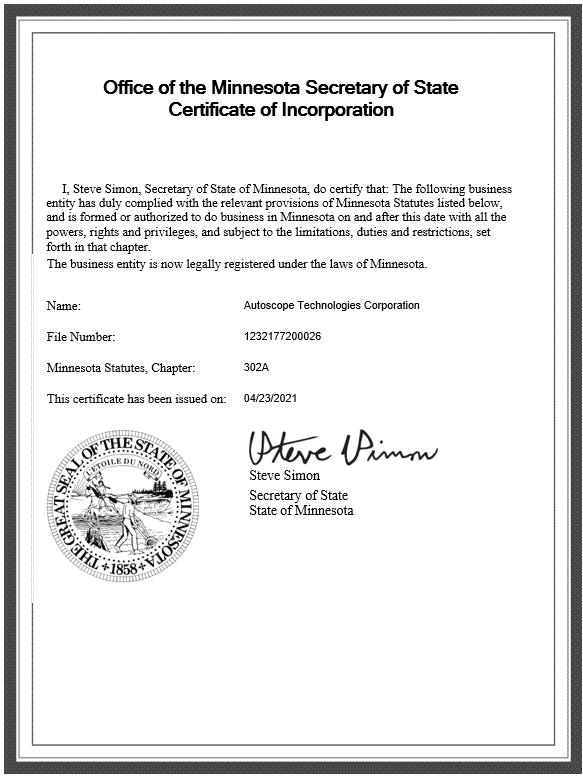

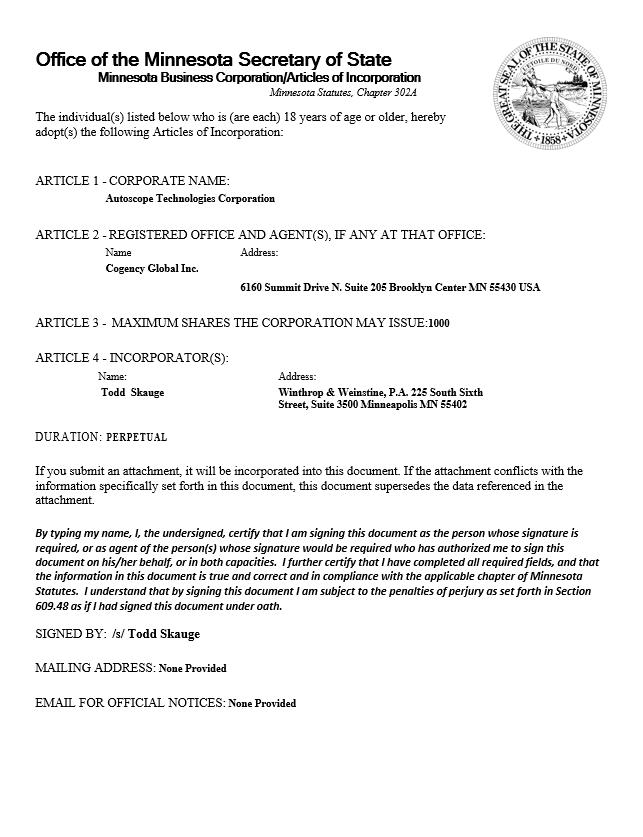

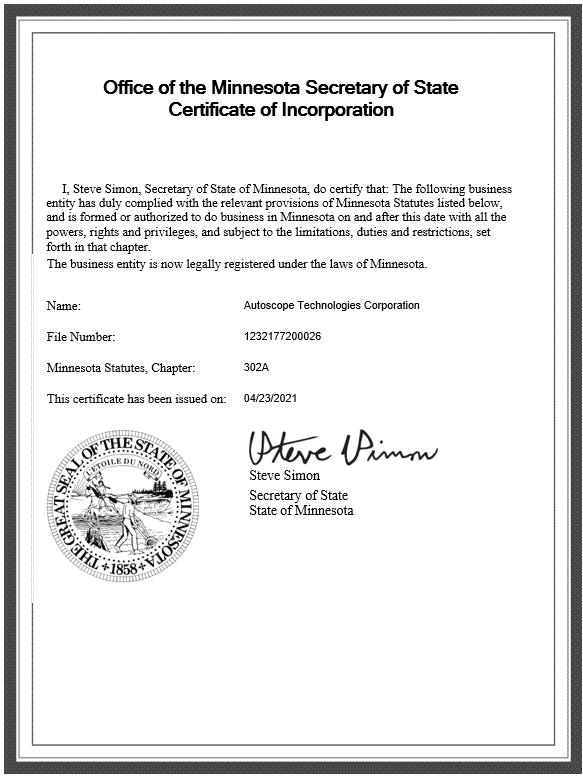

ARTICLES OF INCORPORATION OF

AUTOSCOPE TECHNOLOGIES CORPORATION

The undersigned, of full age, for the purpose of forming a corporation under and pursuant to the provisions of Chapter 302A, Minnesota Statutes and all amendments thereto (the "Act"), hereby adopts the following Articles of Incorporation:

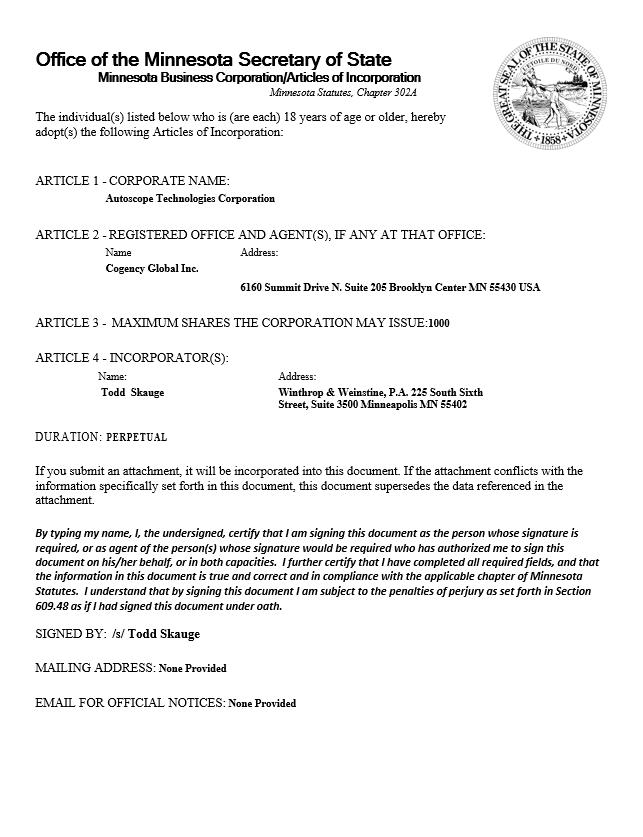

ARTICLE I. NAME

The name of the Corporation shall be: Autoscope Technologies Corporation.

ARTICLE II. REGISTERED AGENT AND OFFICE

The location and post office address of the Corporation's registered office in the State of Minnesota shall be 6160 Summit Drive N., Suite 205, Brooklyn Center, Minnesota, 55430. The name of the Corporation's registered agent in the State of Minnesota shall be Cogency Global Inc.

ARTICLE III. INCORPORATOR

The name and address of the incorporator is as follows:

Todd Skauge Winthrop & Weinstine, P.A.

225 South Sixth Street, Suite 3500

Minneapolis, MN 55402

ARTICLE IV. CAPITAL STOCK

The total authorized capital of the Corporation is 1,000 shares of common stock par value

$.01 per share.

ARTICLE V. PURPOSES AND POWERS

The Corporation shall have general business purposes and shall possess all powers necessary to conduct any business in which it is authorized to engage, including but not limited to, all those powers expressly conferred upon business corporations by the Act, as it may from time to time be amended, together with those powers implied therefrom.

ARTICLE VI. DURATION

The Corporation shall have perpetual duration.

ARTICLE VII. LIMITATION OF LIABILITY

The personal liability of the directors of the Corporation is hereby eliminated to the fullest extent permitted by Section 302A.251 of the Act, as the same may be amended or restated. If the Act is amended after this Article becomes effective to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the Act, as so amended. Any repeal or modification of this Article shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification.

ARTICLE VIII. WRITTEN ACTION OF THE BOARD

Any action required or permitted to be taken at a meeting of the board of directors of the Corporation may be taken by a written action signed, or counterparts of a written action signed in the aggregate, or consented to by authenticated electronic communication, by all of the directors and, if the action does not require shareholder approval, it may be taken by a written action signed, or counterparts of a written action signed in the aggregate, or consented to by authenticated electronic communication, by the number of directors that would be required to take such action at a meeting of the board of directors at which all directors were present.

