EXHIBIT 99.2

AGRIUM INC.

2015

MANAGEMENT’S DISCUSSION & ANALYSIS OF

OPERATIONS AND FINANCIAL CONDITION

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

| 12 | | AGRIUM ANNUAL REPORT 2015 |

This Management’s Discussion and Analysis (MD&A) of operations and financial condition focuses on Agrium’s long-term vision, strategy and growth opportunities as well as its historical performance for the years ended December 31, 2015 and 2014. The Board of Directors of Agrium (the “Board”) carried out its responsibility for review of this disclosure and, prior to publication, approved this disclosure.

Throughout this MD&A, unless otherwise specified, “Agrium”, “the Company”, “we”, “our”, “us” and similar expressions refer collectively to Agrium Inc. and its subsidiaries, any partnerships involving Agrium Inc. or any of its subsidiaries, its significant equity investments and Agrium Inc.’s share of its joint ventures.

Additional information relating to the Company, including its consolidated quarterly and annual financial information and its Annual Information Form (AIF) for the year ended December 31, 2015, is available under Agrium’s corporate profile on SEDAR (www.sedar.com). The Company’s reports are also filed with the U.S. Securities and Exchange Commission on EDGAR (www.sec.gov).

All dollar amounts refer to U.S. dollars, except where otherwise stated. 2015, 2014 and 2013 financial information presented and discussed in this MD&A is prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Certain financial measures in this MD&A, listed in the table below, are not prescribed by, and do not have any standardized meaning under, IFRS. Our method of calculation of the non-IFRS financial measures may not be directly comparable to that of other companies. We consider these non-IFRS financial measures to provide useful information to both management and investors in measuring our financial performance and financial condition. These non-IFRS financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with IFRS. Refer to page 73, “Non-IFRS Financial Measures”, for further details, including a reconciliation of the non-IFRS financial measures to their most directly comparable measures calculated in accordance with IFRS.

|

Non-IFRS financial measures |

|

Cash cost of product manufactured (COPM) |

|

Cash operating coverage ratio |

|

Comparable store sales and normalized comparable store sales |

|

Earnings (loss) from continuing operations before finance costs, income taxes, depreciation and amortization (EBITDA), Adjusted EBITDA, EBITDA to sales |

|

Free cash flow, free cash flow per share, dividends paid as a percent of free cash flow |

|

Wholesale measures, including share of joint ventures: sales, cost of product sold, gross profit |

FORWARD-LOOKING STATEMENTS

Certain statements and other information included in this MD&A constitute “forward-looking information” and/or “financial outlook” within the meaning of applicable Canadian securities legislation or “forward-looking statements” within the meaning of applicable U.S. securities legislation (collectively herein referred to as “forward-looking statements”), including the “safe harbour” provisions of provincial securities legislation and the U.S.Private Securities Litigation Reform Act of 1995, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and Section 27A of the U.S.Securities Act of 1933, as amended. Forward-looking statements are typically identified by the words “believe”, “expect”, “anticipate”, “project”, “intend”, “estimate”, “outlook”, “focus”, “potential”, “will”, “should”, “would”, “could” and other similar expressions.

Forward-looking statements in this MD&A are intended to provide Agrium securityholders and potential investors with information regarding Agrium, including management’s assessment of future financial and operational plans and outlook, and may not be appropriate for other purposes. These forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control and which could cause actual results to differ materially from such forward-looking statements. As such, readers should not place undue reliance on these forward-looking statements. Refer to page 82, “Key Assumptions and Risks in Respect of Forward-looking Statements”, for further details.

| | |

| AGRIUM ANNUAL REPORT 2015 | | 13 |

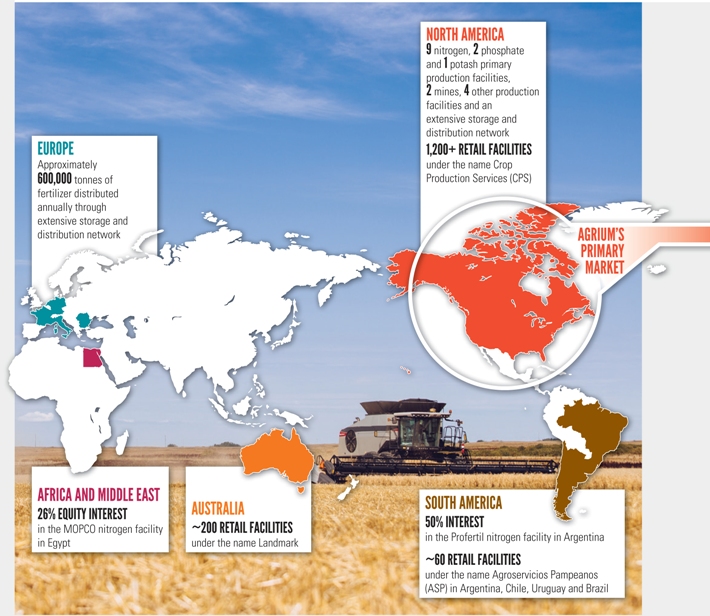

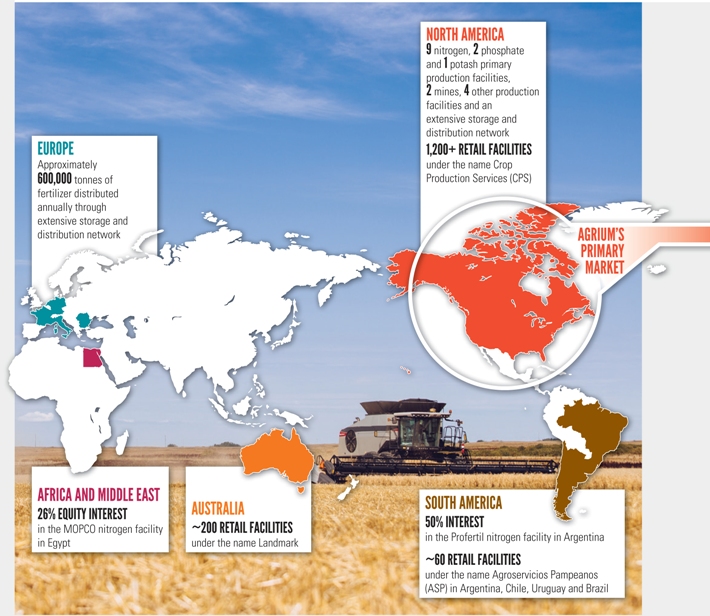

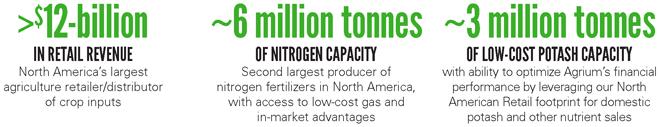

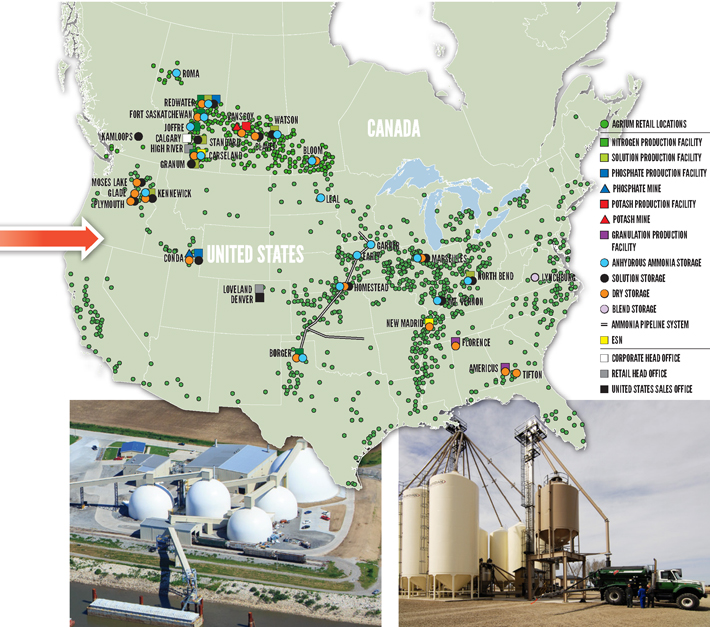

Agrium’s strategic footprint

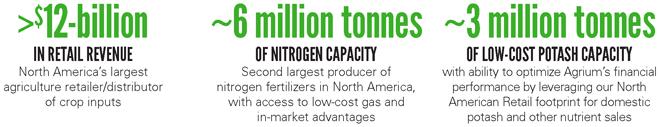

Agrium has significant competitive advantages across our global footprint of operations. We are focused on supplying the important crop inputs, services and solutions farmers require to meet the ever-growing global demand for crops and food, and we are committed to doing so safely and sustainably. Our Retail operations provide us with stability, diversity and long-term earnings growth potential, and our strategically positioned Wholesale operations with low-cost nitrogen and potash operations allow us to reach markets across North America and around the world.

