UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

Commission File Number: 000-22555

OUTERWALL INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-3156448 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 1800 114th Avenue SE, Bellevue, Washington | | 98004 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 425-943-8000

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.001 par value

Name of each exchange on which registered: The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.: Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No x

The aggregate market value of the registrant’s common equity held by non-affiliates of the registrant as of June 30, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter), based upon the closing price as reported in the NASDAQ Global Select Market System, was approximately $1.2 billion.

The number of shares outstanding of the registrant’s Common Stock as of April 22, 2016 was 17,215,104 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FORM 10-K/A

INDEX

-i-

EXPLANATORY NOTE

Outerwall Inc. is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the “Annual Report”), as filed with the Securities and Exchange Commission (“SEC”) on February 4, 2016, for the purpose of including the information that was to be incorporated by reference to its definitive proxy statement relating to its 2016 Annual Meeting of Stockholders. This Amendment hereby amends Part III, Items 10 through 14. We are also including as exhibits the certifications required under Section 302 of the Sarbanes-Oxley Act of 2002.

Except as otherwise expressly stated herein, this Amendment does not reflect events occurring after the date of the Annual Report, nor does it modify or update the disclosure contained in the Annual Report in any way other than as required to reflect the amendments discussed above and reflected below. Accordingly, this Amendment should be read in conjunction with the Annual Report and Outerwall’s other filings made with the SEC on or subsequent to February 4, 2016.

Unless the context requires otherwise, the terms “Outerwall,” the “Company,” “we,” “us” and “our” refer to Outerwall Inc. and its subsidiaries.

-1-

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Board Composition

As of April 22, 2016, the Board of Directors was composed of eight members, divided into three classes as follows:

| | | | | | | | | | |

Name | | Age | | Term

Expiring in | | Audit

Committee | | Compensation

Committee | | Nominating and

Governance

Committee |

Jeffrey J. Brown | | 55 | | 2017 | | | | | | |

Nelson C. Chan | | 54 | | 2018 | | | | | | ** |

Nora M. Denzel† | | 53 | | 2016 | | | | | | * |

David M. Eskenazy | | 53 | | 2017 | | * | | * | | |

Ross G. Landsbaum | | 53 | | 2018 | | * | | | | |

Erik E. Prusch | | 49 | | 2016 | | | | | | |

Robert D. Sznewajs | | 69 | | 2017 | | ** | | * | | |

Ronald B. Woodard | | 73 | | 2016 | | | | ** | | * |

| † | Due to Ms. Denzel’s service as Interim Chief Executive Officer, effective from January 18, 2015 to July 31, 2015, Ms. Denzel resigned as a member of the Audit Committee and Compensation Committee as of the commencement of such service. |

Jeffrey J. Brown

Jeffrey J. Brown has been a director of Outerwall since April 2016. Mr. Brown is the chief executive officer and founding member of Brown Equity Partners, LLC (“BEP”) (a principal investment firm). Prior to founding BEP in 2007, Mr. Brown served as a founding partner and primary deal originator of Forrest Binkley & Brown (a venture capital and private equity firm) from 1993 to 2007. Mr. Brown currently serves as a director of Medifast, Inc. (a nutrition and weight loss company) and RCS Capital Corporation (an investment firm). From 2011 until 2015, Mr. Brown served as a director of Midatech Pharma PLC (a nano-medicine company). From 2012 until 2014, Mr. Brown served as a director of Nordion, Inc. (a health science company). From 2009 until 2011, Mr. Brown served as a director of Steadfast Income REIT, Inc. (a real estate investment trust). In the course of his career, Mr. Brown has also worked at Hughes Aircraft Company (an aerospace and defense contractor), Morgan Stanley & Co. (a global financial services firm), Security Pacific Capital Corporation (a national bank) and Bank of America Corporation (a global financial services firm).

Mr. Brown was appointed as a director pursuant to an agreement between the Company, Engaged Capital, LLC and certain of its affiliates (“Engaged”), and Mr. Brown, as described below in “Related Person Transactions.” Mr. Brown brings to our Board of Directors extensive public and private company board experience. Mr. Brown has significant experience in working with companies on transformational transactions, which will benefit our Board as it evaluates strategic and financial alternatives to maximize stockholder value.

Nelson C. Chan

Nelson C. Chan has been a director of Outerwall since July 2011, and has served as the Board of Directors’ independent non-employee Chair since June 2013. Mr. Chan served as chief executive officer of Magellan Corporation (a portable GPS navigation consumer electronics company) from December 2006 to August 2008. From 1992 to 2006, he held various management positions at SanDisk Corporation (a manufacturer and supplier of flash brand data storage products), including executive vice president and general manager, consumer business. Mr. Chan is currently a director of Adesto Technologies Corporation (provider of low power memory solutions), Deckers Outdoor Corporation (a footwear, apparel and accessories design, marketing, and distribution company), and Synaptics, Inc. (a developer of consumer interface solutions). Mr. Chan was a member of the board of directors of Affymetrix Inc. (a genetic analysis company), from 2010 to 2016, and Silicon Laboratories (an analog-intensive mixed-signal semiconductor company), from 2007 to 2010. Mr. Chan also serves on the board of directors of several private companies.

Mr. Chan brings a wealth of experience to our Board of Directors, including his expertise in building technology companies. Having held numerous senior management positions with other leading companies, including chief executive officer at Magellan Corporation, Mr. Chan has strong operational, financial, and analytical skills. In addition, as a result of his service as a director of several other public companies, Mr. Chan brings valuable corporate governance and strategic insights to our Board.

-2-

Nora M. Denzel

Nora M. Denzel has been a director of Outerwall since January 2013, and has previously served as Interim Chief Executive Officer of Outerwall from January 2015 to July 2015. From February 2008 through August 2012, Ms. Denzel held various management positions at Intuit Inc. (a provider of business and financial management solutions software), including senior vice president of marketing, big data and social, and senior vice president and general manager of the employee management solutions business unit. From 2000 to 2006, Ms. Denzel served as senior vice president of the software global business unit and the storage and consulting divisions at Hewlett-Packard Company (a software and technology hardware provider). From 1997 to 2000, Ms. Denzel served as senior vice president, product operations, at Legato Systems Inc. (a data storage management software company). Ms. Denzel served as director, global storage software, at International Business Machines Corporation (a technology services, enterprise software and systems provider) from 1984 to 1997. Ms. Denzel is a member of the board of directors of Telefonaktiebolaget L.M. Ericsson (a telecommunications equipment and services provider) and Advanced Micro Devices, Inc. (a semiconductor company). Ms. Denzel served as a director of Overland Storage, Inc. (a provider of data management and protection products and services) from 2007 to 2013 and Saba Software, Inc. (a provider of learning and talent management solutions software and services) from 2011 to 2015.

Ms. Denzel brings to our Board of Directors a unique skill set and insight from her background in enterprise software, engineering, social product design, and marketing. Her experience as a senior business and technology executive at global organizations, such as Intuit, Hewlett-Packard, and IBM provide her with special knowledge in customer experience and competitive considerations.

David M. Eskenazy

David M. Eskenazy has been a director of Outerwall since August 2000. Mr. Eskenazy has served as president of Merrill Gardens LLC (a senior living community company) since February 2015. He served as chief financial officer for Aegis Senior Communities (a senior living management company specializing in assisted living and memory care) from August 2009 to May 2014, and as president from May 2014 to June 2014. He served as a principal in Esky Advisors LLC (a business advisory services firm) from 2008 to 2010. He served as chief operating officer and chief investment officer of Investco Financial Corporation (a real estate development and management company in the Puget Sound region) at various times from 2007 to 2008. From 1987 to 2006, he held a number of financial positions, ultimately serving as executive vice president and chief operating officer at R.C. Hedreen Co. (a hotel development and investment firm). Prior to that, he served on the audit staff of Peat Marwick Mitchell & Co. (an accounting firm). Mr. Eskenazy is a certified public accountant (inactive).

Having served as an independent director of Outerwall since 2000 and chairperson of the Audit Committee from 2001 to 2013, Mr. Eskenazy possesses a wealth of historical Outerwall institutional knowledge. In addition, with his over 25 years of management, finance, investment, and accounting experience, he brings deep financial, investment, and management experience and an understanding of complex accounting to our Board of Directors.

