1 S E C O N D Q U A R T ER 2 0 2 3 Wabtec Financial Results and Company Highlights

2 Forward looking statements & non-GAAP financial information This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995 including statements regarding the impact of acquisitions by Wabtec, statements regarding Wabtec’s expectations about future sales and earnings and statements about the impact of evolving global conditions on Wabtec’s business. All statements, other than historical facts, including statements regarding synergies and other expected benefits from acquisitions; statements regarding Wabtec’s plans, objectives, expectations and intentions; and statements regarding macro-economic conditions and evolving production and demand conditions; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward looking statements include statements regarding: Wabtec’s plans, objectives and intention; Wabtec’s expectations about future sales, earnings and cash conversion; Wabtec’s projected expenses and cost savings associated with its Integration 2.0 initiative; Wabtec’s 5-year outlook (established in March 2022); Wabtec’s expectations for evolving global industry, market and macro-economic conditions and their impact on Wabtec’s business; synergies and other expected benefits from Wabtec’s acquisitions; Wabtec’s expectations for production and demand conditions; and any assumptions underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) changes in general economic and/or industry specific conditions, including the impacts of tax and tariff programs, inflation, supply chain disruptions, foreign currency exchange, and industry consolidation; (2) changes in the financial condition or operating strategies of Wabtec's customers; (3) unexpected costs, charges or expenses resulting from acquisitions and potential failure to realize synergies and other anticipated benefits of acquisitions, including as a result of integrating acquired targets into Wabtec; (4) inability to retain and hire key personnel; (5) evolving legal, regulatory and tax regimes; (6) changes in the expected timing of projects; (7) a decrease in freight or passenger rail traffic; (8) an increase in manufacturing costs; (9) actions by third parties, including government agencies; (10) the severity and duration of the evolving COVID-19 pandemic and the resulting impact on the global economy and, in particular, our customers, suppliers and end-markets, (11) potential disruptions, instability, and volatility in global markets from the imposition of economic sanctions on Russia resulting from the invasion of Ukraine; (12) cybersecurity and data protection risks and (13) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. This presentation as well as Wabtec’s earnings release and 2023 financial guidance mention certain non-GAAP financial performance measures, including adjusted gross profit, adjusted operating expenses, adjusted income from operations, adjusted interest and other expense, adjusted operating margin, adjusted income tax expense, adjusted effective tax rate, adjusted earnings per diluted share, EBITDA and adjusted EBITDA, net debt and operating cash flow conversion rate. Wabtec defines EBITDA as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is further adjusted for restructuring costs. Wabtec defines operating cash flow conversion as net cash provided by operating activities divided by net income plus depreciation and amortization including deferred debt cost amortization. While Wabtec believes these are useful supplemental measures for investors, they are not presented in accordance with GAAP. Investors should not consider non-GAAP measures in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have inherent material limitations as performance measures because they add back certain expenses incurred by the company to GAAP financial measures, resulting in those expenses not being taken into account in the applicable non-GAAP financial measure. Because not all companies use identical calculations, Wabtec’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Included in this presentation are reconciliation tables that provide details about how adjusted results relate to GAAP results. Wabtec is not presenting a quantitative reconciliation of its forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share as it is unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of certain regulatory, legal and tax matters; the financial impact of these items is uncertain and is dependent on various factors, including the timing, and could be material to Wabtec’s Consolidated Statement of Earnings.

3 RAFAEL SANTANA President and Chief Executive Officer W A B T E C Today’s participants JOHN OLIN Executive Vice President and Chief Financial Officer KRISTINE KUBACKI Vice President, Investor Relations 3

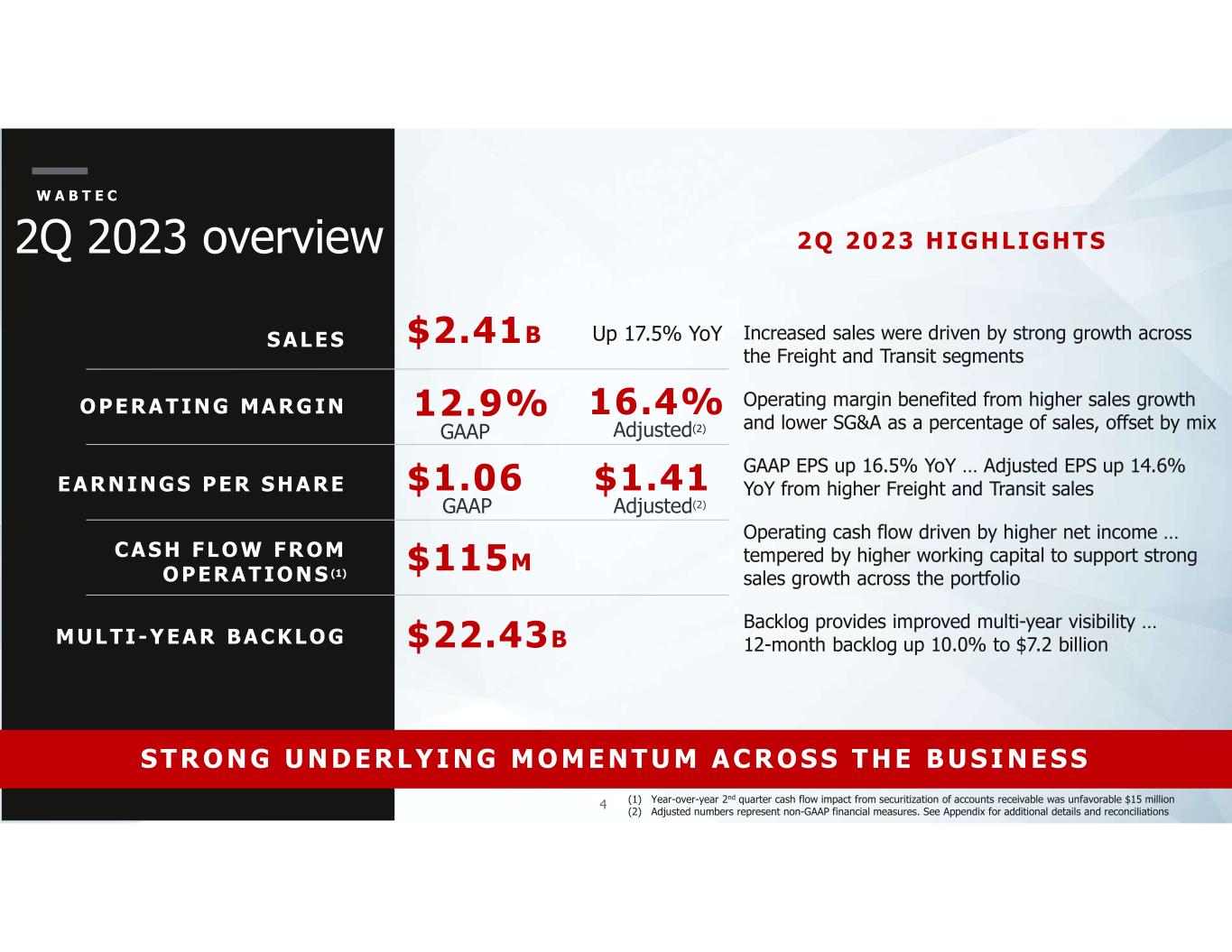

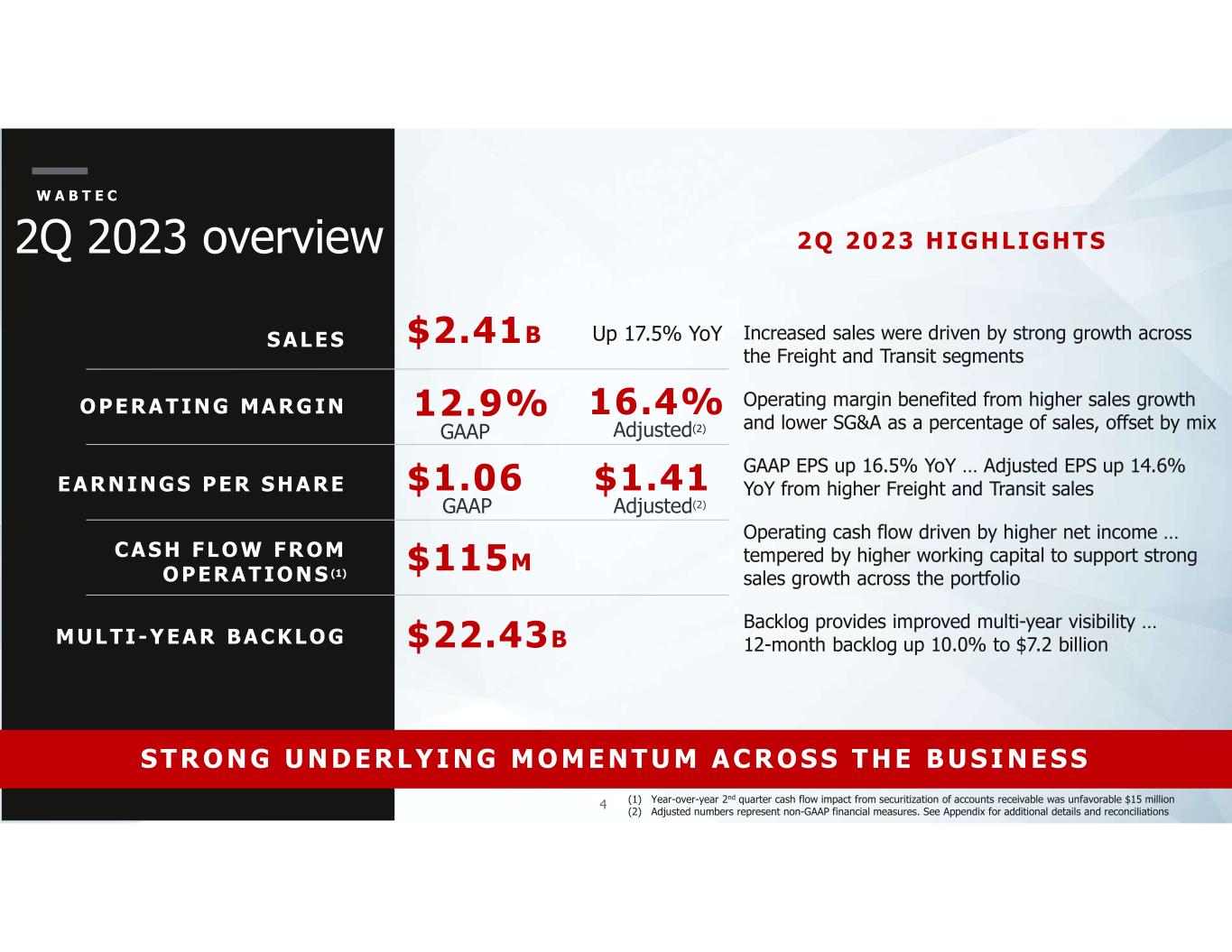

4 2Q 2023 overview Increased sales were driven by strong growth across the Freight and Transit segments Operating margin benefited from higher sales growth and lower SG&A as a percentage of sales, offset by mix GAAP EPS up 16.5% YoY … Adjusted EPS up 14.6% YoY from higher Freight and Transit sales Operating cash flow driven by higher net income … tempered by higher working capital to support strong sales growth across the portfolio Backlog provides improved multi-year visibility … 12-month backlog up 10.0% to $7.2 billion W A B T E C S A L ES O PERAT IN G MARG IN EARN I N GS PER S HARE CAS H F L O W FR OM O PERAT IO N S (1) M UL TI -Y EAR BA CK LO G $2.41B 16.4% $1.06 $115M $22.43B S T R O N G U N D ER L Y I N G M O M ENT U M AC R O S S T HE B U S I N ES S (1) Year-over-year 2nd quarter cash flow impact from securitization of accounts receivable was unfavorable $15 million (2) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations 2Q 2023 HIGHLIGHTS Up 17.5% YoY 12.9% GAAP Adjusted(2) $1.41 GAAP Adjusted(2)

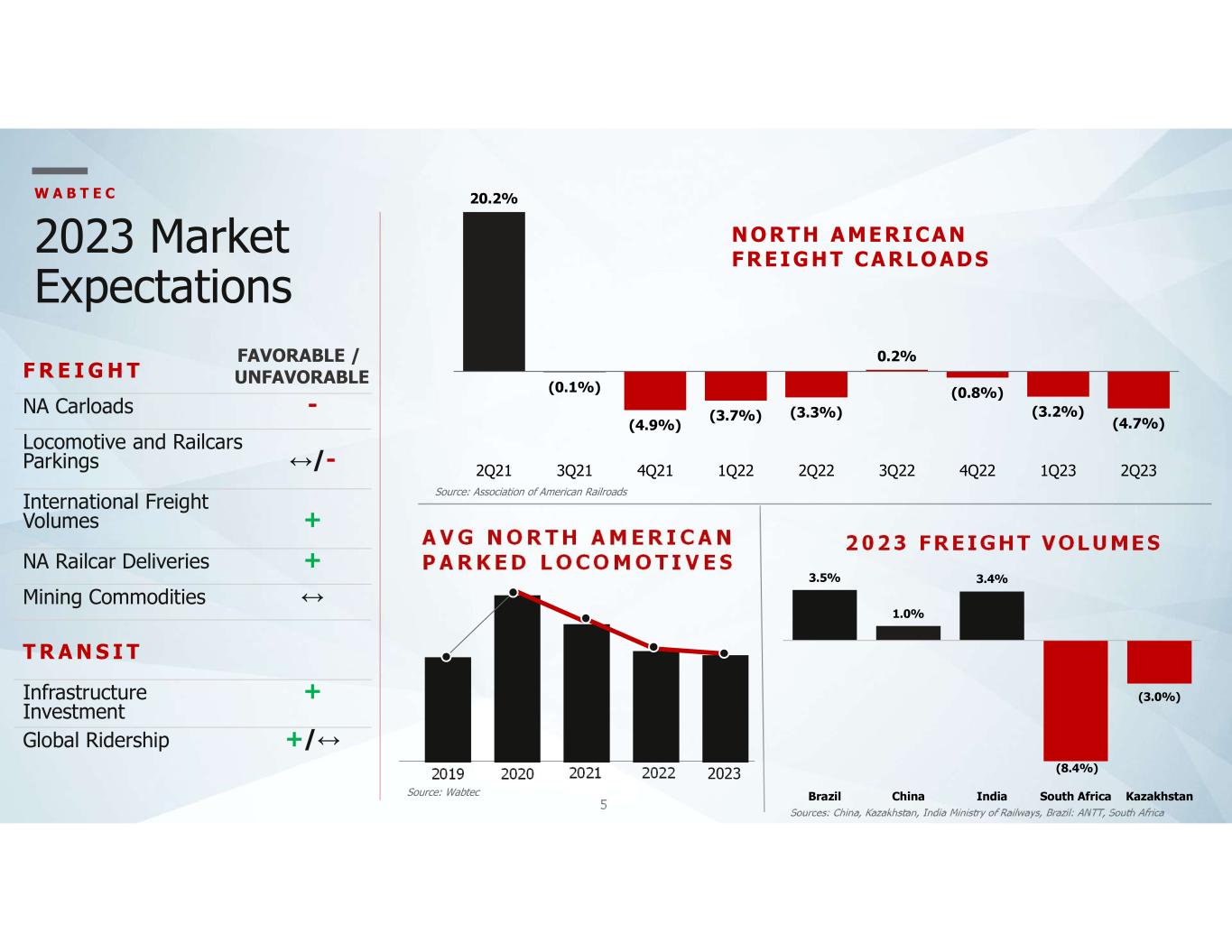

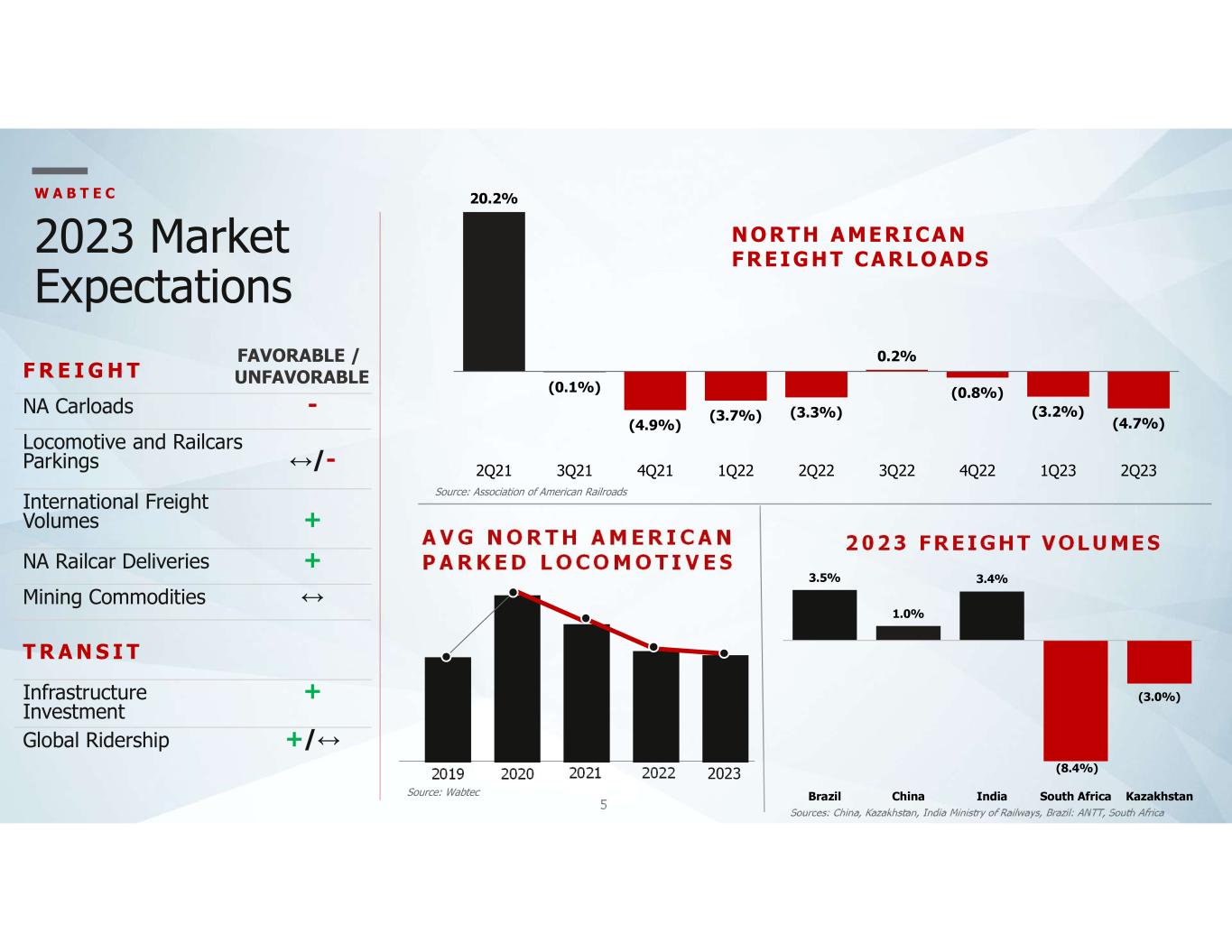

5 20.2% (0.1%) (4.9%) (3.7%) (3.3%) 0.2% (0.8%) (3.2%) (4.7%) 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 F R E I G H T NA Carloads - Locomotive and Railcars Parkings ↔/- International Freight Volumes + NA Railcar Deliveries + Mining Commodities ↔ T R A N S I T Infrastructure Investment + Global Ridership +/↔ W A B T E C 2023 Market Expectations N O RTH AME RI CAN F REI GHT CARL O ADS 202 3 F RE IGHT VO L UM ESA V G N O R T H A M E R I C A N P A R K E D L O C O M O T I V E S 2019 2020 2021 2022 Sources: China, Kazakhstan, India Ministry of Railways, Brazil: ANTT, South Africa 3.5% 1.0% 3.4% (8.4%) (3.0%) Brazil China India South Africa Kazakhstan 2023 Source: Association of American Railroads Source: Wabtec FAVORABLE / UNFAVORABLE

6 DRIVERS OF PORTFOLIO GROWTH RECENT WINS Won strategic order for 30 new locomotives in North America Won largest Certified Pre-owned program order of 69 locomotives from Gennesse & Wyoming 60 modernization order with Canadian National in 3rd quarter Strategic order in Australia for 17 narrow gauge locomotives Secured order from Vale for 3 FLXdrive locomotives Won contract to supply pantograph and PIS systems for up to 504 Stadler cars Completed strategic acquisition of L&M Radiator … expands heat transfer portfolio and global installed base in mining W A B T E C Executing on our value creation framework Accelerate innovation of scalable technologies Grow and refresh expansive global installed base Lead decarbonization of rail Expand high-margin recurring revenue streams Drive continuous operational improvement 6

7 W A B T E C Wabtec is the best technology partner for the industry • Age of Fleets - 16K locomotives - 25+ years old KEY CUSTOMER CHALLENGES • NA carloads vs ‘22 - Overall (4%) - Intermodal (10%) • Regulation - FRA … Safety - STB … Service - EPA/CARB … Emissions • Price pressure - Intermodal back to 2018 levels driven by truck competition WABTEC PORTFOLIO ALIGNED TO KEY CUSTOMER PRIORITIES L O W & Z E R O E M I S S I O N C A P A B I L I T I E S D I G I T A L P O R T F O L I O L O C O M O T I V E S • Reliability - Up to 40%+ improvement with modernization • Power/haulage-ability - 20% gross ton mile per loco for AC adoption • Fuel efficiency - Up to 30% benefit with Trip Optimizer suite • Carbon emissions - 30% -to- 100% … battery electric and hydrogen B E S T P A R T N E R T O P R O V I D E T R A I N I N N O V A T I O N A N D D I G I T A L C A P A B I L I T I E S IMPACT N E X T G E N S O L U T I O N S A N D T E C H N O L O G I E S • Tier 4 in U.S. • New international locomotives • Modernizations (NA & international expansion) • Bio/renewable fuel • FLXdrive • FLXswitch • Hybrid • Hydrogen • Train level (TO, SmartHPT, Locotrol, etc) • Network (PTC, Movement Planner, Yard Planner, etc) 7

