UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

COINSTAR, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 27, 2006

Dear Coinstar Stockholders:

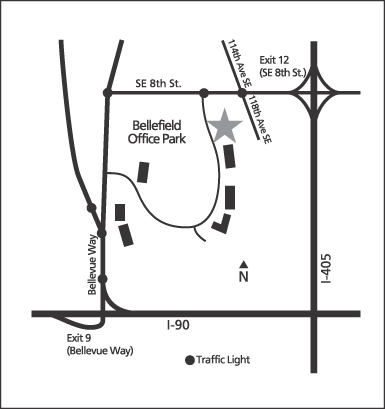

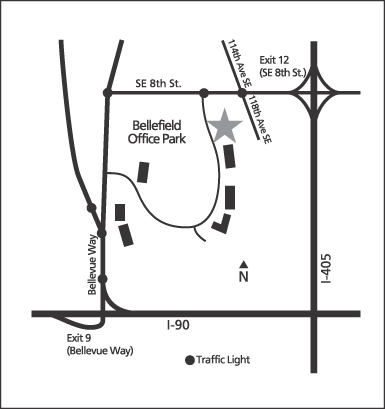

We are pleased to invite you to the 2006 Annual Meeting of Stockholders of Coinstar, Inc. The meeting will begin at 10:00 a.m. local time on Thursday, June 8, 2006, at the Bellefield Conference Center located at 1150 114th Avenue S.E., Bellevue, Washington 98004. Directions and a map to the conference center are located on the back of this Proxy Statement.

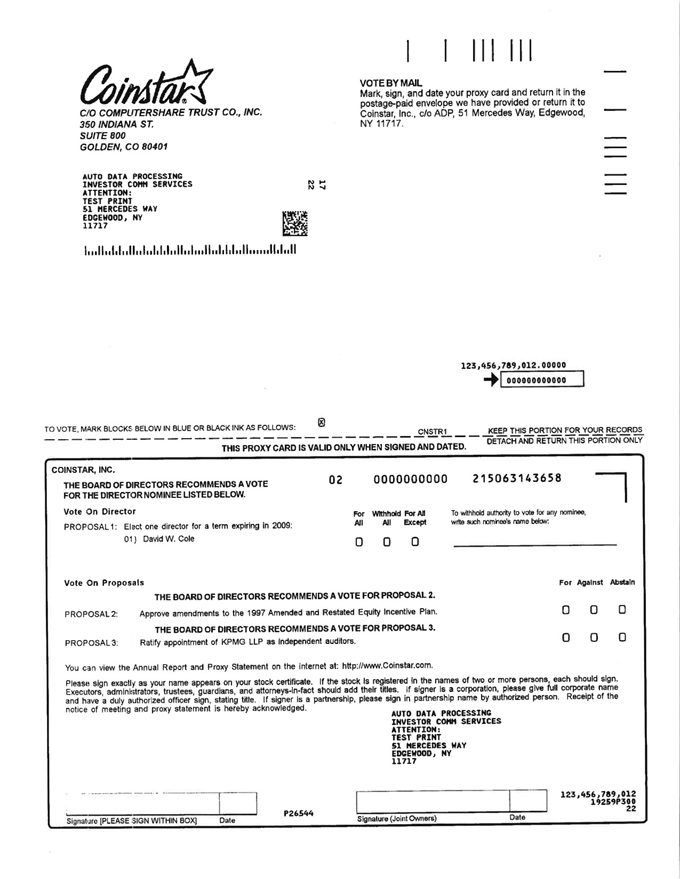

At the meeting, you will be asked to (i) elect one director to our Board of Directors, (ii) approve amendments to our 1997 Amended and Restated Equity Incentive Plan, (iii) ratify the Audit Committee’s appointment of KPMG LLP as our independent auditors, and (iv) consider any other business properly presented at the meeting. The Board of Directors recommends that you voteFOR the election of the director nominee,FOR the amendments to our 1997 Amended and Restated Equity Incentive Plan andFOR the ratification of appointment of KPMG LLP as our independent auditors. You will also have the opportunity to hear a review of our business operations during the past year and ask questions.

If you have any questions concerning the annual meeting or any matters contained in the Proxy Statement, please contact our Investor Relations Department via telephone at (425) 943-8000 or via email atinvest@coinstar.com.

We hope you can join us on Thursday, June 8th. Regardless of whether you plan to attend the meeting, please read the enclosed Proxy Statement. When you have done so, please mark your votes on the enclosed proxy card, sign and date the proxy card, and return it to us in the enclosed envelope. Your vote is important, so please return your proxy card promptly.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

Keith D. Grinstein | | | | David W. Cole |

Chairman of the Board | | | | Chief Executive Officer |

COINSTAR, INC.

1800 114th Avenue S.E.

Bellevue, WA 98004

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 8, 2006

10:00 A.M. LOCAL TIME

BELLEFIELD CONFERENCE CENTER, BELLEVUE, WASHINGTON

TO THE STOCKHOLDERS OF COINSTAR, INC.:

On Thursday, June 8, 2006, we will hold our 2006 Annual Meeting of Stockholders (the “Annual Meeting”) at the Bellefield Conference Center, at 1150 114th Avenue S.E., Bellevue, Washington 98004. The Annual Meeting will begin at 10:00 a.m. local time. Directions and a map to the conference center are located on the back of this Proxy Statement.

At the Annual Meeting, stockholders will be asked to:

| | 1. | elect one director to our Board of Directors; |

| | 2. | approve amendments to our 1997 Amended and Restated Equity Incentive Plan; |

| | 3. | ratify the Audit Committee’s appointment of KPMG LLP, an independent registered public accounting firm, as our independent auditors; and |

| | 4. | consider any other business properly presented at the meeting and any adjournment or postponement of the meeting. |

The Proxy Statement, which follows this notice, fully describes these items. We have not received notice of other matters that may be properly presented at the Annual Meeting.

You are entitled to vote at the Annual Meeting and any postponements or adjournments of the meeting if you were a stockholder of record at the close of business on Thursday, April 13, 2006. At the Annual Meeting and for ten days prior to the meeting at our principal executive offices, 1800 114th Avenue S.E., Bellevue, Washington 98004, a list of stockholders of record entitled to vote will be available for inspection. If you would like to view the stockholder list, please call our Investor Relations Department at (425) 943-8000.

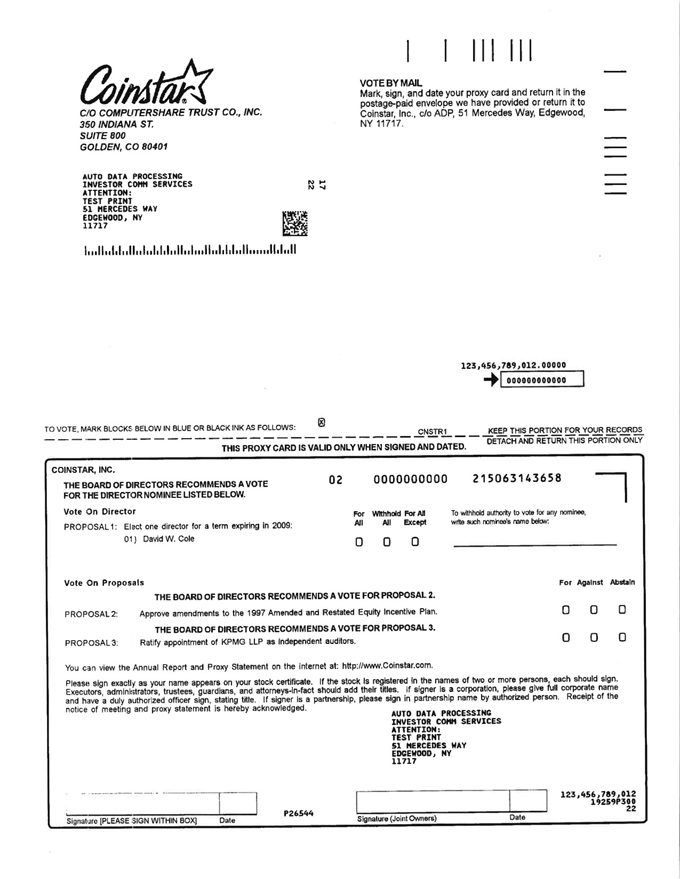

Regardless of whether you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if a broker, bank or other nominee holds your shares as record holder and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy card issued in your name.

This Proxy Statement is furnished in connection with the solicitation of proxies by Coinstar, Inc. on behalf of the Board of Directors for the Annual Meeting. Distribution of this Proxy Statement and form of proxy to stockholders is scheduled to begin on April 27, 2006.

|

By Order of the Board of Directors |

|

|

Donald R. Rench |

Corporate Secretary |

Bellevue, Washington

April 27, 2006

TABLE OF CONTENTS

COINSTAR, INC.

1800 114th Avenue S.E.

Bellevue, WA 98004

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

|

| GENERAL INFORMATION CONCERNING PROXIES AND VOTING AT THE ANNUAL MEETING |

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Coinstar, Inc. (“Coinstar,” the “Company,” “we,” “us” or “our”), a Delaware corporation, of proxies to be voted at our 2006 Annual Meeting of Stockholders (“Annual Meeting”) and at any adjournment or postponement of the Annual Meeting.

You are invited to attend our Annual Meeting on Thursday, June 8, 2006, beginning at 10:00 a.m. local time. The Annual Meeting will be held at the Bellefield Conference Center Building at 1150 114th Avenue S.E., Bellevue, Washington 98004. Directions and a map to the conference center are located on the back of this Proxy Statement.

What information is included in this Proxy Statement?

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, our Board of Directors and Board committees, the compensation of directors and certain current executive officers for fiscal year 2005, and other required information.

Who is entitled to vote?

Holders of Coinstar common stock at the close of business on Thursday, April 13, 2006 are entitled to receive the Notice and vote at the Annual Meeting. As of that date, there were 29,118,231 shares of Coinstar common stock outstanding and entitled to vote.

How many votes do I have?

Each share of Coinstar common stock is entitled to one vote on each matter properly brought before the Annual Meeting. For example, if you own 30 shares of Coinstar common stock, you are entitled to 30 votes at the Annual Meeting. Stockholders do not have cumulative voting rights.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with Coinstar’s transfer agent, Computershare Trust Company, Inc. (“Computershare”), you are considered, with respect to those shares, the “stockholder of record.” The Notice, Proxy Statement, 2005 Annual Report on Form 10-K, and proxy card have been sent directly to you by ADP Investor Communications Services.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of such shares. The Notice, Proxy Statement, 2005 Annual Report on Form 10-K, and proxy card have been forwarded to you by your broker, bank or other holder of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction card included in the mailing.

1

What am I voting on?

You are being asked to vote on the following three proposals:

(i) to elect one director to hold office until the 2009 annual meeting of stockholders;

(ii) to approve amendments to our 1997 Amended and Restated Equity Incentive Plan; and

(iii) to ratify the Audit Committee’s appointment of KPMG LLP, an independent registered public accounting firm, as independent auditors of Coinstar for the fiscal year ending December 31, 2006.

How do I vote?

By Mail. Be sure to complete, sign and date the proxy card or voting instruction card and return it in the prepaid envelope. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by that proxy as recommended by the Board of Directors.

In Person at the Annual Meeting. All stockholders may vote in person at the Annual Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspector of election with your ballot to be able to vote at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions so that your vote will be counted if you later decide not to attend the meeting.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you can revoke your proxy before it is exercised by:

(i) delivering written notice to the Company;

(ii) timely delivery of a valid, subsequent proxy; or

(iii) voting by ballot at the Annual Meeting.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other holder of record. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the answer to the previous question. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting.

Is there a list of stockholders entitled to vote at the Annual Meeting?

A list of the names of our stockholders of record entitled to vote at the Annual Meeting will be available for ten business days prior to the Annual Meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., local time, at our principal executive offices at 1800 114th Avenue S.E., Bellevue, Washington 98004, by contacting our Investor Relations Department at (425) 943-8000. The list will also be available at the Annual Meeting.

What are the voting requirements to elect Directors and to approve each of the proposals described in this Proxy Statement?

The holders of a majority of the outstanding shares of Coinstar common stock entitled to vote at the Annual Meeting, present in person or represented by proxy at the Annual Meeting, are necessary to constitute a quorum for the transaction of business. Abstentions and “broker non-votes” are counted as present and entitled to vote for

2

purposes of determining a quorum. A “broker non-vote” occurs when a broker, bank or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder (i) has not received instructions from the beneficial owner and (ii) does not have discretionary voting power for that particular item.

If you are a beneficial owner, your broker, bank or other holder of record is permitted to vote your shares on the election of directors and the ratification of KPMG LLP as our independent auditors even if the broker does not receive voting instructions from you. However, such record holder may not vote your shares on the proposal to amend our 1997 Amended and Restated Equity Incentive Plan because such proposal is considered “non-discretionary.” Accordingly, without your voting instructions on that proposal, a broker non-vote will occur.

Shares represented by a properly executed proxy will be voted at the Annual Meeting and, when instructions are given by the stockholder, will be voted in accordance with those instructions. If you are a stockholder of record and you return your proxy card but do not indicate your voting preferences, the persons named on the proxy card will vote shares represented by that proxy in the manner recommended by the Board of Directors. The Board recommends a vote for each of the proposals.

Election of Directors. A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected for that slot. Only votes “for” or “withheld” affect the outcome. Abstentions are not counted for purposes of the election of directors.

Approval of Amendments to the 1997 Amended and Restated Equity Incentive Plan. A majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting is required to approve the amendments to the 1997 Amended and Restated Equity Incentive Plan. Abstentions will have the same effect as voting against the proposal to amend the 1997 Amended and Restated Equity Incentive Plan. Broker non-votes will have no impact on the proposal to amend the 1997 Amended and Restated Equity Incentive Plan since they are not considered shares entitled to vote.

Ratification of KPMG LLP and Other Proposals. Under Coinstar’s Bylaws, the votes cast “for” must exceed the votes cast “against” to approve the ratification of KPMG LLP as our independent auditors and any other proposals. Abstentions and, if applicable, broker non-votes, are not counted as votes “for” or “against” these proposals.

We are not aware, as of the date of this Proxy Statement, of any matters to be voted on at the Annual Meeting other than as stated in this Proxy Statement and the Notice. If any other matters are properly presented at the Annual Meeting, the enclosed proxy gives discretionary authority to the persons named in the proxy to vote the shares in their best judgment.

What is the effect of the proposal to ratify the Audit Committee’s appointment of KPMG LLP as our independent auditors for the fiscal year ended December 31, 2006?

Selection of Coinstar’s independent auditors is not required to be submitted to a vote of stockholders. The Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work of the independent auditors. However, the Board of Directors has elected to submit the selection of KPMG LLP as our independent auditors to stockholders for ratification as a matter of good corporate practice. If a majority of all shares present in person or represented by proxy and entitled to vote at the Annual Meeting fail to vote for the appointment, the Audit Committee will reconsider whether to retain KPMG LLP, and may retain that firm or another without resubmitting the matter to Coinstar’s stockholders. Even if a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting vote for the appointment, the Audit Committee may, at its discretion, appoint different independent auditors at any time during the year.

3

Who counts the votes?

Computershare will serve as the inspector of election and will count all votes. The inspector of election will separately count affirmative and negative votes, abstentions and broker non-votes.

Who will pay for the cost of this proxy solicitation?

We will bear the cost of soliciting proxies. Proxies may be solicited on our behalf by Coinstar directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. No additional compensation will be paid to directors, officers or other regular employees for such services. We will furnish copies of solicitation materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial stockholders. We may reimburse persons representing beneficial stockholders of common stock for their costs of forwarding solicitation materials to such beneficial stockholders. In addition, we have retained Georgeson Shareholder Communications, Inc. to aid in the solicitation of proxies for fees of approximately $8,500, plus reimbursement of out-of-pocket expenses.

When will Coinstar announce the results of the voting?

We will announce preliminary voting results at the Annual Meeting. Final and official voting results will be printed in our quarterly report on Form 10-Q for the quarter ended June 30, 2006 (which will be available atwww.sec.gov and on our website atwww.coinstar.com).

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting if you were a Coinstar stockholder as of the record date (April 13, 2006) or you hold a valid proxy for the Annual Meeting. In order to be admitted to the Annual Meeting, you must present photo identification. In addition, if you are a stockholder of record, your name will be verified against the list of stockholders of record on the record date. If you are not a stockholder of record but hold shares through a broker, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to the record date (April 13, 2006), a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting.

|

| PROPOSAL 1: ELECTION OF DIRECTOR |

Our Amended and Restated Certificate of Incorporation and Bylaws divide the Board of Directors into three classes. Each class has a three-year term. Only persons elected by a majority of the remaining directors may fill vacancies on the Board. As of April 27, 2006, the Board was composed of six members, divided into three classes as follows:

| | |

| Term Expiring 2006: | | David W. Cole |

| Term Expiring 2007: | | Keith D. Grinstein and Ronald B. Woodard |

| Term Expiring 2008: | | Deborah L. Bevier, David M. Eskenazy and Robert D. Sznewajs |

If elected at the Annual Meeting, Mr. Cole will serve until the 2009 annual meeting of stockholders or until his successor is duly elected and qualified. Ms. Bevier and each of Messrs. Grinstein, Woodard, Eskenazy and Sznewajs will continue in office until their respective successor is duly elected, or until their death, resignation or retirement.

Except as otherwise specified in a proxy, proxies will be voted for the director nominee. Mr. Cole has agreed to serve if elected and management has no reason to believe that he will be unable to serve. If Mr. Cole

4

becomes unavailable to serve as a director, proxies will be voted for the election of such person as shall be designated by the Board of Directors, unless the Board chooses to reduce the number of directors serving on the Board.

Nominee for election to a three-year term expiring at the 2009 Annual Meeting of Stockholders

David W. Cole

David W. Cole, 58, has served as our Chief Executive Officer and a director since October 2001. Prior to joining Coinstar, Mr. Cole served as president of The Torbitt & Castleman Company (a specialty food products manufacturer) from December 1999 through February 2001. From November 1993 through December 1999, he served as president of Paragon Trade Brands (a private label disposable diaper manufacturer).

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEE.

A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected for that slot. Only votes “for” or “withheld” affect the outcome. Abstentions are not counted for purposes of the election of directors.

Directors continuing in office until the 2007 Annual Meeting of Stockholders

Keith D. Grinstein

Keith D. Grinstein, 45, has been a director of Coinstar since August 2001 and has served as the Board of Directors’ non-employee chairperson since June 2002. Mr. Grinstein is currently a partner at Second Avenue Partners (a venture capital fund). He has also held a number of senior executive positions at Nextel International, Inc. (a telecommunications company), serving as its president from January 1996 to March 1999, its chief executive officer from January 1996 to August 1999 and a member of its board of directors from 1996 until 2002. Mr. Grinstein previously served as president and chief executive officer of the Aviation Communications Division of AT&T Wireless Services, Inc. (formerly McCaw Communications), from January 1991 to December 1995. Mr. Grinstein is currently a director of Labor Ready, Inc. (a provider of temporary manual labor), Nextera Enterprises, Inc. (a holding company of Woodridge Labs, Inc., a developer and marketer of branded consumer products) and F5 Networks, Inc. (an application traffic management software company).

Ronald B. Woodard

Ronald B. Woodard, 63, has been a director of Coinstar since August 2001. Mr. Woodard is chairperson of MagnaDrive Corporation (an industrial magnetic coupling manufacturer). Mr. Woodard co-founded MagnaDrive in April 1999 after a 32-year career with The Boeing Company where he held numerous positions including president of The Boeing Commercial Airplane Group. Mr. Woodard is currently a director of AAR Corp. (a provider of aftermarket support to the aviation and aerospace industry) and Continental Airlines, Inc. (a commercial airline company). He is also a director of Knowledge Anywhere (an on-line provider of employee training) and a trustee and chairman of the Seattle Symphony.

Directors continuing in office until the 2008 Annual Meeting of Stockholders

Deborah L. Bevier

Deborah L. Bevier, 54, has been a director of Coinstar since August 2002. Ms. Bevier is a principal of D.L. Bevier Consulting LLC (an organizational and management consulting firm) and has been president of Waldron Consulting, a division of Waldron & Co. (an organizational and management consulting firm) since July 2004. Prior to that time, from 1996 until 2003, Ms. Bevier served as a director, president and chief executive officer of Laird Norton Financial Group and its predecessor companies (an independent financial advisory services firm). From 1973 to 1996, Ms. Bevier held numerous leadership positions with Key Bank of

5

Washington, including chairman and chief executive officer. Ms. Bevier currently serves on the board of directors of Fisher Communications, Inc. (a media and communications company).

David M. Eskenazy

David M. Eskenazy, 44, has been a director of Coinstar since August 2000. He is the Executive Vice President and Chief Operating Officer of R.C. Hedreen Co. (a hotel development and investment firm) where he has served in various accounting and finance positions since 1987. He has led R.C. Hedreen’s investment arm for the past several years where his responsibilities include the development and oversight of early stage companies as well as management of a fund holding marketable securities. He currently serves on the board of directors for R.C. Hedreen Co., MagnaDrive Corporation (an industrial magnetic coupling manufacturer) and ScreenLife LLC (a developer of DVD board games). Mr. Eskenazy is a certified public accountant (inactive).

Robert D. Sznewajs

Robert D. Sznewajs, 59, has been a director of Coinstar since August 2002. Since January 2000, Mr. Sznewajs has served as president, chief executive officer and a member of the board of directors of West Coast Bancorp (a bank holding company).

|

| BOARD MEETINGS AND DIRECTOR INDEPENDENCE |

During 2005, the Board of Directors met 12 times. The committees of the Board (including any special committees) held a total of 12 meetings. Each director attended 100% of the Board and Board committees on which he or she served. It is the Company’s policy to request and encourage all of the Company’s directors and director nominees to attend in person the Annual Meeting, absent unavoidable conflicts or extenuating circumstances that prohibit a director from attending. Last year, all directors attended the 2005 annual meeting of stockholders.

The Nasdaq Marketplace Rules require that a majority of our directors be “independent,” as defined by Nasdaq Marketplace Rule 4200(a)(15). In April 2006, the Board of Directors reviewed the independence of our directors and examined whether any transactions or relationships exist currently, or during the past three years existed, between each director, or certain family members of each director, and us and our subsidiaries, senior management or their affiliates, other affiliates of the Company, equity investors or independent auditors. As a result of this review, the Board has determined that all of the directors, except Mr. Cole, who is an employee, are “independent” under the applicable Nasdaq Marketplace Rules described above.

6

|

| BOARD COMMITTEES AND MEETINGS |

The Board of Directors has established the following standing committees: Audit, Compensation, and Nominating and Governance. The Board may, by resolution passed by a majority of the Board, from time to time, appoint other special committees to address special projects of or matters of interest to the Board.

All the members of each of the standing committees meet the criteria for independence prescribed by Nasdaq. Membership of the standing committees is determined annually by the Board of Directors. Adjustments to committee assignments may be made at any time. As of April 29, 2006, membership of each standing committee is as follows, with committee chairpersons listed first:

| | | | |

Audit | | Compensation | | Nominating and Governance |

| David M. Eskenazy | | Deborah L. Bevier | | Ronald B. Woodard |

| Keith D. Grinstein | | David M. Eskenazy | | Deborah L. Bevier |

| Robert D. Sznewajs | | Keith D. Grinstein | | Keith D. Grinstein |

| | Robert D. Sznewajs | | |

The Board of Directors has adopted a written charter for each committee. Stockholders may access a copy of each committee’s charter on the Investor Relations section of the Company’s website atwww.coinstar.com. A summary of the duties and responsibilities of each committee is set forth below.

| | |

| Audit Committee | | 5 meetings in 2005 |

The primary purposes of the Audit Committee are to assist the Board of Directors in oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditors’ qualifications and independence, (iv) the performance of the Company’s independent auditors and the internal auditors, and (v) compliance with the Company’s code of ethics for senior financial officers. The Committee retains authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors. The Committee may also retain independent counsel and accounting and other professionals to assist the Committee without seeking Board approval with respect to the selection, fees or terms of engagement of any such advisors.

The Audit Committee meets with our independent auditors at least quarterly, prior to releasing our quarterly results, to review the results of the auditors’ interim reviews or annual audit before they are released to the public or filed with the Securities and Exchange Commission (the “SEC”) or other regulators. The Audit Committee also reviews and comments as to the quality of our accounting principles and financial reporting and controls, adequacy of staff, and the results of procedures performed in connection with the audit process.

The charter of the Audit Committee requires that the Committee be comprised of at least three directors, all of whom meet the independence requirements established by the Board of Directors, Nasdaq and any other regulations applicable to the Company. Each Committee member must, at a minimum, be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement. At least one Committee member must be an “audit committee financial expert” and have accounting or related financial management expertise as required by the Board, the SEC and Nasdaq. No member of the Audit Committee may serve on more than three audit committees of publicly traded companies (including the Audit Committee), unless the Board determines that such simultaneous service would not impair the ability of such member to serve on the Audit Committee. The Board has determined that Mr. Grinstein’s simultaneous service on the audit committees of Labor Ready, Inc., Nextera Enterprises, Inc. and F5 Networks, Inc. will not impair his ability to serve on the Audit Committee.

The Board of Directors has determined that each member of the Audit Committee meets the independence and financial literacy requirements of the SEC and Nasdaq. The Board has also determined that

7

each of Messrs. Eskenazy and Sznewajs is a financial expert under SEC rules, has accounting or related financial management experience and is financially sophisticated under the Nasdaq rules, and is independent, as such term is defined by SEC rules.

| | |

| Compensation Committee | | 6 meetings in 2005 |

The primary purpose of the Compensation Committee is to ensure that the Company’s compensation practices further the shared interests of stockholders and management to attract, hire, retain and motivate the people needed to achieve the Company’s performance goals. In particular, the Committee (i) oversees all aspects of the executive officer compensation programs (including the compensation of the Chief Executive Officer), (ii) reviews and approves employee stock option programs and employee stock purchase programs, (iii) periodically reviews other employee compensation and benefits programs, and (iv) oversees all aspects of the director compensation program.

The Compensation Committee makes recommendations to the Board of Directors concerning salaries and incentive compensation for our executive officers. In addition, the Committee awards stock options and restricted stock to employees and consultants under our stock option plans, and performs other functions regarding compensation as delegated by the Board of Directors. The Committee may use professional consultants to assist it in meeting its responsibilities without seeking Board approval with respect to the selection, fees or terms of engagement of any such advisors.

The charter of the Compensation Committee requires that the Committee be comprised of at least three directors, all of whom are non-employee outside directors and meet the independence requirements established by the Board of Directors and Nasdaq and any other regulations applicable to the Company. The Board has determined that each member of the Committee meets such requirements.

| | |

| Nominating and Governance Committee | | 1 meeting in 2005 |

The primary purposes of the Nominating and Governance Committee (the “Nominating Committee”) are to (i) identify individuals qualified to become members of the Board of Directors, (ii) approve and recommend to the Board director candidates, (iii) oversee evaluations of the Board, (iv) develop, update as necessary and recommend to the Board corporate governance principles and policies applicable to the Company, and (v) monitor compliance with such principles and policies.

The charter of the Nominating Committee requires that the Nominating Committee be comprised of at least three directors, each of whom meets the independence standards required by the Board of Directors and Nasdaq. The Board has determined that each of the Committee members meets such requirements.

As noted above, the Nominating Committee is responsible for making recommendations to the Board of Directors concerning nominees for election as directors and nominees for Board vacancies. To fulfill this role, the Nominating Committee has authority to retain and terminate any search firm that is used to identify director candidates and retains the sole authority to approve fees and other retention terms. Where necessary, the Nominating Committee may also retain independent counsel and other professionals to assist the Nominating Committee. When assessing a director candidate’s qualifications, the Nominating Committee will consider issues of expertise (including retail, public company and policymaking experience), independence, personal and professional ethics, integrity and values, as well as skills relating to finance, public policy, management and business. These director selection guidelines are further described in Exhibit A to the Nominating Committee’s charter.

Pursuant to its charter, the Nominating Committee will also consider qualified candidates for director properly submitted by the Company’s stockholders. The Nominating Committee evaluates the qualifications of candidates properly submitted by stockholders in the same manner as those of director candidates identified by

8

the Committee or the Board. Stockholders can suggest qualified candidates for director by following the instructions outlined on page 38 of this Proxy Statement. No nominations for director were submitted to the Nominating Committee by any stockholder in connection with the Annual Meeting.

|

| NON-EMPLOYEE DIRECTOR COMPENSATION |

2005 Compensation. Coinstar’s non-employee directors received the following cash and equity compensation for their services during the fiscal year 2005. Mr. Cole, as an employee of Coinstar, did not receive any additional cash or equity compensation for his service as a director.

Cash and Equity Compensation

| | | | | | | | | | | | | | | | | |

Director | | Annual Board/

Committee

Cash

Retainers($) | | | Board

Meeting Cash

Fees($) | | Committee

Meeting Cash

Fees($) | | Stock

Option

Awards($)(1) | | Total

Compensation | |

Keith D. Grinstein(2) | | $ | 48,750 | (3) | | $ | 14,750 | | $ | 11,250 | | $ | 136,866 | | $ | 211,616 | |

Deborah L. Bevier | | | 23,750 | | | | 14,750 | | | 5,000 | | | 86,175 | | | 129,675 | (4) |

David M. Eskenazy | | | 32,875 | (5) | | | 14,750 | | | 10,500 | | | 86,175 | | | 144,300 | |

Robert D. Sznewajs | | | 23,750 | | | | 14,000 | | | 10,500 | | | 86,175 | | | 134,425 | |

Ronald B. Woodard | | | 23,750 | | | | 14,750 | | | 750 | | | 86,175 | | | 125,425 | |

| (1) | On June 9, 2005, each non-employee director received a stock option for 8,500 shares at an exercise price of $20.63. Mr. Grinstein received an additional option for 5,000 shares for service as a non-employee chairperson of the Board, also at an exercise price of $20.63. The term of each stock option is five years and the stock options vest in equal monthly installments over one year from the date of grant. The dollar amounts under this column reflect the fair value of these stock options as calculated pursuant to the fair value recognition provisions of Statement of Financial Accounting Standards No. 123 (revised 2004),Share Based-Payments. The fair value of stock options is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions: 4.9 year expected life from the date of grant; expected stock price volatility of 52.6%; risk-free interest rate of 3.79%; and no dividends during the expected term. There is no guarantee that the options will have this value if and when they are exercised. As of December 31, 2005, our non-employee directors held stock options to purchase the following number of shares: Mr. Grinstein—66,000; Ms. Bevier—41,000; Mr. Eskenazy—51,000; Mr. Sznewajs—41,000; and Mr. Woodard—46,000. |

| (2) | In addition to compensation received for service as a Coinstar non-employee director, Mr. Grinstein is also compensated by Coinstar for his service on the board of directors of Redbox Automated Retail, LLC (“Redbox”), a joint venture between Coinstar and McDonald’s Ventures, LLC. For his service on the Redbox board, Mr. Grinstein receives $1,000 per meeting attended in person and $500 per meeting attended telephonically. During 2005, the Redbox board held one meeting. Mr. Grinstein participated in that meeting telephonically, for total Redbox board compensation of $500. |

| (3) | Includes $25,000 for service as a non-employee chairperson of the Board. |

| (4) | Ms. Bevier elected to receive her cash compensation in the form of shares of Coinstar common stock, rather than cash. |

| (5) | Includes $6,500 for service as chairperson of the Audit Committee. |

Cash compensation for attendance at meetings of the Board of Directors or its committees is paid at the end of each fiscal quarter. Annual cash retainers for service as a director or committee chairperson are paid in quarterly installments at the same time as Board and committee meeting fees are paid. Directors may elect to receive their compensation in the form of Coinstar common stock rather than cash, in which case the directors receive the number of whole shares that may be purchased at the fair market value on the last day of the fiscal quarter with the sum of fees otherwise payable in cash.

9

Stock options are automatically awarded following each annual meeting under a non-employee director program administered pursuant to our 1997 Amended and Restated Equity Incentive Plan and have the terms described in footnote 1 above.

2006 Compensation. Effective for 2006, the components of Coinstar’s non-employee director cash and equity compensation are as set forth below.

| | | | | | |

Compensation paid to all non-employee directors | | | | | | |

Annual retainer | | $ | 25,000 | | | |

Attendance (in person) at Board meeting (per meeting fee) | | $ | 1,500 | | | |

Attendance (by phone) at Board meeting (per meeting fee) | | $ | 750 | | | |

Annual restricted stock award | | | 1,500 | shares | | |

Annual stock option grant(1) | | | 8,500 | shares | | |

| | (1) | Upon initial election or appointment to the Board a non-employee director receives a fully vested stock option for 11,000 shares. |

| | | | | |

Compensation for attendance at Committee meetings (in person or by phone) | | | | | |

Audit Committee | | $ | 1,250 | | |

Compensation Committee | | $ | 1,000 | | |

Nominating and Governance Committee | | $ | 1,000 | | |

| | |

Additional Compensation for Board and Committee Chairpersons | | | | | |

Non-employee chairperson of the Board | | $ | 25,000 | | |

plus a stock option for 5,000 | | shares |

Audit Committee (if not Board chairperson) | | $ | 10,000 | | |

Compensation Committee (if not Board chairperson) | | $ | 7,500 | | |

Nominating and Governance Committee (if not Board chairperson) | | $ | 5,000 | | |

Cash compensation is paid to non-employee directors in the same manner and at the same times described above for 2005 compensation. Effective for 2006, non-audit committee meeting fees were increased from $750 to $1,000.

Equity compensation awards are made following each annual meeting under a non-employee director program administered pursuant to our 1997 Amended and Restated Equity Incentive Plan. Effective for 2006, non-employee director compensation was revised to include an annual award of 1,500 shares of restricted stock. The restricted stock awards will vest one year from the date of grant.

10

|

PROPOSAL 2: APPROVAL OF AMENDMENTS TO 1997 AMENDED AND RESTATED EQUITY INCENTIVE PLAN |

The Board of Directors is asking stockholders to approve amendments to the Coinstar, Inc. 1997 Amended and Restated Equity Incentive Plan (the “Plan”). These amendments will enable Coinstar to continue to offer competitive compensation packages to our officers, directors and employees that are responsive to evolving compensation practices that increasingly emphasize a diverse mix of traditional stock options together with stock awards.

The amendments described below were approved by the Board of Directors on April 24, 2006, subject to stockholder approval. The Plan was initially adopted by the Board and approved by the stockholders in 1997. Stockholders approved amendments to the Plan in June 1999, August 2002, June 2004 and June 2005. The Board is asking stockholders to approve the following amendments to the Plan to:

| | • | | Extend the term of the Plan to June 8, 2016. The Plan is currently scheduled to expire on March 28, 2007. Approval of this amendment would extend the expiration date of the Plan to June 8, 2016. |

| | • | | Increase the number of shares authorized for issuance under the Plan by 1,000,000. The total number of shares currently authorized for issuance under the Plan is 6,517,274. As of March 31, 2006, there were only 1,497,671 shares remaining available for grant as new awards under the Plan. The Board is recommending the addition of 1,000,000 shares to the total number of shares authorized for issuance under the Plan to enable us to meet our expected needs over the next year. The Company’s average annual burn rate for 2003 through 2005, which is the total number of equity awards granted in a given year divided by the number of shares of common stock outstanding, was 2.4%. |

| | • | | Increase the limit on stock awards to 600,000 shares. The current limit on the number of shares that can be issued as stock awards under the Plan is 500,000 shares. The Board is recommending that the limit be increased to 600,000 shares. |

Pursuant to Section 162(m) of the Internal Revenue Code of 1986 (the “Code”), in order for Coinstar to be able to deduct compensation in excess of $1 million paid in any year to our Chief Executive Officer or our four other most highly compensated executive officers, such compensation must qualify as “performance-based.” One of the requirements of “performance-based” compensation for purposes of Section 162(m) is that the material terms of the performance goals must be approved by our stockholders. Where the performance goals provide Coinstar a choice among different performance measures, as they do in connection with stock awards under the Plan, Coinstar must obtain stockholder approval of the material terms of such performance goals every five years. Accordingly, we are asking stockholders to re-approve the material terms of the performance goals described below under “Performance-Based Compensation Under Section 162(m) of the Code.” Stockholders last voted on the performance goals at the 2004 Annual Meeting of Stockholders. If the stockholders re-approve the material terms of the performance goals described below, the Section 162(m) requirements will be met for the years 2006 through 2010.

A copy of the Plan as proposed to be amended and restated is attached to this Proxy Statement as Appendix A. The following description of the Plan as proposed to be amended and restated is a summary and does not purport to be a complete description. Please refer to Appendix A for more detailed information.

Summary of Terms

Purpose. The purposes of the Plan are (i) to attract and retain the best available personnel; (ii) to provide additional incentives to our employees and consultants; and (iii) to promote the success of our business.

Stock Subject to the Plan. Subject to adjustment for stock splits and similar events, a maximum of 7,517,274 shares are authorized for issuance under the Plan. The shares issued under the Plan may come from

11

authorized but unissued shares of Coinstar common stock or from shares subsequently reacquired on the market or otherwise. If any awards granted under the Plan expire for any reason or otherwise terminate, in whole or in part, without having been exercised in full (or vested in the case of restricted stock), the stock not acquired under such awards reverts to and again becomes available for issuance under the Plan.

Administration. The Plan may be administered by the Board of Directors or any Board-appointed committee of two or more independent directors (the “plan administrator”). The plan administrator may further delegate authority to different committees of the Board or to an executive officer, subject to limits prescribed by the plan administrator, except that all grants of awards to directors must be approved by a Board-appointed committee consisting of independent directors. The Board has delegated the duties of plan administrator to the Compensation Committee, which has further delegated limited authority to an executive officer who is also a Board member. The plan administrator, subject to the terms of the Plan, selects the individuals to receive awards, determines the terms and conditions of all awards and interprets the provisions of the Plan. The plan administrator is also authorized to make such rules and regulations as it deems necessary to administer the Plan. The plan administrator’s decisions, determinations and interpretations are binding on all holders of awards granted under the Plan.

Awards. The plan administrator is authorized to grant incentive stock options, nonqualified stock options and stock awards under the Plan. Awards may consist of one or more of these grant types.

Eligibility. Awards may be granted to all our employees, consultants and directors and to the employees, consultants and directors of any parent or subsidiary of ours, except that only our employees and employees of our subsidiaries may receive incentive stock options. As of March 31, 2006, approximately 200 persons would have been eligible to receive grants under the Plan.

Stock Option Grants. Options granted under the Plan may be “incentive stock options” (as defined in Section 422 of the Code) or nonqualified stock options. The exercise price for each option is determined by the plan administrator but may not be less than 100% of fair market value of Coinstar common stock on the date of grant (except for options granted in assumption of or substitution for options granted by a company acquired by Coinstar). For purposes of the Plan, “fair market value” means the closing sales price for our stock as reported by the Nasdaq National Market for a single trading day. As of March 31, 2006, the closing sales price for Coinstar common stock on the Nasdaq National Market was $25.91 per share.

The exercise price for shares purchased under an option must be paid in cash or check or, at the discretion of the plan administrator and to the extent permitted by applicable law, by delivery of Coinstar common stock already owned by the optionee for at least six months, a broker-assisted cashless exercise, or such other consideration as the plan administrator may permit, including a promissory note to the extent not prohibited by law.

No option may have a term of more than ten years from the date of grant. Each option will vest and become exercisable by the holder based on a vesting schedule set forth in the individual optionee’s grant notice. Generally, options granted to employees under the Plan vest over a four-year period, with 25% of the option becoming vested and exercisable on each anniversary of the date of grant. Unless the plan administrator determines otherwise, options vested as of the date of termination of the optionee’s employment or service relationship with Coinstar generally will be exercisable for three months after the date of termination for terminations due to reasons other than death or disability, or one year after the date of termination for terminations due to death or disability, but in no event may an option be exercised after the expiration of its term.

Except for adjustments to reflect stock splits and similar events, the plan administrator may not, without stockholder approval, cancel or amend an outstanding stock option for the purpose of repricing, replacing or regranting the option with an exercise price that is less than the exercise price of the original option (as adjusted for stock splits and similar events).

12

Stock Awards. The plan administrator is authorized to make awards of common stock or awards denominated in units of common stock on such terms and conditions and subject to such restrictions, if any, that may be based on continuous service with the Company or the achievement of performance criteria. Subject to adjustment for stock splits and similar events, not more than an aggregate of 600,000 shares of Coinstar common stock are available for issuance pursuant to grants of stock awards under the Plan. The terms, conditions and restrictions that the plan administrator will have the power to determine will include, without limitation, the manner in which shares subject to stock awards are held during the periods they are subject to restrictions and the circumstances under which forfeiture of the stock award will occur by reason of termination of the participant’s employment or service relationship.

Performance-Based Compensation Under Section 162(m) of the Code. The plan administrator may determine that stock awards will be made subject to the attainment of performance goals relating to one or more or a combination of business criteria for purposes of qualifying the award under Section 162(m) of the Code. These business criteria include: profits (including, but not limited to, profit growth, net operating profit or economic profit); profit-related return ratios; return measures (including, but not limited to, return on assets, capital, equity or sales); cash flow (including, but not limited to, operating cash flow, free cash flow or cash flow return on capital); earnings (including, but not limited to, net earnings, earnings per share, or earnings before or after taxes); net sales growth; net income (before or after taxes, interest, depreciation and/or amortization); gross or operating margins; productivity ratios; share price (including, but not limited to, growth measures and total stockholder return); expense targets; margins; operating efficiency; customer satisfaction; and working capital targets, where such criteria may be stated in absolute terms or relative to comparison companies. The plan administrator may not adjust performance goals for any stock award intended to qualify as “performance-based” under Section 162(m) of the Code for the year in which the award is settled in a manner that would increase the amount of compensation otherwise payable to a participant.

Subject to adjustment for stock splits and similar events, no person is eligible to receive awards covering more than 500,000 shares of common stock in any calendar year.

Transferability. An incentive stock option is not transferable except by will or by the laws of descent and distribution, and is exercisable during the lifetime of the person to whom the incentive stock option is granted only by such person. A nonqualified stock option may be transferred to the extent provided in the option agreement; provided that if the option agreement does not expressly permit the transfer of a nonqualified stock option, the nonqualified stock option is not transferable except by will, by the laws of descent and distribution or pursuant to a domestic relations order and will be exercisable during the lifetime of the person to whom the option is granted only by such person or any transferee pursuant to a domestic relations order. Notwithstanding the foregoing, the person to whom the option is granted may, by delivering written notice to us, in a form satisfactory to us, designate a third party who, in the event of the death of the optionee, is thereafter entitled to exercise the option. Stock awards are not transferable except by will or the laws of descent and distribution or, if the stock award agreement so provides, pursuant to a domestic relations order so long as stock awarded under such agreement remains subject to the terms of the agreement.

Adjustment of Shares. If any change is made in the stock subject to the Plan, or subject to any award, without the receipt of consideration by us (through merger, consolidation, reorganization, recapitalization, reincorporation, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or other transaction not involving the receipt of consideration by us), then (i) the Plan will be appropriately adjusted in the class(es) and maximum number of shares authorized for issuance under the Plan, the class(es) and maximum number of shares available for issuance pursuant to stock awards, the class(es) and maximum number of shares that can be made subject to awards granted to any person during any calendar year and the class(es) and number of shares for which Awards may be automatically granted pursuant to a formula program established under the Plan, and (ii) awards outstanding under the Plan will be appropriately adjusted in the class(es) and number of shares and price per share of stock subject to such outstanding awards.

13

Change of Control. The Plan provides that the plan administrator retains the discretion to do one or more of the following in the event of a merger, reorganization or sale of substantially all of the assets of Coinstar: (i) arrange to have the surviving or successor entity or any parent entity thereof assume the options or grant replacement options with appropriate adjustments in the option prices and adjustments in the number and kind of securities issuable upon exercise; (ii) shorten the period during which options are exercisable; (iii) accelerate any vesting schedule to which an option is subject; or (iv) cancel vested options in exchange for a cash payment upon such terms and conditions as determined by the Board of Directors at the time of the event. The plan administrator may also provide for one or more of the foregoing alternatives in any particular option agreement.

Termination and Amendment. The Board of Directors may at any time suspend, amend or terminate the Plan but, other than adjustments for stock splits and similar events, stockholder approval is required for any amendment that (i) increases the number of shares issuable under the Plan, (ii) materially modifies the requirements for participation in the Plan, (iii) otherwise materially amends the Plan to the extent stockholder approval is required by Nasdaq or securities exchange listing requirements, or (iv) otherwise requires stockholder approval under any applicable law or regulation. The Plan will terminate on June 8, 2016, unless earlier terminated by the Board. No suspension, termination or amendment of the Plan and no amendment of awards outstanding under the Plan may impair the rights of holders of outstanding awards without the holder’s written consent.

Plan Benefits. A new plan benefits table, as described in the SEC’s proxy rules, is not provided because all awards made under the Plan are discretionary. However, please refer to the “Option Grants in Fiscal Year 2005” table on page 33 of this Proxy Statement, which provides information on the grants made to the Named Executive Officers (as defined under “Named Executive Officer Compensation”) in the last fiscal year, and please refer to the description of grants made to our non-employee directors under the heading “Non-Employee Director Compensation” on page 9 of this Proxy Statement.

U.S. Federal Income Tax Consequences

The following is a summary of the material U.S. federal income tax consequences to us and to participants in the Plan. The summary is based on the Code, the U.S. Treasury regulations promulgated thereunder and various judicial and administrative authorities in effect as of the date of this Proxy Statement, all of which may change with retroactive effect. The summary does not cover any state or local tax or non-U.S. tax consequences of participation in the Plan. The summary is not intended to be a complete analysis or discussion of all potential tax consequences that may be important to participants in the Plan. Therefore, we strongly encourage participants to consult their own tax advisors as to the specific federal income or other tax consequences of their participation in the Plan. The summary does not discuss the ramifications on awards of the new deferred compensation provisions of the Code. The Plan has been amended to add an express provision stating that it is the intent of Coinstar that, to the extent awards under the Plan are considered deferred compensation, the awards will satisfy the requirements of the new deferred compensation law, and to make it clear that the Plan is to be interpreted and administered accordingly.

Incentive Stock Options. The incentive stock options granted under the Plan are intended to qualify for the favorable federal income tax treatment accorded “incentive stock options” under the Code. Generally, the grant or exercise of an incentive stock option does not result in any federal income tax consequences to the participant or to us. However, the exercise of an incentive stock option generally will increase the participant’s alternative minimum tax liability, if any.

The federal income tax consequences of a disposition of stock acquired through exercise of an incentive stock option will depend on the period such stock is held prior to disposition. If a participant holds stock acquired through exercise of an incentive stock option for at least two years from the date on which the option is granted and more than one year from the date of exercise of the option, the participant will recognize long-term capital gain or loss in the year of disposition, equal to the difference between the amount realized on the disposition of the stock and the amount paid for the stock on exercise of the option.

14

If the participant disposes of the stock before the expiration of either of the statutory holding periods described above (a “disqualifying disposition”), the participant will recognize ordinary income equal to the lesser of (i) the excess of the fair market value of the stock on the date of exercise over the exercise price and (ii) the excess of the amount realized on the disposition of the stock over the exercise price.

Generally, in the taxable year of a disqualifying disposition, the participant will also recognize capital gain or loss equal to the difference between the amount realized on the disposition of such stock over the sum of the amount paid for such stock plus any amount recognized as ordinary income by reason of the disqualifying disposition. Such capital gain or loss will be characterized as short-term or long-term, depending on how long the stock was held. Long-term capital gains generally are subject to lower tax rates than ordinary income and short-term capital gains.

Nonqualified Stock Options. Upon exercise of a nonqualified stock option, the participant generally will recognize ordinary income equal to the excess of the fair market value of the stock on the date of exercise over the amount paid for the stock upon exercise of the option.

Upon disposition of the stock, the participant will recognize capital gain or loss equal to the difference between the amount realized on the disposition of such stock over the sum of the amount paid for such stock plus any amount recognized as ordinary income upon exercise of the option. Such capital gain or loss will be characterized as short-term or long-term, depending on how long the stock was held.

Stock Awards. Generally, upon acquisition of a stock award, the recipient will recognize ordinary income equal to the excess of the fair market value of the stock at the time of receipt over the amount, if any, paid for such stock. However, upon the acquisition of an award of restricted stock or stock units, the recipient will not recognize ordinary income until the restrictions lapse or, if earlier, the time the stock becomes transferable. At such time, the recipient will recognize ordinary income equal to the excess of the current fair market value of the stock over the amount, if any, paid for the stock. Any further appreciation in the fair market value of the stock will be taxed upon disposition of the stock. Within 30 days of receipt of an award of restricted stock, the recipient may elect to recognize ordinary income in the taxable year of receipt, despite the fact that such stock is subject to restrictions. If such election is made, the recipient will recognize ordinary income equal to the excess of the fair market value of the stock at the time of receipt over the amount, if any, paid for the stock. Any further appreciation in the fair market value of the stock will be taxed upon disposition of the stock. If the stock is later forfeited, the participant will not be allowed a deduction for any income recognized in connection with making the election. Upon disposition of the stock, the recipient will recognize capital gain or loss equal to the difference between the amount realized on the disposition of the stock and the sum of the amount paid for the stock, if any, plus any amount recognized as ordinary income upon acquisition or vesting of the stock (including income recognized pursuant to an election as described above). Such capital gain or loss will be characterized as short-term or long-term, depending on how long the stock was held.

Tax Consequences to Coinstar. In the foregoing cases, Coinstar generally will be entitled to a deduction at the same time and in the same amount as a participant recognizes ordinary income, subject to the limitations imposed under Section 162(m) of the Code and other provisions of the Code.

THEBOARDOFDIRECTORSRECOMMENDSAVOTEFORTHEABOVEDESCRIBED

AMENDMENTSTOTHECOINSTAR,INC. 1997AMENDEDANDRESTATEDEQUITYINCENTIVEPLAN.

The affirmative vote of a majority of the votes cast at the Annual Meeting, at which a quorum is present, either in person or by proxy, is required to approve this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

15

|

| EQUITY COMPENSATION PLAN INFORMATION |

The following table provides information as of December 31, 2005 about the shares of Coinstar common stock authorized for issuance under our equity compensation plans.

Our stockholder-approved equity compensation plans consist of our 1997 Amended and Restated Equity Incentive Plan, our 1997 Non-Employee Directors’ Stock Option Plan (the “1997 Director Plan”) and our Employee Stock Purchase Plan, as amended. No additional awards will be granted under the 1997 Director Plan.

Our non-stockholder-approved equity compensation plans consist of our 2000 Amended and Restated Equity Incentive Plan and certain other individual arrangements made outside our 1997 Amended and Restated Equity Incentive Plan and our 1997 Director Plan, but subject to the terms of that plan, as described below.

| | | | | | | | | | |

Plan Category | | Number of

securities to be

issued upon exercise

of outstanding

options, warrants

and rights | | | Weighted-average

exercise price of

outstanding

options, warrants

and rights | | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

the first column) | |

Equity compensation plans approved by stockholders | | 2,029,367 | (1)(2) | | $ | 20.66 | (3) | | 1,658,260 | (4)(5)(6) |

Equity compensation plans not approved by stockholders | | 710,080 | | | $ | 21.23 | | | 6,143 | (6) |

| | | | | | | | | | |

Total | | 2,739,447 | | | $ | 20.81 | | | 1,664,403 | |

| | | | | | | | | | |

| (1) | Includes 82,750 shares of common stock issuable upon vesting of outstanding stock awards granted under the 1997 Amended and Restated Equity Incentive Plan. |

| (2) | Includes shares subject to stock options granted to our non-employee directors under the 1997 Director Plan, which was terminated by Board action in 2005. Also includes shares subject to stock options granted to our non-employee directors pursuant to a program administered under our 1997 Amended and Restated Equity Incentive Plan and described above under “Non-Employee Director Compensation.” |

| (3) | The weighted-average exercise price does not take into account the shares issuable upon vesting of outstanding stock awards granted under the 1997 Amended and Restated Equity Incentive Plan. |

| (4) | Of these shares, 28,530 remained available for issuance under our Employee Stock Purchase Plan on December 31, 2005. The plan was suspended as of December 2005. |

| (5) | This number does not include the 1 million additional shares proposed to be authorized for issuance under the 1997 Amended and Restated Equity Incentive Plan as proposed to be amended subject to stockholder approval. |

| (6) | Under the 1997 Amended and Restated Equity Incentive Plan and the 2000 Amended and Restated Equity Incentive Plan, Coinstar may grant awards of common stock, restricted stock awards or awards denominated in units of common stock in addition to stock options. |

Description of Non-Stockholder-Approved Equity Arrangements

Below is a description of our other equity compensation arrangements that were not approved by stockholders. Approval by stockholders was not required under the SEC and Nasdaq stock market rules in effect at the time these arrangements were entered into.

16

2000 Amended and Restated Equity Incentive Plan

In December 2000, the Board of Directors adopted the 2000 Amended and Restated Equity Incentive Plan (the “2000 Plan”). Subject to adjustment for stock splits and other similar events, a maximum of 770,000 shares are authorized for issuance under the 2000 Plan. As of March 31, 2006, there were 5,759 shares available for grant under the 2000 Plan. The 2000 Plan provides for the grant of nonqualified stock options and stock awards, with terms and conditions substantially similar to those described for nonqualified stock options and stock awards under the description of the 1997 Amended and Restated Equity Incentive Plan above. The 2000 Plan will terminate on April 1, 2010, unless earlier terminated by the Board.

Non-Plan Grants

In October 2001, in connection with his joining Coinstar as our Chief Executive Officer, we granted David W. Cole a nonqualified stock option to purchase 200,000 shares of Coinstar common stock with an exercise price equal to the fair market value of Coinstar common stock on the date of grant, which was $21.24. The option has a ten-year term and vested 25% on the first anniversary of the date of grant, with additional vesting occurring 2.08333% per month thereafter until fully vested four years from the date of grant. As of March 31, 2006, this nonqualified stock option was fully vested. In the event of Mr. Cole’s termination of employment with Coinstar, the option will remain exercisable until the earliest of (i) the expiration of the option, (ii) three months following termination due to reasons other than disability or death, (iii) one year following termination due to disability or death, and (iv) immediately upon termination for cause. In the event of Mr. Cole’s death while the option is still exercisable, the option will remain exercisable until the earlier of the expiration of the option and one year from the date of death. The option was granted outside the 1997 Amended and Restated Equity Incentive Plan but, except as otherwise specified in the agreement evidencing the grant, is subject to the terms of that plan.

In September 2002, we granted each of our non-employee directors, other than our chairperson, nonqualified stock options to purchase 2,500 shares. We granted our chairperson a nonqualified stock option to purchase 7,500 shares. Each of these options has a ten-year term, an exercise price equal to the fair market value of Coinstar common stock on the date of grant, which was $27.60, and vested at the rate of 8.333% of the total grant for each month of continuous service from the date of grant, until fully vested one year from the date of grant. As of March 31, 2006, each of these currently outstanding nonqualified stock options were fully vested. In the event of a non-employee director’s termination of service, the vested portion of the option will remain exercisable until the earlier of the expiration of the option or one year after termination of service. Each of these options was granted outside the 1997 Director Plan (which plan was terminated by the Board of Directors in 2005) but, except as otherwise specified in the agreement evidencing the grant, is subject to the terms of that plan.

17

|

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF KPMG LLP AS INDEPENDENT AUDITORS |

The Audit Committee of the Board of Directors has selected KPMG LLP, an independent registered public accounting firm, as the Company’s independent auditors for the fiscal year ending December 31, 2006. Representatives of KPMG LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of KPMG LLP as the Company’s independent auditors is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to retain KPMG LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF

KPMG LLP AS OUR INDEPENDENT AUDITORS.

The affirmative vote of a majority of the votes cast at the meeting, at which a quorum is present, either in person or by proxy, is required to approve this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

|

| REPORT OF THE AUDIT COMMITTEE |

The Audit Committee serves as the representative of the Board of Directors for general oversight of Coinstar’s financial accounting and reporting, systems of internal control, audit process, and monitoring compliance with laws and regulations and standards of business conduct. Management has responsibility for preparing Coinstar’s financial statements, as well as for Coinstar’s financial reporting process. KPMG LLP, acting as independent auditors, is responsible for expressing an opinion on the conformity of Coinstar’s audited financial statements with generally accepted accounting principles.

In connection with our review of Coinstar’s consolidated audited financial statements for the fiscal year ended December 31, 2005, we relied on reports received from KPMG LLP as well as the advice and information we received during discussions with Coinstar management. In this context, we hereby report as follows:

| (i) | The Audit Committee has reviewed and discussed the audited financial statements for fiscal year 2005 with the Company’s management. |

| (ii) | The Audit Committee has discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 61,Communication with Audit Committees. |

| (iii) | The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with the independent auditors the independent auditors’ independence. |

| (iv) | Based on the review and discussion referred to in paragraphs (i) through (iii) above, the Audit Committee recommended to the Board of Directors of the Company, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the SEC. |

Audit Committee

David M. Eskenazy, Chairperson

Keith D. Grinstein

Robert D. Sznewajs

18

|

| INDEPENDENT AUDITOR’S FEES REPORT |

In connection with the audit of the 2005 financial statements, we entered into an engagement letter with KPMG LLP which sets forth the terms by which KPMG will perform audit services for Coinstar. That agreement is subject to alternative dispute resolution procedures, an exclusion of punitive damages and various other provisions.

We incurred the following fees for services performed by KPMG LLP, our principal auditor, in fiscal years 2004 and 2005, inclusive of out of pocket expenses. Consistent with SEC guidelines, the amounts disclosed below for Audit Fees for fiscal year 2005 reflect fees billed or expected to be billed by KPMG LLP, even if KPMG LLP has not yet invoiced Coinstar for such services as of the date of this Proxy Statement. The amounts disclosed for Audit-Related, Tax and All Other Fees for fiscal year 2005 include amounts billed for such services by KPMG LLP, even if KPMG LLP did not bill Coinstar for such services until after fiscal 2005 year-end.

Audit Fees

| | | |

2005—Audit fees, general | | $ | 547,500 |

2005—Sarbanes-Oxley-required audit of internal controls over financial reporting | | $ | 576,080 |

2005—Fees related to other SEC filings and accounting issues resulting from acquisitions | | $ | 120,171 |

| | | |

2005—Total audit fees | | $ | 1,243,751 |

| |

2004—Total audit fees (including Sarbanes-Oxley related fees) | | $ | 953,660 |

Audit Fees consist of fees for professional services rendered for the audit of our consolidated annual financial statements, reviews of the interim consolidated financial statements included in quarterly reports and services that are normally provided by our independent auditors in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

Audit-Related Fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” Audit-Related Fees reported for 2005 include fees for statutory audits of consolidated subsidiaries required by local statutes. Audit-Related Fees reported for 2004 include fees for services rendered in connection with acquisition-related diligence.

Tax Fees

Tax Fees consist of fees for professional services rendered for assistance with federal, state and international tax compliance, tax advice and tax planning. Of the Tax Fees reported for 2005, $167,186 constituted tax compliance fees and $7,587 constituted tax consultation and planning fees. All Tax Fees for 2004 constituted tax consultation and planning fees paid by Coinstar on behalf of certain Coinstar officers and Named Executive Officers. In prior years our primary tax compliance work was completed by a party other than our principal auditor.

19

All Other Fees

All Other Fees consist of fees for products and services other than the services reported above.

Audit Committee Review and Pre-Approval of Independent Auditors’ Fees

The Audit Committee has considered the non-audit services provided by KPMG LLP as described above and believes that they are compatible with maintaining KPMG LLP’s independence as Coinstar’s principal auditors.