Ross G. Landsbaum

Ross G. Landsbaum has been a director of Outerwall since July 2014. Mr. Landsbaum has served as chief financial officer of ReachLocal, Inc. (a public technology company providing online marketing solutions) since 2008. Before that, he held various executive positions at MacAndrews and Forbes’ Panavision Inc. (a service provider to the motion picture and television industries), including chief financial officer from 2005 to 2007 and chief operating officer in 2007. Mr. Landsbaum served as executive vice president, finance and operations and chief financial officer for Miramax Films (the art-house and independent film division of The Walt Disney Company) from 2001 to 2005. Prior to that, he served in various capacities, including as chief financial officer, at Spelling Entertainment Group, Inc. (a diversified public entertainment concern) and in various capacities at Arthur Andersen LLP (an accounting firm). Mr. Landsbaum is a certified public accountant (inactive).

Mr. Landsbaum brings valuable financial and operational experience to the Board of Directors, currently serving as chief financial officer at a public company and previously serving in various leadership roles at a number of established private companies. Mr. Landsbaum has a strong understanding of accounting functions, compliance and regulatory requirements, and financial operations, as well as a deep knowledge of the media entertainment and communications industries and related businesses.

Erik E. Prusch

Erik E. Prusch has been a director and has served as Chief Executive Officer of the Company since July 2015. Mr. Prusch has served as Interim President, Redbox Automated Retail, LLC (“Redbox”), Outerwall’s wholly-owned subsidiary, since December 2015. Previously, Mr. Prusch served as chief executive officer of NetMotion Wireless, Inc. from January 2014 to November 2014 and of Lumension Security, Inc. from May 2014 to November 2014 (both providers of

-3-

mobile and enterprise security products and services). He also served as an advisor to Clearlake Capital (a private equity fund) from January 2014 to November 2014. Prior to that, Mr. Prusch served as chief executive officer and president of Clearwire Corporation (a provider of 4G wireless broadband services) from August 2011 until July 2013, as its chief operating officer from March 2011 to August 2011, and as its chief financial officer from August 2009 to March 2011; he served as a member of the board of directors of Clearwire from February 2012 to July 2013. Before then, Mr. Prusch served as president and chief executive officer of Borland Software Corporation (a provider of enterprise software tools and solutions) from December 2008 to July 2009 and as its chief financial officer from November 2006 to December 2008. Previous to Borland, Mr. Prusch was vice president of finance in the Turbo Tax division of Intuit Inc. (a provider of business and financial management solutions software) from January 2004 to November 2006. Prior to that, he served as chief financial officer of Identix Incorporated (a provider of identification and authentication platforms and solutions) and before then, he served as vice president and chief financial officer, finance and operations in Gateway Computers’ Gateway Business division (a computer hardware company). He began his career at Touche Ross (an accounting firm) and PepsiCo (a food and beverage processing company).

Through his experience as Chief Executive Officer, Mr. Prusch brings intimate knowledge of Outerwall’s day-to-day operations to our Board of Directors. In addition, through his prior financial and management experience, Mr. Prusch has a broad understanding of the financial, operational, and strategic issues facing companies such as Outerwall.

Robert D. Sznewajs

Robert D. Sznewajs has been a director of Outerwall since August 2002. From 2000 to 2013, Mr. Sznewajs served as president, chief executive officer, and a member of the board of directors of West Coast Bancorp (a bank holding company). He was also a member of the board of directors of the Portland Branch of the Federal Reserve Bank of San Francisco from 2004 to 2009. In 2013, Mr. Sznewajs was appointed as a member of the board of directors of Banc of California, N.A. (a national bank). Mr. Sznewajs is a certified public accountant (inactive).

Mr. Sznewajs brings valuable leadership experience to the Board of Directors, having served in multiple board and executive leadership positions at public and private companies. Mr. Sznewajs also brings to our Board a valuable understanding of accounting functions, financial operations, and retail consumers, as well as a general appreciation for the current economic, business, and governance issues facing public companies from the perspective of a board member and chief executive officer.

Ronald B. Woodard

Ronald B. Woodard has been a director of Outerwall since August 2001. Mr. Woodard is a director of MagnaDrive Corporation (an industrial magnetic coupling manufacturer) and was its chairperson from 2006 to 2010. Mr. Woodard cofounded MagnaDrive in 1999 after a 32-year career with The Boeing Company (an aerospace firm), where he held numerous positions, including president of The Boeing Commercial Airplane Group. Mr. Woodard is currently a director of AAR Corp. (a provider of aftermarket support to the aviation and aerospace industry) and Knowledge Anywhere (an online provider of employee training), and, in 2010, he became a lifetime member of the board of directors of the Seattle Symphony. Mr. Woodard was also a director of Continental Airlines, Inc. (a commercial airline company), from 2003 to 2010, and served as chair of the board of directors of the Seattle Symphony for 11 years (with his most recent three-year term as chair ending in 2007).

With Mr. Woodard’s years of experience at The Boeing Company and his years of board service, including his current board positions, he brings valuable commercial insight and experience to our Board of Directors. His role at The Boeing Company and his other positions in the aerospace industry have provided him with valuable experience in complex public company dynamics, including international operations. In addition, having served as an independent director of Outerwall during times of significant changes, Mr. Woodard has a valuable historical perspective regarding Outerwall’s business.

Executive Officers

The following table sets forth the name, age, and position of each of our executive officers as of April 22, 2016:

| | | | |

Name | | Age | | Position |

Erik E. Prusch | | 49 | | Chief Executive Officer and Interim President, Redbox |

Galen C. Smith | | 39 | | Chief Financial Officer |

Donald R. Rench | | 49 | | Chief Legal Officer, General Counsel, and Corporate Secretary |

James H. Gaherity | | 56 | | President, Coinstar |

David D. Maquera | | 53 | | President, ecoATM |

-4-

Erik E. Prusch has been a director and has served as Chief Executive Officer of the Company since July 2015. Mr. Prusch has served as Interim President, Redbox since December 2015. Previously, Mr. Prusch served as chief executive officer of NetMotion Wireless, Inc. from January 2014 to November 2014 and of Lumension Security, Inc. from May 2014 to November 2014 (both providers of mobile and enterprise security products and services). He also served as an advisor to Clearlake Capital (a private equity fund) from January 2014 to November 2014. Prior to that, Mr. Prusch served as chief executive officer and president of Clearwire Corporation (a provider of 4G wireless broadband services) from August 2011 until July 2013, as its chief operating officer from March 2011 to August 2011, and as its chief financial officer from August 2009 to March 2011; he served as a member of the board of directors of Clearwire from February 2012 to July 2013. Before then, Mr. Prusch served as president and chief executive officer of Borland Software Corporation (a provider of enterprise software tools and solutions) from December 2008 to July 2009 and as its chief financial officer from November 2006 to December 2008. Previous to Borland, Mr. Prusch was vice president of finance in the Turbo Tax division of Intuit Inc. (a provider of business and financial management solutions software) from January 2004 to November 2006. Prior to that, he served as chief financial officer of Identix Incorporated (a provider of identification and authentication platforms and solutions) and before then, he served as vice president and chief financial officer, finance and operations in Gateway Computers’ Gateway Business division (a computer hardware company). He began his career at Touche Ross (an accounting firm) and PepsiCo (a food and beverage processing company).

Galen C. Smith has served as our Chief Financial Officer since April 2013. Previously, he served as Senior Vice President of Finance of Redbox from May 2011 to March 2013. From January 2010 to May 2011, Mr. Smith served as Outerwall’s Corporate Vice President, Finance and Treasurer. From September 2009 to January 2010, he served as Outerwall’s Senior Director of Finance and Treasurer, and from June 2009 to August 2009, he served as Outerwall’s Director of Finance. Prior to joining Outerwall, Mr. Smith was an investment banker at Morgan Stanley & Co. (a global financial services firm) in the consumer and retail investment banking group from 2007 to 2009.

Donald R. Rench has served as our Chief Legal Officer since April 2011, as our General Counsel since August 2002, and as our Corporate Secretary since March 2002. Mr. Rench served as our corporate counsel from March 2000 through August 2002. From 1997 through 2000, Mr. Rench served as corporate counsel for NetManage, Inc., formerly Wall Data, Inc. (a software company). Prior to that, Mr. Rench was an attorney in private practice in Cincinnati, Ohio.