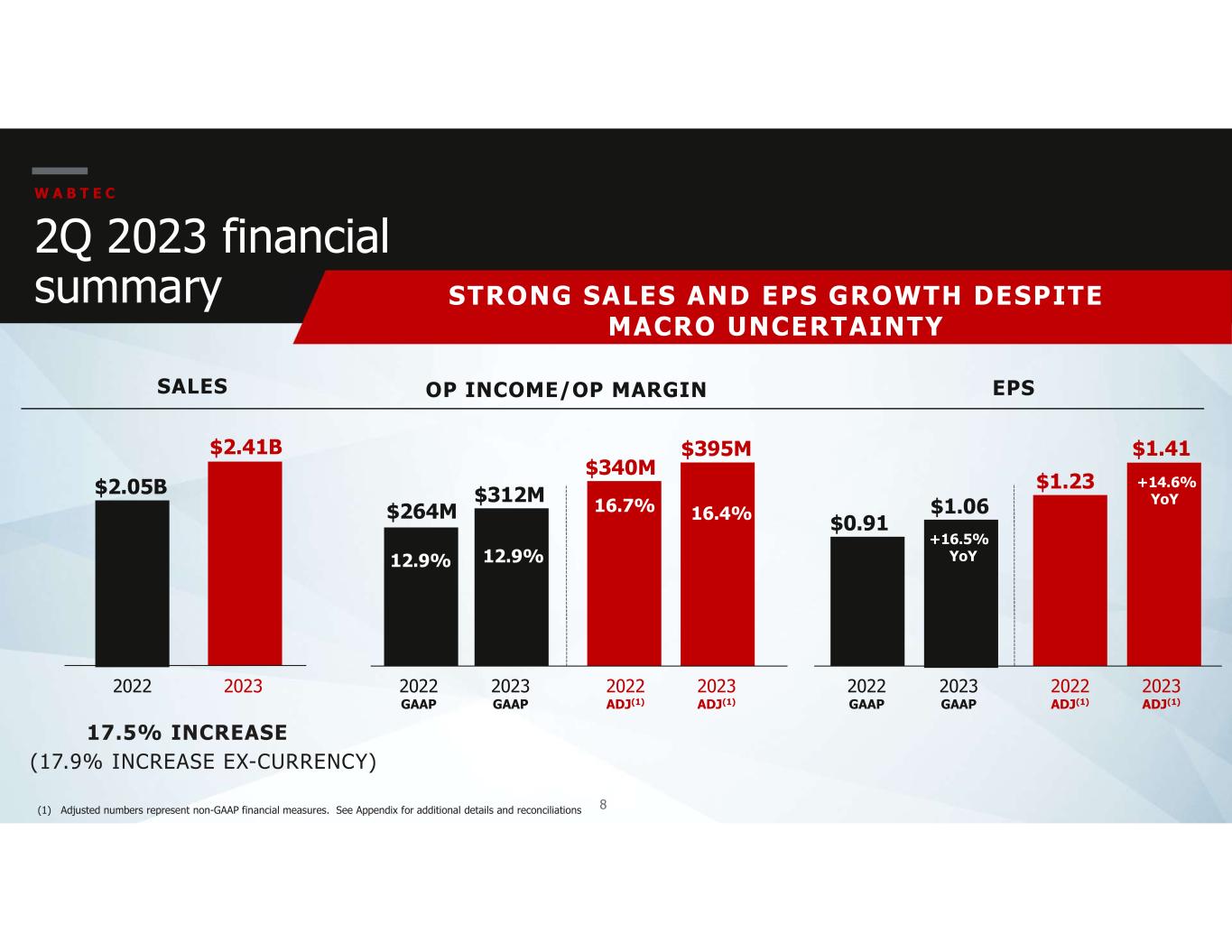

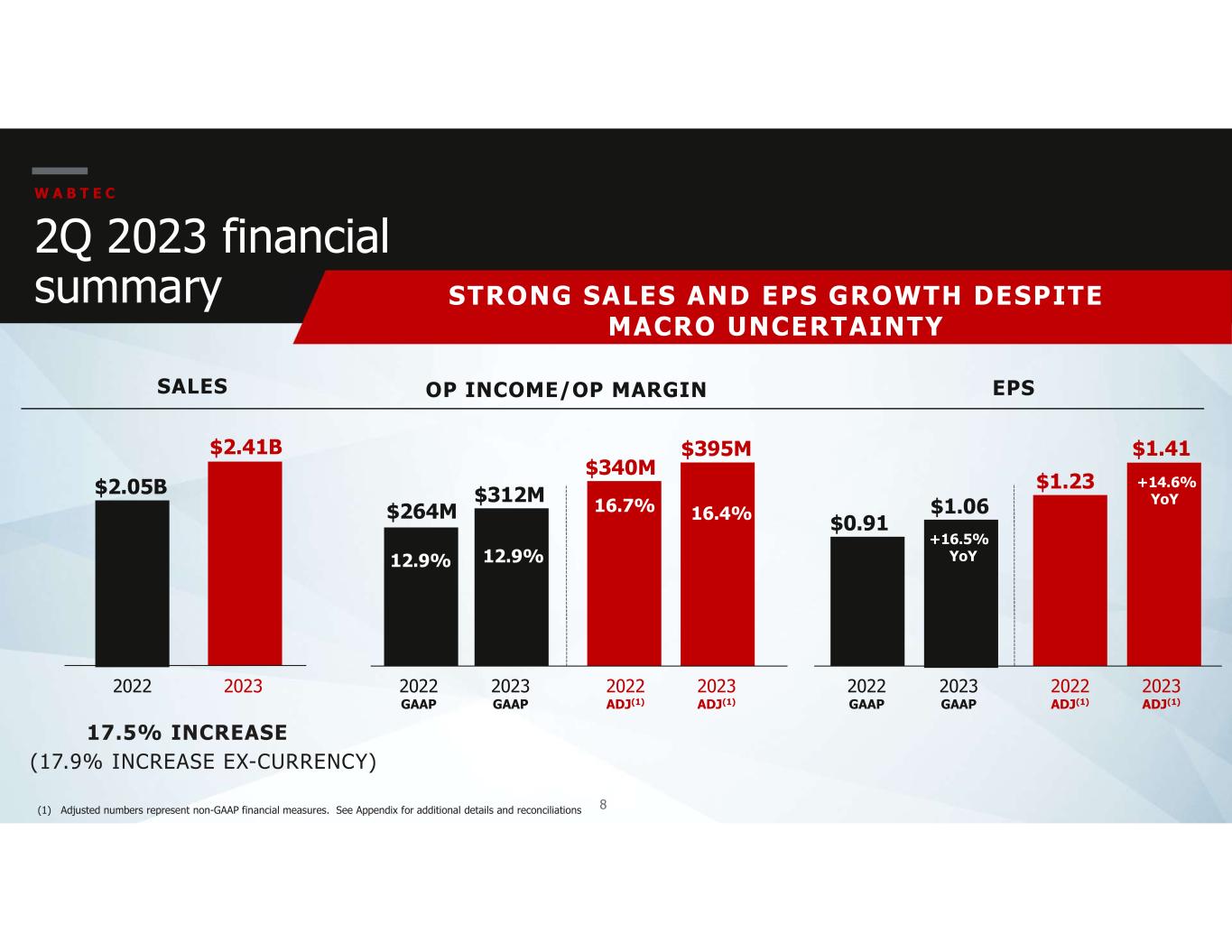

8 STRONG SALES AND EPS GROWTH DESPITE MACRO UNCERTAINTY (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations 2Q 2023 financial summary W A B T E C OP INCOME/OP MARGIN 17.5% INCREASE $264M 12.9% 2022 GAAP SALES EPS $2.05B 2022 $2.41B 2023 $312M 12.9% 2023 GAAP $340M 16.7% 2022 ADJ(1) $395M 16.4% 2023 ADJ(1) $0.91 2022 GAAP $1.06 2023 GAAP $1.23 2022 ADJ(1) $1.41 2023 ADJ(1) (17.9% INCREASE EX-CURRENCY) +14.6% YoY +16.5% YoY

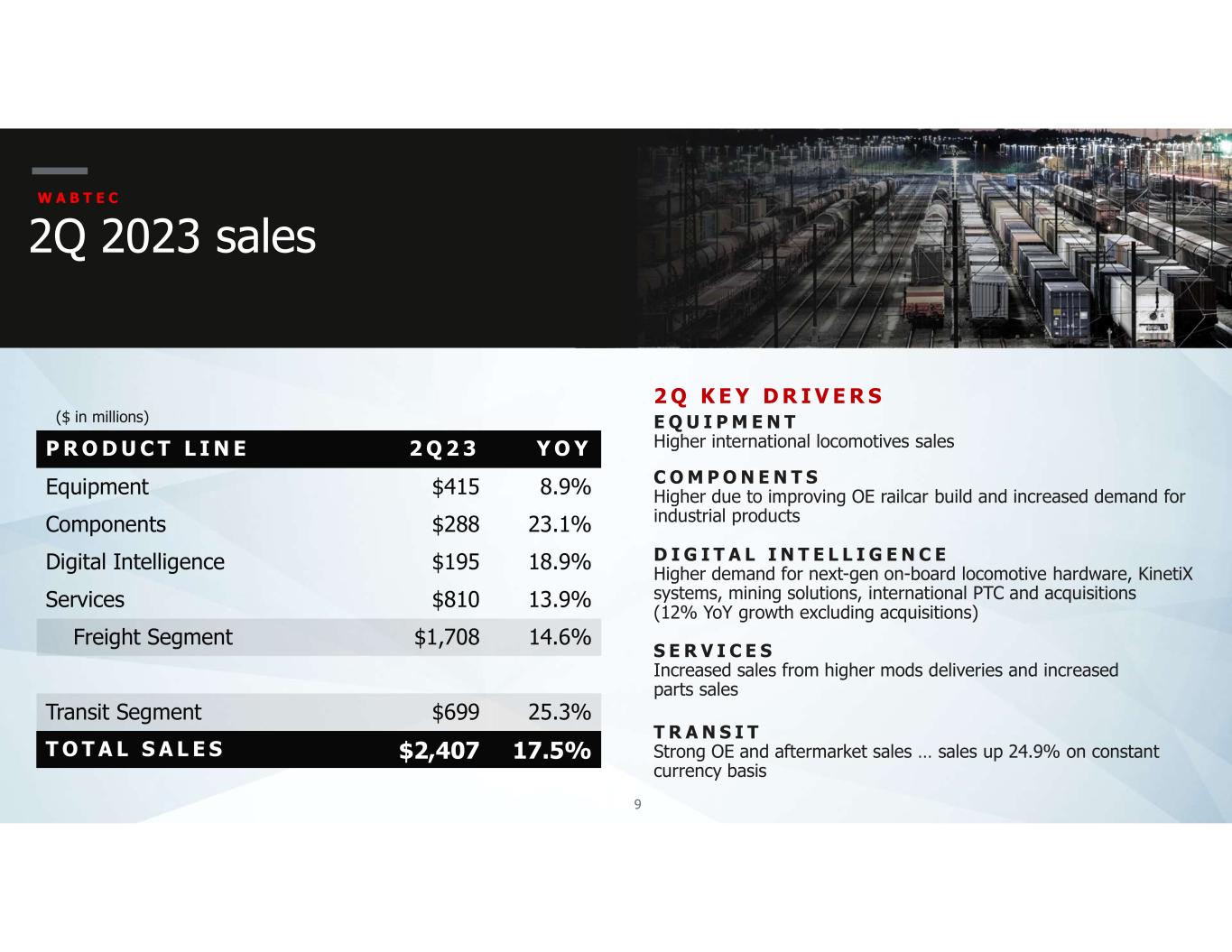

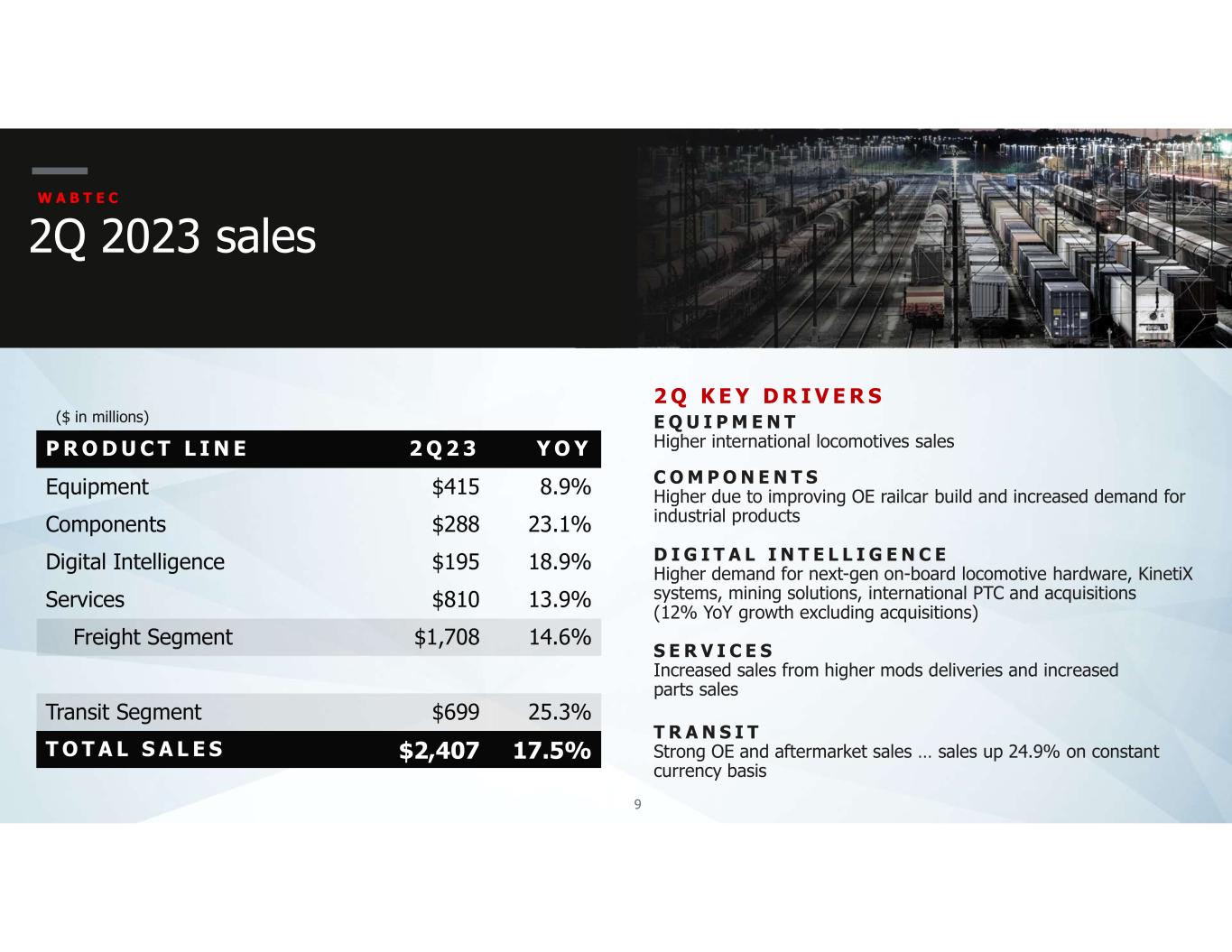

9 W A B T E C 2Q 2023 sales P R O D U C T L I N E 2 Q 2 3 Y O Y Equipment $415 8.9% Components $288 23.1% Digital Intelligence $195 18.9% Services $810 13.9% Freight Segment $1,708 14.6% Transit Segment $699 25.3% T O T A L S A L E S $2,407 17.5% E Q U I P M E N T Higher international locomotives sales C O M P O N E N T S Higher due to improving OE railcar build and increased demand for industrial products D I G I T A L I N T E L L I G E N C E Higher demand for next-gen on-board locomotive hardware, KinetiX systems, mining solutions, international PTC and acquisitions (12% YoY growth excluding acquisitions) S E R V I C E S Increased sales from higher mods deliveries and increased parts sales T R A N S I T Strong OE and aftermarket sales … sales up 24.9% on constant currency basis 2 Q K E Y D R I V E R S ($ in millions)

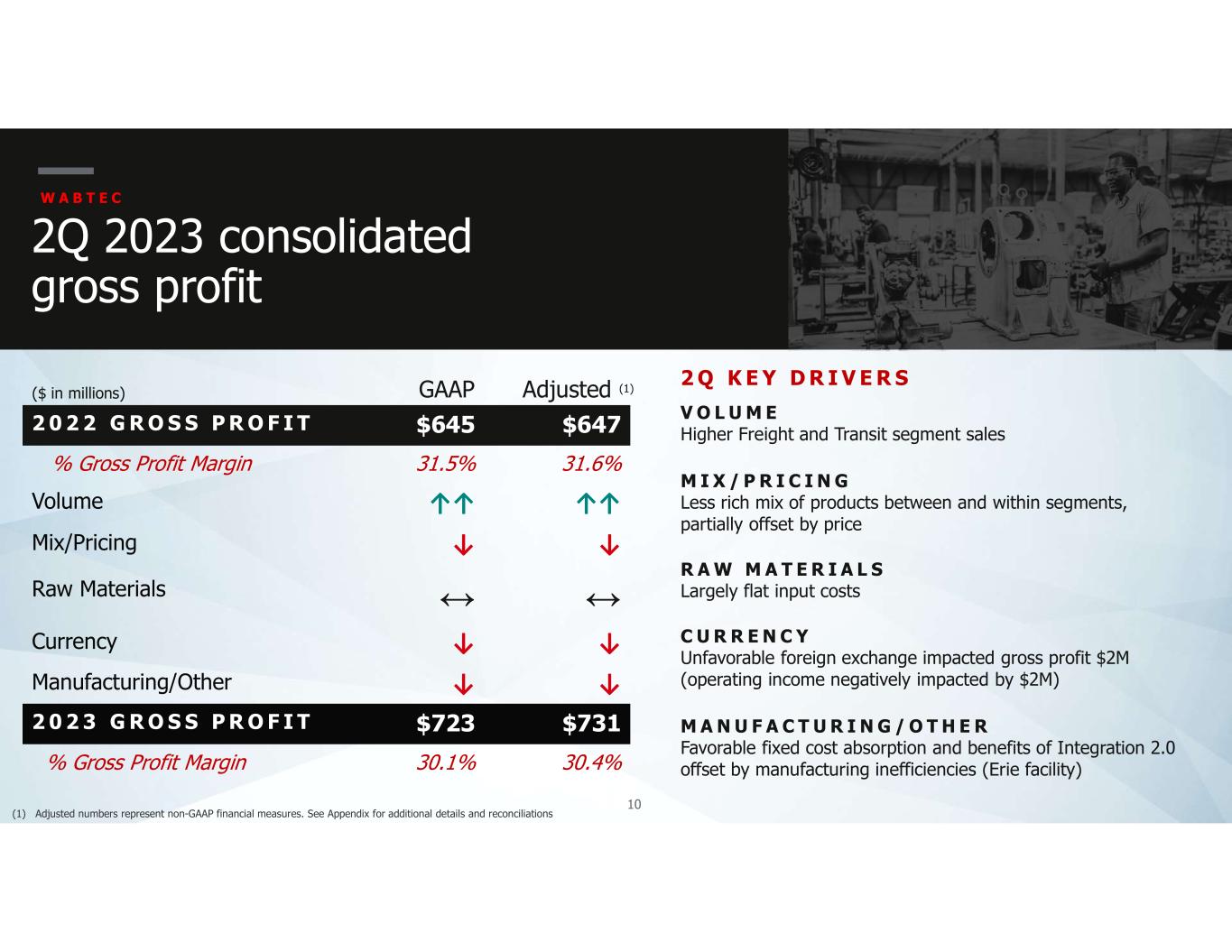

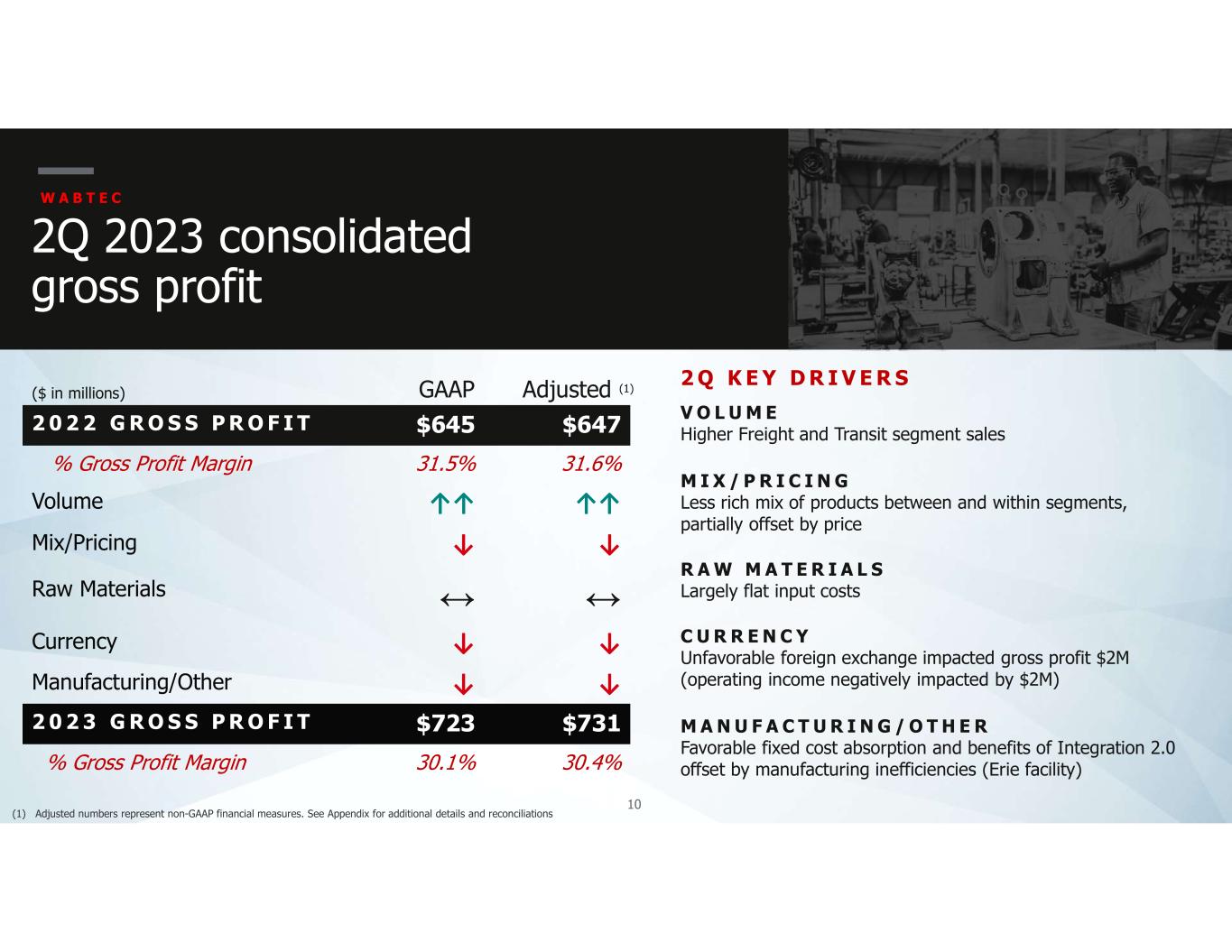

10 W A B T E C 2Q 2023 consolidated gross profit 2 Q K E Y D R I V E R S 2 0 2 2 G R O S S P R O F I T $645 $647 % Gross Profit Margin 31.5% 31.6% Volume ↑↑ ↑↑ Mix/Pricing ↓ ↓ Raw Materials ↔ ↔ Currency ↓ ↓ Manufacturing/Other ↓ ↓ 2 0 2 3 G R O S S P R O F I T $723 $731 % Gross Profit Margin 30.1% 30.4% V O L U M E Higher Freight and Transit segment sales M I X / P R I C I N G Less rich mix of products between and within segments, partially offset by price R A W M A T E R I A L S Largely flat input costs C U R R E N C Y Unfavorable foreign exchange impacted gross profit $2M (operating income negatively impacted by $2M) M A N U F A C T U R I N G / O T H E R Favorable fixed cost absorption and benefits of Integration 2.0 offset by manufacturing inefficiencies (Erie facility) ($ in millions) (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations GAAP Adjusted (1)

