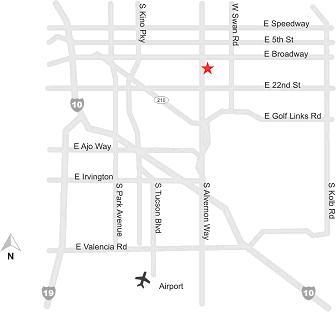

You are cordially invited to attend the UniSource Energy Corporation 2006 Annual Shareholders’ Meeting to be held on Friday, May 5, 2006, at the Doubletree Hotel, 445 S. Alvernon Way, Tucson, Arizona. The meeting will begin promptly at 10:00 a.m., Mountain Standard Time, so please plan to arrive earlier. No admission tickets will be required for attendance at the meeting.

Directors and officers will be available before and after the meeting to speak with you. During the meeting, we will answer your questions regarding our business affairs and we will consider the matters explained in the enclosed Proxy Statement.

We have enclosed a proxy card that lists all matters that require your vote. Please complete, sign, date and mail the proxy card as soon as possible, whether or not you plan to attend the meeting. You may also vote by telephone or the Internet, as explained on the enclosed proxy card. If you attend the meeting and wish to vote your shares personally, you may revoke your proxy at that time.

Your interest in and continued support of UniSource Energy Corporation are much appreciated.

/s/ James S. Pignatelli

James S. Pignatelli

We will hold the 2006 Annual Shareholders’ Meeting (“Meeting”) of UniSource Energy Corporation at the Doubletree Hotel, 445 S. Alvernon Way, Tucson, Arizona, on May 5, 2006, at 10:00 a.m., Mountain Standard Time (“MST”). The purpose of the Meeting is to:

We have enclosed our 2005 Annual Report, including audited financial statements, and the Proxy Statement with this notice. Proxy soliciting material is first being sent or given to shareholders on or about April 3, 2006. Your proxy is being solicited by our Board of Directors.

Please complete, sign, date and mail the enclosed proxy card as soon as possible, or vote by telephone or the Internet, as explained on the enclosed proxy card.

