UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

GENELINK, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

GENELINK, INC.

8250 Exchange Dr. Suite 120

Orlando, FL 32835

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD June 3, 2013

To the Shareholders of GeneLink, Inc.:

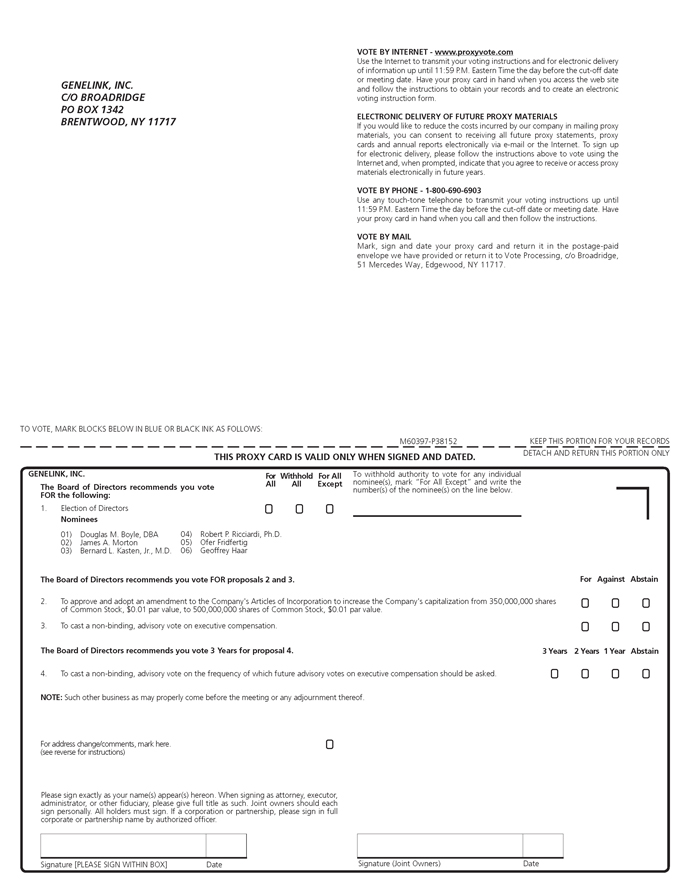

Notice is hereby given that the Annual Meeting of Shareholders of GeneLink, Inc. (the “Company”), a Pennsylvania corporation, will be held at 9:00 a.m. on Monday, June 3, 2013 at the GeneLink Corporate Offices at 8250 Exchange Dr. Suite 120, Orlando, FL 32835, (the “Annual Meeting”), for the following purposes:

| 1. | To elect six (6) directors to server until the next Annual Meeting of Shareholders or until their respective successors are elected and qualified. |

| 2. | To approve and adopt an amendment to the Company’s Articles of Incorporation to increase the Company’s capitalization from 350,000,000 shares of Common Stock, $0.01 par value, to 500,000,000 shares of Common Stock, $0.01 par value; |

| 3. | To cast a non-binding, advisory vote on executive compensation |

| 4. | To cast a non-binding, advisory vote on the frequency of which future advisory votes on executive compensation should be asked. |

| 5. | To transact such other business as may properly be brought before the Annual Meeting or any adjournment(s) thereof. |

Only shareholders of record at the close of business on April 1, 2013, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment(s) or postponement(s) thereof.

The Annual Meeting may be adjourned from time to time without notice other than by announcement at the Annual Meeting. We are providing a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 with this proxy statement.

Your vote is important. Whether or not you plan to attend the meeting in person, we urge you to complete, date and sign the enclosed proxy card and return it promptly in the enclosed return envelope or vote according to the internet instructions provided. A prompt submission will ensure a quorum and save the Company the expense of further solicitation. Each proxy granted may be revoked by the shareholder appointing such proxy at any time before it is voted. If you receive more than one proxy card because your shares are registered in different names or addresses, each such proxy card should be signed and returned to assure that all of your shares will be voted.

| | By Order of the Board of Directors, |

| | |

| | /s/ Bernard L. Kasten, Jr., M.D. |

| | |

| | Bernard L. Kasten, Jr., M.D. |

| | Chairman of the Board |

April 30, 2013

GENELINK, INC.

8250 Exchange Dr. Suite 120

Orlando, FL 32809

PROXY STATEMENT

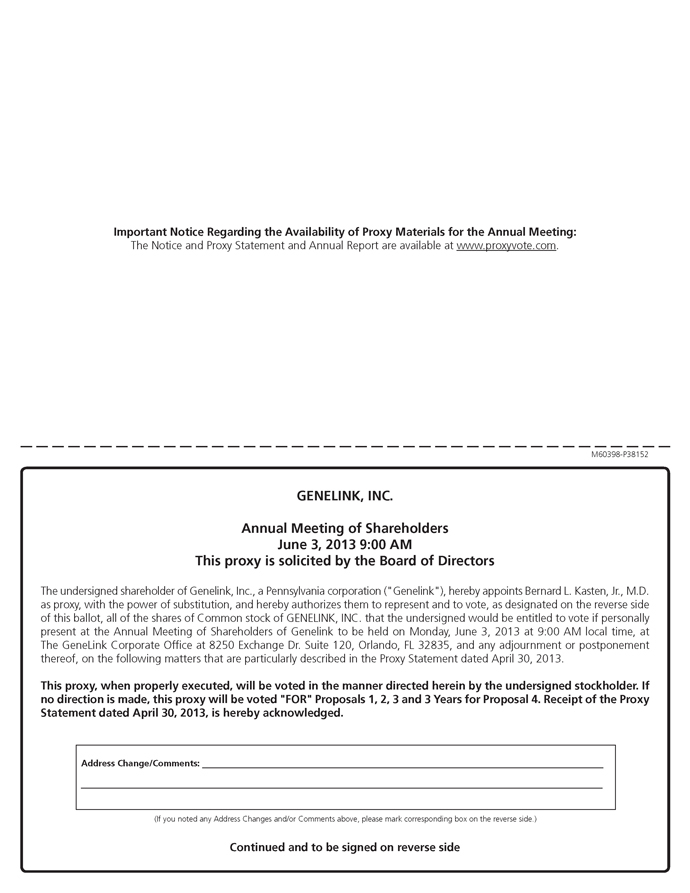

Annual Meeting of Shareholders

June 3, 2013

This Proxy Statement is furnished to shareholders of GeneLink, Inc. (the “Company”), a Pennsylvania corporation, in connection with the solicitation of proxies on behalf of the management of the Company for use at the Annual Meeting of Shareholders to be held at The GeneLink Corporate Office at 8250 Exchange Dr. Suite 120, Orlando, FL 32809 on Monday June 3, 2013, at 9:00 a.m. and at any and all postponements or adjournment thereof (the “Annual Meeting”), for the purpose of considering and acting upon the matters set forth in the attached Notice of Annual Meeting and more fully discussed below.

This Proxy Statement and the accompanying form of proxy were first mailed to shareholders of the Company entitled to notice of the Annual Meeting on or about April 30, 2013.

Quorum and Voting

The presence, in person or by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding, is necessary to constitute a quorum at the Annual Meeting. Shareholders are entitled to one vote per share of Common Stock held on any matter which may properly come before the Annual Meeting.