| | |

| 14 | | AGRIUM ANNUAL REPORT 2015 |

EXTENSIVE COMPETITIVE ADVANTAGES ACROSS OUR STRATEGIC FOOTPRINT

| | |

| AGRIUM ANNUAL REPORT 2015 | | 15 |

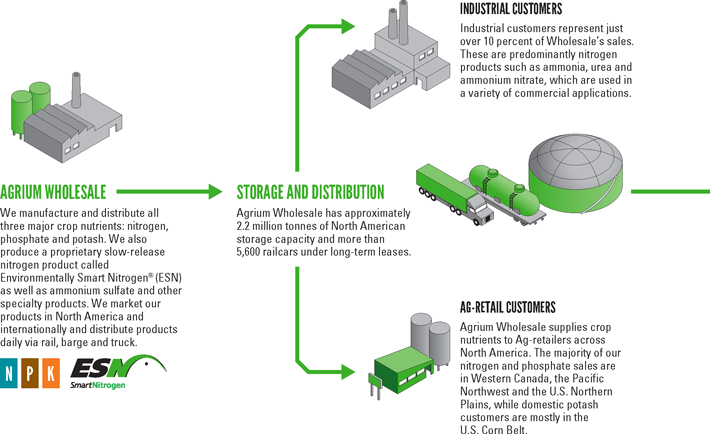

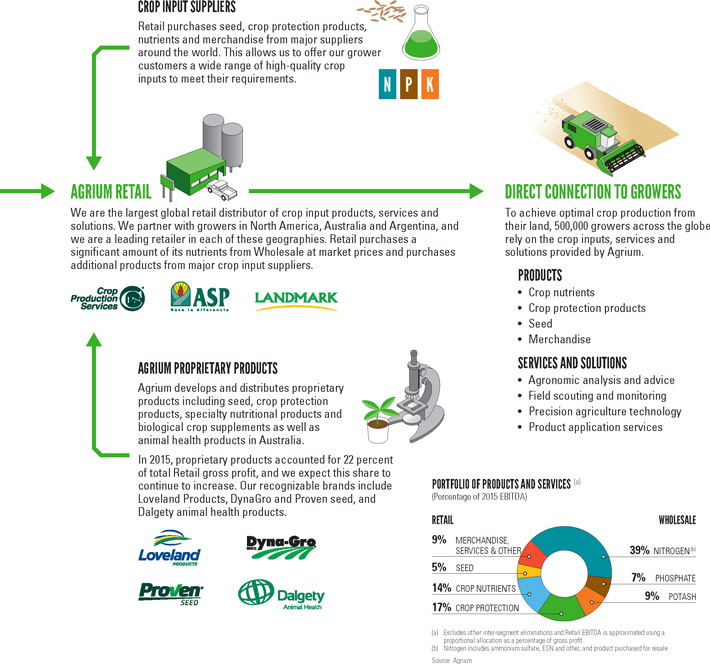

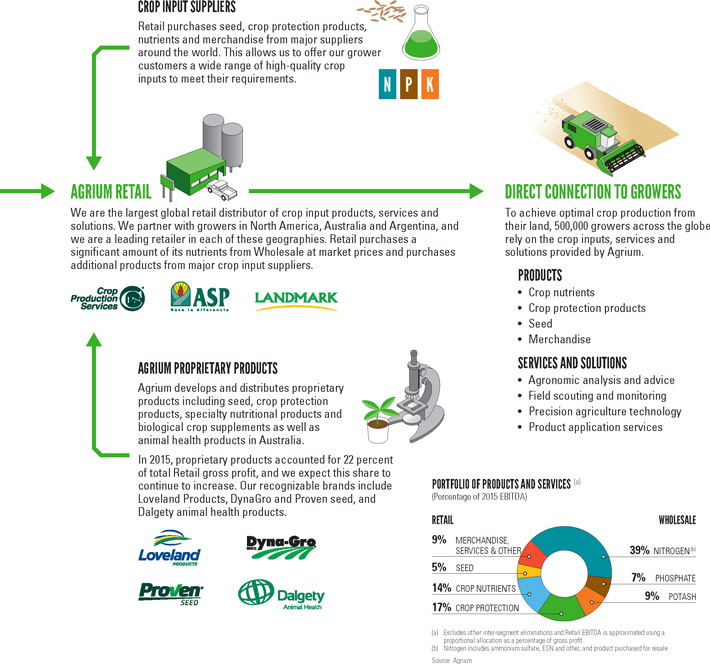

Agrium’s business model

Agrium’s business model combines the production of primary crop nutrients with the world’s largest direct-to-grower distribution network for crop inputs, services and solutions. This structure allows us to generate synergies across the crop input value chain while also achieving higher plant operating rates, leveraging our size and scale with suppliers, capturing significant logistics and distribution synergies, and garnering market intelligence globally throughout our network.

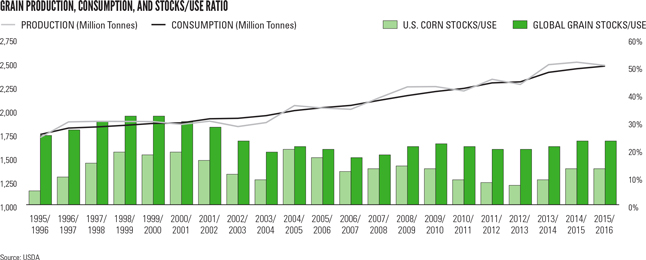

THE MARKET FOR OUR PRODUCTS AND SERVICES

| | |

| 16 | | AGRIUM ANNUAL REPORT 2015 |

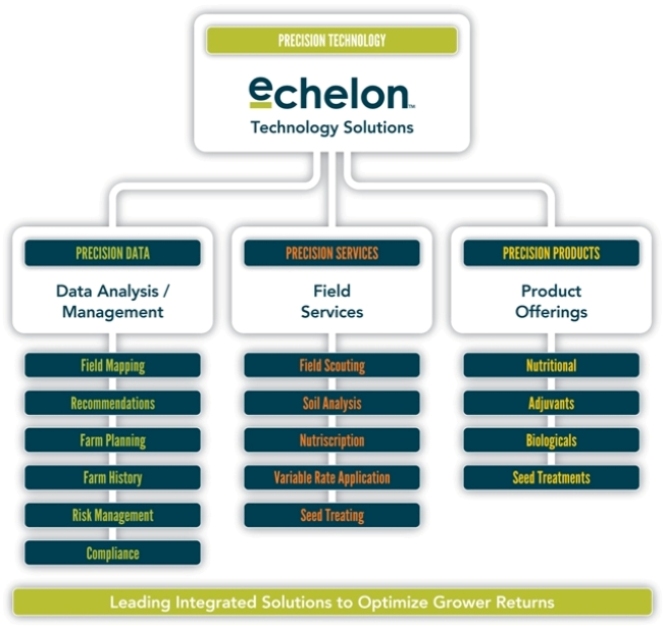

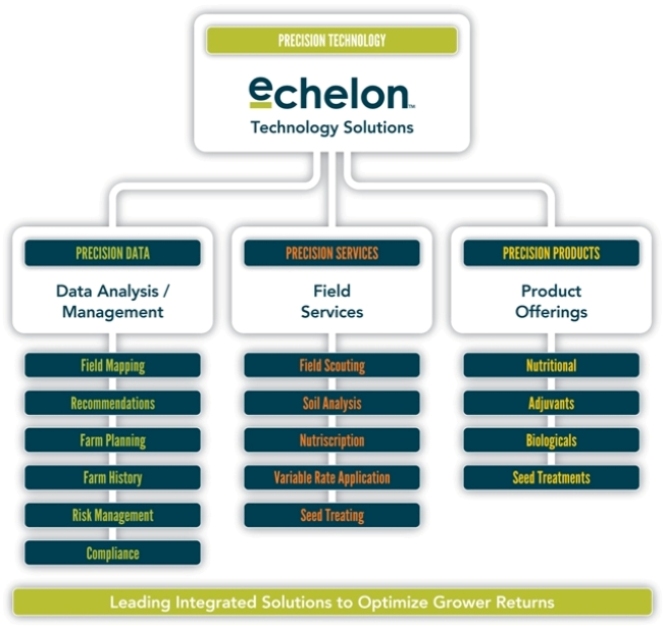

PRECISION AGRICULTURE

Agrium’s Echelon precision agriculture platform brings cutting-edge technology to our grower customers. Precision agriculture uses technology and data to better match crop inputs with soil and crop requirements as they vary across a field rather than treating the whole field homogeneously. Integrating data from satellite imagery, field and yield mapping, soil sampling and foliar analysis to optimize the use of nutrients, crop protection products and seed through variable rate application, Echelon gives growers a powerful set of tools to maximize the productivity of their land. By ensuring products are optimally placed where they will be more fully utilized by the plants, precision agriculture also provides significant environmental benefits and is a highly effective tool in 4R and other agricultural stewardship programs. Echelon works with farm machinery systems and reporting software to seamlessly integrate detailed planning, analysis and record keeping with fieldwork. Agrium is currently touching more than 21 million acres in North America with our Echelon platform.

| | |

| AGRIUM ANNUAL REPORT 2015 | | 17 |

Review of 2015 – A year of execution and controlling our controllables

Consolidated and business unit financial performance

| | | | | | | | | | | | |

| (millions of U.S. dollars, except where noted) | | 2015 | | | 2014 | | | % Change | |

Sales | | | 14,795 | | | | 16,042 | | | | (8 | ) |

Gross profit | | | 3,888 | | | | 3,552 | | | | 9 | |

EBIT | | | 1,616 | | | | 1,160 | | | | 39 | |

EBITDA | | | 2,096 | | | | 1,710 | | | | 23 | |

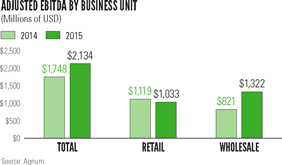

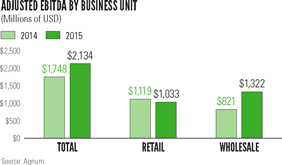

Retail EBITDA | | | 1,033 | | | | 1,119 | | | | (8 | ) |

Wholesale Adjusted EBITDA | | | 1,322 | | | | 821 | | | | 61 | |

Diluted earnings per share from continuing operations | | | 6.98 | | | | 5.51 | | | | 27 | |

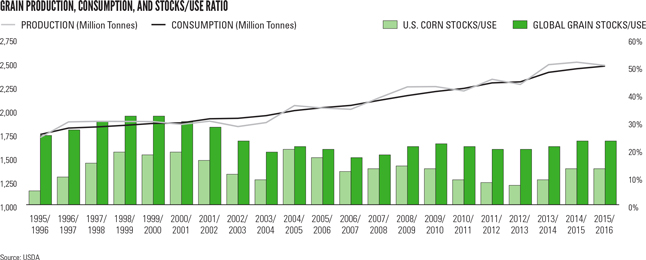

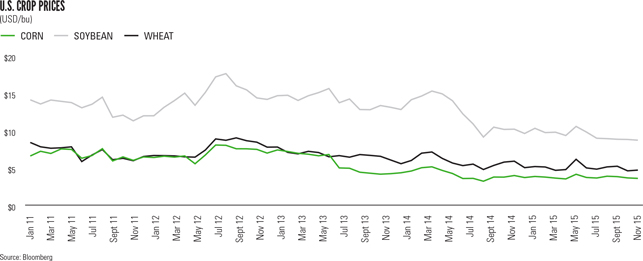

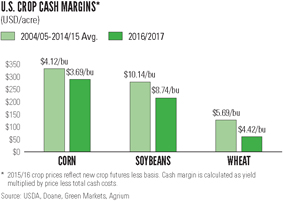

| ● | | The increase in earnings (loss) from continuing operations before finance costs and income taxes (EBIT) and EBITDA primarily reflects improvements in Wholesale’s production, cost profile and sales volumes and relative stability in our Retail earnings, despite pressure on agricultural commodity prices and lower nutrient prices. |

| ● | | OurRetail business unit’sEBITDA decreased due to weaker crop input demand related to lower global crop prices, drought conditions in Western Canada and foreign currency fluctuations in 2015. Partially offsetting this decline were lower selling and general and administrative expenses, which decreased by $133-million compared to 2014 as a result of our Operational Excellence initiatives and the weakening of global currencies versus the U.S. dollar. |

| ● | | OurWholesale business unit’sAdjusted EBITDA increased as a result of higher earnings from all three major products. Sales volumes for these products increased in 2015 due to improved on-stream time at our production facilities and higher product availability. Cost of product sold per tonne decreased due to higher utilization rates, lower cash fixed costs, a weaker Canadian dollar and lower natural gas costs. This was partially offset by lower selling prices for nitrogen and potash due primarily to global incremental capacity additions and a reduction in the global cost curve from currency devaluations and lower energy prices. |

| ● | | We bought back approximately 5.6 million shares in 2015 at prices we believe were below their intrinsic value, which further supported our growth in earnings per share. |

