Corporate Governance Reforms NOVEMBER 2014

Initial Steps on the Road to Good Governance In the first 30 days after the annual meeting of shareholders, the Company has worked diligently to identify areas where we can start to improve our corporate governance practices to be more responsive to our shareholders. The following presentation sets forth our initial short and long term initiatives while we continue our ongoing reform of our corporate governance practices. 2

Immediate Improvements to Our Corporate Governance Practices Below are changes we have already acted upon: • Termination of the Company’s Poison Pill • Implemented Majority Voting Standard for Election of Directors • Repealed Advance Notice Bylaw Amendments Adopted in March 2014 • Implemented Anti-Hedging and Anti-Pledging Policy • Enhanced Political Contributions Report • Enhanced Lobbying Report • Enhanced Shareholder Communication and Interaction • Restructured Director Compensation • Eliminated Executive Committee • Enhanced Duties of Independent Chairman / Lead Director 3

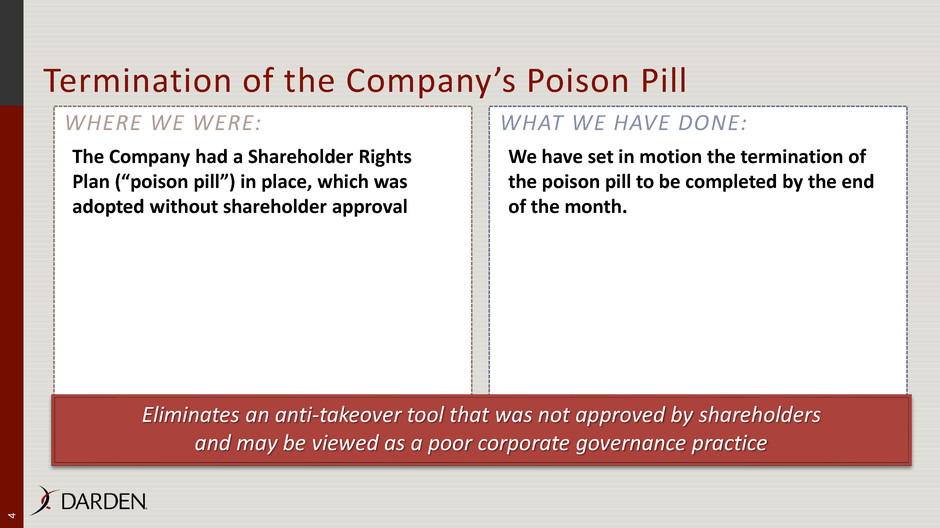

WHERE WE WERE: WHAT WE HAVE DONE: Termination of the Company’s Poison Pill The Company had a Shareholder Rights Plan (“poison pill”) in place, which was adopted without shareholder approval We have set in motion the termination of the poison pill to be completed by the end of the month. 4 Eliminates an anti-takeover tool that was not approved by shareholders and may be viewed as a poor corporate governance practice

WHERE WE WERE: WHAT WE HAVE DONE: Majority Voting Standard for Election of Directors Directors were elected by a plurality vote with a director resignation policy for a director nominee who did not receive a majority of the votes cast We have adopted a majority voting standard in uncontested elections We have provided that in the event that a director does not receive a majority of the votes cast, the director will be a “holdover” director until the Board appoints another director or shrinks Board. 5 A majority voting standard promotes good governance because it prevents a board nominee from being elected if the nominee is not elected by at least a majority of the shareholders

WHERE WE WERE: WHAT WE HAVE DONE: Repeal Advance Notice Bylaw Amendments Adopted in March 2014 The Company amended its Bylaws in March 2014 to impose certain obstacles to shareholder participation in corporate governance Derivative litigation was outstanding in connection with these matters. We have repealed the March 2014 amendments related to the holding and adjournment of shareholder meetings and the disclosures required for shareholders to propose director nominations or business to be considered at a meeting. With these and certain other changes that the Board is bringing to the table, we are able to agree on a settlement of the derivative litigation. Eliminates unnecessarily defensive Bylaw provisions 6

WHERE WE WERE: WHAT WE HAVE DONE: Anti-Hedging and Anti-Pledging Policy The Company permitted employees, officers and directors to hedge or pledge their stock in the Company as collateral for loans with prior approval from the Company’s General Counsel We have prohibited employees, officers and directors from hedging or pledging their Company stock 7 Aligns with good governance practices by prohibiting employees, officers and directors from engaging in speculative transactions in the Company stock.

