As filed with the Securities and Exchange Commission on May 12, 2008

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Image Sensing Systems, Inc.

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of incorporation or organization)

3829

(Primary Standard Industrial Classification Code Number)

41-1519168

(I.R.S. Employer Identification No.)

500 Spruce Tree Centre

1600 University Avenue West

St. Paul, Minnesota 55104

Telephone: (651) 603-7700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gregory R. L. Smith

Chief Financial Officer

Image Sensing Systems, Inc.

500 Spruce Tree Centre

1600 University Avenue West

St. Paul, Minnesota 55104

Telephone: (651) 603-7700

Facsimile: (651) 603-7795

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Michele D. Vaillancourt | W. Morgan Burns |

��

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933; check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration number of earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment to a registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective regulation statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o |

| Accelerated filer o |

| Non-accelerated filer o |

| Smaller reporting company x |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

Title of Each Class |

| Amount |

| Proposed maximum |

| Proposed maximum |

| Amount of |

|

of Securities to Be |

| to be |

| offering price |

| aggregate offering |

| registration |

|

Registered |

| registered(1) |

| per unit(2) |

| price(1)(2) |

| fee |

|

Common Stock, $0.01 par value |

| 1,725,000 shares |

| $15.78 |

| $27,220,500 |

| $1,070 |

|

(1) | Includes 225,000 shares of common stock issuable upon exercise of the underwriters’ over-allotment option. |

(2) | Pursuant to Rule 457(c) under the Securities Act, the offering price is equal to the average of the high and low prices of the common stock reported on The NASDAQ Capital Market on May 7, 2008. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until our registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 12, 2008

PROSPECTUS

1,500,000 Shares

Image Sensing Systems, Inc.

Common Stock

_________________________

We are offering 1,500,000 shares of our common stock. Our common stock is traded on The NASDAQ Capital Market under the symbol “ISNS.” On May 7, 2008, the last reported sale price for our common stock on The NASDAQ Capital Market was $15.68 per share.

_________________________

Investing in our common stock involves risks. See “Risk Factors” beginning on page 7.

_________________________

|

|

|

|

|

|

|

| ||

Public Offering Price |

| $ |

|

|

|

| $ |

|

|

Underwriting Discount |

| $ |

|

|

|

| $ |

|

|

Proceeds, before expenses, to Image Sensing Systems, Inc. |

| $ |

|

|

|

| $ |

|

|

We have granted the underwriters the right to purchase up to an additional 225,000 shares of our common stock to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

_________________________

Needham & Company, LLC | Craig-Hallum Capital Group |

The date of this prospectus is , 2008.

|

| Page |

1 | |

7 | |

15 | |

15 | |

15 | |

16 | |

17 | |

18 | |

Summary Unaudited Pro Forma Condensed Combined Statement of Operations | 19 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

28 | |

36 | |

46 | |

47 | |

47 | |

49 | |

50 | |

52 | |

52 | |

52 | |

F-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Autoscope®, Autoscope Solo® and RTMS® are trademarks we own. This prospectus also refers to trademarks and tradenames of other organizations.

i

You should read the following prospectus summary together with the more detailed information and financial statements appearing elsewhere in this prospectus. Except as otherwise indicated, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option.

Overview

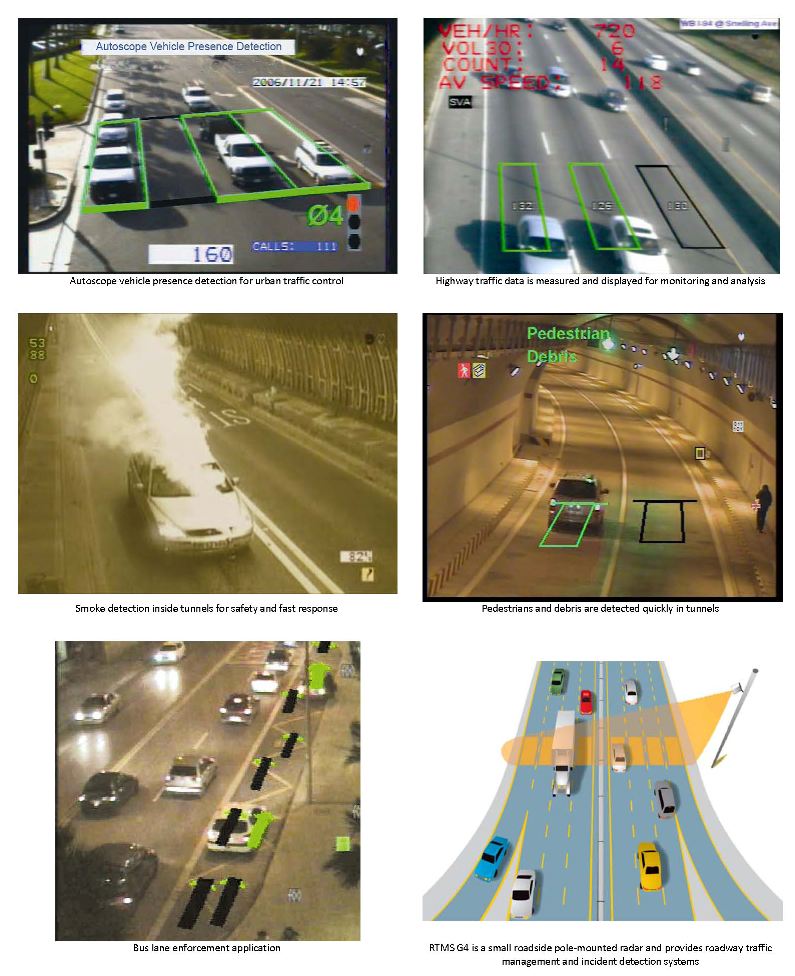

We are the leading provider of software-based computer enabled detection, or CED, products and solutions for the intelligent transportation systems, or ITS, industry. Our family of products, which we market as the Autoscope Video Vehicle Detection System and Remote Traffic Microwave Sensor, or RTMS, Radar Detection System provides end users with the tools needed to optimize traffic flow, enhance driver safety, regulate air quality and address emerging security concerns. Our technology analyzes signals from sophisticated sensors and transmits the information to management systems and controllers or directly to users.

CED is a process in which software rather than humans examines outputs from various types of sophisticated sensors to determine what is happening in a field of view. In the ITS industry, CED is a critical component of managing congestion and traffic flow. In many markets, it is not possible to build roads, bridges and highways quickly enough to accommodate increasing automobile ownership. We believe CED-based ITS solutions therefore will become increasingly necessary to complement existing and new infrastructure to manage traffic flow and optimize throughput.

We believe our CED solutions are technically superior to those of our competitors because they have a higher level of accuracy, limit the occurrence of false detection, are generally easier to install with lower costs of ownership, work effectively in a multitude of light and weather conditions, and provide end users the ability to manage inputs from a variety of sensors for numerous tasks. We believe that the market for CED is increasingly favoring converged solutions that include ITS, security/surveillance and environmental management, which we expect to increase demand for CED products such as ours.