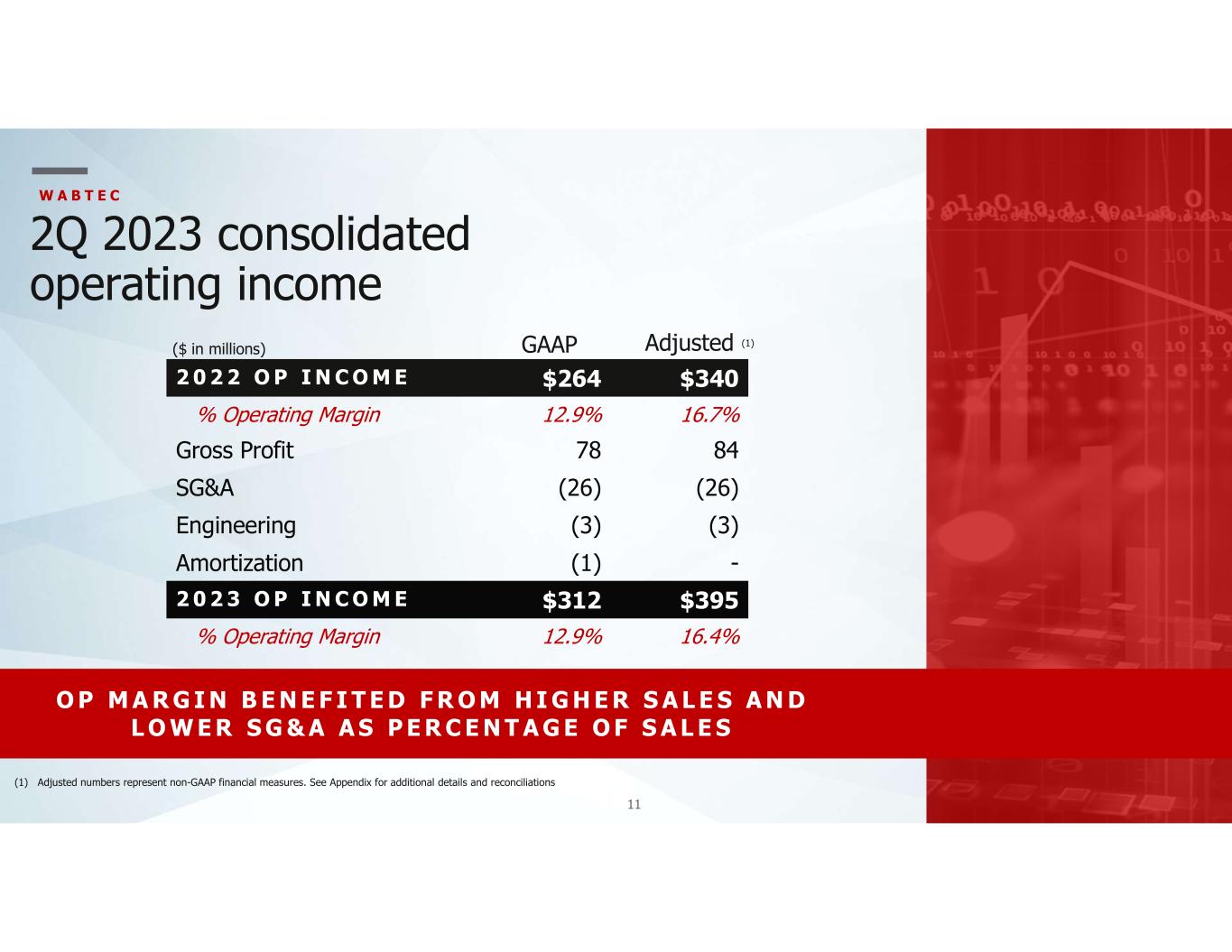

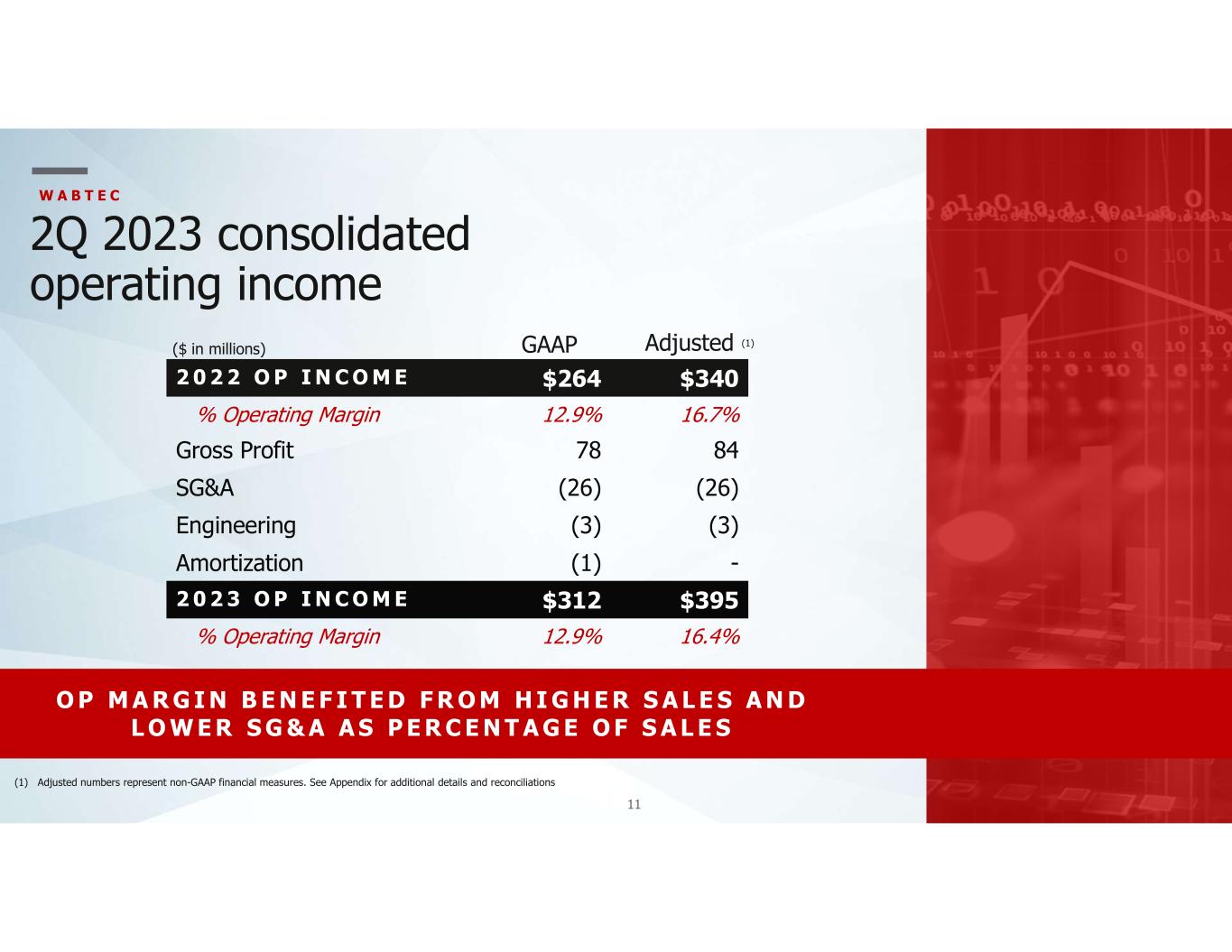

11 2 0 2 2 O P I N C O M E $264 $340 % Operating Margin 12.9% 16.7% Gross Profit 78 84 SG&A (26) (26) Engineering (3) (3) Amortization (1) - 2 0 2 3 O P I N C O M E $312 $395 % Operating Margin 12.9% 16.4% W A B T E C 2Q 2023 consolidated operating income (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations O P M A R G I N B E N E F I T E D F R O M H I G H E R S A L E S A N D L O W E R S G & A A S P E R C E N T A G E O F S A L E S Adjusted (1)($ in millions) GAAP

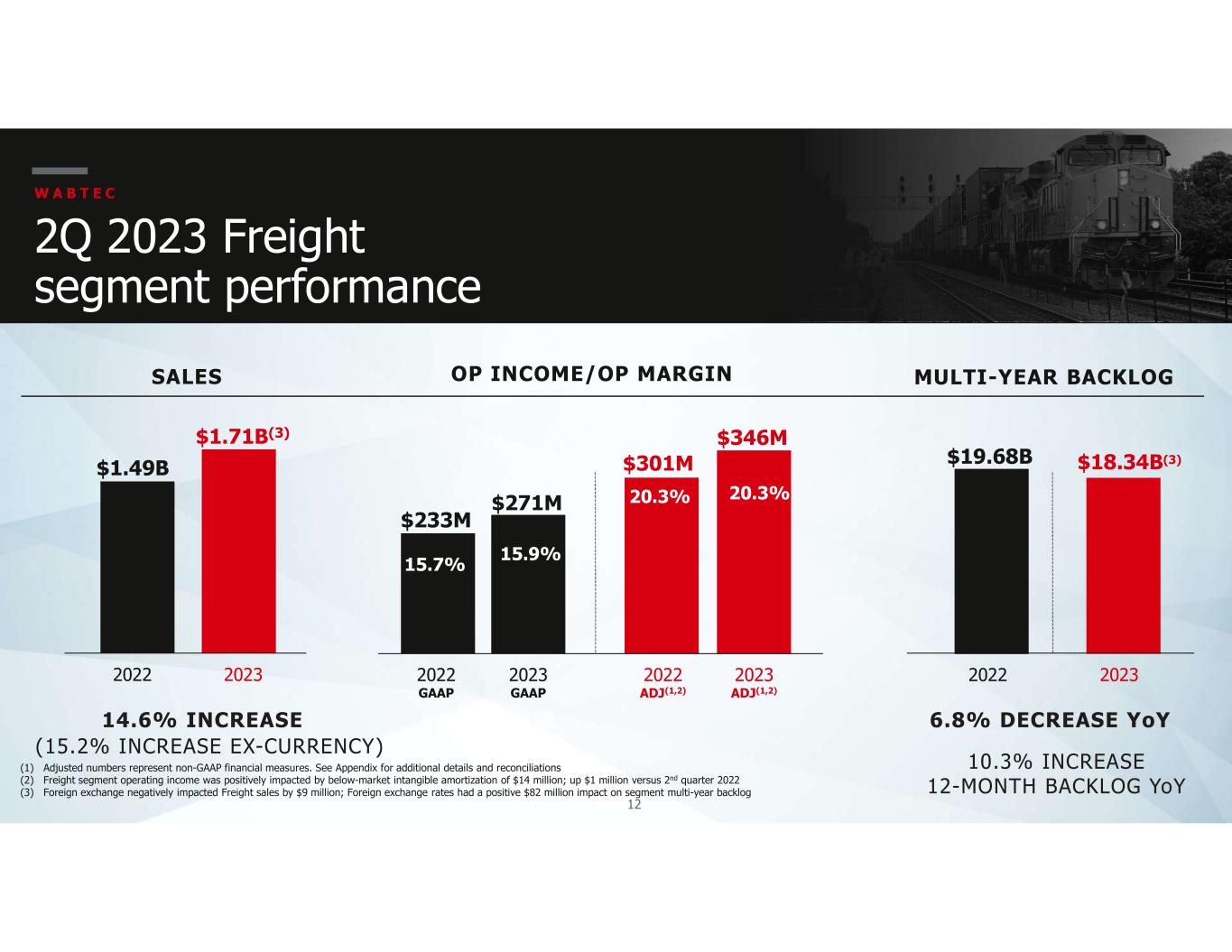

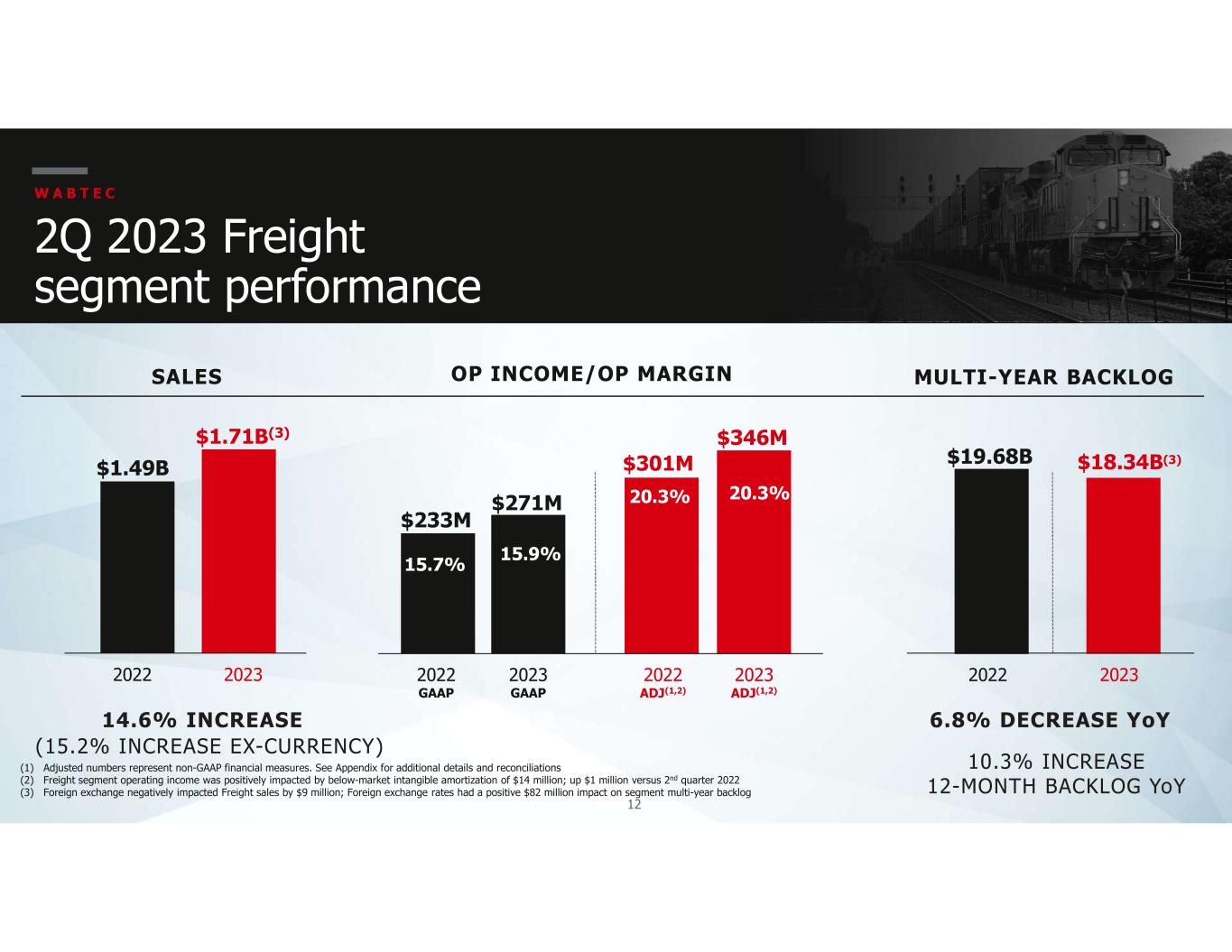

12 (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (2) Freight segment operating income was positively impacted by below-market intangible amortization of $14 million; up $1 million versus 2nd quarter 2022 (3) Foreign exchange negatively impacted Freight sales by $9 million; Foreign exchange rates had a positive $82 million impact on segment multi-year backlog 2Q 2023 Freight segment performance W A B T E C 14.6% INCREASE OP INCOME/OP MARGIN $233M 15.7% 2022 GAAP SALES MULTI-YEAR BACKLOG 6.8% DECREASE YoY $1.49B 2022 $1.71B(3) 2023 $271M 15.9% 2023 GAAP $301M 20.3% 2022 ADJ(1,2) $346M 20.3% 2023 ADJ(1,2) $19.68B 2022 $18.34B(3) 2023 10.3% INCREASE 12-MONTH BACKLOG YoY (15.2% INCREASE EX-CURRENCY)

