| 787 Seventh Avenue |

| New York, NY 10019-6099 |

| Tel: 212 728 8000 |

| Fax: 212 728 8111 |

April 24, 2009

VIA EDGAR

Ellen Sazzman

Division of Investment Management

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: | Credit Suisse Trust (the “Trust”) |

| File Nos. 33-58125; 811-07261 |

| Post-Effective Amendment No. 29 Filed on March 2, 2009 |

Dear Ms. Sazzman:

This letter responds to comments on the above-referenced Post-Effective Amendment (the “Amendment”) that you provided in a telephone conversation with the undersigned and Jonathan Burwick of this office on April 17, 2009.

For your convenience, the substance of those comments has been restated below in italicized text. Defined terms, unless otherwise defined herein, have the meanings given them in the Amendment. The Registrant’s responses to each comment are set out immediately under the restated comment.

General Comments

Comment No. 1: Please confirm that the new name of each Portfolio is the name referenced in the Amendment and that the new name of each Portfolio matches the name associated with the Portfolio’s EDGAR identifier. Please also confirm that the name of each Portfolio referenced in the transmittal letter accompanying the filing of the Amendment and in the supplement filed on February 24, 2009 is the new name for the Portfolio.

Response: Upon the effectiveness of each Portfolio’s change in investment strategy as disclosed in the Amendment, its name will change. The new name of each Portfolio is the name referenced in the Amendment, the transmittal letter accompanying the Amendment and the supplement filed on February 24, 2009, all of which reference the same names for each respective Portfolio. The name associated with each Portfolio’s EDGAR identifier will be changed to reflect the Portfolio’s new name upon the effectiveness of the name change on or about May 1, 2009.

NEW YORK WASHINGTON PARIS LONDON MILAN ROME FRANKFURT BRUSSELS

in alliance with Dickson Minto W.S., London and Edinburgh

Comment No. 2: Explain whether the Trust obtained shareholder approval to make the changes in each Portfolio’s investment objective, strategies and policies. If no shareholder approval was obtained, explain why shareholder approval was not necessary and state the entity that approved the changes.

Response: Shareholder approval for the change in each Portfolio’s investment objective, strategies and policies was not obtained, as it was not required. The investment objective of each Portfolio may be changed without shareholder approval, as stated in each Portfolio’s prospectus. None of the Portfolios’ respective investment strategies is fundamental, and therefore may be changed without shareholder approval. In addition, following the proposed changes, each Portfolio’s investment strategies and policies will continue to comply with its fundamental investment restrictions, and therefore the proposed changes do not require shareholder approval of a change to any fundamental investment restrictions. The Board of Trustees of the Trust approved the changes to each Portfolio’s investment objective, strategies and policies.

Comment No. 3: The Trust filed a supplement pursuant Rule 497 under the Securities Act of 1933 (the “Securities Act”) on February 24, 2009. Please explain why the filing of such supplement is consistent with Section I.E. of the Securities and Exchange Commission (“Commission”) staff’s industry comment letter dated February 3, 1995, which states that registrants may not materially alter the nature of the fund contemplated in the last pre-effective amendment by merely filing a Rule 497(b) or (c) prospectus, but instead should use a post-effective amendment filed under Rule 485(a) as the vehicle for reflecting the change.

Response: The Registrant’s filing of the supplement on February 24, 2009 was filed under Rule 497(e) of the Securities Act, not Rule 497(b) or (c). Further, the supplement did not effect any changes to the Portfolios, but rather served as a notification to shareholders of impending changes to the Portfolios, which are scheduled to take effect on or about May 1, 2009. The Trust filed the Amendment pursuant to Rule 485(a) under the Securities Act for the purpose of effecting the changes to the Portfolios, consistent with Section I.E. of the industry comment letter referenced above.

Comment No. 4: Explain the reason for the Trust’s filing of four nearly identical prospectuses for the U.S. Portfolios and three nearly identical prospectuses for the International Portfolios.

Response: The Trust intends to harmonize the Portfolios’ investment strategies, because following the changes to each Portfolio’s investment strategy, the Trust intends to propose the merger of the U.S. Portfolios into one Portfolio and the merger of the International Portfolios into one Portfolio in order to realize economies of scale from a larger portfolio, assuming that the Portfolios to be merged are of sufficient size. The Trust will seek shareholder approval in connection with such mergers.

Comment No. 5: Please confirm that the new investment objective and strategies for each Portfolio will not focus on the particular sector indicated by the current name of the relevant Portfolio (e.g., Blue Chip Portfolio).

2

Response: The current name of each Portfolio will be changed (see response to Comment No. 1) and, thereafter, the Portfolio’s assets will be managed consistent with its new investment strategies.

Prospectus Comments

Comment No. 6: “Key Points — Goal and Principal Strategies” section. Please put the terms “long positions” and “short positions” in the third bulletpoint of the “Principal Strategies” section of the table into plain English.

Response: The above-referenced terms have been restated in plain English by replacing the phrase “hold long positions” with “purchase securities (i.e., hold long positions)” and replacing the phrase “hold short positions” with “sell securities short (i.e., hold short positions).”

Comment No. 7: “Key Points — Goal and Principal Strategies” section. Please clarify the meaning of the terms “balance sheet quality” and “earnings and price momentum” in the fifth bulletpoint of the “Principal Strategies” section of the table.

Response: An analysis of “balance sheet quality” is an attempt to quantify how a company management’s reporting of balance sheet items for a specific firm may deviate from standards followed by the majority of firms. To clarify the disclosure, the Registrant has changed the above term to “management’s approach to financial reporting.”

“Earnings and price momentum” is meant to refer to the strategy of trading in the direction of the current trend in prices or earnings. If the price or earnings of an equity is increasing, the portfolio manager is more likely to hold an overweight position for the Portfolio. If the price or earnings is decreasing, the portfolio manager is more likely to underweight or potentially hold a short position for the Portfolio. To clarify the disclosure, the Registrant has changed the above term to “level and trend of earnings and share price.”

Comment No. 8: “Key Points — Goal and Principal Strategies” section. Please clarify the meaning of the phrase “maintains investment attributes that are similar to those of the Russell 3000 Index” for the U.S. Portfolios and “maintains investment attributes that are similar to those of the MSCI EAFE Index” for the International Portfolios in the last bulletpoint of the “Principal Strategies” section of the table. Please also include the full name of the MSCI EAFE Index the first instance it is used.

Response: The above-referenced phrases have been revised to clarify their meaning. The revised disclosure includes the clause “the basket of securities included in” before the reference to the index. The full name of the International Portfolio’s Benchmark index is the MSCI EAFE Index, which is the name used in the prospectus. A description of the MSCI EAFE Index immediately follows the initial reference in the prospectus to the index.

3

Comment No. 9: “Key Points — A Word About Risk” and “More About Risk — Types of Investment Risk” sections. The discussion entitled “Derivatives Risk” identifies certain risks to which derivatives are subject. Please include such risks as separate principal risks.

Response: The risks referenced in the “Derivatives Risk” discussion are disclosed later in the prospectus. The Registrant does not consider such other risks as principal risks to each Portfolio, but rather identifies them as risks related to derivatives and discloses them in the “More About Risk — Types of Investment Risk — Other Risk Factors” section of the prospectus.

Comment No. 10: “Key Points — A Word About Risk” section. The discussion entitled “Derivatives Risk” identifies “options, forwards, futures and swap agreements” as types of derivatives. Please include, or provide a cross-reference to a section with, an explanation of such instruments.

Response: The instruments identified in the “Derivatives Risk” discussion are explained later in the prospectus in the table under the “More About Risk — Certain Investment Practices” section. A cross-reference to such section has been added to the “Derivatives Risk” discussion.