James H. Gaherity has served as our President, Coinstar since March 2014. Previously, he served as Senior Vice President, World Wide Operations from February 2012 to March 2014. From March 2010 to February 2012, Mr. Gaherity served as Vice President of North America Operations, from May 2006 to March 2010, as Vice President of Regional Operations, and from April 2004 to May 2006, as Director of U.S. Operations for Coinstar. Prior to joining Outerwall, Mr. Gaherity served in various management roles at The Brinks Company (a security services company) from 1988 to 2004.

David D. Maquera has served as our President, ecoATM since November 2015. Previously, he served as president and chief executive officer of Edgewave, Inc. (an internet security company) from February 2012 to November 2015, and as a director from June 2013 to February 2016. From November 2009 to July 2011, Mr. Maquera served as senior vice president and chief strategy officer of Clearwire Corporation (a provider of 4G wireless broadband services). From 2001 to 2009, he served in various roles at Cricket Communications (a wireless service provider), including head of strategic development from 2006 to 2009 and chief information officer from 2003 to 2006. Prior to that, Mr. Maquera held positions at Backwire.com, Inc. (an internet messaging company), Proxicom, Inc. (an internet software company), McKinsey & Company (a consulting firm) and the United States Navy.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires Outerwall’s directors, officers, and beneficial holders of more than 10% of a registered class of Outerwall’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. To our knowledge, all of the applicable directors, officers, and beneficial holders of more than 10% of the Company’s stock complied with all of the Section 16(a) reporting requirements applicable to them with respect to transactions during fiscal year 2015.

Code of Conduct and Code of Ethics

Outerwall’s Board of Directors has adopted a Code of Ethics that applies to its Chief Executive Officer, Chief Financial Officer, principal accounting officer, and controller (or persons performing similar functions) and a Code of Conduct that applies to all directors, officers, and employees of the Company. A copy of each is available on our website atir.outerwall.com. Substantive amendments to and waivers from either regarding executive officers and directors, if any, will be disclosed on the Investor Relations section of Outerwall’s website.

-5-

Audit Committee

The Board of Directors has established a standing Audit Committee. Membership of the Audit Committee is determined periodically by the Board of Directors. Adjustments to committee assignments may be made at any time. As of April 22, 2016, membership of the Audit Committee was as set forth above under “Board Composition.”

The Board of Directors has determined that each member of the Audit Committee meets the independence and financial literacy requirements of the SEC and Nasdaq. The Board has also determined that Messrs. Eskenazy, Landsbaum, and Sznewajs are “audit committee financial experts” under SEC rules, have accounting or related financial management experience, and are financially sophisticated under the Nasdaq Listing Rules.

-6-

| Item 11. | Executive Compensation. |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis describes the 2015 compensation program and related determinations by the Compensation Committee for our “Named Executive Officers.” Our current Named Executive Officers include:

| | • | | Erik E. Prusch, our Chief Executive Officer, effective as of July 31, 2015; |

| | • | | Galen C. Smith, our Chief Financial Officer; |

| | • | | Donald R. Rench, our Chief Legal Officer, General Counsel, and Corporate Secretary; |

| | • | | James H. Gaherity, our President, Coinstar; and |

| | • | | David D. Maquera, our President, ecoATM, effective as of November 23, 2015. |

Our former Named Executive Officers include:

| | • | | Nora M. Denzel, our Interim Chief Executive Officer, who served in that position from January 18, 2015 to July 31, 2015; |

| | • | | J. Scott Di Valerio, our former Chief Executive Officer, who served in that position until January 18, 2015, but remained an employee of the Company through February 28, 2015; and |

| | • | | Mark Horak, our former President, Redbox, who served in that position until December 4, 2015, but remained an employee of the Company through January 4, 2016. |

The Compensation Committee, which is composed of all independent directors, designed our program to ensure that our compensation practices further the shared interests of stockholders and management to attract, hire, retain, and motivate the people needed to achieve our performance goals.

Executive Summary

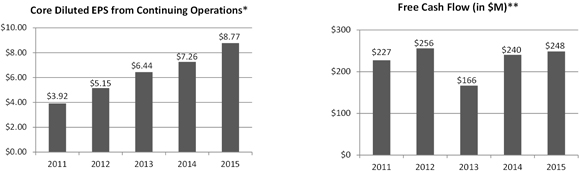

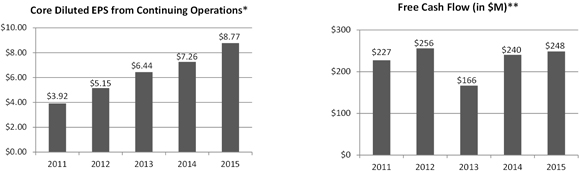

In 2015, the Board of Directors appointed Erik E. Prusch as our new Chief Executive Officer and David D. Maquera as our President, ecoATM. Messrs. Prusch and Maquera brought additional seasoned leadership expertise to our executive team. In 2015, our leadership team continued to focus on managing the business for profitability and free cash flow in order to maximize stockholder value. As demonstrated in the graphs below, despite challenging headwinds that impacted our Redbox business, our performance in 2015 improved in these areas and demonstrated our long-term commitment to these metrics by:

| | • | | Growing core diluted earnings per share (“EPS”) from continuing operations by 20.8% for fiscal year 2015 from fiscal year 2014, to $8.77; and |

| | • | | Generating strong free cash flow, which was $248.5 million for fiscal year 2015, up from $240.4 million in fiscal year 2014. |

| * | Core diluted EPS from continuing operations is a non-GAAP (generally accepted accounting principles) financial measure; for reconciliation to diluted EPS from continuing operations (the most comparable GAAP measure) and other information on this measure, please reference our 2015 Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures—Core Diluted EPS from continuing operations” on page 42 and for additional detail on core diluted EPS from continuing operations for 2011 and 2012, please see our Annual Report on Form 10-K for the year ended |

-7-

| | December 31, 2013 on page 35. The core diluted EPS results included above are calculated using the treasury stock method and are as presented in the indicated annual reports as adjusted to reflect continuing operations. Note that the information regarding core diluted EPS from continuing operations for 2012 as was presented in our Annual Report on Form 10-K for the year ended December 31, 2013 has not been adjusted for the impact of Redbox Canada’s partial first year of operations because its impact is not considered significant. |

| ** | Free cash flow is a non-GAAP financial measure; for reconciliation to net cash provided by operating activities (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures—Free Cash Flow” on page 43. For additional detail on free cash flow for 2011 and 2012, please see our Annual Report on Form 10-K for the year ended December 31, 2012 on page 37. |

In addition, we experienced solid results in other key areas for fiscal year 2015, including:

| | • | | We returned value to our stockholders by repurchasing approximately $159.8 million of our common stock, representing approximately 2.5 million shares and paid $21.3 million in quarterly cash dividends returning approximately over 73% of our free cash flow to stockholders; |

| | • | | Our Coinstar business generated record revenue of $318.6 million; |

| | • | | We acquired certain assets of Gazelle, Inc. and closed the transaction in the 4th quarter of 2015; |

| | • | | We opportunistically repurchased $41 million in face value bonds in the 4th quarter of 2015; |

| | • | | We continued the successful implementation of our price increase at Redbox, which helped offset secular decline; and |

| | • | | We extended existing content agreements for Redbox with Sony, Twentieth Century Fox Home Entertainment (Fox), and Paramount and signed new agreements with Warner Brothers and several leading game publishers. |

We also experienced some challenges in fiscal year 2015, including:

| | • | | Our revenue for Redbox did not meet our expectations due to, among other things, content strength and release schedule, secular decline and consumer transition to new generation platforms in our video games rental business; and |

| | • | | Our revenue was impacted by underperformance of ecoATM kiosks at grocery locations and, to mitigate this impact, we began to remove those kiosks during the year. |