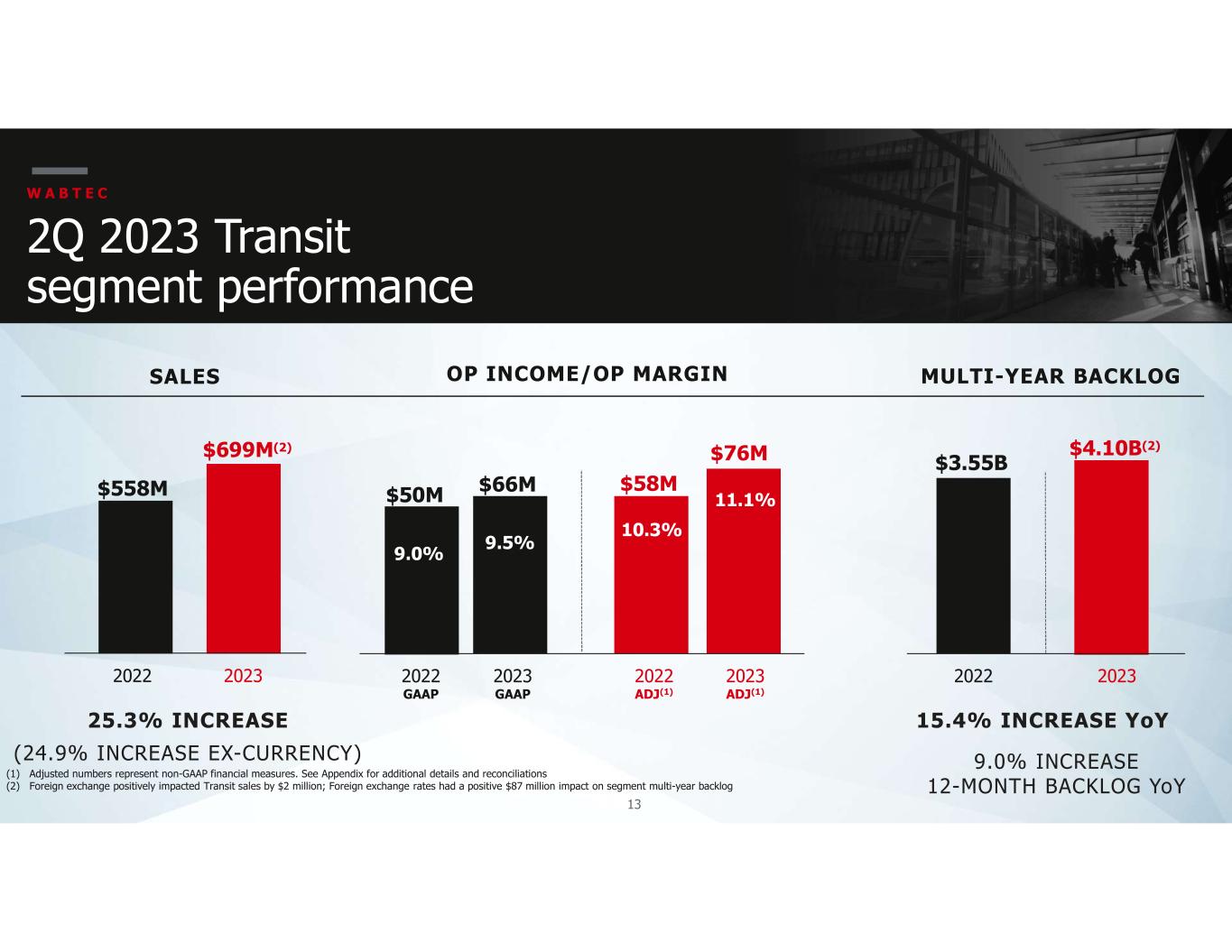

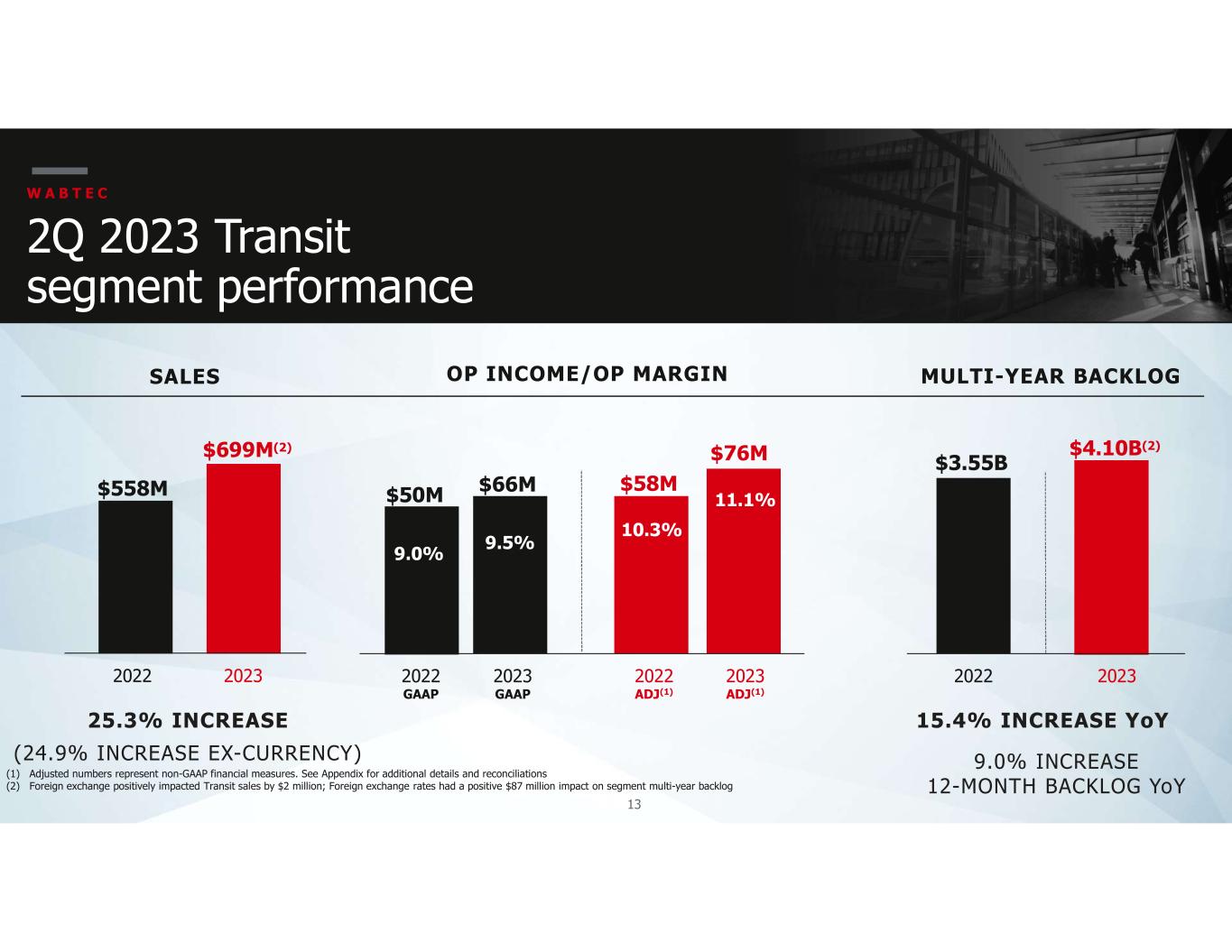

13 (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (2) Foreign exchange positively impacted Transit sales by $2 million; Foreign exchange rates had a positive $87 million impact on segment multi-year backlog 2Q 2023 Transit segment performance W A B T E C OP INCOME/OP MARGIN 25.3% INCREASE $50M 9.0% 2022 GAAP SALES MULTI-YEAR BACKLOG 15.4% INCREASE YoY $558M 2022 $699M(2) 2023 $66M 9.5% 2023 GAAP $58M 10.3% 2022 ADJ(1) $76M 11.1% 2023 ADJ(1) $3.55B 2022 $4.10B(2) 2023 (24.9% INCREASE EX-CURRENCY) 9.0% INCREASE 12-MONTH BACKLOG YoY

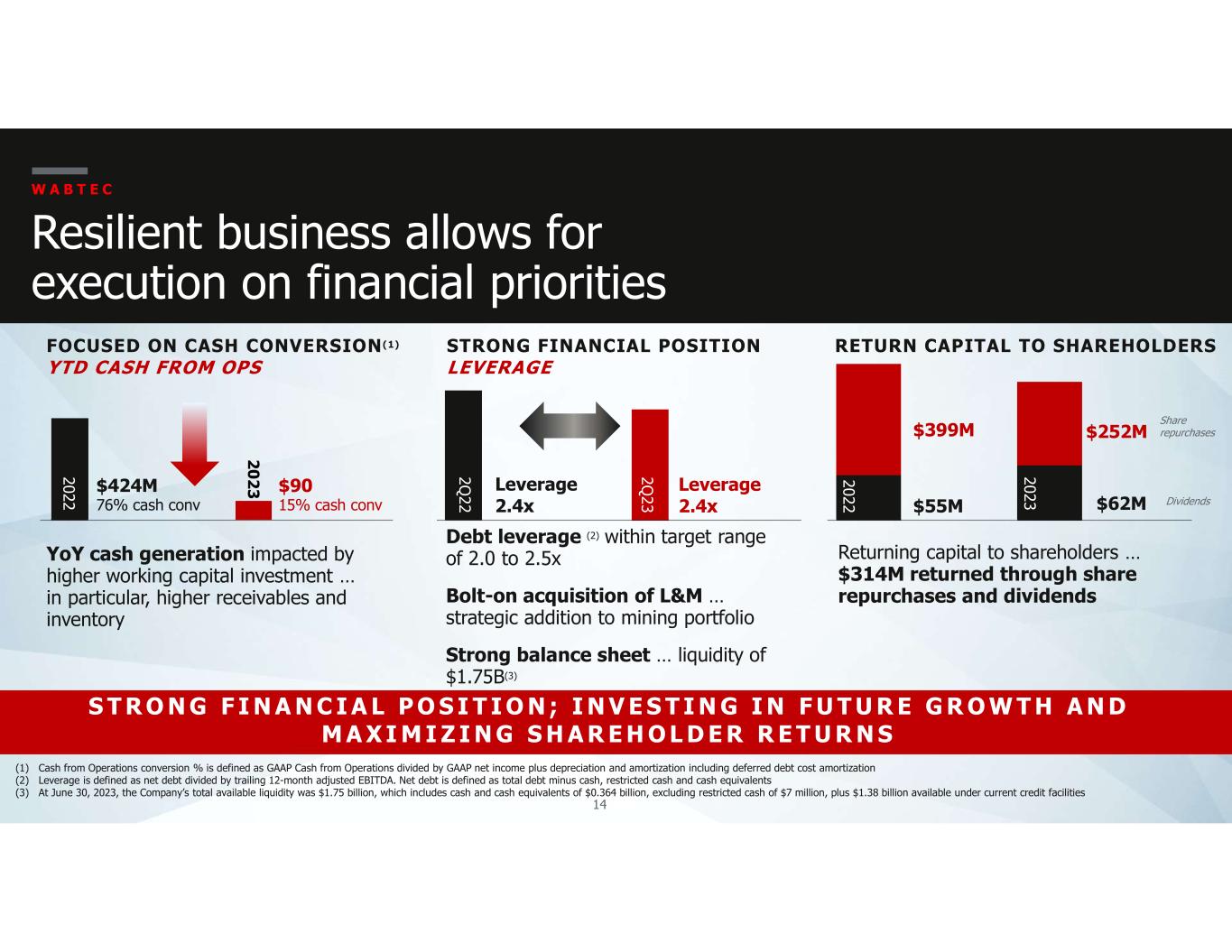

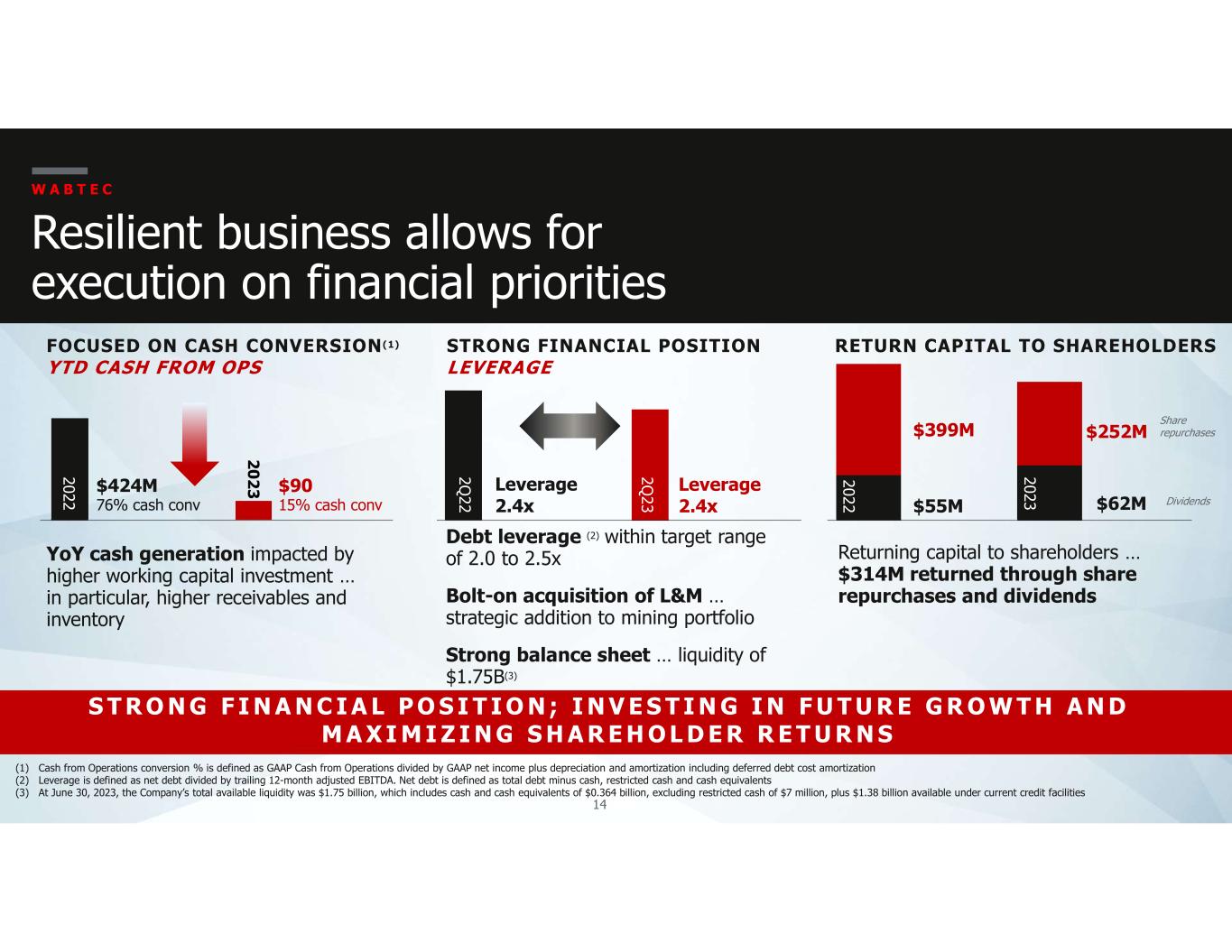

14 W A B T E C Resilient business allows for execution on financial priorities STRONG FINANCIAL POSITION LEVERAGE FOCUSED ON CASH CONVERSION(1) YTD CASH FROM OPS RETURN CAPITAL TO SHAREHOLDERS YoY cash generation impacted by higher working capital investment … in particular, higher receivables and inventory Debt leverage (2) within target range of 2.0 to 2.5x Bolt-on acquisition of L&M … strategic addition to mining portfolio Strong balance sheet … liquidity of $1.75B(3) Returning capital to shareholders … $314M returned through share repurchases and dividends S T R O N G F I N A N C I A L P O S I T I O N ; I N V E S T I N G I N F U T U R E G R O W T H A N D M A X I M I Z I N G S H A R E H O L D E R R E T U R N S (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization (2) Leverage is defined as net debt divided by trailing 12-month adjusted EBITDA. Net debt is defined as total debt minus cash, restricted cash and cash equivalents (3) At June 30, 2023, the Company’s total available liquidity was $1.75 billion, which includes cash and cash equivalents of $0.364 billion, excluding restricted cash of $7 million, plus $1.38 billion available under current credit facilities 76% cash conv $424M 2022 15% cash conv $90 2 0 2 3 Leverage 2.4x 2Q 22 Leverage 2.4x 2Q 23 $55M Dividends $399M Share repurchases $62M 2022 2023 $252M

15 Adjusted operating margin up - Favorable productivity/absorption offset by mix - SG&A as % of sales down - Engineering as % of sales flat W A B T E C 2023 updated financial guidance(1) (1) See Forward looking statements and non-GAAP financial information (2) Cash from operations conversion % is defined as GAAP cash from operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization STRONG MOMENTUM ACROSS THE PORTFOLIO K E Y A S S U M P T I O N S Tax rate ~25.5% Capex ~2% of sales R E V E N U E S $8.7B to $9.0B A D J U S T E D E P S $5.15 to $5.55 C A S H C O N V E R S I O N (2) >90% UPDATED GUIDANCEPRIOR GUIDANCE R E V E N U E S $9.25B to $9.50B A D J U S T E D E P S $5.50 to $5.80 C A S H C O N V E R S I O N (2) >90%

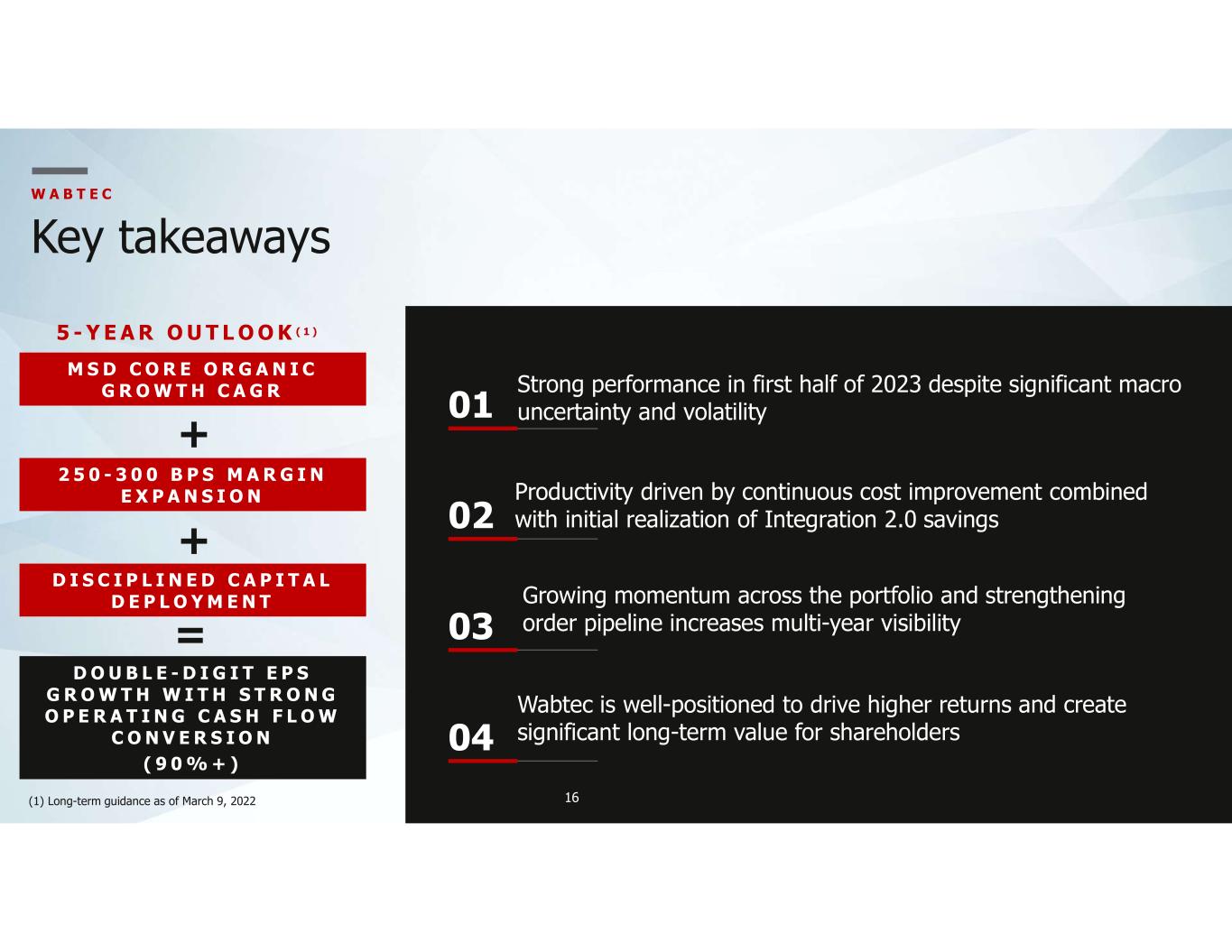

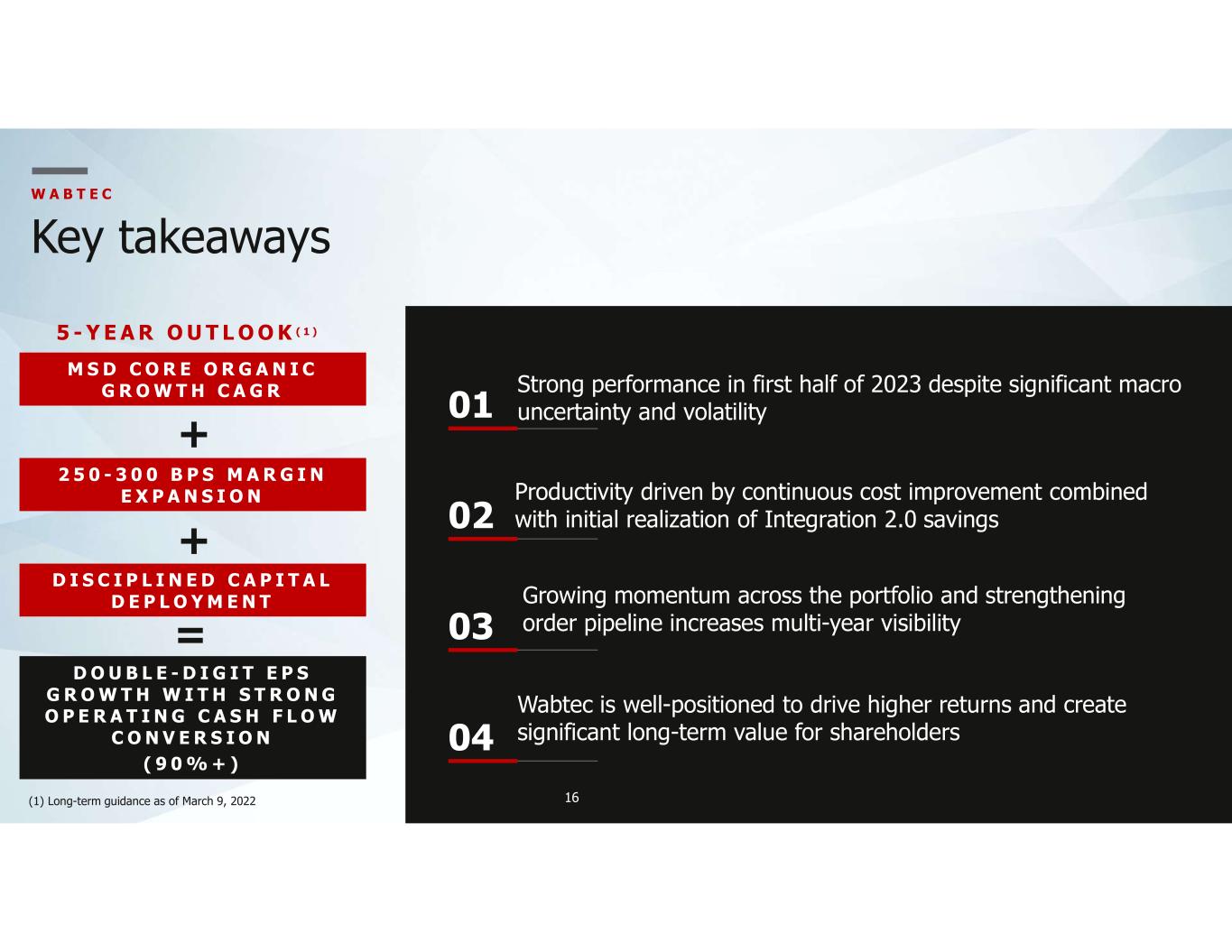

16 W A B T E C Key takeaways 02 Growing momentum across the portfolio and strengthening order pipeline increases multi-year visibility 03 Productivity driven by continuous cost improvement combined with initial realization of Integration 2.0 savings 04 Wabtec is well-positioned to drive higher returns and create significant long-term value for shareholders 01 Strong performance in first half of 2023 despite significant macro uncertainty and volatility M S D C O R E O R G A N I C G R O W T H C A G R 2 5 0 - 3 0 0 B P S M A R G I N E X P A N S I O N + + D I S C I P L I N E D C A P I T A L D E P L O Y M E N T = D O U B L E - D I G I T E P S G R O W T H W I T H S T R O N G O P E R A T I N G C A S H F L O W C O N V E R S I O N ( 9 0 % + ) 5 - Y E A R O U T L O O K ( 1 ) (1) Long-term guidance as of March 9, 2022 16