Comment No. 11: “Key Points — A Word About Risk” and “More About Risk — Types of Investment Risk” sections. The “Leveraging Risk” discussion states that “the portfolio uses leverage through activities such as borrowing, entering into short sales, purchasing securities on margin or on a “when-issued” basis, etc.” Purchasing securities on margin or on a “when-issued” basis are not disclosed as principal strategies. Please include disclosure of such practices in the principal strategies discussions.

Response: Neither purchasing securities on margin nor purchasing securities on a “when-issued” basis is a principal strategy, so additional disclosure has not been added.

Comment No. 12: “Key Points — A Word About Risk” section. Unless explained earlier in the prospectus, please clarify the meaning of the terms “short position” and “long position” in the discussion of “Short Sales Risk.”

Response: The terms “short position” and “long position” are explained earlier in the prospectus. Please see the response to Comment No. 6.

Comment No. 13: “Key Points — A Word About Risk” and “More About Risk — Types of Investment Risk” sections. Consider whether sector risk or industry concentration risk should be included as a principal risk, given that each Portfolio will have exposure to different industry sectors.

Response: The Portfolios will not concentrate their investments in any sector or industry, so additional disclosure has not been added.

Comment No. 14: “Key Points — A Word About Risk” and “More About Risk — Types of Investment Risk” sections. Consider whether counterparty risk should be disclosed as a separate principal risk.

4

Response: Short sales expose a Portfolio to counterparty risk. As a result, such risk is included in the discussion of “Short Sales Risk,” instead of being identified as a stand-alone risk.

Comment No. 15: “Key Points — A Word About Risk” and “More About Risk — Types of Investment Risk” sections. Please ensure that disclosure of principal risks is aligned with the principal strategies. For example, please include disclosure regarding risks associated with investing based on “expected growth potential and earnings and price momentum.” Additionally, please do not include small company risk as a principal risk, unless investing in small companies is disclosed as a principal strategy.

Response: We have reviewed the disclosure of principal risks to ensure that it is aligned with the principal strategies. The Registrant has not identified any principal risks particularly related to investing based on “expected growth potential and earnings and price momentum” that are not already included within the risks set out in each prospectus. Specifically, “Model Risk” and “Market Risk” cover the risks associated with investing based on “expected growth potential and earnings and price momentum.” With respect to investment in small companies, each Portfolio’s principal strategies include investment in small companies. Specifically, the “The Portfolio in Detail — Goal and Strategies” section of each prospectus states that “the portfolio may invest in equity securities without regard to market capitalization,” and therefore may invest in small-capitalization companies.

Comment No. 16: “Performance Summary” section. Please clarify supplementally the reason for including specific market indices in the Average Annual Total Returns table, such as the S&P Smallcap 600 Index, instead of the relevant benchmark index (i.e., Russell 3000 Index or MSCI EAFE Index).

Response: The performance information shown in the Average Annual Total Returns table is based on the current investment strategy of each Portfolio, not the new investment strategy of each Portfolio set out in the Amendment. Therefore, the Registrant is of the view that it is more appropriate to include the performance of the current benchmark index, instead of the performance of the new benchmark index. In next year’s post-effective amendment, the new benchmark will be used for comparison purposes.

Comment No. 17: “Investor Expenses — Fees and Portfolio Expenses” section. Please include a sentence in the introductory paragraph to the fee and expense table stating that if charges and expenses imposed under the variable contracts or plans were included in the fee and expense table, the fees and expenses shown would have been higher.

Response: The requested sentence has been added to the introductory paragraph.

Comment No. 18: “Investor Expenses — Fees and Portfolio Expenses” section. Please add a note to the fee and expense table that operating expenses are deducted from portfolio assets.

Response: The requested disclosure is currently reflected in the fee and expense table in parentheses under the row entitled “Annual portfolio operating expenses.”

5

Comment No. 19: “Investor Expenses — Fees and Portfolio Expenses” section. Please confirm that Credit Suisse obtained any necessary permission or approvals to impose dividends from short sales as a Portfolio expense.

Response: Each Portfolio’s investment advisory agreement with Credit Suisse does not require Credit Suisse to pay for any dividends incurred on securities the Portfolio borrowed in connection with a short sale. As a result, no permission or approvals to impose dividends from short sales as a Portfolio expense was necessary.

Comment No. 20: “Investor Expenses — Fees and Portfolio Expenses” section. Please confirm that no voluntary fee waivers or expense reimbursements are reflected in the fee and expense table and that no Portfolio incurred any acquired fund fees and expenses.

Response: There are no voluntary fee waivers or expense reimbursements reflected in any of the fees and expenses shown in the fee and expense tables and none of the Portfolios incurred, or expects to incur over the next fiscal year, any acquired fund fees and expenses. Some of the prospectuses show expected fees and expenses after voluntary fee waivers and expense reimbursements in a footnote to the fee table.

Comment No. 21: “The Portfolio in Detail — The Management Firm” section. Please include the aggregate fee paid to the investment adviser for the most recent fiscal year.

Response: The requested information is currently disclosed in the penultimate paragraph of the above-referenced section.

Comment No. 22: “The Portfolio in Detail — The Management Firm” section. (International Equity Flex III Portfolio only.) Please clarify whether all advisory fees are based on average daily net assets.

Response: The International Equity Flex III Portfolio’s advisory fee is based on two components: (1) a monthly base management fee of 1/12 of 1.20% of the average daily closing net asset value of the Portfolio plus or minus (2) a performance fee adjustment calculated by applying a variable rate of up to 0.20% (positive or negative) to average daily net assets during the applicable performance measurement period. The disclosure has been revised to clarify the advisory fee and method of its calculation.

Comment No. 23: “The Portfolio in Detail — Goal and Strategies” section. Please provide the market capitalization range for (i) the Russell 3000 Index in the prospectuses for the U.S. Portfolios and (ii) the MSCI EAFE Index in the prospectuses for the International Portfolios.

Response: The requested disclosure has been added.

Comment No. 24: “The Portfolio in Detail — Goal and Strategies” section. Please put the terms “long positions” and “short positions” in the second paragraph into plain English.

6

Response: The above-referenced terms have been explained earlier in the prospectus. Please see the response to Comment No. 6.

Comment No. 25: “The Portfolio in Detail — Goal and Strategies” section. Please clarify the statement that “[t]he portfolio normally will be managed by both overweighting and underweighting” relative to the Benchmark in the sixth paragraph of the above-referenced section.

Response: The Registrant has added the words “certain securities” after “underweighting” to clarify how the Portfolio will be managed. The sentence now states that “[t]he portfolio normally will be managed by both overweighting and underweighting certain securities and selling short certain securities relative to the Benchmark, etc.”

Comment No. 26: “The Portfolio in Detail — Goal and Strategies” section. The sixth paragraph of the above-referenced section states that the Portfolio “intends to limit its divergence from the Benchmark in terms of market, industry and sector exposures.” Such paragraph also states that “[t]he portfolio may invest in equity securities without regard to market capitalization.” Please state the circumstances under which the Portfolio will diverge from the Benchmark and invest in equity securities without regard to market capitalization.

Response: The Portfolio is not an index fund and is not intended to replicate the holdings in the Benchmark. Nevertheless, the divergence in terms of market, industry and sector weightings from the Benchmark will not normally be significant, which is what the disclosure is intended to advise investors of. Since the Benchmark includes large, medium and small cap companies, the disclosure is intended to put investors on notice that the Portfolio can do so as well.

Comment No. 27: “The Portfolio in Detail — Portfolio Investments” section. Please include convertible securities, rights and warrants and non-U.S. and restricted securities as principal strategies and identify principal risks related thereto. Please also explain the meaning of “restricted securities.”

