- STC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Stewart Information Services (STC) DEF 14ADefinitive proxy

Filed: 5 Apr 23, 4:30pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

SCHEDULE 14A

__________________

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

Stewart Information Services Corporation

(Name of Registrant as Specified In Its Charter)

________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

STEWART INFORMATION SERVICES CORPORATION

1360 Post Oak Boulevard, Suite 100

Houston, Texas 77056

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 17, 2023

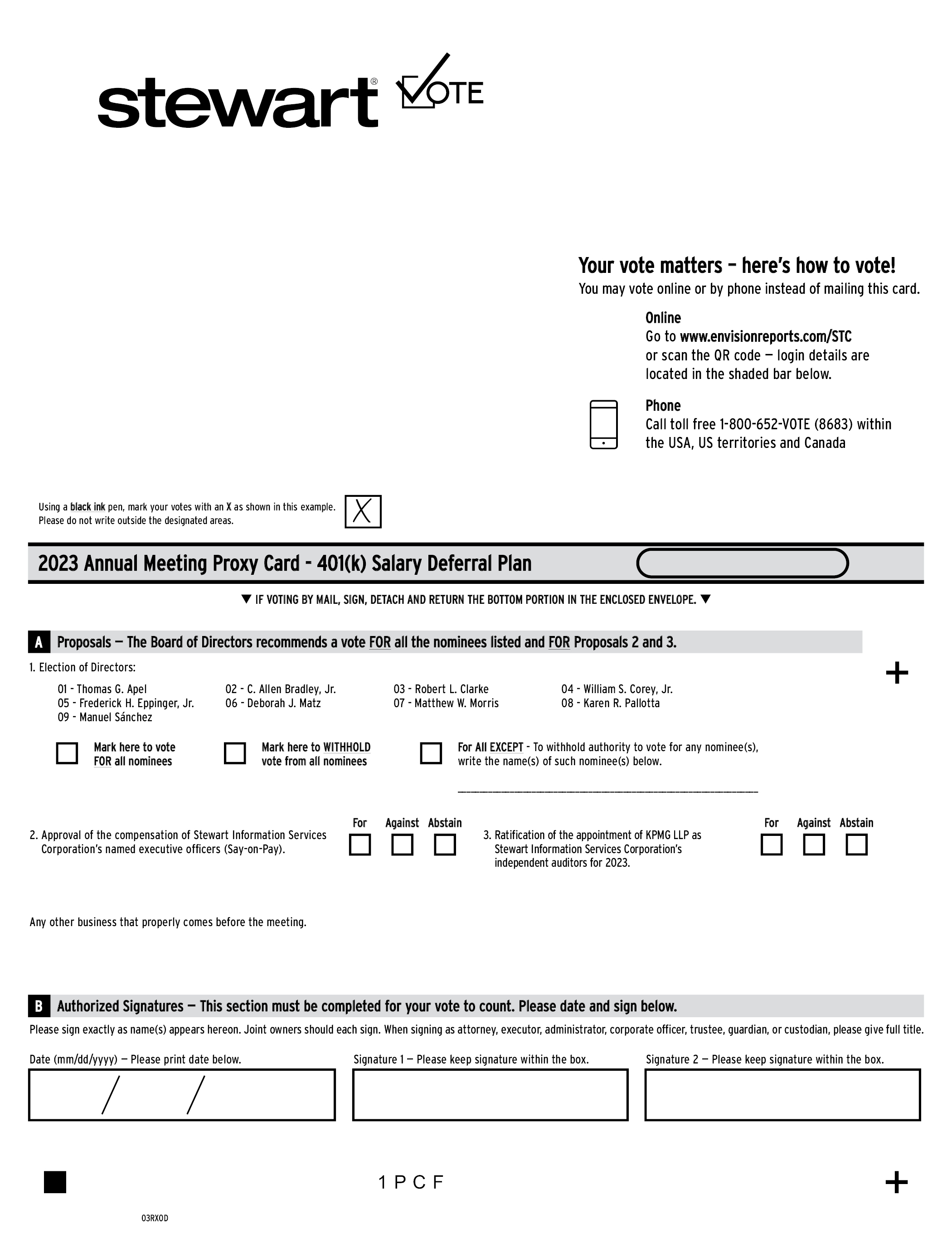

Notice is hereby given that Stewart Information Services Corporation, a Delaware corporation, will hold its 2023 Annual Meeting on Wednesday, May 17, 2023, at 8:30 a.m., Central Time. This year’s Annual Meeting will be a completely virtual meeting of stockholders, conducted solely online. There is no physical location for the Annual Meeting. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions during the meeting by visiting www.meetnow.global/MZ4JL6S and using the 15-digit control number provided on your Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card which are being delivered (by postal service or e-mail) to you on or around April 5, 2023. Details regarding how to participate in the meeting online and the business to be conducted at the Annual Meeting are more fully described in the accompanying proxy statement. This meeting is being held for the following purposes:

(1) To elect nine directors to the Stewart Information Services Corporation Board of Directors;

(2) To approve an advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers;

(3) To ratify the appointment of KPMG LLP as Stewart Information Services Corporation’s independent auditors for 2023; and

(4) To transact such other business as may properly come before the meeting or any adjournment(s) thereof.

In addition to the foregoing, the Annual Meeting will include the transaction of such other business as may properly come before the Annual Meeting, or any adjournment(s), continuation(s), rescheduling(s) or postponement(s) thereof.

The holders of record of Stewart Information Services Corporation Common Stock at the close of business on March 20, 2023, will be entitled to vote at the Annual Meeting.

As permitted by the Securities and Exchange Commission rules, the Company will furnish 2023 proxy materials over the Internet. On or around April 5, 2023, we are delivering (by postal service or e-mail) to most of our stockholders the Notice instead of a paper copy of our proxy materials, which includes the Notice of Annual Meeting, our Proxy Statement, our 2022 Annual Report and a proxy card or voting instruction form. The Notice contains instructions on how to access those documents on the Internet and how to cast your vote via the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials. All stockholders who do not receive the Notice will receive a paper copy of the proxy materials by postal service or by e-mail. If you receive a paper copy of our proxy materials, you can cast your vote by completing the enclosed proxy card and returning it in the postage-prepaid envelope provided, or by utilizing the telephone or Internet voting systems. Returning a signed proxy card or submitting a proxy over the Internet or by telephone will not affect your right to vote at the virtual Annual Meeting. Please submit your proxy promptly to avoid the expense of additional proxy solicitation.

By Order of the Board of Directors, | ||||||

| ||||||

Elizabeth K. Giddens | ||||||

April 5, 2023 | Corporate Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDERS’ MEETING TO BE HELD MAY 17, 2023

The proxy statement for the 2023 Annual Meeting and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available free of charge at:

For registered holders: www.envisionreports.com/STC

For beneficial holders: www.edocumentview.com/STC

IMPORTANT

You are cordially invited to attend the 2023 Annual Meeting online. YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Annual Meeting, please vote as soon as possible. As an alternative to voting at the 2023 Annual Meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing a completed proxy card. For detailed information regarding voting instructions, please refer to the section entitled “How You Can Vote” on page 3 of the proxy statement. You may revoke a previously delivered proxy at any time prior to the 2023 Annual Meeting. If you are a registered holder and decide to attend the 2023 Annual Meeting and wish to change your proxy vote, you may do so automatically by voting at the Annual Meeting.

TABLE OF CONTENTS

Page | ||

1 | ||

5 | ||

9 | ||

Environmental, Social and Governance (“ESG”) Responsibility & Commitment | 14 | |

16 | ||

18 | ||

33 | ||

40 | ||

42 | ||

46 | ||

47 | ||

48 | ||

49 | ||

Security Ownership of Certain Beneficial Owners and Management | 51 | |

53 | ||

54 | ||

54 | ||

54 |

i

STEWART INFORMATION SERVICES CORPORATION

1360 Post Oak Boulevard, Suite 100

Houston, Texas 77056

(713) 625-8100

PROXY STATEMENT FOR THE

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 17, 2023

Except as otherwise specifically noted, the “Company,” “Stewart,” “we,” “our,” “us,” and similar words in this proxy statement refer to Stewart Information Services Corporation.

Stewart Information Services Corporation is furnishing this proxy statement to our stockholders in connection with the solicitation by our board of directors (the “Board” or the “Board of Directors”) of proxies for the 2023 Annual Meeting of stockholders we are holding on Wednesday, May 17, 2023, at 8:30 a.m., Central Time (the “2023 Annual Meeting”), or for any adjournment(s) of that meeting.

