UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | |

| | Filed by the Registrantý |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

|

ý |

|

Preliminary Proxy Statement |

|

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

|

Definitive Proxy Statement |

|

o |

|

Definitive Additional Materials |

|

o |

|

Soliciting Material Pursuant to §240.14a-12

|

| | | | |

Cameron International Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

| | |

| | Jack B. Moore

Chairman of the Board

|

To the Stockholders of Cameron International Corporation:

You are cordially invited to attend the Annual Meeting of Stockholders of Cameron International Corporation to be held on Friday, May 11, 2012, at Cameron's corporate headquarters, 1333 West Loop South, Suite 1700, Houston, Texas, commencing at 10:00 a.m.

At this year's Annual Meeting, you will be asked to vote on a number of items more fully addressed in our Notice of Annual Meeting of Stockholders, including the election of directors, our executive pay practices, and amendments to the Company's Amended and Restated Certificate of Incorporation.

We know that most of our stockholders will not be attending the Annual Meeting in person. As a result, Cameron's Board of Directors is soliciting proxies so that each stockholder has an opportunity to vote on all matters that are scheduled to come before the meeting.If you do not plan to attend, please vote your shares by Internet, by telephone, or, if you received our proxy material by mail, by returning the accompanying proxy card, as soon as possible so that your shares will be voted at the meeting. Instructions on how to vote can be found in our Proxy Statement.

Thank you for your continued support of and interest in Cameron.

| | |

| | Very truly yours, |

|

|

|

| | |

|

| | Jack B. Moore |

Table of Contents

| | |

| | CAMERON INTERNATIONAL CORPORATION

1333 West Loop South, Suite 1700

Houston, Texas 77027

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| Time | | | 10:00 a.m. on May 11, 2012 |

Place |

|

|

1333 West Loop South, Suite 1700, Houston, Texas |

Items of Business |

|

|

1. |

|

To elect four director nominees to our Board of Directors as Class II Directors. |

|

|

|

2. |

|

To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accountants for 2012. |

|

|

|

3. |

|

To conduct an advisory vote to approve the Company's 2011 executive compensation. |

|

|

|

4. |

|

To approve an amendment to the Company's Amended and Restated Certificate of Incorporation ("Certificate of Incorporation") to provide for the annual election of all directors. |

|

|

|

5. |

|

To approve an amendment to the Company's Certificate of Incorporation to provide that, with certain exceptions, the Court of Chancery of the State of Delaware be the exclusive forum for certain legal actions. |

|

|

|

6. |

|

To approve a restatement of the Certificate of Incorporation, which would integrate all amendments since its original filing in 1994 and remove obsolete provisions. |

|

|

|

7. |

|

To transact any other business as may properly come before the meeting or any adjournment thereof. |

Record Date |

|

|

March 16, 2012 |

Annual Report |

|

|

Cameron's Annual Report to Stockholders for the year ended December 31, 2011, which is not a part of the proxy solicitation materials, is available on our website atwww.c-a-m.com/investors. If you received a printed copy of the proxy materials, a printed Annual Report was enclosed. |

Notice Regarding The

Availability of Proxy Materials |

|

|

On or about March , 2012, we mailed to Stockholders who have not elected to receive printed versions of our proxy materials a Notice informing them of the Internet availability of our 2012 proxy materials and containing instructions on how to access these materials and how to vote. |

Proxy Voting |

|

|

Stockholders of record may vote in person at the meeting, but may also appoint proxies and vote their shares in one of three ways, by: |

| | | | • | | Internet |

| | | | • | | Telephone |

| | | | • | | Mail |

|

|

|

Stockholders whose shares are held by a bank, broker or other holder of record may appoint proxies and vote as instructed by that bank, broker or other holder of record. |

|

|

|

Any proxy may be revoked at any time prior to its exercise at the meeting.

|

| | |

| | By Order of the Board of Directors, |

| |

|

| | Grace B. Holmes |

| | Corporate Secretary and Chief Governance Officer |

| | March , 2012 |

Table of Contents

TABLE OF CONTENTS

| | |

CONTENTS

| | PAGE

|

|---|

|

|

|

Proxy Summary Information | | |

Business Highlights | | i |

Executive Compensation Highlights | | i |

Corporate Governance Highlights | | ii |

Proposals for Stockholder Action | | iii |

Recommendations of the Board of Directors Regarding the Proposals | | iv |

Communicating with the Board of Directors | | iv |

Governance Documents | | iv |

Information about the Notice of Internet Availability of Proxy Materials | | iv |

Questions and Answers about the Annual Meeting and Voting | | 1 |

Voting Securities and Principal Holders | | 4 |

Security Ownership of Certain Beneficial Owners | | 4 |

Security Ownership of Management | | 5 |

/*/PROPOSAL 1. Election of Directors | |

6 |

Selection Criteria and Qualifications of Director Candidates | |

6 |

Director Selection Process | | 6 |

Director Selection Criteria | | 7 |

Qualifications of Director Nominees and Continuing Directors | | 8 |

Director Nominees | | 8 |

Composite Business Experience of Directors | | 19 |

Corporate Governance | | 19 |

Overview | | 19 |

Corporate Governance Principles | | 19 |

Code of Ethics for Directors | | 19 |

Code of Conduct | | 19 |

Board's Role in Risk Oversight | | 20 |

Policy On Related Person Transactions | | 20 |

Compensation Committee Interlocks and Insider Participation | | 21 |

Stock Ownership Guidelines | | 21 |

Hedging Policy | | 21 |

The Board of Directors and Its Committees | | 21 |

Board Responsibilities | | 21 |

Board Committees | | 22 |

Board Leadership Structure | | 23 |

Director Independence | | 23 |

Meetings and Meeting Attendance | | 24 |

Communicating With the Board | | 24 |

Internet Access to Principles, Codes and Policies | | 25 |

Director Compensation | | 25 |

Director Compensation Table | | 26 |

/*/PROPOSAL 2. Ratification of the Appointment of Independent

Registered Public Accountants for 2012 | |

27 |

Audit Related Matters | |

27 |

Report of the Audit Committee | | 27 |

Audit Committee Financial Experts | | 29 |

Principal Accounting Firm Fees | | 29 |

Table of Contents

| | |

CONTENTS

| | PAGE

|

|---|

|

|

|

Pre-approval Policies and Procedures | | 30 |

/*/PROPOSAL 3. Advisory Vote to Approve 2011 Executive Compensation | |

30 |

Executive Compensation | |

31 |

Compensation Committee Report | | 31 |

Compensation Discussion and Analysis | | 31 |

Summary Compensation Table | | 47 |

Grants of Plan-Based Awards in Fiscal Year 2011 | | 49 |

Outstanding Equity Awards at Fiscal Year-End | | 51 |

Option Exercises and Stock Vested | | 52 |

Pension Benefits Table | | 52 |

Nonqualified Deferred Compensation | | 53 |

Potential Payments Upon Termination or Change in Control | | 53 |

/*/PROPOSAL 4. Approval of an Amendment to the Company's Certificate of

Incorporation to Provide for the Annual Election of All Directors | |

58 |

/*/PROPOSAL 5. Approval of an Amendment to the Company's Certificate of Incorporation to

Provide that the Court of Chancery of the State of Delaware be the Exclusive Forum

for Certain Legal Actions | |

58 |

/*/PROPOSAL 6. Approval of a Restatement of the Company's

Certificate of Incorporation | |

59 |

Other Business | |

60 |

Additional Information | | 60 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 60 |

Stockholder Proposals and Nominations for the 2013 Annual Meeting | | 60 |

Solicitation of Proxies | | 61 |

Electronic Delivery of Proxy Statement and Annual Report | | 62 |

Householding of Annual Meeting Materials | | 62 |

Stockholder List | | 63 |

Annual Report to Stockholders and Annual Report on Form 10-K | | 63 |

Appendix A — Amendment to the Company's Amended and Restated Certificate of Incorporation to Provide for the Annual Election of All Directors | |

64 |

Appendix B — Amendment to the Company's Amended and Restated Certificate of Incorporation to Provide that the Court of Chancery of the State of Delaware be the Exclusive Forum for Certain Legal Actions | |

65 |

Appendix C — Restated Certificate of Incorporation | |

66 |

Table of Contents

PROXY SUMMARY INFORMATION

This Summary is included to provide an introduction and overview of the information contained in this Proxy Statement. This is a summary only and does not contain all of the information we have included in the 2012 Proxy Statement. You should refer to the full Proxy Statement that follows for more information about the Company and the proposals you are being asked to consider.