| | |

| 18 | | AGRIUM ANNUAL REPORT 2015 |

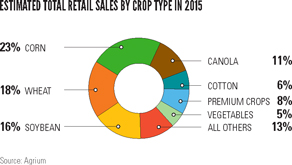

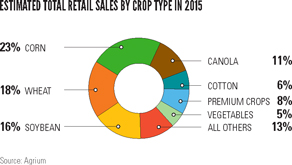

Retail overview and 2015 results

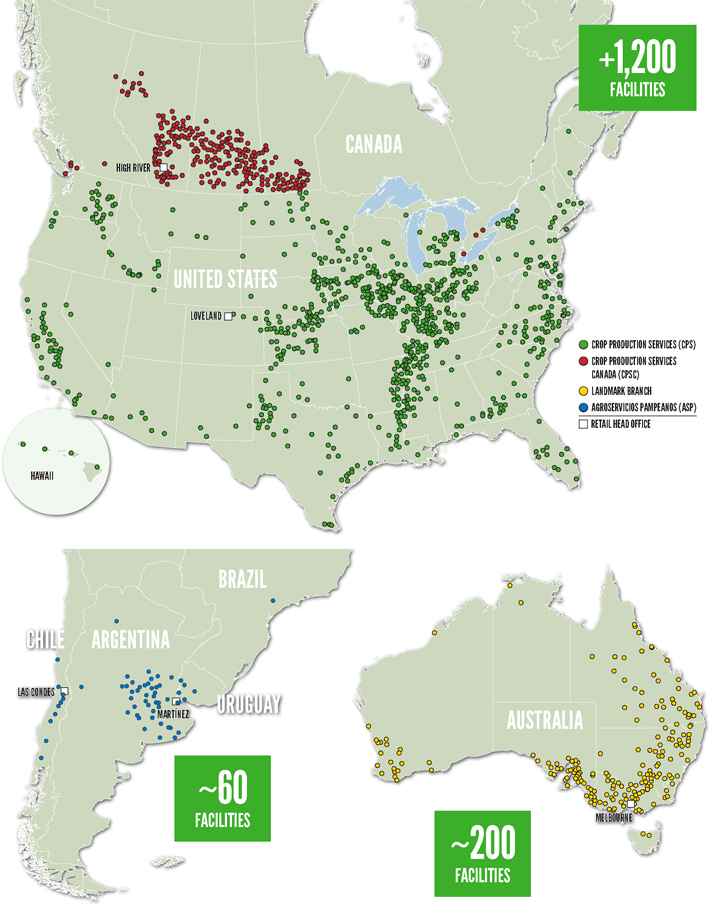

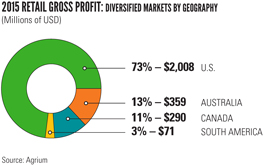

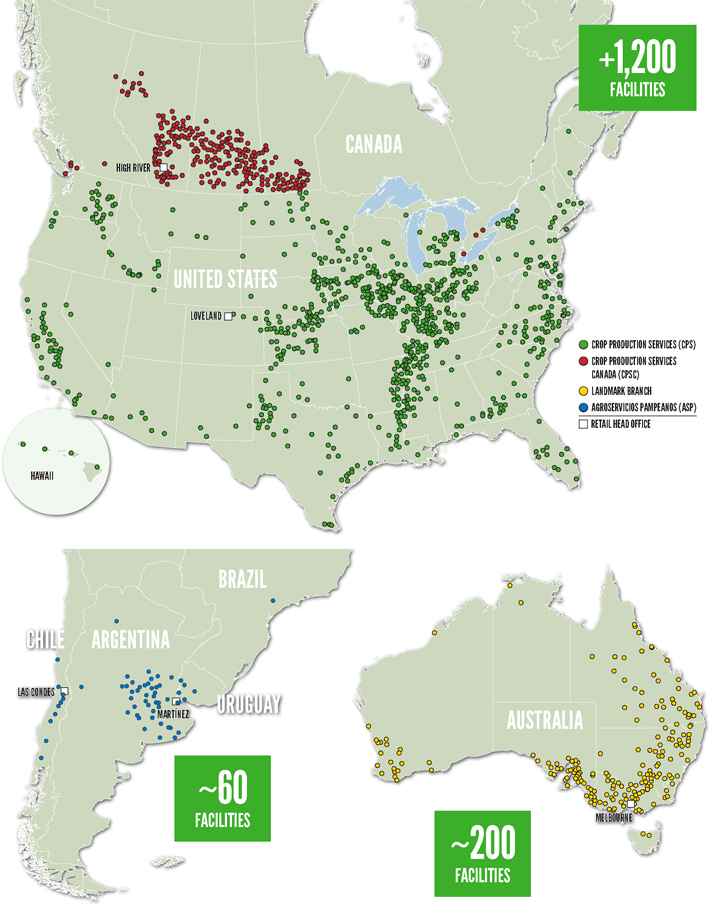

To meet the ever increasing global demand for nutritious food, farmers are faced with the challenge of increasing crop yields in an economic and environmentally sustainable manner. As the world’s largest agricultural retail-distributor of crop inputs, we offer an innovative, custom-built portfolio of products, services and solutions to help our grower customers achieve their yield goals and maximize their returns on investment. We accomplish this through over 1,400 facilities that we operate across the U.S., Canada, Australia and key areas of South America and through the strong partnerships we have built between our grower customers and our agronomists.

Our Retail distribution and services business provides growers with leading products, technologies and extensive agronomic experience, all backed by a commitment to sound environmental practices. Our more than 3,800 agronomists and field experts work directly with growers, helping them maximize the productivity of their farms by implementing the best management practices based on a thorough understanding of soils, climate conditions and crop requirements. Supporting this expertise is our own Echelon precision agriculture platform, which provides diagnostic recommendations to further enhance crop yields and create additional value for the grower.

We also provide innovative proprietary crop protection products and nutritionals under the Loveland Products brand, seed products under the brand names Dyna-Gro and Proven, and animal health products under the Dalgety brand. These leading crop inputs provide growers with options to profitably produce and protect their crops, while delivering higher margins for Agrium. In certain regions, we also provide other rural services.

In Australia, in addition to the above services, we provide livestock marketing and auction services and facilitate real estate and insurance services to our broad customer base. In Canada, we also market crop storage bins, provide fuel sales and services, and offer financial services to our customers.

CROP NUTRIENTS: PRODUCTS AND SERVICES

Retail supplies the crop nutrients essential to growing healthy plants, including nitrogen in both dry and liquid forms, potash, phosphates, sulfur and proprietary micronutrients. Retail acquires crop nutrient products from a wide variety of suppliers at market prices, including purchases from Agrium’s Wholesale business unit. Historically, approximately 30 percent of Retail’s North American crop nutrient purchases come from Wholesale, although for certain regions and products, Wholesale supplies the majority of crop nutrient inputs. The total volume supplied by Wholesale as a percentage of Retail’s needs is expected to grow in 2016. These crop nutrient products are typically blended at the local retail branch or in the field using variable-rate application equipment.

Retail delivers additional value to growers through its application services provided on a fee-for-service basis.

Our Retail branches work closely with growers to understand their goals and customize our delivery of products, agronomic advice and product application services to help achieve those goals. Retail’s agronomists use the 4R Nutrient Stewardship System together with our Echelon precision agriculture platform to help determine the right nutrient source and apply it at the right time, at the right rate and in the right place. Using Echelon’s highly sophisticated tools, our agronomists help growers identify the differences in yield potential within a field and adjust crop inputs accordingly, thereby increasing their productivity and returns while reducing environmental impacts.

Nutrient application windows during the growth cycle of a crop can be very narrow due to the weather, so growers need a reliable and efficient distribution system for crop inputs. Retail’s distribution network – the largest in North America – has efficiently moved on average more than nine million tonnes of crop nutrients to our grower customers annually.

| | |

| AGRIUM ANNUAL REPORT 2015 | | 19 |

RETAIL GLOBAL OPERATIONS

| | |

| 20 | | AGRIUM ANNUAL REPORT 2015 |

CROP PROTECTION PRODUCTS: PRODUCTS AND SERVICES

Retail’s crop protection business markets a broad spectrum of supplier and proprietary herbicide, fungicide, insecticide and adjuvant products that help growers minimize yield losses from weeds, diseases and insects. Our Retail business serves as both a retailer of crop protection products to growers and, to a lesser extent, a wholesaler to other retail operators. We are the largest independent distributor of crop protection products in North America, and we support our products by providing sound technical advice and product application services. As part of our proprietary Loveland crop protection operations, we own and operate numerous blending and formulation facilities, including major production facilities in Greeley, Colorado; Billings, Montana; Greenville, Mississippi; Fairbury, Nebraska; Casilda, Argentina; Buenos Aires, Argentina; and two formulation facilities in Western Australia and Victoria, Australia. We also have an investment in a formulation plant in Winnipeg, Manitoba. Retail also owns significant interests in two agricultural biotechnology companies through our Loveland Products, Inc. business, which allows us to be at the forefront of the latest developments in this technology and develop new crop protection products for our customers.

SEED: PRODUCTS AND SERVICES

What type of seed to use is among a grower’s most important crop input decisions. We provide the seed and seed-related information and analysis our customers need. Beyond our proprietary Dyna-Gro and Proven branded seed, we procure and sell seed from top global suppliers. Our Dyna-Gro seed specialists license leading seed traits from major suppliers, match seed characteristics to local soil and growing conditions, and research and test these choices to ensure the best results for each grower’s area. We continue to see growth in our seed sales and market share over the medium term.

We also have significant investments in canola and rice plant breeding programs to supply industry-leading seed products for these crops. Our canola program has laboratories in Saskatoon, Saskatchewan, and Horsham, Australia, as well as vast germplasm bank and research farms in Saskatchewan with seed marketed under the brand name Proven. Retail’s rice research and development platform, acquired from Bayer CropScience in June 2015 and located in El Campo, Texas, provides the latest in disease-resistant rice hybrids. We expect to sell our proprietary rice seed products commercially in 2017/2018. In total, these proprietary product lines represented 23 percent of our total seed sales in 2015 and added significant margin value to our overall seed sales.

Agrium’s Retail locations also provide seed treatment products and related services, which involve applying crop protection products specifically designed to promote healthy seed germination and early stage plant growth directly to the seed prior to planting.

MERCHANDISE: PRODUCTS AND SERVICES

The merchandise product category includes fencing, feed supplements, livestock-related animal health products, storage and irrigation equipment, and other products. It also includes the fuel and equipment businesses in Canada. Merchandise is a much larger component of our Australian and Canadian Retail operations than our U.S. and South American operations.

SERVICES AND OTHER: PRODUCTS AND SERVICES

Agrium delivers value to growers and earns customer loyalty through services such as product application, soil and leaf testing, crop scouting and precision agriculture services. We maintain a large fleet of application equipment and other rolling stock to ensure timely applications of both nutrients and crop protection products at optimal rates. Our Australian operations also offer livestock marketing, as well as various insurance and real estate services.

PRECISION AGRICULTURE: OVER A DECADE OF EXPERIENCE

Precision agriculture refers to agricultural practices that use information technology, global positioning systems, and related data and production practices to recognize variance in a field’s fertility and yield potential. This information allows growers to better match crop input use and other farming practices to specific field and crop conditions, which helps optimize yields and returns. To obtain the greatest value from precision agriculture technology, providers help growers analyze massive amounts of information including yield maps, detailed field analyses, and soil and foliar nutrient analyses to create specific product recommendations that can be precisely applied to fields. This typically includes variable-rate application of crop inputs as well as monitoring of crop, soil and yield conditions. The technology also helps growers with recordkeeping and mapping. As better measurement and placement of crop inputs maximizes uptake by the plants and minimizes waste, precision agriculture can also deliver significant environmental benefits.

With continual improvements in analytical capabilities, accuracy, connectivity and data synthesis, the focus on and benefits from precision agriculture products and services have been increasing.

| | |

| AGRIUM ANNUAL REPORT 2015 | | 21 |

Agrium has been offering objective precision agriculture services to U.S. grower customers for more than a decade. Echelon – the precision agriculture technology platform we use across North America – offers services such as soil nutrient testing, tissue sampling, yield data mapping, soil fertility management, variable-rate fertilizer application and variable-rate seeding recommendations, along with agronomic advice, proprietary product considerations and recordkeeping. We currently provide this multi-crop service offering to over 35,000 growers and have mapped more than 21 million acres across the U.S., provided field scouting on over 8.8 million acres, and conducted over 65,000 tissue samples and soil tested on over 1.2 million acres to date. With our custom-built Echelon platform, our goal is to ensure that our trusted agronomic advisors also become trusted technological advisors to strengthen our relationships with existing customers and increase opportunities to bring in new customers. This also allows our crop advisors to better analyze and illustrate the effectiveness of new products and practices and to showcase our proprietary products in an unbiased environment. Echelon generates value for Retail primarily through direct charge services such as soil sampling; product bundling opportunities; and objective recommendations for specific products, including our extensive propriety product offering. Furthermore, Echelon is integrated with our Enterprise Resource Planning sales system, which leads to efficiencies from a Retail work order and inventory management perspective.

| | |

| 22 | | AGRIUM ANNUAL REPORT 2015 |

RETAIL >> KEY DEVELOPMENTS IN 2015

Operational Excellence

Agrium’s Retail business is focused on Operational Excellence and the pursuit of continual improvement in all aspects of its operations. A key focus is on continually improving product, service and solution offerings to our half million grower customers. We also strive to continue to grow our propriety product sales, optimize our extensive distribution network, manage working capital and control costs – measures that will continue to drive improvement in our key metrics and financial measures.

