1 T HI R D Q U A RT E R 2 0 2 3 Wabtec Financial Results and Company Highlights

2 Forward looking statements & non-GAAP financial information This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995 including statements regarding the impact of acquisitions by Wabtec, statements regarding Wabtec’s expectations about future sales and earnings and statements about the impact of evolving global conditions on Wabtec’s business. All statements, other than historical facts, including statements regarding synergies and other expected benefits from acquisitions; statements regarding Wabtec’s plans, objectives, expectations and intentions; and statements regarding macro-economic conditions and evolving production and demand conditions; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward looking statements include statements regarding: Wabtec’s plans, objectives and intention; Wabtec’s expectations about future sales, earnings and cash conversion; Wabtec’s projected expenses and cost savings associated with its Integration 2.0 initiative; Wabtec’s 5-year outlook (established in March 2022); Wabtec’s expectations for evolving global industry, market and macro-economic conditions and their impact on Wabtec’s business; synergies and other expected benefits from Wabtec’s acquisitions; Wabtec’s expectations for production and demand conditions; and any assumptions underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) changes in general economic and/or industry specific conditions, including the impacts of tax and tariff programs, inflation, supply chain disruptions, foreign currency exchange, and industry consolidation; (2) changes in the financial condition or operating strategies of Wabtec's customers; (3) unexpected costs, charges or expenses resulting from acquisitions and potential failure to realize synergies and other anticipated benefits of acquisitions, including as a result of integrating acquired targets into Wabtec; (4) inability to retain and hire key personnel; (5) evolving legal, regulatory and tax regimes; (6) changes in the expected timing of projects; (7) a decrease in freight or passenger rail traffic; (8) an increase in manufacturing costs; (9) actions by third parties, including government agencies; (10) the impacts of epidemics, pandemics (including the COVID-19 pandemic), or similar public health crises on the global economy and, in particular, our customers, suppliers and end-markets, (11) potential disruptions, instability, and volatility in global markets as a result of global miliary action, acts of terrorism or armed conflict, including from the imposition of economic sanctions on Russia resulting from the invasion of Ukraine; (12) cybersecurity and data protection risks and (13) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. This presentation as well as Wabtec’s earnings release and 2023 financial guidance mention certain non-GAAP financial performance measures, including adjusted gross profit, adjusted operating expenses, adjusted income from operations, adjusted interest and other expense, adjusted operating margin, adjusted income tax expense, adjusted effective tax rate, adjusted earnings per diluted share, EBITDA and adjusted EBITDA, net debt and operating cash flow conversion rate. Wabtec defines EBITDA as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is further adjusted for restructuring costs. Wabtec defines operating cash flow conversion as net cash provided by operating activities divided by net income plus depreciation and amortization including deferred debt cost amortization. While Wabtec believes these are useful supplemental measures for investors, they are not presented in accordance with GAAP. Investors should not consider non-GAAP measures in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have inherent material limitations as performance measures because they add back certain expenses incurred by the company to GAAP financial measures, resulting in those expenses not being taken into account in the applicable non-GAAP financial measure. Because not all companies use identical calculations, Wabtec’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Included in this presentation are reconciliation tables that provide details about how adjusted results relate to GAAP results. Wabtec is not presenting a quantitative reconciliation of its forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share as it is unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of certain regulatory, legal and tax matters; the financial impact of these items is uncertain and is dependent on various factors, including the timing, and could be material to Wabtec’s Consolidated Statement of Earnings.

3 RAFAEL SANTANA President and Chief Executive Officer W A B T E C Today’s participants JOHN OLIN Executive Vice President and Chief Financial Officer KRISTINE KUBACKI Vice President, Investor Relations 3

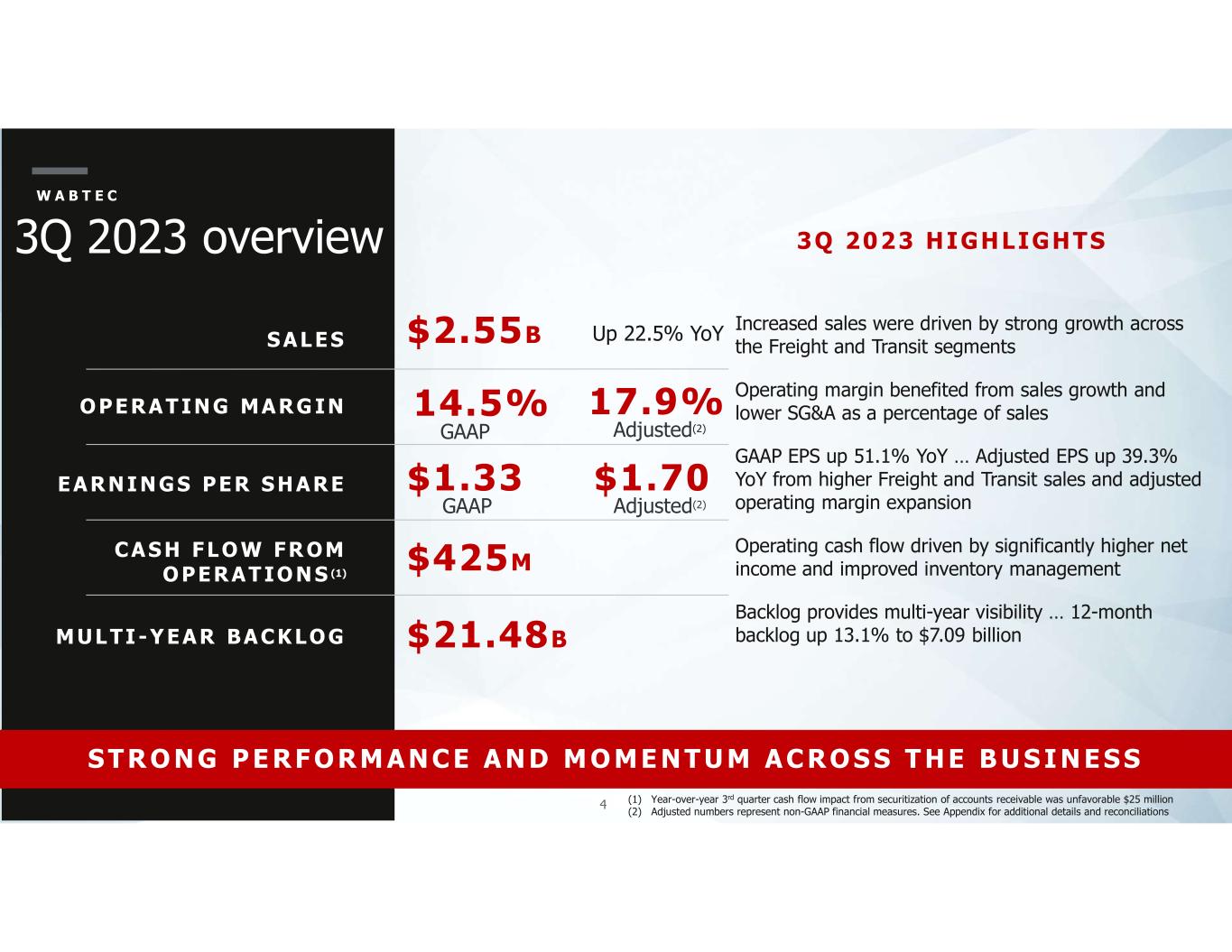

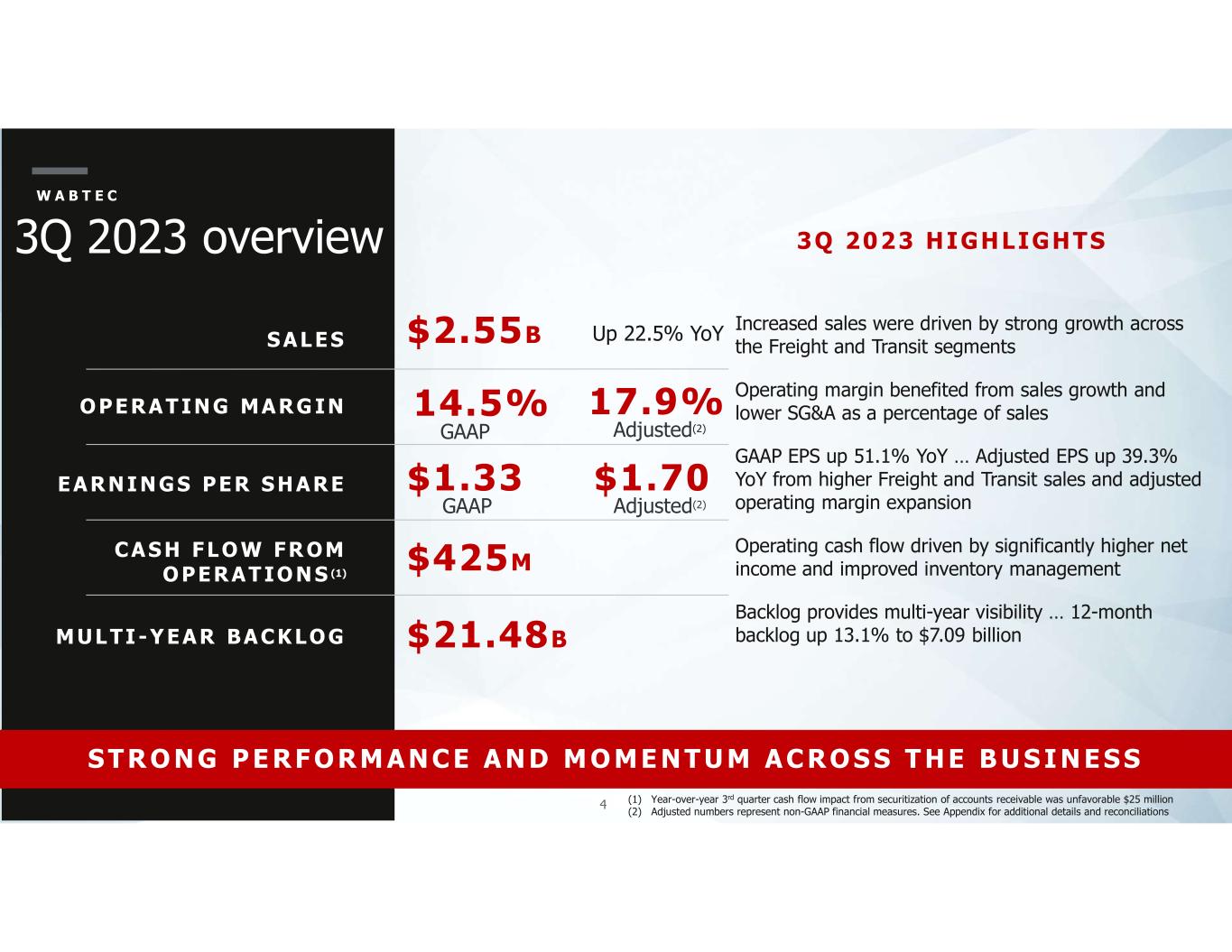

4 3Q 2023 overview Increased sales were driven by strong growth across the Freight and Transit segments Operating margin benefited from sales growth and lower SG&A as a percentage of sales GAAP EPS up 51.1% YoY … Adjusted EPS up 39.3% YoY from higher Freight and Transit sales and adjusted operating margin expansion Operating cash flow driven by significantly higher net income and improved inventory management Backlog provides multi-year visibility … 12-month backlog up 13.1% to $7.09 billion W A B T E C S A L ES O PERAT IN G MARG IN EARN I N GS PER S HARE CAS H F L O W FR OM O PERAT IO N S (1) M UL TI -Y EAR BA CK LO G $2.55B 17.9% $1.33 $425M $21.48B S T R O N G P E RF O RM AN C E A N D M O M E N T U M AC RO S S T HE B U S I N ES S (1) Year-over-year 3rd quarter cash flow impact from securitization of accounts receivable was unfavorable $25 million (2) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations 3Q 2023 HIGHLIGHTS Up 22.5% YoY 14.5% GAAP Adjusted(2) $1.70 GAAP Adjusted(2)

5 (0.1%) (4.9%) (3.7%) (3.3%) 0.2% (0.8%) (3.2%) (4.6%) (3.4%) 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 F R E I G H T NA Carloads - Locomotive and Railcars Parkings ↔/- International Freight Volumes + NA Railcar Deliveries + Mining Commodities ↔ T R A N S I T Infrastructure Investment + Global Ridership +/↔ W A B T E C 2023 Market Expectations N O RTH AME RI CAN F REI GHT CARL O ADS 202 3 F RE IGHT V O L UM ESA V G N O R T H A M E R I C A N P A R K E D L O C O M O T I V E S 2019 2020 2021 2022 Sources: China, Kazakhstan, India Ministry of Railways, Brazil: ANTT, South Africa 3.6% 0.6% 3.2% (6.8%) 0.7% Brazil China India South Africa Kazakhstan 2023 Source: Association of American Railroads Source: Wabtec FAVORABLE / UNFAVORABLE

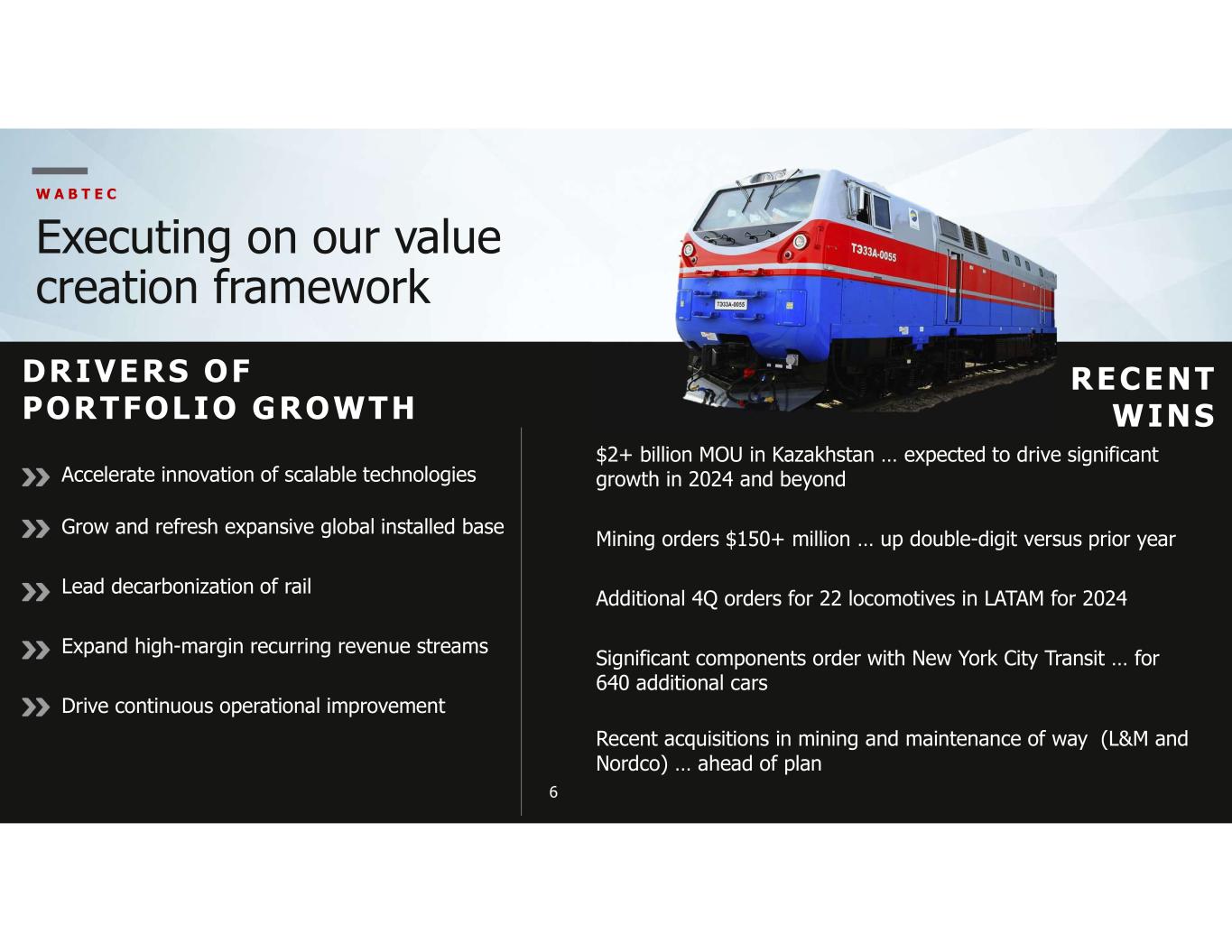

6 DRIVERS OF PORTFOLIO GROWTH RECENT WINS $2+ billion MOU in Kazakhstan … expected to drive significant growth in 2024 and beyond Mining orders $150+ million … up double-digit versus prior year Additional 4Q orders for 22 locomotives in LATAM for 2024 Significant components order with New York City Transit … for 640 additional cars Recent acquisitions in mining and maintenance of way (L&M and Nordco) … ahead of plan W A B T E C Executing on our value creation framework Accelerate innovation of scalable technologies Grow and refresh expansive global installed base Lead decarbonization of rail Expand high-margin recurring revenue streams Drive continuous operational improvement 6