Response: The information in the above-referenced section is provided in response to the second part of Item 4(b)(1) of Form N-1A which requires a registrant to describe “the particular type or types of securities in which the Fund principally invests or will invest.” The particular investment strategies that each Portfolio will implement are discussed in the “Goal and Strategies” subsection. All principal risks related to the Portfolio’s investment strategies and investments are disclosed as principal risks. Restricted securities are explained later in the prospectus in the table under the “More About Risk — Certain Investment Practices” section. A cross-reference to such section has been added.

Comment No. 28: “More About Risk — Types of Investment Risk” section. To the extent any of the risks discussed in the “Other Risk Factors” subsection are principal risks, please include them in the discussion of principal risks in the above-referenced section and in the earlier sections of the prospectus discussing principal risks.

Response: None of the risks discussed in the “Other Risk Factors” subsection are considered by the Registrant to be principal risks.

7

Comment No. 29: “More About Risk — Types of Investment Risk” section. Please clarify the meaning of “hedging instrument” in the definition of “Correlation Risk.”

Response: The term “hedging instrument” has been changed to “instrument used for hedging purposes.”

Comment No. 30: “More About Risk — Types of Investment Risk” section. Please clarify the description of “Exposure Risk — Speculative.”

Response: The second and third sentences of such risk factor have been replaced with the following sentence: “Potential losses from speculative positions in a derivative, such as writing uncovered call options, and from speculative short sales, are unlimited.”

Comment No. 31: “More About Risk — Types of Investment Risk” section. The description of “Interest-rate Risk” references “bonds and other fixed-income securities.” Please disclose the extent to which each Portfolio may invest in such securities.

Response: None of the Portfolios intends to invest in bonds and other-fixed income securities. As a result, the second sentence under the description of “Interest-rate Risk” which contains a reference to such securities has been deleted.

Comment No. 32: “More About Risk — Certain Investment Practices” section. Please state whether the investment limitations disclosed in the table are statutory or otherwise imposed.

Response: The investment limitations on “Borrowing,” “Restricted and other illiquid securities,” and “Securities lending” are statutory. All of the other investment limitations in the table are otherwise imposed.

Comment No. 33: “More About Risk — Certain Investment Practices” section. Please explain the purpose of the table, including how the strategies and risks contained therein relate to strategies and risks disclosed earlier in the prospectus. Please also include a discussion of short sales against the box, REITs, and short term trading earlier in the prospectus. Please explain the meaning of “Exchange-traded contracts” in the “Futures and options on futures” section of the table.

Response: The table has been in the Portfolios’ prospectuses since the prospectuses were “simplified” in response to Form N-1A changes several years ago. The table includes principal and non-principal investment practices in which the Portfolio may engage. As a result, certain of such practices are not disclosed earlier in the prospectus, which only discusses principal investment practices. Short sales against the box, investment in REITs and short-term trading are non-principal investment practices, and are therefore not discussed earlier in the prospectus. The futures and options on futures in which the Portfolio may invest are traded on an exchange. The Registrant has revised the phrase “exchange-traded contracts” to state “futures contracts traded on an exchange.”

Comment No. 34: “More About Risk — Certain Investment Practices” section. Please clarify the meaning of “initial margin and premium amounts” in footnote 2 to the table.

8

Response: Footnote 2 to the table has been revised to state that “[t]he portfolio is limited to using 5% of net assets for amounts necessary for initial margin and premiums on futures positions, etc.”

Comment No. 35: “Buying and Selling Shares” section. Please provide the legal basis for the right reserved by the Portfolio to take the actions discussed in the first, third and fifth bulletpoints of the above-referenced section.

Response: With respect to the right reserved by the Portfolio in the first bulletpoint, the language drafted is designed to be consistent with Rule 11a-3 under the Investment Company Act of 1940 (the “1940 Act”). With respect to the right reserved by the Portfolio in the third bulletpoint, it is our understanding that registered investment companies have a right to redeem-in-kind, as evidenced by Rule 18f-1 under the 1940 Act. With respect to the right reserved by the Portfolio in the fifth bulletpoint, the Portfolio is not required to sell shares and therefore may stop selling shares for a period of time.

Comment No. 36: “Buying and Selling Shares — Frequent Purchases and Sales of Portfolio Shares” section. Please explain whether the restriction on contract owners or plan participants determined to be engaged in market timing from making futures purchases or exchange purchases is permanent or temporary.

Response: The restriction is permanent.

Comment No. 37: Back Cover Page. Please include a statement that reports about the Portfolio are available on the EDGAR database on the Commission website, in compliance with Item 1(b)(3) of Form N-1A.

Response: The disclosure on the back cover page of each prospectus has been revised to make clear that reports about the Portfolio are available on the EDGAR database on the Commission website.

Statement of Additional Information Comments

Comment No. 38: “Management of the Trust — Disclosure of Portfolio Holdings” section. Please explain the meaning of the phrase “[u]nless the context clearly suggests that the recipient is under a duty of confidentiality” in the third paragraph of the above-referenced section.

Response: The meaning of the above-referenced phrase is meant to encompass situations where the recipient knows or reasonably should know that it is under a duty of confidentiality (e.g., an attorney receiving the information through an attorney-client relationship).

Comment No. 39: “Portfolio Manager” section. Please provide the information relating to conflicts of interest required by Item 15(a)(4) of Form N-1A.

9

Response: The information required by Item 15(a)(4) of Form N-1A is provided in the subsection entitled “Potential Conflicts of Interest.”

Part C Comments

Comment No. 40: Please file actual agreements as exhibits, not forms of agreements (unless actual agreements are not otherwise available, in which case they should be filed by amendment), and please file a power of attorney for the signatories.

Response: The only form of agreement filed is the form of Participation Agreement. The Registrant is of the view that it would be impracticable to file the actual Participation Agreements, as it is a type of agreement that is entered into with various entities, and there are a large number of actual agreements. The power of attorney is incorporated by reference.

Comment No. 41: Please provide the Tandy representations.

Response: The above-referenced Registrant has authorized us to represent that, with respect to filings made by the Registrant with the Commission and reviewed by the Commission’s staff (the “Staff”), it acknowledges that:

(a) the Registrant is responsible for the adequacy and accuracy of the disclosure in the filings;

(b) Staff comments or changes to disclosure in response to Staff comments in the filings reviewed by the Staff do not foreclose the Commission from taking any action with respect to the filings; and

(c) the Registrant may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Should you have any questions concerning the above, please call the undersigned at (212) 728-8138.

Sincerely, | |

| |

/s/ Elliot J. Gluck | |

| |

Elliot J. Gluck | |

cc: | J. Kevin Gao, Esq., Credit Suisse Asset Management, LLC |

| Rose DiMartino, Esq., Willkie Farr & Gallagher LLP |

| Jonathan Burwick, Esq., Willkie Farr & Gallagher LLP |

10

CREDIT SUISSE FUNDS

Prospectus

May 1, 2009

CREDIT SUISSE TRUST

n INTERNATIONAL EQUITY FLEX III PORTFOLIO

Credit Suisse Trust shares are not available directly to individual investors, but may be offered only through certain insurance products and pension and retirement plans.

As with all mutual funds, the Securities and Exchange Commission ("SEC") has not approved these securities, nor has it passed upon the adequacy or accuracy of this Prospectus. It is a criminal offense to state otherwise.

The Trust is advised by Credit Suisse Asset Management, LLC.

This prospectus will not be generally distributed or circulated in India. The portfolio shares may not be offered or sold directly or indirectly, in India or to any residents of India, except as permitted by applicable Indian laws and regulations.