We believe the strength of our distribution channels positions us to increase the penetration of our technology-driven solutions in the marketplace. We market our Autoscope products in North America, the Caribbean and Latin America through an exclusive agreement with Econolite Control Products Inc., which we believe is the leading distributor of ITS control products in North America and the Caribbean. We market our Autoscope products outside of North America, the Caribbean and Latin America and our RTMS products through a combination of distribution and direct sales channels, including our overseas wholly-owned subsidiaries. Our end users primarily include governmental agencies and municipalities, and, as of December 31, 2007, we had sold over 80,000 instances in more than 60 countries.

In December 2007, we purchased certain radar-based detection assets from EIS Electronic Integrated Systems, Inc. and its affiliate, Dan Manor, which we refer to in this prospectus as the EIS asset purchase. EIS was a leading provider of radar-based detection solutions. On a pro forma basis for 2007, our revenue, including revenue from the EIS asset purchase, increased approximately 82% compared with our stand-alone revenue for 2006. In addition to the increased scale we gained through the EIS asset purchase, the addition of EIS’ RTMS radar products enables us to provide a wider array of CED products to our end users and support the introduction of hybrid product offerings to help drive market demand.

Industry Overview

The Intelligent Transportation Systems Market. The market for ITS is large and growing. According to a December 2007 report by Global Industry Analysts, Inc., total ITS sales in the United States and Europe for 2007 were approximately $3.4 billion and $2.8 billion, respectively, and total global ITS sales were approximately $8.7 billion. Global Industry Analysts expects total global ITS sales to reach $12.5 billion by the end of 2010, representing a compound annual growth rate of 11.6% for the period from 2000 to 2010.

ITS encompasses a broad range of information processing and control electronics technologies that, when integrated into roadway infrastructure, help monitor and manage traffic flow, reduce congestion and enhance driver safety. ITS applications include a wide array of traffic management systems, such as traffic signal control, automatic number plate recognition and variable messaging signs. ITS technologies include video vehicle detection, inductive loop detection, sensing technologies, floating cellular data, computational technologies and wireless communications.

1

In traffic management applications, CED products are used for automated vehicle detection and are a primary data source upon which ITS solutions are built. Traditionally, automated vehicle detection is performed using inductive wire loops buried in the pavement. However, in-pavement loop detectors are costly to install, difficult to maintain, expensive to repair and not capable of wide-area vehicle detection without installations of multiple loops. Above-ground CED solutions for ITS offer several advantages to in-pavement loop detectors. Above-ground CED solutions tend to have lower total cost of ownership than in-pavement loop detectors because above-ground CED solutions are non-destructive to road surfaces, have no wear and tear from traffic and pavement expansion and contraction, do not require closing roadways to install or repair, and are capable of wide-area vehicle detection with a single device, thus enabling one input device to do the work of many in-pavement loops. In addition, unlike in-pavement loops, above-ground CED solutions can detect smoke and debris. These factors result in greater up-time and increased reliability and functionality of above-ground CED solutions compared to in-pavement loop detectors.

We believe our Autoscope and RTMS products are competitive with and can take market share from in-pavement loop detectors. We believe the U.S. ITS video detection market sales in 2007 were approximately $110 to $130 million and growing at approximately 20% per year. We believe we are the leader in the U.S. ITS video detection market in terms of unit sales, and we estimate that U.S. sales of the in-pavement loop detectors our products can supplant were approximately $500 million in 2007.

Solutions for Adjacent Markets. We believe that the adjacent markets of ITS, security/surveillance and environmental management are converging, and that this convergence will accelerate as CED systems become more cost-effective when a single CED unit can be used for multiple purposes.

Our Competitive Strengths

We believe the following competitive strengths will continue to enhance our leadership position in ITS and adjacent industries:

Leading Proprietary Technologies. Over the last two decades, we have developed a proprietary portfolio of complex software algorithms that allow our video and radar detector products to capture and analyze objects in diverse weather and lighting conditions and balance the accuracy of positive detection and the avoidance of false detections.

Proven Ability to Develop, Enhance and Market New Products. Over the last two decades, we have demonstrated the ability to lead the market with new products and product enhancements. For example, we were the first company to provide our end users with a fully integrated color camera, zoom lens and machine vision processor in our Autoscope Solo system. Additionally, EIS was the first company to introduce radar-based technology solutions for ITS applications, and it has continued to lead the market with technology enhancements and new products, such as RTMS.

Leading Distribution Channel. Since 1991, we have maintained a relationship with Econolite for the distribution of our Autoscope products in North America and the Caribbean and, since May 2002, in Latin America. We believe Econolite is the leading distributor of ITS products in North America and the Caribbean and our relationship enhances our ability to commercialize new products and allows us to focus on our core business of advanced signal processing software algorithms.

Broad Product Portfolio. We believe that our family of Autoscope and RTMS products allows us to meet the needs of our end users and affords us the opportunity to offer next-generation hybrid products that will satisfy traffic, security/surveillance and environmental management requirements.

Experienced Management Team and Engineering Staff. We recently transitioned to a new, highly experienced management team charged with executing our growth strategy. Additionally, we believe that the continuity of our engineering staff allows us to develop improved products.

Strong Financial Performance. Over the past five years, we have grown our revenue organically at an average double-digit compound annual growth rate and maintained average net margins approaching 25%.

Our Growth Strategy

As part of our growth strategy, we seek to:

2

Enhance and Extend Our Technology Leadership in ITS. We believe we have established ourselves as the leading provider of CED in the ITS market. We believe that we have an opportunity to accelerate our growth while maintaining our traditionally high level of profitability by improving the functionality of our products, expanding our product offering to include hybrid products, and expanding our product portfolio and distribution channels through licensing or selected acquisitions.

Expand into Adjacent Markets. Our core skill, implementing software-based CED products and solutions, can be utilized more broadly as traffic, security/surveillance and environmental management markets converge. We are integrating this concept into our long-range engineering development road-map and evaluating the use of technology licensing, acquisition and channel strategies that support this vision.

Increase the Scope of Our Distribution and Direct Sales. We have made substantial investments in product adjustments to tailor our solutions to the differing needs of our international end users, and have expanded our European and Asian subsidiaries. We believe these investments will permit us to take advantage of the accelerated pace of adoption of CED throughout the developing world.

Grow Through Complementary Acquisitions. We intend to pursue strategic acquisitions that extend our technology leadership, breadth of product offerings, sales and distribution channels and market share in ITS and adjacent market segments.

Recent Developments

Quarter Ended March 31, 2008. Our net income for the quarter ended March 31, 2008 was $1.1 million, or $0.26 per fully diluted share, compared to $556,000, or $0.14 per fully diluted share, for the same period in 2007. Revenues for the first quarter of 2008 were $5.9 million, compared to $2.6 million for the same period a year ago. Revenue from royalties increased 26% to $2.9 million from $2.3 million in the first quarter of 2007 and reflects the continued success of Econolite in selling Autoscope products in the United States and Canada. North American sales, which are sales of RTMS in North America, were $1.6 million. International sales, which include both Autoscope and RTMS sales outside of North America, were $1.4 million in the first quarter of 2008, a four-fold increase over $353,000 in the same period in 2007. Sales of RTMS world-wide for the 2008 first quarter were $1.8 million. We acquired the RTMS family of products in December 2007.