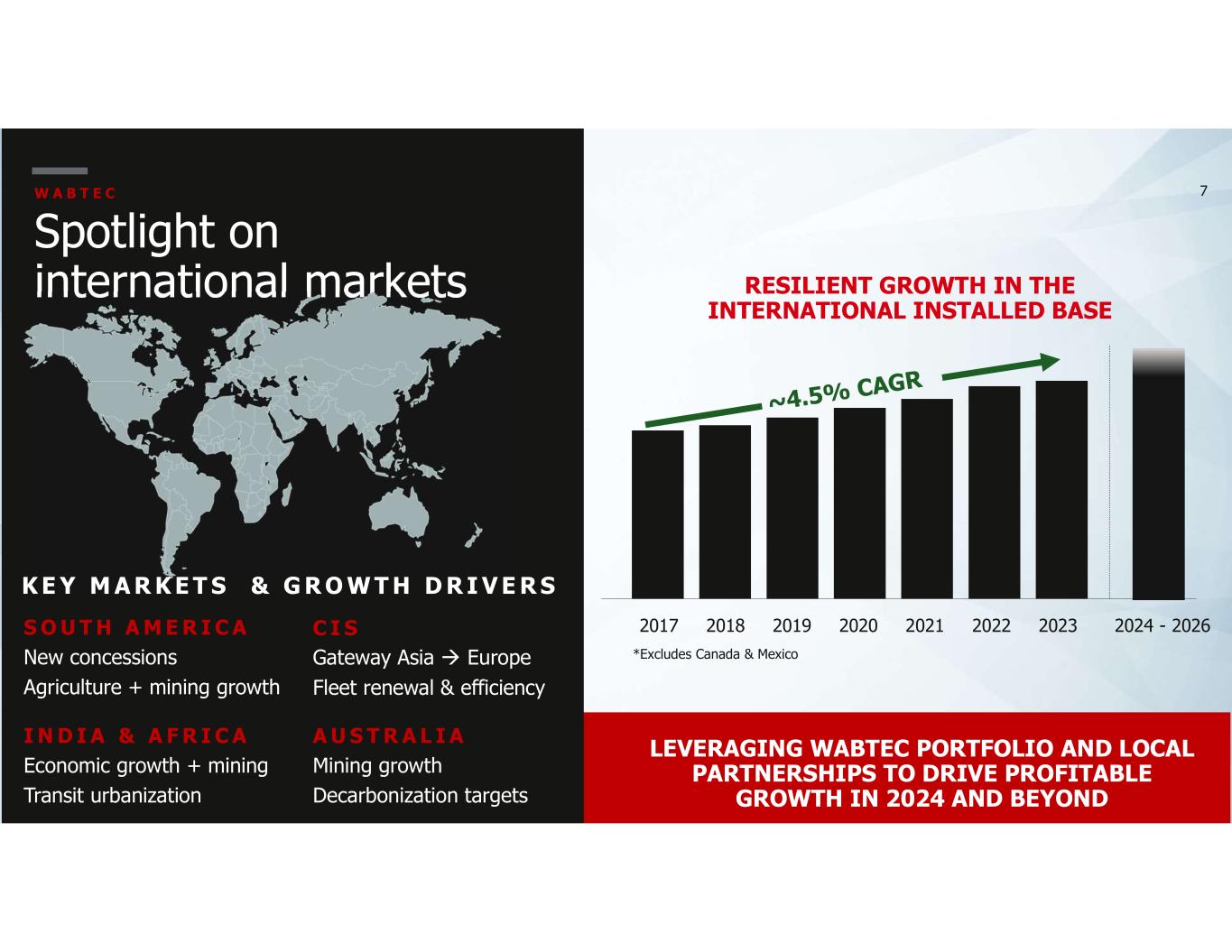

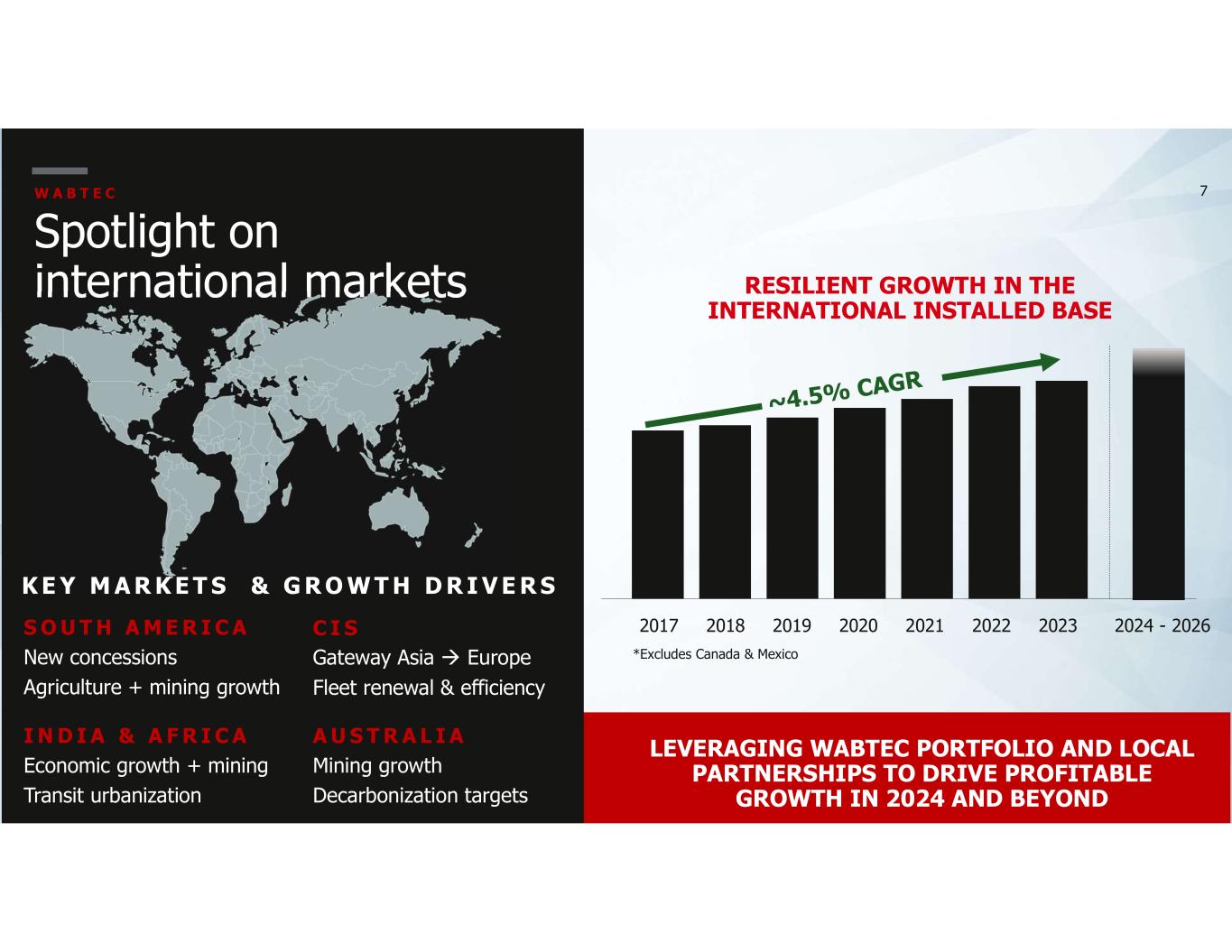

7 Spotlight on international markets W A B T E C 7 A U S T R A L I A Mining growth Decarbonization targets S O U T H A M E R I C A New concessions Agriculture + mining growth C I S Gateway Asia Europe Fleet renewal & efficiency I N D I A & A F R I C A Economic growth + mining Transit urbanization K E Y M A R K E T S & G R O W T H D R I V E R S 2017 2018 2019 2020 2021 2022 2023 RESILIENT GROWTH IN THE INTERNATIONAL INSTALLED BASE *Excludes Canada & Mexico 2024 - 2026 LEVERAGING WABTEC PORTFOLIO AND LOCAL PARTNERSHIPS TO DRIVE PROFITABLE GROWTH IN 2024 AND BEYOND

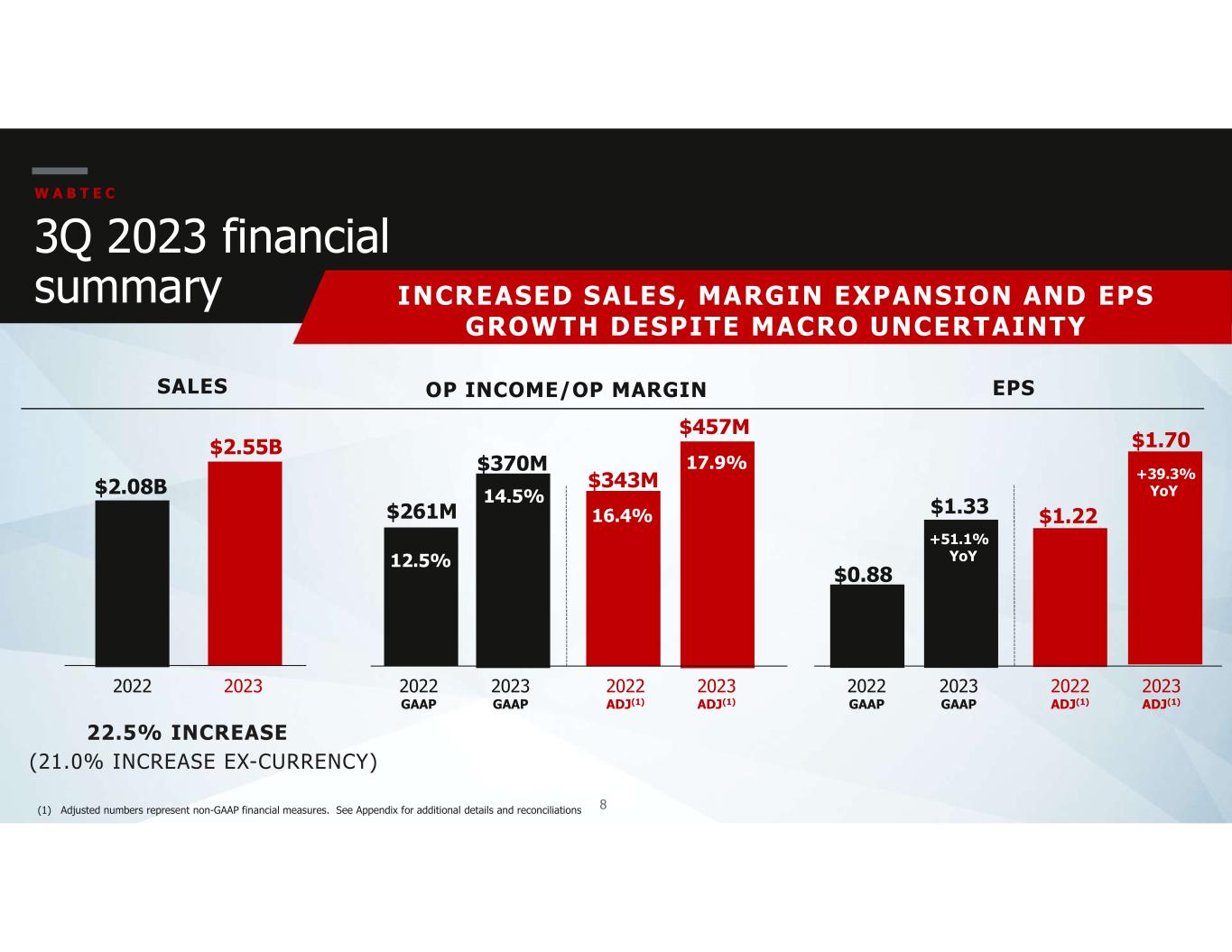

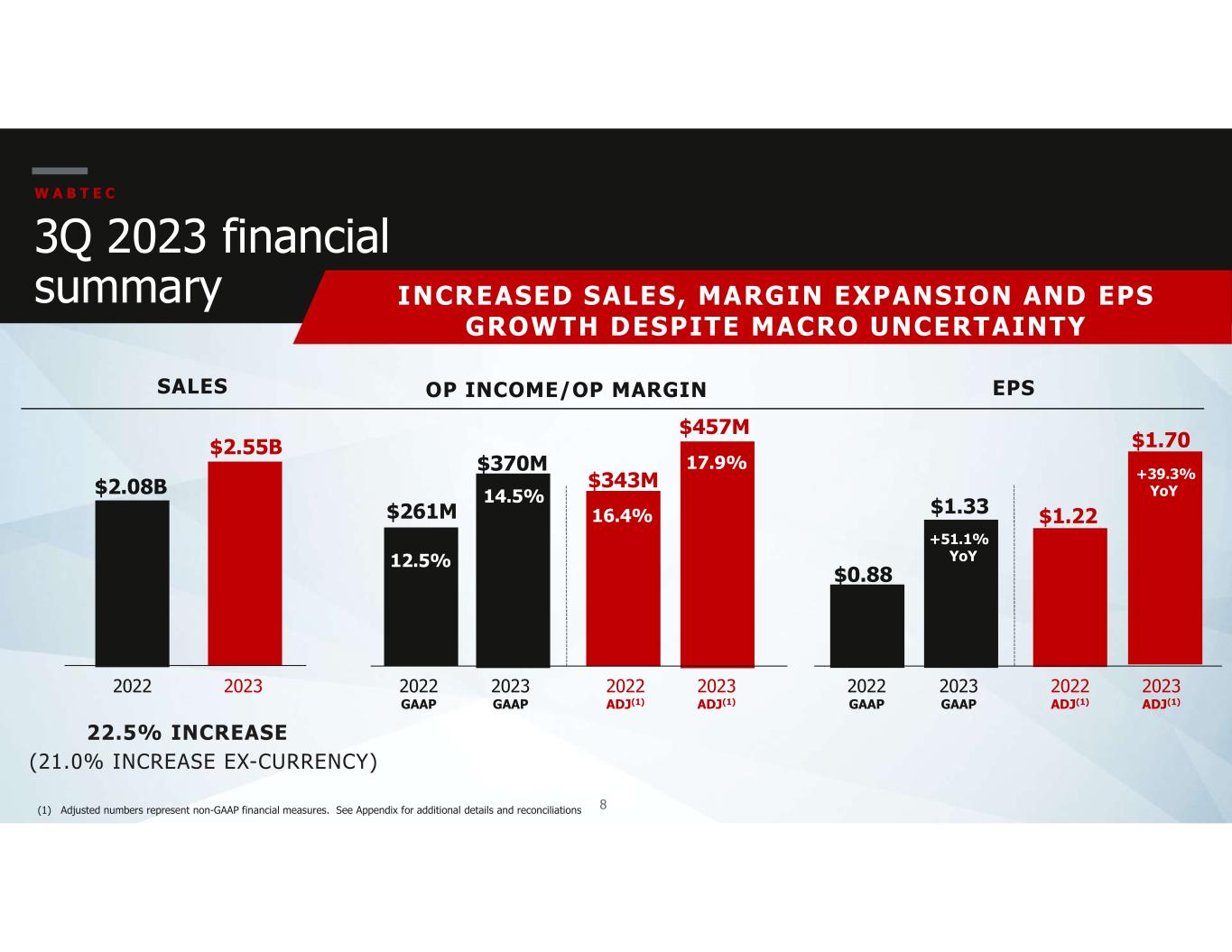

8 INCREASED SALES, MARGIN EXPANSION AND EPS GROWTH DESPITE MACRO UNCERTAINTY (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations 3Q 2023 financial summary W A B T E C OP INCOME/OP MARGIN 22.5% INCREASE $261M 12.5% 2022 GAAP SALES EPS $2.08B 2022 $2.55B 2023 $370M 14.5% 2023 GAAP $343M 16.4% 2022 ADJ(1) $457M 17.9% 2023 ADJ(1) $0.88 2022 GAAP $1.33 2023 GAAP $1.22 2022 ADJ(1) $1.70 2023 ADJ(1) (21.0% INCREASE EX-CURRENCY) +39.3% YoY +51.1% YoY

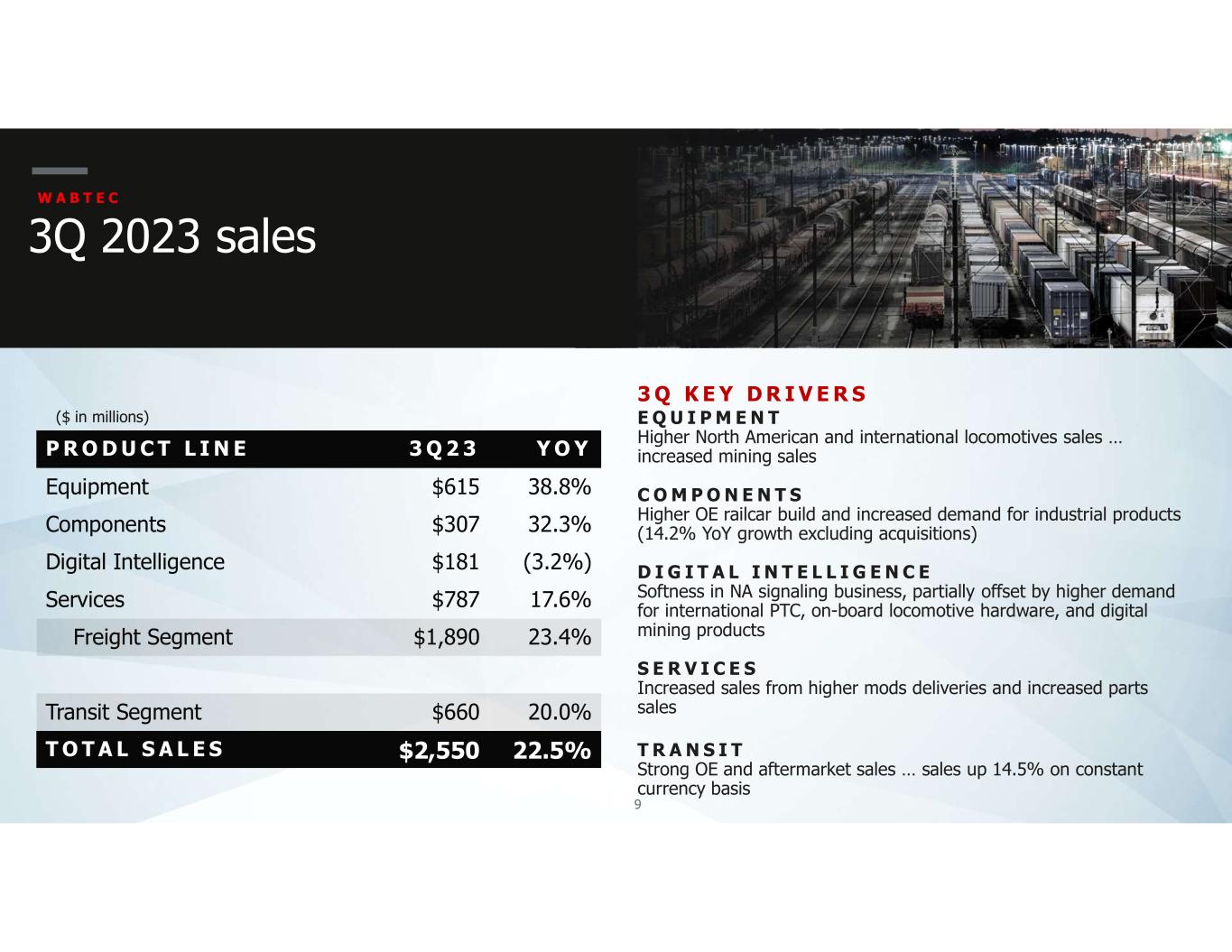

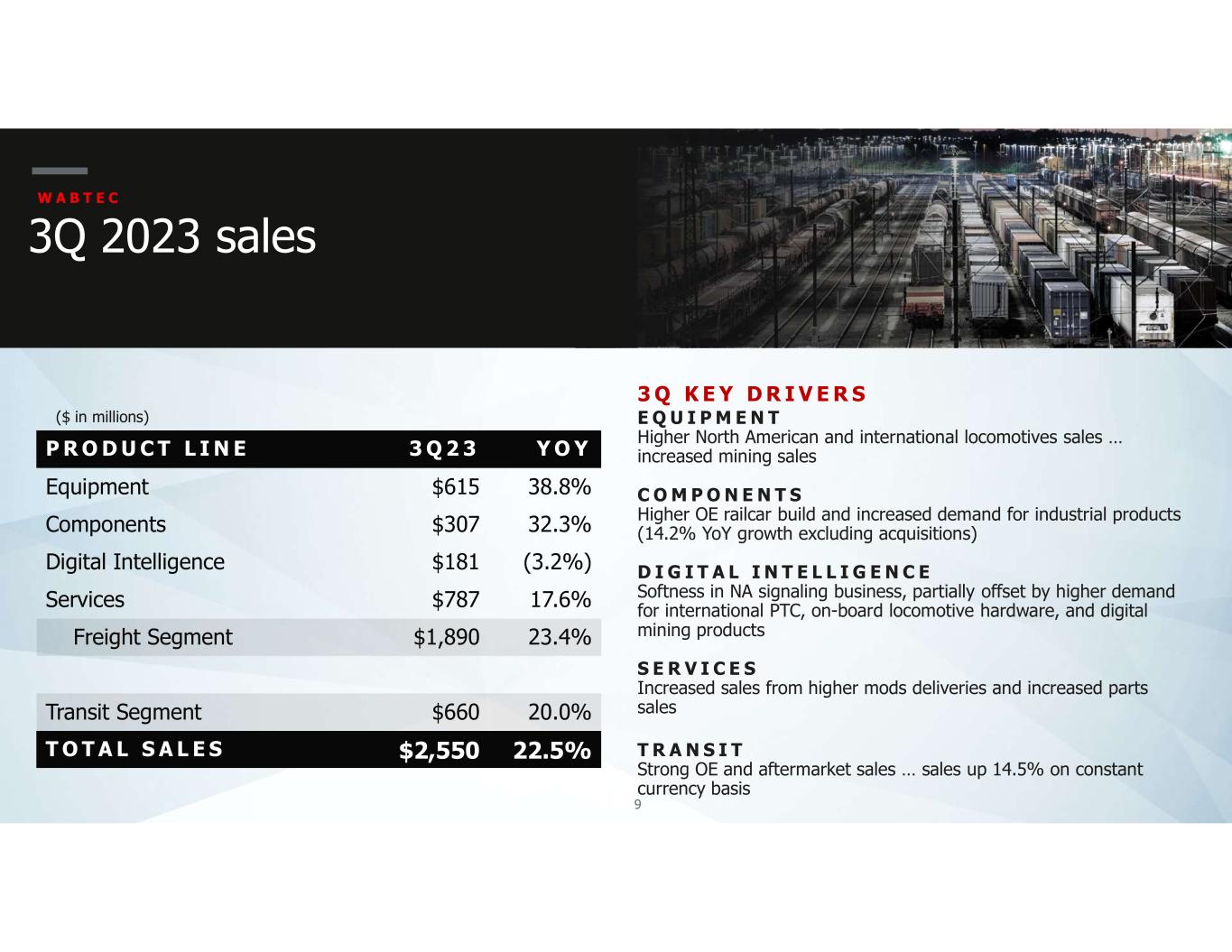

9 W A B T E C 3Q 2023 sales P R O D U C T L I N E 3 Q 2 3 Y O Y Equipment $615 38.8% Components $307 32.3% Digital Intelligence $181 (3.2%) Services $787 17.6% Freight Segment $1,890 23.4% Transit Segment $660 20.0% T O T A L S A L E S $2,550 22.5% E Q U I P M E N T Higher North American and international locomotives sales … increased mining sales C O M P O N E N T S Higher OE railcar build and increased demand for industrial products (14.2% YoY growth excluding acquisitions) D I G I T A L I N T E L L I G E N C E Softness in NA signaling business, partially offset by higher demand for international PTC, on-board locomotive hardware, and digital mining products S E R V I C E S Increased sales from higher mods deliveries and increased parts sales T R A N S I T Strong OE and aftermarket sales … sales up 14.5% on constant currency basis 3 Q K E Y D R I V E R S ($ in millions)

