| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2011 Estimated average burden hours per response: 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number ___811-09000________________________

Oak Value Trust

(Exact name of registrant as specified in charter)

| 1450 Raleigh Road, Suite 220 Chapel Hill, North Carolina | 27517 |

| (Address of principal executive offices) | (Zip code) |

Larry D. Coats, Jr.

Oak Value Capital Management, Inc. 1450 Raleigh Road, Suite 220 Chapel Hill, NC 27517

(Name and address of agent for service)

Registrant's telephone number, including area code: (919) 419-1900

Date of fiscal year end: June 30, 2010

Date of reporting period: December 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

DECEMBER 31, 2009

(Unaudited)

WWW.OAKVALUEFUND.COM

| LETTER TO SHAREHOLDERS | January 27, 2010 |

Dear Fellow Oak Value Fund Shareholders,

The Oak Value Fund (the “Fund”) advanced 23.53% during the first half of its 2010 fiscal year, outpacing the S&P 500 Index return of 22.59%. In what has been called the “lost decade of equities,” the Fund significantly outperformed the broader market’s negative returns. These recent and longer term results have earned the Fund an Overall four-star rating by Morningstar in the Large Blend category*.

| Performance For Periods Ended December 31, 2009 | |||||

| 6 Month | 1 Year | 3 Year1 | 10 Year1 | Since Inception 01/18/931 | |

| Oak Value Fund | 23.53% | 33.41% | -2.48% | 2.86% | 8.84% |

| S&P 500 Index | 22.59% | 26.46% | -5.63% | -0.95% | 7.76% |

| + / - S&P 500 Index | 0.94% | 6.95% | 3.15% | 3.81% | 1.08% |

| 1 | Annualized. |

The performance information quoted above represents past performance and past performance does not guarantee future results. The Fund’s expense ratio for the fiscal year ended 06/30/09 was 1.57%.

*Morningstar RatingsTM for the Oak Value Fund as of December 31, 2009 | ||||

| 3 Year | 5 Year | 10 Year | Overall | |

| Star Rating | ★★★★ (out of 1,757 Large Blend funds) | ★★★ (out of 1,376 Large Blend funds) | ★★★★ (out of 710 Large Blend funds) | ★★★★ (out of 1,757 Large Blend funds) |

| Please see the Important Information section at the end of this report for disclosure that applies to this chart. | ||||

As we reflect upon this six-month period (and for that matter the entire 2009 calendar year), we are reminded of the wisdom of a quote by Philip Fisher, one of history’s most influential growth investors: “The stock market is filled with individuals who know the price of everything, but the value of nothing.” With the proliferation of easily accessible market information, price is frequently used as a proxy for value. In our experience, using near-term prices to estimate long-term value is not a winning formula, so we are not interested in being able to price everything or even value everything. We focus our efforts on understanding a collection of growing, advantaged businesses and having an informed opinion of the value of those businesses. For this group of businesses, we are very interested in price, but only in relation to our estimate of their value. After all, determining price just requires a buyer and a seller. Assessing value requires knowledge, insight and judgment. Price is a reaction to the present. Value is a function of the future – growth, predictability and quality.

As opportunistic buyers of advantaged businesses, we view this distinction between price and value as essential to our efforts. In our opinion, the Fund’s portfolio has never been better positioned. Our focus in recent years on identifying

1

and understanding advantaged businesses placed us in a position of unprecedented preparedness as Mr. Market’s preoccupation with price facilitated our quest for value in the form of high quality, growing and predictable businesses.

We have included the Fund’s financial statements for the six month period ended December 31, 2009 as well as other financial and portfolio data in the pages that follow. A detailed summary of the Fund’s investment activities is provided in the Investment Adviser’s Review posted on the Fund’s website - www.oakvaluefund.com. We encourage you to review this and other information posted to the site on a regular basis. For your convenience, we have established an electronic mailing list to efficiently provide information to Fund shareholders and prospective shareholders. Investors interested in receiving information from the Fund in electronic form may subscribe to this service at the following URL address: www.oakvaluefund.com/mail.aspx.

We thank you for your continued interest and partnership and welcome your questions and comments.

Oak Value Fund Co-Managers,

|  |  |

| David R. Carr, Jr. | Larry D. Coats, Jr. | Christy L. Phillips |

Important Information:

The Overall Morningstar RatingTM is derived from a weighted average of the performance figures associated with a fund’s three-, five-, and 10-year (if applicable) Morningstar RatingTM metrics. For funds with at least a 3-year history, a Morningstar RatingTM is based on a risk-adjusted return measure (including the effects of sales charges, loads, and redemption fees) with emphasis on downward variations and consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% 4 stars, the next 35% 3 stars, the next 22.5% 2 stars, and the bottom 10% 1 star. Each share class is counted as a fraction of one fund within this scale and rated separately. Morningstar RatingTM is for the retail share class only; other classes may have different performance characteristics. Past performance is no guarantee of future results.