/s/ Catherine A. Nichols

Catherine A. Nichols

UNISOURCE ENERGY CORPORATION

2006 Omnibus Stock and Incentive Plan

TABLE OF CONTENTS

| | Page |

| ARTICLE I ESTABLISHMENT, PURPOSE, AND EFFECTIVE DATE OF PLAN | 1 |

1.1. Establishment | 1 |

1.2. Purpose | 1 |

1.3. Effective Date | 1 |

| ARTICLE II DEFINITIONS | 1 |

2.1. “Award” | 1 |

2.2. “Award Agreement” | 1 |

2.3. “Board” | 1 |

2.4. “Change in Control” | 1 |

2.5. “Code” | 3 |

2.6. “Committee” | 3 |

2.7. “Company” | 3 |

2.8. “Director” | 3 |

2.9. “Disability” | 3 |

2.10. “Employee” | 3 |

2.11. “Fair Market Value” | 3 |

2.12. “Incentive Stock Option” or “ISO” | 3 |

2.13. “Named Executive Officer” | 3 |

2.14. “Nonqualified Stock Option” or “NQSO” | 3 |

2.15. “Non-Tandem SAR” | 4 |

2.16. “Option” | 4 |

2.17. “Participant” | 4 |

2.18. “Performance-Based Exception” | 4 |

2.19. “Performance Share” | 4 |

2.20. “Performance Unit” | 4 |

2.21. “Period of Restriction” | 4 |

2.22. “Plan” | 4 |

2.23. “Restricted Stock” | 4 |

2.24. “Retirement” | 4 |

2.25. “Share” | 4 |

2.26. “Stock” | 4 |

2.27. “Stock Appreciation Right” and “SAR” | 4 |

2.28. “Stock Unit” | 5 |

2.29. “Subsidiary” | 5 |

2.30. “Tandem SAR” | 5 |

2.31. “Termination of Service” | 5 |

| ARTICLE III ADMINISTRATION | 5 |

3.1. Administration | 5 |

3.2. Actions of the Committee | 5 |

3.3. Authority of the Committee | 5 |

TABLE OF CONTENTS

| | Page |

| ARTICLE IV STOCK SUBJECT TO PLAN | 6 |

4.1. Number | 6 |

4.2. Lapsed Awards | 7 |

4.3. Adjustment in Capitalization | 7 |

4.4. Replacement Awards | 7 |

| ARTICLE V DURATION OF PLAN | 8 |

5.1. Duration of Plan | 8 |

| ARTICLE VI STOCK OPTIONS | 8 |

6.1. Grant of Options | 8 |

6.2. Limitations on Incentive Stock Options | 8 |

6.3. Option Award Agreement | 8 |

6.4. Exercise Price | 8 |

6.5. Duration of Options | 9 |

6.6. Exercise of Options | 9 |

6.7. Payment | 9 |

6.8. Termination of Service | 9 |

6.9. Non Transferability of Options | 9 |

| ARTICLE VII STOCK APPRECIATION RIGHTS | 10 |

7.1. Grant of Stock Appreciation Rights | 10 |

7.2. SAR Award Agreement | 10 |

7.3. Duration of SAR | 10 |

7.4. Exercise of SARs | 10 |

7.5. Payment of SAR Amount | 11 |

7.6. Termination of Service | 11 |

7.7. Non-Transferability of SARs | 11 |

| ARTICLE VIII RESTRICTED STOCK AND STOCK UNITS | 11 |

8.1. Grant of Restricted Stock | 11 |

8.2. Period of Restriction and Vesting Conditions | 11 |

8.3. Transferability | 12 |

8.4. Voting Rights | 12 |

8.5. Dividends and Other Distributions | 12 |

8.6. Termination of Service | 12 |

8.7. Form and Timing of Payment | 13 |

| ARTICLE IX PERFORMANCE UNITS AND PERFORMANCE SHARES | 13 |

9.1. Grant of Performance Units or Performance Shares | 13 |

9.2. Value of Performance Units and Performance Shares | 13 |

9.3. Form and Timing of Payment | 14 |

9.4. Termination of Service | 14 |

9.5. Non-Transferability | 14 |

| ARTICLE X PERFORMANCE MEASURES | 15 |

10.1. Permitted Performance Measures | 15 |

10.2. Compliance with Code Section 162(m) | 15 |

TABLE OF CONTENTS

| | Page |

| ARTICLE XI BENEFICIARY DESIGNATION | 16 |

11.1. Beneficiary Designation | 16 |

| ARTICLE XII RIGHTS AND OBLIGATIONS OF PARTIES | 16 |

12.1. No Guarantee of Employment or Service Rights | 16 |

12.2. Participation | 16 |

12.3. Right of Setoff | 16 |

12.4. Section 83(b) Election | 16 |

12.5. Disqualifying Disposition Notification | 17 |

12.6. Forfeiture of Awards | 17 |

12.7. Restrictions on Stock Transferability | 17 |

12.8. Rights of Shareholder | 18 |

| ARTICLE XIII CHANGE IN CONTROL | 18 |

13.1. In General | 18 |

13.2. Exceptions | 18 |

| ARTICLE XIV AMENDMENT, MODIFICATION, AND TERMINATION OF PLAN | 19 |

14.1. Amendment, Modification, and Termination | 19 |

14.2. Awards Previously Granted | 19 |

| ARTICLE XV TAX WITHHOLDING | 19 |

15.1. Tax Withholding | 19 |

15.2. Share Withholding | 19 |

| ARTICLE XVI INDEMNIFICATION | 20 |

16.1. Indemnification | 20 |

| ARTICLE XVII REQUIREMENTS OF LAW | 20 |

17.1. Requirements of Law | 20 |

17.2. Governing Law | 20 |

17.3. Securities Law Compliance | 20 |

17.4. Severability | 20 |

| ARTICLE XVIII MISCELLANEOUS | 21 |

18.1. Funding of Plan | 21 |

18.2. Successors | 21 |

18.3. Fractional Shares | 21 |

18.4. Gender and Number; Headings | 21 |

UNISOURCE ENERGY CORPORATION

2006 OMNIBUS STOCK AND INCENTIVE PLAN

ARTICLE I

Establishment, Purpose, and Effective Date of Plan

1.1. Establishment. Subject to the approval of the shareholders of UniSource Energy Corporation, an Arizona corporation (“UniSource” or the “Company”), the Company has established the UniSource Energy Corporation 2006 Omnibus Stock and Incentive Plan (the “Plan”), as set forth herein, effective as of January 1, 2006. The Plan supercedes and replaces the UniSource Energy Corporation 1994 Omnibus Stock and Incentive Plan (the “1994 Omnibus Plan”) and the UniSource Energy Corporation Amended and Restated 1994 Outside Directors Stock Option Plan (the “1994 Directors Plan”), and all other prior equity compensation plans or programs maintained by the Company; provided, however, that the 1994 Omnibus Plan, the 1994 Directors Plan and any prior stock option plans of the Company shall remain nominally in effect until all stock options granted under such prior plans have been exercised, forfeited, canceled, expired or otherwise terminated in accordance with the terms of such grants.

1.2. Purpose. The Plan is intended to provide certain present and future employees, directors and consultants stock based incentives and other equity interests in the Company, thereby giving them a stake in the growth and prosperity of the Company and encouraging the continuance of their services with the Company or its subsidiaries.

1.3. Effective Date. The Plan is effective January 1, 2006, subject to approval by the shareholders of the Company.

ARTICLE II

Definitions

Whenever used herein, the following terms shall have their respective meanings set forth below.

2.1. “Award” means any Option, Stock Appreciation Right, Restricted Stock, Stock Unit, Performance Unit or Performance Share granted under this Plan.

2.2. “Award Agreement” means a written agreement between the Company and each Participant that sets forth the terms and provisions applicable to an Award granted to the Participant under the Plan, and is a condition to the grant of an Award hereunder.

2.3. “Board” means the Board of Directors of the Company.

2.4. “Change in Control” means and shall be deemed to have occurred, except as otherwise provided in an applicable Award Agreement, as of the date of the first to occur of the following events:

(a) any Person or Group acquires stock of the Company that, together with stock held by such Person or Group, constitutes more than 50% of the total Fair Market Value or total voting power of the stock of the Company. However, if any Person or Group is considered to own more than 50% of the total Fair Market Value or total voting power of the stock of the Company, the acquisition of additional stock by the same Person or Group is not considered to cause a Change in Control of the Company. An increase in the percentage of stock owned by any Person or Group as a result of a transaction in which the Company acquires its stock in exchange for property will be treated as an acquisition of stock for purposes of this subsection. This subsection applies only when there is a transfer of stock of the Company (or issuance of stock of the Company) and stock in the Company remains outstanding after the transaction;

(b) any Person or Group acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such Person or Group) ownership of stock of the Company possessing 35% or more of the total voting power of the stock of the Company;

(c) a majority of members of the Company’s Board is replaced during any 12-month period by Directors whose appointment or election is not endorsed by a majority of the members of the Company’s Board prior to the date of the appointment or election; or

(d) any Person or Group acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such Person or Group) assets from the Company that have a total gross fair market value equal to or more than 40% of the total gross fair market value of all of the assets of the Company immediately prior to such acquisition or acquisitions. For this purpose, gross fair market value means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets. However, no Change in Control shall be deemed to occur under this subsection (d) as a result of a transfer to:

(i) A shareholder of the Company (immediately before the asset transfer) in exchange for or with respect to its stock;

(ii) An entity, 50% or more of the total value or voting power of which is owned, directly or indirectly, by the Company;

(iii) A Person or Group that owns, directly or indirectly, 50% or more of the total value or voting power of all the outstanding stock of the Company; or

(iv) An entity, at least 50% of the total value or voting power of which is owned, directly or indirectly, by a person described in clause (iii) above.

For these purposes, the term “Person” shall mean an individual, corporation, association, joint stock company, business trust or other similar organization, partnership, limited liability company, joint venture, trust, unincorporated organization or government or agency, instrumentality or political subdivision thereof. The term “Group” shall have the meaning set forth in Rule13d-5 of the Securities Exchange Commission (“SEC”), modified to the extent

necessary to comply with Proposed Treasury Regulation Section 1.409A-3(g)(5)(v)(B), or any successor thereto in effect at the time a determination of whether a Change in Control has occurred is being made. If any one Person, or Persons acting as a Group, is considered to effectively control the Corporation as described in subsections (b) or (c) above, the acquisition of additional control by the same Person or Persons is not considered to cause a Change in Control.

2.5. “Code” means the Internal Revenue Code of 1986, as amended.

2.6. “Committee” means the Compensation Committee of the Board, or such other person or persons as the Board shall designate to administer the Plan, as provided in Article III.

2.7. “Company” means UniSource Energy Corporation, an Arizona Corporation and (except for purposes of determining whether a Change in Control has occurred) any successor corporation.

2.8. “Director” means any individual who is a member of the Board, who is not also an Employee.

2.9. “Disability” means that a Participant who is an Employee (a) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to last for a continuous period of not less than 12 months; (b) is, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than 3 months under an accident and health plan covering employees of the Company; or (c) has been determined to be totally disabled by the Social Security Administration.

2.10. “Employee” means any full-time or part-time employee of the Company or one of its Subsidiaries (including any officer or Director who is also an employee).

2.11. “Fair Market Value” means the average of the highest and lowest sales prices of the Stock as reported on the consolidated tape for securities listed on the New York Stock Exchange (“NYSE”) (or, if the Stock is not listed on the NYSE, such other established securities market on which the Stock is traded) on a particular date. In the event that there are no Stock transactions on such date, the Fair Market Value shall be determined by utilization of the above formula as of the immediately preceding date on which there were Stock transactions.

2.12. “Incentive Stock Option” or “ISO” means the right to purchase Stock pursuant to terms and conditions that provide that such right will be treated as an incentive stock option within the meaning of Code Section 422, as described in Article VI.

2.13. “Named Executive Officer” means a Participant who is one of the group of covered employees as defined in the regulations promulgated under Code Section 162(m), or any successor provision or statute.

2.14. “Nonqualified Stock Option” or “NQSO” means the right to purchase Stock pursuant to terms and conditions that provide that such right will not be treated as an Incentive Stock Option, as described in Article VI.

2.15. “Non-Tandem SAR” means an SAR that is granted independently of any Options, as described in Article VII.

2.16. “Option” means the right to purchase Stock at a stated price for a specified period of time. For purposes of the Plan, an Option may be either an Incentive Stock Option or a Nonqualified Stock Option.

2.17. “Participant” means an Employee, prospective Employee, Director or consultant who has outstanding an Award granted under the Plan, and includes those former Employees, Directors or consultants who have certain post-termination rights under the terms of an Award granted under the Plan.

2.18. “Performance-Based Exception” means the exception for performance-based compensation from the tax deductibility limitations of Code Section 162(m).

2.19. “Performance Share” means an Award granted to a Participant as described in Article IX.

2.20. “Performance Unit” means an Award granted to a Participant as described in Article IX.

2.21. “Period of Restriction”means the period during which shares of Restricted Stock are subject to restrictions pursuant to Article VIII of the Plan, or the period during which Performance Shares or Performance Units are subject to restrictions pursuant to Article IX of the Plan.

2.22. “Plan” means the UniSource Energy Corporation 2006 Omnibus Stock and Incentive Plan, as set forth herein.

2.23. “Restricted Stock” means an Award of Stock that is subject to forfeiture if the Participant does not satisfy the restrictions specified in the Award Agreement applicable to such Restricted Stock, granted to a Participant pursuant to Article VIII of the Plan.