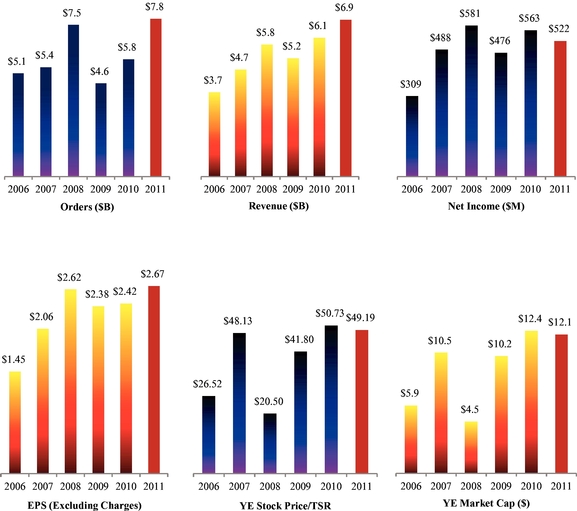

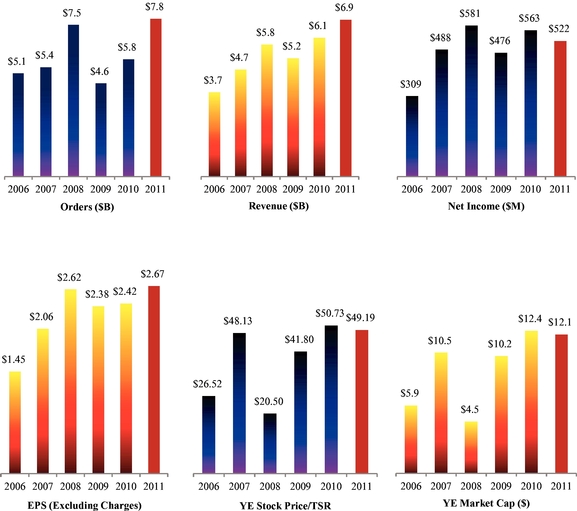

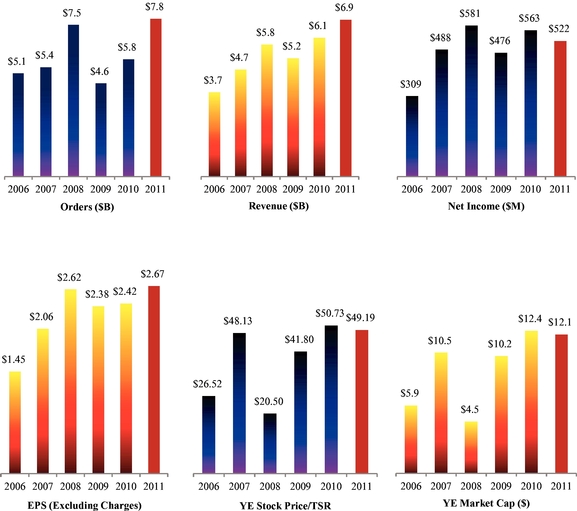

Business Highlights

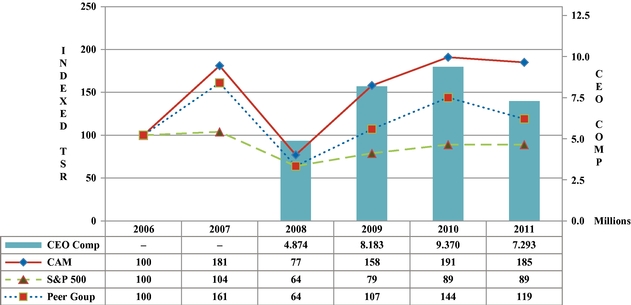

The graphs below provide a "snapshot" of the performance of the Company over the past 5 years.

Executive Compensation Highlights

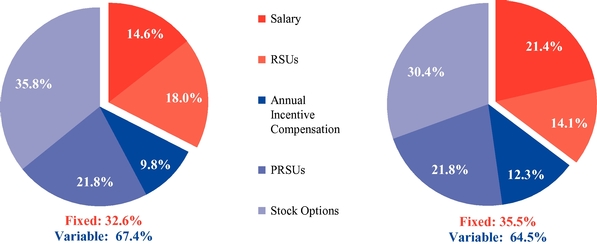

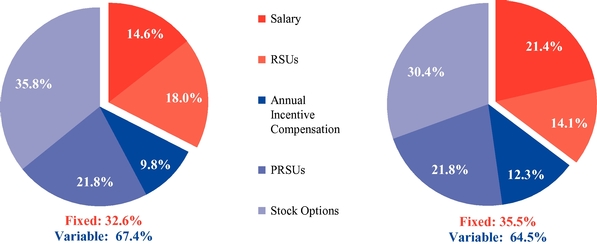

In 2011, our Compensation Committee made a number of decisions impacting 2012 executive compensation (see page 32 for more details):

- •

- A total shareholder return ("TSR") objective was added to a portion of our performance-based restricted stock unit ("PRSU") awards.

- •

- The portion of our long-term incentive compensation made up of performance-based restricted stock units for 2012 was increased from 30% to 40%; and that of stock options reduced from 50% to 40%.

i

Table of Contents

- •

- The target value of equity grants under our long-term incentive plan is now based upon proxy and peer group grant data for equivalent positions as well as stockholder value transfer.

- •

- Ten percent (10%) of annual incentive opportunities is now based on achieving improvements in safety.

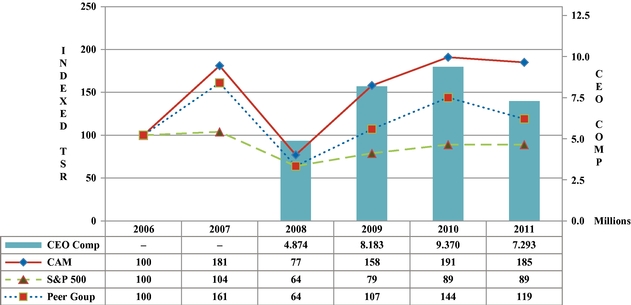

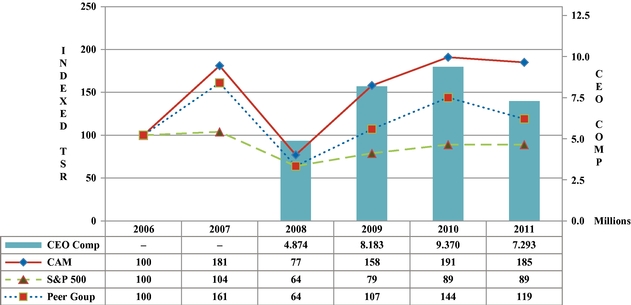

The following table shows a comparison of our TSR with that of our compensation peer group and the S&P 500 for the last five years, and with that of our CEO's total compensation from year-end 2008, the year during which he became our CEO.

Compensation Comparison of CEO Compensation vs. TSR

Corporate Governance Highlights

The Board has implemented several policies and structures that are "best practices" in corporate governance, including:

- •

- appointing an independent Presiding Director who participates in the process of preparing meeting agendas and schedules and presides over executive sessions of the Board of Directors;

- •

- holding executive sessions with only independent directors present in connection with each meeting of the Board;

- •

- engaging Frederick W. Cook & Co., an independent executive compensation consultant;

- •

- adopting majority voting in connection with elections of directors;

- •

- maintaining minimum stock ownership guidelines applicable to directors and executive officers;

- •

- approving a policy prohibiting certain derivative and speculative transactions involving Company stock by executive officers, directors and key employees; and

- •

- eliminating excise tax gross-ups for directors and executive officers.

ii

Table of Contents

Proposals for Stockholder Action

Below is a summary of the proposals on which you will vote. Please review additional information regarding these proposals included in this Proxy Statement.