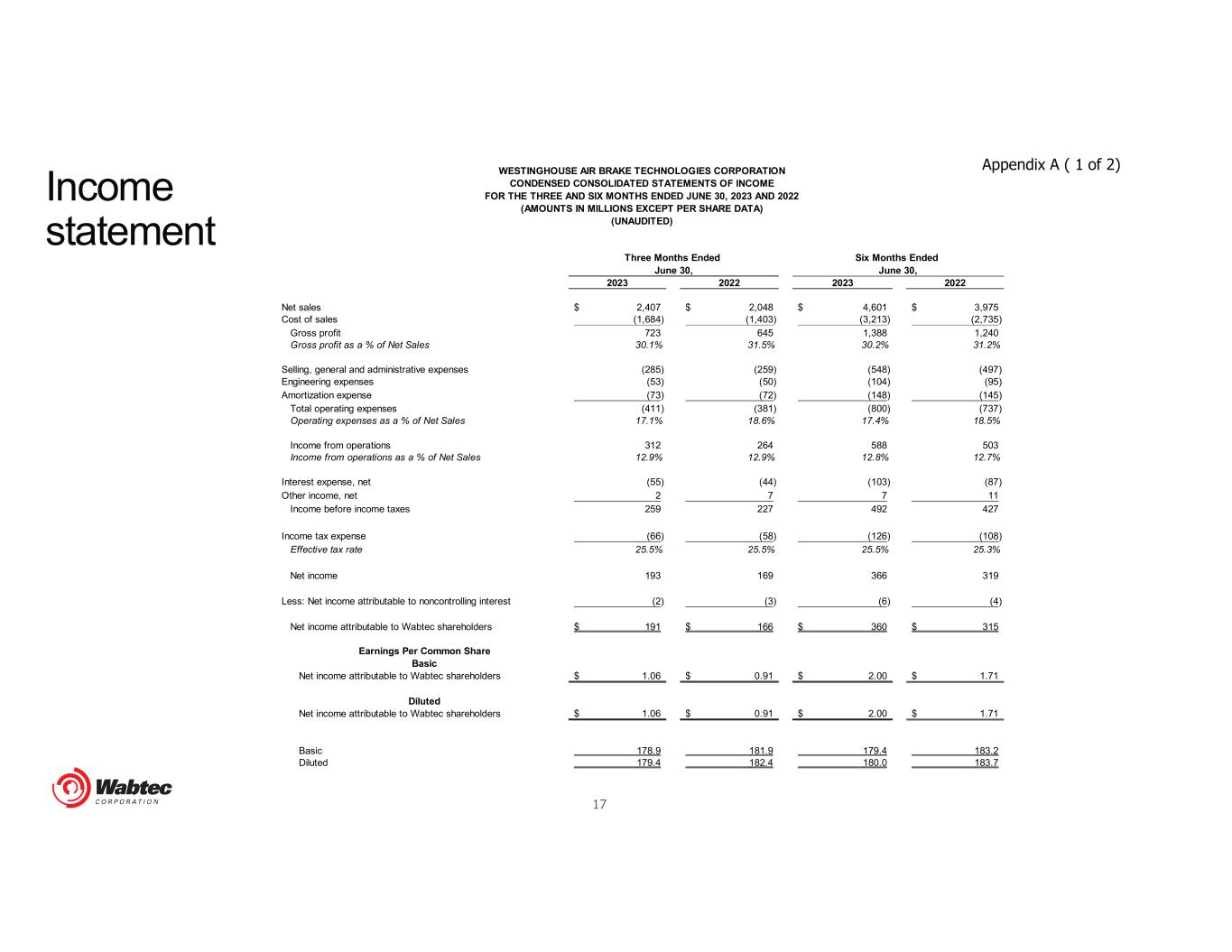

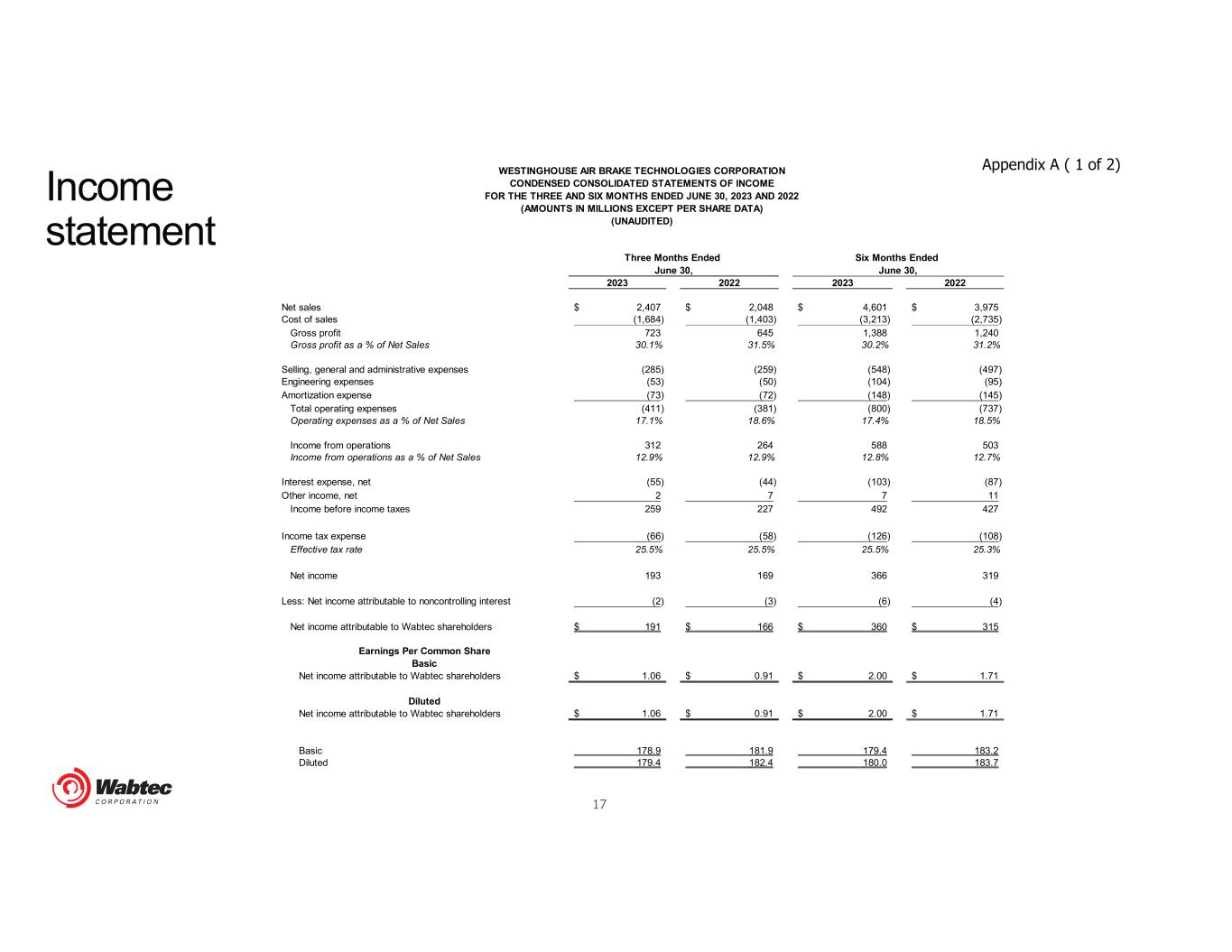

17 2023 2022 2023 2022 Net sales 2,407$ 2,048$ 4,601$ 3,975$ Cost of sales (1,684) (1,403) (3,213) (2,735) Gross profit 723 645 1,388 1,240 Gross profit as a % of Net Sales 30.1% 31.5% 30.2% 31.2% Selling, general and administrative expenses (285) (259) (548) (497) Engineering expenses (53) (50) (104) (95) Amortization expense (73) (72) (148) (145) Total operating expenses (411) (381) (800) (737) Operating expenses as a % of Net Sales 17.1% 18.6% 17.4% 18.5% Income from operations 312 264 588 503 Income from operations as a % of Net Sales 12.9% 12.9% 12.8% 12.7% Interest expense, net (55) (44) (103) (87) Other income, net 2 7 7 11 Income before income taxes 259 227 492 427 Income tax expense (66) (58) (126) (108) Effective tax rate 25.5% 25.5% 25.5% 25.3% Net income 193 169 366 319 Less: Net income attributable to noncontrolling interest (2) (3) (6) (4) Net income attributable to Wabtec shareholders 191$ 166$ 360$ 315$ Earnings Per Common Share Basic Net income attributable to Wabtec shareholders 1.06$ 0.91$ 2.00$ 1.71$ Diluted Net income attributable to Wabtec shareholders 1.06$ 0.91$ 2.00$ 1.71$ Basic 178.9 181.9 179.4 183.2 Diluted 179.4 182.4 180.0 183.7 Three Months Ended Six Months Ended June 30, June 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED) Income statement Appendix A ( 1 of 2)

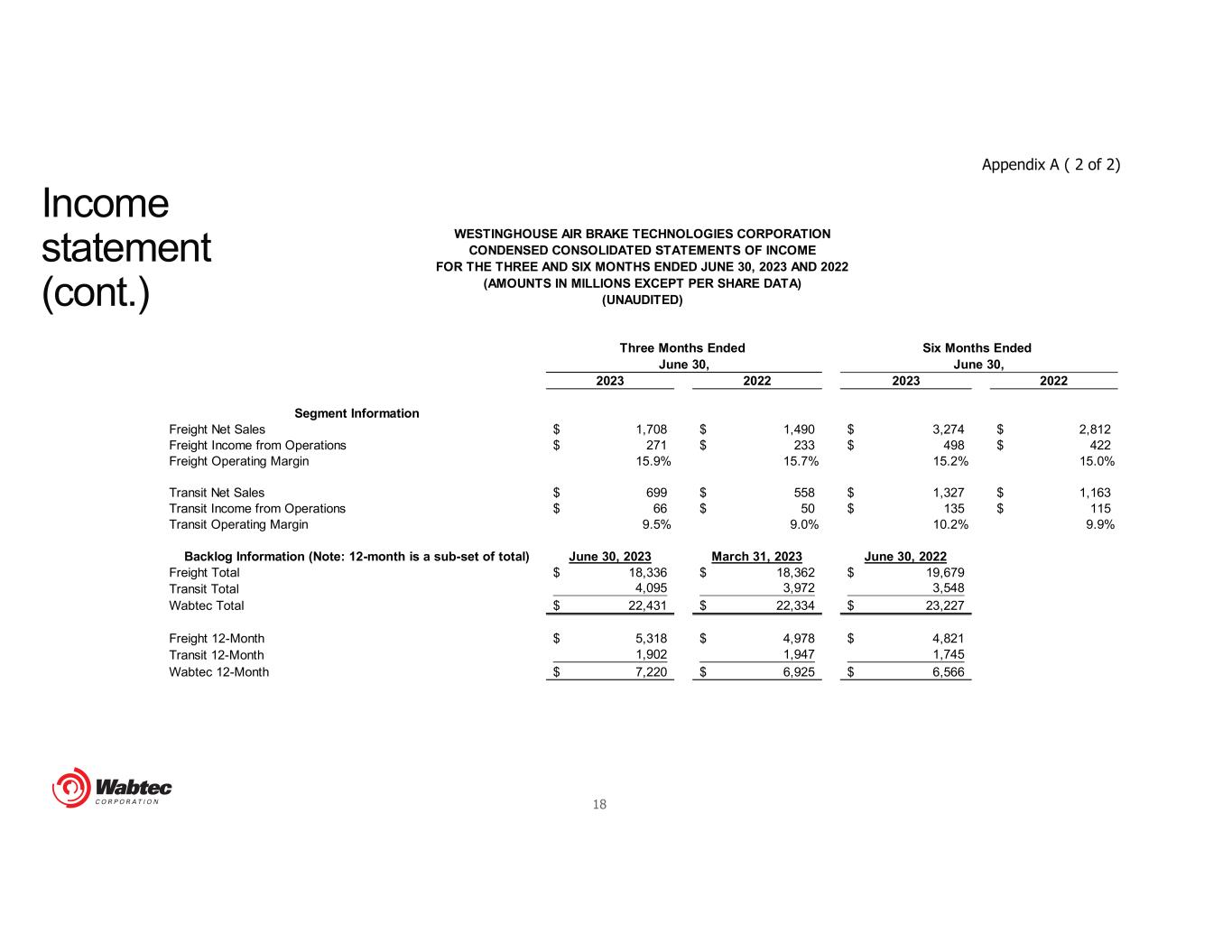

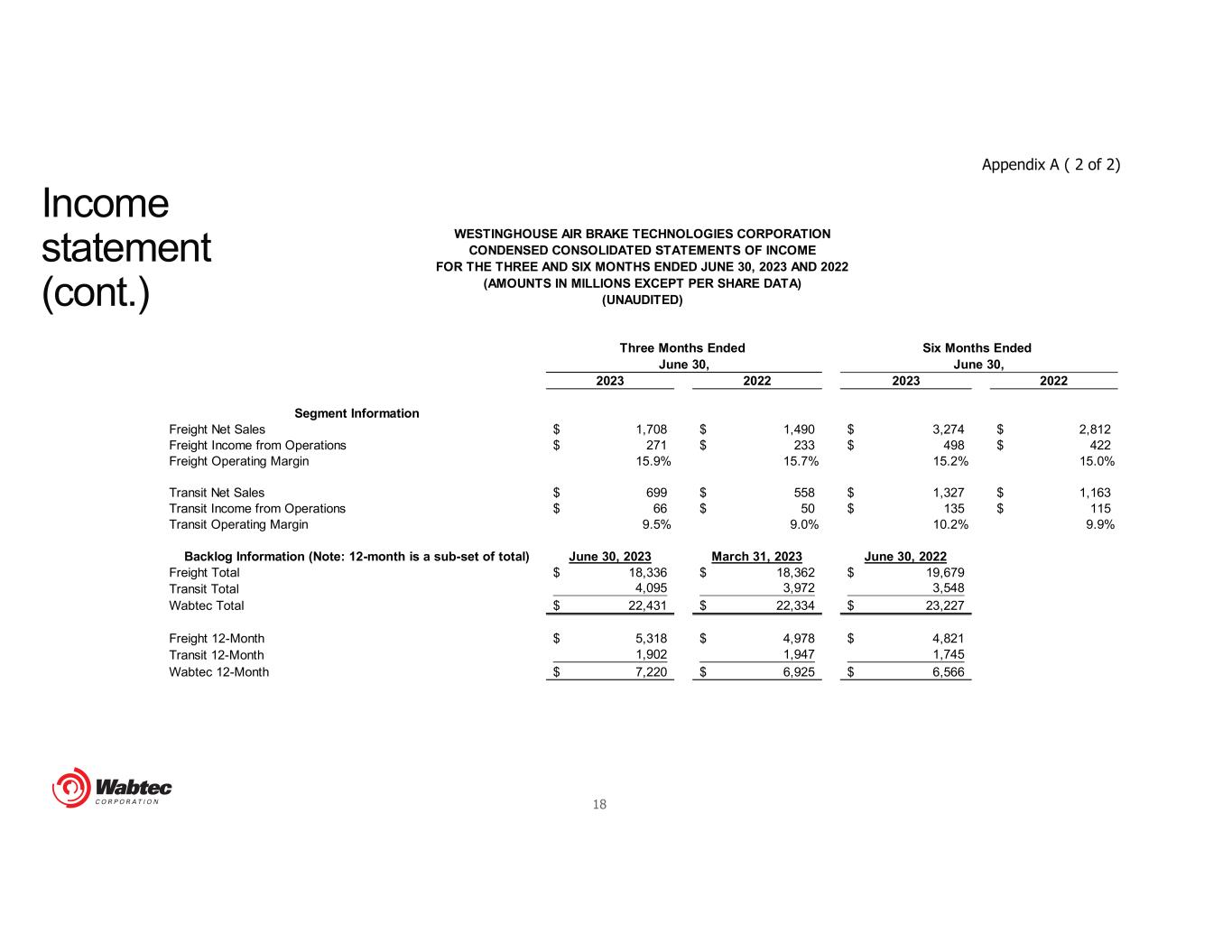

18 2023 2022 2023 2022 Segment Information Freight Net Sales 1,708$ 1,490$ 3,274$ 2,812$ Freight Income from Operations 271$ 233$ 498$ 422$ Freight Operating Margin 15.9% 15.7% 15.2% 15.0% Transit Net Sales 699$ 558$ 1,327$ 1,163$ Transit Income from Operations 66$ 50$ 135$ 115$ Transit Operating Margin 9.5% 9.0% 10.2% 9.9% Backlog Information (Note: 12-month is a sub-set of total) June 30, 2023 March 31, 2023 June 30, 2022 Freight Total 18,336$ 18,362$ 19,679$ Transit Total 4,095 3,972 3,548 Wabtec Total 22,431$ 22,334$ 23,227$ Freight 12-Month 5,318$ 4,978$ 4,821$ Transit 12-Month 1,902 1,947 1,745 Wabtec 12-Month 7,220$ 6,925$ 6,566$ Three Months Ended Six Months Ended June 30, June 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED) Appendix A ( 2 of 2) Income statement (cont.)

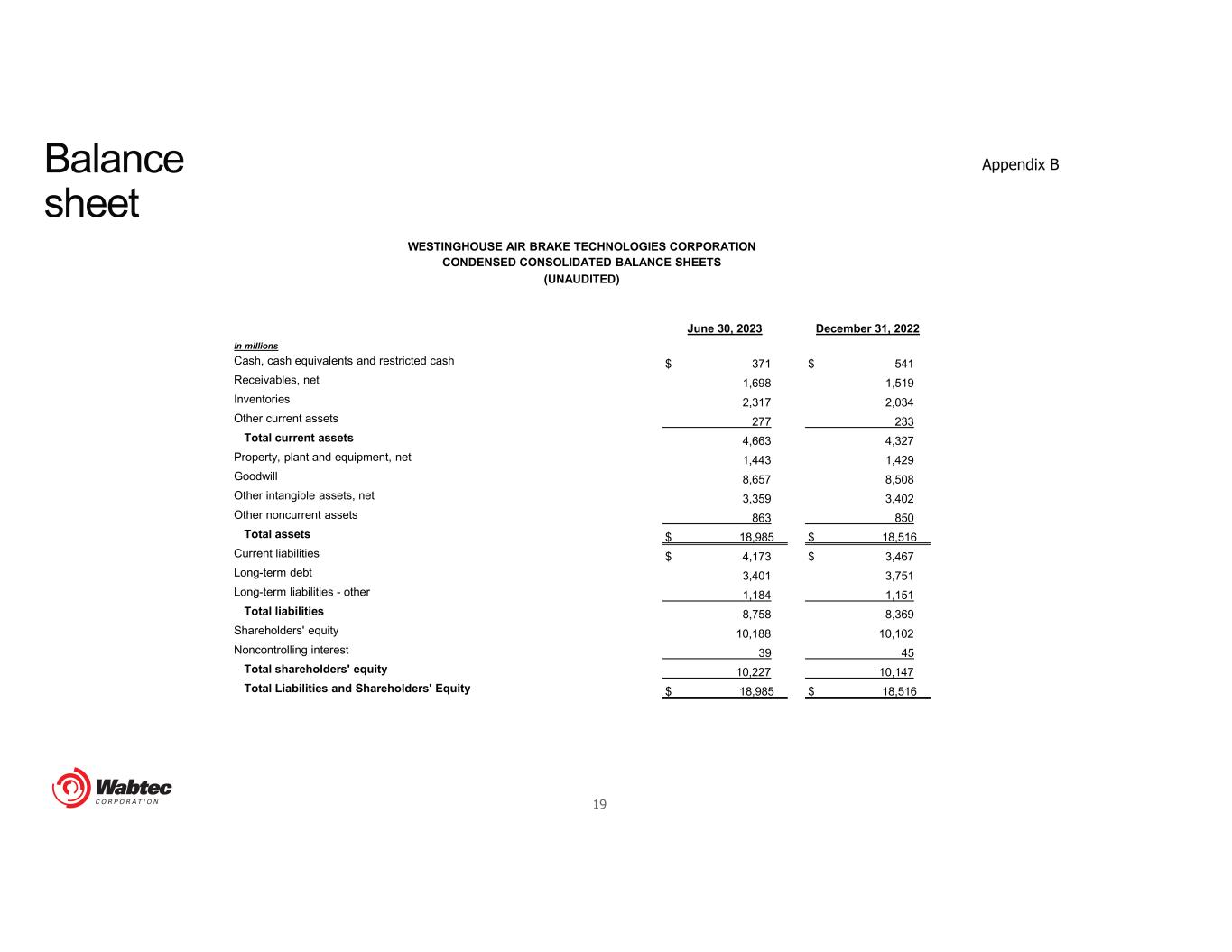

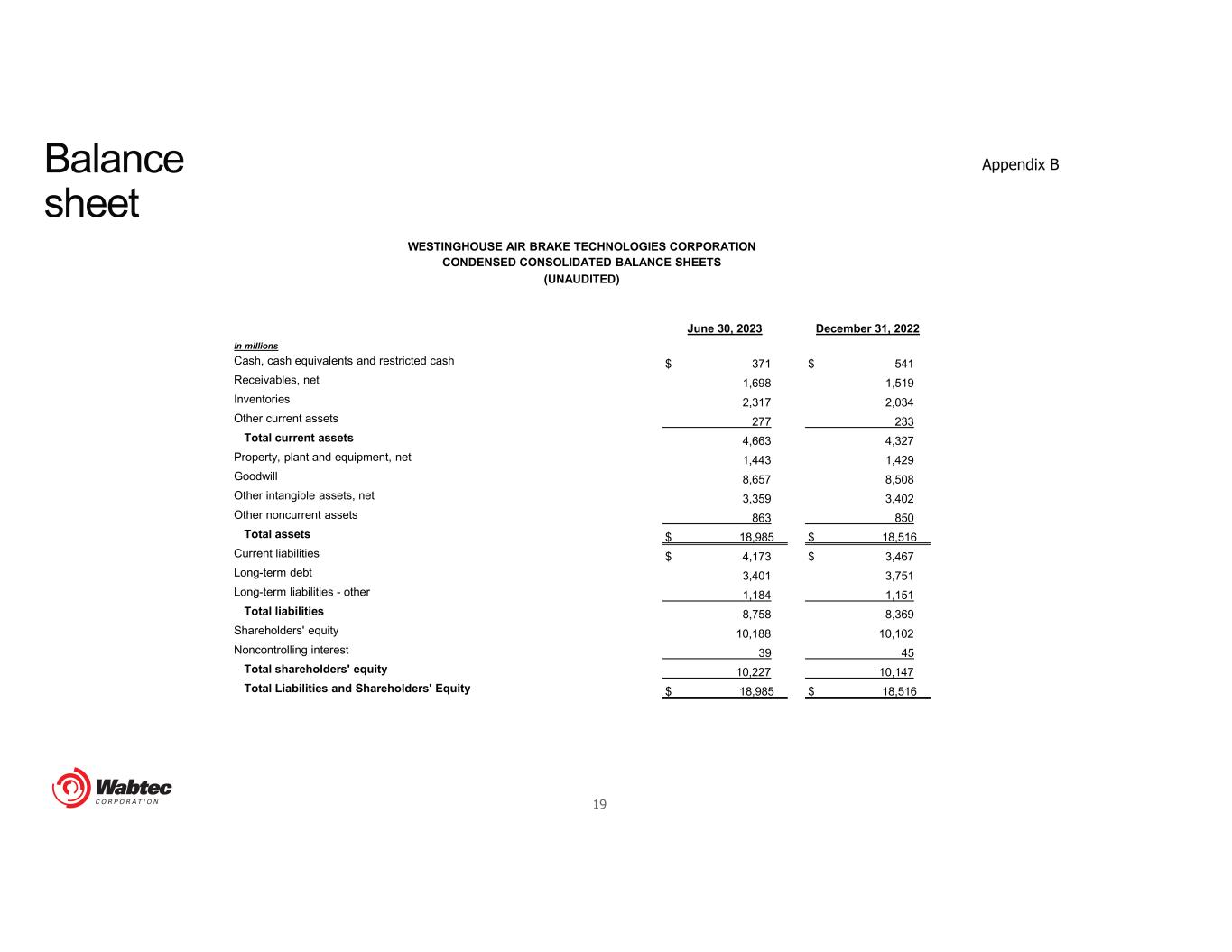

19 WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) June 30, 2023 December 31, 2022 In millions Cash, cash equivalents and restricted cash $ 371 $ 541 Receivables, net 1,698 1,519 Inventories 2,317 2,034 Other current assets 277 233 Total current assets 4,663 4,327 Property, plant and equipment, net 1,443 1,429 Goodwill 8,657 8,508 Other intangible assets, net 3,359 3,402 Other noncurrent assets 863 850 Total assets $ 18,985 $ 18,516 Current liabilities $ 4,173 $ 3,467 Long-term debt 3,401 3,751 Long-term liabilities - other 1,184 1,151 Total liabilities 8,758 8,369 Shareholders' equity 10,188 10,102 Noncontrolling interest 39 45 Total shareholders' equity 10,227 10,147 Total Liabilities and Shareholders' Equity $ 18,985 $ 18,516 Balance sheet Appendix B

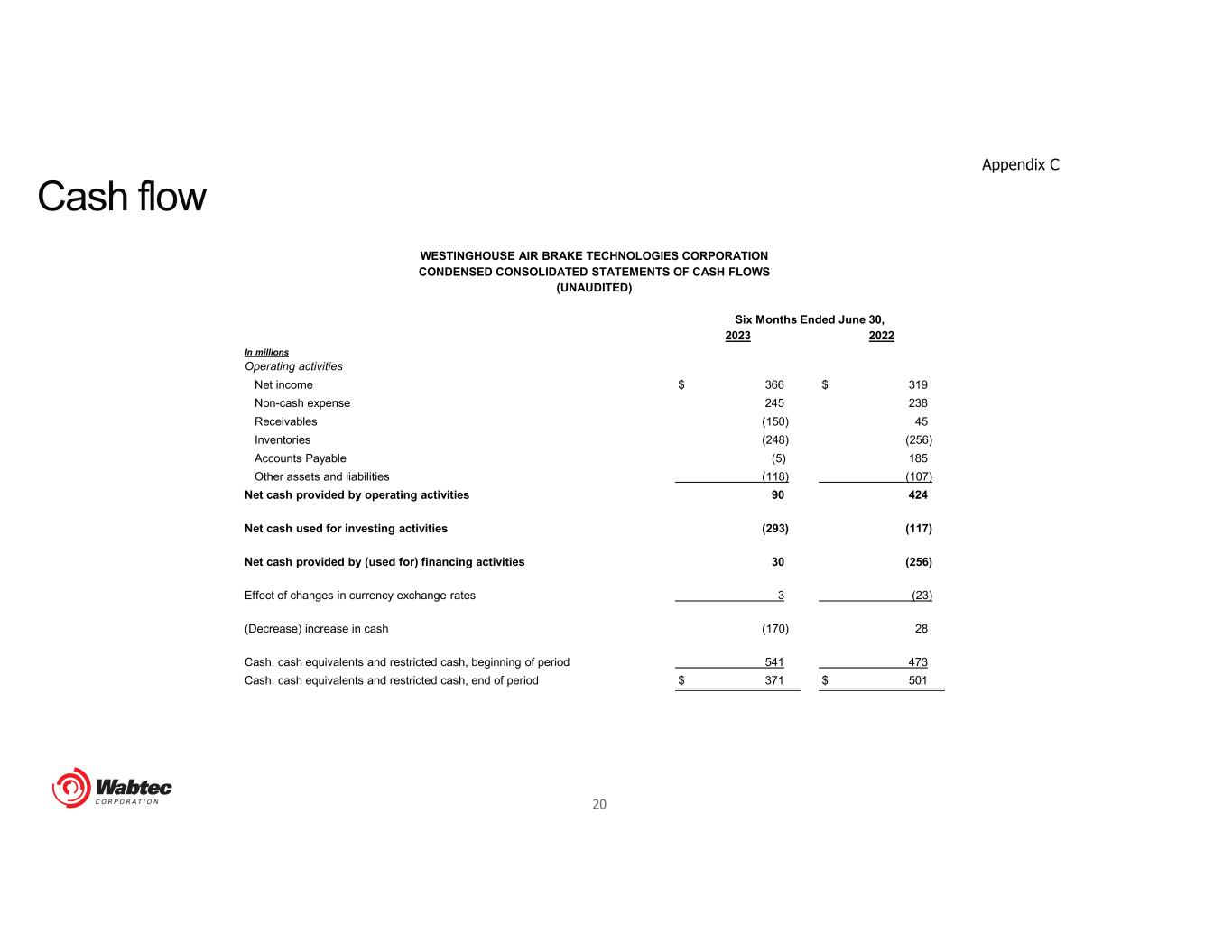

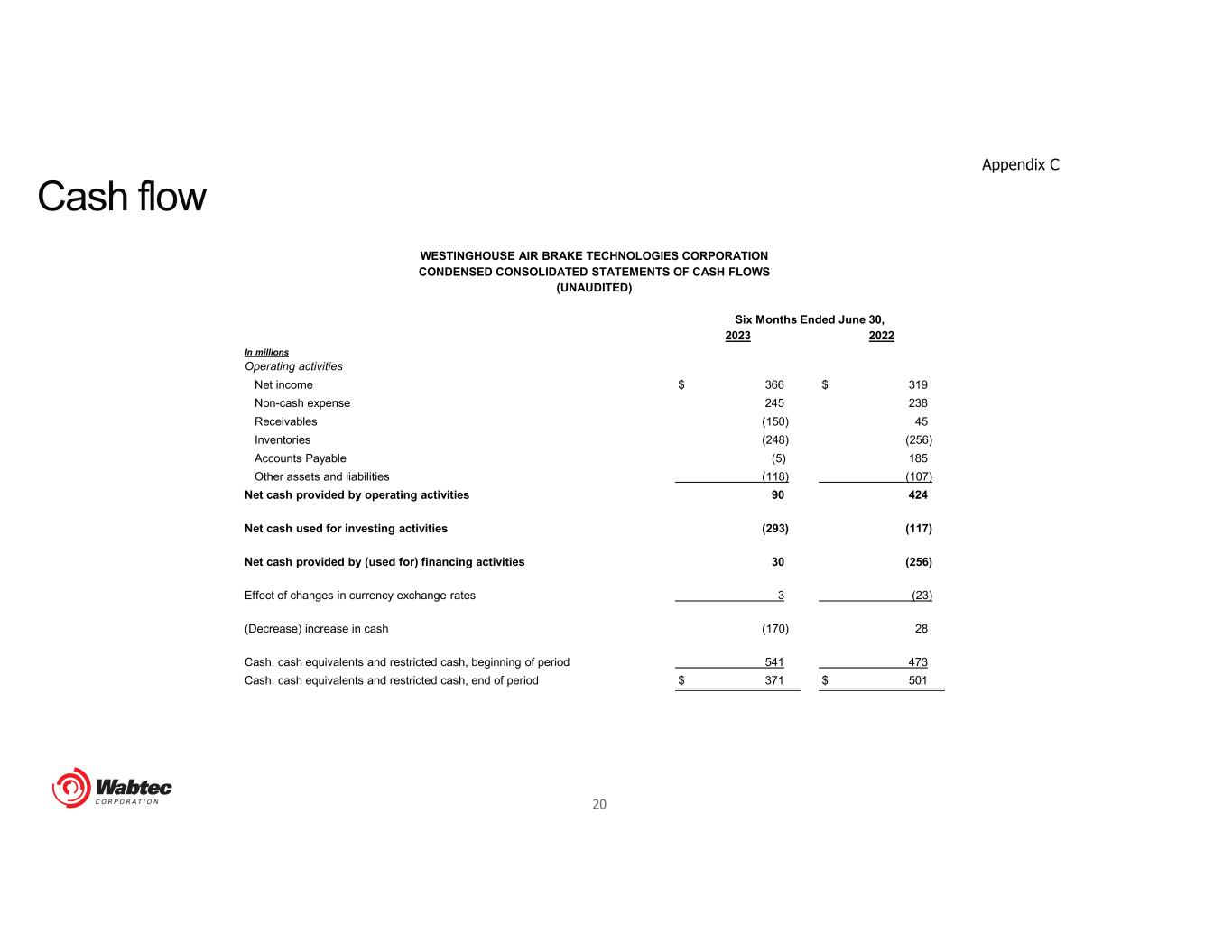

20 WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Six Months Ended June 30, 2023 2022 In millions Operating activities Net income $ 366 $ 319 Non-cash expense 245 238 Receivables (150) 45 Inventories (248) (256) Accounts Payable (5) 185 Other assets and liabilities (118) (107) Net cash provided by operating activities 90 424 Net cash used for investing activities (293) (117) Net cash provided by (used for) financing activities 30 (256) Effect of changes in currency exchange rates 3 (23) (Decrease) increase in cash (170) 28 Cash, cash equivalents and restricted cash, beginning of period 541 473 Cash, cash equivalents and restricted cash, end of period $ 371 $ 501 Appendix C Cash flow

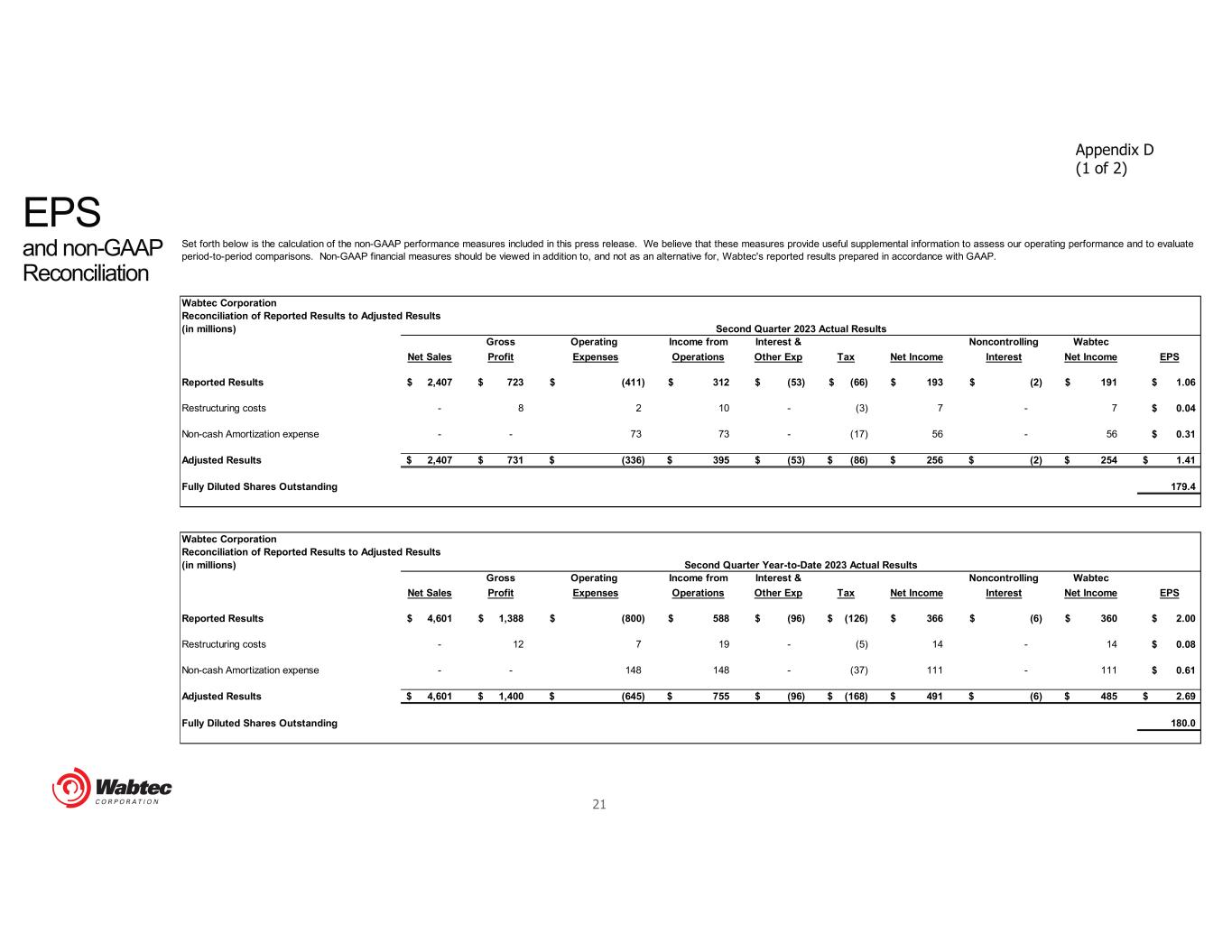

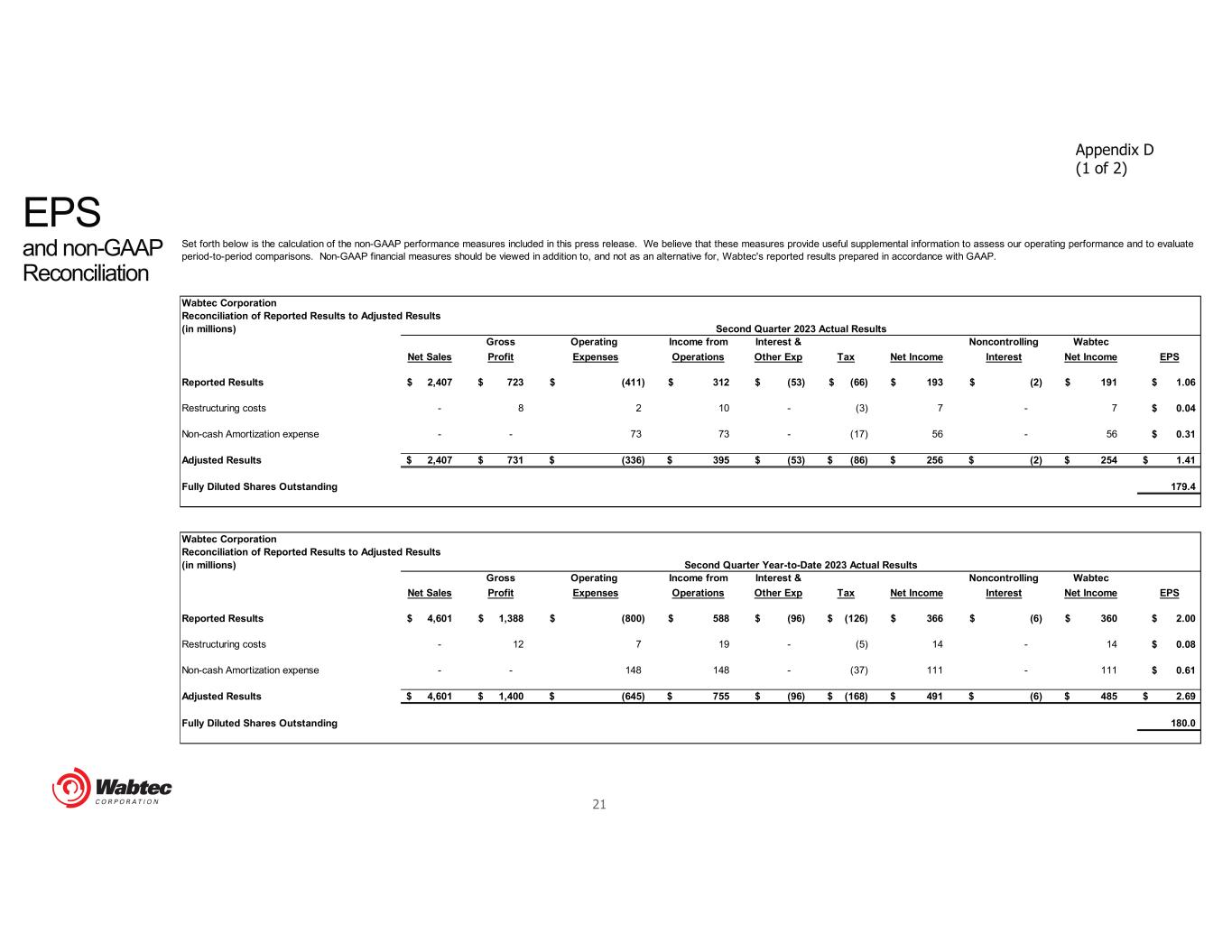

21 EPS and non-GAAP Reconciliation Appendix D (1 of 2) Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,407$ 723$ (411)$ 312$ (53)$ (66)$ 193$ (2)$ 191$ 1.06$ Restructuring costs - 8 2 10 - (3) 7 - 7 0.04$ Non-cash Amortization expense - - 73 73 - (17) 56 - 56 0.31$ Adjusted Results 2,407$ 731$ (336)$ 395$ (53)$ (86)$ 256$ (2)$ 254$ 1.41$ Fully Diluted Shares Outstanding 179.4 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 4,601$ 1,388$ (800)$ 588$ (96)$ (126)$ 366$ (6)$ 360$ 2.00$ Restructuring costs - 12 7 19 - (5) 14 - 14 0.08$ Non-cash Amortization expense - - 148 148 - (37) 111 - 111 0.61$ Adjusted Results 4,601$ 1,400$ (645)$ 755$ (96)$ (168)$ 491$ (6)$ 485$ 2.69$ Fully Diluted Shares Outstanding 180.0 Second Quarter Year-to-Date 2023 Actual Results Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Second Quarter 2023 Actual Results