Compensation for our Named Executive Officers during 2015 reflected the Company’s performance and pay-for-performance philosophy, including:

| | • | | Base salary increases for 2015 ranged from 2.6% to 10.7% for all applicable Named Executive Officers, with the highest increase provided to Mr. Smith. |

| | • | | Bonuses reflected the Company’s strong focus on managing the business for profitability. While revenue results were below target, profitability (measured as core direct contribution margin percent – “Core DCM Percent”) was significantly above target. Bonuses for applicable Named Executive Officers ranged from 67.3% of target (for Mr. Horak) to 161.0% of target (for Mr. Gaherity). |

| | • | | The aggregate value of all annual equity awards granted to each of our participating Named Executive Officers in 2015 ranged from $350,000 to $3,000,000 (based on performance-based restricted stock awards at target), reflecting our emphasis on long-term compensation and our philosophy of aligning the interests of our executives with the interests of stockholders. Performance-based restricted stock awards granted in 2015 have a two-year performance period (2015-2016) and will be earned, if at all, after the end of fiscal 2016. Performance-based restricted stock awards for the 2014-2015 performance period were earned at 114.35% of target as a result of the Company’s achievement of 110.1% of the target free cash flow (“Free Cash Flow”) goal and the Company’s achievement of 116.8% of the target core return on invested capital (“Core ROIC”) goal. |

The financial goals for the 2015 Incentive Compensation Plans are defined and calculated as described below under the discussion of “Short-Term Incentives,” and the financial goals for the 2014-2015 performance-based restricted stock awards are defined and calculated as described below under the discussion of “Long-Term Incentives—Payout of 2014-2015 Performance-Based Restricted Stock Awards.”

Over the last several years, the Compensation Committee has taken several actions and also continued several long-standing practices that it believes reflect its pay-for-performance philosophy and contribute to good corporate governance, including:

| | • | | prohibiting our executive officers, directors, and certain other covered individuals from holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan; |

-8-

| | • | | adopting a recoupment policy (also known as a “clawback policy”) covering incentive compensation paid to executives (please refer to the related discussion under “Policy on Reimbursement of Incentive Payments”); |

| | • | | requiring directors and executives to obtain pre-clearance from the Company before entering into hedging transactions involving the Company’s securities; |

| | • | | formalizing an annual process to assess risks associated with our compensation policies and programs; |

| | • | | establishing stock ownership guidelines for our executives (please refer to the related discussion under “Officer Stock Ownership Guidelines”); |

| | • | | retaining discretion to adjust amounts payable under various compensation components; |

| | • | | approving change of control benefits for executives that place stronger emphasis on “double-trigger” benefits and do not include any tax gross-ups (please refer to the related discussions under “Severance and Change of Control” in this “Compensation Discussion and Analysis” and under “Elements of Post-Termination Compensation and Benefits” in “Named Executive Officer Compensation”); |

| | • | | establishing caps of 200% of target and 150% of target under the short-term incentive program and the long-term performance-based restricted stock program, respectively; |

| | • | | providing limited perquisites (please refer to related discussion under “Other Benefits and Perquisites”); and |

| | • | | engaging independent compensation consultants to report directly to the Compensation Committee. |

Interim Chief Executive Officer and New Chief Executive Officer Compensation Arrangements

Following the departure of Mr. Di Valerio, Ms. Denzel, a director of the Company, was appointed to serve as our Interim Chief Executive Officer, effective January 18, 2015. For her service in this capacity, the Compensation Committee approved a base salary of $780,000 (with a minimum of $390,000 to be paid) and a cash bonus of between 50% and 75% of base salary paid, as determined by the Compensation Committee. A discussion of the cash bonus actually paid to Ms. Denzel is provided below under “Interim Chief Executive Officer Bonus.” Due to the temporary nature of her position, Ms. Denzel did not participate in any of the Company’s executive incentive plans, including equity programs. While serving in this position, Ms. Denzel was also not eligible to receive cash, equity, or any other compensation under the Company’s non-employee director compensation programs.

Mr. Prusch succeeded Ms. Denzel as our Chief Executive Officer, effective as of July 31, 2015. In connection with his new hire, the Compensation Committee approved a base salary of $800,000, a target bonus opportunity for 2015 under our Short-Term Incentive Compensation Plan for Executive Leaders of 100% of actual base salary earned in 2015, long-term incentive awards with an aggregate value of $3,000,000 in a combination of time-based restricted stock (30%) and performance-based restricted stock (70%) and a new hire performance-based restricted stock award with a value of $1,000,000. Mr. Prusch’s 2015 compensation and the Compensation Committee’s related decisions are discussed in more detail below.

Principles of Executive Compensation Programs

Our executive compensation programs are designed to attract, motivate, and retain executives critical to our long-term success and the creation of stockholder value. The decisions by the Compensation Committee concerning the specific compensation elements and total compensation paid or awarded to our Named Executive Officers for 2015 were made with the following principles in mind:

| | • | | “total” compensation—the Compensation Committee believes that executive compensation packages should take into account the competitiveness of each component of compensation and also total direct compensation, which includes base salary, short-term (cash) and long-term (equity) incentives, and benefits; |

| | • | | “pay-for-performance”—the Compensation Committee believes that a significant portion of executive compensation should be determined based on Company performance as compared to pre-established quantitative and qualitative performance goals to ensure accountability and to motivate executives to achieve a higher level of performance; |

| | • | | “at-market” compensation—the Compensation Committee believes that executive total direct compensation should generally be near the median (but below the 75th percentile) of compensation in the market and considers the market data from published surveys and a similarly situated peer group of companies in order to attract and retain the most qualified candidates; |

-9-

| | • | | “at-risk” compensation—the Compensation Committee believes that the allocation among the different forms of compensation should vary based on the position and level of responsibility; for example, those executives with the greater ability to influence Company performance will have a higher level of at-risk compensation in the form of an increased percentage of total compensation in time-based restricted stock, performance-based restricted stock, and performance-based short-term incentives; |

| | • | | “stockholder aligned” compensation—the Compensation Committee believes that equity compensation awarded to executives (consisting of a mix of time-based restricted stock and performance-based restricted stock) should be a significant portion of each executive’s compensation, should assist in the retention of our executives, and should further the shared interests of our executives and stockholders; |

| | • | | “fair” compensation—the Compensation Committee believes that executive compensation levels should be perceived as fair, both internally and externally; and |

| | • | | “tax deductible” compensation—the Compensation Committee believes that we should maximize the tax deductibility of compensation paid to executives, as permitted under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), but may approve components of executive compensation that will not meet the requirements of Section 162(m) in order to attract, motivate, and retain executives. |

The executive compensation program principles for 2015 were established based on discussions among the Compensation Committee, management, and outside consultants. The Compensation Committee reviews the compensation program principles annually when determining the next year’s executive compensation.

Benchmarking of Compensation

The Compensation Committee generally attempts to set Named Executive Officer total direct compensation (consisting of base salary and target short-term and long-term incentives) near the median of the aggregate market survey and proxy data in order to attract and retain the most qualified candidates. However, the Compensation Committee set Messrs. Gaherity and Horak’s 2015 total direct compensation (and each element of compensation) between the median and the 75th percentile of the aggregate market survey and proxy data to reflect their prior experience and the responsibilities of their position, and Mr. Maquera’s 2015 total direct compensation (and each element of compensation) above the 75th percentile of the aggregate market survey and proxy data to reflect his extensive prior experience and the responsibilities and expectations of his position. Ms. Denzel’s compensation was set below the median of the survey and market data, reflective of the interim nature of her position.