As permitted by the Securities and Exchange Commission (“SEC”), we are providing most of our stockholders with access to our proxy materials over the Internet rather than in paper form. Accordingly, on or about April 5, 2023, we will deliver (by postal service or e-mail) to most stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the proxy materials over the Internet and mail printed copies of the proxy materials to the rest of our stockholders. If you receive the Notice by mail, you will not receive a printed copy of the proxy materials by postal delivery. Instead, the Notice instructs you on how to access and review all the important information contained in this proxy statement and our 2022 Annual Report to Stockholders. The Notice also instructs you on how to submit your proxy via the Internet. If you receive the Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Notice.

Record Date; Voting Rights; and Outstanding Shares

At the close of business on March 20, 2023 (the “Record Date”), 27,390,756 shares of our Common Stock were outstanding and entitled to vote, and only the holders of record on the Record Date may vote at the 2023 Annual Meeting. A quorum will exist if a majority of Common Stock issued and outstanding and entitled to vote, are present in person or represented by proxy. We will count the shares held by each stockholder who is present in person or represented by proxy at the meeting to determine the presence of a quorum at the meeting. Virtual attendance at our 2023 Annual Meeting constitutes presence in person for purposes of a quorum at the 2023 Annual Meeting.

Each holder of our Common Stock will be entitled to cast one vote per share for or against each of the director nominees.

Unless there are director nominees other than those nominated by the Board of Directors, a director nominee will be elected as a director if the votes cast for his or her election exceed votes cast against his or her election. In this case, any director nominee who does not receive a majority of votes cast “FOR” his or her election would be required to tender his or her resignation following the failure to receive the required vote. Pursuant to the Company’s By-Laws, if the Secretary of the Company determines that the number of director nominees exceeds the number of directors to be elected as of the date seven days prior to the scheduled mail date of this proxy statement, a plurality voting standard will apply and a director nominee receiving a plurality of votes cast will be elected as a director. For the purpose of electing directors, broker non-votes and abstentions are not treated as a vote cast affirmatively or negatively, and therefore will not affect the outcome of the election of directors. Both abstentions and broker non-votes are counted for purposes of determining the presence of a quorum. If your properly executed proxy does not specify how you want your shares voted, the shares represented by your proxy will be voted “FOR” each of the director nominees proposed by the Company.

Our stockholders will vote on the approval of the advisory resolution regarding the compensation of our named executive officers. Approval of this proposal requires the affirmative vote of the majority of the shares voted at the 2023 Annual Meeting. Brokers do not have discretionary authority to vote shares on this proposal without direction

1

from the beneficial owner. Broker non-votes will not be counted. Abstentions, which will be counted as shares present for purposes of determining a quorum, will not be considered in determining the results of the voting for this proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, the shares represented by your proxy will be voted “FOR” the approval of this proposal.

Our stockholders will vote on the ratification of the appointment of KPMG LLP as our independent auditors for 2023. The ratification of this proposal requires the affirmative vote of a majority of the shares voted at the 2023 Annual Meeting. Under New York Stock Exchange (“NYSE”) rules, the approval of our independent auditors is considered a routine matter, which means that brokerage firms may vote in their discretion on this proposal if the beneficial owners do not provide the brokerage firms with voting instructions. Abstentions, which will be counted as shares present for purposes of determining a quorum, will not be considered in determining the results of the voting for this proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, the shares represented by your proxy will be voted “FOR” the approval of this proposal.

With respect to all of the Proposals described above, if you hold your shares through the Company’s 401K Plan, and you do not timely vote, the trustee for the 401K Plan will vote the shares allocated to you in the same proportion as the shares that are voted by all other participants under the 401K Plan.

Whether or not you plan to attend the 2023 Annual Meeting, and whatever the number of shares you own, if you received proxy materials by mail please complete, sign, date and promptly return the enclosed proxy card. Please use the accompanying envelope, which requires no postage if mailed in the United States. You may also vote your shares by telephone or Internet by following the instructions on the enclosed proxy card. Please note, however, that if you wish to vote in person at the 2023 Annual Meeting and your shares are held of record by a broker, bank or other nominee, you must obtain a “legal” proxy issued in your name from that record holder.

If a proxy is duly granted and returned over the Internet, by telephone or by mailing a proxy card in the accompanying form, the shares represented by the proxy will be voted as directed. Unless you specify otherwise, the shares represented by your proxy will be voted (i) for the nine Board of Directors’ nominees proposed by the Company listed therein, (ii) for the approval of the advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers, and (iii) for the ratification of KPMG LLP as Stewart Information Services Corporation’s independent auditors for 2023.

Recommendation of the Board of Directors

The Board of Directors recommends that you vote:

• FOR the nine nominees for director proposed by the Company (Proposal 1);

• FOR the approval of the advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers (Proposal 2); and

• FOR the ratification of KPMG LLP as Stewart Information Services Corporation’s independent auditors for 2023 (Proposal 3).

Revocation of Proxies

You may revoke or change a previously delivered proxy at any time prior to its exercise at the 2023 Annual Meeting by the following methods:

• if you voted by Internet or telephone, by subsequent voting via the Internet or by telephone;

• by voting your shares electronically during the online 2023 Annual Meeting by using the “Cast Your Vote” link on the meeting site;

• if you have instructed a broker, bank or other nominee to vote your shares, by following the directions received from your broker, bank or other nominee to change those instructions; or

• mailing your request to our Secretary at Stewart Information Services Corporation, 1360 Post Oak Boulevard, Suite 100, Houston, Texas 77056, specifying such revocation, so that it is received no later than 4:00 p.m. Central Time, on May 16, 2023.

2

How You Can Vote

You may vote by attending the 2023 Annual Meeting which is being held virtually and voting at the meeting, or you may vote by submitting a proxy. If you are the record holder of your stock, you may submit your proxy via the Internet, by telephone or through the mail.

To vote via the Internet, follow the instructions on the Notice or go to the Internet address stated on your proxy card. To vote by telephone, call the number on your proxy card. If you receive only the Notice, you may follow the procedures outlined in the Notice, which contains instructions on how to vote via the Internet or receive a paper proxy card to vote by mail. Internet and telephone voting for Common Stock are available through 11:59 p.m. Eastern Time on May 16, 2023.

As an alternative to voting by telephone or via the Internet, you may vote by mail. If you receive only the Notice, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail. If you receive a paper copy of the proxy materials and wish to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-prepaid envelope. Proxy cards sent by mail, if received in time for voting and not revoked, will be voted at the Annual Meeting according to the instructions on the proxy cards. If no instructions are indicated, the shares represented by the proxy will be voted as set forth above under “Record Date; Voting Rights; and Outstanding Shares.”

If you hold your shares of our Common Stock in street name, you will receive the Notice from your broker, bank, or other nominee that includes instructions on how to vote your shares. Your broker, bank, or other nominee will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of this proxy statement and proxy card by following the instructions on the Notice provided by your broker, bank, or other nominee.

Stockholders who submit a proxy via the Internet should be aware that they may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by such stockholders. Stockholders who submit a proxy via the Internet or by telephone need not return a proxy card or the form forwarded by your broker, bank, or other nominee by mail.

Attending the 2023 Annual Meeting

The 2023 Annual Meeting will be completely virtual, conducted solely online at www.meetnow.global/MZ4JL6S. You are entitled to participate in the 2023 Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the 2023 Annual Meeting.

You will be able to attend the 2023 Annual Meeting online and may submit your questions during the meeting by visiting www.meetnow.global/MZ4JL6S. You will also be able to vote your shares online by attending the 2023 Annual Meeting. If you encounter technical difficulties accessing the virtual Annual Meeting, please call 1-888-724-2416 for common issues and questions.

To participate in the 2023 Annual Meeting virtually, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. You may also visit www.meetnow.global/MZ4JL6S and use the 15-digit control number provided on your Notice or proxy card which were mailed to you on or around April 5, 2023 to access additional information.

If you were a beneficial holder of record of our Common Stock as of the Record Date (i.e., you hold your shares in “street name” through an intermediary, such as a bank or broker), you must register in advance to virtually attend the 2023 Annual Meeting. To register, you must obtain a legal proxy, executed in your favor, from the holder of record and submit proof of your legal proxy reflecting the number of shares of our Common Stock you held as of the Record Date, along with your name and email address, to Computershare. Please forward the email from your broker or attach an image of your legal proxy to legalproxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 10, 2023. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to www.meetnow.global/MZ4JL6S and enter your 15-digit control number.

3

The Annual Meeting will begin promptly at 8:30 a.m., Central Time. We encourage you to access the virtual meeting platform prior to the start time leaving ample time for check-in. Please follow the registration instructions as outlined in this proxy statement.

During the meeting, registered holders will be able to submit questions by logging into the virtual platform at www.meetnow.global/MZ4JL6S and following the instructions within.

Questions pertinent to meeting matters will be answered during the 2023 Annual Meeting. The 2023 Annual Meeting is not to be used as a forum to present personal matters, or general economic, political, or other views that are not directly related to the business of Stewart and the matters properly before the 2023 Annual Meeting, and therefore questions on such matters will not be answered.