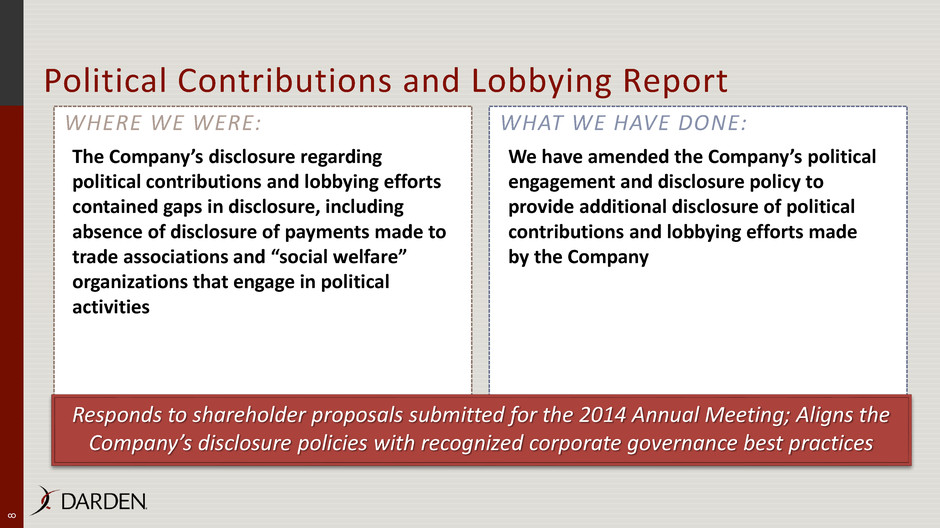

WHERE WE WERE: WHAT WE HAVE DONE: Political Contributions and Lobbying Report The Company’s disclosure regarding political contributions and lobbying efforts contained gaps in disclosure, including absence of disclosure of payments made to trade associations and “social welfare” organizations that engage in political activities We have amended the Company’s political engagement and disclosure policy to provide additional disclosure of political contributions and lobbying efforts made by the Company 8 Responds to shareholder proposals submitted for the 2014 Annual Meeting; Aligns the Company’s disclosure policies with recognized corporate governance best practices

WHERE WE WERE: WHAT WE HAVE DONE: Shareholder Communication and Interaction The Dissemination Policy did not designate the Chairman of the Board as an Authorized Spokesperson of the Company The Lead Director and Shareholder Communication Procedures designated the Lead Director as the contact for shareholder communications to the Board We have revised the Dissemination Policy to, among other things, add the Chairman of the Board as an Authorized Spokesperson and to make other changes to bring the policy in line with “best practices” We have revised the Lead Director and Shareholder Communication Procedures to, among other things, designate the independent Chairman as the contact for shareholders 9 Aligns the Company’s policies with recognized corporate governance best practices; Secures the independence of shareholders communications with the Board