ARTICLE IX.

PREEMPTIVE RIGHTS; CUMULATIVE VOTING

The shareholders of the Corporation shall not have preemptive rights to subscribe for or acquire securities or rights to purchase securities of any kind, class or series of the Corporation. The shareholders of the Corporation shall not have the right of cumulative voting.

ARTICLEX.

WRITTEN ACTION OF THE SHAREHOLDERS

Any action required or permitted to be taken at a meeting of the shareholders may be taken by a written action signed, or counterparts of a written action signed in the aggregate, or consented to by authenticated electronic communication, by shareholders having voting power equal to the voting power that would be required to take the same action at a meeting of the shareholders at which all shareholders were present.

IN WITNESS WHEREOF, the undersigned has executed these Articles as of this 23rd day of April, 2021.

Todd Skauge, Incorporator

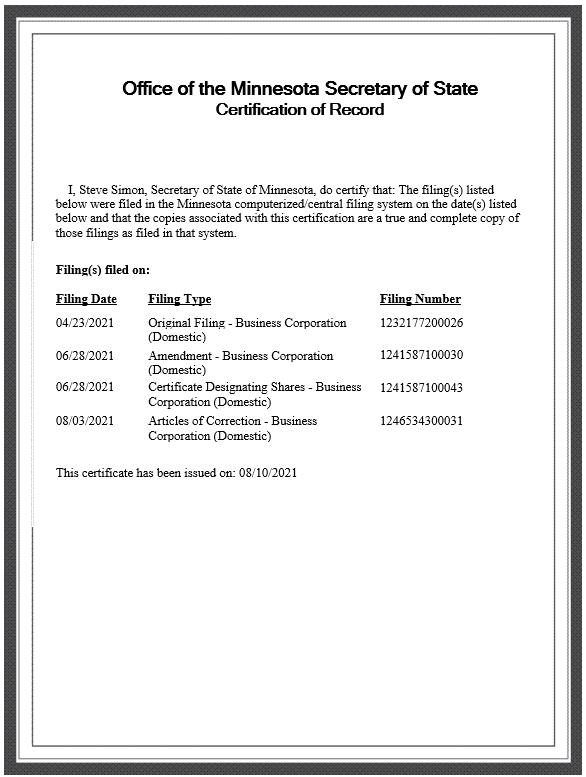

Work Item 1232177200026

Original File Number 1232177200026

STATE OF MINNESOTA OFFICE OF THE SECRETARY OF STATE

FILED

04/23/2021 11:59 PM

Steve Simon Secretary of State

- ; :

ARTICLES OF AMENDMENT AMENDING AND RESTATING THE

ARTICLES OF INCORPORATION OF

AUTOSCOPE TECHNOLOGIES CORPORATION

1. The name of the corporation is Autoscope Technologies Corporation, a Minnesota corporation.

2. The document entitled Restated Articles of Incorporation of Autoscope Technologies Corporation marked Exhibit A attached hereto contains the full text of the amendments to the articles of incorporation of Autoscope Technologies Corporation.

3. The amendment has been adopted pursuant to the Minnesota Business Corporation Act Chapter 302A of the Minnesota Statutes.

4. The amendment restates the articles of incorporation in their entirety, and the restated articles supersede the original articles of incorporation and all amendments hereto.

IN WITNESS WHEREOF, the undersigned, the President and Chief Executive Officer of Autoscope Technologies Corporation, being duly authorized on behalf of Autoscope Technologies Corporation, has executed this document as of the 25th day of June, 2021.

/s/ Frank G. Hallowell

Frank G. Hallowell

Chief Financial Officer

EXHIBIT A

RESTATED ARTICLES OF INCORPORATION OF

AUTOSCOPE TECHNOLOGIES CORPORATION

The following Restated Articles of Incorporation shall supersede and take the place of the existing Articles of Incorporation and all amendments thereto:

ARTICLE 1. NAME

The name of the corporation is Autoscope Technologies Corporation.

ARTICLE 2. REGISTERED OFFICE

The address of the registered office of the corporation is 1600 University Ave W, Suite 400 St. Paul, MN 55104-3825 USA.