New Bank Financing. On May 1, 2008, we entered into a loan agreement with Associated Bank, National Association for a line of credit and a term loan that replaced our previous arrangements with Wells Fargo Bank, N.A. The loan agreement provides for a three-year amortizing $3.0 million term loan and a three-year $5.0 million revolving line of credit. We had drawn fully the $3.0 million term loan and have borrowed $2.0 million on the line of credit as of May 1, 2008. A major benefit of the new credit facilities is that we are required to pledge only our auction rate securities as collateral, and the borrowings are based on an advance formula which includes auction rate securities and receivables. This has freed up over $3.5 million in money market funds that were pledged under the Wells Fargo Bank arrangement.

Auction Rate Securities. At March 31, 2008, we held $5.5 million (par value) of investments comprised of auction rate securities, or ARS, with maturity dates ranging from 2031 to 2047. All our ARS held are AAA/Aaa rated, with substantially all collateralized by student loans guaranteed by the U.S. government under the Federal Family Education Loan Program. Until mid-February 2008, the auction rate securities market was highly liquid. Since mid-February 2008, a substantial number of auctions have failed, meaning that there was not enough demand to sell all of the securities that holders desired to sell at auction. The immediate effect of a failed auction is that the holders cannot sell the securities at auction. In the case of a failed auction, with respect to the ARS held by us, the ARS are deemed not currently liquid. In the case of funds invested by us in ARS which are the subject of a failed auction, we may not be able to access the funds in the near term without a loss of principal unless a future auction on these investments is successful or the issuer calls the security pursuant to a mandatory tender or redemption prior to maturity.

At March 31, 2008, there was insufficient observable ARS market information available to determine the fair value of our investments. Therefore, we estimated fair value by using broker quotes based primarily on (a) a discounted cash flow model with factors including tax status, credit quality, duration, insurance swaps, levels of federal guarantees and likelihood of redemption and (b) estimates of observable market data for similar securities (when available). Based on this analysis, we recorded an unrealized loss of $251,000 ($166,000 net of tax) related to our ARS investments and have classified the investments as long-term on our balance sheet as of March 31, 2008. We believe this unrealized loss is primarily attributable to the limited liquidity of these investments, and it is our intent to hold these investments long enough to avoid realizing any significant loss. Nonetheless, if uncertainties in the credit and capital markets continue, if these markets further deteriorate, or if we no longer have the ability to hold these investments, we may be required to recognize other-than-temporary impairment charges.

Corporate Information

We were incorporated under Minnesota law in December 1984. Our executive offices are located at 500 Spruce Tree Centre, 1600 University Avenue West, St. Paul, Minnesota 55104. Our telephone number is (651) 603-7700. Our website is www.imagesensing.com. The information contained on our website is not a part of this prospectus. We have included our website address in this prospectus as an inactive textual reference only.

3

The Offering

Common stock offered by Image Sensing Systems, Inc. |

| 1,500,000 shares |

|

|

|

Common stock to be outstanding after this offering |

| 5,427,806 shares |

|

|

|

Over-allotment option |

| The underwriters have a 30-day option to purchase up to 225,000 additional shares of common stock from us. |

|

|

|

Use of proceeds |

| We intend to use the net proceeds from this offering to repay an outstanding term loan and line of credit and for general corporate purposes, including acquiring or investing in businesses, products or technologies. See “Use of Proceeds.” |

|

|

|

NASDAQ Capital Market symbol |

| ISNS |

Except as otherwise noted, the information in this prospectus is based upon 3,927,806 shares of our common stock outstanding as of April 30, 2008 and excludes (a) 381,233 shares of common stock issuable upon the exercise of then outstanding stock options (of which options to purchase 202,983 shares are exercisable) at a weighted average exercise price of $8.92 per share; (b) 78,200 shares of common stock reserved and available for future issuances under our 2005 Stock Incentive Plan; and (c) exercise of the underwriters’ overallotment option.

4

Summary Financial Data

(in thousands, except per share data)

The following tables set forth, for the periods and dates indicated, our summary financial data. The summary financial data as of and for the years ended December 31, 2005, 2006 and 2007 have been derived from our audited financial statements included elsewhere in this prospectus. The pro forma financial data presented for the year ended December 31, 2007 is unaudited and gives effect to our acquisition of certain assets from EIS Electronic Integrated Systems, Inc. on December 6, 2007 as if the acquisition had occurred on January 1, 2007. The unaudited pro forma financial data is based on our audited financial statements and the audited financial statements of EIS and reflects the assumptions set forth in this prospectus under “Summary Unaudited Pro Forma Condensed Combined Statement of Operations.” The pro forma data is presented for informational purposes only, and does not purport to represent what our results of operations would actually have been if the transaction had occurred on the date indicated. The as adjusted balance sheet data assumes the sale of 1,500,000 shares in this offering at an assumed public offering price of $ per share, after deducting estimated underwriting discounts and expenses, as well as the application of the net proceeds in this offering as described under “Use of Proceeds.” Neither the actual statement of income data nor the pro forma or as adjusted financial data presented is necessarily indicative of the results we may achieve in any future period.

Pro Forma | |||||||||||||

Fiscal Year Ended | Year Ended | ||||||||||||

2005 | 2006 | 2007 | 2007 | ||||||||||

(unaudited) | |||||||||||||

Consolidated Statement of Income Data: | |||||||||||||

Revenue: | |||||||||||||

Product sales | $ | 2,407 | $ | 2,980 | $ | 4,336 | $ | 13,078 | |||||

Royalties | 8,595 | 10,136 | 10,747 | 10,747 | |||||||||

11,002 | 13,116 | 15,083 | 23,825 | ||||||||||

Cost of revenue: | |||||||||||||

Product sales | 1,042 | 1,501 | 1,987 | 4,739 | |||||||||

Royalties | 383 | 220 | — | — | |||||||||

1,425 | 1,721 | 1,987 | 4,739 | ||||||||||

Gross profit | 9,577 | 11,395 | 13,096 | 19,086 | |||||||||

Operating expenses: | |||||||||||||

Selling, marketing and product support | 2,567 | 2,850 | 3,463 | 4,466 | |||||||||