In accordance with our By-Laws, a complete list of stockholders entitled to vote at the 2023 Annual Meeting will be available for inspection by stockholders at our headquarters during normal business hours, during the 10 days prior to the 2023 Annual Meeting.

Registering to Attend the 2023 Annual Meeting

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the 2023 Annual Meeting virtually on the Internet. Please follow the instructions on the Notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the 2023 Annual Meeting virtually on the Internet.

To register to attend the 2023 Annual Meeting online you must submit proof of your proxy power (legal proxy) reflecting your Stewart holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 10, 2023.

You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to

legalproxy@computershare.com.

By mail*:

Computershare

Stewart Information Services Corporation Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Cost of Solicitation

We will bear the cost of the solicitation of our proxies. In addition to mail and e-mail, proxies may be solicited personally, via the Internet or by telephone or facsimile, or by a few of our employees and officers without additional compensation and by certain officers or employees of Innisfree M&A Incorporated (“Innisfree”). We have hired Innisfree, 501 Madison Avenue, 20th Floor, New York, NY 10022 to assist us in the solicitation of proxies for a fee of $9,500 plus out-of-pocket expenses.

Questions

If you have any questions or need assistance in voting your shares, please call Innisfree at 888-750-5834.

____________

* As stated above, you must include your email address in your request.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At our 2023 Annual Meeting, our stockholders will elect nine directors, constituting the entire Board of Directors. The Chairman of the Board is elected by the Board of Directors following the annual meeting of stockholders.

Director Nominees

The following persons have been nominated by the Board of Directors for election as directors by our stockholders. The persons named in your proxy intend to vote the proxy for the election of each of these nominees, unless you specify otherwise. Although we do not believe that any of these nominees will become unavailable, if one or more should become unavailable before the 2023 Annual Meeting, your proxy will be voted for another nominee, or other nominees, selected by our Board of Directors.

Nominee | Age | Position | Since | |||

Thomas G. Apel | 62 | Director and Chairman of the Board | 2009 | |||

C. Allen Bradley, Jr. | 71 | Director | 2016 | |||

Robert L. Clarke(1) | 80 | Director | 2004 | |||

William S. Corey, Jr. | 63 | Director | 2020 | |||

Frederick H. Eppinger, Jr. | 64 | Director and Chief Executive Officer | 2016 | |||

Deborah J. Matz | 72 | Director | 2020 | |||

Matthew W. Morris | 51 | Director | 2016 | |||

Karen R. Pallotta | 59 | Director | 2019 | |||

Manuel Sánchez | 57 | Director | 2019 |

____________

(1) Under our Guidelines on Corporate Governance, directors are generally expected to retire at age 80. The Board may waive this age limitation in special circumstances. After careful consideration as to the mix of skills, experience and other characteristics that is desired by the Board to ensure optimal performance, the Board, in consultation with the Nominating and Corporate Governance Committee, has decided that it is in the best interest of the Company to waive Mr. Clarke’s mandatory retirement at age 80 so that he may stand for reelection this year. Mr. Clarke’s extensive experience in legal, regulatory, and corporate governance matters, as well as his in-depth knowledge of banking and finance were considered in making this decision. Mr. Clarke recused himself from all Board discussions of the waiver and abstained from the vote.

All director nominees were elected as a director at our 2022 annual meeting of stockholders.

Thomas G. Apel is the Chairman of the Board. He is Chief Executive Officer (“CEO”) of Adfitech, Inc., a recognized leader in mortgage services located in Edmond, Oklahoma. He serves on the board of Parlance Corp., a leading provider of speech recognition and natural language processing enabled telecommunication technology for over 25 years, as well as the Board and Compensation Committee of CompSource Mutual Insurance Company. Until December of 2019, he also served as a research affiliate with the Massachusetts Institute of Technology (MIT), focused on business model taxonomy, corporate board effectiveness, and IT portfolio strategies. From 2006 until January 1, 2013, Mr. Apel was President of Intrepid Ideas Inc., a product development, technology evaluation, and business strategy-consulting firm for financial services and real estate finance companies. Additionally, from 2006 to September 2009, Mr. Apel served as Chairman of Adfitech, Inc. Prior to 2006, he served as President and CEO of Centex Title and Ancillary Services, and was responsible for management, strategy development and implementation of a highly profitable business unit containing national title, escrow, title insurance and property and casualty insurance operations. His background also includes extensive experience in technology, mortgage lending, and related real estate lending operations.

Qualifications: Mr. Apel has significant knowledge and experience in the mortgage, title, insurance and technology industries, as well as in corporate management, strategy, finance and start-up businesses. His familiarity with mortgage and other real estate lending provides a valuable perspective on one of the Company’s essential customer segments.

5

C. Allen Bradley, Jr. served as executive chairman of Amerisafe, Inc. from 2005 to 2016. He served at Amerisafe as CEO from 2003 to 2015 and president from 2002 to 2008. Additionally, Mr. Bradley served in the role of Executive Vice President and General Counsel from 1996 to 2000. As Executive Vice President - Operations from 1994 to 1996, he managed operations for Mor-Tem Systems, Inc.

Mr. Bradley practiced law in Louisiana from 1976 to 1994 and was elected to the Louisiana House of Representatives, where he served as a state representative from 1984 to 1992. He also served on the board of the National Council on Compensation Insurance, Inc. from 2012 to 2016, and is a past board member of Amerisafe, Inc. He earned his Bachelor of Arts at Southeastern Louisiana University. He was awarded his Juris Doctor degree from Louisiana State University. Mr. Bradley formerly served as a member of the Board of Directors and the Audit Committee of Tiberius Acquisition Corporation (a special purpose acquisition company) and on the Board of Directors, Audit, Nominating and Corporate Governance, and Compensation Committees of Acacia Research Corporation (NASDAQ: ACTG).

Qualifications: Having served for over 26 years in corporate leadership positions, Mr. Bradley has extensive financial, legal, and operational expertise. Given his comprehensive knowledge of the insurance industry and appreciation of the title industry, his contributions and insights bring substantial value to the Company.

Robert L. Clarke serves as Chair of the Audit Committee. He is a retired partner of Bracewell LLP, where he founded the law firm’s national and international financial services practice. Mr. Clarke was appointed U.S. Comptroller of the Currency by President Ronald Reagan in 1985 and served until 1992 under Presidents Reagan and George H. W. Bush. He has extensive experience in bank ownership and operations, and expert knowledge of banking laws, regulations, and supervision, both in the U.S. and internationally.

Mr. Clarke has previously served as a consultant to the World Bank, as senior advisor to the President of the National Bank of Poland and as a Director of the Dubai Financial Services Authority. Mr. Clarke has also previously served as an Advisory Director of Mutual of Omaha Bank (2016-2019), a director and member of the Audit and Nominating and Corporate Governance Committees of the board of directors of Eagle Materials Inc., a NYSE-listed manufacturer of building materials (1994-2016), and as Chair of the Risk Committee and member of the Audit Committee of Mutual of Omaha Insurance Company (2006-2016). Mr. Clarke is a Trustee Emeritus of Rice University from which he received its Distinguished Alumnus and Gold Medal awards and continues to serve as a member of its Audit and Public Affairs Committees. Additionally, Mr. Clarke is a Trustee and Treasurer of the Santa Fe Chamber Music Festival and a Trustee of its supporting Foundation, an Advisory Trustee of the Museum of New Mexico Foundation, and a Trustee of the Financial Services Volunteer Corps. He received a Bachelor of Arts in economics from Rice University, and an LL.B. from Harvard Law School.

Qualifications: Mr. Clarke is a veteran attorney and banking professional with extensive experience in legal, regulatory, and corporate governance matters. His tenure in the U.S. government, along with his in-depth knowledge of banking and finance, as well as his prior board service, provide valued expertise to the Company.

William S. Corey, Jr. served as an Audit, Senior Relationship and National Pursuit Team Partner for PricewaterhouseCoopers LLP (“PwC”) from 2002 to 2020. He led the audit practice and served as office managing partner for PwC’s Baltimore office for over 11 years. He is on the Board of GSE Systems, Inc. (NASDAQ: GVP), and serves as Chair of the Audit Committee, and as a member of both the Compensation and Nominating and Corporate Governance Committees. Additionally, Mr. Corey is also on the Board of Directors for Fundbox, Ltd., where he serves as Chair of the Audit Committee and is a member of both the Compensation and Nominating and Corporate Governance Committees. He also serves on the LP Advisory Committee for Squadra Ventures, and the Board of Advisors for StepStone VC Global Partners, L.P. and StepStone VC Diversity, L.P., all Venture Capital Funds located in the Baltimore, Maryland area. Mr. Corey is currently on the Board of Directors of the Port Discovery Children’s Museum and on the Board of Advisors of the James Madison University College of Business.