The Oak Value Fund is distributed by Ultimus Fund Distributors, LLC. The information presented above is not to be construed as an offer or solicitation to purchase the Oak Value Fund (the “Fund”), which is offered only by prospectus. An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Oak Value Fund’s prospectus please visit our website at www.oakvaluefund.com or call 1-800-622-2472 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

2

OAK VALUE FUND

PERFORMANCE INFORMATION (Unaudited)

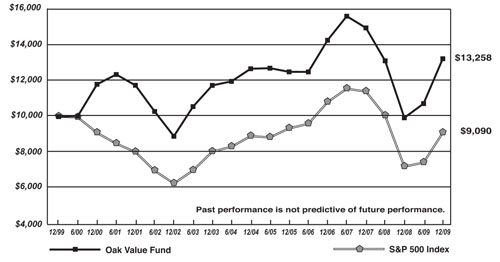

Comparison of the Change in Value of a $10,000 Investment

in the Oak Value Fund and the S&P 500 Index

Cumulative Total Returns(A) | |||||||||||

Calendar 2000 | Calendar 2001 | Calendar 2002 | Calendar 2003 | Calendar 2004 | Calendar 2005 | Calendar 2006 | Calendar 2007 | Calendar 2008 | Calendar 2009 | Since Inception* (as of 12/31/09) | |

| Oak Value Fund | 18.17% | -0.47% | -24.34% | 32.11% | 7.97% | -1.37% | 14.18% | 4.87% | -33.71% | 33.41% | 320.15%(B) |

| S&P 500 Index | -9.10% | -11.89% | -22.10% | 28.68% | 10.88% | 4.91% | 15.79% | 5.49% | -37.00% | 26.46% | 254.74%(B) |

Average Annual Total Returns(A) | |||||

| For the Periods Ended December 31, 2009 | |||||

| One Year | Three Years | Five Years | Ten Years | Since Inception* | |

| Oak Value Fund | 33.41% | -2.48% | 0.87% | 2.86% | 8.84% |

| S&P 500 Index | 26.46% | -5.63% | 0.42% | -0.95% | 7.76% |

| * | Inception date of the Oak Value Fund was January 18, 1993. |

| (A) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (B) | Not annualized. |

3

OAK VALUE FUND

PORTFOLIO INFORMATION

December 31, 2009 (Unaudited)

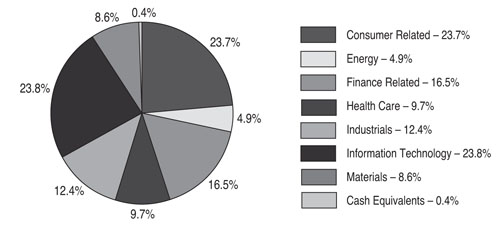

Distribution by Business Category (% of Net Assets)

Ten Largest Holdings

| Company | % of Net Assets |

| Berkshire Hathaway, Inc. - Class A | 6.75% |

| Avon Products, Inc. | 5.51% |

| Coach, Inc. | 5.47% |

| American Express Co. | 5.06% |

| Oracle Corp. | 4.86% |

| Cisco Systems, Inc. | 4.57% |

| Praxair, Inc. | 4.57% |

| Republic Services, Inc. | 4.54% |

| Diageo PLC - ADR | 4.31% |

| 3M Co. | 4.10% |

4

OAK VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2009 (Unaudited)

| Shares | COMMON STOCKS — 99.6% | Value | |||||

| Consumer Discretionary — 11.8% | |||||||

| 37,800 | Apollo Group, Inc. - Class A (A) | $ | 2,289,924 | ||||

| 114,450 | Coach, Inc. | 4,180,858 | |||||

| 26,525 | ITT Educational Services, Inc. (A) | 2,545,339 | |||||

| 9,016,121 | |||||||

| Consumer Staples — 11.9% | |||||||

| 133,550 | Avon Products, Inc. | 4,206,825 | |||||

| 19,375 | Colgate-Palmolive Co. | 1,591,656 | |||||

| 47,475 | Diageo PLC - ADR | 3,295,240 | |||||

| 9,093,721 | |||||||

| Energy — 4.9% | |||||||

| 96,100 | Chesapeake Energy Corp. | 2,487,068 | |||||

| 27,000 | XTO Energy, Inc. | 1,256,310 | |||||

| 3,743,378 | |||||||

| Financials — 16.5% | |||||||

| 25,500 | AFLAC, Inc. | 1,179,375 | |||||

| 95,500 | American Express Co. | 3,869,660 | |||||

| 61,250 | AON Corp. | 2,348,325 | |||||

| 52 | Berkshire Hathaway, Inc. - Class A (A) | 5,158,400 | |||||

| 12,555,760 | |||||||

| Health Care — 9.7% | |||||||

| 30,750 | Becton, Dickinson & Co. | 2,424,945 | |||||

| 54,000 | Medtronic, Inc. | 2,374,920 | |||||

| 43,900 | Zimmer Holdings, Inc. (A) | 2,594,929 | |||||

| 7,394,794 | |||||||

| Industrials — 12.4% | |||||||

| 37,875 | 3M Co. | 3,131,126 | |||||

| 122,600 | Republic Services, Inc. | 3,470,806 | |||||

| 41,750 | United Technologies Corp. | 2,897,868 | |||||

| 9,499,800 | |||||||

| Information Technology — 23.8% | |||||||

| 157,225 | Activision Blizzard, Inc. (A) | 1,746,770 | |||||

| 51,825 | Automatic Data Processing, Inc. | 2,219,146 | |||||

| 145,875 | Cisco Systems, Inc. (A) | 3,492,248 | |||||

| 76,875 | Intuit, Inc. (A) | 2,360,831 | |||||

| 12,175 | MasterCard, Inc. - Class A | 3,116,556 | |||||

| 50,975 | Microsoft Corp. | 1,554,228 | |||||

| 151,175 | Oracle Corp. | 3,709,834 | |||||

| 18,199,613 | |||||||

| Materials — 8.6% | |||||||

| 37,775 | Monsanto Co. | 3,088,106 | |||||

| 43,450 | Praxair, Inc. | 3,489,470 | |||||

| 6,577,576 | |||||||

Total Common Stocks (Cost $64,670,076) | $ | 76,080,763 | |||||

5

OAK VALUE FUND

SCHEDULE OF INVESTMENTS (Continued)

| Shares | CASH EQUIVALENTS — 0.5% | Value | |||||

| 375,642 | First American Government Obligations Fund - Class Y, 0.00% (B) (Cost $375,642) | $ | 375,642 | ||||

Total Investments at Value — 100.1% (Cost $65,045,718) | $ | 76,456,405 | |||||

| Liabilities in Excess of Other Assets — (0.1)% | (45,405 | ) | |||||

| Net Assets — 100.0% | $ | 76,411,000 | |||||

| (A) | Non-income producing security. |

| (B) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2009. |

ADR - American Depositary Receipt

See accompanying notes to financial statements.

6

OAK VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2009 (Unaudited)

| ASSETS | ||||

| Investments in securities: | ||||

| At cost | $ | 65,045,718 | ||

| At market value (Note 1) | $ | 76,456,405 | ||

| Receivable for capital shares sold | 4,115 | |||

| Dividends receivable | 62,875 | |||

| Other assets | 37,456 | |||

| TOTAL ASSETS | 76,560,851 | |||

| LIABILITIES | ||||

| Dividends payable | 698 | |||

| Payable for capital shares redeemed | 48,036 | |||

| Accrued investment advisory fees (Note 3) | 58,190 | |||

| Payable to administrator (Note 3) | 13,000 | |||

| Other accrued expenses and liabilities | 29,927 | |||

| TOTAL LIABILITIES | 149,851 | |||

| NET ASSETS | $ | 76,411,000 | ||

| Net assets consist of: | ||||

| Paid-in capital | $ | 68,804,254 | ||

| Accumulated undistributed net investment income | 310 | |||

| Accumulated net realized losses from security transactions | (3,804,251 | ) | ||

| Net unrealized appreciation on investments | 11,410,687 | |||

| Net assets | $ | 76,411,000 | ||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 3,951,143 | |||

Net asset value, offering price and redemption price per share (A) | $ | 19.34 | ||

| (A) | Redemption price may differ from the net asset value per share depending upon the length of time the shares are held (Note 1). |

See accompanying notes to financial statements.

7

OAK VALUE FUND

STATEMENT OF OPERATIONS

For the Six Months Ended December 31, 2009 (Unaudited)

| INVESTMENT INCOME | ||||

| Dividends | $ | 559,182 | ||

| EXPENSES | ||||

| Investment advisory fees (Note 3) | 323,811 | |||

| Transfer agent and shareholder services fees (Note 3) | 43,669 | |||

| Administration fees (Note 3) | 33,139 | |||

| Professional fees | 25,830 | |||

| Postage and supplies | 20,961 | |||

| Fund accounting fees (Note 3) | 15,576 | |||

| Insurance expense | 15,277 | |||

| Trustees’ fees and expenses | 14,093 | |||

| Registration fees | 12,362 | |||

| Compliance service fees (Note 3) | 9,000 | |||

| Printing of shareholder reports | 7,298 | |||

| Custody and bank service fees | 7,001 | |||

| Other expenses | 16,318 | |||

| TOTAL EXPENSES | 544,335 | |||

| NET INVESTMENT INCOME | 14,847 | |||

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | ||||

| Net realized losses from security transactions | (359,810 | ) | ||

| Net change in unrealized appreciation/depreciation on investments | 15,013,296 | |||

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | 14,653,486 | |||

| NET INCREASE IN NET ASSETS FROM OPERATIONS | $ | 14,668,333 | ||

See accompanying notes to financial statements.