ARTICLE 3. AUTHORIZED SHARES

- Authorized Shares.

The total number of shares of capital stock which the corporation is authorized to issue shall be 25,000,000 shares, consisting of 20,000,000 shares of common stock, par value

$.01 per share (“Common Stock”), and 5,000,000 shares of preferred stock, par value $.01 per share (“Preferred Stock”). All shares of Common Stock of the Company outstanding as of the date of filing of these Restated Articles of Incorporation shall have a par value of $.01 per share.

- Common Stock.

All shares of Common Stock shall be voting shares and shall be entitled to one vote per share. Subject to any preferential rights of holders of Preferred Stock, Holders of Common Stock shall be entitled to receive their pro rata share, based upon the number of shares of Common Stock held by them, of such dividends or other distributions as may be declared by the board of directors from time to time and of any distribution of the assets of the corporation upon its liquidation, dissolution or winding up, whether voluntary or involuntary.

- Preferred Stock.

The board of directors of the corporation is hereby authorized to provide, by resolution or resolutions adopted by such board, for the issuance of Preferred Stock from time to time in one or more classes and/or series, to establish the designation and number of shares of each such class or series, and to fix the relative rights and preferences of the shares of each such class or series, all to the full extent permitted by the Minnesota Business Corporation Act, Section 302A.401, or any successor provision. Without limiting the generality of the foregoing , the board of directors is authorized to provide that shares of a class or series of Preferred Stock:

(a) are entitled to cumulative, partially cumulative or noncumulative dividends or other distributions payable in cash, capital stock or indebtedness of the corporation or other property, at such times and in such amounts as are set forth in the board resolutions establishing such class or series or as are determined in a manner specified in such resolutions;

(b) are entitled to a preference with respect to payment of dividends over one or more other classes and/or series of capital stock of the corporation;

(c) are entitled to a preference with respect to any distribution of assets of the corporation upon its liquidation, dissolution or winding up over one or more other classes and /or series of capital stock of the corporation in such amount as is set forth in the board resolutions establishing such class or series or as is determined in a manner specified in such resolutions;

(d) are redeemable or exchangeable at the option of the corporation and/or on a mandatory basis for cash, capital stock or indebtedness of the corporation or other property, at such times or upon the occurrence of such events, and at such prices, as are set forth in the board resolutions establishing such class or series or as are determined in a manner specified in such resolutions;

(e) are entitled to the benefits of such sinking fund, if any, as is required to be established by the corporation for the redemption and/or purchase of such shares by the board resolutions establishing such class or series;

(f) are convertible at the option of the holders thereof into shares of any other class or series of capital stock of the corporation, at such times or upon the occurrence of such events, and upon such terms, as are set forth in the board resolutions establishing such class or series or as are determined in a manner specified in such resolutions;

(g) are exchangeable at the option of the holders thereof for cash, capital stock or indebtedness of the corporation or other property, at such times or upon the occurrence of such events, and at such prices, as are set forth in the board resolutions establishing such class or series or as are determined in a manner specified in such resolutions;

(h) are entitled to such voting rights, if any, as are specified in the board resolutions establishing such class or series (including, without limiting the generality of the foregoing, the right to elect one or more directors voting alone as a single class or series or together with one or more other classes and/or series of Preferred Stock, if so specified by such board resolutions) at all times or upon the occurrence of specified events; and

(i) are subject to restrictions on the issuance of additional shares of Preferred Stock of such class or series or of any other class or series, or on the reissuance of shares of Preferred Stock of such class or series or of any other class or series, or on increases or decreases in the number of authorized shares of Preferred Stock of such class or series or of any other class or series.

Without limiting the generality of the foregoing authorizations, any of the rights and preferences of a class or series of Preferred Stock may be made dependent upon facts ascertainable outside the board resolutions establishing such class or series, and may incorporate by reference some or all of the terms of any agreements, contracts or other arrangements entered into by the corporation in connection with the issuance of such class or series, all to the full extent permitted by the Minnesota Business Corporation Act. Unless otherwise specified in the board resolutions establishing a class or series of Preferred Stock, holders of a class or series of Preferred Stock shall not be entitled to cumulate their votes in any election of directors in which they are entitled to vote and shall not be entitled to any preemptive rights to acquire shares of any class or series of capital stock of the corporation.