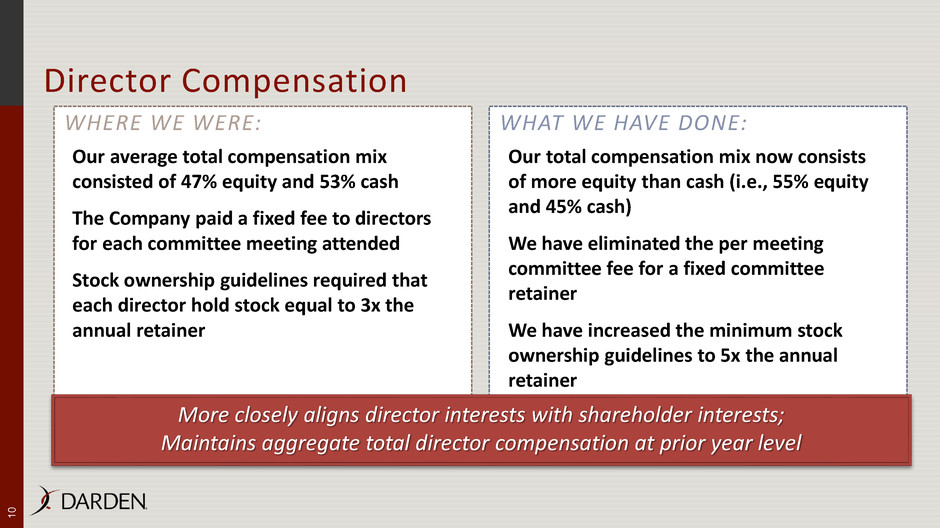

WHERE WE WERE: WHAT WE HAVE DONE: Director Compensation Our average total compensation mix consisted of 47% equity and 53% cash The Company paid a fixed fee to directors for each committee meeting attended Stock ownership guidelines required that each director hold stock equal to 3x the annual retainer Our total compensation mix now consists of more equity than cash (i.e., 55% equity and 45% cash) We have eliminated the per meeting committee fee for a fixed committee retainer We have increased the minimum stock ownership guidelines to 5x the annual retainer 1 0 More closely aligns director interests with shareholder interests; Maintains aggregate total director compensation at prior year level

WHERE WE WERE: WHAT WE HAVE DONE: Eliminate Executive Committee The Company’s Bylaws required the Company to have an Executive Committee empowered to exercise all powers of the Board in the management of the business and affairs of the corporation We have eliminated the requirement for an Executive Committee as well as the Executive Committee itself. 1 1 Eliminates the requirement to designate a subset of the Board of Directors to act with full Board powers. Board action can be taken only by at least a quorum of the entire seated Board of Directors.

WHERE WE WERE: WHAT WE HAVE DONE: Enhancing Duties of Independent Chairman/Lead Director The Company’s Corporate Governance Guidelines did not specifically include the authority to call meetings of independent directors as a duty of the independent Chairman or the Lead Director We have explicitly listed the authority to call meetings of the independent directors as one of the duties of the independent Chairman and Lead Director We have amended the Corporate Governance Guidelines to specifically state that the independent Chairman shall have all of the duties of the Lead Director 1 2 Enhances the duties independent Chairman and Lead Director; Aligns our Company’s governance policy with recognized best practices

Commitment to Seek Shareholder Approval of Corporate Governance Initiatives Our board has committed to seek shareholder approval of the following initiatives at the next annual meeting: • Allow Shareholders to Call a Special Meeting at 10% Threshold • Obtain Shareholder Ratification of Exclusive Forum Selection Provision in Bylaws • Eliminate Supermajority Vote for Certain Charter Amendments • Eliminate Supermajority Vote for Removal of Directors by Shareholders For Cause • Eliminate Supermajority Vote for Certain Business Combinations with interested Shareholders / Fair Price Provision 1 3

WHERE WE ARE: WHAT WE HAVE DONE: Ability of Shareholders to Call a Special Meeting The Company’s Charter currently requires 50% of the outstanding shareholders to call a special meeting We have resolved to recommend for shareholder approval an amendment to the Charter to provide a 10% threshold to call a special meeting 1 4 Empowers shareholders with greater accessibility to call a meeting of shareholders; Aligns the Company’s policy with recognized corporate governance best practices

WHERE WE WERE: WHAT WE HAVE DONE: Shareholders to Ratify Exclusive Forum Selection Provision in Bylaws In March 2014, the Board amended the Bylaws to designate Orange County, Florida as the exclusive forum for certain shareholder litigation We have resolved to seek shareholder ratification of the exclusive forum bylaw provision 1 5 Empowers shareholders with the ability to ratify a decision that impacts shareholder rights