General and administrative | 1,400 | 2,382 | 2,653 | 4,942 | |||||||||

Research and development | 1,516 | 2,639 | 2,299 | 2,761 | |||||||||

Amortization of intangible assets | — | — | 51 | 768 | |||||||||

In-process research and development | — | — | 4,500 | 4,500 | |||||||||

Legal expense - lawsuit | — | — | — | 409 | |||||||||

5,483 | 7,871 | 12,966 | 17,846 | ||||||||||

Income (loss) from operations | 4,094 | 3,524 | 130 | 1,240 | |||||||||

Other income (expense), net | 252 | 523 | 543 | (328 | ) | ||||||||

Income (loss) before income taxes | 4,346 | 4,047 | 673 | 912 | |||||||||

Income taxes (benefit) | 1,505 | 942 | (199 | ) | 255 | ||||||||

Net income (loss) | $ | 2,841 | $ | 3,105 | $ | 872 | $ | 657 | |||||

Net income (loss) per share: | |||||||||||||

Basic | $ | 0.79 | $ | 0.83 | $ | 0.23 | $ | 0.17 | |||||

Diluted | $ | 0.73 | $ | 0.80 | $ | 0.22 | $ | 0.16 | |||||

Weighted average number of common shares outstanding: | |||||||||||||

Basic | 3,602 | 3,725 | 3,789 | 3,936 | |||||||||

Diluted | 3,868 | 3,891 | 3,881 | 4,028 | |||||||||

5

|

| December 31, 2007 |

| ||||

Balance Sheet Data: |

| Actual |

| As Adjusted(1) |

| ||

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 5,613 |

| $ |

|

|

Accounts receivable, net |

|

| 4,997 |

|

| 4,997 |

|

Total current assets |

|

| 17,822 |

|

|

|

|

Goodwill and intangible assets |

|

| 10,140 |

|

| 10,140 |

|

Short-term debt |

|

| 5,000 |

|

| — |

|

Total shareholders’ equity |

|

| 23,225 |

|

|

|

|

_____________________________________

(1) | Reflects the sale of 1,500,000 shares in this offering at an assumed public offering price of $ per share, after deducting estimated underwriting discounts and commissions and offering expenses, and the application of the net proceeds from our sale of common stock in this offering. |

6

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all the other information contained in this prospectus before you decide to buy our common stock. If any of the following risks related to our business actually occurs, our business, financial condition and operating results would be adversely affected. The market price of our common stock could decline due to any of these risks and uncertainties related to our business, or related to an investment in our common stock, and you may lose part or all of your investment.

Risks Related to Our Business

Historically, substantially all of our revenue has been generated from sales of our Autoscope family of products, and if we do not maintain the market for these products, our business will be harmed.

Historically, substantially all of our revenue has been generated from sales of, or royalties from the sales of, the Autoscope Vehicle Detection System. We anticipate that revenue from the sale of the Autoscope system will continue to account for a substantial portion of our revenue for the foreseeable future. As such, any decline in sales of our Autoscope system would have a material adverse impact on our business, financial condition and results of operations.

The features and functions in our products have not been as widely utilized as traditional products offered by our competitors, and if our end users do not have demand for the features and functions in our products, it could adversely affect our business and growth prospects.

Machine vision and radar technologies have not been utilized in the traffic management industry as extensively as other more traditional technologies, mainly in-pavement loop detectors. Our financial success and growth prospects depend on the continued development of the market for advanced technology solutions for traffic management and the acceptance of our Autoscope and RTMS systems, and future systems we may develop, as reliable, cost-effective alternatives to traditional vehicle detection systems. We cannot assure you that we will be able to utilize our technology profitably in other products or markets. If our end users do not continue to increase their demand for the features and functions provided by our Autoscope and RTMS systems, or hybrid or other systems we may develop, our business and growth prospects could be adversely affected.

If governmental entities elect not to use our products due to budgetary constraints, project delays or other reasons, our revenue may fluctuate severely or be substantially diminished.

The Autoscope and RTMS systems are sold primarily to governmental entities for use in large traffic control projects using advanced technologies. We expect that we will continue to rely substantially on revenue and royalties from sales of the Autoscope and RTMS systems to governmental entities. In addition to normal business risks, it often takes considerable time before governmental traffic control projects are developed to the point at which a purchase of the Autoscope and RTMS systems would be made, and a purchase of our products also may be subject to a time-consuming approval process. Additionally, governmental budgets and plans may change without warning. Other risks of selling to governmental entities include dependence on appropriations and administrative allocation of funds, changes in governmental procurement legislation and regulations and other policies that may reflect political developments, significant changes in contract scheduling, intense competition for government business and termination of purchase decisions for the convenience of the governmental entity. Substantial delays in purchase decisions by governmental entities, or governmental budgetary constraints, could cause our revenue and income to drop substantially or to fluctuate significantly between fiscal periods.

If Econolite’s sales volume decreases or if it fails to pay royalties to us in a timely manner or at all, our financial results will suffer.

We have an agreement with Econolite under which Econolite is the exclusive distributor of the Autoscope system in North America, the Caribbean and Latin America. The agreement also grants Econolite a first refusal right that arises when we make a proposal to Econolite to extend the license to additional products in North America, the Caribbean and Latin America and a first negotiation right that arises when we make a proposal to Econolite to include rights corresponding to Econolite’s rights under our current agreement in countries not in these territories. In exchange for its rights under the agreement, Econolite pays us royalties for sales of the Autoscope system. Since 2002, a significant part of our revenue has consisted of royalties resulting from sales made by Econolite, including 78% in 2005, 77% in 2006 and 71% in 2007. Econolite’s account receivable represented 67% of our accounts receivable at December 31, 2007 and 69% of our accounts receivable at December 31, 2006. We expect that Econolite will continue to account for a significant portion of our revenue for the foreseeable future. Any decrease in Econolite’s sales volume could significantly reduce our royalty revenue and adversely impact earnings. A failure by Econolite to make royalty payments to us in a timely manner or at all will harm our financial condition. In addition, we believe sales of our products are a material part of Econolite’s business, and any significant decrease in Econolite’s sales of the other products it sells could harm Econolite, which could have a material adverse effect on our business and prospects.

7

Increased competition may make it difficult for us to acquire and retain end users. If we are unsuccessful in developing new applications and product enhancements, our products may become noncompetitive or obsolete.

Competition in the area of advanced traffic management and surveillance is growing. Some of the companies that may compete with us in the business of developing and implementing traffic control systems have substantially more financial, technological, marketing, personnel and research and development resources than we have. Therefore, they may be able to respond more quickly than we can to new or changing opportunities, technologies, standards or end user requirements. If we are unable to compete successfully with these companies, the market share for our products will decrease, and competitive pressures may seriously harm our business.

Additionally, the market for vehicle detection is continuously seeking more advanced technological solutions to traffic management and control problems. Technologies such as embedded loop detectors, pressure plates, pneumatic tubes, radars, lasers, magnetometers, acoustics and microwaves that have been used as traffic sensing devices in the past will be enhanced for use in the traffic management industry, and new technologies may be developed. We are aware of several companies that are developing traffic management devices using machine vision technology or other advanced technology. We expect to face increasingly competitive product developments, applications and enhancements. New technologies or applications in traffic control systems may provide our end users with alternatives to the Autoscope and RTMS systems and could render our solutions noncompetitive or obsolete. If we are unable to increase the number of our applications and develop and commercialize product enhancements and applications in a timely manner that responds to changing technology and satisfies the needs of our end users, our business and financial results will suffer.

Our dependence on third parties for manufacturing and marketing our products may prevent us from meeting customers’ needs in a timely manner.

