr. Unsec. Nts., 5/17/242 | | EUR | | | 6,000,000 | | | | 7,321,881 | |

| | | | | | | | | | |

| | | | | | | | | 134,266,694 | |

| | | | | | | | | | | |

| Real Estate Investment Trusts (REITs)—0.1% | | | | | | | | | | |

| Banco Invex SA/Hipotecaria Credito y Casa SA de CV, 6.45% Sec. Nts., 3/13/344,8,9 | | MXN | | | 27,602,566 | | | | — | |

| Trust F/1401, 5.25% Sr. Unsec. Nts., 1/30/263 | | | | | 6,805,000 | | | | 6,813,506 | |

| | | | | | | | | | |

| | | | | | | | | 6,813,506 | |

| | | | | | | | | | | |

| Real Estate Management & Development—0.6% | | | | | | | | | | |

| Agile Group Holdings Ltd., 9.00% Sr. Sec. Nts., 5/21/202 | | | | | 10,770,000 | | | | 11,275,932 | |

| CIFI Holdings Group Co. Ltd., 7.75% Sr. Unsec. Nts., 6/5/202 | | | | | 7,030,000 | | | | 7,126,423 | |

| Country Garden Holdings Co. Ltd., 7.50% Sr. Sec. Nts., 3/9/202 | | | | | 7,030,000 | | | | 7,172,920 | |

| New Metro Global Ltd., 6.50% Sr. Unsec. Nts., 4/23/212 | | | | | 3,280,000 | | | | 3,211,313 | |

| Times China Holdings Ltd., 6.25% Sr. Sec. Nts., 1/23/202 | | | | | 3,280,000 | | | | 3,254,354 | |

| | | | | | | | | | |

| | | | | | | | | 32,040,942 | |

| | | | | | | | | | | |

| Thrifts & Mortgage Finance—0.1% | | | | | | | | | | |

| Housing Development Finance Corp. Ltd.: | | | | | | | | | | |

| 8.75% Sr. Sec. Nts., 1/13/20 | | INR | | | 330,000,000 | | | | 4,530,551 | |

| 8.95% Sec. Nts., 10/19/20 | | INR | | | 125,000,000 | | | | 1,723,439 | |

| | | | | | | | | | |

| | | | | | | | | 6,253,990 | |

| | | | | | | | | | | |

| Health Care—0.3% | | | | | | | | | | |

| Health Care Providers & Services—0.1% | | | | | | | | | | |

| OCP SA, 4.50% Sr. Unsec. Nts., 10/22/253 | | | | | 6,360,000 | | | | 6,129,450 | |

| | | | | | | | | | | |

| Life Sciences Tools & Services—0.2% | | | | | | | | | | |

| IQVIA, Inc.: | | | | | | | | | | |

| 3.25% Sr. Unsec. Nts., 3/15/253 | | EUR | | | 6,000,000 | | | | 7,131,283 | |

| 3.25% Sr. Unsec. Nts., 3/15/252 | | EUR | | | 1,000,000 | | | | 1,186,335 | |

| | | | | | | | | | |

| | | | | | | | | 8,317,618 | |

| | | | | | | | | | | |

| Industrials—0.5% | | | | | | | | | | |

| Construction & Engineering—0.1% | | | | | | | | | | |

| Fideicomiso PA Concesion Ruta al Mar, 6.75% Sr. Sec. Nts., 2/15/443,4 | | COP | | | 8,000,000,000 | | | | 2,683,483 | |

| Fideicomiso PA Costera, 6.25% Sr. Sec. Nts., 1/15/343,4 | | COP | | | 5,916,031,565 | | | | 2,058,085 | |

| Fideicomiso PA Pacifico Tres, 8.25% Sr. Sec. Nts., 1/15/3510 | | | | | 3,060,000 | | | | 3,396,621 | |