10 W A B T E C 3Q 2023 consolidated gross profit 3 Q K E Y D R I V E R S 2 0 2 2 G R O S S P R O F I T $648 $653 % Gross Profit Margin 31.1% 31.4% Volume ↑↑ ↑↑ Mix/Pricing ↑ ↑ Raw Materials ↔ ↔ Currency ↑ ↑ Manufacturing/Other ↓ ↓ 2 0 2 3 G R O S S P R O F I T $792 $805 % Gross Profit Margin 31.0% 31.5% V O L U M E Significantly higher Freight and Transit segment sales M I X / P R I C I N G Favorable mix of products between and within segments R A W M A T E R I A L S Largely flat input costs C U R R E N C Y Favorable foreign exchange increased gross profit $7M (operating income favorable by $3M) M A N U F A C T U R I N G / O T H E R Favorable fixed cost absorption and benefits of Integration 2.0 offset by manufacturing inefficiencies related to Erie strike ($ in millions) (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations GAAP Adjusted (1)

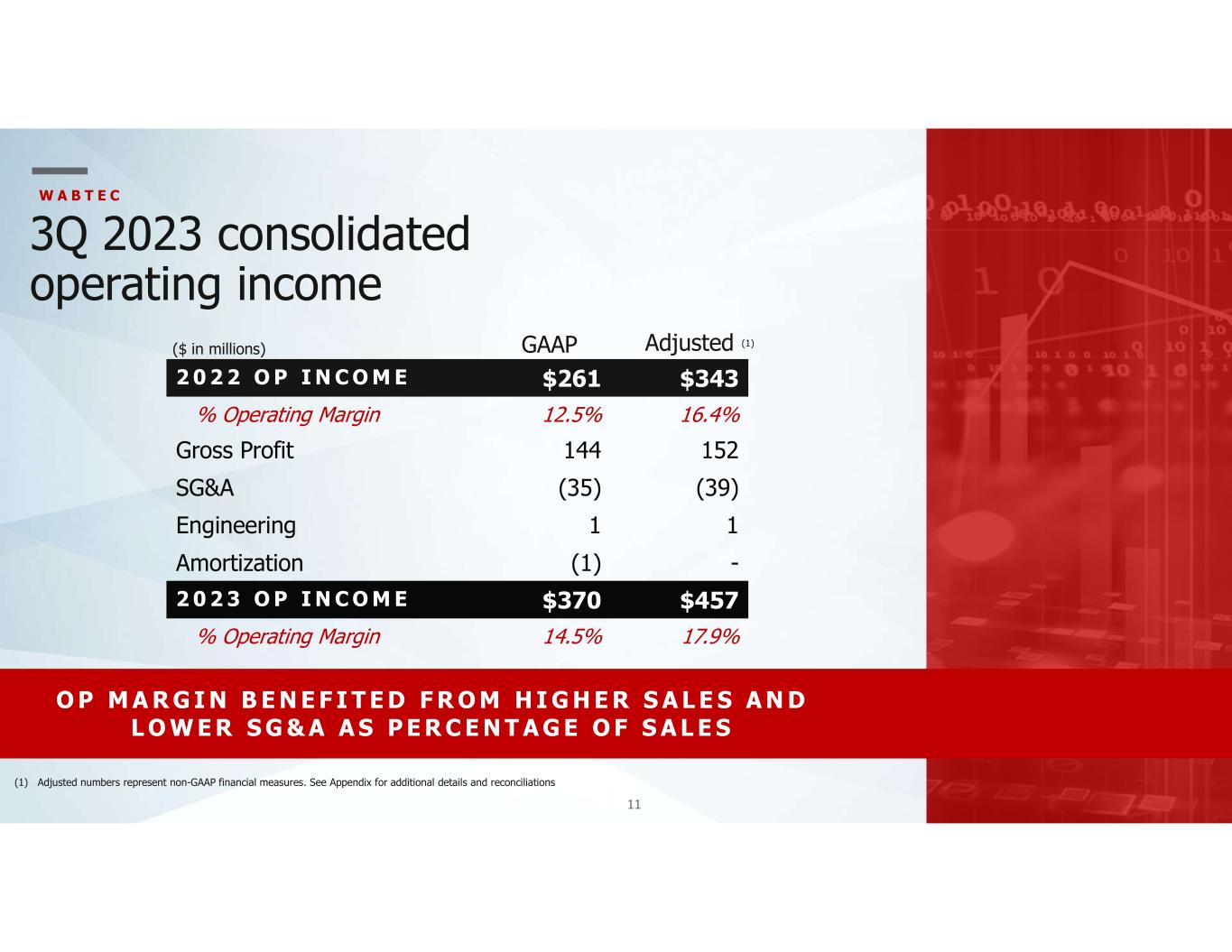

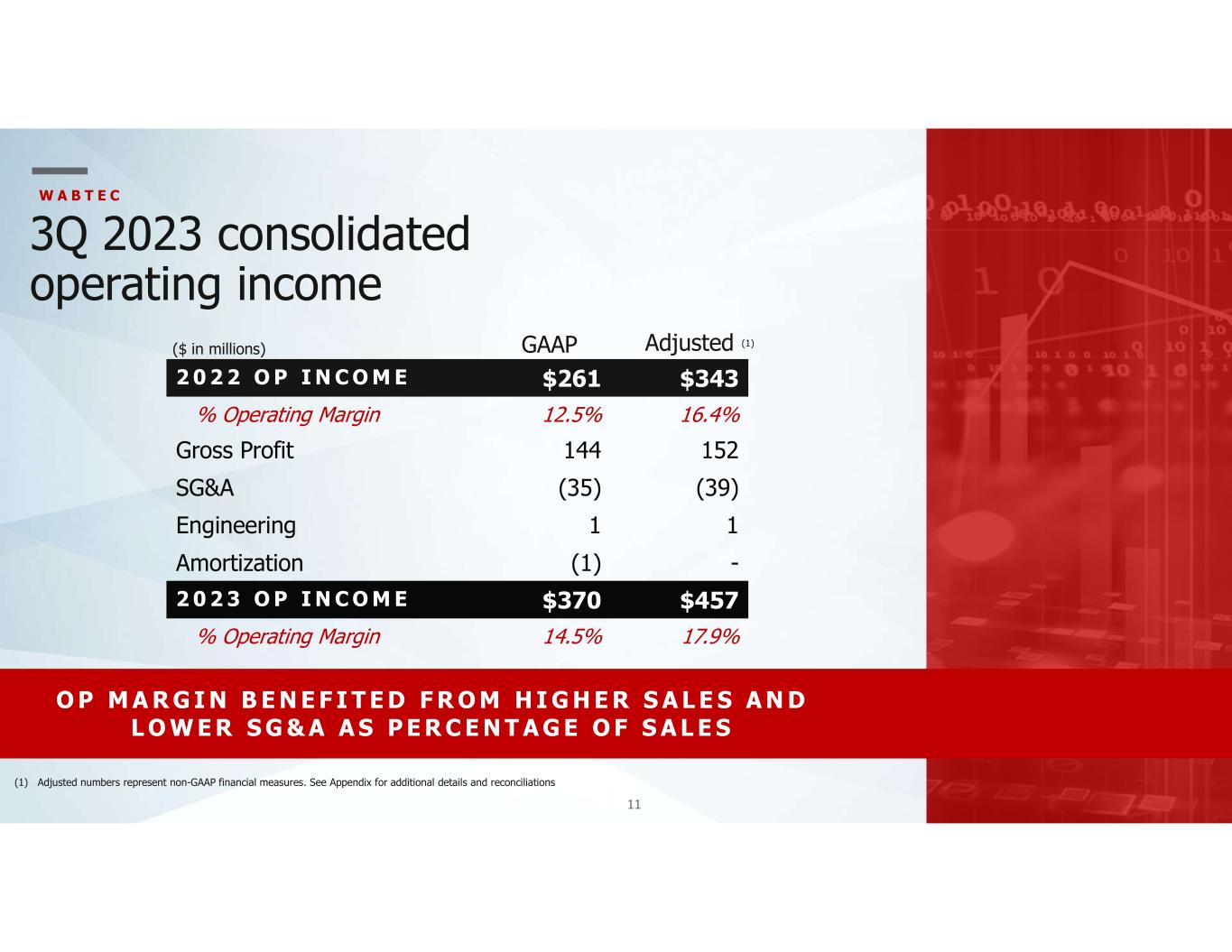

11 2 0 2 2 O P I N C O M E $261 $343 % Operating Margin 12.5% 16.4% Gross Profit 144 152 SG&A (35) (39) Engineering 1 1 Amortization (1) - 2 0 2 3 O P I N C O M E $370 $457 % Operating Margin 14.5% 17.9% W A B T E C 3Q 2023 consolidated operating income (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations O P M A R G I N B E N E F I T E D F R O M H I G H E R S A L E S A N D L O W E R S G & A A S P E R C E N T A G E O F S A L E S Adjusted (1)($ in millions) GAAP

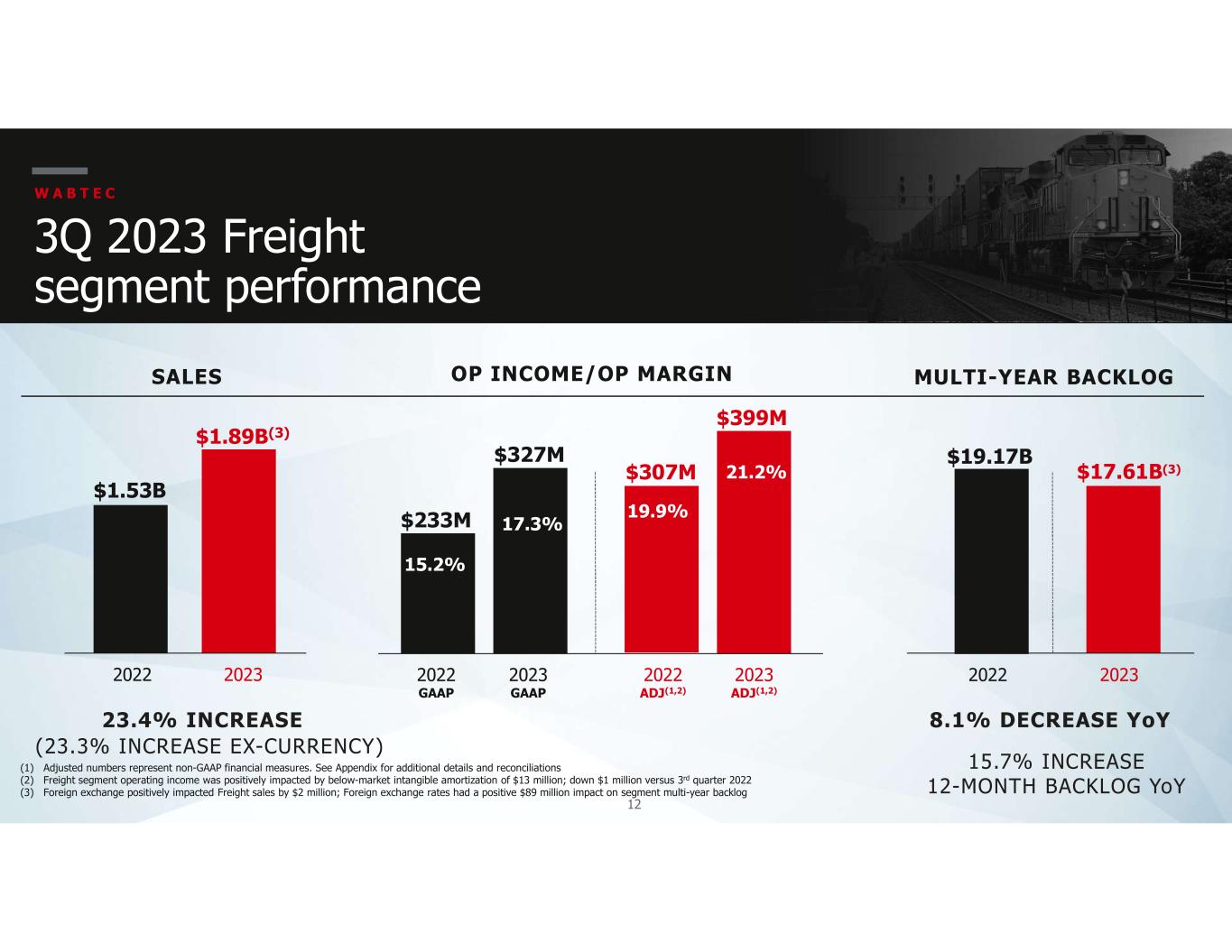

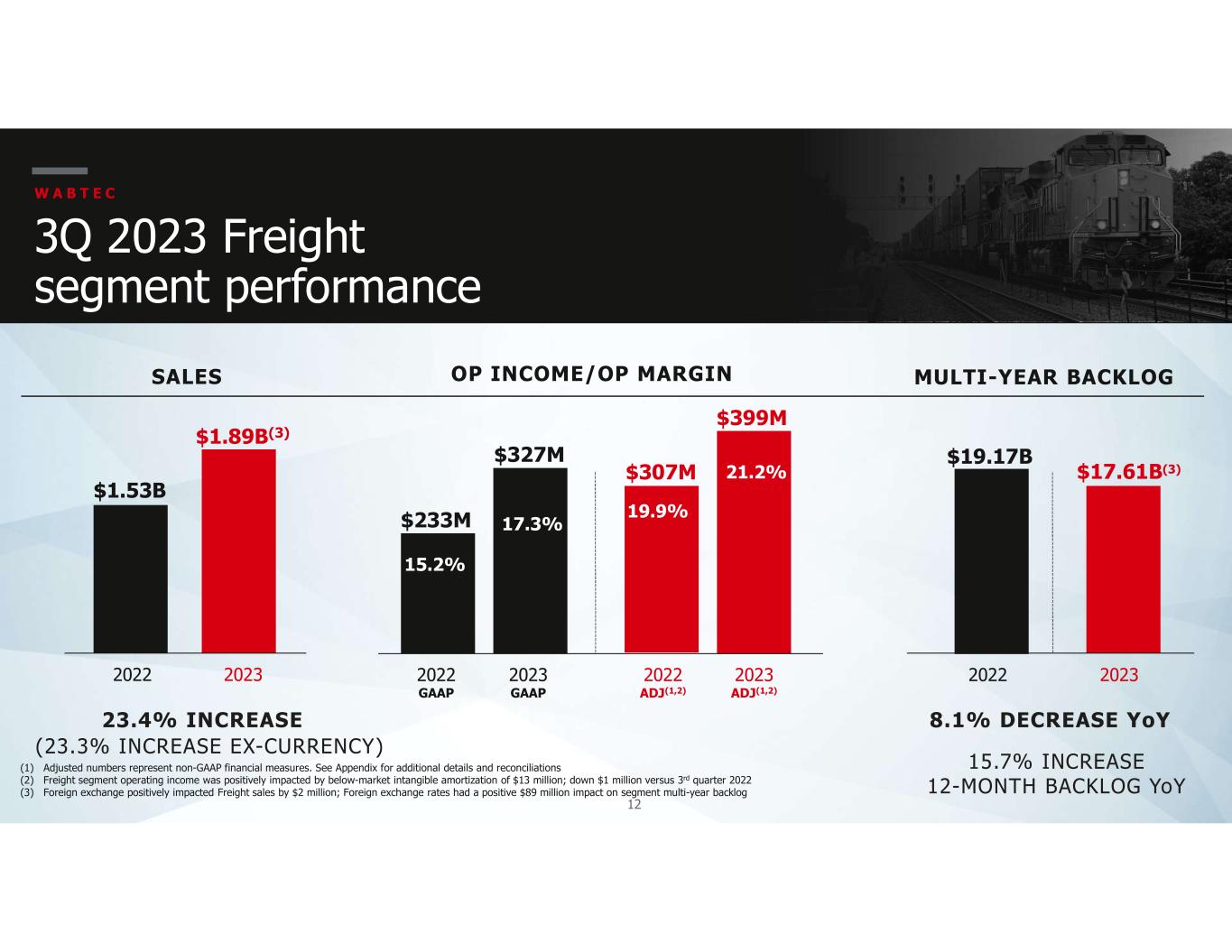

12 (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (2) Freight segment operating income was positively impacted by below-market intangible amortization of $13 million; down $1 million versus 3rd quarter 2022 (3) Foreign exchange positively impacted Freight sales by $2 million; Foreign exchange rates had a positive $89 million impact on segment multi-year backlog 3Q 2023 Freight segment performance W A B T E C 23.4% INCREASE OP INCOME/OP MARGIN $233M 15.2% 2022 GAAP SALES MULTI-YEAR BACKLOG 8.1% DECREASE YoY $1.53B 2022 $1.89B(3) 2023 $327M 17.3% 2023 GAAP $307M 19.9% 2022 ADJ(1,2) $399M 21.2% 2023 ADJ(1,2) $19.17B 2022 $17.61B(3) 2023 15.7% INCREASE 12-MONTH BACKLOG YoY (23.3% INCREASE EX-CURRENCY)