| • | | The downturn in agricultural and crop input markets challenged the entire crop input value chain in 2015. Coupled with drought conditions in Western Canada, this held us back from achieving year-over-year improvement in most of our key metrics this year. |

| • | | We were successful in maintaining a low average non-cash working capital to sales ratio of 18 percent, meeting our stated target. |

| • | | To further optimize our distribution network and reduce operational costs, we closed 140 branches, satellites and other retail locations during the year. These efforts tie to our “hub and spoke” strategy, aimed at serving local customers more efficiently with a centralized regional service and distribution structure. These actions supported our cash operating coverage ratio metric, which has declined since 2013. |

| • | | EBITDA to sales declined slightly in 2015 as a result of the weakness in the agricultural commodity and crop input markets. |

Retail metrics

| | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | | | 2015 | | | 2015

Target | |

Average non-cash working capital to sales (%) | | | 20 | | | | 17 | | | | 18 | | | | 18 | |

Cash operating coverage ratio (%) (a) | | | 64 | | | | 61 | | | | 62 | | | | 60 | |

EBITDA (millions of U.S. dollars) | | | 986 | | | | 1,119 | | | | 1,033 | | | | 1,300 | |

EBITDA to sales (%) | | | 8 | | | | 9 | | | | 8 | | | | 10 | |

ROCE (%) (b) | | | 9 | | | | 10 | | | | 9 | | | | 13 | |

ROOCE (%) (c) | | | 17 | | | | 18 | | | | 17 | | | | 22 | |

Normalized comparable store sales (%) | | | 5 | | | | (2 | ) | | | (4 | ) | | | N/A | |

| (a) | 2013 metric adjusted to exclude the impact of the Viterra purchase gain of $257-million and a $220-million goodwill impairment for the Australian operations. |

| (b) | Return on capital employed represents last 12 months’ EBIT less income taxes at a tax rate of 28 percent (2014 and 2013 – 27 percent) divided by rolling four quarter average capital employed. Capital employed includes operating capital employed, intangibles and goodwill. |

| (c) | Return on operating capital employed represents last 12 months’ EBIT less income taxes at a tax rate of 28 percent (2014 and 2013 – 27 percent) divided by rolling four quarter average operating capital employed. Operating capital employed includes non-cash working capital, property, plant and equipment, investments in associates and joint ventures and other assets. |

| • | | Our Australian Retail operations made significant improvements in 2015, with EBITDA reaching $94-million compared to $90-million in 2014, despite significant weakness in the Australian dollar compared to the U.S. dollar. The continuing year-over-year improvement reflects ongoing emphasis on cost control and increased proprietary product sales. |

| • | | Normalized comparable store sales (normalized for changes in commodity nutrient prices) decreased by 4 percent in 2015, compared to a 2 percent decrease in 2014. The decrease was driven primarily by the impacts of drought conditions and foreign exchange on our Canadian operations. By contrast, our U.S. locations reported a year-over-year increase of 2 percent, demonstrating the resilience of our operations in this region during a difficult year for the crop input market. |

Focused Growth

| • | | In line with our strategy, Agrium acquired 26 independent retail operator facilities in 2015 for approximately $95-million excluding working capital. We expect these acquisitions to add incremental annual EBITDA of approximately $20-million. Most of these acquisitions took place in North America, where we continue to see the best opportunities for further growth and consolidation on a risk-adjusted basis, given our extensive presence in the region and the potential for significant synergies. We believe the opportunity for additional acquisitions remains robust and will continue to pursue accretive transactions to capture synergies and optimize our strategic footprint in North America. |

| • | | During 2015, Retail also completed the acquisition of Bayer CropScience’s proprietary rice hybrid research platform in El Campo, Texas, which we expect to be another valuable growth platform for Agrium’s seed business. We look to bring these new seed products to market in 2017/2018, thereby providing North American and potentially global rice growers with a new disease-resistant seed to improve yields for this important crop. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 23 |

Proprietary products – percent of total Retail sales by product

| | | | | | | | |

| (in percentages) | | 2015 | | | 2014 | |

Crop nutrients | | | 7 | | | | 7 | |

Crop protection products | | | 22 | | | | 19 | |

Seed | | | 23 | | | | 23 | |

Total | | | 14 | | | | 12 | |

| ● | | Our proprietary products sales continued to deliver strong results in 2015. Total sales increased by 5 percent, or $74-million, relative to 2014. Proprietary crop protection sales grew by 10 percent while proprietary seed sales decreased by 2 percent over 2014 sales. |

| ● | | Total proprietary and proprietary crop protection product sales as a percentage of total sales both increased in 2015, demonstrating the value and performance of our products in a challenging year for crop inputs. We will continue to highlight the importance and value of these products to our customers to touch more global acres and drive further organic growth across this platform. |

RETAIL >> FINANCIAL RESULTS

Retail performance

| | | | | | | | |

| (millions of U.S. dollars, except as noted) | | 2015 | | | 2014 | |

Sales | | | 12,199 | | | | 12,981 | |

Cost of product sold | | | 9,471 | | | | 10,089 | |

Gross profit | | | 2,728 | | | | 2,892 | |

Expenses | | | | | | | | |

Selling | | | 1,902 | | | | 2,023 | |

General and administrative | | | 112 | | | | 124 | |

Earnings from associates and joint ventures | | | (5 | ) | | | (6 | ) |

Other income | | | (60 | ) | | | (63 | ) |

EBIT | | | 779 | | | | 814 | |

EBITDA | | | 1,033 | | | | 1,119 | |

EBITDA to sales(%) | | | 8 | | | | 9 | |

Selling expense to sales(%) | | | 16 | | | | 16 | |

Cash operating coverage ratio(%) | | | 62 | | | | 61 | |

Comparable store sales(%) | | | (7 | ) | | | (4 | ) |

Normalized comparable store sales(%) | | | (4 | ) | | | (2 | ) |

Average non-cash working capital to sales(%) | | | 18 | | | | 17 | |

Non-cash working capital | | | 2,044 | | | | 2,031 | |

| ● | | Global seed markets and margins were pressured in 2015 by lower crop prices following record crop yields in the U.S. in 2014. Total U.S. crop input expenditures decreased due to the shift from corn to soybean crop area, the loss of 4.5 million acres due to excessive moisture, and lower cotton planted area in 2015. As soybeans require significantly lower inputs than corn, the acreage shift, combined with the decrease in total acres, reduced sales opportunities for U.S. agricultural retailers this year. Despite these market challenges, Agrium grew sales of both corn and soybean seeds in 2015. |

| ● | | Our International and Canadian Retail operations were impacted by weakening regional currencies, which put pressure on their purchases in U.S. dollars and sales to customers in local funds. |

| ● | | Our U.S. Retail earnings this year were also impacted by lower-than-expected fall ammonia applications due to weather conditions that narrowed the application window, limiting ammonia sales volumes and related application services in the fourth quarter of 2015. |

| ● | | As a result of these factors, 2015 Retail EBIT was 4 percent lower than in 2014, while our U.S. operations were comparable to 2014. |

| | |

| 24 | | AGRIUM ANNUAL REPORT 2015 |

RETAIL >> EXPENSES

| ● | | Retail selling expenses decreased by 6 percent in 2015, while total selling expenses as a percentage of sales were consistent with the prior year. Retail also reduced general and administrative costs by $12-million. The reduction in costs was largely a result of Operational Excellence cost-control initiatives including the optimization of our distribution network, reduced depreciation and amortization, and the favorable impact of currency volatility in our International operations. |

| ● | | While total selling and general and administrative costs declined in 2015, our cash operating coverage ratio increased as a result of lower sales related to the weaker agriculture and crop input market. |

| ● | | Depreciation and amortization decreased to $254-million in 2015 from $305-million in 2014 due to our reassessment of the useful lives of our Retail assets at the end of 2014 to better reflect the rate of consumption of our capital assets. |

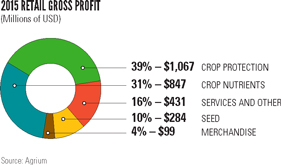

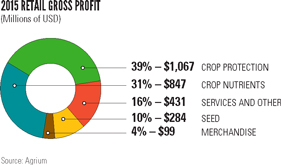

RETAIL >> PRODUCT LINE PERFORMANCE

Product line performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Sales | | | Gross profit | | | Gross profit (%) | |

| (millions of U.S. dollars, except as noted) | | 2015 | | | 2014 | | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

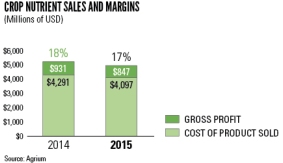

Crop nutrients | | | 4,944 | | | | 5,222 | | | | 847 | | | | 931 | | | | 17 | | | | 18 | |

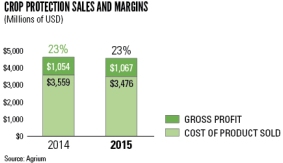

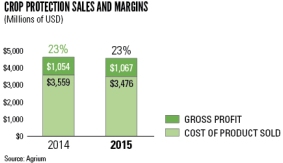

Crop protection products | | | 4,543 | | | | 4,613 | | | | 1,067 | | | | 1,054 | | | | 23 | | | | 23 | |

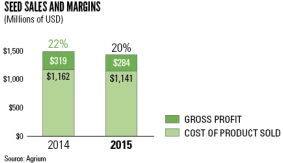

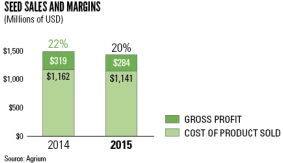

Seed | | | 1,425 | | | | 1,481 | | | | 284 | | | | 319 | | | | 20 | | | | 22 | |

Merchandise | | | 638 | | | | 871 | | | | 99 | | | | 114 | | | | 16 | | | | 13 | |

Services and other | | | 649 | | | | 794 | | | | 431 | | | | 474 | | | | 66 | | | | 60 | |

Total | | | 12,199 | | | | 12,981 | | | | 2,728 | | | | 2,892 | | | | 22 | | | | 22 | |

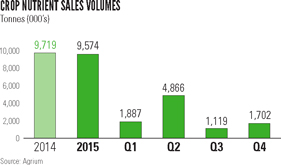

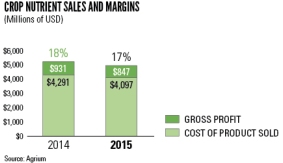

Crop nutrients: Financial results

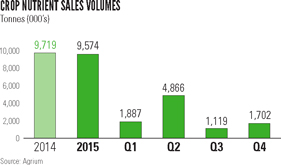

| ● | | Our crop nutrient sales and gross profit decreased in 2015 due to lower nutrient sales prices, margins and volumes compared to 2014. Adverse weather conditions in the Canadian and South American operations drove most of the decline in volumes, which was partly offset by slightly higher nutrient sales volumes within our U.S. operations. As a result, sales volumes were 9.6 million tonnes in 2015 compared to 9.7 million tonnes in 2014. |

| ● | | Gross profit declined by $84-million in 2015, primarily due to the lower nutrient sales prices and lower per-tonne margins. |

| ● | | Our U.S. Retail business was able to maintain crop nutrient gross profit at levels similar to last year despite the reduction in planted corn acres and the lower nutrient price environment. We increased U.S. sales volumes this year by 69,000 tonnes, while margins were down only $4 per tonne from 2014. |

| ● | | Sales of our proprietary nutrient products decreased by 1 percent in 2015 from 2014 levels, due to the weaker crop input market this year. This product line helped support Agrium’s overall crop nutrient margins again in 2015, and we remain focused on growing volumes of this highly value-added product line. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 25 |

Crop protection products: Financial results

| ● | | In 2015, our crop protection product line delivered gross profit in line with the prior year, despite lower crop prices, dry conditions affecting our Canadian and South American operations and lower glyphosate prices this year. This was offset by an increase in higher-margin proprietary crop protection products. |

| ● | | Our proprietary crop protection products accounted for approximately 22 percent of our total crop protection product sales in 2015, compared to approximately 19 percent in 2014. Sales of our proprietary crop protection products rose 10 percent over last year and continued to represent the largest portion of our total proprietary product offering, primarily under the Loveland Products brand. |

Seed: Financial results

| ● | | Seed sales declined 4 percent in 2015, as lower crop prices pressured seed prices and margins. Higher-value corn and canola acreage also declined this year, as did total U.S. seeded acreage. Furthermore, some growers chose to purchase lower priced seed with fewer traits this year, which also impacted average seed selling prices and margins. As a result, gross profit declined by $35-million in 2015 and gross profit as a percentage of sales was 2 percent lower than in 2014. |

| ● | | Despite the lower U.S. planted acreage and the more challenging year for seed markets in general, we believe we gained market share in the U.S. seed market, selling approximately 5 percent more corn and soybean volumes this year versus 2014. |

| ● | | In 2015, Agrium’s proprietary seed sales decreased in line with the overall demand decline for seed, but our proprietary seed sales remained consistent at 23 percent of total seed sales in both 2015 and 2014. |

Merchandise: Financial results

| ● | | Merchandise sales decreased by 27 percent in 2015 as a result of lower demand and lower prices in our Canadian fuel business. |

| ● | | Merchandise gross profit declined $15-million or 13 percent in 2015, while gross profit as a percentage of sales increased by 3 percent compared to 2014. The higher margins this year reflect the decrease in the lower-margin Canadian fuel business sales and a better cost position in the Australian merchandise business. |

| | |

| 26 | | AGRIUM ANNUAL REPORT 2015 |

Services and Other: Financial results

| ● | | Sales of services and other were down 18 percent in 2015 due mainly to the closure of one of our livestock export operations in Australia. Sales of application and other services were up in North America compared to last year, as growers continued to use our application services and equipment and our precision agriculture tools and technology to help optimize their yields. |

| ● | | Gross profit declined by $43-million in 2015, but gross profit as a percentage of sales increased to 66 percent from 60 percent in 2014. The higher margins in 2015 are largely attributable to the closure of a lower margin livestock export operation and increased demand for higher-margin services in North America. |

| | | | | | | | | | | | | | | | |

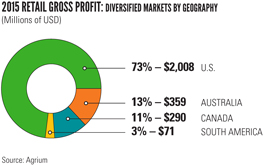

| Regional performance | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | |

| (millions of U.S. dollars, except as noted) | | North

America | | | International | | | North

America | | | International | |

Sales | | | 10,124 | | | | 2,075 | | | | 10,463 | | | | 2,518 | |

Cost of product sold | | | 7,826 | | | | 1,645 | | | | 8,080 | | | | 2,009 | |

Gross profit | | | 2,298 | | | | 430 | | | | 2,383 | | | | 509 | |

Gross profit (%) | | | 23 | | | | 21 | | | | 23 | | | | 20 | |

Expenses | | | | | | | | | | | | | | | | |

Selling | | | 1,571 | | | | 331 | | | | 1,622 | | | | 401 | |

General and administrative | | | 79 | | | | 33 | | | | 80 | | | | 44 | |

Earnings from associates and joint ventures | | | (3 | ) | | | (2 | ) | | | (3 | ) | | | (3 | ) |

Other income | | | (35 | ) | | | (25 | ) | | | (39 | ) | | | (24 | ) |

EBIT | | | 686 | | | | 93 | | | | 723 | | | | 91 | |

EBITDA | | | 915 | | | | 118 | | | | 980 | | | | 139 | |

| ● | | Regionally, our North American Retail sales and EBITDA declined in 2015 primarily as a result of lower earnings in our Canadian operations, which were impacted by drought conditions in 2015. Earnings from Canadian operations were also negatively impacted by the much weaker Canadian currency relative to the U.S. dollar. Our U.S. operations saw a 1 percent decline in EBITDA, primarily due to the weaker seed market and slightly lower crop nutrient margins this year. |

| ● | | International Retail sales were also impacted by the weaker agricultural markets and currency fluctuations. However, our Australian operations demonstrated year-over-year improvement in EBITDA and posted record EBITDA results in 2015. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 27 |

RETAIL >> QUARTERLY RESULTS

| ● | | Our Retail business is seasonal. The most important quarter is the second quarter, which includes the spring application and planting season in North America and the early fall application season in Australia that precedes the winter wheat seeding season. |

| ● | | Western Canada experienced drought conditions during the planting and early growing season in 2015, while the eastern U.S. Corn Belt experienced a wet and late planting season. The wet weather in the U.S. only partially delayed growers from getting into their fields to seed and apply crop inputs. |

| ● | | The third and fourth quarters of 2015 saw a normal fall application window for Canada. In the U.S., however, warmer-than-expected soil temperatures followed by snow and rain in the fourth quarter reduced overall applications of ammonia and other products. We expect this will push some U.S. nitrogen applications into the 2016 spring season. |

Retail quarterly results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | |

| (millions of U.S. dollars, except as noted) | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

Sales – North America | | | 1,340 | | | | 1,587 | | | | 5,421 | | | | 1,776 | | | | 1,485 | | | | 1,744 | | | | 5,513 | | | | 1,721 | |

Sales – International | | | 425 | | | | 424 | | | | 739 | | | | 487 | | | | 572 | | | | 551 | | | | 884 | | | | 511 | |

Total sales | | | 1,765 | | | | 2,011 | | | | 6,160 | | | | 2,263 | | | | 2,057 | | | | 2,295 | | | | 6,397 | | | | 2,232 | |

Cost of product sold | | | 1,166 | | | | 1,517 | | | | 4,896 | | | | 1,892 | | | | 1,443 | | | | 1,753 | | | | 5,048 | | | | 1,845 | |

Gross profit | | | 599 | | | | 494 | | | | 1,264 | | | | 371 | | | | 614 | | | | 542 | | | | 1,349 | | | | 387 | |

Gross profit (%) | | | 34 | | | | 25 | | | | 21 | | | | 16 | | | | 30 | | | | 24 | | | | 21 | | | | 17 | |

Gross profit by product | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Crop nutrients | | | 154 | | | | 113 | | | | 454 | | | | 126 | | | | 156 | | | | 142 | | | | 505 | | | | 128 | |

Crop protection products | | | 268 | | | | 234 | | | | 457 | | | | 108 | | | | 260 | | | | 232 | | | | 457 | | | | 105 | |

Seed | | | 54 | | | | 26 | | | | 164 | | | | 40 | | | | 50 | | | | 27 | | | | 196 | | | | 46 | |

Merchandise | | | 27 | | | | 25 | | | | 27 | | | | 20 | | | | 30 | | | | 36 | | | | 24 | | | | 24 | |

Services and other | | | 96 | | | | 96 | | | | 162 | | | | 77 | | | | 118 | | | | 105 | | | | 167 | | | | 84 | |

EBIT | | | 133 | | | | 64 | | | | 647 | | | | (65 | ) | | | 104 | | | | 51 | | | | 714 | | | | (55 | ) |

EBITDA | | | 199 | | | | 129 | | | | 713 | | | | (8 | ) | | | 181 | | | | 130 | | | | 791 | | | | 17 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Retail | | 2015 | | | 2014 | |

| (in percentages) | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | |

Average non-cash working capital to sales(a) | | | 18 | | | | 18 | | | | 18 | | | | 18 | | | | 17 | | | | 17 | | | | 17 | | | | 19 | |

Cash operating coverage ratio(a)(c) | | | 62 | | | | 63 | | | | 64 | | | | 62 | | | | 61 | | | | 62 | | | | 61 | | | | 64 | |

EBITDA to sales(a)(c) | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 9 | | | | 8 | | | | 9 | | | | 8 | |

ROOCE(a)(c) | | | 17 | | | | 16 | | | | 16 | | | | 17 | | | | 18 | | | | 17 | | | | 19 | | | | 15 | |

ROCE(a)(c) | | | 9 | | | | 9 | | | | 9 | | | | 10 | | | | 10 | | | | 9 | | | | 10 | | | | 8 | |

Comparable store sales(b) | | | (7 | ) | | | | | | | (4 | ) | | | | | | | (4 | ) | | | | | | | (3 | ) | | | | |

Normalized comparable store sales(b) | | | (4 | ) | | | | | | | (1 | ) | | | | | | | (2 | ) | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail – North America(a)(c) | | 2015 | | | 2014 | |

| (in percentages) | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | |

EBITDA to sales | | | 9 | | | | 9 | | | | 9 | | | | 9 | | | | 9 | | | | 9 | | | | 10 | | | | 9 | |

ROOCE | | | 18 | | | | 18 | | | | 17 | | | | 19 | | | | 20 | | | | 19 | | | | 21 | | | | 18 | |

ROCE | | | 9 | | | | 9 | | | | 9 | | | | 10 | | | | 10 | | | | 10 | | | | 11 | | | | 9 | |

| (a) | These measures are based on rolling four quarters ended on the measurement date. |

| (b) | These measures are based on six months ended for June 30 results and 12 months ended for December 31 results. |

| (c) | Adjusted to exclude the impacts of the 2013 Viterra purchase gain of $257-million and a $220-million goodwill impairment for the Australian operations. |

| | |

| 28 | | AGRIUM ANNUAL REPORT 2015 |

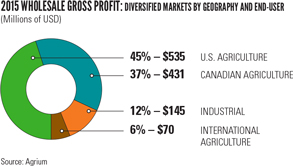

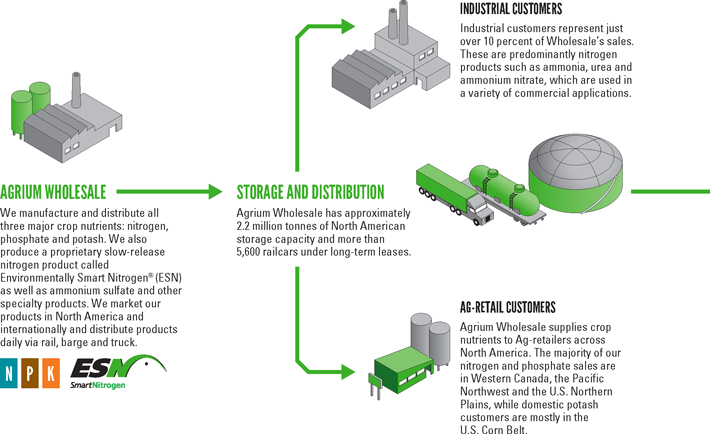

Wholesale overview and 2015 results

Agrium’s Wholesale business unit produces the crop nutrients essential for optimizing crop yields and quality, making a major contribution to feeding a growing global population. Agrium produces and markets the three primary crop nutrients with a capacity in 2015 of approximately six million tonnes of nitrogen, three million tonnes of potash and more than one million tonnes of phosphate. We are focused on producing, distributing and using these nutrients as efficiently, safely and sustainably as possible. Agrium has competitive cost and in-market advantages across our product lines and significant associated warehousing and distribution assets. Wholesale has recently increased production capacity at its Vanscoy potash facility by one million tonnes, and is in the process of completing its Borger, Texas nitrogen expansion project.

Our Wholesale operations have numerous competitive advantages that help ensure profitability even in challenging market conditions. One key advantage is that the majority of our production capacity and distribution capability is located close to our key end-markets, allowing us to benefit from lower freight costs. Another important advantage stems from our position as the largest agricultural retail distribution business in North America, which allows us to realize meaningful logistical synergies. Our nitrogen facilities have access to some of the lowest cost natural gas globally, due to their locations in Alberta, Canada, and the U.S. Our potash reserves in Saskatchewan, Canada, represent some of the highest quality and lowest cost reserves in the world.

Our potash expansion project has significantly reduced per-tonne cost of production compared to the prior year and is expected to continue to bring this cost down over the next few years as we continue to ramp up the new incremental capacity. Our phosphate business benefits from an in-market transportation advantage, a competitive cost position in sulfur and an integrated ammonia supply from our nitrogen facilities.

Growers use the following three critical crop nutrients to help replenish soil nutrient balance and enhance crop yields and quality.

| | | | |

| |

| |

|

| NITROGEN | | POTASH | | PHOSPHATE |

| Role of nutrient |

| Improves crop growth, yield and protein levels | | Regulates plant growth processes and helps protect crops from drought and disease | | Stimulates root development and flowering and encourages early crop development |

| Our products |

| Ammonia, urea, urea ammonium nitrate (UAN) solutions, ammonium nitrate | | Muriate of potash (MOP or “potash”) | | Monoammonium phosphate (MAP), superphosphoric acid (SPA) products |

| Our advantages |

| | | |

• Overall low North American natural gas prices and a further Western Canadian AECO gas advantage relative to NYMEX • Facilities located near key end-markets in the Americas and Europe • Retail distribution network in Western Canada and the U.S. Pacific Northwest, allowing product to be placed in higher netback markets | | • World-scale, high-quality and low-cost advantage • High historical operating rate due to integration with Retail and a balanced geographic sales mix • Capacity expansion that drives lower cost of manufacturing • Partner in a major international marketing and logistics company (Canpotex) | | • Competitive cost position for sulfur and ammonia • In-market freight advantage • Integrated Conda rock supply • Retail distribution network in Western Canada and the U.S. Pacific Northwest, allowing product to be placed in higher netback markets |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 29 |

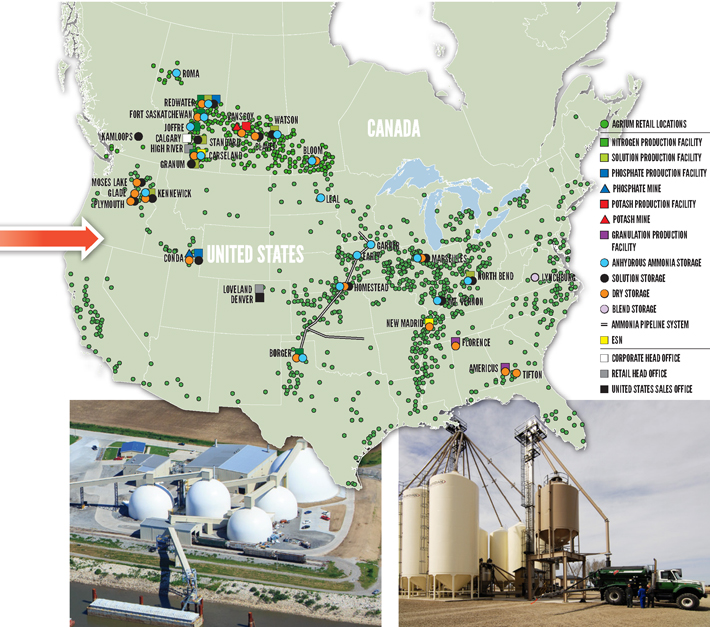

WHOLESALE GLOBAL OPERATIONS

| | |

| 30 | | AGRIUM ANNUAL REPORT 2015 |

NITROGEN PRODUCTS

PRODUCTS

Representing approximately 60 percent of the total volume of crop nutrients used globally, nitrogen is the most important crop nutrient in terms of global use and trade. It is also the crop nutrient for which reduced application rates within a growing season are most likely to immediately and adversely impact yield for most crops. For Agrium, nitrogen is the most important nutrient in terms of capacity, production and sales. It represents over 50 percent of our nutrient capacity. Natural gas is the primary input for producing ammonia – the base for virtually all nitrogen products. Ammonia can be applied directly as a fertilizer or upgraded to products such as urea, UAN solutions and ammonium nitrate.

Agrium owns and operates five major nitrogen production facilities in North America and has a 50 percent joint venture interest in Profertil S.A. (“Profertil”), which owns a South American nitrogen facility. We also own four facilities in North America that upgrade ammonia to other nitrogen products such as UAN and nitric acid. These facilities have a combined annual nitrogen production capacity of approximately 5.3 million tonnes. Agrium also has a 26 percent equity ownership position in Misr Fertilizers Production Company S.A.E. (“MOPCO”), which owns an Egyptian nitrogen facility. MOPCO recently completed its planned nitrogen expansion project, bringing the total annual production capacity of the complex to approximately two million tonnes of urea (of which approximately 510,000 tonnes are attributable to Agrium through our equity position). This puts our global nitrogen capacity at approximately 5.8 million tonnes, placing Agrium among the world’s top four publicly traded nitrogen producers.

Our extensive North American nitrogen facilities benefit from the development of long-term, low-cost, non-conventional (shale) natural gas, which has positioned North America among the lowest-cost gas and nitrogen producing regions in the world, and Alberta nitrogen producers continue to benefit from discounted natural gas prices relative to other North American regions. Furthermore, Agrium’s numerous production facilities and extensive North American Retail distribution operations are key competitive advantages. Our Retail network can be leveraged to optimize operating rates and netbacks by placing greater volumes through these distribution channels. We supply much of our nitrogen and phosphate product volumes to our core markets in Western Canada and the U.S. Pacific Northwest, where we obtain more attractive netbacks due to logistical efficiencies. Profertil’s nitrogen facility benefits from similar in-market advantages related to its position in Argentina’s large domestic fertilizer market. The MOPCO Egyptian facility benefits from competitively priced natural gas and direct access to tidewater for international exports.

In 2015, approximately 82 percent of our North American nitrogen sales were directed to agricultural markets, with the remaining 18 percent sold to industrial customers. Agricultural customer demand is seasonal, while industrial demand is more evenly distributed throughout the year. As a result, our average sales price for ammonia in a given quarter will be influenced by the relative weighting of sales to industrial customers compared to sales to the generally higher-return agricultural markets. A high proportion of our industrial ammonia sales are priced on a gas index-plus margin basis, thereby contributing to stability in sales and earnings throughout the year. Industrial ammonia sales volumes were approximately 513,000 tonnes in 2015, compared to 498,000 tonnes in 2014.

POTASH PRODUCTS

PRODUCTS

Agrium is North America’s third largest producer of potash. Global potash deposits are highly concentrated in only a few specific regions. The world’s largest known potash deposits are located in Saskatchewan, Canada; and Canada accounted for approximately 34 percent of the global potash trade in 2015. Agrium produces potash at our facility in Vanscoy, Saskatchewan, and exports international sales through our interest in Canpotex – an industry association owned by the three major Canadian potash producers and tasked with marketing potash sold outside of Canada and the U.S. Our share of Canpotex total sales averaged 7.3 percent in 2015 and 7.7 percent in 2014. The downward trend prior to 2016 was a result of recent capacity expansions by the other Canpotex producers. However, following the completion of Agrium’s one million tonne capacity expansion and the Canpotex proving run completed in 2015, our Canpotex allocation has increased to 10.3 percent of total sales for 2016.

| | |

| |  |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 31 |

PHOSPHATE PRODUCTS

PRODUCTS

Agrium is North America’s fourth largest producer of phosphate, representing over 7 percent of North American production. Collectively, Agrium’s two phosphate facilities have the capacity to produce approximately 1.2 million tonnes of phosphate-based fertilizer products annually. At our facility in Conda, Idaho, we produce MAP, SPA and merchant-grade phosphoric acid (MGA) products, which are sold primarily in the Northwestern U.S. Our Redwater, Alberta, facility – the only phosphate production site in Canada – produces MAP primarily for distribution in Western Canada.

Producing granular ammonium phosphate requires three primary raw materials: phosphate rock, sulfur and ammonia. Our Conda, Idaho, facility obtains rock from our integrated mine in the region. Our Redwater, Alberta, facility sources rock through a supply agreement with OCP S.A. (“OCP”). This agreement covers rock supply up to 2020, with purchase prices based on a formula derived from the global price of finished phosphate products. The agreement enables Agrium to continue to benefit from our Redwater phosphate facility’s competitive sulfur and ammonia cost positions as well as our in-market logistical advantage in Western Canada.

Our Redwater phosphate facility produces ammonia on-site and sources sulfur locally. Given the abundant supply of sulfur in the region due to the presence of oil and gas producers, we obtain sulfur at highly favorable prices relative to global benchmark prices. Our Conda facility sources sulfur and sulfuric acid domestically, while obtaining the majority of its ammonia from our Alberta nitrogen facilities. Our competitive cost position for sulfur and ammonia is a major advantage. An additional competitive strength is our transportation cost advantage for local customers in Western Canada and the Western U.S. relative to the major phosphate producers based in the Southeastern U.S.

AMMONIUM SULFATE, ENVIRONMENTALLY SMART NITROGEN® (ESN) AND OTHER WHOLESALE PRODUCTS

Our Other Wholesale products primarily comprise ammonium sulfate products produced in Western Canada, ESN and product purchased for resale. Ammonium sulfate fertilizer contains both nitrogen and sulfur, resulting in one of the most effective methods of supplying sulfur to soils in an immediately available form. Agrium produces ammonium sulfate at our Redwater facility, where we have competitive advantages from in-market selling price premiums and logistical advantages as well as lower priced sulfur, which is a byproduct from the oil and gas industry. ESN is a leading controlled release nitrogen fertilizer product that provides growers with significant economic and environmental benefits. This patented coated fertilizer product allows for more efficient delivery of nitrogen to the growing plant based on soil moisture and temperature characteristics.

Our Rainbow® Plant Food (“Rainbow”) operations produce nitrogen, phosphate and potash (NPK) products in the Southeastern U.S. The Rainbow product line offers homogeneous distribution of NPK products with a specific combination of nutrients and additional micronutrients contained in each granule.

In addition to selling our manufactured products, our Wholesale business unit purchases crop nutrient products from other suppliers for resale to customers primarily in Europe. This product purchased for resale business enables us to leverage our distribution and marketing network beyond what is possible through the sale of our manufactured products alone.

| | |

| 32 | | AGRIUM ANNUAL REPORT 2015 |

WHOLESALE >> DISTRIBUTION AND STORAGE

Wholesale has an extensive transportation, storage and warehousing network to optimize deliverability of product to our agricultural customers in the highly seasonal peak demand periods. In total, our North American distribution and storage capacity amounts to approximately 2.2 million tonnes. This is in addition to the extensive distribution and warehousing available through our Retail business; and in some cases, warehousing facilities are shared between the business units. We have over 5,600 railcars under long-term operating leases.

| | | | | | | | | | | | |

| 2015 Wholesale capacity, production and sales | | | | | | | | | |

| (thousands of metric product tonnes) | | Capacity (a) | | | Production (a)(b) | | | Sales (c) | |

Nitrogen volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 3,515 | | | | 2,688 | | | | 1,835 | |

U.S. | | | 1,129 | | | | 961 | | | | 1,821 | |

Total nitrogen | | | 4,644 | | | | 3,649 | | | | 3,656 | |

Potash volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 3,024 | | | | 1,929 | | | | 204 | |

U.S. | | | | | | | | | | | 929 | |

International | | | | | | | | | | | 601 | |

Total potash | | | 3,024 | | | | 1,929 | | | | 1,734 | |

Phosphate volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 660 | | | | 595 | | | | 622 | |

U.S. | | | 510 | | | | 547 | | | | 544 | |

Total phosphate | | | 1,170 | | | | 1,142 | | | | 1,166 | |

Ammonium sulfate, ESN and other volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 546 | | | | 489 | | | | 545 | |

U.S. | | | 559 | | | | 386 | | | | 447 | |

Total ammonium sulfate, ESN and other | | | 1,105 | | | | 875 | | | | 992 | |

Total produced product | | | 9,943 | | | | 7,595 | | | | 7,548 | |

Product purchased for resale volumes(d) | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

U.S. | | | | | | | | | | | 488 | |

International | | | | | | | | | | | 601 | |

Total product purchased for resale | | | | | | | | | | | 1,089 | |

Total Wholesale | | | 9,943 | | | | 7,595 | | | | 8,637 | |

Wholesale equity accounted joint ventures: | | | | | | | | | | | | |

International nitrogen(e) | | | 687 | | | | 445 | | | | 506 | |

International product purchased for resale | | | | | | | | | | | 117 | |

| (a) | Aqua ammonia and nitrates, SPA and MGA are reported by cargo weight. |

| (b) | Production, net of transfers. |

| (c) | Sales represent country of sales destination, not country of production. |

| (d) | Product purchased for resale includes sales of all the major crop nutrient products. |

| (e) | Primarily represents our 50 percent joint venture interest in the capacity of Profertil, which is accounted for using the equity method. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 33 |

WHOLESALE >> KEY DEVELOPMENTS

| ● | | Wholesale continued to concentrate on Operational Excellence and completing previously identified growth projects. Growth projects included the ramp up of production at our recently expanded Vanscoy potash facility, the associated successful completion of our Canpotex test run at the mine in the fourth quarter of 2015 and progression of our Borger nitrogen expansion project. Our Operational Excellence focus during the year primarily centered on improving the reliability and utilization rates of our facilities, and we attained significant improvements over 2014 levels. |

Operational Excellence

| ● | | In 2015, Wholesale achieved EBITDA improvements from higher asset utilization, phosphate and nitrogen repatriation, and reduced discretionary selling, general and administrative spending. We achieved recurring EBITDA improvements in excess of our Operational Excellence targets and remain focused on delivering further savings in 2016 and beyond. |

| ● | | Capacity utilization of our production facilities was another major focus in 2015. We achieved 89 percent utilization for ammonia production and 94 percent for both potash and phosphate. Each of these utilization rates was a considerable improvement over 2014 levels, and we will strive for further improvements to the on-stream time of our facilities in the coming year. |

| ● | | The portfolio review was another important initiative with further divestitures of non-core assets in 2015, including the West Sacramento nitrogen upgrading facility. The facility had sale proceeds of $27-million in 2015. In late 2014, Agrium decided to discontinue our purchase for resale business in North America and scale back operations in Europe. In 2015, we sold certain under-performing assets related to the business, generating $50-million in sale proceeds and associated reductions in working capital. In Europe, we impaired $19-million of goodwill as a result of our ongoing portfolio review. |

| ● | | Another Operational Excellence initiative is the ‘repatriation’ of phosphate and nitrogen sales to Western Canada - a region with higher netbacks due to freight advantages for our Western Canadian facilities. In 2015, we achieved our multi-year target of 600,000 tonnes of repatriated volumes, with approximately 40 percent of the total targeted volumes achieved in the past year. |

Focused Growth

| ● | | The Vanscoy potash expansion project was completed in 2014. Our focus in 2015 was on ramping up production at the facility in order to complete our Canpotex allocation proving run by year end. We successfully completed the proving run in the fourth quarter, which set our new allocation of international Canpotex sales at 10.3 percent of total Canpotex shipments for 2016. Based on the proving run, our new nameplate capacity for the mine is 3.024 million tonnes. |

| ● | | Cash cost of product manufactured per tonne decreased significantly at the Vanscoy facility following the ramp-up of production after the expansion and due to the impact of the lower Canadian dollar compared to the U.S. dollar this year. We expect to see further reductions in the cash cost of product manufactured as the facility attains full production levels. |

| ● | | In mid-2015, we took steps in the Borger nitrogen expansion project to minimize risk due to significant cost and timeline pressures. We amended the scope of the project to reduce the size of the ammonia plant expansion while continuing with the 610,000 tonne urea facility expansion. We are targeting completion of construction of the project by the end of 2016 with the new capacity expected to come on-line in the first quarter of 2017. Under the new scope and timeline, the project is progressing on time and on budget. |

| ● | | In Egypt, construction on the MOPCO nitrogen facility expansion was completed in 2015, adding two new production trains to the facility. Agrium holds a 26 percent share in the MOPCO facility, which is located in Damietta. The facility previously operated one production train with annual capacity of 650,000 tonnes. The expansion added two additional trains, each with annual production capacity of 650,000 tonnes. Following the provisional acceptance of each additional train, Agrium will have the marketing rights to 100 percent of the additional production and will utilize its global distribution network to market the additional volumes manufactured at the facility. |

| | |

| 34 | | AGRIUM ANNUAL REPORT 2015 |

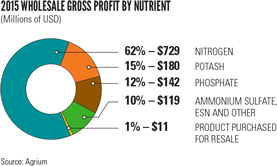

WHOLESALE >> FINANCIAL RESULTS

| | | | | | | | |

| Wholesale performance | | | | | | |

| (millions of U.S. dollars) | | 2015 | | | 2014 | |

Sales | | | 3,602 | | | | 3,973 | |

Cost of product sold | | | 2,421 | | | | 3,318 | |

Gross profit | | | 1,181 | | | | 655 | |

Expenses | | | | | | | | |

Selling | | | 36 | | | | 44 | |

General and administrative | | | 39 | | | | 48 | |

Loss (earnings) from associates and joint ventures | | | 10 | | | | (18 | ) |

Other expenses | | | 23 | | | | 28 | |

EBIT | | | 1,073 | | | | 553 | |

EBITDA | | | 1,284 | | | | 783 | |

Adjusted EBITDA | | | 1,322 | | | | 821 | |

| ● | | Wholesale gross profit increased over the prior year as significantly lower cost of product sold more than offset lower sales. |

| ● | | The decline in Wholesale sales was due to lower nutrient selling prices in 2015 and our decision to significantly scale back the product purchased for resale business. This decrease was partially offset by higher sales volumes for all three major products due to higher on-stream time and product availability. |

| ● | | Cost of product sold was lower than in 2014 due to lower natural gas costs, lower cash fixed costs, improved operating rates and efficiencies at our facilities, and a weaker Canadian dollar. |

| ● | | Higher Wholesale expenses in 2015 were primarily due to losses from our associates and joint ventures pertaining to our interest in the nitrogen facilities in Egypt and Argentina, which are accounted for in expenses. Partially offsetting this was a decrease of $17-million in selling and general and administrative expenses and a decrease of $5-million in other expenses during the year. Excluding the losses from associates and joint ventures, overall Wholesale expenses declined by 18 percent due to Operational Excellence cost saving initiatives and a weaker Canadian dollar. |

| ● | | Our 26 percent interest in MOPCO reported a $5-million equity loss in 2015 compared to a $1-million equity loss in 2014. The higher loss was due to significant gas curtailments, which limited the ability to run the facility. Our 50 percent interest in Profertil reported a $5-million equity loss in 2015 compared to earnings of $18-million in 2014 due to lower sales volumes, lower selling prices for urea (consistent with global benchmark pricing), and downtime associated with the completion of the energy efficiency project at the facility. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 35 |

NITROGEN >> FINANCIAL RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| Nitrogen performance | | | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | |

| (millions of U.S. dollars, except as noted) | | Consolidated | | | Equity

accounted

joint ventures | | | Total (a) | | | Consolidated | | | Equity

accounted

joint ventures | | | Total (a) | |

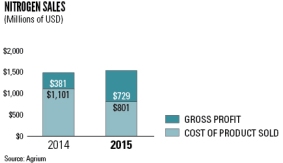

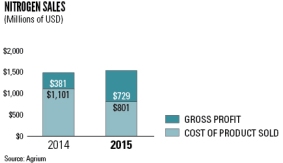

Sales | | | 1,530 | | | | 194 | | | | 1,724 | | | | 1,482 | | | | 197 | | | | 1,679 | |

Cost of product sold | | | 801 | | | | 178 | | | | 979 | | | | 1,101 | | | | 149 | | | | 1,250 | |

Gross profit | | | 729 | | | | 16 | | | | 745 | | | | 381 | | | | 48 | | | | 429 | |

| (a) | Wholesale measures including share of joint ventures. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nitrogen performance | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | |

| | | Ammonia | | | Urea | | | Other | | | Total | | | Ammonia | | | Urea | | | Other | | | Total | |

Tonnes sold (‘000) | | | 1,209 | | | | 1,583 | | | | 864 | | | | 3,656 | | | | 1,042 | | | | 1,287 | | | | 983 | | | | 3,312 | |

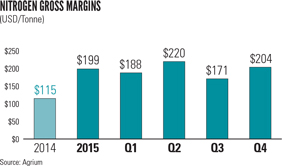

Selling price per tonne (U.S. dollars) | | | 530 | | | | 395 | | | | 305 | | | | 418 | | | | 553 | | | | 443 | | | | 341 | | | | 447 | |

Cost of product sold per tonne (U.S. dollars) | | | | | | | | | | | | | | | 219 | | | | | | | | | | | | | | | | 332 | |

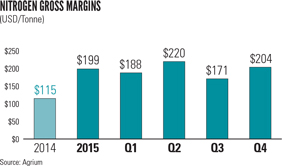

Margin per tonne (U.S. dollars) | | | | | | | | | | | | | | | 199 | | | | | | | | | | | | | | | | 115 | |

Tonnes produced (‘000)(a) | | | 2,653 | | | | 1,780 | | | | | | | | | | | | 2,328 | | | | 1,478 | | | | | | | | | |

Cash COPM per tonne (U.S. dollars) | | | 145 | | | | 134 | | | | | | | | | | | | 242 | | | | 205 | | | | | | | | | |

Capacity utilization (%) (2015 Target: 90%)(b) | | | 89 | | | | | | | | | | | | | | | | 79 | | | | | | | | | | | | | |

| (a) | Gross production, before transfers. |

| (b) | Excludes results from Joffre nitrogen facility. |

Nitrogen gross profit

| ● | | Nitrogen gross profit increased 91 percent in 2015 due to lower cost of product sold and higher sales volumes, which more than offset lower realized selling prices. |

Nitrogen sales volumes and operating rates

| ● | | Our nitrogen product category consists primarily of urea, ammonia, UAN and industrial-grade ammonium nitrate. Urea – the highest volume nitrogen product sold globally – accounted for 43 percent of Agrium’s nitrogen sales volumes in 2015. |

| ● | | Agrium significantly improved its nitrogen operating rates in 2015, with ammonia capacity utilization of 89 percent in 2015 compared to 79 percent in 2014. The lower utilization rate in 2014 was due to several planned and unplanned outages that reduced volumes available for sale and increased cost of product sold. |

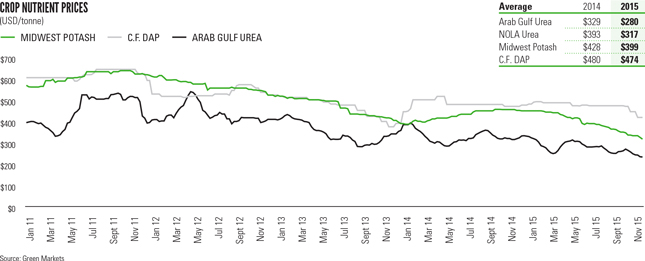

Nitrogen prices

| ● | | The 6 percent decrease in average realized nitrogen sales price reflects lower benchmark nitrogen prices throughout 2015. Benchmark prices for international urea and North American ammonia and UAN solutions were down between 5 and 20 percent in 2015 compared to 2014. |

| | |

| 36 | | AGRIUM ANNUAL REPORT 2015 |

Nitrogen product and gas cost

| ● | | The decrease in cost of product sold was primarily due to our average gas costs in 2015 declining by 37 percent from 2014 levels, lower fixed costs, higher utilization rates and a weaker Canadian dollar compared to the prior year. |

| ● | | Production asset depreciation and amortization expense of $19 per tonne in 2015 (compared to $26 per tonne in 2014) is included in cost of product sold. In the fourth quarter of 2015, we revised our depreciation accounting methodology for nitrogen facilities to a units of production basis, which better reflects our consumption pattern of the assets prospectively, rather than the straight-line methodology we had used previously. |

| ● | | Starting January 1, 2015, we designated all our natural gas derivatives as hedges for accounting purposes, with realized gains and losses now recorded in cost of product sold. In 2015, Agrium continued to take advantage of historically low gas prices to secure hedges for 25 percent of our estimated natural gas requirements for 2016 and 2017, and 21 percent of our estimated requirements for 2018. Our average hedged price is $2.78 per MMBtu for 2016 to 2018 hedges. Subsequent to January 2015, we did not add any further long-term natural gas hedges given the current low-price market outlook for North American natural gas. |

| ● | | As of February 2016, we have hedged approximately 44 percent of our anticipated North American natural gas needs for 2016. This takes into account our industrial business, which represents about 18 percent of our total nitrogen sales and, because it is largely based on cost-plus contracts, is not at risk of gas price fluctuations. |

| | | | | | | | |

| Natural gas prices: North American indices and North American Agrium | | | | | | |

| (U.S. dollars per MMBtu) | | 2015 | | | 2014 | |

NYMEX | | | 2.67 | | | | 4.38 | |

AECO | | | 2.18 | | | | 3.87 | |

Basis | | | 0.49 | | | | 0.51 | |

Wholesale | | | | | | | | |

Overall gas cost excluding realized derivative impact | | | 2.36 | | | | 4.26 | |

Realized derivative impact | | | 0.18 | | | | (0.20 | ) |

Overall gas cost(a) | | | 2.54 | | | | 4.06 | |

| (a) | Weighted average gas price of all gas purchases, excluding our 50 percent share of the Profertil facility. |

| | | | | | | | | | | | | | | | | | | | |

| Natural gas use | | | | | | | | | | | | | | | |

| (BCF) | | Western

Canada | | | U.S.

(Borger, Texas) | | | International

(Profertil) | | | Potash

and other | | | Total | |

2015 | | | 84 | | | | 19 | | | | 14 | | | | 1 | | | | 118 | |

2014 | | | 74 | | | | 20 | | | | 13 | | | | 1 | | | | 108 | |

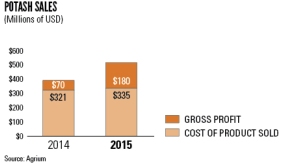

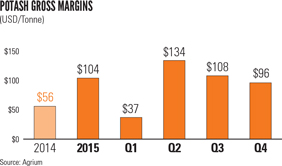

POTASH >> FINANCIAL RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| Potash performance | | | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | |

| (millions of U.S. dollars, except as noted) | | North

America | | | International | | | Total | | | North

America | | | International | | | Total | |

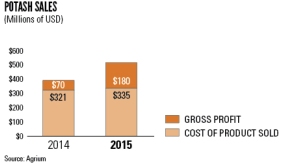

Sales | | | 374 | | | | 141 | | | | 515 | | | | 295 | | | | 96 | | | | 391 | |

Cost of product sold | | | | | | | | | | | 335 | | | | | | | | | | | | 321 | |

Gross profit | | | | | | | | | | | 180 | | | | | | | | | | | | 70 | |

Tonnes sold(’000) | | | 1,133 | | | | 601 | | | | 1,734 | | | | 821 | | | | 443 | | | | 1,264 | |

Selling price per tonne | | | 330 | | | | 235 | | | | 297 | | | | 359 | | | | 217 | | | | 309 | |

Cost of product sold per tonne | | | | | | | | | | | 193 | | | | | | | | | | | | 253 | |

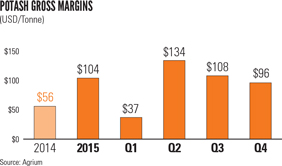

Margin per tonne | | | | | | | | | | | 104 | | | | | | | | | | | | 56 | |

Tonnes produced(’000) | | | | | | | | | | | 1,967 | | | | | | | | | | | | 1,058 | |

Cash COPM per tonne | | | | | | | | | | | 96 | | | | | | | | | | | | 157 | |

Capacity utilization (2015 Target: 100%)(a) | | | | | | | | | | | 94 | | | | | | | | | | | | 52 | |

| (a) | Actual and target capacity utilization are adjusted to reflect the tie-in of the Vanscoy expansion and the 2015 ramp-up of production. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 37 |

Potash gross profit

| ● | | The increase in potash gross profit was due to the completion of the Vanscoy expansion project in late 2014, which led to increased on-stream time for the facility in 2015. In 2014, the facility experienced an extended outage during the fourth quarter to tie in the expansion project, which significantly reduced volumes produced and sold and increased costs per tonne sold during the year. In 2015, we successfully ramped up the expanded capacity and reached two million tonnes of production, resulting in significantly lower costs and higher margins per tonne. |

Potash sales volumes and operating rates

| ● | | The 37 percent increase in potash sales volumes in 2015 was due to the ramp-up of production at the Vanscoy facility following completion of the expansion project. Sales volumes in 2015 were lower than produced volumes, as we refilled our inventory pipelines after being fully drawn down at the end of 2014. |

Potash prices

| ● | | North American and international benchmark potash prices declined in 2015 as a result of competitive pricing pressures. Global benchmark prices were impacted by weakening global currencies against the U.S. dollar, which reduced purchasing power and demand particularly in Brazil, India and Southeast Asia and also lowered the global potash cost curve. Global inventories also built up in end-markets in the second half of 2014 and the first half of 2015, leading to reduced shipments in the second half of 2015. |

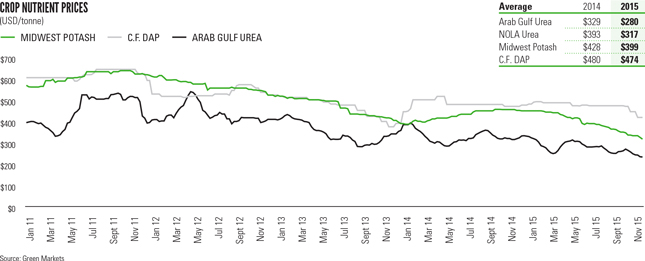

| ● | | Benchmark prices in the U.S. Corn Belt trended lower for most of 2015, averaging $399 per tonne in 2015 compared to $428 per tonne in 2014 and ending 2015 at $317 per tonne. This directly impacted our realized selling price per tonne on domestic volumes. |

| ● | | Our international prices are referenced at the mine site, thereby excluding transportation and distribution costs, while our North American sales are referenced at delivered prices and include transportation and distribution costs. |

Potash product cost

| ● | | The cost of product sold for potash increased slightly due to the increase in sales volumes during the year. The cost of product sold per tonne decreased significantly due to fixed costs being distributed over greater production volumes. Production costs also decreased due to the significant weakening of the Canadian dollar against the U.S. dollar this year. Our production costs are reported as a weighted average of domestic and international sale volumes. A shift in relative weighting between these two end-markets can impact our reported average per tonne costs due to the inclusion of freight in the North American cost of product sold. |

| ● | | Production asset depreciation and amortization expense was $42 per tonne in 2015 (compared to $51 per tonne in 2014) and is included in cost of product sold. Effective January 1, 2015 we revised our depreciation accounting methodology for our potash facility to a units of production basis, which better reflects our consumption pattern of the assets prospectively, rather than the straight-line methodology we had previously employed. The impact of the change in accounting methodology was offset by the additional depreciation associated with the capital expenditure for the Vanscoy expansion. |

| | |

| 38 | | AGRIUM ANNUAL REPORT 2015 |

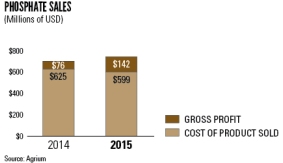

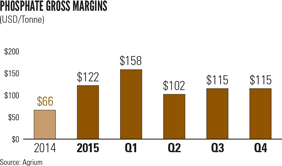

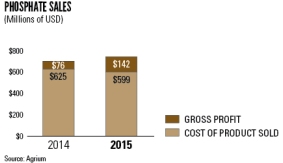

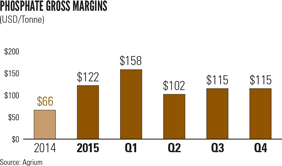

PHOSPHATE >> FINANCIAL RESULTS

| | | | | | | | |

| Phosphate | | | | | | |

| (millions of U.S. dollars, except as noted) | | 2015 | | | 2014 | |

Sales | | | 741 | | | | 701 | |

Cost of product sold | | | 599 | | | | 625 | |

Gross profit | | | 142 | | | | 76 | |

Tonnes sold(’000) | | | 1,166 | | | | 1,142 | |

Selling price per tonne | | | 635 | | | | 614 | |

Cost of product sold per tonne | | | 513 | | | | 548 | |

Margin per tonne | | | 122 | | | | 66 | |

Phosphoric acid capacity utilization(%) (2015 Target: 96%) | | | 94 | | | | 92 | |

Phosphate gross profit

| ● | | The increase in phosphate gross profit in 2015 was due to a combination of slightly higher realized prices, increased sales volumes and lower cost of production, mainly driven by slightly higher capacity utilization rates. |

Phosphate sales volumes and operating rates

| ● | | We achieved higher capacity utilization at our phosphate facilities this year, which contributed to the slightly higher sales volumes in 2015. Operating rates at our Redwater and Conda facilities reached 85 percent and 104 percent, respectively, in 2015. |

Phosphate prices

| ● | | Our realized phosphate price represents a blend of phosphate products, with over 81 percent of our sales volumes in 2015 consisting of MAP and the remainder being higher-value SPA, MGA and phosphate solutions. |

| ● | | The increase in phosphate selling price was due to tighter regional supply and increased local market demand as well as high operating rates at our facilities during peak seasonal demand this year. |

Phosphate product cost

| ● | | Total cost of product sold was down 4 percent due to further manufacturing efficiency projects and the impact of the lower Canadian dollar at the Redwater facility and lower fixed costs at both facilities. Higher sales volumes and lower total costs resulted in the cost of product sold per tonne declining by 6 percent. |

| ● | | Production asset depreciation and amortization expense of $43 per tonne in 2015 (compared to $46 per tonne in 2014) is included in the cost of product sold. In the fourth quarter of 2015, we updated our depreciation accounting methodology for phosphate facilities to a units of production basis, which better reflects our consumption pattern of the assets prospectively, rather than the straight-line methodology we had been using previously. |

| | |

| AGRIUM ANNUAL REPORT 2015 | | 39 |

AMMONIUM SULFATE, ESN AND OTHER WHOLESALE PRODUCTS >> FINANCIAL RESULTS

| | | | | | | | |

| Wholesale Other | | | | | | |

| (millions of U.S. dollars, except as noted) | | 2015 | | | 2014 | |

Sales | | | 816 | | | | 1,399 | |

Cost of product sold | | | 686 | | | | 1,271 | |

Gross profit | | | 130 | | | | 128 | |

Tonnes sold(’000) | | | | | | | | |

Product purchased for resale | | | 1,089 | | | | 2,490 | |

Ammonium sulfate | | | 336 | | | | 349 | |

ESN and other | | | 656 | | | | 714 | |

Selling price per tonne | | | | | | | | |

Product purchased for resale | | | 366 | | | | 370 | |

Ammonium sulfate | | | 330 | | | | 332 | |

Cost of product sold per tonne | | | | | | | | |

Product purchased for resale | | | 356 | | | | 360 | |

Ammonium sulfate | | | 140 | | | | 175 | |

Margin per tonne | | | | | | | | |

Product purchased for resale | | | 10 | | | | 10 | |

Ammonium sulfate | | | 190 | | | | 157 | |

| ● | | Ammonium sulfate, ESN and Other gross profit increased due to lower urea input costs and a weaker Canadian dollar. This was partially offset by a downward trend in urea prices. |