Exhibit 5.3

October 15, 2009

US Oncology, Inc.

10101 Woodloch Forest

The Woodlands, TX 77380

Ladies and Gentlemen:

We have acted as local corporate counsel in the State of Kansas (the “State”) to AccessMED, LLC, a Kansas limited liability company (“AccessMED”) in connection with the Registration Statement on Form S-4 (the “Registration Statement”) filed by the Issuer and the subsidiary guarantors listed on Schedule I (the “Guarantors”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement includes a prospectus (the “Prospectus”) which provides for the issuance by the Issuer in an exchange offer (the “Exchange Offer”) of $775,000,000 aggregate principal amount of 9.125% Senior Secured Notes due 2017 (the “Exchange Notes”). The Exchange Notes will be offered by the Issuer in exchange for a like principal amount of the Issuer’s outstanding 9.125% Senior Secured Notes due 2017 (the “Original Notes”). The Exchange Notes are to be issued pursuant to an Indenture, dated as of June 18, 2009 (as amended, supplemented or modified through the date hereof, the “Indenture”), among the Issuer, the Guarantors and Wilmington Trust FSB, as trustee (the “Trustee”). Payment of the Exchange Notes will be guaranteed by AccessMED pursuant to Article X of the Indenture (the “Subsidiary Guarantee”).

The terms of the Subsidiary Guarantee is contained in the Indenture and the Subsidiary Guarantee will be issued pursuant to the Indenture. Capitalized terms used herein but not otherwise defined will have the meaning set forth in the Indenture.

We have examined such documents and made such other investigation as we have deemed appropriate to render the opinion set forth below. As to matters of fact material to our opinion, we have relied, without independent verification, on representations made in the Indenture, certificates and other documents and other inquiries of officers of the Issuer and AccessMED and of public officials.

October 15, 2009

Page 2

In our examination, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified or photostatic copies, and the authenticity of the originals of such copies. In making our examination of executed documents, we have assumed that the parties thereto, other than AccessMED, had or will have the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents and, except as set forth below, the validity and binding effect thereof on such parties.

Our opinions set forth herein are limited to the laws of the State that are applicable to securities of the type covered by the Registration Statement and, to the extent that judicial or regulatory orders or decrees or consents, approvals, licenses, authorizations, validations, filings, recordings or registrations with governmental authorities are relevant, to those required under such laws (all of the foregoing being referred to as “Opined on Law”). We do not express any opinion with respect to the law of any jurisdiction other than Opined on Law or as to the effect of any such non-opined-on law on the opinions herein stated.

Based upon the foregoing and subject to the additional qualifications set forth below, we are of the opinion that:

1. AccessMED is validly existing as a Kansas limited liability company and is in good standing under the laws of the State of Kansas.

2. The Subsidiary Guarantee has been duly authorized by all requisite corporate action of AccessMED.

3. When the Exchange Notes are executed and authenticated in accordance with the terms of the Indenture and delivered upon completion of the Exchange Offer, the Subsidiary Guarantee will constitute legal, valid and binding obligations of AccessMED, enforceable against AccessMED in accordance with its terms.

The opinions expressed herein are subject to (i) bankruptcy, insolvency, reorganization, receivership, liquidation, moratorium, fraudulent conveyance and other similar laws relating to or affecting the rights or remedies of creditors or secured parties generally and (ii) general principles of equity (regardless of whether considered in a proceeding in equity or at law).

October 15, 2009

Page 3

We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an exhibit to the Registration Statement and further consent to the filing of this opinion as an exhibit to the applications to securities commissioners for the various states of the United States for registration of the Exchange Notes and the Subsidiary Guarantee. We also consent to the reference to our firm under the caption “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Securities and Exchange Commission.

| Very truly yours, |

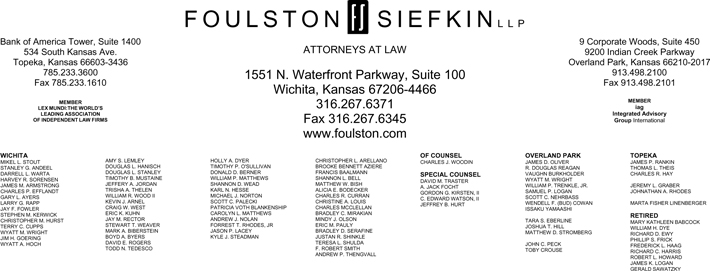

| /S/ FOULSTON SIEFKIN LLP |

| FOULSTON SIEFKIN LLP |