CONTENTS

| KEY POINTS | | | 4 | | |

|

| Goal and Principal Strategies | | | 4 | | |

|

| A Word About Risk | | | 5 | | |

|

| Investor Profile | | | 7 | | |

|

| PERFORMANCE SUMMARY | | | 8 | | |

|

| Year-by-Year Total Returns | | | 8 | | |

|

| Average Annual Total Returns | | | 9 | | |

|

| INVESTOR EXPENSES | | | 10 | | |

|

| Fees and Portfolio Expenses | | | 10 | | |

|

| Example | | | 11 | | |

|

| THE PORTFOLIO IN DETAIL | | | 12 | | |

|

| The Management Firms | | | 12 | | |

|

| Portfolio Information Key | | | 13 | | |

|

| Goal and Strategies | | | 13 | | |

|

| Portfolio Investments | | | 15 | | |

|

| Risk Factors | | | 16 | | |

|

| Portfolio Management | | | 16 | | |

|

| Financial Highlights | | | 17 | | |

|

| MORE ABOUT RISK | | | 18 | | |

|

| Introduction | | | 18 | | |

|

| Types of Investment Risk | | | 18 | | |

|

| Certain Investment Practices | | | 22 | | |

|

| MEET THE MANAGERS | | | 26 | | |

|

| MORE ABOUT YOUR PORTFOLIO | | | 27 | | |

|

| Share Valuation | | | 27 | | |

|

| Distributions | | | 28 | | |

|

| Taxes | | | 28 | | |

|

| Statements and Reports | | | 30 | | |

|

| BUYING AND SELLING SHARES | | | 31 | | |

|

| OTHER INFORMATION | | | 33 | | |

|

| About The Distributor | | | 33 | | |

|

| FOR MORE INFORMATION | | | back cover | | |

|

3

KEY POINTS

GOAL AND PRINCIPAL STRATEGIES

| GOAL | | PRINCIPAL STRATEGIES | | PRINCIPAL RISK FACTORS | |

| Capital appreciation | | n Invests, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of foreign companies and derivatives providing exposure to equity securities of foreign companies

n Seeks to outperform the MSCI EAFE Index which is designed to measure the performance of equities in developed markets outside of North America, which include Europe, Australasia (Australia & New Zealand) and the Far East

n Generally will (i) purchase securities (i.e., hold long positions), either directly or through derivatives, in an amount up to approximately 130% of its net assets and (ii) sell securities short (i.e., hold short positions), either directly or through derivatives, in an amount up to approximately 30% of its net assets

n Uses proprietary quantitative models designed to:

n forecast the expected relative return of stocks by analyzing a number of fundamental factors, including a company's relative valuation, use of capital, management's approach to financial reporting, profitability, realized and expected growth potential and level and trend of earnings and share price

n identify stocks that are likely to suffer declines in price if market conditions deteriorate and either limit the portfolio's overall long exposure or increase the portfolio's overall short exposure to such low quality stocks and

n help determine the portfolio's relative exposure to different industry sectors by analyzing sector performance under different market scenarios

n Maintains investment attributes that are similar to those of the basket of securities included in the MSCI EAFE Index and intends to limit its divergence from the that index in terms of market, industry and sector exposures | | n Derivatives risk

n Foreign securities risk

n Leveraging risk

n Market risk

n Model risk

n Short sales risk

n Small companies

n Special-situation companies | |

|

4

g A WORD ABOUT RISK

All investments involve some level of risk. Simply defined, risk is the possibility that you will lose money or not make money.

Principal risk factors for the portfolio are discussed below. Before you invest, please make sure you understand the risks that apply to the portfolio. As with any mutual fund, you could lose money over any period of time.

Investments in the portfolio are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

DERIVATIVES RISK

Derivatives, such as options, forwards, futures and swap agreements (see "Certain Investment Practices" table beginning on page 22), are financial contracts whose value depends on, or is derived from, the value of an underlying asset, reference rate or index. The portfolio typically uses derivatives as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate or currency risks. The portfolio may also use derivatives for leverage. The portfolio's use of derivative instruments involves risk different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks described below, such as correlation risk, liquidity risk, interest-rate risk, market risk and credit risk. Also, suitable derivative transactions may not be available in all circumstances and there can be no assurance that the portfolio will engage in these transactions to reduce exposure to other risks when that would be beneficial.

FOREIGN SECURITIES RISK

A portfolio that invests outside the U.S. carries additional risks that include:

n Currency Risk Fluctuations in exchange rates between the U.S. dollar and foreign currencies may negatively affect an investment. Adverse changes in exchange rates may erode or reverse any gains produced by foreign-currency-denominated investments and may widen any losses. Although the portfolio may seek to reduce currency risk by hedging part or all of its exposure to various foreign currencies, it is not required to do so.

n Information Risk Key information about an issuer, security or market may be inaccurate or unavailable.

n Political Risk Foreign governments may expropriate assets, impose capital or currency controls, impose punitive taxes, or nationalize a company or industry. Any of these actions could have a severe effect on security prices and impair the portfolio's ability to bring its capital or income back to the U.S. Other political risks include economic policy changes, social and political instability, military action and war.

5

LEVERAGING RISK

When the portfolio uses leverage through activities such as borrowing, entering into short sales, purchasing securities on margin or on a "when-issued" basis or purchasing derivative instruments in an effort to increase its returns, the portfolio has the risk of magnified capital losses that occur when losses affect an asset base, enlarged by borrowings or the creation of liabilities, that exceeds the net assets of the portfolio. The net asset value of the portfolio when employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the portfolio to pay interest.

MARKET RISK

The market value of a security may fluctuate, sometimes rapidly and unpredictably. These fluctuations, which are often referred to as "volatility," may cause a security to be worth less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy, or the market as a whole. Market risk is common to most investments—including stocks and bonds and the mutual funds that invest in them.

MODEL RISK

The portfolio bears the risk that the proprietary quantitative models used by the portfolio manager will not be successful in identifying securities that will help the portfolio achieve its investment objectives, causing the portfolio to underperform its benchmark or other funds with a similar investment objective.

SHORT SALES RISK

Short sales expose the portfolio to the risk that it will be required to cover its short position at a time when the securities have appreciated in value, thus resulting in a loss to the portfolio. The portfolio's loss on a short sale could theoretically be unlimited in a case where the portfolio is unable, for whatever reason, to close out its short position. Short sales also involve transaction and other costs that will reduce potential gains and increase potential portfolio losses. The use by the portfolio of short sales in combination with long positions in its portfolio in an attempt to improve performance may not be successful and may result in greater losses or lower positive returns than if the portfolio held only long positions. It is possible that the portfolio's long equity positions will decline in value at the same time that the value of the securities it has sold short increases, thereby increasing potential losses to the portfolio. In addition, the portfolio's short selling strategies may limit its ability to fully benefit from increases in the equity markets. Short selling also involves a form of financial leverage that may exaggerate any losses realized by the portfolio. Also, there is the risk that the

6

counterparty to a short sale may fail to honor its contractual terms, causing a loss to the portfolio.

SMALL COMPANIES

Small companies may have less-experienced management, limited product lines, unproven track records or inadequate capital reserves. Their securities may carry increased market, liquidity, information and other risks. Key information about the company may be inaccurate or unavailable.

SPECIAL-SITUATION COMPANIES

"Special situations" are unusual developments that affect a company's market value. Examples include mergers, acquisitions and reorganizations. Securities of special-situation companies may decline in value if the anticipated benefits of the special situation do not materialize.

g INVESTOR PROFILE

This portfolio is designed for investors who:

n are investing for long-term goals

n are willing to assume the risk of losing money in exchange for attractive potential long-term returns

n are investing for capital appreciation

n want to diversify their investments internationally

It may NOT be appropriate if you:

n are investing for a shorter time horizon

n are uncomfortable with an investment that will fluctuate in value

n want to limit your exposure to foreign securities

n are looking for income

You should base your investment decision on your own goals, risk preferences and time horizon.

