MANAGEMENT DISCUSSION AND ANALYSIS

FOR THE NINE MONTHS ENDED MAY 31, 2018

The following is management’s discussion and analysis of the results of operations and financial conditions (“MD&A”) of Miranda Gold Corp. (the “Company” or “Miranda”) and should be read in conjunction with the accompanying unaudited condensed consolidated interim financial statements and related notes thereto for the nine months ended May 31, 2018 (the “Financial Report”), and with the audited financial statements for the years ended August 31, 2017, 2016, and 2015 all of which are available on the SEDAR website at www.sedar.com.

The financial information in this MD&A is derived from the Financial Report prepared in accordance with International Accounting Standard 34 Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”), and all dollar amounts are expressed in Canadian dollars unless otherwise indicated.

Additional information relating to the Company is available on SEDAR at www.sedar.com.

The MD&A contains information to July 26, 2018.

Overall Performance

Description of Business and Overview of Projects

Miranda is an exploration company active in Colombia with an emphasis on generating gold exploration projects with world-class discovery potential. Miranda performs its own grass-roots exploration and then employs a joint venture business model on its projects in order to maximize exposure to discovery while preserving its treasury.

The highlights of the Company’s activities in the nine months ended May 31, 2018, and up to the date of this MD&A, include:

●

On January 8, 2018, the Company notified the lessee of its intent to terminate the Cerro Oro Option and return the property. The process of termination will include the unwinding of the trust agreement between the Company, the lessees, and the trustee;

●

On March 9 and March 20, 2018, the Company closed a non-brokered private placement. The aggregate gross proceeds were $1,513,187.50 from the sale of 27,512,500 units at a price of $0.055 per unit. Each unit comprised one common share and one non-transferable common share purchase warrant. Each warrant entitles the holder thereof to purchase one additional common share of the Company at a price of $0.12 until March 9, 2022. The common shares issued, and any common shares issued pursuant to the exercise of Warrants prior to July 9, 2018, were restricted from trading until July 9, 2018. The Company paid finder’s fees in cash, to persons who introduced it to investors of $36,774;

●

On June 18, 2018, the Company announced it had signed an option agreement on the Cauca project - an advanced gold-copper project in the Miocene-age mineral belt of southern Colombia. The Cauca project is in the Cauca department, 47km south of the department capital Popayan - in the Almaguer Mining District - and consists of one title and one application, for a total land area of 1,808 hectares. The Miocene Mineral Belt containing Cauca extends from Colombia into Ecuador, and is characterized by numerous well-known districts and discoveries including Solgold’s Cascabel Project less than 40km from the Colombia border. Cauca is within one of the least explored terrains in Colombia. Cauca will join Miranda’s Mallama Project for our second project in this important region;

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

●

On June 21, 2018, the Company announced that our new applications in the Middle Cauca Belt will provide a regional-scale exploration play within a well-consolidated and strategic land position adjacent to advanced projects; and

●

On June 26, 2018, the Company announced that Gold Torrent, Inc. (“GTI”) was unable to complete its share financing required under the agreement with Cartesian Royalty Holdings. As a consequence of this, GTI and Alaska Gold Torrent, LLC (“AGT LLC”) are in default under the project finance arrangement with Cartesian Royalty Holdings, Cartesian Capital Group, and CRH Funding II Pte. Ltd. and will not receive development financing.

Alaska Update – Lucky Shot (Willow Creek) Project

Joint Venture Agreement

On November 5, 2014, the Company signed a definitive agreement with GTI on its Willow Creek / Lucky Shot project in Alaska that superseded the letter of intent signed on August 6, 2014. Under the terms of the agreement, GTI would be the operator of the Alaska Gold Torrent, LLC joint venture; GTI will sole fund the first US$10 million (“Initial Capital”) of expenditures on the joint venture to incrementally earn a 70% interest in the joint venture at which time Miranda would have a 30% interest in the joint venture. Capital calls in excess of the Initial Capital are dilutive to any non-funding party.

On November 6, 2017, Gold Torrent presented a “capital cash call” to the Company, requesting the payment of approximately US$5.0m from Miranda. The Company chose to not fund this cash call, and instead allowed its interest in AGT LLC to be theoretically diluted. However, GTI also did not fund their share of this same cash call, and thus the dilution of Miranda has not occurred.

GTI was unable to complete its share financing required under the agreement with Cartesian Royalty Holdings. As a consequence of this, GTI and AGT LLC are in default under the project finance arrangement with Cartesian Royalty Holdings, Cartesian Capital Group, and CRH Funding II Pte. Ltd. and will not receive development financing.

Miranda maintains its installment purchase of the 3.3% NSR on the project, in anticipation of future production.

After discussions between Miranda and Cartesian, it was determined that the best course of action for Cartesian was to foreclose on the Deed of Trust, and to request that GTI and Miranda sign over their respective holdings in AGT LLC to satisfy the provisions of the Deed of Trust.

Pursuant to a Membership Transfer and Assignment Agreement, both GTI and Miranda have now transferred their respective ownership in AGT LLC to CRH Funding II Pte. Ltd. for the consideration of CRH Funding II Pte. Ltd. assuming all of the obligations of GTI and Miranda under the AGT LLC Operating Agreement and that each of the parties is released from all liability on such assumed obligations arising after the date of transfer, being June 13, 2018.

Miranda has agreed to continue to work with Cartesian on other scenarios in order to assist with bringing the Lucky Shot project to production.