2.24. “Retirement” (including “Early Retirement” and “Normal Retirement”) means, with respect to an Employee, Termination of Service of the Employee after he or she has become eligible for an immediate early, normal or late retirement benefit under the terms of a defined benefit pension plan sponsored by the Company and applicable to such Employee.

2.25. “Share” means a share of Stock.

2.26. “Stock” means the Common Stock of the Company, no par value.

2.27. “Stock Appreciation Right” and “SAR” mean the right to receive a payment from the Company equal to the excess of the Fair Market Value of a share of Stock at the date of exercise over a specified price fixed by the Committee in the Award Agreement, which shall not be less than 100% of the Fair Market Value of the Stock on the date of grant. In the case of a Stock Appreciation Right which is granted in conjunction with an Option, the specified price shall be the Option exercise price.

2.28. “Stock Unit” means a non-voting unit of measurement which is deemed for bookkeeping purposes to be equivalent to one outstanding share of Stock (subject to adjustment), granted to a Participant pursuant to Article VIII of the Plan.

2.29. “Subsidiary” means any corporation, partnership, joint venture, affiliate, or other entity in which the Company is at least a majority-owner of all issued and outstanding equity interests or has a controlling interest.

2.30. “Tandem SAR” means a SAR that is granted in connection with a related Option pursuant to Article VII, the exercise of which shall require forfeiture of the right to purchase a Share under the related Option (and when a Share is purchased under the Option, the Tandem SAR shall similarly be forfeited).

2.31. “Termination of Service” means the cessation of performance of services for the Company, as determined by the Committee. For this purpose, transfer of a Participant among the Company and any Subsidiary, or transfer from a position as Director or consultant to Employee, shall not be considered a Termination of Service with the Company. Whether an Employee, Director or consultant incurs a Termination of Service in respect of an Award subject to Code Section 409A will be determined in accordance with the requirements thereof.

ARTICLE III

Administration

3.1. Administration. The Committee shall be responsible for the administration of the Plan. The Compensation Committee, or other committee appointed to administer the Plan, shall consist of not less than two Directors of the Company who are “non-employee directors” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, “outside directors” within the meaning of Code Section 162(m) and regulations thereunder, and “independent directors” as described in the NYSE’s Listed Company Manual, as each such rule or regulation is in effect from time to time. The Board may, from time to time, remove members from, or add members to, the Committee. Any vacancies on the Committee shall be filled by members of the Board. The foregoing notwithstanding, the Board shall perform the functions of the Committee for purposes of granting Awards to non-Employee Directors.

3.2. Actions of the Committee. A majority of the members of the Committee shall constitute a quorum. The Committee may act at a meeting, including a telephonic meeting, by action of a majority of the members present, or without a meeting by unanimous written consent.

3.3. Authority of the Committee. The Committee is authorized to interpret the Plan and any Award Agreement issued under the Plan, the 1994 Omnibus Plan and the 1994 Directors Plan; to prescribe, amend, and rescind rules and regulations relating to the Plan; to provide for conditions and assurances deemed necessary or advisable to protect the interests of the Company; and to make all other determinations necessary or advisable for the administration of the Plan, but only to the extent not contrary to the express provisions of the Plan. Determinations, interpretations, or other actions made or taken by the Committee in good faith pursuant to the provisions of the Plan shall be final, binding and conclusive for all purposes and upon all persons whomsoever. In addition, the Committee may prescribe, amend and rescind

such rules and regulations as may be necessary or appropriate to permit the participation of Participants in foreign jurisdictions (e.g., rules for the conversion of currency and compliance with applicable securities laws).

The Committee shall have the authority, subject to the express provisions of the Plan, in its discretion, (a) to determine the Employees, Directors and consultants to whom Awards shall be granted; (b) to determine the times when such Awards shall be granted, the size and type of Awards, the purchase price or exercise price of Awards, the period(s) during which such Awards shall be exercisable (whether in whole or in part), and the any other terms, restrictions and conditions applicable to Awards (which need not be identical); and (c) to amend or modify any outstanding Awards under the Plan, the 1994 Omnibus Plan and the 1994 Directors Plan, to the extent the terms of such Award are within the discretion of the Committee as provided under the Plan, the 1994 Omnibus Plan or the 1994 Directors Plan, as applicable, subject to Section 14.1. As permitted by law, the Committee may delegate any authority granted to it herein.

Notwithstanding the provisions hereof regarding the term of this Plan, all authority of the Board and the Committee with respect to Awards hereunder, including the authority to amend outstanding Awards, shall continue after the term of this Plan, so long as any Award remains outstanding.

ARTICLE IV

Stock Subject to Plan

4.1. Number. The shares to be delivered under the Plan may consist, in whole or in part, of authorized but unissued Stock or treasury Stock, not reserved for any other purpose. Subject to adjustment as provided in Section 4.3, a total of Two Million Two Hundred Fifty Thousand (2,250,000) Shares shall be authorized for issuance or to be used for reference purposes pursuant to Awards granted under the Plan. Any Shares issued or used for reference purposes in connection with Awards other than Options and Stock Appreciation Rights shall be counted against the Share limit described in the preceding sentence as three (3) Shares for every one Share issued in connection with such Award or by which the Award is valued by reference; and any Shares issued or used for reference purposes in connection with Awards of Options and Stock Appreciation Rights shall be counted against the Share limit described in the preceding sentence as one Share for every one Share issued in connection with such Award or by which the Award is valued by reference. In addition to the above aggregate limitation:

(a) No Participant under this Plan shall be granted Options, Stock Appreciation Rights or other Awards in any 36-month period covering more than Seven Hundred Fifty Thousand (750,000) Shares.

(b) No Participant under this Plan shall be granted a cash award in settlement of Performance Units in excess of Two Million Dollars ($2,000,000) in any 12 month period.

(c) The maximum number of Shares that may be issued under the Plan as Incentive Stock Options is Two Million Two Hundred Fifty Thousand (2,250,000).

4.2. Lapsed Awards. In the event any Awards granted under this Plan, or under the 1994 Omnibus Plan or the 1994 Directors Plan and outstanding on January 1, 2006, shall be forfeited, terminate, be canceled or expire, the number of Shares subject to such Award, to the extent of any such forfeiture, termination, cancellation or expiration, shall thereafter again be available for grant under the Plan; provided, however, that in the case of Awards other than Options and Stock Appreciation Rights, [three (3)] Shares shall thereafter again be available for grant under the Plan for every one Share issued in connection with such Award or by which the Award was valued by reference. In addition, if Shares are not delivered pursuant to a Stock Unit or Performance Unit Award or a SAR Award that is not related to an Option, because the Award is paid in cash, such Shares shall not be deemed to have been delivered for purposes of determining the maximum number of Shares available for delivery under the Plan. However, Shares tendered or withheld for payment of an Option exercise price or for tax withholding, and Shares not issued upon settlement of a SAR in Stock will not increase the number of Shares available for grant under the Plan.

4.3. Adjustment in Capitalization. In the event of any change in corporate capitalization, such as a stock split, or a corporate transaction, such as any merger, consolidation, separation, including a spin-off, or other distribution of stock or property of the Company, extraordinary cash dividend, any reorganization (whether or not such reorganization comes within the definition of such term in Code Section 368) or any partial or complete liquidation of the Company, an adjustment shall be made in the number and class of Shares available for Awards, the number and class of and/or price of Shares subject to outstanding Awards granted under the Plan and the number of Shares set forth in Sections 4.1 and 4.2, as may be determined to be appropriate and equitable by the Committee, in its sole discretion, to prevent dilution or enlargement of rights; provided, however, that the number of Shares subject to any Award shall always be a whole number by rounding any fractional Share to the nearest whole Share.

