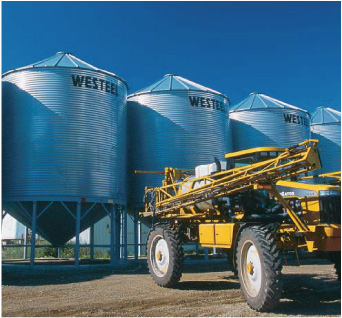

Retail

The expected strength in grain and nutrient prices should allow our retail operations in North America to continue their pattern of solid earnings. Pursuing opportunities to grow our retail operations in North America either incrementally or through a larger acquisition remains key.

In South America, we expect the uncertain political and economic climate to persist. Agriculture is forecast to continue to be a positive force for recovery, and moderate increases in EBIT should be achievable.

Key risks and uncertainties

The global nutrient business, like all agriculture-based industries, is subject to risks and uncertainties in commodity prices, weather and political uncertainty, as well as many risks specific to each product. The following is a discussion of the key risks and uncertainties facing our business on a day-to-day basis, and the strategies we adopt to mitigate these risks. However, it should not be assumed that this discussion is exhaustive or that the strategies adopted to mitigate these risks will be effective.

Raw materials

Low-cost raw material inputs such as natural gas, phosphate rock and potash ore are crucial to our business. These materials are subject to price volatility that can have a significant impact on our profitability. In the long term, locating or acquiring our facilities in areas of abundant low-cost supplies will manage this volatility, or where security of supply may be at risk, we may develop our own sources of supply and integrate them with our operations.

In the shorter term, we manage volatility in our raw material input costs through the use of derivative products and other contractual arrangements where available. However, these strategies cannot eliminate these risks entirely.

There is ongoing uncertainty as to the quantity of low-cost natural gas that will be delivered to our Alaskan facility under the Unocal supply contract. As discussed under the segmented performance section for North America Wholesale, we are currently engaged in litigation and arbitration with Unocal over these and other matters, and the outcome remains subject to the uncertainty related to legal issues.

Weather

Weather can have a significant and unpredictable impact on demand. We must manufacture product throughout the year in order to meet peak season demand, and we must react quickly to changes in expected weather patterns that affect demand. We do this by utilizing long-range weather outlooks in our annual planning and by adjusting production levels and moving product to locations where demand is strongest. However, our ability to react is limited by the shortness of the peak selling season.

Geographic diversity of our wholesale markets and our retail facilities affords some protection against adverse regional weather patterns, but we also strive to mitigate our exposure through increased sales to industrial customers.

Pricing and markets

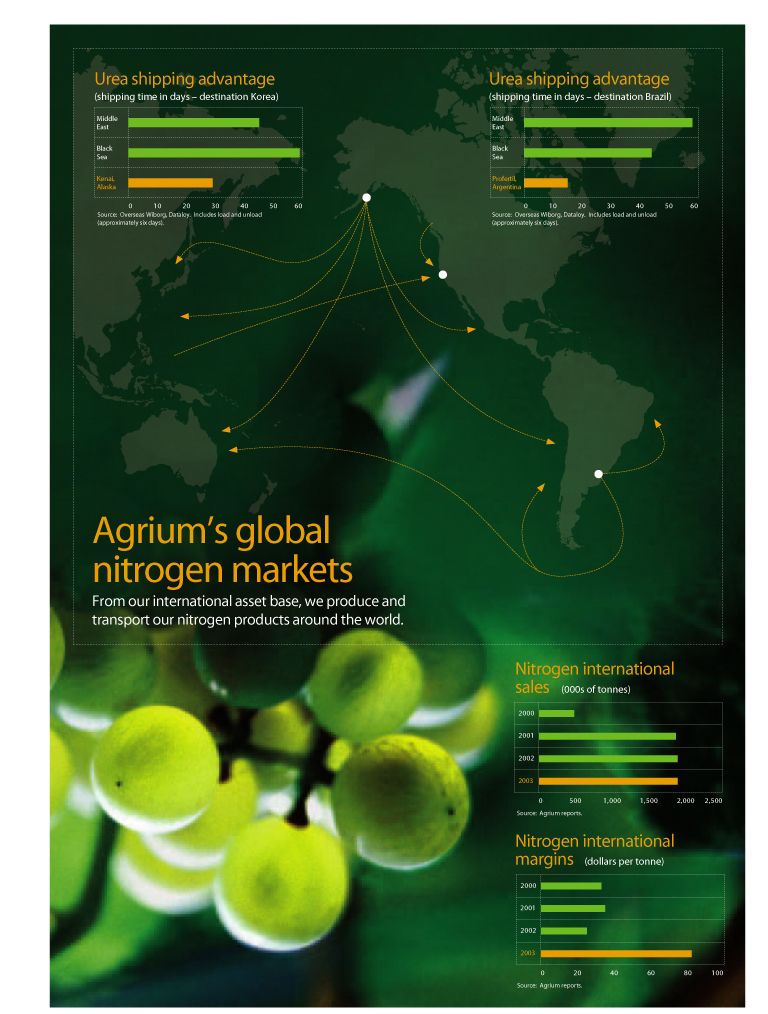

Wholesale nutrient prices can be volatile and are driven by the world supply and demand balance as well as grain prices and regional market conditions. Geographic sales diversity and accurate forecasting of

both short-term and long-term market conditions are essential. This allows us to balance production levels with anticipated demand or to divert production to the most profitable markets using our extensive distribution system.

The ability of nitrogen producers to continue to offset increases in North American natural gas prices by increasing nitrogen prices is not assured. Should international prices retreat or North American gas prices increase substantially further, this may attract additional imported product into our market areas and could affect pricing.

In the global market, uncertainty remains over the participation level of China and other major producers and consumers in the international urea and phosphate markets. Changes in the requirements of these countries can have a significant impact on demand and, consequently, on the price of our products.

Operations and transportation

Our operations face a number of additional risks including production reliability at our manufacturing facilities, the reliability of our storage and distribution systems, a growing concern around the environmental impact of nitrogen fertilizers, and the unpredictable strategies of suppliers and competitors, particularly those in financial distress.

Global nitrogen capacity

The global nitrogen industry faces risks associated with increased capacity scheduled to come on stream after 2005. The current high capacity utilization is due to strong industrial and agricultural demand, the closure of certain high-cost plants and technological refinements that have improved operating rates at some facilities.

Current growth in global nitrogen demand has been met by swing producers restarting facilities and by producers increasing operating rates in response to rising prices. It is estimated that only 6.2 million metric tonnes of global nitrogen capacity was idle at the end of 2003, compared to the total world nitrogen capacity of 128.6 million metric tonnes.