Sale of AGT LLC to Gold Torrent - terminated

On November 11, 2017, the Company signed a binding Letter of Agreement (“LOI”) with GTI for the sale of its diluted interest in AGT LLC. The closing date was to be the date on which GTI completed its listing on the Toronto Stock Venture Exchange – which has not occurred to date. This LOI is now terminated.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Renshaw Royalty purchase

The Company has an agreement with Mr. Daniel Renshaw (“Renshaw”) for the purchase of his 3.3% royalty held on the Lucky Shot (Willow Creek), Alaska project. Miranda and Renshaw have separated the Renshaw royalty into the area that covers the patented mining claims on the west side of the project (the “’A’ Royalty”) and the area that covers the patented mining claims on the east side of the project (the “’B’ Royalty”). The ‘A’ Royalty covers the area, including the Coleman resource, the plan for which is to initially develop and place this area into production. The ‘B’ Royalty covers ground that is prospective for exploration including the Bullion Mountain targets.

Miranda has agreed to purchase up to 100% of the ‘A’ Royalty in a series of seven (7) contracts, with each subsequent contract contingent on the prior contract being paid in full. Pursuant to each contract Miranda will purchase 0.4% to 0.5% of the ‘A’ Royalty for each cumulative US$143,000 paid at the rate of US$5,000 per month plus interest, with the first payment commencing on October 31, 2015.

As each contract is paid Miranda will register its ownership of the ‘A’ Royalty purchased. If Miranda does not complete payment of any contract the remainder of the ‘A’ Royalty will remain with Renshaw. The seven contracts will be over an aggregate period of up to 200 months, but such contracts and payments can be accelerated and paid off at any time, providing that Miranda pays Renshaw the full payment of an aggregate US$1,000,000 of principal so that Miranda will have purchased the entire 3.3% ‘A’ Royalty.

In addition, Renshaw has agreed to grant Miranda the option to purchase the ‘B’ Royalty, which option may be exercised at any time provided that the ‘A’ Royalty contracts are not in default. Miranda may purchase up to 100% of the ‘B’ Royalty for the aggregate amount of US$500,000 in principal to be paid under terms, conditions and instalments that are generally consistent with those of the ‘A’ Royalty.

As at May 31, 2018, the Company has paid $281,439 towards the purchase of the first of the series of the ‘A’ Royalty contracts, all of which is being capitalized as exploration and evaluation assets.

Colombia Update

Antares Project – the Option Agreement

On March 15, 2017, the Company announced that it had signed an Option Agreement (the “Agreement”) that allows IAMGold Corporation (“IAMGold”) to earn an interest in the Antares Project by conducting exploration on a scheduled earn-in basis. IAMGold will operate the project with input from Miranda.

IAMGold has incurred US$100,000 in expenditures during the calendar year 2017 (complete) and has maintained the right to enter into the option - which shall begin on the later of January 1, 2018, or such other date on which the mineral title to one or more of the exploration applications making up the Antares Project has been granted by the Colombian government – expected to occur in 2018. At such time, should IAMGold elect to enter into the option, it will be obligated to incur US$750,000 in expenditures during the subsequent 12 months.

The Agreement grants IAMGold an option to acquire an initial undivided 51% interest in the mineral rights of Antares by funding a total of US$5,000,000 in expenditures - including a commitment to drill at least 3,000 meters - over four years. IAMGold also has a second option to acquire a further undivided 14% interest in the mineral rights, for an aggregate 65% interest by making additional exploration expenditures of US$7,000,000 - including a commitment to drill at least 12,000 meters within a subsequent term of four years - from the exercise of the first option. IAMGold can attain a further 10% interest, for an aggregate 75% in the mineral rights of Antares, by providing Miranda, at its election, the required financing for mine construction.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Antares Project – details

The Antares Project consists of ten primarily contiguous exploration applications. The project covers 10,500 hectares, and is located 20 kilometers east-northeast of Medellin and 45 kilometers west-southwest of the Gramalote deposit within the Antioquia Department. There are two operating mines within 40 kilometers of Antares - Red Eagle Mining Corporation’s San Ramon Mine and Antioquia Gold Inc.’s Cisneros project - indicating it is possible to permit mines in this part of Antioquia in less than two years.

The Antares Project was generated using Gramalote as a deposit analog model. Antares is a granite-hosted sheeted vein and fracture and stockwork-hosted gold system within northeast shear zones hosted within the Antioquia Batholith, characteristics similar to Gramalote. Antares is notable for its numerous large hydraulically mined excavations of in situ, bulk-mineralized granite that occur on a northeast trend through the project. Gramalote is also characterized by areas of hydraulic mining, including zones which lie within its resource and designed pit area.

Antares mineralization occurs within the geochemical footprint of an impressive stream sediment anomaly extending for at least 14-square kilometers at a reconnaissance survey density of 2 to 3 samples per square kilometer, with nearly all values greater than 300 ppb Au in conventional stream sediment samples. The Santa Rita and Guaricu pits (hydraulic excavations) show consistent mineralization in systematic channel samples, with anomalies in the Santa Rita pit extending for 300 meters by 150 meters - with gold values from below detection up to 9.0 g Au/t in two-meter channel samples - but with channel sample intervals as high as 32 meters of 1.2 g Au/t. There are likely two main parallel shears within the Santa Rita pit - similar to Gramalote - where several parallel shears in that deposit will be mined within the same designed pit.

Miranda’s sampling was difficult - and only sporadically representative - in the Guaricu pit because of extensive wall failure. However, a soil grid in an area of small workings adjacent to Guaricu shows an open soil anomaly of 600 meters by 100 to 150 meters with values in a range of 100 to 538 ppb Au. Importantly, this grid shows both that soil sampling will be effective to explore the property and that significant anomalies adjoin or extend from the large hydraulically mined excavations. The excavations, surrounding areas, and the associated soils anomalies will provide immediate drill targets - after application to title conversion and permitting. There are no environmentally sensitive areas or indigenous lands within the applications.