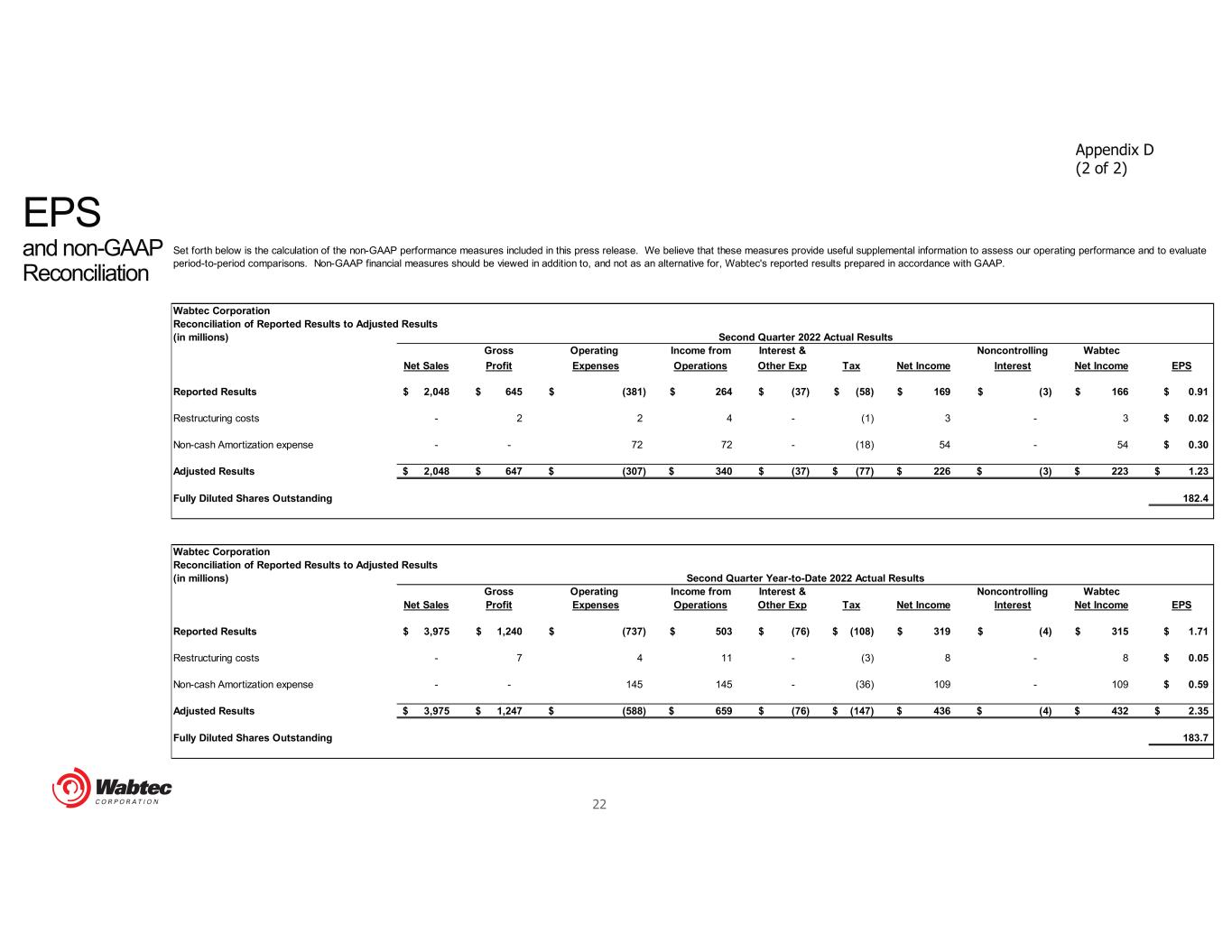

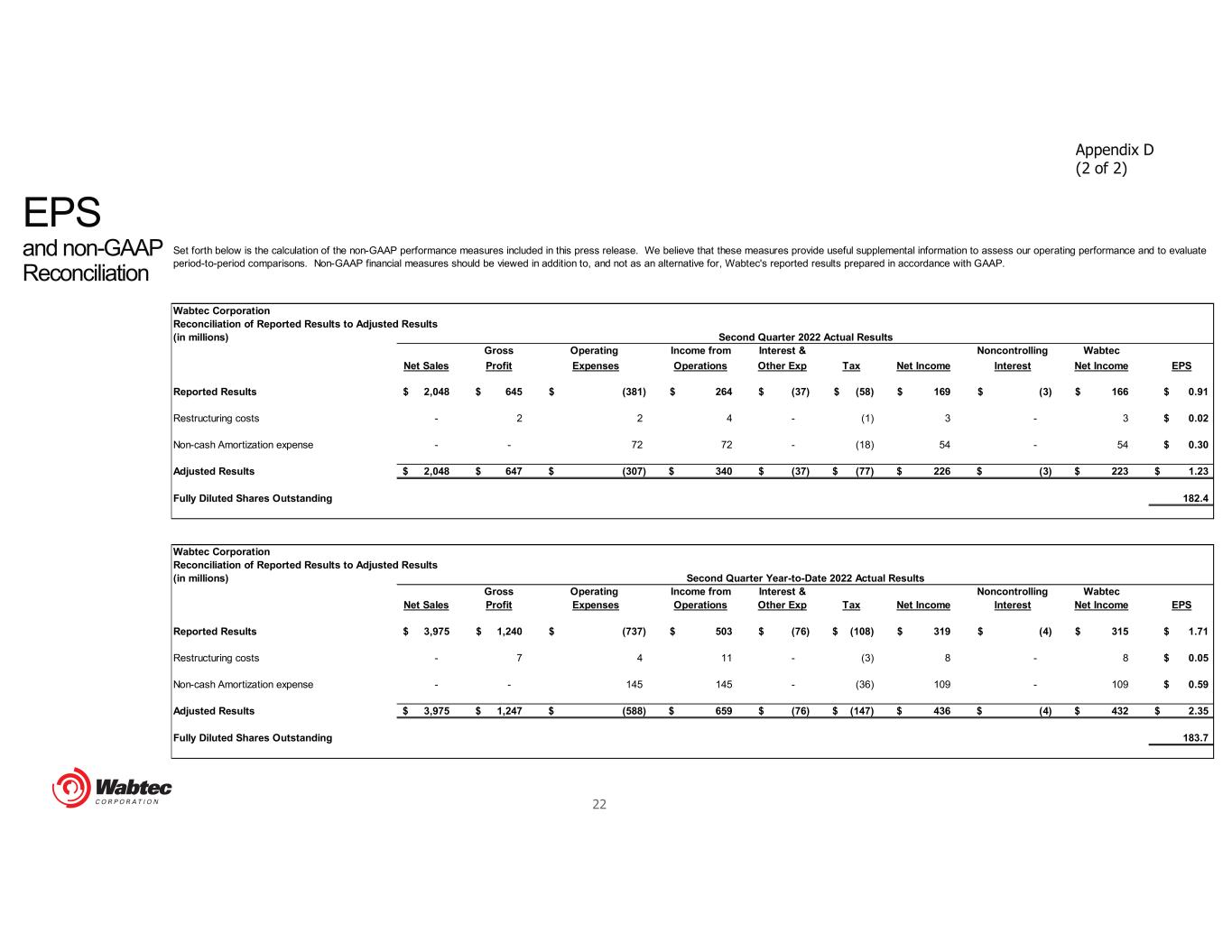

22 EPS and non-GAAP Reconciliation Appendix D (2 of 2) Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,048$ 645$ (381)$ 264$ (37)$ (58)$ 169$ (3)$ 166$ 0.91$ Restructuring costs - 2 2 4 - (1) 3 - 3 0.02$ Non-cash Amortization expense - - 72 72 - (18) 54 - 54 0.30$ Adjusted Results 2,048$ 647$ (307)$ 340$ (37)$ (77)$ 226$ (3)$ 223$ 1.23$ Fully Diluted Shares Outstanding 182.4 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 3,975$ 1,240$ (737)$ 503$ (76)$ (108)$ 319$ (4)$ 315$ 1.71$ Restructuring costs - 7 4 11 - (3) 8 - 8 0.05$ Non-cash Amortization expense - - 145 145 - (36) 109 - 109 0.59$ Adjusted Results 3,975$ 1,247$ (588)$ 659$ (76)$ (147)$ 436$ (4)$ 432$ 2.35$ Fully Diluted Shares Outstanding 183.7 Second Quarter Year-to-Date 2022 Actual Results Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Second Quarter 2022 Actual Results

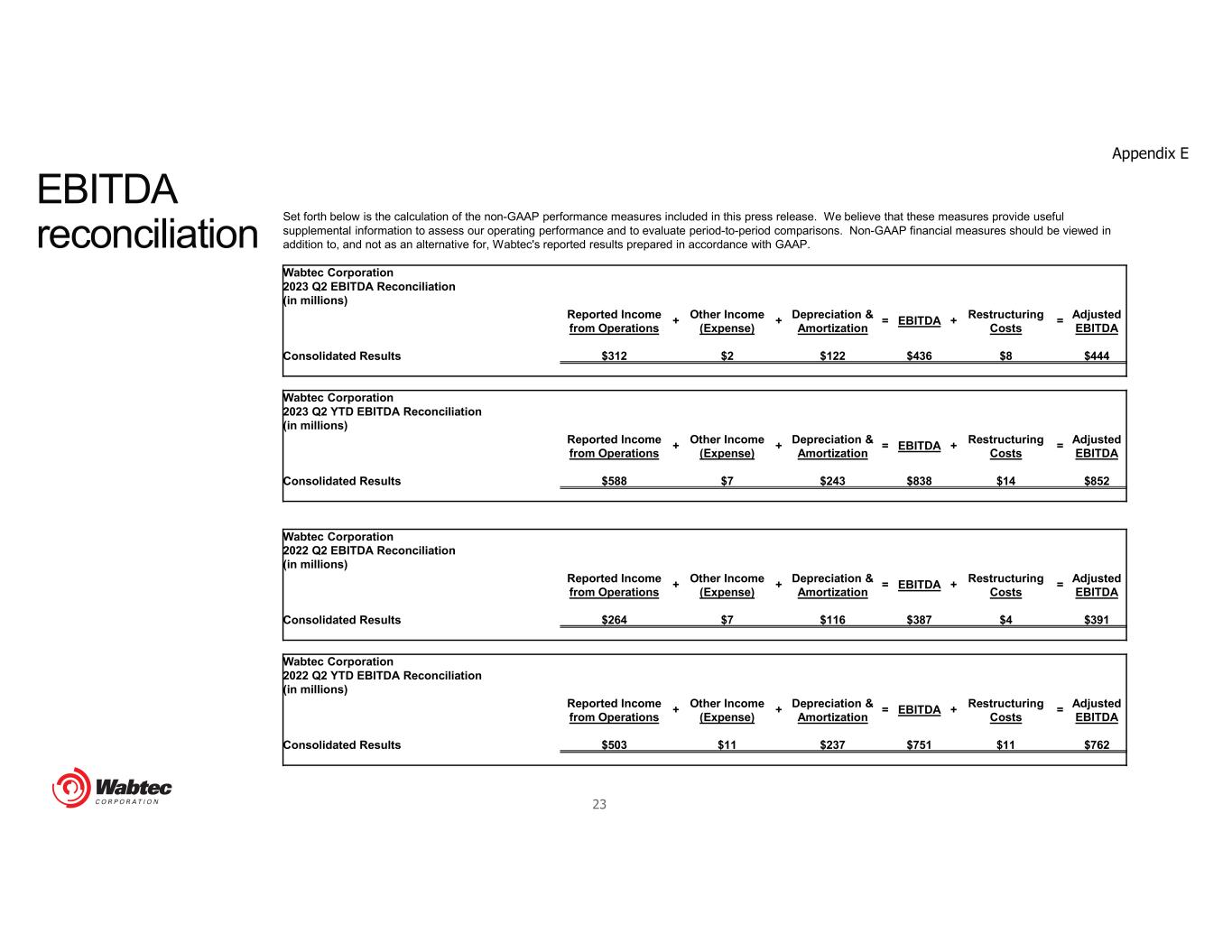

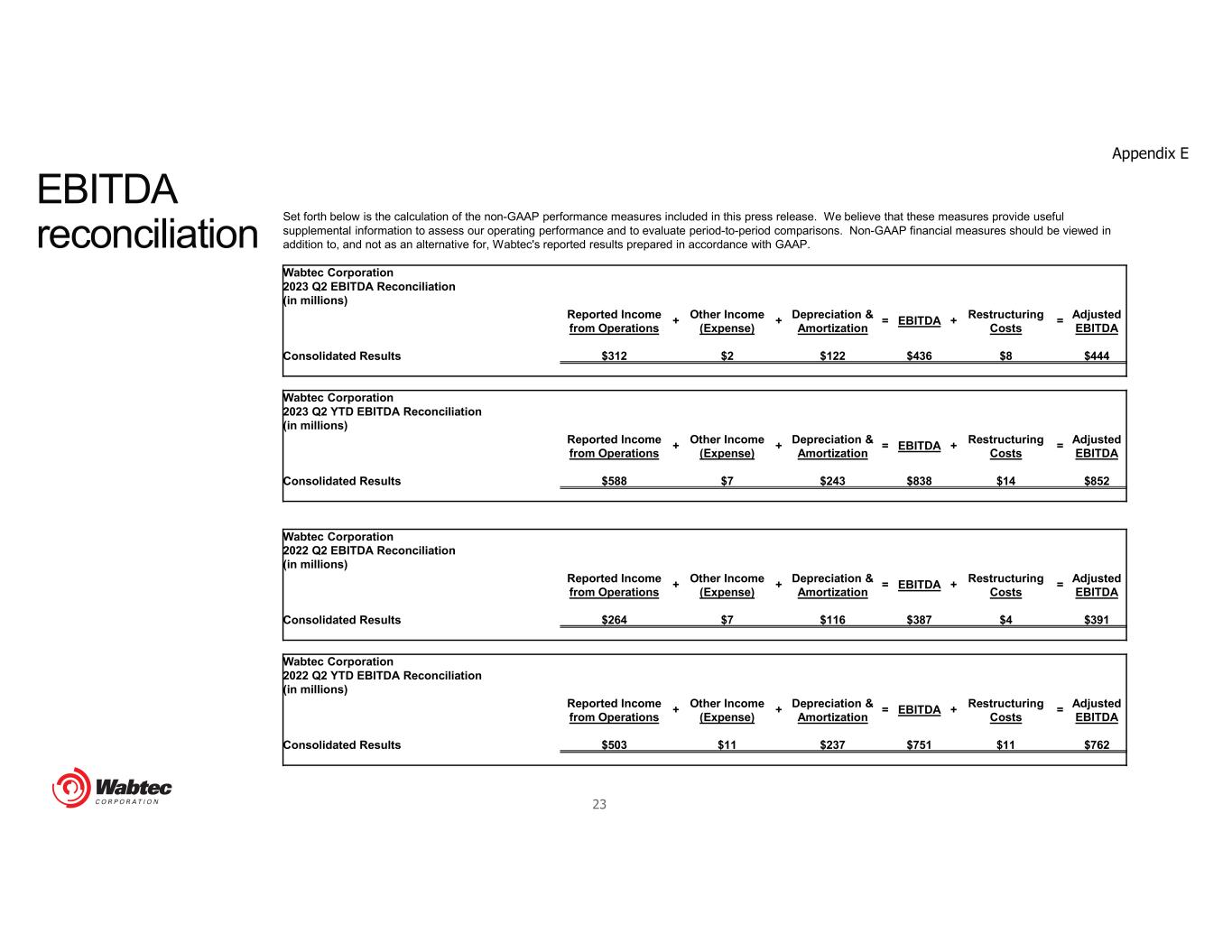

23 Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Wabtec Corporation 2023 Q2 EBITDA Reconciliation (in millions) Reported Income + Other Income + Depreciation & = EBITDA + Restructuring = Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $312 $2 $122 $436 $8 $444 Wabtec Corporation 2023 Q2 YTD EBITDA Reconciliation (in millions) Reported Income + Other Income + Depreciation & = EBITDA + Restructuring = Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $588 $7 $243 $838 $14 $852 Wabtec Corporation 2022 Q2 EBITDA Reconciliation (in millions) Reported Income + Other Income + Depreciation & = EBITDA + Restructuring = Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $264 $7 $116 $387 $4 $391 Wabtec Corporation 2022 Q2 YTD EBITDA Reconciliation (in millions) Reported Income + Other Income + Depreciation & = EBITDA + Restructuring = Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $503 $11 $237 $751 $11 $762 EBITDA reconciliation Appendix E

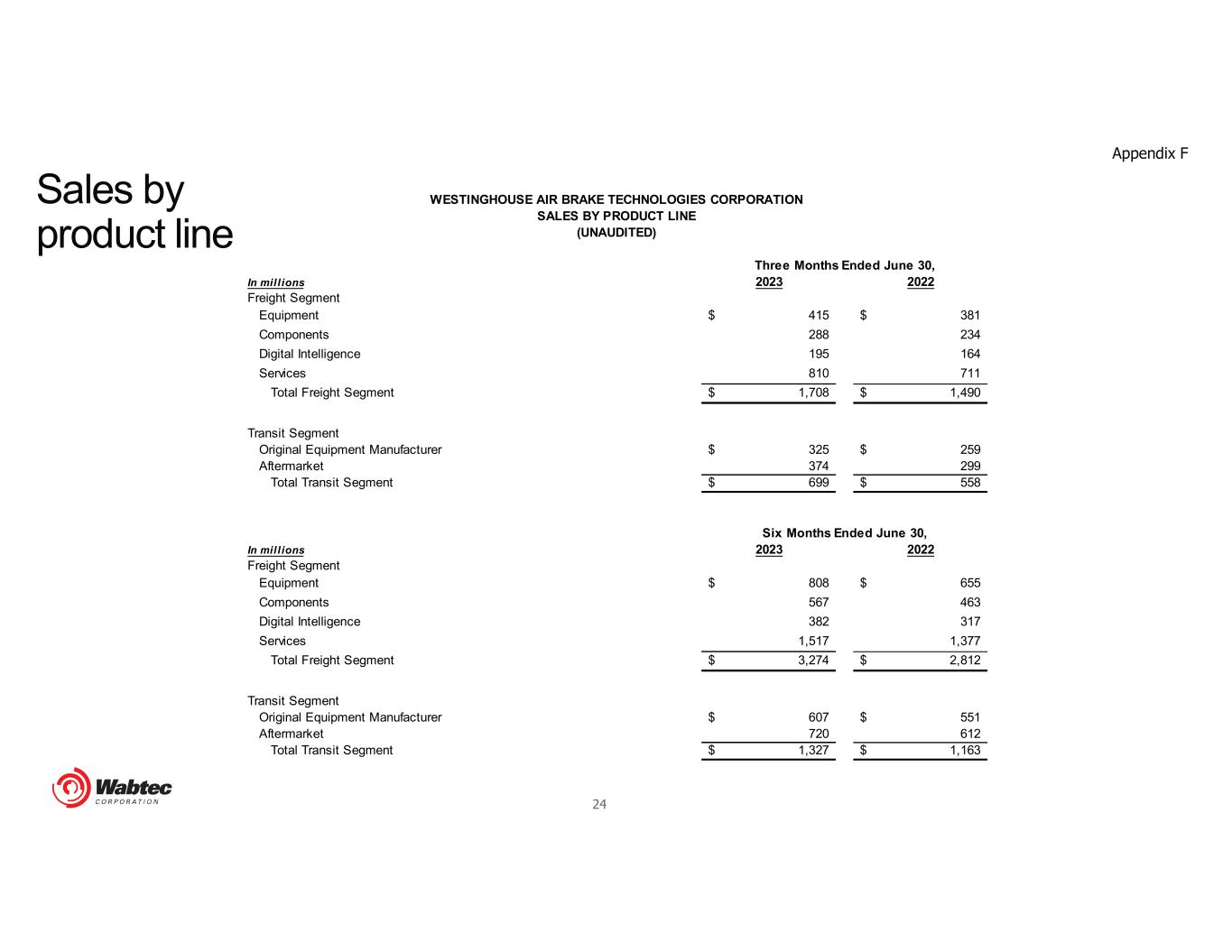

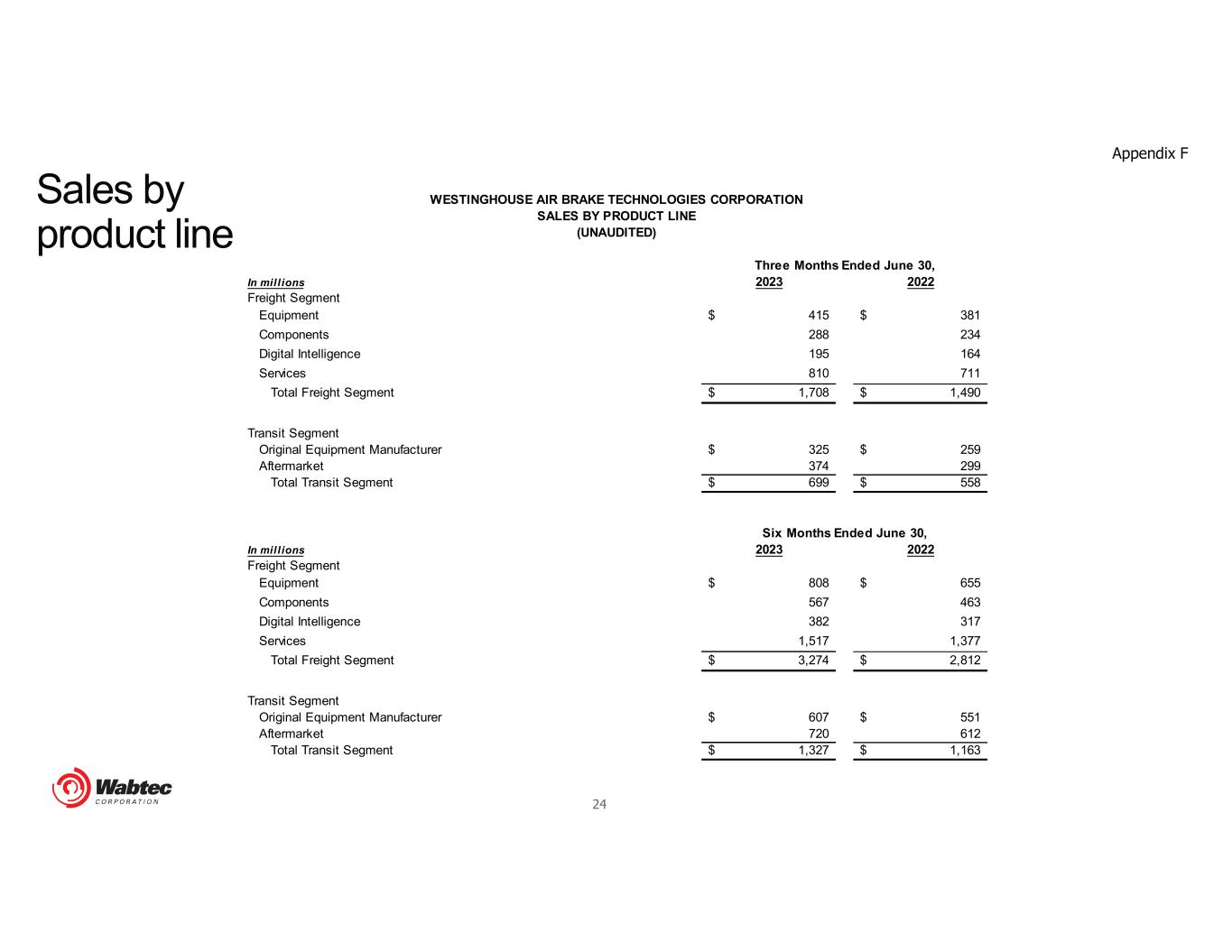

24 Sales by product line Appendix F In mill ions 2023 2022 Freight Segment Equipment 415$ 381$ Components 288 234 Digital Intelligence 195 164 Services 810 711 Total Freight Segment 1,708$ 1,490$ Transit Segment Original Equipment Manufacturer 325$ 259$ Aftermarket 374 299 Total Transit Segment 699$ 558$ In mill ions 2023 2022 Freight Segment Equipment 808$ 655$ Components 567 463 Digital Intelligence 382 317 Services 1,517 1,377 Total Freight Segment 3,274$ 2,812$ Transit Segment Original Equipment Manufacturer 607$ 551$ Aftermarket 720 612 Total Transit Segment 1,327$ 1,163$ Six Months Ended June 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION SALES BY PRODUCT LINE (UNAUDITED) Three Months Ended June 30,