We do not have, and do not intend to develop in the near future, internal capabilities to manufacture our products. We have entered into agreements with Econolite and Wireless Technology, Inc., or WTI, to manufacture the Autoscope system and related products for sales in North America, the Caribbean and Latin America. The hardware components for our RTMS products are made by manufacturers in Taiwan and Canada, and the components are assembled and tested in Canada. In addition, we work with suppliers, some of whom are overseas, to manufacture Autoscope and RTMS products that need to comply with the European Union’s regulatory RoHS directive on the restriction of the use of certain hazardous substances in electrical and electronic equipment. If Econolite, WTI and our suppliers are unable to manufacture our products in the future, we may be unable to identify other manufacturers able to meet product and quality demands in a timely manner or at all. Our inability to find suitable manufacturers for our products could result in delays or reductions in product shipments, which in turn may harm our business reputation and results of operations. In addition, we have granted Econolite the exclusive right to market the Autoscope system and related products in North America, the Caribbean and Latin America. Consequently, our revenue depends to a significant extent on Econolite’s marketing efforts. Econolite’s inability to effectively market the Autoscope system, or the disruption or termination of that relationship, could result in reduced revenue and market share for our products.

We and our third party manufacturers obtain some of the components of our products from a single source, and an interruption in the supply of those components may prevent us from meeting customers’ needs in a timely manner and could therefore reduce our sales.

Although substantially all of the hardware components incorporated into the Autoscope and RTMS systems are standard electronics components that are available from multiple sources, we and our third party manufacturers obtain some of the components from a single source. The loss or interruption of any of these supply sources could force us or our manufacturers to identify new suppliers, which could increase our costs, reduce our sales and profitability, or harm our customer relations by delaying product deliveries.

8

We may face increased competition if we fail to adequately protect our intellectual property rights, and efforts to protect our intellectual property rights may result in costly litigation.

Our success depends in large measure on the protection of our proprietary technology rights. We rely on trade secret, copyright and trademark laws, and confidentiality agreements with employees and third parties, all of which offer only limited protection. Although we acquired six patent applications filed with the U.S. Patent and Trademark Office, or USPTO, in the EIS asset purchase, we cannot assure you that the scope of these or any future patents relating to our products will exclude competitors or provide competitive advantages to us. We also cannot assure you that we will become aware of all instances in which others develop similar products, duplicate any of our products, reverse engineer or misappropriate our proprietary technology. If our proprietary technology is misappropriated, our business and financial results could be adversely affected. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. In addition, we may be the subject of lawsuits by others who claim we violate their intellectual property rights. Even if the result is favorable, litigation could result in substantial costs and the diversion of management resources, either of which could harm our business.

As described above, although we have acquired six patent applications filed with the USPTO, we have not applied for patent protection in all countries in which we market and sell the Autoscope and RTMS systems. Consequently, our proprietary rights in the technology underlying the Autoscope and RTMS systems in countries other than the U.S. will be protected only to the extent that trade secret, copyright or other non-patent protection is available and to the extent we are able to enforce our rights. The laws of other countries in which we market our products may afford little or no effective protection of our proprietary technology, which could harm our business.

The expiration of the University of Minnesota patent for certain aspects of our Autoscope system may result in additional competition, which could adversely affect our revenue and earnings.

The patent rights for certain aspects of the underlying technology for the Autoscope system previously owned by the University of Minnesota expired in July 2006. Other businesses may choose to use the University patent technology to develop a product that competes with the Autoscope system, and this competition could adversely impact our revenue and earnings.

We plan to continue introducing new products and technologies and may not realize the degree or timing of benefits we initially anticipated, which could adversely affect our business and results of operations.

We regularly invest substantial amounts in research and development efforts that pursue advancements in a range of technologies, products and services. Our ability to realize the anticipated benefits of these advancements depends on a variety of factors, including meeting development, production, certification and regulatory approval schedules; execution of internal and external performance plans; availability of supplier-produced parts and materials; performance of suppliers and vendors; achieving cost efficiencies; validation of innovative technologies; and the level of end user interest in new technologies and products. These factors involve significant risks and uncertainties. We may encounter difficulties in developing and producing these new products and may not realize the degree or timing of benefits initially anticipated. In particular, we cannot predict with certainty whether, when or in what quantities our current or potential end users will have a demand for products currently in development or pending release. Moreover, as new products are announced, sales of current products may decrease as end users delay making purchases until such new products are available. Any of the foregoing could adversely affect our business and results of operations.

We price our products at a premium compared to other technologies. As such, we may not be able to quickly respond to emerging low-cost competitors, and our inability to do so could adversely affect revenue and profitability.

We price our products at a premium as compared to less sophisticated technologies. As the technological sophistication of our competitors and the size of the market increases, competing low-cost developers of machine vision products for traffic are likely to emerge and grow stronger. If end users prefer low-cost alternatives over our products, our revenue and profitability could be adversely affected.

9

Our revenue could be adversely affected by the emergence of local competitors and local biases in international markets.

Our experience indicates that local officials that purchase traffic management products in the international markets we serve favor products that are developed and manufactured locally. As local competitors to our products emerge, local biases could erode our revenue in Europe and Asia and adversely affect our sales and revenue in those markets.

Failure to predict technological convergence could harm our business and could reduce our sales.

With our Autoscope and RTMS product families, we currently utilize only certain detection technologies available in the ITS field. If we fail to predict convergence of technology preferences in the market for ITS, or fail to acquire complementary businesses or products that broaden our current product offerings, we may fail to capture certain segments of the market, which could harm our business and reduce our sales.

We sell our products internationally and are subject to various risks relating to such international activities, which could harm our international sales and profitability.

During 2005, 2006 and 2007, 22%, 23% and 27% of our total revenue, respectively, was attributable to international sales. We sell outside of the U.S. through our agreement with Econolite, through our wholly-owned subsidiaries and through our distributor network. By doing business in international markets, including Canada, we are exposed to risks separate and distinct from those we face in our domestic operations. Our international business may be adversely affected by changing economic conditions in foreign countries. Because most of our sales are currently denominated in U.S. dollars, if the value of the U.S. dollar increases relative to foreign currencies, our products could become more costly to the international consumer and therefore less competitive in international markets, which could adversely affect our profitability. Furthermore, although currently only a small percentage of our sales are denominated in non-U.S. currency, this percentage may increase in the future, in which case fluctuations in exchange rates could affect demand for our products. Engaging in international business inherently involves a number of other difficulties and risks, including:

|

|

|

| • | export restrictions and controls relating to technology; |

|

|

|

| • | pricing pressure that we may experience internationally; |

|

|

|

| • | required compliance with existing and new foreign regulatory requirements and laws; |

|

|

|

| • | laws and business practices favoring local companies; |

|

|

|

| • | longer payment cycles; |

|

|

|

| • | difficulties in enforcing agreements and collecting receivables through foreign legal systems; |

|

|

|

| • | political and economic instability; |

|

|

|

| • | potentially adverse tax consequences, tariffs and other trade barriers; |

|

|

|

| • | international terrorism and anti-American sentiment; |

|

|

|

| • | difficulties and costs of staffing and managing foreign operations; |

|

|

|

| • | changes in currency exchange rates; and |

|

|

|

| • | difficulties in enforcing intellectual property rights. |

Our exposure to each of these risks may increase our costs, lengthen our sales cycle and require significant management attention. We cannot assure you that one or more of these factors will not harm our business.

10

Our inability to comply with European and Asian regulatory restrictions over hazardous substances and electronic waste could restrict product sales in those markets and reduce profitability in the future.