Mr. Corey is a certified public accountant licensed in Maryland, has over 37 years of experience in public accounting with extensive experience in auditing SEC registrants, financial reporting, complex accounting, and internal controls evaluation. Prior to his PwC roles, he served as an audit partner at Arthur Andersen LLP from 1995 to 2002 and served in other roles in its Audit Practice from 1982 to 1995. Mr. Corey graduated with honors from James Madison University with a Bachelor of Business Administration in accounting and finance and a minor in economics in 1982.

6

Qualifications: For over 37 years, Mr. Corey audited public and large private companies, and advised boards of directors and audit committees on financial reporting, internal controls, internal and external investigations, disaster recovery, regulatory reviews and cyber-attacks. Additionally, he is highly qualified as a “Financial Expert” for all public company audit committee and audit committee chair requirements. Having traveled extensively for clients around the world, he possesses a global perspective, and he has a proven ability to work collaboratively with management and board members. Mr. Corey’s financial insights and his expertise in risk and audit matters brings added depth and strength to the Board.

Frederick H. Eppinger serves as the CEO of the Company. Mr. Eppinger is an accomplished insurance industry veteran with more than 35 years of experience. He has served as a Stewart director since 2016 and is currently a director at Centene Corp. Until December 2019, he also served as a director of QBE Insurance Group Limited. Before joining Stewart, he served as president and CEO of The Hanover Insurance Group from 2003 until his retirement in 2016. Under his leadership, Hanover transformed into a property/casualty carrier with global reach, more than doubling the company’s employees and revenues.

From 2001 to 2003, Mr. Eppinger was executive vice president of Property and Casualty Field and Service Operations for The Hartford Financial Service Group. From 2000 to 2001, he was executive vice president of industry services, marketing and service operations for Channel Point, Inc., a business-to-business technology firm for insurance companies. Mr. Eppinger was a senior director and partner at the consulting firm of McKinsey & Co. from 1985 to 2000, where he was a leader in the insurance, financial services and health practices, and worked closely with insurance CEOs. Mr. Eppinger earned his Bachelor of Arts from the College of the Holy Cross and a Master of Business Administration from Dartmouth.

Qualifications: Mr. Eppinger has more than 30 years of experience in the insurance industry. As CEO of Hanover Insurance, Mr. Eppinger led the company’s growth from its regional status to a global property/casualty carrier.

Deborah J. Matz is a member of the Board of Advisors of elphi, a start-up up company that uses cutting edge technology to streamline the mortgage lending process. She also serves as an Advisor to RenoFi, a start-up that has developed a platform which enables financial institutions to make consumer home renovation loans based on the post-renovation value of the homes. From 2016 to 2020, she was a director for Mutual of Omaha Bank (“MO”), was vice chair of the Risk and Compliance Committee, and a member of the Audit and Compensation Committees. Prior to her tenure as director for MO, in 2009 she was appointed by President Barack Obama to serve as Board Chair for the National Credit Union Administration (“NCUA”) and was confirmed unanimously by the U.S. Senate. She served in that position until 2016. As NCUA Board Chair, Ms. Matz headed the independent agency that charters, regulates, and supervises federal credit unions and insures all federally insured credit unions. Together the credit unions that she supervised held $1.2 trillion in assets. At NCUA, Ms. Matz oversaw the implementation of a cyber regime to protect privacy, safeguard NCUA’s systems from viable intrusion and establish protocols for redundant operations and breakdowns in service.

As one of 10 voting members of the Financial Stability Oversight Council (FSOC), Ms. Matz served alongside the U.S. Secretary of the Treasury, the Chairman of the Federal Reserve Board of Governors, the Chairman of the SEC, the Chairman of the FDIC, the Director of the Consumer Financial Protection Bureau, and the leaders of other financial regulatory agencies. Ms. Matz worked on Capitol Hill for 12 years in various capacities, including 9 years as an economist with the Congressional Joint Economic Committee. Ms. Matz earned a Master’s Degree in political science and government from George Washington University, and a Bachelor’s Degree in labor and industrial relations from Cornell University.

Qualifications: Ms. Matz has extensive experience in regulatory oversight and risk management. As a leader, she instituted policies to enhance financial stability, workforce diversity and to improve cyber- and technological security. She is an effective, results-driven, visionary leader who embraces change and innovation, builds consensus, and applies the highest standards of governance. Her background and expertise brings valuable insight to Board discussions and decisions.

Matthew W. Morris served as CEO of Stewart Information Services Corporation from 2011 to September 9, 2019, and as President from September 9, 2019 to January 15, 2020. Before that, he served in various executive management positions for the Company, Stewart Title Company, and Stewart Title Guaranty Company.

7

Mr. Morris is the founder and CEO of Lutroco, LLC, a private firm targeting purpose driven strategic opportunities and also serves on the Board of Directors of both Stabilis Solutions, Inc. where he is on the Audit and Compensation Committees, as well as the Cornerstone Strategic Value Fund, Inc. and Cornerstone Total Return Fund, Inc. where he is a member of the Audit and Nominating and Corporate Governance Committees. He previously served as director for a strategic litigation consulting firm, offering trial, settlement sciences, crisis management, and communications strategy.

Mr. Morris received a Bachelor of Business Administration in organizational behavior and business policy from Southern Methodist University and a Master of Business Administration with a concentration in finance from The University of Texas.

Qualifications: As a member of the Company’s founding family, and his time in executive management with the Company, Mr. Morris has intimate knowledge of the Company’s associates, operations, legal and regulatory matters, and history. The Company benefits from his business experience, his highly respected leadership, and his extensive knowledge of the title industry.

Karen Pallotta has been a director of Stewart since 2019. Ms. Pallotta is currently the President of KRP Advisory Services, a firm that she founded in 2012. Prior to that, Ms. Pallotta was employed at Fannie Mae for more than 20 years in progressive positions of leadership until her retirement in 2011. At Fannie Mae she most recently served as Executive Vice President of the Single Family Credit Guaranty division running the company’s largest business segment, and had direct responsibility for managing the firm’s $2.5 trillion guaranteed mortgages and overseeing all aspects of the acquisition and securitization of $50 billion in mortgages each month. In this role, Ms. Pallotta also served on the company’s eight-member executive committee comprising the company’s top executives responsible for setting the overall strategic direction of the firm. During her decades at the company, she held many prior executive positions with responsibility for risk management, product development, sales and marketing, customer technology, transaction management and credit guaranty pricing. Most recently, Ms. Pallotta served on the Board of Directors of Redwood Trust (NYSE: RWT) and as a member of their Audit and Compensation committees.

Ms. Pallotta received her Bachelor of Arts degree from the Pennsylvania State University in University Park, Pennsylvania and her Master of Business Administration from the University of Maryland in College Park, Maryland.

Qualifications: Ms. Pallotta has more than 30 years of management experience in financial services, risk management and mortgage banking. The industry knowledge she brings is a tremendous asset to Stewart as the Company focuses on growth strategies going forward.

Manuel Sánchez was chairman and CEO of BBVA Compass for 10 years, during which time he served as director of the American Bankers Association, the Institute of International Bankers and the Greater Houston Partnership. He previously served as a director at Elevate Credit (NYSE: ELVT) and is currently a director at Fannie Mae. The Murcia, Spain native currently teaches disruption in financial services at Rice University’s Jones School of Business. Mr. Sánchez also served on the Board of Directors of OnDeck Capital and BanCoppel from 2018 to 2021.

In his 27-year banking career, he has held executive roles in risk management, real estate, correspondent, community, corporate and investment banking. A graduate of Yale University, Sánchez earned master’s degrees in international relations from the London School of Economics and in advanced European economics from the College of Europe in Bruges, Belgium. A naturalized U.S. citizen, he lives in Houston with his wife and three children.

Qualifications: Mr. Sánchez brings to the Stewart board more than 28 years of experience in the banking industry, working in the U.S., Mexico, France and Spain, having served in executive roles in risk management, real estate, correspondent, community, corporate and investment banking. His global insight, as well as his in-depth knowledge of banking and finance, provide valued expertise to the Company.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE ABOVE NINE NOMINEES FOR DIRECTOR.

8

CORPORATE GOVERNANCE

Board of Directors

We are currently managed by a Board of Directors comprised of nine members, the majority of whom are “independent” within the meaning of the listing standards of the NYSE. Assuming the election of the 2023 director slate set proposed by the Company and described above, these independent directors are: Thomas G. Apel, William S. Corey, Jr., Robert L. Clarke, C. Allen Bradley, Jr., Deborah J. Matz, Karen R. Pallotta and Manuel Sánchez. The Board of Directors has determined that none of these directors has any material relationship with us or our management that would impair the independence of their judgment in carrying out their responsibilities to us.