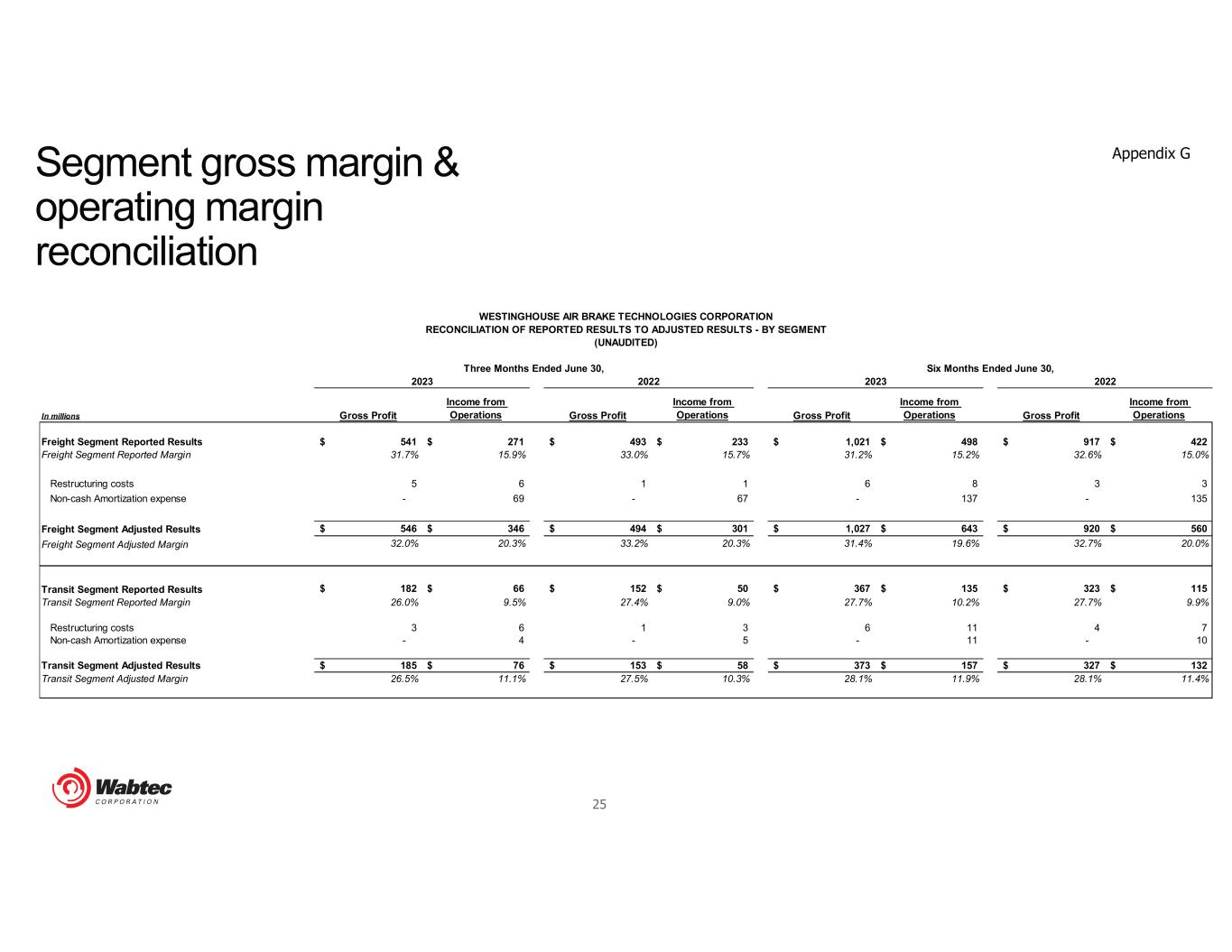

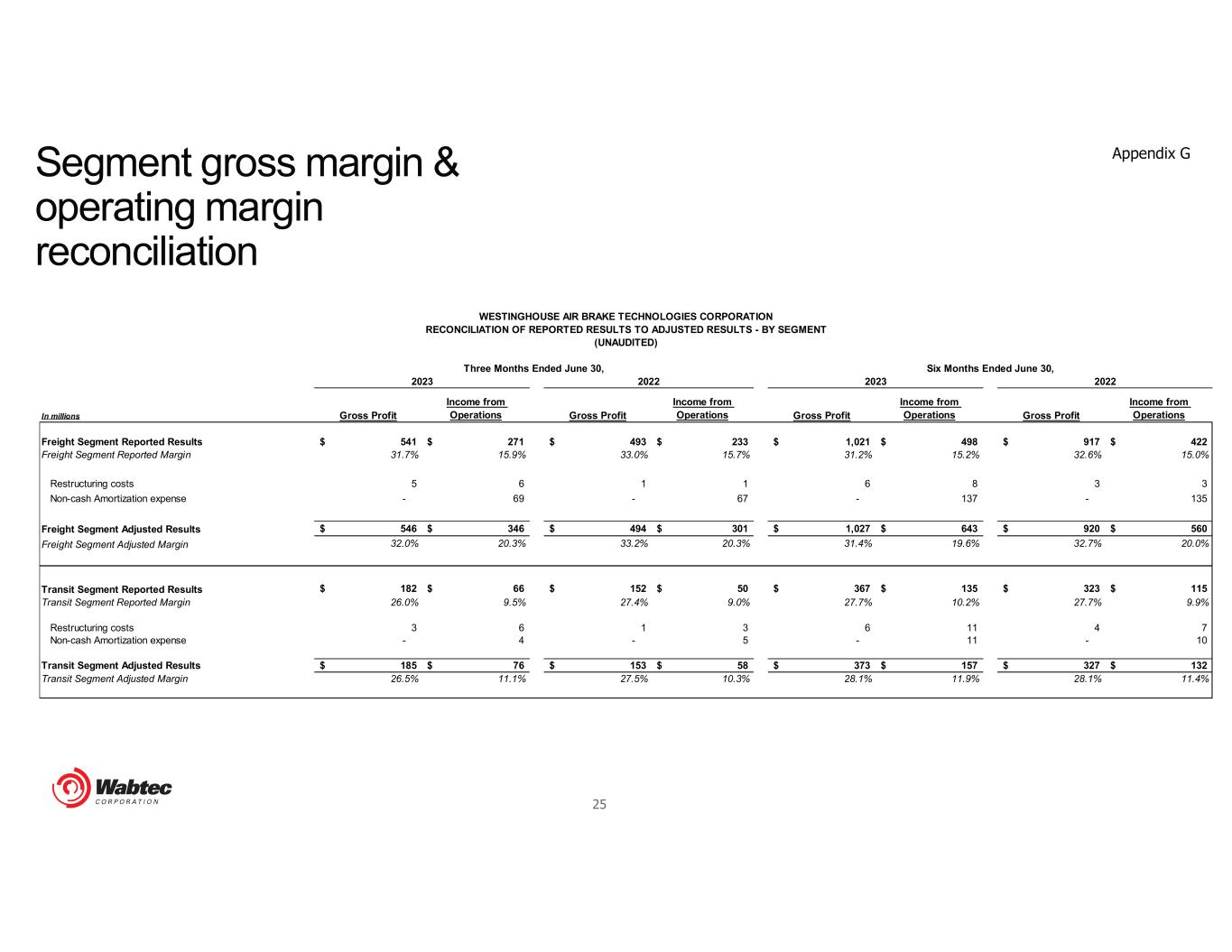

25 In millions Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Freight Segment Reported Results 541$ 271$ 493$ 233$ 1,021$ 498$ 917$ 422$ Freight Segment Reported Margin 31.7% 15.9% 33.0% 15.7% 31.2% 15.2% 32.6% 15.0% Restructuring costs 5 6 1 1 6 8 3 3 Non-cash Amortization expense - 69 - 67 - 137 - 135 Freight Segment Adjusted Results 546$ 346$ 494$ 301$ 1,027$ 643$ 920$ 560$ Freight Segment Adjusted Margin 32.0% 20.3% 33.2% 20.3% 31.4% 19.6% 32.7% 20.0% Transit Segment Reported Results 182$ 66$ 152$ 50$ 367$ 135$ 323$ 115$ Transit Segment Reported Margin 26.0% 9.5% 27.4% 9.0% 27.7% 10.2% 27.7% 9.9% Restructuring costs 3 6 1 3 6 11 4 7 Non-cash Amortization expense - 4 - 5 - 11 - 10 Transit Segment Adjusted Results 185$ 76$ 153$ 58$ 373$ 157$ 327$ 132$ Transit Segment Adjusted Margin 26.5% 11.1% 27.5% 10.3% 28.1% 11.9% 28.1% 11.4% WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION RECONCILIATION OF REPORTED RESULTS TO ADJUSTED RESULTS - BY SEGMENT (UNAUDITED) 2023 2022 Three Months Ended June 30, Six Months Ended June 30, 2023 2022 Segment gross margin & operating margin reconciliation Appendix G

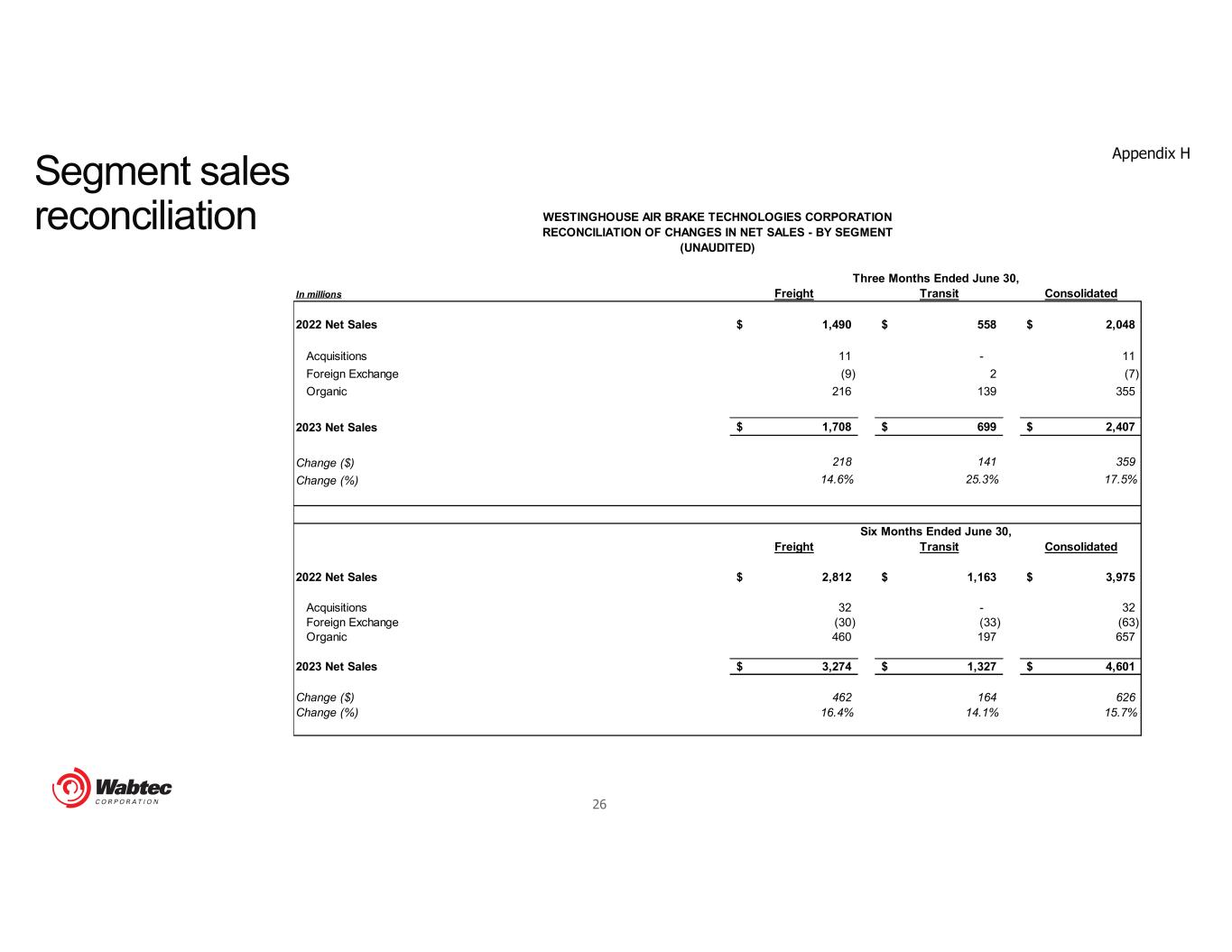

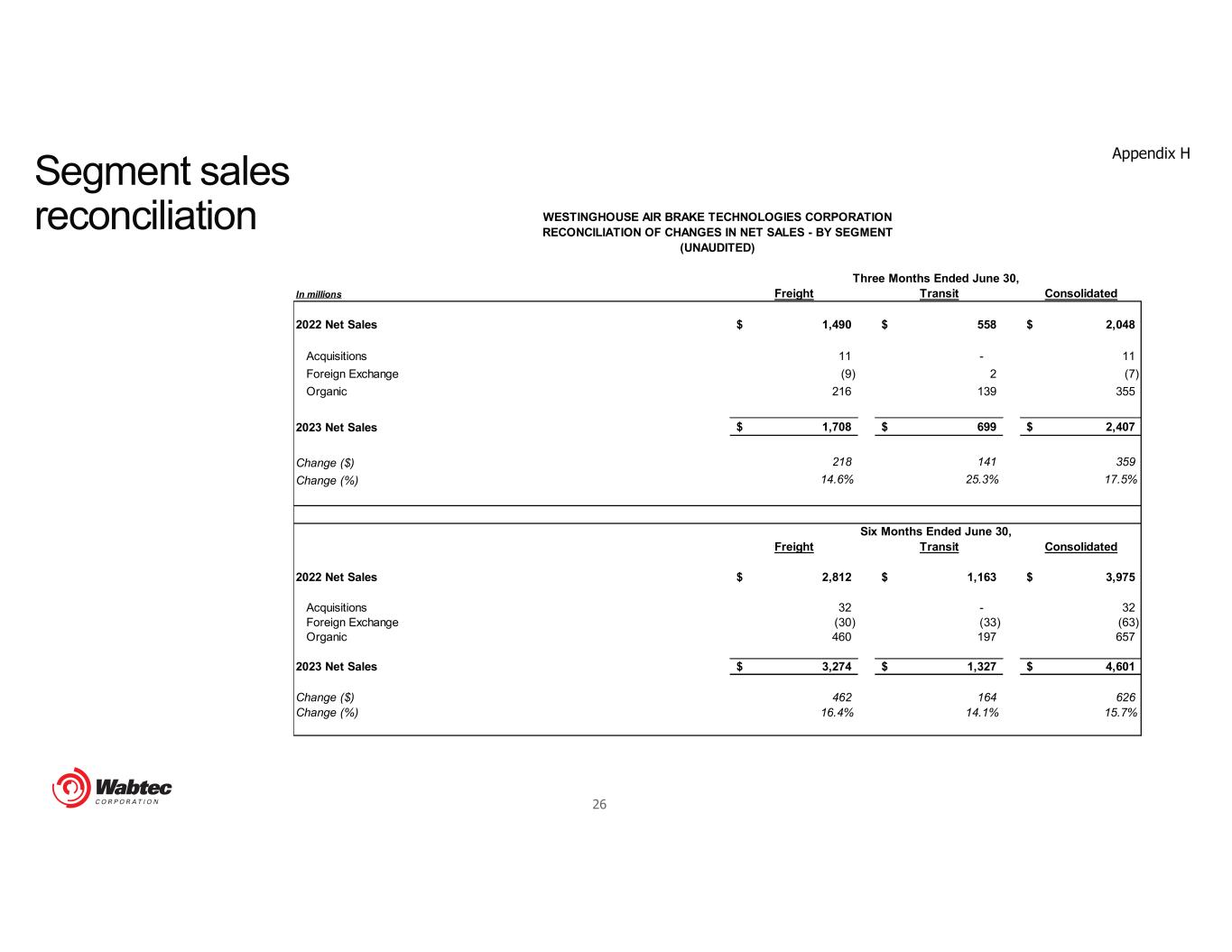

26 In millions Freight Transit Consolidated 2022 Net Sales 1,490$ 558$ 2,048$ Acquisitions 11 - 11 Foreign Exchange (9) 2 (7) Organic 216 139 355 2023 Net Sales 1,708$ 699$ 2,407$ Change ($) 218 141 359 Change (%) 14.6% 25.3% 17.5% Freight Transit Consolidated 2022 Net Sales 2,812$ 1,163$ 3,975$ Acquisitions 32 - 32 Foreign Exchange (30) (33) (63) Organic 460 197 657 2023 Net Sales 3,274$ 1,327$ 4,601$ Change ($) 462 164 626 Change (%) 16.4% 14.1% 15.7% (UNAUDITED) Three Months Ended June 30, Six Months Ended June 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION RECONCILIATION OF CHANGES IN NET SALES - BY SEGMENT Segment sales reconciliation Appendix H

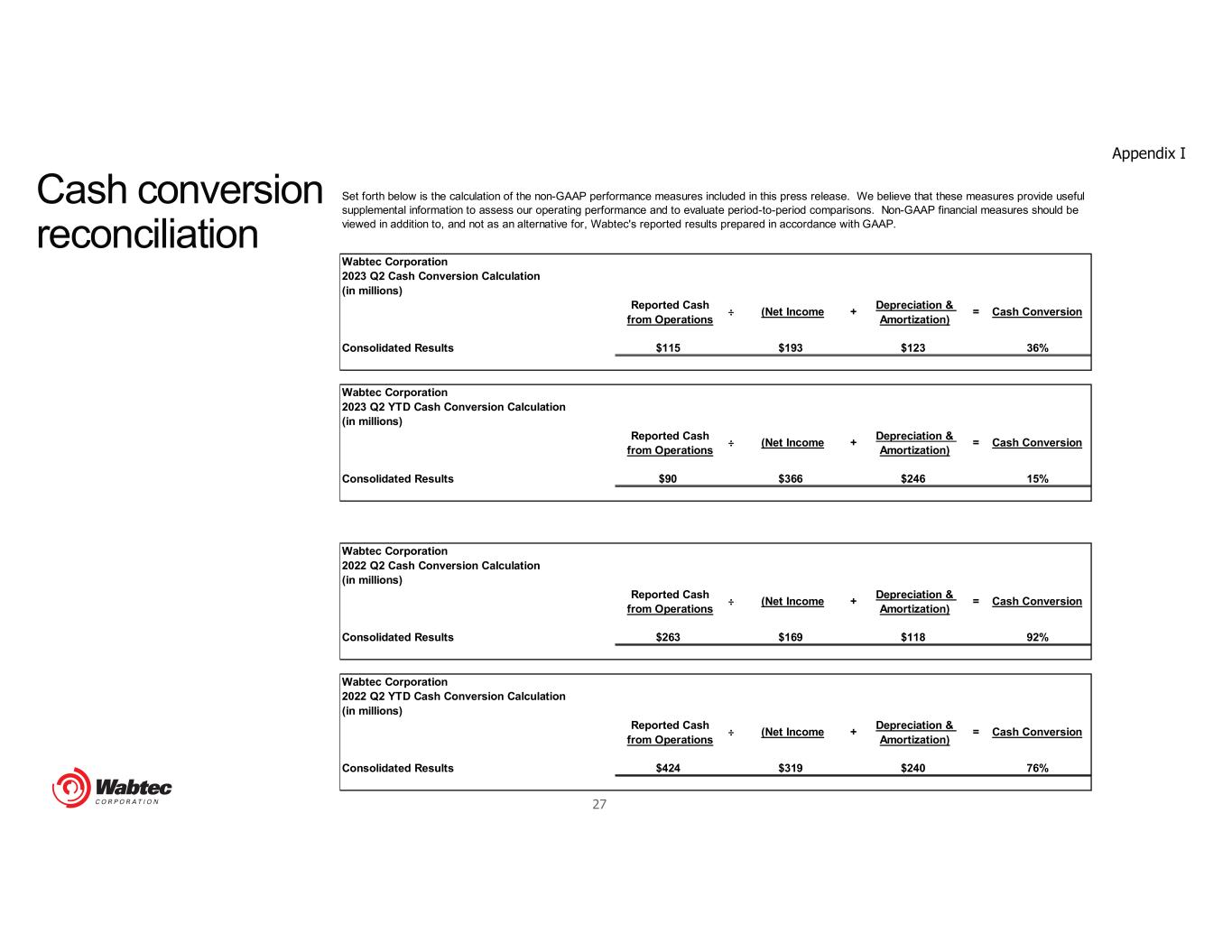

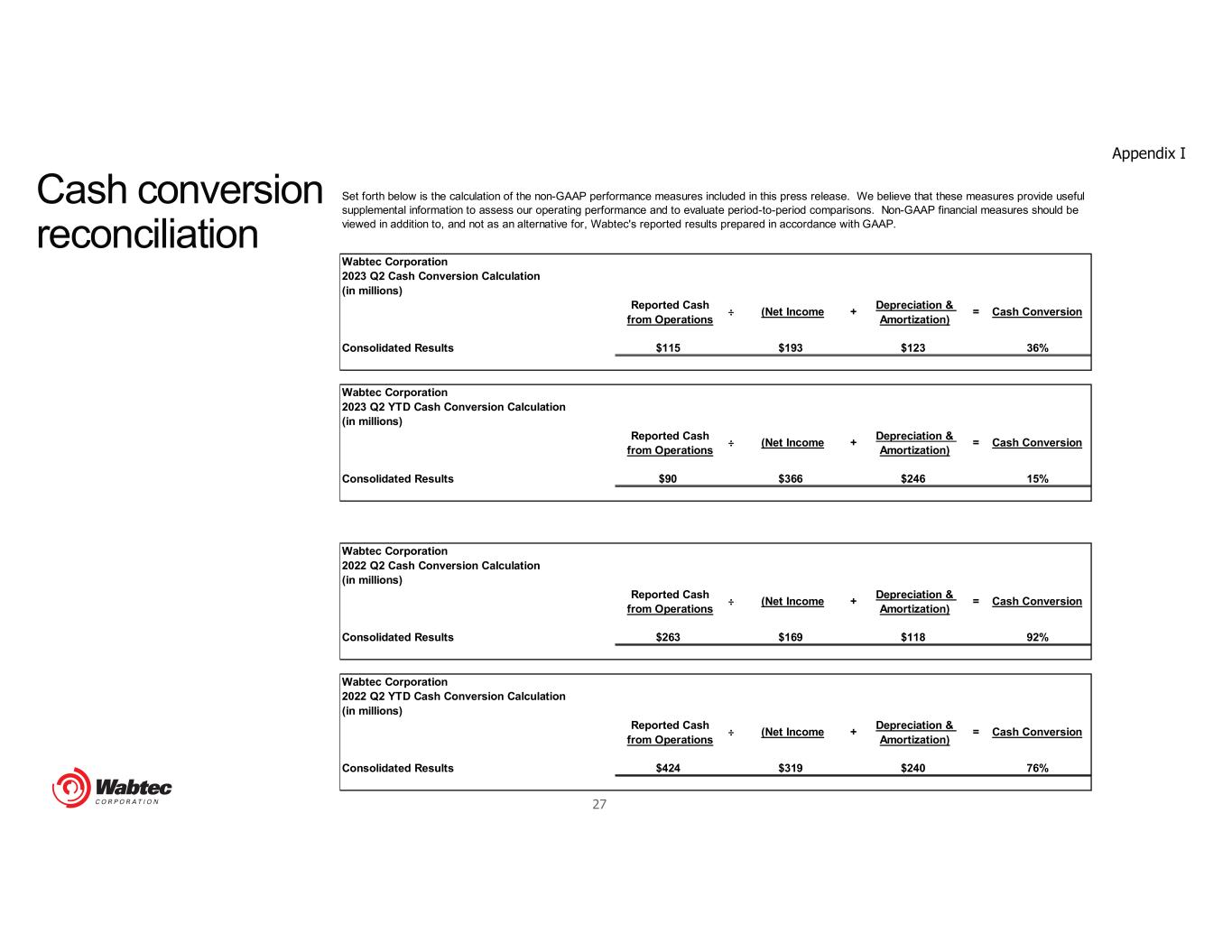

27 Cash conversion reconciliation Appendix I Wabtec Corporation 2023 Q2 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $115 $193 $123 36% Wabtec Corporation 2023 Q2 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $90 $366 $246 15% Wabtec Corporation 2022 Q2 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $263 $169 $118 92% Wabtec Corporation 2022 Q2 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $424 $319 $240 76% Cash Conversion Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) =