| | | | | | | | | | |

| | | | | | | | | 8,138,189 | |

| | | | | | | | | | | |

| Industrial Conglomerates—0.1% | | | | | | | | | | |

| Tupras Turkiye Petrol Rafinerileri AS, 4.50% Sr. Unsec. Nts., 10/18/243 | | | | | 3,165,000 | | | | 2,794,537 | |

|

| 25 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

| Trading Companies & Distributors—0.1% | | | | | | | | | | |

| National Bank for Agriculture & Rural Development, 8.39% Sr. Unsec. Nts., 7/19/21 | | INR | | | 300,000,000 | | | $ | 4,107,943 | |

| | | | | | | | | | | |

| Transportation Infrastructure—0.2% | | | | | | | | | | |

| DP World Ltd., 5.625% Sr. Unsec. Nts., 9/25/483 | | | | | 6,540,000 | | | | 6,491,578 | |

| GMR Hyderabad International Airport Ltd., 4.25% Sr. Sec. Nts., 10/27/273 | | | | | 6,495,000 | | | | 5,713,749 | |

| | | | | | | | | | |

| | | | | | | | | 12,205,327 | |

| | | | | | | | | | | |

| Information Technology—0.2% | | | | | | | | | | |

| Communications Equipment—0.2% | | | | | | | | | | |

| HTA Group Ltd., 9.125% Sr. Unsec. Nts., 3/8/223 | | | | | 3,170,000 | | | | 3,265,100 | |

| Virgin Media Finance plc, 4.50% Sr. Unsec. Nts., 1/15/252 | | EUR | | | 6,950,000 | | | | 8,280,213 | |

| | | | | | | | | | |

| | | | | | | | | 11,545,313 | |

| | | | | | | | | | | |

| Materials—1.2% | | | | | | | | | | |

| Chemicals—0.4% | | | | | | | | | | |

| Crown European Holdings SA, 3.375% Sr. Unsec. Nts., 5/15/253 | | EUR | | | 5,000,000 | | | | 6,019,295 | |

| ONGC Videsh Ltd., 2.75% Sr. Unsec. Nts., 7/15/212 | | EUR | | | 7,565,000 | | | | 9,242,747 | |

| Petkim Petrokimya Holding AS, 5.875% Sr. Unsec. Nts., 1/26/233 | | | | | 5,385,000 | | | | 4,986,074 | |

| Starfruit Finco BV/Starfruit US Holdco LLC: | | | | | | | | | | |

| 6.50% Sr. Unsec. Nts., 10/1/2612 | | EUR | | | 1,500,000 | | | | 1,762,256 | |

| 8.00% Sr. Unsec. Nts., 10/1/263,12 | | | | | 1,250,000 | | | | 1,268,750 | |

| | | | | | | | | | |

| | | | | | | | | 23,279,122 | |

| | | | | | | | | | | |

| Construction Materials—0.2% | | | | | | | | | | |

| CIMPOR Financial Operations BV, 5.75% Sr. Unsec. Nts., 7/17/243 | | | | | 12,810,000 | | | | 8,994,798 | |

| | | | | | | | | | | |

| Containers & Packaging—0.1% | | | | | | | | | | |

| Klabin Finance SA, 4.875% Sr. Unsec. Nts., 9/19/273 | | | | | 6,330,000 | | | | 5,609,963 | |

| | | | | | | | | | | |

| Metals & Mining—0.3% | | | | | | | | | | |

| JSW Steel Ltd., 4.75% Sr. Unsec. Nts., 11/12/192 | | | | | 6,330,000 | | | | 6,320,125 | |

| Metinvest BV, 7.75% Sr. Unsec. Nts., 4/23/233 | | | | | 3,185,000 | | | | 3,066,209 | |

| Southern Copper Corp., 7.50% Sr. Unsec. Nts., 7/27/35 | | | | | 6,105,000 | | | | 7,570,200 | |