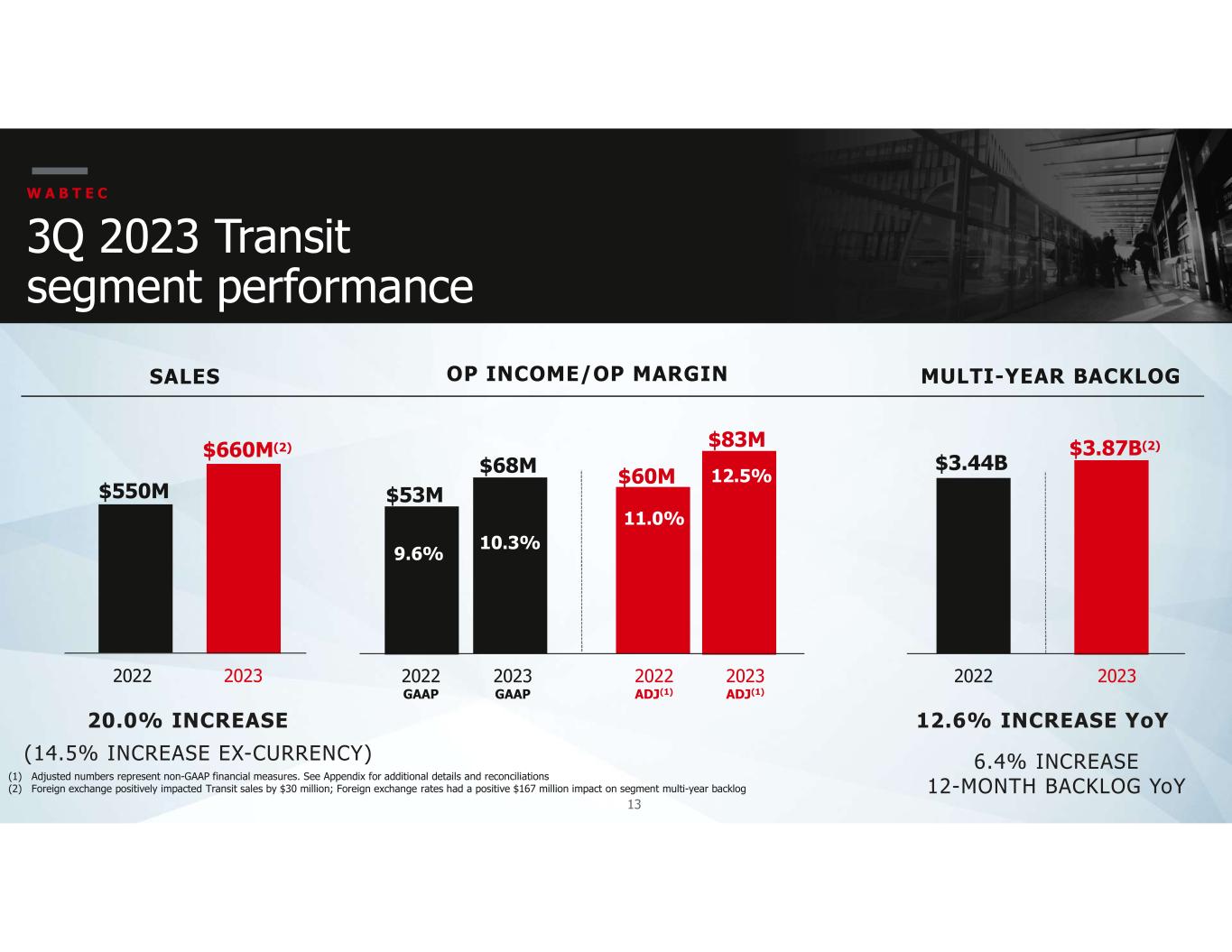

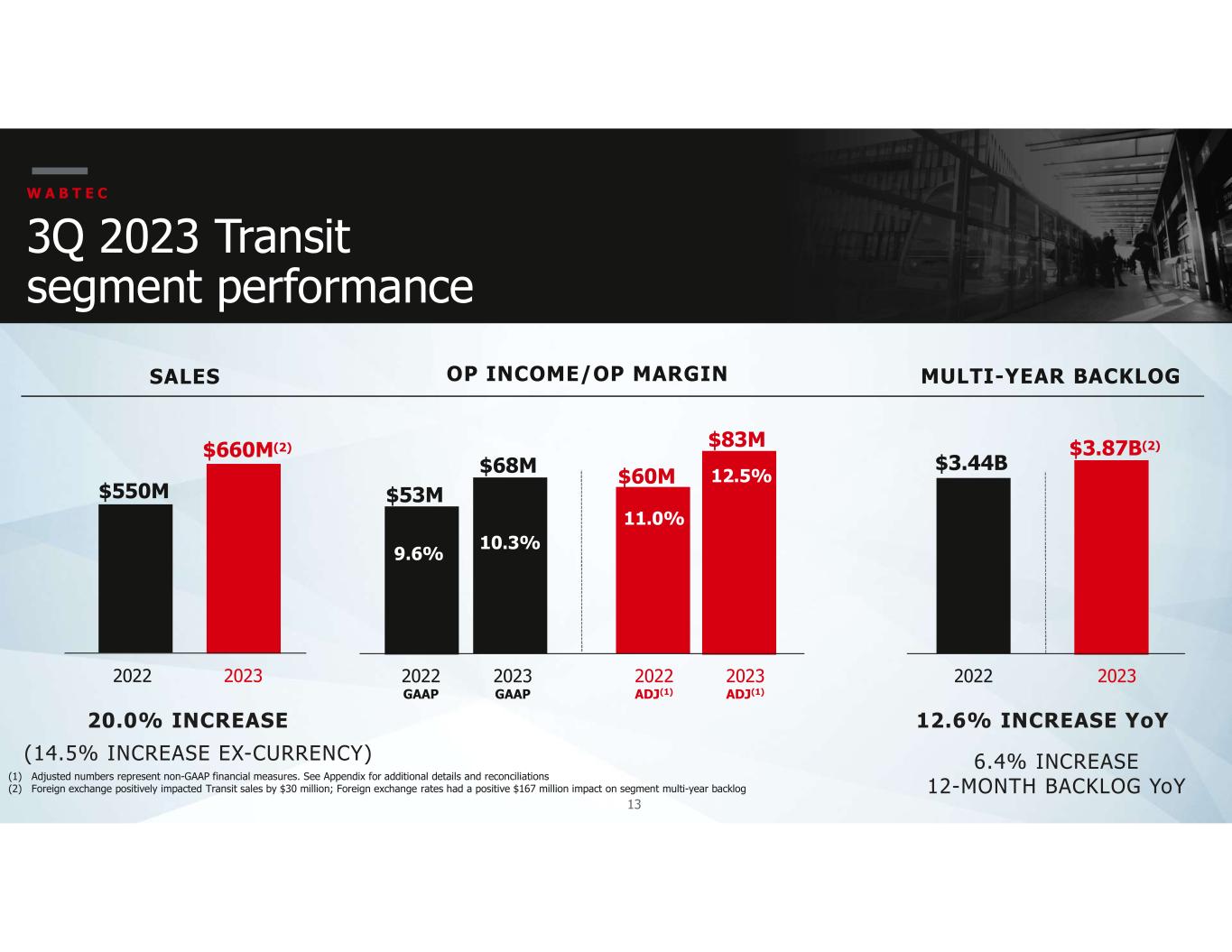

13 (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (2) Foreign exchange positively impacted Transit sales by $30 million; Foreign exchange rates had a positive $167 million impact on segment multi-year backlog 3Q 2023 Transit segment performance W A B T E C OP INCOME/OP MARGIN 20.0% INCREASE $53M 9.6% 2022 GAAP SALES MULTI-YEAR BACKLOG 12.6% INCREASE YoY $550M 2022 $660M(2) 2023 $68M 10.3% 2023 GAAP $60M 11.0% 2022 ADJ(1) $83M 12.5% 2023 ADJ(1) $3.44B 2022 $3.87B(2) 2023 (14.5% INCREASE EX-CURRENCY) 6.4% INCREASE 12-MONTH BACKLOG YoY

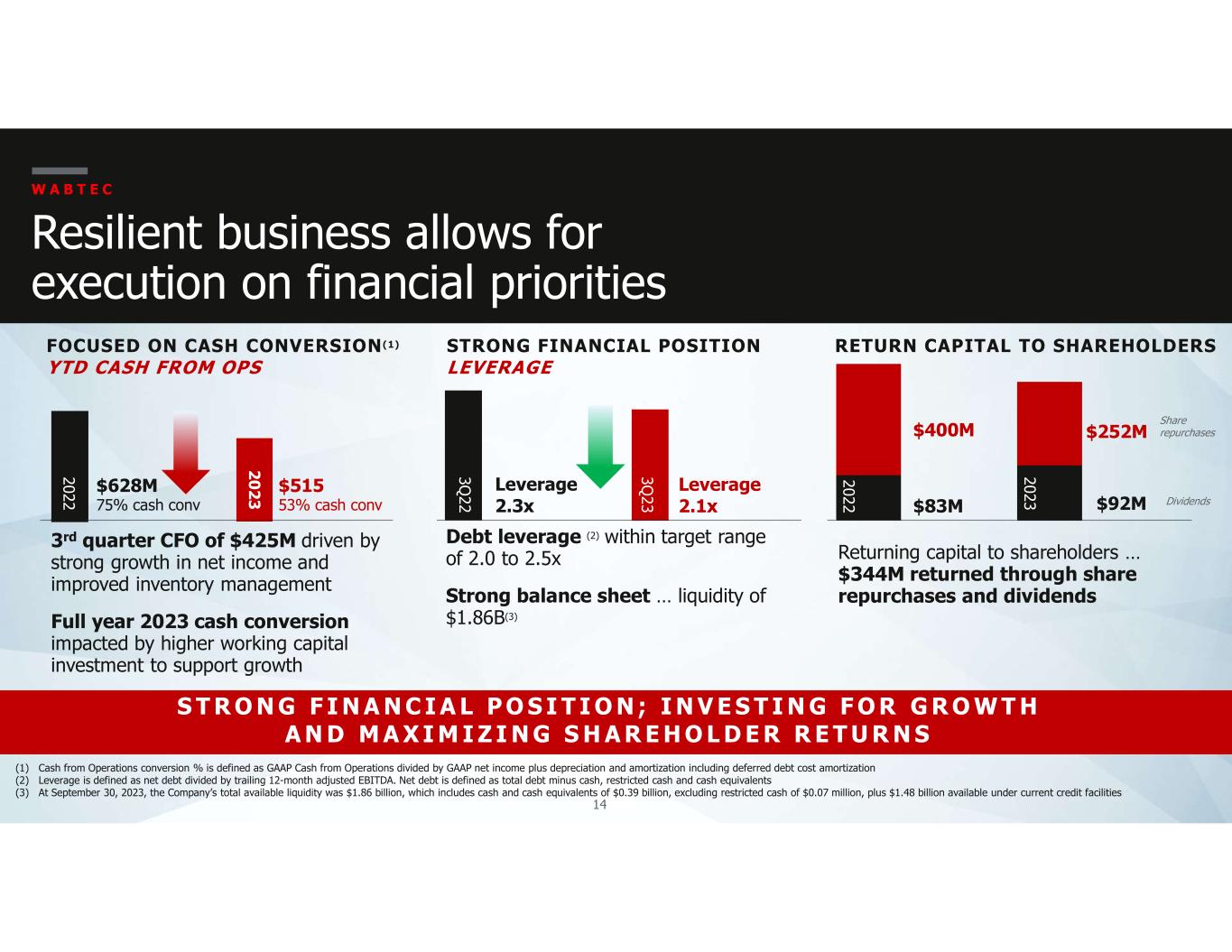

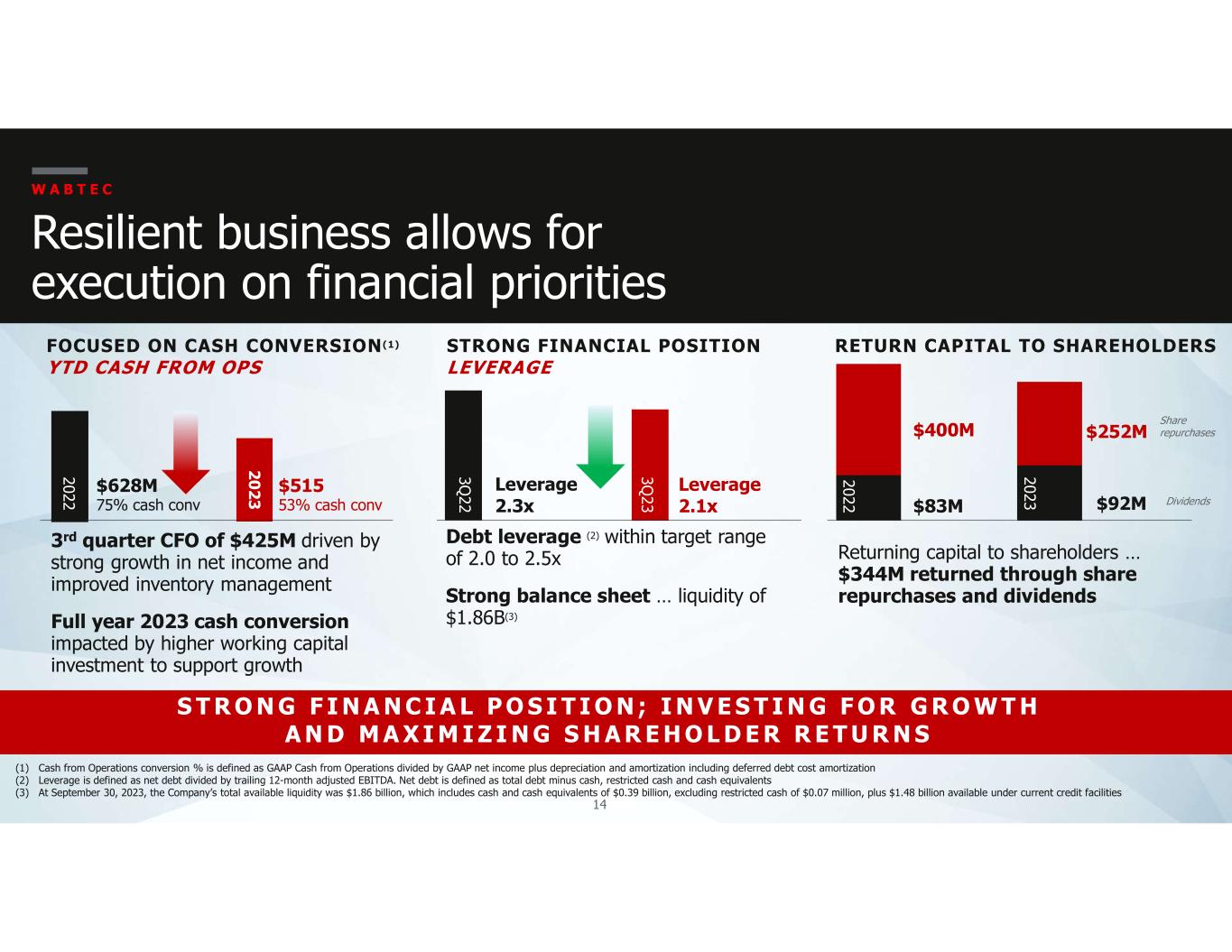

14 W A B T E C Resilient business allows for execution on financial priorities STRONG FINANCIAL POSITION LEVERAGE FOCUSED ON CASH CONVERSION(1) YTD CASH FROM OPS RETURN CAPITAL TO SHAREHOLDERS 3rd quarter CFO of $425M driven by strong growth in net income and improved inventory management Full year 2023 cash conversion impacted by higher working capital investment to support growth Debt leverage (2) within target range of 2.0 to 2.5x Strong balance sheet … liquidity of $1.86B(3) Returning capital to shareholders … $344M returned through share repurchases and dividends S T R O N G F I N A N C I A L P O S I T I O N ; I N V E S T I N G F O R G R O W T H A N D M A X I M I Z I N G S H A R E H O L D E R R E T U R N S (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization (2) Leverage is defined as net debt divided by trailing 12-month adjusted EBITDA. Net debt is defined as total debt minus cash, restricted cash and cash equivalents (3) At September 30, 2023, the Company’s total available liquidity was $1.86 billion, which includes cash and cash equivalents of $0.39 billion, excluding restricted cash of $0.07 million, plus $1.48 billion available under current credit facilities 75% cash conv $628M 2022 53% cash conv $515 2 0 2 3 Leverage 2.3x 3Q 22 Leverage 2.1x 3Q 23 $83M Dividends $400M Share repurchases $92M 2022 2023 $252M

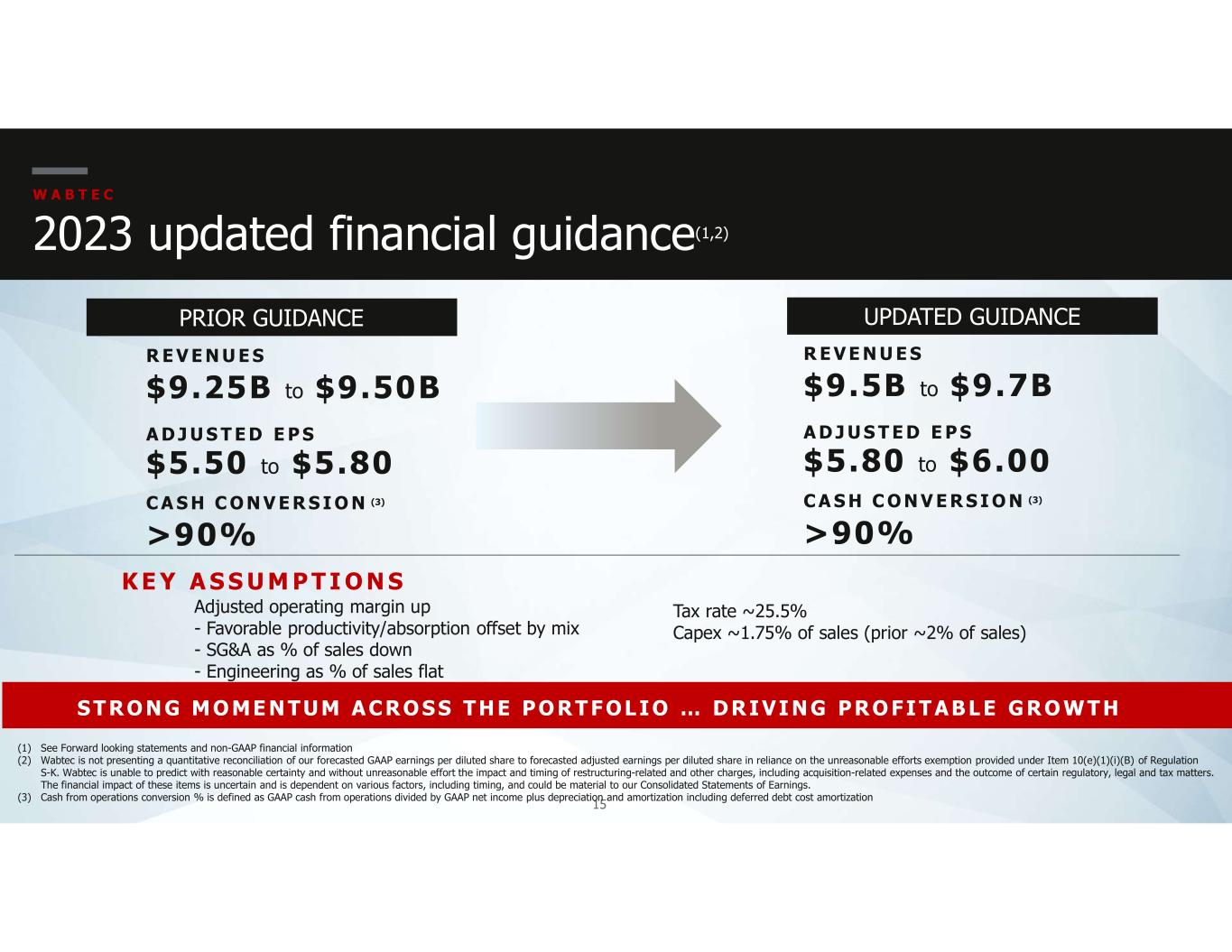

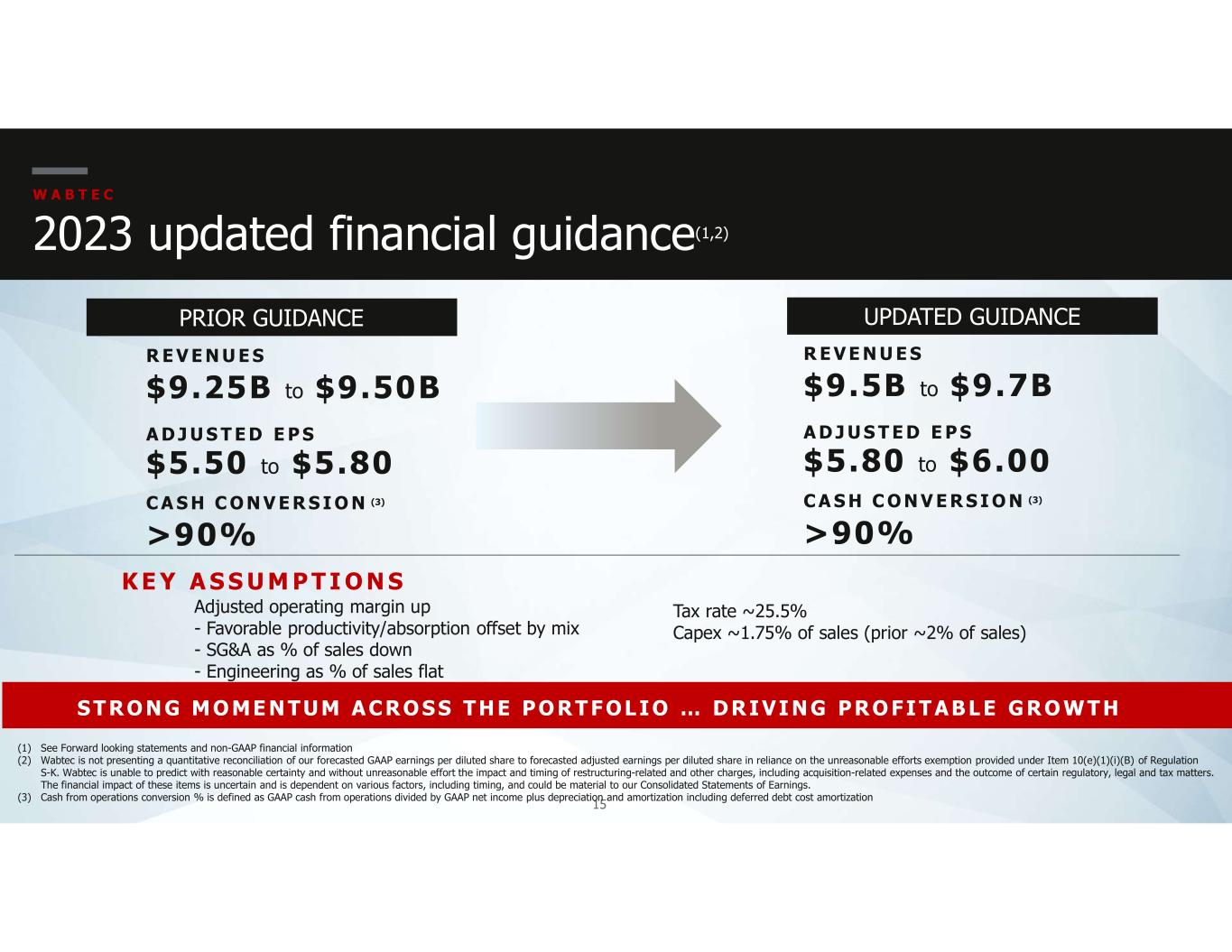

15 Adjusted operating margin up - Favorable productivity/absorption offset by mix - SG&A as % of sales down - Engineering as % of sales flat W A B T E C 2023 updated financial guidance(1,2) (1) See Forward looking statements and non-GAAP financial information (2) Wabtec is not presenting a quantitative reconciliation of our forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share in reliance on the unreasonable efforts exemption provided under Item 10(e)(1)(i)(B) of Regulation S-K. Wabtec is unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of certain regulatory, legal and tax matters. The financial impact of these items is uncertain and is dependent on various factors, including timing, and could be material to our Consolidated Statements of Earnings. (3) Cash from operations conversion % is defined as GAAP cash from operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization S T RO N G M O ME N TUM ACRO S S THE PO RT F OL I O … DRI VI N G PRO FI T ABL E GRO WT H K E Y A S S U M P T I O N S Tax rate ~25.5% Capex ~1.75% of sales (prior ~2% of sales) R E V E N U E S $9.25B to $9.50B A D J U S T E D E P S $5.50 to $5.80 C A S H C O N V E R S I O N (3) >90% UPDATED GUIDANCEPRIOR GUIDANCE R E V E N U E S $9.5B to $9.7B A D J U S T E D E P S $5.80 to $6.00 C A S H C O N V E R S I O N (3) >90%

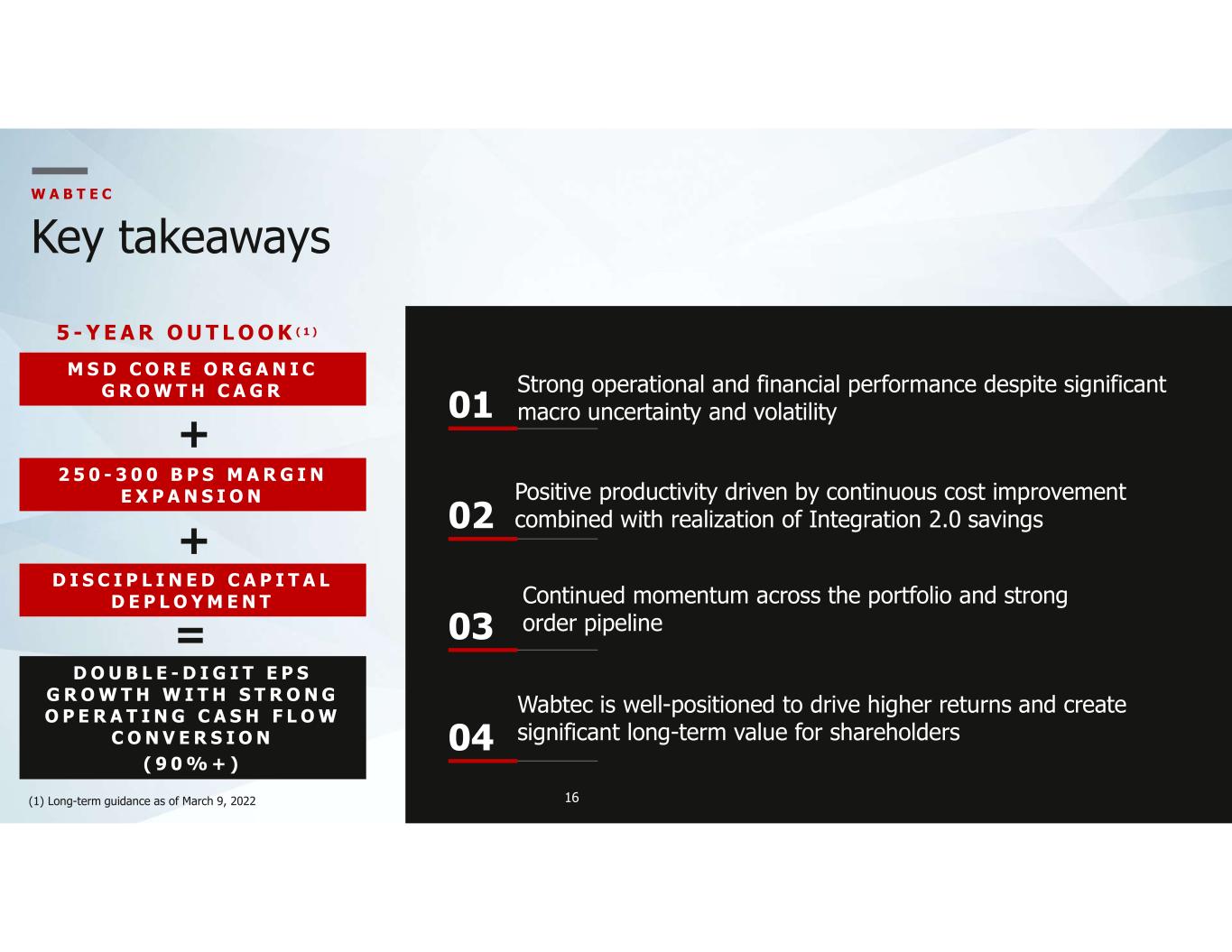

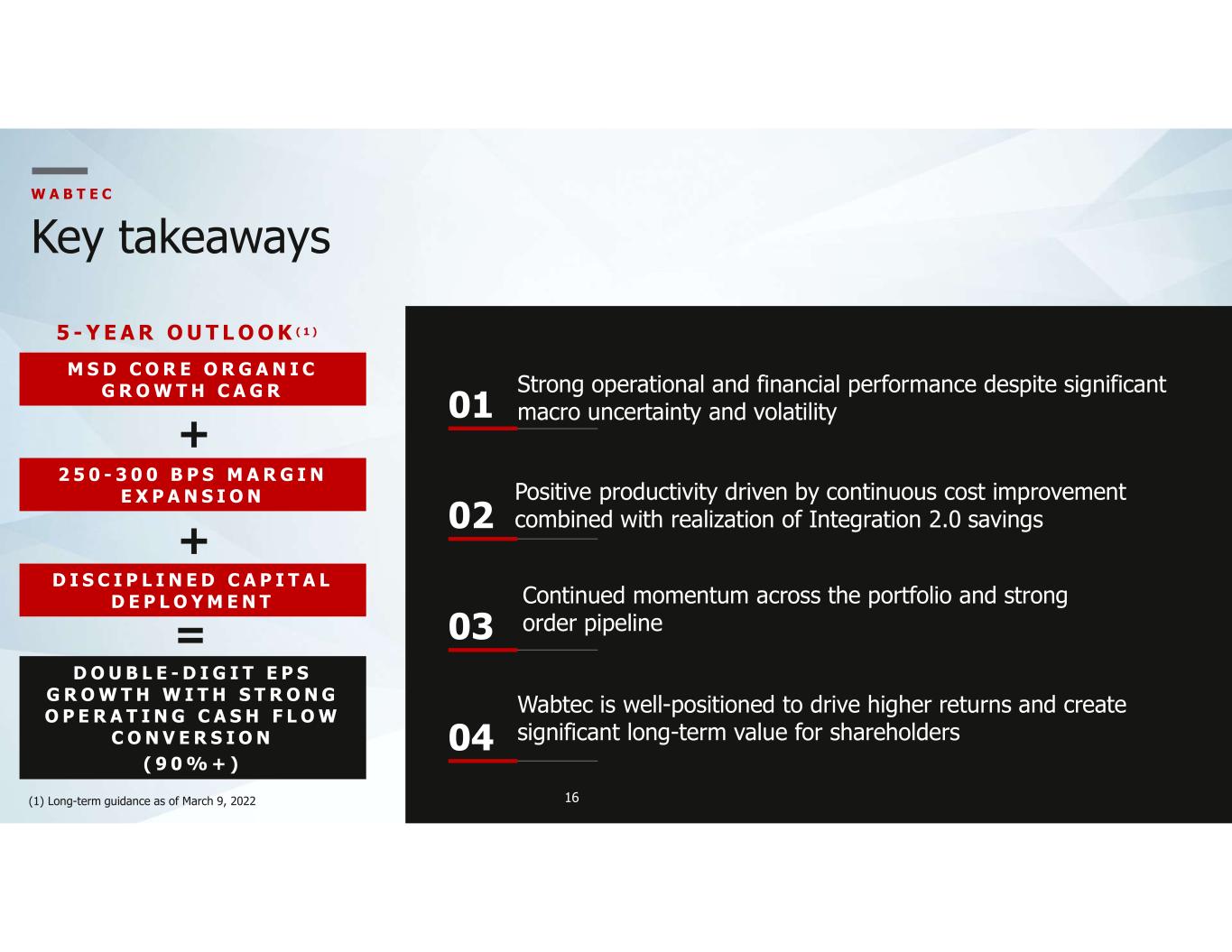

16 W A B T E C Key takeaways 02 Continued momentum across the portfolio and strong order pipeline03 Positive productivity driven by continuous cost improvement combined with realization of Integration 2.0 savings 04 Wabtec is well-positioned to drive higher returns and create significant long-term value for shareholders 01 Strong operational and financial performance despite significant macro uncertainty and volatility M S D C O R E O R G A N I C G R O W T H C A G R 2 5 0 - 3 0 0 B P S M A R G I N E X P A N S I O N + + D I S C I P L I N E D C A P I T A L D E P L O Y M E N T = D O U B L E - D I G I T E P S G R O W T H W I T H S T R O N G O P E R A T I N G C A S H F L O W C O N V E R S I O N ( 9 0 % + ) 5 - Y E A R O U T L O O K ( 1 ) (1) Long-term guidance as of March 9, 2022 16

17 Income statement Appendix A ( 1 of 2) 2023 2022 2023 2022 Net sales 2,550$ 2,081$ 7,151$ 6,056$ Cost of sales (1,758) (1,433) (4,971) (4,168) Gross profit 792 648 2,180 1,888 Gross profit as a % of Net Sales 31.0% 31.1% 30.5% 31.2% Selling, general and administrative expenses (295) (260) (843) (757) Engineering expenses (53) (54) (157) (149) Amortization expense (74) (73) (222) (218) Total operating expenses (422) (387) (1,222) (1,124) Operating expenses as a % of Net Sales 16.5% 18.6% 17.1% 18.6% Income from operations 370 261 958 764 Income from operations as a % of Net Sales 14.5% 12.5% 13.4% 12.6% Interest expense, net (60) (48) (163) (135) Other income, net 10 4 17 15 Income before income taxes 320 217 812 644 Income tax expense (78) (54) (204) (162) Effective tax rate 24.5% 24.7% 25.1% 25.1% Net income 242 163 608 482 Less: Net income attributable to noncontrolling interest (2) (3) (8) (7) Net income attributable to Wabtec shareholders 240$ 160$ 600$ 475$ Earnings Per Common Share Basic Net income attributable to Wabtec shareholders 1.34$ 0.88$ 3.34$ 2.60$ Diluted Net income attributable to Wabtec shareholders 1.33$ 0.88$ 3.33$ 2.59$ Basic 178.6 181.3 179.1 182.6 Diluted 179.2 181.9 179.7 183.1 September 30, September 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED) Three Months Ended Nine Months Ended

18 Appendix A ( 2 of 2) Income statement (cont.) 2023 2022 2023 2022 Segment Information Freight Net Sales 1,890$ 1,531$ 5,164$ 4,343$ Freight Income from Operations 327$ 233$ 825$ 655$ Freight Operating Margin 17.3% 15.2% 16.0% 15.1% Transit Net Sales 660$ 550$ 1,987$ 1,713$ Transit Income from Operations 68$ 53$ 203$ 168$ Transit Operating Margin 10.3% 9.6% 10.2% 9.8% Backlog Information (Note: 12-month is a sub-set of total) September 30, 2023 June 30, 2023 September 30, 2022 Freight Total 17,614$ 18,336$ 19,173$ Transit Total 3,869 4,095 3,437 Wabtec Total 21,483$ 22,431$ 22,610$ Freight 12-Month 5,282$ 5,318$ 4,567$ Transit 12-Month 1,809 1,902 1,700 Wabtec 12-Month 7,091$ 7,220$ 6,267$ September 30, September 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED) Three Months Ended Nine Months Ended

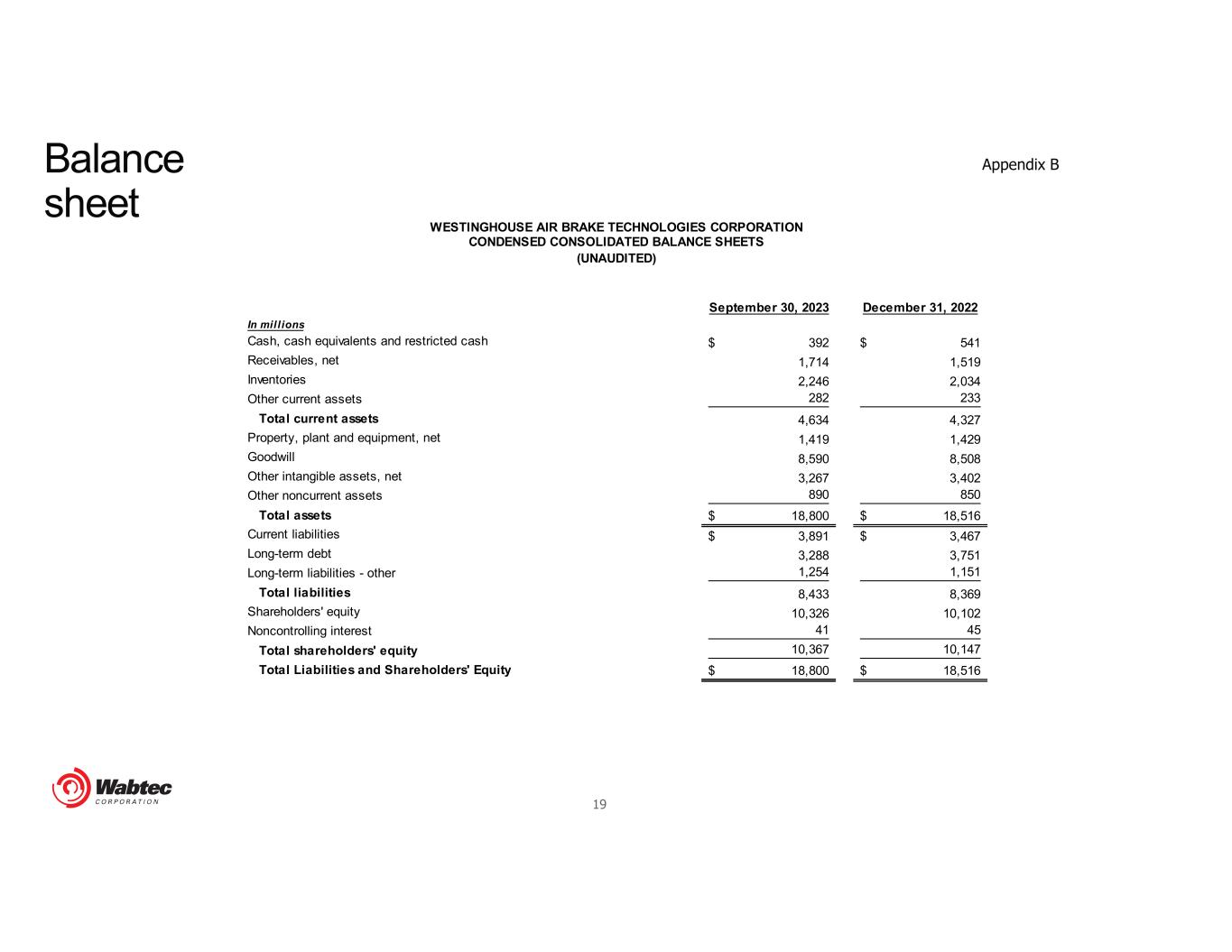

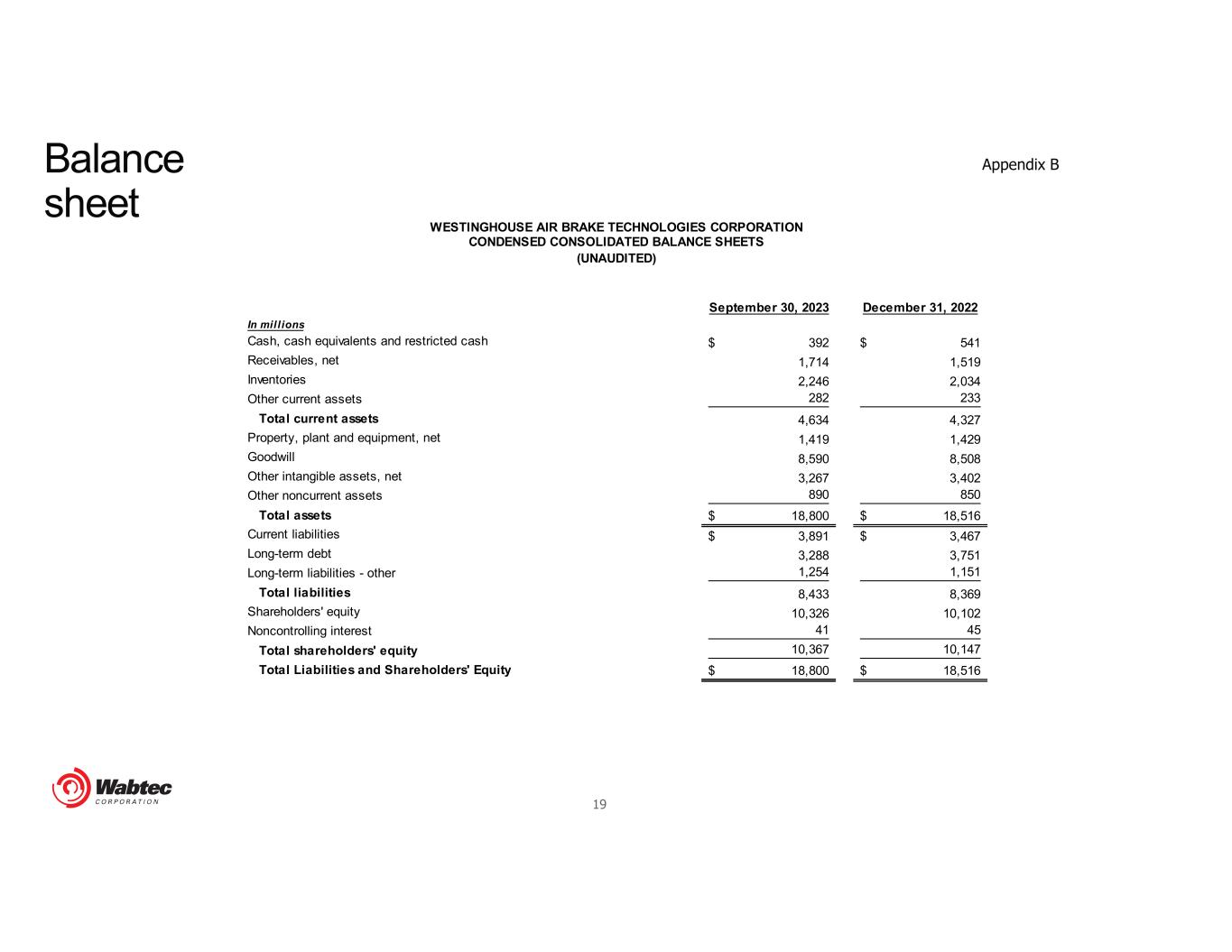

19 Balance sheet Appendix B September 30, 2023 December 31, 2022 In mill ions Cash, cash equivalents and restricted cash 392$ 541$ Receivables, net 1,714 1,519 Inventories 2,246 2,034 Other current assets 282 233 Total current assets 4,634 4,327 Property, plant and equipment, net 1,419 1,429 Goodwill 8,590 8,508 Other intangible assets, net 3,267 3,402 Other noncurrent assets 890 850 Total assets 18,800$ 18,516$ Current liabilities 3,891$ 3,467$ Long-term debt 3,288 3,751 Long-term liabilities - other 1,254 1,151 Total liabilities 8,433 8,369 Shareholders' equity 10,326 10,102 Noncontrolling interest 41 45 Total shareholders' equity 10,367 10,147 Total Liabilities and Shareholders' Equity 18,800$ 18,516$ WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

20 Appendix C Cash flow 2023 2022 In mill ions Operating activities Net income 608$ 482$ Non-cash expense 372 355 Receivables (214) (39) Inventories (201) (401) Accounts Payable (50) 232 Other assets and liabilities - (1) Net cash provided by operating activities 515 628 Net cash used for investing activities (336) (149) Net cash used for financing activities (323) (395) Effect of changes in currency exchange rates (5) (43) (Decrease) increase in cash (149) 41 Cash, cash equivalents and restricted cash, beginning of period 541 473 Cash, cash equivalents and restricted cash, end of period 392$ 514$ Nine Months Ended September 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

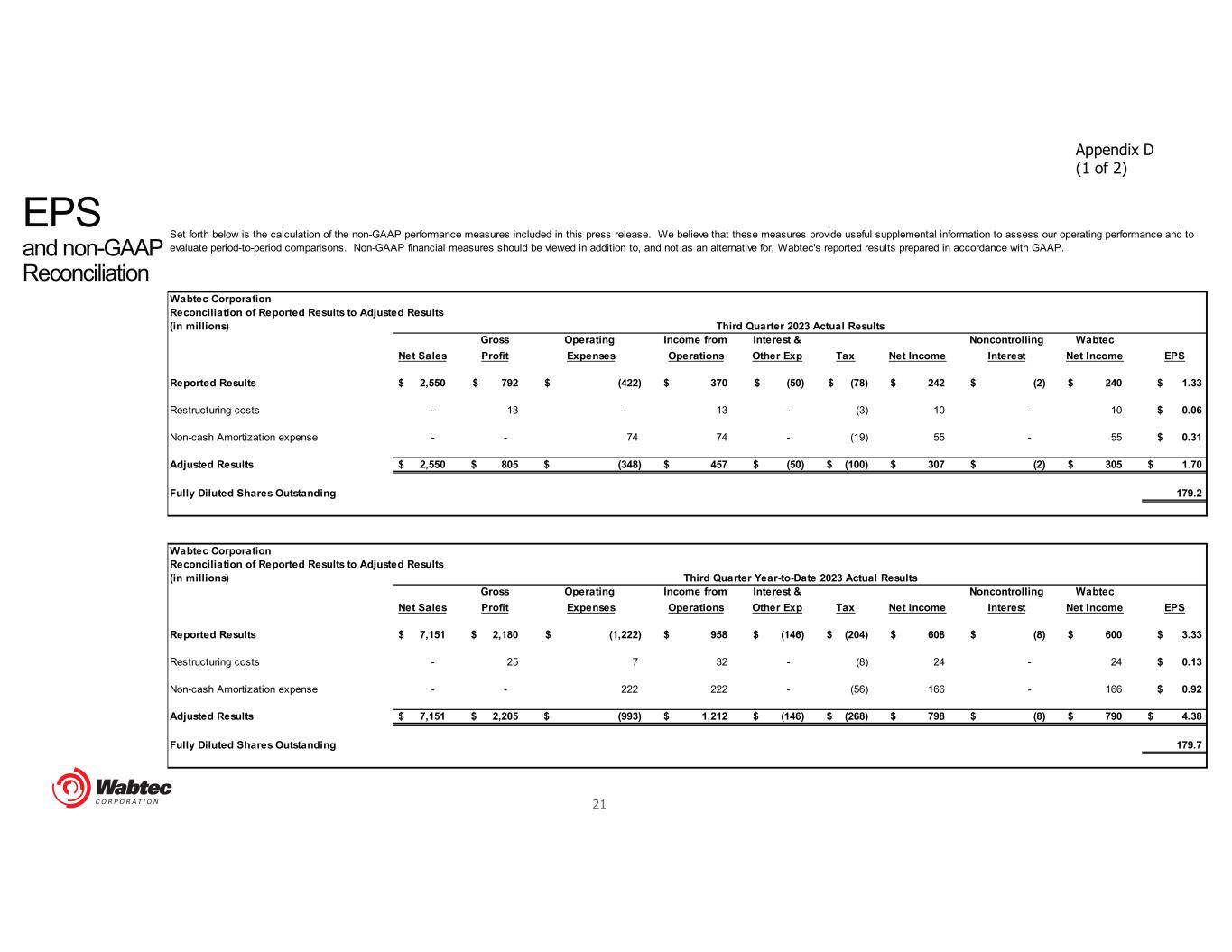

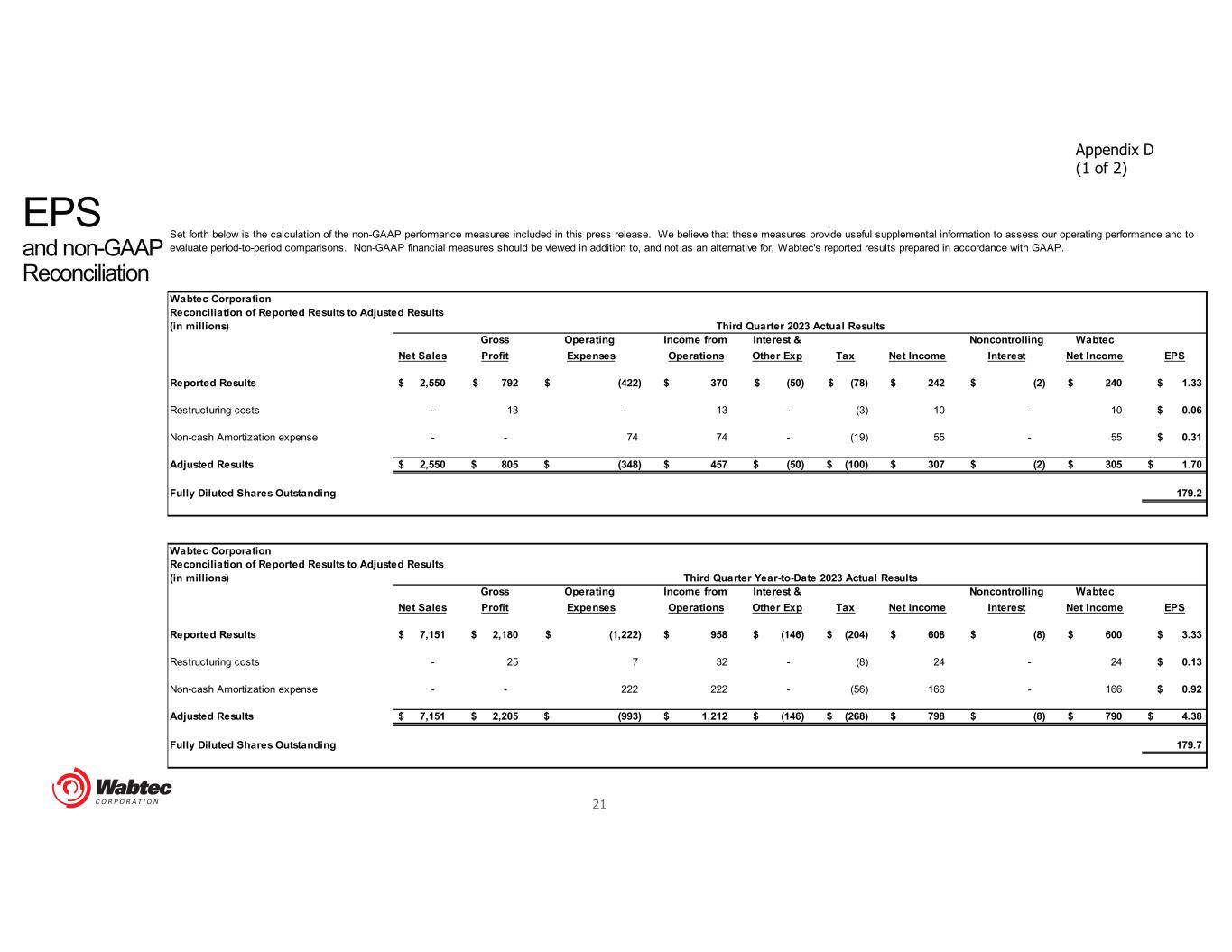

21 EPS and non-GAAP Reconciliation Appendix D (1 of 2) Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,550$ 792$ (422)$ 370$ (50)$ (78)$ 242$ (2)$ 240$ 1.33$ Restructuring costs - 13 - 13 - (3) 10 - 10 0.06$ Non-cash Amortization expense - - 74 74 - (19) 55 - 55 0.31$ Adjusted Results 2,550$ 805$ (348)$ 457$ (50)$ (100)$ 307$ (2)$ 305$ 1.70$ Fully Diluted Shares Outstanding 179.2 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 7,151$ 2,180$ (1,222)$ 958$ (146)$ (204)$ 608$ (8)$ 600$ 3.33$ Restructuring costs - 25 7 32 - (8) 24 - 24 0.13$ Non-cash Amortization expense - - 222 222 - (56) 166 - 166 0.92$ Adjusted Results 7,151$ 2,205$ (993)$ 1,212$ (146)$ (268)$ 798$ (8)$ 790$ 4.38$ Fully Diluted Shares Outstanding 179.7 Third Quarter Year-to-Date 2023 Actual Results Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Third Quarter 2023 Actual Results

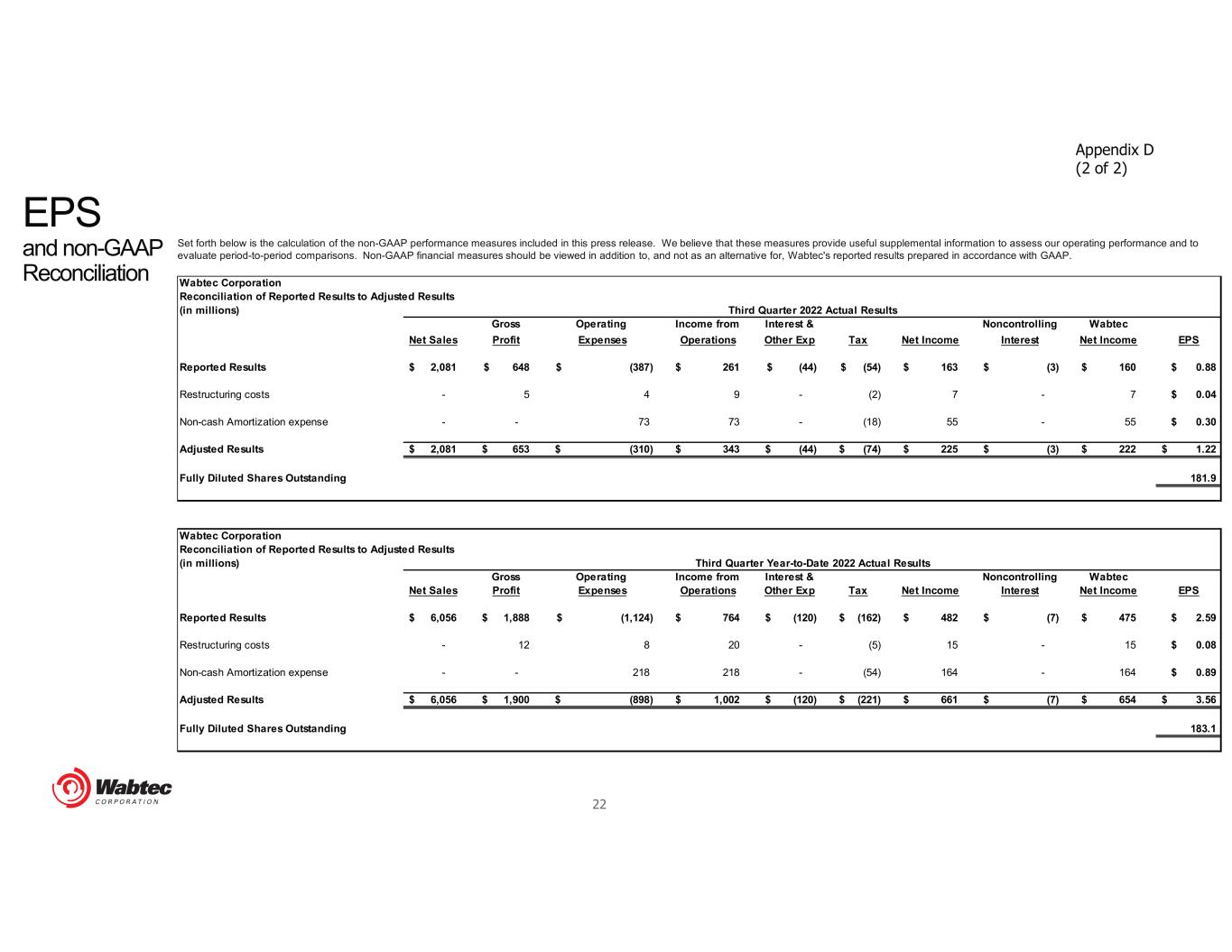

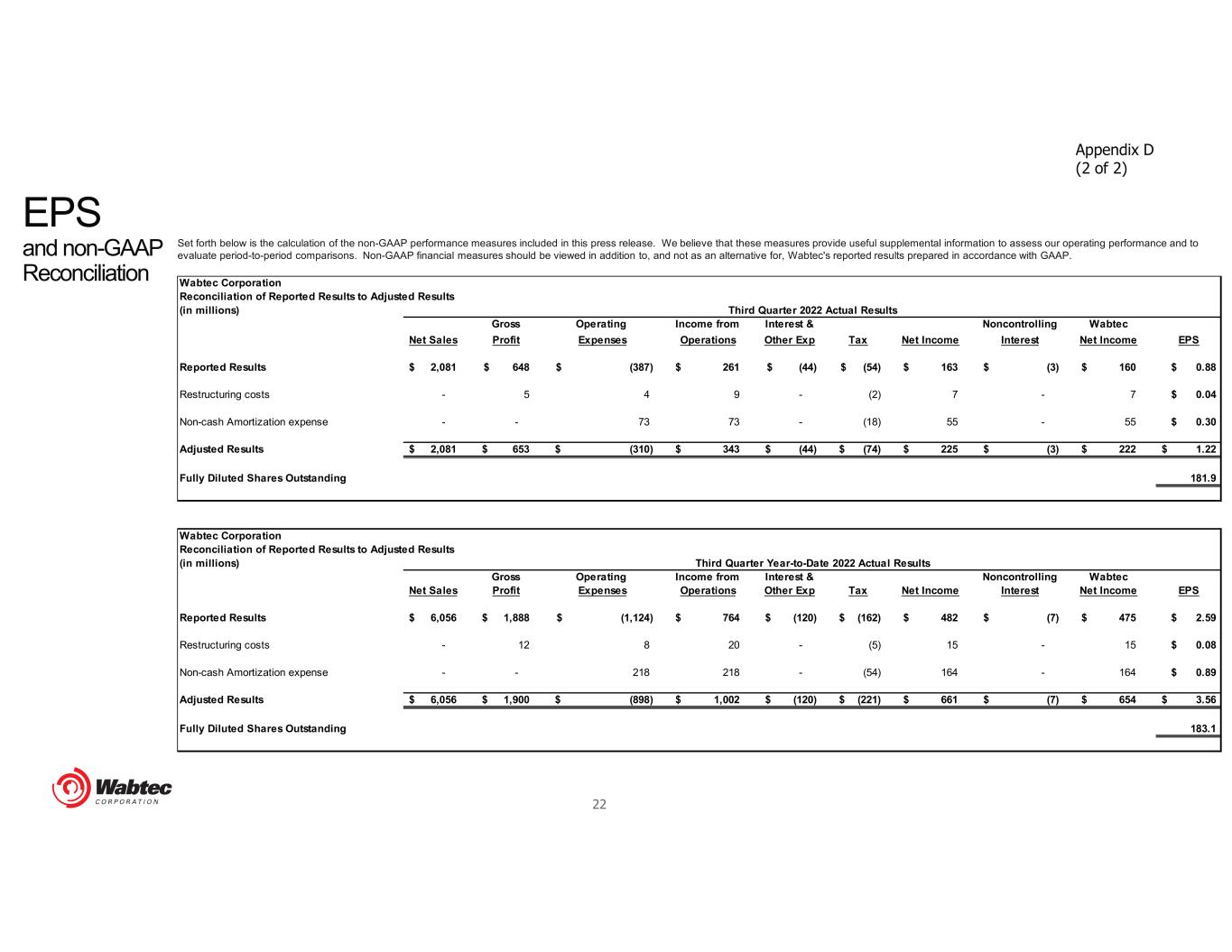

22 EPS and non-GAAP Reconciliation Appendix D (2 of 2) Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,081$ 648$ (387)$ 261$ (44)$ (54)$ 163$ (3)$ 160$ 0.88$ Restructuring costs - 5 4 9 - (2) 7 - 7 0.04$ Non-cash Amortization expense - - 73 73 - (18) 55 - 55 0.30$ Adjusted Results 2,081$ 653$ (310)$ 343$ (44)$ (74)$ 225$ (3)$ 222$ 1.22$ Fully Diluted Shares Outstanding 181.9 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 6,056$ 1,888$ (1,124)$ 764$ (120)$ (162)$ 482$ (7)$ 475$ 2.59$ Restructuring costs - 12 8 20 - (5) 15 - 15 0.08$ Non-cash Amortization expense - - 218 218 - (54) 164 - 164 0.89$ Adjusted Results 6,056$ 1,900$ (898)$ 1,002$ (120)$ (221)$ 661$ (7)$ 654$ 3.56$ Fully Diluted Shares Outstanding 183.1 Third Quarter Year-to-Date 2022 Actual Results Third Quarter 2022 Actual Results

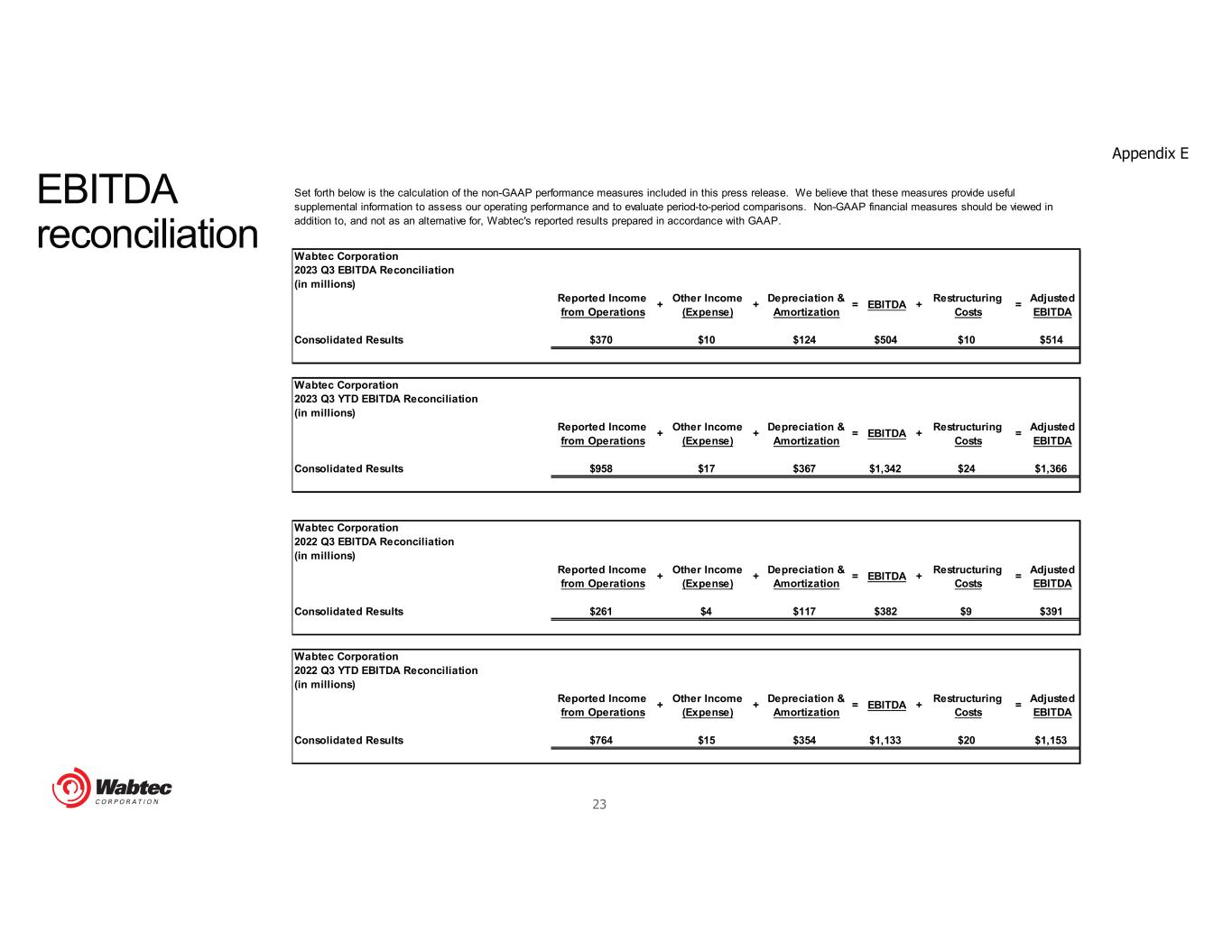

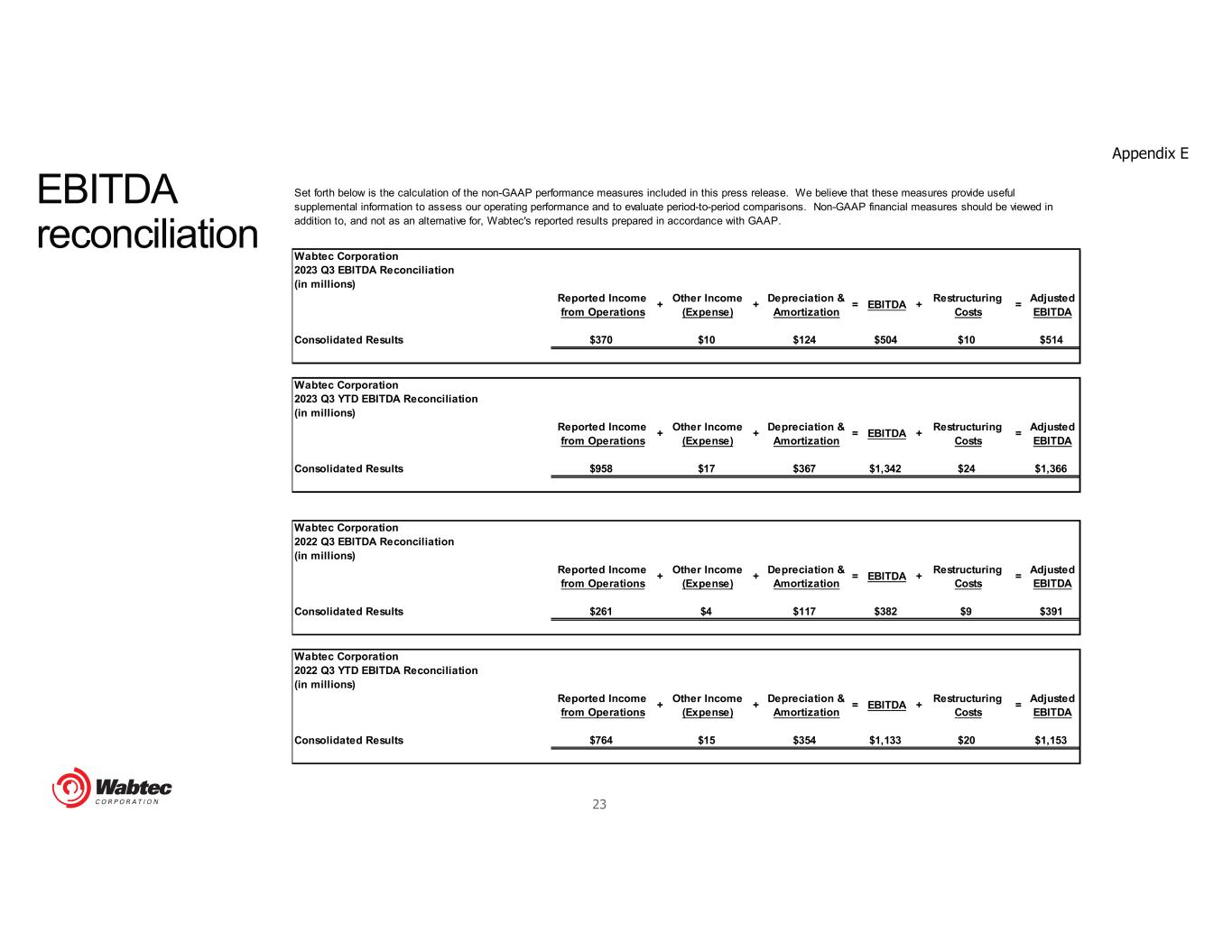

23 EBITDA reconciliation Appendix E Wabtec Corporation 2023 Q3 EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $370 $10 $124 $504 $10 $514 Wabtec Corporation 2023 Q3 YTD EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $958 $17 $367 $1,342 $24 $1,366 Wabtec Corporation 2022 Q3 EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $261 $4 $117 $382 $9 $391 Wabtec Corporation 2022 Q3 YTD EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $764 $15 $354 $1,133 $20 $1,153 + = Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. + + = EBITDA + = EBITDA + =+ = + =+ = EBITDA + + + = EBITDA +

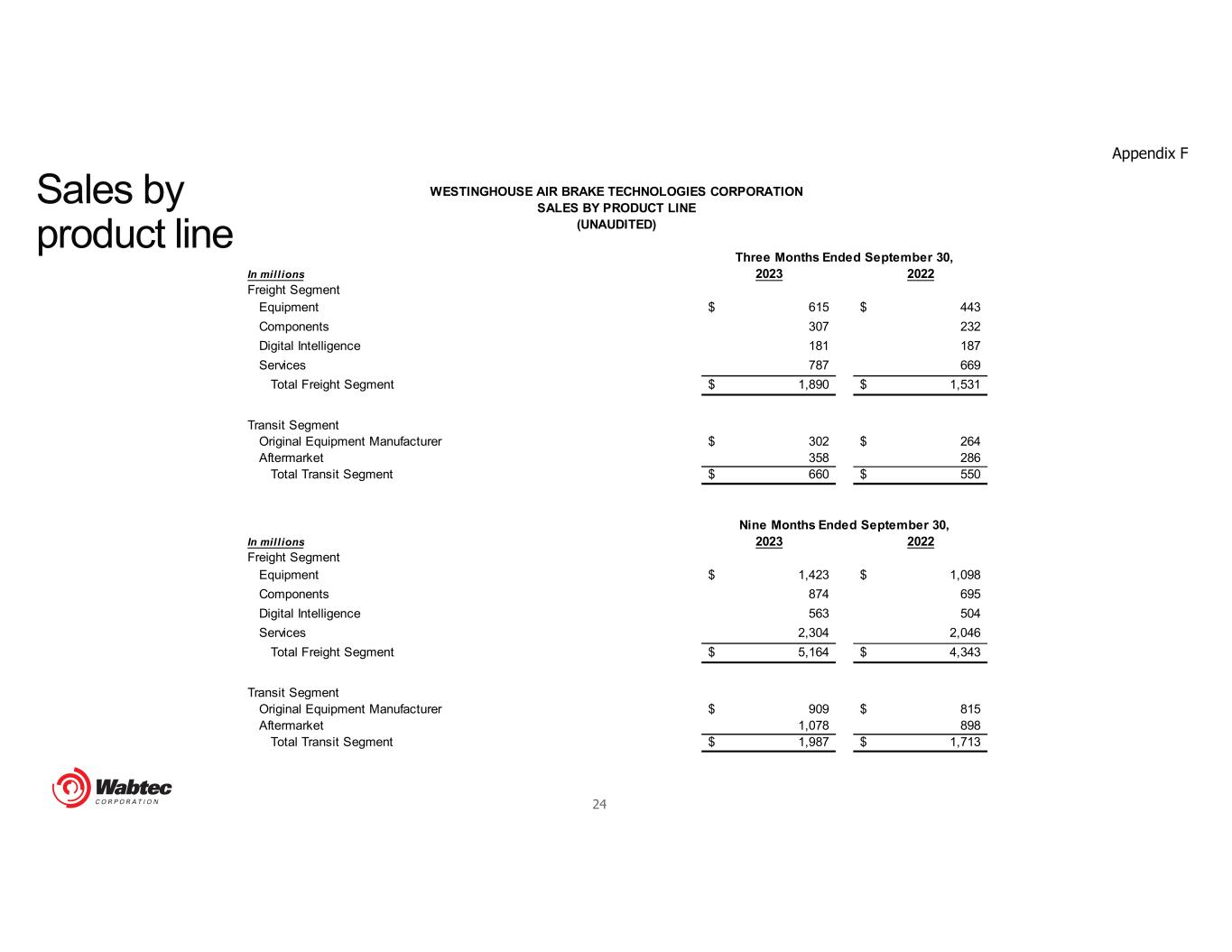

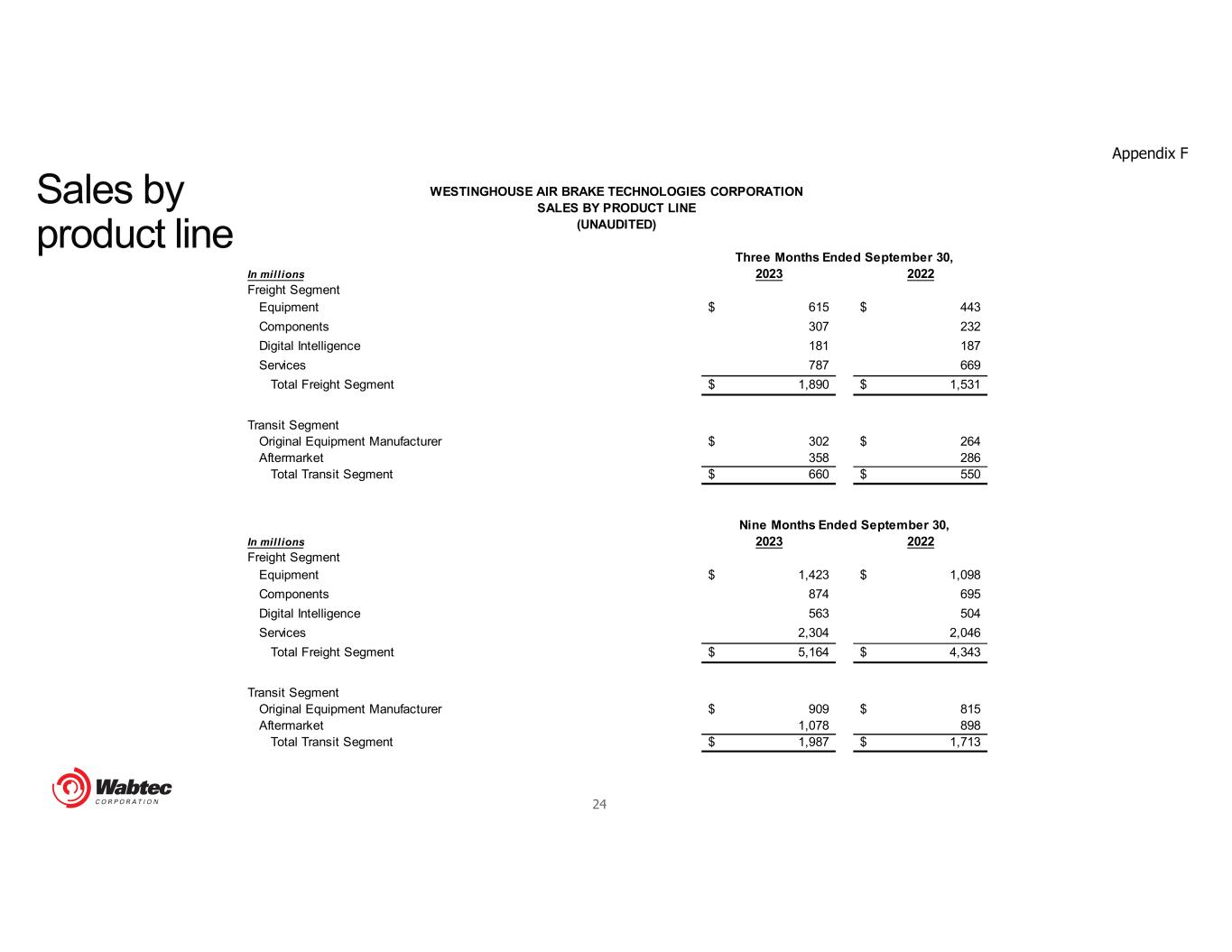

24 Sales by product line Appendix F In mill ions 2023 2022 Freight Segment Equipment 615$ 443$ Components 307 232 Digital Intelligence 181 187 Services 787 669 Total Freight Segment 1,890$ 1,531$ Transit Segment Original Equipment Manufacturer 302$ 264$ Aftermarket 358 286 Total Transit Segment 660$ 550$ In mill ions 2023 2022 Freight Segment Equipment 1,423$ 1,098$ Components 874 695 Digital Intelligence 563 504 Services 2,304 2,046 Total Freight Segment 5,164$ 4,343$ Transit Segment Original Equipment Manufacturer 909$ 815$ Aftermarket 1,078 898 Total Transit Segment 1,987$ 1,713$ Nine Months Ended September 30, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION SALES BY PRODUCT LINE (UNAUDITED) Three Months Ended September 30,