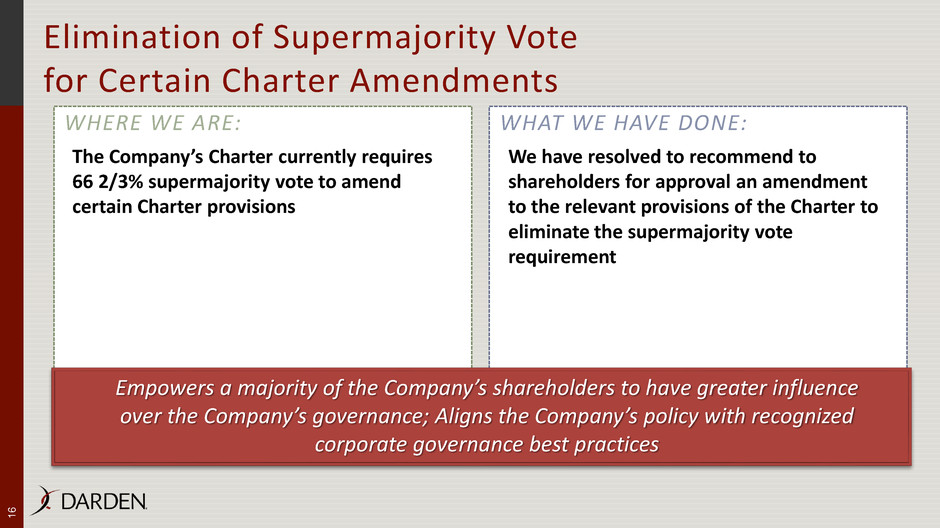

WHERE WE ARE: WHAT WE HAVE DONE: Elimination of Supermajority Vote for Certain Charter Amendments The Company’s Charter currently requires 66 2/3% supermajority vote to amend certain Charter provisions We have resolved to recommend to shareholders for approval an amendment to the relevant provisions of the Charter to eliminate the supermajority vote requirement 1 6 Empowers a majority of the Company’s shareholders to have greater influence over the Company’s governance; Aligns the Company’s policy with recognized corporate governance best practices

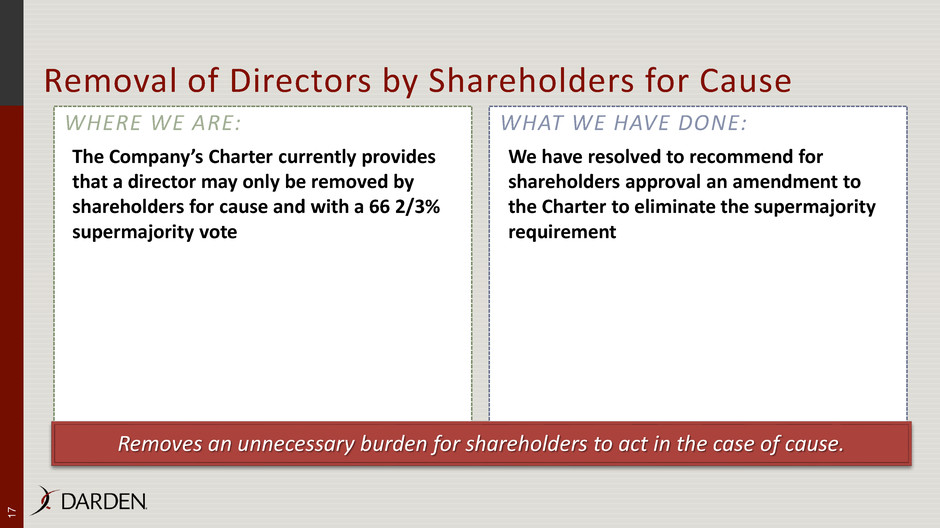

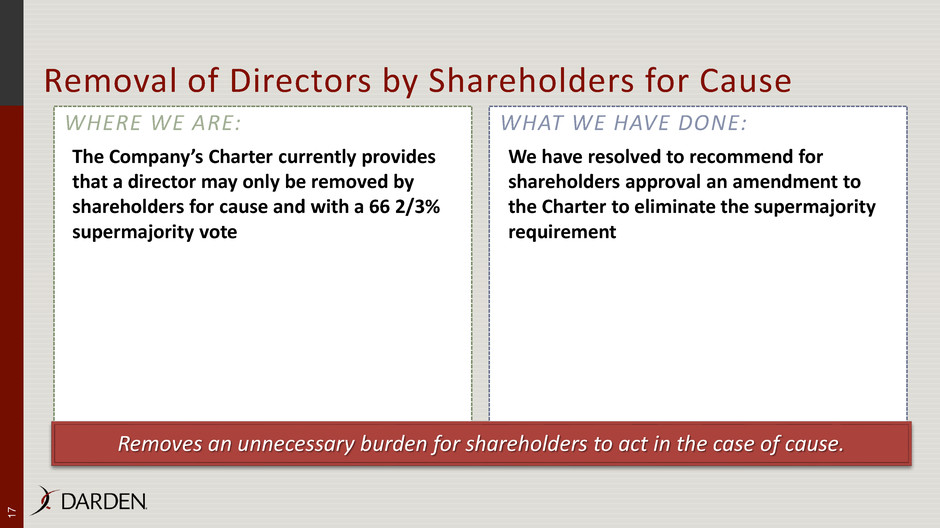

WHERE WE ARE: WHAT WE HAVE DONE: Removal of Directors by Shareholders for Cause The Company’s Charter currently provides that a director may only be removed by shareholders for cause and with a 66 2/3% supermajority vote We have resolved to recommend for shareholders approval an amendment to the Charter to eliminate the supermajority requirement 1 7 Removes an unnecessary burden for shareholders to act in the case of cause.

WHERE WE ARE: WHAT WE HAVE DONE: Certain Business Combinations with Interested Shareholders/Fair Price Provision The Company’s Charter currently requires 66 2/3% supermajority vote , excluding the Voting Securities beneficially owned by any shareholder who is party to the business combination, to approve or authorize certain business combinations with interested shareholders The Charter also currently provides that the Company had elected not to be governed by Section 607.0901 of the Florida Act, which required that certain transactions involving a corporation and an interested shareholder owning 10% or more of the corporation’s outstanding voting shares must generally be approved by the affirmative vote of the holders of two-thirds of the voting shares other than those owned by the affiliated shareholder We have resolved to recommend to shareholders to eliminate the Charter provision requiring a supermajority vote for business combinations with interested shareholders entirely and revert to the requirements of the Florida statute. 1 8 Eliminates another Charter provision that would have required a supermajority vote of the Company’s shareholders

WHERE WE WERE: WHAT WE HAVE DONE: Peer Group The current peer group includes many companies that are (a) in unrelated industries and (b) that are not of comparable size or complexity The current peer group has relatively high dispersion (high to low) on key measures (e.g., revenue, market capitalization and enterprise value) We have significantly changed the composition of the peer group to improve industry size and comparability, while reducing the overall dispersion on key measures We have improved the comparability of the peer group by limiting the number of companies that are not in the restaurant, retail or hospitality industries, and by increasing the concentration of companies that are in the restaurant and retail industries 1 9

APPENDIX 2 0

Compensation Peer Group 2 1 • The Gap, Inc. • Nordstrom Inc. • L Brands, Inc. • AutoZone, Inc. • The Wendy’s Company • Dunkin’ Brands Group, Inc. • DineEquity, Inc. • PetSmart, Inc. • Dick’s Sporting Goods Inc. • Tractor Supply Company • Wyndham Worldwide Corporation • Brinker International, Inc. • Williams-Sonoma Inc. • Panera Bread Company • Bloomin’ Brands, Inc. • Starwood Hotels & Resorts Worldwide Inc. • Chipotle Mexican Grill, Inc. • Buffalo Wild Wings Inc. • Cracker Barrel Old Country Store, Inc. • The Cheesecake Factory Incorporated • Texas Roadhouse, Inc.

2 2