The roles of Chairman of the Board and CEO are separate, and each role is held by a different individual. The Chairman of the Board is elected by the Board of Directors following the annual meeting of stockholders. As discussed below, the Chairman of the Board presides over the regular and any special meetings of our non-management directors. Our non-management directors meet after each regularly scheduled Board meeting.

All of our directors shall be elected at the 2023 Annual Meeting and hold office until the next annual election of directors or until his or her successor shall be chosen and shall be qualified, or until his or her death or the effective date of his or her resignation or removal for cause. Currently, the act of the majority of a quorum of the directors shall be the act of the Board of Directors, except as may be otherwise specifically provided by statute, the Certificate of Incorporation, or the By-Laws.

The Company has a majority voting standard such that votes cast for any director must exceed the votes cast against such director in an uncontested election. The Company also requires a director who fails to receive a majority vote in an uncontested election to tender his or her resignation. Under the Company’s By-Laws, in a contested election (i.e., where the Secretary of the Company determines that the number of nominees exceeds the number of directors to be elected as of the date seven days prior to the scheduled mailing date of the proxy statement for such annual meeting of stockholders), the plurality voting standard would apply and a director nominee receiving a plurality of votes cast will be elected as a director. During 2022, the Board of Directors held six regular meetings, and executed twelve consents in lieu of meetings. Additionally, in 2022, each of our directors attended all of the meetings of our Board of Directors and all of the Board of Director’s committee meetings for the committee(s) on which that director served.

The Board of Directors has adopted the Stewart Code of Business Conduct and Ethics, Guidelines on Corporate Governance, and Code of Ethics for Chief Executive Officer, Principal Financial Officer, and Principal Accounting Officer, each of which is available on our website at stewart.com/corporate-governance and in print to any stockholder who requests it. In 2022, we updated the Code of Business Conduct and Ethics to specifically prohibit the Company’s funds from being used for contributions to political campaigns. We intend to disclose any amendment to or waiver under our Code of Ethics for Chief Executive Officer, Principal Financial Officer, and Principal Accounting Officer by posting such information on our website. In 2022, we had no such waivers. Our Guidelines on Corporate Governance and the charters of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee are available on our website at stewart.com/corporate-governance and in print to any stockholder who requests them. Our Guidelines on Corporate Governance strongly encourage attendance in person by our directors at our annual meetings of stockholders. All of our then elected directors attended our 2022 annual meeting of stockholders.

Director Qualifications

Each of our directors is an individual of high character and integrity, with an inquiring mind, and works well with others. Each director nominee brings a unique background and set of skills to the Board, giving the Board of Directors, as a whole, competence and experience in a wide variety of areas, including insurance, real estate, technology, strategic planning, corporate governance, executive management, accounting, finance, government and international business. For information regarding the qualifications, backgrounds, and experience of our director nominees, please see each nominee’s biographical information set forth in “Proposal 1” above.

Pursuant to our Guidelines on Corporate Governance, the Board of Directors has adopted a director education policy in order to encourage our directors to periodically attend director continuing education programs. Under the policy, a stipend is available to directors for purposes of attending continuing education programs consistent with their

9

duties as directors, and we also reimburse directors for reasonable expenses incurred to attend such programs. The Company and each director are members of the National Association of Corporate Directors (“NACD”). As members of NACD, our directors have access to various educational programs, materials, and reports. In addition to encouraging director education through external programs, the Board of Directors also routinely incorporates educational topics into its meeting agendas.

Risk Oversight

The Board of Directors has ultimate responsibility for protecting value for all stakeholders. Among other things, the Board of Directors is responsible for understanding the risks to which we are exposed, approving management’s strategy to manage these risks, and monitoring and measuring management’s performance in implementing the strategy. The Board of Directors works with its committees and management to effectively implement its risk oversight role.

The Audit Committee, with the assistance of management, oversees the risks associated with the integrity of our financial statements, our compliance with legal and regulatory requirements, our liquidity requirements, cybersecurity protections and procedures, other exposures to financial risk, and the Company’s enterprise risk management program. The Audit Committee reviews with management, independent accountants, and internal auditors (which internal audit function has been outsourced to Deloitte & Touche LLP) the accounting policies, the systems of internal controls and the quality and appropriateness of disclosure and content in the financial statements or other external financial communications. The Audit Committee, with the assistance of our legal and human resources departments, also performs oversight of our various conduct and ethics programs and policies, including the Stewart Code of Business Conduct and Ethics, reviews these programs and policies and monitors the results of our compliance efforts. To the extent the Audit Committee identifies any material risks or related issues, the risks or issues are addressed with the full Board of Directors.

Stewart and its Board of Directors recognizes the importance of protecting our clients’ and partners’ privacy, confidentiality, and data integrity. As such, we continuously and methodically evaluate cyber risks, monitor how they evolve, and evaluate their impact. Our Chief Information Security Officer reports quarterly to the Audit Committee concerning the Company’s cybersecurity program and operations.

The Nominating and Corporate Governance Committee, with the assistance of management, oversees risks associated with administering our Guidelines on Corporate Governance and is responsible for reviewing and making recommendations for selection of nominees for election as directors by our stockholders and reviewing the various governance policies affecting the Company, including the Company’s Environmental, Social and Governance policies and practices. To the extent the Nominating and Corporate Governance Committee identifies any material risks or related issues, the risks or issues are addressed with the full Board of Directors.

The Compensation Committee, with the assistance of management, oversees risks associated with our compensation programs and policies. To the extent the Compensation Committee identifies any material risks or related issues, the risks or issues are addressed with the full Board of Directors.

Committees of the Board of Directors

For 2023, the Board of Directors will have the following committees (the “Committees”): an Audit Committee, a Nominating and Corporate Governance Committee, and a Compensation Committee.

Audit Committee. The Audit Committee’s duty is to assist the Board of Directors in fulfilling its oversight responsibility of

• the integrity of the financial statements of the Company;

• the independent registered accountants’ qualifications, independence, and performance;

• the Company’s system of controls over financial reporting, performance of its internal audit function and the independent registered accountants, and compliance with ethical standards adopted by the Company;

• the compliance by the Company with legal and regulatory requirements; and

• the procedures relating to the Company’s cybersecurity and data oversight.

10

The Audit Committee has sole authority to appoint or replace our independent registered accountants. The Audit Committee has the authority to engage independent counsel and other advisors as it determines necessary to carry out its duties. For a complete list of the Audit Committee’s responsibilities, please see the Audit Committee charter adopted by our Board of Directors, which is available on our website at stewart.com/corporate-governance. The Audit Committee currently consists of Robert L. Clarke (Chair), William S. Corey, Deborah Matz, and Manuel Sánchez.

During 2022, the Audit Committee held nine regular meetings, at which all members were present. Each of the members of the Audit Committee is “independent” as defined under the listing standards of the NYSE and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Board of Directors has determined that each of the members of the Audit Committee is an “audit committee financial expert” as defined in the rules of the SEC. No member of our Audit Committee serves on the audit committees of more than three public companies.

The Audit Committee has established procedures for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls and auditing matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Persons wishing to communicate with the Audit Committee may do so by writing in care of the Chair, Audit Committee, Stewart Information Services Corporation, 1360 Post Oak Boulevard, Suite 100, Houston, Texas 77056.

Nominating and Corporate Governance Committee. It is the Nominating and Corporate Governance Committee’s duty to

• identify individuals who may become Board members or advisory directors;

• select or recommend director nominees for the next annual meeting of stockholders;

• develop and recommend to the Board of Directors a set of corporate governance principles applicable to the Company;

• provide oversight of the Company’s corporate governance;

• oversee the evaluation of the Board of Directors, its Committees and management; and

• review and evaluate the Company’s Environmental, Social and Governance policies and practices.

The Nominating and Corporate Governance Committee currently consists of C. Allen Bradley, Jr. (Chair), Deborah Matz, Karen R. Pallotta, and Manuel Sánchez, each of whom is “independent” as that term is defined in the listing standards of the NYSE. The Nominating and Corporate Governance Committee held five meetings during 2022, at which all members were present. For a complete list of the responsibilities of the Nominating and Corporate Governance Committee, please see our Nominating and Corporate Governance Committee’s charter, which is available on our website at stewart.com/corporate-governance.

Our Guidelines on Corporate Governance require that a majority of our Board of Directors be “independent” as that term is defined in the rules of the NYSE. As described above, a majority of our current Board of Directors is “independent” under the listing standards of the NYSE. In considering candidates for election as independent directors, our Guidelines on Corporate Governance also provide that the Nominating and Corporate Governance Committee shall be guided by the following principles:

• Each director should be an individual of the highest character and integrity and have an inquiring mind, experience at a strategic or policy-setting level, or otherwise possess a high level of specialized expertise, and the ability to work well with others. Special expertise or experience that will benefit the growth of the Company’s business is particularly desirable.