Any shareholder executing and delivering the accompanying proxy has the power to revoke the same by giving notice to the Secretary of the Company. The presence at the Annual Meeting of a shareholder will not revoke his or her proxy. Proxies in the accompanying form which are properly executed, duly returned to the Company, and not revoked will be voted in accordance with the instructions therein.

Shareholders may vote via the Internet by following the instructions on their proxy card. When voting via the Internet, Shareholders must have available the control number included on their proxy cards. Abstentions and broker non-votes will be counted for purposes of determining a quorum, but will not be counted as votes cast. A broker non-vote occurs when a bank, broker, or other nominee holding shares for a beneficial owner has not received voting instruction from the beneficial owner on a particular matter and the bank, broker, or nominee cannot vote the shares on such matter because the matter is not considered routine.

With respect to Proposal I, directors are elected by a plurality of the votes cast by shareholders present, in person or by proxy, at the meeting.

Under Pennsylvania law, the approval of Proposal II, the amendment to Articles of Incorporation to increase the authorized shares of Common Stock, Proposal III, the non-binding advisory vote on executive compensation, and Proposal IV, the non-binding advisory vote on the frequency of future non-binding advisory vote on executive compensation require the affirmative vote of at least a majority of the votes cast by shareholders present, in person or by proxy, at the meeting. Abstention and broker non-votes will, therefore, have no effect in determining the outcome of any of these matters.

Shareholders will not have dissenters’ rights under the Pennsylvania Business Corporation Law in connection with the approval and adoption of the proposed amendment to the Company’s Articles of Incorporation.

IF NO INSTRUCTION IS GIVEN WITH RESPECT TO ANY PROPOSAL TO BE ACTED UPON, THE PROXY WILL BE VOTED ON FOR APPROVAL OF THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION, FOR APPROVAL, ON AN ADVISORY BASIS, OF THE EXECUTIVE COMPENSATION, AND THE ADVISORY VOTE ON EXECUTIVE COMPENSATION BE HELD EVERY THREE YEARS. No matter is expected to be considered at the Meeting other than the proposals set forth in the accompanying Notice of Annual Meeting, but if any other matters are properly brought before the Meeting for action, it is intended that the persons named in the proxy and acting thereunder will vote their discretion on such matters.

Record Date and Shares Outstanding

The close of business on April 1, 2013 has been fixed as the record date for the determination of shareholders entitled to receive notice of, and to vote at, the Annual Meeting. The stock transfer books will not be closed. As of April 1, 2013, there were issued and outstanding 253,352,022 shares of the Company’s Common Stock.

PRINCIPAL SHAREHOLDERS

Security Ownership of Management and Certain Beneficial Owners

The following table sets forth certain information as of April 1, 2013 regarding the ownership of Common Stock (i) by each person known by the Company to be the beneficial owner of more than five percent of the outstanding Common Stock, (ii) by each current officer and director of the Company, (iii) by each nominee for director, and (iv) by all current officers and directors of the Company as a group.

The beneficial owners and amount of securities beneficially owned have been determined in accordance with Rule 13d-3 under the Exchange Act and, in accordance therewith, includes all shares of the Company’s Common Stock that may be acquired by such beneficial owners within 60 days of April 1, 2013 upon the exercise or conversion of any options, warrants or other convertible securities. This table has been prepared based on 253,352,022 shares of Common Stock outstanding on April 1, 2013. Unless otherwise indicated, each person or entity named below has sole voting and investment power with respect to all Common Stock beneficially owned by that person or entity, subject to the matters set forth in the footnotes to the table below. Unless otherwise stated, the beneficial owners exercise sole voting and/or investment power over their shares.

| Name | | Number of Shares

Beneficially Owned | | | Approximate Percentage

Of Stock Outstanding | |

Jon A. Marshall

3330 Willowfork Place

Katy, TX 77494 | | | 41,666,667 | | | | 16.4 | % |

Kenneth R. Levine

2 Oaklawn Road

Short Hills, NJ 07078 | | | 26,130,706 | (1) | | | 9.8 | % |

Robert Trussell

167 W. Main Street

Suite 1500

Lexington, KY 40507 | | | 16,166,667 | (2) | | | 6.4 | % |

Gene Elite, LLC

1481 North Ocean Boulevard

Pompano Beach, FL 33062 | | | 14,000,000 | (3) | | | 5.4 | % |

Chesed Congregation of America One State Street Plaza, 29th Floor New York, NY 10004 | | | 13,958,334 | (4) | | | 5.2 | % |

Bernard L. Kasten, Jr. M.D. 4380 27th Court S.W., Apt. 104 Naples, FL 34116 | | | 13,084,894 | (5) | | | 5.1 | % |

Geoff Haar

53 Hamilton Drive East

N. Caldwell, NJ 07006 | | | 11,697,411 | (6) | | | 4.6 | % |

Robert P. Ricciardi, Ph.D.

831 Newhall Road

Kennett Square, PA 19348 | | | 6,635,000 | (7) | | | 2.6 | % |

Ofer Fridfertig

3001 Seigneury Dr.

Windermere, FL 34786 | | | 1,950,000 | | | | * | |

James Monton

11489 Grandstone Lane

Cincinnati, Ohio 45249 | | | 1,337,500 | (8) | | | * | |

Douglas M. Boyle, DBA

111 Weatherly Street

Dalton, PA 18414 | | | 925,000 | (9) | | | * | |

Michael Smith

3732 Winding Lake Cir

Orlando, FL 32835 | | | 125,000 | (10) | | | * | |

| Directors, Officers, Nominees and Management as a Group | | | 35,754,805 | (5)(6)(7)(8)(9)(10) | | | 13.8 | % |

| (1) | Includes currently exercisable options to acquire 643,750 shares of Common stock and 350,000 shares of Common Stock held by a retirement plan for Mr. Levine. Also includes currently exercisable warrants to acquire 13,270,737 shares of Common Stock held by First Equity Capital Securities, Inc. of which Mr. Levine is president and owner. |

| (2) | Includes currently exercisable to acquire 875,000 shares of Common Stock held by the Robert and Martha Trussell Family Foundation of which Mr. Trussell is trustee. Mr. Trussell disclaims beneficial interest in these warrants. |

| (3) | Includes currently exercisable warrants to acquire 8,000,000 shares of Common Stock. |

| (4) | Includes 13,333,334 shares of Common Stock issuable upon the conversion of convertible notes as of February 28, 2013. Chesed holds $1,000,000 principal balance of convertible notes, which have accrued $333,334 of interest through February 28, 2013 and convert at an exercise price of $.10 per share. |

| (5) | Includes currently exercisable options to acquire 3,916,625 shares of Common Stock. |

| (6) | Includes 2,381,000 shares held by GMH Children, LLC, of which Mr. Haar is a manager, and 4,900,000 shares held by the George A Haar 1996 Irrevocable Trust, of which Mr. Haar is trustee. Mr Haar disclaims beneficial interest in these shares. |

| (7) | Includes currently exercisable options and warrants to acquire 2,125,000 shares of Common Stock. |

| (8) | Includes currently exercisable options and warrants to acquire 512,500 shares of Common Stock. |

| (9) | Includes currently exercisable options and warrants to acquire 550,000 shares of Common Stock. |

| (10) | Includes currently exercisable options to acquire 125,000 shares of Common Stock |

| | | |

| | | *less than 1% |

Certain Relationships and Related Transactions

During the year ended December 31, 2012, the Company sold 52,500,000 shares of restricted Common Stock of the Company at an exercise price of $0.03 per share pursuant to a Confidential Private Offering Memorandum, and received an aggregate gross amount of $1,504,000.