The European Union has finalized the Waste Electrical and Electronic Equipment, or WEEE, directive, which makes producers of electrical goods financially responsible for specified collection, recycling, treatment and disposal of past and future covered products. This directive must now be enacted and implemented by individual European Union governments, and certain producers are to be financially responsible under the WEEE legislation. This may impose on us requirements, which, if we are unable to meet them, could adversely affect our ability to market our products in European Union countries, and sales revenues and profitability would suffer as a consequence. In addition, the European Parliament has enacted a directive for the restriction of the use of certain hazardous substances in electrical and electronic equipment, or RoHS. This legislation governs restriction of the use of such substances as mercury, lead, cadmium and hexavalent cadmium. If we are unable to have our product manufactured in compliance with the RoHS directive, we would be unable to market our products in European Union countries, and sales revenues and profitability would suffer. In addition, various Asian governments could adopt their own versions of environment-friendly electronic regulations similar to the European directives, RoHS and WEEE. This could require new and unanticipated manufacturing changes, product testing and certification requirements, thereby increasing cost, delaying sales and lowering revenue and profitability.

Our inability to manage growth effectively could seriously harm our business.

Growth and expansion of our business could significantly strain our capital resources as well as the time and abilities of our management personnel. Our ability to manage growth effectively will require continued improvement of our operational, financial and management systems and the successful training, motivation and management of our employees. If we are unable to manage growth successfully, our business and operating results will suffer.

Our business operations will be severely disrupted if we lose key personnel or if we fail to attract and retain qualified personnel.

Our technology depends upon the knowledge, experience and skills of our key management and scientific and technical personnel. Additionally, our ability to continue technological developments and to market our products, and thereby develop a competitive edge in the marketplace, depends in large part on our ability to attract and retain qualified scientific and technical personnel. Competition for qualified personnel is intense, and we cannot assure you that we will be able to attract and retain the individuals we need, especially if our business expands and requires us to employ additional personnel. In addition, the loss of personnel or our failure to hire additional personnel could materially and adversely affect our business, operating results and ability to expand. The loss of key personnel, including Ken Aubrey and Dan Manor, or our inability to hire and retain qualified personnel, will harm our business.

Our operating costs tend to be fixed, while our revenue tends to be seasonal, thereby resulting in operating results that fluctuate from quarter to quarter.

Our expense levels are based in part on our product development efforts and our expectations regarding future revenues and, in the short-term, are generally fixed. Our quarterly revenues, however, have varied significantly in the past, with our first quarter historically being the weakest due to weather conditions in North America, Europe and northern Asia that make roadway construction more difficult. Additionally, our international revenues have a significant large project component, resulting in a varying revenue stream. We expect the seasonality of our revenue and the fixed nature of our operating costs to continue in the foreseeable future. Therefore, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall. As a result, if anticipated revenues in any quarter do not occur or are delayed, our operating results for the quarter would be disproportionately affected. Operating results also may fluctuate due to factors such as the demand for our products, product life cycle, the development, introduction and acceptance of new products and product enhancements by us or our competitors, changes in the mix of distribution channels through which our products are offered, changes in the level of operating expenses, end user order deferrals in anticipation of new products, competitive conditions in the industry, and economic conditions generally. No assurance can be given that we will be able to achieve or maintain profitability on a quarterly or annual basis in the future.

11

As of March 31, 2008, we had $5.5 million invested in auction rate securities, or ARS. Since mid-February 2008, the auctions for these securities have failed, which adversely affects their liquidity. In May 2008, we recorded an unrealized loss of $251,000 ($166,000 net of tax) due to a determination of a temporary impairment to the value of our ARS. If we must record other-than-temporary impairment charges on our ARS or recognize a loss on their disposition, our financial condition would be adversely affected.

At March 31, 2008, we held $5.5 million (par value) of investments comprised of ARS. Liquidity for these securities has been provided by an auction process that resets the applicable interest rate at pre-determined intervals, usually every 28 to 35 days. Until mid-February 2008, the auction rate securities market was highly liquid. Since mid-February 2008, a substantial number of auctions have failed. In the case of a failed auction, with respect to the ARS held by us, the ARS are deemed not currently liquid. In the case of funds invested by us in ARS which are the subject of a failed auction, we may not be able to access the funds in the near term without a loss of principal unless a future auction on these investments is successful or the issuer calls the security pursuant to a mandatory tender or redemption prior to maturity. In May 2008, based on an analysis of our ARS portfolio, we determined there was an unrealized loss of $251,000 ($166,000 net of tax). We cannot predict whether future auctions related to our ARS will be successful. If uncertainties in the credit and capital markets continue, if these markets further deteriorate, or if we no longer have the ability to hold these investments, we may be required to recognize other-than-temporary impairment charges on our ARS or a loss on the disposition of our ARS, which would have an adverse effect on our financial condition.

EIS is party to a lawsuit involving assets that we acquired from EIS in December 2007. If the assets are determined to infringe a third party’s patent and EIS and its affiliates fail to fulfill their obligation to indemnify us or our affiliates, or if our losses from the allegedly infringing technology exceed the obligations of EIS and its affiliates to indemnify us, our business could suffer.

In 2005, a third party sued EIS alleging infringement of a patent held by the third party on automatic lane calibration. The allegedly infringing technology is part of the assets we purchased in the EIS asset purchase. In October 2007, the court entered a final judgment dismissing the third party’s claim of patent infringement, but the third party has appealed the court’s order. Under the EIS asset purchase agreement, EIS agreed to defend this litigation at its own expense, we are not responsible for any liabilities of EIS or its affiliates arising before the closing of the EIS asset purchase on December 6, 2007, and EIS and its affiliates are obligated to indemnify us and our affiliates for any losses we or our affiliates incur in connection with the litigation or disputed technology. However, if the EIS technology we acquired is finally determined to infringe the third party patent and EIS and its affiliates fail to satisfy their indemnification obligations to us or our affiliates, or if our losses from the allegedly infringing technology exceed the obligation of EIS or its affiliates to indemnify us, our business could suffer.

Risks Related to This Offering

Because our stock is thinly traded and our stock price is volatile, you may not be able to resell your shares at or above the public offering price.

Our common stock is thinly traded, with 3,476,781 shares of our 3,927,806 outstanding shares held by non-affiliates as of April 30, 2008. Based on the trading history of our common stock and the nature of the market for publicly traded securities of companies in evolving high-tech industries, we believe there are several factors that have caused and are likely to continue to cause the market price of our common stock to fluctuate substantially. The fluctuations may occur on a day-to-day basis or over a longer period of time. Factors that may cause fluctuations in our stock price include announcements of large orders obtained by us or our competitors, substantial cutbacks in government funding of highway projects or of the potential availability of alternative technologies for use in traffic control and safety, quarterly fluctuation in our financial results or the financial results of our competitors, consolidation among our competitors, fluctuations in stock market prices and volumes, and the volatility of the stock market. Consequently, you may not be able to sell our common stock at prices equal to or greater than the price you paid in this offering.

Securities class action litigation often has been initiated when a company’s stock price has fallen below the company’s public offering price soon after the offering closes or following a period of volatility in the market price of the company’s securities. If class action litigation is initiated against us, we would incur substantial costs, and our management’s attention would be diverted from our operations. All of these factors could cause the market price of our stock to decline further, and you may lose some or all of your investment.

Future sales of our common stock by our existing shareholders could cause our stock price to decline.

If our shareholders sell substantial amounts of our common stock in the public market, the market price of our common stock could decrease significantly. The perception in the public market that our shareholders might sell shares of our common stock could also depress the market price of our common stock. Shareholders who beneficially own 147,202 shares acquired in the EIS asset purchase hold registration rights. In addition, we have registration statements on file with the Securities and Exchange Commission covering shares of our common stock acquired upon option exercises. The market price of shares of our common stock may decrease significantly when the lock-up agreements, as described in “Underwriting,” lapse and such shareholders and option holders are able to sell shares of our common stock into the market. A decline in the price of shares of our common stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities and may cause you to lose part or all of your investment in our shares of common stock.

12

We have broad discretion in the use of the proceeds of this offering and may apply the proceeds in ways with which you do not agree.

Our net proceeds from this offering will be used to repay an outstanding term loan and line of credit and, as determined by management in its sole discretion, for general corporate purposes, including acquiring or investing in businesses, products or technologies. However, other than the payment of the outstanding term loan, we have not determined the allocation of these net proceeds among the various uses described in this prospectus. Our management will have broad discretion over the use and investment of these net proceeds, and, accordingly, you will have to rely upon the judgment of our management with respect to our use of these net proceeds, with only limited information concerning management’s specific intentions. You will not have the opportunity, as part of your investment decision, to assess whether we use the net proceeds from this offering appropriately. We may place the net proceeds in investments that do not produce income or that lose value, which may cause our stock price to decline.

We may not be successful in implementing our acquisition strategy, and future acquisitions could result in disruptions to our business by, among other things, distracting management time and diverting financial resources. Further, if we are unsuccessful in integrating acquired companies into our business, it could materially and adversely affect our financial condition and operating results.

Part of our continuing business strategy is to make acquisitions of or investments in companies, products or technologies that complement our current products, enhance our market coverage or technical capabilities or offer growth opportunities. As part of this strategy, in December 2007, we completed the EIS asset purchase. We may not be able to identify suitable acquisition candidates or investment partners or products in the future or, if we do, we may not be able to make such acquisitions on commercially acceptable terms or at all. For any acquisitions, including the EIS asset purchase, a significant amount of management’s time and financial resources may be required to complete the acquisition and integrate the acquired business into our existing operations. Even with this investment of management time and financial resources, an acquisition, including the EIS asset purchase, may not produce the revenue, earnings or business synergies anticipated. Acquisitions involve numerous other risks, including assumption of unanticipated operating problems or legal liabilities, problems integrating the purchased operations, technologies or products, diversion of management’s attention from our core businesses, restrictions on the manner in which we may use purchased companies or assets imposed by acquisition agreements, adverse effects on existing business relationships with suppliers and customers, incorrect estimates made in the accounting for acquisitions and amortization of acquired intangible assets that would reduce future reported earnings (such as goodwill impairments), ensuring acquired companies’ compliance with the requirements of the Sarbanes-Oxley Act, and potential loss of customers or key employees of acquired businesses. In addition, the accounting for acquisitions will change for us upon adoption of SFAS No. 141 (Revised 2007), “Business Combinations,” on January 1, 2009. We cannot assure you that any acquisitions, investments, strategic alliances or joint ventures, including the EIS asset purchase, will be completed in a timely manner or achieve anticipated synergies, will be structured or financed in a way that will enhance our business or creditworthiness, or will meet our strategic objectives or otherwise be successful. In addition, we may not be able to secure the financing necessary to consummate future acquisitions, and future acquisitions and investments could involve the issuance of additional equity securities or the incurrence of additional debt, which could increase dilution or harm our financial condition or creditworthiness.

Our directors and executive officers will continue to have substantial control over us after this offering and could limit your ability to influence the outcome of key transactions, including changes of control.

We anticipate that our executive officers and directors and entities affiliated with them will, in the aggregate, beneficially own 8.0% of our outstanding common stock after the completion of this offering, assuming the underwriters do not exercise their over-allotment option. Our executive officers and directors and their affiliated entities, if acting together, would be able to control or influence significantly all matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other significant corporate transactions. These shareholders may have interests that differ from yours, and they may vote in a way with which you disagree and that may be adverse to your interests. The concentration of ownership of our common stock may have the effect of delaying, preventing or deterring a change of control of our company, could deprive our shareholders of an opportunity to receive a premium for their common stock as part of a sale of our company, and may affect the market price of our common stock. This concentration of ownership of our common stock may also have the effect of influencing the completion of a change in control that may not necessarily be in the best interests of all of our shareholders.

13

Our articles of incorporation and bylaws, Minnesota law and the terms of the EIS asset purchase agreement may inhibit a takeover that shareholders consider favorable.

Provisions of our articles of incorporation and bylaws and applicable provisions of Minnesota law may delay or discourage transactions involving an actual or potential change in our control or change in our management, including transactions in which shareholders might otherwise receive a premium for their shares or transactions that our shareholders might otherwise deem to be in their best interests. These provisions:

| • | permit our board of directors to issue up to 5,000,000 shares of preferred stock with any rights, preferences and privileges as it may designate, including the right to approve an acquisition or other change in our control; |

| • | provide that the authorized number of directors may be changed by resolution of the board of directors; |

| • | provide that all vacancies, including newly-created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum; and |

| • | eliminate cumulative voting rights, therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose. |

In addition, Section 302A.671 of the Minnesota Business Corporation Act, or MBCA, generally limits the voting rights of a shareholder acquiring a substantial percentage of our voting shares in an attempted takeover or otherwise becoming a substantial shareholder of our company unless holders of a majority of the voting power of the disinterested shares approve full voting rights for the substantial shareholder. Section 302A.673 of the MBCA generally limits our ability to engage in any business combination with certain persons who own 10% or more of our outstanding voting stock or any of our associates or affiliates who at any time in the past four years have owned 10% or more of our outstanding voting stock. These provisions may have the effect of entrenching our management team and may deprive you of the opportunity to sell your shares to potential acquirers at a premium over prevailing prices. This potential inability to obtain a control premium could reduce the price of our common stock.

The EIS asset purchase also accelerates earn-out payments we must make to EIS if we are acquired or sell substantially all of our assets prior to December 6, 2010. The required acceleration of these payments could negatively affect the ability of our shareholders to obtain a premium over our prevailing stock price and reduce our stock price generally.

We can issue shares of preferred stock without shareholder approval, which could adversely affect the rights of common shareholders.

Our articles of incorporation permit our board of directors to establish the rights, privileges, preferences and restrictions, including voting rights, of future series of our preferred stock and to issue such stock without approval from our shareholders. The rights of holders of our common stock may suffer as a result of the rights granted to holders of preferred stock that may be issued in the future. In addition, we could issue preferred stock to prevent a change in control of our company, depriving common shareholders of an opportunity to sell their stock at a price in excess of the prevailing market price.

We do not intend to declare dividends on our stock after this offering.