Argelia Project – details

Argelia represents Miranda’s continuing focus on adding robust epithermal gold systems that display numerous sub-parallel veins, which commonly show high values from reconnaissance systematic channel sampling. Eighteen or more distinct veins observed in surveyed historic workings on the project - with ten showing sample values of greater than 10 g Au/t up to 109 g Au/t from 0.5 meters to 4 meters sampled vein widths. The best sampling returned 20.5 g Au/t over 4 meters in a historic crosscut. Approximately 100 meters below these workings there is another adit on the same veins showing one meter at 20 g Au/t, suggesting that a continuous mineralized “shoot” may exist between the two levels.

The veins appear to be distributed sub-parallel over a regional-scale, 2-kilometer northeast-trending shear zone and are inferred to extend for 8 kilometers along strike. The veins strike at an oblique angle to the shear zone and may be emplaced in dilational structures, secondary to the main shear. Veins are only noted in workings, and it is likely that significantly more veins are unexposed within the shear zone. The style of mineralization and associated metals suggest that Argelia is an intermediate sulfidation (IS) epithermal system.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

All of Miranda’s vein projects were screened for the potential to deliver future major company production profiles and resources. The Argelia Project totals 5,400 hectares in exploration application, and is 145km or about four-hours by road from Medellin, within the Antioquia Department. No indigenous lands impact the project. However, the project requires conversion to title and then subtraction from the forestry reserve - as do all applications granted under the “Second Mining Law”.

Cauca Project – the Option Agreement

Miranda has signed a definitive option agreement to earn up to 100% of the Cauca Project, in three phases, as follows:

a)

To acquire the first 51% undivided interest in the Cauca project:

| Performance Date | Annual Expenditure Amount | Cumulative Expenditure Amount |

| First anniversary of Effective Date | US$250,000 (1) | US$250,000 |

| Second anniversary of Effective Date | US$750,000 | US$1,000,000 |

| Third anniversary of the Effective Date | US$2,000,000 | US$3,000,000 |

Fourth (2) anniversary of Effective Date | US$2,000,000 | US$5,000,000 |

(1) obligation

(2) may be extended up to 12-months with payment of US$500,000

Also included in the earn-in, is a commitment to core drill up to 12,000 meters, to be completed during the first earn-in period.

Subsequent to Miranda’s exercise of the first option, the vendor shall be entitled to a 1.5% NSR royalty (the “Base Royalty”) on any gold or gold equivalent ounces in excess of 1.0 million ounces produced from the property.

b)

To acquire the second 19% undivided interest in the Cauca project:

| Performance Date | Annual Expenditure Amount | Cumulative Expenditure Amount |

| First anniversary of the exercise of first option | $2,000,000 | $7,000,000 |

| Second anniversary of the exercise of first option | $4,500,000 | $11,500,000 |

Also included is a commitment to core drill up to 15,000 meters, to be completed during the second earn-in period, for a total commitment of 27,000 meters.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

c)

To acquire the final 30% undivided interest in the Cauca project:

| Performance Date | Performance Criteria |

| First anniversary of the exercise of second option | Delivery of a NI 43-101 Preliminary Economic Assessment (“PEA”), with the cost borne entirely by Miranda. |

| Maximum of 120 days following the delivery of the PEA | Delivery of a notice of intent to purchase the remaining 30%. |

| Maximum of 90 (or 180) days following the delivery of the intent to purchase | Agreement as to the fair market value (“FMV”) of the Cauca project, within 90 days, to be mutually determined; or failing mutual agreement, by the use of an independent professional valuation expert. The valuation expert, if needed, may be given an additional 90 days to produce the final FMV report. |

| Maximum of 60 days following the FMV agreement or delivery of the final FMV report on the Cauca project | Payment of the pro-rata portion of the FMV, in cash. Payment of a 1.5% NSR royalty on all gold and gold equivalent ounces of production from the property (replacing the Base Royalty), beginning from the FMV agreement closing date and continuing for the life-of-mine. |

In addition, there will be a payment due to the vendor based upon either Miranda’s Maiden NI 43-101 Technical Report, or Miranda’s Maiden internal resource estimate – either of which must contain an estimate of measured, indicated and/or inferred gold resources on the property (the “Resource Bonus”). The payment of the Resource Bonus shall be calculated as USD$5.00 per ounce of gold or gold equivalent of such resources to a maximum of USD $4,500,000. The Resource Bonus shall be payable in two tranches: the first 50% shall be due on the date of the exercise of the first option, and the second 50% shall be due 12-months later.

Cauca Project – details

The newly acquired Cauca project is an advanced gold-silver-copper project in the Miocene-age mineral belt of southern Colombia. The Cauca project is in the Cauca department, 47km south of the department capital Popayan - in the Almaguer Mining District - and consists of one title and one application, for a total land area of 1,808 hectares. The Miocene Mineral Belt containing Cauca extends from Colombia into Ecuador, and is characterized by numerous well-known districts and discoveries including Solgold’s Cascabel Project less than 40km from the Colombia border. Cauca is within one of the least explored terrains in Colombia.

Structural controls and porphyry-emplacement are related to fault and fracture systems of the Cauca-Romeral Mega-structure or Suture zone. The predominant lithologies are continental sediments intruded by hypabyssal diorite and quartz-diorite porphyry. Alteration is external propylitic to phyllic to internal potassic in the core of the intrusives. Epithermal veins trend predominantly northwest and secondarily northeast and have phyllic and potassic selvages. The La Custodia is a gold-copper porphyry deposit with a persistent low-sulfidation epithermal overprint, including gold-silver quartz veins, veinlets and stockwork, and quartz-carbonate veins with base metals and gold.

The epithermal mineralization shows classic dark ginguro texture and abundant fine-to-coarse free gold. Fluid inclusion studies show temperatures of vein formation at 400 to 500°C for Type A and Type B porphyry-style veins, and 150°C for epithermal veins, indicating specific stages for vein formation. Porphyry mineralization was probably followed by carbonate-gold-base metal veins, and then low-temperature gold - silver veins.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

The concession has several exploration targets - the most studied being the La Custodia. Other exploration targets similar to La Custodia include La Esperanza and El Limón - both with porphyry-gold-copper combined with epithermal-type mineralization. The Hueco Hondo prospect is 3.8km from La Custodia - and midway between La Custodia and La Esperanza – and is characterized chiefly by parallel epithermal veins that show reconnaissance channel sample values up to 127 g Au/t. The Hueco Hondo target is important in that it may illustrate the prevalent orientation of veins, including the orientation of potentially under-sampled veins in the La Custodia zone. Hueco Hondo consists of multiple parallel high-grade veins without a porphyry component, further supporting a persistent epithermal overprint.

Several gold-arsenic soil anomalies occur across a significant part of the 1,808 hectare property - but only two anomalies have been drilled to date. Drilling in one of these soil anomalies resulted in the identification of the La Custodia deposit. Open soil anomalies occur between La Custodia and Hueco Hondo, east of La Custodia, and north, south and east of La Esperanza, which is seven kilometers north of La Custodia. Several high level stream sediment anomalies have not been followed up with prospecting or soil grids.

Drilling in La Custodia and other targets (62 core holes for 22,047m total) on the project shows gold-copper porphyry mineralization with a persistent overprint of epithermal gold and carbonate-gold-base metal veins. Carboandes produced an internal resource estimate from the La Custodia deposit of 700,000 ounces at 0.66 g Au/t; but Miranda believes vertical epithermal veins are significantly under-sampled by wide-spaced drilling, and a more accurate representation of higher-grade veins in the deposit may provide a higher estimated resource grade.

Of particular interest to Miranda in the La Custodia deposit, are local intercepts containing epithermal mineralization that range from 2m at 28.4 g Au/t (2 g Ag/t) up to 2m at 1,095 g Au/t (257g Ag/t) superposed on lower-grade porphyry-style veinlets. Miranda has determined that core intercepts over 1 g Au/t consistently show high-angle epithermal veins sub-parallel to core, cross-cutting porphyry-style veins. It is likely that numerous untested veins or vein extensions occur between the current drill-holes that are spaced at an average of 100m to 200m.

Cauca Historic Internal Valuation Studies:

Carboandes discovered the La Custodia in 2010, and produced a project technical report. They have conducted internal studies in support of resource estimations, preliminary economic evaluations, metallurgy, and mining studies. The internal resource estimate of the La Custodia - completed and internally reported in 2015 – provided a resource of 700,000 ounces gold at 0.66 g Au/t. Within this resource, using a plus-0.3 g Au/t cut-off, a three-dimensional “grade-shell” was modeled and used for a trial pit optimization. Internal to the pit, the gold-grade shell contains estimates of 307,450 ounces of gold, 1,323,000 ounces of silver, and 80,897,000 pounds of copper from a volume of 34 million tons of mineralized material - at prices significantly below current prevailing prices. Additional plus-0.3 g Au/t grade shells occur both below and adjacent to the pit shell. The vendor’s internal metallurgical work shows a 95% gravimetric recovery of gold in the oxide zone and an 85% recovery of gold; 80% recovery of copper; and 60% recovery of silver combining gravity with flotation, in the sulfide zone.

The optimization utilized very preliminary assumptions for mining costs for an open-pit blast, shovel, and truck operation with a production rate of 5,000 tons per day. A simple inverse distance-squared isometric projection appropriate to generally uniformly distributed mineralization, with cumulative frequency grade capping was used to model grades. The optimization used metal prices of $1,254 per ounce gold, $15.80 ounce silver, and $2.05 per pound copper and recovery by gravimetric and conventional flotation milling. Recoveries were estimated from multiple bench-scale and larger tests performed by independent labs. The Carboandes internal report refers to all of its estimated resource as “inferred” but this should be considered a general term and not completed in accordance with CIM definitions of mineral resource categories.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

No other resource estimates pre- or post-date the 2015 estimate, and a qualified person has not done enough work to verify or classify this historical resource estimate as current mineral resources or reserves. Therefore, Miranda is not treating the information as a current mineral resource or reserve. The internal work was conducted using professional internal company standards and is considered reliable for its level of detail, but Miranda has not independently reviewed and substantiated the work - Miranda is using the internal Carbonandes work only to provide an estimate of exploration potential and as rationale to continue exploration. An independent qualified person will need to perform their own grade and resource modeling after additional drilling - and will do its own cost estimations and studies before preparing and filing an independent NI 4-101 technical report to support the mineral resource. Most important will be an accurate measurement and projection of higher grade epithermal-associated gold.

Importantly, Carboandes’ internal pit design is contained within a small area of only 14 hectares of the total 1,808 hectare project area. The project is near the Pan-American Highway and secondary paved roads, the national power grid, and an airport. Topographic, elevation, social, and environmental aspects of the Project are favorable for exploration and development.

The Agreement provides Miranda a 60-day due diligence period before it becomes fully effective. The due diligence concludes on or before August 13, 2018.

Work completed on the Cauca project is summarized in the following table:

| | La Custodia | La Esperanza | El Limon | Total |

| Stream sediments | 9 | 16 | 2 | 27 |

| Soil samples | 800 | 1,051 | 166 | 2,017 |

| Rock chip samples | 110 | 58 | 85 | 253 |

| Channel samples | 763 | 251 | 57 | 1,071 |

| Thin-section samples | 91 | 70 | 19 | 180 |

| Pima samples | 952 | 513 | - | 1,465 |

| Core drilling samples | 9,555 | 3,896 | - | 13,451 |

| Screened Au samples | 205 | 18 | - | 223 |

| Cyanide leach samples | 53 | 18 | - | 71 |

Significant drill intercepts are provided in the following table from the La Custodia zone. Only intercepts greater than 0.5 g Au/t are shown. Values over 1 g Au/t consistently show some amount of epithermal quartz or quartz-carbonate veins, generally sub-parallel to core and thus are probably near vertical.

Miranda believes that closer-spaced, and properly angled holes with respect to vein trend, will better delineate the continuity and thickness of sub-vertical, higher gold grade epithermal veins that we believe are presently under-sampled on a volume weighted basis in the current La Custodia drill pattern and the internal resource estimate.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

| HOLE | From (m) | To (m) | Interval (m)** | Average (Au g/t) |

| DHHU007 | 216 | 254 | 38 | 0.68 |

| DHHU004 | 230 | 288 | 58 | 0.60 |

| DHHU008 | 3.3 | 32 | 28.7 | 1.38 |

| 69.6 | 92 | 22.4 | 0.71 |

| DHHU008A | 161 | 181.35 | 20.35 | 0.54 |

| DHLC002 | 20 | 80.86 | 60.86 | 0.52 |

| 123.5 | 144 | 20.5 | 0.52 |

| 152.45 | 161.6 | 9.15 | 0.61 |

| 272 | 291 | 19 | 1.47 |

| 347 | 357 | 10 | 0.72 |

| 399 | 408 | 9 | 2.61 |

| 414.2 | 447.61 | 33.41 | 2.18 |

| DHLC003 | 154.9 | 177.8 | 22.9 | 0.63 |

| 193 | 199 | 6 | 0.82 |

| 335.4 | 343.5 | 8.1 | 0.75 |

| 418.65 | 428.2 | 9.55 | 0.74 |

| DHLC004 | 8 | 24 | 16 | 0.61 |

| 88.8 | 96.1 | 7.3 | 0.96 |

| 116.4 | 121.7 | 5.3 | 0.68 |

| 344 | 353.8 | 9.8 | 0.94 |

| 369 | 381.3 | 12.3 | 0.68 |

| 408.8 | 416.5 | 7.7 | 0.84 |

| DHLC006 | 29.8 | 75 | 45.2 | 0.97 |

| 104 | 125.9 | 21.9 | 0.81 |

| 461.4 | 479.8 | 18.4 | 0.73 |

| 484.5 | 491.37 | 6.87 | 1.44 |

| 513 | 530.25 | 17.25 | 0.86 |

| DHLC007 | 47.9 | 51.8 | 3.9 | 0.85 |

| DHLC008 | 105 | 139.46 | 34.46 | 1.3 |

| 143.5 | 165.6 | 22.1 | 1.02 |

| 375 | 388.65 | 13.65 | 1.09 |

| DHLC009A | 144 | 153.5 | 9.5 | 0.71 |

| 292 | 297.45 | 5.45 | 0.74 |

** True thicknesses cannot be accurately estimated at this time, but generally, due to the nature of the deposit, drill thicknesses are thought to be close to true thicknesses.

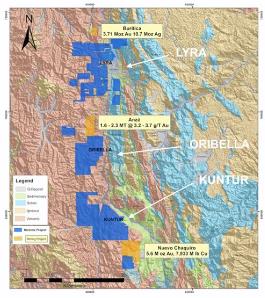

Middle Cauca Belt: Kuntur Project – details

The newly-acquired Kuntur project totals 47,664 hectares and directly adjoins the Quebradona District on the northwest and southeast. Kuntur shows the prevalent north and west-northwest fault framework that the copper-gold footprint of AngloGold Ashanti Limited’s (NYSE: AU) Quebradona (Nuevo Chaquiro) District coincides with, on a deposit scale. Both AngloGold Ashanti’s Quebradona district and Miranda’s Kuntur project occur where strong northwest fault systems span the distance between the major north-south Mistrato and Romeral Fault Systems - the regional faults that bound this part of the Middle Cauca Mineral Belt. Miranda will soon begin reconnaissance prospecting and stream sediment sampling on Kuntur.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Middle Cauca Belt: Lyra Project – details

The Lyra project comprises 52,482 hectares and directly adjoins Continental Gold Inc.’s (TSX: CNL) Buriticá project, covering more than 25km of the Tonusco Fault that extends south from the Buriticá vein system. Data compiled by the Instituto Colombiano de Geología y Minería (“Ingeominas”) shows 50 of 61 samples on Lyra are non-detectable to 0.3 g Au/t - while 11 samples are greater than 0.3 g Au/t - with 6 of those 11 samples greater than 10 g Au/t. Those higher-grade samples likely reflect sampled veins, but detailed data was not provided by Ingeominas. Current Miranda reconnaissance shows five areas on Lyra where mapped colluvium indicates the presence of porphyritic intrusives. The Ingeominas samples are historic and have not been confirmed by Miranda, but are considered reliable and may indicate anomalous areas and the location of possible veins.

Middle Cauca Belt: Oribella Project – details

The original Oribella project comprised approximately 24,000 hectares including and one application on which the technical study is complete and the canon is paid.

Oribella has been expanded contiguously to where the project now adjoins Orosur Mining Inc.’s (TSX/AIM: OMI) Anza project – which contains the APTA vein deposit and the Charrascala porphyry-epithermal anomalies. Oribella was expanded to the northwest where it is now within 3km of AngloGold Ashanti’s Nuevo Guintar project - where low grade epithermal mineralization is reported in two drill-holes (source: AngloGold Q3-2017, “Exploration Update”).

Oribella falls within the Western Cordillera close to the convergence of regional structures which reflect a suture zone between Cretaceous oceanic rocks and mixed oceanic-continental rocks to the east. Miranda was attracted to the area by mineralization controls inferred to be related to the suture zone and reported geologic features which suggested an area of high-sulfidation epithermal Au-Cu mineralization. The local geology consists of volcanic and volcano-clastic sequences, sedimentary rocks, and hypabyssal andesite and dacite intrusions that appear related to gold mineralization. Of particular interest is a large kilometer-scale area of alteration that includes strong silicification, brecciation, alunite and pyrophyllite mineralization and clays associated with anomalous grades of gold and copper. This alteration is consistent with an epithermal style of gold mineralization. | |

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Oribella captures strands of the Tonusco and Mulatos Fault and contains a gold-in-soil anomaly produced by Miranda with dimensions of approximately 500m by 250m - the anomaly is open in two directions. Limited hand trenching within the soil anomaly shows 11m @ 1.1 g Au/t in outcrop. This mineralization extends to the limits of the short trench. Copper and gold values are somewhat offset from each other, but taken together define an anomaly 800m wide by 500m - centered on an andesite porphyry stock and related breccia bodies at a major fault inflection. Oribella gold mineralization is interpreted as predominantly epithermal replacement of tuff and sedimentary rocks, but copper values and magnetic intrusive breccias suggest the epithermal mineralization may be associated with porphyry-style mineralization. Locally, vegetation anomalies correlate with strong hematite alteration in road cuts.

Mallama Project – details

The Mallama project is part of a large district that contains more than 30 mapped intermediate sulfidation epithermal veins with strike lengths of over four kilometers. In 1983, the Japanese International Cooperation Agency (JICA) mapped, sampled, and drilled a portion of the larger vein system - of which the Mallama project covers a part. The El Diamante Mine is just north of Miranda’s Mallama project, and has been active for more than 30 years - the gold at El Diamante, in particular, is associated with pyrite and quartz and secondarily with arsenopyrite, sphalerite and galena.

Historic sampling presented by the owners of the titles on the Mallama project shows vein grades from 33 g Au/t to 87 g Au/t with silver occurring on an average ratio of 10:1 silver to gold. Limited confirmation sampling assays by Miranda geologists shows 42 g Au/t over 0.5m in an active artisan mine that displays numerous parallel veins. Mallama consists of government granted titles. These titles must be subtracted from the “forestry reserve” under the “Second Mining Law” of Colombia.

Preliminary work by Miranda shows significant mineralization in the Bombona Zone where systematic sampling in an area of sublevel production shows 15 samples with a weighted average grade of 23.2 g Au/t and 182.3 g Ag/t, over an average of 0.69m vein width. Soil sampling conducted by JICA shows that the Bombona Zone correlates well with gold anomalies in soils, and eight or more parallel veins can be inferred adjacent the Bombona vein. Aligned artisanal workings suggest the Bombona Zone extends for up to 4 km in length.

Terminated Projects

Cerro Oro Project – terminated

On January 16 2013, the Company entered into a lease agreement on the Cerro Oro property (the “Cerro Oro Option”) which required payment of US$10,000 on signing and a payment of US$80,000 upon conversion of the application to a license.

On January 8, 2018, the Company notified the lessee of its intent to terminate the Cerro Oro Option and return the property. The process of termination will include the unwinding of the trust agreement between the Company, the lessees, and the trustee.

Qualified Person

The data disclosed in this MD&A has been reviewed and verified by Joseph Hebert, B.S.Geo. C.P.G., a Qualified Person as defined by National Instrument 43-101.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Results of Operations

For the three and nine-months ended May 31, 2018 and 2017

Significant or noteworthy expenditure differences between the periods include:

| | For the three months ended | For the nine months ended |

| | May 31, | May 31, | May 31, | May 31, |

| | 2018 | 2017 | 2018 | 2017 |

| Loss for the period | $ 745,969 | $ 638,180 | $ 1,785,337 | $ 1,707,338 |

| Consulting fees | $ 37,599 | $ 37,500 | $ 167,599 | $ 100,000 |

| | | | | |

| | No material difference. | Increase due to a bonus of $55,000 paid to CFO during Q2-2018. |

| | | | | |

| Directors fees | 14,212 | 10,326 | 206,658 | 30,645 |

| | | | | |

| | No material difference. | Bonuses of $55,000 were paid to each of the three directors during Q2-2018. |

| | | | | |

| Exploration and evaluation expenditures | 350,156 | 437,530 | 896,768 | 1,015,447 |

| | | | | |

| | No material difference. | No material difference. |

| | | | | |

| Investor Relations | 33,989 | 35,768 | 64,626 | 119,048 |

| | | | | |

| | No material difference. | Commencement of new IR contract with Palisades in March 2018. |

| | | | | |

| Professional fees | 9,248 | 49,616 | 30,775 | 73,140 |

| | | | | |

| | Reduced usage of external counsel in the current period and YTD. |

| | | | | |

| Office rent, telephone, secretarial, and sundry | 7,955 | 14,402 | 35,901 | 40,512 |

| | | | | |

| | Year-over-year figures are now within our expected range. |

| | | | | |

| Stock-based compensation | - | - | - | 133,468 |

| | | | | |

| | No stock options have been granted in fiscal 2018. |

| | | | | |

| Travel and business promotion | 9,690 | 12,713 | 20,919 | 22,604 |

| | | | | |

| | Year-over-year figures are now within our expected range. |

| | | | | |

| Wages and benefits | 33,823 | 56,490 | 131,297 | 183,817 |

| | | | | |

| | The reduction is due to a greater allocation of wage costs to Colombia exploration projects and an overall reduction in management salaries and benefits in fiscal 2018 due to Mr. Cunningham’s retirement. |

| | | | | |

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Summary of Quarterly Results

The following is a summary of the Company’s financial results for the eight most recently completed quarters:

| | May 31, 2018 $ | February 28, 2018 $ | November 30, 2017 $ | August 31, 2017 $ | May 31, 2017 $ | February 28, 2017 $ | November 30, 2016 $ | August 31, 2016 $ |

Revenue | nil | nil | nil | nil | nil | nil | nil | nil |

Net loss for the period | (745,969) | (706,229) | (333,139) | (938,441) | (638,180) | (644,090) | (425,068) | (204,460) |

| Basic and diluted loss per share | (0.00) | (0.00) | (0.00) | (0.01) | (0.01) | (0.01) | (0.00) | (0.00) |

The Company is a mineral exploration company. At this time, any issues of seasonality or market fluctuations have no material impact. The Company currently defers its mineral property acquisition costs. The Company expenses its exploration and project investigation and general and administration costs and these amounts are included in the net loss for each quarter. The Company’s treasury, in part, determines the level of exploration undertaken.

Liquidity and Capital Resources

The Company’s primary source of funds since incorporation has been through the issue of its common stock and the exercise of common stock options and common stock share purchase warrants.

The Company applies the option to joint venture business model to its operations. Through generative exploration it stakes claims on mineral properties, or acquires the property by way of an option to lease agreement. It then seeks partners to option to joint venture its projects in order to have those partners fund the exploration of the project to earn an interest. In some cases the Company receives common stock and/or cash option payments as a portion of the partner’s cost to earn an interest.

The Company records management fees earned for acting as a service contractor to certain exploration funding partners as an offset to expenses. Mineral property option proceeds from properties where all acquisition costs have been recovered further reduce expenses. The Company does not anticipate mining revenues from the sale of mineral production in the near future. The operations of the Company consist of the exploration and evaluation of mining properties and as such the Company’s financial success will be dependent on the extent to which it can discover new mineral deposits. The Company anticipates seeking additional equity investment from time to time to fund its activities that cannot be funded through other means.

On March 9 and 20, 2018, the Company closed a non-brokered private placement with aggregate gross proceeds of $1,513,187 from the sale of 27,512,500 units at a price of $0.055 per unit. Each unit comprised one common share and one non-transferable common share purchase warrant. Each warrant entitles the holder thereof to purchase one additional common share of Miranda at a price of $0.12 until March 9, 2022. The common shares issued, and any common shares issued pursuant to the exercise of warrants prior to July 9, 2018, will be restricted from trading until July 9, 2018. The Company paid finder’s fees in cash, to persons who introduced it to investors of $36,774.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

The Company began the 2018 fiscal year with cash of $1,243,911. In the nine months ended May 31, 2018, the Company expended $2,018,183 on operating activities; and expended $80,068 on investing activities; and recorded cash inflows of $1,462,519 for financing activities; with a $15,258 positive effect of foreign exchange on cash, to end on May 31, 2018, with $623,437 in cash.

At the date of this MD&A, the Company has 4,682,500 stock options outstanding, all of which are exercisable, and 56,653,055 outstanding share purchase warrants. Additional cash would be raised if stock option and share purchase warrant holders choose to exercise these instruments - albeit, none of these securities are currently “in-the-money”.

The Company does not have sufficient cash to meet its obligations as they come due over the next twelve months.

Transactions with Related Parties

a)

The Company’s related parties consist of companies with directors and officers in common and companies owned in whole or in part by executive officers and directors as follows:

| Name | Nature of transactions |

| Goldnor Global Management Inc. (“GGMI”) | Consulting as CFO, Corporate Secretary, |

| | corporate compliance services and financial reporting |

The Company incurred the following fees in the normal course of operations in connection with individuals and companies owned, or partially owned, by key management and directors. Expenses have been measured at the exchange amount.

| | Three months ended | Nine months ended |

| | May 31, 2018 | May 31, 2017 | May 31, 2018 | May 31, 2017 |

| Consulting fees – GGMI | $ 37,500 | $ 37,500 | $ 167,500 | $ 100,000 |

Accounts payable and accrued liabilities to related parties at May 31, 2018, amounted to $24,081 (August 31, 2017 - $189,926).

b)

Compensation of directors and members of key management personnel (CEO, CFO, Corporate Secretary):

The remuneration of directors and other members of key management personnel, including amounts disclosed above, during the nine-month period ended May 31, 2018 and 2017 were as follows:

| | Three months ended | Nine months ended |

| | May 31, 2018 | May 31, 2017 | May 31, 2018 | May 31, 2017 |

| Consulting fees | $ 37,500 | $ 37,500 | $ 167,500 | $ 100,000 |

Salaries and benefits (1) | 87,900 | 114,331 | 254,264 | 297,508 |

| Directors fees | 14,212 | 10,326 | 206,658 | 30,645 |

| Share based compensation | - | - | - | 121,335 |

| Total | $ 139,612 | $ 162,157 | $ 628,422 | $ 549,488 |

(1) – a portion of salaries are included in exploration and evaluation expenditures

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Future Canadian Accounting Standards

Refer to Note 3 of the Financial Report. The Company has not applied any of the future and revised IFRS detailed therein, all of which have been issued but are not yet effective at the date of this MD&A.

Financial Instruments and Risk Management

Categories of Financial Assets and Financial Liabilities

Financial instruments are classified into one of the following categories: FVTPL; held-to-maturity investments; loans and receivables; available-for-sale; or other liabilities. The carrying values of the Company’s financial instruments are classified into the following categories:

| Financial Instrument | Category | May 31, 2018 | August 31, 2017 |

| Cash | FVTPL | $ 623,437 | $ 1,243,911 |

| Amounts receivable | Loans and receivables | 6,339 | 4,166 |

| Marketable securities | Available-for-sale | 14,000 | 32,000 |

| Investments | Available-for-sale | - | 188,040 |

| Advances | Loans and receivables | 500 | 473 |

Accounts payable and accrued liabilities | Other liabilities | 42,275 | 268,033 |

The Company’s financial instruments recorded at fair value require disclosure about how the fair value was determined based on significant levels of inputs described in the following hierarchy:

Level 1 - Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions occur in sufficient frequency and value to provide pricing information on an ongoing basis.

Level 2 - Pricing inputs are other than quoted prices in active markets included in Level 1. Prices in Level 2 are either directly or indirectly observable as of the reporting date. Level 2 valuations are based on inputs including quoted forward prices for commodities, time value and volatility factors, which can be substantially observed or corroborated in the market place.

Level 3 - Valuations in this level are those with inputs for the asset or liability that are not based on observable market data.

The recorded amounts for amounts receivable, advances, and accounts payable and accrued liabilities approximate their fair value due to their short-term nature. Fair value of cash, marketable securities, and investments are determined as follows:

| Financial Instrument | Quoted prices in active markets for identical assets | Significant other observable inputs | Significant unobservable inputs | Total as at May 31, 2018 |

| | Level 1 | Level 2 | Level 3 | |

| Cash | $ 623,437 | $ - | $ - | $ 623,437 |

Marketable securities | 14,000 | - | - | 14,000 |

Investments | - | - | - | - |

| Total | $ 637,437 | $ - | $ - | $ 637,437 |

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Risk Management

The Company’s risk exposures and the impact on the Company’s financial instruments are summarized as follows:

Credit Risk

Credit risk is the risk of potential loss to the Company if a counterparty to a financial instrument fails to meet its contractual obligations. The Company’s credit risk is primarily attributable to its liquid financial assets, including cash, receivables, and balances receivable from the government. The Company limits the exposure to credit risk in its cash by only investing its cash with high-credit quality financial institutions in business and savings accounts, guaranteed investment certificates and in government treasury bills which are available on demand by the Company for its programs.

Liquidity Risk

Liquidity risk is the risk that the Company will not have the resources to meet its obligations as they fall due. The Company manages this risk by closely monitoring cash forecasts and managing resources to ensure that it will have sufficient liquidity to meet its obligations. All of the Company’s financial liabilities are classified as current and are anticipated to mature within the next sixty days.

Market Risk

Market risk is the risk of loss that may arise from changes in market factors such as interest rates, foreign exchange rates, and commodity and equity prices. These fluctuations may be significant.

(a)

Interest Rate Risk: The Company is exposed to interest rate risk to the extent that its cash balances bear variable rates of interest. The interest rate risks on cash and short-term investments and on the Company’s obligations are not considered significant.

(b)

Foreign Currency Risk: The Company has identified its functional currencies as the Canadian dollar and the US dollar. Transactions are transacted in Canadian dollars, US dollars, and Colombian Pesos (“COP”). The Company maintains US dollar bank accounts in the USA and maintains COP bank accounts in Colombia to support the cash needs of its foreign operations. Management believes the foreign exchange risk related to currency conversions are minimal and therefore, does not hedge its foreign exchange risk.

Balances at May 31, 2018, are as follows:

| | US dollars | Colombian Pesos | Canadian dollar equivalent |

| Cash | 109,407 | 159,893,573 | $ 213,491 |

| Amounts receivable | - | 3,728,352 | 1,675 |

| Advances and deposits | - | 1,113,285 | 500 |

| | 109,407 | 164,735,210 | 215,666 |

Accounts payable and accrued liabilities | (8,296) | (29,998,750) | (24,219) |

Net foreign currency monetary assets | 101,111 | 134,736,460 | $ 191,447 |

Based upon the above net exposures and assuming that all other variables remain constant, a 10% increase or decrease in the Canadian dollar against the US dollar and the Colombian Peso would result in a decrease or increase in the reported loss of approximately $19,100 in the period.

(c)

Commodity Price Risk: While the value of the Company’s mineral resource properties are related to the price of gold and the outlook for this mineral, the Company currently does not have any operating mines and hence does not have any hedging or other commodity based risks in respect to its operational activities.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Historically, the price of gold has fluctuated significantly and is affected by numerous factors outside of the Company’s control, including but not limited to industrial and retail demand, central bank lending, forward sales by producers and speculators, levels of worldwide production, short-term changes in supply and demand because of speculative hedging activities, and certain other factors related specifically to gold.

Forward Looking Statements

This MD&A contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

This MD&A may contain information about adjacent properties on which we have no right to explore or mine. We advise U.S. investors that the SEC's mining guidelines strictly prohibit information of this type in documents filed with the SEC. U.S. investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.

Risks and Uncertainties

Mineral exploration is subject to a high degree of risk, which a combination of experience, knowledge, and careful evaluation may fail to overcome. Exploration activities seldom result in the discovery of a commercially viable mineral resource. Exploration activities require significant cash expenditures. The Company will therefore require additional financing to carry on its business and such financing may not be available when it is needed.

Information concerning risks specific to the Company and its industry, which are required to be included in this MD&A are incorporated by reference to the Company’s Annual Information Form filed on Form 20-F for the year ended August 31, 2017, dated as of December 8, 2017, in the section entitled “ITEM 3 KEY INFORMATION, D. Risk Factors”.

Additional Disclosure for Venture Issuers without Significant Revenue

The components of exploration and evaluation assets are described in Note 10 to the Financial Report.

| Miranda Gold Corp. Management Discussion and Analysis for the nine months ended May 31, 2018 |

Outstanding Share Data as at the date of this MD&A

Authorized: an unlimited number of common shares without par value:

| | Common Shares Issued and Outstanding | Common Share Purchase Warrants | Common Share Purchase Options |

| Balance as at May 31, 2018 | 132,517,577 | 56,653,055 | 4,682,500 |

| Balance as of the date of this MD&A | 132,517,577 | 56,653,055 | 4,682,500 |

Other Information

Additional information relating to the Company is available for viewing on SEDAR at www.sedar.com and at the Company’s web site www.mirandagold.com.