In connection with the above offering, the Company incurred a total of $71,000 in placement fees and expenses and issued warrants to acquire 5,041,667 shares of Common Stock at an exercise price of $0.03 per share to First Equity Capital Securities, Inc., as placement agent, in connection with the sale of some of these units. Kenneth R. Levine, a holder of more than five percent of the equity securities of the Company and a member of the Company’s Scientific Advisory Board, is an officer and owner of First Equity Capital Securities, Inc. (“First Equity”)

During the year ended December 31, 2011, the Company sold 48,270,000 shares of restricted Common Stock of the Company at an exercise price of $0.05 per share pursuant to a Confidential Private Offering Memorandum, and received an aggregate gross amount of $2,413,500.

In connection with the above offering, the Company incurred a total of $125,180 in placement fees and expenses and issued warrants to acquire 3,104,500 shares of Common Stock at an exercise price of $0.05 per share to First Equity Capital Securities, Inc., as placement agent, in connection with the sale of some of these units.

First Equity has been engaged by the Company to perform investment banking services since 2003, including capital formation, for which First Equity has, from time to time, acted as a Placement Agent for compensation. Although First Equity receives a stipend of $5,000 per month for such services, payment is reviewed monthly by the Company’s Chairman, Dr. Bernard Kasten, who will decide whether any payment is due and whether such payment should be released or accrued. At the invitation of Dr. Kasten, Mr. Levine may attend Board of Directors and Audit Committee meetings on behalf of First Equity as a non-voting observer. Mr. Levine is also a member of the Company’s Scientific Advisory Board.

On March 2, 2012, First Equity converted its accrued stipend for 2011 and the first three months of 2012 amounting to $74,361 in exchange for 1,497,226 restricted shares of GeneLink common stock. Such shares were issued into the name Kenneth R. Levine, principal and owner of First Equity. On March 15, 2012, GeneLink paid to First Equity a consulting fee in the amount of $80,000 in consideration for First Equity's work in relation to the transactions resulting in the Stock Purchase Agreement, the LDA and the closing thereof. GeneLink has agreed that certain legal fees incurred by First Equity are related to private placement services provided First Equity to GeneLink. During the year ended December 31, 2012 GeneLink reimbursed First Equity $105,647 for such legal fees

EXECUTIVE COMPENSATION

|

| SUMMARY COMPENSATION TABLE | |

Name and

principal

position | | Year | | | Salary

($) | | | Bonus

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation ($) | | | Nonqualified

Deferred

Compensation

Earnings

($) | | | All Other

Compensation

($) | | | Total

($) | |

| (a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | |

| Bernard L. Kasten Jr., M.D. Chief Executive Officer (1) | | 2012 | | | | 15,954 | | | | - | | | | - | | | | 71,938 | | | | - | | | | - | | | | 7,768 | | | | 95,660 | |

| | | 2011 | | | | 15,152 | | | | - | | | | - | | | | 201,563 | | | | - | | | | - | | | | 8,229 | | | | 224,944 | |

| John A Webb, CFO/Vice President of Operations (2) | | 2012 | | | | 99,130 | | | | - | | | | - | | | | 27,750 | | | | - | | | | - | | | | 5,989 | | | | 132,869 | |

| | | 2011 | | | | 110,000 | | | | 19,250 | | | | - | | | | 69,813 | | | | - | | | | - | | | | 11,543 | | | | 210,606 | |

| Susan Hunt, Interim CFO (3) | | 2012 | | | | 71,193 | | | | - | | | | - | | | | 3,000 | | | | - | | | | - | | | | 3,287 | | | | 77,480 | |

1Dr. Kasten was appointed Chief Executive Officer on December 30, 2010. Dr. Kasten’s compensation as CEO is presently set at minimum wage, and includes health care benefits. No employment contract exists for Dr. Kasten. Because of the late appointment in 2010, all compensation for that year relates to service as Chairman of the Board of Directors for that year.

2 Mr. Webb was appointed Chief Financial Officer on June 1, 2011. His employment provides for a base salary of $110,000 plus healthcare and vacation benefits. The agreement also allows for certain bonus, separation and termination provisions. Mr. Webb received a bonus of $19,250 in 2011. Mr. Webb’s employment ended on July 13, 2012. Separation compensation of $27,500 is included in base pay amounts.

3Ms. Hunt was appointed Interim Chief Financial Officer on July 13, 2012. Her base salary is $75,000 plus healthcare and vacation benefits.

Agreements with Executive Officers

The Company has entered into a consulting agreement with Dr. Ricciardi (shareholder and officer) dated February 24, 1998. The initial term of the agreement was five (5) years. Pursuant to an agreement dated September 27, 2007, Dr. Ricciardi agreed to reduce the accrued compensation payable to him to $90,000 as of September 30, 2007, payable when the Board of Directors of the Company determines that the Company’s financial position can accommodate such payments, and to reduce the compensation payable to him for future services to be rendered pursuant to the consulting arrangement to $30,000 per year, payable in monthly installments of $2,500 each commencing, October 2007 and payable on the last day of each month. On January 18, 2011, Dr. Ricciardi chose to apply and convert to common stock his accrued compensation of $90,000 to 1,800,000 shares in the Confidential Private Placement.

John A. Webb, former CFO and Vice President of Operations, entered into an employment agreement with the Company effective February 16, 2010. His position at the time was Controller for the Company. Pursuant to this employment agreement, Mr. Webb received an annual base salary of $110,000, is entitled to receive annual bonuses based on personal and Company performance and is entitled to receive severance payments if he is terminated without cause. Mr. Webb received bonuses in 2011 of $19,250, and no bonus was received for 2012. Mr. Webb’s employment terminated July 13, 2012 and he received severance payments of $27,500 through November 16, 2012 and continued health insurance coverage through September 30, 2012.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

| OPTION AWARDS |

Name

(a) | | Number of Securities

Underlying Unexercised

Options (#)

Exercisable

(b) | | | Number of Securities

Underlying

Unexercised Options

(#)

Unexercisable

(c) | | | Equity Incentive Plan

Awards: Number of

Securities Underlying

Unexercised

Unearned Options

(#)

(d) | | | Option

Exercise

Price

($)