For 2015 Named Executive Officer compensation, the Compensation Committee retained Towers Watson as a compensation consultant to conduct a total direct compensation analysis for executives and to make recommendations for changes based on our pay philosophy, business objectives, and stockholder expectations. Towers Watson conducted a competitive market analysis that included published national survey sources of similarly sized companies augmented by proxy data of companies with revenues of similar size to the Company. The data gathered included 25th percentile, 50th percentile (median), and 75th percentile base salary and actual cash compensation levels as well as 50th percentile and 75th percentile long-term incentive and total direct compensation levels. Specifically, Towers Watson provided data from the following surveys and the proxy data for the peer companies listed below:

| | • | | 2014 Mercer Executive Compensation Survey Report (for companies with $1 billion to $2.5 billion in revenues and $2.5 billion to $5 billion in revenues); |

| | • | | 2014 Towers Watson Executive Compensation Database (for companies with $1 billion to $3 billion in revenues); and |

| | • | | 2014 Radford Global Technology Survey (for companies with $1 billion to $3 billion in revenues). |

The 2015 peer group remained the same as the 2014 peer group, consisting of the following companies:

| | |

| Blackhawk Network Holdings, Inc. | | International Game Technology |

| The Brink’s Company | | Netflix, Inc. |

| Diebold, Incorporated | | Scientific Games Corporation |

| GameStop Corp. | | TiVo Inc. |

Role of Executive Officers

In 2015, Ms. Denzel, in her role as Interim Chief Executive Officer and with support from the Company’s human resources and finance departments, prepared and provided recommendations to the Compensation Committee on the

-10-

following items: base salaries and bonus targets for Messrs. Smith, Rench, Gaherity and Horak, the design of the 2015 short-term and long-term incentive plans for executives, and the grant value of equity awards provided to Messrs. Smith, Rench, Gaherity and Horak. Mr. Prusch, with support from the Company’s human resources department, prepared and provided recommendations to the Compensation Committee on base salary, new-hire bonus and the grant value of equity awarded to Mr. Maquera. Ms. Denzel and Mr. Prusch, as applicable, considered several factors when making these recommendations as outlined below in the “Elements of 2015 Compensation” section.

Elements of 2015 Compensation

Compensation paid to our Named Executive Officers in 2015 consisted of the following primary annual compensation components:

| | • | | short-term (cash) incentives; and |

| | • | | long-term (equity) incentives. |

We pay base salaries in order to attract and retain executives as well as to provide a base of cash compensation for employment for the year. We pay short-term incentives to reward executives for individual and team performance and for achieving key measures of corporate performance during the fiscal year. We pay long-term incentives in order to retain executives as well as to align the interests of executives directly with the long-term interests of our stockholders.

In addition, in 2015 the Compensation Committee approved bridge awards for Messrs. Smith, Rench, Horak and Gaherity and new hire awards to Messrs. Prusch and Maquera. Mr. Horak also received payment of a new hire bonus in 2015 that the Compensation Committee approved at the time of his hire in 2014. In connection with additional responsibilities assumed by Mr. Gaherity in 2015, the Compensation Committee awarded an additional special bonus to Mr. Gaherity. These awards are discussed in more detail below under “New Hire Awards,” “Gaherity Special Bonus” and “Bridge Awards.”

Base Salary. Base salaries for our executives are determined by evaluating a number of factors, including:

| | • | | the responsibilities of the position; |

| | • | | the strategic value of the position; |

| | • | | the experience, skills, and performance of the individual filling the position; |

| | • | | market data for comparable positions, with base salaries generally targeted near the median; and |

| | • | | the other elements of compensation and the overall value of total direct compensation. |

Base salaries are reviewed annually and are effective on or about March 1 of the new fiscal year. The Compensation Committee may adjust base salaries from time to time to recognize changes in individual performance, promotions, and competitive compensation levels.

In February 2015, the Compensation Committee established 2015 base salaries for the Named Executive Officers who were executives of the Company at that time, other than Ms. Denzel. Base salaries for Ms. Denzel and Messrs. Prusch and Maquera were established at the time of their appointment or hire, as applicable. Base salary increases for Messrs. Smith, Rench, Gaherity and Horak ranged from 2.6% to 10.7%, with the highest increase provided to Mr. Smith to more closely align his base salary to the median of the market data for his position. The Compensation Committee approved the following 2015 base salaries:

| | | | | | | | |

Named Executive Officer* | | 2015 Base

Salary | | | Percentage

Increase Over

2014 Base Salary | |

| | |

Erik E. Prusch | | $ | 800,000 | | | | N/A | |

Nora M. Denzel | | | 780,000 | | | | N/A | |

Galen C. Smith | | | 465,000 | | | | 10.7 | % |

Donald R. Rench | | | 400,000 | | | | 2.6 | % |

James H. Gaherity | | | 310,000 | | | | 3.3 | % |

David D. Maquera | | | 400,000 | | | | N/A | |

Mark Horak | | | 460,000 | | | | 3.4 | % |

| * | The Compensation Committee did not approve a base salary amount for Mr. Di Valerio for 2015 due to his termination of employment in February 2015. |

-11-

Short-Term Incentives. The 2015 short-term incentives for our Named Executive Officers (other than Ms. Denzel and Messrs. Di Valerio and Maquera) were awarded under either the 2015 Incentive Compensation Plan for Executive Leaders (Messrs. Prusch, Smith and Rench) or the 2015 Incentive Compensation Plan for Line of Business Leaders—Coinstar or Redbox, as applicable (Messrs. Gaherity and Horak, respectively), and consisted of a cash bonus to reward executives for performance during 2015. Ms. Denzel did not participate in the 2015 Incentive Compensation Plans due to the interim nature of her position and Messrs. Di Valerio and Maquera did not participate due to the timing of their departure and hire date, respectively. The structure of each of the 2015 Incentive Compensation Plans was as follows:

| | • | | 70% was based on the Company’s achievement of certain corporate performance measures described below; and |

| | • | | 30% was based on the Compensation Committee’s evaluation of the management team’s and/or the individual’s performance. |

For 2015, the Compensation Committee changed the mix of the two performance components, which in 2014 was 80% based on the Company’s achievement of corporate performance measures and 20% based on management team and/or individual performance. The Compensation Committee adjusted the weightings in 2015 to increase the impact of individual results and hold executives accountable for individual performance.

As noted above, the Compensation Committee believes that those executives who have a greater ability to influence Company performance should have a higher level of at-risk compensation. Accordingly, target bonus amounts varied by position. In 2015, the Compensation Committee increased the short-term incentive target award for Mr. Smith by 5% consistent with our principles of providing pay-for-performance, at-risk compensation, and at-market compensation. Target award percentages for the other Named Executive Officers remained the same as 2014 levels, as applicable. As a result, target award percentages for 2015 as compared to 2014 were as follows:

| | | | | | | | |

Named Executive Officer* | | 2015 Target Award

as Percentage of

Base Salary** | | | 2014 Target Award

as Percentage of

Base Salary | |

| | |

Erik E. Prusch | | | 100 | % | | | N/A | |

Galen C. Smith | | | 65 | % | | | 60 | % |

Donald R. Rench | | | 60 | % | | | 60 | % |

James H. Gaherity | | | 50 | % | | | 50 | % |

Mark Horak | | | 70 | % | | | 70 | % |

| * | Mr. Di Valerio, Ms. Denzel and Mr. Maquera did not participate in the 2015 Incentive Compensation Plans. |

| ** | Bonus opportunities were based on the executive’s base salary multiplied by the target award percentage. Mr. Prusch’s bonus opportunity was prorated to reflect a partial year of employment. |

Corporate Performance Component

In 2015, the Compensation Committee chose to measure our short-term incentives based on overall results, as well as results from core activities. We define our core activities as those associated with our primary operations which we directly control, while our non-core activities may include nonrecurring events or events that we do not directly control. For further information regarding core activities and non-core activities, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Non-GAAP Financial Measures—Core and Non-Core Results” on page 40.

-12-

For the 70% attributable to the achievement of corporate performance measures, the Compensation Committee reviewed the following performance measures, weighted as noted in the table below:

| | | | | | | | | | | | |

| | | Participants and Weightings | |

Measure | | Messrs. Prusch,

Smith and Rench | | | Mr. Gaherity | | | Mr. Horak | |

| | | |

Corporate Core DCM Percent* | | | 45 | % | | | 20 | % | | | 20 | % |

Corporate Revenue | | | 25 | % | | | — | | | | — | |

Coinstar Unallocated DCM Margin Percent* | | | — | | | | 35 | % | | | — | |

Coinstar Revenue | | | — | | | | 15 | % | | | — | |

Redbox Unallocated DCM* | | | — | | | | — | | | | 35 | % |

Redbox Revenue | | | — | | | | — | | | | 15 | % |

Corporate Core DCM Percent is defined as net income from core activities before taxes and stock-based compensation divided by revenue.

Coinstar Unallocated DCM Margin Percent is defined as Coinstar operating income from core activities before corporate and shared-service allocations and stock-based compensation divided by Coinstar revenue.

Redbox Unallocated DCM is defined as Redbox operating income from core activities before corporate and shared-service allocations and stock-based compensation.

These measures were recommended by management and approved by the Compensation Committee to support ongoing attention on revenue and continued focus on managing the business for profitability. The tables below show the level of achievement and the related level of payout (between 0% and 200%) attributable to each measure, including adjustments related to the disposition of Redbox Canada, as provided by the terms of the plans. Amounts are interpolated for achievement between the levels provided in the tables.

Corporate Core DCM Percent

| | | | | | | | | | |

| | | | Corporate Core

DCM Percent

Achievement | | | | |

| DCM Margin % | | | % of Target | | | Payout % | |

| | |

| | 6.52 | % | | | 75.0 | % | | | 20.0 | % |

| | 6.86 | % | | | 79.0 | % | | | 40.0 | % |

| | 7.04 | % | | | 81.0 | % | | | 49.0 | % |

| | 7.21 | % | | | 83.0 | % | | | 58.0 | % |

| | 7.39 | % | | | 85.0 | % | | | 67.0 | % |

| | 7.56 | % | | | 87.0 | % | | | 76.0 | % |

| | 7.82 | % | | | 90.0 | % | | | 82.0 | % |

| | 7.99 | % | | | 92.0 | % | | | 88.0 | % |

| | 8.17 | % | | | 94.0 | % | | | 94.0 | % |

| | 8.34 | % | | | 96.0 | % | | | 100.0 | % |

| | 8.69 | % | | | 100.0 | % | | | 100.0 | % |

| | 8.95 | % | | | 103.0 | % | | | 100.0 | % |

| | 9.04 | % | | | 104.0 | % | | | 107.5 | % |

| | 9.21 | % | | | 106.0 | % | | | 115.0 | % |

| | 9.38 | % | | | 108.0 | % | | | 130.0 | % |

| | 9.56 | % | | | 110.0 | % | | | 145.0 | % |

| | 9.77 | % | | | 112.5 | % | | | 160.0 | % |

| | 10.08 | % | | | 116.0 | % | | | 180.0 | % |

| | 10.43 | % | | | 120.0 | % | | | 200.0 | % |

-13-

Corporate Revenue

| | | | | | | | | | |

| | | | Corporate

Revenue

Achievement | | | | |

| Amount | | | % of Target | | | Payout % | |

| | |

| $ | 2,134,841,000 | | | | 90.0 | % | | | 20.0 | % |

| | 2,206,003,000 | | | | 93.0 | % | | | 54.3 | % |

| | 2,253,444,000 | | | | 95.0 | % | | | 77.2 | % |

| | 2,300,885,000 | | | | 97.0 | % | | | 100.0 | % |

| | 2,372,046,000 | | | | 100.0 | % | | | 100.0 | % |

| | 2,443,207,000 | | | | 103.0 | % | | | 100.0 | % |

| | 2,490,648,000 | | | | 105.0 | % | | | 133.0 | % |

| | 2,538,089,000 | | | | 107.0 | % | | | 166.0 | % |

| | 2,585,530,000 | | | | 109.0 | % | | | 200.0 | % |

Coinstar Unallocated DCM Margin Percent and Revenue

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Coinstar Unallocated

DCM Margin Percent

Achievement | | | | | | | | | Coinstar Revenue

Achievement | | | | |

DCM Margin % | | | % of Target | | | Payout % | | | Amount | | | % of Target | | | Payout % | |

| | | | | |

| | 35.01 | % | | | 96.0 | % | | | 20.0 | % | | $ | 303,373,000 | | | | 96.0 | % | | | 20.0 | % |

| | 35.19 | % | | | 96.5 | % | | | 37.5 | % | | | 306,533,000 | | | | 97.0 | % | | | 46.0 | % |

| | 35.38 | % | | | 97.0 | % | | | 55.0 | % | | | 309,693,000 | | | | 98.0 | % | | | 73.0 | % |

| | 35.56 | % | | | 97.5 | % | | | 72.5 | % | | | 312,853,000 | | | | 99.0 | % | | | 100.0 | % |

| | 35.74 | % | | | 98.0 | % | | | 90.0 | % | | | 316,013,000 | | | | 100.0 | % | | | 100.0 | % |

| | 36.11 | % | | | 99.0 | % | | | 100.0 | % | | | 319,173,000 | | | | 101.0 | % | | | 100.0 | % |

| | 36.47 | % | | | 100.0 | % | | | 100.0 | % | | | 322,333,000 | | | | 102.0 | % | | | 133.0 | % |

| | 36.83 | % | | | 101.0 | % | | | 100.0 | % | | | 325,494,000 | | | | 103.0 | % | | | 166.0 | % |

| | 37.20 | % | | | 102.0 | % | | | 110.0 | % | | | 328,654,000 | | | | 104.0 | % | | | 200.0 | % |

| | 37.38 | % | | | 102.5 | % | | | 132.5 | % | | | | | | | | | | | | |

| | 37.56 | % | | | 103.0 | % | | | 155.0 | % | | | | | | | | | | | | |

| | 37.75 | % | | | 103.5 | % | | | 177.5 | % | | | | | | | | | | | | |

| | 37.93 | % | | | 104.0 | % | | | 200.0 | % | | | | | | | | | | | | |

Redbox Unallocated DCM and Revenue

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Redbox Unallocated

DCM Achievement | | | | | | | | | Redbox Revenue

Achievement | | | | |

Amount | | | % of Target | | | Payout % | | | Amount | | | % of Target | | | Payout % | |

| | | | | |

| $ | 410,644,000 | | | | 84.0 | % | | | 20.0 | % | | $ | 1,752,888,000 | | | | 92.0 | % | | | 20.0 | % |

| | 425,310,000 | | | | 87.0 | % | | | 32.5 | % | | | 1,790,994,000 | | | | 94.0 | % | | | 46.0 | % |

| | 432,643,000 | | | | 88.5 | % | | | 40.0 | % | | | 1,829,100,000 | | | | 96.0 | % | | | 73.0 | % |

| | 439,976,000 | | | | 90.0 | % | | | 50.0 | % | | | 1,867,207,000 | | | | 98.0 | % | | | 100.0 | % |

| | 447,309,000 | | | | 91.5 | % | | | 60.0 | % | | | 1,905,313,000 | | | | 100.0 | % | | | 100.0 | % |

| | 454,642,000 | | | | 93.0 | % | | | 70.0 | % | | | 1,943,419,000 | | | | 102.0 | % | | | 100.0 | % |

| | 461,975,000 | | | | 94.5 | % | | | 80.0 | % | | | 1,981,526,000 | | | | 104.0 | % | | | 133.0 | % |

| | 469,308,000 | | | | 96.0 | % | | | 85.0 | % | | | 2,038,685,000 | | | | 107.0 | % | | | 166.0 | % |

| | 474,196,000 | | | | 97.0 | % | | | 92.5 | % | | | 2,076,791,000 | | | | 109.0 | % | | | 200.0 | % |

| | 479,085,000 | | | | 98.0 | % | | | 100.0 | % | | | | | | | | | | | | |

| | 488,862,000 | | | | 100.0 | % | | | 100.0 | % | | | | | | | | | | | | |

| | 493,751,000 | | | | 101.0 | % | | | 100.0 | % | | | | | | | | | | | | |

| | 496,195,000 | | | | 101.5 | % | | | 107.5 | % | | | | | | | | | | | | |

| | 498,639,000 | | | | 102.0 | % | | | 115.0 | % | | | | | | | | | | | | |

| | 503,528,000 | | | | 103.0 | % | | | 130.0 | % | | | | | | | | | | | | |

| | 508,416,000 | | | | 104.0 | % | | | 145.0 | % | | | | | | | | | | | | |

| | 527,971,000 | | | | 108.0 | % | | | 160.0 | % | | | | | | | | | | | | |

| | 557,703,000 | | | | 114.0 | % | | | 180.0 | % | | | | | | | | | | | | |

| | 586,634,000 | | | | 120.0 | % | | | 200.0 | % | | | | | | | | | | | | |

-14-

In February 2016, the Compensation Committee determined that after adjustments to Corporate Core DCM Percent and Corporate Revenue related to the Gazelle acquisition as provided by the terms of the plans, the various performance measures for the 2015 Incentive Compensation Plans were achieved as follows:

| | | | | | | | |

Measure | | Achievement Level | | | Payout % | |

| | |

Corporate Core DCM Percent | | | 11.22 | % | | | 200.0 | % |

Corporate Revenue | | $ | 2,179,193,000 | | | | 41.7 | % |

Coinstar Unallocated DCM Margin Percent | | | 39.68 | % | | | 200.0 | % |

Coinstar Revenue | | $ | 318,611,000 | | | | 100.0 | % |

Redbox Unallocated DCM | | $ | 452,620,000 | | | | 67.2 | % |

Redbox Revenue | | $ | 1,760,899,000 | | | | 25.5 | % |

Management Team and/or Individual Performance Component

For the 30% attributable to the Compensation Committee’s discretion after evaluating the management team’s and/or the individual’s performance applicable to the Named Executive Officers, the Compensation Committee considered the recommendations of Mr. Prusch for all participating executives (excluding himself) and conducted its own evaluation of Mr. Prusch. The following table summarizes the factors evaluated by the Compensation Committee for each participating Named Executive Officer and the percentage payout approved by the Compensation Committee for this component of the award.

| | | | | | |

Named Executive Officer | | Management Team/Individual Performance Factors | | Component

Payout % | |

| | |

Erik E. Prusch | | Strong transition into the Chief Executive Officer position. Enhanced senior leadership team. Key leadership role in the review of Company businesses and strategy. Guided strong focus on business optimization and generating free cash flow. | | | 100 | % |

| | |

Galen C. Smith | | Drove solid free cash flow. Continued leadership on efficiency and expense management programs and helped drive review of Company strategy. Led successful execution of first dividend distributions and debt repurchases. | | | 100 | % |

| | |

Donald R. Rench | | Led the legal team in the successful completion of key studio and retailer contracts. Successfully guided legal and governance components of Chief Executive Officer transitions. | | | 100 | % |

| | |

James H. Gaherity | | Led the Coinstar business unit to its highest annual revenue. Drove strong profit margins for the Coinstar business. Provided interim leadership for several shared service functions. | | | 120 | % |

| | |

Mark Horak | | Did not meet key objectives. | | | 0 | % |

Total Payouts

Overall, the total cash bonuses paid to participating Named Executive Officers under the 2015 Incentive Compensation Plans ranged from 67.3% to 161.0% of each of their respective target bonus amounts. Total individual cash bonuses paid to each of the participants for 2015 consisted of the following:

| | | | | | | | | | | | | | | | |

Named Executive Officer | | Company

Performance | | | Management

Team /

Individual

Performance | | | Total Bonus | | | Total Bonus as

a Percent of

Target | |

| | | | |

Erik E. Prusch | | $ | 338,969 | | | $ | 101,260 | | | $ | 440,229 | | | | 130.4 | % |

Galen C. Smith | | | 303,535 | | | | 90,675 | | | | 394,210 | | | | 130.4 | % |

Donald R. Rench | | | 241,020 | | | | 72,000 | | | | 313,020 | | | | 130.4 | % |

James H. Gaherity | | | 193,750 | | | | 55,800 | | | | 249,550 | | | | 161.0 | % |

Mark Horak | | | 216,851 | | | | 0 | | | | 216,851 | | | | 67.3 | % |

Long-Term Incentives. Long-term incentives awarded in 2015 to participating Named Executive Officers consisted of equity compensation in the form of time-based restricted stock awards and performance-based restricted stock awards. All long-term incentive grants to the Named Executive Officers are approved by the Compensation Committee. Annual long-term incentive grants are typically granted at the beginning of the service period for which the awards cover (e.g., the long-term incentive grants for performance in 2015 were made in February 2015) in order to motivate and retain the executive for

-15-

the upcoming year. The Compensation Committee also periodically makes promotional or new hire equity grants. Messrs. Prusch and Maquera’s long-term incentive grants were approved in July 2015 and November 2015, respectively, in conjunction with their hire dates.

The Compensation Committee believes that stock ownership is an essential tool to align the interests of our executives and stockholders. Generally, the higher the level of the executive’s position, the greater the percentage of long-term incentives granted in the form of time-based restricted stock and performance-based restricted stock, which we consider to be at-risk compensation. The Compensation Committee believes that a percentage of total compensation should be at risk in terms of Company performance to maintain strong stockholder alignment. Based on this philosophy, the Compensation Committee began granting performance-based restricted stock in 2007. In 2014, the Compensation Committee eliminated stock options from the mix of annual long-term incentive compensation for executive officers to reduce complexity in equity compensation and improve the balance between retention and incentives in equity compensation. The mix of annual long-term incentives for participating Named Executive Officers other than Mr. Maquera in 2015 consisted of:

| | • | | 30% time-based restricted stock and 70% performance-based restricted stock for Mr. Prusch; and |

| | • | | 50% time-based restricted stock and 50% performance-based restricted stock for other participating Named Executive Officers. |

As a result of his start date late in 2015, Mr. Maquera’s long-term incentive compensation for 2015 was all in time-based restricted stock and for 2016, it will be all in performance-based restricted stock. Although Ms. Denzel did not receive long-term incentive awards as an executive officer of the Company, she did receive a grant of time-based restricted stock with a value of $110,000 for services as a director after she was no longer serving as Interim Chief Executive Officer, pursuant to the terms of our non-employee director program, as described in this Amendment under “2015 Director Compensation.”

Consistent with the terms of the performance-based restricted stock awards granted in 2013 and 2014, the Compensation Committee approved a two-year performance period (2015-2016) for the 2015 performance-based restricted stock awards to better align the awards with results over time.

The Compensation Committee determined the total dollar value of long-term compensation delivered to the participating Named Executive Officers based on an evaluation of the following factors (without assigning a relative weight to any one particular factor):

| | • | | the past performance at the Company and anticipated contribution by the executive; |

| | • | | the equity awards necessary to attract and/or retain the services of a valued executive; |

| | • | | the market data for comparable positions provided by Towers Watson; |

| | • | | the value of equity awards already held by the executive; |

| | • | | the value of long-term incentives as a percentage of total direct compensation; |

| | • | | the realized and realizable value of total compensation over the prior two years; and |

| | • | | the other elements of compensation and the current overall value and potential future value of total direct compensation. |

The total dollar value of long-term incentive compensation was converted into the number of shares subject to each type of award based on the mix of long-term incentives described above, using the closing price of our common stock on the date of grant. The total dollar value of annual target long-term incentive compensation granted to participating Named Executive Officers in 2015 was as follows:

| | | | |

Named Executive Officer* | | Total Dollar Value | |

| |

Erik E. Prusch | | $ | 3,000,000 | |

Galen C. Smith | | | 850,000 | |

Donald R. Rench | | | 650,000 | |

James H. Gaherity | | | 350,000 | |

David D. Maquera | | | 500,000 | |

Mark Horak | | | 850,000 | |

| * | Mr. Di Valerio and Ms. Denzel did not receive long-term incentive compensation in 2015. |

-16-

Time-Based Restricted Stock Awards

The participating Named Executive Officers were granted the following annual time-based restricted stock awards in 2015:

| | | | |

Named Executive Officer | | Time-Based

Restricted Stock | |

| |

Erik E. Prusch | | | 12,708 | |

Galen C. Smith | | | 6,422 | |

Donald R. Rench | | | 4,911 | |

James H. Gaherity | | | 2,644 | |

David D. Maquera | | | 7,697 | |

Mark Horak* | | | 6,422 | |

| * | This award was forfeited by Mr. Horak as a result of his termination of employment. |

The time-based restricted stock awards granted to Messrs. Smith, Rench, Gaherity, Maquera and Horak in 2015 were scheduled to vest (and be no longer subject to forfeiture) in four equal annual installments starting on the one-year anniversary of the vesting commencement date of February 24, 2015, except that for Mr. Maquera, the vesting commencement date was November 23, 2015. The time-based restricted stock award granted to Mr. Prusch vests (and is no longer subject to forfeiture) in two equal installments on July 31, 2018 and July 31, 2019.

We do not have, nor do we intend to have, a program, plan, or practice to time stock awards to our existing executives or to new executives in coordination with the release of material nonpublic information for the purpose of affecting the value of executive compensation.

2015-2016 Performance-Based Restricted Stock Awards

As noted above, the performance-based restricted stock awards (at target) constituted 70% (for Mr. Prusch) and 50% (for other Named Executive Officers) of the total dollar value of annual long-term incentive compensation delivered to participating Named Executive Officers (other than Mr. Maquera) in 2015. For 2015 compensation, participating executives received performance-based restricted stock awards in February 2015, except for Mr. Prusch who received his award in July 2015.

The Compensation Committee annually reviews the structure of its performance-based restricted stock awards to ensure that the focus is on the right measures to incentivize executives and create value for our stockholders. For the 2015 awards, the Compensation Committee determined to continue to use Free Cash Flow and Core ROIC as in 2014, but applied those measures to 2015 results only and added EBITDA Margin averaged for 2015 and 2016 as a multiplier that can increase or decrease the payouts for the other two measures. Accordingly, the applicable measures and weightings were as follows:

| | • | | 50% based on Free Cash Flow (as defined below) measured for 2015; |

| | • | | 50% based on Core ROIC (as defined below) measured for 2015; and |

| | • | | EBITDA Margin (as defined below) averaged for 2015 and 2016 as a multiplier. |

The Compensation Committee made these changes to the performance measures for the 2015 performance-based restricted stock awards to ensure that targets were challenging but realistic and to continue to emphasize managing the business for profitability.

If the minimum specified performance goals for the 2015-2016 performance period are not achieved, the performance-based restricted stock awards will be forfeited. An executive could earn between 50% and 150% of the target number of shares if the minimum and maximum specified performance goals are achieved, respectively. Amounts are based on the level of achievement between the minimum and maximum performance goals. Once the performance-based restricted stock awards for the 2015-2016 performance period are earned following completion of the performance period, for all participating Named Executive Officers other than Mr. Prusch, 65% of the shares earned will vest in February 2017 and 35% will vest in February 2018, provided the executive continues to provide services to us. Any awards earned by Mr. Prusch will vest 65% on July 31, 2017 and 35% on July 31, 2018.

-17-

The following table shows the number of performance-based shares of restricted stock that could be earned by a participating Named Executive Officer for the 2015-2016 performance period, depending on the level of achievement of the performance goals and continued service:

| | | | | | | | | | | | |

Named Executive Officer* | | Minimum | | | Target | | | Maximum | |

| | | |

Erik E. Prusch | | | 14,826 | | | | 29,652 | | | | 44,478 | |

Galen C. Smith | | | 3,211 | | | | 6,422 | | | | 9,633 | |

Donald R. Rench | | | 2,455 | | | | 4,911 | | | | 7,366 | |

James H. Gaherity | | | 1,322 | | | | 2,644 | | | | 3,966 | |

Mark Horak** | | | 3,211 | | | | 6,422 | | | | 9,633 | |

| * | Mr. Di Valerio, Ms. Denzel and Mr. Maquera were not granted performance-based restricted stock in 2015. |

| ** | This award was forfeited by Mr. Horak as a result of his termination of employment. |

For ease of understanding, formulas and definitions for our Core ROIC calculation are presented below:

| | | | | | | | |

| | Core ROIC = | | | | NOPAT | | |

| | | | | Invested Capital | | |

NOPAT = (Income from continuing operations from core activities before taxes - Interest income + Interest expense) x (1 - Corporate tax rate)

Invested Capital = Total stockholder equity + Net Debt

Net Debt = (short- and long-term debt and capital lease obligations) - (cash and cash equivalents - cash identified for settling our payable to retail partners in relation to our Coinstar kiosks)

Free Cash Flow is defined as net cash provided by operating activities after capital expenditures. (Free Cash Flow is a non-GAAP financial measure; for reconciliation to net cash provided by operating activities (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures—Free Cash Flow” on page 43). For purposes of calculating NOPAT, we apply a 37% corporate tax rate. Invested capital is averaged for the beginning and the end of the fiscal year.

EBITDA Margin is defined as Core Adjusted EBITDA from continuing operations divided by revenue. Core Adjusted EBITDA from continuing operations is defined as earnings from continuing operations before depreciation, amortization and other; interest expense, net; income taxes, share-based payments expense; and non-core adjustments. (Core Adjusted EBITDA from continuing operations is a non-GAAP financial measure; for reconciliation to net income from continuing operations (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures—Core Adjusted EBITDA from continuing operations” on page 41).

The Core ROIC measure and the EBITDA Margin measure are based on results from core activities, which are indicative of our ongoing performance. As explained above in the discussion of our short-term incentives, we define our core activities as those associated with our primary operations.

Payout of 2014-2015 Performance-Based Restricted Stock Awards

The measures and weightings for the performance-based restricted stock awards granted in 2014 for the 2014-2015 performance period and certified as earned in 2016 were as follows:

| | • | | 50% based on Free Cash Flow (as defined above) cumulative results for 2014 and 2015; and |

| | • | | 50% based on Core ROIC (as defined above with the exception that for the 2014-2015 calculation we applied a corporate tax rate of 39%) measured for 2014 and 2015 separately and then averaged. |

The 2014-2015 performance-based restricted stock awards were earned depending on the level of achievement of the performance goals. The tables below show the level of achievement and the related level of payout (between 50% and 150% of target) attributable to each measure, including adjustments related to the disposition of Redbox Canada, as provided by the terms of the awards. Amounts are interpolated for achievement between the levels provided in the tables.

-18-

| | | | | | | | | | |

| | | | Free Cash Flow

2014-2015

Cumulative

Achievement | | | | |

| Amount | | | % of Target | | | Payout % | |

| | |

| $ | 346,880 | | | | 80.0 | % | | | 50.0 | % |

| | 368,560 | | | | 85.0 | % | | | 70.0 | % |

| | 390,240 | | | | 90.0 | % | | | 85.0 | % |

| | 411,920 | | | | 95.0 | % | | | 95.0 | % |

| | 433,600 | | | | 100.0 | % | | | 100.0 | % |

| | 466,120 | | | | 107.5 | % | | | 107.5 | % |

| | 498,640 | | | | 115.0 | % | | | 115.0 | % |

| | 531,160 | | | | 122.5 | % | | | 130.0 | % |

| | 563,680 | | | | 130.0 | % | | | 150.0 | % |

| | | | | | | | | | |

| | | | Core ROIC 2014-

2015 Average

Achievement | | | | |

| Amount | | | % of Target | | | Payout % | |

| | |

| | 14.93 | % | | | 85.0 | % | | | 50.0 | % |

| | 15.80 | % | | | 90.0 | % | | | 80.0 | % |

| | 16.68 | % | | | 95.0 | % | | | 90.0 | % |

| | 17.56 | % | | | 100.0 | % | | | 100.0 | % |

| | 19.32 | % | | | 110.0 | % | | | 110.0 | % |

| | 21.07 | % | | | 120.0 | % | | | 120.0 | % |

| | 22.83 | % | | | 130.0 | % | | | 150.0 | % |

At its meeting in February 2016, the Compensation Committee determined that the Company achieved $506.5 million in Free Cash Flow for a payout of 118.6% attributable to this measure and achieved 19.33% of Core ROIC for a payout of 110.09% attributable to this measure. As a result, the Compensation Committee established the total amount of shares of restricted stock earned by the participating Named Executive Officers under their respective 2014-2015 performance-based restricted stock awards at 114.35% of target amounts. The earned shares will vest 65% in February 2016 and 35% in February 2017, provided the executive continues to provide services to us.

The following table shows the number of performance-based shares of restricted stock that were earned by the Named Executive Officers who received grants for the 2014-2015 performance period based on the level of achievement of the performance goals:

| | | | | | | | |

Named Executive Officer | | Target | | | Earned | |

| | |

J. Scott Di Valerio* | | | 16,852 | | | | — | |

Galen C. Smith | | | 5,502 | | | | 6,291 | |

Donald R. Rench | | | 3,783 | | | | 4,325 | |

James H. Gaherity | | | 2,063 | | | | 2,359 | |

Mark Horak* | | | 5,742 | | | | — | |

| * | Messrs. Di Valerio and Horak forfeited their awards as a result of their termination of employment. |

Dividends on Unvested Restricted Stock Awards