| | | | | | | | | | |

| | | | | | | | | 16,956,534 | |

| | | | | | | | | | | |

| Paper & Forest Products—0.2% | | | | | | | | | | |

| Suzano Austria GmbH: | | | | | | | | | | |

| 5.75% Sr. Unsec. Nts., 7/14/263 | | | | | 6,815,000 | | | | 6,891,668 | |

| 6.00% Sr. Unsec. Nts., 1/15/293 | | | | | 5,095,000 | | | | 5,121,749 | |

| | | | | | | | | | |

| | | | | | | | | 12,013,417 | |

| | | | | | | | | | | |

| Telecommunication Services—1.1% | | | | | | | | | | |

| Diversified Telecommunication Services—0.7% | | | | | | | | | | |

| Axtel SAB de CV, 6.375% Sr. Unsec. Nts., 11/14/243 | | | | | 6,495,000 | | | | 6,439,533 | |

|

| 26 OPPENHEIMER INTERNATIONAL BOND FUND |

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

| Diversified Telecommunication Services (Continued) | | | | | | | | | | |

| Telecom Italia Finance SA, 7.75% Sr. Unsec. Nts., 1/24/33 | | EUR | | | 10,000,000 | | | $ | 16,025,450 | |

| Telefonica Europe BV, 3.75% [EUSA5+385.8] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 13,300,000 | | | | 15,826,917 | |

| | | | | | | | | | |

| | | | | | | | | 38,291,900 | |

| | | | | | | | | | | |

| Wireless Telecommunication Services—0.4% | | | | | | | | | | |

| C&W Senior Financing DAC, 6.875% Sr. Unsec. Nts., 9/15/273 | | | | | 3,820,000 | | | | 3,820,000 | |

| Telefonica Europe BV, 5.875% [EUSA10+430.1] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 5,000,000 | | | | 6,413,060 | |

| VEON Holdings BV, 4.95% Sr. Unsec. Nts., 6/16/243 | | | | | 6,005,000 | | | | 5,764,560 | |

| Wind Tre SpA, 3.125% Sr. Sec. Nts., 1/20/25 | | EUR | | | 6,315,000 | | | | 6,721,338 | |

| | | | | | | | | | |

| | | | | | | | | 22,718,958 | |

| Utilities—1.7% | | | | | | | | | | |

| Electric Utilities—1.1% | | | | | | | | | | |

| Capex SA, 6.875% Sr. Unsec. Nts., 5/15/243 | | | | | 2,740,000 | | | | 2,335,850 | |

| ContourGlobal Power Holdings SA, 3.375%, 8/1/23 | | EUR | | | 10,000,000 | | | | 11,642,429 | |

| Electricite de France SA, 5.375% [EUSA12+379.4] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 3,100,000 | | | | 3,895,902 | |

| Enel SpA, 8.75% [USSW5+588] Jr. Sub. Nts., 9/24/731,3 | | | | | 9,000,000 | | | | 9,990,000 | |

| Eskom Holdings SOC Ltd.: | | | | | | | | | | |

| 5.75% Sr. Unsec. Nts., 1/26/213 | | | | | 6,485,000 | | | | 6,325,871 | |

| 6.75% Sr. Unsec. Nts., 8/6/233 | | | | | 15,740,000 | | | | 15,166,749 | |

| Inkia Energy Ltd., 5.875% Sr. Unsec. Nts., 11/9/273 | | | | | 5,865,000 | | | | 5,593,802 | |

| Light Servicos de Eletricidade SA/Light Energia SA, 7.25% Sr. Unsec. Nts., 5/3/233 | | | | | 6,325,000 | | | | 6,024,563 | |

| | | | | | | | | | |

| | | | | | | | | 60,975,166 | |

| | | | | | | | | | | |

| Gas Utilities—0.1% | | | | | | | | | | |

| Gas Natural Fenosa Finance BV, 4.125% [EUSA8+335.3] Jr. Sub. Perpetual Bonds1,2,7 | | EUR | | | 5,000,000 | | | | 6,107,756 | |

| | | | | | | | | | | |

| Independent Power and Renewable Electricity Producers—0.2% | | | | | | | | | | |