(e) | | | Option

Expiration Date

(f) |

| Bernard L. Kasten, Jr., M.D. | | | 1,625,000 | | | | | | | | | | | $ | 0.08 | | | June 1, 2017 |

| Bernard L. Kasten, Jr., M.D | | | 100,000 | | | | | | | | | | | $ | 0.12 | | | May 20, 2018 |

| Bernard L. Kasten, Jr., M.D. | | | 325,000 | | | | 495,833 | | | | | | | $ | 0.50 | | | July 28, 2018 |

| Bernard L. Kasten, Jr., M.D | | | 1,012,500 | | | | 337,500 | | | | | | | $ | 0.08 | | | July 7, 2020 |

| Bernard L. Kasten, Jr., M.D | | | 218,750 | | | | 218,750 | | | | | | | $ | 0.10 | | | January 25, 2021 |

| Bernard L. Kasten, Jr., M.D | | | 300,000 | | | | 800,000 | | | | | | | $ | 0.08 | | | May 20, 2021 |

| Bernard L. Kasten, Jr., M.D | | | 25,000 | | | | 75,000 | | | | | | | $ | 0.03 | | | September 1, 2022 |

| John A. Webb | | | 250,000 | | | | | | | | | | | $ | 0.50 | | | July 28, 2018 |

| John A. Webb | | | 250,000 | | | | | | | | | | | $ | 0.13 | | | February 16, 2020 |

| John A. Webb | | | 262,500 | | | | | | | | | | | $ | 0.10 | | | January 25, 2021 |

| John A. Webb | | | 100,000 | | | | | | | | | | | $ | 0.08 | | | May 20, 2021 |

| John A. Webb | | | 137,500 | | | | | | | | | | | $ | 0.06 | | | January 1, 2022 |

| Susan Hunt | | | 37,500 | | | | 112,500 | | | | | | | $ | 0.02 | | | July 1, 2022 |

director compensation

Directors do not receive any cash compensation for their service as directors of the Company or for attending any meetings.

| DIRECTOR COMPENSATION |

Name

(a) | | Fees

Earned

($)

(b) | | | Stock

Awards

($)

(c) | | | Options

Awards

($)

(d) | | | Non-Equity

Incentive Plan

Compensation

($)

(e) | | | Change in

Pension Value

and Nonqualified

Deferred

Compensation

($)

(f) | | | All Other

Compensation

($)

(g) | | | Total

($)

(h) | |

| Douglas M. Boyle, DBA (1) | | | | | | | | | | | 15,000 | | | | | | | | | | | | | | | | 15,000 | |

| James A. Monton (2) | | | | | | | | | | | 3,000 | | | | | | | | | | | | | | | | 3,000 | |

| Robert P. Ricciardi, Ph.D. (3) | | | 30,000 | | | | | | | | 3,000 | | | | | | | | | | | | | | | | 33,000 | |

| Bernard L. Kasten, Jr. M.D. | | | | | | | | | | | 3,000 | | | | | | | | | | | | | | | | 3,000 | |

(1) On September 1, 2012, Dr. Boyle received options to acquire 500,000 shares of Common Stock at an exercise price of $0.03 per share, of which one fourth vested immediately and one fourth vest additionally on each of the next three anniversary dates thereafter.

(2) On September 1, 2012, Mr. Monton received options to acquire 100,000 shares of Common Stock at an exercise price of $0.03 per share, of which one fourth vested immediately and one fourth vest additionally on each of the next three anniversary dates thereafter.

(3) On September 1, 2012, Dr. Ricciardi received options to acquire 100,000 shares of Common Stock at an exercise price of $0.03 per share, of which one fourth vested immediately and one fourth vest additionally on each of the next three anniversary dates thereafter. Dr. Ricciardi also received a stipend of $30,000 for consulting services to the Company.

(4)On September 1, 2012, Dr. Kasten received options to acquire 100,000 shares of Common Stock at an exercise price of $0.03 per share, of which one fourth vested immediately and one fourth vest additionally on each of the next three anniversary dates thereafter. Dr. Kasten also serves as CEO of GeneLink and additional compensation information is included in the executive compensation table above.

Compensation Discussion and Analysis

Our compensation program for senior executives is administered by the Compensation Committee of our Board of Directors. The Compensation Committee is responsible for considering and making recommendations to the Board of Directors regarding executive compensation and is responsible for administering our stock option and executive incentive compensation plans. The Compensation Committee is committed to ensure that its compensation plan is consistent with our company goals and objectives and the long term interests of its shareholders.

Overview of Compensation Philosophy and Objectives

Our compensation programs are designed to deliver a compensation package which is competitive in attracting and retaining key executive talent in our industry. Different programs are geared to short and longer term performance with the goal of increasing shareholder value over the long term. The Compensation Committee believes that our executive compensation should encompass the following:

| · | help attract and retain the most qualified individuals by being competitive with compensation packages paid to persons having similar responsibilities and duties in comparable businesses; |

| · | motivate and reward individuals who help us achieve our short term and long term objectives and thereby contribute significantly to the success of our company; |

| · | relate to the value created for shareholders by being directly tied to our financial performance and condition and the particular executive officer’s contribution; and |

| · | reflect the qualifications, skills, experience, and responsibilities of the particular executive officer. |

The Compensation Committee has approved a compensation structure for the named executive officers, determined on an individual basis, which incorporates four key components: base salary, bonuses commencing in 2012 based upon the annual performance of the Company, stock options and other benefits.

In connection with its compensation determinations, the Compensation Committee seeks the views of the Chief Executive Officer with respect to appropriate compensation levels of the other officers.

Executive Compensation Components

For the year ended December 31, 2012, the principal components of compensation for the named executive officers were annual base salary, stock options and other benefits.

Annual Base Salary

In general, base salary for each employee, including the named executive officers, is established based on the individual’s job responsibilities, performance and experience; our size relative to competitors; the competitive environment; a general view as to available resources of the Company and the compensation agreed to in employment agreements with the named executive officers.

Stock Options and Stock Awards

We provide a long term incentive opportunity for each of the named executive officers through awards of stock options. Our stock option program is a long term plan designed to create a link between executive compensation and our financial performance, provide an opportunity for increased equity ownership by executives, and maintain competitive levels of total compensation.

All stock options have been granted at an exercise price equal to or above the closing market price of our common stock on the date of grant. Stock options generally vest in four equal annual installments; however, options will immediately vest in full upon a change on control of the Company. Stock options expire ten years from date of grant.

Other Benefits

| · | Medical Benefits. Our employees have a choice of coverage options under our company-sponsored group health insurance plan. Each option covers the same services and supplies but differs in the quality of provider network. |

| · | Life Insurance. We maintain a basic group life insurance plan that provides for basic life and accidental death and dismemberment coverage. We pay the premiums under this plan. |

| · | Vacation and paid time off. All employees are eligible for paid vacation based on years of service as well as sick and other personal time. |

| · | Other Perquisites. Nutritional and skin care products are made available for certain executives and immediate family. |

| · | Retirement Benefits. We have begun to establish a 401(k) plan for our employees and it is anticipated to be effective May 1, 2013. Named executive officers would be eligible to participate in these plans on the same terms as other eligible employees, subject to any legal limits on the amount that may be contributed by executives under the plans. |

Deductibility of Compensation Expenses

Pursuant to Section 162(m) under the Internal Revenue Code, certain compensation paid to executive officers in excess of $1 million is not tax deductible, except to the extent such excess constitutes performance-based compensation. The Compensation Committee has and will continue to carefully consider the impact of Section 162(m) when establishing incentive compensation plans and could, in certain circumstances, approve and authorize compensation that is not fully tax deductible.

Accounting and Tax Considerations

We consider the accounting implications of all aspects of our executive compensation program. Our executive compensation program is designed to achieve the most favorable accounting (and tax) treatment possible as long as doing so does not conflict with the intended plan design or program objectives.