7

PERFORMANCE SUMMARY

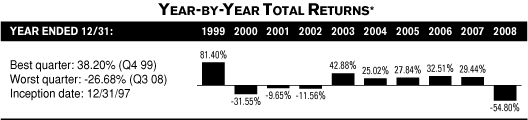

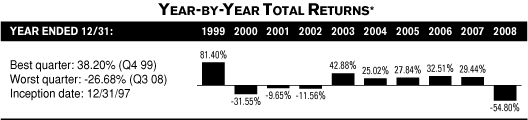

The bar chart below and the table on the next page provide an indication of the risks of investing in the portfolio. The bar chart shows you how the portfolio's performance has varied from year to year for up to 10 years. The table compares the portfolio's performance over time to that of a broad-based securities market index. The bar chart and table do not reflect additional charges and expenses which are, or may be, imposed under the variable contracts or plans; such charges and expenses are described in the prospectus of the insurance company separate account or in the plan documents or other informational materials supplied by plan sponsors. Inclusion of these charges and expenses would reduce the total return for the periods shown. As with all mutual funds, past performance is not a prediction of future performance.

* Effective May 1, 2009, the portfolio adopted new investment strategies so that its holdings are selected using quantitative stock selection models rather than the fundamental analysis approach and through which it invests primarily in foreign equity securities using a "flexible 130/30 strategy" in an attempt to outperform the MSCI EAFE Index. Investors should be aware that performance information shown above does not reflect the current investment strategies of the portfolio. Prior to May 1, 2009, the portfolio was known as "Emerging Markets Portfolio."

8

AVERAGE ANNUAL TOTAL RETURNS1

| PERIOD ENDED 12/31/08: | | ONE YEAR

2008 | | FIVE YEARS

2004-2008 | | TEN YEARS

1999-2008 | | INCEPTION

DATE | |

INTERNATIONAL EQUITY

FLEX III PORTFOLIO | | | -54.80 | % | | | 4.38 | % | | | 5.79 | % | | | 12/31/97 | | |

MSCI EMERGING MARKETS

FREE INDEX2

(REFLECTS NO DEDUCTIONS

FOR FEES AND EXPENSES) | | | -53.18 | % | | | 8.02 | % | | | 9.31 | % | | | | | |

1 Performance information shown above does not reflect the current investment strategies of the portfolio. Effective May 1, 2009, the MSCI EAFE Index replaced the MSCI Emerging Markets Free Index as the benchmark-index for the portfolio.

2 The Morgan Stanley Capital International Emerging Markets Free Index is a free float-adjusted market-capitalization index that is designed to measure equity-market performance in the global emerging markets. It is the exclusive property of Morgan Stanley Capital International Inc. Investors cannot invest directly in an index.

UNDERSTANDING PERFORMANCE

n Total return tells you how much an investment in the portfolio has changed in value over a given time period. It assumes that all dividends and capital gains (if any) were reinvested in additional shares. The change in value can be stated either as a cumulative return or as an average annual rate of return.

n A cumulative total return is the actual return of an investment for a specified period. The year-by-year total returns in the bar chart are examples of one-year cumulative total returns.

n An average annual total return applies to periods longer than one year. It smoothes out the variations in year-by-year performance to tell you what constant annual return would have produced the investment's actual cumulative return. This gives you an idea of an investment's annual contribution to your portfolio, assuming you held it for the entire period.

n Because of compounding, the average annual total returns in the table cannot be computed by averaging the returns in the bar chart.

9

INVESTOR EXPENSES

FEES AND PORTFOLIO EXPENSES

This table describes the fees and expenses you may pay as a shareholder. Annual portfolio operating expenses are estimated for the fiscal year ending December 31, 2009. The table below and the example on the next page do not reflect additional charges and expenses which are, or may be, imposed under the variable contracts or plans; such charges and expenses are described in the prospectus of the insurance company separate account or in the plan documents or other informational materials supplied by plan sponsors. If such charges and expenses were reflected in the table and example, the expenses shown below would have been higher. The portfolio's expenses should be considered with these charges and expenses in evaluating the overall cost of investing in the separate account.

Shareholder fees

(paid directly from your investment) | |

| Sales charge (load) on purchases | | | N/A | | |

| Deferred sales charge (load) | | | N/A | | |

| Sales charge (load) on reinvested distributions | | | N/A | | |

| Redemption fees | | | N/A | | |

| Exchange fees | | | N/A | | |

Annual portfolio operating expenses

(deducted from portfolio assets) | |

| Management fee1 | | | 1.00 | % | |

| Distribution and service (12b-1) fee | | | NONE | | |

| Other expenses | |

| Dividends on short sales2 | | | 0.80 | % | |

| All other expenses | | | 0.40 | % | |

| Total annual portfolio operating expenses3 | | | 2.20 | % | |

1 The portfolio pays a management fee that consists of two components: (1) a monthly base management fee calculated by applying a fixed rate of 1.20% ("Base Fee") plus or minus (2) a performance fee adjustment calculated by applying a variable rate of up to 0.20% (positive or negative) to average daily net assets during the applicable performance measurement period. The actual rate of the performance fee adjustment is based on the portfolio's performance relative to its previous benchmark index, the MSCI Emerging Markets Free Index, as follows:

Annualized Return

(Net of Expenses)

Relative to MSCI Emerging

Markets Free Index | | >2.00%

| | 2.00% to

1.00%

| | 1.00% to

0.00%

| | 0.00% to

-1.00%

| | -1.00% to

-2.00%

| | >-2.00%

| |

| Performance Adjustment | | +0.20% | | +0.10% | | None | | None | | -0.10% | | -0.20% | |

The performance fee adjustment went into effect on October 1, 2007. Based on performance as of December 31, 2008, the portfolio's advisory fee is comprised of a base fee of 1.20% and a performance adjustment of (0.31)%.

Credit Suisse Asset Management, LLC, the portfolio's investment adviser, has contractually agreed to waive its fee so that it does not exceed 1.00%. This arrangement will be terminated upon an amendment to the portfolio's investment advisory contract relating to a change in the management fee

10

to the lesser of (i) a monthly fee calculated at an annualized rate of 1.00% of the Portfolio's average daily net assets or (ii) the current management fee which consists of the Base Fee plus or minus the performance fee adjustment for the applicable performance measurement period.

2 Dividends on short sales are dividends paid to lenders on borrowed securities. These expenses relating to dividends on short sales will vary depending on whether the securities the portfolio sells short pay dividends and on the size of such dividends.

3 Credit Suisse Asset Management, LLC has also voluntarily agreed to waive an additional portion of its fees payable by the portfolio. Expected fees and expenses for the fiscal year ending December 31, 2009 (after waivers and expense reimbursements or credits) are shown below. Fee waivers and expense reimbursements reflected in the fees and expenses shown below are voluntary and may be discontinued at any time. Credit Suisse Asset Management, LLC will not reimburse the portfolio for any expenses relating to dividends on short sales.

EXPENSES AFTER WAIVERS,

REIMBURSEMENTS AND CREDITS | |

| Management fee | | | 0.95 | % | |

| Distribution and service (12b-1) fee | | | NONE | | |

| Other expenses | |

| Dividends on short sales | | | 0.80 | % | |

| All other expenses | | | 0.40 | % | |

| Net annual portfolio operating expenses | | | 2.15 | % | |

EXAMPLE

This example may help you compare the cost of investing in the portfolio with the cost of investing in other mutual funds. Because it uses hypothetical conditions, your actual costs may be higher or lower.

Assume you invest $10,000, the portfolio returns 5% annually, expense ratios remain as listed in the first table above (before fee waivers, expense reimbursements or credits), and you close your account at the end of each of the time periods shown. Based on these assumptions, your cost would be:

| ONE YEAR | | THREE YEARS | | FIVE YEARS | | TEN YEARS | |

| $ | 223 | | | $ | 688 | | | $ | 1,180 | | | $ | 2,534 | | |

11

THE PORTFOLIO IN DETAIL

g THE MANAGEMENT FIRMS

CREDIT SUISSE ASSET

MANAGEMENT, LLC

Eleven Madison Avenue

New York, NY 10010

n Investment adviser for the portfolio

n Responsible for managing the portfolio's assets according to its goal and strategies

n Is part of the asset management business of Credit Suisse, one of the world's leading banks

n Credit Suisse provides its clients with investment banking, private banking and asset management services worldwide. The asset management business of Credit Suisse is comprised of a number of legal entities around the world that are subject to distinct regulatory requirements

For easier reading, Credit Suisse Asset Management, LLC will be referred to as "Credit Suisse" or "we" throughout this Prospectus.

For the 2008 fiscal year, the portfolio paid Credit Suisse 0.64% of its average net assets for advisory services, due to voluntary fee waivers. The portfolio's contractual management fee consists of two components: (1) a monthly base management fee calculated by applying a fixed rate of 1.20% ("Base Fee") plus or minus (2) a performance fee adjustment calculated by applying a variable rate of up to 0.20% (positive or negative) to average daily net assets during the applicable performance measurement period. The actual rate of the performance fee adjustment is based on the portfolio's performance relative to its previous benchmark index, the MSCI Emerging Markets Free Index, as follows:

Annualized Return

(Net of Expenses)

Relative to MSCI Emerging

Markets Free Index | | >2.00%

| | 2.00% to

1.00%

| | 1.00% to

0.00%

| | 0.00% to

-1.00%

| | -1.00% to

-2.00%

| | >-2.00%

| |

| Performance Adjustment | | +0.20% | | +0.10% | | None | | None | | -0.10% | | -0.20% | |

Based on performance as of December 31, 2008, the portfolio's advisory fee was comprised of a base fee of 1.20% and a performance adjustment of (0.31)%.

Credit Suisse Asset Management, LLC, the portfolio's investment adviser, has contractually agreed to waive its fee so that it does not exceed 1.00%. This arrangement will be terminated upon an amendment to the portfolio's investment advisory contract relating to a change in the management fee to the lesser of (i) a monthly fee calculated at an annualized rate of 1.00% of the portfolio's average daily net assets or (ii) the current management fee which consists of the Base Fee plus or minus the performance fee adjustment for the applicable performance measurement period.

A discussion regarding the basis for the Board of Trustees' approval of the investment advisory and sub-advisory contracts of the portfolio is available in

12

the portfolio's Annual Report to shareholders for the period ended December 31, 2008.

g PORTFOLIO INFORMATION KEY

A concise description of the portfolio follows. The description provides the following information:

GOAL AND STRATEGIES

The portfolio's particular investment goal and the strategies it intends to use in pursuing that goal. Percentages of portfolio assets are based on total assets unless indicated otherwise.

PORTFOLIO INVESTMENTS

The principal types of securities in which the portfolio invests. Secondary investments are described in "More About Risk."

RISK FACTORS

The principal risk factors associated with the portfolio. Additional risk factors are included in "More About Risk."

PORTFOLIO MANAGEMENT

The individuals designated by the investment adviser to handle the portfolio's day-to-day management.

FINANCIAL HIGHLIGHTS

A table showing the portfolio's audited financial performance for up to five years. Certain information in the table reflects financial results for a single portfolio share.

n Total return How much you would have earned or lost on an investment in the portfolio, assuming you had reinvested all dividend and capital-gain distributions.

n Portfolio turnover An indication of trading frequency. The portfolio may sell securities without regard to the length of time they have been held. A high turnover rate may increase the portfolio's transaction costs and negatively affect its performance.

The Annual Report includes the independent registered public accounting firm's report, along with the portfolio's financial statements. It is available free upon request through the methods described on the back cover of this Prospectus.

g GOAL AND STRATEGIES

The portfolio seeks capital appreciation. To pursue this goal, it invests, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of foreign companies and derivatives providing exposure to equity securities of foreign companies. The portfolio will consist of the securities of companies included within the MSCI EAFE Index (the "Benchmark"), as well as other companies that the portfolio manager deems to have similar characteristics to the companies included in the Benchmark. The Benchmark is designed to measure the performance of equities in developed markets outside of North America, which include Europe, Australasia (Australia & New Zealand) and the Far East. As of March 31, 2009, the

13

Benchmark had a market capitalization range of approximately $482 million to $129.614 billion.

The portfolio generally will hold (i) long positions, either directly or through derivatives, in an amount up to approximately 130% of its net assets and (ii) short positions, either directly or through derivatives, in an amount up to approximately 30% of its net assets. The portfolio intends to maintain an approximate net 100% long exposure to the equity market (i.e., long market value minus short market value). The long and short positions held by the portfolio may vary over time depending on the relative performance of the portfolio's securities selections and the availability of attractive investment opportunities.

The term "flex" in the portfolio's name refers to the ability of the portfolio to vary from 100% to 130% its long positions and to vary from 0% to 30% its short positions, based on market conditions. While the portfolio intends to utilize short exposure, under certain conditions, it may be entirely long. In a traditional fund that does not permit short sales of securities, the fund's adviser can at most assign a zero weighting to securities that the adviser expects to underperform. With respect to the portfolio, however, the portfolio manager may actually sell securities short that it views as likely to decline in value or underperform. Additionally, the ability of the portfolio to sell securities short generally enables the portfolio to invest in additional securities as long positions while normally keeping the overall net exposure to the market the same as a traditional long-only strategy.

The portfolio intends to maintain an approximate net 100% long exposure to the equity market (i.e., long market value minus short market value). The long and short positions held by the portfolio may vary over time depending on the relative performance of the portfolio's securities selections and the availability of attractive investment opportunities. In times of unusual or adverse market, economic or political conditions, the portfolio's long positions may be closer to 100% and/or its short positions may be closer to 0% of its net assets.

The portfolio follows quantitative portfolio management techniques rather than a traditional fundamental equity research approach. The portfolio manager selects securities for the portfolio using proprietary quantitative models, which are designed to:

n forecast the expected relative return of stocks by analyzing a number of fundamental factors, including a company's relative valuation, use of capital, management's approach to financial reporting, profitability, realized and expected growth potential and level and trend of earnings and share price

n identify stocks that are likely to suffer declines in price if market conditions deteriorate and either limit the portfolio's overall long exposure or increase the portfolio's overall short exposure to such low quality stocks and

14

n help determine the portfolio's relative exposure to different industry sectors by analyzing sector performance under different market scenarios

The portfolio manager applies these models to companies that are represented in the Benchmark, as well as other companies that it deems to have similar characteristics to the companies included in the Benchmark. The portfolio normally will be managed by both overweighting and underweighting certain securities and selling short certain securities relative to the Benchmark, using the proprietary quantitative models discussed above and based on the expected return and the risks associated with individual securities considered relative to the portfolio as a whole, among other characteristics. In general, the portfolio will seek to maintain investment attributes that are similar to those of the basket of securities included in the Benchmark, and intends to limit its divergence from the Benchmark in terms of market, industry and sector exposures. The portfolio may invest in equity securities without regard to market capitalization.

The portfolio manager generally maintains a long or short position until the quantitative stock selection models described above indicate that such position be reduced or eliminated, although the portfolio manager is not required to reduce or eliminate the position under those circumstances. The portfolio manager may also reduce or eliminate a position in a security for a variety of reasons, such as to realize profits or take advantage of better investment opportunities.

Some companies may cease to be represented in the Benchmark after the portfolio has purchased their securities. The portfolio is not required to sell securities solely because the issuers are no longer represented in the Benchmark, and may continue to hold such securities.