4.4. Replacement Awards. In the event of any corporate transaction in which the Company or a Subsidiary acquires a corporate entity which, at the time of such transaction, maintains an equity compensation plan pursuant to which awards of stock options, stock appreciation rights, performance shares, performance units or restricted stock are then outstanding (the “acquired plan”), the Committee may, in its discretion, make Awards under this Plan to assume, substitute or convert such outstanding awards in such manner as may be determined to be appropriate and equitable by the Committee, in its sole discretion, to prevent dilution or enlargement of rights; provided, however, that the number of Shares subject to any Award shall always be a whole number by rounding any fractional Share to the nearest whole Share. Options or SARs issued pursuant to this Section 4.4 shall not be subject to the requirement that the exercise price of such Award not be less than the Fair Market Value of Stock on the date the Award is granted. Shares used in connection with an Award granted in substitution for an award outstanding under an acquired plan under this Section 4.4 shall not be counted against the number of Shares reserved under this Plan under Section 4.1. Any shares authorized and available for issuance under the acquired plan shall, subject to adjustment as described in Section 4.3, be available for use in making Awards under this Plan with respect to persons eligible under such acquired plan, by virtue of the Company’s assumption of such acquired plan, consistent with Rule 303A(8) of the NYSE Listed Company Manual.

ARTICLE V

Duration of Plan

5.1. Duration of Plan. The Plan shall remain in effect, subject to the right of the Company’s Board of Directors to amend or terminate the Plan at any time pursuant to Section 14.1, until all Shares subject to the Plan shall have been purchased or granted according to the Plan’s provisions. However, in no event may an Award be granted under the Plan on or after January 1, 2016. Any Awards granted under the Plan prior to January 1, 2016 shall continue in effect until they expire, terminate, are exercised or are paid in full.

ARTICLE VI

Stock Options

6.1. Grant of Options. Subject to the terms and provisions of the Plan, Options may be granted to one or more Participants in such number, upon such terms and provisions, and at any time and from time to time, as determined by the Committee in its sole discretion. The Committee may grant either Nonqualified Stock Options or Incentive Stock Options and shall have complete discretion in determining the number of Options of each granted to each Participant, subject to the limitations of Article IV.

6.2. Limitations on Incentive Stock Options. To the extent the aggregate Fair Market Value (determined at the time the Option is granted) of the Stock with respect to which Incentive Stock Options are exercisable for the first time by a Participant in any calendar year (under this Plan and any other plans of the Company) exceeds $100,000, such Options shall not be deemed Incentive Stock Options. Any ISOs that become exercisable in excess of such amount shall be deemed NQSOs to the extent of such excess. In determining which Options may be treated as NQSOs under the preceding sentence, Options will be taken into account in the order of their dates of grant. Nothing in this Section 6.2 of the Plan shall be deemed to prevent the grant of NQSOs in amounts which exceed the maximum on ISOs established by Code Section 422.

6.3. Option Award Agreement. Each Option shall be evidenced by an Award Agreement that shall specify the type of Option granted, the Option price, the duration of the Option, the number of shares of Stock to which the Option pertains, and such other terms and conditions (which need not be identical among Participants) as the Committee shall determine in its sole discretion; provided, however, that no cash dividends or dividend equivalents shall be paid or provided with respect to Options. The Award Agreement shall specify whether the Option is to be treated as an ISO within the meaning of Code Section 422. If such Option is not designated as an ISO, such Option shall be deemed a NQSO.

6.4. Exercise Price. Except as otherwise provided in Section 4.4 with respect to replacement Awards, no Option shall be granted pursuant to the Plan at an exercise price that is less than the Fair Market Value of the Stock on the date the Option is granted. With respect to a Participant who owns, directly or indirectly, more than 10% of the total combined voting power of all classes of the stock of the Company or any Subsidiary, the exercise price of Incentive Stock Options shall be at least 110% of the Fair Market Value of Stock on the ISO’s grant date. Notwithstanding any other provision in the Plan to the contrary, an Option may not be amended

or modified to reduce the exercise price after the Grant Date, and may not be surrendered in consideration of or exchanged for cash, other Awards or a new Option having an exercise price below that of the Option being surrendered or exchanged, except as otherwise provided in Section 4.3 with respect to an adjustment in capitalization, without approval of the Company’s shareholders.

6.5. Duration of Options. Each Option shall expire at such time or times as the Committee shall determine at the time it is granted, provided, however, that no Option shall be exercisable later than ten years from the date of its grant. Notwithstanding the foregoing, with respect to ISOs, in the case of a Participant who owns, directly or indirectly, more than 10% of the total combined voting power of all classes of the stock of the Company or any Subsidiary, no ISO shall be exercisable later than the fifth anniversary of the grant date.

6.6. Exercise of Options. Options granted under the Plan shall be exercisable at such time or times and in such manner, and be subject to such restrictions and conditions, as the Committee shall in each instance approve, which need not be the same for all Participants; provided, however, that an Option shall not be exercisable prior to the first anniversary of the date on which the Option was granted, except (in the Committee’s discretion) in the case of death, Disability or a Change in Control.

6.7. Payment. The purchase price of Stock upon exercise of any Option shall be paid in full either (a) in cash, (b) in Stock valued at its Fair Market Value on the date of exercise, or (c) by a combination of (a) and (b), at the discretion of the Committee. The Committee, in its sole discretion, may also permit payment of the purchase price upon exercise of any Option to be made by having shares withheld from the total number of shares of common stock to be delivered upon exercise, or by such other method as the Committee shall permit. The proceeds from the payment of Option exercise prices shall be added to the general funds of the Company and shall be used for general corporate purposes.

6.8. Termination of Service. The Committee shall set forth in the applicable Award Agreement the extent to which a Participant shall have the right to exercise the Option or Options following termination of his or her employment, service as a Director, or consulting arrangement with the Company and/or its Subsidiaries. Such provisions shall be in the sole discretion of the Committee, need not be uniform among all Options issued pursuant to the Plan, and may reflect distinctions based on the reasons for such termination, including, but not limited to, termination for cause or good reason, or reasons relating to the breach or threatened breach of restrictive covenants.

6.9. Non-Transferability of Options. No Option granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, otherwise than by will or by the laws of descent and distribution. Further, all Incentive Stock Options and, except as otherwise provided in the applicable Award Agreement, Nonqualified Stock Options, granted to a Participant under the Plan shall be exercisable only by such Participant during his or her lifetime. Notwithstanding the foregoing, the Committee may, in its sole discretion upon application of a Participant, permit the transfer of an Option to a family member or family trust or partnership, or to a charitable organization, provided that no value or consideration is received by the Participant with respect to such transfer.

ARTICLE VII

Stock Appreciation Rights

7.1. Grant of Stock Appreciation Rights. Subject to the terms and provisions of the Plan, Stock Appreciation Rights may be granted to one or more Participants in such number, upon such terms and provisions, and at any time and from time to time, as determined by the Committee in its sole discretion. The Committee may grant Non-Tandem SARs, Tandem SARs, or any combination of these forms of SARs. The Committee shall designate, at the time of grant, the grant price of a Non-Tandem SAR, which grant price shall be at least equal to the Fair Market Value of a Share on the grant date of the SAR, except as otherwise provided in Section 4.4 with respect to replacement awards. The grant price of Tandem SARs shall equal the Option Price of the related Option. Notwithstanding any other provision in the Plan to the contrary, an SAR may not be amended or modified to reduce the grant price after the Grant Date, and may not be surrendered in consideration of or exchanged for cash, other Awards or a new SAR having a grant price below that of the SAR being surrendered or exchanged, except as otherwise provided in Section 4.3 with respect to an adjustment in capitalization, without shareholder approval.

7.2. SAR Award Agreement. Each SAR shall be evidenced by an Award Agreement that shall specify the type of SAR granted, the SAR grant price, the duration of the SAR, the number of shares of Stock to which the Award pertains, and such other terms and conditions (which need not be identical among Participants) as the Committee shall determine in its sole discretion; provided, however, that no cash dividends or dividend equivalents shall be paid or provided with respect to SARs.

7.3. Duration of SAR. The term of an SAR granted under the Plan shall not exceed ten years. Notwithstanding the foregoing, a Tandem SAR shall have the same term as the Option to which it relates.

7.4. Exercise of SARs. SARs granted under the Plan shall be exercisable at such time or times and in such manner, and be subject to such restrictions and conditions, as the Committee shall in each instance approve, which need not be the same for all Participants; provided, however, that a SAR shall not be exercisable prior to the first anniversary of the date on which the SAR was granted, except (in the Committee’s discretion) in the case of death, Disability or a Change in Control. Tandem SARs may be exercised for all or part of the Shares subject to the related Option upon the surrender of the right to exercise the equivalent portion of the related Option. A Tandem SAR may be exercised only with respect to the Shares for which its related Option is then exercisable. Notwithstanding any other provision of the Plan to the contrary, with respect to a Tandem SAR granted in connection with an ISO: (a) the Tandem SAR will expire no later than the expiration of the underlying ISO; (b) the value of the payout with respect to the Tandem SAR may be for no more than 100% of the difference between the Option exercise price of the underlying ISO and the Fair Market Value of the Shares subject to the underlying ISO at the time the Tandem SAR is exercised; and (c) the Tandem SAR may be exercised only when the Fair Market Value of the Shares subject to the ISO exceeds the Option exercise price of the ISO.

7.5. Payment of SAR Amount. Upon exercise of the SAR, the holder shall be entitled to receive payment of an amount determined by multiplying (a) the difference between the Fair Market Value of a share of Stock at the date of exercise over the price fixed by the Committee at the date of grant, by (b) the number of shares with respect to which the SAR is exercised. Except as otherwise provided in the Award Agreement, payment for SARs may be made in cash or Stock, or deferred cash or Stock, or in a combination thereof, at the sole discretion of the Committee; provided, however, that any cash or deferred payment hereunder shall comply with the provisions of Code Section 409A and regulations thereunder. Payment shall be made in the manner and at the time designated by the Committee in the Award Agreement.

7.6. Termination of Service. The Committee shall set forth in the applicable Award Agreement the extent to which a Participant shall have the right to exercise the SARs following termination of his or her employment, service as a Director, or consulting arrangement with the Company and/or its Subsidiaries. Such provisions shall be in the Committee’s discretion, need not be uniform among all SAR Awards issued pursuant to the Plan, and may reflect distinctions based on the reasons for such termination, including, but not limited to, termination for cause or good reason, or reasons relating to the breach or threatened breach of restrictive covenants.

7.7. Non-Transferability of SARs. No SAR granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, otherwise than by will or by the laws of descent and distribution. Further, except as otherwise provided in the Award Agreement, all SARs granted to a Participant under the Plan shall be exercisable only by such Participant during his or her lifetime. Notwithstanding the foregoing, the Committee may, in its sole discretion upon application of a Participant, permit the transfer of a SAR to a family member or family trust or partnership, or to a charitable organization, provided that no value or consideration is received by the Participant with respect to such transfer.

ARTICLE VIII

Restricted Stock and Stock Units

8.1. Grant of Restricted Stock. Subject to the terms and provisions of the Plan, Restricted Stock and/or Stock Units may be granted to one or more Participants in such number, upon such terms and provisions, and at any time and from time to time, as determined by the Committee in its sole discretion. The Company and each Participant to whom an award of Restricted Stock and/or Stock Units is granted shall execute an Award Agreement that shall specify the Period or Periods of Restriction, the number of Shares of Restricted Stock or the number of Stock Units granted, whether Stock Units shall be settled in cash or Stock, and such other provisions as the Committee shall determine.

8.2. Period of Restriction and Vesting Conditions. Subject to Article X relating to the Performance-Based Exception, the Committee may impose such conditions and/or restrictions on any Shares of Restricted Stock and/or Stock Units granted pursuant to the Plan as it may deem advisable, including, without limitation, a requirement that Participants pay a stipulated purchase price for each Share of Restricted Stock, restrictions based upon the achievement of specific performance goals as described in Section 9.1, time-based restrictions on vesting, which may or may not follow the attainment of the performance goals, sales restrictions under applicable

shareholder agreements or similar agreements, and/or restrictions under applicable Federal or state securities laws. The Period of Restriction for Restricted Stock or Stock Units shall not be less than three (3) years, during which period incremental amounts of Restricted Stock and/or Stock Units may be released from restriction in accordance with the provisions of the Award Agreement; provided, however, that the Period of Restriction for Restricted Stock or Stock Unit Awards issued to newly hired Employees in order to replace forfeited awards granted by a prior employer, or issued as a form of payment of earned Performance Awards or other incentive compensation, shall not be less than one (1) year.

8.3. Transferability. Restricted Stock and/or Stock Units granted under the Plan may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, during the Period of Restriction, except as otherwise provided in the Award Agreement or by will or by the laws of descent and distribution. All rights with respect to Restricted Stock and/or Stock Units granted to a Participant under the Plan shall be available during his or her lifetime only to such Participant. Except as otherwise provided in the Plan or in any Award Agreement, Restricted Stock shall become freely transferable by the Participant after the last day of the applicable Period of Restriction.

8.4. Voting Rights. Except as otherwise provided in the Award Agreement, Participants holding shares of Restricted Stock granted hereunder may exercise full voting rights with respect to those shares during the Period of Restriction.

8.5. Dividends and Other Distributions. Unless otherwise designated by the Committee, Participants holding Restricted Stock granted hereunder shall be credited with regular cash dividends declared by the Company with respect to the underlying Shares during the Period of Restriction. Any other distributions with respect to the underlying Shares shall be held (without provision for interest accrual) subject to the Period of Restriction applicable to the underlying Shares. The Committee may apply any restrictions to such dividends or other distributions as it deems appropriate.

Without limiting the generality of the preceding paragraph, if the grant or vesting of Restricted Stock granted to a Named Executive Officer is designed to comply with the requirements of the Performance-Based Exception, the Committee may apply any restrictions it deems appropriate to the payment of dividends declared with respect to such Shares of Restricted Stock, such that the dividends and/or the Shares of Restricted Stock maintain eligibility for the Performance-Based Exception. In the event that any dividend constitutes a derivative security or an equity security pursuant to the rules under Section 16 of the Securities Exchange Act of 1934, such dividend shall be subject to a vesting period equal to the remaining vesting period of the Shares of Restricted Stock with respect to which the dividend is paid.

8.6. Termination of Service. The Committee shall set forth in the applicable Award Agreement the extent to which a Participant shall have the right to retain Restricted Stock following termination of his or her employment, service as a Director, or consulting arrangement with the Company and/or its Subsidiaries, during the Period of Restriction. Such provisions shall be in the sole discretion of the Committee, need not be uniform among all Restricted Stock or Stock Unit Awards issued pursuant to the Plan, and may reflect distinctions based on the reasons

for such termination, including, but not limited to, termination for cause or good reason, or reasons relating to the breach or threatened breach of restrictive covenants.

8.7. Form and Timing of Payment. Except as otherwise provided in the Award Agreement, payment for Stock Units may be made in cash or Stock, or in deferred cash or Stock, or in a combination thereof, at the sole discretion of the Committee; provided, however, that any deferred payment hereunder shall comply with the provisions of Code Section 409A and regulations thereunder. Payment shall be made in the manner and at the time designated by the Committee in the Award Agreement.

ARTICLE IX

Performance Units and Performance Shares

9.1. Grant of Performance Units or Performance Shares. Subject to the terms and provisions of the Plan, Performance Units or Performance Shares may be granted to one or more Participants in such number, upon such terms and conditions, and at any time and from time to time, as shall be determined by the Committee in its sole discretion. The Company and each Participant to whom an award of Performance Units or Performance Shares is granted shall execute an Award Agreement that shall specify the Period or Periods of Restriction, the number of Performance Units or Performance Shares granted, and such other provisions as the Committee shall determine in its sole discretion.