REPORT OF COMPENSATION COMMITTEE

The Compensation Committee of our Board of Directors currently consists of Mr. Monton (Chair) and Dr. Boyle. The Compensation Committee is responsible for considering and making recommendations to the Board of Directors regarding executive compensation and is responsible for administering our stock option and executive incentive compensation plans.

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis included in this report. Based on the review and discussion with management, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K.

| | | COMPENSATION COMMITTEE |

| | | |

| | | James Monton (Chair)

Dr. Douglas M. Boyle |

OFFICERS AND DIRECTORS

Information with respect to each of the executive officers and current directors of the Company is set forth below

| Name | | Age | | Position |

| Bernard L. Kasten, Jr. M.D. | | 66 | | Executive Chairman of the Board, Director, Chief Executive Officer, Interim Chief Financial Officer |

| Douglas M. Boyle, DBA | | 46 | | Director |

| James A. Monton | | 66 | | Director |

| Robert P. Ricciardi, Ph.D. | | 66 | | Chief Science Officer, Secretary, Director |

| Michael Smith | | 46 | | Senior Vice President of Operations |

Michael G. Smith has spent more than 25 years either building startups or working for high growth companies. Michael’s career started with budgeting for The American-Water System. He followed that position with a different Information Technology and Operations roles, both as a consultant and corporate executive, most notably Tempur-Pedic. Michael led both domestic and global implementation and operations teams as the company grew from $17 million to $1 billion. He has spent his entire career leading, organizing, and implementing all facets of a company’s operations including sales, customer service, manufacturing, and finance. Michael’s real passion and direction is utilizing his serial entrepreneur background to help companies structure themselves to prepare for high volume due to the results of the sales and marketing efforts of the company. With three plus years of direct experience in both the GeneLink and their market partner brands Dermagenetics, geneME, and foru, Michael is a natural fit for GeneLink’s business model. Michael happily moved his family to Florida in March of 2012 to assume his current role.

The nominees for director and the descriptions for each appear under the caption “Nominees for Director” beginning on page 13.

Audit Committee

Dr. Boyle (Chair) and Mr. Monton, who both are independent members of the Board of Directors, served on the Audit Committee for the fiscal year ended December 31, 2012. The Board of Directors has determined that Dr. Boyle, a director of the Company, is the audit committee financial expert as defined in section 3(a)(58) of the Exchange Act and the related rules of the SEC, based upon his professional and educational background as set forth above in this Item 10.

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. Prior to engagement of the independent auditor for the next year’s audit, management will submit a detailed description of the audit and permissible non-audit services expected to be rendered during that year for each of four categories of services described above to the Audit Committee for approval. In addition, management will also provide to the Audit Committee for its approval a fee proposal for the services proposed to be rendered by the independent auditor. Prior to the engagement of the independent auditor, the Audit Committee will approve both the description of audit and permissible non-audit services proposed to be rendered by the independent auditor and the budget for all such services. The fees are budgeted and the Audit Committee requires the independent registered public accounting firm and management to report actual fees versus the budget periodically throughout the year by category of service.

During the year, circumstances may arise when it may become necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires separate pre-approval before engaging the independent registered public accounting firm. To ensure prompt handling of unexpected matters, the Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting. The four categories of services provided by the independent registered public accounting firm are as defined in the footnotes to the fee table set forth above.

Nominating Committee

The Board of Directors has not created a standing Nominating Committee. The directors are or have been actively involved in the Company’s business and all are able to contribute valuable insights into the identification of suitable candidates for nomination to the Board. As a result, the Company believes that it is in its best interest that the entire Board oversees the composition of the Board of Directors and therefore, the Company has not created a standing nominating committee of the Board. Recommendations to the Board of Directors are approved by a majority of directors. The full Board of Directors is responsible for identifying and evaluating individuals qualified to become Board members and to recommend such individuals for nomination. All candidates must possess an unquestionable commitment to high ethical standards and have a demonstrated reputation for integrity. Other facts considered include an individual’s business experience, education, civic and community activities, knowledge and experience with respect to the issues impacting the biogenetic industry and public companies, as well as the ability of the individual to devote the necessary time to service as a director.

The Board of Directors does not have a formal policy with regard to the consideration of any director candidates recommended by security holders. The Board of Directors will consider candidates recommended by shareholders. All nominees will be evaluated in the same manner, regardless of whether they were recommended by the Board of Directors, or recommended by a shareholder. This will ensure that appropriate director selection continues.

Section 16(a) Beneficial Ownership Reporting Compliance.

Based solely on the Company’s review of certain reports filed with the Securities and Exchange Commission pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and written representations of the Company’s officers and directors, the Company believes that all reports required to be filed pursuant to the 1934 Act with respect to transactions in the Company’s Common Stock through December 31, 2012 were filed on a timely basis.

Code of Ethics.

The Company has adopted a code of conduct that applies to all employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions. A copy of the Company’s code of conduct will be provided to anyone without charge upon request therefor.

Meeting of Directors

The Board of Directors met 10 times in 2012. Each director attended at least 75% of the meetings.

Communications with the Board of Directors

You may contact the Board of Directors as a group by writing to them c/o GeneLink, Inc., 8250 Exchange Dr. Suite 120, Orlando, FL 32809, Attention: Chairman. Any communications received will be forwarded to all Board members.

REPORT FROM THE AUDIT COMMITTEE

The Audit Committee is responsible for considering management’s recommendation of independent certified public accountants for each fiscal year, recommending the appointment or discharge of independent accountants to the board of directors and confirming the independence of the accountants. It is also responsible for reviewing and approving the scope of the planned audit, the results of the audit and the accountants’ compensation for performing such audit, reviewing the Company’s audited financial statements, and reviewing and approving the Company’s internal accounting controls and discussing such controls with the independent accountants.

In connection with the audit of the Company’s financial statements for the year ended December 31, 2012, the Audit Committee met with representatives from Hancock Askew & Co., LLP, the Company’s independent auditors. The Audit Committee reviewed and discussed with the Company’s financial management and financial structure, as well as the matters relating to the audit required to be discussed by Statements on Auditing Standards 61 and 90.

Based upon the review and discussions described above, the Audit Committee recommended to the Board of Directors that the Company’s financial statements audited by Hancock Askew & Co., LLP be included in the Company’s Annual Report on Form 10-K for year ended December 31, 2012 and December 31, 2011.

Douglas M. Boyle, DBA (Chairman)

James Monton

INDEPENDENT PUBLIC ACCOUNTANTS

Hancock Askew & Co., LLP was the Company’s independent public accountant for the years ended December 31, 2012 and December 31, 2011. Hancock Askew & Co., LLP audited the 2012 and the 2011 statements included in the 2012 10-K statement.

Fees for Independent Auditors for Fiscal Years 2012 and 2011

Set forth below are the fees billed for services rendered by Hancock Askew & Co., LLP in 2012 and 2011.

| | | 2012 | | | 2011 | |

| Audit Fees | | $ | 48,500 | | | $ | 25,000 | |

| Audit-Related Fees | | | 0 | | | | 0 | |

| Tax Fees | | | 0 | | | | 0 | |

| All Other Fees | | | 0 | | | | 0 | |

| Total Fees | | $ | 48,500 | | | $ | 25,000 | |

Audit fees consist of fees billed for professional services rendered by the Company’s independent accountant for the audit of the Company’s annual financial statements, review of financial statements included in quarterly reports on Form 10-Q and services that are normally provided by the independent accountant in connection with statutory and regulatory filings or engagements.