ARTICLE 4. NO CUMULATIVE VOTING

There shall be no cumulative voting by the shareholders of the corporation.

ARTICLE 5. NO PREEMPTIVE RIGHTS

The shareholders of the corporation shall not have any preemptive rights to subscribe for or acquire securities or rights to purchase securities of any class, kind or series of the corporation.

ARTICLE 6. BOARD OF DIRECTORS

The number of directors shall initially be five and, thereafter, shall be fixed from time to time by the board of directors or by the affirmative vote of the holders of at least a majority of the voting power of the outstanding Common Stock of the corporation.

Newly created directorships resulting from any increase in the authorized number of directors or vacancies in the board of directors resulting from death, resignation, retirement, disqualification, removal from office or other cause may be filled by a majority vote of the directors then in office though less than a quorum, and directors so chosen shall hold office for a term expiring at the next annual meeting of shareholders at which a vote is held with respect to the class for which such director has been chosen. No decrease in the number of directors constituting the board of directors shall shorten the term of any incumbent director.

ARTICLE 7. WRITTEN ACTION BY DIRECTORS

An action required or permitted to be taken at a meeting of the board of directors of the corporation may be taken by a written action signed, or counterparts of a written action signed in the aggregate, by all of the directors unless the action need not be approved by the shareholders of the corporation, in which case the action may be taken by a written action signed, or counterparts of a written action signed in the aggregate, by the number of directors that would be required to take the same action at a meeting of the board of directors of the corporation at which all of the directors were present.

ARTICLE 8. DIRECTOR LIABILITY

To the fullest extent permitted by the Minnesota Business Corporation Act as the same exists or may hereafter be amended, a director of this corporation shall not be liable to this corporation or its shareholders for monetary damages for breach of fiduciary duty as a director.

Work Item 1241587100030

Original File Number 1232177200026

STATE OF MINNESOTA OFFICE OF THE SECRETARY OF STATE

FILED

06/28/2021 11:59 PM

Steve Simon Secretary of State

Certificate of Designation

of

Series A Junior Participating Preferred Stock

of

Autoscope Technologies Corporation

Autoscope Technologies Corporation, a corporation organized and existing under the Minnesota Business Corporation Act, Chapter 302A of the Minnesota Statutes (the “Company”) hereby certifies in accordance with Minnesota Statutes, Section 302A.401, Subd. 3(b), that the following resolutions were adopted by the Board of Directors of the Company as required by Minnesota Statutes, Section 302A by a written action of the Company's Board of Directors dated as of June 25, 2021:

RESOLVED, that pursuant to the authority granted to and vested in the Board of Directors in accordance with the provisions of the Company’s Articles of Incorporation, the Board of Directors hereby creates a series of Series A Junior Participating Preferred Stock, par value $0.01 per share, of the Company, and hereby states that such series shall have the rights, powers, preferences, and restrictions set forth in the Designation attached as Exhibit A;

RESOLVED FURTHER, that the Company’s Chief Executive Officer and Chief Financial Officer, and each of them accent alone, are hereby authorized and directed to execute and file with the Minnesota Secretary of State in the manner required by law, such Designation, and to take all other action as such officer or officers shall deem necessary or advisable to carry into effect the foregoing resolution; and

RESOLVED FURTHER, that the remaining balance of the Company’s authorized but unissued shares of undesignated preferred stock, par value $0.01 per share, shall continue to be undesignated.

[Signature page follows]

IN WITNESS WHEREOF, Autoscope Technologies Corporation has caused this Certificate of Designation to be signed by the undersigned officer on behalf of the Company as of the 25th day of June, 2021.

/s/ Frank G. Hallowell

Frank G. Hallowell

Chief Financial Officer

[Signature page to Certificate of Designation of Series A Junior Participating Preferred Stock of Autoscope Technologies Corporation]

EXHIBIT A

Designation

of

Series A Junior Participating Preferred Stock

of

Autoscope Technologies Corporation

Section 1. Designation and Amount. Of the 5,000,000 shares of preferred stock, par value $0.01 per share, which the Company is authorized to issue under its Articles of Incorporation, 50,000 of such shares shall be designated as "Series A Junior Participating Preferred Stock" (the "Series A Preferred Stock"). Such number of shares may be increased or decreased by resolution of the Board of Directors; provided that no decrease shall reduce the number of shares of Series A Preferred Stock to a number less than the number of shares then outstanding plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the conversion of any outstanding securities issued by the Company convertible into Series A Preferred Stock.