| AES Andres BV/Dominican Power Partners/Empresa | | | | | | | | | | |

| Generadora de Electricidad Itabo SA, 7.95% Sr. Unsec. Nts., 5/11/263 | | | | | 3,325,000 | | | | 3,449,687 | |

| Azure Power Energy Ltd., 5.50% Sr. Sec. Nts., 11/3/223 | | | | | 2,620,000 | | | | 2,494,502 | |

| Reliance Jio Infocomm Ltd., 8.32% Sec. Nts., 7/8/21 | | INR | | | 335,000,000 | | | | 4,588,599 | |

| | | | | | | | | | |

| | | | | | | | | 10,532,788 | |

| | | | | | | | | | | |

| Multi-Utilities—0.3% | | | | | | | | | | |

| Eskom Holdings SOC Ltd., 6.35% Sr. Unsec. Nts., 8/10/283 | | | | | 17,410,000 | | | | 17,372,917 | |

| | | | | | | | | | |

| Total Corporate Bonds and Notes (Cost $1,588,695,185) | | | | | | | | | 1,529,763,329 | |

| | | | | | Shares | | | | | |

| Common Stock—0.0% | | | | | | | | | | |

| JSC Astana Finance, GDR9,10,13 (Cost $0) | | | | | 868,851 | | | | — | |

|

| 27 OPPENHEIMER INTERNATIONAL BOND FUND |

CONSOLIDATED STATEMENT OF INVESTMENTS Continued

| | | | | | | | | | | | |

| | | |

| | | | | | Principal Amount | | | Value | |

| Structured Securities—0.3% | | | | | | | | | | | | |

Deutsche Bank AG, Coriolanus Ltd. Sec. Credit Linked Bonds: | | | | | | | | | | | | |

3.003%, 4/30/253,14 | | | | | | $ | 2,312,616 | | | $ | 2,050,839 | |

3.054%, 4/30/253,14 | | | | | | | 2,946,629 | | | | 2,613,084 | |

3.098%, 4/30/253,14 | | | | | | | 2,543,942 | | | | 2,255,980 | |

3.131%, 4/30/253,14 | | | | | | | 2,273,963 | | | | 2,016,562 | |

3.179%, 4/30/253,14 | | | | | | | 2,831,269 | | | | 2,510,783 | |

3.231%, 4/30/253,14 | | | | | | | 3,231,464 | | | | 2,865,677 | |

3.265%, 4/30/253,14 | | | | | | | 2,581,561 | | | | 2,289,341 | |

| 3.346%, 4/30/253,14 | | | | | | | 2,426,558 | | | | 2,151,883 | |

Morgan Stanley, Russian Federation Total Return Linked Bonds, Series 007, Cl. VR, 5.00%, 8/22/349 | | | RUB | | | | 123,753,293 | | | | 449,989 | |

| | | | | | | | | | | | |

Total Structured Securities (Cost $21,973,630) | | | | | | | | | | | 19,204,138 | |

| | | | | | | | | | | | |

| Short-Term Notes—4.3% | | | | | | | | | | | | |

Arab Republic of Egypt Treasury Bills: | | | | | | | | | | | | |

16.166%, 10/9/1814 | | | EGP | | | | 77,300,000 | | | | 4,317,598 | |

18.914%, 3/19/1914 | | | EGP | | | | 25,000,000 | | | | 1,283,008 | |

18.983%, 3/5/1914 | | | EGP | | | | 26,150,000 | | | | 1,351,736 | |

19.049%, 2/26/1914 | | | EGP | | | | 110,000,000 | | | | 5,706,631 | |

Argentine Republic Treasury Bills: | | | | | | | | | | | | |

0.00%, 1/31/1914 | | | ARS | | | | 880,000,000 | | | | 21,596,572 | |

0.00%, 12/28/1814 | | | ARS | | | | 44,500,000 | | | | 1,102,531 | |

4.34%, 11/30/1814 | | | ARS | | | | 220,000,000 | | | | 5,368,128 | |