Subject to Article X relating to the Performance-Based Exception, the Committee may impose such other conditions and/or restrictions on any Performance Units or Performance Shares Stock granted pursuant to the Plan as it may deem advisable, including, without limitation, restrictions based upon the achievement of specific performance goals (Company-wide, Subsidiary-wide, divisional, and/or individual), time-based restrictions on vesting, which may or may not be following the attainment of the performance goals, sales restrictions under applicable shareholder agreements or similar agreements, and/or restrictions under applicable Federal or state securities laws. Performance criteria may include (among others), in the Committee’s sole discretion, revenue; revenue growth; earnings (including earnings before taxes, earnings before interest and taxes or earnings before interest, taxes, depreciation and amortization); operating income; pre- or after-tax income; cash flow (before or after dividends); cash flow per share (before or after dividends); net earnings; earnings per share; return on equity; return on capital (including return on total capital or return on invested capital); cash flow return on investment; return on assets or net assets; economic value added (or an equivalent metric); share price performance; total shareholder return; improvement in or attainment of expense levels; and improvement in or attainment of working capital levels. Measurement of performance against goals may exclude, in the Committee’s sole discretion, the impact of charges for restructurings, discontinued operations, extraordinary items, and other unusual or non-recurring items, and the cumulative effects of tax or accounting changes, each as defined by generally accepted accounting principles and as identified in the financial statements, notes to the financial statements, management’s discussion and analysis or other SEC filings.

9.2. Value of Performance Units and Performance Shares. Each Performance Unit shall have an initial value that is established by the Committee at the time of grant. Each

Performance Share shall have an initial value determined by reference to the Fair Market Value of a Share on the grant date. The Committee shall set performance goals in its sole discretion which, depending on the extent to which they are met, will determine the number and/or value of Performance Units and/or Performance Shares that will be paid out to the Participant. The time period during which the performance goals must be met shall be called a Period of Restriction or performance period and shall be determined by the Committee in its sole discretion; provided, however, that the Period of Restriction for a Performance Unit or Performance Share Award shall not be less than one year or longer than 5 years.

9.3. Form and Timing of Payment. Except as otherwise provided in the Award Agreement, payment for Performance Unit or Performance Share Awards may be made in cash or Stock, or in deferred cash or Stock, or in a combination thereof, at the sole discretion of the Committee; provided, however, that any payment hereunder shall comply with the provisions of Code Section 409A and regulations thereunder. Payment shall be made in the manner and at the time designated by the Committee in the Award Agreement. At the time of grant or shortly thereafter, the Committee, in its sole discretion and upon such terms as the Committee shall determine consistent with Code Section 409A, may provide for a voluntary and/or mandatory deferral of all or any part of an otherwise earned Performance Unit and/or Performance Share Award.

To the extent set forth in the Award Agreement, in the sole discretion of the Committee, Participants may be entitled to receive any regular cash dividends and other distributions declared with respect to Shares which have been earned in connection with grants of Performance Units and/or Performance Shares but not yet distributed to Participants. Such dividends or other distributions shall be subject to the terms and conditions similar to those set forth in Section 8.5.

9.4. Termination of Service. The Committee shall set forth in the applicable Award Agreement the extent to which a Participant shall have the right to receive Performance Units and/or Performance Shares following termination of his or her employment, service as a Director, or consulting arrangement with the Company and/or its Subsidiaries, during the Period of Restriction. Such provisions shall be in the discretion of the Committee, need not be uniform among all Performance Units and/or Performance Shares Awards issued pursuant to the Plan, and may reflect distinctions based on the reasons for such termination, including, but not limited to, termination for cause or good reason, or reasons relating to the breach or threatened breach of restrictive covenants.

9.5. Non-Transferability. No Performance Units or Performance Shares granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, otherwise than by will or by the laws of descent and distribution, until the termination of the applicable performance period. All rights with respect to Performance Units and Performance Shares granted to a Participant under the Plan shall be exercisable only by such Participant during his or her lifetime.

ARTICLE X

Performance Measures

10.1. Permitted Performance Measures. Unless and until the Committee proposes for shareholder vote and shareholders approve a change in the general performance measures set forth in this Article X, the attainment of which may determine the degree of payout and/or vesting with respect to Awards to Named Executive Officers that are designed to qualify for the Performance-Based Exception, the performance goals to be used for purposes of such grants shall be established by the Committee in writing and stated in terms of the attainment of specified levels of or percentage changes in any one or more of the performance measurements set forth in Section 9.1, or any individual performance objective which is measured solely in terms of quantitative targets related to the Company or the Company’s business; or any combination thereof. In addition, such performance goals may be based in whole or in part upon the performance of the Company, a Subsidiary, division and/or other operational unit under one or more of such measures.

The degree of payout and/or vesting of such Awards designed to qualify for the Performance-Based Exception shall be determined based upon the written certification of the Committee as to the extent to which the performance goals and any other material terms and conditions precedent to such payment and/or vesting have been satisfied. The Committee shall have the sole discretion to adjust the determinations of the degree of attainment of the preestablished performance goals; provided, however, that the performance goals applicable to Awards which are designed to qualify for the Performance-Based Exception, and which are held by Named Executive Officers, may not be adjusted so as to increase the payment under the Award (the Committee shall retain the sole discretion to adjust such performance goals upward, or to otherwise reduce the amount of the payment and/or vesting of the Award relative to the preestablished performance goals).

In the event that applicable tax and/or securities laws change to permit Committee sole discretion to alter the governing performance measures without obtaining shareholder approval of such changes, the Committee shall have sole discretion to make such changes without obtaining shareholder approval. In addition, in the event that the Committee determines that it is advisable to grant Awards which shall not qualify for the Performance-Based Exception, the Committee may make such grants without satisfying the requirements of Code Section 162(m) and, thus, which use performance measures other than those specified above.

10.2. Compliance with Code Section 162(m). The Company intends that Options and SARs granted to Named Executive Officers and other Awards designated as Awards to Named Executive Officers shall constitute qualified “performance-based compensation” within the meaning of Code Section 162(m) and regulations thereunder, unless otherwise determined by the Committee at the time of allocation of an Award. Accordingly, the terms of Sections 2.13, 8.1, 9.1 and similar or related provisions, including the definitions of Named Executive Officer and other terms used therein, shall be interpreted in a manner consistent with Code Section 162(m) and regulations thereunder. The foregoing notwithstanding, because the Committee cannot determine with certainty whether a given Participant will be a Named Executive Officer with respect to a fiscal year that has not yet been completed, the term Named Executive Officer as used herein shall mean only a person designated by the Committee as likely to be a Named

Executive Officer with respect to a specified fiscal year. If any provision of the Plan or any Award Agreement relating to an Award that is designated as intended to comply with Code Section 162(m) does not comply or is inconsistent with the requirements of Code Section 162(m) or regulations thereunder, such provision shall be construed or deemed amended to the extent necessary to conform to such requirements, and no provision shall be deemed to confer upon the Committee or any other person sole discretion to increase the amount of compensation otherwise payable in connection with any such Award upon attainment of the applicable performance objectives.

ARTICLE XI

Beneficiary Designation

11.1. Beneficiary Designation. Each Participant under the Plan may, from time to time, name any beneficiary or beneficiaries (who may be named contingently or successively) to whom any benefit under the Plan is to be paid in case of his or her death before he or she receives any or all of such benefit. Each such designation shall revoke all prior designations by the same Participant, shall be in a form prescribed by the Company, and will be effective only when filed by the Participant in writing with the Secretary of the Company during the Participant’s lifetime. In the absence of any such designation, benefits remaining unpaid at the Participant’s death shall be paid to the Participant’s estate.

ARTICLE XII

Rights and Obligations of Parties

12.1. No Guarantee of Employment or Service Rights. Nothing in the Plan shall interfere with or limit in any way the right of the Company to terminate any Participant’s employment or consulting arrangement at any time, nor confer upon any Participant any right to continue in the employ of or consulting arrangement with the Company or any Subsidiary.

12.2. Participation. No Employee, Director or consultant shall have the right to be selected to receive an Award under the Plan, or, having been so selected, to be selected to receive a future Award.

12.3. Right of Setoff. The Company or any Subsidiary may, to the extent permitted by applicable law, deduct from and set off against any amounts the Company or Subsidiary may owe to the Participant from time to time, including amounts payable in connection with any Award, owed as wages, fringe benefits, or other compensation owed to the Participant, such amounts as may be owed by the Participant to the Company, although the Participant shall remain liable for any part of the Participant’s payment obligation not satisfied through such deduction and setoff. By accepting any Award granted hereunder, the Participant agrees to any deduction or setoff under this Section 12.3.

12.4. Section 83(b) Election. No election under Section 83(b) of the Code (to include in gross income in the year of transfer the amounts specified in Code Section 83(b)) or under a similar provision of the laws of a jurisdiction outside the United States may be made, unless expressly permitted by the terms of the Award Agreement or by action of the Committee in

writing before the making of such election. In any case in which a Participant is permitted to make such an election in connection with an Award, the Participant shall notify the Company of such election within ten days of filing notice of the election with the Internal Revenue Service or other governmental authority, in addition to any filing and notification required pursuant to regulations issued under Code Section 83(b) or other applicable provision.

12.5. Disqualifying Disposition Notification. If any Participant shall make any disposition of Shares delivered pursuant to the exercise of an Incentive Stock Option under the circumstances described in Code Section 421(b) (relating to certain disqualifying dispositions), such Participant shall notify the Company of such disposition within ten days thereof.

12.6. Forfeiture of Awards. The Committee may, in its sole discretion, include in any Award Agreement the requirement that the Award be subject to additional forfeiture conditions, to which the Participant, by accepting an Award hereunder, agrees. Upon the occurrence of any forfeiture event specified by the Committee in the Award Agreement (a “Forfeiture Event”), except as otherwise provided by the Committee in the Award Agreement:

(a) The unexercised portion of any Option, whether or not vested, and any other Award not then settled will be immediately forfeited and canceled upon the occurrence of the Forfeiture Event; and

(b) The Participant will be obligated to repay to the Company upon demand, in cash, the total amount of Award Gain (as defined herein) realized by the Participant upon each exercise of an Option or SAR or settlement of an Award that occurred within the period beginning twelve (12) months prior to the earlier of the Forfeiture event or the date of the Participant’s Termination of Service, and ending on the date of the Company’s demand.

For purposes hereof, the term “Award Gain” shall mean (A) with respect to a given Option exercise, the product of (X) the Fair Market Value per Share at the date of such exercise (without regard to any subsequent change in the market price of shares) minus the Option exercise price times (Y) the number of Shares as to which the Option was exercised at that date, and (B) with respect to any other settlement of an Award granted to the Participant, the Fair Market Value of the cash or Shares paid or payable to the Participant less any cash or the Fair Market Value of any Shares or property (other than an Award or award that would have itself then been forfeitable hereunder and excluding any payment of tax withholding) paid by the Participant to the Company as a condition of or in connection such settlement, with actual earnings on such Award Gain through the date of payment of the Company’s demand hereunder.

12.7. Restrictions on Stock Transferability. The Committee shall impose such restrictions on any shares of Stock acquired pursuant to the exercise of an Option or lapse of restrictions of any Award under the Plan as it may deem advisable, including, without limitation, restrictions under applicable Federal securities law, under the requirements of any stock exchange on which the Stock is then listed and under any blue sky or state securities laws applicable to such shares. The Committee may legend any certificates for such stock to give appropriate notice of such restrictions.

12.8. Rights of Shareholder. No Participant shall have any rights as a shareholder of the Company with respect to any Award under the Plan, except as specifically otherwise provided in the Plan or the Award Agreement.

ARTICLE XIII

Change in Control

13.1. In General. Unless otherwise specified in a Participant’s Award Agreement at time of grant, except as provided in Section 13.2, or except to the extent specifically prohibited under applicable laws or by the rules and regulations of any governing governmental agencies or national securities exchanges, upon the occurrence of a Change in Control:

(a) Any and all Options and SARs granted hereunder shall become immediately exercisable, and shall remain exercisable throughout their entire then remaining term;

(b) Any Period of Restriction and other restrictions imposed on Restricted Stock or Stock Units shall lapse; and

(c) Awards of Performance Units and Performance Shares shall be converted to Restricted Stock, which shall vest over the then-remaining Period of Restriction (or upon earlier Termination of Service, death or Disability as provided in the Award Agreement). If 50% or more of the Period of Restriction has elapsed as of the date of the Change in Control, such conversion shall be based upon the value of the Performance Units and/or Performance Shares determined based upon actual performance to date; and if less than 50% of the Period of Restriction has elapsed as of the date of the Change in Control, such conversion shall be made based upon the target value of the Performance Units and/or Performance Shares.

13.2. Exceptions. Notwithstanding the foregoing provisions of Section 13.1, the Board, prior to a Change in Control, may determine that no Change in Control shall be deemed to have occurred or that some or all of the enhancements to the rights of Participants under outstanding Awards upon a Change in Control, as provided under Section 13.1 or the Award Agreement, shall not apply to specified Awards if, before or immediately upon the occurrence of the specified event that would otherwise constitute a Change in Control (the “Event”), both the Board of the Company prior to the Change in Control, and the Board of the Company (or any successor thereto) after the Change in Control reasonably conclude, in good faith, that Participants holding Awards affected by action of the Board under this Section 13.2 shall be protected by legally binding obligations of the Company because such Awards either shall remain outstanding following consummation of all transactions involved in or contemplated by such Change in Control or shall be assumed and adjusted by the surviving entity resulting from such transactions, and that changes in the terms of the Award resulting from such transactions will not materially impair the value of the Awards to the Participants or their opportunity for future appreciation in respect of such Awards.

ARTICLE XIV

Amendment, Modification, and Termination of Plan

14.1. Amendment, Modification, and Termination. The Board may amend, suspend or terminate the Plan or the Committee’s authority to grant Awards under the Plan without the consent of shareholders or Participants, except as described in Sections 6.4 and 7.1; provided, however, that if shareholder approval of any amendment is required by any federal or state law or regulation or the rules of any stock exchange or automated quotation system on which the Shares may then be listed or quoted, such amendment shall be submitted to the Company’s shareholders for approval not later than the earliest annual meeting for which the record date is after the date of such Board action; and provided further, that no such Board action may materially and adversely affect the rights of any Participant under any outstanding Award without the consent of such Participant. The Committee shall have no authority to waive or modify any other Award term after the Award has been granted to the extent that the waived or modified term was mandatory under the Plan.

14.2. Awards Previously Granted. The Committee may amend or modify any Award Agreement issued under the Plan or under the 1994 Omnibus Plan or 1994 Directors Plan solely to the extent provided in such Award Agreement. No termination, amendment, or modification of the Plan shall adversely affect in any material way any Award previously granted under the Plan or under the 1994 Omnibus Plan or 1994 Directors Plan, without the written consent of the Participant holding such Award.

ARTICLE XV

Tax Withholding

15.1. Tax Withholding. The Company shall have the power and the right to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy Federal, state, and local taxes, domestic or foreign, required by law or regulation to be withheld with respect to any taxable event arising as a result of the Plan.

15.2. Share Withholding. With respect to withholding required upon the exercise of Options or SARs, upon the lapse of restrictions on Restricted Stock or Stock Units, or upon any other taxable event arising as a result of Awards granted hereunder, Participants may elect, subject to the approval of the Committee, to satisfy the withholding requirement, in whole or in part, by having the Company withhold Shares having a Fair Market Value on the date the tax is to be determined equal to the minimum statutory total tax which would be imposed on the transaction. All such elections shall be irrevocable, made in writing, signed by the Participant, and shall be subject to any restrictions or limitations that the Committee, in its sole discretion, deems appropriate.

ARTICLE XVI

Indemnification

16.1. Indemnification. Each person who is or shall have been a member of the Committee or of the Board shall be indemnified and held harmless by the Company against and from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which he may be involved by reason of any action taken or failure to act under the Plan and against and from any and all amounts paid by him in settlement thereof, with the Company’s approval, or paid by him or her in satisfaction of any judgment in any such action, suit, or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company’s Articles of Incorporation or Bylaws, as a matter of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

ARTICLE XVII

Requirements of Law

17.1. Requirements of Law. The granting of Awards and the issuance of Stock in connection with any Award shall be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

17.2. Governing Law. The Plan, and all agreements hereunder, shall be construed in accordance with and governed by the laws of the State of Arizona.

17.3. Securities Law Compliance. With respect to “insiders,” transactions under the Plan are intended to comply with all applicable conditions of Rule 16b-3 or its successors under the Securities Exchange Act of 1934, as amended. To the extent any provision of the Plan or action by the Committee fails to so comply, it shall be deemed null and void, to the extent permitted by law and deemed advisable by the Committee. An “insider” includes any individual who is, on the relevant date, an officer, Director or more than 10% beneficial owner of any class of the Company’s equity securities that is registered pursuant to Section 12 of the Exchange Act, all as defined under Section 16 of the Exchange Act.

17.4. Severability. In the event any provision of the Plan shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of the Plan, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

ARTICLE XVIII

Miscellaneous

18.1. Funding of Plan. Except in the case of Awards of Restricted Stock, the Plan shall be unfunded. The Company shall not be required to segregate any of its assets to assure the payment of any Award under the Plan. Neither the Participant nor any other persons shall have any interest in any fund or in any specific asset or assets of the Company or any other entity by reason of any Award, except to the extent expressly provided hereunder. The interest of each Participant and former Participant hereunder are unsecured and shall be subject to the general creditors of the Company.

18.2. Successors. All obligations of the Company under the Plan with respect to Awards granted hereunder shall be binding on any successor to the Company, whether the existence of such successor is the result of a direct or indirect merger, consolidation, purchase of all or substantially all of the business and/or assets of the Company or otherwise.

18.3. Fractional Shares. No fractional Shares shall be issued or delivered pursuant to the Plan or any Award. The Committee shall determine whether cash, other Awards or other property shall be issued or paid in lieu of such fractional Shares or whether such fractional Shares or any rights thereto shall be forfeited or otherwise eliminated.

18.4. Gender and Number; Headings. Except where otherwise indicated by the context, any masculine term used herein also shall include the feminine; the plural shall include the singular and the singular shall include the plural. Headings are included for the convenience of reference only and shall not be used in the interpretation or construction of any such provision contained in the Plan.

Amended

December 2, 2005

UNISOURCE ENERGY CORPORATION

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

CHARTER

| | The Audit Committee of the Board of Directors (the “Committee”) consists of no fewer than three independent Directors appointed annually by the Board. Directors eligible to serve on the Committee shall be determined in accordance with the NYSE Listed Company Manual, Corporate Governance Standards for Audit Committees and the Sarbanes-Oxley Act of 2002. The Board shall designate one of the Committee members as Chairman of the Committee. Each member of the Committee shall be financially literate, and at least one member shall have accounting or financial management expertise. |

2. | APPOINTMENT AND REMOVAL OF COMMITTEE MEMBERS |

| | All members of the Committee shall be appointed and/or removed by the Board of Directors. |

| | The Committee will hold at least four regular meetings each year, and such additional meetings as it may deem necessary. Additional meetings will be called by the Chairman of the Committee. The agendas for the regular meetings shall include all items necessary to complete the duties of the Committee as set forth herein. In addition to the Committee members and the Secretary, the Chairman of the Board, Chief Executive Officer and other members of management, internal audit and representatives of the independent auditors may attend as appropriate. |

| | The Committee will determine its own rules of procedure with respect to how its meetings are to be called, as well as the place and time. |

| | Each member will be paid such fees as may be established from time to time by the Board for service on the Committee, and will be reimbursed for travel expenses incurred by attendance at meetings. Directors’ fees are the only compensation an Audit Committee member may receive from the Company. |

| | The Secretary of the Committee will be the Corporate Secretary of the Company (or such other representative of management as the Committee may designate) and not be a member of the Committee. The Secretary will attend all meetings and maintain minutes, advise members of all meetings called, arrange with the Chairman or other convening authority for preparation and distribution of the agenda for each meeting, and carry out other functions as may be assigned from time to time by the Committee. At such meetings where attendance by a Company representative is not appropriate, the Chairman shall act as |

| | secretary of the meeting or appoint another member of the Committee to act as secretary of such meetings. |

| | A majority of the total membership of the Committee will constitute a quorum. |

| | The Audit Committee is appointed by the Board to assist with Board oversight of |

| | (1) | the integrity of the Company’s financial statements |

| | (2) | the Company’s compliance with legal and regulatory requirements, except those handled by the Environmental, Safety & Security Committee |

| | (3) | the independent auditor’s qualifications and independence, and, |

| | (4) | the performance of the Company’s internal audit function and independent auditors. |

| | The Audit Committee must also prepare the report that SEC rules require be included in the Company’s annual proxy statement. |

9. | SPECIFIC DUTIES OF THE COMMITTEE |

| | (1) | Sole authority to appoint, retain and terminate the Company’s independent auditor. |

| | (2) | Sole authority to approve all audit engagement fees and terms, as well as all significant, non-audit engagements (in accordance with SEC) with the independent auditors. |

| | (3) | Annually obtain and review a report from the independent auditors delineating all relationships between the auditor and the Company (to assess the auditors’ independence). |

| | (4) | Review the experience and qualifications of the lead partner of the independent auditor. |

| | (5) | Ensure the rotation of the audit partner(s) as required by law. |

| | (6) | At least annually, obtain and review a report from the independent auditors describing the firm’s internal quality control process, including any material issues raised by the most recent internal quality control review or peer review of the firm, or by any inquiry or investigation by governmental, regulatory or professional authorities within the past five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues. |

| | (7) | Review the results of each independent audit, including any qualifications in the independent auditor’s opinion, and deficiencies identified by the independent auditor in connection with the audit. |

| | (8) | Review the annual audited financial statements with management and the independent auditor, including management’s discussion and analysis, major issues regarding accounting and auditing principles and practices, as well as the adequacy of internal |

| | | controls. Recommend to the Board, based on such review and discussion, whether the audited financial statements should be included in the Company’s annual report on Form 10-K. |

| | (9) | Annually review an analysis prepared by management and the independent auditor of significant financial reporting issues, quality of financial reporting, and judgments made in connection with the preparation of the Company’s financial statements, including an analysis of the effect of alternative GAAP methods on the Company’s financial statements. Review the procedures employed by the Company in preparing published financial statements and related management commentaries. |

| | (10) | Review with management and the independent auditor the Company’s quarterly financial statements prior to the filing of its Form 10-Q, including management’s discussion and analysis and the results of the independent auditors’ review of the quarterly financial statements (SAS 90). Note: This can be performed by a member of the Audit Committee. |

| | (11) | Discuss annually with the independent auditor the required communications contained within Statement on Auditing Standards No. 61 relating to the conduct of the audit. |

| | (12) | Discuss with the independent auditor material issues on which the national office of the independent auditor was consulted by the Company’s audit team. |

| | (13) | Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit. |

Internal Audit: