Exhibit 99.2

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Today, May 1, 2014, Outerwall Inc. issued a press release announcing financial results for the first quarter of 2014. The following prepared remarks provide additional information related to the company’s operating and financial performance as well as second quarter and full year 2014 guidance. The prepared remarks also include supplementary slides.

The company will host a conference call today at 2:00 p.m. PDT to discuss first quarter 2014 results and second quarter and full year 2014 guidance.

The first quarter 2014 earnings press release, prepared remarks and conference call webcast are available on the Investor Relations section of Outerwall’s website at ir.outerwall.com.

Safe Harbor for Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “estimate,” “expect,” “intend,” “will,” “anticipate,” “goals,” variations of such words, and similar expressions identify forward-looking statements, but their absence does not mean that the statement is not forward-looking. The forward-looking statements in this release include statements regarding Outerwall Inc.’s anticipated growth and future operating results, including 2014 second quarter and full year results. Forward-looking statements are not guarantees of future performance and actual results may vary materially from the results expressed or implied in such statements. Differences may result from actions taken by Outerwall Inc. or its subsidiaries, as well as from risks and uncertainties beyond Outerwall Inc.’s control. Such risks and uncertainties include, but are not limited to,

| | • | | competition from other entertainment providers, |

| | • | | the ability to achieve the strategic and financial objectives for our entry into new businesses, including ecoATM, SAMPLEit and Redbox Instant™ by Verizon, |

| | • | | our ability to repurchase stock and the availability of an open trading window, |

| | • | | the termination, non-renewal or renegotiation on materially adverse terms of our contracts with our significant retailers and suppliers, |

| | • | | payment of increased fees to retailers, suppliers and other third-party providers, including financial service providers, |

| | • | | the timing of new DVD releases and the inability to receive delivery of DVDs on the date of their initial release to the general public, or shortly thereafter, or in sufficient quantity, for home entertainment viewing, |

| | • | | the effective management of our content library, |

| | • | | the timing of the release slate and the relative attractiveness of titles in a particular quarter or year, |

| | • | | the ability to attract new retailers, penetrate new markets and distribution channels and react to changing consumer demands, |

| | • | | the ability to adequately protect our intellectual property, and |

| | • | | the application of substantial federal, state, local and foreign laws and regulations specific to our business. |

The foregoing list of risks and uncertainties is illustrative, but by no means exhaustive. For more information on factors that may affect future performance, please review “Risk Factors” described in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. These forward-looking statements reflect Outerwall Inc.’s expectations as of the date of this press release. Outerwall Inc. undertakes no obligation to update the information provided herein.

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Use of Non-GAAP Financial Measures

Non-GAAP measures may be provided as a complement to results provided in accordance with United States generally accepted accounting principles (“GAAP”).

We use the following non-GAAP financial measures to evaluate our financial results:

| | • | | Core adjusted EBITDA from continuing operations; |

| | • | | Core diluted earnings per share (“EPS”) from continuing operations; |

| | • | | Net debt and net leverage ratio. |

These measures, the definitions of which are presented in Appendix A, are non-GAAP because they exclude certain amounts which are included in the most directly comparable measure calculated and presented in accordance with GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for our GAAP financial measures and may not be comparable with similarly titled measures of other companies.

Core and Non-Core Results

We distinguish our core activities, those associated with our primary operations which we directly control, from non-core activities. Non-core activities are primarily nonrecurring events or events we do not directly control. Our non-core adjustments for the periods presented include i) restructuring costs associated with actions to reduce costs in our continuing operations primarily through workforce reductions across the Company, ii) compensation expense for rights to receive cash issued in conjunction with our acquisition of ecoATM and attributable to post-combination services as they are fixed amount acquisition related awards and not indicative of the directly controllable future business results, iii) income or loss from equity method investments, which represents our share of income or loss from entities we do not consolidate or control, iv) a tax benefit related to a net operating loss adjustment (“Non-Core Adjustments”).

We believe investors should consider our core results because they are more indicative of our ongoing performance and trends, are more consistent with how management evaluates our operational results and trends, provide meaningful supplemental information to investors through the exclusion of certain expenses which are either non-recurring or may not be indicative of our directly controllable business operating results, allow for greater transparency in assessing our performance, help investors better analyze the results of our business and assist in forecasting future periods.

Additional information and reconciliations of the non-GAAP financial measures are included in Appendix A.

Page 2

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Solid Execution and on Track for 2014

Q1 Consolidated Results Highlights1

| | | | | | | | | | | | |

| (In MM, except per share data) | | Q1 2014 | | | Q1 2013 | | | Change (%) | |

GAAP Results | | | | | | | | | | | | |

Consolidated revenue | | $ | 600.4 | | | $ | 573.3 | | | | 4.7 | % |

Net income | | $ | 23.2 | | | $ | 22.6 | | | | 2.5 | % |

Income from continuing operations | | $ | 23.9 | | | $ | 28.0 | | | | (14.7 | )% |

Diluted EPS from continuing operations | | $ | 0.96 | | | $ | 0.97 | | | | (1.0 | )% |

Net cash provided by operating activities | | $ | 94.3 | | | $ | 41.1 | | | | 129.4 | % |

| | | |

Core Results2 | | | | | | | | | | | | |

Core adjusted EBITDA from continuing operations | | $ | 117.6 | | | $ | 110.2 | | | | 6.7 | % |

Core diluted EPS from continuing operations | | $ | 1.27 | | | $ | 1.12 | | | | 13.4 | % |

Free cash flow (“FCF”) | | $ | 67.6 | | | $ | 7.9 | | | | 759.4 | % |

Our Q1 accomplishments included:

| | • | | Consolidated revenue increased to $600.4 million primarily reflecting the ecoATM business that we acquired in July 2013 and continued revenue growth from Redbox and Coinstar |

| | • | | Redbox revenue and segment operating profit were better than we expected due to better title performance in February despite the Winter Olympics and our ongoing focus on cost efficiencies |

| | • | | Coinstar revenue grew and segment margins improved as a result of the price increase effective on October 1, 2013 |

| | • | | Higher core adjusted EBITDA from continuing operations and core diluted EPS from continuing operations than we expected due to stronger revenue growth and our ongoing focus on increasing profitability |

| | • | | Generated $67.6 million in free cash flow, up significantly from the prior year due to working capital benefits, higher profitability and lower capital expenditures |

| | • | | Repurchased approximately 6.0 million shares of our common stock for $420.8 million under our 10b5-1 plan and through a tender offer; repurchases through the tender offer benefited Q1 core diluted EPS from continuing operations by $0.06 and were not included in our Q1 guidance |

| 1 | The year-over-year comparisons we make will be Q1 2014 versus Q1 2013 unless we note otherwise |

| 2 | Additional information and reconciliations of non-GAAP financial measures are included in Appendix A |

Page 3

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Additional Q1 Consolidated Metrics

| | | | | | |

Metric | | Amount | | | Comment |

| | |

Total net interest expense | | $ | 9.6MM | | | Includes $1.3MM in non-cash interest expense |

| | |

Core effective tax rate | | | 38.4 | % | | |

| | |

Ending cash and cash equivalents | | $ | 251.5MM | | | Includes $78.1MM payable to retailer partners; additionally, $90.9MM of total cash was held in financial institutions domestically |

| | |

Total outstanding debt, including capital leases | | $ | 1.01Bn | | | |

| | |

Net leverage ratio3 | | | 1.85x | | | Target range of 1.75x – 2.25x |

Capital Returns

On January 30, 2014, our board of directors approved an additional repurchase program of up to $500.0 million of common stock plus the cash proceeds received from the exercise of stock options to our remaining authority of $201.3 million.

During the first quarter of 2014, we repurchased approximately 6.0 million shares of our common stock for $420.8 million, including 736,000 shares at an average price of $67.93 per share under our10b5-1 plan and approximately 5.3 million shares at $70.07 per share through a modified Dutch auction tender offer completed in March 2014. The aggregate cost of share repurchases through the Dutch auction was approximately $370.8 million, excluding fees and expenses.

At March 31, 2014, there was approximately $282.5 million in authority remaining under the company’s stock repurchase authorization.

In 2014, we remain committed to returning 75%-100% of free cash flow (FCF) to shareholders that includes the $70.8 million previously repurchased through the 10b5-1 plan and tender offer upsize. We continue to believe that share repurchases provide compelling return on capital given our confidence in the business and potential new growth opportunities. We intend to be opportunistic in purchasing our shares at attractive price levels going forward.

| 3 | Additional information and reconciliations of non-GAAP financial measures are included in Appendix A |

Page 4

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Capital Expenditures

We discuss our capital expenditures (CAPEX) on an accrual basis since we believe this methodology better aligns the reported CAPEX to activities during the quarter driving the expenditures. In Q1, our total investment in CAPEX was $27.5 million. Following is a breakdown of CAPEX by category:

| | | | | | | | | | | | | | | | |

| (In MM) | | New | | | Maintenance | | | Other | | | TOTAL | |

Redbox | | $ | 2.0 | | | $ | 9.7 | | | $ | 0.2 | | | $ | 11.9 | |

Coinstar | | | 3.7 | | | | 2.2 | | | | — | | | | 5.9 | |

New Ventures | | | 6.2 | | | | — | | | | — | | | | 6.2 | |

Corporate | | | — | | | | — | | | | 3.5 | | | | 3.5 | |

TOTAL | | $ | 11.9 | | | $ | 11.9 | | | $ | 3.7 | | | $ | 27.5 | |

Redbox

| | • | | During the first quarter, Redbox continued to focus on maximizing profitability through network optimization, with a net reduction of approximately 160 kiosks in the U.S. |

| | • | | In Canada, Redbox added approximately 200 net installs in Q1, bringing total active kiosks to more than 1,300 as of March 31, 2014 |

| | • | | Maintenance CAPEX included routine kiosk-related maintenance and a one-time system upgrade for Redbox kiosks that was substantially completed by the end of April |

Coinstar

| | • | | Focused on network optimization, removing approximately 250 kiosks and adding approximately 300 kiosks consisting of Coinstar kiosks in the U.K. and Coinstar Exchange kiosks in the U.S. |

| | • | | Coinstar also invested in routine maintenance to upgrade components on existing kiosks |

New Ventures

| | • | | Primarily consisting of new ecoATM kiosks built for installations later this year |

Corporate

| | • | | Investment in software and hardware to generally support our business |

Page 5

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Redbox

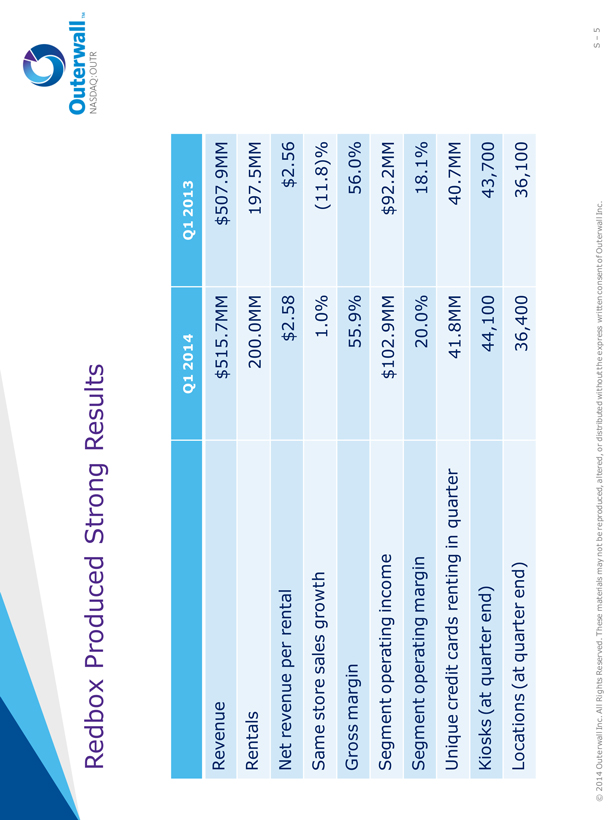

Redbox Q1 Results Summary

| | | | | | | | |

| Category | | Q1 2014 | | | Q1 2013 | |

Revenue | | $ | 515.7MM | | | $ | 507.9MM | |

Rentals | | | 200.0MM | | | | 197.5MM | |

Net revenue per rental | | $ | 2.58 | | | $ | 2.56 | |

Same store sales growth | | | 1.0 | % | | | (11.8 | )% |

Gross margin | | | 55.9 | % | | | 56.0 | % |

Segment operating income | | $ | 102.9MM | | | $ | 92.2MM | |

Segment operating margin | | | 20.0 | % | | | 18.1 | % |

Unique credit cards renting in quarter | | | 41.8MM | | | | 40.7MM | |

Kiosks (at quarter end) | | | 44,100 | | | | 43,700 | |

Locations (at quarter end) | | | 36,400 | | | | 36,100 | |

Redbox Segment Operating Results

Q1 Redbox revenue increased 1.5%, and rents and revenue per kiosk were up year-over-year, primarily driven by approximately 200 million rentals that increased 1.2% from Q1 2013. Movie rentals increased 2.0% year-over-year despite the impact from the Winter Olympics in February. Movie rental growth offset an expected decline in video game rentals as the industry transitions to new gaming platforms.

Unique credit cards renting during Q1 increased by 2.6% compared with Q1 2013, and high frequency renters generated approximately 60% of revenue. The Target credit card security breach that occurred in late 2013 resulted in a significant number of new credit cards that were issued to consumers and that we believe increased our new unique credit cards in the quarter.

Redbox segment operating income in Q1 was $102.9 million, an increase of 11.7% compared with Q1 2013. Segment operating margin was 20.0%, an increase of 190 basis points year-over-year, primarily due to a $7.7 million increase in revenue and a $3.8 million decrease in general and administrative expenses mainly due to the restructuring that we announced in December 2013 as well as our ongoing focus on managing general and administrative expenses.

January rentals increased 7.1% year-over-year primarily driven by stronger content compared with Q1 2013. Although February 2014 was a challenging month due to lower box office and the Olympics spanning three weekends of the month, Redbox rentals were higher than expected. March 2014 was our strongest month of the quarter as Redbox capitalized on a robust release slate that includedHunger Games: Catching Fire,American Hustle andThe Wolf of Wall Street. Academy Award contendersDallas Buyers Club, Nebraskaand Blue Jasmine also performed above our expectations.

Page 6

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Several factors contributed to the $0.02 increase to $2.58 in net revenue per rental (average check) compared with Q1 2013, including continued growth in Blu-ray mix, a reduction in promotional discounts and ongoing stabilization in the percentage of one-night rentals. These factors also drove 1.0% growth in same store sales, a significant increase compared with negative 11.8% last year.

Redbox made substantial progress on reducing promotional discounting in late 2013, terminating less productive programs and improving discounting efficiency as our CRM tool reached scale. In Q1, we reduced total promotional dollars by 38.1% year-over-year and were still able to exceed our rental expectations. The reduction in discounting allows us to collect more revenue per rental and reduce the mix of one-night rentals on promotion.

Recently, Nielsen reported that the rate of decline in the total physical rental category improved significantly in Q1, down 6% year-over-year compared with down 14% in Q4 2013, driven by a strong title slate and continued growth from Redbox.

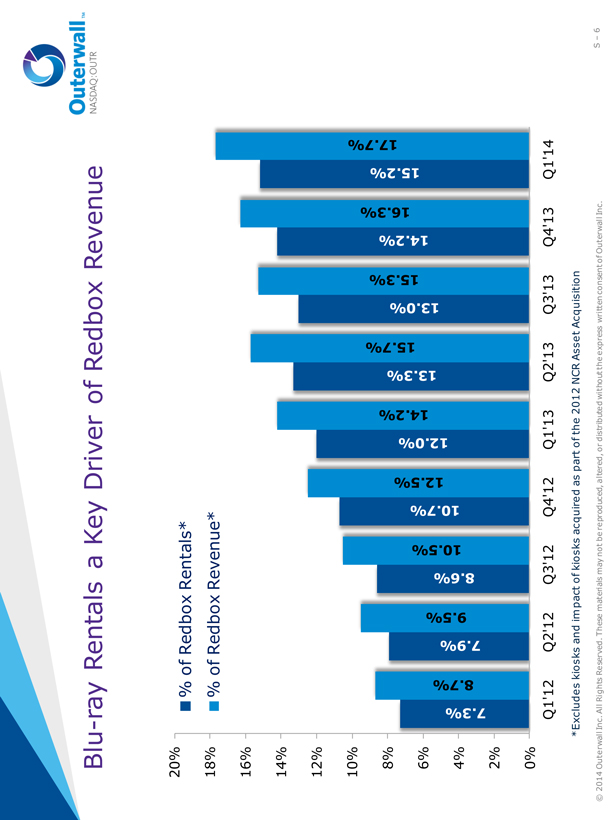

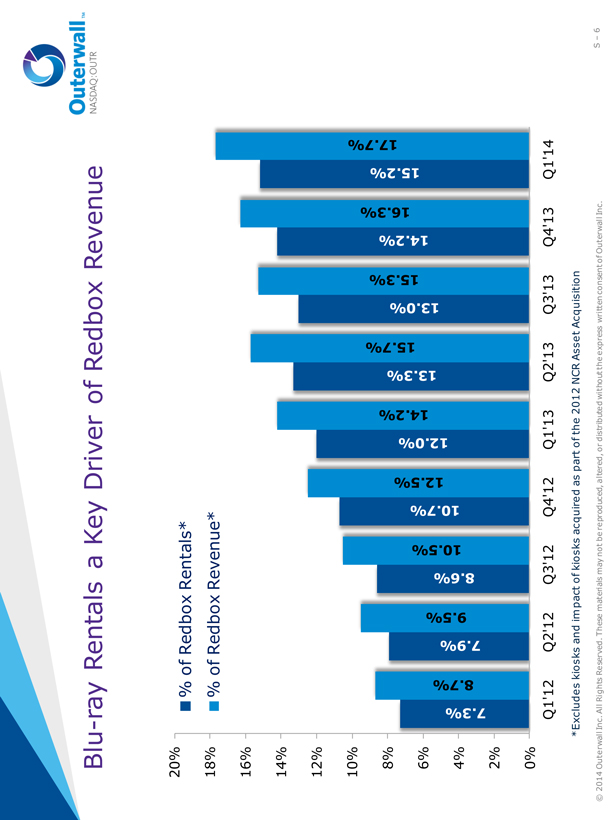

Blu-ray Rentals and Revenue

| | | | | | | | |

| Blu-ray Performance | | Q1 2014 | | | Q1 2013 | |

Percentage of rentals | | | 15.2 | % | | | 12.0 | % |

Percentage of Redbox revenue | | | 17.7 | % | | | 14.2 | % |

Blu-ray growth is a key strategic initiative, and in Q1, Blu-ray rentals increased 28.0% year-over-year, with both Blu-ray rentals and revenue exceeding the records we set in Q4 2013. Blu-ray continues to perform well across multiple genres, giving us confidence that we can continue to grow the format. Our online tools to upsell customers to Blu-ray are producing incremental rentals, and we have plans to implement this feature at the kiosk in the second half of 2014.

Video Games Rentals and Revenue

| | | | | | | | |

| Video Games Performance | | Q1 2014 | | | Q1 2013 | |

Percentage of rentals | | | 1.4 | % | | | 2.2 | % |

Percentage of Redbox revenue | | | 3.4 | % | | | 5.1 | % |

As we expected, video games declined as a percentage of Redbox rentals and revenue, reflecting the game industry’s transition to new platforms. Game publishers continued to support games for Xbox 360 and PS3, and those formats continued to rent well, while Wii rentals continued to decline. We are seeing positive signs from our initial next generation platform testing and plan to expand the pilot further in 2014.

Page 7

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Canada

We installed approximately 200 kiosks in Canada, ending the quarter with more than 1,300 installations. We continued to concentrate on the greater Toronto and Vancouver areas to build out the network and enhance the benefit of the ability to rent and return anywhere. The market awareness of the business continues to grow with an aided awareness of 73%, up from 64% in Q4 2013 and 51% a year ago. We will continue to install kiosks in the next few quarters to further enhance the availability and convenience for Canadian consumers.

Redbox Instant™ by Verizon

In March, Redbox Instant by Verizon reached the one-year mark for its public availability. During Q1, we continued to increase subscribers, aided by the strong level of connected device sales in Q4. We made several product enhancements during the quarter that improve the consumer experience and resulted in monthly increases in engagement with the service. We also made a required capital contribution of $10.5 million to Redbox Instant by Verizon in Q1.

Coinstar

Coinstar Q1 Results Summary

| | | | | | | | |

| Category | | Q1 2014 | | | Q1 2013 | |

Revenue | | $ | 68.8MM | | | $ | 65.4MM | |

Average transaction | | $ | 40.76 | | | $ | 39.22 | |

Transactions | | | 16.6MM | | | | 17.4MM | |

Same store sales (SSS) growth | | | 3.1 | % | | | 0.2 | % |

Segment operating income | | $ | 22.7MM | | | $ | 18.6MM | |

Segment operating margin | | | 33.1 | % | | | 28.5 | % |

Kiosks (at quarter end) | | | 21,000 | | | | 20,600 | |

Locations (at quarter end) | | | 20,300 | | | | 20,400 | |

Coinstar Segment Operating Results

Coinstar segment revenue increased 5.2% year-over-year to $68.8 million in Q1, primarily driven by the following:

| | • | | the price increase4 implemented in October 2013 that contributed $5.0 million for the quarter; |

| | • | | additional kiosks in the U.K. kiosk base resulting in higher U.K. volume; and |

| | • | | additional Coinstar™ Exchange kiosks that exchange gift cards for cash. |

| 4 | On October 1, 2013 the coin-counting fee was raised to 10.9% from 9.8% for all U.S. retail grocery locations |

Page 8

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

U.S. volume was lower in Q1, primarily in markets with severe weather in the first half of the quarter. Transactions also decreased year-over-year; however, average transaction size increased to $40.76, up 3.9% from Q1 2013.

Same store sales grew 3.1% in Q1, an increase from 0.2% in Q1 2013, primarily due to the October 2013 price increase.

Coinstar segment operating income increased 22.1% year-over-year to $22.7 million, and Coinstar segment operating margin was 33.1%, up 460 basis points. The segment operating income increase is attributable to the October 2013 price increase and lower research and development expense, despite higher general and administrative expense to support growth in our Coinstar Exchange business.

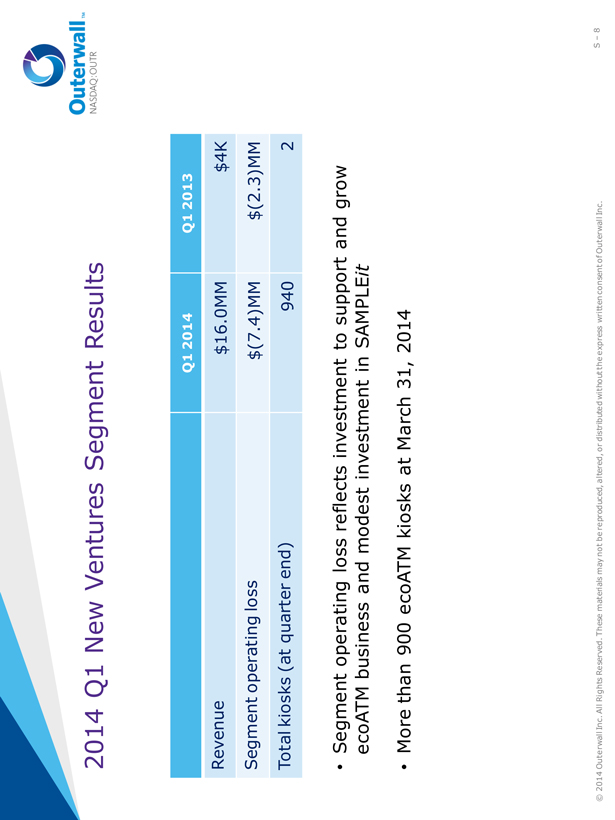

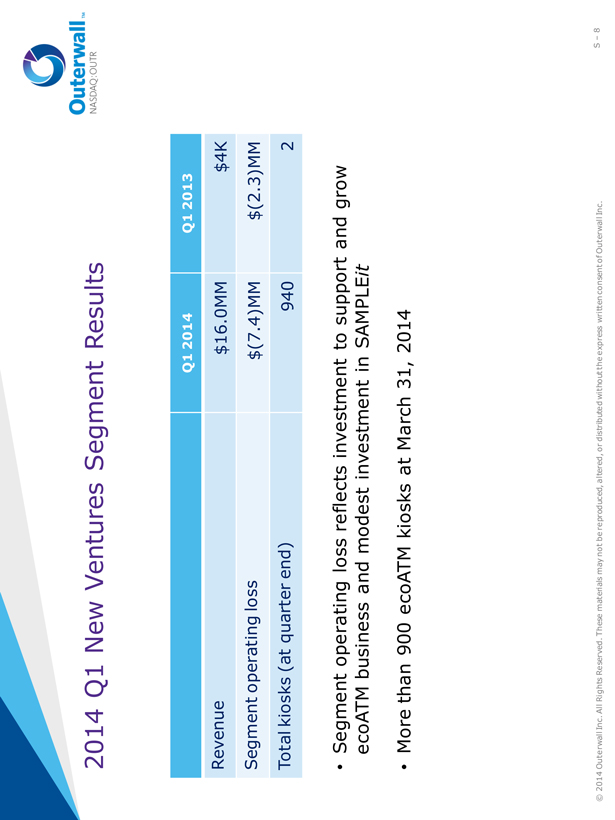

New Ventures

New Ventures Q1 Results Summary

| | | | | | | | |

| Category | | Q1 2014 | | | Q1 2013 | |

Revenue | | $ | 16.0MM | | | $ | 4K | |

Segment operating loss | | $ | (7.4)MM | | | $ | (2.3)MM | |

Total kiosks | | | 940 | | | | 2 | |

New Ventures Segment Operating Results

The New Ventures segment includes ecoATM and SAMPLEit. The company discontinued several concepts in 2013 that were previously included in the New Ventures segment. These concepts were moved to discontinued operations for 2013 and prior periods.

The segment operating results primarily reflect the operations and performance of ecoATM, which we acquired in July 2013, with the majority of segment revenue of $16.0 million generated by ecoATM. Since we hold devices for at least 30 days before selling them to comply with second-hand dealer laws, Q1 revenue reflects devices acquired from December 2013 through February 2014. As previously communicated, the locked iPhone issue impacted device collections in Q4 2013 and, as a result, impacted January revenue. We deployed a software solution late last year that resulted in improved collection rates in Q1.

We are currently focused on scaling ecoATM, and the increase in segment operating loss to $7.4 million in Q1 reflects the investments necessary to support and grow this business as well as our investment in SAMPLEit. Direct operating expense of $16.3 million, a $16.1 million year-over-year increase, includes

Page 9

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

expenses primarily related to servicing the kiosks; payments to retailers for use of their space; and acquiring, transporting and processing the ecoATM mobile devices. General and administrative expense includes building the teams and infrastructure needed to scale the ecoATM business and support our ongoing testing of SAMPLEit.

We continued to make progress expanding ecoATM in the mass merchant and grocery channels, and, although installations are off to a slow start, we still expect to install approximately 1,000 to 1,200 ecoATM kiosks this year.

Importantly, device collection per kiosk per day at our mature machines improved and average sale price increased as our software solution addressed locked iPhones and the collection of higher value devices increased.

Non-Core Results

During Q1 2014, the pretax loss from non-core results totaled $13.3 million compared with a pretax loss of $7.0 million in Q1 2013, primarily driven by losses at Redbox Instant by Verizon as the business is built out. Our share of the total start-up losses for the joint venture was $9.1 million in the quarter.

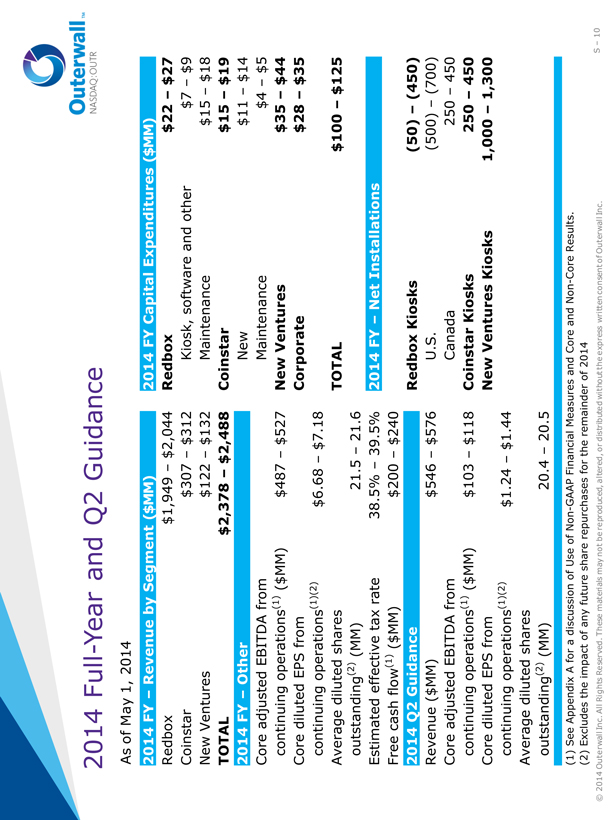

Guidance

Beginning in 2015, we will provide annual guidance only. We believe annual guidance is a more relevant measurement of the business given our stage of growth, and full-year results capture the varying seasonal patterns for each of our businesses.

As Redbox matures, the key driver of Redbox performance is the availability of new release content, including the strength of titles and the release schedule.

For Coinstar, the price increase implemented in October 2013 will continue to benefit the top and bottom lines.

Page 10

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Q2 2014 Guidance

Q2 2014 currently has an estimated total box office of $1.35 billion, which is approximately 38% lower than $2.18 billion last year. 22 of the 31 titles scheduled for Q2 reached box office results of less than $40 million. There are eight weeks in the quarter with two or fewer new titles, and we will enter June with no new releases in the first week.

The shift in box office from April to May compared with the prior year reflects the late Easter holiday as certain strong sell-through titles from delay studios were released nationally in April to capitalize on elevated holiday demand. For example,The Hobbit: The Desolation of Smaug,released three weeks after the release of the first installment in the trilogyThe Hobbit: An Unexpected Journey in the prior year. Content strength in May 2014 compares favorably to 2013, with three more theatrical titles and 165% greater box office. We will rely on the strength of May releases to help fulfill increased seasonal rental demand in June. We expect only four theatrical releases in June 2014, and three of the four weeks in June have less than $40 million combined box office.

A breakdown of content for Redbox kiosks by month follows:

| | | | | | | | | | | | | | | | |

| | | Q2 2014 | | | Q2 2013 | |

| (2014 data estimated) | | Box Office | | | Titles* | | | Box Office | | | Titles* | |

TOTAL | | $ | 1.35Bn | | | | 31 | | | $ | 2.18Bn | | | | 35 | |

April | | $ | 477.9MM | | | | 14 | | | $ | 1.14Bn | | | | 12 | |

May | | $ | 744.9MM | | | | 13 | | | $ | 280.9MM | | | | 10 | |

June | | $ | 129.7MM | | | | 4 | | | $ | 758.7MM | | | | 13 | |

| * | Box office greater than or equal to $5 million |

Historically, we have experienced seasonality in Q2, with a drop in box office and number of titles compared with Q1, and this year the seasonality is magnified, with a total box office that is $2.25 billion, or 62%, lower than Q1 2014, and approximately 31% fewer titles.

Despite the light content slate in Q2, we expect a year-over-year increase in Blu-ray demand to contribute to revenue growth. Blu-ray rentals are expected to represent 14% to 16% of rentals in Q2, compared with 13.3% in Q2 2013, driven by increased device penetration, customer experience enhancements and improved marketing tactics.

We expect rentals and revenue per kiosk to be down year-over-year in the second quarter due to the release schedule and installations in Canada. We expect both rents and revenue per kiosk to be upyear-over-year in the third and fourth quarters.

As a reminder, Q2 2013 results included a $21.7 million one-time pretax benefit resulting from an accounting change related to amortizing content costs at Redbox that will impact year-over-year comparisons.

Page 11

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

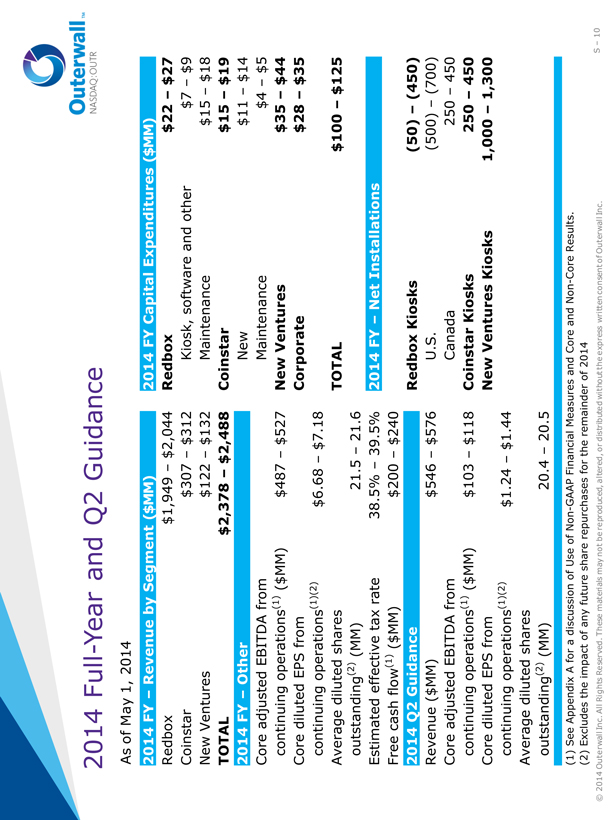

2014 Q2 consolidated guidance follows:

| | • | | Consolidated revenue between $546MM and $576MM |

| | • | | Core adjusted EBITDA from continuing operations between $103MM and $118MM |

| | • | | Core diluted EPS from continuing operations between $1.24 and $1.44 |

| | • | | For the quarter, we expect average diluted shares in the range of 20.4MM to 20.5MM |

2014 Full-Year Guidance

Full-year 2014 guidance includes the following:

| | • | | The second half of the year is expected to benefit from improved revenue and profitability at Redbox, particularly in Q3, as we have adjusted the promotional strategy that was utilized in 2013 |

| | • | | The weak release slate and schedule in June creates a lack of momentum going into July and could lead to a slow start next quarter despite what looks like a good release schedule in July |

| | • | | Our expectations for Redbox revenue are based on our current visibility of the second half release schedule, which will continue to evolve over the coming months |

| | • | | Results include our expectations for the rollout of ecoATM kiosks, including the timing of installations |

| | • | | Core diluted EPS from continuing operations includes the benefit of the share repurchases completed in Q1, but does not include the benefit of any additional share repurchases that we may complete in the remainder of 2014 |

For the 2014 full year, we currently expect:

| | • | | Consolidated revenue between $2.378Bn and $2.488Bn |

| | • | | Core adjusted EBITDA from continuing operations between $487MM and $527MM |

| | • | | Core diluted EPS from continuing operations between $6.68 and $7.18 |

| | • | | Free cash flow in the range of $200MM to $240MM |

| | • | | We estimate an effective tax rate of 38.5% to 39.5% and cash taxes in the range of $105MM to $115MM, including the $24MM cash tax refund received in Q1 |

| | • | | For the year, we expect average diluted shares in the range of 21.5MM to 21.6MM |

Page 12

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Summary

We are off to a solid start to 2014 as demonstrated by our first quarter results. Consolidated revenue increased to more than $600 million, and profitability exceeded our expectations. Revenue and segment operating margins grew in both our Redbox and Coinstar businesses. In addition, we repurchased 23.0% of shares outstanding during the quarter and expect to repurchase additional shares throughout the remainder of the year, reflecting our confidence in our ability to execute on key initiatives in 2014 and our commitment to return 75% to 100% of free cash flow to shareholders.

Page 13

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

APPENDIX A

Use of Non-GAAP Financial Measures

Non-GAAP measures may be provided as a complement to results provided in accordance with United States generally accepted accounting principles (“GAAP”).

We use the following non-GAAP financial measures to evaluate our financial results:

| | • | | Core adjusted EBITDA from continuing operations; |

| | • | | Core diluted earnings per share (“EPS”) from continuing operations; |

| | • | | Net debt and net leverage ratio. |

These measures, the definitions of which are presented below, are non-GAAP because they exclude certain amounts which are included in the most directly comparable measure calculated and presented in accordance with GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for our GAAP financial measures and may not be comparable with similarly titled measures of other companies.

Core and Non-Core Results

We distinguish our core activities, those associated with our primary operations which we directly control, from non-core activities. Non-core activities are primarily nonrecurring events or events we do not directly control. Our non-core adjustments for the periods presented include i) restructuring costs associated with actions to reduce costs in our continuing operations primarily through workforce reductions across the Company, ii) compensation expense for rights to receive cash issued in conjunction with our acquisition of ecoATM and attributable to post-combination services as they are fixed amount acquisition related awards and not indicative of the directly controllable future business results, iii) income or loss from equity method investments, which represents our share of income or loss from entities we do not consolidate or control, iv) a tax benefit related to a net operating loss adjustment (“Non-Core Adjustments”).

We believe investors should consider our core results because they are more indicative of our ongoing performance and trends, are more consistent with how management evaluates our operational results and trends, provide meaningful supplemental information to investors through the exclusion of certain expenses which are either non-recurring or may not be indicative of our directly controllable business operating results, allow for greater transparency in assessing our performance, help investors better analyze the results of our business and assist in forecasting future periods.

Page 14

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Core Adjusted EBITDA from continuing operations

Our non-GAAP financial measure core adjusted EBITDA from continuing operations is defined as earnings from continuing operations before depreciation, amortization and other; interest expense, net; income taxes; share-based payments expense; and Non-Core Adjustments.

A reconciliation of core adjusted EBITDA from continuing operations to net income from continuing operations, the most comparable GAAP financial measure, is presented in the following table:

| | | | | | | | |

| | | Three Months Ended | |

| | | March 31, | |

| Dollars in thousands | | 2014 | | | 2013 | |

Net income from continuing operations | | $ | 23,886 | | | $ | 28,007 | |

Depreciation, amortization and other | | | 52,943 | | | | 48,597 | |

Interest expense, net | | | 9,645 | | | | 5,533 | |

Income taxes | | | 14,076 | | | | 16,155 | |

Share-based payments expense(1) | | | 3,765 | | | | 4,837 | |

| | | | | | | | |

Adjusted EBITDA from continuing operations | | | 104,315 | | | | 103,129 | |

Non-Core Adjustments: | | | | | | | | |

Restructuring costs | | | 469 | | | | — | |

Rights to receive cash issued in connection with the acquisition of ecoATM | | | 3,421 | | | | — | |

Loss from equity method investments | | | 9,368 | | | | 7,025 | |

| | | | | | | | |

Core adjusted EBITDA from continuing operations | | $ | 117,573 | | | $ | 110,154 | |

| (1) | Includes both non-cash share-based compensation for executives, non-employee directors and employees as well as share-based payments for content arrangements. |

Page 15

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

Core Diluted EPS from continuing operations

Our non-GAAP financial measure core diluted EPS from continuing operations is defined as diluted earnings per share from continuing operations excluding Non-Core Adjustments, net of applicable taxes.

A reconciliation of core diluted EPS from continuing operations to diluted EPS from continuing operations, the most comparable GAAP financial measure, is presented in the following table:

| | | | | | | | |

| | | Three Months Ended | |

| | March 31, | |

| | | 2014 | | | 2013 | |

Diluted EPS from continuing operations | | $ | 0.96 | | | $ | 0.97 | |

Non-Core Adjustments, net of tax:(1) | | | | | | | | |

Restructuring costs | | | 0.01 | | | | — | |

Rights to receive cash issued in connection with the acquisition of ecoATM | | | 0.11 | | | | — | |

Loss from equity method investments | | | 0.23 | | | | 0.15 | |

Tax benefit from net operating loss adjustment | | | (0.04 | ) | | | — | |

| | | | | | | | |

Core diluted EPS from continuing operations | | $ | 1.27 | | | $ | 1.12 | |

| (1) | Non-Core Adjustments are presented after-tax using the applicable effective tax rate for the respective periods. |

Free Cash Flow

Our non-GAAP financial measure free cash flow is defined as net cash provided by operating activities after capital expenditures. We believe free cash flow is an important non-GAAP measure as it provides additional information to users of the financial statements regarding our ability to service, incur or pay down indebtedness and repurchase our securities.

A reconciliation of free cash flow to net cash provided by operating activities, the most comparable GAAP financial measure, is presented in the following table:

| | | | | | | | |

| | | Three Months Ended | |

| | | March 31, | |

| Dollars in thousands | | 2014 | | | 2013 | |

Net cash provided by operating activities | | $ | 94,305 | | | $ | 41,102 | |

Purchase of property and equipment | | | (26,658 | ) | | | (33,231 | ) |

| | | | | | | | |

Free cash flow | | $ | 67,647 | | | $ | 7,871 | |

Page 16

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

Outerwall Inc. 2014 First Quarter Earnings

Prepared Remarks

May 1, 2014

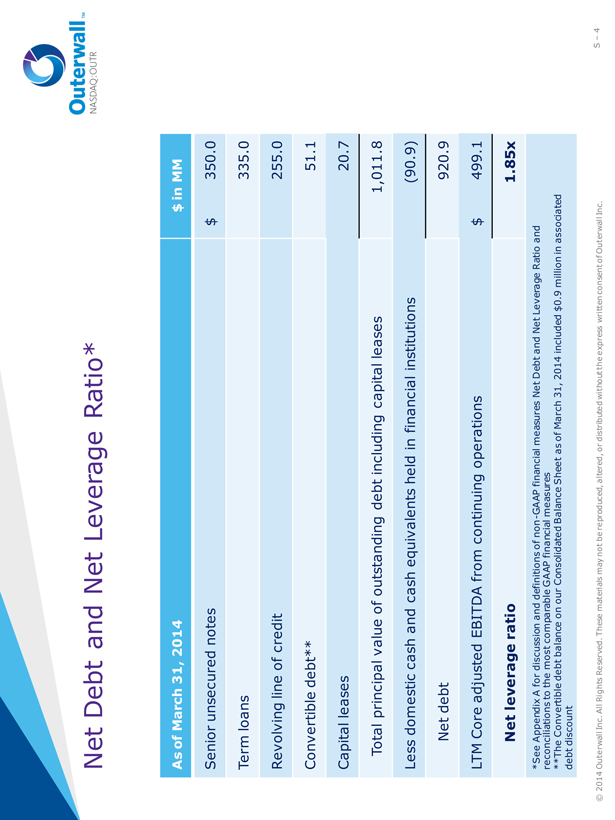

Net Debt and Net Leverage Ratio

Our non-GAAP financial measure net debt is defined as the total face value of outstanding debt, including capital leases, less cash and cash equivalents held in financial institutions domestically. Our non-GAAP financial measure net leverage ratio is defined as net debt divided by core adjusted EBITDA from continuing operations for the last twelve months (LTM). We believe net debt and net leverage ratio are important non-GAAP measures because they:

| | • | | are used to assess the degree of leverage by management; |

| | • | | provide additional information to users of the financial statements regarding our ability to service, incur or pay down indebtedness and repurchase our securities as well as additional information about our capital structure; and |

| | • | | are reported quarterly to support covenant compliance under our credit agreement. |

A reconciliation of net debt to total outstanding debt including capital leases, the most comparable GAAP financial measure, is presented in the following table:

| | | | | | | | |

| | | March 31, | | | December 31, | |

| Dollars in thousands | | 2014 | | | 2013 | |

Senior unsecured notes | | $ | 350,000 | | | $ | 350,000 | |

Term loans | | | 335,000 | | | | 344,375 | |

Revolving line of credit | | | 255,000 | | | | — | |

Convertible debt(1) | | | 51,144 | | | | 51,148 | |

Capital leases | | | 20,701 | | | | 21,361 | |

| | | | | | | | |

Total principal value of outstanding debt including capital leases | | | 1,011,845 | | | | 766,884 | |

Less domestic cash and cash equivalents held in financial institutions | | | (90,863 | ) | | | (199,027 | ) |

| | | | | | | | |

Net debt | | | 920,982 | | | | 567,857 | |

LTM Core adjusted EBITDA from continuing operations(2) | | $ | 499,071 | | | $ | 491,652 | |

| | | | | | | | |

Net leverage ratio | | | 1.85 | | | | 1.15 | |

| (1) | The Convertible debt balance on our Consolidated Balance Sheets as of March 31, 2014 and December 31, 2013 included $0.9 million and $1.4 million, respectively, in associated debt discount. |

| (2) | LTM Core Adjusted EBITDA from continuing operations for the twelve months ended March 31, 2014 and December 31, 2013 was determined as follows: |

| | | | |

| Dollars in thousands | | | |

Core adjusted EBITDA from continuing operations for the three months ended March 31, 2014 | | $ | 117,573 | |

Add: Core adjusted EBITDA from continuing operations for the twelve months ended December 31, 2013(A) | | | 491,652 | |

Less: Core adjusted EBITDA from continuing operations for the three months ended March 31, 2013 | | | (110,154 | ) |

| | | | |

LTM Core adjusted EBITDA from continuing operations for the twelve months ended March 31, 2014 | | $ | 499,071 | |

| (A) | Core adjusted EBITDA from continuing operations for the twelve months ended December 31, 2013 is obtained from our Annual Report on Form 10-K for the period ended December 31, 2013, where it is reconciled to net income from continuing operations, the most comparable GAAP financial measure, and represents the LTM core adjusted EBITDA from continuing operations we use in our calculation of net leverage ratio as of December 31, 2013. |

Page 17

©2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered or distributed without the express written consent of Outerwall Inc.

NASDAQ:OUTR

Supplementary Slides 2014 Q1 Prepared Remarks

May 1, 2014

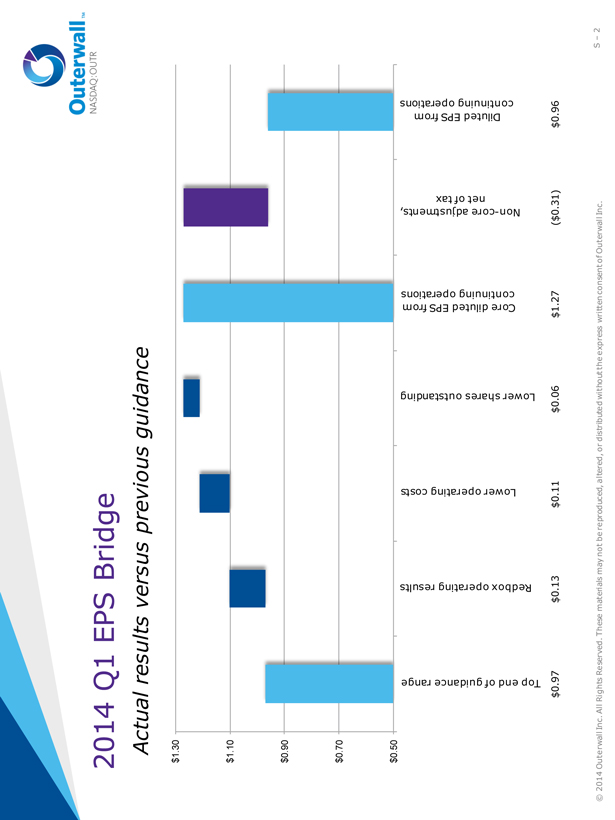

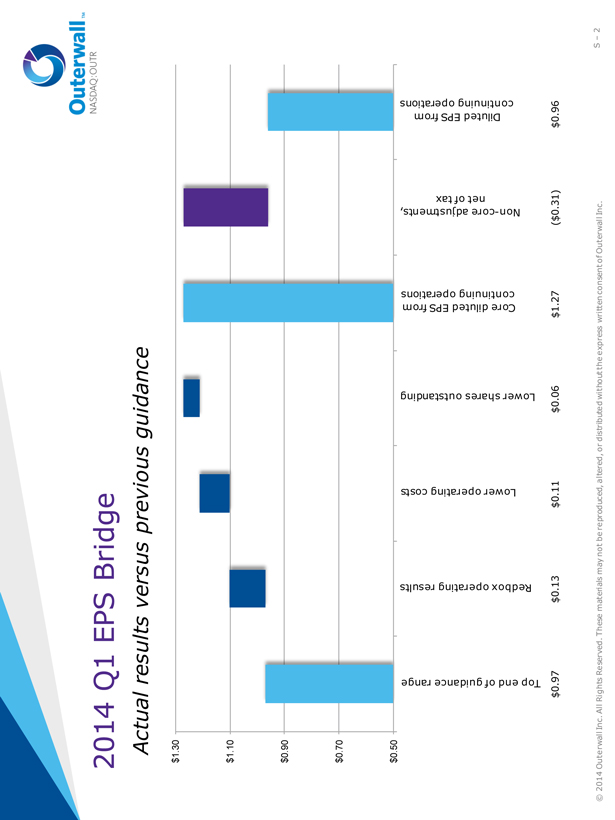

2014 Q1 EPS Bridge

Actual results versus previous guidance

$1.30 $1.10 $0.90 $0.70

$0.50 results costs outstanding operations adjustments, operations range guidance operating operating EPS from diluted EPS from continuing Diluted continuing shares net of tax Lower Redbox Top end of Lower Core Non-core $0.97 $0.13 $0.11 $0.06 $1.27 ($0.31) $0.96

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 2

Share Repurchase and Capital Returns

Repurchased approximately 6.0 million shares, or 23% of shares outstanding, for $420.8 million

$ 282.5 million authority remaining at March 31, 2014

Remain committed to returning 75%-100% of FCF in 2014

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 3

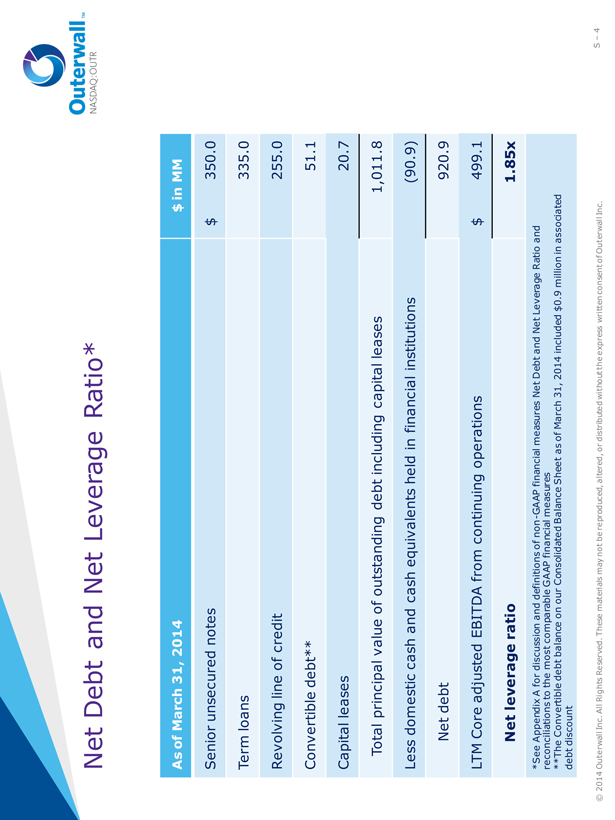

Net Debt and Net Leverage Ratio*

As of March 31, 2014 $ in MM

Senior unsecured notes $ 350.0 Term loans 335.0 Revolving line of credit 255.0 Convertible debt** 51.1 Capital leases 20.7 Total principal value of outstanding debt including capital leases 1,011.8 Less domestic cash and cash equivalents held in financial institutions (90.9) Net debt 920.9 LTM Core adjusted EBITDA from continuing operations $ 499.1