Audit Committee Pre-Approval Procedures.The Audit Committee approves the engagement of the independent auditors, and meets with the independent auditors to approve the annual scope of accounting services to be performed and the related fee estimates. It also meets with the independent auditors, on a quarterly basis, following completion of their quarterly reviews and annual audit and prior to our earnings announcements, if any, to review the results of their work. During the course of the year, the chairman has the authority to pre-approve requests for services that were not approved in the annual pre-approval process. The chairman reports any interim pre-approvals at the following quarterly meeting. At each of the meetings, management and the independent auditors update the Audit Committee with material changes to any service engagement and related fee estimates as compared to amounts previously approved. During 2012, all audit and non-audit services performed by our independent accountants were pre-approved by the Audit Committee in accordance with the foregoing procedures.

PROPOSAL I

ELECTION OF DIRECTORS

In accordance with the Company’s By-Laws, the board of directors has set the number of directors at six (6) and, accordingly, six (6) directors will be elected at the Meeting. Each director elected will serve as a director until his or her successor is elected and shall have qualified. The six (6) persons named below are the Board of Directors’ nominees for election as directors and four (4) such persons are current directors of the Company and two (2) would be new directors.

Management has no reason to believe that any of its nominees will be unable to serve if elected to office and, to the knowledge of management, its nominees intend to serve the entire term for which election is sought.

NOMINEES for director

Information with respect to each nominee is set forth below:

Dr. Douglas M. Boyle, DBA, CPA, CMA. Director since 2009. Dr. Boyle is currently a director of the Company. He has over 25 years of professional experience in the areas of finance, operations, corporate governance and business turnarounds, including over 17 years of experience in the healthcare field as a financial and operational executive. He has served in executive roles in start-up, middle market and Fortune 500 companies, where he has held the titles of Chief Executive Officer, President, Chief Operations Officer and Chief Financial Officer, prior to which he worked as a Senior Auditor for KPMG Peat Marwick. Dr. Boyle also led the national financial revenue operations for Quest Diagnostics Incorporated, and was Chief Financial Officer for Doylestown Hospital and Health Care System and MediMax Incorporated. Dr. Boyle serves as a department chair and professor at the University of Scranton and holds numerous awards for teaching, research, and publication in the areas of business and corporate governance. He serves on the Board of Directors of Allied Services Health System. In addition to his role as Director, he serves on the Finance Committee and as Chairman of the Board for the Allied Services Skilled Nursing Division. He also serves on the Board of Directors of Chiliad Incorporated. Dr. Boyle is a Certified Public Accountant and a Certified Management Accountant. He holds a DBA from Kennesaw State University, an MBA from Columbia University, and a BS in Accounting from the University of Scranton.

The Board of Directors concluded that Dr. Boyle is qualified and should serve, in part, because of his experience in finance, operations, management and, in particular, his expertise in corporate governance.

Dr. Bernard L. Kasten, Jr. Director since 2007. Dr. Kasten is currently the Chief Executive Officer and President, the Executive Chairman and a director of the Company. Dr. Kasten has been a scientific advisor to the Company since 1999 and a member of the Company's Advisory Committee since 2001. Dr. Kasten is a graduate of Miami University (Oxford Ohio), BA Chemistry 1967, and the Ohio State University College of Medicine MD 1971. His residency was served at the University of Miami, Florida and fellowships at the National Institutes of Health Clinical Center and National Cancer Institute, Bethesda, Maryland. Dr. Kasten is a Diplomat of the American Board of Pathology with Certification in Anatomic and Clinical Pathology with sub-specialty certification in Medical Microbiology. Dr. Kasten is an author of "Infectious Disease Handbook" 1st through 5th Editions 1994-2003 and the "Laboratory Test Handbook" 1st through 4th Editions 1984-1996 published by Lexi-Comp Inc., Hudson, Ohio. Dr. Kasten has been active with the College of American Pathologists (CAP) serving as Chairman of its Publication Committee from 1985-1993, its Management Resources Committee from 1993-1998 and its Chairman Internet Editorial Board from 1999-2003. Dr. Kasten received the College of American Pathologists Presidents Medal Awarded for Outstanding Service in 1989 and the College of American Pathologists Frank W. Hartman Award, in 1993 for Meritorious Service to the College (Founding CAP Today) the organizations highly successful monthly tabloid magazine. Dr. Kasten's professional staff appointments have included the Cleveland Clinic, Northeastern Ohio Universities College of Medicine, the Bethesda Hospitals and Quest Diagnostics. Dr. Kasten served eight years, 1996-2004, at Quest Diagnostics Incorporated [NYSE-DGX], where he was Chief Laboratory Officer; Vice-President of Business Development for Science and Medicine and Vice-President of Medical Affairs of a Quest Diagnostics wholly-owned subsidiary, MedPlus Inc. Dr. Kasten joined SIGA Technologies, Inc. [NASDAQ-SIGA] as a Board of Directors member in May 2003, and accepted the appointment as SIGA's Chief Executive Officer in July of 2004, serving through April 2006. Dr. Kasten has been Chairman of the Board of Directors of Cleveland Bio Labs Inc. [NASDAQ-CBLI] from 2006-2013, and currently serves as a member of the CBLI Board of Directors. He also currently serves on the Board of Directors of Enzo Biochem [NYSE-ENZ].

The Board of Directors has concluded that Dr. Kasten is qualified and should serve, in part, because of his extensive leadership experience, both as an executive and board member, in publicly traded companies, His expertise includes medicine, laboratory operations, general medical and genetic science, intellectual property, regulatory compliance, and corporate governance. Dr. Kasten is also well qualified in view of his extensive experience in business development and strategic relationships

James A. Monton. Director since 2009. Mr. Monton is currently a director of the Company. After graduating Magna Cum Laude from Michigan State University Honors College, Mr. Monton joined Procter & Gamble (P&G) in 1968 as a research scientist. He holds one of P&G’s key beauty care patents. He led a number of successful projects including the launch of Pantene Pro V, which has become the world’s largest beauty care brand. Mr. Monton worked for P&G in Europe from 1979 to 1982 where he helped lay the foundation for P&G becoming the most successful health and beauty care company in Europe. As a director in P&G’s Latin American organization from 1984 to 1988, he managed projects in the health, beauty, cleaning, and food industries. Mr. Monton worked at P&G’s Asian headquarters in Kobe, Japan from 1996 to 2001, leading much of P&G’s Asian Beauty Care organization and serving on the China Beauty Care Management Leadership Team. From 2001 until 2005, he was a Director in P&G’s External Relations Department where he led much of the company’s connections with the media and outside influencers. Mr. Monton retired from P&G in 2005 where he was honored for 37 years of outstanding service. Mr. Monton currently serves on the Boards of the Northern Kentucky University’s Business School and the International Business Center. He is a frequent speaker at international business seminars, guest lectures on management to MBA students, and sponsors scholarships for business students to work as interns outside the United States. Mr. Monton is a member of the Foreign Policy Leadership Council of Cincinnati and also uses his expertise to consult for companies on strategic management and organizational issues.