Section 2. Dividends and Distributions.

(a) Subject to the rights of the holders of any shares of any series of Preferred Stock (or any similar stock) ranking prior and superior to the Series A Preferred Stock with respect to dividends, the holders of shares of Series A Preferred Stock, in preference to the holders of Common Stock, par value $0.01 per share (the "Common Stock"), of the Company, and of any other junior stock; shall be entitled to receive, when, as and if declared by the Board of Directors out of funds legally available for the purpose, quarterly dividends payable in cash on the last day of March, June, September and December in each year (each such date being referred to herein as a “Quarterly Dividend Payment Date”) commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the greater of (a) $1.00 or (b) subject to the provision for adjustment hereinafter set forth, l,000 times the aggregate per share amount of all cash dividends, and 1,000 times the aggregate per share amount (payable in kind) of all

non-cash dividends or other distributions, other than a dividend payable in shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Series A Preferred Stock. If the Company shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then, in each such case, the amount to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event under clause (b) of the preceding sentence shall be adjusted by multiplying such amount by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(b) The Company shall declare a dividend or distribution on the Series A Preferred Stock as provided in paragraph (a) of this Section immediately after it declares a dividend or distribution on the Common Stock (other than a dividend payable in shares of Common Stock); provided that, if no dividend or distribution shall have been declared on the Common Stock during the period between any Quarterly Dividend Payment Date and the next subsequent Quarterly Dividend Payment Date, a dividend of $1.00 per share on the Series A Preferred Stock shall nevertheless be payable on such subsequent Quarterly Dividend Payment Date.

(c) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date, in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share by share basis among all such shares at the time outstanding. The Board of Directors may fix a record date for the determination of holders of shares of Series A Preferred Stock entitled to receive payment of a dividend or distribution declared thereon, which record date shall be not more than 60 days prior to the date fixed for the payment thereof.

Section 3. Voting Rights. The holders of shares of Series A Preferred Stock shall have the following voting rights:

(a) Subject to the provision for adjustment hereinafter set forth, each share of Series A Preferred Stock shall entitle the holder thereof to 1,000 votes on all matters submitted to a vote of the shareholders of the Company. If the Company shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the number of votes per share to which holders of shares of Series A Preferred Stock were entitled immediately prior to such

event shall be adjusted by multiplying such number by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(b) Except as otherwise provided herein, in any other Certificate of Designation creating a series of the Company's preferred stock or any similar stock, or by law, the holders of shares of Series A Preferred Stock and the holders of shares of Common Stock and any other capital stock of the Company having general voting rights shall vote together as one class on all matters submitted to a vote of shareholders of the Company.

(c) Except as set forth herein, or as otherwise provided by law, holders of Series A Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action.

Section 4. Certain Restrictions.

(a) Whenever quarterly dividends or other dividends or distributions payable on the Series A Preferred Stock as provided in Section 2 are in arrears, thereafter, and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Preferred Stock outstanding shal1 have been paid in full, the Company shall not:

(i) declare or pay dividends, or make any other distributions, on any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock;

(ii) declare or pay dividends, or make any other distributions, on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Preferred Stock, except dividends paid ratably on the Series A Preferred Stock and all such parity stock on which dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled;

(iii) redeem or purchase or otherwise acquire for consideration shares of any stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock, provided that the Company may at any time redeem. purchase or otherwise acquire shares of any such junior stock in exchange for shares of any stock of the Company ranking junior (either as to dividends or upon dissolution, liquidation or winding up) to the Series A Preferred Stock; or

(iv) redeem or purchase or otherwise acquire for consideration any shares of Series A Preferred Stock, or any shares of stock ranking on a parity with the Series A Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the Board of Directors) to all holders of such shares upon such terms as the Board of Directors, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective series and classes, shall determine in good faith will result in fair and equitable treatment among the respective series or classes.

(b) The Company shall not permit any subsidiary of the Company to purchase or otherwise acquire for consideration any shares of stock of the Company unless the Company could, under paragraph (a) of this Section 4, purchase or otherwise acquire such shares at such time and in such manner.