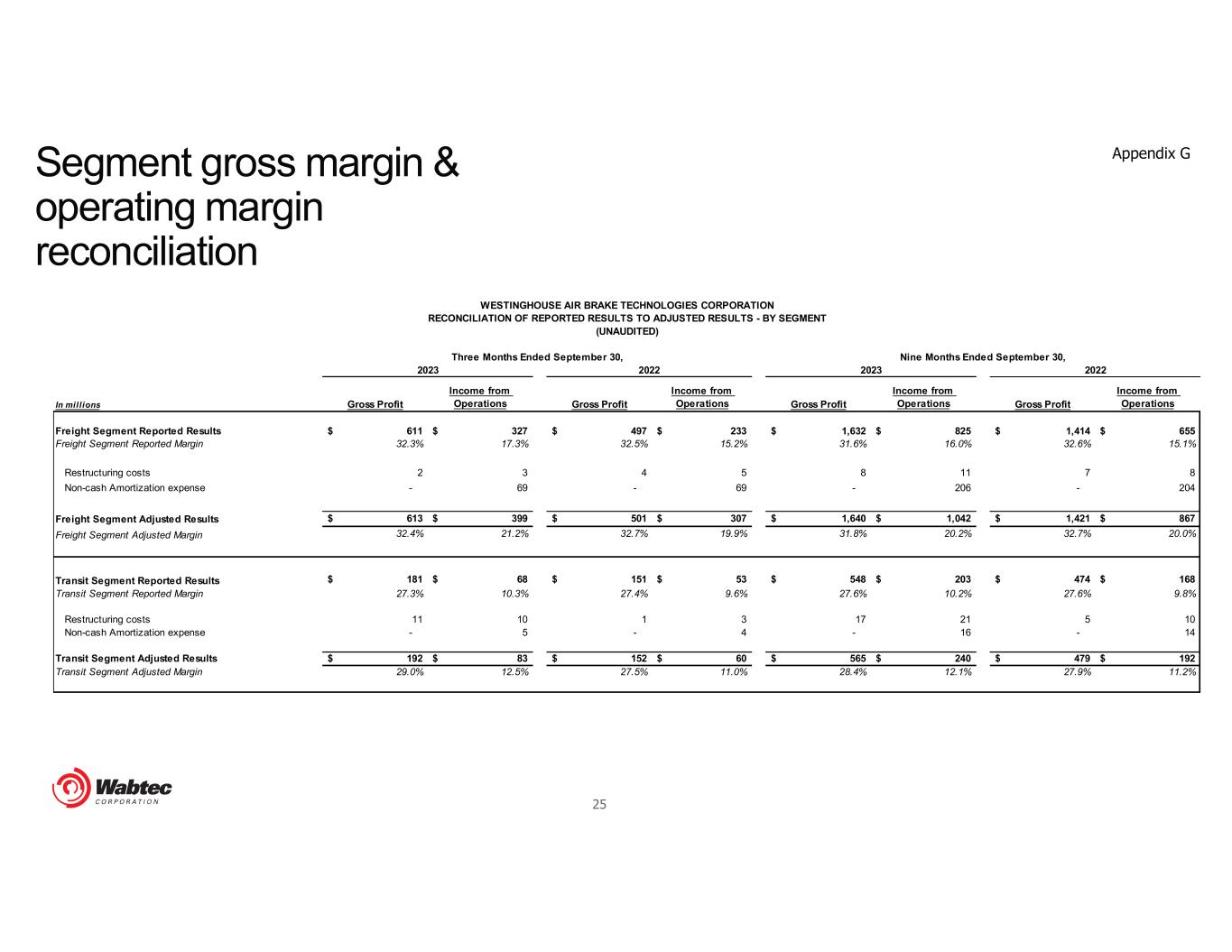

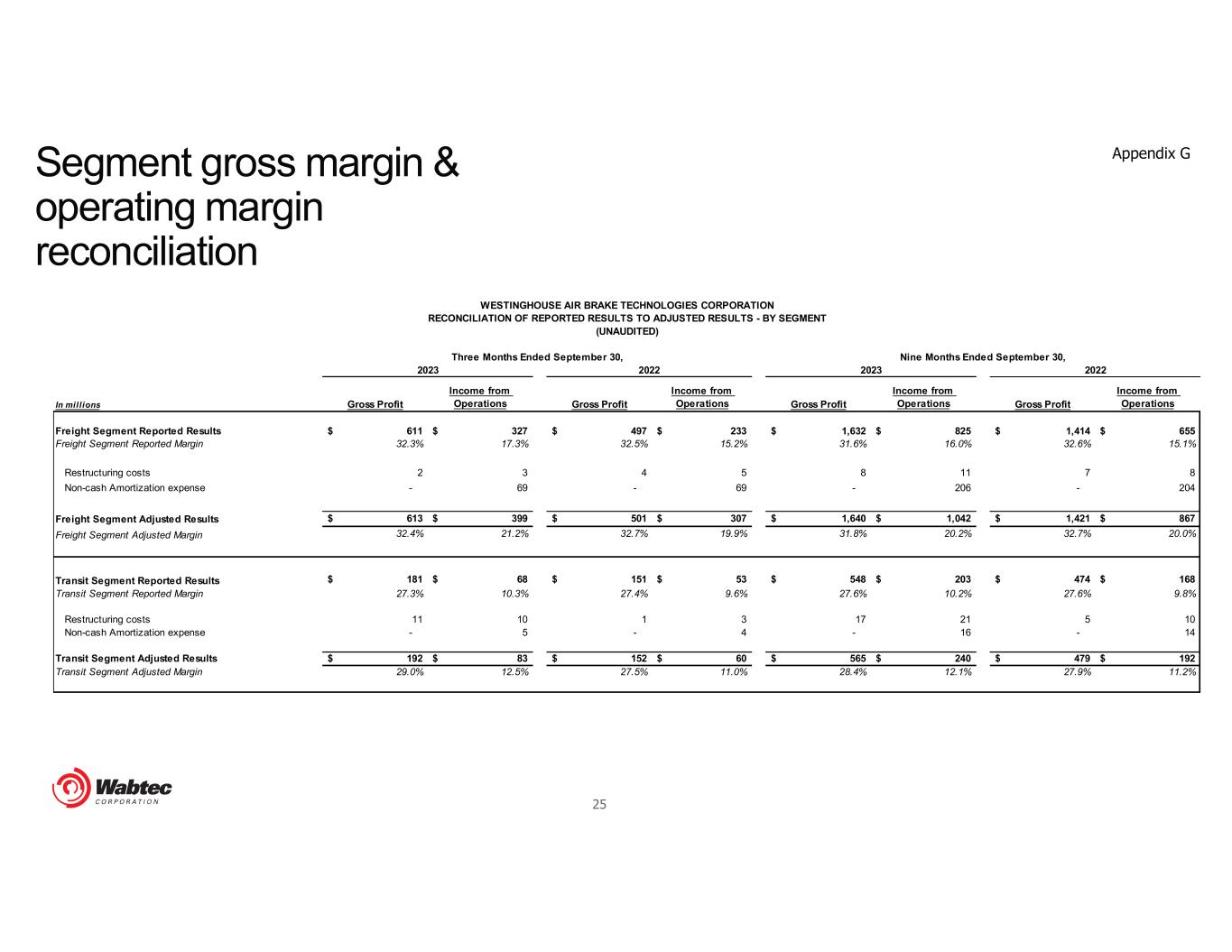

25 Segment gross margin & operating margin reconciliation Appendix G In millions Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Freight Segment Reported Results 611$ 327$ 497$ 233$ 1,632$ 825$ 1,414$ 655$ Freight Segment Reported Margin 32.3% 17.3% 32.5% 15.2% 31.6% 16.0% 32.6% 15.1% Restructuring costs 2 3 4 5 8 11 7 8 Non-cash Amortization expense - 69 - 69 - 206 - 204 Freight Segment Adjusted Results 613$ 399$ 501$ 307$ 1,640$ 1,042$ 1,421$ 867$ Freight Segment Adjusted Margin 32.4% 21.2% 32.7% 19.9% 31.8% 20.2% 32.7% 20.0% Transit Segment Reported Results 181$ 68$ 151$ 53$ 548$ 203$ 474$ 168$ Transit Segment Reported Margin 27.3% 10.3% 27.4% 9.6% 27.6% 10.2% 27.6% 9.8% Restructuring costs 11 10 1 3 17 21 5 10 Non-cash Amortization expense - 5 - 4 - 16 - 14 Transit Segment Adjusted Results 192$ 83$ 152$ 60$ 565$ 240$ 479$ 192$ Transit Segment Adjusted Margin 29.0% 12.5% 27.5% 11.0% 28.4% 12.1% 27.9% 11.2% WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION RECONCILIATION OF REPORTED RESULTS TO ADJUSTED RESULTS - BY SEGMENT (UNAUDITED) 2023 2022 Three Months Ended September 30, Nine Months Ended September 30, 2023 2022

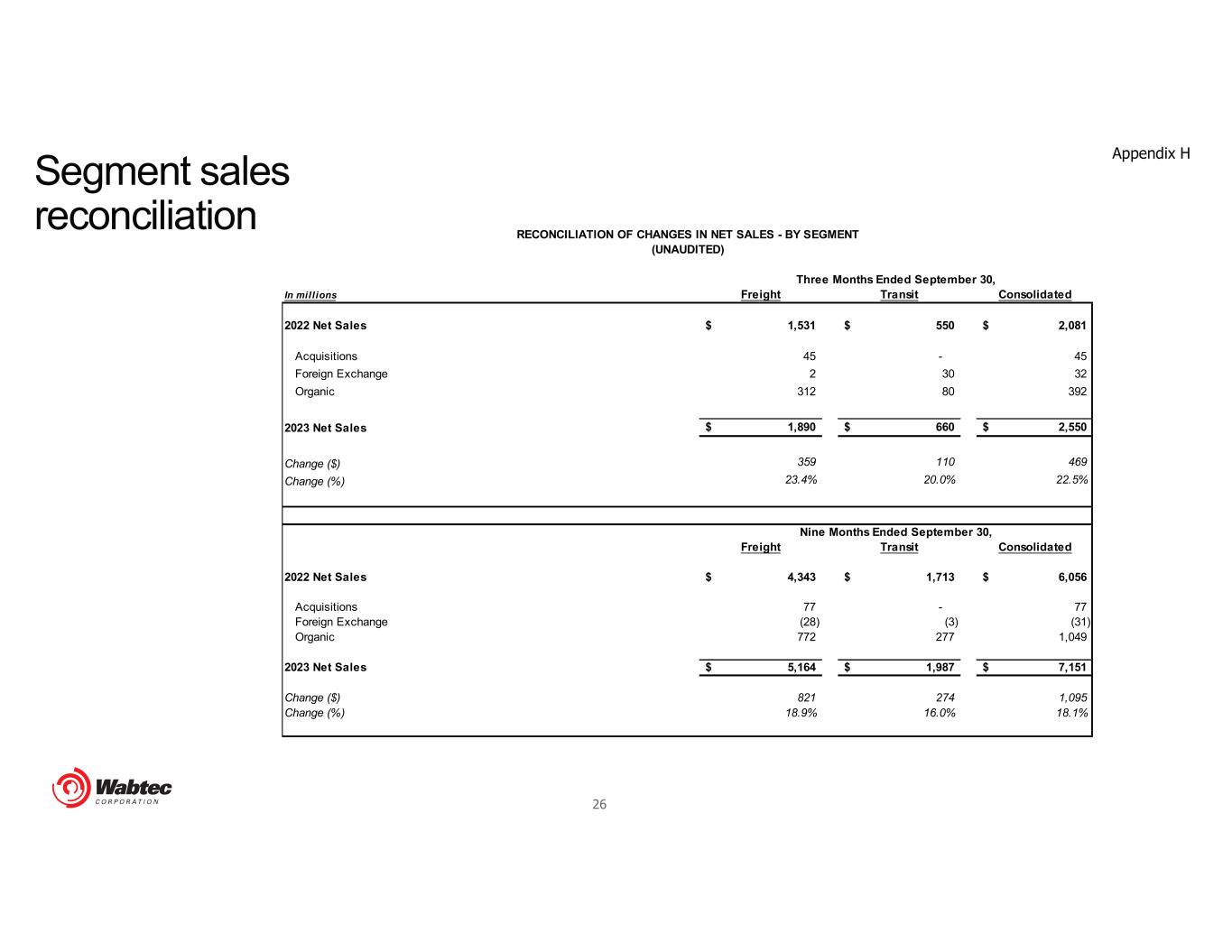

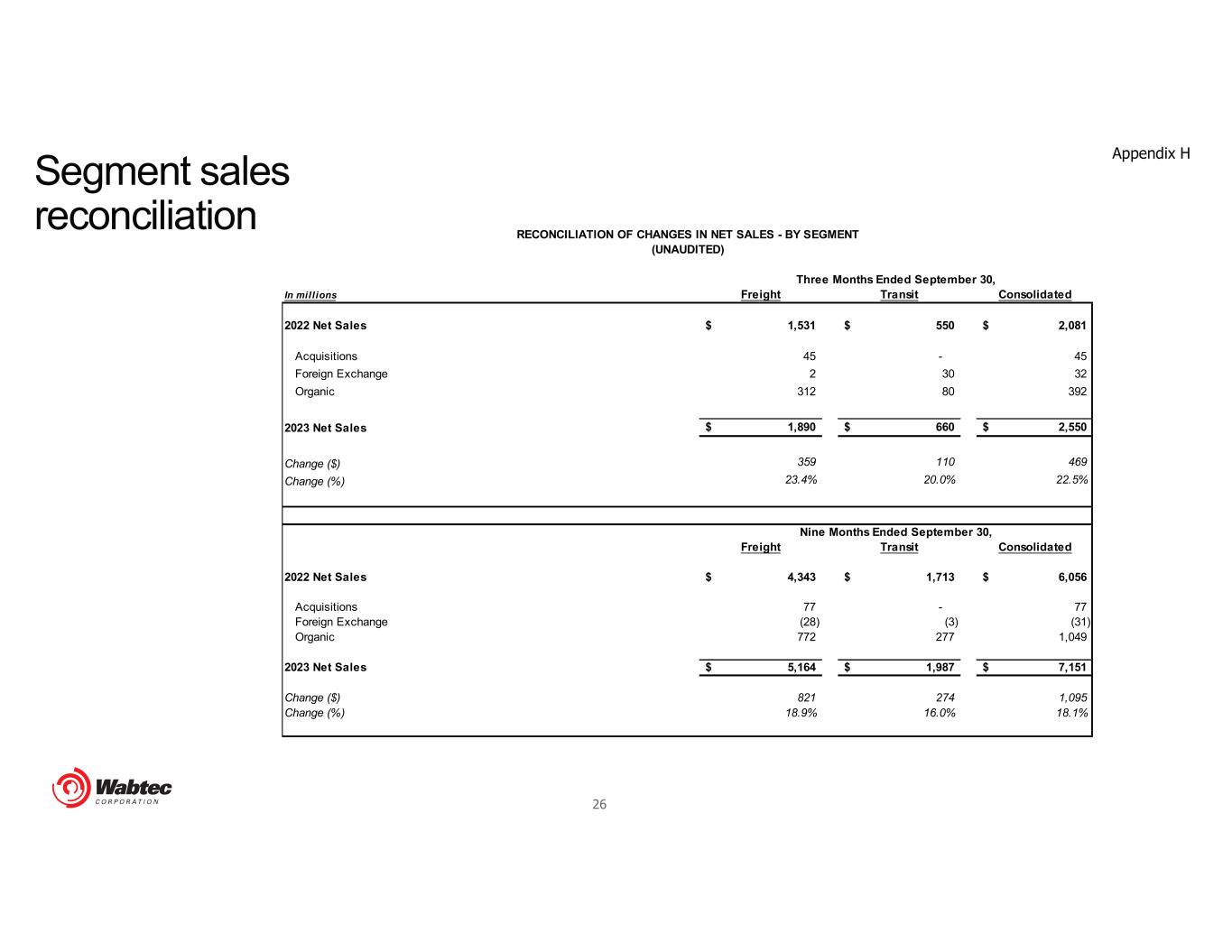

26 Segment sales reconciliation Appendix H In millions Freight Transit Consolidated 2022 Net Sales 1,531$ 550$ 2,081$ Acquisitions 45 - 45 Foreign Exchange 2 30 32 Organic 312 80 392 2023 Net Sales 1,890$ 660$ 2,550$ Change ($) 359 110 469 Change (%) 23.4% 20.0% 22.5% Freight Transit Consolidated 2022 Net Sales 4,343$ 1,713$ 6,056$ Acquisitions 77 - 77 Foreign Exchange (28) (3) (31) Organic 772 277 1,049 2023 Net Sales 5,164$ 1,987$ 7,151$ Change ($) 821 274 1,095 Change (%) 18.9% 16.0% 18.1% (UNAUDITED) Three Months Ended September 30, Nine Months Ended September 30, RECONCILIATION OF CHANGES IN NET SALES - BY SEGMENT

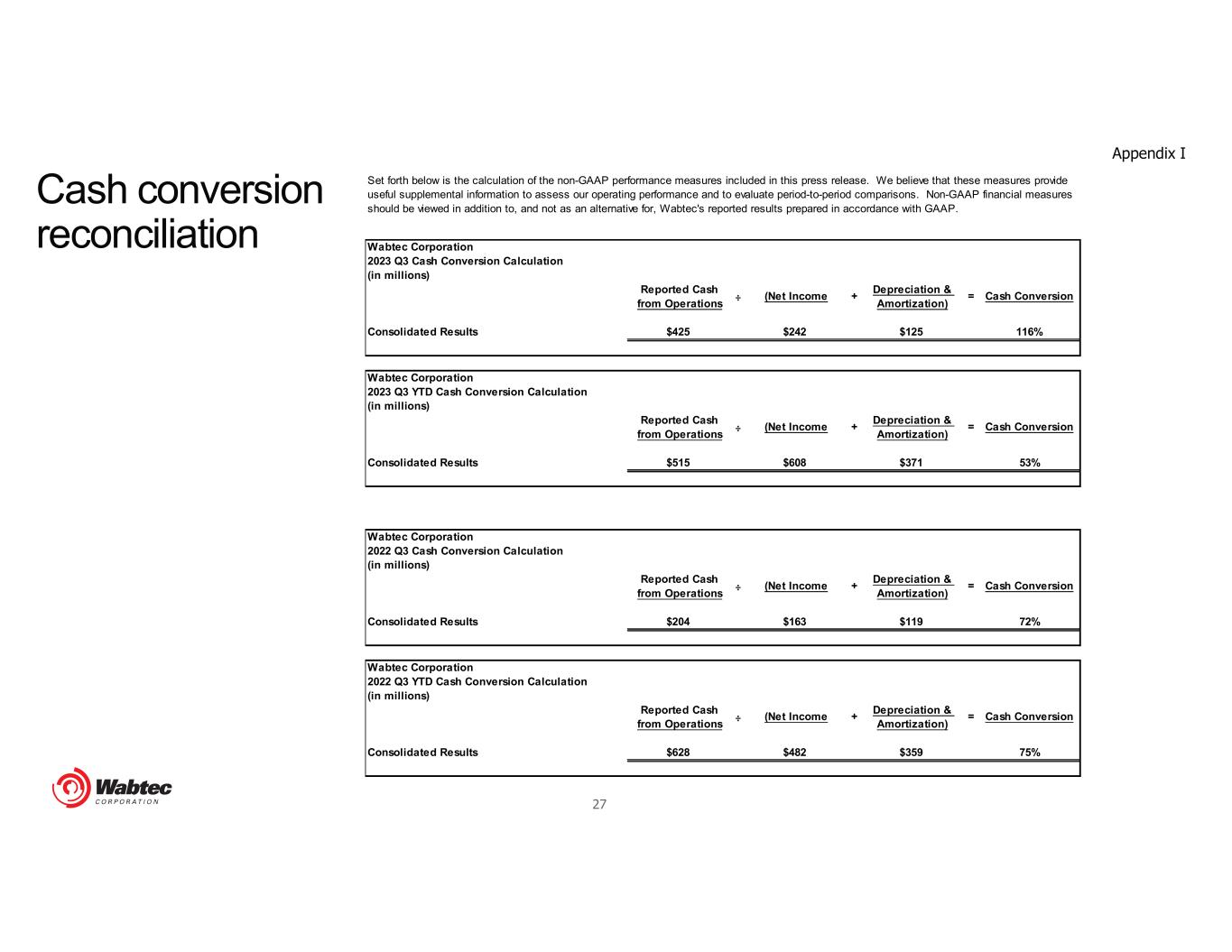

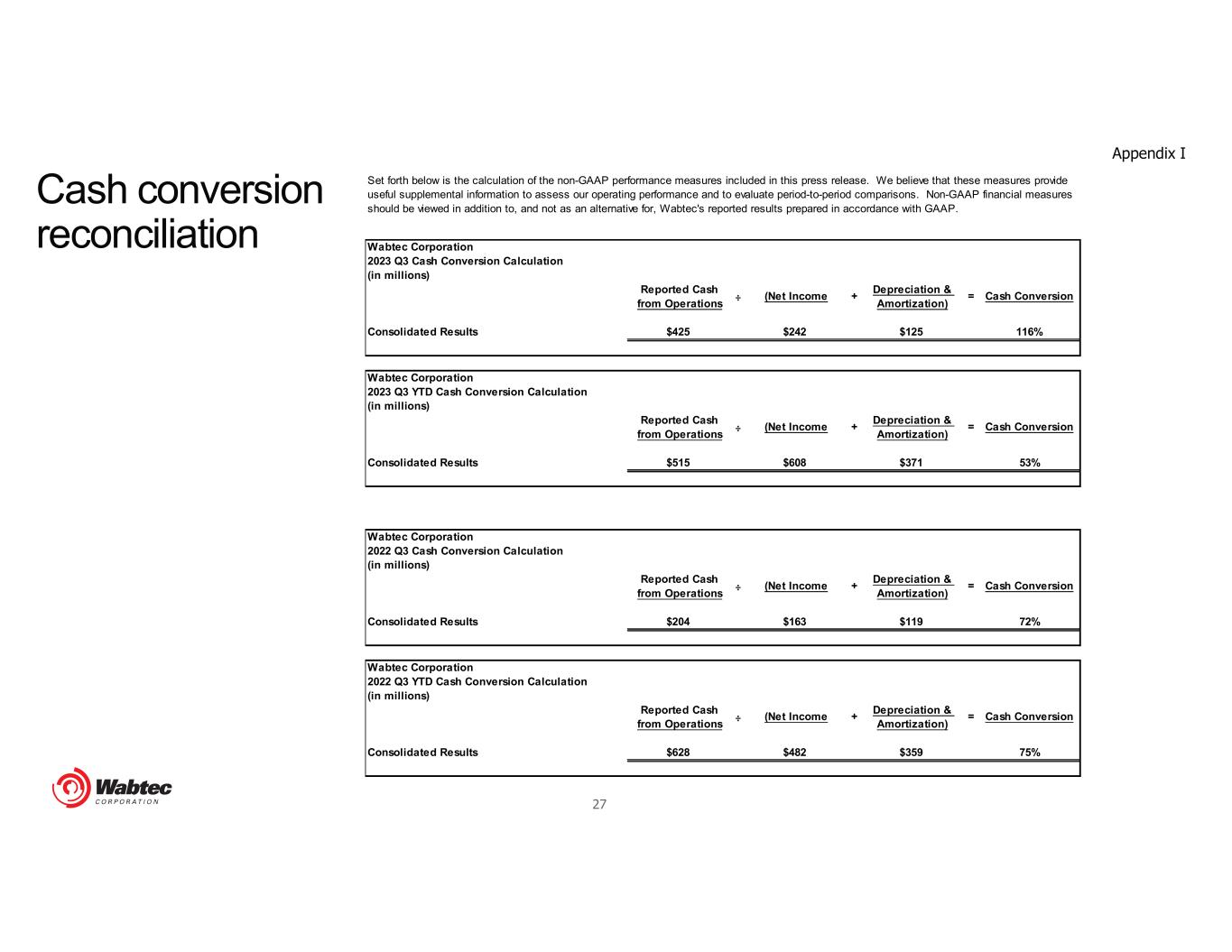

27 Cash conversion reconciliation Appendix I Wabtec Corporation 2023 Q3 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $425 $242 $125 116% Wabtec Corporation 2023 Q3 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $515 $608 $371 53% Wabtec Corporation 2022 Q3 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $204 $163 $119 72% Wabtec Corporation 2022 Q3 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $628 $482 $359 75% Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. ÷ + = Cash Conversion(Net Income Depreciation & Amortization) ÷ + = Cash Conversion(Net Income Depreciation & Amortization) ÷ + = Cash Conversion(Net Income Depreciation & Amortization) ÷ + = Cash Conversion(Net Income Depreciation & Amortization)