We currently intend to retain all future earnings for the operation and expansion of our business and, therefore, do not anticipate declaring or paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends on our common stock will be at the discretion of our board of directors and will depend upon our operating results, earnings, current and anticipated cash needs, capital requirements, financial condition, future prospects, any contractual restrictions and any other factors deemed relevant by our board of directors. Therefore, you should not expect to receive dividend income from shares of our common stock.

14

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties. In some cases, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve known and unknown risks, uncertainties and other factors that may cause our results or our industry’s actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Forward-looking statements are only predictions and are not guarantees of performance. These statements are based on our management’s beliefs and assumptions, which in turn are based on currently available information.

These important factors include those that we discuss in this prospectus under the heading “Risk Factors.” You should read these risk factors and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus. We cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should read this prospectus completely. Other than as required by law, we undertake no obligation to update these forward-looking statements, even though our situation may change in the future.

We estimate that the net proceeds from our sale of shares of common stock in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full. These estimates are based upon an assumed public offering price of $ per share, less estimated underwriting discounts and commissions and offering expenses payable by us.

We intend to use $2.0 million of the net proceeds to repay the $2.0 million outstanding under our revolving line of credit with Associated Bank that we incurred on May 1, 2008. The revolving line of credit provides up to $5.0 million in borrowings at an annual rate equal to the greater of LIBOR plus 2.75% as reset from time to time by Associated Bank or 4.5% (effective rate of 5.65% at May 1, 2008). We also intend to use $3.0 million of the net proceeds to repay the $3.0 million outstanding on our term loan owed to Associated Bank that we incurred on May 1, 2008. The term loan bears interest at an annual rate of 6.75%. The line of credit and the term loan mature on May 1, 2011.

Outstanding borrowings under the line of credit and term loan from Associated Bank are secured by a security interest in all of our goods, general intangibles, accounts, deposit accounts, investment property, letter of credit rights, letters of credit, chattel paper and instruments. We have also pledged $5.4 million in auction rate securities to Associated Bank to secure the line of credit and term loan.

The line of credit and the term loan from Associated Bank replaced our $3.0 million line of credit facility and the $8.0 million term loan facility from Wells Fargo Bank, which were terminated. We used the proceeds of the loan from Wells Fargo Bank to pay part of the price for the EIS asset purchase.

We intend to use the remaining net proceeds for general corporate purposes, including acquiring or investing in businesses, products or technologies. However, we have no current plans, agreements or commitments and are not currently engaged in any negotiations with respect to any transaction. We reserve the right to modify the use of proceeds for other purposes if we are unable to identify suitable acquisition partners or investment opportunities. Pending the uses described above, we intend to invest the net proceeds of this offering in short- to medium-term, investment-grade, interest-bearing securities.

We have not historically paid any dividends on our common stock. After the completion of this offering, we intend to retain our future earnings, if any, to finance the expansion and growth of our business. We do not expect to pay cash dividends on our common stock in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including our operating results, earnings, current and anticipated cash needs, capital requirements, financial condition, future prospects, any contractual restrictions and any other factors deemed relevant by our board of directors.

15

Our common stock is traded on The NASDAQ Capital Market under the symbol “ISNS.” The quarterly high and low sales prices for our common stock for our last two fiscal years are set forth below.

Quarter | Low |

| High |

| |||

2008 Quarter Two (through April 30, 2008) |

| $11.37 |

| $14.17 |

| ||

2008 Quarter One |

| 12.08 |

| 17.50 |

| ||

2007 Quarter Four |

| 11.65 |

| 18.54 |

| ||

2007 Quarter Three |

| 11.56 |

| 16.74 |

| ||

2007 Quarter Two |

| 14.86 |

| 19.70 |

| ||

2007 Quarter One |

| 13.70 |

| 18.90 |

| ||

2006 Quarter Four |

| 12.50 |

| 14.57 |

| ||

2006 Quarter Three |

| 11.25 |

| 14.25 |

| ||

2006 Quarter Two |

| 11.50 |

| 14.91 |

| ||

2006 Quarter One |

| 11.44 |

| 13.50 |

| ||

On May 7, 2008, the last reported sales price of our common stock on The NASDAQ Capital Market was $15.68 per share.

16

The following table sets forth our capitalization as of December 31, 2007:

| • | on an actual basis; and |

| • | on an as adjusted basis to reflect our sale of shares in this offering at an assumed public offering price of $ per share, after deducting estimated underwriting discounts and commissions and offering expenses, and the application of the net proceeds from our sale of common stock in this offering. |

You should read this information in conjunction with the sections entitled “Use of Proceeds” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes appearing elsewhere in this prospectus.

|

| December 31, 2007 |

| ||||

|

| Actual |

| As Adjusted |

| ||

|

| (in thousands) |

| ||||

Cash and cash equivalents |

| $ | 5,613 |

| $ |

|

|

Short-term debt(1) |

| $ | 5,000 |

| $ | — |

|

Shareholders’ equity: |

|

|

|

|

| ||

Preferred stock, $.01 par value, 5,000 authorized, none issued and outstanding, actual and as adjusted |

| — |

| — |

| ||

Common stock $.01 par value, 20,000 shares authorized, 3,928 issued and outstanding, actual, and 5,428 issued and outstanding, as adjusted |

|

| 39 |

|

| 57 |

|

Additional paid-in capital |

|

| 11,004 |

|

|

|

|

Accumulated other comprehensive income |

|

| 161 |

|

| 161 |

|

Retained earnings |

|

| 12,021 |

|

| 12,021 |

|

Total shareholders’ equity |

|

| 23,225 |

|

|

|

|

Total capitalization |

| $ | 28,225 |

| $ |

|

|

| (1) | We have pledged cash equivalents as collateral for 105% of our short-term debt. This collateral is reflected as restricted cash on our consolidated balance sheet appearing elsewhere in this prospectus. |

17

You should read the following selected financial data together with our financial statements and the related notes appearing elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which follows immediately after this section. The selected financial data in this section is not intended to replace our consolidated financial statements and related notes. Our historical results are not necessarily indicative of our future results.

We derived the consolidated statement of income data for the years ended December 31, 2003, 2004, 2005, 2006 and 2007 and the consolidated balance sheet data as of December 31, 2003, 2004, 2005, 2006 and 2007 from our audited consolidated financial statements, which for 2005, 2006 and 2007 are contained elsewhere in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Years Ended December 31, |

| |||||||||||||

|

| |||||||||||||||

|

| 2003 |

| 2004 |

| 2005 |

| 2006 |

| 2007(1) |

| |||||

|

|

|

|

|

|

| ||||||||||

|

| (in thousands, except per share data) |

| |||||||||||||

Consolidated Statement of Income Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International sales |

| $ | 3,339 |

| $ | 3,309 |

| $ | 2,407 |

| $ | 2,980 |

| $ | 4,067 |

|

North American sales |

|

| — |

|

| — |

|

| — |

|

| — |

|

| 269 |

|

Royalties |

|

| 5,920 |

|

| 7,521 |

|

| 8,595 |

|

| 10,136 |

|

| 10,747 |

|

|

|

|

|

|

|

| ||||||||||

|

|

| 9,259 |

|

| 10,830 |

|

| 11,002 |

|

| 13,116 |

|

| 15,083 |

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International sales |

|

| 1,533 |

|

| 1,599 |

|

| 1,042 |