Net leverage ratio 1.85x

*See Appendix A for discussion and definitions of non-GAAP financial measures Net Debt and Net Leverage Ratio and reconciliations to the most comparable GAAP financial measures **The Convertible debt balance on our Consolidated Balance Sheet as of March 31, 2014 included $0.9 million in associated debt discount

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 4

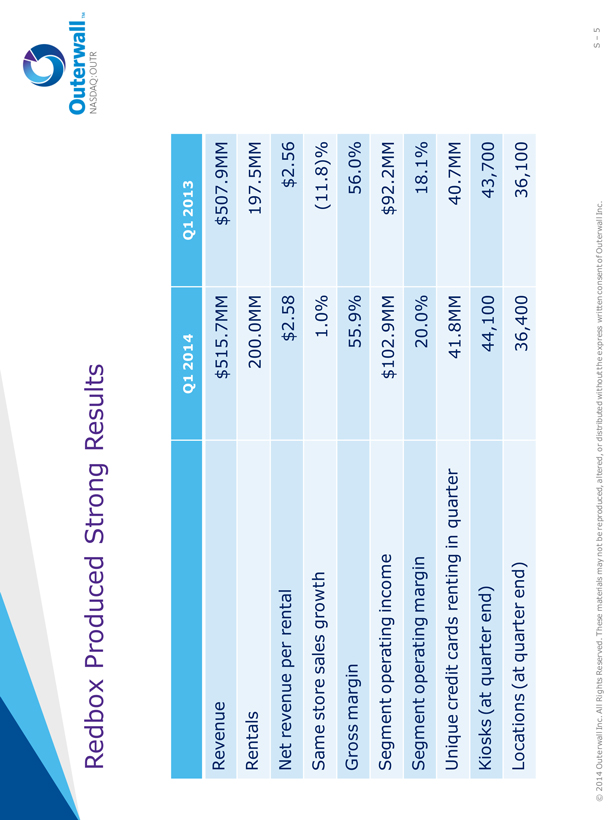

Redbox Produced Strong Results

Q1 2014 Q1 2013

Revenue $515.7MM $507.9MM Rentals 200.0MM 197.5MM Net revenue per rental $2.58 $2.56 Same store sales growth 1.0% (11.8)% Gross margin 55.9% 56.0% Segment operating income $102.9MM $92.2MM Segment operating margin 20.0% 18.1% Unique credit cards renting in quarter 41.8MM 40.7MM Kiosks (at quarter end) 44,100 43,700 Locations (at quarter end) 36,400 36,100

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 5

Blu-ray Rentals a Key Driver of Redbox Revenue

20%

% of Redbox Rentals* 18% % of Redbox Revenue*

16% 14% 12%

10%

8% 15.7% 15.3% 16.3% 15.2% 17.7%

6% 10.5% 10.7% 12.5% 12.0% 14.2% 13.3% 13.0% 14.2%

4% 7.3% 8.7% 7.9% 9.5% 8.6%

2%

0%

Q1’12 Q2’12 Q3’12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1’14

*Excludes kiosks and impact of kiosks acquired as part of the 2012 NCR Asset Acquisition

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 6

Coinstar Generated Significant Margin Expansion

Q1 2014 Q1 2013

Revenue $68.8MM $65.4MM Average transaction $40.76 $39.22 Transactions 16.6MM 17.4MM Same store sales growth 3.1% 0.2% Segment operating income $22.7MM $18.6MM Segment operating margin 33.1% 28.5% Kiosks (at quarter end) 21,000 20,600 Locations (at quarter end) 20,300 20,400

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 7

2014 Q1 New Ventures Segment Results

Q1 2014 Q1 2013

Revenue $16.0MM $4K Segment operating loss $(7.4)MM $(2.3)MM Total kiosks (at quarter end) 940 2

Segment operating loss reflects investment to support and grow ecoATM business and modest investment in SAMPLEit

More than 900 ecoATM kiosks at March 31, 2014

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 8

2014 Q2 Redbox Release Schedule

Typical Q1 to Q2 seasonality with lower box office and fewer titles

As of May 1, 2014 Q2 2014 Q2 2013 $350 Box Office (MM)* 2014 data

estimated Box Office Titles* Box Office Titles*

6 Total $1.35Bn 31 $2.18Bn 35

$300

April $477.9MM 14 $1.14Bn 12

2

May $744.9MM 13 $280.9MM 10

$250

June $129.7MM 4 $758.7MM 13

$200 3 = # of new releases

3 $150

5

$100

3 2 2

$50 1 1

2 1 0 $0 4/1 4/8 4/15 4/22 4/29 5/6 5/13 5/20 5/27 6/3 6/10 6/17 6/24

*Includes titles with total North American box office greater than $5MM

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 9

2014 Full-Year and Q2 Guidance

As of May 1, 2014

2014 FY – Revenue by Segment ($MM) 2014 FY Capital Expenditures ($MM)

Redbox $1,949 – $2,044 Redbox $22 – $27 Coinstar $307 – $312 Kiosk, software and other $7 – $9 New Ventures $122 – $132 Maintenance $15 – $18

TOTAL $2,378 – $2,488 Coinstar $15 – $19 2014 FY – Other New $11 – $14 Core adjusted EBITDA from Maintenance $4 – $5 continuing operations(1) ($MM) $487 – $527 New Ventures $35 – $44 Core diluted EPS from Corporate $28 – $35 continuing operations(1)(2) $6.68 – $7.18 Average diluted shares TOTAL $100 – $125 outstanding(2) (MM) 21.5 – 21.6 Estimated effective tax rate 38.5% – 39.5% 2014 FY – Net Installations Free cash flow(1) ($MM) $200 – $240

2014 Q2 Guidance Redbox Kiosks (50) – (450) Revenue ($MM) $546 – $576 U.S. (500) – (700) Core adjusted EBITDA from Canada 250 – 450 continuing operations(1) ($MM) $103 – $118 Coinstar Kiosks 250 – 450 Core diluted EPS from New Ventures Kiosks 1,000 – 1,300 continuing operations(1)(2) $1.24 – $1.44 Average diluted shares outstanding(2) (MM) 20.4 – 20.5

(1) See Appendix A for a discussion of Use of Non-GAAP Financial Measures and Core and Non-Core Results. (2) Excludes the impact of any future share repurchases for the remainder of 2014

© 2014 Outerwall Inc. All Rights Reserved. These materials may not be reproduced, altered, or distributed without the express written consent of Outerwall Inc.

S – 10