• Each director should have sufficient time available to devote to the affairs of the Company in order to carry out the responsibilities of a director and, absent special circumstances approved by the Board of Directors; no director should simultaneously serve on the board of directors of more than three other entities, excluding non-public companies such as those related to personal or family business and charitable,

11

educational or other non-profit entities. Directors are not qualified for service on the Board of Directors unless they are able to make a commitment to prepare for, and attend, meetings of the Board of Directors and its committees on a regular basis.

• Each independent director should be free of any significant conflict of interest that would interfere with the independence and proper performance of the responsibilities of a director. Directors to be nominated for election by the holders of Company Common Stock should not be chosen as representatives of a constituent group or organization; rather, each should utilize his or her unique experience and background to represent and act in the best interests of all stockholders as a group.

• Each director is required to have equity ownership in the Company.

While the Board of Directors does not have a formal quantitative policy with respect to Board nominee diversity, the Nominating and Corporate Governance Committee of the Board of Directors considers Board diversity an integral part of the nominating selection process. In recommending proposed nominees to the full Board of Directors, the Nominating and Corporate Governance Committee is charged with building and maintaining a Board that has an ideal mix of talent and experience to achieve our business objectives in the current environment. In particular, the Nominating and Corporate Governance Committee is focused on relevant subject matter expertise, depth of knowledge in key areas that are important to us, and diversity of thought, background, perspective, and experience as well as diversity including, but not limited to race, gender, national origin, age and sexual orientation so as to facilitate robust debate and broad thinking on strategies and tactics pursued by us. There are no minimum requirements for nomination. For further information on director qualification, see our Guidelines on Corporate Governance located at stewart.com/corporate-governance.

In March 2023, we engaged a search firm to identify and present new candidates for director, with priorities of increasing the gender diversity of the Board and adding additional areas of expertise and experience. The Nominating and Corporate Governance Committee is overseeing the search with the goal of expeditiously adding a director and, in any case, before the end of 2023. If a suitable candidate is identified, we expect that the Board will expand its size to ten directors.

Pursuant to our By-Laws, the Nominating and Corporate Governance Committee will accept and consider director nominations made by stockholders. To be considered for nomination at our 2024 annual meeting of stockholders, stockholder nominations must be received by us no later than February 17, 2024, and no earlier than January 18, 2024. In addition to satisfying the foregoing requirements under our By-Laws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

Persons wishing to submit the names of candidates for consideration by the Nominating and Corporate Governance Committee may submit such nominations in writing addressed to the Nominating and Corporate Governance Committee in care of the Secretary, Stewart Information Services Corporation, 1360 Post Oak Boulevard, Suite 100, Houston, Texas 77056. Any such submission should include the information required by our By-Laws, including the candidate’s name, credentials, contact information and consent to be considered as a candidate.

Compensation Committee. It is the duty of the Compensation Committee to assist the Board of Directors in discharging its responsibilities relating to the Company’s compensation policies, the compensation of the Company’s officers and senior managers, and to produce the required report on executive compensation for inclusion in the Company’s annual proxy statement. The Compensation Committee currently consists of Karen R. Pallotta (Chair), Thomas G. Apel, and William S. Corey. During 2022, the Compensation Committee held five meetings, at which all members were present, and executed three consents in lieu of meetings. Our Board of Directors has determined that each member of our Compensation Committee is “independent” as that term is defined under the listing standards of the NYSE.

For a complete list of the responsibilities of the Compensation Committee, please see our Compensation Committee charter, which is available on our website at stewart.com/corporate-governance. The Compensation Committee’s specific duties and responsibilities include, but are not limited to, the following:

• Establishing and monitoring the basic philosophy and policies governing the compensation of executive officers and employees or officers of the Company who are also serving as members of the Board of Directors;

12

• Reviewing recommendations submitted by the CEO, then approving and submitting to the Board of Directors for formal ratification any decisions with respect to the compensation for executive officers and officers of the Company who also are serving as members of the Board of Directors. These recommendations may include base pay, incentive compensation plans, perquisites, equity-based plans and relevant metrics and target award levels;

• Approving and submitting to the Board of Directors for formal ratification compensation decisions with respect to the compensation plan of the CEO;

• Recommending a pay-for-performance based CEO compensation plan to the Board of Directors and overseeing administration of the plan, including evaluating the CEO’s performance in light of the goals under the plan;

• Reviewing and approving employment agreements, severance agreements and change in control agreements with the executive officers and any employees or officers of the Company who are also serving as members of the Board of Directors;

• Reviewing the overall compensation structure and programs for all employees (including a review of any risks to the Company that may arise from such structure or programs);

• Approving the equity-based compensation plans of the Company; and

• Reviewing and discussing with management the disclosures in this proxy statement’s Compensation Discussion and Analysis (the “CD&A”), making a recommendation to the Board of Directors regarding the inclusion of the CD&A in this proxy statement, and producing a Compensation Committee Report for inclusion in the Company’s proxy statement, each in accordance with the requirements of the SEC.

In addition, the Compensation Committee has the sole authority to retain and terminate any independent compensation consultant. The Compensation Committee is responsible for determining the independence of its advisors by taking into consideration all factors relevant to advisor independence, including the factors set forth in the NYSE Listed Company Manual. The Compensation Committee has authority to direct the work of the compensation consultants and establish the consultants’ fees. It may also obtain advice and assistance from other advisors it determines necessary for effective completion of its duties. The Company is required to fund (i) the Compensation Committee’s approved expenses for any independent advisors employed by the Compensation Committee, and (ii) any other reasonable expenses incurred by the Compensation Committee.

Share Ownership Guidelines; Restrictions on Trading in Company Securities

In an effort to more closely link our non-employee directors’ financial interests with those of our stockholders, our Board established share ownership guidelines for our non-management directors. Each director is required to own an amount of Common Stock equal to a multiple of five times the stock portion of the annual director retainer. Each director has five years from initial election to acquire the required amount of Common Stock. Currently, five of the nine directors hold shares in excess of the shares required to meet the ownership guideline. The acquisition period for the remaining four shorter-tenured directors has not expired and each is progressing appropriately toward the required holdings.

Because short-range speculation in our securities based on fluctuations in the market may cause conflicts of interests with our stockholders, our Securities Trading and Investment Policy, applicable to our directors, executive officers (including the Named Executive Officers (as defined herein)) and all other employees prohibits trading in options, warrants, and puts and calls related to our securities and prohibits selling our securities short, holding our securities in margin accounts or pledging our securities as collateral for a loan except under very limited circumstances. Further, our Securities Trading and Investment Policy contains an anti-hedging policy that prohibits our directors, executive officers (including the Named Executive Officers) and all other employees from entering into hedging transactions, such as zero-cost collars and forward sale contracts, that are designed to hedge or offset any decrease in the market value of Company securities.

13

Compensation Committee Interlocks and Insider Participation

During 2022, the Compensation Committee members were Karen R. Pallotta (Chair), Thomas G. Apel, and William S. Corey. None of the current or former members of the Compensation Committee is a former or current officer or employee of the Company or any of its subsidiaries. None of our executive officers currently serve, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee. Please refer to “Certain Transactions” for information regarding Mr. Apel.

Sessions of Non-Management Directors

Our non-management directors meet at regularly scheduled sessions. The Chairman of the Board presides at those sessions. Persons wishing to communicate with our non-management directors may do so by writing in care of the Chair, Audit Committee, Stewart Information Services Corporation, 1360 Post Oak Boulevard, Suite 100, Houston, Texas 77056. Persons wishing to communicate with our other directors may do so by writing in care of the Secretary, Stewart Information Services Corporation, at the same address.

Environmental, Social and Governance (“ESG”) Responsibility & Commitment

The Role of Sustainability in Our Journey

As we map the future of the Company and its employees, we recognize the role we play in our customers’ businesses, our industry, and the greater world community. As part of our corporate responsibility commitment, we intend to soon publish the third edition of our Environmental, Social and Governance Report which can be found at stewart.com/sustainability. We view the ESG Report and the work that forms its core as central to our path ahead. Our ESG Committee, with representation from each of our business units and internal support services, will continue to guide us on this journey. We recently established the ESG Executive Leadership Council which is comprised of the Chief Legal Officer, the Chief Human Resources Officer, and the Controller, who oversee the ESG Committee. The ESG Executive Leadership Council reports to the Nominating and Corporate Governance Committee at each of its regularly scheduled meetings. Below are some of the highlights of our ESG journey and progress made in 2022.