Section 5. Reacquired Shares. Any shares of Series A Preferred Stock purchased or otherwise acquired by the Company in any manner whatsoever shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become

authorized but unissued shares of preferred stock and may be reissued as part of a new series of preferred stock subject to the conditions and restrictions on issuance Set forth herein, in the Company's Articles of Incorporation, or in any other Certificate of Designation creating a series of preferred stock of the Company or any similar stock or as otherwise required by law.

Section 6. Liquidation. Dissolution or Winding Up. Upon any liquidation, dissolution or winding up of the Company, no distribution shall be made (1) to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock unless, prior thereto, the holders of shares of Series A Preferred Stock shall have received $1,000 per share, plus an amount equal to accrued and unpaid dividends and distributions thereon, whether or not declared, to the date of such payment, provided that the holders of shares of Series A Preferred Stock shall be entitled to receive an aggregate amount per share, subject to the provision for adjustment hereinafter set forth, equal to 1,000 times the aggregate amount to be distributed per share to holders of shares of Common Stock, or (2) to the holders of shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Preferred Stock, except distributions made ratably on the Series A Preferred Stock and all such parity stock in proportion to the total amounts to which the holders of such shares are entitled upon such liquidation, dissolution or winding up. In the event the Company shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the aggregate amount to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event under the proviso in clause (1) of the preceding sentence shall be adjusted by multiplying such amount by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event

Section 7. Consolidation, Merger, etc. In case the Company shall enter into any consolidation, merger, combination or other transaction in which the shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case each share of Series A Preferred Stock shall at the same time be similarly exchanged or changed into an amount per share, subject to the provision for adjustment hereinafter set forth, equal to 1,000 times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged. If the Company shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the amount set forth in the preceding sentence with respect to the exchange or change of shares of Series A Preferred Stock shall be adjusted by multiplying such amount by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

Section 8. No Redemption. The shares of Series A Preferred Stock shall not be redeemable

Section 9. Rank. The Series A Preferred Stock shall rank, with respect to the payment of dividends and the distribution of assets, junior to all series of any other class of the Company's preferred stock.

Section 10. Amendment. The Articles of Incorporation of the Company shall not be amended in any manner which would materially alter or change the powers, preferences or special rights of the Series A Preferred Stock so as to affect them adversely without the affirmative vote of the holders of at least two-thirds of the outstanding shares of Series A Preferred Stock, voting together as a single class.

Work Item 1241587100043

Original File Number 1232177200026

STATE OF MINNESOTA OFFICE OF THE SECRETARY OF STATE

FILED

06/28/2021 11:59 PM

Steve Simon Secretary of State

ARTICLES OF CORRECTION

The undersigned does hereby sign and acknowledge these Articles of Correction on behalf of Autoscope Technologies Corporation, a Minnesota corporation (the "Corporation"), in accordance with Minnesota Statutes, Section 5.16.

WHEREAS, the Articles of Amendment Amending and Restating the Articles of Incorporation of Autoscope Technologies Corporation (the "Articles of Amendment") were filed with the Minnesota Secretary of State on June 28, 202 1; and

WHEREAS, the last paragraph of the Articles of Amendment incorrectly stated the title of Frank G. Hallowell, who is and was the Chief Financial Officer of the Corporation signing the Articles of Amendment on behalf of the Corporation, as “the President and Chief Executive Officer" of the Corporation, although his title was correctly stated underneath his signature on the Articles of ,Amendment.

NOW, THEREFORE, Autoscope Technologies Corporation hereby corrects the last paragraph of the Articles of Amendment to read in its entirety as follows:

IN WITNESS WHEREOF, the undersigned, the Chief Financial Officer of Autoscope Technologies Corporation, being duly authorized on behalf of Autoscope Technologies Corporation, has executed this document as of the 25th day of June, 2021.

IN WITNESS WHEREOF, the undersigned does hereto set his hand as of the 26th day of July, 2021.

Autoscope Technologies Corporation

By: /s/ Frank G. Hallowell

Frank G. Hallowell

Chief Financial Officer

Work Item 1246534300031

Original File Number 1232177200026

STATE OF MINNESOTA OFFICE OF THE SECRETARY OF STATE

FILED

08/03/2021 11:59 PM

Steve Simon Secretary of State