8

OAK VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

Six Months Ended December 31, 2009 (Unaudited) | Year Ended June 30, 2009 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 14,847 | $ | 178,332 | ||||

| Net realized losses from security transactions | (359,810 | ) | (3,343,745 | ) | ||||

| Net change in unrealized appreciation/depreciation on investments | 15,013,296 | (14,518,138 | ) | |||||

| Net increase (decrease) in net assets from operations | 14,668,333 | (17,683,551 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net investment income | (16,996 | ) | (175,873 | ) | ||||

| From net realized gains from security transactions | — | (182,611 | ) | |||||

| Decrease in net assets from distributions to shareholders | (16,996 | ) | (358,484 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from shares sold | 3,432,382 | 2,636,301 | ||||||

| Reinvestment of distributions to shareholders | 16,298 | 349,638 | ||||||

| Proceeds from redemption fees collected (Note 1) | 5,560 | 4,759 | ||||||

| Payments for shares redeemed | (4,426,618 | ) | (15,957,667 | ) | ||||

| Net decrease in net assets from capital share transactions | (972,378 | ) | (12,966,969 | ) | ||||

| NET INCREASE (DECREASE) IN NET ASSETS | 13,678,959 | (31,009,004 | ) | |||||

| NET ASSETS | ||||||||

| Beginning of period | 62,732,041 | 93,741,045 | ||||||

| End of period | $ | 76,411,000 | $ | 62,732,041 | ||||

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | $ | 310 | $ | 2,459 | ||||

| SUMMARY OF CAPITAL SHARE ACTIVITY | ||||||||

| Shares sold | 190,611 | 171,685 | ||||||

| Shares reinvested | 843 | 24,168 | ||||||

| Shares redeemed | (246,256 | ) | (1,052,157 | ) | ||||

| Net decrease in shares outstanding | (54,802 | ) | (856,304 | ) | ||||

| Shares outstanding, beginning of period | 4,005,945 | 4,862,249 | ||||||

| Shares outstanding, end of period | 3,951,143 | 4,005,945 | ||||||

See accompanying notes to financial statements.

9

OAK VALUE FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Period

Six Months Ended December 31, 2009 (Unaudited) | Year Ended June 30, 2009 | Year Ended June 30, 2008 | Year Ended June 30, 2007 | Year Ended June 30, 2006 | Year Ended June 30, 2005 | |||||||||||||||||||

| Net asset value at beginning of period | $ | 15.66 | $ | 19.28 | $ | 25.80 | $ | 28.00 | $ | 30.82 | $ | 29.02 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment income (loss) | 0.00 | (A) | 0.04 | (0.02 | ) | (0.05 | ) | 0.08 | (0.12 | ) | ||||||||||||||

| Net realized and unrealized gains (losses) on investments | 3.68 | (3.58 | ) | (3.87 | ) | 6.61 | (0.60 | ) | 1.92 | |||||||||||||||

| Total from investment operations | 3.68 | (3.54 | ) | (3.89 | ) | 6.56 | (0.52 | ) | 1.80 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||||||

| From net investment income | (0.00 | )(A) | (0.04 | ) | — | (0.00 | )(A) | (0.08 | ) | — | ||||||||||||||

| From net realized gains from security transactions | — | (0.04 | ) | (2.63 | ) | (8.77 | ) | (2.22 | ) | — | ||||||||||||||

| Total distributions | (0.00 | )(A) | (0.08 | ) | (2.63 | ) | (8.77 | ) | (2.30 | ) | — | |||||||||||||

| Proceeds from redemption fees collected (Note 1) | 0.00 | (A) | 0.00 | (A) | 0.00 | (A) | 0.01 | 0.00 | (A) | 0.00 | (A) | |||||||||||||

| Net asset value at end of period | $ | 19.34 | $ | 15.66 | $ | 19.28 | $ | 25.80 | $ | 28.00 | $ | 30.82 | ||||||||||||

Total return (B) | 23.53% | (C) | (18.31% | ) | (16.04% | ) | 25.03% | (1.66% | ) | 6.20% | ||||||||||||||

| Net assets at end of period (000’s) | $ | 76,411 | $ | 62,732 | $ | 93,741 | $ | 142,339 | $ | 201,024 | $ | 248,782 | ||||||||||||

| Ratio of expenses to average net assets | 1.51% | (D) | 1.57% | 1.37% | 1.35% | 1.29% | 1.25% | |||||||||||||||||

| Ratio of net investment income (loss) to average net assets | 0.04% | (D) | 0.26% | (0.08% | ) | (0.16% | ) | 0.24% | (0.39% | ) | ||||||||||||||

| Portfolio turnover rate | 23% | (C) | 37% | 52% | 44% | 29% | 29% | |||||||||||||||||

| (A) | Amount rounds to less than $0.01 per share. |

| (B) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (C) | Not annualized. |

| (D) | Annualized. |

See accompanying notes to financial statements.

10

OAK VALUE FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2009 (Unaudited)

1. Organization and Significant Accounting Policies

The Oak Value Fund (the “Fund”) is a diversified series of Oak Value Trust (the “Trust”). The Trust, registered as an open-end management investment company under the Investment Company Act of 1940, was organized as a Massachusetts business trust on March 3, 1995. The Fund began operations on January 18, 1993, as a series of the Albemarle Investment Trust.

The Fund’s investment objective is to seek capital appreciation primarily through investments in equity securities, consisting of common and preferred stocks and securities convertible into common stocks traded in domestic and foreign markets.

The following is a summary of the Fund’s significant accounting policies:

Securities Valuation — The Fund’s portfolio securities are valued as of the close of business of the regular session of the principal exchange where the security is traded. Securities traded on a national stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities which are traded over-the-counter are valued at the last sales price, if available, otherwise, at the last quoted bid price. In the event that market quotations are not readily available, securities are valued at fair value as determined in accordance with procedures adopted in good faith by the Board of Trustees. Such methods of fair valuation may include, but are not limited to: multiple of earnings, discount from market of a similar freely traded security, or a combination of these or other methods. The fair value of securities with remaining maturities of 60 days or less has been determined in good faith by the Board of Trustees to be represented by amortized cost value, absent unusual circumstances.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2009 by security type.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Common Stocks | $ | 76,080,763 | $ | — | $ | — | $ | 76,080,763 | ||||||||

| Money Market Funds | — | 375,642 | — | 375,642 | ||||||||||||

| Total | $ | 76,080,763 | $ | 375,642 | $ | — | $ | 76,456,405 | ||||||||

See the Fund’s Schedule of Investments for a listing of the common stocks valued using Level 1 inputs by sector type.

11

OAK VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Share Valuation — The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the net asset value per share, except that shares of the Fund are subject to a redemption fee of 2% if redeemed within 90 days of the date of purchase. During the periods ended December 31, 2009 and June 30, 2009, proceeds from redemption fees totaled $5,560 and $4,759, respectively.

Repurchase Agreements — The Fund may enter into repurchase agreements from financial institutions such as banks and broker-dealers that the Trust’s investment adviser deems creditworthy under the guidelines approved by the Board of Trustees, subject to the seller’s agreement to repurchase such securities at a mutually agreed-upon date and price. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates, which may be more or less than the rate on the underlying portfolio securities. The seller under a repurchase agreement is required to maintain the value of collateral held pursuant to the agreement at not less than the repurchase price (including accrued interest). If the seller defaults, and the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited.

Investment Income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date.

Distributions to Shareholders — Dividends arising from net investment income, if any, are declared and paid semi-annually to shareholders of the Fund. Net realized short-term capital gains, if any, may be distributed throughout the year and net realized long-term capital gains, if any, are distributed at least once each year. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from GAAP. These “book/tax” differences are temporary in nature and are primarily due to losses deferred due to wash sales. The tax character of distributions paid during the six months ended December 31, 2009 was ordinary income. The tax character of distributions paid during the year ended June 30, 2009 was $175,873 of ordinary income and $182,611 of long-term capital gains. Dividends and distributions to shareholders are recorded on the ex-dividend date.

Security Transactions — Security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Tax — It is the Fund’s policy to comply with the special provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. As provided therein, in any fiscal year in which the Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

12

OAK VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

The following information is computed on a tax basis for each item as of December 31, 2009:

| Tax cost of portfolio investments | $ | 65,045,718 | ||

| Gross unrealized appreciation | $ | 14,149,091 | ||

| Gross unrealized depreciation | (2,738,404 | ) | ||

| Net unrealized appreciation | $ | 11,410,687 | ||

| Undistributed ordinary income | 1,008 | |||

| Capital loss carryforward | (819,758 | ) | ||

| Post-October losses | (2,570,562 | ) | ||

| Other losses | (413,931 | ) | ||

| Other temporary differences | (698 | ) | ||

| Accumulated earnings | $ | 7,606,746 |

As of June 30, 2009, the Fund had a capital loss carryforward for federal income tax purposes of $819,758, which expires on June 30, 2017. In addition, the Fund had net realized capital losses of $2,570,562 during the period November 1, 2008 through June 30, 2009, which are treated for federal income tax purposes as arising during the Fund’s tax year ending June 30, 2010. The capital loss carryforward and “post-October” losses may be utilized in the current and future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on Federal income tax returns for all open tax years (tax years ended June 30, 2006 through June 30, 2009) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

2. Investment Transactions

During the six months ended December 31, 2009, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments, amounted to $15,799,216 and $16,673,372, respectively.

3. Transactions with Affiliates

The Fund’s investments are managed by Oak Value Capital Management, Inc. (the “Adviser”) under the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.90% of the Fund’s average daily net assets.

Certain Trustees and officers of the Trust are also officers of the Adviser or of Ultimus Fund Solutions, LLC (“Ultimus”), the Fund’s administrator, transfer agent and fund accounting services agent. Such Trustees and officers receive no direct payments or fees from the Trust for serving as officers.

Under the terms of an Administration Agreement with the Trust, Ultimus provides internal regulatory compliance services and executive and administrative services. Ultimus supervises the preparation of tax returns, reports to shareholders of the Fund, reports to and filings with the Securities and Exchange Commission (the “SEC”) and state securities commissions, and materials for meetings of the Board of Trustees. For the performance of these services, the Fund pays Ultimus a fee at the annual rate of .10% of

13

OAK VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

the average value of its daily net assets up to $50 million, .075% of such assets from $50 million to $200 million and .05% of such assets in excess of $200 million, provided, however, that the minimum fee is $2,000 per month.

Under the terms of a Transfer Agent and Shareholder Services Agreement with the Trust, Ultimus maintains the records of each shareholder’s account, answers shareholders’ inquiries concerning their accounts, processes purchases and redemptions of the Fund’s shares, acts as dividend and distribution disbursing agent and performs other shareholder service functions. Ultimus receives from the Fund for its services as transfer agent a fee payable monthly at an annual rate of $16 per account, provided, however, that the minimum fee is $2,000 per month. In addition, the Fund pays out-of-pocket expenses, including but not limited to, postage and supplies. Accordingly, during the six months ended December 31, 2009, Ultimus received $19,011 for transfer agent and shareholder services.

The Fund has entered into agreements with certain financial intermediaries to provide record keeping, processing, shareholder communications and other services to the Fund. These services would be provided by the Fund if the shares were held in accounts registered directly with the Fund’s transfer agent. Accordingly, the Fund pays a fee to such service providers in an amount equivalent to or less than the per account fee paid to the transfer agent. During the six months ended December 31, 2009, the Fund paid $24,658 for such services. These fees are included in “Transfer agent and shareholder services fees” on the Statement of Operations.

Under the terms of a Fund Accounting Agreement with the Trust, Ultimus calculates the daily net asset value per share and maintains such books and records as are necessary to enable Ultimus to perform its duties. For these services, the Fund pays Ultimus a base fee of $2,000 per month, plus an asset-based fee at the annual rate of .01% of the average value of its daily net assets up to $500 million and .005% of such assets in excess of $500 million. In addition, the Fund pays all costs of external pricing services.

Under the terms of a Compliance Consulting Agreement with the Trust, Ultimus provides an individual with the requisite background and familiarity with the Federal Securities Laws to serve as the Chief Compliance Officer and to administer the Trust’s compliance policies and procedures. For these services, the Fund pays Ultimus a base fee of $1,500 per month, plus an asset-based fee at the annual rate of .01% of the average value of its daily net assets from $100 million to $500 million, .005% of such assets from $500 million to $1 billion and .0025% of such assets in excess of $1 billion. In addition, the Fund reimburses Ultimus for its reasonable out-of-pocket expenses, if any, relating to these compliance services.

4. Bank Line of Credit

The Fund has an unsecured $20,000,000 bank line of credit. Borrowings under this arrangement bear interest at a rate per annum equal to Prime Rate minus 0.50%. During the six months ended December 31, 2009, the Fund incurred $11 of interest expense related to borrowings under the line of credit. Average debt outstanding during the six months ended December 31, 2009 was $789. As of December 31, 2009, the Fund had no outstanding borrowings.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

14

OAK VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For nonrecognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund will be required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. In addition, GAAP requires the Fund to disclose the date through which subsequent events have been evaluated. Management has evaluated subsequent events through the issuance of these financial statements on February 16, 2010 and has noted no such events.

7. Recent Accounting Pronouncement

In June 2009, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 168, “The FASB Accounting Standards CodificationTM and the Hierarchy of Generally Accepted Accounting Principles – a replacement of FASB Statement No. 162” (“SFAS 168”). SFAS 168 replaces SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” and establishes the “FASB Accounting Standards CodificationTM” (“the Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with GAAP. All guidance contained in the Codification carries an equal level of authority. The Codification supersedes all then-existing non-SEC accounting and reporting standards. All other non-grandfathered non-SEC accounting literature not included in the Codification has become nonauthoritative. SFAS 168 is effective for financial statements issued for interim and annual periods ending after September 15, 2009, and therefore the Fund has adopted SFAS 168 with these financial statements. Management has evaluated this new pronouncement and has determined that it does not have a material impact on the determination or reporting of these financial statements.

15

OAK VALUE FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these ongoing costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio.�� The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (July 1, 2009) and held until the end of the period (December 31, 2009).

The table below illustrates the Fund’s costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not impose any sales charges. However, a redemption fee of 2% is applied on the sale of shares sold within 90 days of the date of purchase. The redemption fee does not apply to the redemption of shares acquired through reinvestment of dividends and other distributions.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including annual expense ratios for the prior five fiscal years, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

Beginning Account Value July 1, 2009 | Ending Account Value December 31, 2009 | Expenses Paid During Period* | |

| Based on Actual Fund Return | $1,000.00 | $1,235.30 | $8.51 |

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,017.59 | $7.68 |

| * | Expenses are equal to the annualized expense ratio of 1.51% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

16

OAK VALUE FUND

OTHER INFORMATION (Unaudited)

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-622-2474, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-800-622-2474, or on the SEC’s website http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available without charge upon request, by calling 1-800-622-2474. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

17

OAK VALUE FUND

APPROVAL OF ADVISORY AGREEMENT (Unaudited)

The Board of Trustees of the Trust, with the Independent Trustees voting separately, has approved the continuance of the Fund’s Investment Advisory Agreement (the “Agreement”) with the Adviser. Approval took place at a meeting held on November 10, 2009, at which all of the Trustees were present.

The Trustees were advised by counsel of their fiduciary obligations in approving the Agreement, and the Independent Trustees requested such information from the Adviser as they deemed reasonably necessary to evaluate the terms of the Agreement and whether the Agreement will continue to be in the best interests of the Fund and its shareholders. The Trustees reviewed: (i) the nature, extent and quality of the services provided by the Adviser; (ii) the investment performance of the Fund and the Adviser; (iii) the costs of the services provided and the profits realized by the Adviser from its relationship with the Fund; (iv) the extent to which economies of scale would be realized as the Fund grows; and (v) whether fee levels reflect these economies of scale for the benefit of the Fund’s shareholders. The Trustees reviewed the background, qualifications, education and experience of the Adviser’s portfolio managers, research staff and support personnel and the operations and ownership of the Adviser. The Trustees also reviewed the responsibilities of the Adviser under the Agreement and considered the quality of the advisory services provided to the Trust, including the Adviser’s intensive research process and its practices with regards to shareholder protection, shareholder services and communications, and compliance. The Independent Trustees were advised and supported by counsel experienced in securities matters throughout the process. Prior to voting, the Independent Trustees reviewed and discussed the proposed continuance of the Agreement with management of the Adviser.

The Adviser provided the Board with extensive information to assist the Trustees with analyzing the Fund’s performance over various periods. The Fund’s returns for periods ended September 30, 2009 were compared to the returns of its benchmark index and similarly managed mutual funds. These analyses and comparisons showed that the short-term (1 year) and longer-term (5-year and 10-year) performance of the Fund exceeded the returns of the S&P 500 Index and the average of Large Cap Blend funds as categorized by Morningstar. Based upon their review, the Trustees found that the Adviser has provided valuable advisory services and has consistently adhered to the stated investment objective and strategies of the Fund, while demostrating its ability to fine-tune its investment process. The Trustees recognized that the ability of the Fund to outperform the S&P 500 Index in both a bear and a bull market is notable and that the Adviser was opportunistic in its pursuit of companies having the potential to emerge as stronger competitiors coming out of an economic downturn.

In reviewing the advisory fees and the total expense ratio of the Fund, the Trustees were provided with comparative expense and advisory fee information for other similarly situated mutual funds, categorized both by fund size and by investment style. The Trustees also considered the “fallout benefits” received by the Adviser in its management of the Fund, including certain research services received as a result of placement of the Fund’s brokerage, but, given the amounts involved, viewed these as secondary factors in connection with the reasonableness of the advisory fees being paid by the Fund. The Trustees concluded that, based upon the investment strategies and the long-term performance of the Fund, the advisory fees paid by the Fund are reasonable.

18

OAK VALUE FUND

APPROVAL OF ADVISORY AGREEMENT (Unaudited)

(Continued)

The Trustees reviewed a recent balance sheet of the Adviser and a statement of the Adviser’s revenues and estimated expenses with respect to its management of the Fund during the Fund’s fiscal year ended June 30, 2008. The Trustees also reviewed the Fund’s brokerage costs and determined that the brokerage commissions negotiated by the Adviser on behalf of the Fund are competitive with industry averages.

The Independent Trustees concluded that: (i) in considering the Adviser’s disciplined investment approach of buying businesses having durable competitive advantages and adequate margins or safety, the risk characteristics of the Fund and the effectiveness of the Adviser in achieving the Fund’s stated objective, they believe the nature, extent and quality of services provided by the Adviser have proven to be of significant value to shareholders during the past year and over the lifetime of the Fund; (ii) the Fund’s performance (computed over periods ended September 30, 2009) for the one year, five year and ten year periods, which was well above the returns of its benchmark index (the S&P 500) for all such periods, says a great deal about the merits of the Adviser’s investment approach; (iii) although the advisory fees and overall operating expenses of the Fund are in the higher range of advisory fees and expenses for mutual funds of similar size and similar investment goals, the Independent Trustees believe that the considerable effort and resources that the Adviser dedicates to its investment process support the appropriateness of the advisory fees payable by the Fund and were mindful that the Adviser did not realize any profits from the advisory fees paid by the Fund during the past year; and (iv) given the current and projected asset levels in the Fund, it would not be relevant at this time to consider the extent to which economies of scale would be realized as the Fund grows, at this time and whether fee levels reflect these economies of scale. The Independent Trustees also reviewed and considered the profitability of the Adviser with regards to its management of the Fund, concluding that the Adviser’s profitability was not excessive given the high quality and scope of services provided by the Adviser and the long-term investment performance of the Fund. The Independent Trustees agreed that it is not appropriate to introduce fee breakpoints at the present time. The Independent Trustees noted, however, that if the Fund grows significantly in assets, it may become necessary for the Adviser to consider adding fee breakpoints to the Agreement.

No single factor was considered in isolation or to be determinative to the decision of the Independent Trustees to approve continuance of the Agreement. Rather, the Independent Trustees concluded, in light of a weighing and balancing of all factors considered, that the advisory fees payable by the Fund under the Agreement are fair and reasonable. The Independent Trustees determined that it would be in the best interests of the Fund and its shareholders for the Adviser to continue to serve as investment adviser and voted to renew the Agreement for an additional annual period.

19

This page intentionally left blank.

This page intentionally left blank.

OAK VALUE FUND Investment Adviser Oak Value Capital Management, Inc. 1450 Raleigh Road, Suite 220 Chapel Hill, North Carolina 27517 1-800-680-4199 www.oakvaluefund.com Administrator Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 Independent Registered Public Accounting Firm BBD, LLP 1835 Market Street 26th Floor Philadelphia, Pennsylvania 19103 Custodian US Bank, N.A. 425 Walnut Street Cincinnati, Ohio 45202 Board of Trustees Joseph T. Jordan, Jr., Chairman C. Russell Bryan Larry D. Coats, Jr. John M. Day Officers Larry D. Coats, Jr., President Margaret C. Landis, Vice President Robert G. Dorsey, Vice President Mark J. Seger, Treasurer/ Chief Compliance Officer John F. Splain, Secretary |

| This report is for the information of the shareholders of the Oak Value Fund. It may not be distributed to prospective investors unless it is preceded or accompanied by the current fund prospectus. |

Item 2. Code of Ethics.

Not required

Item 3. Audit Committee Financial Expert.

Not required

Item 4. Principal Accountant Fees and Services.

Not required

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Schedule of Investments.

| (a) | Not applicable [schedule filed with Item 1] |

| (b) | Not applicable |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant’s governance, nomination and compensation committee will consider shareholder recommendations to fill vacancies on the registrant’s board of trustees if such recommendations are submitted in writing and addressed to the committee at the registrant’s offices. The committee may adopt, by resolution, a policy regarding its procedures for considering candidates for the board of trustees, including any recommended by shareholders.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

(a)(1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit: Not required

(a)(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

(a)(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons: Not applicable

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto

| Exhibit 99.CERT | Certifications required by Rule 30a-2(a) under the Act |

| Exhibit 99.906CERT | Certifications required by Rule 30a-2(b) under the Act |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Oak Value Trust

| By (Signature and Title)* | /s/ Larry D. Coats, Jr. | |

| Larry D. Coats, Jr., President |

Date February 19, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Larry D. Coats, Jr. | |

| Larry D. Coats, Jr., President |

Date February 19, 2010

| By (Signature and Title)* | /s/ Mark J. Seger | |

| Mark J. Seger, Treasurer |

Date February 19, 2010

* Print the name and title of each signing officer under his or her signature.