The portfolio's 80% investment policy may be changed by the Board of Trustees on 60 days' notice to shareholders. The portfolio's investment objective may be changed without shareholder approval.

g PORTFOLIO INVESTMENTS

The portfolio's equity holdings may include:

n common stocks

n preferred stocks

n securities convertible into common stocks

n securities whose values are based on common stock, such as rights and warrants

The portfolio invests primarily in foreign equity securities, including both listed and unlisted securities, but may also invest in foreign securities and restricted securities or other instruments with no ready market (see "Certain Investment Practices" table on page 22). The portfolio may also engage in other investment practices, such as investing or using options, forwards, futures, swaps and other types of derivative instruments in

15

seeking to achieve its investment objective or for hedging purposes.

g RISK FACTORS

The portfolio's principal risk factors are:

n derivatives risk

n foreign securities risk

n leveraging risk

n market risk

n model risk

n short sales risk

n small companies

n special-situation companies

The portfolio's use of derivative instruments involves risk different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

Because the portfolio invests internationally, it carries additional risks, including currency, information and political risks. These risks are defined in "More About Risk."

When the portfolio uses leverage, the portfolio has the risk of magnified capital losses that occur when losses affect an asset base, enlarged by borrowings or the creation of liabilities, that exceeds the net assets of the portfolio. The net asset value of the portfolio when employing leverage will be more volatile and sensitive to market movements.

The value of your investment generally will fluctuate in response to stock-market movements.

The portfolio bears the risk that the proprietary quantitative models used by the portfolio manager will not be successful in identifying securities that will help the portfolio achieve its investment objectives, causing the portfolio to underperform the Benchmark or other funds with a similar investment objective.

Short sales expose the portfolio to the risk that it will be required to cover its short position at a time when the securities have appreciated in value, thus resulting in a loss to the portfolio. The portfolio's loss on a short sale could theoretically be unlimited in a case where the portfolio is unable, for whatever reason, to close out its short position. The use by a portfolio of short sales in combination with long positions in its portfolio in an attempt to improve performance may not be successful and may result in greater losses or lower positive returns than if the portfolio held only long positions.

Investing in small companies may expose the portfolio to increase market, liquidity and information risks. These risks are defined in "More About Risk."

Securities of companies in "special situations" may decline in value and hurt the portfolio's performance if the anticipated benefits of the special situation do not materialize.

"More About Risk" details certain other investment practices the portfolio may use. Please read that section carefully before you invest.

g PORTFOLIO MANAGEMENT

Jordan Low is responsible for the day-to-day portfolio management of the portfolio. Mr. Low is supported by a team of investment professionals from the Credit Suisse Quantitative Equities Group. See "Meet the Manager."

16

FINANCIAL HIGHLIGHTS

The figures below have been audited by the portfolio's independent registered public accounting firm, PricewaterhouseCoopers LLP, whose report on the portfolio's financial statements is included in the portfolio's Annual Report. The total returns do not reflect additional charges and expenses which are, or may be, imposed under the variable contracts or plans; if such charges and expenses were reflected, total returns would be lower.

| FOR THE YEAR ENDED DECEMBER 31: | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| Per share data | |

| Net asset value, beginning of year | | $ | 23.58 | | | $ | 21.85 | | | $ | 16.82 | | | $ | 13.25 | | | $ | 10.63 | | |

| Investment Operations | |

| Net investment income | | | 0.25 | | | | 0.37 | | | | 0.21 | | | | 0.14 | | | | 0.12 | | |

Net gain on investments and

foreign currency related items (both

realized and unrealized) | | | (10.11 | )1 | | | 5.58 | | | | 5.19 | | | | 3.53 | | | | 2.53 | | |

| Total from investment operations | | | (9.86 | ) | | | 5.95 | | | | 5.40 | | | | 3.67 | | | | 2.65 | | |

| Less Dividends and Distributions | |

| Dividends from net investment income | | | (0.34 | ) | | | (0.37 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.03 | ) | |

| Distributions from net realized gains | | | (9.30 | ) | | | (3.85 | ) | | | (0.26 | ) | | | — | | | | — | | |

| Total dividends and distributions | | | (9.64 | ) | | | (4.22 | ) | | | (0.37 | ) | | | (0.10 | ) | | | (0.03 | ) | |

| Net asset value, end of year | | $ | 4.08 | | | $ | 23.58 | | | $ | 21.85 | | | $ | 16.82 | | | $ | 13.25 | | |

| Total return2 | | | (54.80 | )% | | | 29.44 | % | | | 32.51 | % | | | 27.84 | % | | | 25.02 | % | |

| Ratios and Supplemental Data | |

| Net assets, end of year (000s omitted) | | $ | 53,245 | | | $ | 179,817 | | | $ | 242,319 | | | $ | 186,190 | | | $ | 115,224 | | |

| Ratio of expenses to average net assets | | | 1.04 | % | | | 1.30 | % | | | 1.36 | % | | | 1.40 | % | | | 1.40 | % | |

Ratio of net investment income

to average net assets | | | 1.40 | % | | | 0.94 | % | | | 1.11 | % | | | 1.11 | % | | | 1.21 | % | |

Decrease reflected in above operating

expense ratios due to waivers/reimbursements | | | 0.25 | % | | | 0.15 | % | | | 0.23 | % | | | 0.25 | % | | | 0.29 | % | |

| Portfolio turnover rate | | | 61 | % | | | 62 | % | | | 80 | % | | | 77 | % | | | 121 | % | |

1 The investment adviser fully reimbursed the Portfolio for a loss on a transaction that did not meet the Portfolio's investment guidelines, which otherwise would have reduced the amount by $0.01.

2 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the years shown, total returns would have been lower. Total returns do not reflect charges and expenses attributable to any particular variable contract or plan.

17

MORE ABOUT RISK

g INTRODUCTION

The portfolio's goal and principal strategies largely determine its risk profile. You will find a concise description of the portfolio's risk profile in "Key Points." The preceding discussion of the portfolio contains more detailed information. This section discusses other risks that may affect the portfolio.

The portfolio may use certain investment practices that have higher risks associated with them. However, the portfolio has limitations and policies designed to reduce many of the risks. The "Certain Investment Practices" table describes these practices and the limitations on their use.

The portfolio offers its shares to (1) insurance company separate accounts that fund both variable annuity contracts and variable life insurance contracts and (2) tax-qualified pension and retirement plans including participant-directed plans which elect to make the portfolio an investment option for plan participants. Due to differences of tax treatment and other considerations, the interests of various variable contract owners and plan participants participating in the portfolio may conflict. The Board of Trustees will monitor the portfolio for any material conflicts that may arise and will determine what action, if any, should be taken. If a conflict occurs, the Board may require one or more insurance company separate accounts and/or plans to withdraw its investments in the portfolio, which may cause the portfolio to sell securities at disadvantageous prices and disrupt orderly portfolio management. The Board also may refuse to sell shares of the portfolio to any variable contract or plan or may suspend or terminate the offering of shares of the portfolio if such action is required by law or regulatory authority or is in the best interests of the shareholders of the portfolio.

g TYPES OF INVESTMENT RISK

The following risks are referred to throughout this Prospectus.

PRINCIPAL RISK FACTORS

Derivatives Risk Derivatives, such as options, forwards, futures and swap agreements (see "Certain Investment Practices" table beginning on page 22), are financial contracts whose value depends on, or is derived from, the value of an underlying asset, reference rate or index. The portfolio typically uses derivatives as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate or currency risks. The portfolio may also use derivatives for leverage. The portfolio's use of derivative instruments involves risk different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks described below, such as correlation risk, liquidity risk, interest-rate risk, market risk and credit risk. Also, suitable derivative transactions may not be available in all circumstances and there can be no

18

assurance that the portfolio will engage in these transactions to reduce exposure to other risks when that would be beneficial.

Foreign Securities Risk A portfolio that invests outside the U.S. carries additional risks that include:

n Currency Risk Fluctuations in exchange rates between the U.S. dollar and foreign currencies may negatively affect an investment. Adverse changes in exchange rates may erode or reverse any gains produced by foreign-currency-denominated investments and may widen any losses. Although the portfolio may seek to reduce currency risk by hedging part or all of its exposure to various foreign currencies, it is not required to do so.

n Information Risk Key information about an issuer, security or market may be inaccurate or unavailable.

n Political Risk Foreign governments may expropriate assets, impose capital or currency controls, impose punitive taxes, or nationalize a company or industry. Any of these actions could have a severe effect on security prices and impair the portfolio's ability to bring its capital or income back to the U.S. Other political risks include economic policy changes, social and political instability, military action and war.

Leveraging Risk When the portfolio uses leverage through activities such as borrowing, entering into short sales, purchasing securities on margin or on a "when-issued" basis or purchasing derivative instruments in an effort to increase its returns, the portfolio has the risk of magnified capital losses that occur when losses affect an asset base, enlarged by borrowings or the creation of liabilities, that exceeds the net assets of the portfolio. The net asset value of the portfolio when employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the portfolio to pay interest.

Market Risk The market value of a security may fluctuate, sometimes rapidly and unpredictably. These fluctuations, which are often referred to as "volatility," may cause a security to be worth less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy, or the market as a whole. Market risk is common to most investments – including stocks and bonds, and the mutual funds that invest in them.

Model Risk The portfolio bears the risk that the proprietary quantitative models used by the portfolio manager will not be successful in identifying securities that will help the portfolio achieve its investment objectives, causing the portfolio to underperform its benchmark or other funds with a similar investment objective.

Short Sales Risk Short sales expose the portfolio to the risk that it will be required to cover its short position at a time when the securities have appreciated in value, thus resulting in a

19

loss to the portfolio. The portfolio's loss on a short sale could theoretically be unlimited in a case where the portfolio is unable, for whatever reason, to close out its short position. Short sales also involve transaction and other costs that will reduce potential gains and increase potential portfolio losses. The use by the portfolio of short sales in combination with long positions in its portfolio in an attempt to improve performance may not be successful and may result in greater losses or lower positive returns than if the portfolio held only long positions. It is possible that the portfolio's long equity positions will decline in value at the same time that the value of the securities it has sold short increases, thereby increasing potential losses to the portfolio. In addition, the portfolio's short selling strategies may limit its ability to fully benefit from increases in the equity markets. Short selling also involves a form of financial leverage that may exaggerate any losses realized by the portfolio. Also, there is the risk that the counterparty to a short sale may fail to honor its contractual terms, causing a loss to the portfolio.

Small Companies Small companies may have less-experienced management, limited product lines, unproven track records or inadequate capital reserves. Their securities may carry increased market, liquidity, information and other risks. Key information about the company may be inaccurate or unavailable.

Special-Situation Companies "Special situations" are unusual developments that affect a company's market value. Examples include mergers, acquisitions and reorganizations. Securities of special-situation companies may decline in value if the anticipated benefits of the special situation do not materialize.

OTHER RISK FACTORS

Access Risk Some countries may restrict the portfolio's access to investments or offer terms that are less advantageous than those for local investors. This could limit the attractive investment opportunities available to the portfolio.

Correlation Risk The risk that changes in the value of an instrument used for hedging purposes will not match those of the investment being hedged.

Emerging Markets Risk Investing in emerging (less developed) markets involves higher levels of risk, including increased currency, information, liquidity, market, political and valuation risks. Deficiencies in regulatory oversight, market infrastructure, shareholder protections and company laws could expose the portfolio to operational and other risks as well. Some countries may have restrictions that could limit the portfolio's access to attractive opportunities. Additionally, emerging markets often face serious economic problems (such as high external debt, inflation and unemployment) that could subject the portfolio to increased volatility or substantial declines in value.

20

Credit Risk The issuer of a security or the counterparty to a contract may default or otherwise become unable to honor a financial obligation.

Exposure Risk The risk associated with investments (such as derivatives) or practices (such as short selling) that increase the amount of money a portfolio could gain or lose on an investment.

n Hedged Exposure risk could multiply losses generated by a derivative or practice used for hedging purposes. Such losses should be substantially offset by gains on the hedged investment. However, while hedging can reduce or eliminate losses, it can also reduce or eliminate gains.

n Speculative To the extent that a derivative or practice is not used as a hedge, the portfolio is directly exposed to its risks. Potential losses from speculative positions in a derivative, such as writing uncovered call options, and from speculative short sales, are unlimited.

Interest-rate Risk Changes in interest rates may cause a decline in the market value of an investment.

Liquidity Risk Certain portfolio securities may be difficult or impossible to sell at the time and the price that the portfolio would like. The portfolio may have to lower the price, sell other securities instead or forgo an investment opportunity. Any of these could have a negative effect on portfolio management or performance.

Operational Risk Some countries have less-developed securities markets (and related transaction, registration and custody practices) that could subject the portfolio to losses from fraud, negligence, delay or other actions.

Regulatory Risk Governments, agencies or other regulatory bodies may adopt or change laws or regulations that could adversely affect an issuer, the market value of a security, or the portfolio's performance.

Valuation Risk The lack of an active trading market may make it difficult to obtain an accurate price for a portfolio security.

21

CERTAIN INVESTMENT PRACTICES

For each of the following practices, this table shows the applicable investment limitation. Risks are indicated for each practice.

KEY TO TABLE:

n Permitted without limitation; does not indicate actual use

20% Bold type (e.g., 20%) represents an investment limitation as a percentage of net portfolio assets; does not indicate actual use

20% Roman type (e.g., 20%) represents an investment limitation as a percentage of total portfolio assets; does not indicate actual use

o Permitted, but not expected to be used to a significant extent

| INVESTMENT PRACTICE | | LIMIT | |

Borrowing The borrowing of money from banks to meet redemptions or for other temporary

or emergency purposes. Leveraging, speculative exposure risk. | | 331/3% | |

|

Country/region focus Investing a significant portion of portfolio assets in a single country

or region. Market swings in the targeted country or region will be likely to have a greater

effect on portfolio performance than they would in a more geographically diversified equity

portfolio. Currency, market, political, regulatory risks. | | n | |

|

Currency transactions Instruments, such as options, futures, forwards or swaps, intended

to manage portfolio exposure to currency risk or to enhance total return. Options, futures or

forwards involve the right or obligation to buy or sell a given amount of foreign currency at a

specified price and future date. Swaps involve the right or obligation to receive or make

payments based on two different currency rates.1 Correlation, credit, currency, derivatives,

hedged exposure, leveraging, liquidity, political, speculative exposure, valuation risks. | | n | |

|

Emerging markets Countries generally considered to be relatively less developed or industrialized.

Emerging markets often face economic problems that could subject the portfolio to increased

volatility or substantial declines in value. Deficiencies in regulatory oversight, market infrastructure,

shareholder protections and company laws could expose the portfolio to risks beyond those

generally encountered in developed countries. Access, currency, emerging markets, information,

liquidity, market, operational, political, regulatory, valuation risks. | | n | |

|

Equity and equity-related securities Common stocks and other securities representing or

related to ownership in a company. May also include warrants, rights, options, preferred stocks

and convertible debt securities. These investments may go down in value due to stock market

movements or negative company or industry events. Liquidity, market, valuation risks. | | n | |

|

Foreign securities Securities of foreign issuers. May include depository receipts. Currency,

information, liquidity, market, operational, political, regulatory, valuation risks. | | n | |

|

1 The portfolio is not obligated to pursue any hedging strategy. In addition, hedging practices may not be available, may be too costly to be used effectively or may be unable to be used for other reasons.

22

| INVESTMENT PRACTICE | | LIMIT | |

Futures and options on futures Futures contracts traded on an exchange that enable the portfolio to hedge

against or speculate on future changes in currency values, interest rates or stock indexes.

Futures obligate the portfolio (or give it the right, in the case of options) to receive or make

payment at a specific future time based on those future changes.1 Correlation, currency,