Election of Directors (Proposal 1 — Page 6)

You will find important information about the qualifications and experience of each of the four director nominees that you are being asked to elect. The Nominating and Governance Committee performs an annual review to determine that our directors have the skills, experience and qualifications necessary to effectively oversee the management of the Company. All of our directors have integrity, proven leadership and a commitment to the financial and strategic success of the Company.

Appointment of Independent Registered Public Accountants (Proposal 2 — Page 27)

Ernst & Young LLP has served as the Company's independent registered public accountants since 1995. You are being asked to ratify the appointment of Ernst & Young by the Audit Committee for 2012.

Advisory Vote to Approve Executive Compensation (Proposal 3 — Page 30)

Our stockholders have the opportunity to cast a non-binding advisory vote on our executive compensation. We recommend that you review our Compensation Discussion and Analysis beginning on page 31, which explains the actions and decisions of the Compensation Committee of the Board during 2011 regarding our compensation programs. We are pleased that last year our stockholders approved the compensation of our named executive officers by a vote of 96%. Our stockholders also expressed a preference for an annual advisory vote and the Company is again conducting such a vote this year.

Vote on an Amendment to the Company's Certificate of Incorporation to Provide for the Annual Election of Directors (Proposal 4 — Page 58)

Our Board is currently divided into three classes and members of each class are elected to serve for staggered three-year terms. If the amendment is adopted, directors elected prior to the filing of the amendment with the Secretary of State of the State of Delaware (including directors elected at the 2012 Annual Meeting) will complete their three-year terms and, thereafter, such directors or their successors would be elected to one-year terms. Therefore, beginning with the 2015 Annual Meeting, the declassification of the Board would be complete and all directors would be subject to annual election.

Vote on an Amendment to the Company's Certificate of Incorporation to Provide that the Court of Chancery of the State of Delaware be the Exclusive Forum for Certain Legal Actions (Proposal 5 — Page 58)

This Amendment provides that, unless the Company consents in writing to the selection of an alternative forum or certain specified jurisdictional reasons, the Court of Chancery of the State of Delaware will be the exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company's stockholders, (iii) any action asserting a claim against the Company or any of its directors, officers or other employees alleging a violation of the Delaware General Corporation Law or the Company's Certificate of Incorporation or bylaws, or (iv) any action asserting a claim against the Company governed by the internal affairs doctrine.

iii

Table of Contents

Vote on a Restatement of the Company's Certificate of Incorporation (Proposal 6 — Page 59)

The restatement would incorporate all amendments to the Certificate of Incorporation approved by stockholders since the Certificate of Incorporation was filed when the Company completed its spin-off from its former parent. This would include amendments since the Certificate was initially filed in 1994, as well as any amendment approved at this meeting.

Recommendations of the Board of Directors Regarding the Proposals

Our Board unanimously recommends that you vote:

- 1.

- "FOR" each of the director nominees named in the Proxy Statement;

- 2.

- "FOR" the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accountants for 2012;

- 3.

- "FOR" the proposal to approve, on an advisory basis, the Company's 2011 executive compensation;

- 4.

- "FOR" the proposal to approve the amendment to the Certificate of Incorporation to provide for the annual election of directors;

- 5.

- "FOR" the proposal to approve the amendment to the Certificate of Incorporation to provide that the Court of Chancery of the State of Delaware be the exclusive forum for certain legal actions; and

- 6.

- "FOR" the proposal to approve a restatement of the Company's Certificate of Incorporation.

Communicating with the Board of Directors

Any interested party can communicate with our Board of Directors, any individual director or groups of directors by sending a letter addressed to the Board of Directors as a whole, to the individual director or to a group of directors, c/o Corporate Secretary, 1333 West Loop South, Suite 1700, Houston, Texas 77027.

Governance Documents

Governance documents, such as the Corporate Governance Principles, the Board Committee Charters, the Code of Ethics for Directors, the Code of Ethics for Senior Financial Officers, and the Code of Conduct for Employees, can be found in the "Governance" section of our website:www.c-a-m.com. Please note that documents and information on our website are not incorporated herein by reference. These documents are also available at no cost in print by writing to the Corporate Secretary, 1333 West Loop South, Suite 1700, Houston, Texas 77027.

Information about the Notice of Internet Availability of Proxy Materials

Pursuant to Securities and Exchange Commission ("SEC") rules and regulations, we have provided a Notice regarding Internet access to our proxy materials, including our 2011 Annual Report, to you because you have not elected to receive our proxy materials by mail. The Notice contains instructions on how you can access our proxy materials over the Internet as well as on how to request a printed copy. If you received such a Notice, you will not receive a printed copy of our proxy materials unless you request one.

iv

Table of Contents

If you wish to receive our proxy materials by mail in the future, you can so choose by following the instructions in the Notice Regarding the Availability of Proxy Materials. Your election to receive proxy materials by email will remain in effect until you terminate it.

Stockholders who hold their shares in "street-name", that is other than directly in their own names, but in the name of a bank, broker, or other holder of record, will receive a Notice Regarding the Availability of Proxy Materials directly from their bank, broker, or other holder of record.

Important Notice Regarding the Availability of Proxy Materials for the

2012 Annual Meeting of Stockholders to Be Held on May 11, 2012

v

Table of Contents

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 11, 2012

This Proxy Statement, and the accompanying proxy/voting instruction card ("proxy card"), are being made available to stockholders of record of Cameron International Corporation ("the Company") by the Company's Board of Directors ("Board") in connection with its solicitation of proxies to be used at the Company's 2012 Annual Meeting of Stockholders, scheduled to be held on May 11, 2012, or any postponements and adjournments thereof ("Annual Meeting" or "Meeting"). This Proxy Statement and any accompanying proxy card were first made available to stockholders beginning March , 2012.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

A Notice of Annual Meeting of Stockholders or Notice Regarding the Availability of Proxy Materials has been provided to you because the Board is soliciting your proxy to vote your shares at the Company's upcoming Annual Meeting.

What is the purpose of the Annual Meeting?

At the Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders on the cover page of this Proxy Statement.

Where can I find more information about proxy voting?

The SEC has created an educational website where you can learn more about proxy voting —www.sec.gov/spotlight/proxymatters.shtml.

Who is entitled to vote at the Meeting?

Owners of shares of the common stock of the Company ("Common Stock") at the close of business on March 16, 2012, (the "Record Date"), are entitled to vote at and participate in the Annual Meeting.

Participants in the Company's retirement savings plans, the Company-sponsored Individual Account Retirement Plan, the Nonqualified Deferred Compensation Plan, and the Deferred Compensation Plan for Non-employee Directors (collectively, "Retirement or Deferred Compensation Plans" or "Plans") may give voting instructions with respect to the Common Stock credited to their accounts in the Plans to the

Plans' trustees who have the actual voting power over the Common Stock in the Plans.

What are the voting rights of holders of Common Stock?

Each outstanding share of Common Stock will be entitled to one vote on each matter to come before the Meeting.

What happens if additional matters are presented at the Meeting?

If another proposal is properly presented for consideration at the Meeting, the persons named in the proxy card will vote as recommended by the Board or, if no recommendation is given, these persons will exercise their discretion in voting on the proposal.

How can shares be voted?

Shares of Common Stock can be voted in person at the Meeting or they can be voted by proxy or voting instructions can be given, in one of three ways, by:

- •

- Internet

- •

- telephone

- •

- mail

The instructions for each are on the proxy card, in the Notice Regarding the Availability of Proxy Materials, or on the voting form enclosed with the proxy from the trustee, bank or brokerage firm.

1

Table of Contents

How will votes be counted?

For shares held in your own name, votes will be counted as directed, except when no choice for any particular matter is made. In that case, and only for the matter for which no choice is indicated, the shares will be voted as recommended by the Board unless the shares are held in one of the Retirement or Deferred Compensation Plans. If held in one of these Plans, they will be voted in the same proportion as the other shares in the Retirement or Deferred Compensation Plans have been voted.

For shares held indirectly through a bank, broker or other holder of record, unless you give your broker, bank or other holder of record specific instructions, your shares will not be voted on any of the proposals other than Proposal 2. Under the New York Stock Exchange ("NYSE") rules that govern voting by brokers of shares held in street name, brokers have the discretion to vote these shares only on routine matters, but not on non-routine matters, as defined by those rules. The only matter that will be voted on that is considered routine under these rules is Proposal 2, the ratification of the appointment of Ernst & Young LLP to serve as our independent registered public accountants for fiscal year 2012.

What vote is required for approval?

With regard to Proposal 1, our Bylaws require that director nominees are elected by an affirmative vote of the majority of votes cast, except for certain exceptions that are not currently applicable.

The affirmative vote of the majority of shares of our common stock represented at the meeting and entitled to vote thereat is required for approval of each of the following proposals: Proposal 2 (ratification of independent registered public accountants) and Proposal 3 (advisory vote on the Company's 2011 executive compensation). The affirmative vote of 50% of the outstanding shares of common stock of the Company is required for approval of Proposal 5 (amendment of the Certificate of Incorporation to provide for the exclusive forum for certain legal actions in the Court of Chancery of the State of Delaware), and

Proposal 6, (a restatement of the Certificate of Incorporation).

The affirmative vote of 80% of the outstanding shares of common stock of the Company is required for approval of Proposal 4 (amendment of the Certificate of Incorporation to provide for the annual election of directors).

Two of the matters that will be presented to a vote of stockholders are advisory in nature and will not be binding on the Company or the Board of Directors: Proposal 2 (ratification of the appointment of independent registered public accountants) and Proposal 3 (approval of the 2011 executive compensation).

What is a broker non-vote and what is the effect of a broker non-vote?

A "broker non-vote" occurs when a street-name stockholder does not give instructions to the holder of record on how the stockholder wants his or her shares voted, but the holder of record exercises its discretionary authority under the rules of the NYSE to vote on one or more, but not all, of the proposals. In such a case, a "broker non-vote" occurs with respect to the proposals not voted on. Shares represented by "broker non-votes" will, however, be counted in determining whether a quorum is present.

In the absence of instructions from the stockholder, the holder of record may exercise its discretionary authority and vote the shares it holds as a holder of record only for Proposal 2 (the ratification of the appointment of the independent registered public accountants), and does not have the discretionary authority to vote them on any of the other Proposals.

Therefore, if you are a street-name stockholder, your shares will not be voted on any Proposal for which you do not give your broker, bank or other holder of record instructions on how to vote on any Proposal other than Proposal 2.

What is an abstention and what is the effect of an abstention?

If you do not desire to vote on any proposal or have your shares voted as provided for in the

2

Table of Contents

preceding answer, you may abstain from voting by marking the appropriate space on the proxy card or by following the telephone or Internet instructions. Shares voted as abstaining will be counted as present for the purpose of establishing a quorum and the purpose of determining the number of votes needed for approval of any proposal before the Meeting other than Proposals 4, 5 and 6.

Abstentions will be counted as votes cast but since they are not counted as "For", they have the effect of a negative vote for Proposals 1, 2 and 3.

What constitutes a quorum?

The presence at the Meeting of the holders of a majority of the shares of the Common Stock outstanding on the Record Date, in person or by proxy, will constitute a quorum, permitting business to be conducted at the Meeting. As of the Record Date, �� shares of Common Stock, representing the same number of votes, were outstanding. Therefore, the presence of the holders of Common Stock representing at least votes will be required to establish a quorum.

What shares will be considered "present" at the Meeting?

The shares voted at the Meeting, shares properly voted by Internet or telephone and shares for which properly signed proxy cards have been returned will be counted as "present" for purposes of establishing a quorum. Proxies containing instructions to abstain on one or more

matters, those voted on one or more matters and those containing broker non-votes will be included in the calculation of the number of votes considered to be present at the Meeting.

How can a proxy be revoked?

You can revoke a proxy at any time prior to a vote at the Meeting by:

- •

- notifying the Secretary of the Company in writing;

- •

- signing and returning a proxy with a later date; or

- •

- subsequent vote by Internet or telephone.

Shares held in the name of a bank, broker or other institution may be revoked pursuant to the instructions provided by such institution.

Who will count the votes?

The Company has hired a third party, Computershare Trust Company, N.A., to determine whether or not a quorum is present at the Meeting and to tabulate votes cast.

Where can I find the results of the voting?

The voting results will be announced at the Meeting and filed on a Form 8-K with the Securities and Exchange Commission within four business days of the Meeting.

3

Table of Contents

VOTING SECURITIES AND PRINCIPAL HOLDERS

Security Ownership of Certain Beneficial Owners

The following table lists the stockholders known by the Company to have been the beneficial owners of more than 5% of the Common Stock outstanding as of December 31, 2011, and entitled to be voted at the Meeting:

| | | | | | | | |

| |

| |

|

|---|

| | Name and Address of Beneficial Owner

| | Shares of

Common

Stock

| | Percent of

Common

Stock

| |

|

|---|

| | T. Rowe Price Associates, Inc.(1)

100 E. Pratt Street

Baltimore, MD 21202 | | 17,509,980 | | 7.10% | | |

| | BlackRock, Inc.(2)

40 East 52nd Street

New York, NY 10022 | | 15,119,098 | | 6.17% | | |

- (1)

- According to a Schedule 13G filed with the SEC by T. Rowe Price Associates, Inc. ("Price Associates") as of December 31, 2011, Price Associates had sole voting power over 5,637,643 shares of Common Stock and sole dispositive power over 17,509,980 shares of Common Stock. These securities are owned by various individual and institutional investors which Price Associates serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities.

- (2)

- According to a Schedule 13G filed with the SEC by BlackRock Inc. ("BlackRock") as of December 31, 2011, BlackRock had sole voting power and sole dispositive power over 15,119,098 shares of Common Stock. Various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Common Stock of Cameron, but no one person's interest is more than five percent of the total outstanding Common Stock.

4

Table of Contents

Security Ownership of Management

The following table sets forth, as of December 31, 2011, unless otherwise noted, the number of shares of Common Stock beneficially owned (as defined by the SEC) by each current director and each executive officer named in the Summary Compensation Table included herein who is not also a director, and by all directors and executive officers as a group.

| | | | | | | | | | |

| |

| |

| |

|

|---|

| | Directors

| | Number of

Shares of

Common

Stock

Owned

| | Number of Shares

That May Be

Acquired By

Options

Exercisable Within

60 Days(1)

| | Percent of Class

| |

|

|---|

| | C. Baker Cunningham | | 87,376 | | 0 | | * | | |

| | Sheldon R. Erikson | | 1,487,291 | | 472,666 | | * | | |

| | Peter J. Fluor | | 62,834 | | 0 | | * | | |

| | Douglas L. Foshee | | 24,298 | | 0 | | * | | |

| | Rodolfo Landim | | 2,755 | | 0 | | * | | |

| | Jack B. Moore | | 333,837 | | 691,289 | | * | | |

| | Michael E. Patrick | | 49,192 | | 0 | | * | | |

| | Jon Erik Reinhardsen | | 18,994 | | 0 | | * | | |

| | David Ross | | 33,192 | | 0 | | * | | |

| | Bruce W. Wilkinson | | 52,534 | | 0 | | * | | |

| | Executive Officers Named in the Summary Compensation Table Other Than Those Listed Above: | | | | | | | | |

| | Charles M. Sledge | | 120,243 | | 173,968(2) | | * | | |

| | John D. Carne | | 99,713 | | 182,469(2) | | * | | |

| | William C. Lemmer | | 150,897 | | 186,636(2) | | * | | |

| | James E. Wright | | 78,599 | | 136,267 | | * | | |

| | All directors and executive officers as a group (17 persons, including those named above) | | 2,722,164 | | 2,065,212 | | 2.0 | | |

- *

- Indicates ownership of less than one percent of Common Stock outstanding.

- (1)

- As defined by the SEC, securities beneficially owned include securities that the above persons have the right to acquire at any time within 60 days after December 31, 2011.

- (2)

- Includes shares held in the Company's Retirement Savings Plan as of December 31, 2011.

5

Table of Contents

ELECTION OF DIRECTORS — Proposal Number 1 on the Proxy Card

The Company's Certificate of Incorporation provides for a Board of Directors of between five and fifteen members divided into three classes. The current number of authorized directors is ten. The term of each class of directors is three years, and the term of one class expires each year in rotation, so that approximately one-third of the Board is elected each year. The term of the Class II directors expires at this year's Meeting, at which the stockholders will elect new Class II directors. The current Class II directors are C. Baker Cunningham, Sheldon R. Erikson, Douglas L. Foshee, and Rodolfo Landim.

Pursuant to the Company's Bylaws, directors are elected by a majority of the votes cast in the election, except in the case where there are more director nominees than open board seats. Should an incumbent director nominee be required, but fail, to receive a majority of the votes cast in the election, under the terms of our director resignation policy that director must submit his or her resignation to our Nominating and Governance Committee within five days of the election. The Committee will have 45 days from the election to accept or reject the resignation. In making its decision, the Committee may consider all factors it deems relevant, including the stated reason(s) why the stockholders voted against the director's election or re-election, whether the underlying reason for the failure to receive a majority vote is a Company matter that could be cured, the qualifications of the director, and whether the resignation would be in the best interests of the Company and its stockholders. The full Board will then have an additional 30 days to consider the Committee's recommendation. The Board's decision and its reasons therefore will be disclosed on a Current Report on Form 8-K filed with the SEC within four business days of its decision.

The Board recommends that stockholders vote "FOR" the election of each of the nominees.

SELECTION CRITERIA AND QUALIFICATIONS OF DIRECTOR CANDIDATES

Director Selection Process

The Nominating and Governance Committee is responsible for developing the Company's slate of candidates for director nominees for election by stockholders, which the Committee then recommends to the Board for its consideration. The Committee customarily engages the services of a third-party search firm to assist in the identification or evaluation of Board member candidates when searching for director nominees.

The Committee determines the required selection criteria and qualifications for director nominees based upon the needs of the Company at the time nominees are considered. The Committee determines these needs in relation to the composition of the Board evaluated as a whole. The Committee's primary objective is to assemble a group that can effectively work together using its diversity of experience and perspectives to see that the Company is well managed and represents the interests of the Company and its stockholders.

The qualifications the Committee uses to judge and select director candidates, including diversity, are discussed in "Director Selection Criteria," below. The Committee will consider the same criteria for nominees whether identified by the Committee, by stockholders or by some other source. When current Board members are considered for nomination for re-election, the Nominating and Governance Committee also takes into consideration their prior Board contributions, performance and meeting attendance records.

Stockholders wishing to identify a candidate for director may do so by sending the following information to the Nominating and Governance Committee, c/o Corporate Secretary, 1333 West Loop South, Suite 1700, Houston, Texas 77027: (1) the name of the candidate and a brief biographical sketch and resumé; (2) contact information for the candidate and a document evidencing the candidate's willingness to serve as a director, if elected; and (3) a signed statement as to the submitting stockholder's current status as a stockholder and the number of shares currently held.

6

Table of Contents

The Nominating and Governance Committee assesses each candidate based upon the candidate's resumé and biographical information, willingness to serve, and other background information. This information is evaluated against the criteria set forth below and the specific needs of the Company at the time. Based upon this preliminary assessment, candidates may be invited to participate in a series of interviews. Following this process, the Nominating and Governance Committee determines which candidates to recommend to the Board for nomination for election by our stockholders at the next annual meeting. The Nominating and Governance Committee uses the same process for evaluating all candidates, regardless of how the candidates are brought to the attention of the Committee.

No candidates for director were submitted to the Nominating and Governance Committee by any stockholder in connection with the 2012 Annual Meeting. Any stockholder desiring to present a director candidate for consideration by the Committee for our 2013 Annual Meeting must do so prior to September 1, 2012, in order to provide adequate time to duly consider the candidate and comply with our Bylaws.

Director Selection Criteria

A candidate, at a minimum, must possess the ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care. Candidates should be persons of high integrity who have exhibited proven leadership capabilities, experience with high levels of responsibilities within their chosen fields, and have the ability to quickly grasp complex principles of business, finance, and the complexities of a global industry subject to a myriad of laws and regulations. Candidates should have large public company experience and experience in the energy or oilfield service industry, preferably including operational experience, and hold or have held an established executive level position in business, finance or education. In general, qualified candidates who are currently serving as executive officers of unrelated entities would be preferred. The Nominating and Governance Committee will consider these same criteria for nominees whether identified by the Committee, by stockholders or by some other source. When current Board members are considered for nomination for re-election, the Nominating and Governance Committee also takes into consideration their prior Board contributions, performance and meeting attendance records.

Cameron is a diverse, global enterprise that generates approximately half of its revenues from locations outside the U.S. We do business in 300 locations, in more than 50 countries, with a workforce more than half of which is outside the U.S., spread over six continents. We translate our Compliance materials into ten different languages. We believe diversity includes gender and race, but we also believe it includes geographical and cultural diversity. As a company that has expanded significantly outside the U.S., it is important to, and in the best interest of, the Company to think in global terms and define diversity accordingly. While we believe that the primary criteria should be whether candidates have the qualifications, experience, skills and talents required to oversee the operations of a corporation as large and as complex as Cameron, we also believe that diversity is an important ingredient in a successful board mix. The Charter of our Nominating and Governance Committee provides that when evaluating director candidates, consideration will be given to those otherwise qualified individuals who offer diversity of geographical and/or cultural background, race/ethnicity, and/or gender, and that any search firm retained to assist the Committee in identifying director candidates be instructed to seek out and include diverse candidates for consideration.

In 2009, the Board elected Jon Erik Reinhardsen, president and CEO of Petroleum Geo-Services ASA, as a director. Mr. Reinhardsen, a Norwegian who resides in Oslo, Norway, has extensive experience in the global oilfield service industry, particularly in his home country, which is an important oil and gas producing region.

In 2011, the Board elected Rodolfo Landim, controlling partner and managing director of Mare Investimentos S.A., as a director. He provides extensive experience in the oil and gas industry, particularly within the oilfield service sector. Mr. Landim is a Brazilian residing in Rio de Janeiro and has held leadership and executive positions in several Brazilian entities, including Petroleo Brasileiro S.A. which is a wholly-owned subsidiary of Petrobras, for over 30 years.

7

Table of Contents

Qualifications of Director Nominees and Continuing Directors

The Nominating and Governance Committee and the Board of Directors have determined that each of our current directors meets the criteria that have been established. The following are the names of the nominees for director and the continuing directors, in order of their classification, including a description of each director's experience, qualifications and skills.

Director Nominees

CLASS II — TERM ENDING 2015

The Nominating and Governance Committee has recommended, and the Board has nominated, the following for reelection as Class II directors for a three-year term expiring at the Annual Meeting of Stockholders in 2015, or when their successors are elected and qualified. If any of the director nominees is unable or unwilling to serve as a nominee at the time of the Annual Meeting, the persons named as proxies may vote either (1) for a substitute nominee designated by the present Board to fill the vacancy, or (2) for the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. The Board has no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

The names of the nominees for director, their principal occupations during the past five years, other directorships held within the past five years, and certain other information are set out below.

8

Table of Contents

| | |

| |

C. BAKER CUNNINGHAM, Former Chairman of the Board, CEO and President of

Belden Inc. and Belden CDT Inc.

Director Since: 1996 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • International Operations • Engineering & Manufacturing Background • Former CEO • Advanced Degree • Corporate Governance | | Current Directorships: Rea Magnet Wire Company, Inc. Former Directorships Held During the Past 5 Years:

None Committee Assignments: Compensation Nominating and Governance |

Mr. Cunningham, age 70, has demonstrated his leadership capabilities, senior-level experience and the ability to deal with the complexities of business and finance in a global context and brings to our Board an in-depth knowledge of operations, finance and corporate governance. In addition, he has an engineering and manufacturing background, two of the core competencies required of the Company.

He has served in the roles of Chairman of the Board, CEO and President, first with Belden Inc., a wire, cable and fiber optic products manufacturing company, and then following a merger, as the President, CEO and director, of Belden CDT Inc., a manufacturer of high-speed electronic cables, focusing on products for the specialty electronic and data networking markets, including connectivity, with manufacturing operations in countries around the world. Mr. Cunningham also held a number of executive positions, including Executive Vice President, Operations, with Cooper Industries Inc., a diversified manufacturer, marketer and seller of electronic products, tools and hardware.

Mr. Cunningham is a director of Rea Magnet Wire Company, Inc., a privately held corporation in Fort Wayne, Indiana, and serves in positions of leadership in charitable and non-profit organizations, including President and a director of the Central Institute for the Deaf, St. Louis, Missouri.

He has a B.S. degree in Civil Engineering from Washington University, an M.S. degree in Civil Engineering from Georgia Institute of Technology, and an M.B.A. from the Harvard Graduate School of Business Administration.

9

Table of Contents

| | |

| |

SHELDON R. ERIKSON, Former Chairman of the Board, Chief Executive Officer and

President of Cameron

Director Since: 1995 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • International Operations • Engineering & Manufacturing Background • Former CEO • Advanced Degree • Corporate Governance | | Current Directorships: Endeavour International Corporation Rockwood Holdings, Inc. Former Directorships Held During the Past 5 Years: None Committee Assignment: None |

Mr. Erikson, age 70, was Chairman of the Board of Cameron from 1996 to May 2011. He was CEO and President of Cameron from the time of its creation in 1995 through the transition to our current President and CEO on April 1, 2008. Under Mr. Erikson's leadership, guidance and direction, Cameron grew from a company with annual revenues of $1.14 billion to one with $6.135 billion when Mr. Erikson retired in 2008. His knowledge of the Company and the industry and his continued involvement with the Company following the transition to our new CEO is of great value to the Board and the Company.

Prior to assuming his leadership role with Cameron, Mr. Erikson had a long and distinguished career in the energy and manufacturing sectors. He was Chairman of the Board, President and CEO of The Western Company of North America, an international petroleum service company engaged in pressure pumping, well stimulating and cementing and offshore drilling. Previously, he was President of the Joy Petroleum Equipment Group of Joy Manufacturing Company.

Mr. Erikson is a director of Endeavour International Corporation, an oil and gas exploration and production company, and Rockwood Holdings, Inc., a company in the specialty chemicals and advanced materials businesses, and has been a director of Triton Energy Company and Spinnaker Exploration Company, both oil and gas exploration companies, Layne Christensen Co., a provider of services and related products for the water, mineral and energy markets, and NCI Building Systems, a provider of products and services for the construction industry. He also serves on the boards of directors of the National Petroleum Council, American Petroleum Institute, National Ocean Industries Association and the Petroleum Equipment Suppliers Association, of which he is a past chairman. He also serves in positions of leadership in charitable and non-profit organizations, including The University of Texas MD Anderson Cancer Center and the Texas Heart Institute.

He has an M.B.A. from the Harvard Graduate School of Business Administration and studied engineering and economics at the University of Illinois.

10

Table of Contents

| | |

| |

DOUGLAS L. FOSHEE, Chairman, President & Chief Executive Officer of

El Paso Corporation

Director Since: 2008 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • Current CEO • Other Director Experience • International Operations • Corporate Governance • Advanced Degree | | Current Directorships: El Paso Corporation El Paso Pipeline GP Company, L.L.C. Former Directorships Held During the Past 5 Years: None Committee Assignment: Audit |

Mr. Foshee, age 52, is the Chairman and CEO of El Paso Corporation and a director of El Paso Pipeline GP Company, L.L.C., the general partner of El Paso's publicly traded master limited partnership, El Paso Pipeline Partners, L.P. He provides significant experience in the oil and gas industry and a depth of financial and corporate governance knowledge. He has held leadership and executive positions in the oilfield service sector, in which Cameron competes, and in finance.

Mr. Foshee served as Executive Vice President and Chief Operating Officer and Executive Vice President and Chief Financial Officer of Halliburton Company. Prior to Halliburton, he was President, CEO and Chairman of Nuevo Energy Company, an exploration and production company, and CEO and Chief Operating Officer of Torch Energy Advisors Inc., a privately-held energy company. He held various positions in finance and new business ventures with ARCO International Oil and Gas Company and spent several years in energy banking. He served as a Trustee of AIG Credit Facility Trust, overseeing the U.S. government's equity interest in American International Group for the benefit of the U.S. Treasury, and is Chairman of the Federal Reserve Bank of Dallas, Houston Branch.

He is on the Council of Overseers of the Jesse H. Jones Graduate School of Management at Rice University, Rice University's board of trustees and KIPP Houston's board of trustees. He also serves in positions of leadership in charitable and non-profit organizations, including the Texas Business Hall of Fame Foundation, Central Houston, Inc. and the Greater Houston Partnership.

Mr. Foshee has an MBA from the Jesse H. Jones School at Rice University, a B.B.A. degree from Southwest Texas State University and is a graduate of the Southwestern Graduate School of Banking at Southern Methodist University.

11

Table of Contents

| | |

| |

RODOLFO LANDIM, Controlling Partner and Managing Director of Mare

Investimentos S.A. and Chief Executive Officer, YXC Oleo e Gas

Director Since: 2011 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • International Operations • Engineering & Manufacturing Background • Current CEO • Other Director Experience | | Current Directorships: Mare Investimentos S.A. Former Directorships Held During the Past 5 Years: Smith International, Inc. Wellstream Holding PLC Committee Assignment: Audit |

Rodolfo Landim, age 54, is the Controlling Partner and Managing Director of Mare Investimentos S.A., a private equity and venture capital firm that seeks to invest in supply chain goods and services for the oil and gas sector in Brazil, and Chief Executive Officer of YXC Oleo e Gas, a Brazilian oil & gas company integrating business strategy and technical expertise to Brazil's exploration sector. He was elected to the Board in October 2011, and is the Board's second non-U.S. director. He provides extensive experience in the oil and gas industry, particularly within the oilfield service sector. He has held leadership and executive positions in several Brazilian entities for over 30 years.

He has served as President; Chief Executive Officer of OSX Brasil, an oil service company; Chief Executive Officer of OGX Petróleo e Gás Participaçöes S.A., the second largest Brazilian oil and gas company; Executive President of MMX Mineração & Metálicos S.A., a company operating in the mining, metal and logistics sectors. He also has served in various leadership positions with Petroleo Brasileiro S.A., a wholly-owned subsidiary of Petrobras. He is a former director of Smith International, Inc. and Wellstream Holding PLC in the United Kingdom and several public and private companies in Brazil.

He has a B.S. degree in Civil Engineering from Universidade Federal Do Rio De Janeiro, Petroleum Engineering Coursework from the University of Alberta, Edmonton, Alberta, Canada, and completed the Program for Management Development (PMD) at Harvard Business School.

12

Table of Contents

Continuing Directors

CLASS III — TERM ENDING 2013

| | |

| |

Michael E. Patrick, Former Vice President and Chief Investment Officer of Meadows

Foundation, Inc.

Director Since: 1996 |

| | |

Skills and Qualifications: • Financial Oversight

• Energy/Oil Field Services Experience

• Advanced Degree

• Other Director Experience | | Current Directorships: Apptricity Corporation Former Directorships Held During the Past 5 Years: BJ Services Company Committee Assignments: Audit, Chairman

Compensation |

Michael E. Patrick, age 68, brings to the Board and Cameron a depth of knowledge of the financial markets and matters of finance in general, as well as experience as a director of oil and gas service companies for 20 years. Until his retirement in 2010, he served as the Vice President and Chief Investment Officer of Meadows Foundation, Inc., a philanthropic association.

He is a director of Apptricity Corporation, which provides enterprise applications and services used to automate financial management, advanced logistics, supply chain, and workforce management, and was a director of BJ Services Company, an oilfield services company acquired by Baker Hughes International in 2010. He was a director of The Western Company of North America, an oilfield service company acquired by and merged into BJ Services Company.

He has a B.B.A. degree from Harvard University and an M.B.A. from the Harvard Graduate School of Business Administration and has been a director of Cameron since 1996.

13

Table of Contents

| | |

| |

Jon Erik Reinhardsen, President and Chief Executive Officer of Petroleum Geo-Services

ASA

Director Since: 2009 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • International Operations • Current CEO • Other Director Experience • Advanced Degree | | Current Directorships: Höegh LNG Holdings Ltd. Höegh Autoliners Holding AS AWilhelmsen Management AS Former Directorships Held During the Past 5 Years: None Committee Assignment: Audit Nominating and Governance |

Jon Erik Reinhardsen, age 55, adds to the Board a unique geographical and cultural perspective and he provides knowledge of the oil and gas industry, the oilfield service sector, and experience with other global industries from an executive level. He is President and CEO of Petroleum Geo-Services ASA (PGS), a company headquartered in Lysaker, Norway, that provides a broad range of products to help oil companies find oil and gas reserves offshore worldwide, including seismic and electromagnetic services, data acquisition, processing, reservoir analysis/interpretation and multi-client library data. He has been a Vice President of Alcoa Inc. and President of its Primary Products Global Growth, Energy and Bauxite businesses, and a Group Executive Vice President. He has also held various senior-level positions with Aker Kvaerner ASA, a provider of engineering and construction services, technology products and integrated solutions.

Mr. Reinhardsen's expertise with large-scale projects for offshore drilling, similar in scope and complexity to those of PGS and Aker Kvaerner, is extremely helpful in Cameron's evaluation and execution of its subsea systems projects. He serves on the boards of Höegh LNG Holdings Ltd., a provider of maritime LNG transportation and regasification services and publicly listed on the Oslo Stock Exchange, Höegh Autoliners Holding AS, a privately-owned Norwegian company and global provider of Ro/Ro vehicle transportation services which operates Pure Car and Truck Carriers (PCTCs) in global trade systems, and AWilhelmsen Management AS, a privately-owned investment company located in Oslo, Norway with holdings in shipping, retail, real estate, cruise vacations, and financial investments.

He has a Masters of Science degree in Applied Mathematics/Geophysics from the University of Bergen, Norway and attended the International Executive Program at the International Institute for Management Development in Lausanne, Switzerland.

14

Table of Contents

| | |

| |

Bruce W. Wilkinson, Principal of ANCORA Partners, LLC; Former Chairman, Chief

Executive Officer and President of McDermott International, Inc.

Director Since: 2002 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • Former CEO • Other Director Experience • International Operations • Corporate Governance • Advanced Degree | | Current Directorships: PNM Resources, Inc. Former Directorships Held During the Past 5 Years: McDermott International, Inc. Committee Assignments: Compensation Nominating and Governance |

Bruce W. Wilkinson, age 67, currently is a principal of ANCORA Partners, LLC, a private equity group. He provides extensive experience to the Board as a result of having served as Chairman, CEO and President of McDermott International, Inc., a leading global engineering and construction company serving the energy and power industries. In addition to his knowledge of the oilfield service sector and governance matters affecting public corporations, Mr. Wilkinson's familiarity with the large-scale, complex projects undertaken by McDermott is valuable to Cameron's evaluation and execution of its subsea systems projects, which carry similar challenges of scope and complexity.

He has served as Chairman and CEO of Chemical Logistics Corporation, a company formed to consolidate chemical distribution companies; President and CEO of Tyler Corporation, a diversified manufacturing and service company; Interim President and CEO of Proler International, Inc., a ferrous metals recycling company; and Chairman and CEO of CRSS, Inc. a global engineering and construction services company. He has also been a Principal of Pinnacle Equity Partners, L.L.C., a private equity group.

He serves on the Board of Directors of PNM Resources, Inc., an energy holding company based in New Mexico. He also serves in positions of leadership in charitable and non-profit organizations, including the University of St. Thomas in Houston, Texas, and the Duchesne Academy of the Sacred Heart in Houston, where he serves as a Trustee of each.

Mr. Wilkinson has B.A. and J.D. degrees from the University of Oklahoma and an LLM from the University of London.

15

Table of Contents

CLASS I — TERM ENDING 2014

| | |

| |

Peter J. Fluor, Chairman of the Board and Chief Executive Officer of Texas Crude

Energy, LLC

Director Since: 2005 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • Current CEO • Other Director Experience • International Operations • Advanced Degree | | Current Directorships: Anadarko Petroleum Corporation Fluor Corporation Texas Crude Energy, Inc. Former Directorships Held During the Past 5 Years: Devon Energy Company Committee Assignments: Compensation Committee, Chairman |

Peter J. Fluor, age 64, is the Chairman of the Board and CEO of Texas Crude Energy, Inc., a private, independent oil and gas exploration company, where he has been employed since 1972 in positions of increasing responsibilities, including President and Chief Financial Officer. He offers the perspective of an experienced leader and executive in the energy industry. He is a director of Fluor Corporation, a provider of engineering, procurement, construction, maintenance and project management, for which he served as Interim Chairman from January 1998 through July 1998, and is currently its Lead Independent Director. He is also a director of Anadarko Petroleum Corporation and a former director of Devon Energy Company, both exploration and production companies. He is a member of the All-American Wildcatters Association, and an Emeritus member of the Council of Overseers of the Jesse H. Jones Graduate School of Management at Rice University. He also serves in positions of leadership in charitable and non-profit organizations.

He has a B.S. degree in Business and an M.B.A. from the University of Southern California.

16

Table of Contents

| | |

| |

Jack B. Moore, Chairman, President and Chief Executive Officer of Cameron

Director Since: 2007 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • Current CEO • Other Director Experience • International Operations • Corporate Governance | | Current Directorships: KBR Corporation Former Directorships Held During the Past 5 Years: None Committee Assignments: None |

Jack B. Moore, age 58, is our current Chairman, President and CEO. He has a wealth of experience with Cameron and in the oilfield service sector and has had positions of increasing responsibility throughout his career evidencing his leadership capabilities and his understanding of the business and financial complexities of a global manufacturing company. Prior to becoming our President and CEO, he was Cameron's Chief Operating Officer, the President of Cameron's Drilling and Production Systems group and General Manager of Cameron's Western Hemisphere.

Before joining Cameron, he held various management positions, including Vice President, Eastern and Western Hemisphere Operations, of Baker Hughes Incorporated, where he was employed for 23 years. He currently serves on the Board of KBR Corporation, a technology-driven engineering, procurement and construction (EPC) company and defense services provider. He served on the board of Maverick Tube Corporation, a manufacturer of metal tubular goods for oil drilling, from 2005 until it was sold to Tenaris, S.A. in 2006. He serves on the Board of the Petroleum Equipment Suppliers Association, where he served as Chairman of the Board, the National Ocean Industries Association, and the American Petroleum Institute. He also serves in positions of leadership in charitable and non-profit organizations, including Spindletop Charities, the Greater Houston Partnership and The University of Houston C.T. Bauer College of Business Dean's Executive Board.

Mr. Moore has a B.B.A. from the University of Houston and attended the Advanced Management Program at Harvard Graduate School of Business Administration.

17

Table of Contents

| | |

| |

David Ross, Presiding Director and Investor

Director Since: 1995 |

| | |

Skills and Qualifications: • Executive Leadership and Financial Oversight • Energy/Oil Field Services Experience • Former CEO • Other Director Experience • Academia/Education • Corporate Governance • Advanced Degree | | Current Directorships: None Former Directorships Held During the Past 5 Years: Compete-At.com Process Technology Holdings Nuevo Energy Company

Committee Assignments: Nominating and Governance, Chairman Audit |

David Ross, age 71, is our Presiding Director. He offers broad executive experience in the oil and gas industry, finance and academia. He was Chairman and CEO of the Sterling Consulting Group, a firm which provides analytical research, planning and evaluation services to companies in the oil and gas industry; before that, he was a principal in the Sterling Group, a firm engaged in leveraged buyouts, primarily in the chemical industry, and in Camp, Ross, Santoski & Hanzlik, Inc., which provided planning and consulting services to the oil and gas industry; and was Treasurer of Enstar Corporation, an oil and gas company. He is an Emeritus member of the Council of Overseers of the Jesse H. Jones Graduate School of Management at Rice University and was an Adjunct Professor of Finance at Rice University for 25 years.

He has been a director of Compete-At.com, a company which provides online event registration and membership software, Process Technology Holdings, a company that manufactures linear valve actuators, and a director of Nuevo Energy Company, an exploration and production company. He also serves in positions of leadership in charitable and non-profit organizations, including the Nantucket Conservation Foundation and the Nantucket Historical Association.

Mr. Ross has a B.A. degree in Mathematics from Yale and an M.B.A. from the Harvard Graduate School of Business Administration.

18

Table of Contents

Composite Business Experience of Directors

The following table notes the breadth and variety of business experience that each of our directors brings to the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

|

|---|

| | Name

| |

| | Executive

Leadership

| |

| | Financial

Oversight

Responsibilities

| |

| | Energy/Oil

Field Services

| |

| | International

Operations

| |

| | Current or

Former CEO

| |

| | Advanced

Degree

| |

| | Other

Director

Experience

| |

|

|---|

| | C. Baker Cunningham | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

| | Sheldon R. Erikson | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

| | Peter J. Fluor | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

| | Douglas L. Foshee | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

| | Rodolfo Landim | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | | | | | ü | | |

| | Jack B. Moore | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | | | | | ü | | |

| | Michael E. Patrick | | | | ü | | | | ü | | | | ü | | | | | | | | | | | | ü | | | | ü | | |

| | Jon Erik Reinhardsen | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

| | David Ross | | | | ü | | | | ü | | | | ü | | | | | | | | ü | | | | ü | | | | ü | | |

| | Bruce W. Wilkinson | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | | | ü | | |

CORPORATE GOVERNANCE

Overview

Corporate governance is typically defined as the system that allocates authority, duties and responsibilities among a company's stockholders, board of directors and management. The stockholders elect the directors and vote on extraordinary matters; the board of directors acts as a company's governing body and is responsible for oversight of a Company's business and affairs and for hiring, overseeing, evaluating and compensating executive officers, particularly the chief executive officer ("CEO"); and management is responsible for managing a company's day-to-day operations.

The business and affairs of our Company are governed in accordance with the provisions of the Delaware General Corporation Law and the Company's Certificate of Incorporation and Bylaws. Our Board has adopted written policies to further guide and regulate actions.

Corporate Governance Principles

These Principles set out the essence of our rules and guidelines for self-governance and address such matters as the functions and duties of directors and the Board, the desired composition of our Board, its procedures as well as other matters such as stock ownership guidelines.

Code of Ethics for Directors

This Code is designed to promote honest and ethical conduct and compliance with applicable laws, rules, regulations and standards. Our Board recognizes that no code of conduct and ethics can replace the thoughtful behavior of an ethical director, but such a code can focus attention on areas of ethical risk, provide guidance to help recognize and deal with ethical issues, and help to foster a culture of honesty and accountability.

Code of Conduct

Our Code of Conduct applies to all of our employees and contractors and is designed to promote honest and ethical conduct and to articulate and provide guidance on our commitment to several key matters such as safety and health, protecting the environment, fair dealing, proper stewardship of our products, use of company resources, and accurate communication about our finances and products. It also addresses the many legal and ethical facets of integrity in business dealings with customers, suppliers, investors, the public, governments and the communities where we do business. Our Code of Conduct has been translated into more than ten languages and is distributed to our employees, who certify their commitment to and compliance with the Code on an annual basis.

19

Table of Contents

Board's Role in Risk Oversight

Our Board has and exercises ultimate oversight responsibility with respect to the management of the strategic, operational, financial and legal risks facing the Company and its operations and financial condition. The Board is involved in setting the Company's business and financial strategies and establishing what constitutes the appropriate level of risk for the Company and its business segments. Various committees of the Board also have responsibility for risk management.

The Board delegated to its Audit Committee the responsibility to oversee financial and compliance risks, including internal controls. It has delegated to its Nominating and Governance Committee the responsibility to oversee the effectiveness of the Company's compliance programs.

The Compensation Committee is responsible for assessing the nature and degree of risk that may be created by our compensation policies and practices to ensure the appropriateness of risk-taking and their consistency with the Company's business strategies. To conduct the assessment, the Committee, with the assistance of Frederick W. Cook & Co. Inc., its independent compensation consultant, reviews the Company's compensation policies and practices and in particular, our incentive plans, by plan, eligible participants, performance measurements, parties responsible for certifying performance achievement, and sums that could be earned. The Committee determined at its March 2012 meeting that the Company's compensation policies and practices do not encourage or create risk-taking that could be reasonably likely to have a material adverse impact on the Company.

Policy on Related Person Transactions

Our Board has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which the Company is a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% stockholders (or their immediate family members), each a "related person," has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship (a "related person transaction"), the related person must report the proposed related person transaction and the Board's Nominating and Governance Committee will review, and if appropriate, approve the proposed related person transaction. Any related person transaction that is ongoing in nature will be reviewed annually.

A related person transaction reviewed under the Policy will be considered approved or ratified if it is authorized by the Committee after full disclosure of the related person's interest in the transaction. As appropriate for the circumstances, the Committee will review and consider: the approximate dollar value of the amount involved; the related person's involvement in the negotiation of the terms and conditions, including the price of the transaction; the related person's interest in the related person transaction; whether the transaction was undertaken in the ordinary course of our business; whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party; the purpose of, and the potential benefits to us of, the transaction; and any other information regarding the transaction or the related person in the context of the proposed transaction that the Committee determines to be relevant to its decision to either approve or disapprove the transaction.

The Committee may approve or ratify the transaction only if the Committee determines that, under all of the circumstances, the transaction is not inconsistent with the Company's best interests. The Committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC's related person transaction disclosure rule, the Board has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not

20

Table of Contents

related person transactions for purposes of this policy:

- •

- interests arising solely from the related person's position as an executive officer of another entity that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, (c) the amount involved in the transaction equals less than the greater of $1 million or 2% of the annual consolidated gross revenues of the other entity that is a party to the transaction, and (d) the amount involved in the transaction equals less than 2% of the Company's annual consolidated gross revenues; and

- •

- a transaction that is specifically contemplated by provisions of the Company's Certificate of Incorporation or Bylaws, such as a contract of indemnity.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee is comprised entirely of independent directors. None of the members of the Committee during fiscal 2011 or as of the date of this proxy statement is or has been an officer or employee of the Company and no executive officer of the Company has served on the compensation committee or board of any company that employed any member of the Company's Compensation Committee or Board.

Stock Ownership Guidelines

The Company has had stock ownership guidelines for its directors, and stock ownership requirements for its officers and other key executives, since 1996. The Board adopted these guidelines and requirements in order to align the economic interests of the directors, officers and other key executives of the Company with those of all stockholders and to further focus their attention on enhancing stockholder value. Under these guidelines, outside directors are expected to own shares of Common Stock within one year, and own shares of Common Stock with a value of at least $300,000 within three years, of their election to the Board. Officers and other key executives are required to own Common Stock having a value between two and six times their base salary, as is more fully described in "Executive Compensation — Compensation Discussion and Analysis — Stock Ownership Requirements" on page 45 of this Proxy Statement. Valuation for these purposes is calculated using current fair market value or cost, whichever is greater. Deferred stock units ("DSUs") owned by directors and restricted stock units ("RSUs") owned by officers and other key executives are included in the stock ownership calculation. All directors and officers are in compliance with the guidelines.

Hedging Policy