The Board of Directors concluded that Mr. Monton is qualified and should serve, in part, because of his experience in business development, consumer development/brand building, international expansion, and his corporate experience in beauty care.

Robert P. Ricciardi, Ph.D. Director since 1995. Dr. Ricciardi is currently the Chief Science Officer and a director of the Company. Dr. Ricciardi is the founder of GeneLink and is a Professor of Microbiology at the University of Pennsylvania, where he is a Department Chairman. He received his Ph.D. from the University of Illinois at Urbana. He was a Postdoctoral Fellow at Brandeis University and Harvard Medical School in the Department of Biological Chemistry where he was awarded Fellowships by the American Cancer Society, National Institutes of Health and the Charles A. King Trust. He developed one of the first genomic technologies, which was used widely to discover and map many hundreds of genes by identifying the proteins they encode. Most of Dr. Ricciardi’s research has centered on understanding basic mechanisms of cancer. He identified one of the first gene activators from a virus that can make cells cancerous by enabling them to escape the immune system. These studies in turn, disclosed a key mechanism that modulates the master regulator that governs the immune system. In addition, Dr. Ricciardi discovered a new technological platform for discovering therapeutic compounds to be used as drugs that will block viral infections. Dr. Ricciardi has served as a consultant to Children’s Hospital of Philadelphia, Smith Kline Pharmaceuticals, the NIH, and was awarded a NATO Visiting Professorship at Ferrara Medical School and has been an invitational speaker at numerous international scientific meetings and universities. He has authored over 100 publications and has been issued patents on recombinant delivery vectors for potential use as vaccines and gene therapy, therapeutic antiviral compounds, DNA collection kit, and methods for collecting DNA, assessing genes associated with oxidative stress and skin health.

The Board of Directors concluded that Dr. Ricciardi is qualified and should serve, in part, because of his extensive scientific knowledge and experience, particularly in the areas important to the Company – genetics and biochemistry. Dr. Ricciardi was also a co-founder of the Company dating back to 1994 and is the sole link to that phase of the Company’s genesis and history. As such, Dr. Ricciardi is a valuable scientific, intellectual property and regulatory resource.

Ofer Fridfertig. New nominee, age 47. Mr. Fridfertig earned a Bachelor of Science in Electrical Engineering at Florida State University in 1988 and achieved his Professional Engineer license in 1993. Mr. Fridfertig began his career in engineering and manufacturing within Fortune 500 companies, where he progressed from operations to executive roles. At Pepsi Bottling Group, Mr. Fridfertig directed manufacturing, warehousing and infrastructure planning worldwide. His organization managed distribution center design and construction, manufacturing plant expansion, and real estate management, including over 300 facilities and 35 million square feet of space. As Director of Bulk Power Systems at Florida Power Corporation (now part of Duke Energy) Mr. Fridfertig led a business unit responsible for system wide engineering, construction, maintenance and operations of the high voltage electric grid. He managed a large, geographically diverse organization including professional, office and Bargaining Unit (union) employees. Mr. Fridfertig’s experience in the entrepreneurial world began in 1999 as President of Harvest Basket Foods, LLC, where he operated a cheesecake manufacturing plant and two full service supermarkets. Mr. Fridfertig has over 10 years of experience in start-up companies, including the financial modeling and management of start-ups as they grow. Mr. Fridfertig is currently President of Fairfield Consultants, LLC (a consulting company specializing in engineering, manufacturing and operations), Senior Vice President of Lake Buena Vista Resort Village & Spa, co-owner (with his wife) of Lani’s Luau Food & Spirits, and is an investor in other public and private businesses. Mr. Fridfertig has previously served on the Board of Directors of the National Conference for Community and Justice and was a member of the Executive Committee of the Board.

The Board of Directors concluded that Mr. Fridfertig is qualified and should serve, in part, because of his experience in management, manufacturing, operations, distribution systems and corporate governance of emerging growth businesses.

Geoffrey Haar.New nominee, age 64.After graduating from Franklin & Marshall College in 1970 with a B.A., Mr. Haar joined J.H. Haar & Sons, an institutional food service distribution company in the New York metropolitan market. Mr. Haar served as sales manager, director of marketing, and ultimately President and CEO. Under Mr. Haar's leadership, the company grew from $1 million in annual sales to $60 million and the company was sold to US Food Service (a public company) in 1998. After the acquisition, Mr. Haar remained as Division President until 2001, increasing sales to $90 million. Throughout this period, Mr. Haar remained active in various trade association groups. Since 2001, Mr. Haar became an industry consultant focusing on marketing and distribution. Since 2001, Mr. Haar founded a business buying and selling exotic minerals and fossils and remains involved in this pursuit today. Mr. Haar has served on the Board of Directors of Agudath Israel in Caldwell, NJ and is currently in his seventh year on the Board at Chabad in West Orange, NJ.

The Board of Directors concluded that Mr. Haar is qualified and should serve, in part, because of his experience as a senior corporate officer, his corporate experience in operations, and distribution systems and corporate governance of growing businesses, as well as, previous Board of Director service.

Required Vote

Directors will be elected by a plurality of the votes cast by shareholders of the Company present at the Annual Meeting in person or represented by proxy.

PROPOSAL II

PROPOSED AMENDMENT TO THE

ARTICLES OF INCORPORATION

On March 22, 2013, the Board of Directors adopted a resolution proposing that Article 4 of the Company’s Articles of Incorporation be amended to increase the authorized shares of the Capital Stock of the Corporation from 350,000,000 shares of Common Stock, $0.01 par value to 500,000,000 shares of Common Stock, $0.01 par value (the “Amendment”). The Board directed that the proposed Amendment be submitted to a vote of the shareholders at the Annual Meeting.

As of April 1, 2013, 253,352,022 shares of Common Stock were issued and outstanding and 64,320,542 shares were reserved for issuance upon exercise of options or warrants or the conversion of convertible debentures. The Board of Directors believes that the flexibility provided by the Amendment to permit the Company to issue or reserve additional Common Stock, in the discretion of the Board and without the delay or expense of calling and convening a special meeting of shareholders, is in the best interests of the Company and its shareholders. Shares of Common Stock may be used for general purposes, including stock splits and stock dividends, acquisitions, possible financing activities, and other employee, executive and director benefit plans, including the 2011 Stock Option Plan. Upon approval of the proposed Amendment by the Shareholders, the Company will have authority to issue 500,000,000 shares of Common Stock. The Company has no present plans, arrangements, commitments or understanding with respect to the issuance of any of the additional shares of Common Stock that would be authorized by adoption of the Amendment, other than the reservation of the remaining 3,790,000 shares in connection with the 2011 Stock Option Plan.

If the Amendment is not approved, the Company may not be able to issue a sufficient amount of additional shares of Common Stock or securities convertible into shares of Common Stock to raise future funds needed to operate the Company’s business operations and implement its business and marketing initiatives. In such event, the only remaining option to finance the Company’s operations would be to borrow funds to the extent that such financing would be available on terms acceptable to the Company. If that were unsuccessful, the Company would be forced to cease its operations.

If the Amendment were approved by the Company’s shareholders, Article 4 of the Company’s Articles of Incorporation would be amended and restated in its entirety to read as follows:

“4. The authorized capital stock of the Corporation shall be 500,000,000 shares of Common Stock, $0.01 par value.”

A copy of the proposed Amendment is attached as Appendix A.

The additional authorized shares of the Company’s Common Stock, if and when issued, would be part of the existing class of Common Stock and would have the same rights and privileges as the shares of Common Stock presently issued and outstanding. Although the additional shares of Common Stock would not have any effect on the rights and privileges of the Company’s existing shareholders, the issuance of additional shares of Common Stock, other than in connection with a stock split or stock dividend, would have the effect of diluting the voting power of existing shareholders and decreasing earnings and the book value attributable to shares presently issued and outstanding. If the Amendment is approved, in general, no further approval of the Company’s shareholders will be required prior to the issuance of additional shares of Common Stock.

The availability of additional authorized but unissued shares of Common Stock may have the effect of discouraging attempts to take over control of the Company, as additional shares of Common Stock could be issued to dilute the stock ownership and voting power of, or increase the cost to, a party seeking to obtain control of the Company.

If the Amendment is approved, it will become effective upon its filing with the Pennsylvania Secretary of the Commonwealth, which will occur as soon as reasonably practicable after approval.

Required Vote

The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and voting at the Annual Meeting will be required to approve this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ADOPTION OF THIS PROPOSAL

PROPOSAL iIi

non-binding, advisory vote on executive compensation

As required by Regulation 14A of the Exchange Act, we are seeking shareholder approval, on an advisory basis, of the compensation of our named executive officers as disclosed under the “Executive Compensation” section of this proxy statement. Accordingly, for the reasons discussed in the “Compensation Discussion and Analysis” section of this proxy statement, we are asking our shareholders to vote “FOR” this proposal.

While we intend to carefully consider the voting results of this proposal, the vote is advisory in nature and therefore not binding on us, our Board of Directors or our Compensation Committee. Our Board of Directors and Compensation Committee value the opinions of all our shareholders and will consider the outcome of this vote when making future compensation decisions for our named executive officers.

Approval of this proposal requires the favorable vote of a majority of the votes cast by our shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THIS PROPOSAL TO APPROVE, ON AN ADVISORY BASIS, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED UNDER THE “EXECUTIVE COMPENSATION” SECTION OF THIS PROXY STATEMENT.

PROPOSAL iV

NON-BINDING ADVISORY VOTE ON FREQUENCY OF THE SHAREHOLDER VOTE ON EXECUTIVE COMPENSATION

As required by Regulation 14A of the Exchange Act, we are seeking a shareholder vote, on an advisory basis, on the frequency with which we include in our proxy statement an advisory vote on executive compensation. By voting on this proposal, shareholders may indicate whether they prefer that we seek such an advisory vote every one, two or three years. Pursuant to Section 14A of the Exchange Act, we are required to hold at least once every six years an advisory shareholder vote to determine the frequency of the advisory shareholder vote on executive compensation.

After consideration of this proposal, our Board of Directors determined that an advisory vote on executive compensation that occurs every three years is the most appropriate alternative for the Company and therefore recommends a vote for a triennial advisory vote. In reaching its recommendation, our Board of Directors considered that a triennial advisory vote would permit the pay for performance elements of our compensation programs to be judged over a period of time. Our Board of Directors believes that a well-structured compensation program should include policies and practices that emphasize the creation of shareholder value over the long-term and that the effectiveness of such plans cannot be best evaluated on an annual or biennial basis.

While we intend to carefully consider the voting results of this proposal, the vote is advisory in nature and therefore not binding on us, our Directors or our Compensation Committee. Our Board of Directors and Compensation Committee value the opinions of our all our shareholders and will consider the outcome of this vote when deciding upon the frequency of shareholder votes on executive compensation.

Approval of this proposal requires the favorable vote of a majority of the votes cast by our shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT AN ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS BE HELD “EVERY THREE YEARS.”

SHAREHOLDER PROPOSALS FOR NEXT YEAR

Shareholders who intend to have a proposal considered for inclusion in the Company’s proxy materials for presentation at the 2014 Annual Meeting of Shareholders pursuant to Rule 14a-8 under the Exchange Act must submit their proposal to us at the Company’s offices at 8250 Exchange Dr. Suite 120, Orlando, FL 32835, not later than December 22, 2013. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with Rule 14a-8 and all other applicable requirements.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Company’s Proxy Statement or Annual Report may have been sent to multiple shareholders in your household. The Company will promptly deliver a separate copy of either document to you if you write to the Company at 8250 Exchange Dr. Suite 120 Orlando, FL 32835, attention: Chairman or call the Company at (800) 558-4363. If you want to receive separate copies of the Annual Report and Proxy Statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact the Company at the above address and phone number.

ANNUAL REPORT ON FORM 10-K

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, including financial statements for such period, is being mailed to shareholders with this Proxy Statement, but such report does not constitute a part of this Proxy Statement.

OTHER MATTERS

As of the date hereof, management does not intend to present, nor has it been informed that other persons intend to present, any matters for action at the Meeting, other than those specifically referred to herein. If, however, any other matters should properly come before the Meeting, it is the intention of the persons named in the proxies to vote the shares represented thereby in accordance with their best judgment on such matters.

The expenses of soliciting proxies in the form included with this Proxy Statement and the cost of preparing, assembling and mailing materials in connection with such solicitation of proxies will be borne by the Company. In addition to the use of mail, the Company’s directors, executive officers and employees may solicit proxies personally or by telephone.

| | By Order of the Board of Directors: |

| | |

| | Bernard L. Kasten, Jr., M.D. |

| | Chairman of the Board |

April 30, 2013

APPENDIX A

ARTICLES OF AMENDMENT TO THE

ARTICLES OF INCORPORATION

OF

GENELINK, INC.

THE UNDERSIGNED BUSINESS CORPORATION, desiring to amend its Articles of Incorporation, in compliance with the requirements of Section 1915 of the Pennsylvania Business Corporation Law of 1988, hereby certifies that:

| 1. | The name of the Corporation is: |

GeneLink, Inc.

| 2. | The address, including street and number, of the Corporation’s registered office is: |

c/o CT Corporation

1635 Market Street

Philadelphia, PA 19103

(Philadelphia County)

| 3. | The statute under which the Corporation was incorporated is the Pennsylvania Business Corporation Law of 1988. |

| 4. | The date of its incorporation is: January 6, 1995 |

| 5. | The amendment was adopted pursuant to Section 1914(a) of the Pennsylvania Business Corporation Law of 1988 by the Corporation’s Shareholders. |

| 6. | The amendment adopted by the Corporation, set forth in full, is as follows: |

Article 4 of the Corporation’s Articles of Incorporation is hereby amended to read in full as follows:

4. The authorized capital stock of the Corporation shall be 500,000,000 shares of Common Stock, $0.01 par value.

IN WITNESS WHEREOF, the undersigned Corporation has caused these Articles of Amendment to be signed by its duly authorized officer this 3rd day of June, 2013.

| | | GENELINK, INC. |

| | | |

| | By: | |

| | | Bernard L. Kasten, Jr., M.D., Chief Executive Officer |