Sustainability: A Year in Review

Governance

• Reviewed the Company’s cybersecurity profile and risk mitigation with the full Board of Directors and continued quarterly reporting to the Audit Committee on the Company’s cybersecurity program and operations;

• Reviewed the Company’s enterprise risk management program with the full Board with regular updates to the Board on the program; and

• Updated, on a regular basis, our Nominating and Corporate Governance Committee and Board on matters relating to ESG.

Social

• Increased our charitable donations through our semi-annual Community Service Awards program by 29% from 2021, supporting employee designated charities, foundations and other non-profit organizations in 47 states and the District of Columbia;

• Onboarded more than 1,100 new employees, with 33% from ethnic minority groups, an increase from both 2020 and 2021;

• Continued Diversity Equity & Inclusion (DE&I) Council efforts through an increased focus on community service and employee resources and remained committed to our employee value proposition through enhanced benefits offerings and learning opportunities;

• Since 2020, increased Company spend with diverse suppliers/vendors by 157%;

14

• Expanded the Employee Stock Purchase Plan to include our Canadian employees;

• Delivered an employee appreciation bonus mid-year to all employees; and

• Partnered with an outside firm to complete a U.S. Employee Engagement Survey in February 2022, with our results affording us recognition in the Top Workplaces program as a 2023 Top Workplace USA and for Employee Appreciation, Employee Well-Being, and several regional Top Workplaces awards.

Environmental

• Formed our Environmental Management Committee in 2022 including business leaders from across the Company to give us better insight into identifying decisions that can make Stewart a more sustainable company;

• Recycled or sold substantially all technology assets that became obsolete;

• Included environmental impacts in making leasing decisions; and

• Impacted the environment positively through recycling efforts that resulted in:

• More than 16,000 trees kept from being harvested

• Continued our emphasis on reduced water usage and use of technology to reduce paper consumption and CO2 emissions.

Additional information regarding our governance, sustainability initiatives and progress is available through our website at stewart.com/sustainability and stewart.com/corporate-governance. The information on our website, including our most recent Environmental, Social and Governance Report, is not, and shall not be deemed to be incorporated by reference into this Proxy Statement or any other filings with the SEC unless expressly noted in any such other filings.

15

EXECUTIVE OFFICERS

The following table sets forth the names and positions of our executive officers as of March 20, 2023:

Frederick H. Eppinger | Chief Executive Officer | |

Elizabeth K. Giddens | Chief Legal Officer and Corporate Secretary | |

David C. Hisey | Chief Financial Officer and Treasurer | |

Emily A. Kain | Chief Human Resources Officer | |

Steven M. Lessack | Group President | |

Brad A. Rable | Group President | |

Tara S. Smith | Group President |

Below is biographical information for our executive officers (except Mr. Eppinger, whose biographical information is contained on page 7):

Elizabeth K. Giddens. Elizabeth K. Giddens, 52 years old, serves as Stewart’s Chief Legal Officer and Corporate Secretary. Ms. Giddens leads Stewart’s legal organization, overseeing underwriting, claims, litigation, compliance, corporate governance, and regulatory areas for Stewart and its affiliated companies. Ms. Giddens is also a member of the board of directors of Stewart Title Guaranty Company, Stewart Title Company, and Stewart Title Insurance Company, the Company’s New York underwriter. She joined Stewart in 2022 as Deputy Chief Legal Officer and was promoted to Chief Legal Officer in 2023. Prior to joining Stewart, Ms. Giddens served as Senior Vice President, General Counsel, Chief Ethics & Compliance Officer, and Corporate Secretary for Integer Holdings Corporation from 2019 – 2021. From 2012 – 2019, she served as Senior Vice President, Deputy General Counsel, and Corporate Secretary for Mr. Cooper Group Inc. Ms. Giddens has 25 years of legal experience and holds a Juris Doctorate from the University of Oklahoma College of Law, a Master of Business Administration from the University of Tulsa, and a Bachelor of Arts from Trinity University. She is a member of the Texas and Oklahoma Bar Associations and is licensed to practice law in Texas and Oklahoma.

David C. Hisey. David C. Hisey, 62 years old, has served as Chief Financial Officer (“CFO”) and Treasurer of the Company since 2017. He leads Stewart’s financial organization and strategy, overseeing financial planning and analysis, accounting, treasury and audit functions, as well as investor relations, corporate development, lender services and property management. As CFO, Mr. Hisey partners with each area of the business to help with their financial and commercial success, focusing on top-line growth and bottom-line improvement. Mr. Hisey has more than 35 years of financial leadership experience and holds a Bachelor of Business Administration magna cum laude in Accounting from James Madison University and is licensed as a Certified Public Accountant in the Commonwealth of Virginia.

Emily A. Kain. Emily A. Kain, 40 years old, has served as Stewart’s Chief Human Resources Officer (“CHRO”) since 2020. She is responsible for the people side of the business, focusing on the development and execution of the broader human resource and talent strategies, and also leads the corporate communications and community relations functions. Ms. Kain serves as an essential member of both Stewart’s DE&I Council and ESG Committee. Ms. Kain joined Stewart in 2014 as the manager of employee onboarding and re-engineered the hiring and onboarding processes, employee experience and employee referral program, and developed and launched the Stewart Celebrates global recognition program. As CHRO, she leads the organization in the areas of talent management, organizational design and succession planning, performance management, inclusion and diversity, total rewards, and all aspects of HR operations transformation. Prior to joining Stewart, Ms. Kain worked in public accounting and held multiple human resources positions in both the professional services and oil and gas industries. She draws on experience from both domestic and international roles of increasing scope and responsibility and has applied her extensive experience to advancing Stewart’s HR function and strategy in support of the overall business plan and strategic direction of the organization. She holds a Bachelor’s degree in accounting from Louisiana State University and a Master’s degree in accounting, with a concentration in internal audit, from the University of New Orleans. She also completed the Executive Education, Emerging Leaders Program at Rice University in 2011.

Steven M. Lessack. Steven M. Lessack, 70 years old, has served as Group President of the Company since 2019. With more than 35 years of title insurance and related real estate knowledge, he also holds the position of Group President for Stewart Title Guaranty Company and Stewart Title Company. He is responsible for and oversees Direct Operations throughout the United States as well as our Commercial Services group, Asset Preservation, Inc., and Stewart Insurance Risk Management within the United States. In 1997, he opened the Company’s Canadian operation and is responsible for the Company’s expansion activities outside of the United States. He serves as Executive Director

16

for Stewart Title Europe Limited and Stewart Title Malta as well as CEO for Stewart Title Limited and Chairman of the Board of Stewart Title Insurance Company (“STIC”), the Company’s New York underwriter. Prior to joining Stewart, Mr. Lessack was an independent agent of STIC, which has offices throughout upstate New York. He attended California State University in San Bernardino.

Brad A. Rable. Brad Rable, 56 years old, has served as Group President, Technology and Operations of the Company since 2022. Prior to being promoted to his current role, Mr. Rable served as Chief Information Officer of the Company from 2015 – 2022. A veteran IT leader and executive with significant experience in developing major initiatives, Mr. Rable is responsible for all areas of digital business enablement, enterprise technology solutions, enterprise operations, and related strategies. Prior to joining Stewart, Mr. Rable was an executive partner with Gartner Executive Programs. He previously served as Executive Vice President, CIO, and Chief Strategy Officer for AIG/United Guaranty, leading the technology and product development divisions, as well as the innovation team that launched the AIG Mortgage Advisory Company. Mr. Rable received a Master of Arts in computer information resource management from Webster University, Missouri, and a Bachelor of Science in management information systems from Bowling Green State University, Ohio.

Tara S. Smith. Tara S. Smith, 43 years old, has served as Group President of Stewart’s Agency Operations since 2019. In this role, she manages Stewart’s independent title agency network and all products and services offered to our agents, while also having oversight of Stewart’s corporate marketing function. Ms. Smith joined Stewart in 2013 after 12 years in public accounting through which she provided strategic guidance to clients in the oil-and-gas and financial services industries. Her leadership, deep knowledge, strategy implementation and problem-solving led to her rising through leadership roles at Stewart that included the positions of Vice President, Agency Financial Director, and Executive Vice President. Ms. Smith serves on the American Land Title Association’s Board of Governors and was named one of Housing Wire’s “Women of Influence” in both 2017 and 2021 for her contributions to the industry. She earned a Bachelor of Business Administration in finance from the University of Texas at Austin.

17

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (“CD&A”) describes the Company’s executive compensation program for 2022. The following pages explain the process, objectives and structure of the executive compensation decisions made by our Compensation Committee (the “Committee”) and our Board of Directors for 2022. This CD&A is intended to be read in conjunction with the tables beginning on page 33 below, which provide detailed historical compensation information for our Named Executive Officers (“NEOs”).

For 2022, our NEOs were:

NEO | Title | |

Frederick H. Eppinger | Chief Executive Officer | |

David C. Hisey | Chief Financial Officer, Secretary and Treasurer | |

Steven M. Lessack | Group President | |

John L. Killea(1) | Chief Legal Officer and Chief Compliance Officer | |

Tara S. Smith | Group President |

____________

(1) John L. Killea retired from the position of Chief Legal Officer and Chief Compliance Officer effective December 31, 2022.

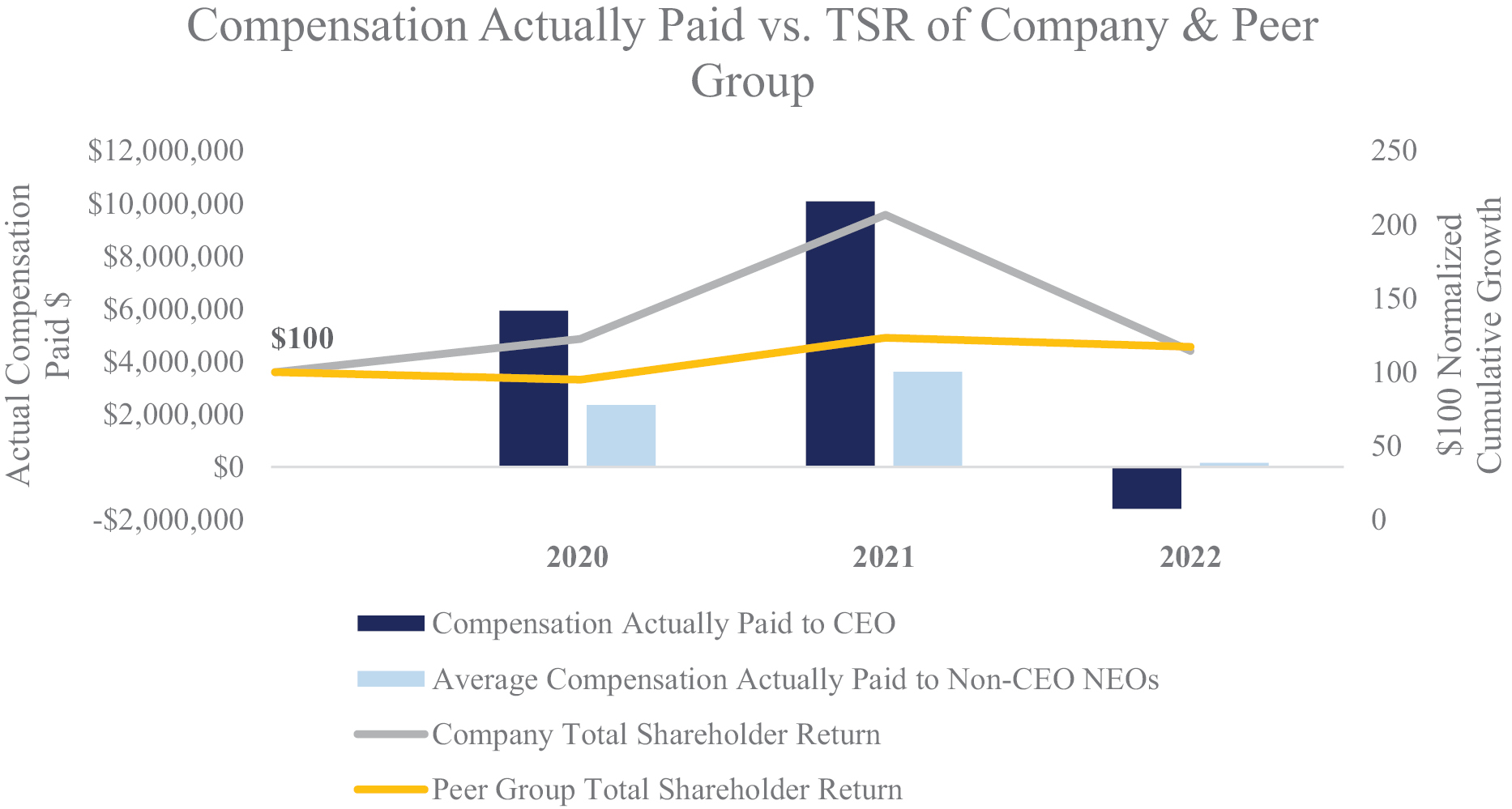

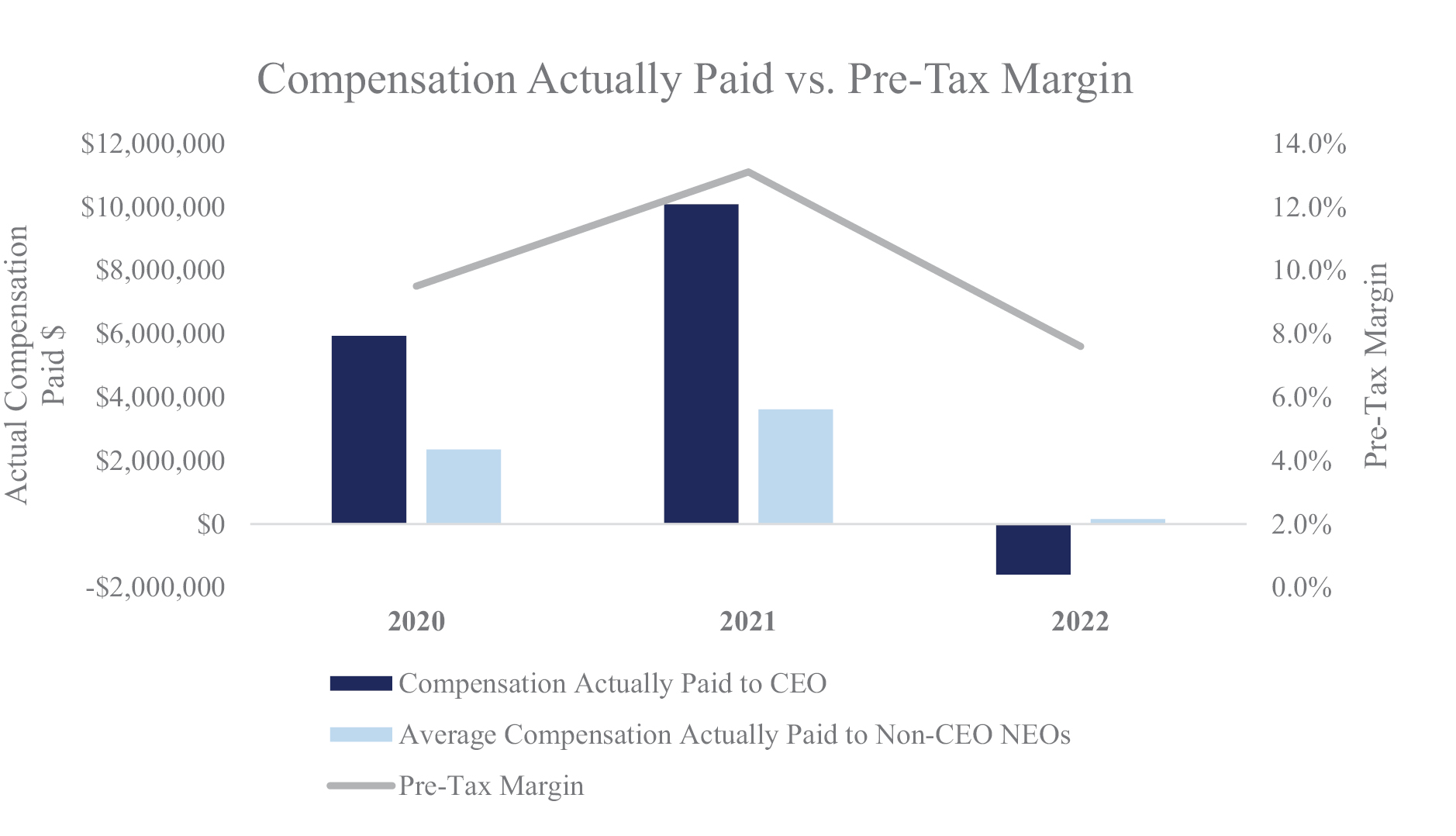

Executive Summary

2022 was a challenging year, especially compared to a historically strong 2021, primarily driven by an unprecedented rapid rise in interest rates that negatively impacted the real estate market. This led the Company to manage the business with a focus on cost discipline while also seeking out opportunities for targeted investments in skills and capabilities to best position us for the long term. We closed on a number of targeted acquisitions that enhanced our ability to compete in several strategic markets and broaden our technology and services offerings. While we are pleased with the structural improvements and investments we have made in building a stronger and more resilient business, our results were negatively impacted by the significant downturn in the market for home refinances and purchases relative to 2021. Results of the year include: